FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of March, 2006

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

1 Energy Sector Environment 2 Excellent Results 2005 3 Shareholder Return 4 Takeover Bids 5 Endesa: stronger business, greater value

Energy Sector Environment

Macroeconomic Environment Europe Deregulation of the energy market Growing integration of wholesale markets Concern for security of supply High fuel and CO2 prices Latin America Currency stability Economic recovery Change of the energy matrix

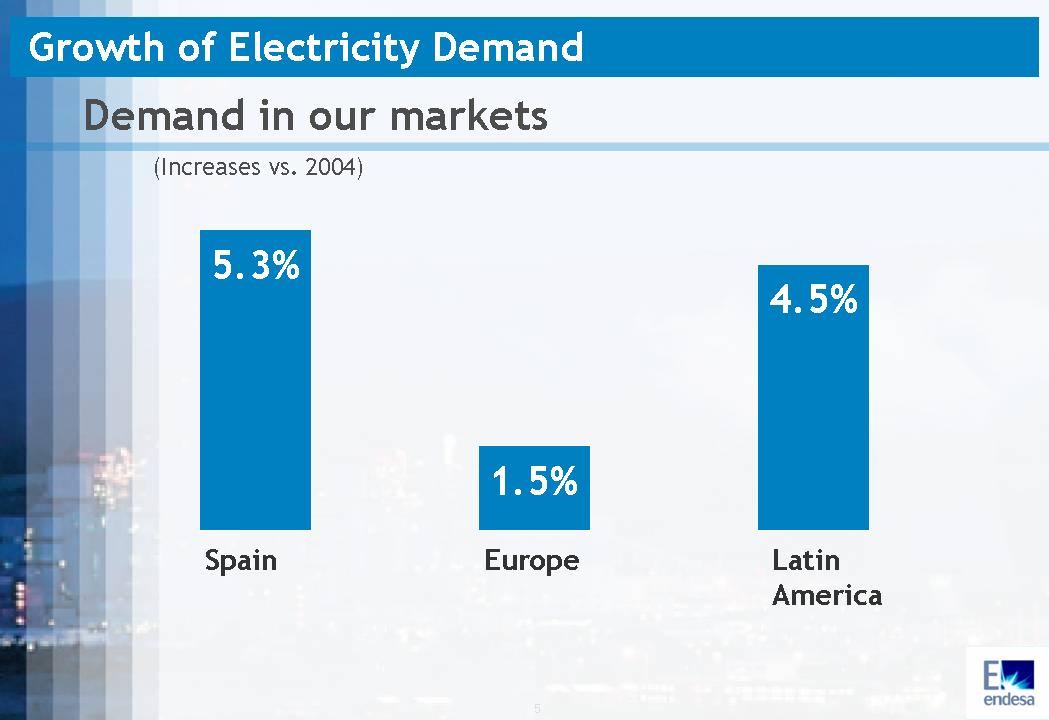

Growth of Electricity Demand Demand in our markets (Increases vs. 2004) Spain 5.3% Europe 1.5% Latin America 4.5%

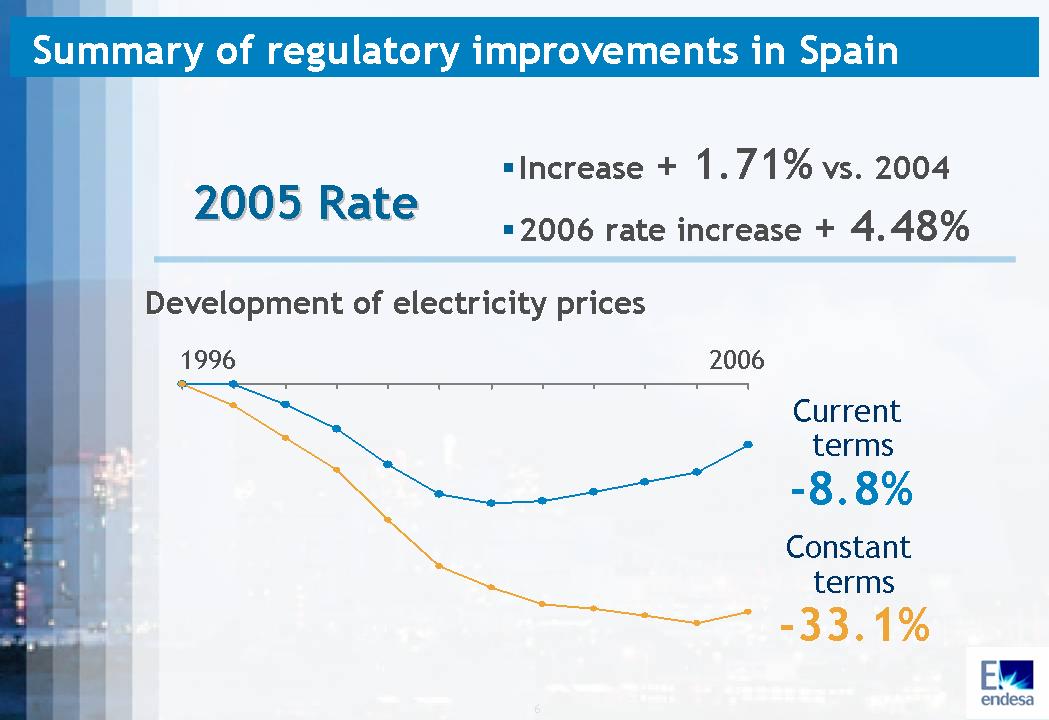

Summary of regulatory improvements in Spain 2005 Rate Increase + 1.71% vs. 2004 2006 rate increase + 4.48% Development of electricity prices 1996 2006 Current terms -8.8%Constant terms -33.1%

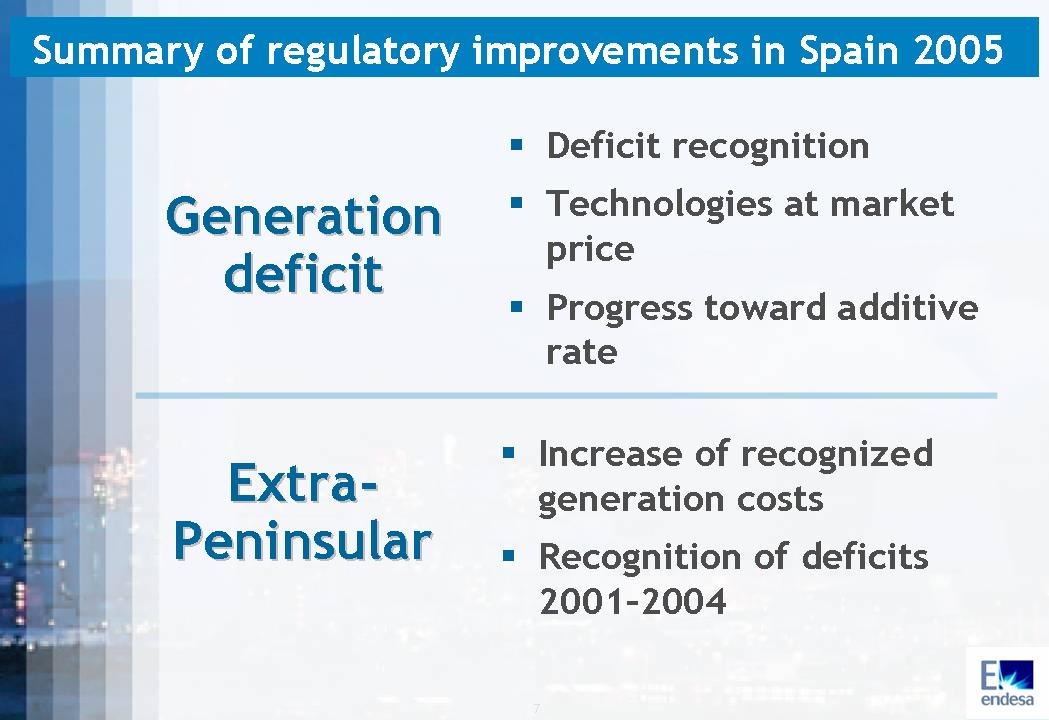

Summary of regulatory improvements in Spain 2005 Generation deficit Deficit recognition Technologies at market price Progress toward additive rate Extra- Peninsular Increase of recognized generation costs Recognition of deficits 2001–2004

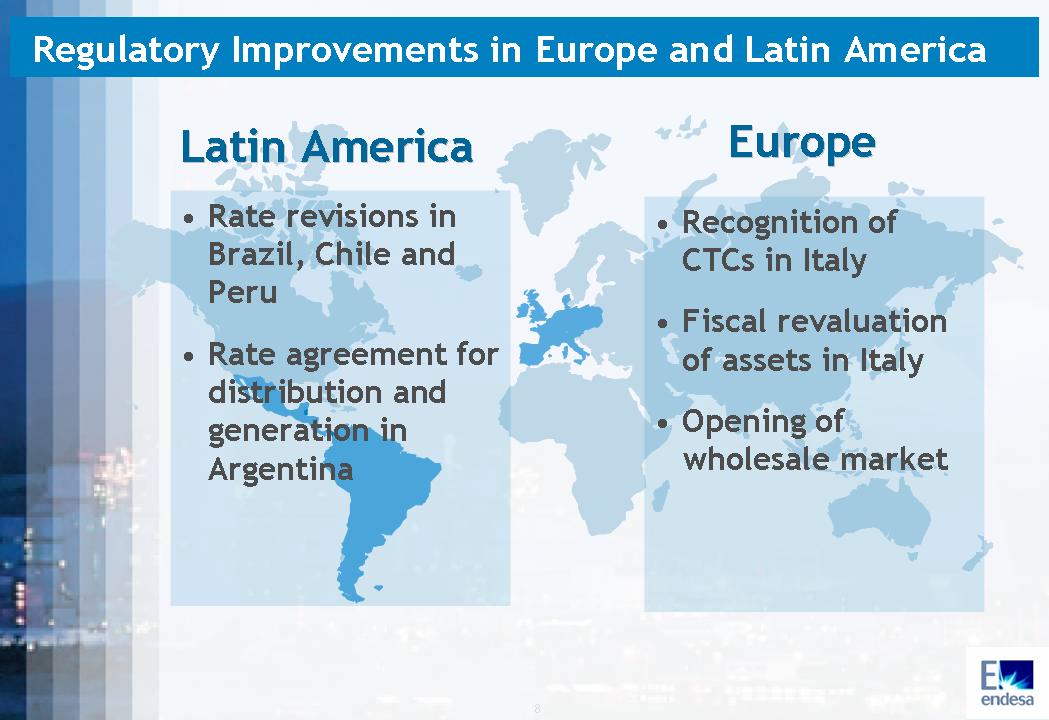

Regulatory Improvements in Europe and Latin America Latin America Rate revisions in Brazil, Chile and Peru Rate agreement for distribution and generation in Argentina Europe Recognition of CTCs in Italy Fiscal revaluation of assets in Italy Opening of wholesale market

Excellent Results in 2005

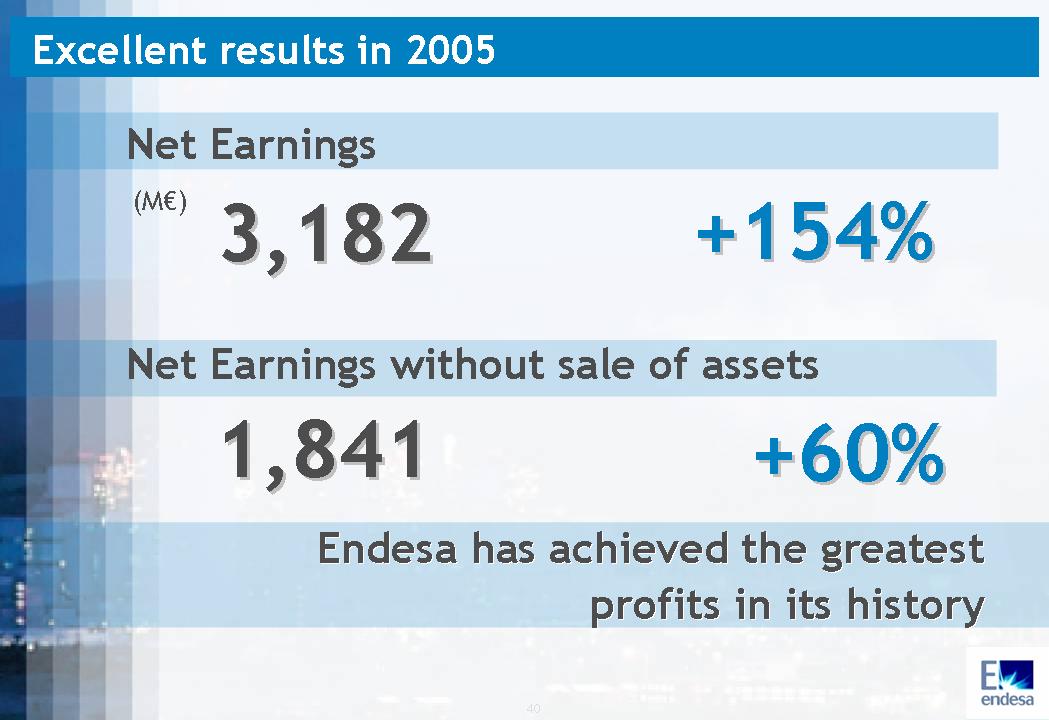

Endesa has achieved the greatest profits in its history (M€) 2004 2005 Variation Sales 13,509 17,508 +30% Net Profit without sales of assets 1,149 1,841 +60% Net Profit 1,253 3,182 +154% Dividends 782 2,541 +225%

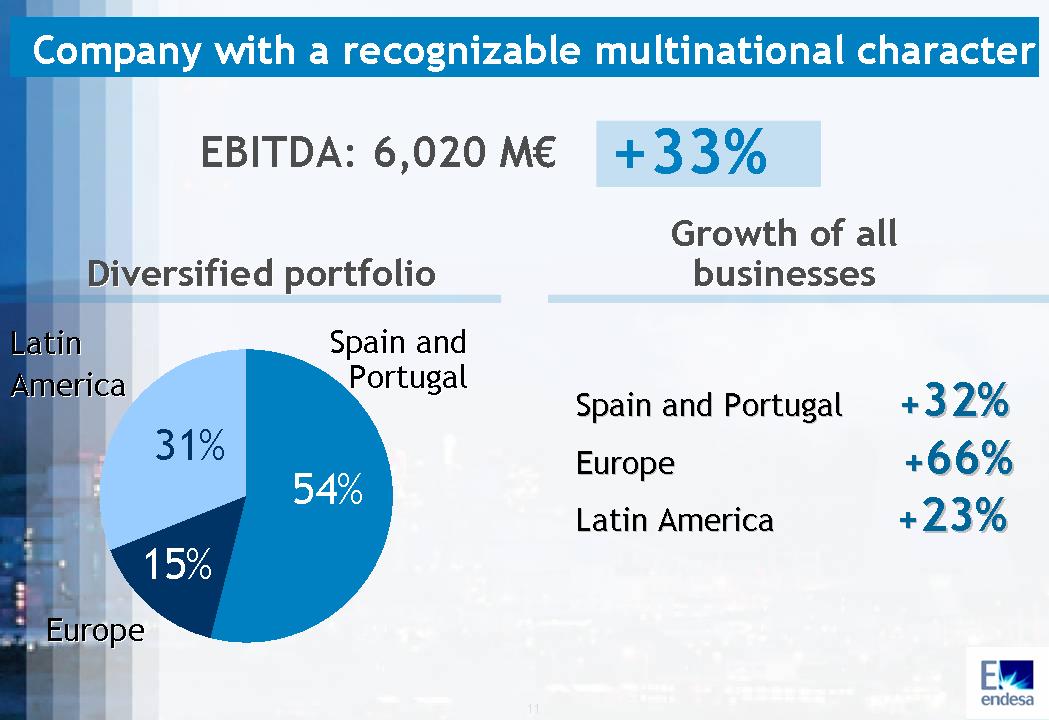

Company with a recognizable multinational character EBITDA: 6,020 M€ +33%Diversified portfolio Latin America 31% Spain and Portugal 54% Europe 15% Growth of all businesses Spain and Portugal +32% Europe +66% Latin America +23%

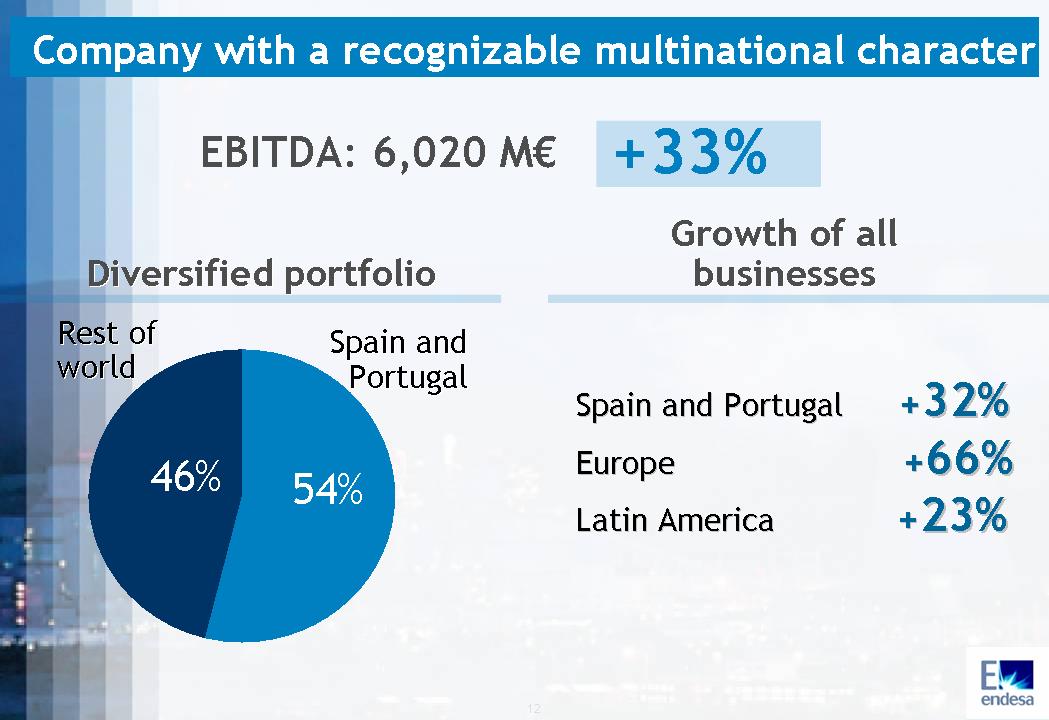

Company with a recognizable multinational character EBITDA: 6,020 M€ +33%Diversified portfolio Rest of world 46% Spain and portugal 54% Growth of all businesses Spain and Portugal +32% Europe +66% Latin America +23%

Spain and Portugal

Endesa has achieved the greatest profits in its history Spain and Portugal Excellent Results Strengths

(M€) 2004 2005 Variation

Sales 6,648 8,761 +32%

EBITDA 2,472 3,266 +32%

Net Profit 888 1,358 +53%

Excellent Results in 2005 Spain and Portugal Excellent results Strengths

Net Profit (M€)

888 2004

1,358 2005 +53%

Increase in activity Containment of operating costs Competitive cost of fuel

Endesa is a leader in the national market Spain and Portugal Excellent results Strengths No.1 in Spain 22,400 MW Sales: 101 TWh12 million customers Balanced generation mix Generation-sales balance

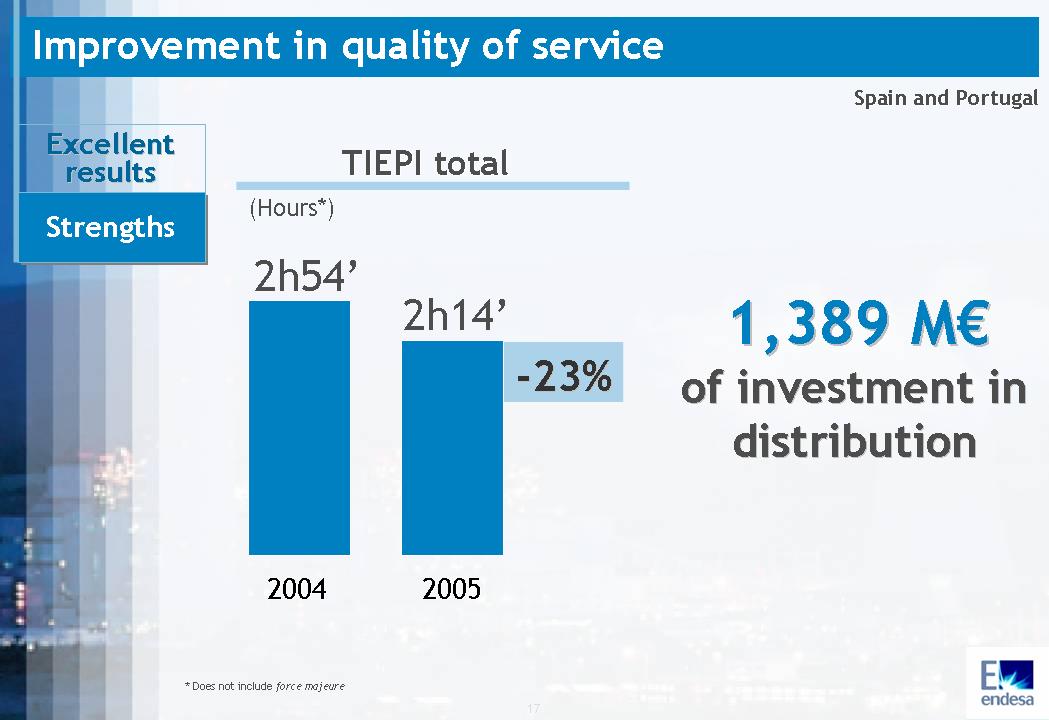

Improvement in quality of service Spain and Portugal Excellent results Strengths

TIEPI total

(Hours*)

2h54’ 2004

2h14’ 2005 -23%

* Does not include force majeure

1,389 M€ of investment in distribution

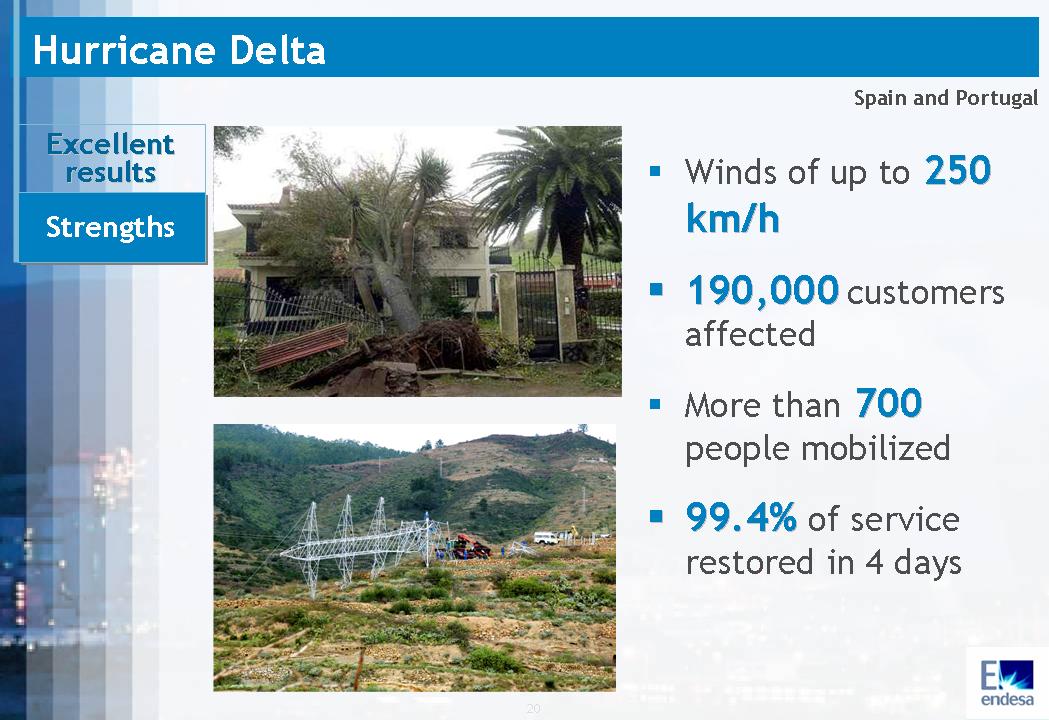

Hurricane Delta Spain and Portugal Excellent results Strengths

Hurricane Delta Spain and Portugal Excellent results Strengths

Hurricane Delta Spain and Portugal Excellent results Strengths Winds of up to 250 km/h 190,000 customers affected More than 700 people mobilized 99.4% of service restored in 4 days

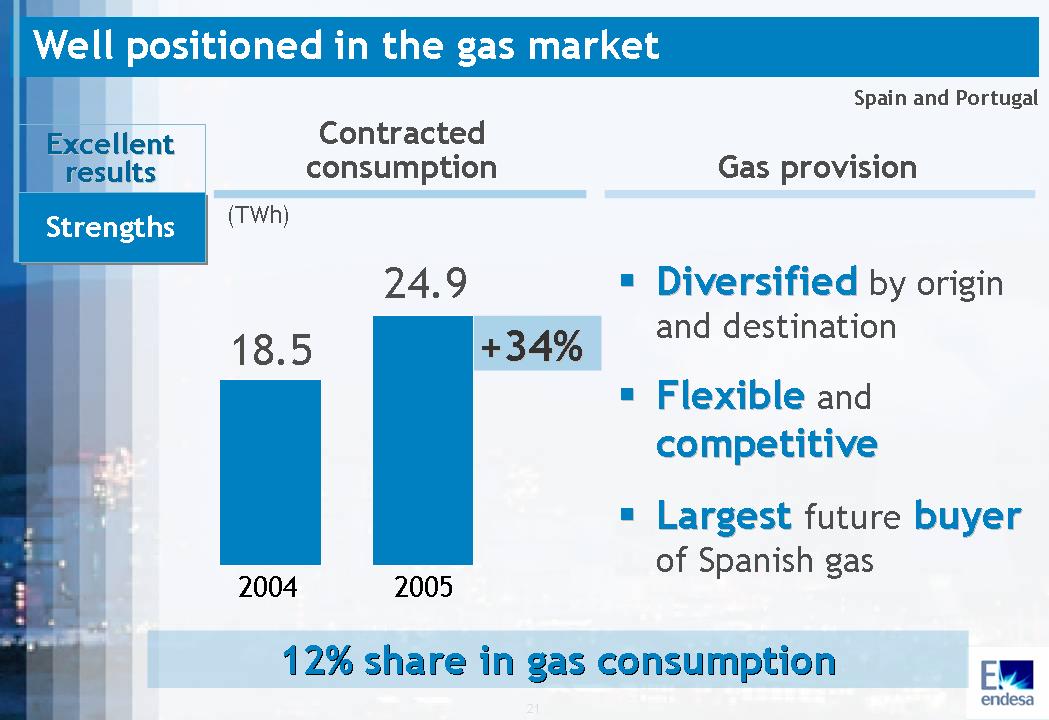

Well positioned in the gas market Spain and Portugal Excellent results Strengths Contracted consumption (TWh)

18.5 2004

24.9 2005 +34%

Gas provision Diversified by origin and destination Flexible and competitive Largest future buyer of Spanish gas 12% share in gas consumption

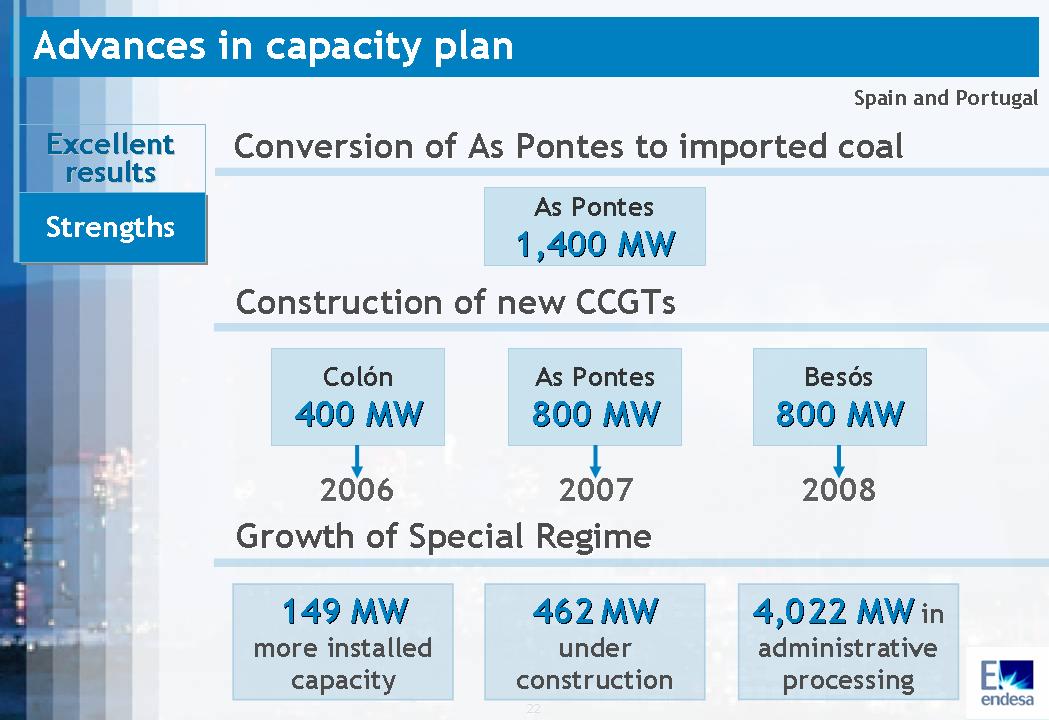

Advances in capacity plan Spain and Portugal Excellent results Strengths Conversion of As Pontes to imported coal As Pontes 1,400 MW Construction of new CCGTs Colón 400 MW 2006 As Pontes 800 MW 2007 Besós 800 MW 2008 Growth of Special Regime 149 MW more installed capacity 462 MW under construction 4,022 MW in administrative processing

Europe

Endesa has achieved the greatest profits in its history Europe Excellent results Strengths

(M€) 2004 2005 Variation

Sales 2,557 3,598 +41%

EBITDA 535 887 +66%

Net Profit 169 425 +151%

Excellent Results in the European Business Europe Excellent Results

Strengths Net Profit (M€)

169 2004

425 2005 +151%

In Italy:

Strong increase in activity and improvement of unit margin

Fiscal revaluation of assets Operational improvements in France

Endesa: a great leader in the European market Europe Excellent results StrengthsItaly

Endesa: a great leader in the European market Europe Excellent results Strengths France Italy No. 3 in Italy 6,590 MW

Endesa: a great leader in the European market Europe Excellent results Strengths

Poland France No. 3 in France 2,477 MW

Italy No. 3 in Italy 6,590 MW

Endesa: a great leader in the European market Europe Excellent results Strengths Poland 330 MW Dolna Odra Agreement France No. 3 in France 2,477 MW Italy No. 3 in Italy 6,590 MW 9,400 MW Sales 47 TWh

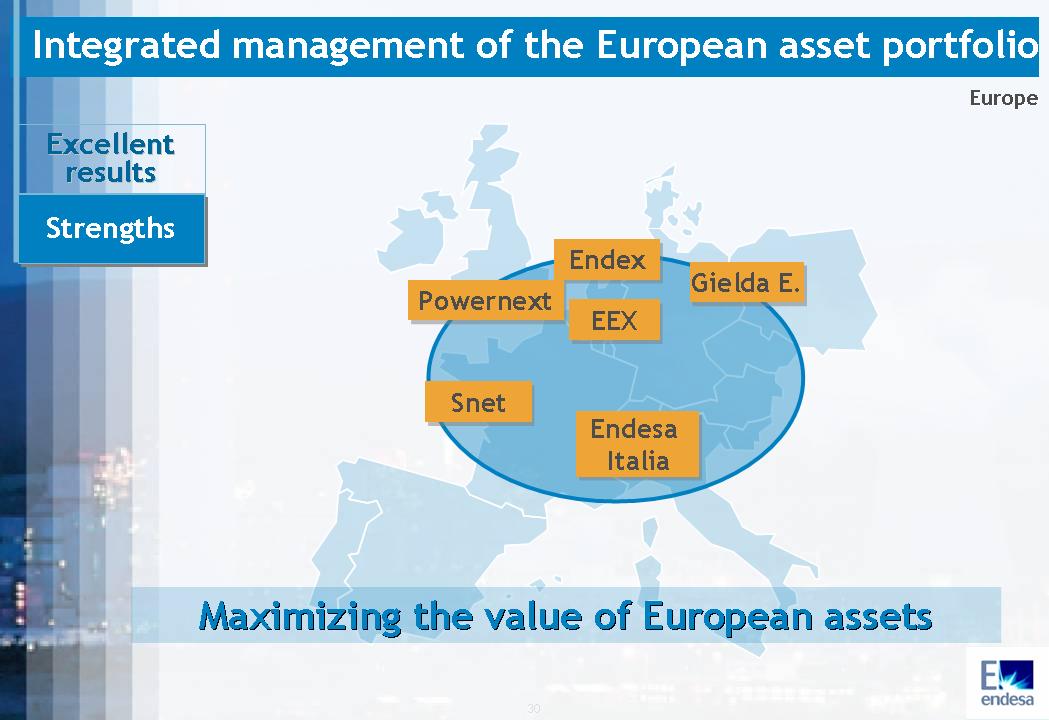

Integrated management of the European asset portfolio Europe Excellent results Strengths

Endex Powernext Gielda E. EEX Snet Endesa Italia

Maximizing the value of European assets

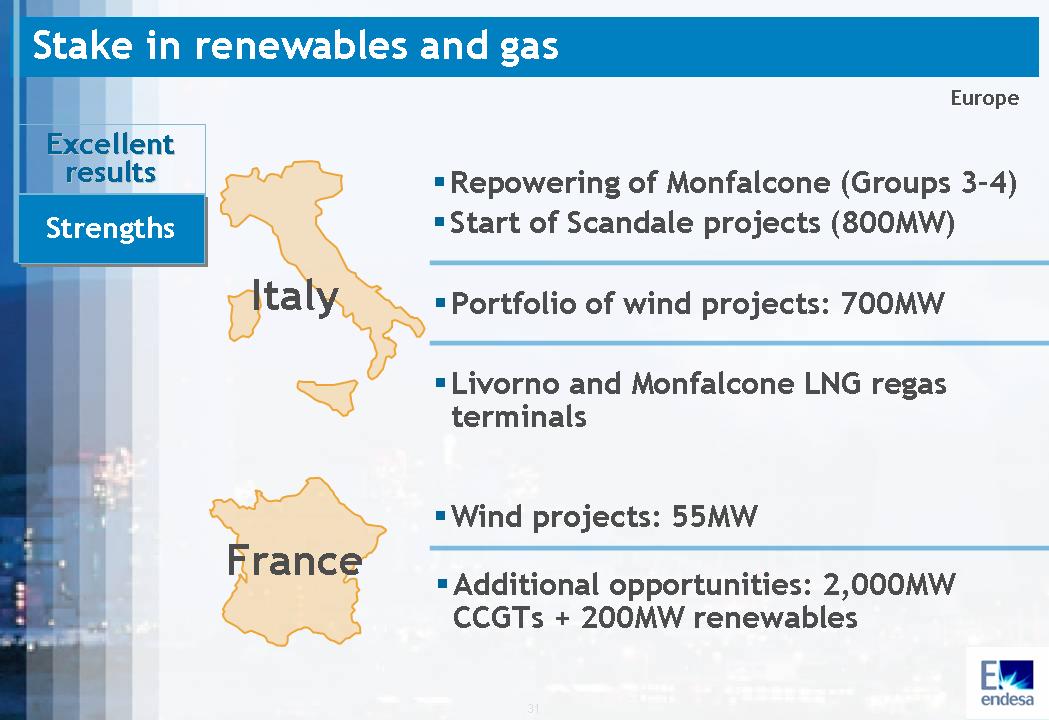

Stake in renewables and gas Europe Excellent results Strengths

Italy

Repowering of Monfalcone (Groups 3–4) Start of Scandale projects (800MW) Portfolio of wind projects: 700MW

Livorno and Monfalcone LNG regas terminals

France

Wind projects: 55MW Additional opportunities: 2,000MW CCGTs + 200MW renewables

Endesa: among the five largest European electric companies Europe Excellent results Strengths

Spain and Portugal Italy United Kingdom Central Europe

Endesa EDF E.ON ENEL RWE

Latin America

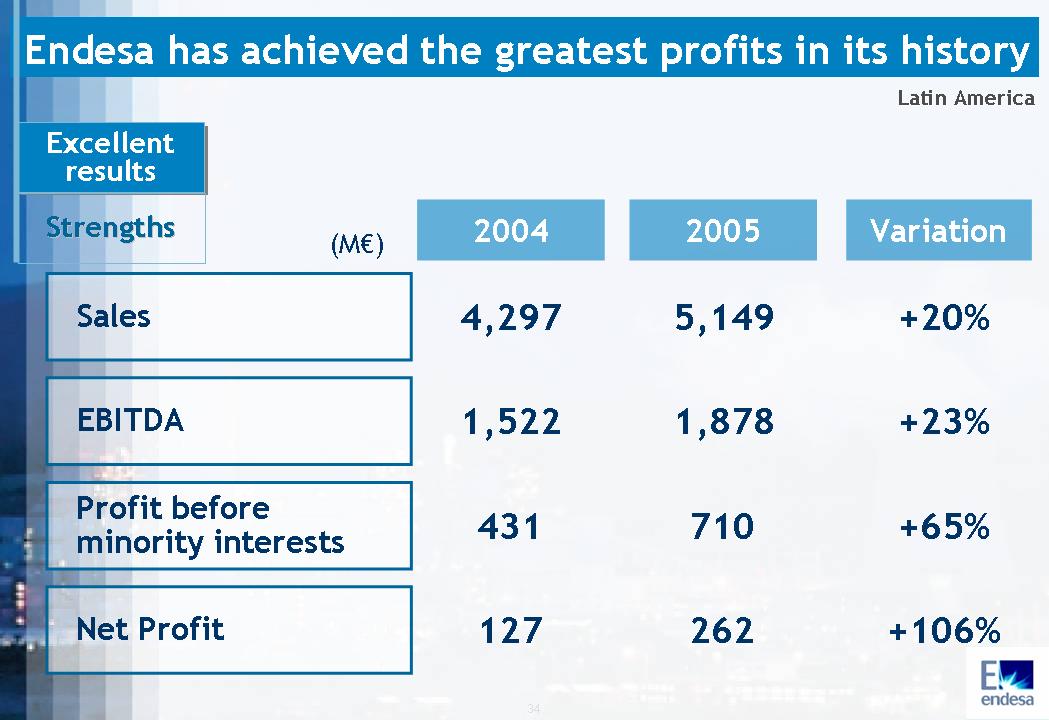

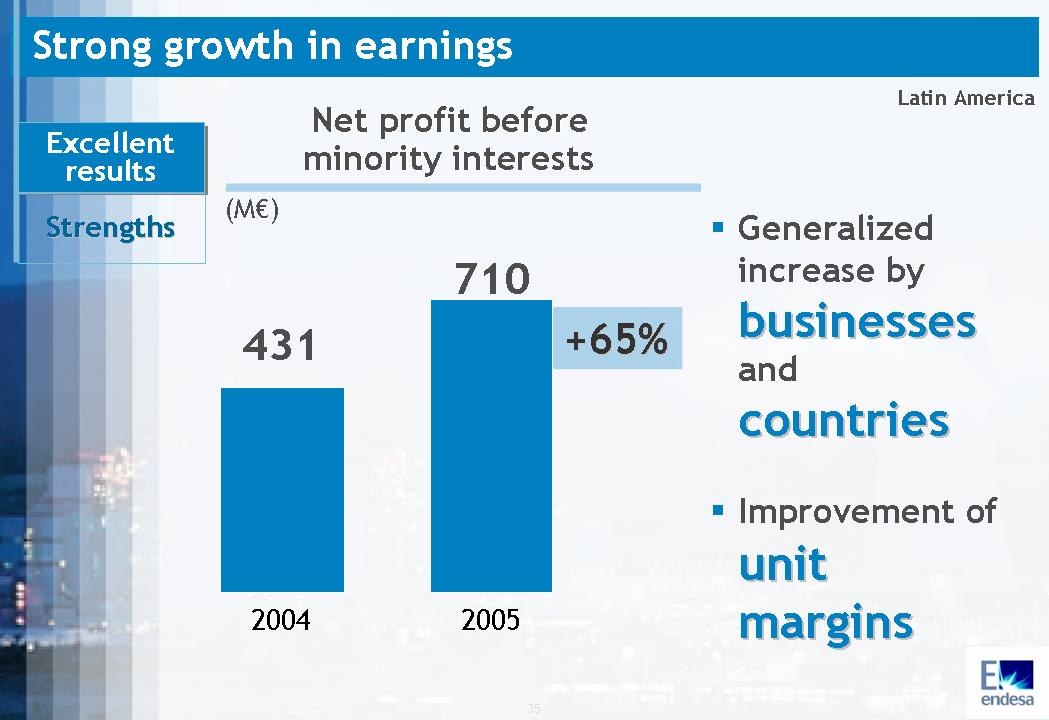

Endesa has achieved the greatest profits in its history Latin America Excellent results Strengths

(M€) 2004 2005 Variation

Sales 4,297 5,149 +20%

EBITDA 1,522 1,878 +23%

Profit before minority interests 431 710 +65%

Net Profit 127 262 +106%

Strong growth in earnings Latin America Excellent results Strengths

Net profit before minority interests (M€) 431

2004 710

2005 +65%

Generalized increase by businesses and countries Improvement of unit margins

Improvement of returns for the matrix Latin America Excellent results Strengths

(M USD) 2004 2005

Dividends and interest received 46 86

Capital reductions 221 195(1)

Disinvestments 8 27(2)

Total 275 308(3)

1 Includes Elesur payments for 41 M USD

2 Sale of CEPM for 24 M USD and repurchase of EEB shares for 3 M USD

3 Does not include the tax credit received for 104 M USD in 2005

Good stock market performance Latin America Excellent results Strengths Endesa Chile +55.1% Enersis +18.7%

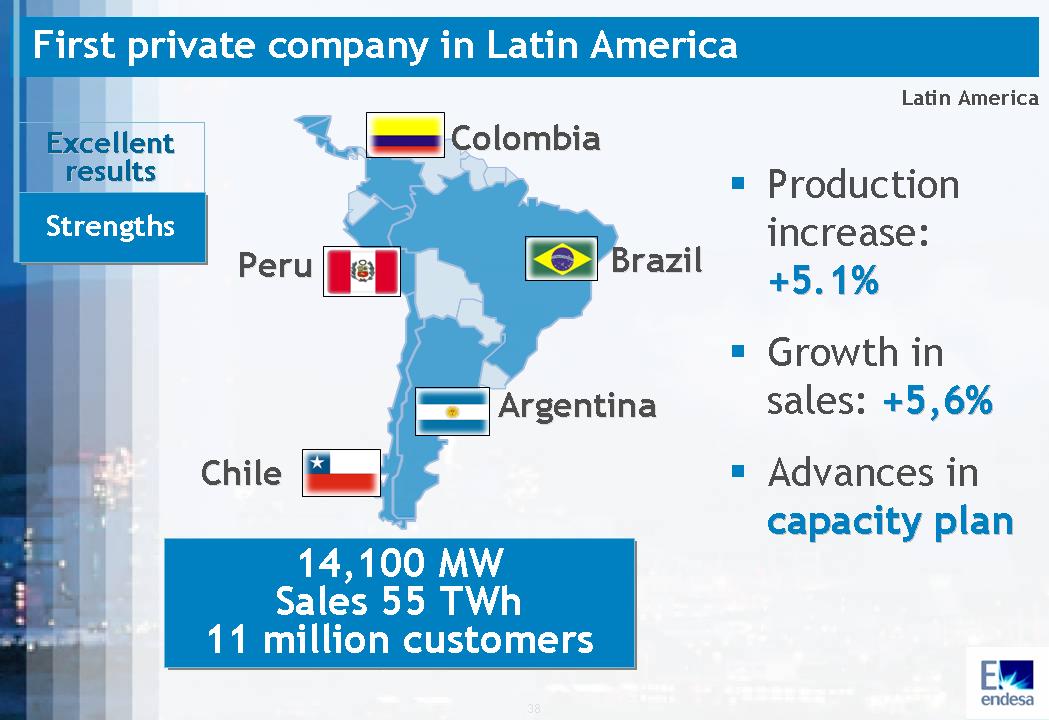

First private company in Latin America Latin America Excellent results Strengths Colombia Peru Brazil Argentina Chile 14,100 MW Sales 55 TWh 11 million customers Production increase: +5.1% Growth in sales: +5,6% Advances in capacity plan

Shareholder Return

Excellent results in 2005 Net Earnings (M€) 3,182 +154%Net Earnings without sale of assets 1,841 +60%Endesa has achieved the greatest profits in its history

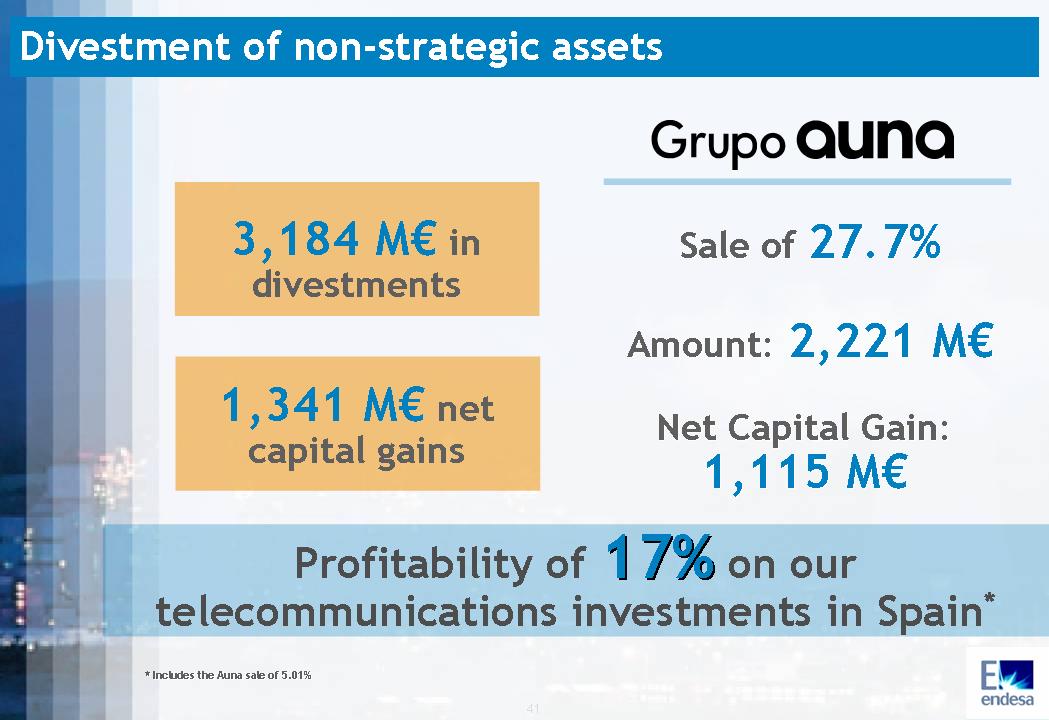

Divestment of non-strategic assets Grupo Auna 3,184 M€ in divestments 1,341 M€ net capital gains Sale of 27.7% Amount: 2,221 M€ Net Capital Gain: 1,115 M€ Profitability of 17% on our telecommunications investments in Spain* * Includes the Auna sale of 5.01%

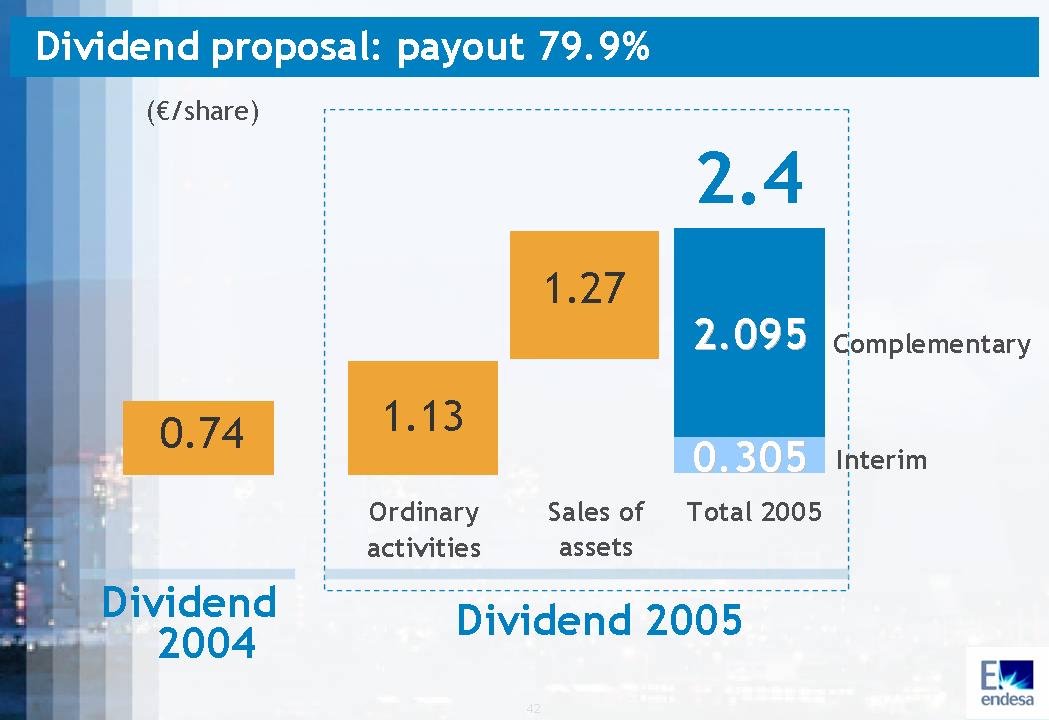

Dividend proposal: payout 79.9% (€/share)

0.74 Dividend 2004

1.13 Ordinary activities

1.27 Sales of assets

2.4 2.095 Complementary 0.305

Interim Total 2005 Dividend 2005

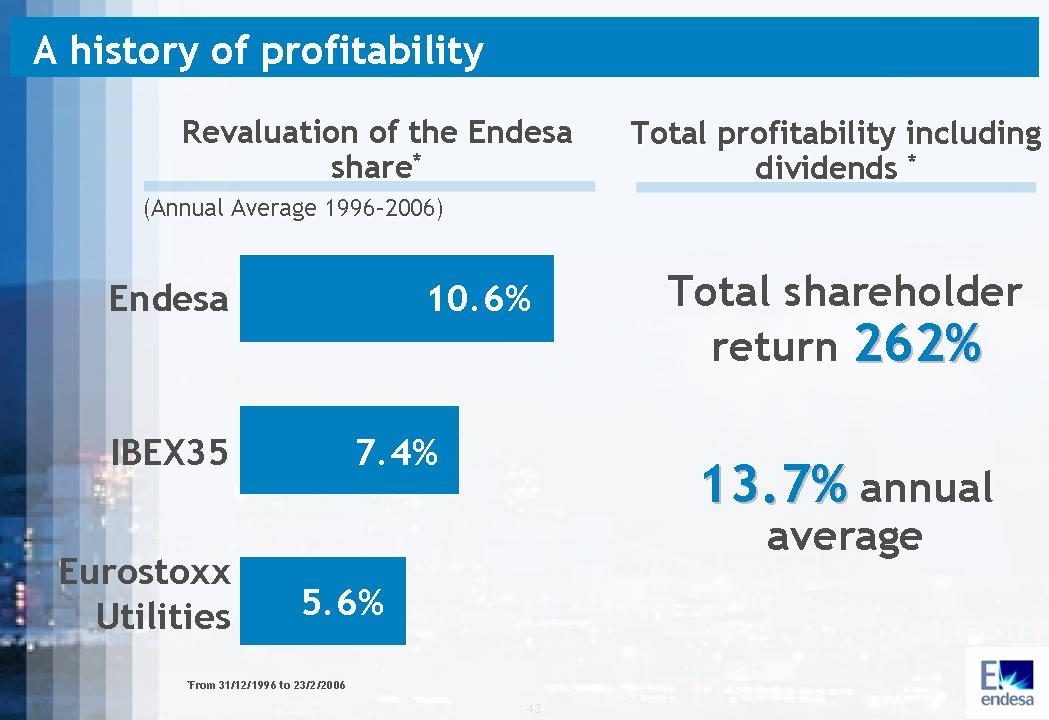

A history of profitability Revaluation of the Endesa share* (Annual Average 1996–2006)

Endesa 10.6% IBEX35 7.4% 5.6% Eurostoxx Utilities 5.6% Total profitability including dividends * Total shareholder return 262% 13.7% annual average *From 31/12/1996 to 23/2/2006

Takeover Bids

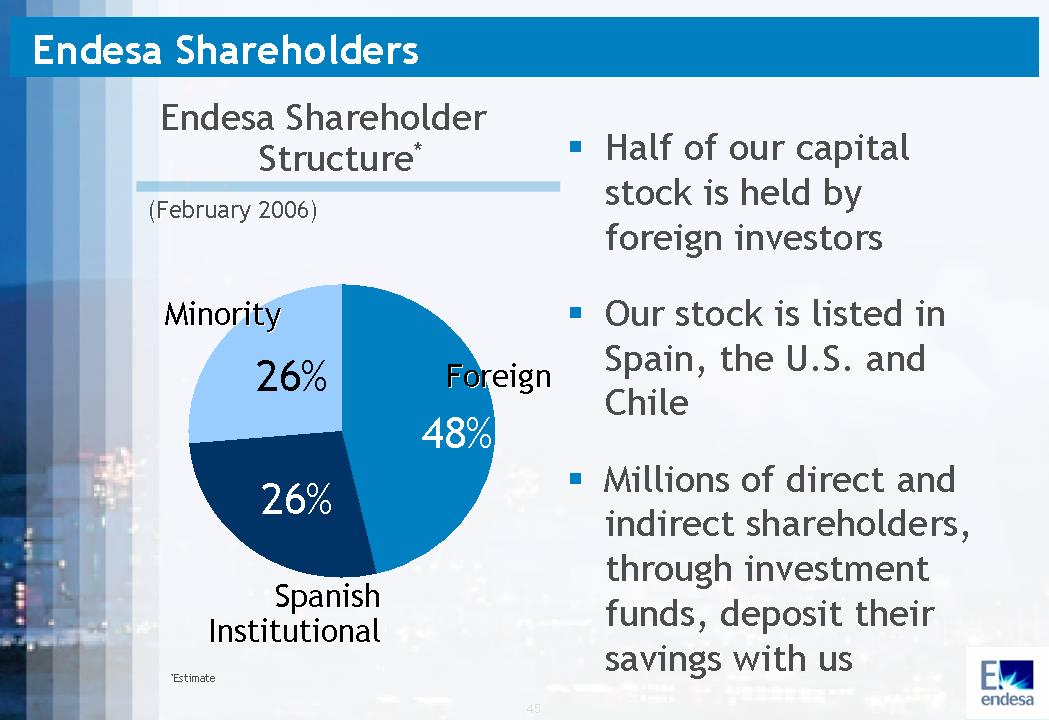

Endesa Shareholders Endesa Shareholder Structure* (February 2006) Minority 26% Foreign 48% Spanish Institutional 26% Half of our capital stock is held by foreign investors Our stock is listed in Spain, the U.S. and Chile Millions of direct and indirect shareholders, through investment funds, deposit their savings with us *Estimate

Endesa’s Action Objective of Endesa’s Board of Directors and Management Team: To defend the interests of shareholders To defend the company’s value To defend the business project

Description of the Gas Natural Bid

Terms

Takeover bid on 100% of the capital

For each Endesa share 7.34 €/share + 0.569 Gas Natural shares

21.3 Euros per share as of 2 September 2005

Total Equity: 22,500 M€

Conditions

Acceptance of 75% of Endesa’s capital

Amendment of the bylaws

Preliminary Evaluation of the Gas Natural Bid

Bid proposed in a hostile manner

Insufficient price

Inadequate method of payment

Industrial project that destroys value

No commitment to shareholders

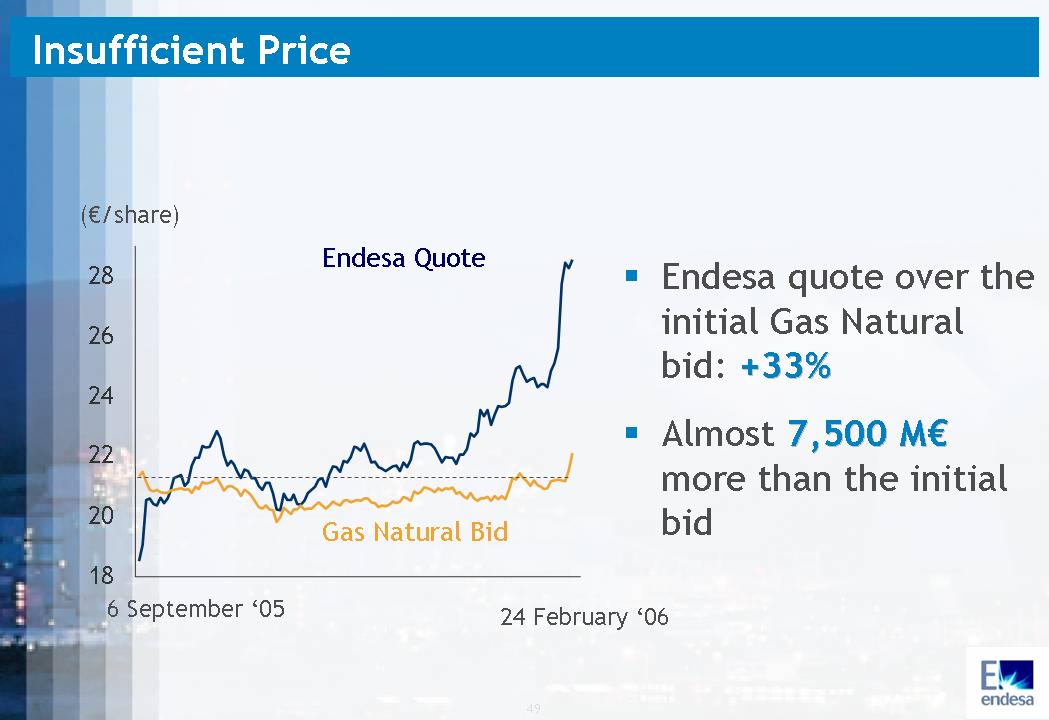

Insufficient Price (€/share) Endesa Quote Gas Natural Bid

6 September ‘05 24 February ‘06

Endesa quote over the initial Gas Natural bid: +33%

Almost 7,500 M€ more than the initial bid

Inadequate Method of Payment

2/3 in shares of Gas Natural Legal Action

Need to clarify all the regulatory and jurisdictional uncertainties that may affect the action of the merged company in the future so that shareholders can make a decision with the best information possible

Endesa is already a global leader Enterprise Value (MM€)

EDF 125 E.On 92 RWE 75 Suez 62 Endesa 57 Enel 57 Gas Natural 14

EBITDA 2005 (M€)

EDF 13,010 E.On 10,300 RWE 8,324 Enel 8,075 Suez 6,274 Endesa 6,020 Gas Natural 1,538

NOTE: Enterprise Value as of 22 February 2006; EBITDA 2005 IBES except companies with publication of results

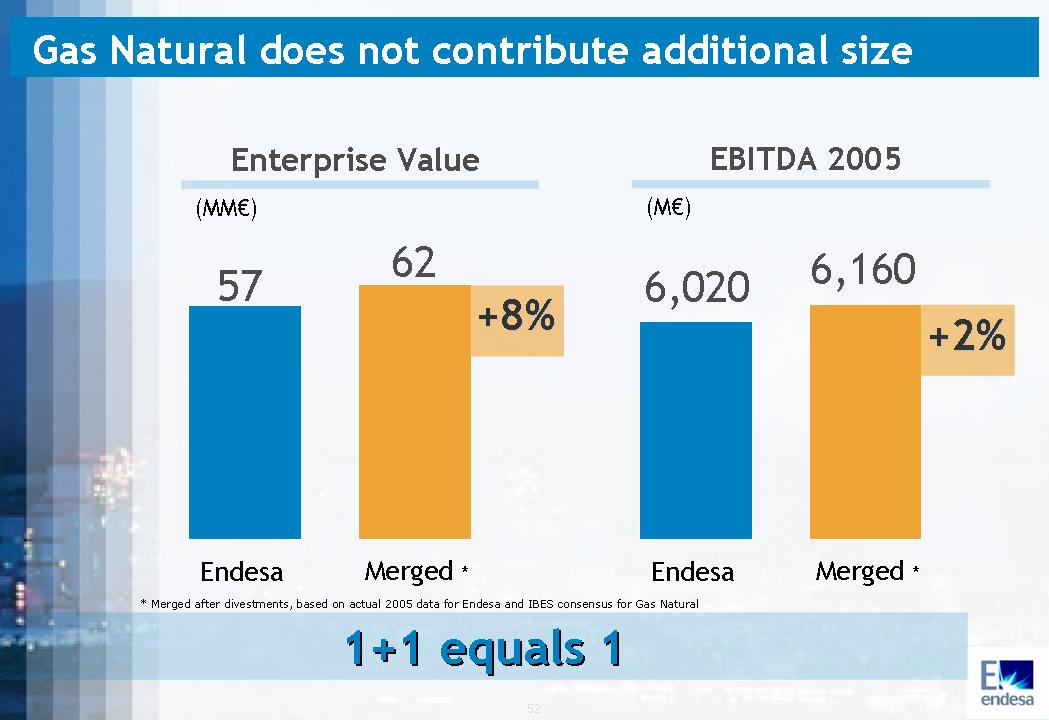

Gas Natural does not contribute additional size Enterprise Value (MM€)

57 Endesa

62 Merged * +8%

EBITDA 2005 (M€)

6,020 Endesa

6,160 Merged * +2%

* Merged after divestments, based on actual 2005 data for Endesa and IBES consensus for Gas Natural 1+1 equals 1

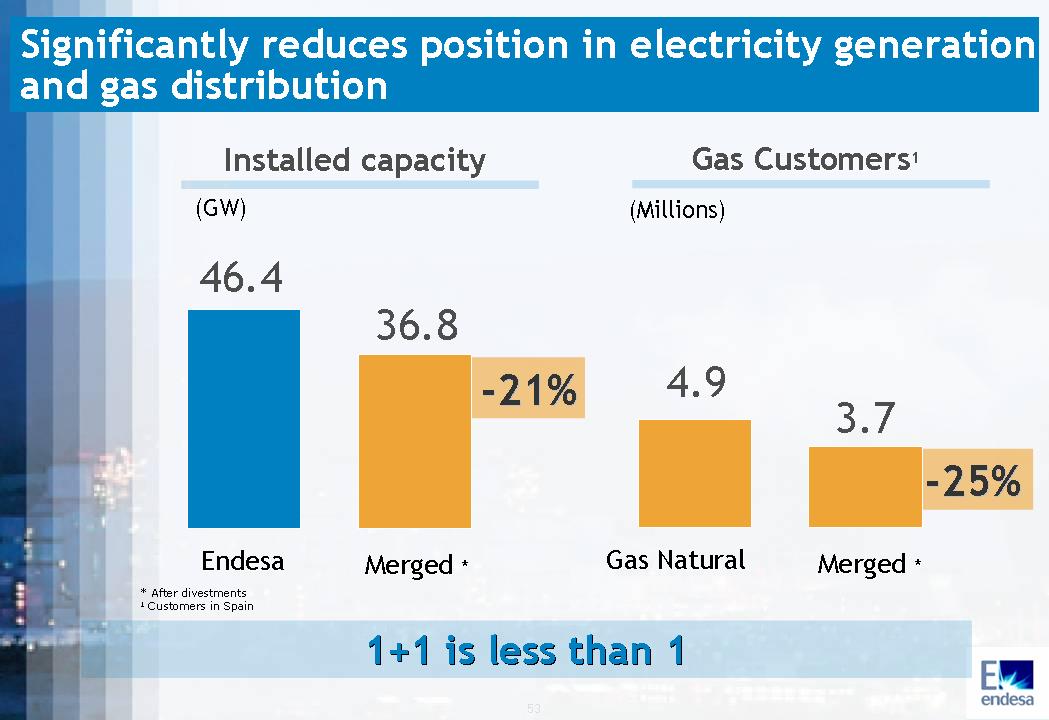

Significantly reduces position in electricity generation and gas distribution Installed capacity (GW)

46.4 Endesa 36.8 Merged * -21% Gas Customers1 (Millions) 4.9 Gas Natural 3.7 Merged * -25% * After divestments 1 Customers in Spain 1+1 is less than 1

Handing Over of Leadership in Spain to the Principal Competitor

Peninsular Production Share*

Other 30% 34%

Iberdrola 27% 36%

Gas Natural 4%

Endesa 39% 30%

Pre-operation Post-operation

*Ordinary System 2005

The agreement does not maximize the value of the assets, favoring Iberdrola shareholders

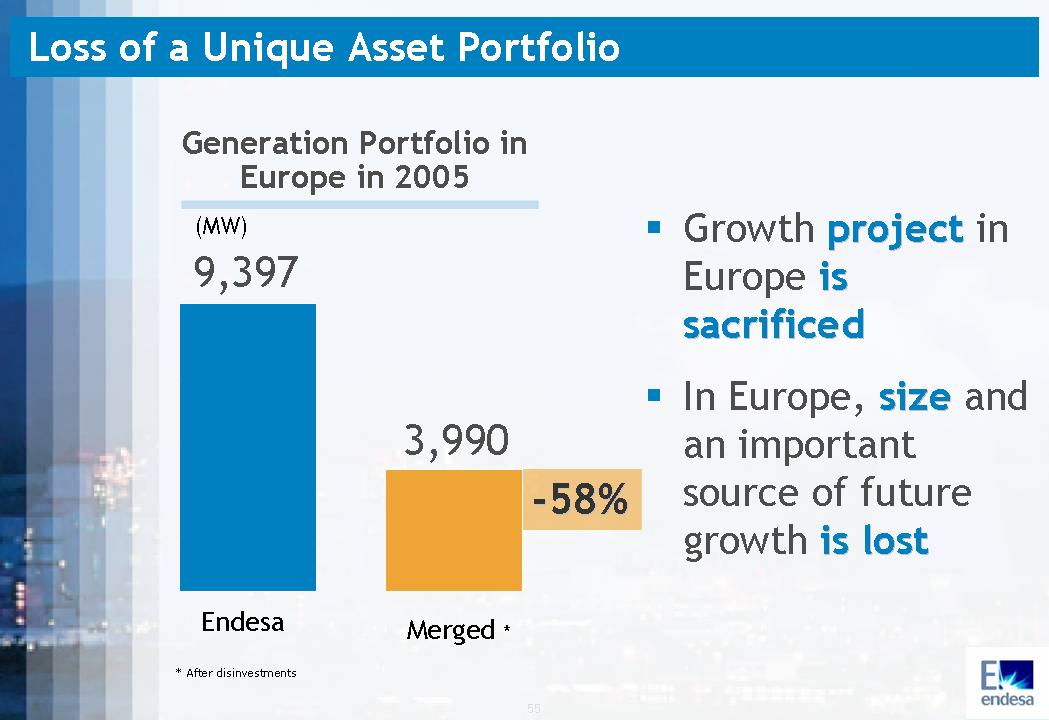

Loss of a Unique Asset Portfolio Generation Portfolio in Europe in 2005 (MW)

9,397 Endesa

3,990 Merged * -58%

Growth project in Europe is sacrificed In Europe, size and an important source of future growth is lost

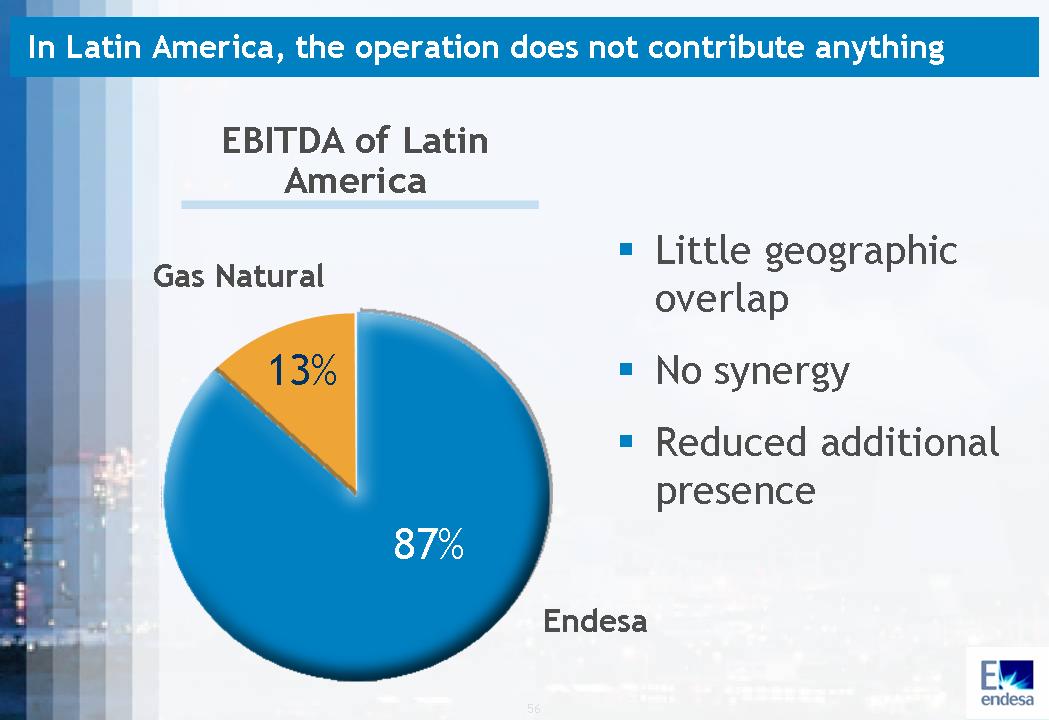

In Latin America, the operation does not contribute anything

EBITDA of Latin America

Gas Natural 13%

Endesa 87%

Little geographic overlap No synergy Reduced additional presence

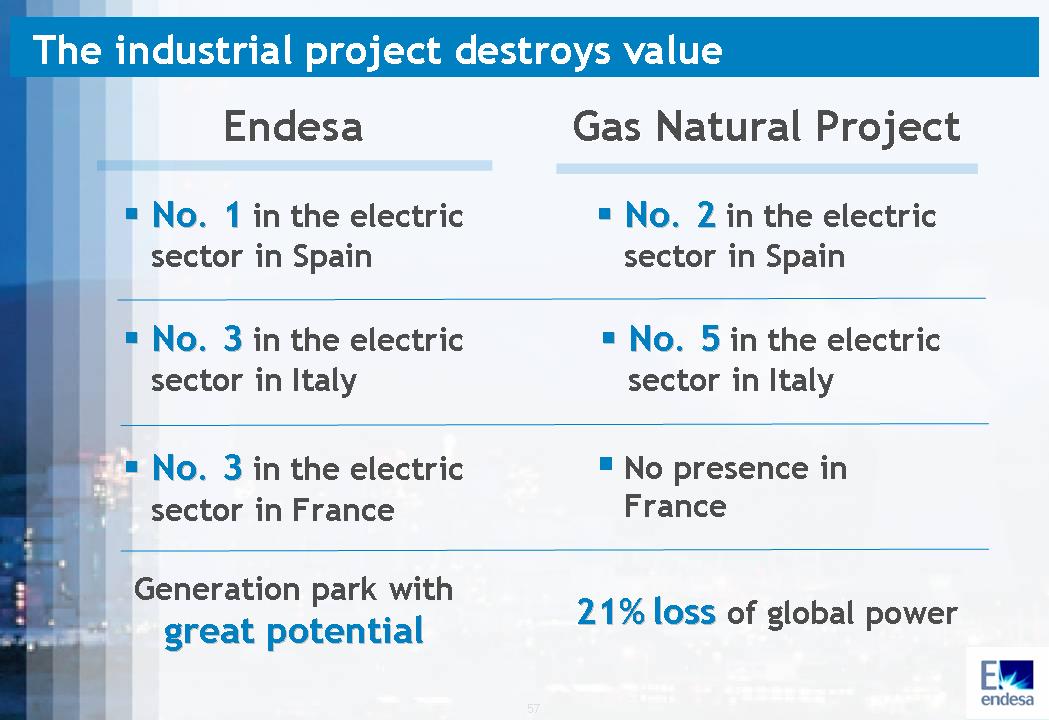

The industrial project destroys value

Endesa No. 1 in the electric sector in Spain No. 3 in the electric sector in Italy No. 3 in the electric sector in France Generation park with great potential

Gas Natural Project No. 2 in the electric sector in Spain No. 5 in the electric sector in Italy No presence in France 21% loss of global power

No commitment to shareholders Strategic plan? Growth of EBITDA and Net Earnings? Return for shareholders? How can the bid be valued?

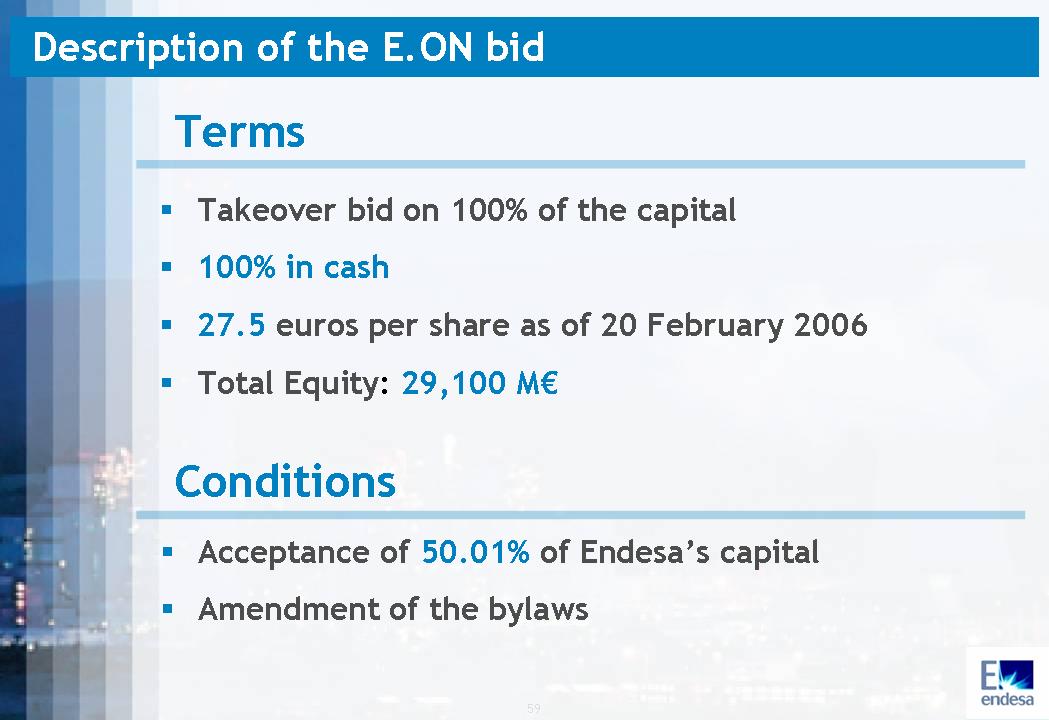

Description of the E.ON bid

Terms Takeover bid on 100% of the capital 100% in cash 27.5 euros per share as of 20 February 2006 Total Equity: 29,100 M€ Conditions Acceptance of 50.01% of Endesa’s capital Amendment of the bylaws

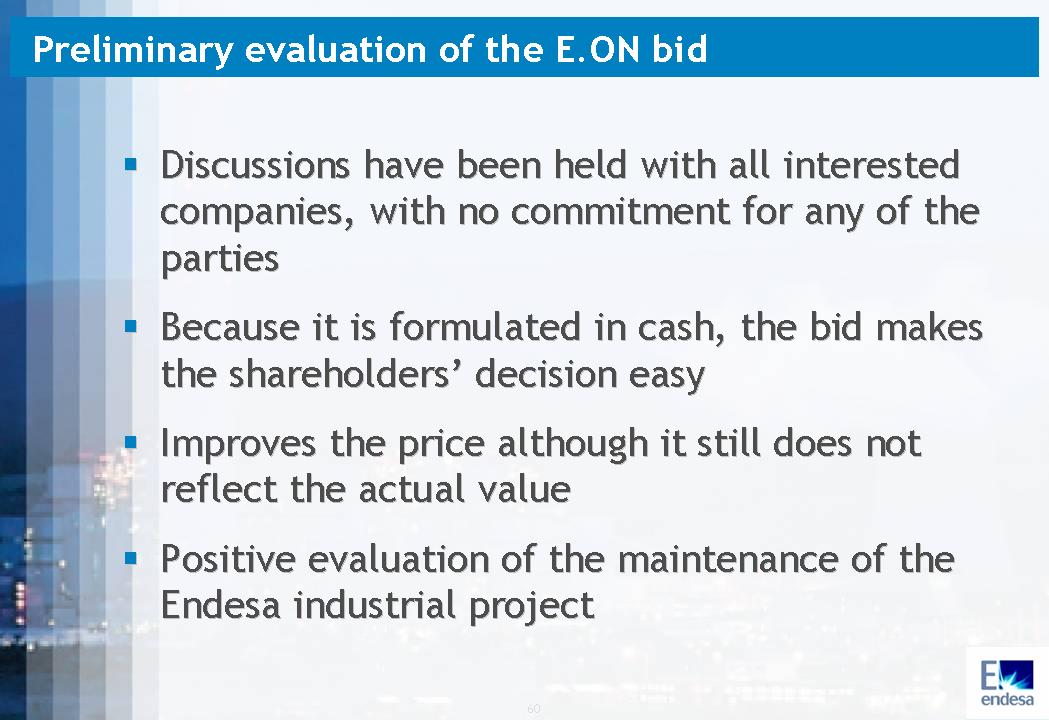

Preliminary evaluation of the E.ON bid

Discussions have been held with all interested companies, with no commitment for any of the parties Because it is formulated in cash, the bid makes the shareholders’ decision easy Improves the price although it still does not reflect the actual value Positive evaluation of the maintenance of the Endesa industrial project

Endesa Stronger business Greater value

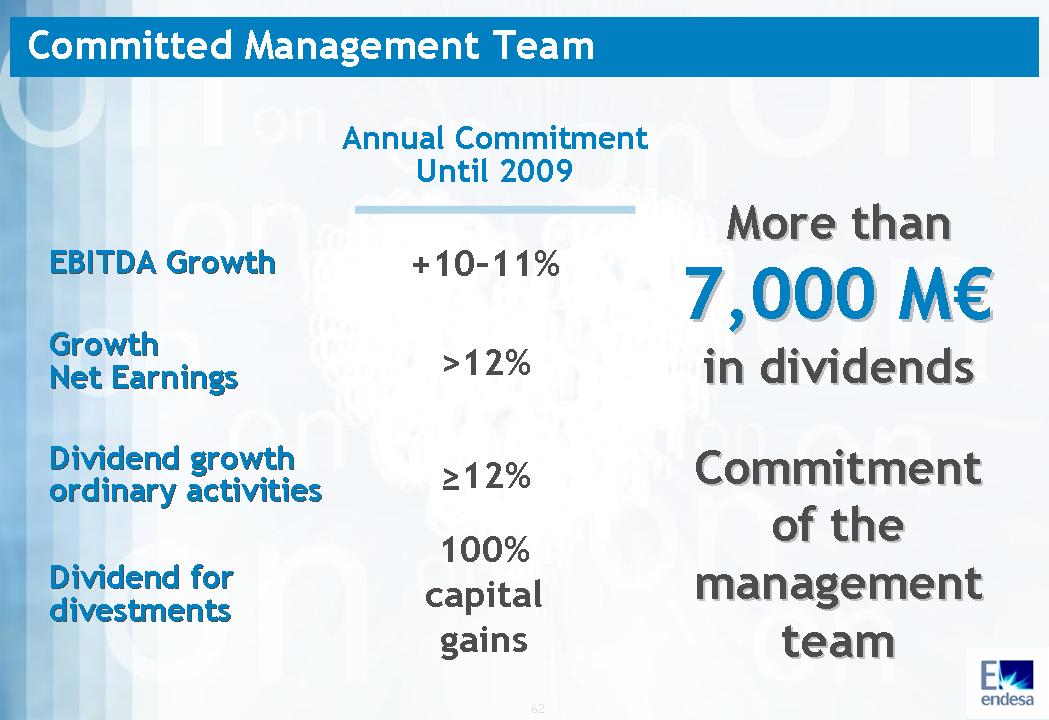

Committed Management Team Annual Commitment Until 2009

EBITDA Growth +10–11%

Growth Net Earnings >12%

Dividend growth ordinary activities ≥12%

Dividend for divestments 100% capital gains

More than 7,000 M€ in dividends Commitment of the management team

With clearly surpassable commitments

Annual commitment until 2009 2005 Fulfillment

EBITDA Growth +10–11% +33% ü

Growth Net Earnings >12% 60–154% ü

Dividend growth ordinary activities ≥12% 54% ü

Dividend for divestments 100% capital gains 1,341 M€ü ü

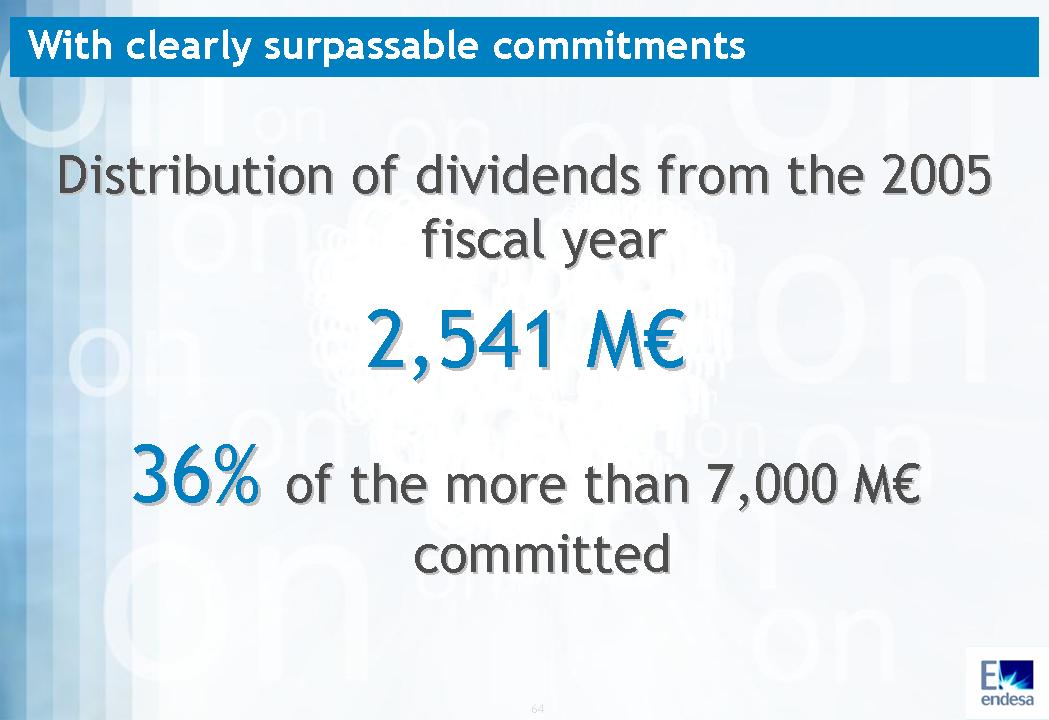

With clearly surpassable commitments

Distribution of dividends from the 2005 fiscal year 2,541 M€

36% of the more than 7,000 M€ committed

Excellent Prospects for 2006 EBITDA (M€) 4,521 2004 6,020 2005 +33% 6,725 +12% 2006 E 2009 Estimate: +7,500 M€

Net Profit (M€) Excess Profit 1,253 2004 3,182 2005 +60% 2,400 2006 E +12% 2009 Estimate: +2,200 M€

Endesa is worth more

Ambitious commitments + Excellent results 2005 + Good prospects 2006 + Maximizing of shareholder return

Endesa is worth more 28.35 € as of 24 February 2006

Endesa is already a global leader

No. 1 in the electric sector in Spain

Endesa is already a global leader

No. 3 in the electric sector in Italy

Endesa is already a global leader

No. 3 in the electric sector in France

Endesa is already a global leader

No. 1 in Latin America

Endesa is already a global leaderUnique asset portfolio in Spain and Europe

Endesa is already a global leader Market capitalization of 30,000 million €

Endesa’s Action Objective of Endesa’s Board of Directors and Management Team:

shareholders

Endesa’s Action Objective of Endesa’s Board of Directors and Management Team: Defend the interests of shareholders value

Endesa’s Action Objective of Endesa’s Board of Directors and Management Team: Defend the interests of shareholders Defend the company’s value project

Endesa’s Action

Defend the business project

Endesa Stronger business Greater value

Important Legal Information

| | Investors are urged to read Endesa’s Solicitation/Recommendation Statement on Schedule 14D-9 when it is filed with the U.S. Securities and Exchange Commission (the “SEC”), as it will contain important information. The Solicitation/Recommendation Statement and other public filings made from time to time by Endesa with the SEC are available without charge from the SEC’s website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. |

| | This presentation contains certain “forward-looking statements” regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and are subject to material risks, uncertainties, changes and other factors which may be beyond Endesa’s control or may be difficult to predict. |

| | Forward‑looking statements include, but are not limited to, information regarding: estimated future earnings; anticipated increases in wind and CCGTs generation and market share; expected increases in demand for gas and gas sourcing; management strategy and goals; estimated cost reductions; tariffs and pricing structure; estimated capital expenditures and other investments; expected asset disposals; estimated increases in capacity and output and changes in capacity mix; repowering of capacity and macroeconomic conditions. For example, the EBITDA and dividends targets for 2004 to 2009 included in this presentation are forward-looking statements and are based on certain assumptions which may or may not prove correct. The principal assumptions underlying these forecasts and targets relate to regulatory environment, exchange rates, divestments, increases in production and installed capacity in the various markets where Endesa operates, increases in demand in these markets, allocation of production among different technologies increased costs associated with higher activity levels not exceeding certain levels, the market price of electricity not falling below certain levels, the cost of CCGT and the availability and cost of gas, fuel, coal and emission rights necessary to operate our business at desired levels. |

| | The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: |

| | Economic and Industry Conditions: materially adverse changes in economic or industry conditions generally or in our markets; the effect of existing regulations and regulatory changes; tariff reductions; the impact of any fluctuations in interest rates; the impact of fluctuations in exchange rates; natural disasters; the impact of more stringent environmental regulations and the inherent environmental risks relating to our business operations; the potential liabilities relating to our nuclear facilities. |

| | Transaction or Commercial Factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments. Any delays in or failure to obtain necessary regulatory approvals, including environmental to construct new facilities, repowering or enhancement of existing facilities; shortages or changes in the price of equipment, materials or labor; opposition of political and ethnic groups; adverse changes in the political and regulatory environment in the countries where we and our related companies operate; adverse weather conditions, which may delay the completion of power plants or substations, or natural disasters, accidents or other unforeseen events; and the inability to obtain financing at rates that are satisfactory to us. |

| | Political/Governmental Factors: political conditions in Latin America; changes in Spanish, European and foreign laws, regulations and taxes. |

| | Operating Factors: technical difficulties; changes in operating conditions and costs; the ability to implement cost reduction plans; the ability to maintain a stable supply of coal, fuel and gas and the impact of fluctuations on fuel and gas prices; acquisitions or restructurings; the ability to implement an international and diversification strategy successfully. |

| Competitive Factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. |

| | Further information about the reasons why actual results and developments may differ materially from the expectations disclosed or implied by our forward-looking statements can be found under “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2004. |

| | No assurance can be given that the forward-looking statements in this document will be realized. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | ENDESA, S.A. |

|

|

|

| Dated: March 3th , 2006 | By: | /s/ Álvaro Pérez de Lema |

| |

Name: Álvaro Pérez de Lema |

| | Title: Manager of North America Investor Relations |