FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2007

Commission File Number: 333-07654

ENDESA, S.A.

(Translation of Registrant's Name into English)

Ribera del Loira, 60

28042 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

Renewables: Current situation and portfolio outlook Renewable Energies Division Valencia , 25 June 2007

Agenda Context within which ENDESA is developing renewable energies ENDESA's vision, positioning, and action lines regarding renewable energies Project portfolio 1

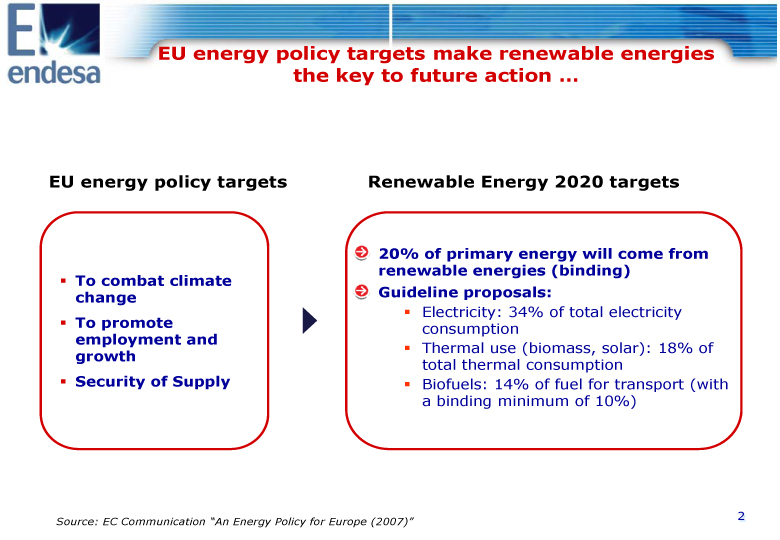

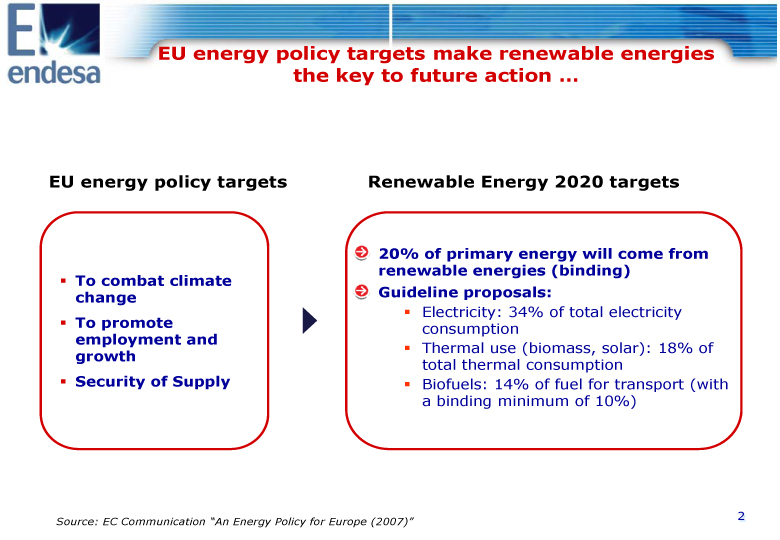

EU energy policy targets make renewable energies the key to future action ... EU energy policy targets Renewable Energy 2020 targets 20% of primary energy will come from renewable energies (binding) To combat climate change Guideline proposals: Electricity: 34% of total electricity To promote consumption employment and Thermal use (biomass, solar): 18% of growth total thermal consumption Security of Supply Biofuels: 14% of fuel for transport (with a binding minimum of 10%) Source: EC Communication "An Energy Policy for Europe (2007)" 2

.... since today they are already an established reality Significant cumulative growth Resources with future potential Gradual achievement of economies of scale Strong technological development Opportunity for industrial development and job creation 3

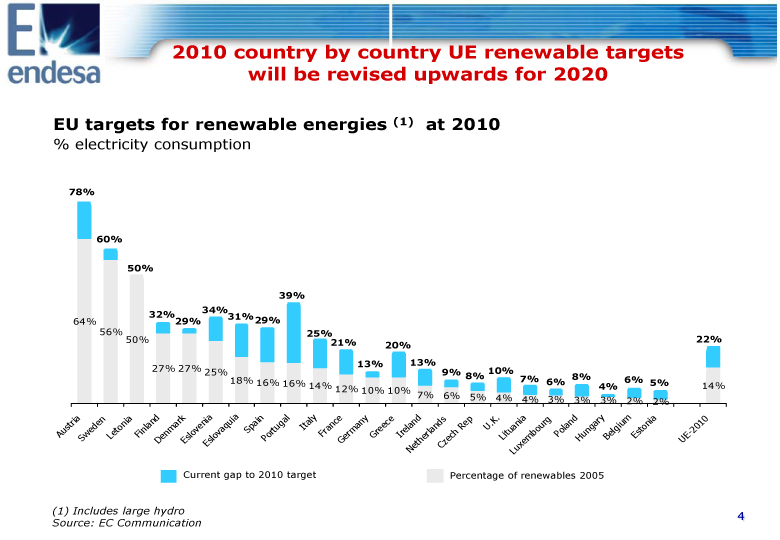

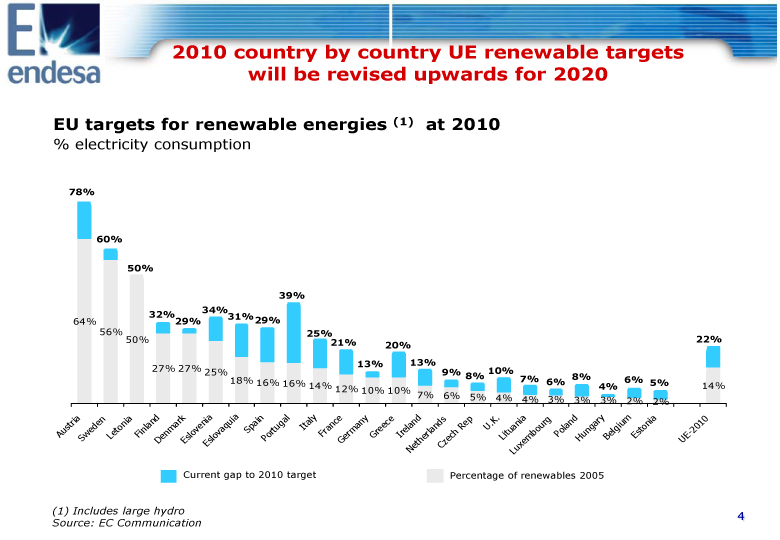

2010 country by country UE renewable targets will be revised upwards for 2020 EU targets for renewable energies (1) at 2010 % electricity consumption 78% 60% 50% 39% 34% 32% 31% 64% 29% 29% 25% 56% 50% 21% 22% 20% 13% 13% 27% 27% 9% 8% 10% 25% 18% 16% 7% 6% 8% 16% 14% 12% 10% 4% 6% 5% 14% 10% 7% 6% 5% 4% 4% 3% 3% 3% 2% 2% ia d k a i n l y l y e . d y 0 r e n n r na n c . K ia n r 1 e a ta a e n a um i 0 d tonia ma v p I ance e land Rep U e S r m r e ol - (2) Austria Sweden Letonia Finland Denmark Eslovenia Eslovaquia Spain Portugal Italy France Germany Greece Ireland Netherlands Czech Rep U.K. Lituania Luxembourg Poland Hungary Belgium Estonia UE- 2010 Current gap t0 2010 target Percentage of renewables 2005 (1) Includes large hydro Source: EC Communication 4

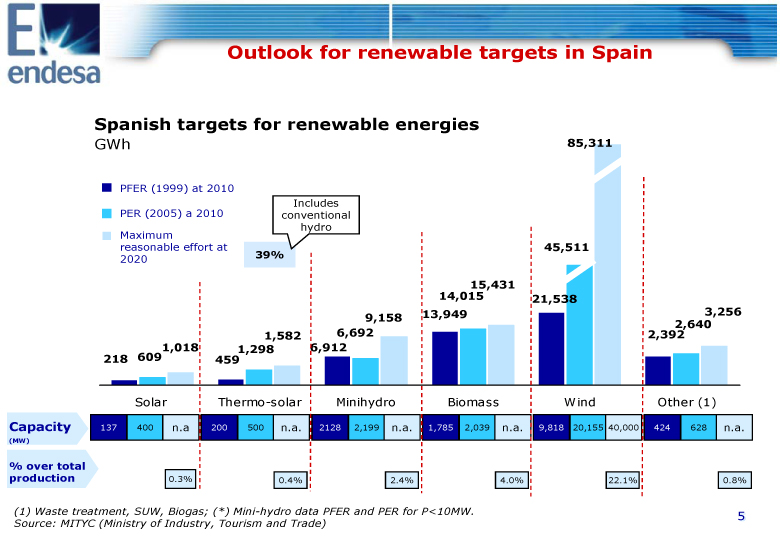

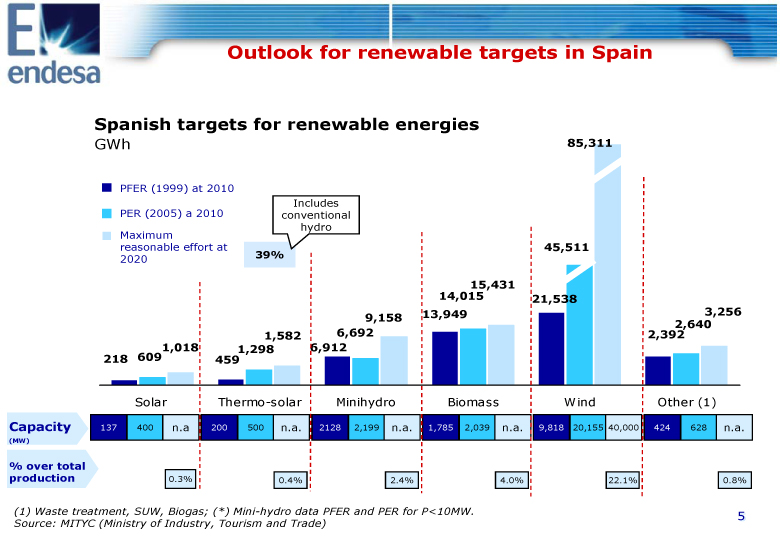

Outlook for renewable targets in Spain Spanish targets for renewable energies GWh 85,311 PFER (1999) at 2010 Includes PER (2005) a 2010 conventional hydro Maximum reasonable effort at 45,511 2020 39% 15,431 14,015 21,538 13,949 3,256 9,158 1,582 6,692 2,392 2,640 1,018 1,298 6,912 218 609 459 Solar Thermo-solar Minihydro Biomass Wind Other (1) Capacity 137 400 n.a 200 500 n.a. 2128 2,199 n.a. 1,785 2,039 n.a. 9,818 20,155 40,000 424 628 n.a. (MW) % over total production 0.3% 0.4% 2.4% 4.0% 22.1% 0.8% (1) Waste treatment, SUW, Biogas; (*) Mini-hydro data PFER and PER for P‹10MW. Source: MITYC (Ministry of Industry, Tourism and Trade) 5

Agenda Context within which ENDESA is developing renewable energies ENDESA's vision, positioning, and action lines regarding renewable energies Project portfolio 6

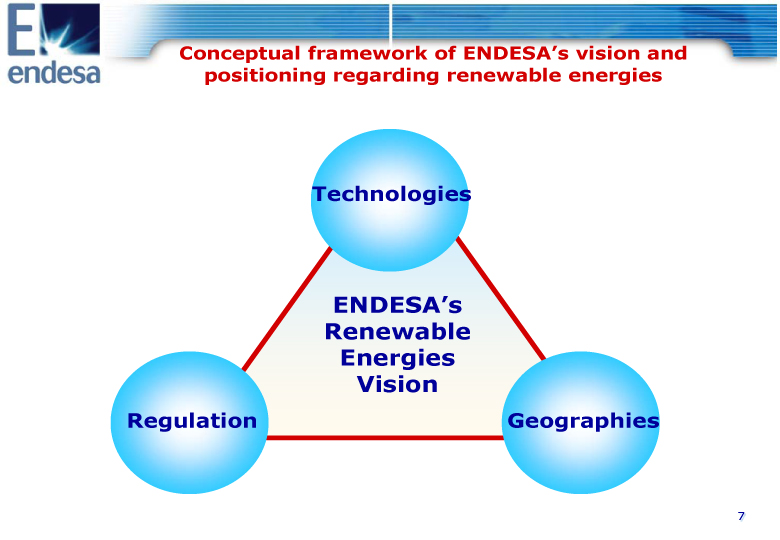

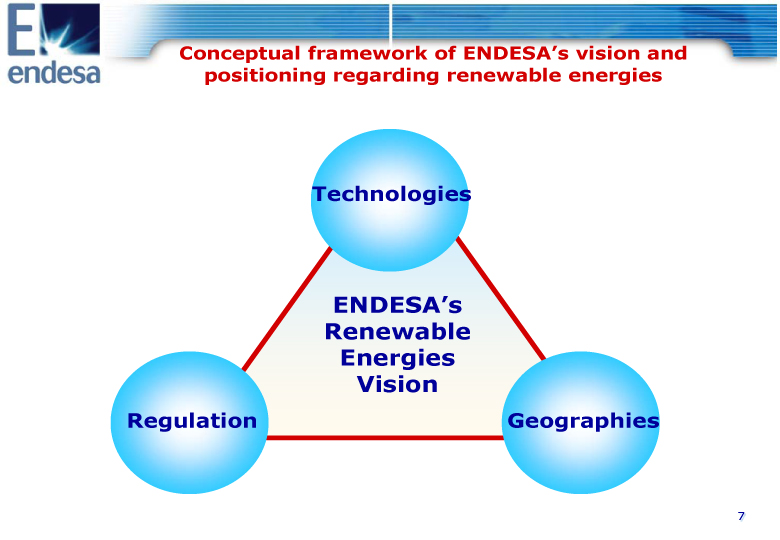

Conceptual framework of ENDESA's vision and positioning regarding renewable energies Technologies ENDESA's Renewable Energies Vision Regulation Geographies 7

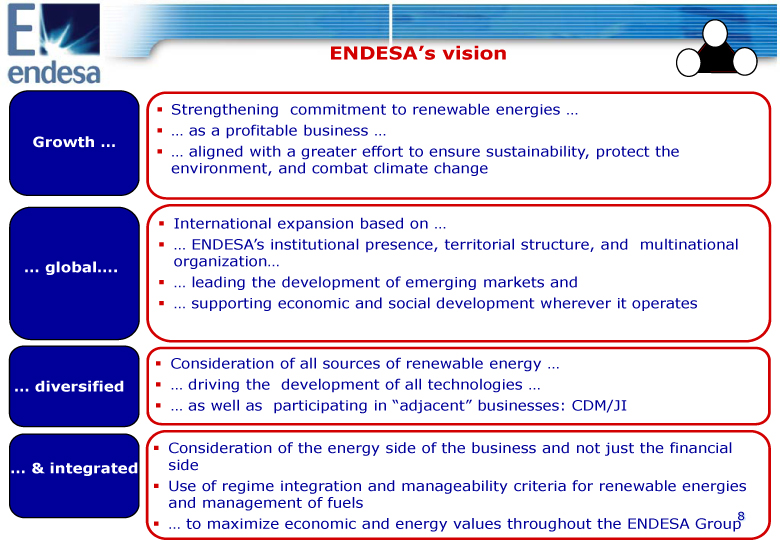

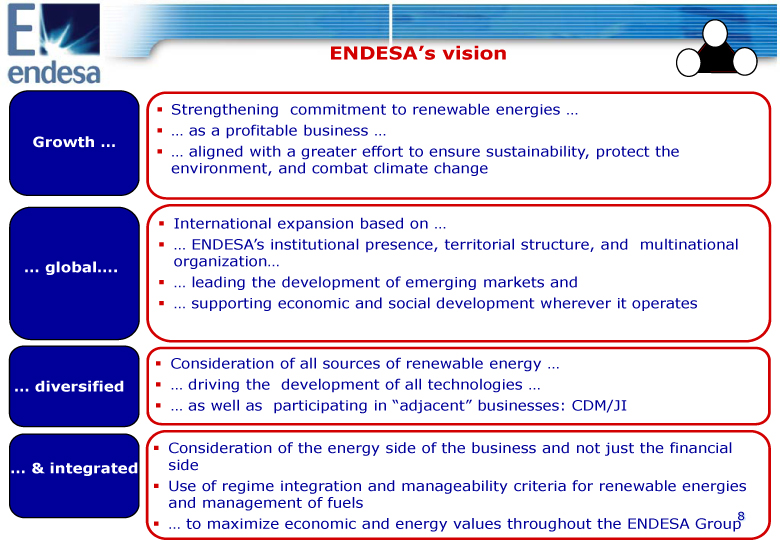

ENDESA's vision Strengthening commitment to renewable energies ... ... as a profitable business ... Growth ... ... aligned with a greater effort to ensure sustainability, protect the environment, and combat climate change International expansion based on ... ... ENDESA's institutional presence, territorial structure, and multinational ... global....organization... ... leading the development of emerging markets and ... supporting economic and social development wherever it operates Consideration of all sources of renewable energy ... ... diversified ... driving the development of all technologies ... .... as well as participating in "adjacent" businesses: CDM/JI Consideration of the energy side of the business and not just the financial ... & integrated side Use of regime integration and manageability criteria for renewable energies and management of fuels ... to maximize economic and energy values throughout the ENDESA Group 8

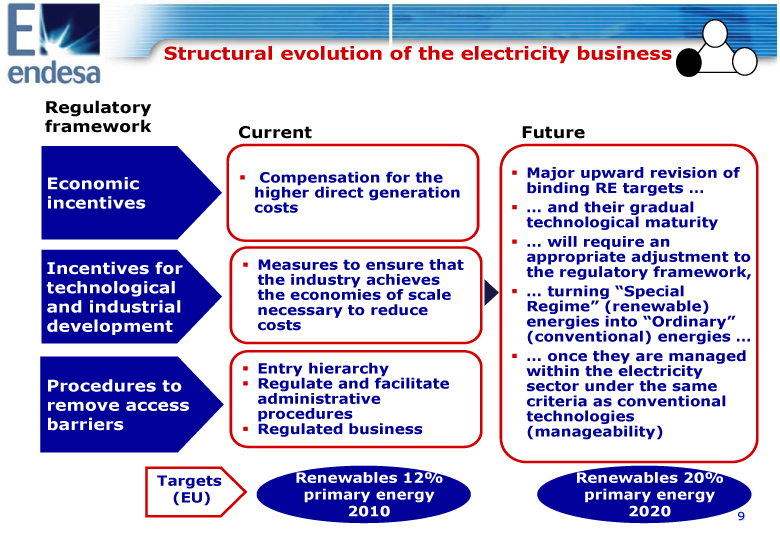

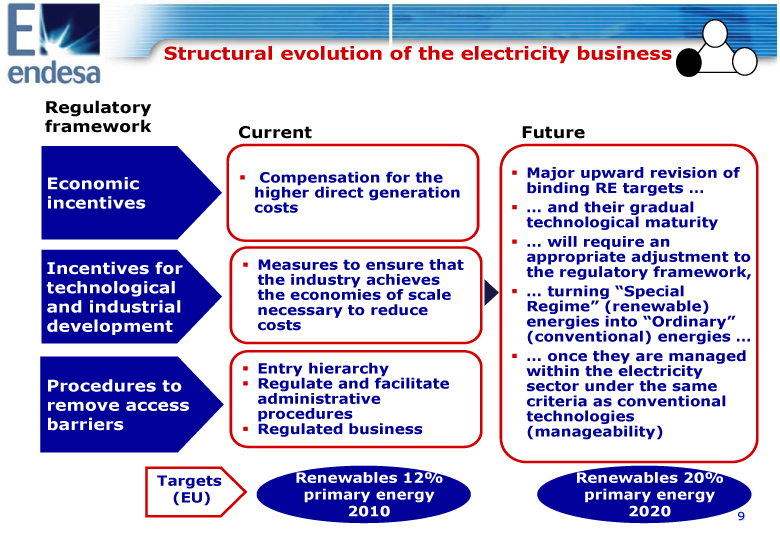

Structural evolution of the electricity business Regulatory framework Current Future Compensation for the Major upward revision of Economic binding RE targets .... higher direct generation incentives costs ... and their gradual technological maturity ... will require an appropriate adjustment to Incentives for Measures to ensure that the regulatory framework, technological the industry achieves the economies of scale ... turning "Special and industrial necessary to reduce Regime" (renewable) development costs energies into "Ordinary" (conventional) energies ... ... once they are managed Entry hierarchy within the electricity Procedures to Regulate and facilitate sector under the same remove access administrative criteria as conventional procedures technologies barriers Regulated business (manageability) Targets Renewables 12% Renewables 20% (EU) primary energy primary energy 2010 2020 9

ENDESA's positioning and action lines by technology (1/4) Positioning Growth and self-development of ENDESA's high quality portfolio, in Wind terms of size and visibility power Solar Action lines To maximize capacity for self-development projects To accelerate and complete inorganic growth in key geographic areas Biomass that have strong growth potential, regulatory stability, and adequate return on investment To ensure the availability of equipment by using the major suppliers around the world To optimize the operation of the current generation portfolio Mini- To maximize intra-group synergies to accelerate portfolio growth and hydro maturity 10

ENDESA's positioning and action lines by technology (2/4) Positioning To promote integrated photovoltaic installations as a way to get closer Wind to the consumption points... power ... and co-leading the technological development of thermoelectric solar in preparation for its introduction in the market Solar Action lines To capture market growth in photovoltaic solar and thermoelectric solar energies Biomass To participate in solar thermoelectric development projects with the most suitable partners To achieve the right technological position in preparation for the emergence of new generation technologies Mini- To maximize intra-group synergies hydro International expansion into countries in which ENDESA already operates (Mediterranean) Hybrid solar/biomass technologies 11

ENDESA's positioning and action lines by technology (3/4) Positioning Aims to lead development in biomass by leveraging co-firing Wind ... and biomass market development initiatives power Action lines Solar To accelerate the conversion of coal-fired plants to co-firing To ensure the transfer of best practices between countries (Italy and in the field experiences in Spain) Biomass Simplification and adaptation to multi-product To lead the creation of a biomass market by leveraging a real demand adapted to the seasonality of supply To create logistics centres for the marketing of biomass fuels Mini- To establish regional programmes for managing farm and forestry hydro waste and the development of energy crops 12

ENDESA's positioning and action lines by technology (4/4) Positioning Wind power To make use of all existing opportunities to develop new mini-hydroelectric plants under the "Special Regime" Solar Action lines To make use of all existing opportunities to develop new mini-hydroelectric plants under the "Special Regime" for renewable energies wherever they may present themselves... Biomass .... starting with the considerable portfolio of mini-hydro plants in Spain (333 MW under the "Special Regime") ... ... and the portfolio of mini-power plants currently operating under the "Ordinary Regime" for conventional generation (935MW ‹10MW) In Latin America, to make use of the region's hydrological potential Mini-hydro 13

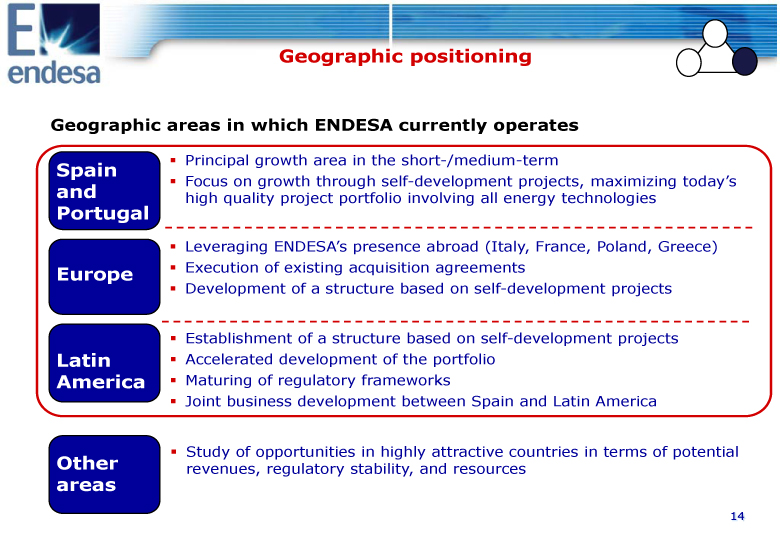

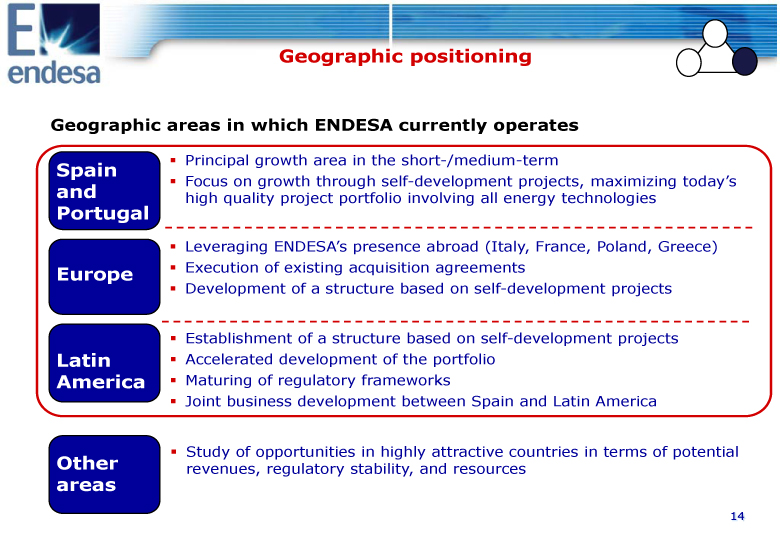

Geographic positioning Geographic areas in which ENDESA currently operates Principal growth area in the short-/medium-term Spain and Focus on growth through self-development projects, maximizing today's high quality project portfolio involving all energy technologies Portugal Leveraging ENDESA's presence abroad (Italy, France, Poland, Greece) Europe Execution of existing acquisition agreements Development of a structure based on self-development projects Establishment of a structure based on self-development projects Latin Accelerated development of the portfolio America Maturing of regulatory frameworks Joint business development between Spain and Latin America Study of opportunities in highly attractive countries in terms of potential Other revenues, regulatory stability, and resources areas 14

Agenda Context within which ENDESA is developing renewable energies ENDESA's vision, positioning, and action lines regarding renewable energies Project portfolio 15

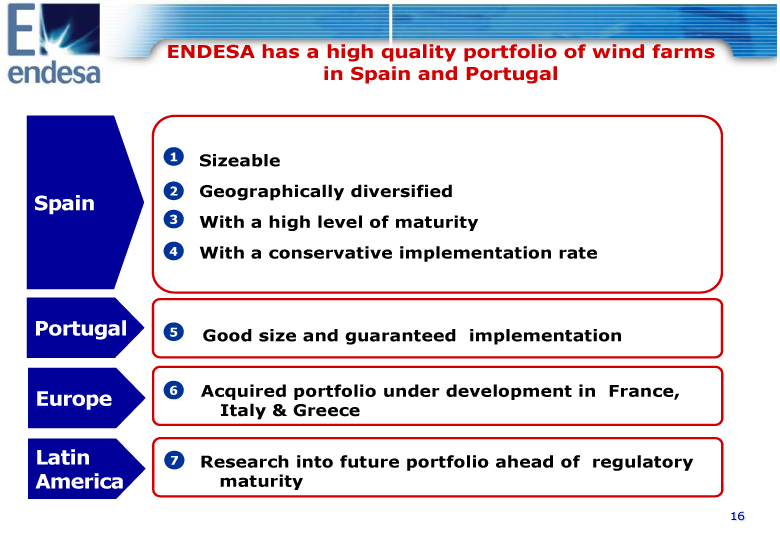

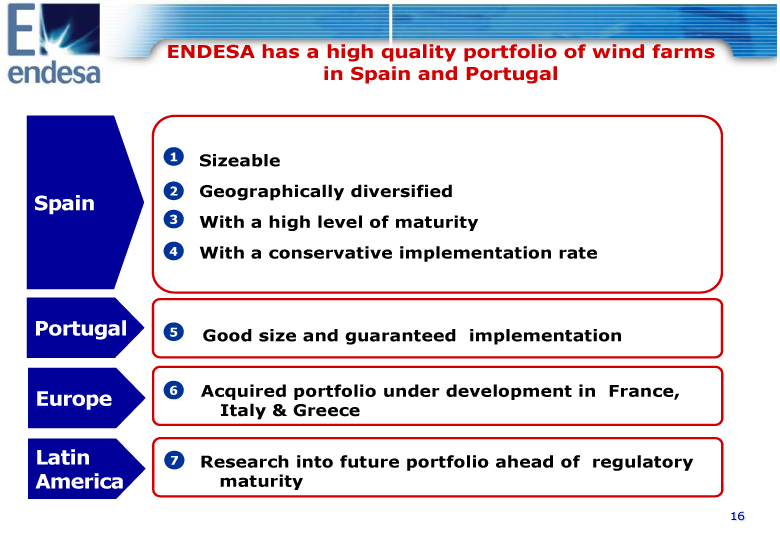

ENDESA has a high quality portfolio of wind farms in Spain and Portugal 1 Sizeable 2 Geographically diversified Spain 3 With a high level of maturity 4 With a conservative implementation rate Portugal 5 Good size and guaranteed implementation Europe 6 Acquired portfolio under development in France, Italy & Greece Latin 7 Research into future portfolio ahead of regulatory Americamaturity 16

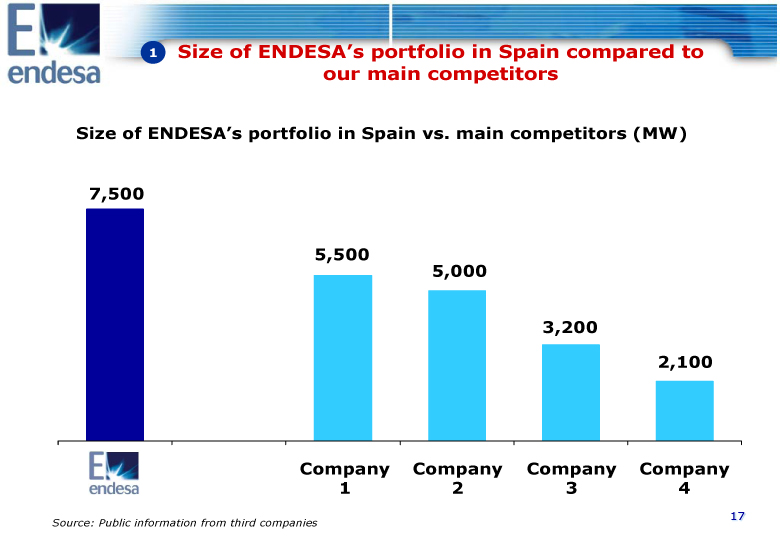

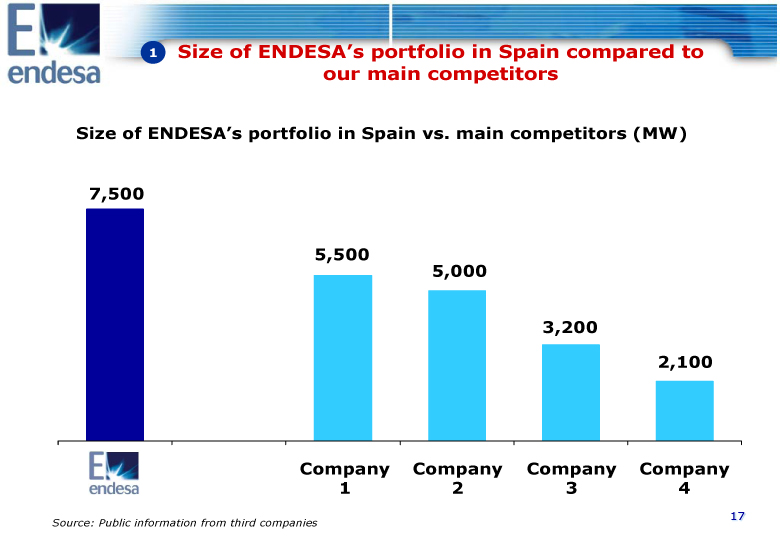

1 Size of ENDESA's portfolio in Spain compared to our main competitors Size of ENDESA's portfolio in Spain vs. main competitors (MW) 7,500 5,500 5,000 3,200 2,100 Company Company Company Company 1 2 3 4 Source: Public information from third companies 17

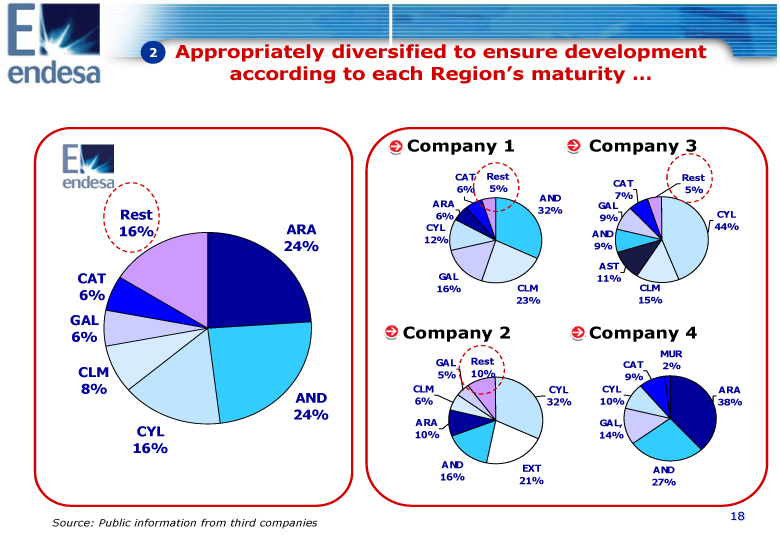

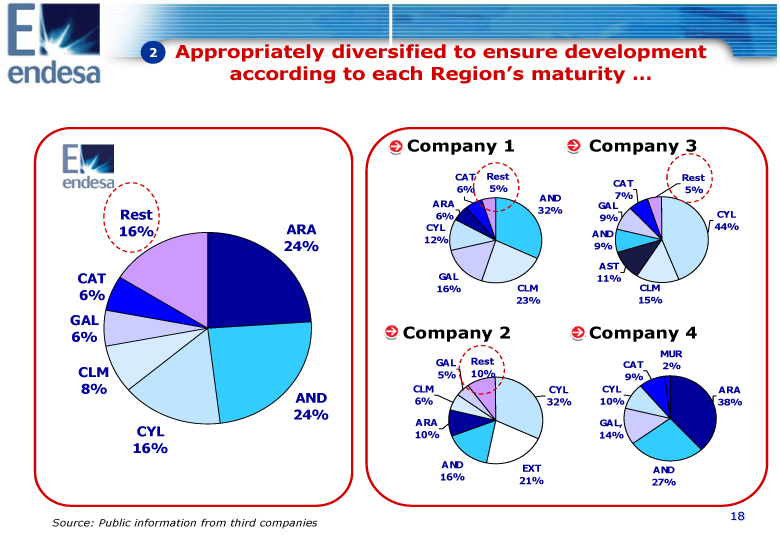

2 Appropriately diversified to ensure development according to each Region's maturity ... Company 1 Company 3 CAT Rest Rest CAT 6% 5% 5% AND 7% ARA GAL 32% CYL Rest 6% 9% 16% ARA CYL 44% AND 12% 24% 9% AST CAT GAL 11% 6% 16% CLM CLM 23% 15% GAL 6% Company 2 Company 4 MUR GAL Rest CAT 2% CLM 5% 10% 9% 8% CLM CYL CYL ARA AND 6% 32% 10% 38% 24% ARA GAL, CYL 10% 14% 16% AND EXT AND 16% 21% 27% Source: Public information from third companies 18

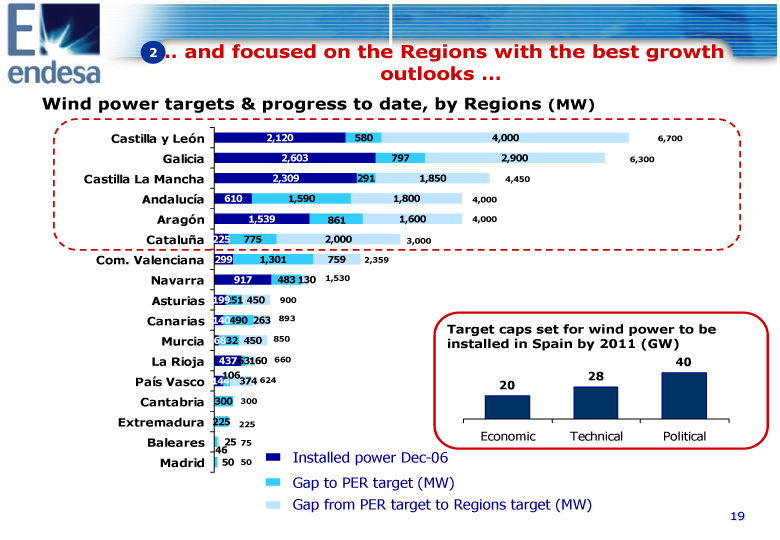

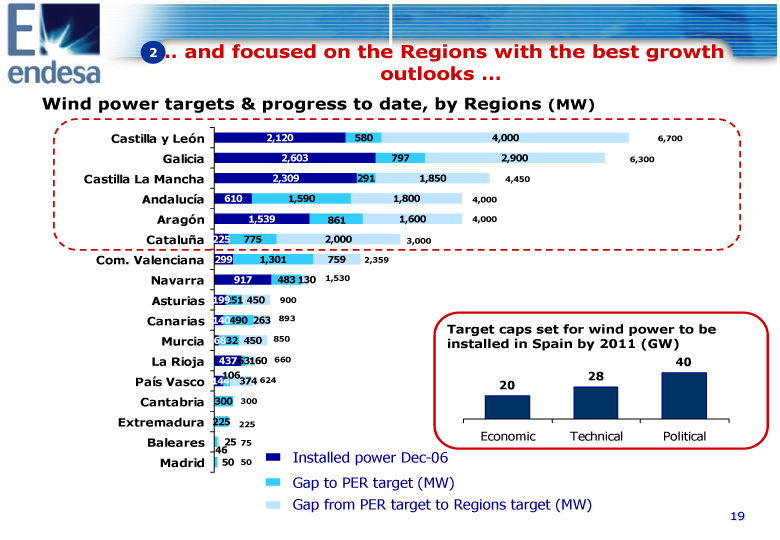

2... and focused on the Regions with the best growth outlooks ... Wind power targets & progress to date, by Regions (MW) Castilla y Leon 2,120 580 4,000 6,700 Galicia 2,603 797 2,900 6,300 Castilla La Mancha 2,309 291 1,850 4,450 Andalucia 610 1,590 1,800 4,000 Aragon 1,539 861 1,600 4,000 Cataluna 225 775 2,0003,000 Com. Valenciana 299 1,301 759 2,359 Navarra 917 483 130 1,530 Asturias 199 251 450 900 Canarias 140490 263 893 Target caps set for wind power to be Murcia 68 332 450 850 installed in Spain by 2011 (GW) La Rioja 43763160 660 40 106 28 Pais Vasco 144 374 624 20 Cantabria 300 300 Extremadura 225 225 4 Economic Technical Political Baleares 25 75 46 Installed power Dec-06 Madrid 50 50 Gap to PER target (MW) Gap from PER target to Regions target (MW) 19

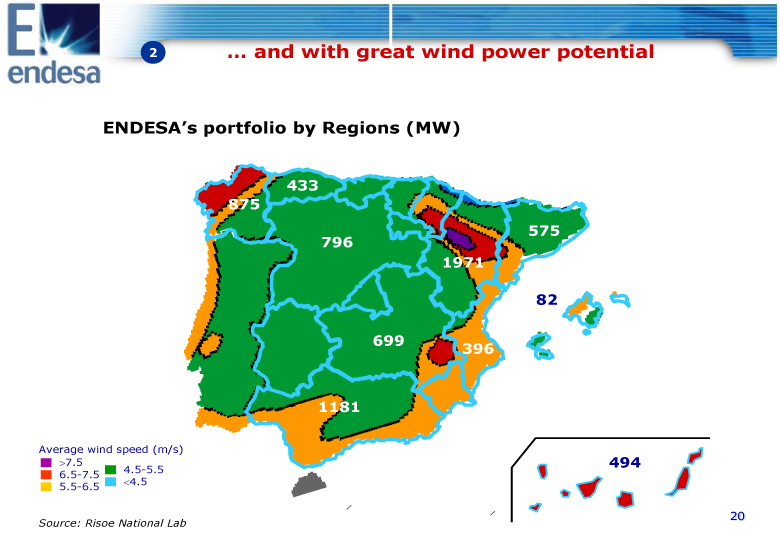

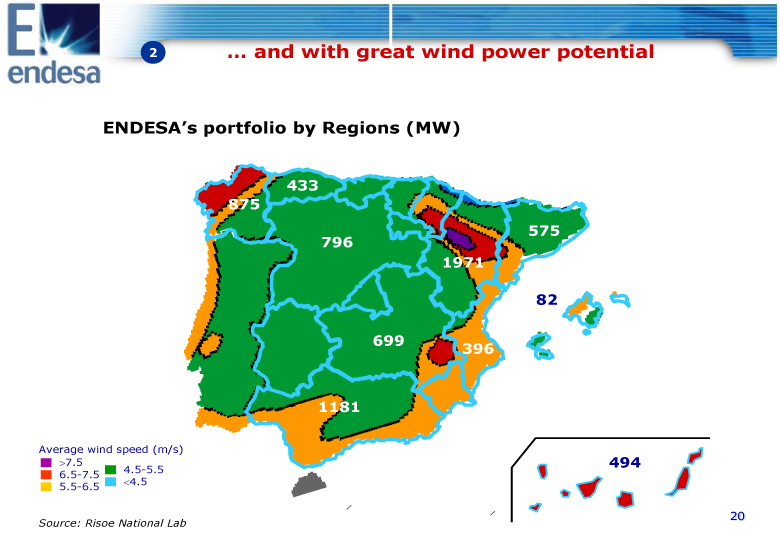

2 ... and with great wind power potential ENDESA's portfolio by Regions (MW) 433 875 575 796 1971 82 699 396 1181 Average wind speed (m/s) >7.5 494 6.5-7.5 4.5-5.5 5.5-6.5 ‹4.5 Source: Risoe National Lab 20

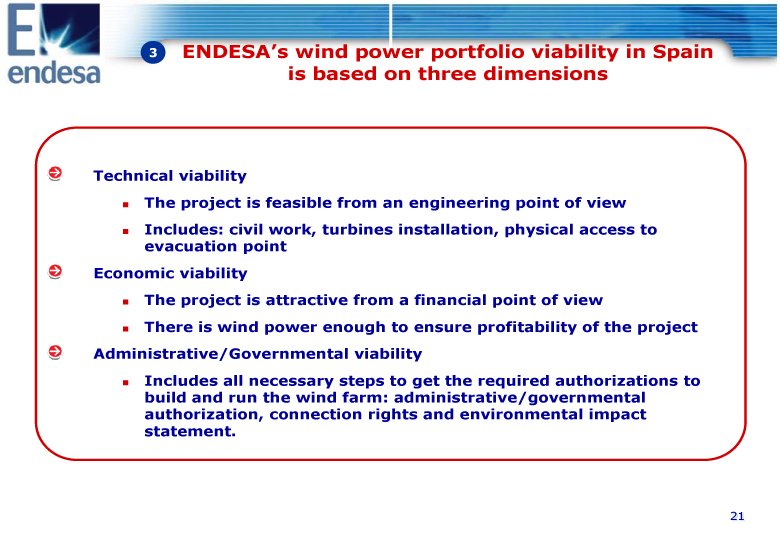

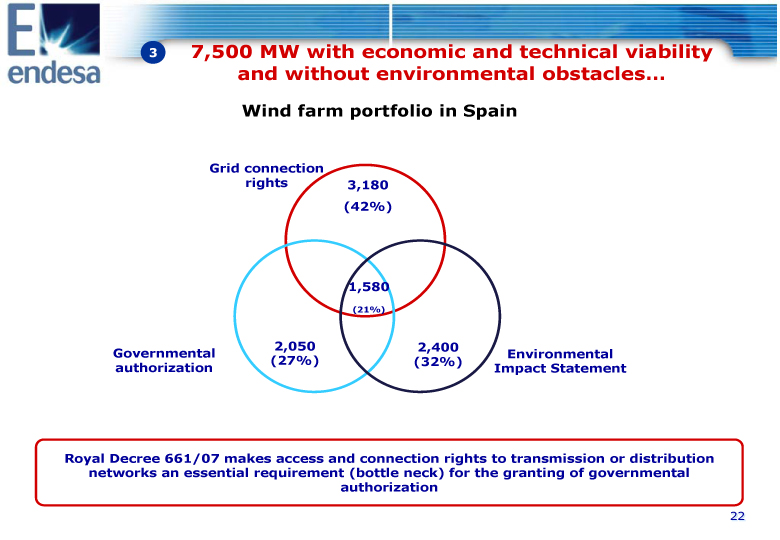

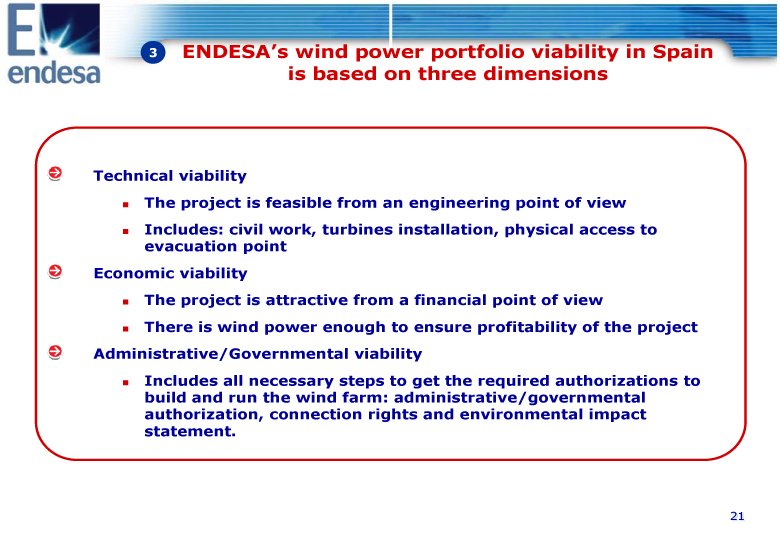

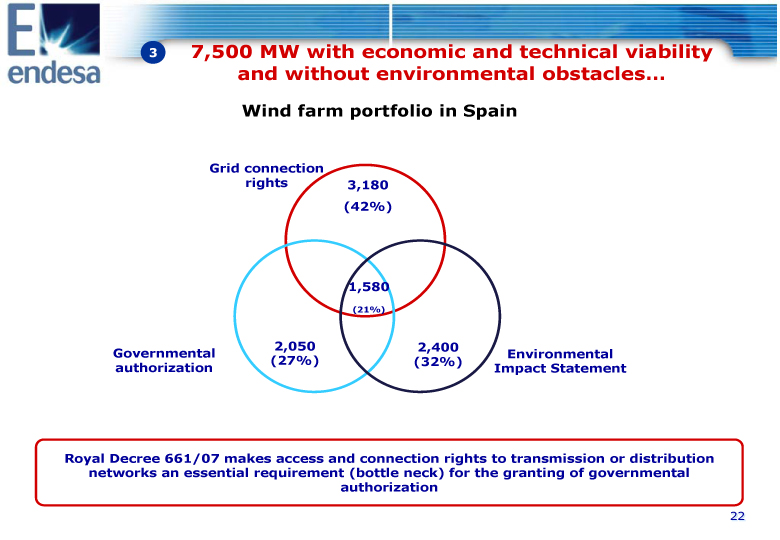

3 ENDESA's wind power portfolio viability in Spain is based on three dimensions Technical viability The project is feasible from an engineering point of view Includes: civil work, turbines installation, physical access to evacuation point Economic viability The project is attractive from a financial point of view There is wind power enough to ensure profitability of the project Administrative/Governmental viability Includes all necessary steps to get the required authorizations to build and run the wind farm: administrative/governmental authorization, connection rights and environmental impact statement. 21

3 7,500 MW with economic and technical viability and without environmental obstacles... Wind farm portfolio in Spain Grid connection rights 3,180 (42%) 1,580 (21%) 2,050 2,400 Governmental Environmental (27%) (32%) authorization Impact Statement Royal Decree 661/07 makes access and connection rights to transmission or distribution networks an essential requirement (bottle neck) for the granting of governmental authorization 22

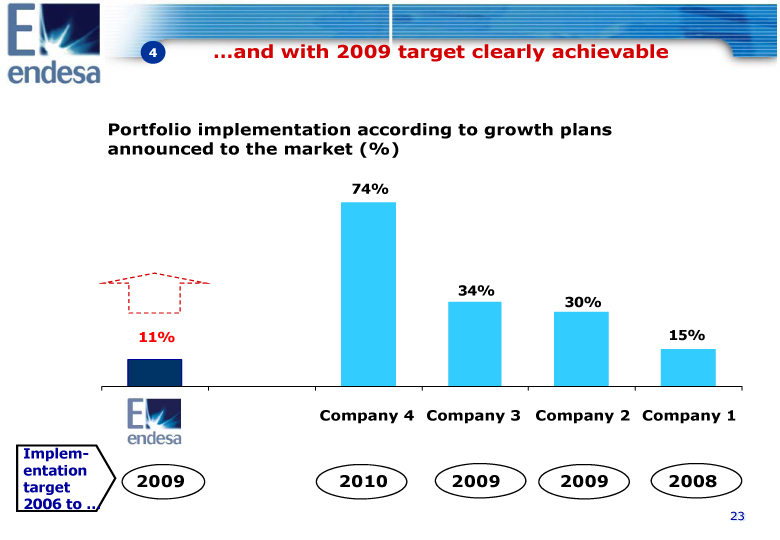

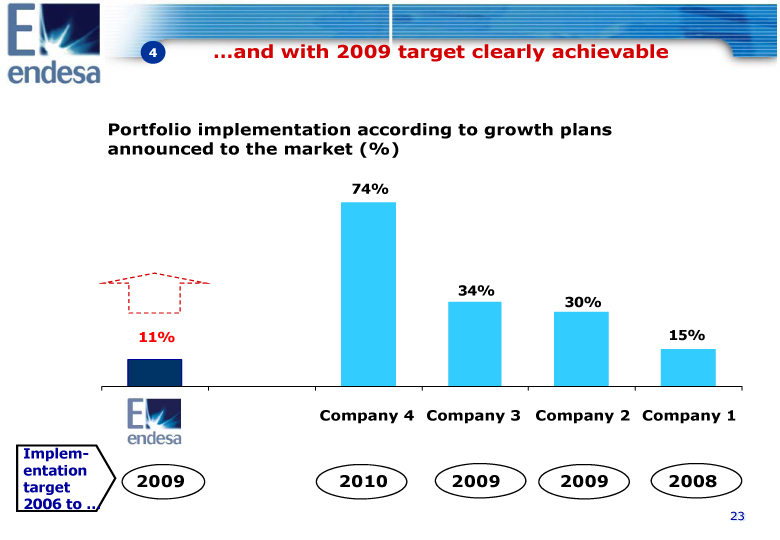

4 ...and with 2009 target clearly achievable Portfolio implementation according to growth plans announced to the market (%) 74% 34% 30% 11% 15% Company 4 Company 3 Company 2 Company 1 Implementation target 2009 2010 2009 2009 2008 2006 to ... 23

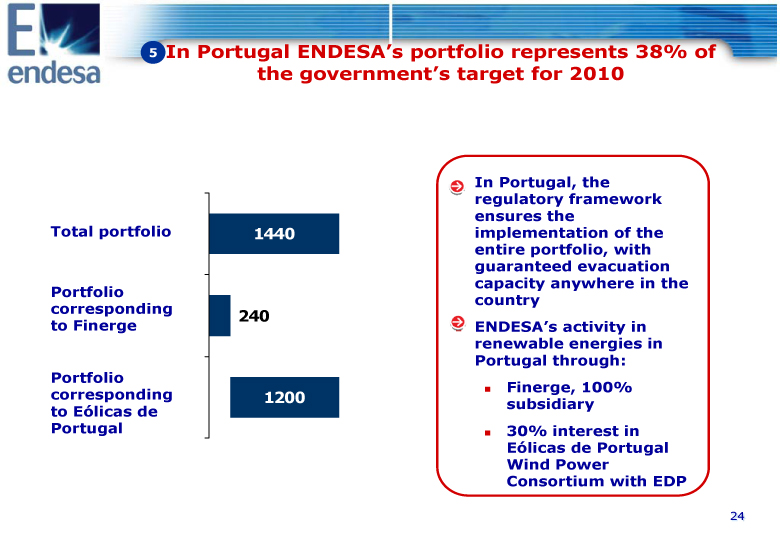

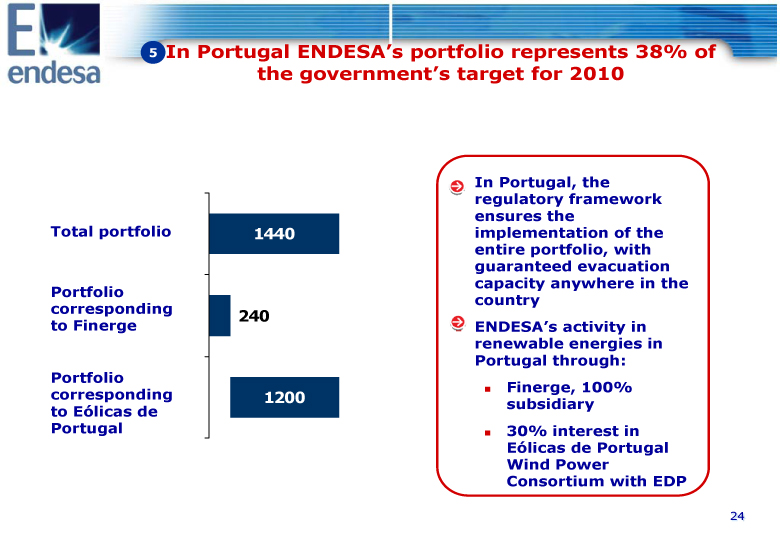

5 In Portugal ENDESA's portfolio represents 38% of the government's target for 2010 In Portugal, the regulatory framework ensures the Total portfolio 1440 implementation of the entire portfolio, with guaranteed evacuation capacity anywhere in the Portfolio country corresponding 240 to Finerge ENDESA's activity in renewable energies in Portugal through: Portfolio corresponding 1200 Finerge, 100% subsidiary to Eolicas de Portugal 30% interest in Eolicas de Portugal Wind Power Consortium with EDP 24

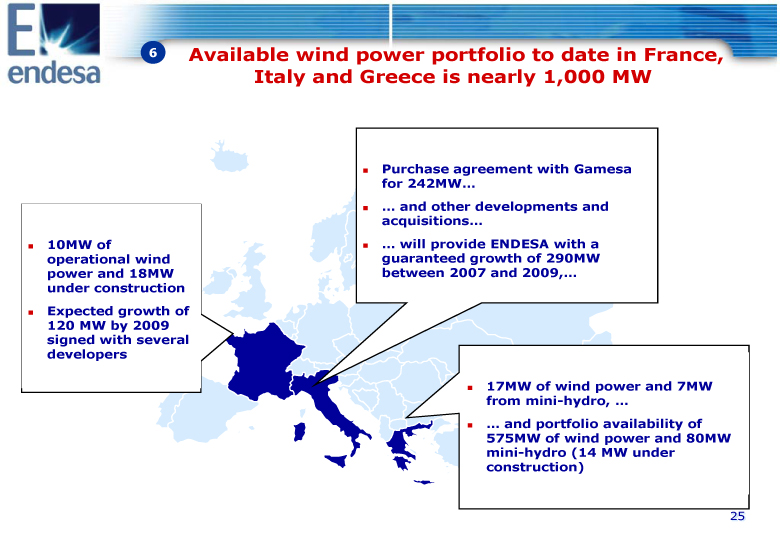

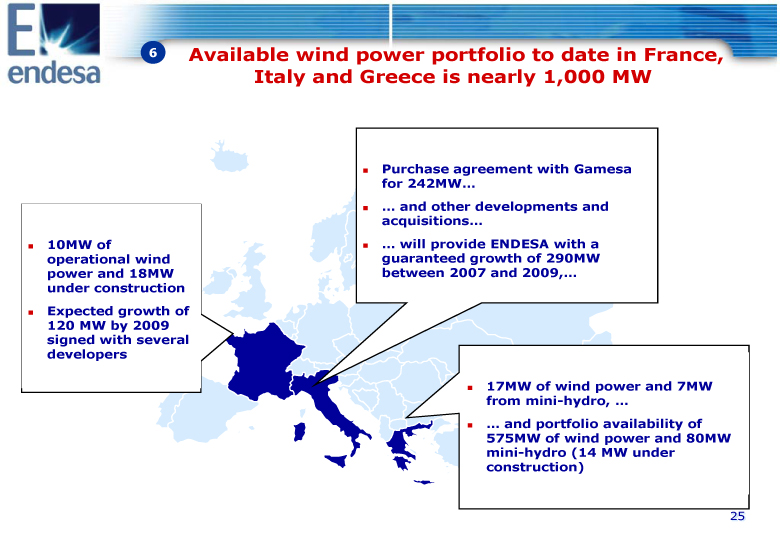

6 Available wind power portfolio to date in France, Italy and Greece is nearly 1,000 MW Purchase agreement with Gamesa for 242MW... ... and other developments and acquisitions... 10MW of ... will provide ENDESA with a operational wind guaranteed growth of 290MW power and 18MW between 2007 and 2009,... under construction Expected growth of 120 MW by 2009 signed with several developers 17MW of wind power and 7MW from mini-hydro, ... ... and portfolio availability of 575MW of wind power and 80MW mini-hydro (14 MW under construction) 25

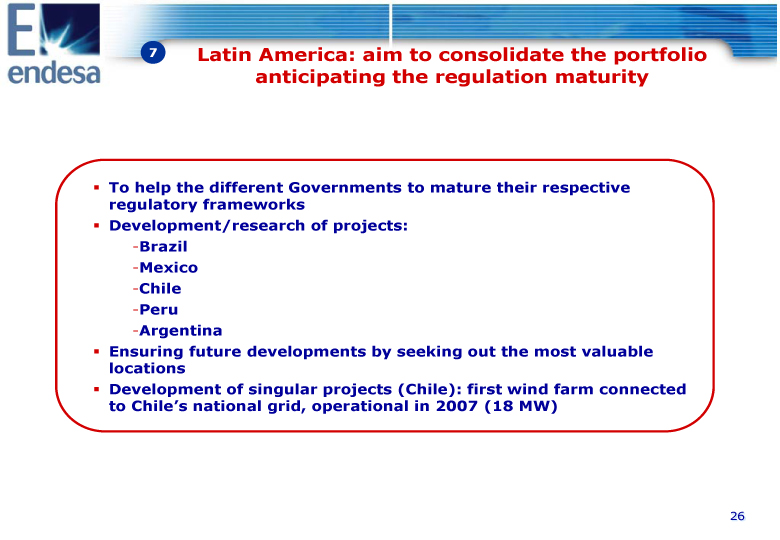

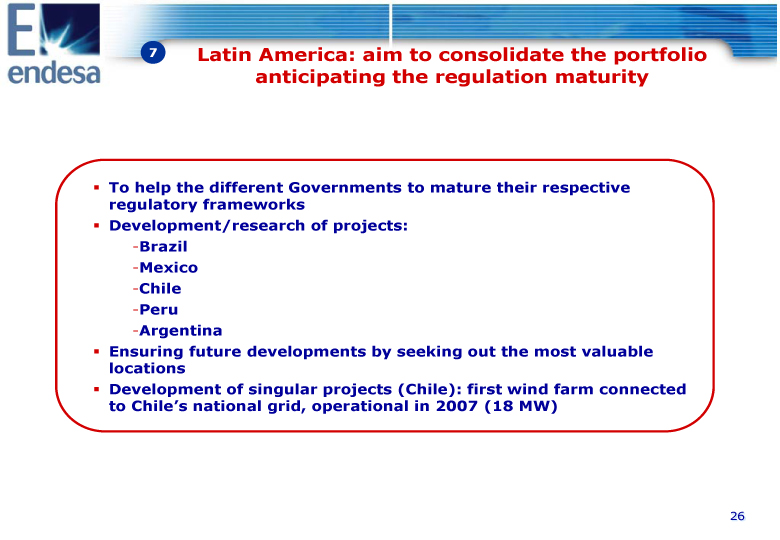

7 Latin America: aim to consolidate the portfolio anticipating the regulation maturity To help the different Governments to mature their respective regulatory frameworks Development/research of projects: -Brazil -Mexico -Chile -Peru - -Argentina Ensuring future developments by seeking out the most valuable locations Development of singular projects (Chile): first wind farm connected to Chile's national grid, operational in 2007 (18 MW) 26

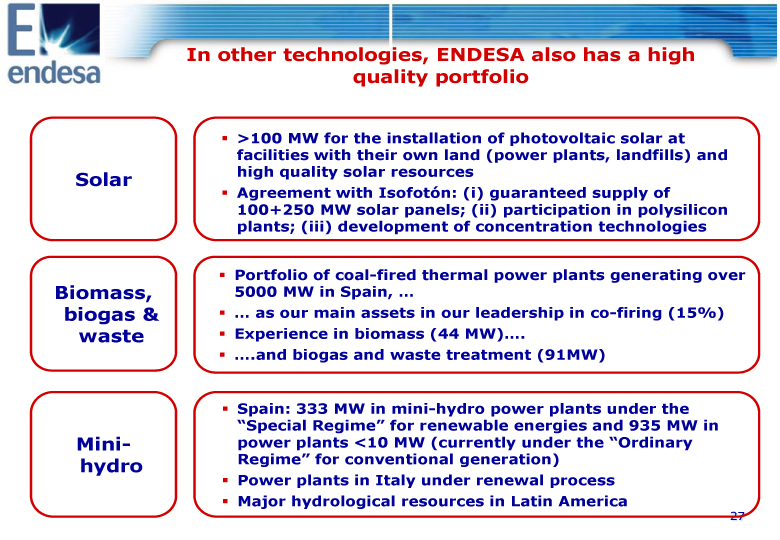

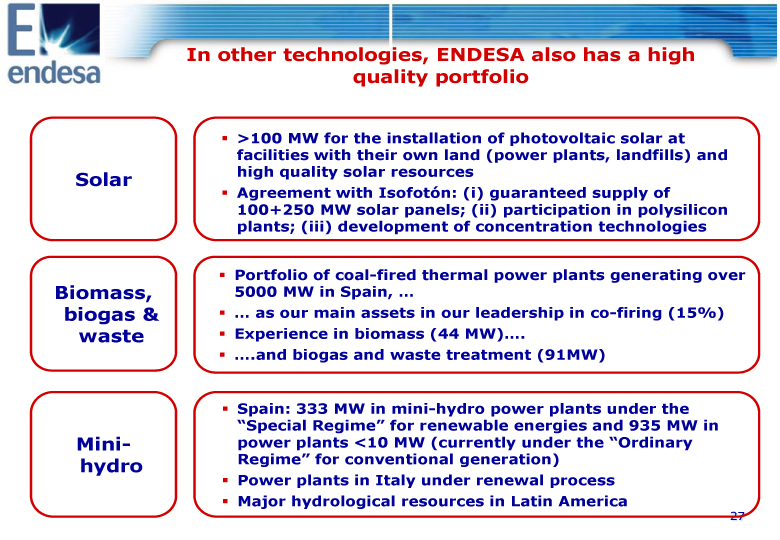

In other technologies, ENDESA also has a high quality portfolio ›100 MW for the installation of photovoltaic solar at facilities with their own land (power plants, landfills) and Solar high quality solar resources Agreement with Isofoton: (i) guaranteed supply of 100+250 MW solar panels; (ii) participation in polysilicon plants; (iii) development of concentration technologies Portfolio of coal-fired thermal power plants generating over Biomass, 5000 MW in Spain, .... biogas & ... as our main assets in our leadership in co-firing (15%) waste Experience in biomass (44 MW).... ....and biogas and waste treatment (91MW) Spain: 333 MW in mini-hydro power plants under the "Special Regime" for renewable energies and 935 MW in Mini- power plants ‹10 MW (currently under the "Ordinary hydro Regime" for conventional generation) Power plants in Italy under renewal process Major hydrological resources in Latin America 27

Conclusions Extensive current political commitments on renewable energies translate into very demanding targets ... ... which will generate significant growth in renewable energies given the technological progress being made Endesa's vision for its renewable energy business is shaped by its commitment to global territorial growth across all technologies, integrated within the electricity system The visibility and scale of Endesa's renewables pipeline guarantees its future positioning, setting the stage for the development of higher growth programs 28

Legal Information This document was made available to shareholders of Endesa, S.A.. In relation with the announced joint offer by ENEL SpA and Acciona, S.A., Endesa shareholders are urged to read the report of Endesa's board of directors when it is filed by the Company with the Comision Nacional del Mercado de Valores (the "CNMV"), as well as Endesa's Solicitation/Recommendation Statement on Schedule 14D-9 when it is filed by the Company with the U.S. Securities and Exchange Commission (the "SEC"), as it will contain important information. Such documents and other public filings made from time to time by Endesa with the CNMV or the SEC are available without charge from the Endesa's website at www.endesa.es, from the the CNMV's website at www.cnmv.es and from the SEC's website at www.sec.gov and at Endesa's principal executive offices in Madrid, Spain. This presentation contains certain "forward-looking" statements regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and they are subject to material risks, uncertainties, changes and other factors that may be beyond ENDESA's control or may be difficult to predict. Forward-looking statements include, but are not limited to, information regarding: estimated future earnings; anticipated increases in wind and CCGTs generation and market share; expected increases in demand for gas and gas sourcing; management strategy and goals; estimated cost reductions; tariffs and pricing structure; estimated capital expenditures and other investments; estimated asset disposals; estimated increases in capacity and output and changes in capacity mix; repowering of capacity and macroeconomic conditions. For example, the investment plan for 2007-2009 included in this presentation are forward-looking statements and are based on certain assumptions which may or may not prove correct. The main assumptions on which these expectations and targets are based are related to the regulatory setting, exchange rates, divestments, increases in production and installed capacity in markets where ENDESA operates, increases in demand in these markets, assigning of production amongst different technologies, increases in costs associated with higher activity that do not exceed certain limits, electricity prices not below certain levels, the cost of CCGT plants, and the availability and cost of the gas, coal, fuel oil and emission rights necessary to run our business at the desired levels. In these statements we avail ourselves of the protection provided by the Private Securities Litigation Reform Act of 1995 of the United States of America with respect to forward-looking statements. The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements: Economic and industry conditions: significant adverse changes in the conditions of the industry, the general economy or our markets; the effect of the prevailing regulations or changes in them; tariff reductions; the impact of interest rate fluctuations; the impact of exchange rate fluctuations; natural disasters; the impact of more restrictive environmental regulations and the environmental risks inherent to our activity; potential liabilities relating to our nuclear facilities. Transaction or commercial factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments. Delays in or impossibility of obtaining the pertinent permits and rezoning orders in relation to real estate assets. Delays in or impossibility of obtaining regulatory authorisation, including that related to the environment, for the construction of new facilities, repowering or improvement of existing facilities; shortage of or changes in the price of equipment, material or labour; opposition of political or ethnic groups; adverse changes of a political or regulatory nature in the countries where we or our companies operate; adverse weather conditions, natural disasters, accidents or other unforeseen events, and the impossibility of obtaining financing at what we consider satisfactory interest rates. Political/governmental factors: political conditions in Latin America; changes in Spanish, European and foreign laws, regulations and taxes. Operating factors: technical problems; changes in operating conditions and costs; capacity to execute cost-reduction plans; capacity to maintain a stable supply of coal, fuel and gas and the impact of the price fluctuations of coal, fuel and gas; acquisitions or restructuring; capacity to successfully execute a strategy of internationalisation and diversification. Competitive factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets. Further details on the factors that may cause actual results and other developments to differ significantly from the expectations implied or explicitly contained in the presentation are given in the Risk Factors section of Form 20-F filed with the SEC and in the ENDESA Share Registration Statement filed with the Comision Nacional del Mercado de Valores (the Spanish securities regulator or the "CNMV" for its initials in Spanish).No assurance can be given that the forward-looking statements in this document will be realised. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements. 29

Renewables: Current situation and portfolio outlook Renewable Energies Division Valencia , 25 June 2007

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ENDESA, S.A. |

| | |

| Dated: June 25, 2007 | By: /s/ Álvaro Pérez de Lema |

| | Name: Álvaro Pérez de Lema |

| | Title: Manager of North America Investor Relations |