Exhibit (a)(5)(L)

E.ON's Offer for Endesa February 3, 2007

E.ON and Endesa create the world's leading power and gas company E.ON is making its final all-cash offer for 100% of Endesa's shares for 38.75 € per share

The integrity of Endesa's business and corporate identity will be secured by E.ON Presence in all major European markets is achieved in one step Growth profile for the combined group will be enhanced Endesa will be responsible for managing the new Southern Europe & Latin America Market Unit of E.ON

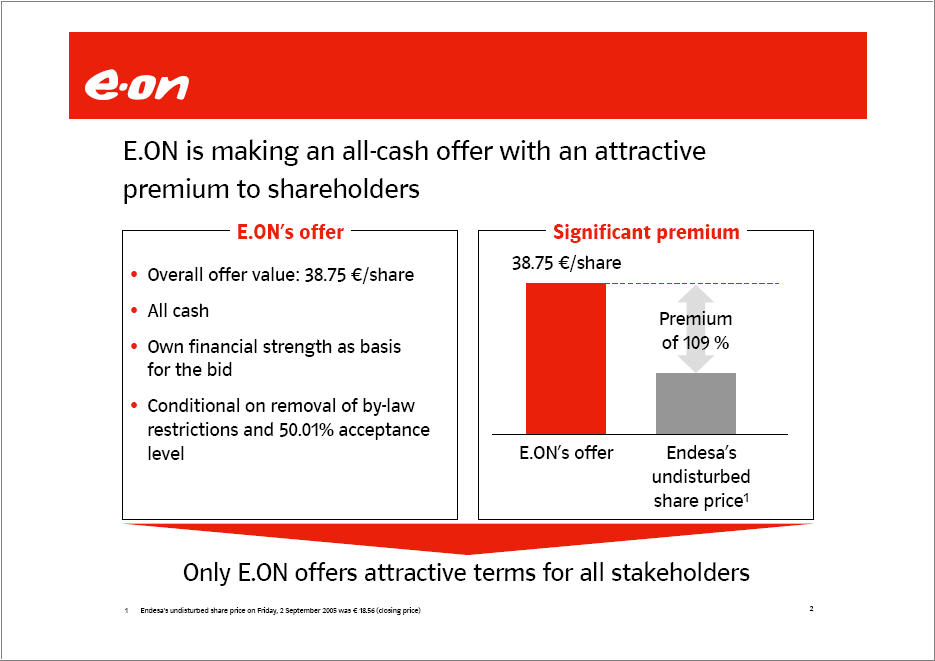

E.ON is making an all-cash offer with an attractive premium to shareholders E.ON’s offer Overall offer value: 38.75 €/share All cash Own financial strength as basis for the bid Conditional on removal of by-law restrictions and 50.01% acceptance level Significant premium 38.75 €/share E.ON's offer Premium of 109 % Endesa's undisturbed share price1 Only EON offers attractive terms for all stakeholders 1 Endesa’s undisturbed share price on Friday, 2 September 2005 was € 18.56 (closing price)

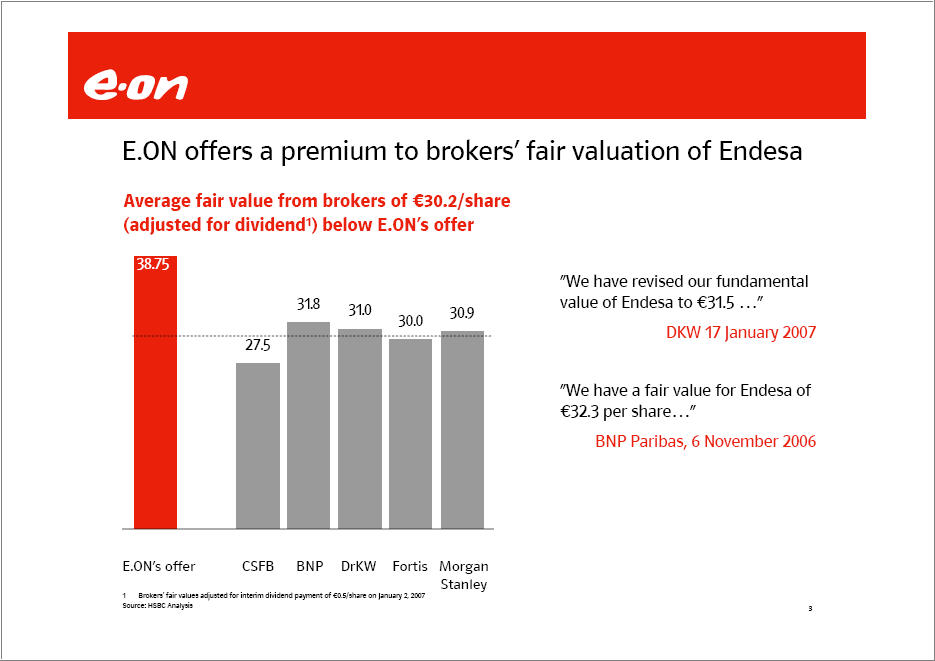

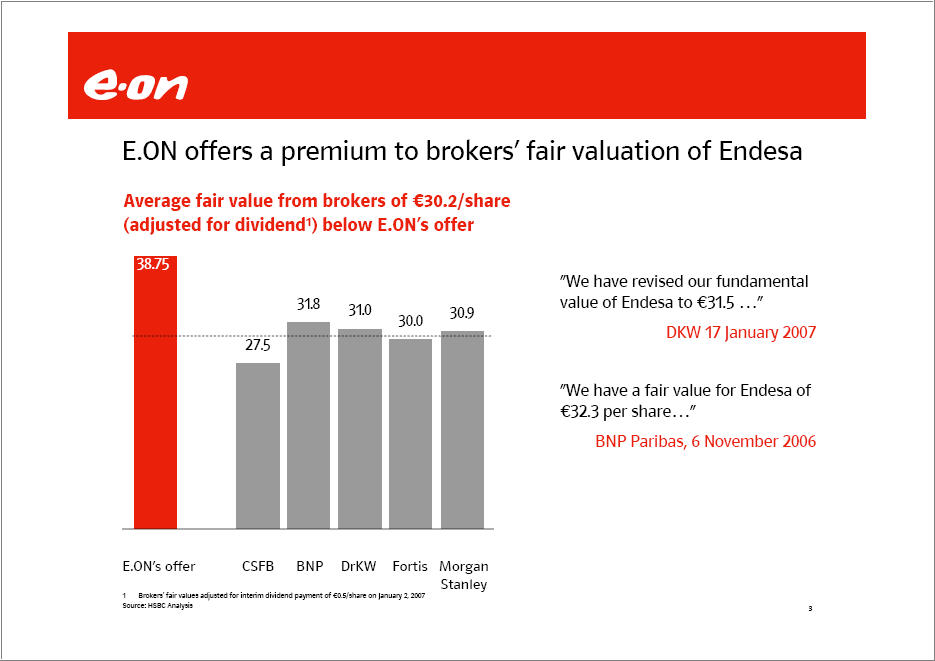

E.ON offers a premium to brokers’ fair valuation of Endesa Average fair value from brokers of €30.2/share (adjusted for dividend1) below E.ON's offer 38.75 27.5 31.8 31.0 30.0 30.9 E.ON’s offer CSFB BNP DrKW Fortis Morgan Stanley 1Brokers’ fair values adjusted for interim dividend payment of €0.5/share on January 2, 2007 Source: HSBC Analysis “We have revised our fundamental value of Endesa to €31.5 ...” DKW 17 January 2007 "We have a fair value for Endesa of €32.3 per share...” BNP Paribas, 6 November 2006

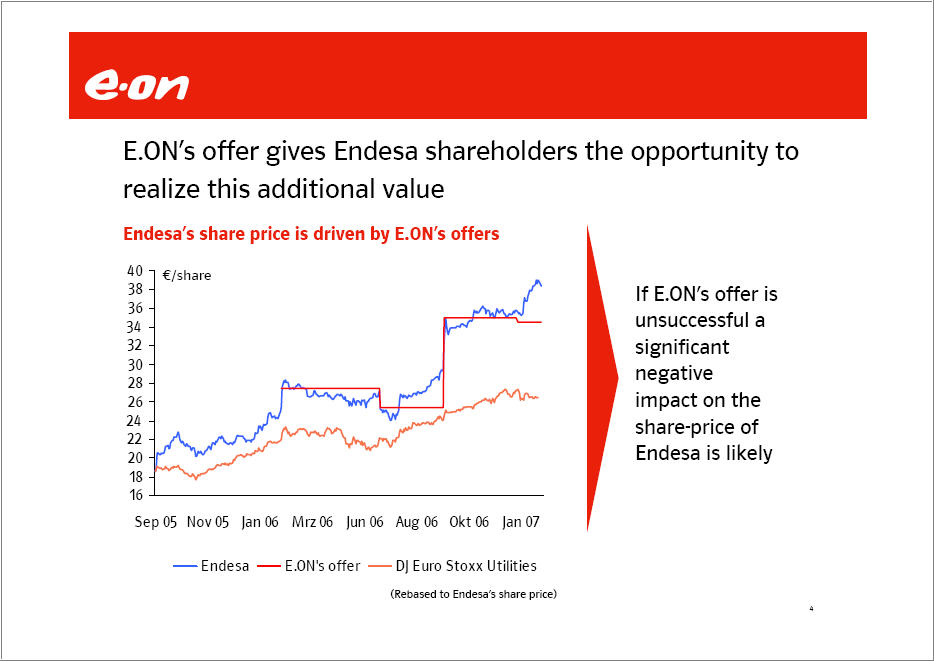

E.ON’s offer gives Endesa shareholders the opportunity to realize this additional value Endesa’s share price is driven by E.ON's offers 40 E/share 38 36 34 32 30 28 26 24 22 20 18 16 Sep 05 Nov 05 Jan 06 Mrz 06 Jun 06 Aug 06 Okt 06 Jan 07 Endesa E.ON’s offer DJ Euro Stoxx Utilities (Rebased to Endesa’s share price) If E.ON’s offer is unsuccessful a significant negative impact on the share-price of Endesa is likely

The combination of E.ON and Endesa creates significant strategic and financial value 1. Creates the world's leading power and gas player with a unique position regarding global scale, portfolio balance, and growth potential 2. Strong presence in all European markets offers an excellent platform to drive further market integration 3. Combination meets E.ON's strict financial criteria, creates superior financial value for shareholders and enhances the efficiency of E.ON's capital structure

E.ON will acquire a great company with excellent management and businesses Endesa’s market presence Leading energy company in Iberia1 Strong positions in European energy markets Leading energy company in Latin America 1 Including leading positions on the Spanish Islands Endesa's key strengths Excellent market positions in Spain, Southern Europe, and Latin America represent a superior platform for further growth Excellent management capabilities across the value chain and markets High commitment to deliver value as demonstrated in past 18 month and confirmed by ambitious target setting High commitment to the development of the Spanish energy market for the benefit of its customers

Together, we will have a unique position regarding global scale, portfolio balance, and growth potential Global scale Europe1 327 TWh power generation 515 TWh power sales 931 TWh gas sales 41 million customers2 The Americas1 94 TWh power generation 93 TWh power sales 13 million customers E.ON Endesa 1 2005 figures 2 Majority controlled customers 3 Adjusted EBITDA for E.ON, EBITDA for Endesa 4 Generation mix (TWh) as of ‘04 Source: Endesa presentations and reports, E.ON Diversified earnings3 EBITDA Central Europe 32% Iberia 20% UK 9% Nordic 7% Italy/France 5% European Gas 12% Latin America 11% US 4% Diversified generation4 TWh Coal 40% Nuclear 25% Hydro16% Gas/Oil 17% Other 1%

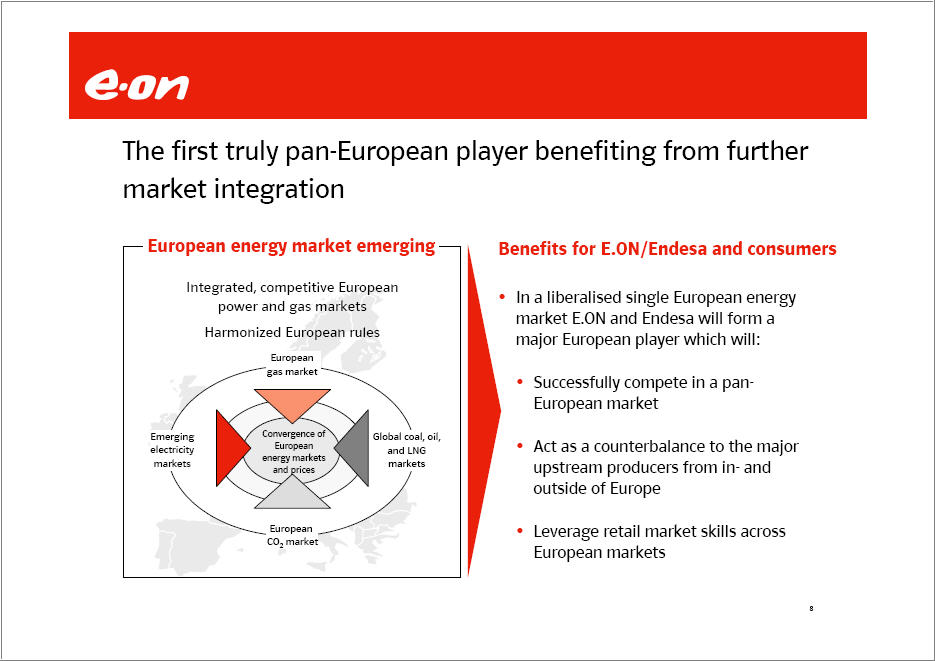

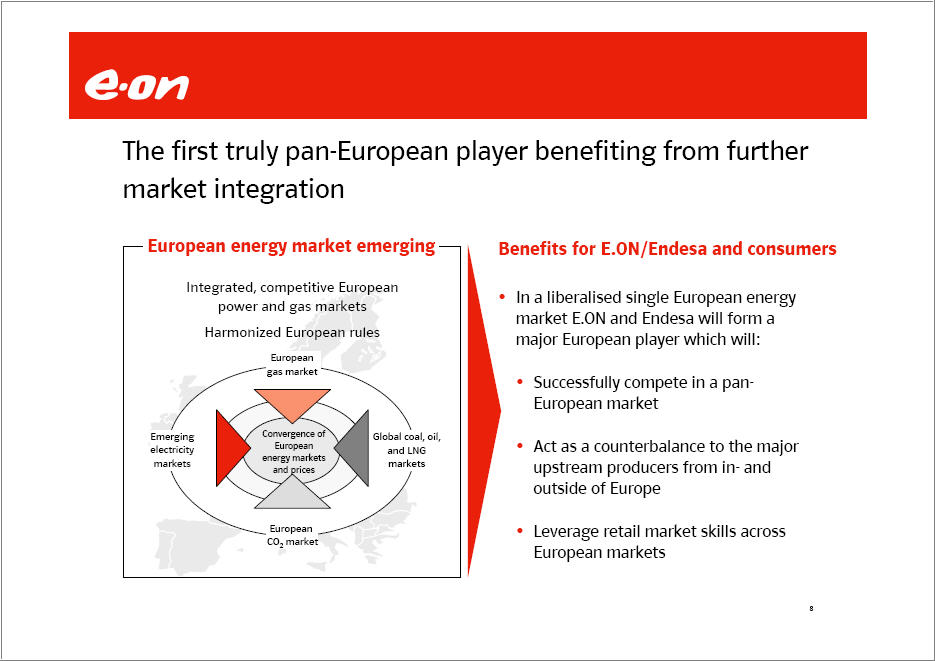

The first truly pan-European player benefiting from further market integration European energy market emerging Integrated, competitive European power and gas markets Harmonized European rules European gas market Emerging electricity markets Convergence of European energy markets and prices Global coal, oil, and LNG markets European CO2 market Benefits for E.ON/Endesa and consumers In a liberalised single European energy market E.ON and Endesa will form a major European player which will: Successfully compete in a pan-European market Act as a counterbalance to the major upstream producers from in- and outside of Europe Leverage retail market skills across European markets

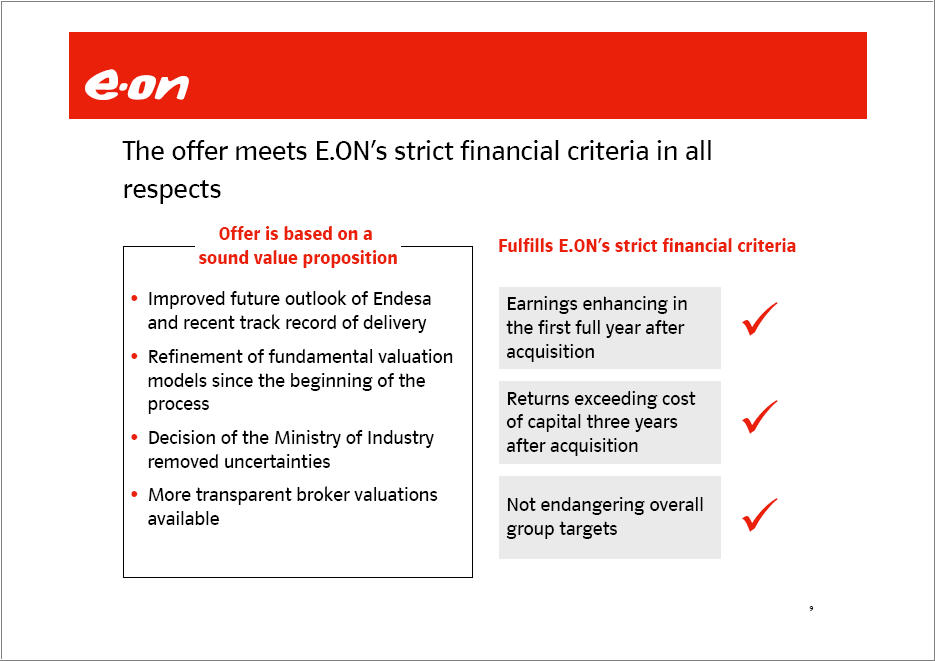

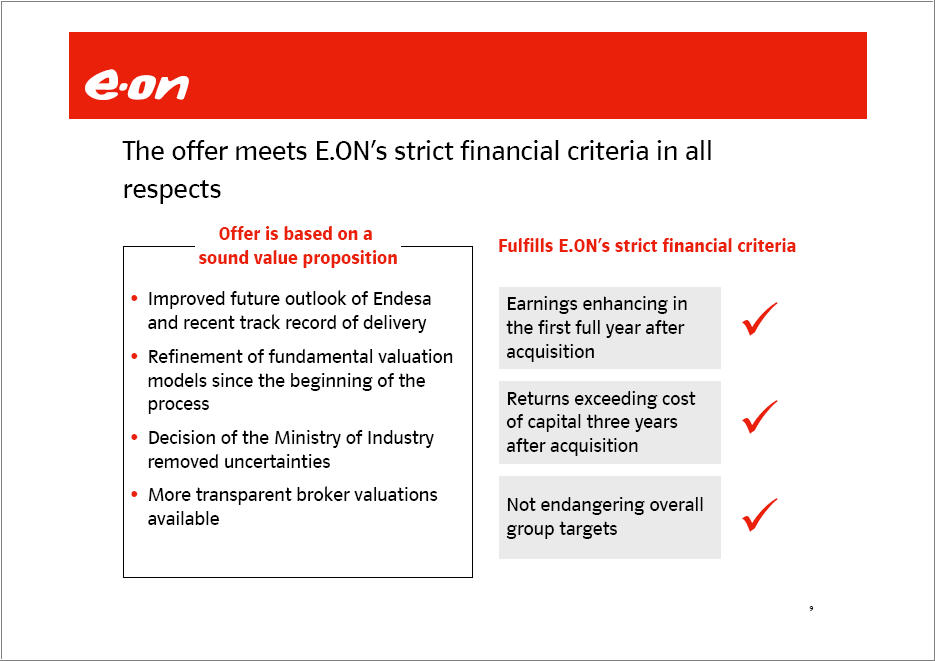

The offer meets E.ON’s strict financial criteria in all respects Offer is based on a sound value proposition Improved future outlook of Endesa and recent track record of delivery Refinement of fundamental valuation acquisition models since the beginning of the process Decision of the Ministry of Industry removed uncertainties More transparent broker valuations available Fulfills E.ON’s strict financial criteria Earnings enhancing in the first full year after acquisition Returns exceeding cost of capital three years after acquisition Not endangering overall group targets

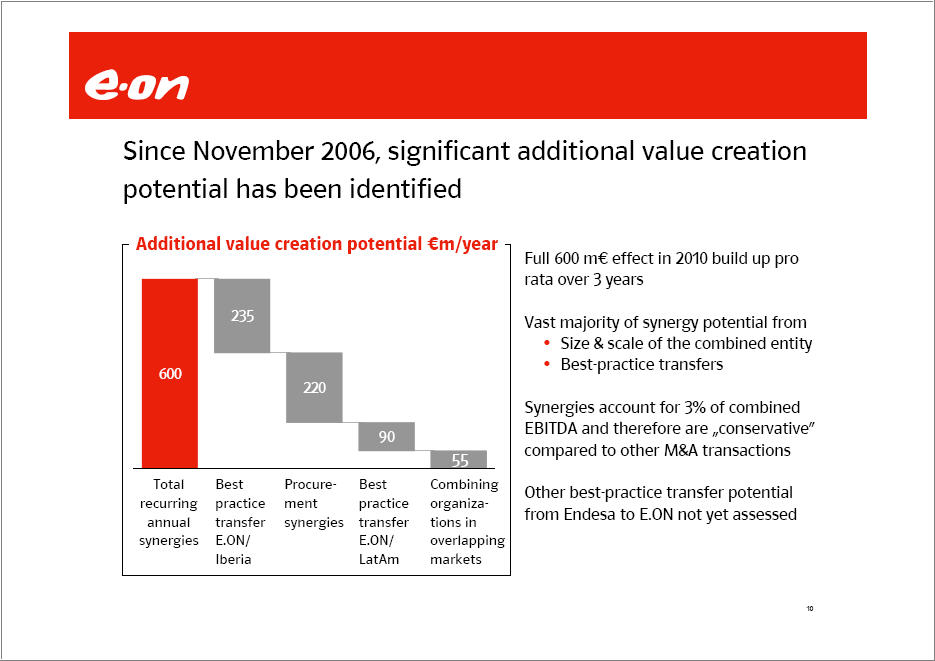

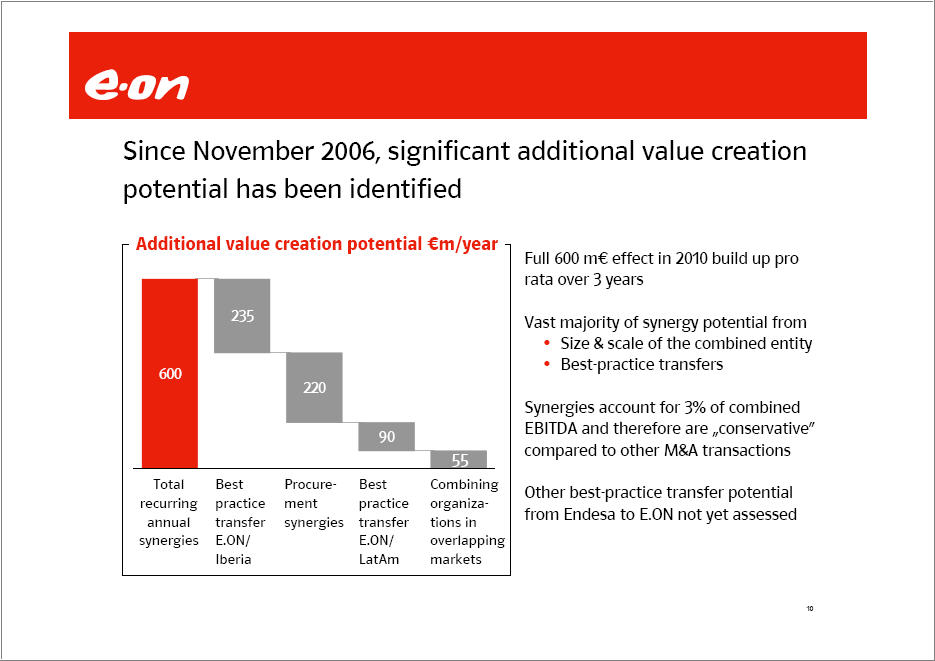

Since November 2006, significant additional value creation potential has been identified Additional value creation potential €m/year 600 Total recurring annual synergies 235 Best practice transfer E.ON/Iberia 220 Procurement synergies 90 Best practice transfer E.ON/LatAm 55 Combining organizations in overlapping markets Full 600 m€ effect in 2010 build up pro rata over 3 years Vast majority of synergy potential from Size & scale of the combined entity Best-practice transfers Synergies account for 3% of combined EBITDA and therefore are “conservative” compared to other M&A transactions Other best-practice transfer potential from Endesa to E.ON not yet assessed

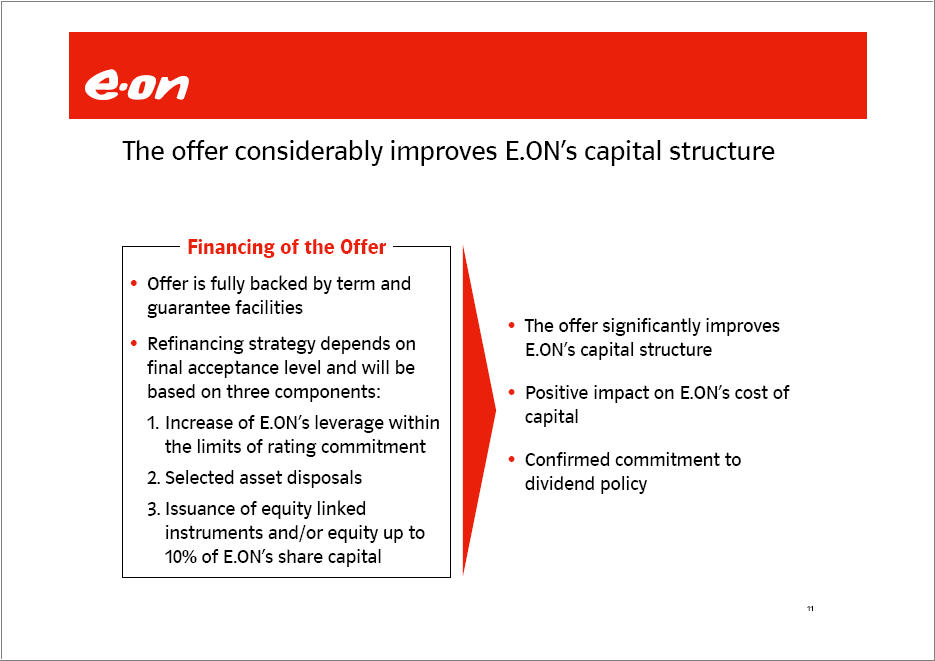

The offer considerably improves E.ON's capital structure Financing of the Offer Offer is fully backed by term and guarantee facilities Refinancing strategy depends on final acceptance level and will be based on three components: 1. Increase of E.ON’s leverage within the limits of rating commitment 2. Selected asset disposals 3. Issuance of equity linked instruments and/or equity up to 10% of E.ON's share capital The offer significantly improves E.ON's capital structure Positive impact on E.ON's cost of capital Confirmed commitment to dividend policy

E.ON is committed to secure Spanish identity and integrity of Endesa to the benefit of all stakeholders Endesa Will benefit from being part of the leading global power and gas group while retaining its distinct Spanish identity Integrity of Endesa assets and employees Full commitment to Endesa’s investment program Spanish market Improves competitive position of leading Spanish player Facilities greater interconnection Commitment to the volumes foreseen in the National Plan of Coal Mining Spanish consumers Commitment to Spanish security of supply and to higher quality of service to Spanish consumers Improved supply security by leveraging customer base vis-à-vis upstream companies Increased competition in Spanish power and gas market

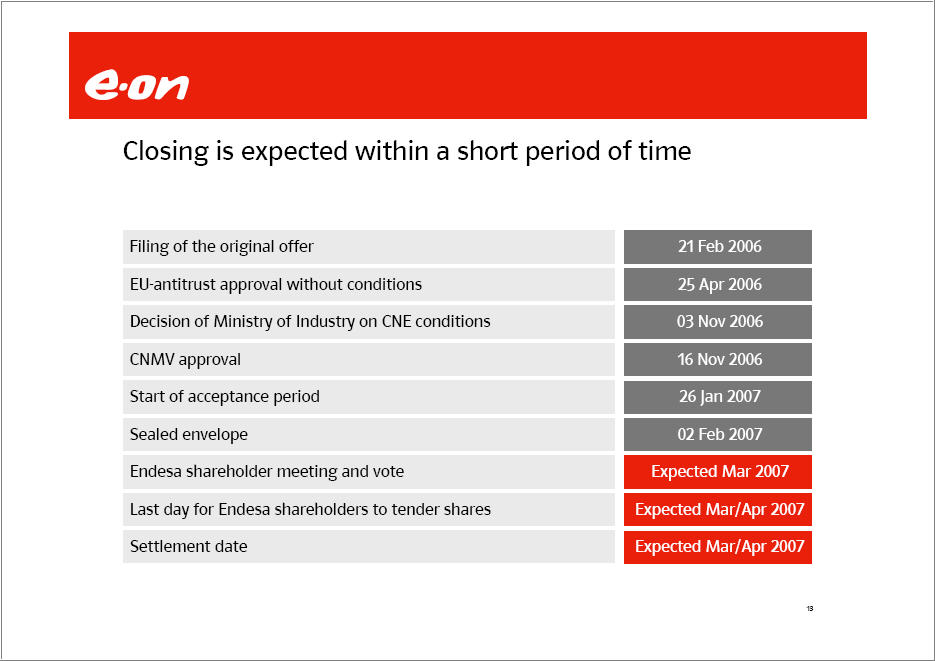

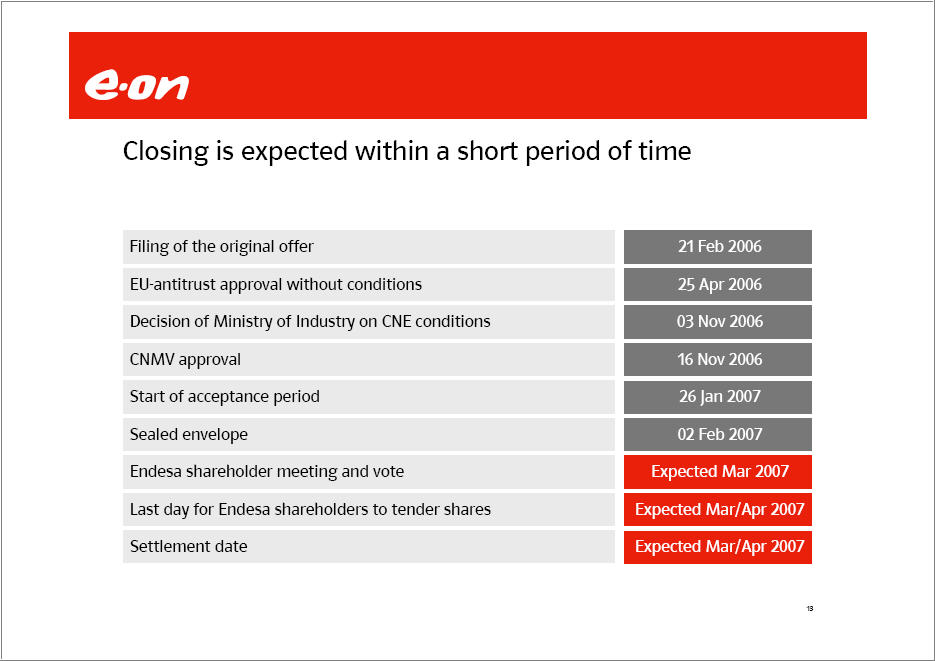

Closing is expected within a short period of time Filing of the original offer 21 Feb 2006 EU-antitrust approval without conditions 25 Apr 2006 Decision of Ministry of Industry on CNE conditions 03 Nov 2006 CNMV approval 16 Nov 2006 Start of acceptance period 26 Jan 2007 Sealed envelope 02 Feb 2007 Endesa shareholder meeting and vote Expected Mar 2007 Last day for Endesa shareholders to tender shares Expected Mar/Apr 2007 Settlement date Expected Mar/Apr 2007

“E.ON and Endesa create the world's leading power and gas company”

On January 26, 2007, E.ON Aktiengesellschaft ("E.ON"), through its wholly owned subsidiary E.ON Zwölfte Verwaltungs GmbH, filed a tender offer statement on Schedule TO regarding its tender offer for ordinary shares and ADSs of Endesa S.A. ("Endesa") with the U.S. Securities and Exchange Commission ("SEC"). Endesa investors and security holders are urged to read the U.S. tender offer statement (as updated and amended), because it contains important information. Furthermore, Endesa investors and security holders are urged to read the Spanish prospectus from E.ON regarding the Spanish tender offer for Endesa because it contains important information. The Spanish prospectus and certain complementary documentation were authorized in Spain by the Spanish Comisión Nacional del Mercado de Valores (the "CNMV"). Investors and security holders may obtain a free copy of the Spanish prospectus and its complementary documentation from E.ON, Endesa, the four Spanish Stock Exchanges, Santander Investment Bolsa SV SA, Santander Investment SA, Corredores de Bolsa, and elsewhere. The Spanish prospectus is also available on the web sites of the CNMV (www.cnmv.es), E.ON (www.eon.com), and elsewhere. Likewise, Endesa investors and security holders may obtain a free copy of the U.S. tender offer statement and other documents filed by E.ON with the SEC on the SEC's web site at www.sec.gov. The U.S. tender offer statement and these other documents may also be obtained for free from E.ON by directing a request to E.ON AG, External Communications, Tel.: 0211- 45 79 - 4 53.

These materials may contain forward-looking statements. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of E.ON and Endesa and the estimates given here. These factors include the inability to obtain necessary regulatory approvals or to obtain them on acceptable terms; the inability to integrate successfully Endesa within the E.ON Group or to realize synergies from such integration; costs related to the acquisition of Endesa; the economic environment of the industries in which E.ON and Endesa operate; and other risk factors discussed in E.ON's public reports filed with the Frankfurt Stock Exchange and with the SEC (including E.ON's Annual Report on Form 20-F) and in Endesa's public reports filed with the CNMV and with the SEC (including Endesa's Annual Report on Form 20-F). E.ON assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.

These materials may contain references to certain financial measures (including forward-looking measures) that are not calculated in accordance with U.S. GAAP and are therefore considered "non-GAAP financial measures" within the meaning of the U.S. federal securities laws. E.ON presents a reconciliation of these non-GAAP financial measures to the most comparable U.S. GAAP measure or target, either in this document, in its Annual Report, in its interim report or on its website at www.eon.com. Management believes that the non-GAAP financial measures used by E.ON, when considered in conjunction with (but not in lieu of) other measures that are computed in U.S. GAAP, enhance an understanding of E.ON's results of operations. A number of these non-GAAP financial measures are also commonly used by securities analysts, credit rating agencies, and investors to evaluate and compare the periodic and future operating performance and value of E.ON and other companies with which E.ON competes. These non-GAAP financial measures should not be considered in isolation as a measure of E.ON's profitability or liquidity, and should be considered in addition to, rather than as a substitute for, net income, cash flow provided by operating activities, and the other income or cash flow data prepared in accordance with U.S. GAAP. The non-GAAP financial measures used by E.ON may differ from, and not be comparable to, similarly titled measures used by other companies. |