Washington, D.C. 20549

PAN AMERICAN GOLDFIELDS LTD.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

The aggregate market value of the voting Common Stock held by non-affiliates of the Registrant, based upon the average of the closing bid and asked price of Common Stock on the OTC Bulletin Board system on August 31, 2012 of $0.17 per share was approximately $15,485,000.

As of March 31, 2013, the Registrant had 94,507,801 shares of Common Stock issued and outstanding.

Portions of our definitive proxy statement for our 2013 annual meeting of stockholders are incorporated by reference into Part III of this annual report on Form 10-K. Our 2013 annual meeting of stockholders is scheduled to be held on June 17, 2013. We intend to file our definitive proxy statement with the Securities and Exchange Commission not later than 120 days after the conclusion of our fiscal year ended February 28, 2013.

This report includes statements of our expectations, intentions, plans, and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements are principally, but not solely, contained in the section captioned “Business” below and the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “estimate,” “project,” “intend,” “forecast,” “anticipate,” “plan,” “planning,” “expect,” “believe,” “will,” “will likely,” “should,” “could,” “would,” “may” or words or expressions of similar meaning. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those projected, anticipated, or implied in the forward-looking statements. The most significant of these risks, uncertainties and other factors are described in this Annual Report on Form 10-K under “Item 1A — Risk Factors”. Except to the limited extent required by applicable law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

As used in this annual report: (i) the terms “we”, “us”, “our”, “Pan American Goldfields” and the “Company” means Pan American Goldfields Ltd.

ITEM 1. BUSINESS

We are an exploration stage company focused on mineral exploration activities in Mexico through our wholly owned Mexican subsidiary, Sunburst Mining de Mexico, S.A. de C.V., (“Sunburst”). In July 2010, we reincorporated from the State of Colorado to the State of Delaware. The reincorporation was effected pursuant to an agreement and plan of merger (the “Merger Agreement”), by and between us and Pan American Goldfields Ltd., a Colorado corporation (formerly Mexoro Minerals Ltd.), with Pan American Goldfields Ltd. (the “Company”) being the surviving corporation.

We are currently engaged in the exploration and development of one gold and silver project, named the Cieneguita Project, which is made up of several mining concessions. The Cieneguita Project is located in the Sierra Madre region of the State of Chihuahua, Mexico.

To help support our exploration activities, in 2009, we entered into a joint venture agreement with Minera Rio Tinto, S.A. de C.V. (“MRT”), a mining operator in Chihuahua, Mexico (as amended, the “Joint Venture Agreement”). Under the Joint Venture Agreement, we authorized MRT to commence a small scale milling operation at our Cieneguita Project (the “pilot project” or “pilot operation”). MRT commenced the pilot operation in March 2010 after the construction of systems and initial plant facilities for crushing and gravity and flotation circuits were complete and adequate water supplies established. Operations have since been expanded from one to two 12-hour shifts per day with a processing rate up to 750 tonnes per day. The terms of the Joint Venture Agreement (as amended) with MRT are discussed in detail below.

Our financial condition has improved substantially since the current executive group took over management of the Company in late 2009. At the time, the Company’s working capital deficiency was approximately $4.7 million and the Company received no revenues. Because of lack of capital, it faced having its interest in the Cieneguita Project reduced from 40% to 25%. Due to the Company renegotiating the Joint Venture Agreement and entering into the second amendment, the Company now receives 35% of net cash flow from pilot operations which were 100% financed by its partner MRT and it retains at all times an 80% interest in the Cieneguita Project. We expect to finalize the preliminary economic assessment (the “PEA”) in June 2013. Information regarding preliminary findings of the PEA can be found on our website, www.panamgoldfields.com, under “Recent News”, March 13, 2013. As of February 28, 2013, the nearly $5 million debt has been substantially reduced while working capital is now positive.

In September 2011, because MRT experienced delays in achieving a steady state of production at the pilot project and was unable to complete a feasibility study for the Cieneguita Project within the prescribed time by the initial terms of the Joint Venture Agreement, management was able to renegotiate the terms of the Joint Venture Agreement to increase the Company’s cash flow from the pilot project and its percentage ownership of the overall Cieneguita Project. The Company assumed responsibility to complete a preliminary economic assessment for the Cieneguita Project, and the parties agreed to fund the future feasibility study for the Cieneguita Project on a pro-rata basis according to their respective ownership percentages.

In September 2012, the Company negotiated a second amendment to the Joint Venture Agreement with MRT, as discussed in more detail below. In the second amendment to the Joint Venture Agreement, the Company was further able to increase cash flow to the Company from the pilot project at the Cieneguita Project, on a retroactive basis to March 2012. The second amendment to the Joint Venture Agreement also increased the Company’s ownership interests in the Cieneguita Project, as well as removed the depth limitations for the pilot project, giving MRT more incentive to implement project efficiencies and increase the production rate of the pilot project. Now, due to the second amendment of the Joint Venture Agreement, we are not wholly dependent on the equity markets for funding the Company’s development because we receive increased net cash flows from the pilot project, a strategy that has turned out to be prescient given the current market conditions.

Gross revenue derived from the pilot project under the Joint Venture Agreement for the year ended February 28, 2013 (“fiscal 2013”) was $16,194,000 compared to $10,510,000 for the year ended February 29, 2012 (“fiscal 2012”), an increase of 54%. Net of operating costs, the Company’s net cash flow from the pilot project was $1,894,000 for fiscal 2013 compared to $794,000 in fiscal 2012, an increase of 139%. This was primarily due to the efforts of the Company in renegotiating the Joint Venture Agreement with MRT and obtaining improved business terms as described below. The increase was also due to the increase in the production rate at the pilot plant, increased efficiencies in the overall operation and higher availability of the milling facilities brought about by the amendment to the Joint Venture Agreement.

As a result of the efforts and strategy of the current executive team, the Company has received revenues from MRT on a regular monthly basis to support the Company's activities since late 2011.

Due to encouraging results at the Cieneguita Project, we decided to focus our resources on developing the Cieneguita Project and dispose of our other exploration projects. In February 2011, we had entered into an agreement with Compañia Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000 hectares Cerro Delta Project in northwest La Rioja Province, Argentina. Under the terms of the agreement, we were required to pay $150,000 upon signing the agreement, $200,000 on the first anniversary, $500,000 on the second anniversary, $750,000 on the third anniversary, $1.2 million on the fourth anniversary, and $2.2 million on the fifth anniversary of the signing, with a final option payment of $5 million to purchase a 100% interest in the Cerro Delta project payable on the sixth anniversary of the signing. However, due to poor results from a field reconnaissance program, a worsening business environment in the country and the approach of an option payment in the amount of $500,000, we elected to terminate the project in January 2013 in order to focus our resources on the development of the Cieneguita project. Additionally, we sold our Encino Gordo Project in Mexico in May 2012 for a total consideration of $300,000.

Since taking effective management and board control of the Company in 2010, the Company has attracted an exceptional team of established resource company experts and mine developers. Our strategy is to leverage this considerable capability, as we continue to produce revenue from our Cieneguita Project and further develop its economic potential.

In 2011 as MRT was experiencing delays with achieving a constant state of production from the pilot project, which effectively reduced the net cash flow attributable to the Company, the Company’s Board with management’s input revised the Company’s strategy to diversify its operations by optioning and exploring other projects of merit. Management would identify prospective mining projects, and then analyze each prospective project to determine if the development of the project was an optimal use of the Company’s resources. These new projects enabled the Company to raise additional capital to fund its operations. At the same time, management was renegotiating the Joint Venture Agreement with MRT, which resulted in the first amendment to the Joint Venture Agreement in September 2011.

In February 2011, we obtained the rights to another exploration project named Cerro Delta located in Argentina. At the same time, we also owned another project in Mexico known as the Encino Gordo Project. After pursuing these projects and performing an analysis of costs, risks and potential benefits, the Board, with management’s input, decided to focus on the Cieneguita Project where recent results were highly encouraging. We sold the Encino Gordo Project in May 2012 for a total consideration of $300,000 and terminated the Cerro Delta Project.

The pilot project at the Cieneguita is now producing revenues for the Company, which helps offset overhead costs, and provides funding towards additional costs related to the development of the Cieneguita Project. We believe the Cieneguita Project provides the Company with an excellent opportunity because it already provides positive cash flow through the pilot project, and has considerable potential to increase in value based on future development efforts. We expect to increase its value by completing a pre-feasibility study, and once completed, will consider the various options that may then present themselves, including the possibility of selling the project. Work to date has significantly enlarged the potential size of the mineral deposits at the Cieneguita Project, making it, in our view, more attractive to mid-sized gold and silver producing companies.

In September 2011, because MRT experienced delays in achieving a steady state of production at the pilot project and was unable to complete a feasibility study for the Cieneguita Project within the prescribed time by the initial terms of the Joint Venture Agreement, management was able to renegotiate the terms of the Joint Venture Agreement to increase the Company’s cash flow from the pilot project and its percentage ownership of the overall Cieneguita Project. The Company assumed responsibility to complete a preliminary economic assessment for the Cieneguita Project, and the parties agreed to fund the future feasibility study for the Cieneguita Project on a pro-rata basis according to their respective ownership percentages.

In September 2012, we entered into the second amendment of the Joint Venture Agreement with MRT. The parties agreed to the following provisions pursuant to the second amendment of the Joint Venture Agreement:

On July 13, 2012, we entered into a $2.1 million private placement offering. In the offering, we issued 17,500,000 shares of our common stock at a subscription price of $0.12 per share. Of the aggregate purchase price, $1,050,000 was paid in cash and $1,050,000 was paid through the transfer of real property in Argentina valued at $1,050,000. The shares were acquired by an accredited investor (as defined under Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”)).

The Company intends to liquidate the real property it acquired as soon as practical and has so far sold one unit for total proceeds of $330,000. We have used the net proceeds we received from the offering for working capital and general corporate purposes, including supporting the further development of the Cieneguita Project.

In July 2011, we entered into an agreement with M3 Engineering and Technology Corporation (“M3”) for the execution and completion of a Canadian National Instrument 43-101 (“NI 43-101”) compliant PEA for the Cieneguita Project.

Our Cieneguita Project is located in the Baja Tarahumara in Cieneguita Lluvia De Oro, an area of canyons in the Municipality of Urique, in southwest Chihuahua, Mexico. The concessions on the Cieneguita Project cover a total area of 822 hectares (approximately 2,031 acres). A new gold discovery was made by Sunburst in early 2008. A NI 43-101 compliant PEA of the economics for a larger scale of gold and silver production is currently occurring. The PEA has been initiated by us and is being conducted by M3. The PEA is expected to be completed in June 2013.

The property associated with our Cieneguita Project is currently owned by Corporativo Minero. Sunburst, with the permission of Corporativo Minero, obtained an exclusive option to acquire the Cieneguita property for $2 million. We are required to make yearly payments to Corporativo Minero in the amount of $120,000 until the outstanding balance owed on the $2 million is paid in full to keep the option in good standing. In the alternative, when the Cieneguita Project is put into production, we are required to pay Corporativo Minero $20 per ounce of gold produced from the Cieneguita Project, in lieu of the yearly payment of $120,000, until we pay Corporativo Minero an aggregate of $2 million. In the event that the price of gold is above $400 per ounce, the payments payable from production will be increased by $0.10 for each dollar increment the spot price of gold trades over $400 per ounce. The total payment of $2 million does not change with fluctuations in the price of gold. Non-payment of any portion of the $2 million total payment will constitute a default, in which case we will lose our rights to the Cieneguita property and the associated concessions, but we will not incur any additional default penalty. Because of the mining operations being conducted by MRT at the Cieneguita Project, we are currently paying Corporativo Minero based on the gold being produced from the Cieneguita Project.

As of February 28, 2013, we have paid $1,177,000 to Corporativo Minero. Once the full $2 million payment has been made, we will own the Cieneguita property and have no further obligation to Corporativo Minero. Corporativo Minero has the obligation to pay, from the funds they receive from us, any royalties that may be outstanding on the properties from prior periods. Corporativo Minero has informed us that there were royalties of up to 7% net smelter return (“NSR”) owned by various former owners of the Cieneguita property. They have informed us that the corporations holding those royalties have been dissolved and that there is no further legal requirement to make these royalty payments. We can make no assurance that these former owners will not contend that we are ultimately responsible to pay all or some of the 7% NSR to these former royalty holders if the Project was ever put into production and Corporativo Minero did not make the payments to the royalty holders. MRT no longer has any ownership interest or payment obligations with respect to the Cieneguita property. There is no affiliation between Corporativo Minero and the Company or its officers, directors or affiliates.

To help fund our exploration activities, we entered into the Joint Venture Agreement with MRT in February 2009, which we amended in December 2009 and further amended in September 2012.

As a result of the amended Joint Venture Agreement and our agreements with the debenture holders, the ownership interest in the Cieneguita project and the net cash flows from the First Phase Production are held by us, MRT and Marje Minerals as follows:

The major terms of the amended Joint Venture Agreement with MRT and Marje Minerals are as follows:

Pursuant to the Joint Venture Agreement, MRT is responsible for all mining operations through the sale of concentrate. MRT starts with primary minerals processed from an open pit at the west end of the Cieneguita Project. MRT produces a bulk sulfide flotation concentrate that it later ships to Choix, Sinaloa, for cleaning and production of a saleable lead concentrate containing gold and silver. The revenues earned by us are the result of the extraction and sale of minerals from the Cieneguita Project, and are not incidental income related to our exploration activities.

All the plant and equipment utilized by MRT at the Cieneguita Project were paid for and are owned by MRT. MRT has also constructed and operates a tailings pond at the Cieneguita Project. Under the Joint Venture Agreement, MRT is required to remove its equipment from the Cieneguita Project at the end of 2013 or at such later date as is mutually agreed upon. As part of that obligation, MRT is currently remediating the tailings pond in accordance with applicable environmental laws.

Cieneguita is located in the Baja Tarahumara in Cieneguita Lluvia De Oro, an area of canyons in the Municipality of Urique, in southwest Chihuahua State, Mexico. The property is located within one half mile of the small village of Cieneguita Lluvia de Oro. Access to the property is by an all-weather dirt road.

The concessions of the Cieneguita Project cover a total area of 822 Hectares (approximately 2,031 acres). The following table is a summary of the concessions on the Cieneguita Project:

In January 2007, the necessary permits to allow for the building and operation of a heap leach operation at the Cieneguita Project were granted to us. Currently, the permit has been updated to allow us to build a crushing and floatation mining operation. The permit is valid until 2016 as long as we continue to provide yearly reports to SEMERNANT (the governing Mexican environmental agency responsible for permitting).

The Cieneguita mines were in limited production in the 1990s. Over a four-year period, Cieneguita was operated by Mineral Glamis La Cieneguita S. De R.L. De C.V. (“Glamis”), a subsidiary of the Canadian company Glamis Gold Ltd. (“Glamis Gold”). According to Glamis’ records, Glamis processed minerals on the property in 1995. Glamis stopped production in the mid-1990s. At that time, Corporativo Minero, the operator of the concessions for Glamis, acquired the property. MRT entered into an agreement with Corporativo Minero on January 12, 2004 pursuant to which MRT acquired all of the mineral rights from Corporativo Minero to explore and exploit the Cieneguita concessions and to purchase them for $2 million. Under our agreements with MRT, MRT has assigned this agreement to Sunburst, our wholly-owned subsidiary.

Our exploration work shows that the geology in the mineralization in the zone of sulfides includes pyrite, galena, sphalerite, tennantite and tetrahedrite, pirargirite and traces of chalcopyrite and pyrhotite. These minerals mainly occur as uniform disseminations and as micro-veins. The previous exploration drilling by Cominco and Glamis Gold delineated a zone of altered volcanics, represented by silica, sericite and argillite that are believed to be 1,000 meters long (strike length) and up to 200 meters wide. Within this zone, the oxidation has been shallow and reaches a maximum depth of 20 meters.

Glamis Gold performed a test pilot heap leach operation on the property in the mid 1990’s. We have completed significant additional development work at the Cieneguita Project, and expect the PEA to be completed in June 2013. Our operations are currently exploratory and we do not have any reserves.

A total of 51 diamond drill holes (6,700 meters) drilled by Cominco (now Teck Cominco Ltd.) defined an auriferous zone approximately 1,000 meters long by 200 wide. On such a zone, two mineralized structures were drilled during their exploration program in 1981 and 1982. Later, two drilling programs were performed by Glamis: 135 holes were drilled during 1994 and 62 holes were drilled during 1997. Both programs confirmed the delineation of the two mineralized ore bodies. We have had access to these reports from Cominco and Glamis. The initial exploration conducted by our Company has focused on further delineating the oxide mixed mineralized structures and the sulfide structures.

We used the original data from Cominco and Glamis to delineate the mineralized zone. In April 2006, we completed a sampling of the property that included more than 500 meters of deep trenches from which we took comprehensive channel sampling. The trenches comprised eight trenches approximately 200 meters long and two to 10 meters deep spaced equally along the 1,000 meters strike length of the property. From the walls of these trenches, we took approximately 550 rock samples. We sent one half of these samples to ALS Chemex’s laboratory in Chihuahua for assaying. The sampling protocol followed the best mining practices. The purpose of the sampling was to further define the ore grade and potential of the property. The other half of the sample was used to complete column tests to determine the leachability of the precious metals from the rock. Subsequent drilling indicated that the mineralized material was much larger than originally anticipated and that the heap leaching process was not the best method for extracting the precious metals from the bulk of the mineralized material.

The Cieneguita town site has the following services: electrical power from the public utility, cellular phone, radio communication (CB), a health center and a school. Because the property was previously in production, it has existing infrastructure such as power, water, railroad transportation (within 20 kilometers), and all weather road access year round. We have an existing source of well water, which MRT is currently utilizing for the milling process it is conducting on the Cieneguita Project. Well water has been scarce during the dry season. Although we do not own any of the plant and equipment currently be used by MRT to conduct its operations at the Cieneguita Project, we believe that as a result of the existing infrastructure the investment needed to put the Cieneguita Project into full production would be less than the investment which would typically be required for a project that was never in production. There is no other equipment or facilities available to us on the property.

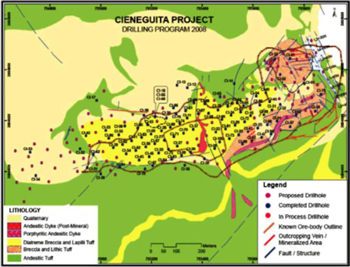

We have conducted a series of exploration programs at Cieneguita since March 2007. The drilling exploration program commenced in December 2007 with one drill rig and a second rig was added in July 2008. The drilling was completed in December 2008. The figure below shows the location of the 103 diamond drill holes on the Cieneguita Project:

Assay results and an analysis of the drilling and exploration work are compiled and described in a Technical Report on NI 43-101, which was completed following the end of fiscal 2010, and is in compliance with the standards and requirements of Canadian security regulatory authorities. The NI 43-101 report is also available on our website, www.panamgoldfields.com.

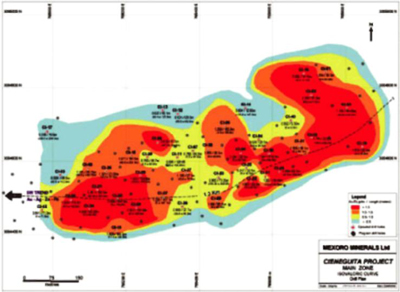

The figure below shows the main mineralization zones our drilling work identified at the Cieneguita Project. Areas in red on the figure represent zones exhibiting mineralization areas where grades are>1.5 g/t Au.

Planned Exploration

The recent exploration activities at the Cieneguita Project have shown that additional exploration is warranted. Considering the latest results and findings the proposed work program for Cieneguita will include:

1. Completing the infill drilling program by doing an additional 10,000 meters of drilling to further identify and support mineralization zones;

2. Continue conducting metallurgical tests; and

3. Complete a Preliminary Economic Assessment and a feasibility study;

There are no known reserves on the Cieneguita property.

Recent Financing Activities

In September 2012 in connection with the amended Joint Venture Agreement, we completed a private placement of 2,000,000 shares of common stock at a price of $0.12 per share for net proceeds of $240,000 pursuant to our private placement subscription agreement. We issued the shares to MRT in reliance on exemptions from registration pursuant to Section 4(2) under the Securities Act and Rule 506 promulgated thereunder.

In July 2012, we completed a private placement offering of 17,500,000 shares of our common stock at a subscription price of $0.12 per share for total proceeds of $2.1 million. Of the aggregate purchase price, $1,050,000 was paid in cash and $1,050,000 was paid through the transfer of real property in Argentina valued at $1,050,000 which consisted of 3 apartments, of which, we sold one of the apartments for $330,000 in January 2013. The shares issued in the offering were acquired by an accredited investor as defined under U.S. securities laws. We paid a finders’ fee of $84,000 and 700,000 shares of common stock to Emilio Alvarez a co-manager of Vortex Capital.

In December 2011, we completed a private placement of 4,400,000 units at $0.20 per unit, for total proceeds of $880,000. Each unit consists of one share of common stock and a warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $0.30 for a period of two years from the closing date. The securities were issued to accredited investors as defined under U.S. securities laws. We paid $61,600 in finders’ fees in conjunction with the private placement.

In March 2011, we completed a private placement of 6,560,000 units at $0.20 per unit, for total proceeds of $1,312,000. Each unit consists of one share of common stock and a warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $0.30 for a period of two years from the closing date. The securities were issued to U.S. “accredited investors” and Canadian and non-U.S. investors. We paid $89,000 in finders’ fees in conjunction with the private placement.

Principal Products

Our principal product is the exploration for precious minerals. Because our Cieneguita Project is in the exploration stage, there is no guarantee that any ore body will be found or extracted. The proposed exploration program is being undertaken by our exploration team using in-house knowledge along with the support and guidance of consultants with expertise in these regions. We believe our existing management team and key advisors have the necessary exploration and mining expertise to locate, evaluate and bring mining properties to production.

Competition

We compete with other mining and exploration companies in connection with the acquisition of mining claims and leases on gold and other precious metals prospects and in connection with the recruitment and retention of qualified employees. Many of these companies are much larger than we are, have greater financial resources and have been in the mining business much longer than we have. As such, these competitors may be in a better position through size, finances and experience to acquire suitable exploration properties. We may not be able to compete against these companies in acquiring new properties and/or qualified people to work on any of our properties.

Given the size of the world market for gold and silver relative to individual producers and consumers of gold and silver, we believe that no single company has sufficient market influence to significantly affect the price or supply of gold and silver in the world market.

Governmental Regulations

Our business is subject to various levels of government controls and regulations, which are supplemented and revised from time to time. Any mineral exploration activities conducted by us requires permits from governmental authorities. The various levels of government controls and regulations address, among other things, the environmental impact of mining and mineral processing operations and establish requirements for the decommissioning of mining properties after operations have ceased. With respect to the regulation of mining and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various components of operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclamation and rehabilitation of mining properties following the cessation of operations, and may require that some former mining properties be managed for long periods of time. In addition, in Argentina, we are subject to foreign investment controls and regulations governing our ability to remit earnings abroad.

Our operations and properties are subject to a variety of governmental regulations including, among others, regulations promulgated by SEMARNAT, Mexico’s environmental protection agency; the Mexican Mining Law; and the regulations of the Comisión National del Agua with respect to water rights. Mexican regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards or that do not have the necessary permits. MRT has the necessary permits and approvals for the pilot project in place. As we put any of our properties into production, operations may also be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and mine safety.

The need to comply with applicable laws, regulations and permits will increase the cost of operation and may delay exploration. All permits required for the conduct of mineral processing or mining operations, including the construction of mining facilities, may not be obtainable, which would have an adverse effect on any mineral processing or mining project we might undertake. Additionally, failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration to cease or be curtailed. Parties engaged in mineral processing or mining operations may be required to compensate those suffering loss or damage by reason of the mineral processing or mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current governmental laws and regulations affecting mineral processing companies, or the more stringent application thereof, could adversely affect our operations. The extent of any future changes to governmental laws and regulations cannot be predicted or quantified. Generally, new laws and regulations result in increased compliance costs, including costs for obtaining permits, delays or fines resulting from loss of permits or failure to comply with the new requirements.

To keep our mineral concessions in good standing with the Government of Mexico, we must pay yearly property taxes. These taxes are based on a tariff per hectare and per the number of years (maturity) of each concession. The taxes are paid twice a year. We have paid:

| July 2009 | MXN $133,626 ($10,179) |

| January 2010 | MXN $141,376 ($10,779) |

| July 2010 | MXN $110,888 ($8,735) |

| January 2011 | MXN $117,215 ($9,685) |

| July 2011 | MXN $117,213 ($8,623) |

| January 2012 | MXN $146,238 ($11,369) |

| July 2012 | MXN $102,550 ($7,731) |

| January 2013 | MXN $78,500 ($6,161) |

We are in compliance with all of our tax payments to the government. We believe that we are in compliance with all material current government controls and regulations at each of our properties.

Compliance with Environmental Laws

Our current exploration activities and any future mining operations (of which we currently have none planned) are subject to extensive laws and regulations governing the protection of the environment, waste disposal, worker safety, mine construction, and protection of endangered and protected species. We have made, and expect to make in the future, significant expenditures to comply with such laws and regulations. Future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have an adverse impact on our financial condition or results of operations. In the event that we make a mineral discovery and decide to proceed to production, the costs and delays associated with compliance with these laws and regulations could stop us from proceeding with a project or the operation or further improvement of a mine or increase the costs of improvement or production.

In Mexico, we are required to submit, for government approval, a reclamation plan for each of our mineral processing sites that establishes our obligation to reclaim property after minerals have been mined from the site. In some jurisdictions, bonds or other forms of financial assurances are required as security for these reclamation activities. We may incur significant costs in connection with these restoration activities. The unknown nature of possible future additional regulatory requirements and the potential for additional reclamation activities create uncertainties related to future reclamation costs.

Pursuant to the amended Joint Venture Agreement, MRT must, at its cost, provide, a quarterly audit within thirty (30) days of the end of each fiscal quarter regarding compliance with environmental laws and steps required to effect remediation or other required actions (if any) to maintain and/or bring the project operations into compliance with all applicable environmental laws. The audit is to be performed by an independent expert environmental consulting firm selected by us and MRT. MRT is solely responsible for any costs of effecting any remediation recommended by the audit.

Employees

There are currently five persons working for Sunburst, of which, one is a geologist and the rest are employed in administrative capacity. Except for our general manager, Manuel Flores, all of these persons are provided to Sunburst under third party contract, either directly or via a personnel service agency. We have hired Neil Maedel as our Executive Chairman, Salil Dhaumya as our Chief Financial Officer, Dr. Fedor Zhimulev as our Chief Geologist and Manuel Flores as our Operations Manager. Other than these employees and our geologists, all of the personnel we utilize are contracted from third parties specializing in providing employees for Mexican companies. In using third party contractors, we minimize our exposure to Mexican employment law, and all liabilities are undertaken by the third party contractors providing the services. In order to deploy our working capital as efficiently as possible we pay a flat rate to the third parties for their services. In the event that our exploration projects are successful and warrant putting any of our properties into production, all such operations would be contracted out to third parties. Also, we rely on members of our management and board of directors to handle all matters related to business development and business operations.

ITEM 1A. RISK FACTORS

Risks Relating to Our Business and Industry

We are in the exploration stage; therefore, it is difficult to evaluate our financial performance and prospects.

We have only completed the initial stages of exploration at our Cieneguita Project, and have no way to evaluate the likelihood that we will be able to operate and develop a successful business. We are considered to be an exploration stage corporation because we are currently engaged in the search for mineral deposits. We will be in the exploration stage until we exploit commercially viable mineral deposits on a property. The early stage of our operations makes it difficult to evaluate our financial performance and prospects, as well as our ability to successfully identify and develop mining projects. We have earned minimal revenues from mineral extraction activities to date at our Cieneguita Project, and we have not emerged from being an exploration stage to a development stage corporation. Because of our limited financial history, we believe that period-to-period comparisons of our results of operations will not be meaningful in the short term and should not be relied upon as indicators of future performance.

Because of our recurring operating losses and the funds required to support our future development activities, our auditor has raised substantial doubt about our ability to continue our business.

We received a report from our independent auditors on our financial statements for the fiscal year ended February 28, 2013, in which our auditors included explanatory paragraphs indicating that our recurring operating losses and our capital deficiency to support our future development activities cause substantial doubt about our ability to continue as a going concern. By issuing this opinion, our auditors indicated that they are uncertain as to whether we have the capability to continue our operations.

We have a history of incurring net losses. We expect our net losses to continue as a result of planned increases in operating expenses to support the further development of our Cieneguita Project, and therefore, may never achieve profitability.

We have a history of operating losses and have incurred significant net losses in each fiscal quarter since our inception. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses to support further development of our Cieneguita Project without realizing significant revenues. Our ability to generate and sustain significant revenues or to achieve profitability will depend upon numerous factors outside of our control, including the precious metals market and the economy. We have no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business, financial condition or results of operations could be materially adversely affected and we may need to curtail or delay future development of our Cieneguita Project or cease operations all together.

If we do not obtain financing when needed, we will need to curtail or delay future development of our Cieneguita Project.

As of February 28, 2013, we had cash on hand in the amount of approximately $177,000, total receivables of $189,000 and outstanding payables of $988,000. The outstanding payables include $168,000 of contingent liabilities related to our recently-terminated Argentine operation. The payables also include a further $240,000 of debt remaining from the Company’s operations in 2007 and 2008, on which we are attempting to negotiate settlements. Because a feasibility study has not been completed at our Cieneguita Project, we have not established any reserves. Although management believes the cash flow from the pilot project will provide funds to satisfy these obligations and also fund the Company’s general and administrative expenses and certain costs to move forward with the Cieneguita Project, and even though the pilot project at Cieneguita has been in a steady state of production for the past year, we cannot provide any assurance that the current rate of net cash flow will continue. As a result, it may be necessary to obtain additional financing to support our future operations. We will also require additional financing to complete the development of the Cieneguita Project necessary to attempt to establish reserves, including a feasibility study, and place it into commercial production. We currently do not have any arrangements for additional financing, and we may not be able to obtain financing when required. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all. These factors, among others, raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustment to reflect the possible future effect on the recoverability and classification of the assets or the amounts and classification of liabilities that may result should we cease to continue as a going concern. If we are unable to obtain additional financing when sought, we will be required to curtail or delay our business plan. Any additional equity financing may involve substantial dilution to our then existing shareholders. There is a significant risk to investors who purchase shares of our common stock because there is a risk that we may not be able to generate and/or raise enough resources to remain operational for an period of time required to reach commercial production at a project.

Our business could be negatively affected as a result of a proxy fight and the actions of activist stockholders.

We recently received a notice from Vortex Capital Ltd. and its affiliates, including Emilio Alvarez, (together, “Vortex”) to nominate five individuals for election to our Board of Directors. If a proxy contest results from this notice or proposal or if other activist activities continue, our business could be adversely affected because:

| · | Responding to proxy contests and other actions by activist stockholders can be costly and time-consuming, disrupting our operations and diverting the attention of management and our employees; |

| · | Perceived uncertainties as to our future direction may result in the loss of potential business opportunities, and may make it more difficult to attract and retain qualified personnel and business partners; and |

| · | If individuals are elected to our Board of Directors with a specific agenda, it may adversely affect our ability to continue to develop and realize value from our Cieneguita Project, and this could in turn have a material adverse effect on our business prospects and on our results of operations and financial condition. |

Additionally, according to the notice we received from Vortex, the five individuals Vortex intends to nominate have no previous experience (i) operating or managing a mining company, or, to our knowledge, (ii) advancing a known mineral resource from a resource category to reserves. If such individuals are elected to the Board, their lack of experience may adversely affect our ability to continue to develop and realize value from our Cieneguita Project, which could in turn, have a material adverse effect on our business prospects and on our results of operations and financial condition.

A proxy contest could also cause our stock price to experience periods of increased volatility.

Our success is dependent on retaining key personnel and on hiring and retaining additional personnel.

Our ability to continue to explore and develop our mineral concessions is, in large part, dependent upon our ability to attract and maintain qualified key personnel. There is competition for such personnel, and there can be no assurance that we will be able to attract and retain them. Our development now and in the future will depend on the efforts of key management and directors. The loss of any of these key people could have a material adverse effect on our business, financial condition or results of operations. We do not currently maintain key-man life insurance on any of our key employees. We may not be able to find qualified geologists and mining engineers on a timely basis or at all to further expand our business plan. Furthermore, if we are able to find qualified employees, the cost to hire them may be too great as there may be other opportunities elsewhere at a higher rate than we are able to pay.

There are no known reserves on the Cieneguita Project, and our future development efforts at our Cieneguita Project may not be successful.

We have decided to focus our resources on developing the Cieneguita Project, and we recently disposed of our other exploration projects. As a result, our long-term success currently depends on our successful development of the Cieneguita Project. There are currently no known reserves on the Cieneguita Project, and we cannot make an assessment of whether there are any known reserves without completing a feasibility study. In the past, we have completed drilling programs and metallurgical studies that have supported a decision to move forward with the development of the Cieneguita Project. In addition, MRT is currently operating a pilot project at the Cieneguita Project that is cash flow positive. As we have discussed, we engaged a third party engineering firm to complete a PEA of the Cieneguita Project, which is a step that must be completed prior to beginning a feasibility study. As we announced on March 13, 2013, the preliminary results from the PEA were promising regarding the potential mineral reserve at the Cieneguita Project. We believe the PEA will be complete in June 2013, at which time we intend to announce the final results from the PEA. Because the PEA is being conducted by a third party engineering firm in accordance with industry standards, we cannot assure you that the PEA will be completed on this timeframe or that the final results of the PEA will be favorable or support the further development of the Cieneguita Project, including moving forward with the feasibility study. Accordingly, no assurances can be given that the Cieneguita Project will contain adequate amounts of gold, silver and base metals for commercialization. Further, even if we commence commercial operations, we cannot guarantee that we will make a profit. If we cannot acquire or locate commercially exploitable precious metal deposits at our Cieneguita Project, or if it is not economical to recover the precious metal deposits, our business and operations will be materially adversely affected.

Because of the speculative nature of exploration and development of mineral concessions and the unique difficulties and uncertainties inherent in the mineral exploration and development business, there is substantial risk that no commercially exploitable minerals will be found and developed and our business will fail.

Exploration for and development of minerals, including at our Cieneguita Project, is a speculative venture involving substantial risk. Any figures presented in this report relating to gold and mineral deposits adjacent to our properties do not indicate that we will be successful in searching for and extracting gold deposits on our properties. New mineral exploration and development companies encounter difficulties, and there is a high rate of failure of such enterprises. The expenditures we may make in the exploration of the mineral concessions may not result in the discovery and development of commercial quantities of ore. In addition, whether a property can be developed successfully also depends on whether the minerals can be extracted on a commercially attractive basis, which is based on a number of factors, including the market price for materials that can be mined at the property. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration and development of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and development and additional costs and expenses that may exceed current estimates. In addition, problems such as unusual or unexpected mineral formations and other geological conditions often result in unsuccessful exploration and development efforts. In such a case, we would be unable to complete our business plan, and our future prospects will be harmed. The search for and development of valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins, the use of explosives, waste disposal, worker safety and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Our mineralization figures are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, the mineralization figures calculated from our exploration efforts and presented in this report and in our filings with securities regulatory authorities, press releases and other public statements, including the preliminary results of the PEA, that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects for further exploration and development, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until a feasibility study is completed, mineral reserves and grades of mineralization must be considered as estimates only. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable.

We cannot assure you that:

| · | these estimates will be accurate; |

| · | reserve, resource or other mineralization estimates will be accurate; or |

| · | this mineralization can be mined or processed profitably. |

Any material changes in mineralization figures and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our technical reports and drill results. There can be no assurance that minerals recovered in small scale tests will be duplicated in large-scale tests under on-site conditions or in production scale. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

Due to numerous factors beyond our control which could affect the marketability of gold and silver, including their respective market price, we may have difficulty selling any gold or silver if commercially viable deposits are found to exist.

The availability of markets and the volatility of market prices are beyond our control and represent a significant risk. Even if commercially viable deposits of gold or silver are found to exist on our property interests, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell the gold or silver in the event that commercially viable deposits are found to exist.

As we undertake exploration and potential development of our mineral claims, we will be subject to compliance with government regulations that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We expect to be subject to federal, state and local laws and regulations in Mexico regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials and other similar laws and regulations. Amendments to current laws, regulations and permits governing operations and activities of exploration and development companies, or more stringent implementation thereof, could have a material adverse impact on us and our operating, increase our expenditures and costs and require abandonment or delays in developing new mineral processing properties. Environmental laws and regulations change frequently, and the implementation of new, or the modification of existing, laws or regulations could harm our business, financial condition or results of operations. We cannot predict how agencies or courts in Mexico will interpret existing laws and regulations or the effect that these adoptions and interpretations may have on our business, financial condition or results of operations. We may be required to make significant expenditures to comply with governmental laws and regulations.

Any significant mineral processing operations that we undertake in the future will have some environmental impact, including land and habitat impact, arising from the use of land for mineral processing and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. No assurances can be given that such environmental issues will not have a material adverse effect on our business, financial condition or results of operations in the future. MRT is required to comply with applicable environmental laws and permits in conducting its operations at the Cieneguita Project under the terms of our agreement with MRT. As a result, we are reliant on MRT complying with its obligations under our agreement with MRT, and our ability to enforce the terms of our agreement with MRT. While we believe we do not currently have any material environmental obligations, exploration and development activities may give rise in the future to significant liabilities on our part to the government and third parties and may require us to incur substantial costs of remediation.

Additionally, we do not maintain insurance against environmental risks. As a result, any claims against us may result in liabilities we will not be able to afford, resulting in the failure of our business. Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in exploration and development operations may be required to compensate those suffering loss or damage by reason of the exploration and development activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

We do not carry title insurance and do not plan to secure any in the future. We are therefore, vulnerable to loss of title.

We do not maintain insurance against title. Title on mineral properties and mining rights involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mining properties. We cannot give any assurance that title to our Cieneguita Project and claims will not be challenged or impugned and cannot be certain that we will have or will acquire valid title to these mining properties and claims. We cannot assume that counterparties to our title transfer agreements will meet their contractual obligations and transfer title on a timely basis. Furthermore, there is a risk that the Mexican government may in the future grant additional titles in excess of our expectations to currently illegal miners or that disputes may arise as to existing title ownership or planned acquisitions. Furthermore, although we believe that mechanisms exist to integrate the titles of mineral properties currently not owned by us, there is a risk that this process could be time consuming and costly. The possibility also exists that title to existing properties or future prospective properties may be lost due to an omission in the claim of title. As a result, any claims against us may result in liabilities we may not be able to afford resulting in the failure of our business.

As a public company, we may have to implement additional and expensive finance and accounting systems, procedures and controls as we grow our business and organization and to satisfy new reporting requirements, which will increase our costs and require additional management resources.

We currently are a company with limited resources and we intend to continue to spend most of our resources on development and other operational expenses. We are currently classified as a Smaller Reporting Company under Exchange Act regulations. Until we are classified as an Accelerated Filer (based upon our market capitalization reaching $75 million as of the applicable measuring date, among other requirements), we are exempt from compliance with Section 404(b) of the Sarbanes-Oxley Act of 2002, relating to the attestation and reporting by our external auditing firm on our internal controls. However, if we were no longer exempt from compliance with certain provisions of the Sarbanes-Oxley Act of 2002, we would incur significant additional costs, which would be material to us and would affect our results of operations. In order to comply with the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC, we may be required to expand disclosures and accelerate our financial reporting requirements. If we are unable to complete the required Section 404(b) assessment as to the adequacy of our internal control over financial reporting, if we fail to maintain or implement adequate controls, or if our independent registered public accounting firm is unable to provide us with an unqualified report as to the effectiveness of our internal control over financial reporting as of the date of our first Form 10-K for which compliance is required, our ability to obtain additional financing could be impaired. In addition, investors could lose confidence in the reliability of our internal control over financial reporting and in the accuracy of our periodic reports filed under the Exchange Act. A lack of investor confidence in the reliability and accuracy of our public reporting could cause our stock price to decline.

Non-payment of our obligations under the agreement with Corporativo Minero could result in Corporativo Minero retaining ownership of the Cieneguita concessions.

MRT entered into an agreement with Corporativo Minero on January 12, 2004 by which it acquired the right to explore and exploit the Cieneguita Property and purchase it for $2,000,000. This agreement gave MRT the exclusive right and option, but not the obligation, to purchase, during the term of the mining concessions of the property, an undivided 100% title to the mining concessions and the exclusive right to carry out mining activities on any portion of the mining concessions. Under our agreements with MRT, MRT has assigned this agreement and all of its rights and obligations to us.

As the small scale operation continues at Cieneguita, our contract calls for any remaining payments to be paid from the sale of gold, up to a total of $2,000,000. The payments are as follows: the remainder of the $2,000,000 payment is being paid out of production from the Cieneguita Property at a rate of $20 dollars per ounce of gold sold, plus an additional $0.10 for every $1.00 the price of gold exceeds $400. This amount is paid by MRT to Corporativo Minero and is deducted from net profits. As of February 28, 2013, we have paid $1,507,241 to Corporativo Minero. Once $2,000,000 is paid, there is no further obligation to Corporativo Minero. Non-payment of any portion of the $2,000,000 total payment will constitute a default. In such case, Corporativo Minero would retain ownership of the concessions, but we will not incur any additional default penalty.

We may be required to pay up to a 7% Net Smelter Royalty fee on any production from Cieneguita Property and seek repayment from Corporativo Minero. If so, our cost of operations will increase, which will decrease any potential profits we might have.

We entered into an agreement with Corporativo Minero in regard to the mineral concessions on the Cieneguita Property. Corporativo Minero has the obligation to pay, from the funds they receive from us, any royalties that may be outstanding on the properties from prior periods. Corporativo Minero has informed us that various former owners of the property owned royalties of up to a 7% Net Smelter Return. They have also informed us that the corporations holding those royalties have been dissolved and that there is no further legal requirement to make these royalty payments. We can make no assurance that Corporativo Minero will satisfy its obligations, and that we will not ultimately be responsible to pay all or some of the 7% Net Smelter Return to these former royalty holders if Corporativo Minero did not make the payments to the royalty holders. If we have to make these royalty payments, any profits from production would be reduced and we will be forced to seek repayment from Corporativo Minero.

If we are unable to obtain all of our required governmental permits, our operations could be negatively impacted.

Our future operations, including exploration and development activities, required permits from various governmental authorities. Such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to acquire all required licenses or permits or to maintain continued operations at economically justifiable costs. Our financial position and results are subject to fluctuations in foreign currency values.

Any mining operations we undertake outside of the United States will be subject to currency fluctuations. Fluctuations in the exchange rate between the U.S. dollar and any foreign currency may adversely impact our operations. We do not anticipate that we will enter into any type of hedging transactions to offset this risk. In addition, with respect to commercial operations in Mexico or other countries, it is possible that material transactions incurred in local currency, such as engagement of local contractors for major projects, will be settled at a U.S. dollar value that is different from the U.S. dollar value of the transaction at the time it was incurred. This could have the effect of undermining profits from operations in that country.

Our property interests in Mexico are subject to risks from instability in those countries.

We have property interests in Mexico which may be affected by risks associated with political or economic instability in those countries. The risks with respect to Mexico and other developing countries include, but are not limited to: military repression, extreme fluctuations in currency exchange rates, criminal activity, lack of personal safety or ability to safeguard property, labor instability or militancy, mineral title irregularities and high rates of inflation.

In addition, changes in mining or investment policies or shifts in political attitude in Mexico may adversely affect our business. We may be affected in varying degrees by government regulation with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The effect of these factors cannot be accurately predicted but may adversely impact our proposed operations in any foreign jurisdiction.

We are in competition with companies that are larger, more established and better capitalized than we are.

We compete with other mining and exploration companies in connection with the acquisition of mining claims and leases on gold and other precious metals prospects and in connection with the recruitment and retention of qualified employees. Many of our potential competitors have:

| · | greater financial and technical resources; |

| · | longer operating histories and greater experience in mining; and |

| · | greater awareness of the political, economic and governmental risks in operating in foreign countries. |

As such, these competitors may be in a better position through size, finances and experience to acquire suitable exploration properties. We may not be able to compete against these companies in acquiring new properties and/or qualified people to work on any of our properties.

Risks Relating to Our Common Stock

There are a large number of shares underlying our warrants that may be available for future sale and the sale of these shares may depress the market price of our common stock.

As of February 28, 2013, we had 94,507,801 shares of common stock issued and outstanding and warrants that may be convertible into 29,160,000 shares of common stock. Each warrant may be exercised to purchase one share of common stock. The sale of these shares may adversely affect the market price of our common stock.

There is a limited trading market for our common stock and if an active market for our common stock does not develop, our investors may not be unable to sell their shares.

Our common stock is presently quoted on the National Association of Securities Dealers Inc.’s Over the Counter QX (the “OTC QX”) and the Frankfurt Stock Exchange. Quotations and trading volume of our common stock on the OTCQX has been sporadic. There is currently very little active trading in the market for our common stock and an active public market may not develop or be sustained in the future. Also, we cannot provide our investors with any assurance that our common stock will continue to be traded on the OTCQX or the Frankfurt Stock Exchange. If our common stock is not quoted on the OTCQX or Frankfurt Stock Exchange or if an active public market for our common stock does not develop, then investors may not be able to resell the shares of our common stock that they have purchased and may lose all of their investment.

Shares of our common stock are subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on the over-the-counter bulletin board administered by FINRA). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

The trading market for our common stock is currently subject to rules adopted by the Securities and Exchange Commission which regulates broker dealer practices in connection with transactions in “penny stocks.” Penny stocks are generally equity securities with a price of less than $5.00, except for securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in those securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to make a special written determination that the penny stock is a suitable investment for the purchaser and to receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock and making it more difficult for holders of our stock to sell their shares, as long as the shares are subject to the penny stock rules.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase shares of our common stock.

We have never declared or paid any cash dividends on shares of our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directs, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, after taking into account various factors, including but not limited to our financial condition, operating result, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

Because our stock price can be volatile, investors may not be able to recover any of their investment.

Stock prices in general, and stock prices of mineral exploration companies in particular, have experienced extreme volatility that often has been unrelated to the operating performance or any specifics of the company. Factors that may influence the market price of our common stock include:

| · | actual or anticipated changes or milestones in our operations ; |

| · | the results of our development efforts at our Cieneguita Project, including the final results of the PEA; |

| · | our ability or inability to generate revenues from the pilot program at the Cieneguita Project; |

| · | increased competition within Mexico and elsewhere; |

| · | government regulations, including mineral exploration regulations that affect our operations; |

| · | predictions and trends in the gold mining exploration industry; |

| · | volatility of the gold and silver market prices; |

| · | sales of common stock by “insiders”; and |

| · | announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors. |

Our stock price may also be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuation, as well as general economic, political and market conditions, such as, but not limited to, armed hostilities or acts of terrorism, recessions, acts of God, interest rates or international currency fluctuations, may adversely affect the market price of our common stock. Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, including shares being offered for sale pursuant to this prospectus or upon the expiration of any statutory holding period, under Rule 144, or upon expiration of lock-up periods applicable to outstanding shares, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate. Recent revisions to Rule 144 may result in shares of our common stock that we may issue in the future becoming eligible for resale into the public market without registration in as little as six months after their issuance.

ITEM IB. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We currently maintain an office at 570 Granville Street, Unit 1200, Vancouver, BC. V6C 3P1, operating under a month-to-month lease, with a monthly rent of $500.

We also operate a Mexican office located at C. General Retana #706, Col. San Felipe, Chihuahua, Chihuahua, Mexico, CP 31203, operating under the terms of this lease on a month-to-month basis, with a monthly rent of $900.

As described in Item 1 above, we have property rights in the Cieneguita Project in Mexico.

ITEM 3. LEGAL PROCEEDINGS

Neither our Company nor our properties are the subject of any material pending legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURE

This item is not applicable because all of our mining properties are outside the United States.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is currently traded on the Over the Counter Bulletin Board (“OTCQX”) under the symbol “MXOM.QX”. The following table sets forth the high and low closing bid prices for our common stock as reported on the OTCBB for the periods indicated.

| Fiscal Year Ending February 28, 2013 | | High | | | Low | |

| First Quarter | | $ | 0.19 | | | $ | 0.08 | |

| Second Quarter | | $ | 0.18 | | | $ | 0.07 | |

| Third Quarter | | $ | 0.17 | | | $ | 0.11 | |

| Fourth Quarter | | $ | 0.20 | | | $ | 0.11 | |

| Fiscal Year Ending February 29, 2012 | | High | | | Low | |

| First Quarter | | $ | 0.32 | | | $ | 0.18 | |

| Second Quarter | | $ | 0.24 | | | $ | 0.15 | |

| Third Quarter | | $ | 0.22 | | | $ | 0.17 | |

| Fourth Quarter | | $ | 0.20 | | | $ | 0.16 | |

The prices presented are bid prices which represent prices between broker-dealers and do not include retail mark-ups and mark-downs or any commission to the dealer. The prices may not reflect actual transactions.

As of February 28, 2013, there were approximately 288 stockholders of record of our common stock. The closing price of our common stock on March 31, 2013 was $0.23 per share.

There have been no cash dividends declared or paid on the shares of common stock, and management does not anticipate payment of dividends in the foreseeable future.

Unregistered Sales of Equity Securities.

In January 2013, the Company issued 500,000 shares of common stock to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.13 per share.

In November 2012, the Company issued 500,000 shares of common stock to a consultant pursuant to consulting agreements. The shares were valued at the time of issuance at $0.12 per share.