CAREER EDUCATION CORPORATION FOURTH quarter 2018 investor conference call FEBRUARY 20, 2019 Ashish Ghia Senior Vice President & Chief Financial Officer Todd Nelson President & Chief Executive Officer Exhibit 99.2

This presentation contains “forward-looking statements,” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects and opportunities, as well as assumptions made by (see, for example, slide 4), and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “believe,” “should,” “will,” “expect,” “estimate,” “continue to,” “outlook,” “trend” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed in Item 1A,“Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2018 and our subsequent filings with the Securities and Exchange Commission that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or any of the forward-looking statements to reflect future events, developments, or changed circumstances or for any other reason. Certain financial information is presented on a non-GAAP basis. The Company believes it is useful to present non-GAAP financial measures which exclude certain significant and non-cash items as a means to understand the performance of its operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its core business, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are provided at the end of this presentation, and this presentation (including the reconciliation) has been posted to our website. Cautionary Statements & Disclosures

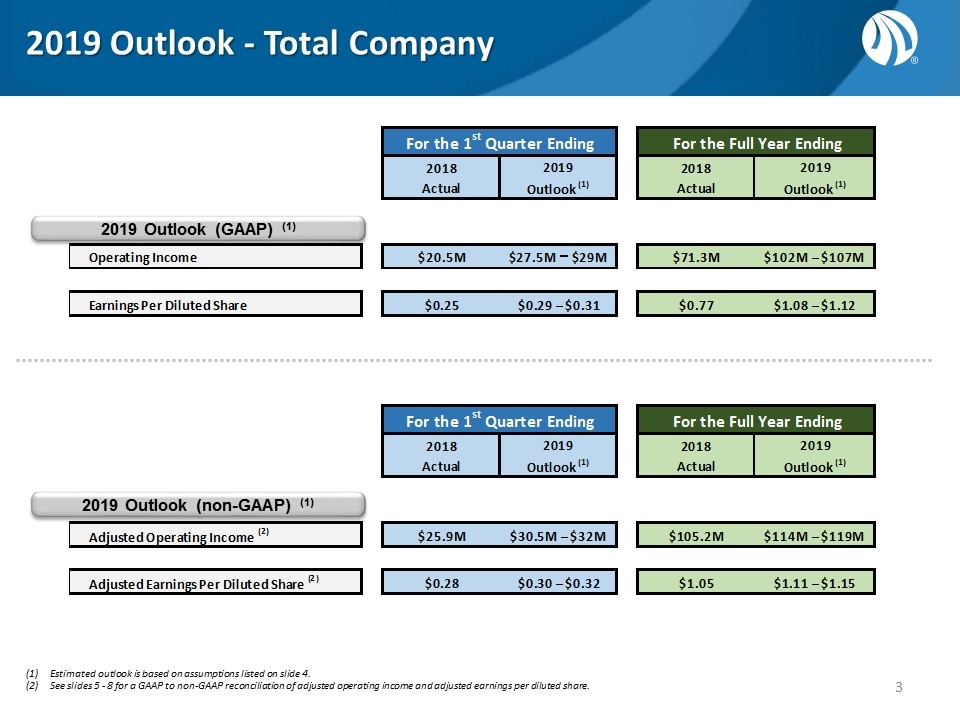

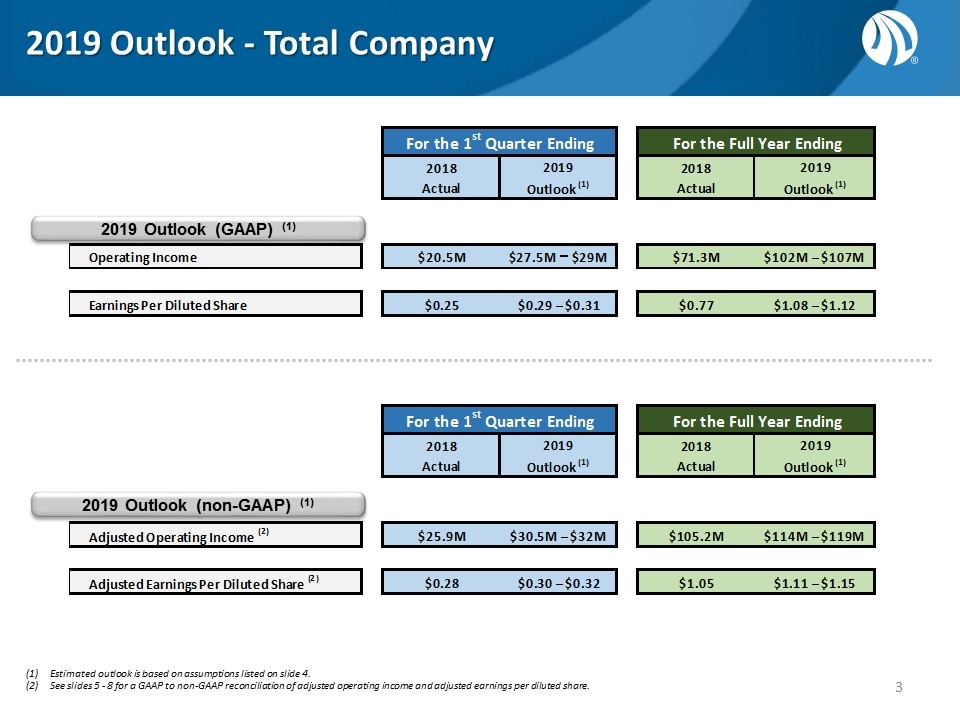

2019 Outlook - Total Company Estimated outlook is based on assumptions listed on slide 4. See slides 5 - 8 for a GAAP to non-GAAP reconciliation of adjusted operating income and adjusted earnings per diluted share. 2019 Outlook (GAAP) (1) 2019 Outlook (non-GAAP) (1) For the 1st Quarter Ending For the Full Year Ending 2018Actual 2019Outlook (1) 2018Actual 2019Outlook (1) Operating Income $20,529,009.474000007 $27.5M – $29M $71,297,483.879999936 $102M – $107M Earnings Per Diluted Share $0.25 $0.29 – $0.31 $0.77 $1.08 – $1.12 For the 1st Quarter Ending For the Full Year Ending 2018Actual 2019Outlook (1) 2018Actual 2019Outlook (1) Adjusted Operating Income (2) $25,851,326.74400001 $30.5M – $32M $,105,159,512.48199993 $114M – $119M Adjusted Earnings Per Diluted Share (2) $0.28000000000000003 $0.30 – $0.32 $1.05 $1.11 – $1.15

Outlook Assumptions Achievement of the outlook included within these slides is based on the following key assumptions and factors, among others: Prospective student interest in the Company’s programs continues to trend in line with recent experiences Initiatives and investments in student-serving operations continue to positively impact enrollment trends within the University Group No material changes in the current legal or regulatory environment, and excludes legal and regulatory liabilities and other related impacts which are not probable and estimable at this time, and any impact of new or proposed regulations, including the “borrower defense to repayment” and gainful employment regulations and any modifications thereto No significant impact from ongoing legal or regulatory matters, including legal fees associated therewith No material changes in the estimated amount of compensation expense that could be impacted by changes in the Company’s stock price or the Company’s assessment of the probable outcome of performance conditions relating to performance-based compensation Earnings per diluted share outlook assumes an effective income tax rate of 21.5% for the quarter and 24.5% for the full year Although these estimates and assumptions are based upon management’s good faith beliefs regarding current events and actions that we may undertake in the future, actual results could differ materially from estimates. In addition, decisions we make in the future as we continue to evaluate diverse strategies to enhance shareholder value may impact the outlook provided.

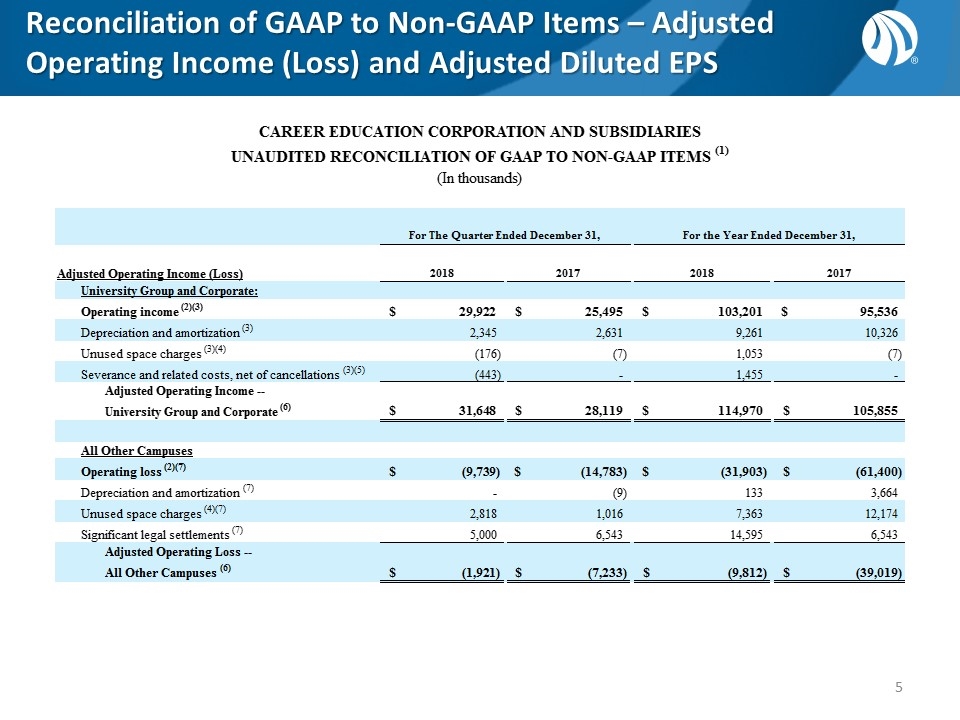

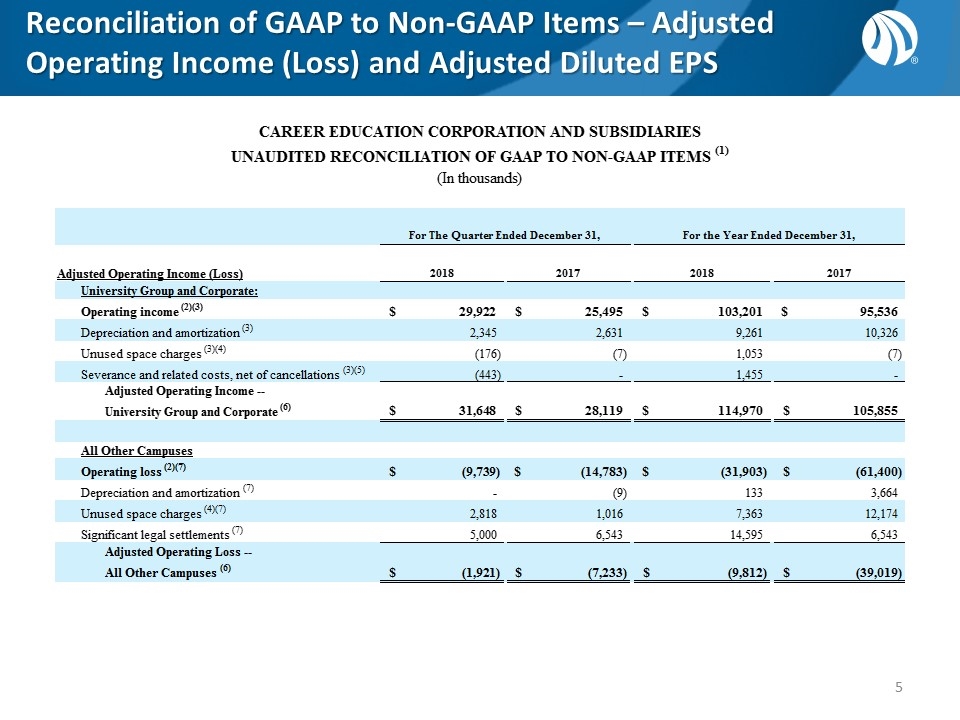

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) and Adjusted Diluted EPS CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) (In thousands) For The Quarter Ended December 31, For the Year Ended December 31, Adjusted Operating Income (Loss) 2018 2017 2018 2017 University Group and Corporate: Operating income (2)(3) $29,922 $25,495 $,103,201 $95,536 Depreciation and amortization (3) 2,345 2,631 9,261 10,326 Unused space charges (3)(4) -,176 -7 1,053 -7 Severance and related costs, net of cancellations (3)(5) -,443 0 1,455 0 Adjusted Operating Income --University Group and Corporate (6) $31,648 $28,119 $,114,970 $,105,855 All Other Campuses Operating loss (2)(7) $-9,739 $,-14,783 $,-31,903 $,-61,400 Depreciation and amortization (7) 0 -9 133 3,664 Unused space charges (4)(7) 2,818 1,016 7,363 12,174 Significant legal settlements (7) 5,000 6,543 14,595 6,543 Adjusted Operating Loss --All Other Campuses (6) $-1,921 $-7,233 $-9,812 $,-39,019 Total Company Operating income $20,183 $10,712 $71,298 $34,136 Depreciation and amortization 2,345 2,622 9,394 13,990 Unused space charges (4) 2,642 1,009 8,416 12,167 Severance and related costs, net of cancellations (5) -,443 0 1,455 0 Significant legal settlements 5,000 6,543 14,595 6,543 Adjusted Operating Income --Total Company $29,727 $20,886 $,105,158 $66,836 $0 $0 $0 $0

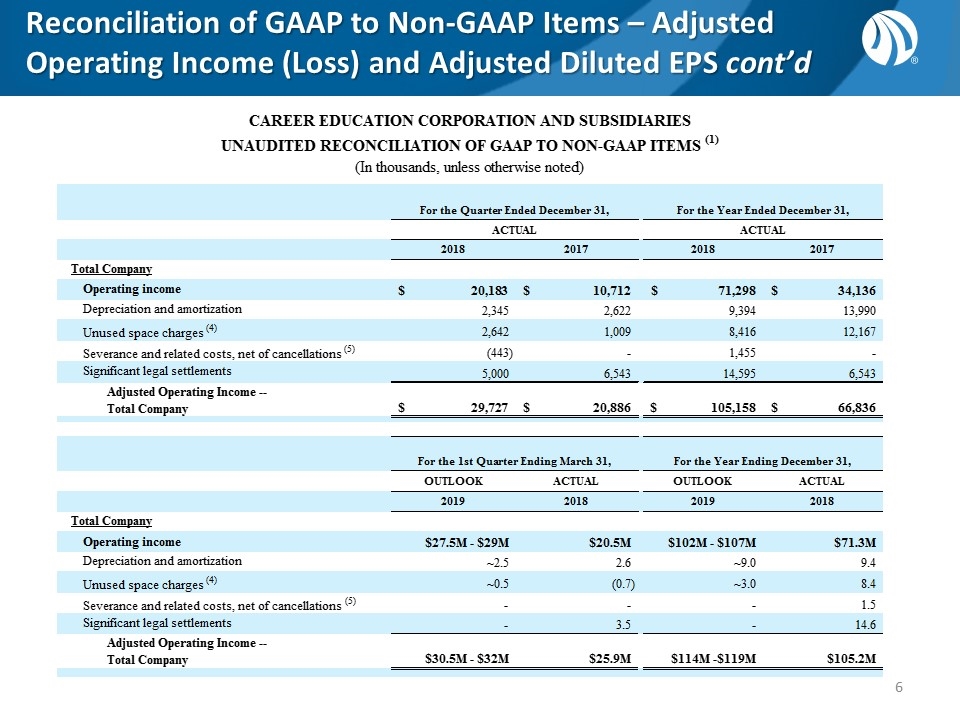

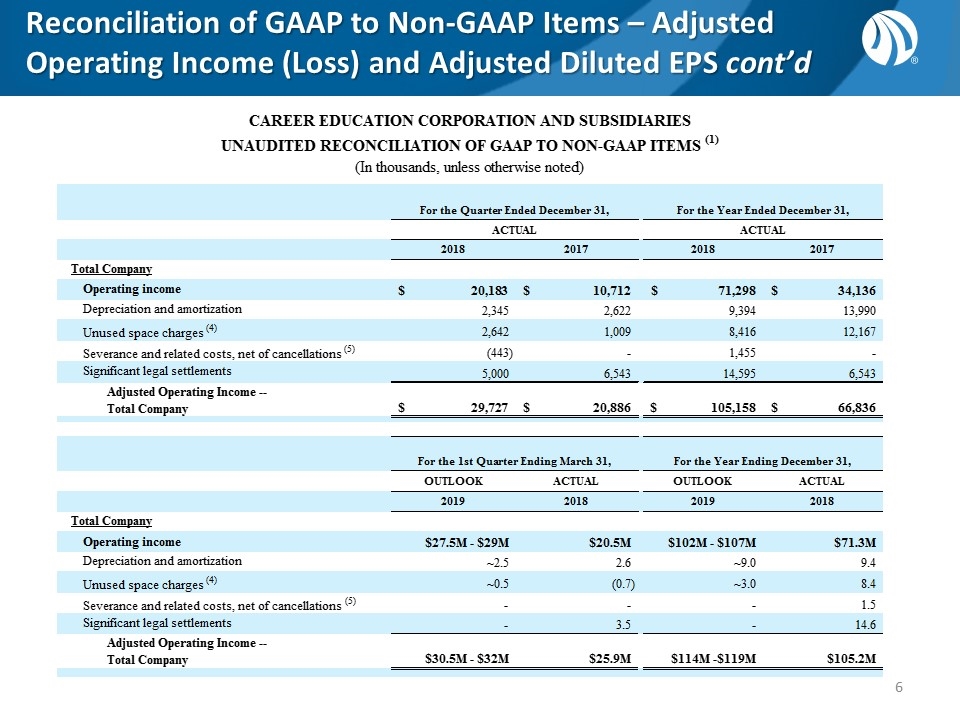

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) and Adjusted Diluted EPS cont’d CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) (In thousands, unless otherwise noted) For the Quarter Ended December 31, For the Year Ended December 31, ACTUAL ACTUAL 2018 2017 2018 2017 Total Company Operating income $20,183 $10,712 $71,298 $34,136 Depreciation and amortization 2,345 2,622 9,394 13,990 Unused space charges (4) 2,642 1,009 8,416 12,167 Severance and related costs, net of cancellations (5) -,443 0 1,455 0 Significant legal settlements 5,000 6,543 14,595 6,543 Adjusted Operating Income --Total Company $29,727 $20,886 $,105,158 $66,836 For the 1st Quarter Ending March 31, For the Year Ending December 31, OUTLOOK ACTUAL OUTLOOK ACTUAL 2019 2018 2019 2018 Total Company Operating income $27.5M - $29M $20.5M $102M - $107M $71.3M Depreciation and amortization ~2.5 2.6 ~9.0 9.4 Unused space charges (4) ~0.5 -0.7 ~3.0 8.4 Severance and related costs, net of cancellations (5) 0 0 0 1.5 Significant legal settlements 0 3.5 0 14.6 Adjusted Operating Income --Total Company $30.5M - $32M $25.9M $114M -$119M $105.2M

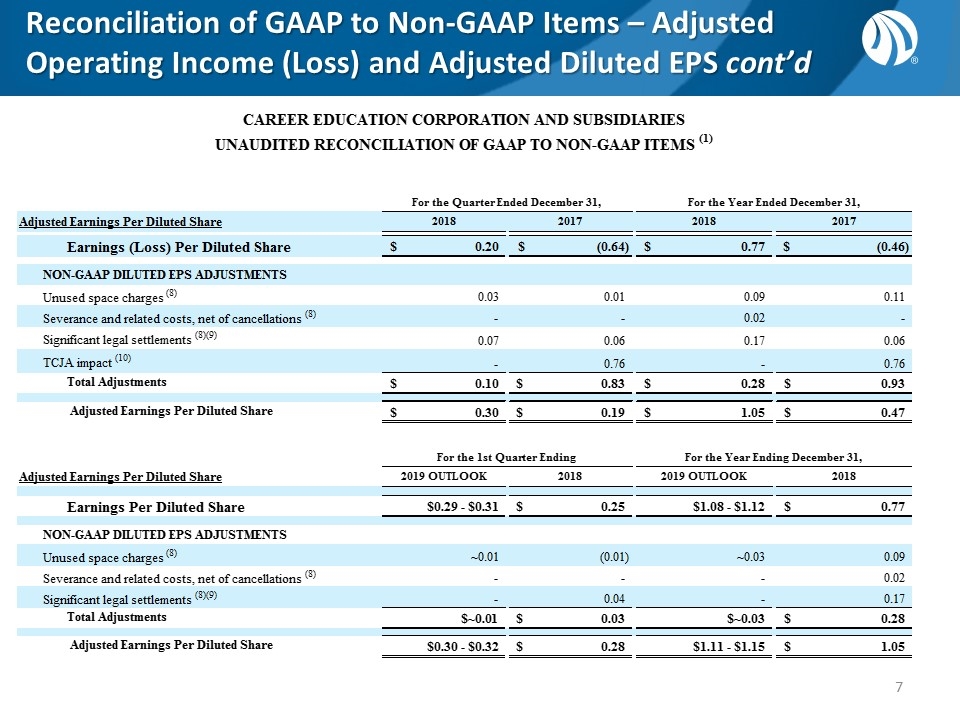

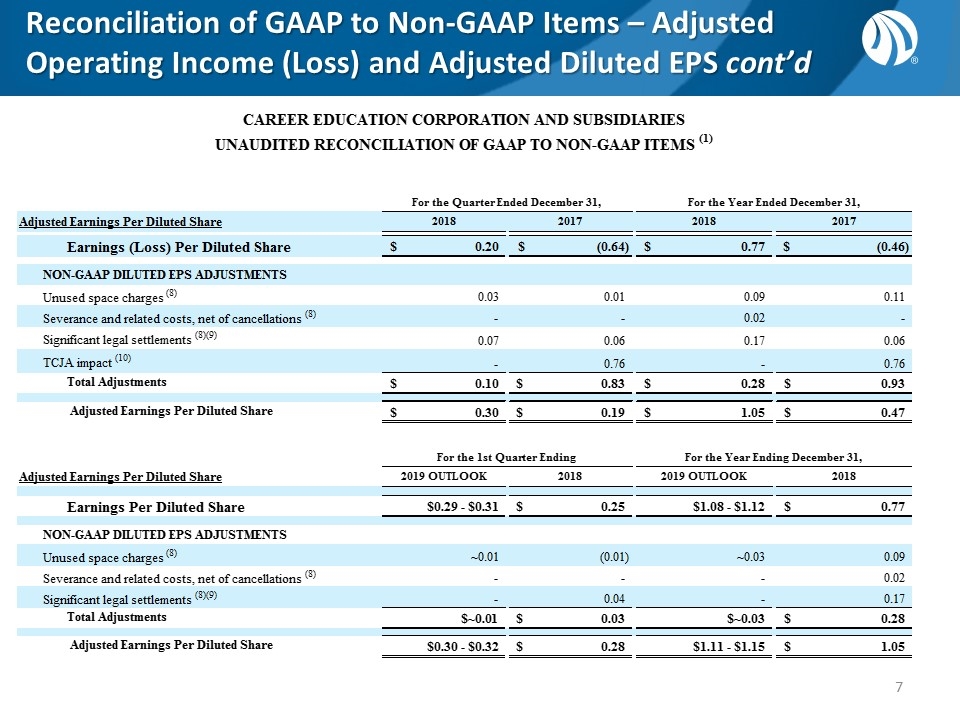

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) and Adjusted Diluted EPS cont’d CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) For the Quarter Ended December 31, For the Year Ended December 31, Adjusted Earnings Per Diluted Share 2018 2017 2018 2017 Earnings (Loss) Per Diluted Share $0.2 $-0.64 $0.77 $-0.46 NON-GAAP DILUTED EPS ADJUSTMENTS Unused space charges (8) 0.03 0.01 0.09 0.11 Severance and related costs, net of cancellations (8) 0 0 0.02 0 Significant legal settlements (8)(9) 7.0000000000000007E-2 0.06 0.17 0.06 TCJA impact (10) 0 0.76 0 0.76 Total Adjustments $0.1 $0.83 $0.28000000000000003 $0.92999999999999994 Adjusted Earnings Per Diluted Share $0.30000000000000004 $0.18999999999999995 $1.05 $0.46999999999999992 For the 1st Quarter Ending For the Year Ending December 31, Adjusted Earnings Per Diluted Share 2019 OUTLOOK 2018 2019 OUTLOOK 2018 Earnings Per Diluted Share $0.29 - $0.31 $0.25 $1.08 - $1.12 $0.77 NON-GAAP DILUTED EPS ADJUSTMENTS Unused space charges (8) ~0.01 -0.01 ~0.03 0.09 Severance and related costs, net of cancellations (8) 0 0 0 0.02 Significant legal settlements (8)(9) 0 0.04 0 0.17 Total Adjustments $~0.01 $0.03 $~0.03 $0.28000000000000003 Adjusted Earnings Per Diluted Share $0.30 - $0.32 $0.28000000000000003 $1.11 - $1.15 $1.05

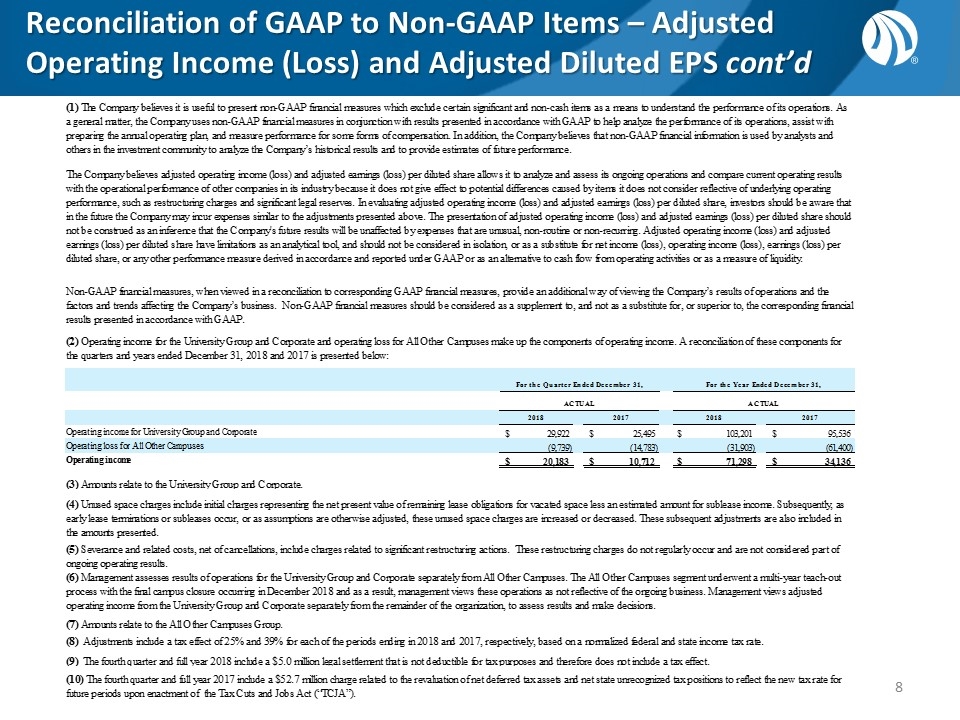

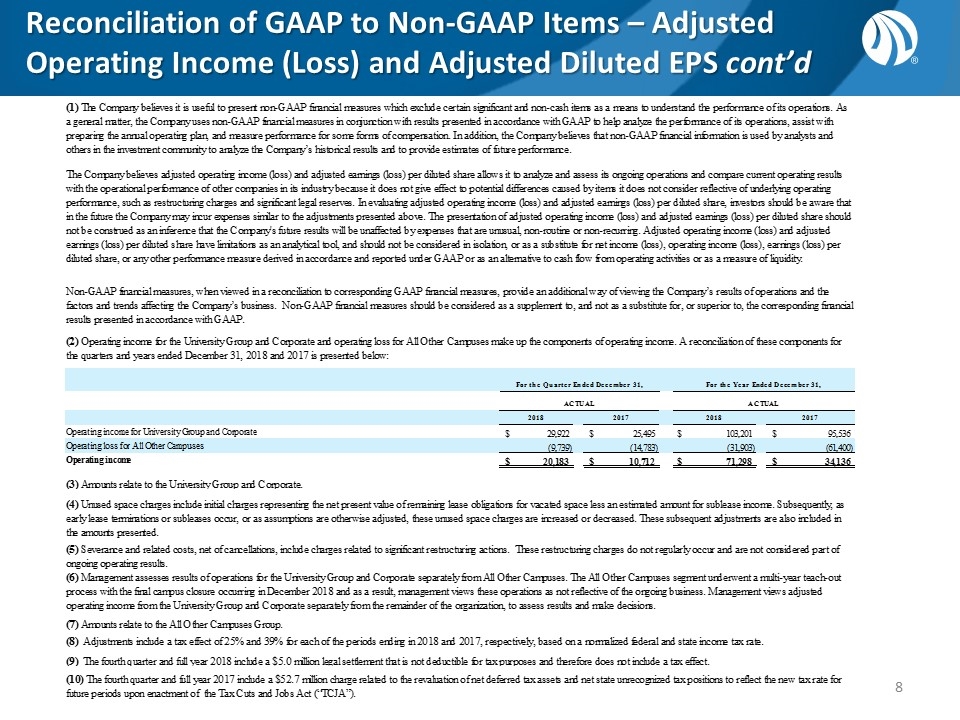

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) and Adjusted Diluted EPS cont’d (1) The Company believes it is useful to present non-GAAP financial measures which exclude certain significant and non-cash items as a means to understand the performance of its operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its operations, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company’s historical results and to provide estimates of future performance. The Company believes adjusted operating income (loss) and adjusted earnings (loss) per diluted share allows it to analyze and assess its ongoing operations and compare current operating results with the operational performance of other companies in its industry because it does not give effect to potential differences caused by items it does not consider reflective of underlying operating performance, such as restructuring charges and significant legal reserves. In evaluating adjusted operating income (loss) and adjusted earnings (loss) per diluted share, investors should be aware that in the future the Company may incur expenses similar to the adjustments presented above. The presentation of adjusted operating income (loss) and adjusted earnings (loss) per diluted share should not be construed as an inference that the Company's future results will be unaffected by expenses that are unusual, non-routine or non-recurring. Adjusted operating income (loss) and adjusted earnings (loss) per diluted share have limitations as an analytical tool, and should not be considered in isolation, or as a substitute for net income (loss), operating income (loss), earnings (loss) per diluted share, or any other performance measure derived in accordance and reported under GAAP or as an alternative to cash flow from operating activities or as a measure of liquidity. Non-GAAP financial measures, when viewed in a reconciliation to corresponding GAAP financial measures, provide an additional way of viewing the Company’s results of operations and the factors and trends affecting the Company’s business. Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding financial results presented in accordance with GAAP. (2) Operating income for the University Group and Corporate and operating loss for All Other Campuses make up the components of operating income. A reconciliation of these components for the quarters and years ended December 31, 2018 and 2017 is presented below: For the Quarter Ended December 31, For the Year Ended December 31, ACTUAL ACTUAL 2018 2017 2018 2017 Operating income for University Group and Corporate $29,922 $25,495 $,103,201 $95,536 Operating loss for All Other Campuses -9,739 ,-14,783 ,-31,903 ,-61,400 Operating income $20,183 $10,712 $71,298 $34,136 (3) Amounts relate to the University Group and Corporate. (4) Unused space charges include initial charges representing the net present value of remaining lease obligations for vacated space less an estimated amount for sublease income. Subsequently, as early lease terminations or subleases occur, or as assumptions are otherwise adjusted, these unused space charges are increased or decreased. These subsequent adjustments are also included in the amounts presented. (5) Severance and related costs, net of cancellations, include charges related to significant restructuring actions. These restructuring charges do not regularly occur and are not considered part of ongoing operating results. (6) Management assesses results of operations for the University Group and Corporate separately from All Other Campuses. The All Other Campuses segment underwent a multi-year teach-out process with the final campus closure occurring in December 2018 and as a result, management views these operations as not reflective of the ongoing business. Management views adjusted operating income from the University Group and Corporate separately from the remainder of the organization, to assess results and make decisions. (7) Amounts relate to the All Other Campuses Group. (8) Adjustments include a tax effect of 25% and 39% for each of the periods ending in 2018 and 2017, respectively, based on a normalized federal and state income tax rate. (9) The fourth quarter and full year 2018 include a $5.0 million legal settlement that is not deductible for tax purposes and therefore does not include a tax effect. (10) The fourth quarter and full year 2017 include a $52.7 million charge related to the revaluation of net deferred tax assets and net state unrecognized tax positions to reflect the new tax rate for future periods upon enactment of the Tax Cuts and Jobs Act (“TCJA”).