UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | |

| þ |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended December 31, 2012 |

OR

|

| | |

| ¨ |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the transition period from to . |

Commission File No. 001-13683

Remy International, Inc.

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 35-1909253 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 600 Corporation Drive, Pendleton, Indiana | 46064 |

| (Address of principal executive offices) | (Zip code) |

| (765) 778-6499 |

| (Registrant's telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

| | | |

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of common stock held by nonaffiliates of the registrant (14,880,611 shares) based on the average bid and asked price of such common stock as reported on the OTC Pink Sheets on June 29, 2012, which was the last business day of the registrant's most recently completed second fiscal quarter, was $224.0 million. For purposes of this computation, all officers, directors, and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors, or 10% beneficial owners are, in fact, affiliates of the registrant.

Number of shares of the registrant’s common stock outstanding as of January 31, 2013: 31,865,008

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions, as expressly described in this report, of the Registrant’s Proxy Statement on schedule 14A for the fiscal year ended December 31, 2012, to be filed within 120 days after the close of the fiscal year that is the subject of this report, are incorporated by reference into Part III, Items 10-14.

Table of contents

|

| | |

| | PART I | Page |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | PART IV | |

| Item 15. | | |

FORWARD-LOOKING STATEMENTS

Certain statements contained or incorporated in this Annual Report on Form 10-K which are not statements of historical fact constitute “Forward-Looking Statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). Forward-looking statements give current expectations or forecasts of future events. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may”, “plan,” “seek” and other words and terms of similar meaning in connection with discussions of future operating or financial performance signify forward-looking statements. Remy International, Inc. (the “Company”) also, from time to time, may provide oral or written forward-looking statements in other materials released to the public. Such statements are made in good faith by the Company pursuant to the “Safe Harbor” provisions of the Reform Act.

Any or all forward-looking statements included in this report or in any other public statements may ultimately be incorrect. Forward-looking statements may involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance, experience or achievements of the Company to differ materially from any future results, performance, experience or achievements expressed or implied by such forward-looking statements. The Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Listed in the Risk Factors section are some of the factors that could potentially cause actual results to differ materially from historical and expected future results. Other factors besides these listed could also materially affect the Company's business.

Part I

Item 1. Business

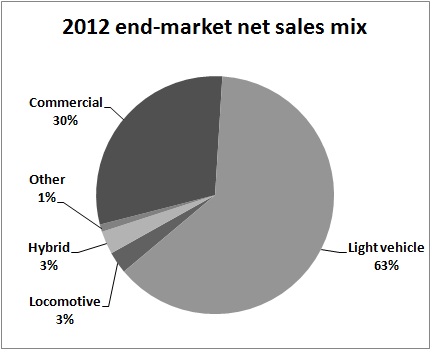

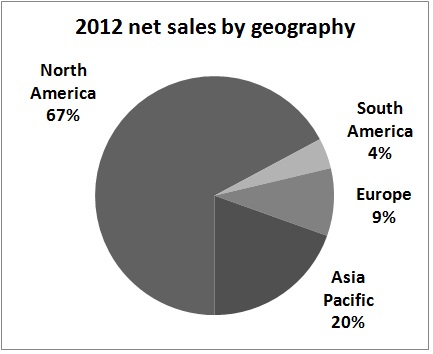

We are a global market leader in the design, manufacture, remanufacture, marketing and distribution of non-discretionary, rotating electrical components for light and commercial vehicles for original equipment manufacturers, or OEMs, and the aftermarket. We sell our products worldwide primarily under the well-recognized “Delco Remy,” “Remy” and “World Wide Automotive” brand names, as well as our customers' well-recognized private label brand names. For the year ended December 31, 2012, we generated net sales of $1.1 billion, net income of $138.6 million and adjusted EBITDA of $153.5 million, representing 13.5% of our 2012 net sales. For the year ended December 31, 2011, we generated net sales of $1.2 billion, net income attributable to Remy International, Inc. of $71.9 million, net income attributable to common stockholders of $62.2 million and adjusted EBITDA of $172.4 million, including $7.3 million of non-recurring benefits, representing 14.4% of our 2011 net sales. For additional information about our financial position and results of operations, including domestic and international revenues, as well as our long-lived assets, total assets and stockholders' equity, see the notes to our consolidated financial statements included elsewhere in this Form 10-K. The Company was incorporated in Delaware in 1993 and currently has one single reportable segment.

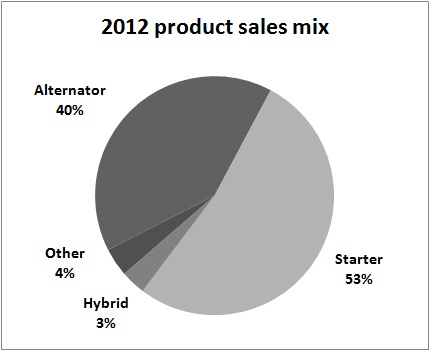

Our principal products include starter motors, alternators and hybrid electric motors. Our starters and alternators are used globally in light vehicle, commercial vehicle, industrial, construction and agricultural applications. We also design, develop and manufacture hybrid electric motors that are used in both light and commercial vehicles including construction, public transit and agricultural applications. These include both pure electric applications as well as hybrid applications, where our electric motors are combined with traditional gasoline or diesel propulsion systems. While the market for these systems is in early stages of development, our technology and capabilities are ideally suited for this growing product category.

We design and market products suited for both light and commercial vehicle applications. Our light vehicle products continue to evolve to meet the technological demands of increasing vehicle electrical loads, improved fuel efficiency, reduced weight and lowered electrical and mechanical noise. Commercial vehicle applications are generally more demanding and require highly engineered and durable starters and alternators.

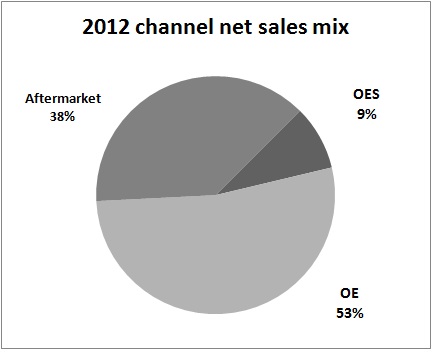

We sell new starters, alternators and hybrid electric motors to U.S. and non-U.S. original equipment manufacturers ("OEMs") for factory installation on new vehicles. We sell remanufactured and new starters and alternators to aftermarket customers, mainly retailers in North America, warehouse distributors in North America and Europe and OEMs globally for the original equipment service, or OES, market. As a leading remanufacturer, we obtain used starters and alternators, which we refer to as cores, that we disassemble, clean, combine with new subcomponents and reassemble into saleable, finished products, which are tested to meet OEM requirements. We have captured leading positions in many key markets by leveraging our global reach and established customer relationships.

We believe there are benefits to serving both original equipment, or OE, and aftermarket customers. Our OE business is driven primarily by new vehicle production. Aftermarket demand is more stable given that our aftermarket products are used for non-discretionary repairs. We believe aftermarket demand remains relatively flat in periods of decreasing OEM sales volumes as customers look to extend the service lives of their existing vehicles by purchasing aftermarket replacement parts rather than new vehicles. This aftermarket demand stabilizes the variability of our OE sales. Our aftermarket and remanufacturing knowledge regarding product reliability allows us to regularly update and enhance new product specifications in our OE and new-build aftermarket businesses. Our expertise in OE product design allows us to bring components to the aftermarket quickly and efficiently, which enhances our brands, giving us a competitive advantage.

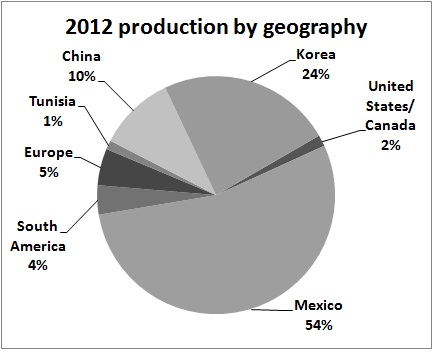

We operate a global, low-cost manufacturing and sourcing network capable of producing technology-driven products. Our 14 primary manufacturing and remanufacturing facilities are located in eight countries, including Brazil, Canada, China, Hungary, Mexico, South Korea and Tunisia. We have two manufacturing facilities in the United States which support a portion of our hybrid electric motor assembly and our locomotive remanufacturing operations. Neither of these two U.S. manufacturing facilities is unionized. Our low-cost strategy results in direct labor costs of less than 2% of net sales. Our global network of manufacturing facilities employs common tools and processes to drive efficiency improvements and reduce waste. We can shift capacity between operations to minimize costs to adapt to changes in demand, raw material costs and exchange and transportation rates. Because of our established presence and available capacity throughout the world, we are well-positioned for growth with minimal incremental investment. See "Item 1A. Risk Factors--Our global operations subject us to risks and uncertainties" and Note 2 and Note 20 to the consolidated financial statements included elsewhere in this Form 10-K for additional information.

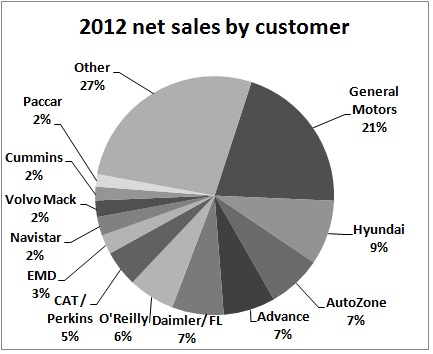

We sell our products globally through an extensive distribution and logistics network. We employ a direct sales force that develops and maintains sales relationships directly with global OEMs, OE dealer networks, commercial vehicle fleets, North American retailers and warehouse distributors around the world. We have a broad customer base, as illustrated below.

We enhance our technology and expand our product lines by investing in new product development and ongoing research. Our OE customers continue to increase their requirements for power, durability and reliability, as well as for increased fuel-efficiency and mechanical and electrical noise reduction. We have over 300 engineers focused on design, application and manufacturing. These engineers work in close collaboration with customers and have a thorough understanding of our product application. Our engineering efforts are designed to create value through innovation, new product features and aggressive cost control. Our 110 years of expertise in rotating electrical components led to the development of our hybrid electric motor capabilities, a natural extension of our products.

Our prior experience in manufacturing process development has provided us with significant, proprietary know-how in hybrid electric motor manufacturing. The U.S. Department of Energy, or the DOE, awarded us a grant in 2009, pursuant to which it agreed to match up to $60.2 million of eligible expenditures we make through 2012 for the commercialization of hybrid electric motor technology. We obtained agreements from the DOE to extend the period of eligibility for the grant through 2013. As of December 31, 2012, we have completed the first phase of the grant award and have received $36.0 million of the total grant. During 2012, a number of our hybrid customers have delayed their programs. We are now moderating our investments until the market develops, and we have elected not to initiate the next phase of the capacity requirements for the grant funding at this time.

We are well-positioned for strong and stable growth, both organically and through opportunistic acquisitions, due to our balanced portfolio of products, strong brand names, focus on new technologies, strategic global footprint and market expertise. These strengths have contributed to our solid operating margins and cash flow profile. Since 2007, our margins have improved significantly as a result of our ongoing productivity initiatives, which included capacity and workforce realignments, the implementation of lean manufacturing principles and the expansion of global purchasing initiatives. In 2010 and 2011, we completed a series of financial transactions focused on improving the strength and flexibility of our capital structure, including a debt refinancing and stockholder rights offering. As a result of these transactions, we extended our debt maturities, reduced our future interest payments and accessed substantial liquidity to execute our strategic plans. Our strengthened balance sheet now provides us with greater ability to reinvest in our business and pursue growth opportunities, including acquisitions.

Our industry

Original equipment market

Light and commercial vehicle production trends. Our OE business is influenced by trends in the light vehicle, commercial vehicle, construction and industrial markets. Common applications include passenger cars and light trucks, delivery vans, transit buses, over-the-road trucks, military vehicles, bulldozers and track-type vehicles, mining equipment, tractors and recreational vehicles.

According to IHS Global Insight, global light vehicle production is forecasted to grow from 81.2 million units in 2012 to 97.0 million units in 2016. In addition, global commercial vehicle production is forecasted to grow from 3.0 million units in 2012 to 3.7 million units in 2016.

Demand for alternators. Overall electrical power requirements have risen as OEMs introduce additional electronics in new vehicles, such as new safety, control, communication and entertainment features and emission control technology in heavy vehicles. We believe OEMs will continue to demand more efficient, more powerful yet durable alternators as electronic vehicle content continues to grow.

Increased deployment of start-stop technology starters. Start-stop technology is designed to shut a vehicle's engine off when it is stopped and rapidly restart it when the driver releases the brake pedal before accelerating. The two primary benefits of start-stop technology are improved fuel economy and green house gas reduction. Various start-stop technologies are estimated to improve fuel economy by 3-12%. Currently there are two competing technologies--Belt Alternator Starter (BAS) and Starter Based Start Stop (SBSS). According to IHS Global Insight, start-stop technology is forecasted to more than triple by 2018, growing from 8.8 million units in 2012 to 34.5 million units in 2018.

OE platform standardization and globalization. Increasingly, OEMs are requiring that their suppliers establish global production capabilities to meet their needs in local markets as they expand internationally and increase platform standardization. We believe our global proximity to customer production will be increasingly valuable.

Aftermarket

Aftermarket demand is based on the need for replacement vehicle parts. Vehicle parts may need to be replaced due to age or failure based on the level of usage and the overall quality and durability of the original part. However, improvements in product quality generally lower the replacement rate for aftermarket products. The aftermarket in mature markets differs from that in growing markets. In North America and Europe, there is a well-established aftermarket, with numerous distribution channels for replacement parts. In the U.S. market, there has also been a growing trend for retail distributors to work directly with installers. However, in growing markets, such as China, parts are generally repaired in individual repair shops. There is potential for significant growth as these markets mature.

Hybrid electric motors

Hybrid electric vehicles use technologies that combine traditional gasoline or diesel propulsion systems with electric motors to reduce emissions and be more fuel efficient. The electric motors used in hybrid vehicles can also be used to provide propulsion for electric-only vehicles. Fuel prices, emission standards and government legislation influence the demand for hybrid electric motors. For instance, the U.S. Environmental Protection Agency and the Department of Transportation's National Highway Traffic Safety Administration have issued a joint rule and announced further initiatives that require and will impose increasing standards to reduce greenhouse gas emissions and improve fuel efficiency. We believe corporations with large distribution operations will continue to add hybrid vehicles to their fleets as part of their corporate responsibility initiatives focused on reducing fuel consumption and pollution. In addition, continued volatility of, and the potential for higher, fuel costs in the future may have a positive impact on demand for hybrid electric motors as consumers seek more energy-efficient solutions.

Our competitive strengths

We believe the following competitive strengths enable us to compete effectively in our industry:

Leading market position and strong brand recognition. We hold leading market and production positions in North America, Europe, South Korea and China across all our products. Our leading market position was established through 100 years of experience delivering superior service, quality and product innovation under the well-recognized brand names, “Delco Remy,” “Remy” and “World Wide Automotive.” In recent years, we have received a number of awards in recognition of our merits, from customers, suppliers and industry associations.

Well-balanced revenue base and end-market exposure. We have a diverse portfolio of revenue sources with OE and aftermarket products that serve both light and commercial vehicle applications. This balance can help us mitigate the inherent cyclicality of demand in any one channel or end-market. We offer our products on a diverse mix of OE vehicle platforms, reflecting the balanced portfolio approach of our business model and the breadth of our product capabilities. We believe our overall diversification provides us with an opportunity to participate in an economic recovery without being overly exposed to any single market.

Innovative, technology-driven product offerings. We are committed to product and manufacturing innovation to improve quality, efficiency and cost for our customers. Our starters address customer requirements for high-power, durability and reliability, while our alternators address the growing demand for high-output, low-noise and high-efficiency performance. We also continue to lead in the production of hybrid electric motors, providing high-output, custom designs for standardized platforms. Our HVH electric motor technology, which we continue to introduce into automotive, agricultural, military and specialty markets, is among the industry leaders in power density and torque density.

Global, low-cost manufacturing, distribution and supply-chain. Our efficient manufacturing capabilities lower costs and address OEMs' engineering requirements. We are well-positioned for continued growth and protected by significant barriers to entry from suppliers who cannot support OEMs on a global scale. We conduct no manufacturing activity in the United States, with the exception of hybrid electric motors and our locomotive power assembly remanufacturing operations.

Strong operating margins and cash flow profile. We believe our operating margins and cash flow from operations provide financial flexibility and enable us to reinvest capital in our business for growth. Our base business, other than our hybrid electric motors, requires low levels of capital expenditures of approximately 1% to 2% of our net sales.

Experienced management team with track record of accomplishments. Our management team, led by industry veteran, CEO John H. Weber, has implemented a number of strategic, operational and financial restructuring initiatives to reposition us for potential profitable growth. Mr. Weber is transitioning from the CEO position effective February 28, 2013 and will remain a member of the Board of Directors. John J. Pittas, Chief Commercial Officer, will succeed Mr. Weber as CEO and President effective March 1, 2013. Mr. Pittas has held various senior management positions with the Company since joining in 2006. Mr. Weber will remain as a Director of Remy International, Inc. Key accomplishments of the management team since the start of 2007 have included:

| |

| • | realigning our manufacturing to low-cost regions; |

•reducing headcount by 15% from 7,800 to 6,600;

•winning numerous aftermarket customers in both Europe and North America;

•securing global platform wins with several customers;

•developing an industry-leading hybrid electric motor platform; and

•increasing our operating margins from (4.5)% in 2006 to 8.6% in 2012.

Our strategy

It is our goal to be the leading global manufacturer and remanufacturer of starters and alternators, yielding superior financial returns. Further, we seek to be a leading participant in the production of hybrid electric motors. We believe the competitive strengths described above provide us with significant opportunities for future growth in our industry. Our strategies for capitalizing on these opportunities include the following:

Build upon market-leading positions in commercial vehicle products. We seek to use our strength in producing durable, high-output starters and alternators for commercial vehicles to increase our market share and capitalize on the growing OE demand for these components over the next few years. We intend to use our know-how in rotating electrical components and strong customer relationships to continue to build our leading market share in the growing aftermarket for commercial vehicle parts.

Expand manufacturing for growth markets in Asia and South America. We have a significant presence in high-growth markets such as China, South Korea and Brazil and are committed to further investment in these regions. We have both wholly owned and joint venture operations in China. China produces more commercial diesel engines and vehicles than any other country in the world.

Continue to invest in hybrid electric motors for commercial vehicles. We are committed to grow in the hybrid electric motor market. We are the leading non-OEM producer of hybrid electric motors in North America. We intend to focus primarily on commercial vehicle applications, which include trucks, buses, off-road equipment and military vehicles, where power density and torque density are primary considerations. With an emphasis on medium-duty and specialty applications, we have over 20 vehicle projects in various stages of development. Since 2009, we have signed a number of long-term supply agreements for commercial vehicle applications. We have created a competitive advantage through our manufacturing capacity and intellectual property portfolio.

Leverage benefits of having both an OE and aftermarket presence. Our aftermarket business has access to the latest technology developed by our OE business. As a result, we are able to provide our aftermarket customers with new products faster than competitors. Our aftermarket presence provides our OE business with useful knowledge regarding long-term product performance and durability. We use this aftermarket knowledge to regularly update and enhance new product offerings in our OE business.

Provide value-added services that enhance customer performance. We provide our aftermarket customers with valuable category management services that strengthen our customer relationships and provide both of us with a competitive advantage. Our Remy Optimized Inventory and Vendor Managed Inventory programs support customer growth and product category profitability. These services have enabled us to improve our customer retention and expand product sales.

Selectively pursue strategic partnerships and acquisitions. We will selectively pursue strategic partnerships and acquisitions that leverage our core competencies. We will remain disciplined in our approach and only close a transaction after a thorough due diligence process. We believe there are significant opportunities in this fragmented industry. We have demonstrated our ability to rationalize and integrate operations and realize cost savings. We believe our balance sheet gives us the flexibility to support this strategy.

Products

We produce a broad range of new starters and alternators for both light and commercial vehicles. We also manufacture electric traction motors used for electric and hybrid vehicle applications. We produce a diverse array of remanufactured starters and alternators as well. Finally, we remanufacture power assemblies for locomotive diesel engines, and also sell a small amount of remanufactured steering gear and brake calipers for light vehicles in Europe.

New starters

We produce a wide range of starters in the industry, with global applications ranging from small cars to industrial engines and the largest mining trucks and locomotives. We make two types of starters: traditional straight drive starters and more technologically advanced gear reduction starters. Gear reduction starters offer greater output at lower weight than comparable straight drive designs. Reduced component weight is extremely important to OEMs, as total vehicle weight is a critical factor for fuel economy. Straight drive starters are used to produce the high torque and power required to start very large displacement engines used in off-highway trucks, tanks and locomotives.

Some light vehicles use a “start/stop” technology, in which the engine automatically shuts down while the vehicle is stopped rather than idling, and then a power source assists the engine in restarting when the vehicle departs. This

approach, which is sometimes referred to as “mild hybrid,” helps meet strict fuel efficiency and CO2 emission regulations. In this design, a separate hybrid electric motor does not power the vehicle. We developed a starter-based start/stop product and launched the product with Hyundai in 2011. In small displacement engines, like those in wide use in light vehicles in Asia, the alternator can be used as the “mild hybrid” power source rather than a starter.

Light vehicles

Our starter products for light vehicle applications offer greater power output in lighter packages for vehicles that are designed to meet increasingly more stringent fuel economy regulations. For example, we launched a redesigned automotive starter that produces more power with 14% less weight than our previous design. We also sell new starters for a wide range of light vehicle models for use as replacement parts.

Commercial vehicles

We manufacture a broad range of heavy-duty starters for use primarily with large diesel engines. Our standard units cover a very wide range of torque and speed requirements. Our commercial vehicle product development for starters has focused on generating more power, torque and life, while reducing size. OEMs are designing engines for more starts per day as anti-idling legislation requires trucks to shut down while loading/unloading freight or stopped for driver downtime. We have developed a patented technology which offers the longest service life as measured by the number of starts and highest output power to drive faster starts. We launched a fully sealed starter for very harsh environments. This starter is well suited for off-highway and military applications. Our portfolio covers the market demand for a higher number of starts and larger engines in North America while also meeting the needs of smaller displacement engines typically used in Europe and Asia.

New alternators

Light vehicles

We offer an extensive range of alternator products for light vehicles designed to cover most output requirements for standard and high-efficiency, low noise units. This diverse portfolio provides proven new parts for OEMs globally, as well as for use as replacement parts.

Commercial vehicles

The increased use of electricity-powered components in commercial vehicles, including in connection with technologies designed to reduce engine emissions, is resulting in higher electrical load requirements. Our product offerings include high-output alternators designed to meet these increasing load demands. These industry changes are also resulting in higher under-hood temperatures and increased vibration. Our products are designed to operate at higher temperatures and provide increased durability. We have developed high temperature heavy-duty alternators that satisfy the standard portion of the market where price is a critical buying factor. We launched a unit which is 10% smaller and operates at a significantly higher temperature (125ºC) than any other unit on the market. Our experience in designing alternators for both light vehicles and commercial vehicles enables us to apply advances made in one vehicle class to others and generates a volume benefit by the ability to share internal components across vehicle classes.

Hybrid electric motors

We make electric traction motors for electric and hybrid vehicle applications, which we refer to as our hybrid electric motors. In a hybrid vehicle application, our electric traction motor is combined with a gasoline or diesel propulsion system to assist in powering the vehicle. Our motors have been used in hybrid bus transmissions since 2002 and on automotive applications since 2007. Our patented winding processes in conjunction with a permanent magnet design deliver among the highest power density and torque density in the industry. This technology provides the basis of our standard platform, allowing commercial and specialty vehicle applications to utilize a common design, create competitive scale and reduce cost.

Remanufactured products

We offer a diverse array of remanufactured starters and alternators for light vehicles. These products include substantially all makes and models of domestic and imported starters and alternators. For commercial vehicles, our remanufactured starters and alternators are predominantly products that we originally manufactured. We also remanufacture power assemblies for locomotive diesel engines and sell a small amount of remanufactured steering gear and brake calipers for light vehicles in Europe.

Starter and alternator technology continues to evolve. We can introduce new models of remanufactured starters and alternators faster than others because we have often made the original product that is being remanufactured.

We also bring our knowledge of advances in technology to bear in remanufacturing products originally made by others.

Customers and distribution channels

Our customer base includes global light and commercial vehicle manufacturers and a large number of retailers, distributors and installers of automotive aftermarket parts. Our credit evaluation process and the geographical dispersion of sales transactions help to mitigate credit risk concentration. We conduct a significant amount of business with GM, three large automotive parts retailers, and a large original equipment manufacturer. Net sales to these customers in the aggregate represented 50.1%, 49.1%, and 49.6% of consolidated net sales for the years ended December 31, 2012, 2011, and 2010, respectively.

GM represents our largest customer and accounted for approximately 20.7%, 20.7%, and 23.0% of the sales for the years ended December 31, 2012, 2011, and 2010, respectively.

OEMs

Our OEM customers include a broad range of global light vehicle producers around the world. GM is our largest OEM customer for light vehicle products, evenly split between North America and the rest of world. Hyundai is our fastest growing OEM customer. It is gaining market share globally, and we have been gaining market share within Hyundai. We are currently their largest supplier of starters and are growing our share of their alternator business. Other notable light vehicle customers include Daimler, DPCA (Dongfeng Peugeot Citroen Automotive), Geely and BYD. Our goal is to expand our customer base and grow with customers who are growing, including Hyundai and other Asian customers.

Principal commercial vehicle OEM customers include Daimler, Caterpillar, Navistar, Mack and Volvo, and Cummins. This mix provides a balance between on-highway trucks and off-highway applications. We also have very strong brand recognition and traditional relationships with the leading operators of commercial vehicle fleets. These fleets will often specify Delco Remy parts as required equipment on their new vehicle purchases from OEMs, and will in many cases purchase upgrades that we offer for increased durability and longer service life as premium options. A key focus of our marketing efforts in commercial vehicle products for OEMs is securing orders for upgrades, which help us generate profits. Currently, our commercial vehicle OEM sales are primarily in North and South America, although we have a growing share in Asia and Europe that we are seeking to expand.

Aftermarket

We are a leading North American rotating electrical supplier to aftermarket customers. We sell both remanufactured and new light vehicle and commercial vehicle starters and alternators into the aftermarket in the United States, Canada, Mexico and Europe, and aftermarket commercial vehicle starters and alternators in Brazil. In North America, we primarily sell our aftermarket products to automotive parts retailers, including AutoZone, Advance Auto Parts and O'Reilly Auto Parts. We also supply warehouse distributors, where we are the preferred supplier of some of the largest buying groups, OES customers, and other smaller middlemen (sometimes called “jobbers”) who distribute parts to installers. We sell substantially more remanufactured units than new units. This mix is consistent with sales in the aftermarket overall.

Auto parts retailers sell parts primarily to the "do it yourself" ("DIY") market. Consumers who purchase parts from the DIY channel generally install parts into their vehicles themselves. In most cases, this is a less expensive alternative to having the repair performed by a professional installer. The second market is the professional installer market, commonly known as the “do it for me” market. This market is served by traditional warehouse distributors, retail chains and the dealer networks. Generally, the consumer in this channel is a professional parts installer. However, large national retailers have increased their efforts to sell to installers and to other smaller middlemen. This change in approach has increased the retailers' market share in the “do it for me” market and hence overall. We are well-positioned to participate in the retailers' growth given our strong relationships with large retailers.

Our primary customers in the aftermarket for commercial vehicle parts are OE dealer networks, independent warehouse distributors and leased truck service groups. Our relationships with trucking fleets also benefit our aftermarket sales, as the fleet operators will often specify that Delco Remy products be used both for initial installation and for subsequent replacements.

In Europe, we principally sell aftermarket products through the warehouse distribution channel. Retail distribution is less developed in Europe than in North America.

Our locomotive assemblies are sold predominantly to Caterpillar's Electro-Motive Diesel (EMD) division.

Sales and distribution

We have an extensive global distribution and logistics network. We employ a direct sales force that develops and maintains sales relationships with our OEM, retail, warehouse distributor and other aftermarket customers, as well as with major North American truck fleet operators. These sales efforts are supplemented by a network of field service engineers and product service engineers. We also use representative agencies to service aftermarket customers in some cases.

Manufacturing and facilities

We operate a global, low-cost manufacturing and sourcing network capable of producing technology-driven products. Our 14 primary manufacturing and remanufacturing facilities are located in eight countries, including Brazil, China, Hungary, Mexico, South Korea, Tunisia, Canada and the United States. There are two manufacturing facilities in the United States, which support a portion of our hybrid electric motor assembly and our locomotive power assembly remanufacturing operations. Neither of these two U.S. manufacturing facilities is unionized. Our low-cost strategy results in direct labor costs of less than 2% of net sales. Our global network of manufacturing facilities employs common tools and processes to drive efficiency improvements and reduce waste. We can shift capacity between operations to minimize cost to adapt to changes in demand, raw material costs and exchange and transportation rates. Because of our established presence and available capacity throughout the world, we are well-positioned for growth with minimal incremental investment.

We have eight manufacturing facilities making new products for OE/OES customers, including two in Mexico, two in China, and one in each of Brazil, South Korea, Hungary and Anderson, Indiana. These modern facilities utilize a flexible cell-based manufacturing approach for production lines for improved flexibility and efficiency in both low- and high-volume production runs. Each operation within a cell is optimized to ensure one-piece flow and other lean operational concepts. Cell manufacturing allows us to match production output better to variable customer requirements while reducing inventory and improving quality. The effectiveness of our approach was tested and proven in the recent market downturn and subsequent recovery. Our distribution facility for these products in North America is in Laredo, TX.

We produce our remanufactured starters and alternators for sale in North America in two facilities in Mexico. For Europe, our remanufactured starters and alternators are made in factories in Tunisia and Hungary. We source our new products for aftermarket sales through third parties, primarily in Asia and from our own manufacturing operations. Our distribution, engineering and administration facilities for these products are in Edmond, Oklahoma for North America and in Brussels for Europe. We conduct no manufacturing in the United States for products sold to our aftermarket customers other than for locomotive power assemblies, which are remanufactured in Peru, Indiana and Winnipeg, Canada.

In our remanufacturing operations, we obtain used starters, alternators and locomotive power assemblies, commonly known as cores, and use them to produce remanufactured products. Most cores are obtained from our customers, who generally deliver us a core for each remanufactured product we sell them. Their end customers in turn deliver their used starter or alternator to the vendor as part of the purchase of the replacement part. We buy approximately 10% of the cores we use from secondary market vendors.

When we receive cores, we sort them by make and model. During remanufacturing, we disassemble the cores into their component parts. We then thoroughly clean, test and refurbish those components that can be incorporated into remanufactured products. We then reassemble remanufactured parts into a finished product. We conduct in-process inspection and testing at various stages of the remanufacturing process. We then inspect each finished product which is tested to meet OEM requirements.

In all our operations, we use frequent communication meetings at all levels of the organization to provide training and instruction, as well as to assure a cohesive, focused effort toward common goals which has proven to be a key element of our recent success. All of our manufacturing facilities are TS certified (a quality and process certification that is a prerequisite for supplying most OEMs), and received numerous supplier quality and performance awards.

Engineering and development

Our engineering staff works both independently and with OEM and aftermarket customers to design new products, improve performance and technical features of existing products and develop methods to lower manufacturing costs. We have over 300 engineers focused on design, application and manufacturing. These engineers work in close collaboration with customers and have a thorough understanding of our product application. Our engineering efforts are designed to create value through innovation, new product features and aggressive cost control.

Our expertise in rotating electrical components led to the development of our hybrid electric motor capabilities as a natural extension of our products. Our HVH electric motor technology is among the industry leaders in power density and torque density. We are applying it in automotive, agricultural, military and specialty markets. Our prior investment in manufacturing process development has provided us with significant, proprietary know-how in hybrid electric motor manufacturing.

For additional information on research and development activities, see Note 2 to our consolidated financial statements included elsewhere in this Form 10-K.

Competition

The automotive components market is highly competitive. Most OEMs and aftermarket customers source the parts that we sell from a limited number of suppliers. We principally compete for new OEM business both at the beginning of the development of new platforms and upon the redesign of existing platforms. New-platform development generally begins two to five years before those models are marketed to the public. Once a supplier has been designated to supply parts for a new program, an OEM usually will continue to purchase those parts from the designated producer for the life of the program, although not necessarily for a redesign. In the aftermarket, many retailers and warehouse distributors purchase starters and alternators from only one or two suppliers, under contracts that run for up to five years. When contracts are up for renewal, competitors tend to bid very aggressively to replace the incumbent supplier, although the cost of switching from the incumbent tends to mitigate this competition.

Our customers typically evaluate us and other suppliers based on many criteria such as quality, price/cost competitiveness, product performance, reliability and timeliness of delivery, new product and technology development capability, excellence and flexibility in operations, degree of global and local presence, effectiveness of customer service and overall management capability. We compete with a number of companies that supply vehicle manufacturers throughout the world. In the light vehicle market, our principal competitors include BBB Industries, Bosch, Denso, Hitachi, Mitsubishi, Motorcar Parts of America and Valeo. In the commercial vehicle market, our competitors include Bosch, Denso, Mitsubishi and Prestolite.

Patents, licenses and trademarks

We have an intellectual property portfolio that includes over 400 issued and pending patents in the United States and foreign countries. While we believe this intellectual property in the aggregate is important to our competitive position, no single patent or patent application is material to us.

We own the “Remy” and “World Wide Automotive” trademarks. Pursuant to a trademark license agreement between us and GM, GM granted us an exclusive license to use the “Delco Remy” trademark on and in connection with automotive starters and heavy-duty starters and alternators. This license is extendable indefinitely at our option upon payment of a fixed $100,000 annual licensing fee to GM. The “Remy” and “Delco Remy” trademarks are registered in the United States, Canada and Mexico and in most major markets worldwide. GM has agreed with us that, upon our request, GM will register the “Delco Remy” trademark in any jurisdiction where it is not currently registered.

Purchased materials

We continually aim to reduce input material and component costs and streamline our supply chain. Our global sourcing strategy is designed to ensure the desired quality and the lowest delivered cost of our required inputs. Our strategy focuses on local material sourcing and the development of standardized processes in freight and logistics that result in the lowest total cost for our global operations.

Principal purchased materials for our business include aluminum castings, gray and ductile iron castings, armatures, solenoids, copper wire, electronics, steel shafts, forgings, bearings, commutators, magnets and carbon brushes. All of these materials are presently readily available from multiple suppliers. We do not foresee difficulty in obtaining adequate inventory supplies. We generally follow the industry practice of passing on to our original equipment customers a portion of the costs or benefits of fluctuation in copper, steel and aluminum prices. For our copper exposure not passed through to customers, we generally purchase hedges for a significant portion and also have a natural hedge in copper, aluminum and steel scrap recovered in our remanufacturing operations. In general, we do not hedge our aluminum and steel exposures. For high volume materials, we typically purchase a portion of our raw materials through multiple-year contracts with price adjustments allowed for changes in metals prices and currency exchange rates.

Foreign operations

Information about our foreign operations is set forth in tables relating to geographic information in Note 20 to our consolidated financial statements included in this Form 10-K.

Employees

As of December 31, 2012, we employed 6,631 people, of which 1,519 were salaried and administrative employees and 5,112 were hourly employees. We had 934 of our employees based in the United States. Our employees represented by trade unions were approximately 3,120, or 47% of our employees in nine countries. Efforts to organize labor unions at facilities that are not currently unionized may be commenced at any time; however, we are not aware of any current efforts. We believe that our relations with our employees are satisfactory.

History

On July 31, 1994, our predecessor, Remy Worldwide Holdings, Inc., purchased substantially all of the assets, other than facilities, of the Delco Remy division of GM in a leveraged buyout. The specific business activities purchased were engaged in the design, manufacture, remanufacture and sale of starters and alternators, among other things, for light and commercial vehicles. The predecessors to these businesses first started their operations nearly 100 years ago. When we first separated from GM in 1994, we sold a substantial majority of our products to GM. Over the years, we have substantially diversified our revenue base.

On October 8, 2007, our predecessor and its domestic subsidiaries, filed voluntary petitions under a prepackaged arrangement for relief under Chapter 11 of the U.S. Bankruptcy Code. The petitions were filed in the U.S. Bankruptcy Court for the District of Delaware, and this proceeding was administered under Case No. 07-11481 (KJC). During bankruptcy, our predecessor operated its business as debtors-in-possession under the jurisdiction of the bankruptcy court and in accordance with the Bankruptcy Code and orders of the Bankruptcy Court. Our subsidiaries in Canada, Europe, Asia Pacific, Mexico and Brazil were not included in the filings. On November 20, 2007, the Bankruptcy Court confirmed the proposed plan of reorganization pursuant to the Bankruptcy Code, and we emerged from bankruptcy protection on December 6, 2007, the effective date of the plan of reorganization.

The plan of reorganization generally provided for the full payment or reinstatement of allowed administrative claims, priority claims and secured claims. The plan provided for the issuance, by us, of new equity and debt securities to our and our predecessor's creditors in full satisfaction of allowed unsecured claims. Further, our current supply agreement with GM has been in effect since July 31, 2007 when it was renegotiated in connection with our Chapter 11 proceeding.

GM and certain of its direct and indirect subsidiaries filed on June 1, 2009 for protection under Chapter 11 of the U.S. Bankruptcy Code. On July 10, 2009, a substantial portion of GM began operations under a new corporate legal structure, called new GM, which acquired substantially all of the assets of the pre-bankruptcy GM. Under this process, we received payment on substantially all amounts invoiced at the time GM filed for bankruptcy and we entered into a Cure Agreement in which new GM assumed all principal contracts under which we conduct our business with them.

Environmental regulation

Our facilities and operations are subject to a wide variety of federal, state, local and foreign environmental laws, regulations, ordinances and directives. These laws, regulations, ordinances and directives, which we collectively refer to as environmental laws, include those related to air emissions, wastewater discharges, chemical and hazardous material, substance and waste management, treatment, storage or disposal, restriction on use of certain hazardous materials and the investigation and remediation of contamination. These environmental laws also require us to obtain permits for some of our operations from governmental authorities. These authorities can modify or revoke our permits and can enforce compliance through fines and injunctions. Our operations also are governed by laws relating to workplace safety and worker health, primarily the Occupational Safety and Health Act, its implementing regulations and analogous state laws and regulations, and foreign counterparts to these laws and regulations, which we refer to as employee safety laws. The nature of our operations exposes us to the risk of liabilities or claims with respect to environmental and employee safety laws.

We believe that the future cost of complying with existing environmental laws (or liability for known environmental claims) and employee safety laws will not have a material adverse effect on our business, financial condition and results of operations. However, future events, such as the enactment of new laws, changes in existing environmental laws and employee safety laws, or their interpretation, or the discovery of presently unknown

conditions, may give rise to additional compliance costs or liabilities. For example, in January 2011, the U.S. Environmental Protection Agency began regulating greenhouse gas emissions from certain mobile and stationary sources pursuant to the Clean Air Act. Future legislative and regulatory initiatives concerning climate change or the reduction of greenhouse gas emissions could affect our business (including indirect impacts of regulation on business trends, such as customer demand), financial condition and results of operations. In addition, future international initiatives concerning climate change or greenhouse gas emissions could give rise to additional compliance costs or liabilities.

Certain environmental laws hold current and former owners or operators of land or businesses liable for their own, and as to current owners or operators only, for previous owners' or operators', releases of hazardous substances or wastes, and for releases at third-party waste disposal sites. Because of the nature of our operations, the long history of industrial uses at some of our facilities, the operations of predecessor owners or operators of certain of the businesses and the use, production and release of hazardous substances or wastes at these sites, we could become liable under environmental laws for investigation and cleanup of contaminated sites. Some of our current or former facilities have experienced in the past or are currently undergoing some level of regulatory scrutiny or investigation or remediation activities, and are, or may become, subject to further regulatory inspections, future requests for investigation or liability for past practices.

Asbestos Claims and Litigation

We have historically been named as a defendant in a number of lawsuits alleging exposure to asbestos and asbestos-containing products by former GM employees. We were successful in getting these matters dismissed on the grounds that the plaintiffs were employees of GM, not our company, following the 1994 asset purchase of the Delco Remy Division of GM. We also received an indemnification from GM concerning costs associated with asbestos exposure claims involving former GM employees.

GM and certain of its direct and indirect subsidiaries filed on June 1, 2009 for protection under Chapter 11 of the U.S. Bankruptcy Code. On July 10, 2009, a substantial portion of GM began operations under a new corporate legal structure, called new GM, which acquired substantially all of the assets of the pre-bankruptcy GM. Following GM's June 2009 filing for protection under Chapter 11 of the U.S. Bankruptcy Code, the indemnification and certain other arrangements were disputed. However, we negotiated a settlement of these issues with new GM whereby, through an Order of the United States Bankruptcy Court for the Southern District of New York, we were accorded protected party status, which requires that any future asbestos exposure claims by former GM employees be directed to an asbestos trust, rather than brought against us directly.

Item 1A. Risk factors

In addition to the normal risks of business, we are subject to significant risks and uncertainties, including those listed below and others described elsewhere in this Annual Report on Form 10-K. Any of the risks described herein could result in a significant or material adverse effect on our results of operations or financial condition.

General economic conditions may have an adverse effect on our business, financial condition and results of operations.

The recent global financial crisis has impacted our business and our customers' businesses in the United States and globally. During 2009, the United States experienced its lowest light vehicle production rate in over 25 years, and commercial vehicle production declined by 38%. Since 2009, U.S. vehicle production has improved, but is still less than the average for the period during 2000 to 2007. The light and commercial vehicle industries in Europe and Asia faced similar trends. Continued weakness or deteriorating conditions in the U.S. or global economy that result in reduction of vehicle production and sales by our customers may harm our business, financial condition and results of operations. Additionally, in a down-cycle economic environment, we may experience increased competitive pricing pressure and customer turnover.

Deteriorating economic conditions impact driving habits of both consumers and commercial operators, leading to a reduction in miles driven. If total miles driven decreases, demand for our aftermarket products could decline due to a reduction in the need for replacement parts.

Difficult economic conditions may cause changes to the business models, products, financial condition, consumer financing and rebate programs of the OEMs. This could reduce the number of vehicles produced and purchased, which would, in turn, reduce the demand for both our OEM and aftermarket products. Our contracts do not require our customers to purchase any minimum volume of our products.

Recent economic conditions have generally increased the availability of capital and decreased the cost of financing. If we, our customers or our suppliers experience a material tightening in the availability of credit, it could adversely affect us. Among other possible effects, we may have to pay suppliers in advance or on short credit terms, which would harm our liquidity or lead to production interruptions.

Risks specific to the light and commercial vehicle industries affect our business.

Our operations, and, in particular, our OE business, are inherently cyclical and depend on many industry-specific factors such as:

| |

| • | credit availability and interest rates; |

| |

| • | fuel prices and availability; |

| |

| • | consumer confidence, spending and preference; |

| |

| • | costs related to environmental hazards; |

| |

| • | governmental incentives; and |

Our business may also be adversely affected by regulatory requirements, trade agreements, our customers' labor relations issues, reduced demand for our customers' product programs that we currently support, the receipt of sales orders for new or redesigned products that replace our current product programs and other factors. The current political environment has led, and may lead in the future, to further federal, state and local government budget cuts. We have in the past received governmental grants that benefit our industry. A significant adverse change in any of these factors may reduce automotive production and sales by our customers, which would materially harm our business, financial condition and results of operations.

Inventory levels and our OE customers' production levels also affect our OE sales. We cannot predict when our customers either increase or reduce inventory levels. This may result in variability in our sales and financial condition. Uncertainty regarding inventory levels may be exacerbated by our customers or governments initiating or terminating consumer financing programs.

Longer useful product life of parts may reduce aftermarket demand for some of our products.

In 2011 and 2012, roughly half of our net sales were to aftermarket customers. The average useful life of automotive parts has been steadily increasing in recent years due to improved quality and innovations in products and technologies. The longer product lives allow vehicle owners to replace parts of their vehicles less often. Additional increases in the average useful life of automotive parts are likely to reduce the demand for our aftermarket products, which could materially harm our business, financial condition and results of operations.

We may incur material losses and costs as a result of product liability and warranty claims, litigation and other disputes and claims.

We are exposed to warranty and product liability claims if our products fail to perform as expected. We have in the past been, and may in the future be, required to participate in a recall of those products. If public safety concerns are raised, we may have to participate in a recall even if our products are ultimately found not to be defective. Vehicle manufacturers have experienced increasing recall campaigns in recent years. Our customers and other OEMs are increasingly looking to us and other suppliers for contribution when faced with recalls and product liability claims. If our customers demand higher warranty-related cost recoveries, or if our products fail to perform as expected, our business, financial condition and results of operations could materially suffer.

We may also be exposed to product liability claims, warranty claims and damage to our reputation if our products (including the parts of our products produced by third-party suppliers) actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury or property damage. Recalls may also cause us to lose additional business from our customers. Material product defect issues may subject us to recalls of those products and restrictions on bidding on new customer programs. We have in the past incurred, and could in the future incur, material warranty or product liability losses and costs to defend these claims.

We are also involved in various legal proceedings incidental to our business. See “Business-Legal proceedings.” There can be no assurance as to the ultimate outcome of any of these legal proceedings, and future legal proceedings may materially harm our business, financial condition and results of operations.

Changes in the cost and availability of raw materials and supplied components could harm our financial performance.

We purchase raw materials and component parts from outside sources. The availability and prices of raw materials and component parts may change due to, among other things, new laws or regulations, increased demand from the

automotive sector and the broader economy, suppliers' allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and worldwide price levels. In recent years, market conditions have caused significant increases in the price of some raw materials and component parts and, in some cases, reductions in short-term availability. We are especially susceptible to changes in the price and availability of copper, aluminum, steel and certain rare earth magnets. The price of these materials has fluctuated significantly in recent years. An increase in the price of these magnets, or a reduction in their supply, could harm our business.

Raw material price inflation and availability have placed significant operational and financial burdens on automotive suppliers at all levels, and are expected to continue for the foreseeable future. Our need to maintain a continuing supply of raw materials and components makes it difficult to resist price increases and surcharges imposed by our suppliers. Further, it is difficult to pass cost increases through to our customers, and, if passed through, recovery is typically delayed. Because the recognition of the cost/benefit and the price recovery/reduction do not occur in the same period, the impact of a change in commodity cost is not necessarily offset by the change in sales price in the same period. Accordingly, a change in the supply of, or price for, raw materials and components could materially harm our business, financial condition and results of operations.

Disruptions in our or our customers' supply chain may harm our business.

We depend on a limited number of suppliers for certain key components and materials. In order to reduce costs, our industry has been rationalizing and consolidating its supply base. Suppliers may delay deliveries to us due to failures caused by production issues, and they may also deliver non-conforming products. Recently, several suppliers have ceased operations.

If one of our suppliers experiences a supply shortage or disruption, we may be unable to procure the components from another source to produce the affected products. The lack of a subcomponent necessary to manufacture one of our products could force us to cease production. Shortages and disruptions could be caused by many problems, such as closures of one of our suppliers' plants or critical manufacturing lines due to strikes, mechanical breakdowns, electrical outages, fires, explosions or political upheaval, or logistical complications due to weather, natural disasters, mechanical failures or delayed customs processing. Also, we and our suppliers deliver products on a just-in-time basis, which is designed to maintain low inventory levels but increases the risk of supply disruptions.

Products delivered by our suppliers may fail to meet quality standards. Potential quality issues could force us to halt deliveries while we revalidate the affected products. When deliveries are not timely, we have to absorb the cost of identifying and solving the problem, as well as expeditiously producing replacement components or products. We may also incur costs associated with “catching up,” such as overtime and premium freight. Our customers may halt or delay their production for the same reason if one of their suppliers fails to deliver necessary components. This may cause our customers to suspend their orders or instruct us to suspend delivery of our products, which may harm our business, financial condition and results of operations. In turn, if we cause a customer to halt production, the customer may seek to recoup its losses and expenses from us, which could be significant or include consequential losses.

Shortages of and volatility in the price of oil may materially harm our business, financial condition and results of operations.

The price and availability of oil impacts our business in numerous ways. Oil prices are very volatile. In general an increase in oil prices, or a shortage of oil, may reduce demand for vehicles or shift demand to smaller, more fuel-efficient vehicles, which provide lower profit margins. Also, an increase in oil prices may reduce the average number of miles driven. Lower vehicle demand or average number of miles driven would, in turn, reduce the demand for both our OE and aftermarket products. An increase in the price of oil could also increase the cost of the plastic components we use in our products. Conversely, lower fuel prices may negatively impact demand for hybrid-powered vehicles, which may also adversely affect our business. Accordingly, shortages and volatility in the price of oil may materially harm our business, financial condition and results of operations.

The loss or the deteriorating financial condition of a major customer could materially harm our business, financial condition and results of operations.

The majority of our sales are to automotive and heavy-duty OEMs, OEM dealer networks, automotive parts retail chains and warehouse distributors. We depend on a small number of customers with strong purchasing power. Our five largest customers represented 50% and 49% of our net sales for 2012 and 2011, respectively. GM, our largest customer, accounted for 21% and 21% of our net sales for 2012 and 2011, respectively.

One or more of our top customers may cease to require all or any portion of the products or services we currently provide or may develop alternative sources, including their own in-house operations, for those products or services.

Customers may restructure, which could include significant capacity reductions or reorganization under bankruptcy laws. The loss of any of our major customers, reduction in their demand for our products or substantial restructuring activities by our major customers could materially harm our business, financial condition and results of operations. OE and OES customers accounted for 62% and 61% of our net sales for 2012 and 2011, respectively.

We face substantial competition. Our failure to compete effectively could adversely affect our net sales and results of operations.

The automotive industry is highly competitive. We and most of our competitors are seeking to expand market share with new and existing customers. Our customers award business based on, among other things, price, quality, service, delivery, manufacturing and distribution capability, design and technology. Our competitors' efforts to grow market share could exert downward pressure on our product pricing and margins. Overseas manufacturers, particularly those located in China, are increasing their operations and could become a significant competitive force in the future. If we are unable to differentiate our products or maintain low-cost manufacturing, we may lose market share or be forced to reduce prices, which would lower our margins. Our business may also suffer if we fail to meet customer requirements.

Some of our competitors may have advantages over us, which could affect our ability to compete effectively. For example, some of our competitors:

| |

| • | are divisions or subsidiaries of companies that are larger and have substantially greater financial resources than we do; |

| |

| • | are affiliated with OEMs or have a “preferred status” as a result of special relationships with certain customers; |

| |

| • | have economic advantages as compared to our business, such as patents and existing underutilized capacity; and |

| |

| • | are domiciled in areas that we are targeting for growth. |

OEMs and suppliers are developing strategies to reduce costs and gain a competitive advantage. These strategies include supply base consolidation and global sourcing. The consolidation trend among automotive parts suppliers is resulting in fewer, larger suppliers who benefit from purchasing and distribution economies of scale. If we cannot achieve cost savings and operational improvements sufficient to allow us to compete favorably in the future, our financial condition and results of operations could suffer due to a reduction of, or inability to increase, sales sufficient to offset other price increases.

Our competitors may foresee the course of market development more accurately than we do, develop products that are superior to our products, have the ability to produce similar products at a lower cost than we can or adapt more quickly than we do to new technologies or evolving regulatory, industry or customer requirements.

Work stoppages or other labor issues at our facilities or the facilities of our customers or suppliers could adversely affect our operations.

Some of our employees, a substantial number of the employees of our largest customers, the employees of our suppliers and the employees of other suppliers to the automotive industry are members of industrial trade unions and are employed under the terms of collective bargaining agreements. To our knowledge, 3,120 of our employees globally are represented by trade unions. Difficult conditions in the light and commercial vehicle industries and actions taken by us, our customers, our suppliers and other suppliers to address negative industry conditions may have the side effect of exacerbating labor relations problems, which could increase the possibility of work stoppages.

We may not be able to negotiate acceptable contracts with unions, and our failure to do so may result in work stoppages. We have agreements with a number of unions in different countries. These agreements expire or are subject to renewal at various times. One or more of these unions could elect not to renew its contract with us. Also, work stoppages at our customers, our suppliers or other suppliers to the automotive industry could cause us to shut down our production facilities or prevent us from meeting our delivery obligations to our customers. The industry's reliance on just-in-time delivery of components could also worsen the effects of any work stoppage. A work stoppage at one or more of our facilities, or the facilities of suppliers and our customers, could materially harm our business, financial condition and results of operations.

Our success partly depends on our development of improved technology-based products and our ability to adapt to changing technology.

Some of our products are subject to changing technology or may become less desirable or be rendered obsolete by changes in legislative, regulatory or industry requirements. Our continued success depends on our ability to

anticipate and adapt to these changes. We may be unable to achieve and maintain the technological advances, machinery and knowledge that may be necessary for us to remain competitive.

We may need to incur capital expenditures and invest in research and development and manufacturing in amounts exceeding our current expectations. We may decide to develop specific technologies and capabilities in anticipation of customers' demands for new innovations and technologies. If this demand does not materialize, then we may be unable to recover the costs incurred to develop those particular technologies and capabilities. If we are unable to recover these costs, or if any development programs do not progress as expected, our business could materially suffer.

To compete, we must be able to launch new products to meet our customers' demand in a timely manner. However, we may be unable to install and certify the equipment needed to manufacture products for new programs in time for the start of production. Transitioning our manufacturing facilities and resources to full production under new product programs may impact production rates and other operational efficiency measures at our facilities. Our customers may not launch new product programs on schedule. Our failure to successfully launch new products, a delay by our customers in introducing our new products or a failure by our customers to successfully launch new programs, could materially harm our business, financial condition and results of operations.

We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance of our customers' vehicles or of our products, delays in product development and failure of products to operate properly. Further, we may be unable to adequately protect our technological developments, which could prevent us from maintaining a sustainable competitive advantage.

A failure to attract and retain executive officers and key personnel could harm our ability to operate effectively.

Our ability to operate our business and implement our strategies effectively partly depends on the efforts of our executive officers and other key employees. Our future success will depend on, among other factors, our ability to attract and retain other qualified personnel in key areas, including engineering, sales and marketing, operations,

information technology and finance. The loss of the services of any of our key employees or our failure to attract or retain other qualified personnel could materially harm our business, financial condition and results of operations.

We may be unable to take advantage of, or successfully complete, potential acquisitions, business combinations and joint ventures.

We may pursue acquisitions, business combinations or joint ventures that we believe present opportunities to enhance our market position, extend our technological and manufacturing capabilities or realize significant synergies, operating expense reductions or overhead cost savings. This strategy will partly depend on whether suitable acquisition targets or joint ventures are available on acceptable terms and our ability to finance the purchase price of acquisitions or the investment in joint ventures. We may also be unable to take advantage of potential acquisitions, business combinations or joint ventures because of regulatory or other concerns. For example, the agreements governing our indebtedness may restrict our ability to engage in certain mergers or similar transactions.

Acquisitions, business combinations and joint ventures may expose us to additional risks.

Any acquisition, business combination or joint venture that we engage in could present a variety of risks. These risks include the following:

| |

| • | the incurrence of debt or contingent liabilities and an increase in interest expense and amortization expenses related to intangible assets with definite lives; |

| |

| • | our failure to discover liabilities of the acquired company for which we may be responsible as a successor owner or operator, despite any investigation we make before the acquisition; |

| |

| • | the diversion of management's attention from our core operations as they attend to any business integration issues that may arise; |

| |

| • | the loss of key personnel of the acquired company or joint venture counterparty; |

| |

| • | our becoming subject to material liabilities as a result of failure to negotiate adequate indemnification rights; |

| |

| • | difficulties in combining the standards, processes, procedures and controls of the new business with those of our existing operations; |

| |

| • | difficulties in coordinating new product and process development; |

| |

| • | difficulties in integrating product technologies; and |

| |

| • | increases in the scope, geographic diversity and complexity of our operations. |

Our failure to integrate acquired businesses successfully into our existing businesses could cause us to incur unanticipated expenses and losses, which could materially harm our business, financial condition and results of operations.