Results

JANUARY-SEPTEMBER 2007

Madrid, 15 November, 2007

CONTENTS

Consolidated results 3

Results by business line 12

Business in Spain and Portugal 13

Business in Europe 22

Business in Latin America 28

Statistical appendix 37

CONSOLIDATED RESULTS

ENDESA reports 9M07 net income of Euro 1,979 million

Endesa reported net income of Euro 1,979 million in 9M07. This figure is Euro 529 million less than the year earlier figure.

To effect a comparison on a like-for-like basis, four significant non-recurring items included in 9M06 need to be factored in:

| - | Recognition of stranded costs for non-mainland generation for 2001-2005, which amounted to Euro 227 million, and for corresponding interest amounting to Euro 31 million, with a combined impact of Euro 197 million on net income. |

| - | The tax effect relating to Endesa Italia’s revaluation of the tax bases of its assets to their book values, as permitted by current legislation in Italy. The amount of this tax effect was Euro 148 million and its impact on net income after minority interests stood at Euro 118 million. |

| - | The fiscal impact of the merger between Elesur and Chilectra, which was Euro 170 million, with an impact on net income after minority interests of Euro 101 million. |

| - | Income generated from asset disposals, which amounted to Euro 453 million, with an impact of Euro 378 million on net income after taxes and minority interests. |

After discounting the four effects mentioned above from 9M06 results, and net income from asset disposals carried out in 9M07, net income in the first nine months of this year grew 13%.

References to a like-for-like comparison of earnings in this document always refer to variations produced after deducting the items mentioned above from the both years’ results.

ENDESA NET INCOME, 9M07 |

| | Euro million | % chg. vs. 9M06 | % chg. vs. 9M06 l-f-l | % contrib. to total net income |

| Spain and Portugal | 1,390 | (7.5) | 21.3 | 70.2 |

| Europe | 287 | (32.6) | (5.8) | 14.5 |

| Latin America | 302 | (26) | 1 | 15.3 |

TOTAL | 1,979 | (21.1) | 13 | 100 |

The distribution of net income between the different electricity businesses is balanced, reinforcing the Company’s multinational character and its appropriately diversified risk profile.

Electricity generation : 137,431 GWh

Electricity generation stood at 137,431 GWh in 9M07, a drop of 2.6% compared to 9M06. The increased output in Spain and Portugal (1.5%) was not sufficient to offset lower output in Europe (-9.7%) and Latin America (-4.5%). In Europe this drop was due to lower demand for electricity in Italy and France during the early months of the year as a result of milder temperatures compared to 2006. In Latin America, the drop in production owed to lower rainfall and gas supply issues.

Electricity sales totalled 168,865 GWh, an increase of 2.8% compared to 9M06.

GENERATION AND ELECTRICITY SALES |

| | Output | Sales |

| | GWh | % chg. vs. 9M06 | GWh | % chg. vs. 9M06 |

| Spain and Portugal | 69,246 | 1.5 | 85,177 | 3.6 |

| Europe | 23,888 | (9.7) | 37,745 | (3.0) |

| Latin America | 44,297 | (4.5) | 45,943 | 6.4 |

TOTAL | 137,431 | (2.6) | 168,865 | 2.8 |

Output/sales balance

ENDESA met 81.4% of its total electricity sales in 9M07 from its own output.

This output/sales balance allows the Company to significantly reduce the risk relating to its electricity business, giving it an advantage over its competitors which is particularly relevant in the Spanish market. In 9M07 the Company met 81.3% of its demand in Spain from its own output.

Growth in gross profit (7.9%), EBITDA (6.9%) and EBIT (5.6%) on a like-for-like basis

Revenues were 3.5% higher on a like-for-like basis at Euro 16,042 million. Sales were Euro 15,549 million, up 6.4%.

Variable costs fell 0.8% mainly due to lower costs of greenhouse gas emission rights as a result of falling prices throughout the course of the year.

The combination of trends in revenues and variable costs boosted gross profit 7.9% higher on a like-for-like basis to Euro 8,189 million.

Meanwhile, EBITDA was Euro 5,612 million and EBIT was Euro 4,100 million, growth of 6.9% and 5.6%, respectively.

| | Gross profit | EBITDA | EBIT |

| | Euro million | % chg vs. 9M06 l-f-l | Euro million | % chg vs. 9M06 l-f-l | Euro million | % chg vs. 9M06 l-f-l |

| Spain and Portugal | 4,573 | 11.2 | 2,964 | 9.8 | 2.086 | 10.7 |

| Europe | 1,129 | (0.7) | 867 | (2.6) | 638 | (7.9) |

| Latin America | 2,487 | 6.2 | 1,781 | 7.1 | 1.376 | 5.5 |

TOTAL | 8,189 | 7.9 | 5,612 | 6.9 | 4.100 | 5.6 |

Net financial losses: down 8% l-f-l

ENDESA reported net financial losses of Euro 715 million in 9M07, a 4.8% improvement on 9M06.

Net interest expense totalled Euro 706 million, Euro 30 million less than in 9M06.

Net financial expenses for the first nine months of 2007 were Euro 83 million lower as a consequence of the higher interest rate used to calculate present value of contingencies related to workforce reduction programs, which were recorded as provisions, compared to the one used in this calculation at the end of 2006, due to a rise in market interest rates.

Asset disposals: stake in Red Eléctrica de España

In September ENDESA sold 2,705,400 shares in Red Eléctrica de España, S.A., representing 2% of REE’s share capital, via a series of transactions carried out over recent months, the largest being the sale of 1.35% to Citigroup, which subsequently placed these shares on the market. Total proceed from this 2% stake were Euro 96 million, generating gross capital gains of Euro 79 million.

Following the sale, ENDESA now owns 1% of REE, in line to the maximum legal ownership limit coming into effect at year-end 2007.

Cash flow from operating activities: up 24.8% l-f-l

The Group reported cash flow from operations of Euro 4,002 million in 9M07, a year-on-year increase of 20.6%. Measured on a like-for-like basis, the increase was 24.8%.

CASH FLOW FROM OPERATING ACTIVITIES |

| | Euro million | % chg vs. 9M06 |

| Spain and Portugal | 2,115 | 20.3 |

| Europe | 630 | 18.5 |

| Latin America | 1,257 | 37 |

TOTAL | 4,002 | 24.8 |

Investment: Euro 2,923 million

ENDESA invested a total of Euro 2,923 million in 9M07, of which Euro 2,621 million was capex and the remaining Euro 302 million was deployed in financial investments.

INVESTMENTS |

| | Euro million |

| Capex and intangible assets | Financial | TOTAL |

| Spain and Portugal | 1,750 | 91 | 1,841 |

| Europe | 325 | 37 | 362 |

| Latin America | 546 | 174 | 720 |

TOTAL | 2,621 | 302 | 2,923 |

Financial situation

ENDESA had net debt of Euro 21,183 million at September 30, 2007, 6.8% more than at year-end 2006.

BREAKDOWN OF NET DEBT BY BUSINESS LINE |

| | Euro million | |

| | 30/09/07 | 31/12/06 | Change | % chg. |

| Business in Spain and Portugal | 13,720 | 12,548 | 1,172 | 9.3 |

Business in Europe -Endesa Italia -Other | 1,716 596 1,120 | 1,674 748 926 | 42 (152) 194 | 2.5 (20.3) 21.0 |

Business in Latin America -Enersis Group -Other | 5,747 5,080 667 | 5,618 4,749 869 | 129 331 (202) | 2.3 7.0 (23.2) |

TOTAL | 21,183 | 19,840 | 1,343 | 6.8 |

We would point out that ENDESA had the recognised right on September 30, 2007 to collect Euro 3,166 million in connection with two regulatory issues: Euro 1,516 million for financing the revenue shortfall from regulated activities and Euro 1,650 million in compensation for stranded costs in non-mainland generation. Factoring in these regulatory receivables, ENDESA’s net debt at 30 September 2007 was Euro 18,017 million.

The average cost of ENDESA’s total debt was 5.79% in 9M07, while the average cost of debt at the ENERSIS Group was 9.74%. Stripping out Enersis Group debt, the average cost of ENDESA’s debt was 4.43% in 9M07.

The average life of the ENDESA Group’s debt at September 30, 2007 was 5.1 years.

57% of total debt is either fixed-rate or hedged. If we include the regulatory receivables in net debt, the percentage of total debt that is either fixed-rate or hedged climbs to 67%.

STRUCTURE OF ENDESA’S NET DEBT |

| | ENDESA and direct subsidiaries | Enersis Group | Total ENDESA Group |

| | Euro million | % of total | Euro million | % of total | Euro million | % of total |

| Euro | 16,038 | 100 | - | - | 16,038 | 100 |

| Dollar | 52 | - | 2,058 | 41 | 2,110 | 10 |

| Other currencies | 13 | - | 3,022 | 59 | 3,035 | 14 |

TOTAL | 16,103 | 100 | 5,080 | 100 | 21,183 | 100 |

| Fixed rate | 6,415 | 40 | 3,801 | 75 | 10,216 | 48 |

| Hedged | 1,677 | 10 | 211 | 4 | 1,888 | 9 |

| Floating | 8,011 | 50 | 1,068 | 21 | 9,079 | 43 |

TOTAL | 16,103 | 100 | 5,080 | 100 | 21,183 | 100 |

| Avg. life (years) | 5.0 | 5.3 | 5.1 |

At 30 September 2007, ENDESA in Spain and its direct subsidiaries, excluding the Enersis Group, had liquidity of Euro 5,705 million. Of this amount, Euro 5,312 million is related to undrawn sums on unconditional credit lines. This liquidity is sufficient to cover maturities falling due in the next 21 months for this group of companies.

The Enersis Group held cash and cash equivalents totalling Euro 547 million at September 30, 2007, as well as Euro 447 million in unconditional undrawn credit lines relating to two syndicated loan transactions. The total covers debt maturities for the next 16 months.

As of the date of release of 9M07 earnings, ENDESA’s long-term debt ratings are A at Standard & Poor's and A3 at Moody’s, both under review for a possible downgrade, while Fitch’s current rating is A, on negative credit watch.

Equity: Euro 17,080 million

ENDESA’s equity was Euro 17,080 million at 30 September 2007, Euro 1,144 million higher than at year-end 2006.

Of this amount, Euro 11,897 million was owned by ENDESA S.A. shareholders, and Euro 5,183 million corresponded to minority shareholders of Group companies.

Total equity corresponding to ENDESA S.A. shareholders increased by Euro 606 million from 31 December 2006 as a result of net income reported in 9M07 of Euro 1,979 million, plus revenues and expenses recognised in equity, with a net positive effect of Euro 130 million, less distribution of Euro 1,207 million to shareholders in the form of a final dividend against 2006 results in addition to Euro 296 million in bonuses for attendance at shareholders’ meetings.

Financial leverage: 124%

The increase in Group equity offset the increase in net debt to leave leverage at 124% on September 30, 2007, as compared to 124.5% on 31 December 2006.

If we factor regulatory receivables into net debt, leverage ratio for 9M07 would be 105.5%.

Shareholder remuneration

At the General Shareholders’ Meeting held on 20 June, the Company agreed to pay a gross dividend of Euro 1.64 per share against 2006 results, entailing a total payment of Euro 1,736 million. On 2 January 2007 a gross interim dividend of Euro 0.50 per share was paid out. Combined with the final gross dividend of Euro 1.14 per share paid on 2 July, the total paid out comes to Euro 1,207 million.

In addition, on 20 March ENDESA distributed an attendance bonus of Euro 0.15 per share, or additional remuneration of Euro 148 million, for attending the Extraordinary General Shareholders’ Meeting which was scheduled for 20 March.

The public takeover bid launched by Acciona, S.A. and Enel Energy Europe, S.r.L. for 100% of ENDESA’s shares was conditional upon the modification of certain of ENDESA’s bylaws. To enable its shareholders to decide whether or not to change the bylaws, modification of which was a prerequisite to the Acciona, S.A. and Enel Energy Europe, S.r.L. bid, the Board of Directors of the Company convened an Extraordinary General Shareholders’ Meeting on 25 September 2007, again agreeing to pay a Euro 0.15 per share attendance bonus, which entailed additional shareholder remuneration of Euro 148 million.

In all, ENDESA paid its shareholders a total of Euro 4,573 million since 2005.

The Public Tender Offer for ENDESA shares

On 5 October 2007, in compliance with the provisions of article 27 of Royal Decree 1197 of 26 July 1991, the Spanish Securities Regulator (the “CNMV” for its initials in Spanish) notified that the public takeover bid launched by Acciona, S.A. and Enel Energy Europe, S.r.L. for 100% of ENDESA, S.A.’s shares, from which 487,116,120 shares equivalent to 46.01% of share capital were immobilised by their respective shareholders, as disclosed in the offer prospectus, was accepted by shareholders owning 487,601,643 shares, or 85.30% of the shares subject to the bid and equivalent to 46.05% of ENDESA’s share capital. Of this amount, 4,541,626 shares corresponded to the US bid.

Now that the takeover bid has closed, Acciona and Enel own 92.1% of ENDESA’s share capital. This stake enables the successful bidders to execute the joint management agreement signed by both companies on 26 March 2007.

With Acciona and Enel sharing management control of the Company, in the coming months ENDESA must complete certain transactions previously agreed between the controlling shareholders or between the controlling shareholders and third parties. Specifically, it must undertake the following transactions:

| - | The contribution by Acciona and ENDESA of their renewable generation assets to a joint venture which will be 51%-owned by Acciona and 49%-owned by Endesa. |

| - | The sale of the following assets to E.On AG: |

| § | The sale of Endesa Europa’s assets in Italy, France, Poland and Turkey. |

| § | Certain assets located in Spain comprising 10-year rights on 450 MW of nuclear energy capacity based on an energy supply contract and three thermal stations with combined installed capacity of around 1,475 MW. |

These asset transfers will be undertaken at market value based on valuation analysis to be prepared by several prestigious international banks.

RESULTS BY BUSINESS LINE

BUSINESS IN SPAIN AND PORTUGAL

Net income - Spain and Portugal: Euro 1,390 million

The Spanish and Portuguese electricity business posted net income of Euro 1,390 million in the first nine months of 2007, a l-f-l increase of 21.3%. This figure represents 70.2% of ENDESA’s total bottom line.

EBITDA was Euro 2,964 million and EBIT stood at Euro 2,086 million, l-f-l growth of 9.8% and 10.7% respectively on 9M06.

Highlights

In 9M07, the Spanish electricity market witnessed a 37% fall in wholesale market prices compared to the first nine months of 2006 due to a slowdown in demand, a sharp slump in CO2 prices from Euro 21.88/tonne to Euro 0.08/tonne, and growth of 52.1% and 12.7% respectively in hydro generation and renewables/CHP, particularly wind generation.

However, this decline in prices had a limited impact on ENDESA’s margins thanks to the Company’s focus on supplying the deregulated market, which acts as natural hedge against the risk associated with generation activities and the fall in variable costs, mostly CO2 costs, as we explain above.

ENDESA sold 54.6% of its output to end customers on the deregulated market in the first nine months of the year, a segment where sales prices increased by 19%. In contrast, the rest of the sector sold only 19% of its output on the deregulated market. This demonstrates that the Company’s supply strategy hedges better against fluctuations in wholesale market prices on a comparative basis.

We would also note that the negative impact of Royal Decree 3/2006 on results for this business was lower than in the same period last year. This year, the output required to service distribution supply demands is not subsumed into bilateral contracts; in 9M06 these contracts had a negative impact of Euro 254 million.

ENDESA continues to apply the same accounting criteria in 2007 in terms of netting the value of emission rights from revenues. The fall in CO2 prices means a deduction of only Euro 9 million, compared to Euro 121 million in the first nine months of 2006.

Meanwhile, results in the gas supply business improved significantly in 9M07, contributing gross profit of Euro 177 million. ENDESA commanded a share of 13.1% of the deregulated gas market in 9M07.

Lastly, revenues from the distribution business increased by Euro 202 million in the first nine months of the year. Recent regulatory changes, improving remuneration for this activity drove this positive performance.

Key operating highlights

Still Spain’s leading electric utility

ENDESA maintained its leading position in the Spanish electricity market in the first nine months of the year.

The Company boasts a 35.5% market share in ordinary regime electricity generation, a 43% share in distribution, 54% in sales to deregulated customers and 40.9% in total sales to end customers.

Competitive advantages in generation relative to peers

In Spain, the Group produced a total of 69,246 GWh in 9M07. As total demand was 85,177 GWh, this output was sufficient to meet 81.3% of demand with its own output.

Nuclear and hydro powered energy accounted for 42.2% of the Company’s mainland generation mix, compared to 35.5% for the rest of the sector. Furthermore, the load factor at its thermal facilities was also higher than the average of its competitors: 70% compared to 49%, respectively.

Growth in sales (3.6%) and customer base

Total demand supplied by ENDESA, measured by its own sales, was 85,177 GWh in 9M07, an increase of 3.6% year-on-year.

At 30 September 2007, the number of customers supplied by the distribution business was 11,398,954, an increase of 239,774 vs. 9M06. The number of customers in the deregulated market reached 1,147,755, growth of 5.8%.

In terms of customer services, ENDESA's retention rate for customers switching to the deregulated market is 107.7%, which implies that the net balance between customers captured and customers lost is positive. This rate is higher than that of its peers and reflects strong loyalty to the Company.

Primary energy emissions auctions

Under Royal Decree 1634/2006, during the second and third quarters, ENDESA and Iberdrola carried out two energy capacity auctions (VPPs) in Spain, auctioning volume of 1.45 TWh and 2.50 TWh, respectively.

Progress in the Capacity Plan

ENDESA has options for development of generation assets on the Spanish mainland for an equivalent of 15,600 MW in new, natural gas-fired CCGT plants, in addition to 1,600 MW in new, highly critical, high-efficiency imported coal-fired generation plants. Of the new CCGT capacity, 4,500 MW are projects which are on course to begin operating in the short- and medium-term, on top of the 800 MW As Pontes plant in Galicia, which began pilot operations in August.

Among ENDESA’s projects underway, we would highlight the 800 MW Besós CCGT, which has recently been granted environmental certification. Construction is due to begin at the beginning of next year. At the 1,200 MW Compostilla plant, 800 MW is due on stream in 2010. Meanwhile the 400 MW La Pereda plant, which stems from an agreement with HUNOSA, has obtained urban compatibility certification. We would also note the 400 MW Gerona facility.

The remainder of the projects within the portfolio, at different stages of maturity, and which have a high likelihood of being moved forward if circumstances dictate, will be developed progressively depending on the market and technological trends.

Additionally, ENDESA has more than 1,000 MW of capacity in development at pumping stations to foster the efficient roll-out of renewable energies, in which, at the same time, it is developing new capacity of more than 2,500 MW in the next five years.

Meanwhile, ENDESA has 380 MW of projects under development for the co-combustion of biomass and coal at its in-service thermal stations, to further reduce CO2 emissions.

Finally, also within the Company’s Capacity Plan, ENDESA added the third converted As Pontes group to the network in October under the umbrella of the project to convert the entire facility to imported coal.

July 1, 2007 tariff revision

On 30 June, the Spanish cabinet passed Royal Decree Law 871/2007 revising the electricity tariff from 1 July 2007. It set an average increase of 1.81% over the previous tariff which had come into effect on 1 January 2007 for non-domestic users.

The Royal Decree recognises, ex ante, a Euro 750 million deficit in revenues from regulated activities between 1 July and 30 September 2007.

Currently the Spanish energy watchdog, CNE, is auctioning the revenue deficit collection rights recognised ex ante for the first and third quarter of 2007. It is expected to conclude during this month. The funds received from this auction will cover the FY07 deficit, so that it will not have to be financed by electric utilities.

Royal Decree 871/2007 also sets the definitive price provided for in Royal Decree Law 3/2006 at Euro 49.23/MWh for sales to the wholesale generation market carried out between the introduction of said regulation and 31 December 2006 in connection with matched purchases by a distributor belonging to the same group for sale to the regulated market. These transactions had been settled at a provisional tariff of Euro 42.35/MWh under Royal Decree Law 3/2006.

The measures included in Royal Decree 3/2006 with the aim of reducing the deficit in revenues from regulated activities include (i) determining the price to be applied to sales between generation and distribution companies belonging to the same group under a bilateral contract – as mentioned above, this price has been set at Euro 49.23/MWh, and (ii) the manner for accounting - netting from revenues - for the internalisation by generators of cost of CO2 emission rights into wholesale prices.

At the time of writing this report, the definitive legislation to enact the method to be used for calculating the revenue discount corresponding to the internalisation of the cost of greenhouse emission gases, was still pending development.

ENDESA believes that the revenue estimate reported in the 2006 annual accounts continues to reflect the best estimate of the amount to be finally settled. Therefore, the Company has not amended recorded revenues as the implementing legislation is still under development.

Once this legislation is finalised, any difference will be recorded in the set of accounts subsequent to implementation. In any event, based on the contents of Royal Decree Law 2/2006, management does not believe that the difference, if any, will have a material impact on ENDESA’s consolidated results.

The tariff deficit

Despite the 4.3% increase in the electricity tariff in 2007, regulated revenues were not sufficient to fully cover system costs in 9M07. This led to an estimated deficit in revenues from regulated activities in the sector of Euro 694 million, of which Euro 307 million corresponds to ENDESA.

As we have mentioned above, Article 2 of Royal Decree 3/2006 states that the cost of CO2 rights should be netted from regulated revenues via the internationalisation of CO2 rights into the sales price of energy matched in the wholesale market. The application of this concept reduces the estimated net tariff shortfall by Euro 9 million to Euro 298 million.

In accordance with Royal Decree 1634/2006, this deficit will be recovered in 2007 by securitising the collection rights with third parties via the auction held this November.

Meanwhile the 2006 deficit receivable was updated in 9M07. The change, which was based on information made available in the last provisional settlement made by the National Energy Commission (CNE), does not affect the Company’s net income.

Non-mainland system regulation

On 2 October 2007, the General Directorate of Energy and Mining resolution which determined the definitive specific costs to be remunerated in island and non-mainland generation systems for 2001 to 2005 was approved. The published figures do not represent significant changes with respect to Endesa’s estimates previously accounted, although it represents the elimination of any uncertainty related to these rights.

Revenues: Euro 7,658 million

Revenues at business in Spain and Portugal totalled Euro 7,658 million in 9M07, a l-f-l increase of 1% on 9M06, despite netting freely allocated CO2 rights from revenues.

Sales advanced 5.6% (l-f-l) to Euro 7,400 million vs. 9M06.

SPAIN AND PORTUGAL SALES |

| | Euro million | |

| | 9M07 | 9M06 | Chg. | % chg. |

| Mainland generation under Ordinary Regime | 2,988 | 3,175 | (187) | (5.9) |

Sales to deregulated customers | 1,768 | 1,334 | 434 | 32.5 |

Other sales in the OMEL | 1,220 | 1,841 | (621) | (33.7) |

| Renewable/CHP generation | 187 | 195 | (8) | (4.1) |

| Regulated revenues from distribution | 1,541 | 1,363 | 178 | 13.1 |

| Non-mainland generation and supply | 1,645 | 1,614 | 31 | 1.9 |

| Supply to deregulated customers outside Spain | 250 | 224 | 26 | 11.6 |

| Gas supply | 519 | 458 | 61 | 13.3 |

| Regulated revenues from gas distribution | 43 | 33 | 10 | 30.3 |

| Other sales and services rendered | 227 | 173 | 54 | 31.2 |

TOTAL | 7,400 | 7,235 | 165 | 2.3 |

Mainland generation

Demand for electricity in the Spanish mainland system as a whole grew by 1.4% in 9M07. Ordinary regime generation was 12.7% higher while renewable/CHP generation fell 1.5%.

ENDESA’s mainland electricity output was 58,153 GWh, up 1.5%.

Of this amount, 55,942 GWh corresponded to power generated under the ordinary regime, a rise of 0.7% vs. 9M06, outperforming this type of generation in Spain as a whole. 2,211 Gwh corresponded to renewables/CHP generation. This marked an increase of 24.9%, which was much higher than the rise in this type of generation in the overall system.

The average pool price fell 38.2% to Euro 39.85/MWh in 9M07.

The increase in mainland output and the higher prices charged to deregulated customers were not enough to offset the lower pool price, triggering a 5.9% decrease in mainland electricity generation revenues under the ordinary regime vs. 9M06. However, this decline was offset by lower variable costs.

ENDESA’s CHP/renewables generation

Renewable and CHP companies fully consolidated by ENDESA generated 2,211 GWh in the first nine months, a year-on-year increase of 24.9%.

Revenues from sales of renewable/CHP energy generated by consolidated companies totalled Euro 187 million, down 4.1%.

This decline was due to the cessation of renewable energy supply activities by Endesa Cogeneración y Renovables (ECyR) in May 2006 which entailed greater electricity purchases and sales. Discounting this factor, sales figures would have remained stable as the negative impact of the lower sales price was offset by higher output.

Despite this fall in revenues, gross profit at ENDESA's renewables/CHP generation business rose 2.9% to Euro 175 million.

Supply to deregulated customers

ENDESA had 1,147,755 customers on the deregulated market at the end of 9M07: 1,073,531 in the Spanish mainland market, 71,502 in the non-mainland market and 2,722 in deregulated European markets other than Spain.

ENDESA’s sales to these customers as a whole rose 5.9% to 30,490 GWh. Of this amount, 27,225 GWh was sold to the Spanish deregulated market, an increase of 6.4%, and 3,265 GWh to other deregulated European markets, growth of 1.3%.

Revenues from sales to deregulated customers in Spain (excluding the tolls payable to Endesa Distribución) totalled Euro 1,883 million, a 30.8% increase on 9M06. Of this amount, Euro 1,768 million corresponded to the mainland deregulated market and Euro 115 million to the non-mainland market.

Revenues from supply to deregulated European markets other than Spain rose 11.6% to Euro 250 million.

Lastly, the average selling price to end customers rose 19% vs. 9M07 thanks to the Company’s stringent and selective sales policy.

Distribution

ENDESA distributed 88,187 GWh of electricity in the Spanish market in the first half of 2007, a 1.6% increase on the same period of 2006.

Revenues from regulated distribution activities totalled Euro 1,541 million, up 13.1% on 9M06, due mainly to the increase in remuneration stipulated in the Royal Decree setting 2007 tariffs.

ENDESA supplied 54,687 GWh of electricity to its regulated customers during 9M07, 2.3% higher than the same period in 2006.

Non-mainland generation

ENDESA’s output in non-peninsular systems was 11,093 GWh in 9M07, up 1.6%.

Like-for-like revenues were 18.6% higher, at Euro 1,645 million. Of this amount, Euro 1,520 million was accounted for by sales to regulated clients and Euro 115 million to regulated clients.

Gas distribution and supply

ENDESA sold a total of 23,090 GWh of natural gas in Spain in the first nine months, 24.2% more than in 9M06.

Of this, 20,860 GWh were sold to customers on the deregulated market, an increase of 23.6%, and 2,230 GWh to customers on the regulated market, 29.3% higher.

The 23,090 GWh sold in both the regulated and deregulated markets, together with the gas consumed in ENDESA’s own generation plants, amount to a total of 36,526 GWh, implying a market share of 12.6%.

Revenues from gas sales in the deregulated market rose 13.3% to Euro 519 million in 9M07. Topline growth boosted gross profit 85.5% higher to Euro 128 million.

Revenues from regulated gas distribution totalled Euro 43 million, Euro 10 million more than the same period last year.

Other operating revenues

Other operating revenues in Spain and Portugal in 9M07 came to Euro 258 million, Euro 317 million less than in 9M06.

This item includes only Euro 3 million corresponding to the 9M07 portion of CO2 emission rights allocated to ENDESA within the scope of the Spanish National Allocation Plan for emissions (NAP), which are recorded under revenues.

This figure is Euro 388 million lower than the figure recorded under revenues in 9M06, due mainly to a strong fall in the market price for these rights. However, this drop in revenues was offset by the lower expense recorded for use of these emission rights.

Operating expenses

The breakdown of operating expenses in the Spanish and Portuguese business is:

OPERATING EXPENSE IN SPAIN AND PORTUGAL |

| | Euro million | |

| | 9M07 | 9M06 | Change | % chg. |

| Purchases and services | 3,085 | 3,471 | (386) | (11.1) |

Power purchases | 726 | 767 | (41) | (5.3) |

Fuel consumption | 1,667 | 1,695 | (28) | (1.7) |

Power transmission expenses | 393 | 272 | 121 | 44.5 |

Other supplies and services | 299 | 737 | (438) | (59.4) |

| Personnel expenses | 827 | 758 | 69 | 9.1 |

| Other operating expenses | 911 | 760 | 151 | 19.9 |

| Depreciation and amortisation | 878 | 814 | 64 | 7.9 |

TOTAL | 5,701 | 5,803 | (102) | (1.8) |

Power purchases

Power purchases in the period fell 5.3% to Euro 726 million.

This fall reflects the net impact of lower costs associated with operations in the wholesale generation market as a result of the lower average pool price, partially offset by higher gas purchases for supply to the deregulated market.

Fuel consumption

Fuel consumption totalled Euro 1,667 million in 9M07, 1.7% less year-on-year due to efficient management of supply contracts against a backdrop of rising fuel costs.

Other supplies and services

Other supplies and service expenses totalled Euro 299 million, some Euro 438 million less than in 9M06.

Of this amount, Euro 388 million is due to lower value assigned to the freely allocated emission rights which offset lower revenues under the same concept, as described in “Other operating revenues”, and Euro 81 million correspond to the lower cost recognised in connection with 2007 emissions not covered by the freely allocated emission rights.

Personnel expenses

Personnel expenses amounted to Euro 827 million in 9M07, an increase of 9.1% vs. 9M06. Excluding provisions for labour force restructuring costs, which totalled Euro 112 millions in 9M07 and Euro 65 million in 9M06, these expenses increased 3.2%.

Net interest expense: down 11.8% (like-for-like)

Net financial losses in 9M07 stood at Euro 310 million, 12.9% lower than the figure reported in 9M06 on a like-for-like basis.

Of this amount, Euro 313 million corresponded to net interest expense, 11.8% less (l-f-l) than in the same period last year, and Euro 3 million to exchange-rate gains.

When assessing financial results, the Euro 3,166 million financial asset corresponding to the tariff deficit receivable and compensation for stranded costs on non-mainland generation, both of which bear financial interest, must be considered.

Net financial expenses in 9M07 include revenue of Euro 83 million corresponding to the higher interest rate applied to calculate the net present value, at 30 September, 2007, of commitments under workforce reduction programs existing at that date compared to the rate used to make this calculation at year end 2006. The difference is due to higher market interest rates.

Net financial debt in the Spanish and Portuguese business at 31 September, 2007 stood at Euro 12,548 million vs. Euro 12,548 million at year-end 2006.

Cash flow from operating activities: Euro 2,115 million

Cash flow from operations from the Spanish and Portuguese business totalled Euro 2,115 million in 9M07, a l-f-l increase of 20.3%.

Investment: Euro 1,841 million

In 9M07, investments in Spain and Portugal totalled Euro 1,841 million, 6.7% higher than in the same period in 2006.

TOTAL INVESTMENT IN SPAIN AND PORTUGAL |

| | Euro million | |

| | 9M07 | 9M06 | % chg. |

| Capex | 1,699 | 1,549 | 9.7 |

| Intangible | 51 | 71 | (28.2) |

| Financial | 91 | 105 | (13.3) |

TOTAL INVESTMENT | 1,841 | 1,725 | 6.7 |

| 92.3% of total investment was capex, i.e., money spent on developing or enhancing electricity generation and distribution facilities. We would highlight the increase in investment at renewable/CHP facilities. |

CAPEX IN SPAIN AND PORTUGAL |

| | Euro million | |

| | 9M07 | 9M06 | % chg. |

| Generation | 867 | 652 | 33.0 |

Ordinary regime | 617 | 507 | 21.7 |

Renewables/CHP | 250 | 145 | 72.4 |

| Distribution | 810 | 869 | (6.8) |

| Other | 22 | 28 | (21.4) |

TOTAL | 1,699 | 1,549 | 9.7 |

BUSINESS IN EUROPE

Net income in Europe: Euro 287 million

Net income in Europe totalled Euro 287 million in the first nine months of 2007, down 5.8% on the same period in the previous year (like-for-like).

Highlights

Gradual pick-up in demand in second and third quarter s

During 9M07 the electricity business in Europe was affected by weak demand for electricity in Italy and France largely due to warmer temperatures in both countries during the first three months of the year.

However, demand has picked up in both countries in recent months. Demand rebounded 1.6% in Italy between April and September, offsetting the decline in the first quarter, to leave demand flat year-on-year in 9M07 vs. 9M06.

Meanwhile, recovery in demand in the third quarter left demand down 4.3% during the first nine months of the year. While a significant drop, this figure marks a considerable improvement on the 10% and 6% declines recorded in the first and second quarters, respectively.

The price differential between France and Italy resulting from the sharp fall in prices in France prompted Italy to replace its own production with imports. As a result, output fell 2% in Italy. On the other hand, the fall in production in France (-1.9%) was narrower than the fall in demand (-4.3%), mitigated by increased export activity.

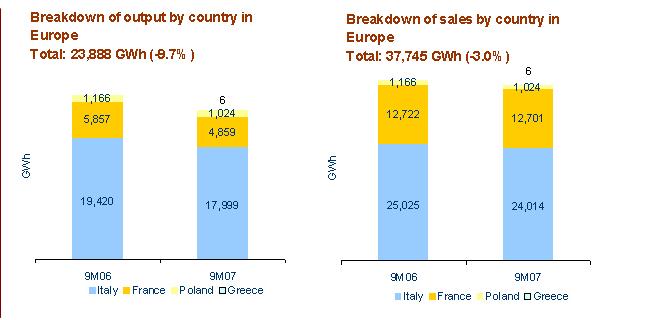

As a result of the above, overall generation at ENDESA’s business in Europe totalled 23,888 GWh in 9M07, 9.7% less than in 9M06. Also, electricity sales fell 3% to 37,745 GWh.

Gross profit and EBITDA in Europe declined 0.7% and 2.6%, respectively in 9M07. In Endesa Italia, production costs fell due to an improved mix, while CO2 costs were lower and self-supply of green certificates was higher. On the other hand, at Endesa France sales in the forward market were made at prices set in 2006 which are higher than 2007 prices while fixed costs were cut following the implementation of Efficiency Improvement Plan.

BREAKDOWN OF ENDESA’S OUTPUT AND SALES IN EUROPE |

| | Output (GWh) | | Sales (GWh) | |

| | 9M07 | 9M06 | % chg. | 9M07 | 9M06 | % chg. |

| Italy | 17,999 | 19,420 | (7.3) | 24,014 | 25,025 | (4) |

| France | 4,859 | 5,857 | (17.7) | 12,701 | 12,722 | (0.2) |

| Poland* | 1,024 | 1,166 | (8.2) | 1,024 | 1,166 | (12.2) |

| Greece | 6 | - | NA | 6 | - | NA |

| TOTAL | 23,888 | 26,443 | (9.7) | 37,745 | 38,913 | (3) |

(*) ENDESA is present in the generation business in Poland through the Bialystock CHP, which is controlled by Snet. |

ENDESA enters the Greek market

On 27 June ENDESA presented Endesa Hellas. This company is the result of a strategic alliance signed in March between ENDESA and Mytilineos Holding, S.A. resulting in the largest independent operator in the Greek market with the potential to expand into other markets in southeast Europe. ENDESA holds a 50.01% stake in the company while the Mytilineos group holds 49.99%.

Mytilineos contributed all its thermal and renewable energy assets in addition to the licences it currently holds making Endesa Hellas the operator with the largest order book of projects under construction and in development in the Greek market which should allow it to obtain a 10% market share by 2010.

Of particular note are the 334 MW CHP plant due to come on stream shortly, the 430 MW CCGT currently under construction and other projects relating to a new 600 MW coal fired plant as well as other renewable energy facilities with over 1,000 MW of installed capacity. The company has also been awarded licences to build another CCGT and coal-fired plant as well as 310 MW in trading activities.

ENDESA will contribute Euro 485 million, plus an additional amount of up to Euro 115 million, payable on the basis of the success of some of the wind farm projects currently in the process of obtaining authorisation. On 31 July the first asset contribution by Mytilineos was successfully completed and Endesa Europa made a Euro 169 million payment.

Through its holding in Endesa Hellas, which has already begun operations, ENDESA has acquired an important stronghold in one of Europe’s most attractive electricity markets both strategically, given its growth prospects, and in terms of its pricing structure and interconnections with Italy, Bulgaria, Macedonia and Albania.

New installations in Italy and France

During the first nine months of 2007, Endesa Europa continued construction as scheduled on the two 400 MW CCGTs at Scandale (Calabria) and successfully completed an agreement with Gamesa for the acquisition of wind assets in Italy. The two last companies to be included in this agreement, acquired in February this year, own the construction and operation rights for the 54 MW Piano di Corda wind farm and the 58 MW Serra Pelata farm.

In July Endesa Europa acquired the 24 MW Alcamo wind farm in Sicily which is expected to be commissioned in 2010.

In 9M07 the Montecute (42 MW), Trapani (32 MW) and Poggi Alti (20 MW) wind farms went on stream. These completions bring total wind power in Italy to 152 MW.

Meanwhile, in France, in the first nine months of the year Endesa France’s first wind farm (Lehaucourt 10 MW) started up and construction of the Les Vents de Cernon farm commenced. The latter will have installed capacity of 18 MW and is expected to start operating in 2008.

Also, on 12 July, Endesa France obtained the construction permit for a 430 MW CCGT at the Lucy site. With this authorisation, Endesa France now has the required permits to construct four combined cycle plants with a total installed capacity of 2,580 MW.

We should also include the tender won to build the 10 MW Muzillac wind farm which will bring the company’s total wind assets to 75 MW.

Lastly, in September Endesa France awarded construction of the two French CCGTs to be built on the Émile Huchet site owned by Endesa’s French subsidiary to Siemens. Construction of these two facilities, which will have combined installed capacity of 860 MW, entails investment of Euro 470 million.

Capacity auctions

At the end of September Endesa Trading acquired 30 MW in the virtual generation capacity auction carried out by E.ON in Germany, the first of its kind to be held in that country.

This new product will increase ENDESA’s flexibility in the supply of energy and service of its customers in Germany, where the Group has no generation assets. Furthermore, the new capacity will enable the Group to optimise management of all operations carried out by ENDESA at interconnections throughout Europe.

Dividends paid by Endesa Italia, Snet and Tahaddart

In 9M07 Endesa Italia paid shareholders Euro 216 million against 2006 earnings, of which Euro 173 million corresponded to Endesa Europa.

Snet also paid a dividend of Euro 33 million to its shareholders, of which Euro 21 million corresponded to Endesa Europa.

Finally, Tahaddart paid out Euro 9 million against 2006 earnings, of which Euro 3 million corresponded to Endesa Europa.

EBITDA: Euro 867 million

ENDESA’s business in Europe generated EBITDA of Euro 867 million in 9M07, a drop of 2.6% vs. 9M06 and EBIT of Euro 638 million, down 7.9%.

EBITDA & EBIT IN EUROPE | |

| | EBITDA (Euro million) | EBIT (Euro million) |

| | 9M07 | 9M06 | % chg. | 9M07 | 9M06 | % chg. |

| Italy | 718 | 746 | (3.8) | 565 | 627 | (9.9) |

| Endesa France | 165 | 147 | 12.2 | 90 | 70 | 28.6 |

| Trading | 27 | 26 | 3.9 | 27 | 26 | 3.9 |

| Holding & others | (43) | (29) | (48.3) | (44) | (30) | (46.7) |

TOTAL | 867 | 890 | (2.6) | 638 | 693 | (7.9) |

High margins in Italy

As mentioned above, in 9M07 demand for electricity in Italy was virtually flat year-over-year and there was a significant increase in imports in the north of the country due to a price differential with France.

These factors, coupled with lower rainfall during the first nine months of the year, meant that the load factor at ENDESA’s plants in Italy fell. As a result, electricity output fell 7.3% to 17,999 GWh. Furthermore, these two factors triggered a significant fall in electricity prices on the wholesale market and a 4% drop in sales in Italy to 24,014 GWh, which led to a 8.3% drop in revenues. This was offset by a 12.2% reduction in supply and service costs due to lower fuel consumption and lower CO2 costs due to a sharp drop in emission rights prices, which mitigated the impact on EBITDA, which narrowed by 3.8%.

ENDESA ITALIA KEY DATA |

| | Euro million | |

| | 9M07 | 9M07 | Change | % chg. |

| Revenues | 2,079 | 2,267 | (188) | (8.3) |

| Gross profit | 844 | 861 | (17) | (2) |

| EBITDA | 718 | 746 | (28) | (3.8) |

| EBIT | 565 | 627 | (62) | (9.9) |

Earnings higher at Endesa France

Despite lower output, triggered by unfavourable weather conditions as in the case of Italy, Endesa France’s earnings grew in 9M07, largely due to lower fixed and variable costs.

EBITDA jumped 12.2% to Euro 165 million in 9M07 and EBIT by 28.6% to Euro 90 million.

ENDESA FRANCE KEY DATA |

| | Euro million | |

| | 9M07 | 9M06 | Change | % chg |

| Revenues | 786 | 801 | (15) | (1.9) |

| Gross profit | 257 | 248 | 9 | 3.6 |

| EBITDA | 165 | 147 | 18 | 12.2 |

| EBIT | 90 | 70 | 20 | 28.6 |

Revenues narrowed 1.9% to Euro 786 million in the first nine months of the year, due to a 17.0% fall in electricity generation (the utility’s output fell by more than overall system generation; production at the company in France is measured by mid and peak hours) and to lower wholesale prices. However, as we have seen above, this fall was partially offset by a high percentage of sales in the forward market at favourable prices agreed the year before.

In Poland, output at Bialystock also fell (-12.2%) due to mild weather although the fall in revenues was mitigated by higher tariffs.

Variable costs fell 4.3% to Euro 24 million in 9M07 largely due to lower output. Fixed costs fell 8.9% as a result of the progress made on the company’s efficiency plan.

Lower fixed and variable costs allowed the company to fully offset the fall in revenues, leading to a 12.2% increase in EBITDA and a 28.6% rise in EBIT to Euro 165 million and Euro 90 million, respectively.

European debt: Euro 1,716 million

Net debt at ENDESA’s electricity business in Europe stood at Euro 1,716 million at the close of 9M07, an increase of Euro 42 million, or 2.5%, over the debt balance at year-end 2006.

Net interest expense amounted to Euro 58 million in 9M07, Euro 22 million more than in 9M06.

We would recall that in 2H06 the European business increased its debt to finance capex, leading to an increase in interest expense.

Cash flow from operating activities: Euro 630 million

ENDESA’s business in Europe generated Euro 630 million of cash in 9M07, an increase of 18.6% with respect to 9M06.

Investment: Euro 362 million

Investment in this business area totalled Euro 362 million in 9M07. Of this amount, Euro 320 million was capex (Euro 165 million at Endesa Italy, Euro 109 million at Endesa France and Euro 46 million at Endesa Hellas).

Financial investment totalled Euro 37 million and included the acquisition of Serra Pelata (Euro 14 million), Piano di Corda (Euro 8 million) and Merwind (Euro 8 million) wind farms.

BUSINESS IN LATIN AMERICA

Net income in Latin America: Euro 302 million

In 9M07 net income at ENDESA’s Latin American businesses totalled Euro 302 million, an increase of 1% on the same period the previous year (l-f-l).

Operating momentum was strong, as reflected by the performance of EBITDA and EBIT. EBITDA was Euro 1,781 million, up 7.1% year-on-year and EBIT was Euro 1,376 million, growth of 5.5%. Measured in local currency, EBITDA rose 9.3% and EBIT 7.6%.

We would point out that these increases occurred despite a challenging operating environment marked by lower rainfall and gas supply issues.

Highlights

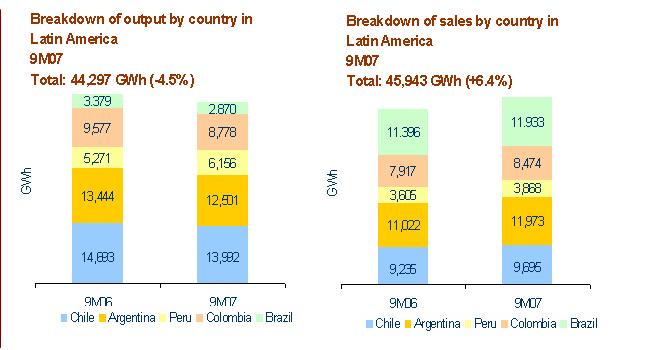

Lower output; higher sales

The continued positive macroeconomic environment in the countries where ENDESA operates led to sharp increases in demand during 9M07, especially in Peru (10.5%), Argentina (6.1%) and Chile (5.3%).

As a result, total distribution sales at these companies rose 6.4% to 45,943 GWh, with Argentina (+8.6%), Peru (+7.3%) and Colombia (+7.0%) performing particularly well.

During the third quarter the generation business was affected by gas supply problems and also lower rainfall in Chile and Argentina. This led to a fall in hydro output and an increase in liquid fuel output.

ENDESA produced 42,869 GWh of power in Latin America through September, 4.5% less than in 9M06. Growth in output in Peru (+16.8%) due to the commissioning of the Ventanilla CCGTs was not enough to offset lower output elsewhere, mainly due to lower rainfall and gas supply shortages.

OUTPUT AND SALES IN THE LATIN AMERICAN BUSINESS |

| | Output (GWh) | Sales (GWh) |

| | 9M07 | % chg. vs. 9M06 | 9M07 | % chg. vs. 9M06 |

| Chile | 13,992 | (4.8) | 9,695 | 5 |

| Argentina | 12,501 | (7) | 11,973 | 8.6 |

| Peru | 6,156 | 16.8 | 3,868 | 7.3 |

| Colombia | 8,778 | (8.3) | 8,474 | 7 |

| Brazil | 2,870 | (15.1) | 11,933 | 4.7 |

TOTAL | 44,297 | (4.5) | 45,943 | 6.4 |

Improvement in generation, transmission and distribution margins

Lower rainfall in the region during second and third quarters, together with gas supply issues, led to higher load factors at the Group’s thermal plants and greater use of traditionally more expensive liquid fuels. Despite these factors, ENDESA’s strong generation mix in Latin America led to a 10% increase in the unit margin to USD27.6/MWh during 9M07.

Generation margins, measured in dollars, rose sharply in Colombia (+28.2%) due to higher average sales prices as well as higher capacity remuneration as a result of the application of the new reliability charge. Meanwhile, in Brazil margins rose 28% due to a higher average sales price and an improved generation mix while in Argentina the 12.5% increase was due higher spot prices. In Chile, increase in sales prices also drove a 1.3% increase in the average margin despite a worse production mix shaped by lower hydro output and higher thermal output using diesel. In Peru, production mix, with a larger thermal component, and lower end customer sales prices triggered a 7.8% reduction in the average margin vs. 9M06.

In the distribution business, rising demand, application of a new tariff regime in Argentina and operating efficiency improvements all led to an improvement in operating indicators. The unit margin stood at $39.9/MWh distributed ($38.6/MWh eliminating the retroactive application of the Argentine tariff), an increase of 6.9% vs. 9M06, after factoring in the retroactive application of the Argentine tariff hike. This overall increase came despite a 4.8% drop in the unit margin in Chile on the back of the new subtransmission tariffs at Chilectra, although this effect was offset by higher sales.

Distribution losses: 11.3%

Energy distribution losses were 11.3% in 9M07, in line with the same period in 2006. We would highlight the 0.2 percentage point improvement in both Brazil and Colombia due to the development and application of highly innovative and technical initiatives to fight against fraud.

New capacity development

In 9M07 Endesa Chile continued with construction of the San Isidro II (Chile) CCGT power plant which will ultimately have installed capacity of 379 MW. In 2Q07, within the established time frame, the open cycle of this plant came on stream with capacity of 249 MW. This capacity is 29 MW greater than initially projected thanks to technical improvements introduced during project development.

The company also continued work on construction of the 32 MW Palmucho hydro plant.

Work also continued on the Aysén project which entails the construction, starting in 2008, of five hydro plants with total installed capacity of 2,750 MW, the last of which is currently estimated to come on stream towards the end of 2021. Endesa Chile and Colbún hold 51% and 49% stakes, respectively, in this project.

Once all pertinent permits were obtained in 2007, the construction tenders were awarded for two new power stations in Chile: the Bocamina II coal-fired plant which will have an estimated installed capacity of 345 MW and is due to begin operations in 2010 and the 250 MW open cycle gas TG Quinero gas plant, expected to be commissioned in 2009.

Also, in May the necessary commercial agreements were signed to give the definitive boost to the Quintero (Chile) liquefied natural gas plant, in which Endesa Chile will hold a 20% stake. Its partners in the project are British Gas, Metrogas and ENAP.

Also, Endesa Eco continued work on construction of the Canela wind farm the first phase of which will have capacity of 9 MW (out of a total of 18 MW) and Ojos de Agua mini hydro station, also with capacity of 9 MW.

Lastly, in Colombia the improvements introduced to the five turbines at the El Guavio hydro plant boosted installed capacity by 50 MW. Also in Colombia, work on the second unit of the Termocartagena plant is slated to commence in the fourth quarter, adding an additional 68 MW to the plant’s current 142 MW capacity.

Regulatory update

In Argentina, Edesur began implementing the first distribution tariff increase since the economic crisis of 2001 following publication of the corresponding resolution by the electricity sector regulator (ENRE).

The application of this increase, which is effective from November 2005, will enable Edesur to regain appropriate levels of profitability and make necessary investments to meet increasing demand in its market and continue to improve its service quality while simultaneously enhancing service quality.

Meanwhile, a resolution by the sector watchdog published on 18 July granted an extension of Edesur’s concession contract until 2013. The 95 year concession agreement is broken down into several management periods. In this connection, the aforementioned ENRE Resolution establishes that the initial management period “will be considered to have concluded upon termination of the five-year tariff period which will commence when the Integral Tariff Revision set forth in the concession agreement, signed by the state and EDESUR, comes into force”. This tariff revision comes into force on 1 February 2008, so that if the deadlines established by the Argentine government are met, EDESUR’s initial management period will end on 1 February 2013.

Also in Argentina, in light of the existing deficit, the Secretary of Energy proposed an extension of Foninvemem financing during 2007. On 15 September, ENDESA’s affiliates subscribed to the official tender (entailing a 50% withholding in 2007), without committing to increasing their participation in the financing.

In Brazil on 2 April Coelce’s tariffs began to factor in the tariff overhaul which is carried out every four years, entailing on this occasion a 6.35% reduction in the VAD. This is only provisional and the definitive tariff is due to be set in 2008 once ANEEL outlines sets prescribes the calculation methodology for all of Brazil’s distributors.

Lastly, the node price report for the April-October half year was published in Chile. The price increased by 6% over the preceding 6-month period to USD73.3/MWh.

In addition, prevailing market conditions in Chile have subsequently triggered two further increases to node prices in the Chilean Central Interconnection System: in July the price was raised to USD80.1/MWh (+9.3%) and in September to USD89.52/MWh (+11.8%). The latest tariff increase is applicable from 16 September until the next regularly scheduled tariff setting in November. As a result, its positive impact on revenues will be reflected in the last quarter of the year. Further, the definitive node price to be applicable from November through March 2008 has been set at USD104.05/MWh, 16.2% higher than prevailing prices.

Optimisation of ownership structure

In 9M07 ENDESA completed the organisational restructuring underway in Colombia.

In December 2006 the boards of Emgesa and Betania in Colombia approved the merger of the two utilities. This merger, effective since 1 September 2007, has given rise to the largest generator in Colombia, with installed capacity of 2,789 MW.

Gas Atacama

Gas Atacama’s financial situation was seriously affected by the lack of availability of gas from Argentina. ENDESA holds a 18.2% stake in this company via its 50% stake in Endesa Chile.

At the same time, CMS, holder of 50% of Gas Atacama, decided to sell its stake along with the loans granted to the company. Endesa Chile exercised its pre-emptive acquisition rights and agreed to simultaneously sell both the stake and the related loans to Southern Cross for the same amount.

Gas Atacama has signed various framework agreements and endorsements to change electricity supply contracts to more advantageous ones which will improve its operating and financial situation.

The agreements signed by Gas Atacama were stipulated upon the exercise by Endesa Chile of its pre-emptive acquisition right over CMS’s stake in and loans to Gas Atacama and their subsequent sale to Southern Cross, as indeed occurred.

On 14 September, Law 20,220 was published in the Official Gazette establishing the rules applicable in the event of bankruptcy of a generator or early resolution of power supply contracts. In the event of a favourable ruling in the arbitration proceedings filed together with Emel, this legislation means that Gas Atacama would have to continue to supply on current conditions for the next 18 months.

Given the current situation, the Group carried out an impairment test at September 30, 2007, taking into account the value of the above-mentioned agreements. The test results suggest that a value adjustment is not necessary.

EBITDA: up 7.1%

EBITDA in the Latin American business totalled Euro 1,781 million in 9M07, a 7.1% increase year-on-year. EBIT rose 5.5% to Euro 1,376 million.

EBITDA & EBIT IN LATIN AMERICA |

| | EBITDA (Euro million) | EBIT (€ m) |

| | 9M07 | 9M06 | % chg. | 9M07 | 9M06 | % chg. |

| Generation and transmission | 920 | 898 | 2.4 | 701 | 709 | (1.1) |

| Distribution | 924 | 815 | 13.4 | 744 | 651 | 14.3 |

| Other | (63) | (50) | NA | (69) | (56) | NA |

TOTAL | 1,781 | 1,663 | 7.1 | 1,376 | 1,304 | 5.5 |

Measured in local currency, EBITDA rose 9.3% and EBIT 7.6%.

The table below depicts the breakdown of EBITDA and EBIT of ENDESA’s fully consolidated subsidiaries by business line and country in 9M07:

BREAKDOWN OF EBITDA AND EBIT IN LATAM BY BUSINESS LINE AND COUNTRY |

Generation and transmission |

| | EBITDA (Euro million) | EBIT (Euro million) |

| | 9M07 | 9M06 | % chg. | 9M07 | 9M06 | % chg. |

| Chile | 366 | 435 | (15.9) | 280 | 362 | (22.7) |

| Colombia | 191 | 168 | 13.7 | 155 | 135 | 14.8 |

| Brazil - Generation | 125 | 92 | 35.9 | 112 | 78 | 43.6 |

| Peru | 113 | 111 | 1.8 | 77 | 80 | (3.8) |

| Argentina - Generation | 89 | 96 | (7.3) | 55 | 73 | (24.7) |

TOTAL Generation | | | | | | |

| Interconnection Brazil-Argent. | 36 | (4) | NA | 22 | (19) | NA |

TOTAL Generation and transmission | 920 | 898 | 2.4 | 701 | 709 | (1.1) |

Distribution |

| | EBITDA (Euro million) | EBIT (€ m) |

| | 9M07 | 9M06 | % chg. | 9M07 | 9M06 | % chg. |

| Chile | 144 | 160 | (10) | 125 | 142 | (12) |

| Colombia | 218 | 213 | 2.3 | 164 | 165 | (0.6) |

| Brazil | 389 | 344 | 13.1 | 321 | 289 | 11.1 |

| Peru | 67 | 63 | 6.3 | 45 | 40 | 12.5 |

| Argentina | 106 | 35 | 202.9 | 89 | 15 | 493.3 |

TOTAL Distribution | 924 | 815 | 13.4 | 744 | 651 | 14.3 |

Generation and transmission

Chile

Output in Chile was 13,992 GWh in 9M07, down 4.8%. Continued weak rainfall and low reservoir levels in Chile led to lower hydro powered output. This was offset by higher thermal fuelled generation, resulting in a significant increase in generation costs. Fuel costs rose 305.6% while power purchases jumped 81.5%.

As a result, EBITDA fell 15.9% in 9M07 to Euro 366 million while EBIT dropped 22.7% to Euro 280 million compared to 9M06.

Colombia

Both generation EBITDA and EBIT in Colombia rose significantly despite being affected by the corporation asset tax levied at 31 December 2006 as part of a tax reform, which totalled Euro 18 million.

This positive performance was due to higher capacity payments at Emgesa following introduction of the new reliability charge and higher sales prices as a result of the change in the generation mix (lower hydro).

Consequently, EBITDA rose 13.7% to Euro 191 million while EBIT totalled Euro 155 million (14.8%).

Brazil - Generation

ENDESA’s subsidiaries in Brazil generated 2,870 GWh in 9M07, 15.1% less than in 9M06. This drop reflects lower output at the Fortaleza station, as a result of gas supply problems, and lower production at Cachoeira, due to lower rainfall. Lower thermal generation was offset by higher purchases on the spot market at lower prices to meet contractual electricity supply obligations. Lower hydro output was offset by higher sales prices to deregulated customers. These factors combined triggered a 28% jump in unit margins.

Consequently, EBITDA rose 35.9% to Euro 125 million while EBIT increased 43.6% to Euro 112 million.

Peru

ENDESA’s subsidiaries in Peru generated total output in 9M07 of 6,156 GWh, 16.8% more than in 9M06.

This growth was due to the company’s higher thermal and hydro output resulting from incorporation of the gas units of the 142 MW Ventanilla CCGT and the increased contribution of the Piura power station, which was off stream for two and a half months last year.

However, the increase in sales (7.2%) failed to fully offset the 7.8% fall in sale unit margins as a result of lower spot prices, the effect on costs of higher thermal powered output and higher energy purchases. In all, EBITDA rose 1.8% to Euro 113 million while EBIT fell 3.8% to Euro 77 million.

Argentina

ENDESA’s subsidiaries in Argentina generated total output in 9M07 of 12,501 GWh, 7% less year-on-year, largely due to lower hydro output. However, higher sales prices drove revenues 33.1% higher.

Low rainfall and ongoing gas supply difficulties continued to trigger increases in fuel costs due to the need to generate power using liquid fuels and higher prices were not sufficient to offset spiralling costs. EBITDA fell 7.3% to Euro 89 million in 9M07, while EBIT fell 24.7% on 9M06 to Euro 55 million.

Interconnection between Argentina and Brazil

Given the problems in exporting electricity from Argentina to Brazil arising from the gas supply issues affecting use of the interconnection line, Cien, the line operator, is in the process of changing its business model so that it becomes profitable again.

As part of this new strategic approach, at the beginning of June the company signed an agreement with CAMMESA to export up to 700 MW of energy to Argentina between June and September 2007 in exchange for a fixed toll of USD5 million/month plus a variable toll of USD5.5/MWh depending on the energy transmitted.

This strategy has enabled use of the transmission line to carry electricity from Brazil to Argentina, charging the corresponding toll.

As a result, EBITDA at the interconnection totalled Euro 36 million in 9M07, Euro 40 million more than in 9M06. EBIT amounted to Euro 22 million, some Euro 41 million more than during the first nine months of 2006.

Distribution

Chile

Sales in Chile rose 3.9% largely due to the 5% increase in electricity sold.

However, this growth did not offset the 4.8% drop in unit margins as a result of the application of the new subtransmission tariff implemented during the period which triggered a 10% drop in EBITDA to Euro 144 million and a 12% decline in EBIT to Euro 125 million.

Colombia

Both EBITDA and EBIT at the Colombian distribution business were affected by the one-off impact of the above-mentioned tax levied on corporate assets at 31 December 2006, which totalled Euro 11 million.

Nevertheless, the 7% jump in sales volume drove EBITDA 2.3% higher to Euro 218 million. EBIT amounted to Euro 164 million, Euro 1 million lower than in 9M06.

Brazil

The increase in sales volume in Brazil (up 4.7%), coupled with a significant decline in energy losses and higher margins led to increases in EBITDA and EBIT of 13.1% and 11.1%, respectively, to Euro 389 million and Euro 321 million.

Peru

EBITDA from distribution in Peru came to Euro 67 million in 9M07, growth of 6.3%, largely due higher sales (up 7.3%).

Meanwhile, EBIT rose 12.5% to Euro 45 million.

Argentina

Sales at the Argentine distribution business increased by 33.9% as a result of a significant increase in distribution activity (volumes up 8.6%) and the booking of Euro 40 million in 1Q07 in connection with the tariff increase approved retroactively from November 2005. This was applied following publication of the corresponding resolution by ENRE, the sector regulator.

This led to a 202.9% increase in EBITDA to Euro 106 million, and a 493.3% rise in EBIT to Euro 89 million.

Net financial losses: Euro 347 million

ENDESA’s Latin American business generated net financial losses of Euro 347 million in 9M07, Euro 12 million less than in 9M06.

The business reported net exchange losses of Euro 12 million compared to net gains of Euro 15 million in 9M06.

Net interest expense was Euro 335 million, down 10.4% or Euro 39 million.

Net debt at ENDESA’s Latin American business stood at Euro 5,747 million at 30 September, 2007, an increase of Euro 129 since the start of the year.

Rating upgrade

On 3 July, the rating agency Standard & Poor´s upgraded its rating for Enersis and Endesa Chile by one notch from BBB- to BBB, both with a stable outlook.

These new ratings reflect the improved financial profile of both companies and the agency’s expectations for a benign macroeconomic backdrop in Latin America.

Cash flow from operating activities: +38.0%

Cash flow generated by ENDESA’s business in Latin America totalled Euro 1,257 million euros in 9M07, an increase of 38% with respect to the same period in 2006.

Cash returns: USD 375 million

In May Enersis paid a final dividend against 2006 results representing an income of USD 184 million for Endesa Internacional. This dividend made a significant contribution to total cash returns from ENDESA’s Latin American business in 9M07 which amounted to USD375 million.

This, coupled with the USD561 million received in 2005 and 2006, brings total returns between since 2005 to USD561 million.

Investment: Euro 720 million

Investment in Latin America totalled Euro 720 million, of which Euro 534 million was capex.

The breakdown of capex is as follows:

CAPITAL EXPENDITURE IN LATIN AMERICA |

| | Euro million | |

| | 9M07 | 9M06 | % chg. |

| Generation | 171 | 240 | (28.9) |

| Distribution and Transmission | 295 | 348 | (15.2) |

| Other | 68 | 13 | 423.6 |

TOTAL | 534 | 601 | (11.1) |

The financial investments undertaken in the period include acquisitions by Endesa Chile in February and March of third-party stakes in Costanera (5.5%), Hidroinvest (25%) and Hidroeléctrica El Chocón (2.48%), entailing aggregate investment of Euro 46 million.

STATISTICAL APPENDIX

KEY FIGURES

Electricity Generation Output (GWh) | | 9M07 | | | 9M06 | | | % chg. | |

| Business in Spain and Portugal | | | 69,246 | | | | 68,222 | | | | 1.5 | |

| Business in Europe | | | 23,888 | | | | 26,443 | | | | (9.7 | ) |

| Business in Latin America | | | 44,297 | | | | 46,364 | | | | (4.5 | ) |

TOTAL | | | 137,431 | | | | 141,029 | | | | (2.6 | ) |

Electricity Generation Output in Spain&Portugal(GWh) | | 9M07 | | | 9M06 | | | % chg, | |

Mainland | | | 58,153 | | | | 57,303 | | | | 1.5 | |

| Nuclear | | | 17,374 | | | | 17,806 | | | | (2.4 | ) |

| Coal | | | 26,320 | | | | 25,700 | | | | 2.4 | |

| Hydro | | | 6,227 | | | | 5,541 | | | | 12.4 | |

| Combined cycle (CCGT) | | | 5,709 | | | | 5,605 | | | | 1.9 | |

| Fuel oil | | | 312 | | | | 881 | | | | (64.6 | ) |

| Renewables/CHP | | | 2,211 | | | | 1,770 | | | | 24.9 | |

Non-mainland | | | 11,093 | | | | 10,919 | | | | 1.6 | |

TOTAL | | | 69,246 | | | | 68,222 | | | | 1.5 | |

Electricity Generation Output in Europe (GWh) | | 9M07 | | | 9M06 | | | % chg, | |

| Coal | | | 10,420 | | | | 11,806 | | | | (11.7 | ) |

| Hydro | | | 1,086 | | | | 1,817 | | | | (40.2 | ) |

| Combined cycle (CCGT) | | | 10,097 | | | | 9,084 | | | | 11.2 | |

| Fuel oil | | | 2,135 | | | | 3,714 | | | | (42.5 | ) |

| Wind | | | 150 | | | | 22 | | | | 581.8 | |

TOTAL | | | 23,888 | | | | 26,443 | | | | (9.7 | ) |

Electricity Generation Output in Latin America (GWh) | | 9M07 | | | 9M06 | | | % chg, | |

| Chile | | | 13,992 | | | | 14,693 | | | | (4.8 | ) |

| Argentina | | | 12,501 | | | | 13,444 | | | | (7 | ) |

| Peru | | | 6,156 | | | | 5,271 | | | | 16.8 | |

| Colombia | | | 8,778 | | | | 9,577 | | | | (8.3 | ) |

| Brazil | | | 2,870 | | | | 3,379 | | | | (15.1 | ) |

TOTAL | | | 44,297 | | | | 46,364 | | | | (4.5 | ) |

Electricity sales (GWh) | | 9M07 | | | 9M06 | | | % chg, | |

Business in Spain and Portugal | | | 85,177 | | | | 82,236 | | | | 3.6 | |

| Regulated market | | | 54,687 | | | | 53,434 | | | | 2.3 | |

| Deregulated market | | | 30,490 | | | | 28,802 | | | | 5.9 | |

Business in Europe | | | 37,745 | | | | 38,913 | | | | (3 | ) |

| Endesa Italia | | | 22,528 | | | | 24,914 | | | | (9.6 | ) |

| Rest of Italy | | | 1,486 | | | | 111 | | | | 1,238.7 | |

| Endesa France | | | 13,725 | | | | 13,888 | | | | (1.2 | ) |

| Endesa Hellas | | | 6 | | | | -- | | | NA | |

Business in Latin America | | | 45,943 | | | | 43,175 | | | | 6.4 | |

| Chile | | | 9,695 | | | | 9,235 | | | | 5 | |

| Argentina | | | 11,973 | | | | 11,022 | | | | 8.6 | |

| Peru | | | 3,868 | | | | 3,605 | | | | 7.3 | |

| Colombia | | | 8,474 | | | | 7,917 | | | | 7 | |

| Brazil | | | 11,933 | | | | 11,396 | | | | 4.7 | |

TOTAL | | | 168,865 | | | | 164,318 | | | | 2.8 | |

Gas sales (GWh) | | 9M07 | | | 9M06 | | | % chg, | |

| Regulated market | | | 2,230 | | | | 1,725 | | | | 29.3 | |

| Deregulated market | | | 20,860 | | | | 16,871 | | | | 23.6 | |

TOTAL | | | 23,090 | | | | 18,596 | | | | 24.2 | |

Workforce | | 30/09/07 | | | 30/09/06 | | | % chg, | |

| Business in Spain and Portugal | | | 12,746 | | | | 12,700 | | | | 0.4 | |

| Business in Europe | | | 2,161 | | | | 2,154 | | | | 0.3 | |

| Business in Latin America | | | 12,188 | | | | 11,964 | | | | 1.9 | |

TOTAL | | | 27,095 | | | | 26,818 | | | | 1 | |

FINANCIAL DATA

Key figures | | 9M07 | | | 9M07 | | | % chg, | |

| EPS (Euro) | | | 1.87 | | | | 2.37 | | | | (21.1 | ) |

| CFPS (Euro) | | | 3.78 | | | | 3.13 | | | | 20.6 | |

| BVPS (Euro) | | | 11.24 | | | | 10.80 | | | | 4.1 | |

Net financial debt (Euro million) | | 30/09/07 | | | 31/12/06 | | | % chg, | |

| Business in Spain and Portugal | | | 13,720 | | | | 12,548 | | | | 9.3 | |

| Business in Europe | | | 1,716 | | | | 1,674 | | | | 2.5 | |

| Endesa Italia | | | 596 | | | | 748 | | | | (20.3 | ) |

| Rest of Europe | | | 1,120 | | | | 926 | | | | 21 | |

| Business in Latin America | | | 5,747 | | | | 5,618 | | | | 2.3 | |

| Enersis | | | 5,080 | | | | 4,749 | | | | 7 | |

| Other | | | 667 | | | | 869 | | | | (23.2 | ) |

TOTAL | | | 21,183 | | | | 19,840 | | | | 6.8 | |

| | | | | | | | | | | | | |

| Financial leverage (%) | | | 124.0 | | | | 124.5 | | | | - | |

| Net debt/operating cash flow (times) | | | 2.8 | | | | 2.8 | | | | - | |

| Interest coverage by operating cash flow (times) | | | 7.7 | | | | 7.4 | | | | - | |

Ratings (15/11/07) | Long term | Short term | Outlook |

| Standard & Poor’s | A | A -1 | U/R (-) |

| Moody’s | A3 | P-2 | U/R (-) |

| Fitch | A | F2 | Negative |

ENDESA’s main fixed/income issues | | Spread over IRS (bp) | |

| | | 30/09/07 | | | 31/12/06 | |

| 5.2Y GBP 400M 6.125% Mat. September 2012 | | | 48 | | | | 25 | |

| 5.97Y Euro 700M 5.375% Mat. Feb 2013 | | | 49 | | | | 24 | |

Stock market data | | 28/09/07 | | | 29/12/06 | | | % chg. | |

| Market cap (Euro million) | | | 42,445 | | | | 37,935 | | | | 11.9 | |

| Number of shares outstanding | | | 1,058,752,117 | | | | 1,058,752,117 | | | // | |

| Nominal share value (Euro) | | | 1.2 | | | | 1.2 | | | // | |

Stock market data | | 9M07 | | | 9M06 | | | % chg, | |

| Trading volumes (shares) | | | |

| Madrid stock exchange | | | 2,555,772,226 | | | | 2,327,950,930 | | | | 9.8 | |

| NYSE | | | 18,650,804 | | | | 19,554,600 | | | | (4.6 | ) |

| Average daily trading volume (shares) | | | |

| Madrid stock exchange | | | 13,451,433 | | | | 12,188,225 | | | | 10.4 | |

| NYSE | | | 100,273 | | | | 104,014 | | | | (3.6 | ) |

Share price | | 9M07 high | | | 9M07 low | | | 28/09/07 | | | 29/12/06 | |

| Madrid stock exchange (Euro) | | | 40.64 | | | | 35.21 | | | | 40.09 | | | | 35.83 | |

| NYSE (USD) | | | 57.10 | | | | 45.75 | | | | 57.10 | | | | 46.52 | |

Dividends (Euro cents/share) | | Against 2006 results | |

| Interim dividend (02/01/07) | | | 50.00 | |

| Final dividend (02/07/07) | | | 114.00 | |

| Total DPS | | | 164.00 | |

| Pay-out (%) | | | 58.48 | |

| Dividend yield (%) | | | 4.58 | |

Important legal disclaimer

This presentation contains certain “forward-looking” statements regarding anticipated financial and operating results and statistics and other future events. These statements are not guarantees of future performance and they are subject to material risks, uncertainties, changes and other factors that may be beyond ENDESA’s control or may be difficult to predict.

Forward-looking statements include, but are not limited to, information regarding: estimated future earnings; anticipated increases in wind and CCGTs generation and market share; expected increases in demand for gas and gas sourcing; management strategy and goals; estimated cost reductions; tariffs and pricing structure; estimated capital expenditures and other investments; estimated asset disposals; estimated increases in capacity and output and changes in capacity mix; repowering of capacity and macroeconomic conditions. For example, the EBITDA (gross operating profit as per ENDESA’s consolidated income statement) target for 2007-2009 included in this presentation are forward-looking statements and are based on certain assumptions which may or may not prove correct. The main assumptions on which these expectations and targets are based are related to the regulatory setting, exchange rates, divestments, increases in production and installed capacity in markets where ENDESA operates, increases in demand in these markets, assigning of production amongst different technologies, increases in costs associated with higher activity that do not exceed certain limits, electricity prices not below certain levels, the cost of CCGT plants, and the availability and cost of the gas, coal, fuel oil and emission rights necessary to run our business at the desired levels.

In these statements we avail ourselves of the protection provided by the Private Securities Litigation Reform Act of 1995 of the United States of America with respect to forward-looking statements.

The following important factors, in addition to those discussed elsewhere in this presentation, could cause actual financial and operating results and statistics to differ materially from those expressed in our forward-looking statements:

Economic and industry conditions: significant adverse changes in the conditions of the industry, the general economy or our markets; the effect of the prevailing regulations or changes in them; tariff reductions; the impact of interest rate fluctuations; the impact of exchange rate fluctuations; natural disasters; the impact of more restrictive environmental regulations and the environmental risks inherent to our activity; potential liabilities relating to our nuclear facilities.

Transaction or commercial factors: any delays in or failure to obtain necessary regulatory, antitrust and other approvals for our proposed acquisitions or asset disposals, or any conditions imposed in connection with such approvals; our ability to integrate acquired businesses successfully; the challenges inherent in diverting management's focus and resources from other strategic opportunities and from operational matters during the process of integrating acquired businesses; the outcome of any negotiations with partners and governments. Delays in or impossibility of obtaining the pertinent permits and rezoning orders in relation to real estate assets. Delays in or impossibility of obtaining regulatory authorisation, including that related to the environment, for the construction of new facilities, repowering or improvement of existing facilities; shortage of or changes in the price of equipment, material or labour; opposition of political or ethnic groups; adverse changes of a political or regulatory nature in the countries where we or our companies operate; adverse weather conditions, natural disasters, accidents or other unforeseen events, and the impossibility of obtaining financing at what we consider satisfactory interest rates.

Political/governmental factors: political conditions in Latin America; changes in Spanish, European and foreign laws, regulations and taxes.

Operating factors: technical problems; changes in operating conditions and costs; capacity to execute cost-reduction plans; capacity to maintain a stable supply of coal, fuel and gas and the impact of the price fluctuations of coal, fuel and gas; acquisitions or restructuring; capacity to successfully execute a strategy of internationalisation and diversification.

Competitive factors: the actions of competitors; changes in competition and pricing environments; the entry of new competitors in our markets.

Further details on the factors that may cause actual results and other developments to differ significantly from the expectations implied or explicitly contained in the presentation are given in the Risk Factors section of Form 20-F filed with the SEC and in the ENDESA Share Registration Statement filed with the Comisión Nacional del Mercado de Valores (the Spanish securities regulator or the “CNMV” for its initials in Spanish).

No assurance can be given that the forward-looking statements in this document will be realised. Except as may be required by applicable law, neither Endesa nor any of its affiliates intends to update these forward-looking statements.