UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM 10-Q

QUARTERLY REPORT UNDER SECTION 13 or 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended August 31, 2008

Commission file number 000-23561

MEXORO MINERALS LTD.

(Exact name of small business issuer as specified in its charter)

| Colorado | 0-23561 | 84-1431797 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | |

C. General Retana #706 Col. San Felipe Chihuahua, Chih. Mexico | 31203 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +52 (614) 426 5505

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | |

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 29,544,416 at October 1, 2008.

ITEM 1. FINANCIAL STATEMENTS

MEXORO MINERALS LTD.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Expressed in U.S. Dollars)

AUGUST 31, 2008

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Consolidated Balance Sheets

(Expressed in U.S. Dollars)

| | | | | | | |

| | | August 31, | | | February 29, | |

| | | 2008 | | | 2008 | |

| | | (Unaudited) | | | (Audited) | |

| Assets | | | | |

| Current | | | | | | |

| Cash and cash equivalents | | $ | 1,352 | | | $ | 12,947 | |

| Accounts receivable | | | 420,937 | | | | 278,847 | |

| Prepaid expenses | | | 56,126 | | | | 104,936 | |

| | | | 478,415 | | | | 396,730 | |

| | | | | | | | | |

Equipment (note 4) | | | 447,016 | | | | 460,941 | |

| | | | | | | | | |

| Total assets | | $ | 925,431 | | | $ | 857,671 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Current | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 2,013,752 | | | $ | 655,677 | |

| Current portion of loans payable (note 8) | | | 39,912 | | | | 71,256 | |

| Promissory notes (note 6) | | | 1,784,654 | | | | 1,480,702 | |

| Convertible debentures (note 7) | | | 1,060,753 | | | | - | |

| | | | 4,899,071 | | | | 2,207,635 | |

| | | | | | | | | |

Loans payable (note 8) | | | 21,731 | | | | 27,481 | |

| | | | | | | | | |

| Total liabilities | | | 4,920,802 | | | | 2,235,116 | |

| | | | | | | | | |

| Stockholders’ deficiency | | | | | | | | |

| Capital stock | | | | | | | | |

| Preferred stock | | | | | | | | |

| Authorized: 20,000,000 shares without par value (note 9) | | | | | | | | |

| Issued: nil | | | | | | | | |

| Common stock | | | | | | | | |

| Authorized: 200,000,000 shares without par value | | | | | | | | |

Issued: 24,119,028 (February 29, 2008 – 25,380,502) (note 10) | | | 24,119,028 | | | | 22,978,654 | |

| Additional paid-in capital | | | 11,984,543 | | | | 11,155,687 | |

| Stock subscriptions | | | 4,943 | | | | 330,000 | |

| Accumulated deficit from prior operations | | | (2,003,427 | ) | | | (2,003,427 | ) |

| Accumulated deficit during the exploration stage | | | (38,066,090 | ) | | | (33,828,011 | ) |

| Accumulated other comprehensive income (loss) | | | (34,368 | ) | | | (10,348 | ) |

| Total stockholders’ deficiency | | | (3,995,371 | ) | | | (1,377,445 | ) |

| | | | | | | | | |

| Total liabilities and stockholders’ deficiency | | $ | 925,431 | | | $ | 857,671 | |

Going-concern (note 3)

Commitments (notes 5, 12 and 14)

Subsequent events (note 15)

The accompanying notes are an integral part of these consolidated financial statements.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Consolidated Statements of Operations and Deficit

(Unaudited) (Expressed in U.S. Dollars)

| | | | | | | | | | | |

| | | | | | | Period from |

| | | | | | | Inception of |

| | | | | | | Exploration |

| | | Three Months Ended | | Six Months Ended | | (March 1, 2004) |

| | | August 31, | | August 31, | | August 31, | | August 31, | | To August 31, |

| | | 2008 | | 2007 | | 2008 | | 2007 | | 2008 |

| | | | | | | | | | | |

| Expenses | | | | | | | | | | |

| General and administrative | $ | 504,751 | $ | 356,858 | $ | 931,161 | $ | 1,292,123 | $ | 5,266,856 |

| Stock-based compensation (note 11) | | 151,252 | | 735,670 | | 339,762 | | 1,673,378 | | 6,060,558 |

| Mineral exploration (note 5) | | 1,462,062 | | 564,358 | | 2,754,885 | | 1,232,634 | | 6,525,063 |

| Impairment of mineral property costs | | - | | - | | - | | - | | 16,145,422 |

| | | | | | | | | | | |

| Operating loss | | (2,118,065) | | (1,656,886) | | (4,025,808) | | (4,198,135) | | (33,997,899) |

| Other income (expenses) | | | | | | | | | | |

| Foreign exchange | | 10,313 | | 2,938 | | 29,115 | | 2,938 | | 30,472 |

| Interest expense | | (124,940) | | - | | (236,978) | | - | | (4,234,699) |

| Interest income | | - | | 3,228 | | - | | (3,129) | | - |

| Loss on sale of assets | | (1,822) | | - | | (4,408) | | - | | (4,408) |

| Gain on settlement of debt | | - | | - | | - | | - | | 140,444 |

| | | | | | | | | | | |

| Net loss | | (2,234,514) | | (1,650,720) | | (4,238,079) | | (4,198,326) | | (38,066,090) |

| Accumulated deficit, beginning | | (35,831,576) | | (28,279,013) | | (33,828,011) | | (25,731,407) | | - |

| Accumulated deficit, ending | $ | (38,066,090) | $ | (29,929,733) | $ | (38,066,090) | $ | (29,929,733) | $ | (38,066,090) |

| | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | |

| Foreign exchange gain (loss) on translation | | 6,030 | | (2,834) | | (24,020) | | 13,093 | | (34,368) |

| | | | | | | | | | | |

| Total comprehensive loss | $ | (2,228,484) | $ | (1,653,554) | $ | (4,262,099) | $ | (4,185,233) | $ | (38,100,458) |

| | | | | | | | | | | |

| Total loss per share – basic and diluted | $ | (0.08) | $ | (0.07) | $ | (0.16) | $ | (0.19) | $ | - |

| | | | | | | | | | | |

| Weighted average number of shares of common stock – basic and diluted | | 26,901,395 | | 22,372,008 | | 26,440,237 | | 21,767,370 | | - |

| | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Consolidated Statements of Cash Flow

(Unaudited) (Expressed in U.S. Dollars)

| | | | | | Period from | |

| | | | | | Inception of | |

| | | Six Months Ended | | | Exploration | |

| | | August 31, | | | August 31, | | | (March 1, 2004) | |

| | | 2008 | | | 2007 | | | to August 31, 2008 | |

| Cash flows from operating activities | | | | | | | | | |

| Net loss | | $ | (4,238,079 | ) | | $ | (4,198,326 | ) | | $ | (38,066,090 | ) |

| Write off of note receivable | | | | | | | - | | | | 57,500 | |

| Acquisition of resource properties costs for stock | | | | | | | - | | | | 13,645,000 | |

| Issuance of shares for consulting services | | | | | | | - | | | | 90,000 | |

| Depreciation | | | 44,121 | | | | 31,575 | | | | 148,360 | |

| Discount on convertible debenture | | | 93,400 | | | | - | | | | 268,400 | |

| Non-cash component of gain on settlement of debt | | | | | | | - | | | | (182,259 | ) |

| Stock-based compensation | | | 341,723 | | | | 1,673,378 | | | | 7,585,519 | |

| Beneficial conversion feature | | | 64,133 | | | | - | | | | 3,781,633 | |

| Prepaid expense | | | 50,048 | | | | 71,917 | | | | (45,187 | ) |

| Accounts receivable | | | (130,430 | ) | | | (15,692 | ) | | | (391,775 | ) |

| Customer deposits | | | | | | | - | | | | (44,809 | ) |

| Notes payable | | | | | | | - | | | | 109,337 | |

| Accounts payable and accrued liabilities | | | 1,530,072 | | | | 724,243 | | | | 2,956,428 | |

| Cash used in operating activities | | | (2,245,012 | ) | | | (1,712,905 | ) | | | (10,087,943 | ) |

| Investing activity | | | | | | | | | | | | |

| Investing activities | | | | | | | | | | | | |

| Purchase of property and equipment | | | (13,171 | ) | | | (35,394 | ) | | | (561,471 | ) |

| Cash used in investing activity | | | (13,171 | ) | | | (35,394 | ) | | | (561,471 | ) |

| Financing activities | | | | | | | | | | | | |

| Proceeds from loans payable | | | - | | | | 47,685 | | | | 182,454 | |

| Proceeds from notes payable | | | 935,156 | | | | 465,088 | | | | 2,579,158 | |

| Proceeds from convertible debentures | | | 1,370,000 | | | | - | | | | 5,062,500 | |

| Proceeds from exercise of options | | | | | | | - | | | | 78,000 | |

| Proceeds from exercise of warrants | | | | | | | 1,264,976 | | | | 3,144,377 | |

| Repayment of loans payable | | | (39,561 | ) | | | - | | | | (126,020 | ) |

| Repayment of notes payable | | | (33,950 | ) | | | - | | | | (393,950 | ) |

| Repayment of convertible debentures | | | - | | | | - | | | | (530,000 | ) |

| Stock subscriptions | | | 4,943 | | | | - | | | | 174,943 | |

| Issuance of common stock | | | 4,942 | | | | - | | | | 482,051 | |

| Cash provided by financing activities | | | 2,241,530 | | | | 1,777,749 | | | | 10,653,513 | |

| Outflow of cash and cash equivalents | | | (16,653 | ) | | | 29,450 | | | | 4,099 | |

| Effect of foreign currency translation on cash | | | 5,058 | | | | 3,756 | | | | (24,824 | ) |

| Cash and cash equivalents, beginning | | | 12,947 | | | | 13,148 | | | | 22,077 | |

| Cash and cash equivalents, ending | | $ | 1,352 | | | $ | 46,354 | | | $ | 1,352 | |

| Supplemental cash flow information | | | | | | | | | | | | |

| Interest paid | | $ | 14,034 | | | $ | - | | | $ | 209,321 | |

| Common stock issued on conversion of debt | | | 103,000 | | | | - | | | | 3,320,500 | |

| Common stock issued on settlement of notes payable | | | 635,008 | | | | - | | | | 1,047,808 | |

| Common stock issued for mineral property costs | | | - | | | | - | | | | 500,000 | |

| Shares issued for services | | | 67,424 | | | | - | | | | 157,424 | |

The accompanying notes are an integral part of these consolidated financial statements.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

Mexoro Minerals Ltd. (formerly Sunburst Acquisitions IV, Inc.) ("Mexoro" or the “Company”) was incorporated in the state of Colorado on August 27, 1997 and on February 15, 2006 its name was changed to Mexoro Minerals Ltd. The Company was formed to seek out and acquire business opportunities. Between 1997 and 2003, the Company was engaged in two business acquisitions and one business opportunity, none of which generated a significant profit or created sustainable business. All were sold or discontinued. Currently, the main focus of the Company’s operations is in Mexico.

The Company had previously been pursuing various business opportunities and, effective March 1, 2004, the Company changed its operations to mineral exploration. Accordingly, as of March 1, 2004, the Company is considered to be an exploration stage company.

On May 25, 2004, the Company completed a “Share Exchange Agreement” with Sierra Minerals and Mining, Inc. (“Sierra Minerals”), a Nevada corporation, which caused Sierra Minerals to become a wholly-owned subsidiary. Sierra Minerals held certain rights to properties in Mexico that the Company now owns or has an option to acquire. Through Sierra Minerals, the Company entered into a joint venture agreement with Minera Rio Tinto, S.A. de C.V. (“MRT”), a company duly incorporated pursuant to the laws of Mexico, which is controlled by an officer of the Company. In August 2005, the Company cancelled the joint venture agreement in order to directly pursue mineral exploration opportunities through a wholly-owned Mexican subsidiary, Sunburst Mining de Mexico S.A. de C.V. (“Sunburst de Mexico”). On August 25, 2005, Sunburst de Mexico, Mexoro and MRT entered into agreements providing Sunburst de Mexico the right to explore and exploit certain properties in Mexico. In December 2005, the Company and Sunburst de Mexico entered into a new agreement with MRT (the “New Agreement”) (note 5). On January 20, 2006, Sierra Minerals was dissolved.

On May 5, 2008, the Company signed a letter of intent (‘LOI’) to enter into a strategic alliance with Paramount Gold and Silver Corp. (‘Paramount’). The agreement called for Paramount to invest a minimum of $4 million and a maximum of $6 million into the Company, at a fixed price of $0.50 per unit by June 23, 2008. On June 18, 2008, the Company and Paramount agreed to extend the date from June 23, 2008 to July 21, 2008. The Company and Paramount then agreed to extend the date to August 5, 2008. On August 6, 2008 Mexoro terminated the LOI with Paramount as Paramount did not meet the terms of the agreement.

During the six months ended August 31, 2008, Paramount provided Mexoro $1,370,000 in the form of secured convertible debentures bearing interest at a rate of 8% per annum for a term of one year. Paramount has the option to convert the debt into units.

The accompanying unaudited consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“US GAAP”) for interim financial information and with the instructions to Form 10-QSB and Item 310 of Regulation S-B. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete consolidated financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the six months ended August 31, 2008 are not necessarily indicative of the results that may be expected for the year ending February 28, 2009. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company’s annual report on Form 10-KSB for the year ended February 29, 2008.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Recent accounting pronouncements |

| (i) | In December 2007, the FASB issued SFAS No. 141 (R), “Business Combinations”, and SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements”. SFAS No. 141 (R) requires an acquirer to measure the identifiable assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree at their fair values on the acquisition date, with goodwill being the excess value over the net identifiable assets acquired. SFAS No. 160 improves the relevance, comparability, and transparency of financial information provided to investors by requiring all entities to report noncontrolling (minority) interests in subsidiaries in the same way as equity in the consolidated financial statements. In addition, SFAS No. 160 eliminates the diversity that currently exists in accounting for transactions between an entity and noncontrolling interests by requiring they be treated as equity transactions. The calculation of earnings per share will continue to be based on income amounts attributable to the parent. SFAS No. 141 (R) and SFAS No. 160 are effective for financial statements issued for fiscal years beginning after December 15, 2008. Early adoption is prohibited. We have not yet determined the effect on our consolidated financial statements, if any, upon adoption of SFAS No. 141 (R) or SFAS No. 160. |

| (ii) | In February 2008, the FASB issued FASB Staff Position (“FSP”) FAS No. 140-3, “Accounting for Transfers of Financial Assets and Repurchase Financing Transactions”, which provides a consistent framework for the evaluation of a transfer of a financial asset and subsequent repurchase agreement entered into with the same counterparty. FSP FAS No. 140-3 provides guidelines that must be met in order for an initial transfer and subsequent repurchase agreement to not be considered linked for evaluation. If the transactions do not meet the specified criteria, they are required to be accounted for as one transaction. This FSP will be effective March 1, 2009, and shall be applied prospectively to initial transfers and repurchase financings for which the initial transfer is executed on or after adoption. The adoption of FSP FAS No. 140-3 will not have an impact on our consolidated financial condition or results of operations. |

| (iii) | In March 2008, the FASB issued SFAS No. 161, “Disclosure About Derivative Instruments and Hedging Activities, an amendment to Financial Accounting Standards Board Financial Accounting Standard No. 133”. SFAS No. 161 requires among other things, enhanced disclosure about the volume and nature of derivative and hedging activities and a tabular summary showing the fair value of derivative instruments included in the statement of financial position and statement of operations. SFAS No. 161 also requires expanded disclosure of contingencies included in derivative instruments related to credit risk. SFAS No. 161 is effective for fiscal 2009. The adoption of SFAS No. 161 will not have an impact on our consolidated financial condition or results of operations. |

| (iv) | In May 2008, the FASB issued Statement No. 162, “The Hierarchy of Generally Accepted Accounting Principles”. This Statement identifies the sources for GAAP in the U.S. and lists the categories in descending order. An entity should follow the highest category of GAAP applicable for each of its accounting transactions. The adoption will not have a material effect on the Company’s consolidated financial statements. |

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

Recent accounting pronouncements (continued)

| (v) | In May 2008, the FASB issued FSP No. APB 14-1, “Accounting for Convertible Debt Instruments That May Be Settled in Cash Upon Conversion (Including Partial Cash Settlements)” (previously FSP APB 14-a), which will change the accounting treatment for convertible securities which the issuer may settle fully or partially in cash. Under the final FSP, cash settled convertible securities will be separated into their debt and equity components. The value assigned to the debt component will be the estimated fair value, as of the issuance date, of a similar debt instrument without the conversion feature, and the difference between the proceeds for the convertible debt and the amount reflected as a debt liability will be recorded as additional paid-in capital. As a result, the debt will be recorded at a discount reflecting its below market coupon interest rate. The debt will subsequently be accreted to its par value over its expected life, with the rate of interest that reflects the market rate at issuance being reflected on the income statement. This change in methodology will affect the calculations of net income and earnings per share for many issuers of cash settled convertible securities. The FSP is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. The Company is currently evaluating the impact of the adoption of FSP No. APB 14-1 on its consolidated financial statements. |

| (vi) | In June 2008, the FASB issued FSP EITF 03-6-1, "Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities", which applies to the calculation of earnings per share (“EPS”) under Statement 128 for share-based payment awards with rights to dividends or dividend equivalents. Under the final FSP EITF 03-6-1, Unvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and shall be included in the computation of EPS pursuant to the two-class method. The FSP EITF 03-6-1 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. The Company is currently evaluating the impact of the adoption of EITF 03-6-1 on its consolidated financial statements. |

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

The accompanying financial statements have been prepared on a going concern basis. The Company has a history of operating losses and will need to raise additional capital to fund its planned operations. As at August 31, 2008, the Company had a working capital deficiency of $4,420,656 (February 29, 2008 - $1,810,905) and cumulative losses during the exploration period of $38,066,090 (February 29, 2008 - $33,828,011). These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company intends to reduce its cumulative losses through the attainment of profitable operations, from its investment in a Mexican mining venture (note 5). In addition, the Company has conducted private placements of convertible debt and common stock (note 10), which have generated a portion of the initial cash requirements of its planned Mexican mining ventures (note 5).

| | | August 31, 2008 | | | February 29, 2008 | |

| | | Cost | | | Accumulated Depreciation | | | Net Book Value | | | Net Book Value | |

| | | | | | | | | | | | | |

| Software | | $ | 25,594 | | | $ | 17,000 | | | $ | 8,594 | | | $ | 7,739 | |

| Machinery | | | 349,610 | | | | 50,409 | | | | 299,201 | | | | 305,221 | |

| Vehicles | | | 167,070 | | | | 63,819 | | | | 103,251 | | | | 109,173 | |

| Computers | | | 34,445 | | | | 15,354 | | | | 19,091 | | | | 21,798 | |

| Office equipment | | | 20,489 | | | | 3,610 | | | | 16,879 | | | | 17,010 | |

| | | $ | 597,208 | | | $ | 150,192 | | | $ | 447,016 | | | $ | 460,941 | |

The Company incurred exploration expenses as follows in the six months ended August 31, 2008:

| | | Cieneguita Operations | | | Sahuayacan | | | Guazapares | | | Cieneguita | | | Encino Gordo | | | New Projects | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | |

| Drilling and sampling | | $ | - | | | $ | - | | | $ | 373,472 | | | $ | 1,195,880 | | | $ | - | | | $ | - | | | $ | 1,569,352 | |

| Geological, geochemical, geophysics | | | - | | | | - | | | | 88,038 | | | | 245,912 | | | | - | | | | 40,978 | | | | 374,928 | |

| Land use permits | | | 53 | | | | 74,954 | | | | 48,049 | | | | 124,246 | | | | (1,646 | ) | | | - | | | | 245,656 | |

| Automotive | | | 260 | | | | - | | | | 3,425 | | | | 6,905 | | | | - | | | | - | | | | 10,590 | |

| Travel | | | 694 | | | | 321 | | | | 29,319 | | | | 18,126 | | | | 213 | | | | - | | | | 48,673 | |

| Consulting | | | 12,989 | | | | - | | | | 119,302 | | | | 88,358 | | | | - | | | | - | | | | 220,649 | |

| Equipment | | | 109 | | | | - | | | | 21,116 | | | | 18,138 | | | | - | | | | - | | | | 39,363 | |

| General | | | 8,764 | | | | 5,151 | | | | 83,866 | | | | 147,451 | | | | 442 | | | | - | | | | 245,674 | |

| | | $ | 22,869 | | | $ | 80,426 | | | $ | 766,587 | | | $ | 1,845,016 | | | $ | (991 | ) | | $ | 40,978 | | | $ | 2,754,885 | |

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 5. | MINERAL PROPERTIES (CONTINUED) |

The Company incurred exploration expenses as follows in the six months ended August 31, 2007:

| | | Cieneguita | | | Sahuayacan | | | Guazapares | | | San Antonio | | | San Francisco | | | Encino Gordo | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | |

| Drilling and sampling | | $ | - | | | $ | 324,834 | | | $ | 116,691 | | | $ | - | | | $ | - | | | $ | - | | | $ | 441,525 | |

| Geological, geochemical, geophysics | | | 16,500 | | | | 83,169 | | | | 17,223 | | | | - | | | | - | | | | 42,739 | | | | 159,631 | |

| Land use permits | | | 17,810 | | | | 51,374 | | | | 7,680 | | | | 400 | | | | 30,530 | | | | 1,886 | | | | 109,680 | |

| Automotive | | | 3,523 | | | | 47 | | | | 718 | | | | - | | | | - | | | | - | | | | 4,288 | |

| Travel | | | 18,082 | | | | 15,201 | | | | 18,040 | | | | - | | | | - | | | | 3,411 | | | | 54,734 | |

| Consulting | | | 143,020 | | | | 30,026 | | | | 71,517 | | | | - | | | | - | | | | 5,124 | | | | 249,687 | |

| Equipment | | | 68,901 | | | | - | | | | 11,201 | | | | - | | | | - | | | | 786 | | | | 80,888 | |

| General | | | 107,488 | | | | - | | | | 25,942 | | | | - | | | | - | | | | (1,229 | ) | | | 132,201 | |

| | | $ | 375,324 | | | $ | 504,651 | | | $ | 269,012 | | | $ | 400 | | | $ | 30,530 | | | $ | 52,717 | | | $ | 1,232,634 | |

Since May 2004, the Company has held interests in gold exploration properties in Mexico.

In August 2005, the Company formed its wholly owned subsidiary, Sunburst de Mexico, which allowed the Company to take title to the properties in the name of Sunburst de Mexico. On August 25, 2005, the Company entered into property agreements with MRT, which provided Sunburst de Mexico options to purchase the mineral concessions of the Cieneguita and Guazapares properties and the right of refusal on three Encino Gordo properties. The Company also entered into an exploration and sale agreement, in October 2006, with Minera Emilio for the mineral concessions of the Sahuayacan Property.

In August 2005, the parties also entered into an operator’s agreement, that gave MRT the sole and exclusive right and authority to manage the Cieneguita Property, and a share option agreement which granted MRT the exclusive option to acquire up to 100% of all outstanding shares of Sunburst de Mexico if the Company did not comply with the terms of the property agreements. The operator’s agreement and share option agreement were cancelled on December 5, 2008 when the Company and Sunburst de Mexico entered into a new contract with MRT as described below under Encino Gordo property.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 5. | MINERAL PROPERTIES (CONTINUED) |

The material provisions of the property agreements are as follows:

Cieneguita

MRT assigned to Sunburst de Mexico, with the permission of the Cieneguita Property’s owner, Corporativo Minero, S.A. de C.V. (“Corporativo Minero”), all of MRT’s rights and obligations acquired under a previous agreement (the Cieneguita option agreement), including the exclusive option to acquire the Cieneguita Property for a price of $2,000,000. As the Cieneguita Property was not in production by May 6, 2006, Sunburst de Mexico was required to pay $120,000 to Corporativo Minero to extend the contract. Corporativo Minero agreed to reduce the obligation to $60,000, of which $10,000 was paid in April 2006 and the balance paid on May 6, 2006. The Company made this payment to Corporativo Minero and the contract was extended.

The Company has the obligation to pay a further $120,000 per year for the next 13 years and the balance of the payments in the 14th year, until the total amount of $2,000,000 is paid. The Company renegotiated the payment due May 6, 2007, to $60,000 payable on November 6, 2007, which was paid, and the balance of $60,000 was paid on December 20, 2007. We paid $60,000 on May 12, 2008 of the $120,000 due on May 6, 2008, and the balance was paid in June 2008. We are not in default on our payments.

In the alternative, if the Cieneguita Property is put into production, of which there is no guarantee, the Company must pay the Cieneguita owners $20 per ounce of gold produced, if any, from the Cieneguita Property to the total $2,000,000 due. In the event that the price of gold is above $400 per ounce, the property payments payable to the Cieneguita owners from production will be increased by $0.10 for each dollar increment over $400 per ounce. The total payment of $2,000,000 does not change with fluctuations in the price of gold. Non-payment of any portion of the $2,000,000 total payment will constitute a default. In such case, the Cieneguita owners will retain ownership of the concessions, but the Company will not incur any additional default penalty. MRT retained no interest in the Cieneguita Property.

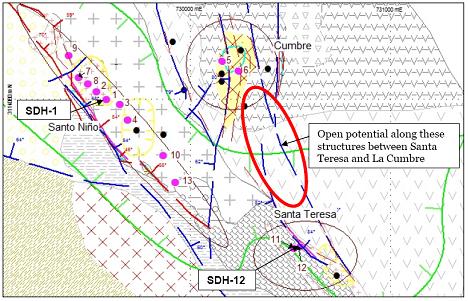

Guazapares

MRT assigned to Sunburst de Mexico, with the consent of the Guazapares Property owner Compañía Minera, S.A. de C.V. (“Compañía Minera”), MRT’s rights and obligations concerning the Guazapares Property, including the exclusive option, for a term of four years, to purchase eight of the Guazapares Property concessions upon payment of $910,000. The total payments for the Company to acquire and retain 100% ownership of all eight concessions are as follows: November 30, 2005 - $100,000 (this payment date was extended – see below), October 31, 2006 - $60,000 (this payment date was extended to February 28, 2007, then to May 31, 2007 and then to August 31, 2007- see below), August 2, 2007 - $140,000 (see below), August 2, 2008 - $110,000 (see below) and August 2, 2009 - $500,000.

On September 19, 2007, Sunburst de Mexico, Mexoro and MRT entered into an agreement to defer any and all property payments regarding Guazapares currently owing to MRT and which would otherwise become due by December 31, 2007, until such time as Sunburst de Mexico and Mexoro have sufficient funds to make the payments, in the opinion of the disinterested directors of Mexoro.

Mexoro agreed to issue 250,000 shares to MRT and/or its assignees in consideration for the deferral of any and all Guazapares Property payments currently outstanding and those arising on or before December 31, 2007.

In return, Sunburst de Mexico granted MRT a 2.5% net smelter royalties (“NSR”) and the right to extract from the Guazapares concessions up to 5,000 tons per month of rock material; this right will terminate on exercise of the option to purchase the concessions. Otherwise, MRT retained no interest in the Guazapares Property.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 5. | MINERAL PROPERTIES (CONTINUED) |

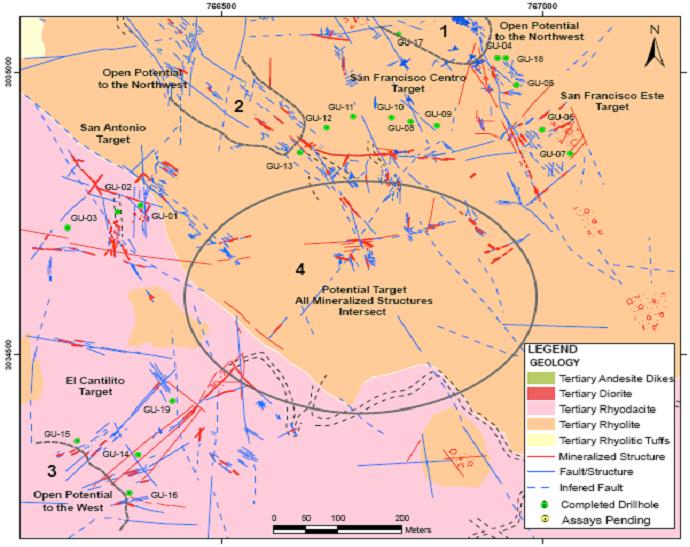

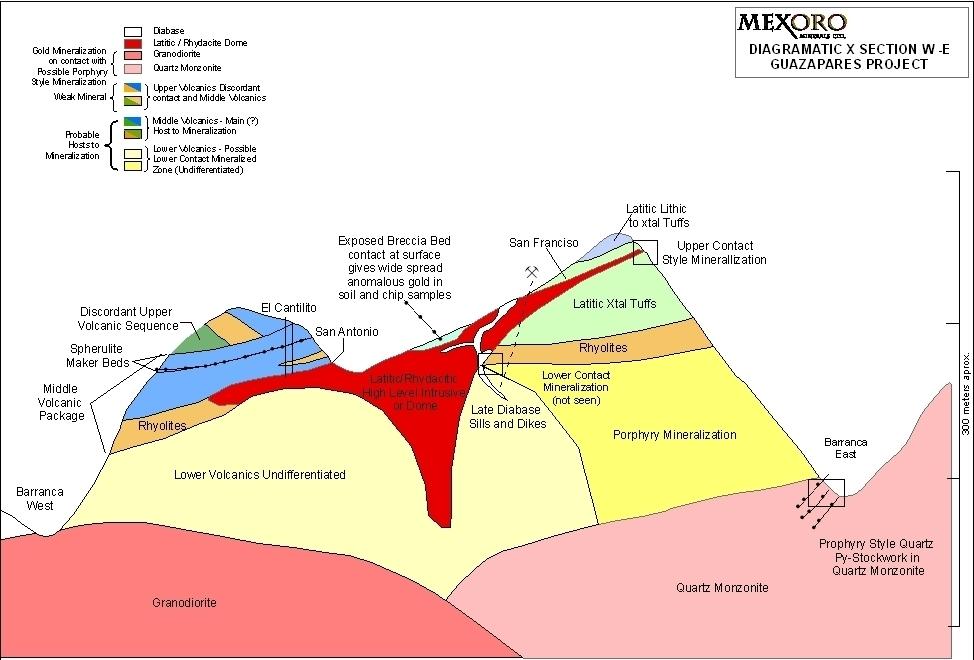

San Francisco (Guazapares)

MRT assigned to Sunburst de Mexico, for a term of 60 months, commencing from June 25, 2004 (the “Option Period”), with the consent of the San Francisco concessions owner Minera Rachasa, S.A. de C.V. (“Minera Rachasa”), MRT’s rights and obligations acquired under the San Francisco option agreement, including the option to purchase the San Francisco concessions for a price of $250,000 on June 25, 2009.

To maintain the option, Sunburst de Mexico assumed the obligation to pay to the San Francisco owner cumulative annual payments. The payments are: $20,000 on June 25, 2006 (paid); $30,000 on June 25, 2007 (paid); and $40,000 on June 25, 2008 (paid).

If the option is exercised prior to the expiration of the Option Period by payment of the purchase price of $250,000; the obligation to pay the annual payments will be terminated. MRT and the San Francisco owner reserved a combined 2.5% NSR. MRT reserved no other rights on the San Francisco concessions.

San Antonio (Guazapares)

MRT assigned to Sunburst de Mexico, with the consent of the San Antonio concessions owner (Rafael Fernando Astorga Hernández), MRT’s rights and obligations acquired under the San Antonio option agreement, including the option to purchase the San Antonio concessions for a price of $500,000, commencing on January 15, 2004 (the signing date of the San Antonio option agreement) and due on January 15, 2010.

To maintain the option, Sunburst de Mexico assumed the obligation to pay to the San Antonio owner cumulative annual payments. The remaining payments are: $50,000 on January 15, 2008 (this payment was deferred to January 31, 2008 and paid) and $50,000 on January 15, 2009.

If the option is exercised prior to the expiration of the option period by payment of the purchase price, the obligation to pay the annual payments will be terminated. The San Antonio owner reserved the right to extract from the San Antonio concessions up to 50 tonnes per day of rock material; this right will terminate on the date of the exercise of the option. MRT and the San Antonio owner reserved a combined 2.5% NSR to be paid to them. MRT reserved no other rights on the San Antonio concessions.

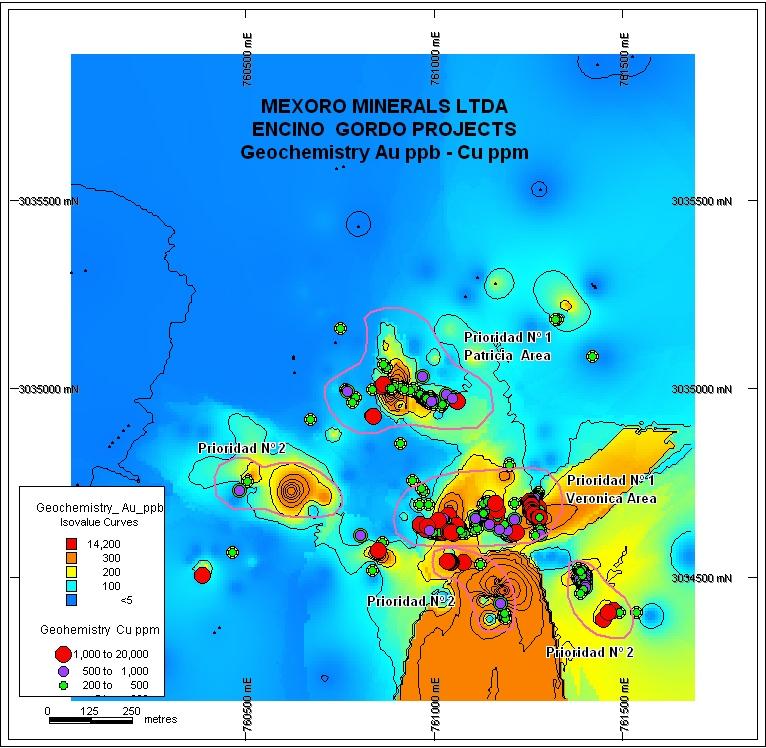

Encino Gordo

On December 8, 2005, the Company and Sunburst de Mexico entered into a “New Agreement” with MRT to exercise their option under the sale and purchase of the mining concessions agreement, dated August 18, 2005, to obtain two mining concessions in the Encino Gordo region. The New Agreement also provided the Company the option to obtain three additional concessions in the Encino Gordo region.

The following are additional material terms of the New Agreement:

| (a) | The share option agreement with MRT was cancelled; |

| (b) | The Company granted MRT the option to buy all of the outstanding shares of Sunburst de Mexico for $100 if the Company failed to transfer $1,500,000 to Sunburst de Mexico by April 30, 2006. On April 6, 2006, MRT agreed to waive its option to purchase the shares of Sunburst de Mexico and also waived the Company’s obligation to transfer $1,500,000 to Sunburst de Mexico. The property agreements were modified to change the NSR to a maximum of 2.5% for all properties covered by the agreements. The property agreements contained NSRs ranging from 0.5% to 7%; |

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 5. | MINERAL PROPERTIES (CONTINUED) |

| (c) | The Company agreed to issue 2,000,000 shares of the Company’s common stock to MRT within four months of the date of the signing of the New Agreement. These shares were issued to MRT and its assignee at the market value of $1.05 per share on February 23, 2006, and $2,100,000 was charged to operations for the year ended February 28, 2006. This issuance fulfilled the Company’s payment obligations under the previous property agreements; |

| (d) | The Company agreed to issue 1,000,000 additional shares of the Company’s common stock to MRT if and when the Cieneguita Property is put into production and reaches 85% of production capacity over a 90-day period, as defined in the New Agreement; and |

| (e) | The operator’s agreement with MRT was cancelled. |

Sunburst de Mexico purchased two of the Encino Gordo concessions from MRT for a price of 1,000 pesos (approximately US$100), and MRT assigned to Sunburst de Mexico a first right of refusal to acquire three additional Encino Gordo concessions. The total payments to acquire 100% of these three additional concessions are as follows: $10,000 on June 30, 2006 (paid); $25,000 on December 31, 2006 (paid), $50,000 on December 31, 2007 ($20,000 of this payment was made on January 3, 2008 and the balance was paid on February 29, 2008), $75,000 on December 31, 2008, $125,000 on December 31, 2009 and $200,000 on December 31, 2010.

Sahuayacan

On June 21, 2006, Sunburst de Mexico entered into an exploration and sale option agreement of mining concessions with Minera Emilio, S.A. de C.V. (“Minera Emilio”) for mineral concessions of the Sahuayacan Property. Minera Emilio granted the Company the exclusive right to conduct exploration on the Sahuayacan Property and the Company must pay $282,000 in the following manner: $20,000 on date of signing agreement (paid); $10,000 due December 1, 2006 (paid); $2,500 per month effective from August 21, 2006 to July 21, 2007, for a total of $30,000 (paid); $3,500 per month effective from August 21, 2007 to July 21, 2008 for a total of $42,000 (paid); and $5,000 per month effective August 21, 2008 to July 21, 2011 (all have been paid to date) for a total of $180,000 until the balance of the total $282,000 is paid (36 months).

Segundo Santo Nino (Sahuayacan)

On May 15, 2006, Sunburst de Mexico entered into an exploration contract with Jose Maria Rascon and Sabino Amador Rascon Polanco and, on November 20, 2007, Sunburst de Mexico entered into an exploration contract with Rene Muro Lugo (all three representatives constitute the “Concessionaires”) for the Segundo Santo Nino concession on the Sahuayacan Property. Each concession representative owns 33.3% of the total Segundo Santo Nino title. The Company must pay the Concessionaires a total of $255,000 for this concession. The payments to acquire 100% of this concession are as follows: all payments up to February 13, 2008 totaling $65,000 have been paid, July 13, 2008 - $20,000 (overdue), February 13, 2009 - $20,000, July 13, 2009 - $30,000 and February 13, 2010 - $120,000.

La Maravilla (Sahuayacan)

On January 25, 2008, Sunburst de Mexico entered into an exploration and option agreement with Maria Luisa Wong Madrigal for mineral concessions under the “La Maravilla” project on the Sahuayacan Property. The Company must pay Maria Luisa Wong Madrigal $600,000 to acquire 100% of this concession as follows: $33,000 – January 25, 2008 (paid); $33,000 – July 25, 2008 (paid); $34,000 – January 25, 2009; $500,000 – at the option to purchase the concession or 36 months – January 25, 2010.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

As at August 31, 2008, the Company had $1,784,654 (February 29, 2008 - $1,480,702) of promissory notes outstanding, comprising the following:

| (a) | $487,997 (CHF 565,000) of promissory notes accruing interest at a rate of 7.5% p.a. payable semi-annually. The principal and interest on the notes was due and payable on April 30, 2008. The Company did not make the payment by April 30, 2008 and is in default. Interest rate payable during the default period is 12%. |

| (b) | $1,296,657 of promissory notes is due to related parties and close associates that bear no interest and have no terms of repayment. |

During the six months ended August 31, 2008, the Company converted promissory notes of $635,008 into $1.00 units. The units consist of two common shares and one warrant exercisable at $0.75 each (note 10).

| 7. | CONVERTIBLE DEBENTURES |

On May 5, 2008, the Company signed a LOI to enter into a strategic alliance with Paramount. The agreement called for Paramount to invest a minimum of $4 million and maximum of $6 million into the Company, fixed at a price of $0.50 per unit by June 23, 2008. The investment timeline was extended until July 21, 2008, and then to August 5, 2008. On August 6, 2008 Mexoro terminated the LOI with Paramount as Paramount did not meet the terms of the agreement.

The Company issued secured convertible debentures to Paramount as follows:

On May 9, 2008, the Company issued $500,000 in convertible debentures to Paramount, with a maturity date of one year, accruing interest at 8% per year payable in arrears and convertible at the option of the holder.

On June 10, 2008, the Company issued $70,000 in convertible debentures to Paramount, with a maturity date of one year, accruing interest at 8% per year payable in arrears and convertible at the option of the holder.

On June 25, 2008, the Company issued $300,000 in convertible debentures to Paramount, with a maturity date of one year, accruing interest at 8% per year payable in arrears and convertible at the option of the holder.

On July 11, 2008, the Company issued $500,000 in convertible debentures to Paramount, with a maturity date of one year, accruing interest at 8% per year payable in arrears and convertible at the option of the holder.

As at August 31, 2008, there were $1,370,000 convertible debentures outstanding.

Paramount may convert all or a portion of the principal amount of the debenture into units consisting of one share of our common stock and half a warrant to purchase one share of our common stock. Subject to certain adjustments upon the occurrence of various capital reorganizations and other events, the units are convertible at $0.50 per unit for a total of up to 2,740,000 shares of common stock and up to 1,370,000 warrants at $0.75 to purchase shares of common stock (the “Warrants”). The Warrants have a term of four years from the date that Paramount converts the debenture or the portion of the debenture covering those warrants. A holder of the Warrants may exercise those Warrants at $0.75 (subject to adjustments upon the occurrence of certain events like stock splits).

The fair value of the Warrants attached to the convertible debentures as discussed above was estimated at the date of grant using the Black-Scholes option pricing model using the following weighted average assumptions:

| | | 2008 | |

| Expected volatility | | | 70% - 111 | % |

| Expected dividend rate | | | - | |

| Expected life of warrants in years | | | 4 | |

| Risk-free rate | | | 2.30% - 3.41 | % |

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

As at August 31, 2008, there were loans payable in the amount of $61,643, of which $39,912 is current and $21,731 is long-term. The loans are repayable in monthly installments of $4,442, including interest ranging from 5.3% to 15.6% per annum, and are secured by specified automotive equipment.

The Company is authorized to issue 20,000,000 shares of preferred stock. The Company’s board of directors is authorized to divide the preferred stock into series, and with respect to each series, to determine the preferences and rights and qualifications, limitations or restrictions thereof, including the dividend rights, conversion rights, voting rights, redemption rights and terms, liquidation preferences, sinking fund provisions, and the number of shares constituting the series and the designations of such series. The board of directors could, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting rights of the holders of common stock, which issuance could have certain anti-takeover effects.

In August 2008, the Company converted $142,508 (MXN 1,449,989) (note 6) of promissory notes into subscription proceeds and issued 280,000 common shares. The subscribers to the subscription proceeds have agreed to purchase one unit for each $1.00 of debt. Each unit consists of two shares of the Company’s common stock and one warrant each exercisable at $0.75, which expire in four years.

In July 2008, the Company converted $67,424 of debt into 150,000 common shares.

In June 2008, the Company converted $60,000 of debt into subscription proceeds and issued 120,000 common shares. The subscribers to the subscription proceeds have agreed to purchase one unit for each $1.00 of debt. Each unit consists of two shares of Company’s common stock and one warrant each exercisable at $0.75, which expire in four years.

In June, 2008, the Company issued 9,885 shares of common stock in a private placement.

In May 2008, the Company converted $535,500 of debt into subscription proceeds and issued 1,071,000 common shares. The subscribers to the subscription proceeds have agreed to purchase one unit for each $1.00 of debt. Each unit consists of two shares of Company’s common stock and one warrant each exercisable at $0.75, which expire in four years.

On April 25, 2008, stock subscriptions of $330,000 were converted into 330,000 shares of common stock.

In fiscal 2008, the Company issued 1,174,000 shares of common stock on the exercise of 1,174,400 warrants where each warrant was exercisable into shares of common stock at the price of $1.00 per share. The warrants were to expire on April 30, 2008.

In the second and third quarter of fiscal 2008, the Company issued 1,000,000 shares of common stock on the exercise of 1,000,000 warrants where each warrant was exercisable into shares of common stock at the price of $0.75 per share. The warrants were to expire on December 31, 2007.

In the first two quarters of fiscal 2008, the Company issued 1,000,000 shares of common stock on the exercise of 1,000,000 warrants where each warrant was exercisable into shares of common stock at the price of $0.50 per share. The warrants were to expire on June 30, 2007.

On November 7, 2007, the Company issued 670,000 shares of common stock on the exercise of 670,000 warrants where each warrant was exercisable into shares of common stock at the price of $1.00 per share. The warrants were to expire on December 31, 2007.

On September 20, 2007, the Company issued 250,000 shares of common stock pursuant to an agreement in consideration of deferral of any and all Guazapares Property payments currently outstanding and those arising on or before December 31, 2007. The shares were valued at $1.16 per share, based on the closing quoted market price on September 18, 2007.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 10. | COMMON STOCK (CONTINUED) |

On September 20, 2007, the Company issued 250,000 shares of common stock pursuant to the Encino Gordo contract. The shares were valued at $1.16 each, based on the closing quoted market price on September 18, 2007.

On August 15, 2006, the Company returned to treasury 50,000 shares of common stock that were issued but not delivered pending payment with respect to the convertible debt converted into shares of common stock on July 5, 2006.

On August 10, 2006, the Company issued 50,000 shares of common stock on the exercise of 50,000 warrants where each warrant was exercisable into shares of common stock at a price of $1.00 per share.

On July 5, 2006, the Company issued 5,835,000 shares of common stock on the exercise of $2,917,500 of convertible debt at a price of $0.50 per share.

On April 3, 2006 and May 31, 2006, the Company issued 550,000 and 200,000 shares of common stock, respectively, pursuant to a private placement unit offering. Units consisted of one share of common stock and one-half of one warrant. Each full warrant entitles the investor to purchase an additional share of the Company’s common stock at a price of $1.00 per share and was exercisable until April 30, 2008.

On March 4, 2006, the Company agreed to issue 1,651,200 shares of common stock at a price of $0.25 per share to settle $412,800 in promissory notes payable. On April 6, 2006, these shares were issued.

| 11. | STOCK COMPENSATION PROGRAM |

On April 29, 2008, the board of directors approved the granting of stock options according to the 2008 Nonqualified Stock Option Plan (“2008 Option Plan”) whereby the board is authorized to grant to employees and other related persons stock options to purchase an aggregate of up to 6,000,000 shares of the Company's common stock. Subject to the adoption of the 2008 Option Plan, all of the options were granted and vest, pursuant to the terms of the 2008 Option Plan, in six equal installments, with the first installment vesting at the date of grant, the second installment vesting October 29, 2008, the third installment vesting April 29, 2009, the fourth installment vesting October 29, 2009, the fifth installment vesting April 29, 2010 and the last installment vesting October 29, 2010.

On April 29, 2008, the Company granted 400,000 stock options to employees at a price of $0.52 per share and 850,000 stock options to management at a price of $0.52 per share.

In the six months ended August 31, 2008, the Company has agreed to grant share stock awards to officers and directors for each newly discovered reserves of 1,000,000 oz AU (or Au-Ag equivalent) to a maximum of 400,000 shares.

In the six months ended August 31, 2008, the Company entered into a consulting agreement with Sam Osman to conduct public relations for the Company. Mr. Osman was granted 200,000 options to purchase 200,000 common shares of the Company at a price of $0.52 per share, expiring June 30, 2010.

In the six months ended August 31, 2008, the Company awarded 1,450,000 options to purchase common shares (2007 – 1,635,000) and recorded stock-based compensation expense of $327,470 (2007 - $698,878). The weighted average fair value of each option granted for the six months ended August 31, 2008 was $0.27. The following weighted average assumptions were used for the Black-Scholes option-pricing model to value stock options granted in 2008:

| | | 2008 | |

| Expected volatility | | | 62% - 72 | % |

| Expected dividend rate | | | - | |

| Expected life of options in years | | | 2 - 10 | |

| Risk-free rate | | | 2.82% - 3.86 | % |

There were no capitalized stock-based compensation costs at August 31, 2008 or August 31, 2007.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 11. | STOCK COMPENSATION PROGRAM (CONTINUED) |

The summary of option activity under the 2008 Option Plan as of August 31, 2008, and changes during the period then ended, is presented below:

| | | | | | | | | | | | | |

| | | Weighted | | | Number of | | | Weighted- | | | Aggregate | |

| | | Average | | | Shares | | | Average | | | Intrinsic | |

| | | Exercise | | | | | | Remaining | | | Value | |

| | | Price | | | | | | Contractual | | | | |

| Options | | | | | | | | Term | | | | |

| | | | | | | | | | | | | |

| Balance at March 1, 2008 | | $ | 0.87 | | | | 2,475,000 | | | | 7.93 | | | $ | 222,500 | |

| Options granted | | | 0.52 | | | | 1,450,000 | | | | 7.86 | | | | - | |

| Options exercised | | | - | | | | - | | | | - | | | | - | |

| Options cancelled/forfeited | | $ | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at August 31, 2008 | | $ | 0.74 | | | | 3,925,000 | | | | 7.86 | | | $ | - | |

| | | | | | | | | | | | | | | | | |

| Exercisable at August 31, 2008 | | $ | 0.73 | | | | 1,979,167 | | | | 7.27 | | | $ | - | |

| | | | | | | | | | | | | | | | | |

The weighted-average grant-date fair value of options granted during the six months ended August 31, 2008 and August 31, 2007 was $0.49 and $0.80, respectively.

A summary of the status of the Company’s nonvested options as of August 31, 2008, and changes during the six months ended August 31, 2008, is presented below:

| | | | | | Weighted-average | |

| | | | | | Grant-Date | |

| Non-vested options | | Shares | | | Fair Value | |

| | | | | | | |

| Nonvested at February 29, 2008 | | | 1,065,000 | | | $ | 0.76 | |

| Granted | | | 1,450,000 | | | | 0.29 | |

| Vested | | | (569,167 | ) | | | 0.39 | |

| | | | | | | | | |

| Nonvested at August 31, 2008 | | | 1,945,833 | | | $ | 0.46 | |

As of August 31, 2008, there was an estimated $845,698 of total unrecognized compensation cost related to nonvested share-based compensation arrangements granted under the 2007 and 2008 nonqualified stock option plans. That cost is expected to be recognized over a weighted-average period of approximately 1.65 years.

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

As at August 31, 2008, the Company had a total of 3,103,443 (February 29, 2008 – 4,486,100) warrants outstanding to purchase common stock. Each warrant entitles the holder to purchase one share of the Company’s common stock. The Company has reserved 3,103,443 shares of common stock in the event that these warrants are exercised.

During the six months ended August 31, 2008, the Company received $nil from warrants exercised.

The outstanding warrants include 1,000,000 Series D Warrants exercisable at $1.25 per share and 1,000,000 Series E Warrants exercisable at $1.50 per share; of which all are exercisable at the option of the holder, have no redemption features, and are settled on a physical basis. All the warrants were fully vested upon issuance.

At August 31, 2008, there were 1,000,000 Series D Warrants and 1,000,000 Series E Warrants outstanding. The Series E Warrants will become exercisable only when the Series D Warrants have been fully exercised. Unless terminated earlier as a result of failure to vest, the Series D and Series E Warrants will each expire on December 31, 2008.

The Company had issued 2,917,500 warrants exercisable at $1.00 each pursuant to the issuance of convertible debentures. These warrants expired on April 30, 2008.

The Company had issued 375,000 warrants exercisable at $1.00 each pursuant to the issuance of a private placement unit offering. These warrants expired on April 30, 2008.

The following table summarizes the continuity of the Company’s share purchase warrants:

| | | Number of Warrants | | | Weighted Average Exercise Price | |

| Balance, February 28, 2007 | | | 8,217,500 | | | $ | 1.00 | |

| | | | | | | | | |

| Issued | | | 113,000 | | | | 1.00 | |

| Cancelled | | | - | | | | - | |

| Exercised | | | (3,844,400 | ) | | | 0.80 | |

| | | | | | | | | |

| Balance, February 29, 2008 | | | 4,486,100 | | | $ | 1.17 | |

| Issued | | | 990,443 | | | | 0.72 | |

| Cancelled | | | (2,043,100 | ) | | | 1.00 | |

| Exercised | | | (330,000 | ) | | | 1.00 | |

| | | | | | | | | |

| August 31, 2008 | | | 3,103,443 | | | $ | 1.15 | |

| | | | | | | | | |

As at August 31, 2008, the following share purchase warrants were outstanding:

| Number of Warrants | | | Exercise Price | | Expiry Date |

| | 250,000 | | | $ | 0.65 | | June 30, 2012 |

| | 740,443 | | | $ | 0.75 | | April to August, 2012 |

| | 1,000,000 | | | $ | 1.25 | | December 31, 2008 |

| | 1,000,000 | | | $ | 1.50 | | December 31, 2008 |

| | 113,000 | | | $ | 1.00 | | January 31, 2010 |

| | 3,103,443 | | | | | | |

MEXORO MINERALS LTD.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Six Months Ended August 31, 2008

(Unaudited) (Expressed in U.S. Dollars)

| 13. | RELATED PARTY TRANSACTIONS |

For the six months ended August 31, 2008, the Company paid or accrued management fees of $104,440 (August 31, 2007 - $298,597) to certain officers and directors and to companies controlled by directors. The Company also paid or accrued $7,449 (August 31, 2007 - $47,929) to certain officers and directors and to companies controlled by directors for travel, office and other related expenses.

As at August 31, 2008, accounts payable of $84,000 (August 31, 2007 - $36,876) were owing to an officer and director of the Company and $nil (August 31, 2007 - $91,771) was owing to companies controlled by directors. In addition, promissory notes of $706,791 (August 31, 2007 - $106,050) were owed to companies controlled by directors (note 6).

All related party transactions are in the normal course of business at the exchange amount agreed to by each party.

During the year ended February 28, 2007, the Company entered into an agreement for the lease of new office premises for a two-year period, commencing on September 15, 2006 and ending on September 14, 2008. The Company is committed to spend approximately $22,800 under this arrangement.

On July 1, 2008, the Company entered into an investor relations agreement with Vastani Company (“Vastani”), whereby Vastani will act as an investor relationship advisor to the Company. The Company has agreed to pay a monthly retainer of €20,000 and 1,000,000 warrants to purchase shares of the Company’s common stock. This includes 250,000 warrants at a price of $0.65 per share vesting on signing, 250,000 warrants at an execution price of $1.30 per share vesting after 90 days, 250,000 warrants at a price of $2.00 per share vesting after 120 days and 250,000 warrants at a price of $2.75 per share vesting after 180 days. The warrants expire on June 30, 2012.

| a) | On September 9, 2008, the Company retained the services of Haywood Securities of Toronto, Canada to sponsor the listing of the common shares of Mexoro on the TSX or TSX-V exchange. |

| b) | On September 10, 2008, the Company sold 212,500 units (consisting of two common shares of the Company and one Series A warrant, exercisable at $0.75 to purchase one share) at a price of $0.80 per unit for the total purchase price of $170,000. The warrants have a term of four years. |

ITEM 2.

| | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-Q constitute "forward-looking statements". These statements, identified by words such as “plan”, "anticipate", "believe", "estimate", "should", "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under this Item 2, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in this Form 10-Q. We do not intend to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. We advise you to carefully review the reports and documents we file from time to time with the United States Securities and Exchange Commission (the “SEC”), particularly our annual reports on Form 10-KSB, our quarterly reports on Form 10-QSB and our current reports on Form 8-K.

Overview

Mexoro Minerals Ltd. (“Mexoro” or the “Company”) is a start-up exploration stage company and has not yet generated or realized any revenues from exploration projects, which commenced on May 1, 2004. On September 9, 2008, we announced that we retained the services of Haywood Securities Inc. of Toronto, Canada to sponsor the listing of our common shares on the TSX or TSX-V exchange. As of August 31, 2008, we had $1,352 in our bank account.

On May 5, 2008, we signed a letter of intent (”LOI”) to enter into a strategic alliance with Paramount Gold and Silver Corp. (“Paramount”) to combine mining and exploration expertise, along with efficient use of personnel, drill rigs and current mining concessions to improve efficiencies and potentially reduce costs for both companies. We believed that the alignment of interest between the two companies created synergy, especially as the two companies’ Guazapares projects are contiguous and create a large land position located in the state of Chihuahua, Mexico.

The LOI called for Paramount to invest a minimum of $4 million and maximum of $6 million into our Company, at a fixed price of $0.50 per unit by June 23, 2008. This date was extended until July 21, 2008 and then to August 5, 2008. Paramount was unable to complete the minimum investment on August 5, 2008, and as such, the strategic alliance with Paramount was terminated on August 6, 2008.

On May 9, 2008, we issued a secured convertible debenture (the “Debenture”) with a one-year term in the amount of $500,000. In connection with the issuance of the Debenture, we entered into a “Security Agreement” with Paramount that secures our assets until there has been full compliance with the terms of the Debenture. Paramount may convert all or a portion of the principal amount of the Debenture into units consisting of one share of our common stock and half a warrant to purchase one share of our common stock. Subject to certain adjustments upon the occurrence of various capital reorganizations and other events, the units are convertible at $0.50 per unit for a total of up to 1,000,000 shares of common stock and up to 500,000 warrants at $0.75 to purchase shares of common stock (the “Warrants”). The Warrants have a term of four years from the date that Paramount converts the Debenture or the portion of the Debenture covering those warrants. A holder of the Warrants may exercise those Warrants at $0.75 (subject to adjustments upon the occurrence of certain events like stock splits).

On June 23, 2008, we signed an addendum to the strategic alliance granting Paramount an extension for the closing of the transaction until July 21, 2008. As such, Paramount invested an additional $370,000 into our Company under the same terms as the original secured convertible debenture. This debenture is convertible into up to 740,000 shares of our common stock and up to 370,000 warrants which are exercisable into shares of our common stock at $0.75 per share.

On July 16, 2008, we received an additional payment from Paramount in the amount of $500,000 pursuant to the strategic alliance. This additional advance allowed Mexoro to continue its ongoing drill program on both the Cieneguita and Guazapares projects. The funds are advanced by way of a secured convertible debenture which bears interest at a rate of 8% per annum for a term of one year. Paramount has the option to convert the debt into units. Along with this additional advance, Mexoro agreed to extend the closing deadline of the strategic alliance transaction until August 5, 2008 with Paramount's continued commitment to fund Mexoro's operating expenses.

On August 6, 2008, the strategic alliance between Mexoro and Paramount was terminated, including Paramount’s right of first refusal on financings. As a result of Paramount holding convertible debentures in the amount of $1,370,000 resulting from advances made to Mexoro Minerals to fund exploration, they agreed to defer interest payments on the advances until September 10, 2008. The September 10, 2008 interest payment date has subsequently been extended again to October 10, 2008.

Our continued existence and plans for future growth depend on our ability to obtain the additional capital necessary to operate either through the generation of revenue or the issuance of additional debt or equity. While we believe that we have raised sufficient funds in our recent offerings to allow us to continue in business until October 31, 2008, we may not be able to continue in business beyond that date unless we obtain additional capital. We have not generated any revenues, and no revenues are anticipated unless and until mineralized material is discovered on the properties in which we have an interest.

For the 12-month period from September 2008 to August 2009, we need to raise additional capital to maintain operations. We will need a minimum of $1,349,000 for property payments and an additional $840,000 for general and administrative costs. This does not include any capital to execute our exploration programs as detailed below. The following table shows our contractual property payments that are due until August 2009:

| Name | Date | Payment Type | USD |

| | | | |

Guazapares Property1 | August 2008 | Property payment | $110,000 |

| | | | |

| Sahuayacan Property | August 2008 to July 2011 | Property payments | $170,000 |

| | | | |

| Encino Gordo Property | December 2008 | Property payment | $75,000 |

| | | | |

| San Antonio (Guazapares) | January 2009 | Property payment | $50,000 |

| | | | |

| Sahuayacan Property (La Maravilla) | January 2009 | Property payment | $34,000 |

| | | | |

| Segundo Santo Nino (Sahauyacan) | November 2008 and May 2009 | Property payment | $40,000 |

| | | | |

| Cieneguita Property | May 2009 | Property payment | $120,000 |

| | | | |

| San Francisco (Guazapares) | June 2009 | Property payment | $250,000 |

| | | | |

| Guazapares Property | August 2009 | Property payment | $500,000 |

| | | | |

1 All Guazapares payments due by December 31, 2008 have been deferred, until in the opinion of the directors of Mexoro, Sunburst de Mexico and Mexoro have sufficient funds to make the payments. This includes deferred payments of $100,000 due in November 2005, $60,000 due in August 2006 and $140,000 due in August 2007.

Additionally, if our exploration during that time period is successful, we may need to raise additional capital to fund those exploration programs. At this time, we cannot assess with any accuracy our total capital needs to fund an expanded exploration program beyond our basic program. We do not have any additional sources of additional capital to fund our operations beyond October 31, 2008. We also believe that we will not generate any revenues that would allow us to continue operations. If we are unable to raise additional capital through debt or equity beyond October 31, 2008, it is most likely that we would need to cease operations and forfeit our properties as we would be unable to make the necessary property payments.

Plan of Operation

Summary

Our business plan is to proceed with the exploration of our Mexican mineral properties to determine whether they contain commercially exploitable reserves of gold, silver or other metals. On May 5, 2008, we entered into a strategic alliance with Paramount to invest between $4 million and $6 million in our company by July 21, 2008. Paramount forwarded an initial $500,000 on May 9, 2008, an additional $370,000, on June 23, 2008, and a final payment of $500,000 on July 16, 2008 for a total investment of $1,370,000 in the form of secured convertible debentures. The proceeds from these placements were primarily used to continue the drilling programs on our Cieneguita and Guazapares properties. As the Paramount strategic alliance was terminated, and in order to continue our exploration plans and fund general administrative expenses as a minimum, we will need to raise additional working capital to maintain basic operations. We would plan to raise those funds through the sale of equity or debt. At this time we do not have any sources to raise additional capital, and we cannot assure you that we will be able to find sources to raise additional capital. Failure to raise any additional capital would most likely require us to cease operations and abandon all of our exploration properties.

In the event that our exploration program finds exploration targets that warrant additional exploration work, including exploration by drilling, we will not have enough cash available to fund an expanded exploration program. If we decide to expand our exploration program, we would need to raise additional capital to meet these needs. We currently do not have any sources of additional capital available to us, and we may not have any in the future. The failure to raise additional capital would severely curtail our ability to conduct any additional exploration work that might be warranted because of the results of our current exploration program.

We are not involved in any research and development on our exploration properties. We have no known reserves on the Cieneguita Property. Our original strategy was to put the Cieneguita property into production, and as such we purchased approximately $250,000 worth of new and used mining equipment to be used for heap leach production. We contemplated putting the Cieneguita Property into production during 2008 but recent positive exploration results from our drilling programs have changed that plan. It is management’s plan to try and sell the equipment that we have purchased. At this time, we have no estimates on what the equipment will be worth in the secondary market. If we are unable to sell it, we may lose all of our capital investment. We cannot assure you that we will be able to sell the equipment at a price to recover our original investment, or at all.

In the event that we did discover a mineral deposit on one of our properties, of which there is no guarantee, we would need to expend substantial amounts of capital to put any of our properties into production, if so warranted. The amount of such expenditures is indeterminable at this time as our exploration program has not advanced far enough to provide us with results to determine this information.

Such expenditures depend upon the size of the mineralized body, the grade of the mineralized and the type of mining that is required to extract any minerals that may be found. Regardless, we do not have enough capital available to us to make any such expenditure that would be required to put any mineral property into production, and we therefore would have to raise the additional capital or, if possible, enter into a joint venture for the production phase. If we were to form a joint venture, we cannot assess what our final position in the project would be. We do not have any sources of capital available to us at this time to fund such a project if one should be discovered.

We hired our VP of Exploration on March 1, 2007. We also hired an office administrator for our office in Chihuahua. We hired one geologist in 2006, three geologists in 2007 and another geologist in February 2008 to work on our exploration programs. One of our geologists resigned in June 2008. We do not expect any significant change in additional contractors to conduct exploration over the next 12 months. Other than the VP of Exploration and our geologists, all of the employees we hire are contracted from third parties specializing in providing employees for Mexican companies. In using third party contractors, we minimize our exposure to Mexican employment law, and all liabilities are undertaken by the third party contractors providing the services. We pay a flat rate to the third parties for their services.

In the event that we should find a mineable reserve, it is management’s intention to contract the mining and milling of any mineralized reserves out to third parties. We do not have any known reserves at this time.

Exploration Projects – Current Status

In the following summaries of the current status of our exploration projects, we do not purport to have an SEC Industry Guide 7 compliant mineral reserve. We do believe, however, that the quantity of mineralized materials as set out in the summaries fall within the definitions and classifications of the Canadian Institute of Mining. For purposes of satisfying Canadian National Instrument 43-101 (“NI 43-101”), the qualified person who has done the geologic modeling and the resource calculation and has reviewed our results is Dana C. Durgin, MSc. Economic Geology. He is a Certified Professional Geologist (CPG #10364) with the American Institute of Professional Geologists, and a Registered Professional Geologist in Wyoming (PG-2886). Mr. Francisco Barry Quiroz, MSc. In Economic Geology and our V.P. Exploration, is the technical person who prepared or supervised the preparation of the technical information that is summarized below. While Mr. Quiroz is a member in good Standing of the Society of Economic Geologists (SEG) and of the Asociacion de Ingenieros Mineros, Metalurgistas y Geologos de Mexico (AIMMGM), membership in such organizations is not recognized under NI 43-101. The disclosure of all our results from our exploration work were prepared under the supervision of Mr. Quiroz and reviewed by Mr. Durgin.

Cieneguita

On August 28, 2008, we announced the completion of a cross section-based geologic model at Cieneguita by Delve Consultants, which calculated inferred geologic material of 14.86 million tons at a grade of 2.12 g/t gold-equivalent. This preliminary estimate was done to better understand the geologic controls of mineralization, and the distribution of areas requiring more drilling rather than as a rigorous reserve estimate.

The preliminary estimate confirmed that the Cieneguita mineralized material is hosted in a diatreme breccia, shaped like a funnel which has been flattened laterally. At the surface, the mineralized body is one kilometer long and averages 200 meters in width. The north and south sides are nearly vertical; the east and west sides are more gently inclined. One of the drill holes was stopped in the breccia at 290 meters, and thus it appears that the breccia body extends to at least that depth.

This is an in situ geologic body. Neither mining procedures nor metallurgical recoveries were considered in the calculation. However, because this is a poly-metallic sulfide body, processing by floatation will probably be necessary. In calculating the estimate, geology and individual assays from 45 drill holes (only the first 37 of these had assays) were displayed on 4 longitudinal sections and 23 cross sections at 40 meter intervals. Using this data and surface mapping, an interpretive geologic model was built and an estimate was calculated. A cut-off grade of $30 per ton gold-equivalent was used to define the boundaries of mineralized bodies. On cross sections, mineralization was projected half the distance to adjacent sections, and half the lateral distance to adjacent holes or 50 meters, whichever was less. The gold-equivalent figures were calculated using $850 per ounce gold, $15.50 per ounce silver, $0.75 per pound lead, and $0.90 per pound zinc.

In addition to producing an inferred geologic report, this modeling also pointed out high priority areas in which to concentrate the ongoing drilling program. We believe that focusing on these areas, coupled with infill drilling, has the potential to expedite the expansion of the mineralized material. It appears that the best grades and greatest thicknesses of this Au-Ag-Pb-Zn mineralization are concentrated in the western half of the deposit, south of the earlier Pit #2 by Glamis Gold, whose subsidiary previously produced on the site. Management believes that Pit #2 is also the area of the inferred throat of the diatreme, so mineralization is expected to extend to greater depths in that area, though we cannot assure you of that result. Also, because of the restrictions that were placed on defining the limits of the mineralized blocks, there appears to be potentially large volumes of mineralized material that were not included in the calculation, due to wide drill spacing of 80 meter centers.

The phase I exploration program at Cieneguita, carried out from November 2006 to February 2007, was initially focused on a systematic geological mapping (1:1,000) and sampling of roadcut and outcrop exposures. This exploration program outlined the main mineralization zone which has been traced in outcrops approximately 800 meters along strike. In addition, three new high-grade gold areas were identified beyond the known limits of mineralization.

The results from the mapping and sampling campaign outlined two main high-grade gold mineralization areas which are providing additional evidence to increase the known mineralized zone of the Cieneguita system to the NE. Analysis of the alteration, structural setting and geochemistry of the northeast part of the PIT 1 area indicates that there is potential for a structurally controlled body to the northeast of the known PIT 1 area. Assay results have been received for samples from roadcuts and outcrop exposures on the Cieneguita Property. The values ranged from trace to 31.6 g/t Au taken from several two meter channel sample located 75 meters to the NE of the known PIT 1 area. This high-grade gold sample is part of the NE PIT1 area, a 20 meters exposure averaging 5.43 g/t Au. The high-grade gold mineralization encountered at the NE PIT 1 area is part of the same structural trend identified in the PIT 1 area where gold values ranged from trace to 29 g/t Au.

All drill holes from this first phase drilling program have been focused on extending zones of high-grade gold mineralization identified by previous drilling programs (Glamis drilling program, 1994-1996). Drill hole CI-4 and CI-11 failed to intersect any economical mineralization.

Mineralized grades in the drilling were intersected by drillholes CI-02, CI-05, CI-06 CI-08, CI-09, CI-10 and CI-21 as follows:

| o | 5 meters (m) with 6.13 g/t Au from 97.50 to 102.50 m |

| o | 4.10 m with 2.75 g/t Au from 40.90 to 45.0 m |

| o | 4.60 m with 2.89 g/t Au from 62.90 to 67.50 m |

| o | 6.00 m with 1.16 g/t Au, 56.1 g/t Ag, 0.44% Pb and 0.76% Zn from 118 to 124 m |

| o | 4.50 m with 0.69 g/t Au, 183.56 g/t Ag, 0.39% Pb and 1.23% Zn from 147.50 to 152 m |

| o | 6.00 m with 0.62 g/t Au, 81.35 g/t Ag, 1.92% Pb and 3.55% Zn from 156.50 to 162.50 m |

| o | 11.70 m with 2.58 g/t Au from 12.3 to 24m |