SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | | |

| Filed by the Registrant | | þ |

| Filed by a Party other than the Registrant | | o |

Check the appropriate box:

| | | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to § 240.14a-12 |

Raindance Communications, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box)

| | | |

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

1. | | Title of each class of securities to which transaction applies: |

| | | |

| |

| | | |

2. | | Aggregate number of securities to which transaction applies: |

| | | |

| |

| | | |

3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| |

| | | |

4. | | Proposed maximum aggregate value of transaction: |

| | | |

| |

| | | |

5. | | Total fee paid: |

| | | |

| |

| | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

6. | | Amount Previously Paid: |

| | | |

| |

| | | |

7. | | Form, Schedule or Registration Statement No.: |

| | | |

| |

| | | |

8. | | Filing Party: |

| | | |

| |

| | | |

9. | | Date Filed: |

| | | |

| |

TABLE OF CONTENTS

RAINDANCE COMMUNICATIONS, INC.

1157 Century Drive

Louisville, Colorado 80027

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 5, 2005

DearStockholder:

You are cordially invited to attend the Annual Meeting ofRaindance Communications, Inc., a Delaware corporation (the “Company”). The meeting will be held on Thursday, May 5, 2005 at 9:00 a.m. local time at the Boulderado Hotel, 2115 13th Street, Boulder, CO 80302 for the following purposes:

| 1. | To elect one director to hold office until the 2008 Annual Meeting of Stockholders. |

| |

| 2. | To ratify the selection by the Audit Committee of the Board of Directors ofKPMGLLPas the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2005. |

| |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 15, 2005. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors

Stephanie A. Anagnostou

Secretary

Louisville, Colorado

April 1, 2005

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

RAINDANCE COMMUNICATIONS, INC.

1157 Century Drive

Louisville, Colorado 80027

(800) 878-7326

PROXY STATEMENT

FOR THE 2005 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 5, 2005

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of Raindance Communications, Inc. (sometimes referred to as the “Company” or “Raindance”) is soliciting your proxy to vote at the 2005 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone.

The Company intends to mail this proxy statement and accompanying proxy card on or about April 1, 2005 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 15, 2005 will be entitled to vote at the annual meeting. On this record date, there were 55,939,623 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 15, 2005 your shares were registered directly in your name with Raindance’s transfer agent, Wells Fargo Bank Minnesota, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 15, 2005 your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

| | | | | |

| Ø | | Election of one director; and |

| | | | | |

| Ø | | Ratification of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2005. |

1.

How do I vote?

You may either vote “For” the nominee to the Board of Directors or you may abstain from voting for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card or vote by proxy over the telephone. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | | | | |

| Ø | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | | | | |

| Ø | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | | | | |

| Ø | | To vote over the telephone, dial toll-free 1-800-560-1965 using a touch-tone phone and follow the recorded instructions. Your vote must be received by 12:00 p.m., Central Daylight Time, on May 4, 2005 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 15, 2005.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of the nominee for director and “For” the ratification of the selection of KPMG LLP as our independent registered public accounting firm. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and returneachproxy card to ensure that all of your shares are voted.

2.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

| | | | | |

| Ø | | You may submit another properly completed proxy card with a later date. |

| | | | | |

| Ø | | You may send a written notice that you are revoking your proxy to Raindance Communications’ Secretary at 1157 Century Drive, Louisville, Colorado 80027. |

| | | | | |

| Ø | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 2, 2005 to: Corporate Secretary, Raindance Communications, Inc., 1157 Century Drive, Louisville, Colorado 80027. If you wish to submit a proposal to be considered for inclusion in next year’s proxy materials or nominate a director, you must do so not later than February 4, 2006 nor earlier than January 5, 2006. You are also advised to review our Amended and Restated Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal. A “broker non-vote” occurs when a broker or bank holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions).

How many votes are needed to approve each proposal?

| | | | | |

| Ø | | For the director election, the nominee receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Broker non-votes will have no effect. |

| | | | | |

| Ø | | To be approved, Proposal No. 2–ratification of the selection of KPMG LLP as the independent registered public accounting firm — must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 55,939,623 sharesoutstanding and entitled to vote. Thus 27,969,812 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in the Company’s quarterly report on Form 10-Q for the second quarter of 2005.

3.

Proposal 1

Election Of Director

Our Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class shall serve for the remainder of the full term of that class, and until the director’s successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

Our Board presently has seven members. There are twodirectors in the class whose term of office expires in 2005, Mr. Steven C. Halstedt and Mr. Patrick J. Lombardi. Mr. Lombardi, who was appointed to our Board in April 2002 and has previously been elected by the stockholders, will stand for reelection at the 2005 Annual Meeting of Stockholders. If elected at the Annual Meeting, Mr. Lombardi would serve until the 2008 annual meeting and until his successor is elected and has qualified, or until his death, resignation or removal. It is our practice to encourage nominees for directors to attend the annual meeting. Three of our directors, Mr. Berberian, Ms. Cunningham and Mr. Detampel, attended our 2004 Annual Meeting of Stockholders.

Mr. Halstedt, pursuant to the internal policies of the Centennial Funds, has informed us that he will not stand for reelection to our Board this year. Mr. Halstedt’s notification was not due to any disagreement with the Company. Since the number of authorized members of our Board will be reduced to six upon his departure, the appointment of a seventh director will not be submitted for a vote at the 2005 Annual Meeting of Stockholders. Accordingly, your shares can not be voted for the election of more than one person to our Board of Directors.

Directors are elected by a plurality of the votes properly cast in person or by proxy. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominee named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of such substitute nominee as management may propose. Mr. Lombardi has agreed to serve if elected. Our management has no reason to believe that he will be unable to serve.

The following is a brief biography of the nominee and each director whose term will continue after the Annual Meeting.

Nominee for Election for a Three-year Term Expiring at the 2008 Annual Meeting

Patrick J. Lombardi

Patrick J. Lombardi, age 57, has served as a member of our Board of Directors since April 2002. Since February 1996, Mr. Lombardi has been owner and president of PJL Associates, Inc., a consultancy company that provides strategic business and financial consulting services. Before founding PJL Associates, Inc., Mr. Lombardi held various positions at Jones International, Ltd. and its subsidiaries, including group president and board member of Jones International Ltd., president and board member of Jones Financial Group, Ltd. and president and board member of Jones Global Group, Inc. Jones International, Ltd. is the corporate parent of multiple subsidiaries in the Internet, e-commerce, software, education and entertainment industries. Mr. Lombardi holds a B.A. degree in accounting from the University of Notre Dame and is a certified public accountant.

The Board Of Directors Recommends

A Vote In Favor Of the Named Nominee.

4.

Directors Continuing in Office Until the 2006 Annual Meeting

Donald F. Detampel, Jr.

Donald F. Detampel, Jr., age 49, has served as a member of our Board of Directors since November 2002 and as our Chief Executive Officer and President since February 2004. From August 2001 to September 2002, Mr. Detampel was chairman of OneSecure, Inc., a network security products company, and chief executive officer from April 2000 to February 2002. From 1998 to February 2000, Mr. Detampel was president of GlobalCenter Inc., a wholly-owned subsidiary of Global Crossing and a director of Global Crossing Ventures. In 1998, Mr. Detampel was senior vice president, data and Internet products of Frontier Corporation, a telecommunications company, and president of the enhanced services group, an operating division of Frontier Corporation. From 1996 to 1997, Mr. Detampel was president of Global Crossing Conferencing (f/k/a ConferTech International), a multi-media teleconferencing company. Mr. Detampel is a Magna Cum Laude graduate of St. Norbert College with degrees in Mathematics and Physics.

Kathleen J. Cunningham

Kathleen J. Cunningham,age 58, has served as a member of our Board of Directors since March 2004. Since November 2003, Ms. Cunningham has been providing consultancy services to various software and technology companies. From May 1999 to August 2001, Ms. Cunningham served as chief financial officer, treasurer and assistant corporate secretary of Requisite Technology, Inc., an internet infrastructure software company. From April 1992 to April 1999, Ms. Cunningham was chief operating officer, chief financial officer and assistant corporate secretary of NxTrend Technology, Inc., a wholesale distributor of ERP application software. Ms. Cunningham received a B.A. in Economics and Political Science from the University of Wisconsin, Madison and an M.B.A. from the University of Denver.

Directors Continuing in Office Until the 2007 Annual Meeting

Paul A. Berberian

Paul A. Berberian, age 39, has served as our Chairman of the Board since co-founding Raindance Communications in April 1997 and served as our Chief Executive Officer and President from such time until his resignation from those offices in September 2003. From November 1995 to April 1997, Mr. Berberian was director of ConferLink, a division of ConferTech International, now Global Crossing, focusing on revenue call management information systems. In June 1993, Mr. Berberian co-founded LINK-VTC, a videoconferencing service provider, and served as its president and a member of its board of directors until it was acquired by ConferTech International in November 1995. He holds a B.A. degree in management and is a distinguished graduate from the U.S. Air Force Academy.

Cary L. Deacon

Cary L. Deacon, age 53, has served as a member of our Board of Directors since March 2003. Mr. Deacon currently serves as an executive officer for Navarre Corporation in a corporate development capacity. From September 2001 to August 2002, Mr. Deacon served as president and chief executive officer of NetRadio Corporation, a media company. From July 2000 to August 2001, Mr. Deacon served as president, chief operating officer and as a member of the board of directors of SkyMall, Inc., an integrated specialty retailer. From August 1998 to July 2000, Mr. Deacon served as president of ValueVision International, Inc., a home-shopping network company. From May 1997 to June 1998, Mr. Deacon served as a general partner of Marketing Advocates Inc., a marketing consulting firm.

William J. Elsner

William J. Elsner,age 53, has served as a member of our Board of Directors since March 2004. Mr. Elsner has served as a managing member of Telecom Partners, a venture capital firm focusing on investment in telecommunications, since November 1997. Mr. Elsner received a B.S. in Accounting from Regis University and an M.B.A. from the University of Denver.

5.

Independence of The Board of Directors

As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with our General Counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board affirmatively has determined that all of our directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Mr. Detampel, the President and Chief Executive Officer of the Company, and Mr. Berberian, the former President and Chief Executive Officer of the Company.

As required under new Nasdaq listing standards, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present.

Information Regarding the Board of Directors and its Committees

The Board has four committees: an Audit Committee, a Compensation Committee, a Nominating Committee and a Non-Management Stock Option Committee. The following table provides current Board committee membership information and information for each Board committee meeting held during the fiscal year 2004:

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | Nominating | | | Non-Management Stock |

| Name | | Audit | | Compensation | | Committee | | Option Committee |

| Kathleen J. Cunningham | | | X | | | | | | | | | | | |

| Donald F. Detampel, Jr. | | | | | | | | | | | | | | X* |

| Cary L. Deacon | | | | | | | X | | | | X* | | | |

| William J. Elsner | | | X | | | | X | | | | | | | |

| Steven C. Halstedt | | | | | | | X* | | | | X | | | |

| Patrick J. Lombardi | | | X* | | | | | | | | | | | |

| |

| Total meetings held in fiscal year 2004 | | | 6 | | | | 5 | | | | 1 | | | 0(1) |

| * | | Committee Chairperson |

| |

| (1) | | The Non-Management Stock Option Committee acts by written consent and did not hold formal meetings during the last fiscal year. |

As described above, Mr. Halstedt, pursuant to the internal policies of the Centennial Funds, has informed us that he will not stand for reelection to our Board this year. Mr. Halstedt’s notification was not due to any disagreement with the Company. As a result of Mr. Halstedt’s planned departure from the Board, our Board of Directors will reduce the size of the Board to six total members and reconstitute its committees effective upon the expiration of Mr. Halstedt’s term at the Annual Meeting or upon his earlier resignation, if such resignation occurs prior to the date of the Annual Meeting. At such time, Mr. Elsner will be appointed as the Chairman of the Compensation Committee and Ms. Cunningham will be appointed to fill the vacancy on the Compensation Committee.

6.

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors oversees our corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance, and assesses the qualifications and independence, of the independent registered public accounting firm; determines and approves the engagement, including the compensation, of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on our audit engagement team as required by law; reviews the accounting and reporting treatment of significant transactions; confers with management and the independent registered public accounting firm regarding the effectiveness of internal controls over accounting and financial reporting, and elicits any recommendations for the improvement of such controls, including, but not limited to, any controls or procedures arising in connection with Section 404 of the Sarbanes-Oxley Act of 2002; reviews legal and ethical conduct and conflict-of-interest compliance programs; reviews with management and the independent registered public accounting firm significant changes, if any, to our accounting principles; reviews any related-party transactions (unless reviewed by another independent body of the Board); establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in our Annual Report on Form 10-K and recommends whether such financial statements should be so included; and discusses with management and the independent registered public accounting firm the results of the annual audit and the results of our quarterly financial statements. Three directors currently comprise the Audit Committee: Ms. Cunningham, Mr. Elsner and Mr. Lombardi. The Audit Committee met six times during the fiscal year ended December 31, 2004. The Audit Committee revised its Charter and recommended its approval by the full Board of Directors, which adopted it in February 2005. The Amended and Restated Audit Committee Charter is attached as Appendix A to these proxy materials and is available on the Company’s website at www.raindance.com.

The Board of Directors annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of our Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards). The Board of Directors has determined that Mr. Lombardi qualifies as an “audit committee financial expert,” as defined in applicable SEC rules.In addition, bothMs. Cunningham and Mr. Elsner meet the criteria of an “audit committee financial expert.”

Compensation Committee

The Compensation Committee of the Board of Directors reviews and approves our overall compensation strategy and policies. The Compensation Committee reviews and approves compensation policies, corporate performance goals and objectives relevant to the compensation of our executive officers and other senior management; reviews and approves the compensation and other terms of employment of our executive officers; and proposes the adoption, amendment, and termination our stock option and purchase plans, pension and profit sharing plans, stock bonus plans, deferred compensation plans and other similar programs, and grants rights, participation and interests in such plans and programs. Threedirectors currently comprise the Compensation Committee: Mr. Deacon, Mr. Elsner and Mr. Halstedt. All members of our Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Compensation Committee met fivetimes during the fiscal year ended December 31, 2004. The Compensation Committee charter is available on our website at www.raindance.com.

7.

Nominating Committee

The Nominating Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as our directors as well as the independence of our directors, reviewing and evaluating incumbent directors, selecting or recommending to the Board for selectioncandidates for election to the Board of Directors and making recommendations to the Board regarding the membership of the committees of the Board. The Nominating Committee also considers from time to time the compensation paid to independent directors and recommends to the Board any changes to such compensation that it deems appropriate. The Nominating Committee has adopted a written Nominating Committee Charter that is available on our website at www.raindance.com. Two directors currently comprise the Nominating Committee: Messrs. Deacon and Halstedt. All members of the Nominating Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Nominating Committee met one time during the fiscal year ended December 31, 2004.

The Nominating Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements and having the highest personal integrity and ethics. The Committee considers such factors as possessing relevant expertise necessary to be able to offer advice and guidance to management, having sufficient time to devote to our affairs, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. The Committee may change or modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements and the long-term interests of stockholders. In conducting this assessment, the Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the committee also determines whether the nominee must be independent for Nasdaqpurposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates.

Currently the Nominating Committee does not have a formal policy with regard to its consideration of director candidates recommended by our stockholders. The Nominating Committee has not developed a formal policy due to the fact that, to date, the Board has not received candidate recommendations from our stockholders. However, pursuant to our bylaws, stockholders who wish to recommend individuals for consideration by the Nominating Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating Committee in compliance with the terms of our bylaws. The Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder or not.

Non-Management Stock Option Committee

The Non-Management Stock Option Committee, consisting solely of Mr. Detampel, who replaced Mr. Berberian in January 2005, awards stock options to purchase up to 10,000 shares per grant to employees.

Meetings of the Board of Directors

The Board of Directors met ten times during the last fiscal year. Each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member, respectively.

8.

Stockholder Communications With The Board Of Directors

Persons interested in communicating with the directors may address correspondence to a particular director, or to the directors generally, in care of Raindance Communications’ Secretary at 1157 Century Drive, Louisville, Colorado 80027.If no particular director is named, letters will be forwarded, depending on the subject matter, to the Chair of the respective committee of our Board of Directors. Every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board has been excellent. During the upcoming year the Board intends to continue to give consideration to the adoption of a formal process for stockholder communications with the Board and, if adopted, publish it promptly on our website.

Code Of Ethics

We adopted the Raindance Communications, Inc.Code of Business Conduct and Ethics and the Audit Committee’s “Whistleblower Policy,” each of which applies to all of our directors and employees. The Code of Business Conduct and Ethics and Whistleblower Policy are available on our website at www.raindance.com.If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code to our Chief Executive Officer, Chief Financial Officer, principal accounting officer or a director, we will promptly disclose the nature of the amendment or waiver on our website or in a report on Form 8-K.

9.

Report of the Audit Committee of the Board of Directors

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (sometimes referred to as the “1933 Act”) or the Securities Exchange Act of 1934, as amended (sometimes referred to as the “1934 Act”), whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

Management is responsible for the Company’s financial reporting process, including its system of internal controls, and for the preparation of its consolidated financial statements in accordance with generally accepted accounting principles in the United States of America. The Company’s independent registered public accounting firm is responsible for rendering an audit opinion on those financial statements, management’s assessment of the effectiveness of its internal controls and the effectiveness of the Company’s internal controls. The Audit Committee’s responsibility is to monitor and review these processes. The Audit Committee is currently comprised of three independent directors and operates under a written charter adopted by the Company’s Board of Directors. The members of the Audit Committee are Ms. Cunningham, Mr. Elsner and Mr. Lombardi. The Audit Committee, among other things, selects the Company’s independent registered public accounting firm.

Revision of Audit Committee Charter. The Audit Committee of the Board of Directors revised its Charter and recommended its approval by the full Board of Directors, which adopted it in February 2005. The revised Charter, in Appendix A to this Proxy Statement, sets forth the Audit Committee’s principal accountabilities, including selecting and engaging the independent registered public accounting firm and approving the audit and non-audit services to be provided by the independent registered public accounting firm.

Committee Report. The following is the report of the Audit Committee with respect to the Company’s audited financial statements, management’s assessment of the effectiveness of its internal controls and the effectiveness of the Company’s internal controls, for fiscal year ended December 31, 2004:

The Audit Committee has reviewed and discussed with the Company’s management and with KPMG LLP, the Company’s independent registered public accounting firm, the audited financial statements, management’s assessment of the effectiveness of its internal controls and the effectiveness of the internal controls of the Company for the year ended December 31, 2004. In addition, the Audit Committee has discussed with KPMG LLP the matters required to be discussed by Statements on Auditing Standards No. 61.

The Audit Committee also has received the written report, disclosure and the letter from KPMG LLP required by Independence Standards Board Standard No. 1, and has reviewed, evaluated and discussed the written report with KPMG LLP. In addition, the Audit Committee has discussed with KPMG LLP its independence from the Company. The Audit Committee also has discussed with the Company’s management and KPMG LLP such other matters and received such assurances from them, as the Audit Committee deemed appropriate.

Based on the foregoing reviews and discussions and relying thereon, the Audit Committee has recommended to the Company’s Board of Directors the inclusion of the audited financial statements and related independent registered public accounting firm reports in the Company’s Annual Report for the year ended December 31, 2004 on Form 10-K, as filed with the Securities and Exchange Commission.

| | | | | |

| | Audit Committee of the Board of Directors

Kathleen J. Cunningham

William J. Elsner

Patrick J. Lombardi, Chairman

| |

| | | |

| | | |

| | | |

10.

Proposal 2

Ratification Of Selection Of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has selected KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005 and, based on the recommendation of the Audit Committee, the Board has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. KPMG LLP has audited the Company’s financial statements since the Company’s inception in 1997. Representatives of KPMG LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Amended and Restated Bylaws nor other governing documents or law require stockholder ratification of the selection of KPMG LLP as our independent registered public accounting firm. However, the Audit Committee and the Board are submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of KPMG LLP.Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Independent Registered Public Accounting Firm Fees

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2004 and December 31, 2003, by KPMG LLP, our independent registered public accounting firm.

| | | | | | | | | |

| | | Fiscal Year | |

| | | 2004 | | | 2003 | |

Audit Fees(1) | | $ | 311,000 | | | $ | 187,000 | |

Audit-related Fees(2) | | | 0 | | | | 32,461 | |

Tax Fees(3) | | | 65,528 | | | | 24,225 | |

All Other Fees(4) | | | 1,164 | | | | 0 | |

| | | | | | | |

| Total Fees | | $ | 377,692 | | | $ | 243,686 | |

| | | | | | | |

All 2004 fees described above were pre-approved by the Audit Committee.

| (1) | | Audit fees consist of fees paid for professional services for the audit of our consolidated financial statements and for the audit of management’s assessment of the effectiveness, as well as the audit of the effectiveness, of our internal controls over financial reporting included in Form 10-K and the review of our financial statements included in Form 10-Q’s, and for services that are normally provided by KPMG LLP in connection with statutory and regulatory filings or engagements. |

| |

| (2) | | Audit-related fees for 2003 consist of fees for the audit of the Raindance Communications, Inc. 401(k) Salary Savings Plan, consultation on accounting and Sarbanes-Oxley matters and due diligence services. |

| |

| (3) | | Tax fees consist of fees for tax consultation and tax compliance services. |

| |

| (4) | | All other fees consist of a subscription to KPMG LLP’s accounting research online library. |

11.

Pre-Approval Policies and Procedures.

The Audit Committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accounting firm, KPMG LLP. Pre-approval may be given as part of the Audit Committee’s approval of the scope of the engagement of the independent registered public accounting firm or on an individual explicit case-by-case basis before the independent registered public accounting firm is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

The Audit Committee has determined that the rendering of the services other than audit services by KPMG LLP is compatible with maintaining the principal registered public accounting firm’s independence.

The Board Of Directors Recommends

A Vote In Favor Of Proposal 2.

12.

Security Ownership Of

Certain Beneficial Owners And Management

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 15, 2005 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its common stock.

| | | | | | | | | |

| | | Beneficial Ownership(1) |

| Beneficial Owner | | Number of Shares | | | Percent of Total |

Donald F. Detampel, Jr. (2) | | | 1,069,080 | | | | 1.9 | % |

Todd H. Vernon(3) | | | 1,357,540 | | | | 2.4 | |

Nicholas J. Cuccaro(4) | | | 860,528 | | | | 1.5 | |

Brian D. Burch(5) | | | 90,833 | | | | * | |

| Randy A. Atherton | | | 20,000 | | | | * | |

| Carolyn W. Bradfield | | | 1,246,488 | | | | 2.2 | |

Centennial Holdings VI, LLC(6) | | | 3,427,832 | | | | 6.1 | |

Caxton International Limited(7) | | | 3,052,438 | | | | 5.5 | |

| Dalton Greiner Hartman Maher & Co., LLC | | | 4,104,700 | | | | 7.3 | |

Tocqueville Asset Management, L.P.(8) | | | 3,109,373 | | | | 5.6 | |

Paul A. Berberian(9) | | | 2,864,554 | | | | 5.0 | |

Cary L. Deacon(10) | | | 59,482 | | | | * | |

Steven C. Halstedt(11) | | | 127,966 | | | | * | |

Patrick J. Lombardi(12) | | | 106,081 | | | | * | |

Kathleen J. Cunningham(13) | | | 21,666 | | | | * | |

William J. Elsner(14) | | | 21,666 | | | | * | |

All executive officers and directors as a group (12 persons)(15) | | | 7,845,884 | | | | 13.3 | % |

| * | | Less than one percent. |

| |

| (1) | | This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the Securities and Exchange Commission (the “SEC”). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 55,939,623 shares outstanding on March 15, 2005, adjusted as required by rules promulgated by the SEC. |

| |

| (2) | | Includes 667,777 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (3) | | Includes 50,000 shares held by Vernon Investments, LLC. Voting and investment power over shares held by Vernon Investments, LLC is shared between Mr. Vernon and his wife. Also includes 801,471 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (4) | | Includes 634,583 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (5) | | Includes 70,833 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (6) | | Includes 3,161,615 shares held by Centennial Fund VI, L.P., 83,200 shares held by Centennial Entrepreneurs Fund VI, L.P. and 166,401 shares held by Centennial Strategic Partners VI, L.P. Centennial Holdings VI, LLC is the sole general partner of Centennial Fund VI, L.P., Centennial Entrepreneurs Fund VI, L.P. and CSPVI Management, LLC, which is the sole general partner of Centennial Strategic Partners VI, L.P., and, accordingly, may be deemed to be the indirect beneficial owner of the shares held by such funds by virtue of its authority to make decisions regarding the voting and disposition of such shares. Excludes 66,560 shares held by Centennial Holdings I, LLC, 2,562,646 shares held by Centennial Fund V, L.P., 62,922 shares held by Centennial Entrepreneurs Fund V, L.P. and 10,479 shares held by Centennial Holdings V, L.P. Centennial Holdings VI, LLC has no voting or investment power over the excluded shares and disclaims beneficial ownership of such |

13.

shares. Mr. Halstedt, who is one of our directors, is one of four managing principals of Centennial Holdings VI, LLC, but, acting alone, does not have voting or investment power over any of the listed or excluded shares and disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. The address of Centennial Holdings VI, LLC is 1428 Fifteenth Street, Denver, Colorado 80202.

| (7) | Includes 195,938 shares held by GDK, Inc. (“GDK”). Caxton Associates, L.L.C. is the trading advisor to Caxton International Limited (“Caxton International”) and GDK and, as such, has voting and dispositive power with respect to the 2,856,500 shares owned by Caxton International and the 195,938 shares owned by GDK. |

| |

| (8) | Includes 56,100 shares held by G-America Small Cap Fund and 174,200 shares held by Schwab Small-Cap Market Master, with respect to which Tocqueville Asset Management LP is a sub-advisor and over which it retains shared voting power. |

| |

| (9) | Includes 1,969,600 shares held by Falcon Investments, LLC and 842,755 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (10) | Includes 50,832 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (11) | Includes 101 shares held by Halstedt Family Limited Partnership. Also includes 107,497 shares subject to options exercisable within 60 days of March 15, 2005. Mr. Halstedt holds such options for the benefit of Centennial Fund V, L.P. and Centennial Fund VI, L.P. Also excludes 66,560 shares held by Centennial Holdings I, LLC, 10,479 shares held by Centennial Holdings V, L.P., 2,562,646 shares held by Centennial Fund V, L.P., 62,922 shares held by Centennial Entrepreneurs Fund V, L.P., 16,616 shares held by Centennial Holdings VI, LLC, 3,161,615 shares held by Centennial Fund VI, L.P., 83,200 shares held by Centennial Entrepreneurs Fund VI, L.P. and 166,401 shares held by Centennial Strategic Partners VI, L.P. Mr. Halstedt is one of three general partners of Centennial Holdings V, L.P., which is the sole general partner of Centennial Fund V, L.P. and Centennial Entrepreneurs Fund V, L.P., is one of four managing principals of Centennial Holdings VI, LLC, which is the sole general partner of Centennial Fund VI, L.P., Centennial Entrepreneurs Fund VI, L.P. and CSPVI Management, LLC, which is the sole general partner of Centennial Strategic Partners VI, L.P., and is one of the managing members of Centennial Holdings I, LLC. Mr. Halstedt, acting alone, does not have voting or investment power over any of the excluded shares and disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. |

| |

| (12) | Includes 88,331 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (13) | Includes 21,666 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (14) | Includes 21,666 shares subject to options exercisable within 60 days of March 15, 2005. |

| |

| (15) | Includes shares as described in the notes above, as applicable. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “1934 Act”) requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2004, all Section 16(a) filing requirements applicable to the Company’s officers, directors and greater than ten percent beneficial owners were complied with, except that one report was filed late for each of Messrs. Deacon, Halstedt and Lombardi, covering one transaction respectively.

14.

Management

Our executive officers and key employees are as follows:

| | | | | | | |

| Name | | Age | | Position |

Executive Officers | | | | | | |

| Donald F. Detampel, Jr. | | | 49 | | | Chief Executive Officer and President |

| Nicholas J. Cuccaro | | | 62 | | | Chief Financial Officer |

| Todd H. Vernon | | | 41 | | | Chief Technology Officer |

| Brian D. Burch | | | 41 | | | Chief Marketing Officer |

| Randy A. Atherton | | | 46 | | | Executive Vice President of Sales |

Key Employees | | | | | | |

| Bryce L. Ambraziunas | | | 35 | | | Senior Vice President of Operations |

| Stephanie A. Anagnostou | | | 37 | | | Senior Vice President, General Counsel and Secretary |

| Peter J. Holst | | | 36 | | | Senior Vice President of Corporate Development |

| Kenneth M. Mesikapp | | | 41 | | | Senior Vice President of Finance and Accounting and Treasurer |

Executive Officers

Biographical information for Donald F. Detampel, Jr. is in the section entitled “Proposal 1 Election of Directors.”

Nicholas J. Cuccarohas served as our Chief Financial Officer since March 2001 and, from September 2003 to January 2004, served as our interim Chief Executive Officer and President. From November 1999 to March 2001, Mr. Cuccaro served as executive vice president and chief financial officer of NetLibrary, an electronic book publisher. From June 1994 to November 1999, Mr. Cuccaro held a number of positions, including president, publishing division, senior vice president and chief executive officer, at Neodata, a customer management company, which was acquired by EDS Corporation and renamed Centrobe. Mr. Cuccaro is a certified public accountant and holds a B.B.A. degree from St. John’s University in Queens, NY.

Todd H. Vernonhas served as our Chief Technology Officer since our inception in April 1997. From August 1996 to April 1997, Mr. Vernon served as senior software engineer for ConferLink, a division of ConferTech International, a multimedia teleconferencing company. Mr. Vernon also has served as product architect and lead developer for Rogue Wave Software, a software company, senior software engineer for Evolving Systems, Inc., also a software company, and senior electronic engineer for NASA Dryden Flight Research Facility. He holds a B.S. degree in electrical engineering from Central Missouri State University.

Brian D. Burchhas served as our Chief Marketing Officer since November 2003. From May 2002 to November 2003, Mr. Burch served as the executive vice president of marketing and general manager of consumer/SOHO sales for Micro Warehouse, a technology reseller. From January 2002 to May 2002, Mr. Burch was employed by Sun Microsystems as the group marketing manager for the microprocessors group. From November 1999 to April 2001, Mr. Burch served as vice president of marketing for Aveo, an enterprise software company. From September 1998 to November 1999, Mr. Burch was the senior vice president of marketing for Insight Enterprises, a technology reseller. He holds a B.A. in journalism and a B.S. in psychology from the University of Kansas.

Randy A. Athertonhas served as our Executive Vice President of Sales since June 2004. Mr. Atherton served as president and chief executive officer of Webscreen Technology Inc., a network-based security software company, from March 2002 to June 2004. From November 1999 to July 2001, Mr. Atherton served as vice president of North American sales for Kana Communications, an Internet application software company, pursuant to Kana Communications’ acquisition of netDialog in November 1999. From January 1998 to March 1999, Mr. Atherton served as vice president of sales for Tumbleweed Communications, an Internet software company. Mr. Atherton is a cum laude graduate of Westmont College and holds a B.A. in biology and physical education.

15.

Key Employees

Bryce L. Ambraziunashas served as our Senior Vice President of Operations since January 2004. From November 1998 to January 2004, he served as our Vice President of Operations. From October 1997 to November 1998, Mr. Ambraziunas served as executive manager of U.K. operations for Frontier Videoconferencing, a division of Frontier ConferTech, a multimedia teleconferencing company. From January 1996 to October 1997, Mr. Ambraziunas held various positions in the operations and sales departments of LINK-VTC, including technical account executive for its videoconferencing offering. He received a B.A. degree in economics from the University of California at Santa Cruz.

Stephanie A. Anagnostouhas served as our Senior Vice President and General Counsel since April 2000 and our Secretary since January 2001. From March 1995 to April 2000, Ms. Anagnostou served as an attorney at Cooley GodwardLLP, practicing primarily in areas of public offerings, private placements, mergers and acquisitions, and strategic partnerships. Ms. Anagnostou is licensed to practice law in Colorado and California. She holds a B.A. degree in mass communications with an emphasis in business from University of California, Los Angeles and a J.D., cum laude, from University of San Francisco School of Law.

Peter J. Holsthas served as our Senior Vice President of Corporate Development since May 2002. From October 2000 to May 2002, he served as our Vice President of Corporate Development. From September 1997 to September 2000, Mr. Holst served as vice president of corporate development for LyncStar Integrated Communications, a broadband services company. From March 1996 to September 1997, Mr. Holst served as director of sales for Autoskill International, a software company. He holds a B.Adm. degree in finance from the University of Ottawa, Canada.

Kenneth M. Mesikapphas served as our Senior Vice President of Finance and Accounting since April 2003 and our Treasurer since January 2001. Mr. Mesikapp also served as our Vice President of Finance and Accounting from October 1999 to April 2003, our Corporate Controller from December 1997 to October 1999, our Assistant Treasurer from October 1999 to January 2001 and our Acting Chief Financial Officer from January 2001 to March 2001. From November 1994 to December 1997, Mr. Mesikapp served as audit manager of Brock and Company, CPAs, P.C., an accounting firm located in Boulder, Colorado. From June 1986 to November 1994, Mr. Mesikapp held a variety of positions, including manager, at Nykiel, Carlin and Company, an accounting firm located in Schaumburg, Illinois. Mr. Mesikapp holds a B.S. degree in accounting from the University of Illinois at Chicago and is a certified public accountant.

16.

Executive Compensation

Compensation of Directors

In addition to reimbursement for customary and reasonable expenses incurred in attending Board and committee meetings in accordance with our company policy effective in January 2004, each of our independent directors currently receives cash compensation in the amount of $15,000 per year conditioned upon such director’s attendance of at least 60% of our regularly scheduled board meetings held during our fiscal year. Each independent director also receives cash compensation in the amount of $1,250 for each Board meeting attended and $1,000 for each committee meeting attended. In addition, on an annual basis immediately following our Annual Meeting of Stockholders, each independent director then in office, who has been in office for at least six months on such date, receives a stock option to purchase 10,000 shares of our common stock. The chair of our Audit Committee and the chair of our Compensation Committee then in office each receive an additional annual cash retainer in the amount of $8,000 and $3,000, respectively. Additionally, the chair of any of the other committees of the Board then in office receives an additional annual retainer in the amount of $2,000. Upon joining our Board, each independent director receives an initial stock option to purchase 60,000 shares.

Options and stock issuances to our independent directors are granted pursuant to our 2000 Equity Incentive Plan. Shares underlying annual option grants issued after January 1, 2004 generally vest over a one year period, with 1/12th of the shares vesting each month. The term of options granted to independent directors is ten years. In the event of our merger with or into another corporation or a consolidation, acquisition of our assets or other change-in-control transaction (“change-in-control”) involving us, options granted to our independent directors may be assumed by the surviving or acquiring entity. If such options are assumed and an independent director’s service is terminated without cause (as defined in our 2000 Equity Incentive Plan) within twelve months of a change-in-control, then the vesting of such director’s options, with respect to such options granted prior to January 1, 2004, shall be accelerated so that the portion of such options which would have been vested twelve months from the date of termination shall vest as of the date of termination, and with respect to such options granted on or after January 1, 2004, shall be accelerated in full. Each of these options will accelerate in full unless the surviving or acquiring entity assumes such option or substitutes an equivalent option for such option.

As of March 15, 2005, no options to purchase shares of our common stock have been exercised by our current independent directors.

17.

Compensation of Executive Officers

Summary of Compensation

The following table shows for the fiscal years ended December 31, 2004, 2003 and 2002, compensation awarded or paid to, or earned by, our Chief Executive Officers and our five most highly compensated executive officers (including one former executive officer) whose total salary and bonus exceeded $100,000 for services rendered to us in all capacities for the year ended December 31, 2004 (the “Named Executive Officers”):

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | Long-Term Compensation | | | | | | |

| | | | | Annual Compensation(1) | | | Awards | | | Payouts | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | Securities | | | | | | |

| | | | | | | | | | | | | | | | | | | | Restricted | | | Under- | | | | | | All Other |

| | | | | | | | | | | | | | | | | | | | Stock | | | Compen- | | | LTIP | | | Compen- |

| | Name and Principal | | | | | | | | Salary | | | Bonus | | | Awards | | | Options/ | | | Payouts | | | sation |

| | Position | | | Year | | | ($) | | | ($)(2)(3) | | | ($)(4)(5) | | | SARs(#) | | | ($)(6) | | | ( $)(7) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Donald F. Detampel, Jr.(8)

President and Chief Executive Officer | | | | 2004 | | | | | 267,692 | | | | | 214,912 | | | | | 877,250 | | | | | 2,000,000 | | | | — | | | | 64 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Nicholas J. Cuccaro

Chief Financial Officer | | | | 2004

2003

2002 | | | | | 223,269

215,000

215,000 | | | | | 180,350

274,675

215,000 | | | | | —

163,000

— | | | | | —

200,000

— | | | | —

—

— | | | | 96

106

116 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Todd H. Vernon

Chief Technology Officer | | | | 2004

2003

2002 | | | | | 223,269

217,456

215,000 | | | | | 180,350

224,675

289,715 | | | | | —

570,500

— | | | | | 10,000

110,000

100,000 | | | | 200,000

—

— | | | | 96

106

116 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Brian D. Burch(9)

Chief Marketing Officer | | | | 2004

2003 | | | | | 223,269

24,808 | | | | | 180,350

50,000 | | | | | —

— | | | | | —

200,000 | | | | —

— | | | | 8,397

— | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Randy A. Atherton(10)

Executive Vice President of Sales | | | | 2004 | | | | | 124,615 | | | | | 98,438 | | | | | — | | | | | 250,000 | | | | — | | | | 43,227 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Carolyn W. Bradfield(11)

Former Senior Vice President of Sales | | | | 2004

2003

2002 | | | | | 119,949 190,000

122,769 | | | | | 76,000 145,768

50,000 | | | | | —

—

— | | | | | —

10,000

150,000 | | | | —

—

— | | | | 95,048

106

62 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| (1) | | As permitted by rules promulgated by the SEC, no amounts are shown with respect to certain “perquisites” where the aggregate amount of such perquisites received by a Named Executive Officer does not exceed the lesser of $50,000 or 10% of his or her salary plus bonus for the applicable year. |

| |

| (2) | | Restricted stock awards are reported under Long-Term Compensation and are not included in bonus amounts. |

| |

| (3) | | The amount shown for Mr. Detampel for 2004 includes 37,853 shares of common stock valued at $85,170 based on the closing market price of our common stock of $2.25 on January 24, 2005, the date on which such shares were granted. |

| |

| (4) | | Calculated by multiplying the closing market price of our common stock on the date of grant ($1.63 with respect to restricted shares granted to Mr. Cuccaro and Mr. Vernon in 2003 and $3.19 with respect to restricted shares granted to Mr. Detampel in 2004) by the number of restricted shares awarded. |

| |

| (5) | | All restricted shares reflected in this column for 2003 were granted pursuant to the Executive Performance-Based Compensation Arrangement (a description of such arrangement and the performance measures are provided in the Report of the Compensation Committee of the Board of Directors on Executive Compensation). The restricted shares vest in full six years after their initial grant or such earlier time that the Company achieves certain performance goals or, generally in the Board’s discretion, upon a change in control of the Company, as |

18.

| | | provided in the Executive Performance-Based Compensation Arrangement. The total number of restricted shares and their aggregate market value at December 31, 2004: Mr. Vernon, 350,000 shares valued at $812,000 (see Note 6 below for acceleration of vesting of a portion of Mr. Vernon’s shares); and Mr. Cuccaro, 100,000 shares valued at $232,000. |

| |

| | | Pursuant to his employment agreement with the Company, in 2004 Mr. Detampel received 275,000 shares of common stock subject to a restricted stock award valued at $638,000, which shares vested or will vest pursuant to the following schedule: 50,000 shares vested in full on January 28, 2004; 100,000 shares will vest in full after he completes 24 months of continuous service with us; and 125,000 shares shall vest in full after he completes 37 months of continuous service with us. This agreement was amended in August 2004 to provide for the acceleration of such vesting in full upon a change in control of the Company. The aggregate market value is based on the closing market price of our common stock on December 31, 2004 of $2.32. Dividends are paid on the restricted shares in the same amount and at the same time as dividends paid to all other owners of common stock. |

| |

| (6) | | In March 2004, a product-based milestone under our Executive Performance-Based Compensation Arrangement was achieved and accordingly, we paid to Mr. Vernon $200,000 pursuant to this commitment and accelerated the vesting on 100,000 shares of common stock subject to a restricted stock award held by him. |

| |

| (7) | | The amounts shown in this column represent the insurance premiums paid by us with respect to term life insurance for the benefit of the Named Executive Officer (or their respective designee). The amount shown for Ms. Bradfield also includes $95,000 in severance payments made by the Company in connection with the termination of her employment in June 2004. The amounts shown for Mr. Burch and Mr. Atherton also include $8,300 and $43,187, respectively, for relocation expenses. |

| |

| (8) | | Mr. Detampel’s employment with us began in January 2004, and accordingly, no amounts are shown for 2002 or 2003. |

| |

| (9) | | Mr. Burch’s employment with us began in November 2003, and accordingly, no amounts are shown for 2002. |

| |

| (10) | | Mr. Atherton’s employment with us began in June 2004, and accordingly, no amounts are shown for 2002 or 2003. |

| |

| (11) | | Ms. Bradfield’s employment with us terminated in June 2004. |

19.

Equity Compensation Plan Information

We grant options to our employees, executive officers and directors under our 2000 Equity Incentive Plan. As of March 15, 2005, options to purchase a total of 11,251,017 shares were outstanding under the 2000 Equity Incentive Plan and 3,604,868 shares remained available for grant under the plan. We may also issue shares of restricted stock pursuant to our 2000 Equity Incentive Plan. As of March 15, 2005, 2,068,048 shares of restricted stock were issued to certain executives and key employees and were outstanding.

Equity Compensation Plan Information

The following table provides certain information with respect to all of the Company’s equity compensation plans in effect as of December 31, 2004:

| | | | | | | | | | | | | | | | | | |

| |

| | | | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)(1) | | | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)(1) | | | Number of securities remaining available for

issuance under equity

compensation plans

(excluding securities

reflected in column(a))

(c)(1)(2) | |

| | Equity compensation

plans approved by

security holders | | | | 11,383,754 | | | | $ | 3.06 | | | | 5,954,972(3) | |

| | Equity compensation

plans not approved

by security

holders(4) | | | | 19,727 | | | | $ | 4.82 | | | | | 0 | | |

| | Total | | | | 11,403,481 | | | | $ | 3.06 | | | | 5,954,972(3) | |

| |

| (1) | Excludes 162,020 shares issuable upon exercise of outstanding options assumed under Contigo Software, Inc.’s 1999 Stock Option Plan and 1999 Section 25102(o) Stock Option/Stock Issuance Plan, with a weighted average exercise price of $3.51 (the “Acquired Options”). The Acquired Options are fully exercisable and expire ten years from the date of grant. Additional stock options will not be granted under any of the assumed plans. |

| |

| (2) | On January 1 of each year for ten years, commencing on January 1, 2001, the share reserve under the 2000 Equity Incentive Plan will be automatically increased by the lesser of: (i) 3% of the number of shares of common stock outstanding on each January 1, (ii) 3% of the total number of shares outstanding as of the effective date of the 2000 Equity Incentive Plan, or (iii) such smaller number of shares as determined by the Board of Directors. On January 1 of each year, commencing on January 1, 2001 and ending (and including) January 1, 2009, the share reserve under the 2000 Employee Stock Purchase Plan will be automatically increased by the lesser of: (a) 3% of the number of shares of common stock outstanding on each January 1, (b) 3% of the total number of shares outstanding as of the effective date of the 2000 Employee Stock Purchase Plan, or (c) such smaller number of shares as determined by the Board of Directors. |

| |

| (3) | Includes 2,528,191 shares that remain available for issuance under the 2000 Equity Incentive Plan and 3,426,781 shares that remain available for future purchase under our 2000 Employee Stock Purchase Plan. |

| |

| (4) | Represents the aggregate number of shares issuable pursuant to the exercise of outstanding warrants to purchase our common stock. Descriptions of such warrants are contained in note 7 of the footnotes to the consolidated financial statements contained in the Company’s Annual Report on Form 10-K, filed with the SEC on March 15, 2005 (File No. 000-31045). |

20.

Our Board of Directors may reprice options pursuant to the terms of our 2000 Equity Incentive Plan. Options are granted at an exercise price equal to the fair market value of our common stock on the date of grant. Since our initial public offering, the fair market value of our common stock is the closing sales price of the stock as reported on Nasdaq for the date of grant. Prior to our initial public offering, the fair market value of our common stock on the date of grant was determined by our Board, taking into consideration a number of factors, including:

| | • | our historical and prospective revenue and profitability; |

| |

| | • | our cash balance and rate of cash consumption; |

| |

| | • | the growth and size of the market for our services; |

| |

| | • | the stability of our management team; and |

| |

| | • | the quality of our services. |

Options granted to new employees generally vest over a four year period, with 25% of the underlying shares vesting one year after the date of grant and the remaining shares vesting at a rate of 1/48th per month thereafter. Options granted to employees who have been employed for more than one year typically vest over a four year period, with 1/48th of the underlying shares vesting each month beginning on the date one month after the date of grant. The term of options granted to employees is ten years. In the event of a change-in-control involving us, options granted to employees may be assumed by the surviving or acquiring entity. If such options are assumed and an employee’s service is terminated without cause (as defined in our 2000 Equity Incentive Plan) within twelve months of a change-in-control, then generally the vesting of such employee’s options shall be accelerated so that the portion of such options which would have vested twelve months from the date of termination shall vest as of the date of termination. Options granted to employees will vest in full unless the acquiring company assumes the options or substitutes similar options. With respect to executive officers, see the section entitled “Employment and Change of Control Agreements” for provisions applicable to such officers.

21.

The following tables show for the fiscal year ended December 31, 2004, certain information regarding options granted to, exercised by, and held at year end by, the Named Executive Officers:

Option/SAR Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Individual Grants | | | | | | | | Potential Realized Value |

| | | | | | | % of Total | | | | | | | | at Assumed Annual Rate |

| | | Number of | | Options | | | | | | | | of Stock Price |

| | | Securities | | Granted to | | | | | | | | Appreciation for Option |

| | | Underlying | | Employees | | Exercise | | | | Term(1) |

| | | Options | | in Fiscal | | Price | | Expiration | | | | |

| Name | | Granted (#) | | Year(2) | | ($/Sh) | | Date | | 5% ($) | | 10% ($) |

Donald F. Detampel, Jr.(3) | | | 2,000,000 | | | | 59.23 | % | | $ | 3.28 | | | 1/27/14 | | $ | 4,125,549 | | | $ | 10,454,951 | |

| Nicholas J. Cuccaro | | | — | | | | — | | | | — | | | — | | | — | | | — |

Todd H. Vernon(4) | | | 10,000 | | | | 0.30 | % | | $ | 2.62 | | | 4/20/14 | | $ | 16,477 | | | $ | 41,756 | |

| Brian D. Burch | | | — | | | | — | | | | — | | | — | | | — | | | — |

Randy A. Atherton(3) | | | 250,000 | | | | 7.40 | % | | $ | 2.06 | | | 6/20/14 | | $ | 323,881 | | | $ | 820,777 | |

| Carolyn W. Bradfield | | | — | | | | — | | | | — | | | — | | | — | | | — |

| (1) | | The potential realizable value is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounding annually for the entire term of the option and that the option is exercised and sold on the last day of its term for the appreciated stock price. The stock price on the date of grant is the closing sales price of the stock as reported on Nasdaq for the date of grant. The amounts shown in the above table represent certain assumed rates of appreciation only, in accordance with the rules of the SEC, and do not reflect our estimate or projection of future stock price performance. Actual gains, if any, are dependent on the actual future performance of our common stock and no gain to the optionee is possible unless the stock price increases over the option term, which will benefit all stockholders. |

| |

| (2) | | Based on options to purchase an aggregate of 3,376,545 shares of common stock granted to employees in 2004. |

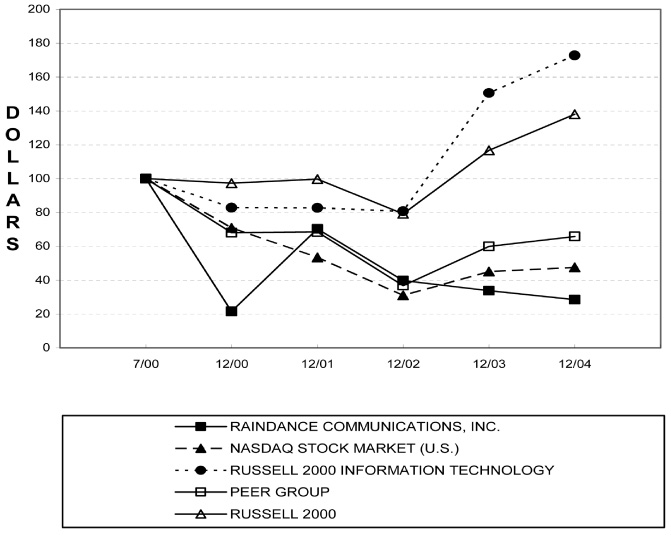

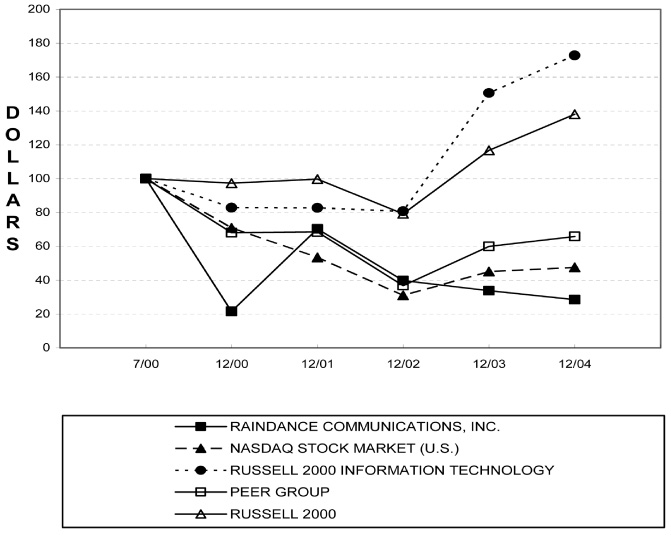

| |