FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2007

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

ENDESA's strategy in deregulated markets New outlook Valencia, 25 June 2007

Energy management Contents 1. Energy management 2. Electricity portfolio management 3. Gas portfolio management 1

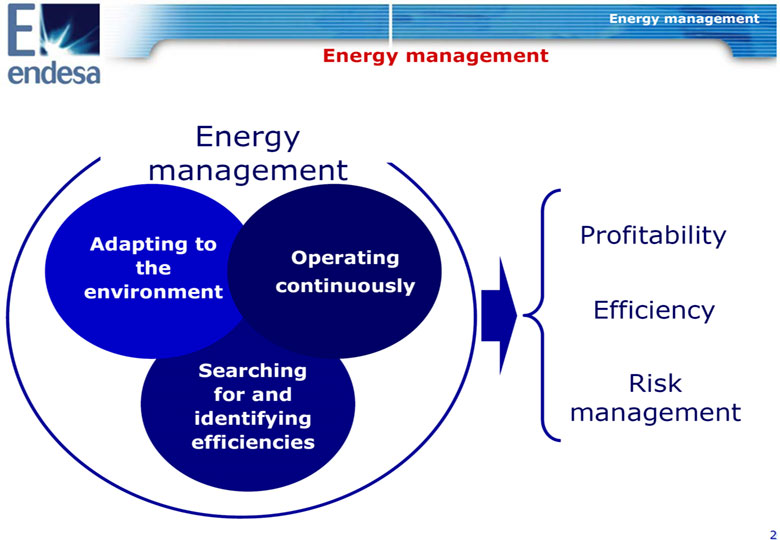

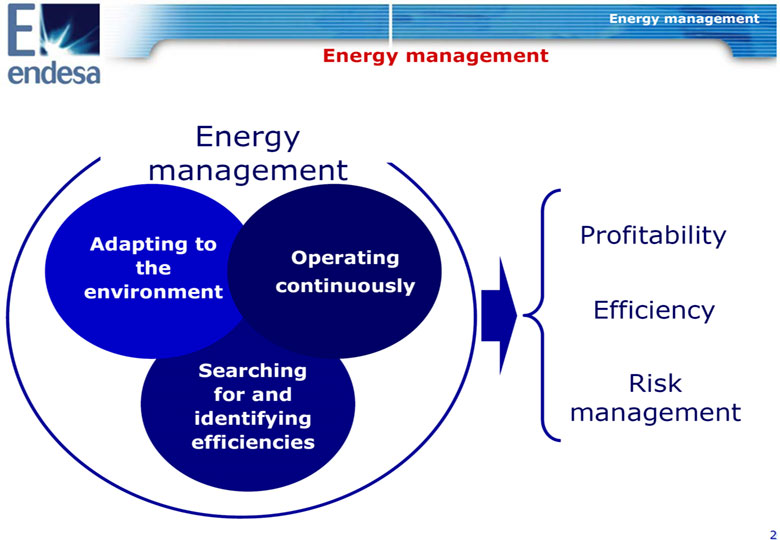

Energy management Energy management Energy management Adapting to Profitability Operating the environment continuously Efficiency Searching Risk for and identifying management efficiencies 2

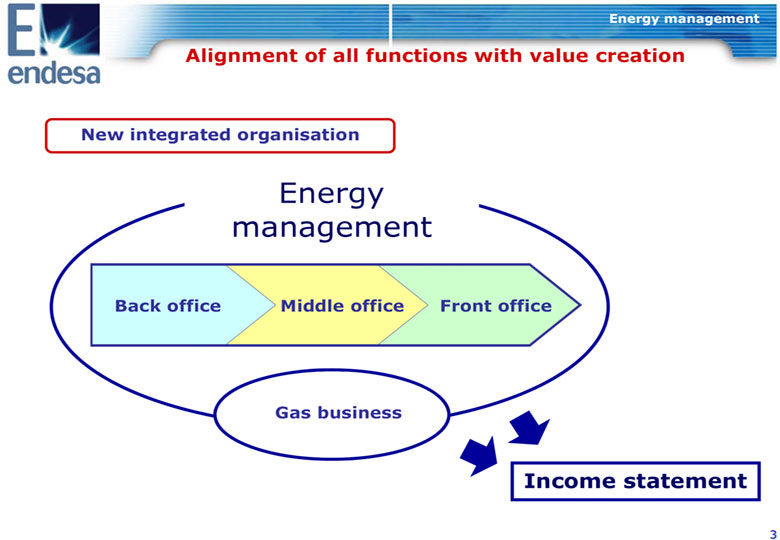

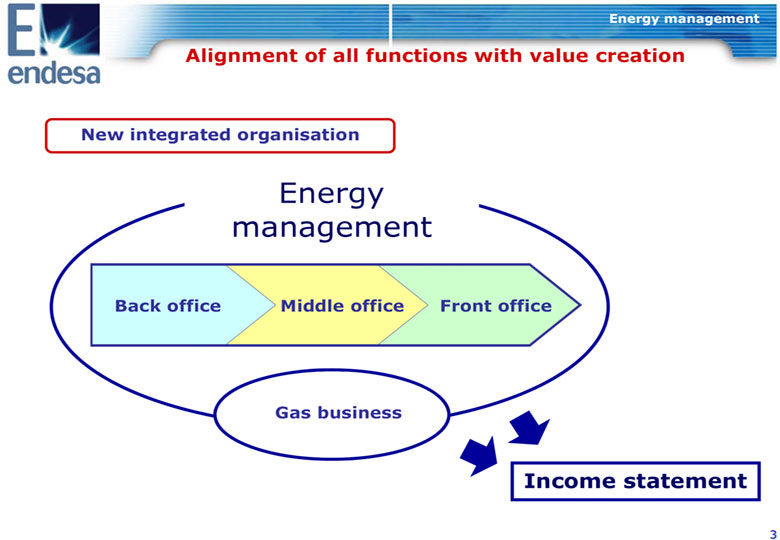

Energy management Alignment of all functions with value creation New integrated organisation Energy management Back office Middle office Front office Gas business Income statement 3

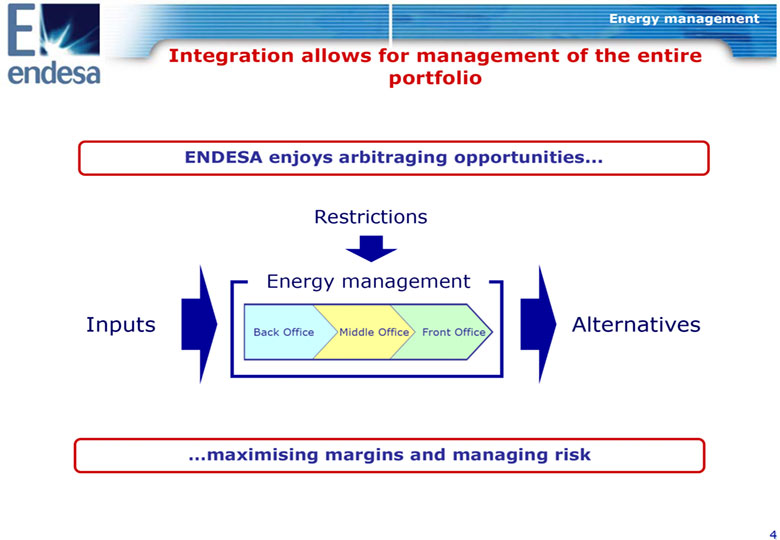

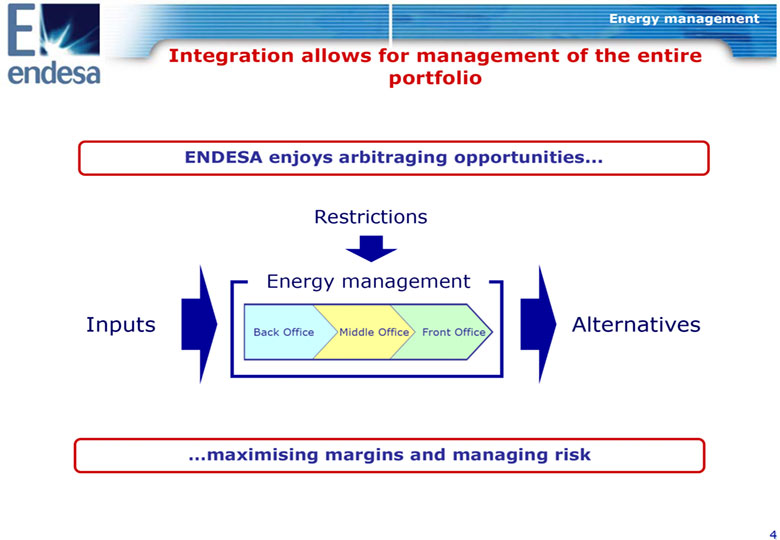

Energy management Integration allows for management of the entire portfolio ENDESA enjoys arbitraging opportunities... Restrictions Energy management Inputs Back Office Middle Office Front Office Alternatives ...maximising margins and managing risk 4

Electricity portfolio management Contents 1. Energy management 2. Electricity portfolio management 3. Gas portfolio management 5

Electricity portfolio management Steps in managing the portfolio 1. Analysis of the portfolio and markets 2. Definition of the management strategy 3. Actions 6

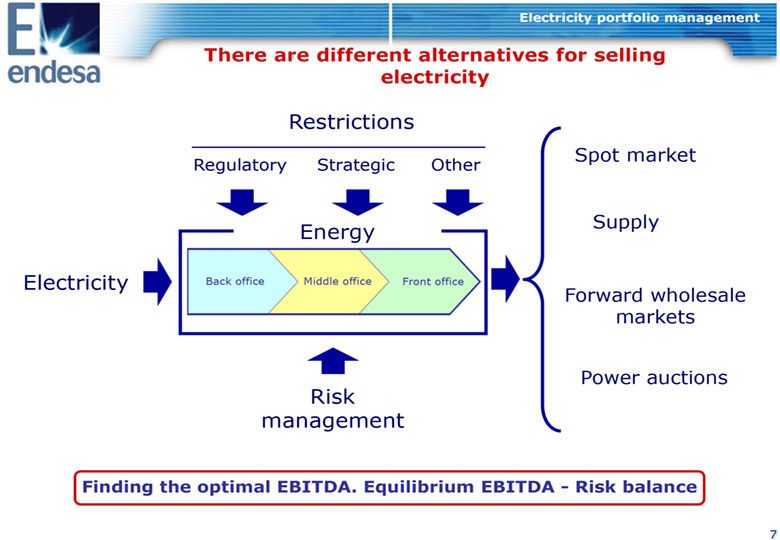

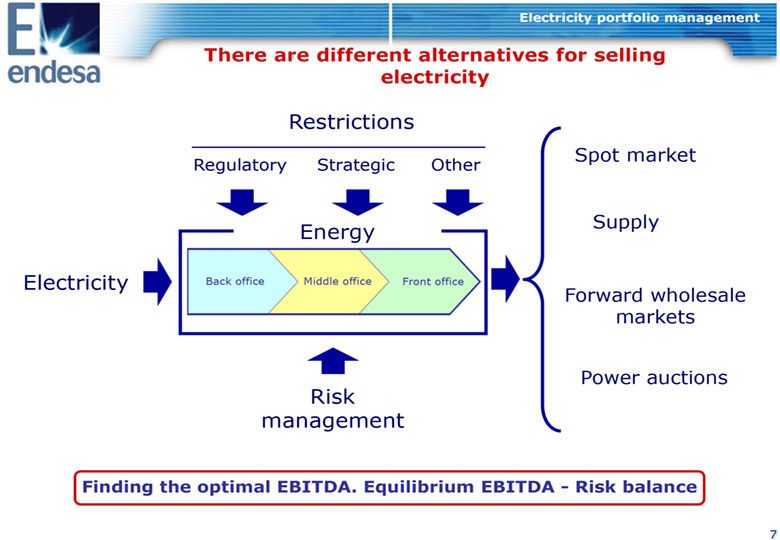

Electricity portfolio management There are different alternatives for selling electricity Restrictions Spot market Regulatory Strategic Other Energy Supply management Electricity Back office Middle office Front office Forward wholesale markets Power auctions Risk management Finding the optimal EBITDA. Equilibrium EBITDA - Risk balance 7

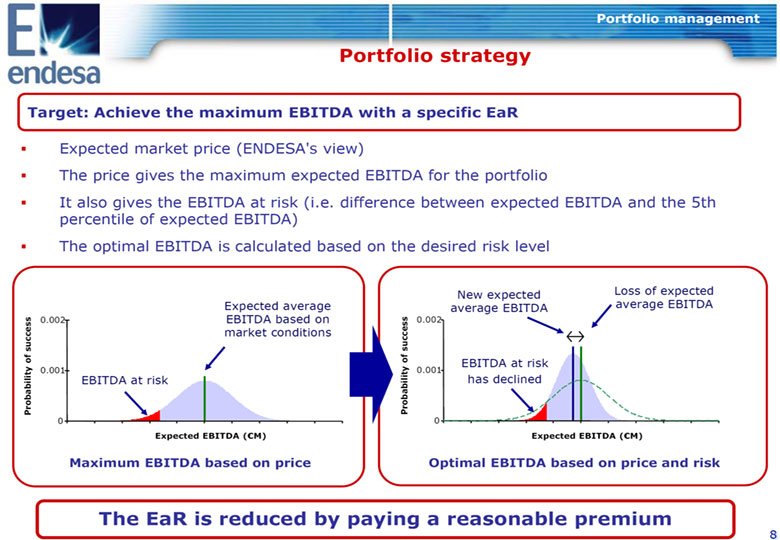

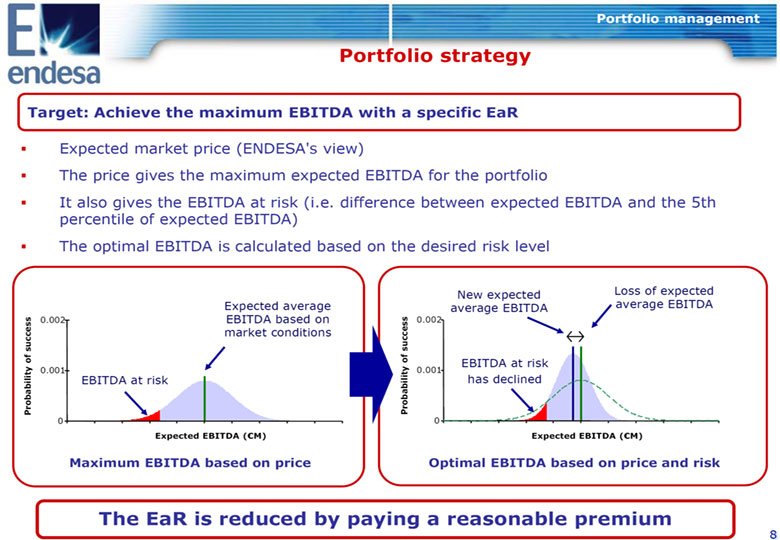

Portfolio management Portfolio strategy Target: Achieve the maximum EBITDA with a specific EaR Expected market price (ENDESA's view) The price gives the maximum expected EBITDA for the portfolio It also gives the EBITDA at risk (i.e. difference between expected EBITDA and the 5th percentile of expected EBITDA) The optimal EBITDA is calculated based on the desired risk level New expected Loss of expected Expected average average EBITDA average EBITDA 0.002 EBITDA based on 0.002 market conditions EBITDA at risk 0.001 0.001 Probability of success EBITDA at risk Probability of successhas declined 0 0 Expected EBITDA ((euro)M) Expected EBITDA ((euro)M) Maximum EBITDA based on price Optimal EBITDA based on price and risk The EaR is reduced by paying a reasonable premium 8

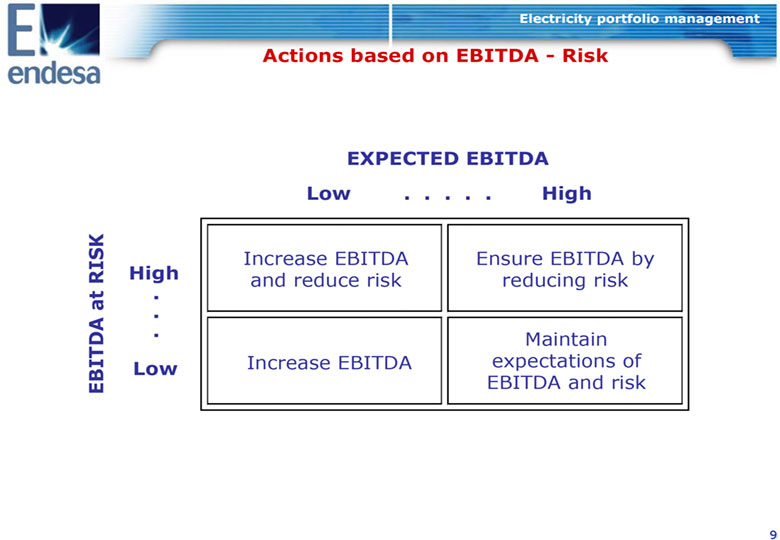

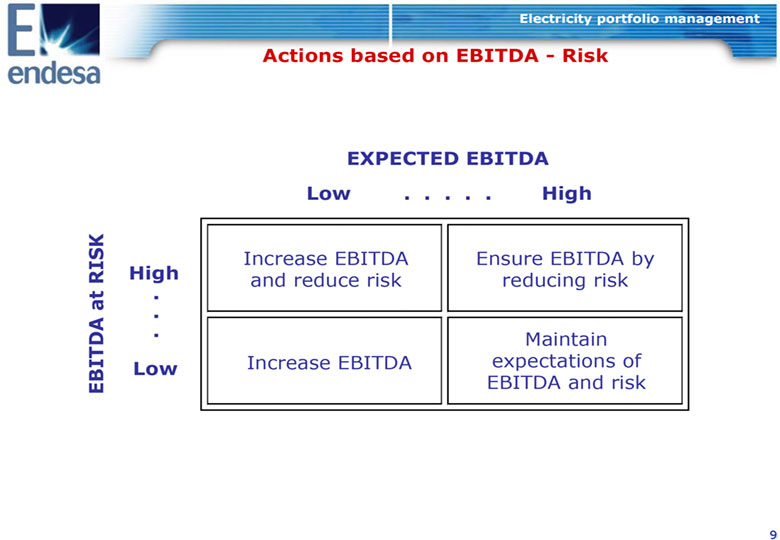

Electricity portfolio management Actions based on EBITDA - Risk EXPECTED EBITDA Low . . . . . High Increase EBITDA Ensure EBITDA by High and reduce risk reducing risk . . . Maintain Low Increase EBITDA expectations of EBITDA at RISK EBITDA and risk 9

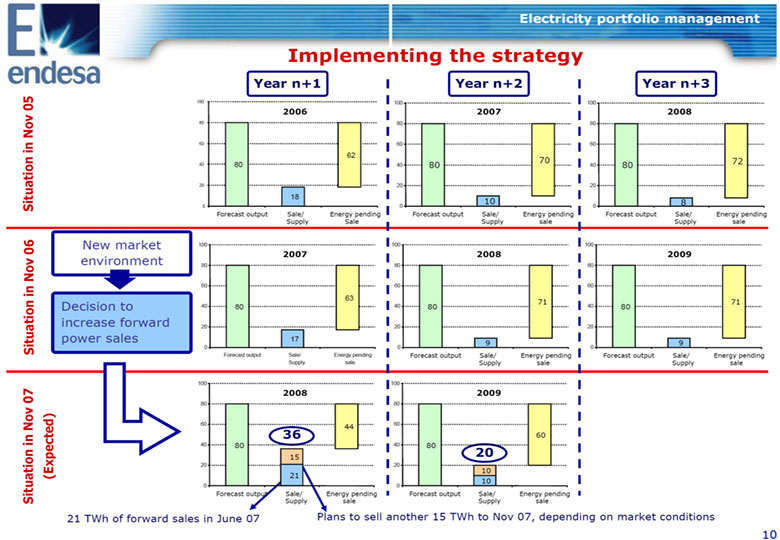

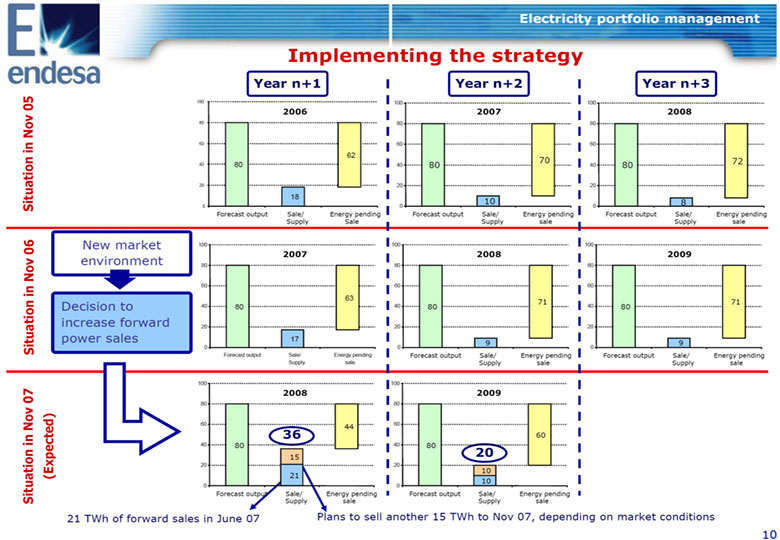

Electricity portfolio management Implementing the strategy Year n+1 Year n+2 Year n+3 100 100 100 2006 2007 2008 80 80 80 60 60 60 62 70 72 40 80 40 80 40 80 20 20 20 18 10 8 Situation in Nov 05 0 0 0 Forecast output Sale/ Energy pending Forecast output Sale/ Energy pending Forecast output Sale/ Energy pending Supply Sale Supply sale Supply sale New market 100 100 100 2007 2008 2009 environment 80 80 80 60 60 60 63 71 71 Decision to 40 80 40 80 40 80 increase forward 20 20 20 power sales 17 9 9 Situation in Nov 06 0 0 0 Forecast output Sale/ Energy pending Forecast output Sale/ Energy pending Forecast output Sale/ Energy pending Supply sale Supply sale Supply sale 100 100 2008 2009 80 80 60 44 60 36 60 40 80 40 80 15 20 20 20 10 (Expected) 21 10 0 0 Forecast output Sale/ Energy pending Forecast output Sale/ Energy pending Situation in Nov 07 Supply sale Supply sale 21 TWh of forward sales in June 07 Plans to sell another 15 TWh to Nov 07, depending on market conditions 10

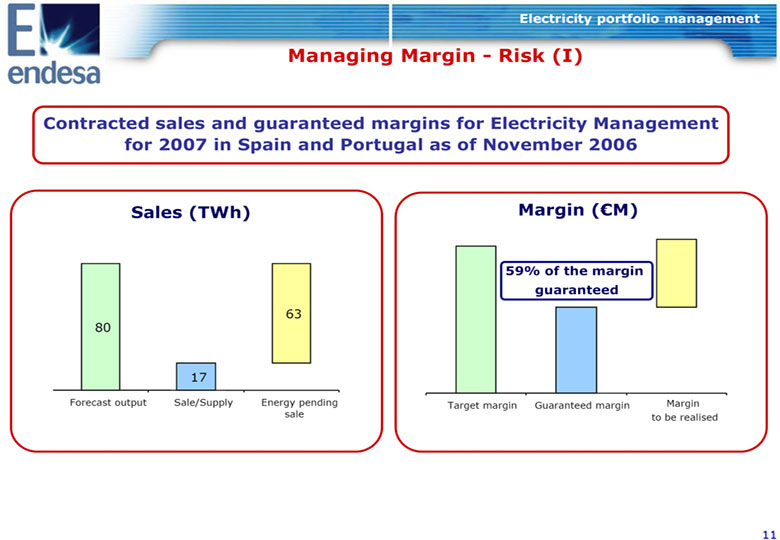

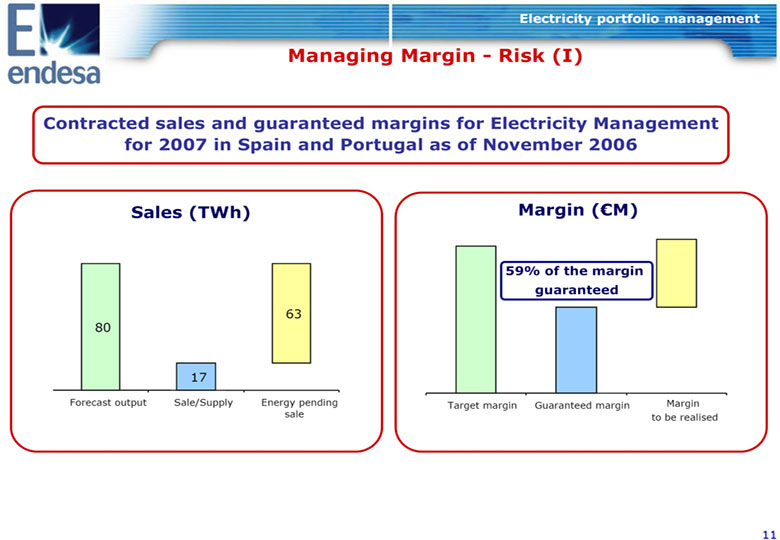

Electricity portfolio management Managing Margin - Risk (I) Contracted sales and guaranteed margins for Electricity Management for 2007 in Spain and Portugal as of November 2006 Sales (TWh) Margin ((euro)M) 59% of the margin guaranteed 63 80 17 Forecast output Sale/Supply Energy pending Target margin Guaranteed margin Margin sale to be realised 11

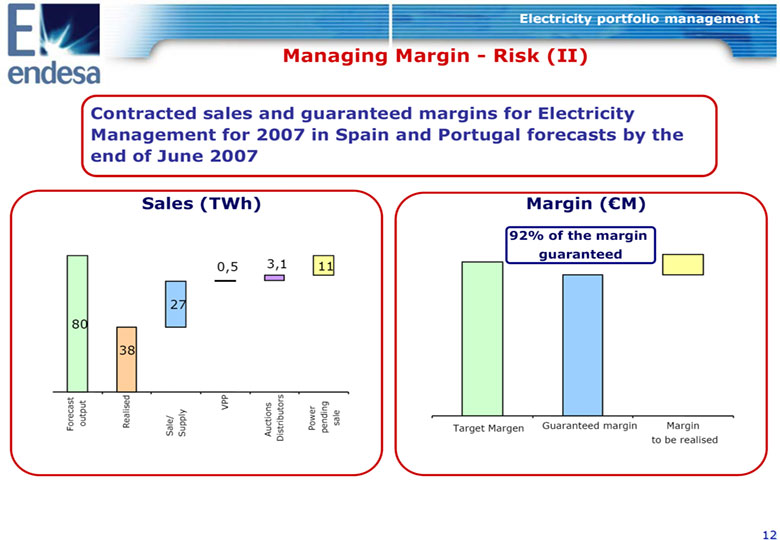

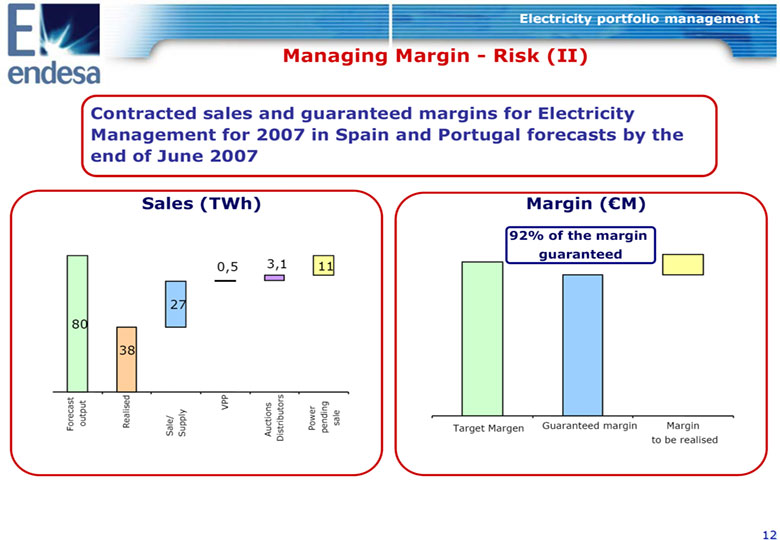

Electricity portfolio management Managing Margin - Risk (II) Contracted sales and guaranteed margins for Electricity Management for 2007 in Spain and Portugal forecasts by the end of June 2007 Sales (TWh) Margin ((euro)M) 92% of the margin guaranteed 0,5 3,1 11 27 80 38 VPP Forecast output Realised Power sale Guaranteed margin Margin Sale/ Supply Auctions Distributors pending Target Margen to be realised 12

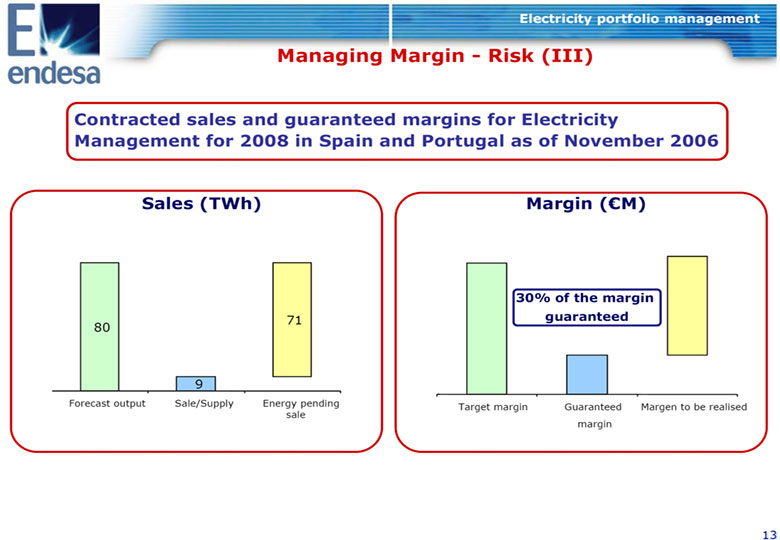

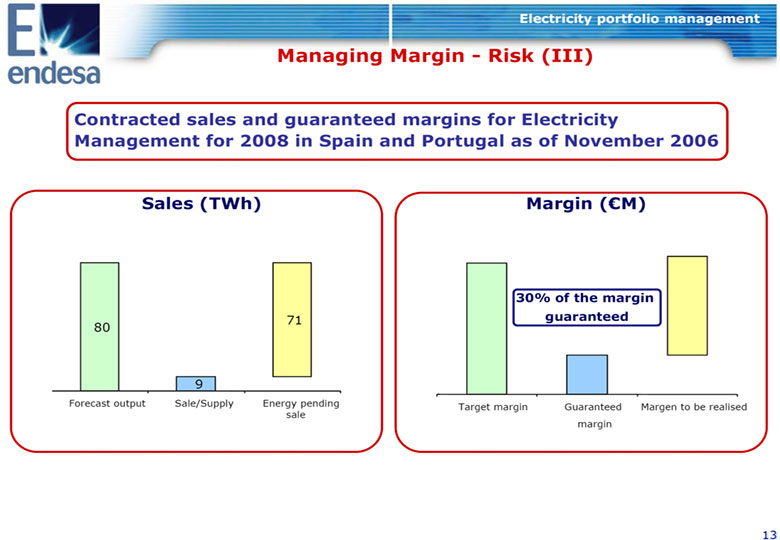

Electricity portfolio management Managing Margin - Risk (III) Contracted sales and guaranteed margins for Electricity Management for 2008 in Spain and Portugal as of November 2006 Sales (TWh) Margin ((euro)M) 30% of the margin 71 guaranteed 80 9 Forecast output Sale/Supply Energy pending Target margin Guaranteed Margen to be realised sale margin 13

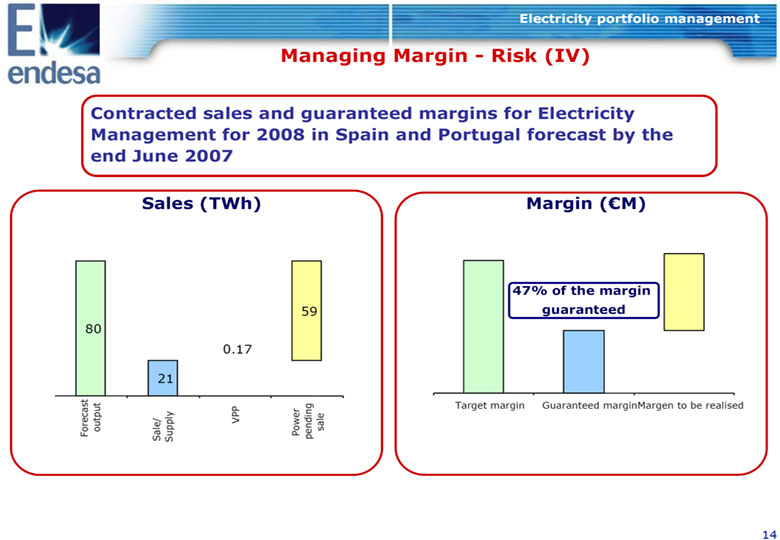

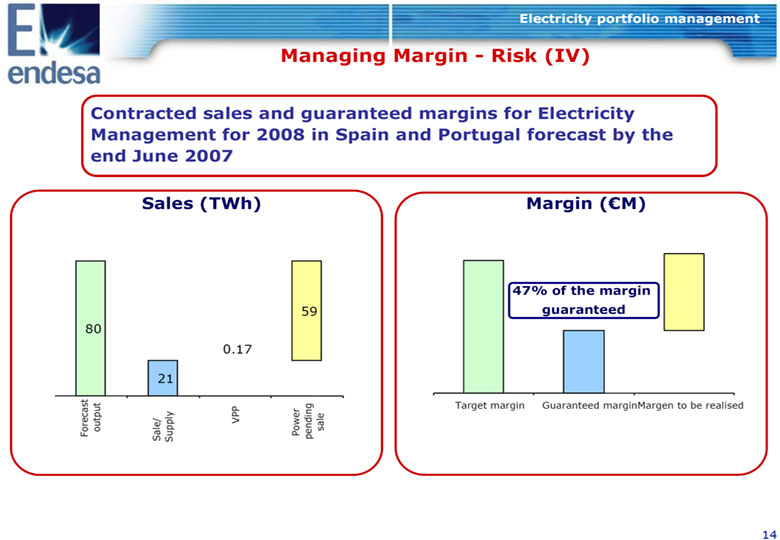

Electricity portfolio management Managing Margin - Risk (IV) Contracted sales and guaranteed margins for Electricity Management for 2008 in Spain and Portugal forecast by the end June 2007 Sales (TWh) Margin ((euro)M) 47% of the margin 59 guaranteed 80 0.17 21 Target margin Guaranteed marginMargen to be realised Forecast output VPP Power pending sale Sale/ Supply 14

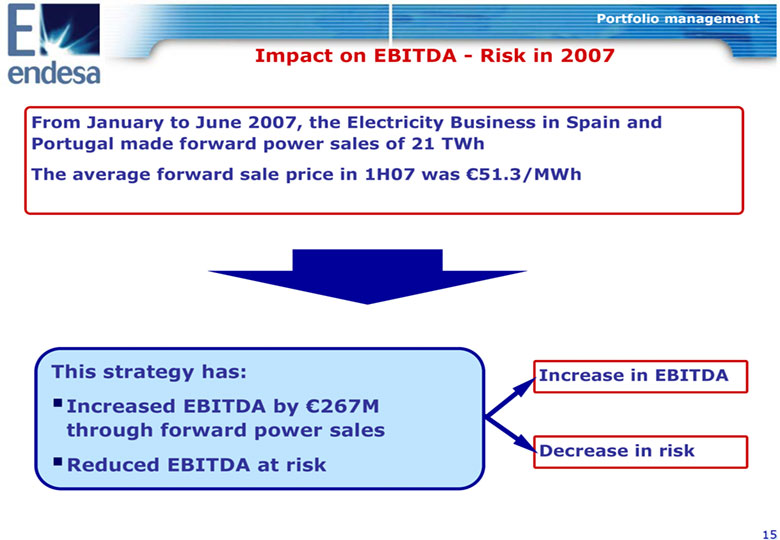

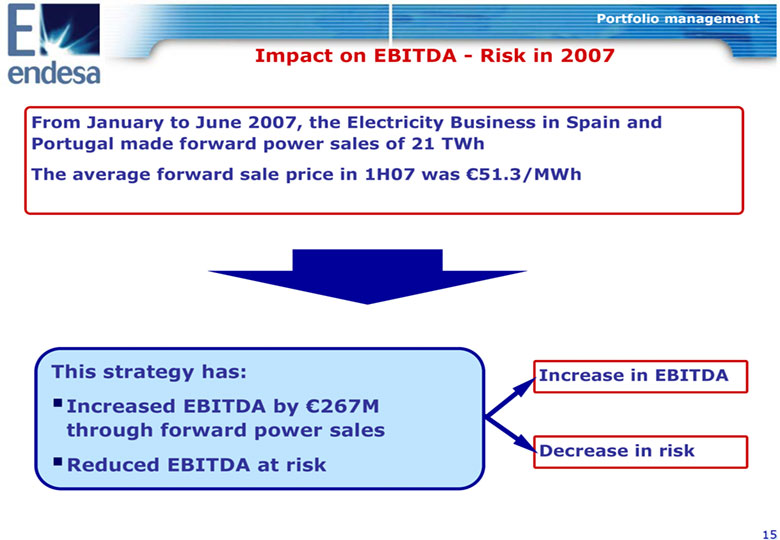

Portfolio management Impact on EBITDA - Risk in 2007 From January to June 2007, the Electricity Business in Spain and Portugal made forward power sales of 21 TWh The average forward sale price in 1H07 was (euro)51.3/MWh This strategy has: Increase in EBITDA Increased EBITDA by (euro)267M through forward power sales Decrease in risk Reduced EBITDA at risk 15

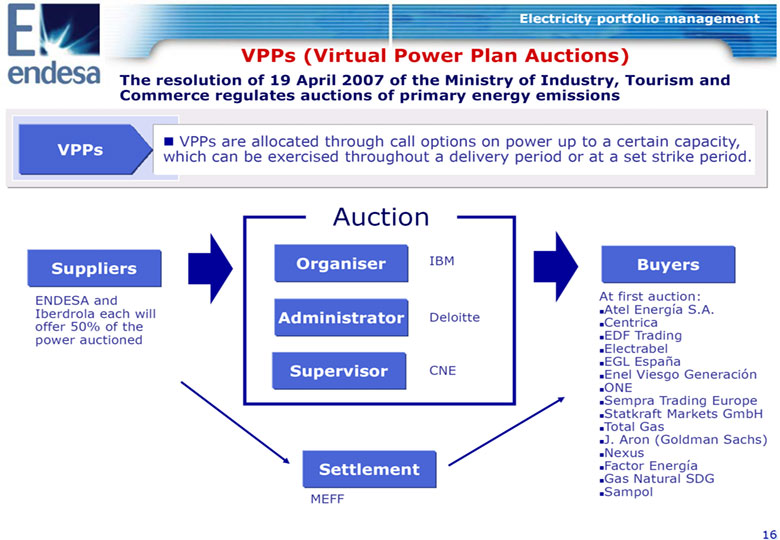

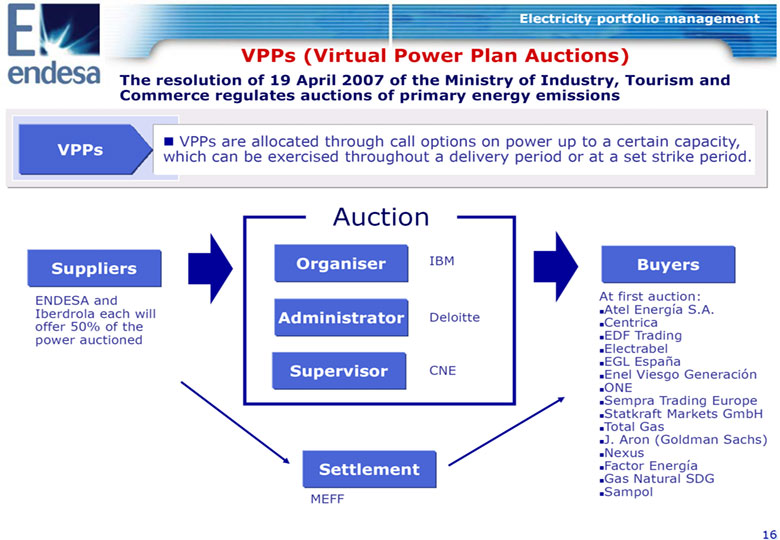

Electricity portfolio management VPPs (Virtual Power Plan Auctions) The resolution of 19 April 2007 of the Ministry of Industry, Tourism and Commerce regulates auctions of primary energy emissions VPPs VPPs are allocated through call options on power up to a certain capacity, which can be exercised throughout a delivery period or at a set strike period. Auction Suppliers Organiser IBM Buyers ENDESA and At first auction: Iberdrola each will Administrator Deloitte Atel Energia S.A. offer 50% of the Centrica power auctioned EDF Trading Electrabel EGL Espana Supervisor CNE Enel Viesgo Generacion ONE Sempra Trading Europe Statkraft Markets GmbH Total Gas J. Aron (Goldman Sachs) Nexus Settlement Factor Energia Gas Natural SDG Sampol MEFF 16

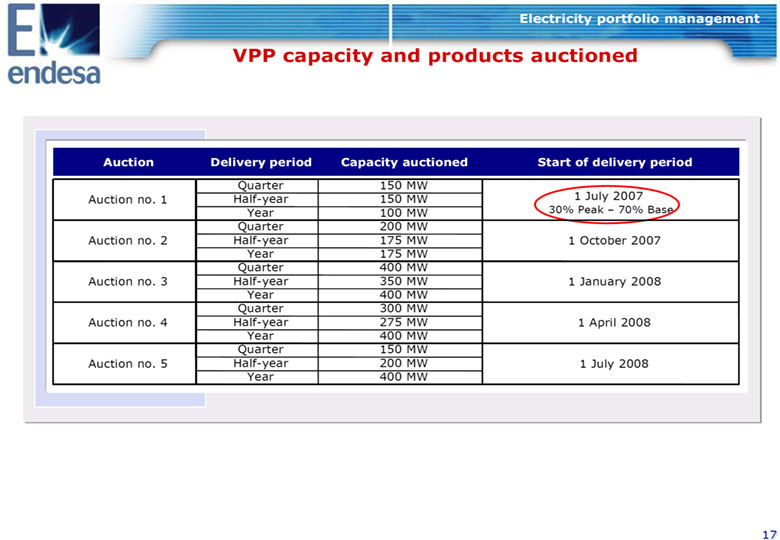

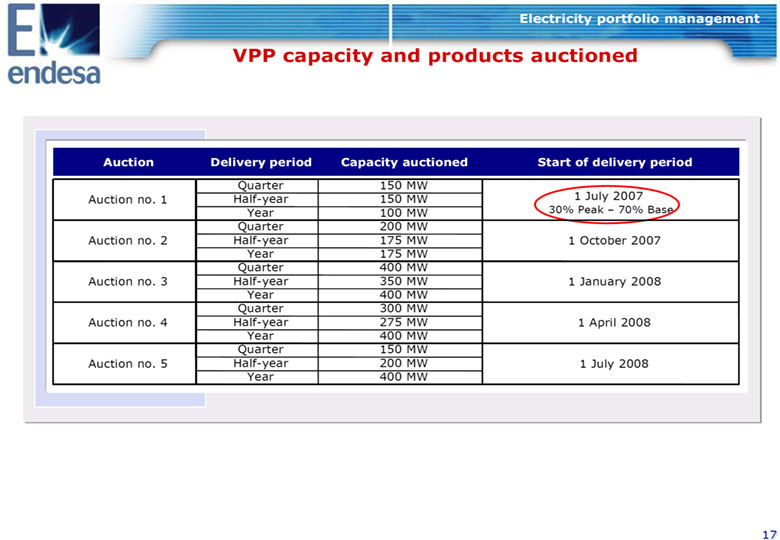

Electricity portfolio management VPP capacity and products auctioned Auction Delivery period Capacity auctioned Start of delivery period Quarter 150 MW Auction no. 1 Half-year 150 MW 1 July 2007 Year 100 MW 30% Peak - 70% Base Quarter 200 MW Auction no. 2 Half-year 175 MW 1 October 2007 Year 175 MW Quarter 400 MW Auction no. 3 Half-year 350 MW 1 January 2008 Year 400 MW Quarter 300 MW Auction no. 4 Half-year 275 MW 1 April 2008 Year 400 MW Quarter 150 MW Auction no. 5 Half-year 200 MW 1 July 2008 Year 400 MW 17

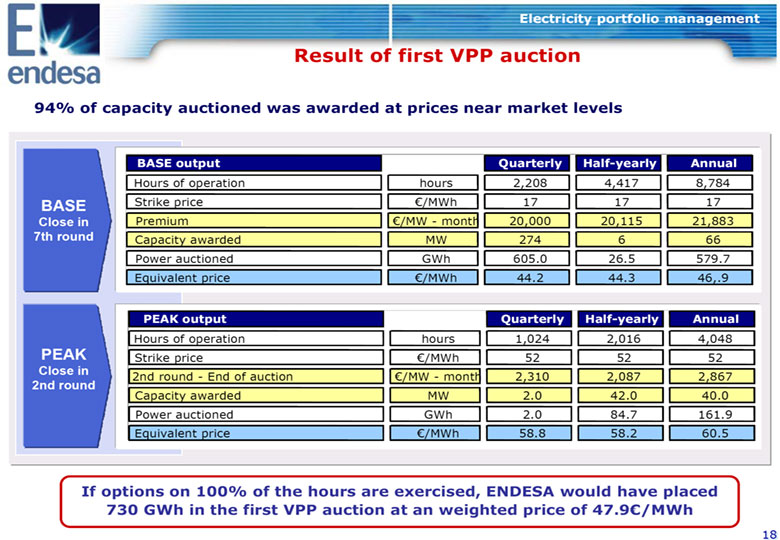

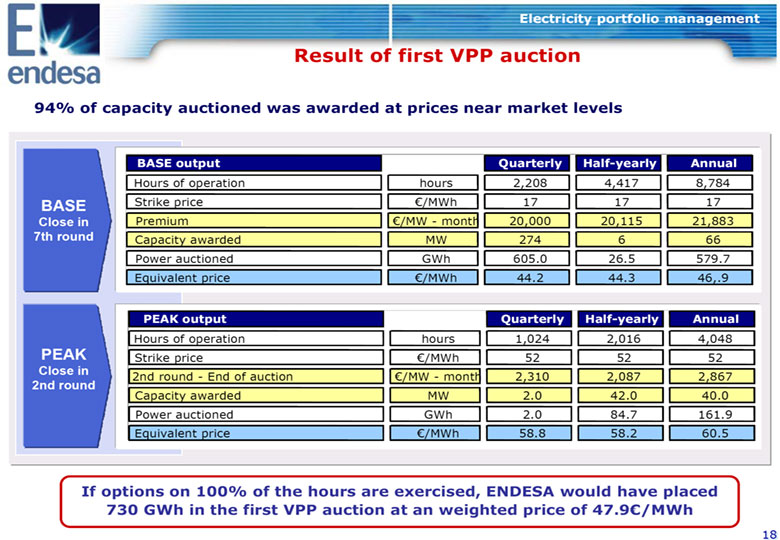

Electricity portfolio management Result of first VPP auction 94% of capacity auctioned was awarded at prices near market levels BASE output Quarterly Half-yearly Annual Hours of operation hours2,208 4,417 8,784 BASE Strike price (euro)/MWh17 17 17 Close in Premium (euro)/MW - month 20,000 20,115 21,883 7th round Capacity awarded MW 274 6 66 Power auctioned GWh605.0 26.5 579.7 Equivalent price(euro)/MWh 44.2 44.3 46,.9 PEAK output Quarterly Half-yearly Annual Hours of operation hours 1,024 2,016 4,048 PEAK Strike price (euro)/MWh 5252 52 Close in 2nd round - End of auction (euro)/MW - month 2,310 2,087 2,867 2nd round Capacity awarded MW2.0 42.0 40.0 Power auctioned GWh 2.0 84.7 161.9 Equivalent price (euro)/MWh 58.8 58.2 60.5 If options on 100% of the hours are exercised, ENDESA would have placed 730 GWh in the first VPP auction at an weighted price of 47.9(euro)/MWh 18

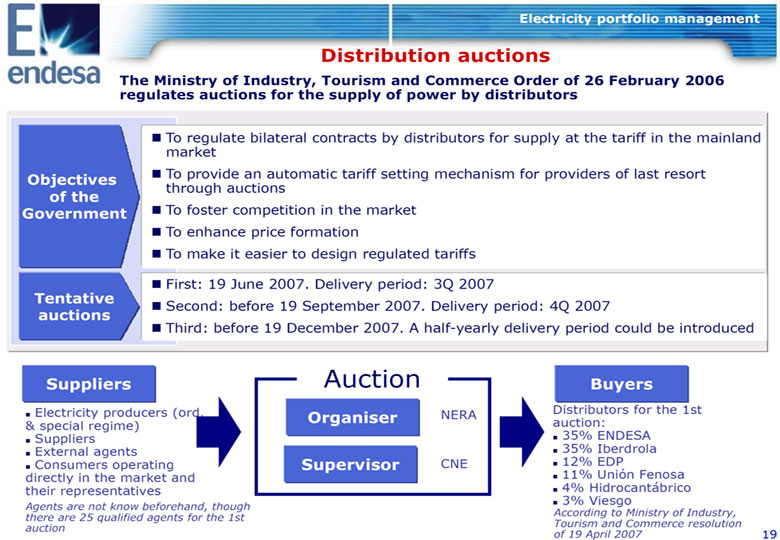

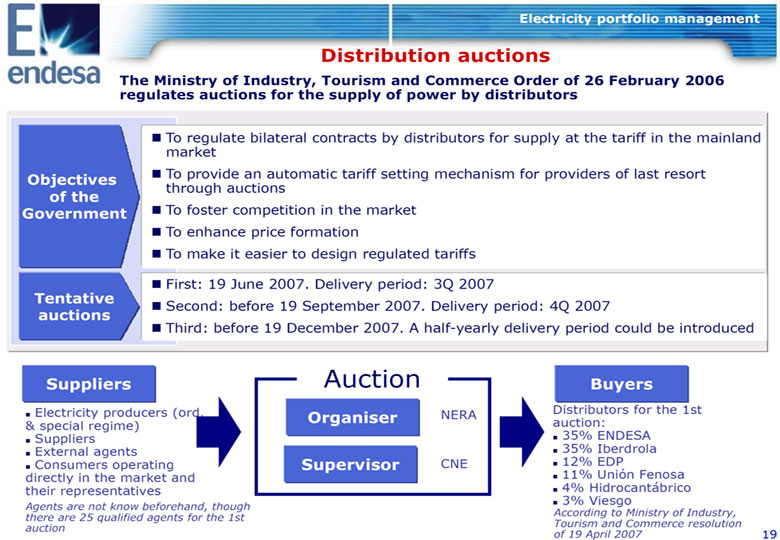

Electricity portfolio management Distribution auctions The Ministry of Industry, Tourism and Commerce Order of 26 February 2006 regulates auctions for the supply of power by distributors To regulate bilateral contracts by distributors for supply at the tariff in the mainland market Objectives To provide an automatic tariff setting mechanism for providers of last resort through auctions of the Government To foster competition in the market To enhance price formation To make it easier to design regulated tariffs First: 19 June 2007. Delivery period: 3Q 2007 Tentative Second: before 19 September 2007. Delivery period: 4Q 2007 auctions Third: before 19 December 2007. A half-yearly delivery period could be introduced Suppliers Auction Buyers Electricity producers (ord. Distributors for the 1st Organiser NERA & special regime) auction: Suppliers 35% ENDESA External agents 35% Iberdrola CNE 12% EDP Consumers operating Supervisor directly in the market and 11% Union Fenosa their representatives 4% Hidrocantabrico Agents are not know beforehand, though 3% Viesgo there are 25 qualified agents for the 1st According to Ministry of Industry, auction Tourism and Commerce resolution of 19 April 2007 19

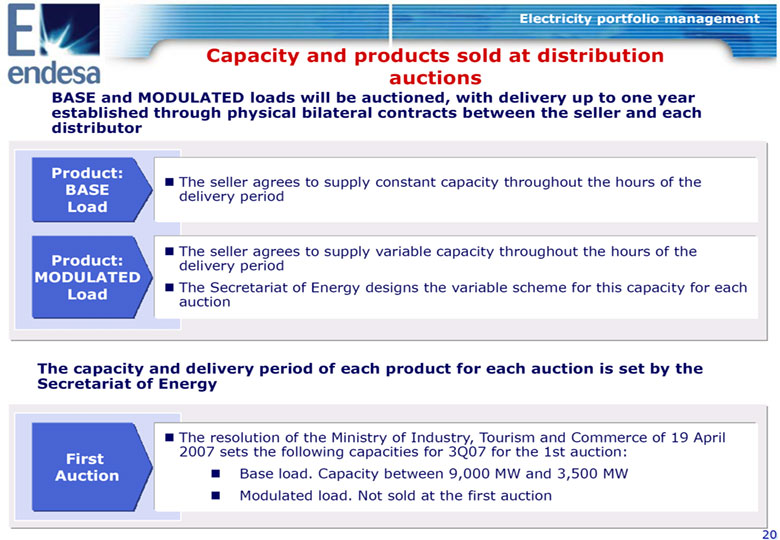

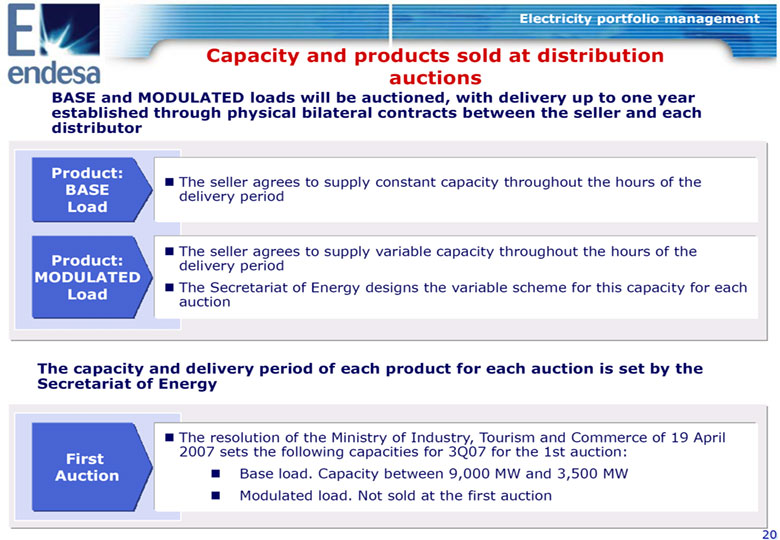

Electricity portfolio management Capacity and products sold at distribution auctions BASE and MODULATED loads will be auctioned, with delivery up to one year established through physical bilateral contracts between the seller and each distributor Product: The seller agrees to supply constant capacity throughout the hours of the BASE delivery period Load The seller agrees to supply variable capacity throughout the hours of the Product: delivery period MODULATED Load The Secretariat of Energy designs the variable scheme for this capacity for each auction The capacity and delivery period of each product for each auction is set by the Secretariat of Energy The resolution of the Ministry of Industry, Tourism and Commerce of 19 April First 2007 sets the following capacities for 3Q07 for the 1st auction: Auction Base load. Capacity between 9,000 MW and 3,500 MW Modulated load. Not sold at the first auction 20

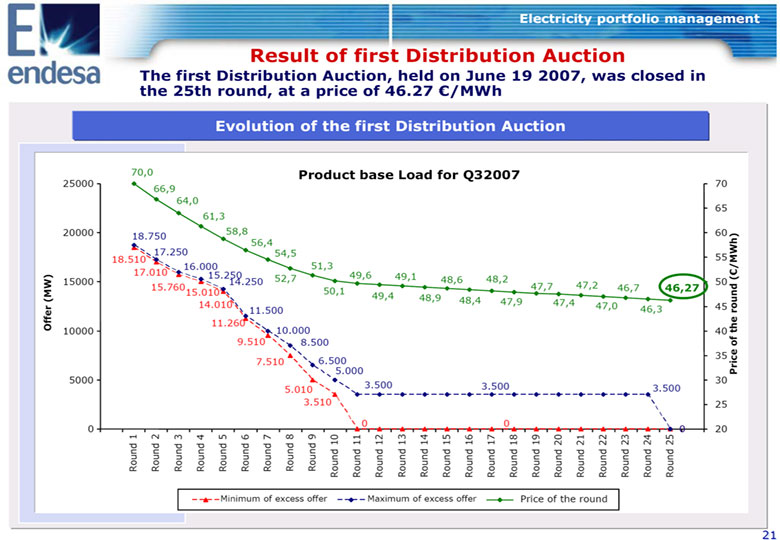

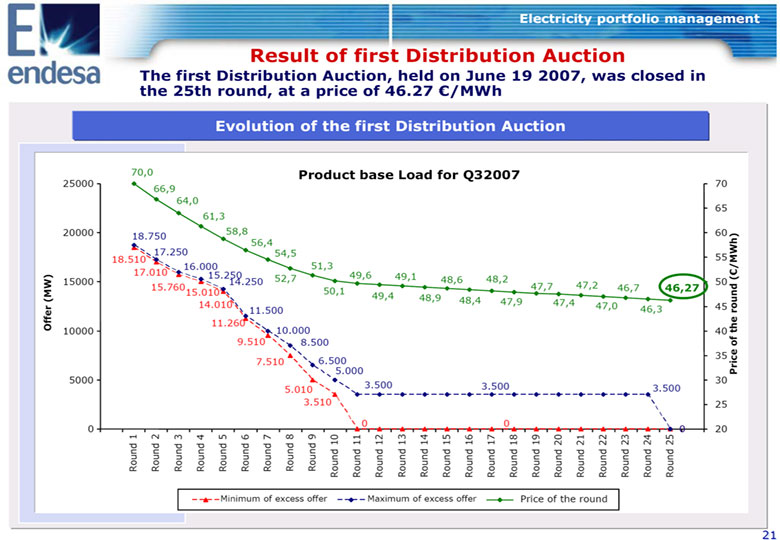

Electricity portfolio management Result of first Distribution Auction The first Distribution Auction, held on June 19 2007, was closed in the 25th round, at a price of 46.27 (euro)/MWh Evolution of the first Distribution Auction 70,0 Product base Load for Q32007 25000 70 66,9 64,0 65 61,3 20000 58,8 60 18.750 56,4 17.250 54,5 18.510 55 51,3 17.010 16.000 15.250 49,6 49,1 15000 14.250 52,7 48,6 48,2 50 15.760 47,7 47,2 46,7 46,27 15.010 50,1 49,4 48,9 48,4 14.010 47,9 47,4 47,0 11.500 46,3 45 Offer (MW) 11.260 10000 10.000 40 9.510 8.500 35 7.510 6.500 Price of the round ((euro)/MWh) 5.000 5000 30 5.010 3.500 3.500 3.500 3.510 25 0 0 0 0 20 Round 1 Round 2 Round 3 Round 4 Round 5 Round 6 Round 7 Round 8 Round 9 Round 10 Round 11 Round 12 Round 13 Round 14 Round 15 Round 16 Round 17 Round 18 Round 19 Round 20 Round 21 Round 22 Round 23 Round 24 Round 25 Minimum of excess offer Maximum of excess offer Price of the round 21

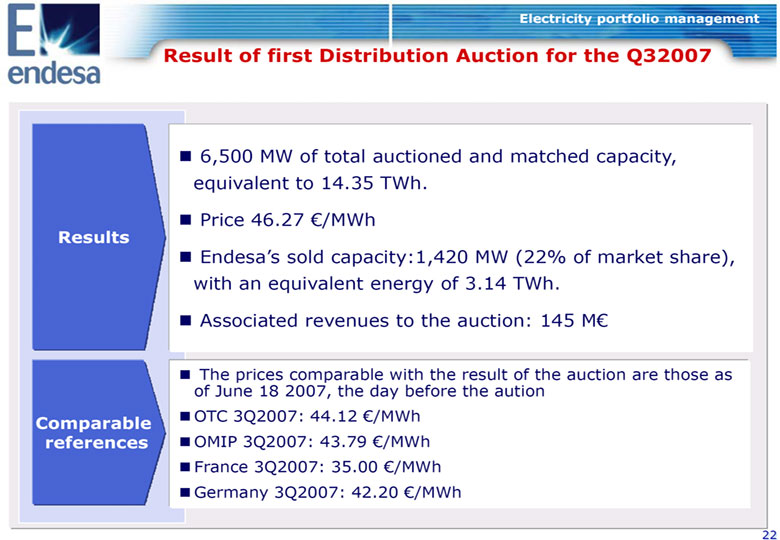

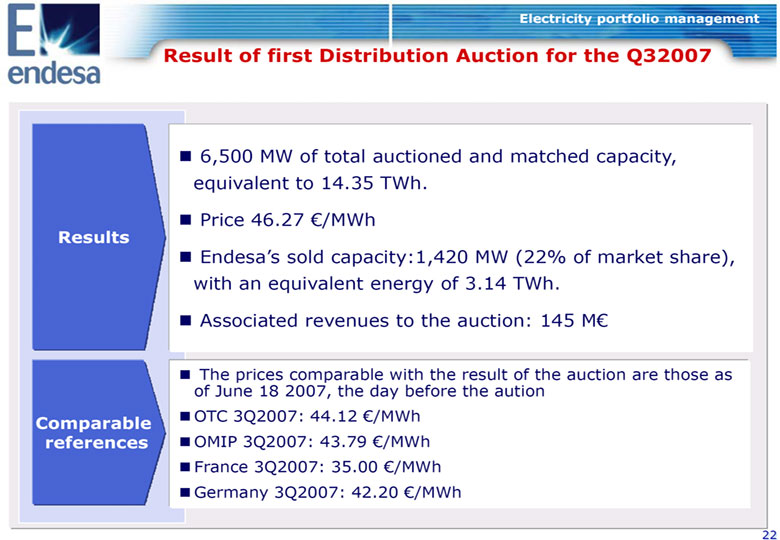

Electricity portfolio management Result of first Distribution Auction for the Q32007 6,500 MW of total auctioned and matched capacity, equivalent to 14.35 TWh. Price 46.27 (euro)/MWh Results Endesa's sold capacity:1,420 MW (22% of market share), with an equivalent energy of 3.14 TWh. Associated revenues to the auction: 145 M(euro) The prices comparable with the result of the auction are those as of June 18 2007, the day before the aution Comparable OTC 3Q2007: 44.12 (euro)/MWh references OMIP 3Q2007: 43.79 (euro)/MWh France 3Q2007: 35.00 (euro)/MWh Germany 3Q2007: 42.20 (euro)/MWh 22

Gas portfolio management Contents 1. Energy management 2. Electricity portfolio management 3. Gas portfolio management 23

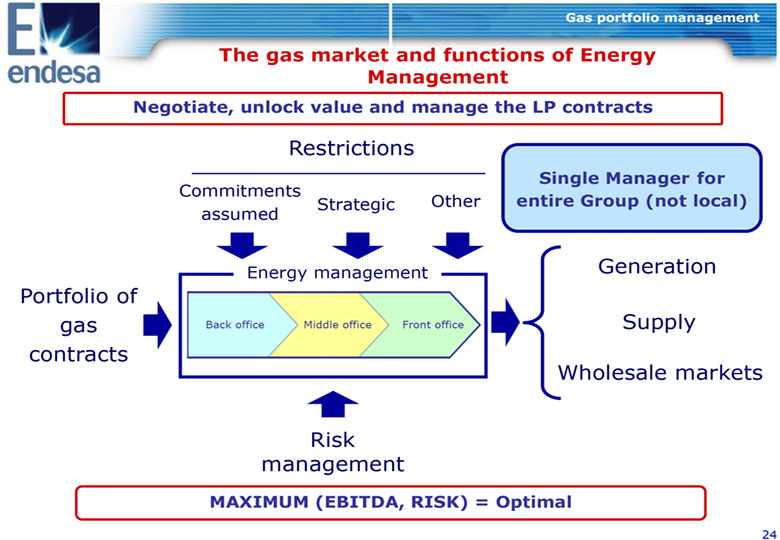

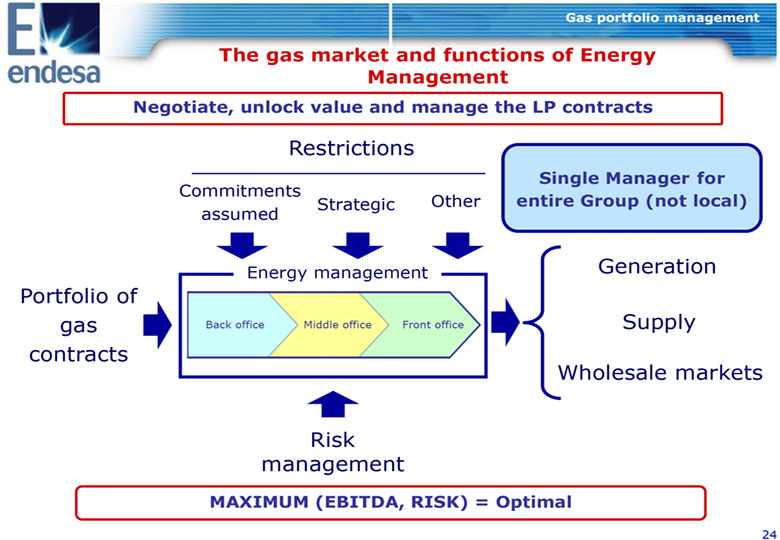

Gas portfolio management The gas market and functions of Energy Management Negotiate, unlock value and manage the LP contracts Restrictions Single Manager for Commitments entire Group (not Strategic Other assumed local) Energy management Generation Portfolio of gas Back office Middle office Front office Supply contracts Wholesale markets Risk management MAXIMUM (EBITDA, RISK) = Optimal 24

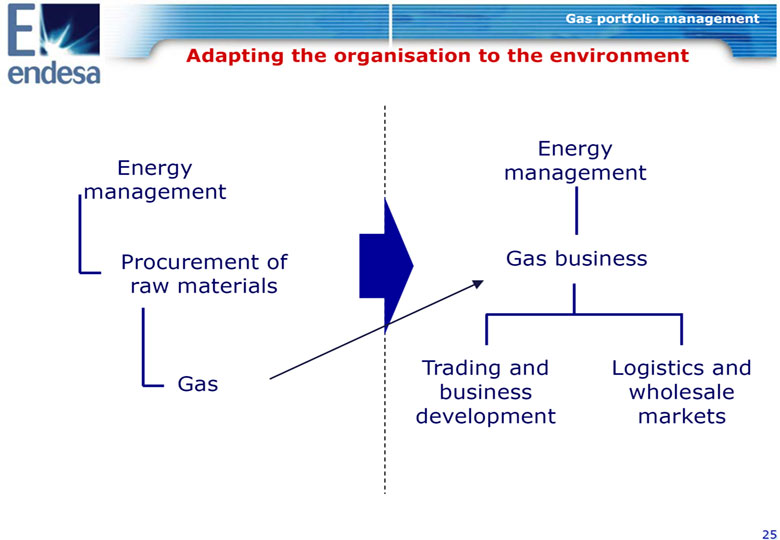

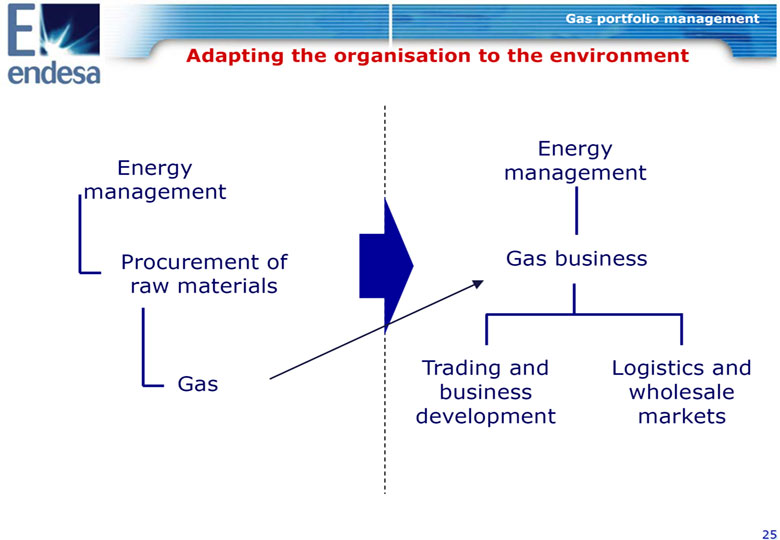

Gas portfolio management Adapting the organisation to the environment Energy Energy management management Procurement of Gas business raw materials Trading and Logistics and Gas business wholesale development markets 25

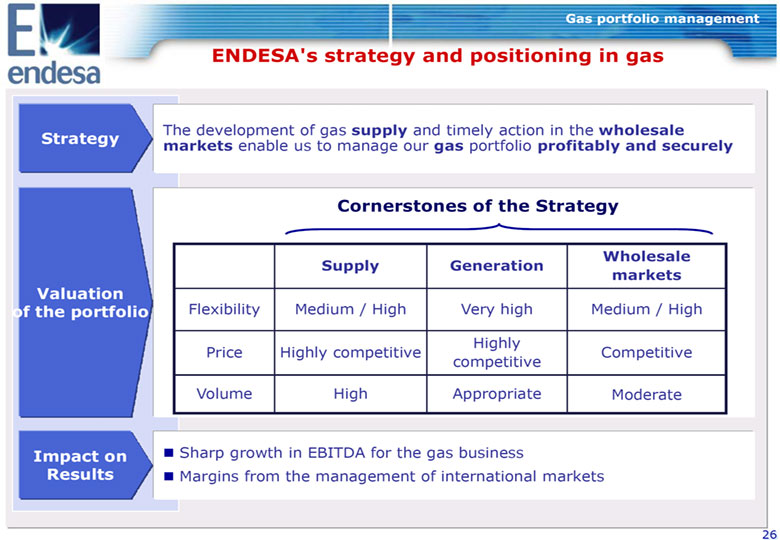

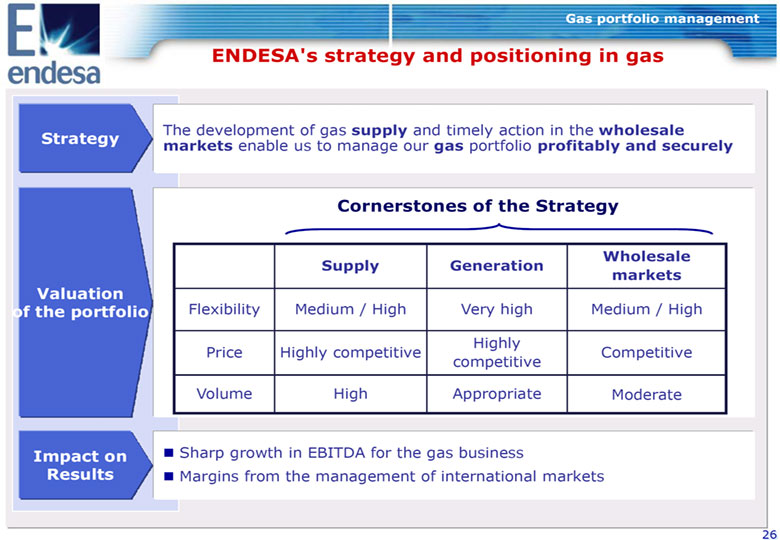

Gas portfolio management ENDESA's strategy and positioning in gas The development of gas supply and timely action in the wholesale Strategy markets enable us to manage our gas portfolio profitably and securely Cornerstones of the Strategy Wholesale Supply Generation markets Valuation of the portfolio Flexibility Medium / High Very high Medium / High Highly Price Highly competitive Competitive competitive Volume High Appropriate Moderate Impact on Sharp growth in EBITDA for the gas business Results Margins from the management of international markets 26

Conclusion Contents Conclusion 27

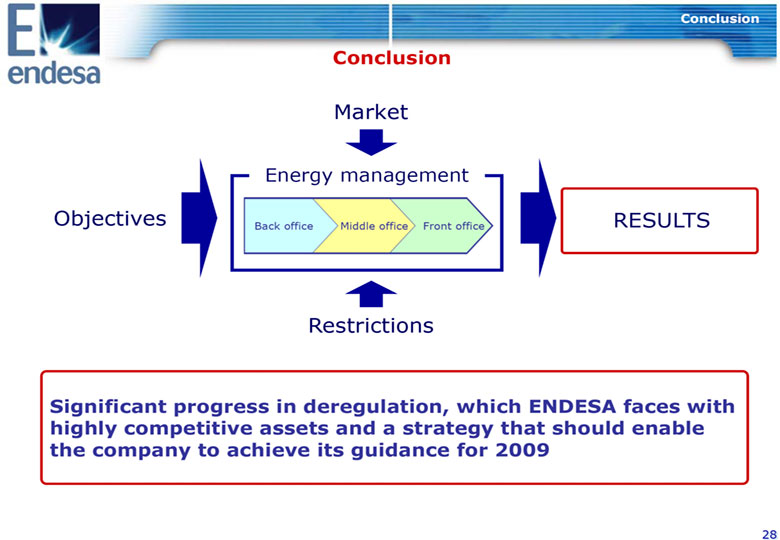

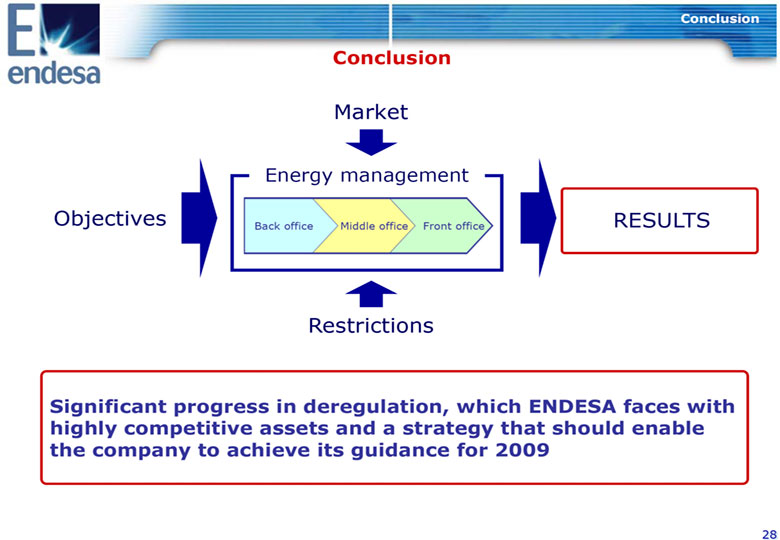

Conclusion Conclusion Market Energy management Objectives Back office Middle office Front office RESULTS Restrictions Significant progress in deregulation, which ENDESA faces with highly competitive assets and a strategy that should enable the company to achieve its guidance for 2009 28

Contents Backup 29

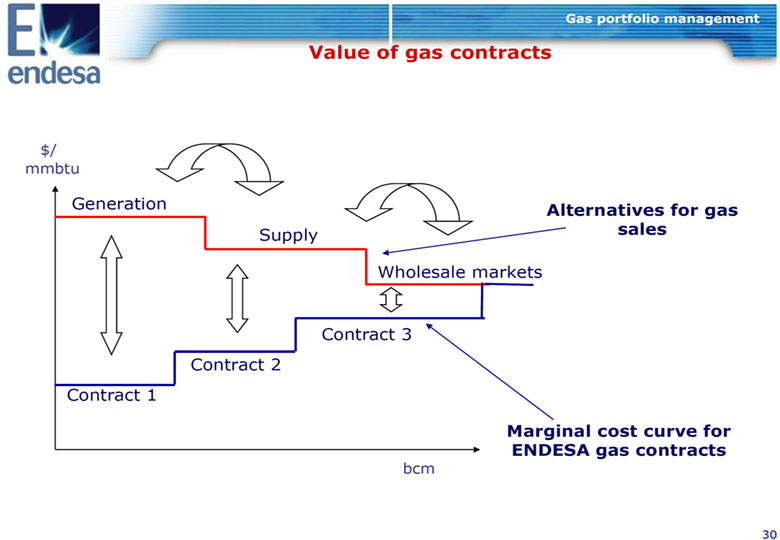

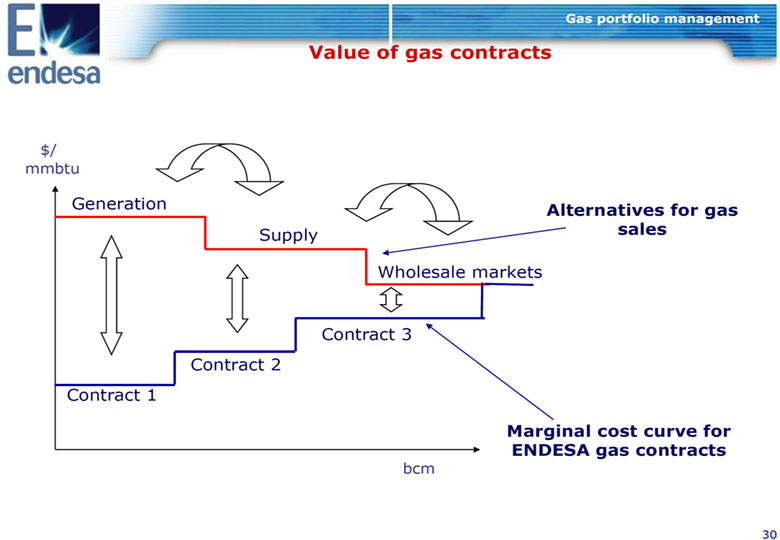

Gas portfolio management Value of gas contracts $/ mmbtu Generation Alternatives for gas Supply sales Wholesale markets Contract 3 Contract 2 Contract 1 Marginal cost curve for ENDESA gas contracts bcm 30

Legal Information This document was made available to shareholders of Endesa, S.A.. In relation with the announced joint offer by ENEL SpA and Acciona, S.A., Endesa shareholders are urged to read the report of Endesa's board of directors when it is filed by the Company with the Comision Nacional del Mercado de Valores (the "CNMV"), as well as Endesa's Solicitation/Recommendation Statement on Schedule 14D-9 when it is filed by the Company with the U.S. Securities and Exchange Commission (the "SEC"), as it will contain important information. Such documents and other public filings made from time to time by Endesa with the CNMV or the SEC are available without charge from the Endesa's website at www.endesa.es, from the the CNMV's website at www.cnmv.es and from the SEC's website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. This presentation contains certain "forward-looking" statements regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and they are subject to material risks, uncertainties, changes and other factors that may be beyond ENDESA's control or may be difficult to predict. Forward-looking statements include, but are not limited to, information regarding: estimated future earnings; anticipated increases in wind and CCGTs generation and market share; expected increases in demand for gas and gas sourcing; management strategy and goals; estimated cost reductions; tariffs and pricing structure; estimated capital expenditures and other investments; estimated asset disposals; estimated increases in capacity and output and changes in capacity mix; repowering of capacity and macroeconomic conditions. For example, the investment plan for 2007-2009 included in this presentation are forward-looking statements and are based on certain assumptions which may or may not prove correct. The main assumptions on which these expectations and targets are based are related to the regulatory setting, exchange rates, divestments, increases in production and installed capacity in markets where ENDESA operates, increases in demand in these markets, assigning of production amongst different technologies, increases in costs associated with higher activity that do not exceed certain limits, electricity prices not below certain levels, the cost of CCGT plants, and the availability and cost of the gas, coal, fuel oil and emission rights necessary to run our business at the desired levels. In these statements we avail ourselves of the protection provided by the Private Securities Litigation Reform Act of 1995 of the United States of America with respect to forward-looking statements. The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Economic and industry conditions: significant adverse changes in the conditions of the industry, the general economy or our markets; the effect of the prevailing regulations or changes in them; tariff reductions; the impact of interest rate fluctuations; the impact of exchange rate fluctuations; natural disasters; the impact of more restrictive environmental regulations and the environmental risks inherent to our activity; potential liabilities relating to our nuclear facilities. Transaction or commercial factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments. Delays in or impossibility of obtaining the pertinent permits and rezoning orders in relation to real estate assets. Delays in or impossibility of obtaining regulatory authorisation, including that related to the environment, for the construction of new facilities, repowering or improvement of existing facilities; shortage of or changes in the price of equipment, material or labour; opposition of political or ethnic groups; adverse changes of a political or regulatory nature in the countries where we or our companies operate; adverse weather conditions, natural disasters, accidents or other unforeseen events, and the impossibility of obtaining financing at what we consider satisfactory interest rates. Political/governmental factors: political conditions in Latin America; changes in Spanish, European and foreign laws, regulations and taxes. Operating factors: technical problems; changes in operating conditions and costs; capacity to execute cost-reduction plans; capacity to maintain a stable supply of coal, fuel and gas and the impact of the price fluctuations of coal, fuel and gas; acquisitions or restructuring; capacity to successfully execute a strategy of internationalisation and diversification. Competitive factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. Further details on the factors that may cause actual results and other developments to differ significantly from the expectations implied or explicitly contained in the presentation are given in the Risk Factors section of Form 20-F filed with the SEC and in the ENDESA Share Registration Statement filed with the Comision Nacional del Mercado de Valores (the Spanish securities regulator or the "CNMV" for its initials in Spanish).No assurance can be given that the forward-looking statements in this document will be realised. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. 31

ENDESA's strategy in deregulated markets New outlook Valencia, 25 June 2007

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ENDESA, S.A. |

| | |

| Dated: June 25, 2007 | By: /s/ Álvaro Pérez de Lema |

| | Name: Álvaro Pérez de Lema |

| | Title: Manager of North America Investor Relations |