UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08397

| The Marsico Investment Fund |

| (Exact name of Registrant as specified in charter) |

| |

1200 17th Street, Suite 1600 |

| Denver, Colorado 80202 |

| (Address of principal executive offices) (Zip code) |

| |

| Christopher J. Marsico |

| The Marsico Investment Fund |

1200 17th Street, Suite 1600 |

| Denver, Colorado 80202 |

| (Name and address of agent for service) |

Copies to:

Sander M. Bieber, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant's telephone number, including area code: (303) 454-5600

Date of fiscal year end: September 30

Date of reporting period: March 31, 2011

| Item 1. | Reports to Stockholders |

SEMI-ANNUAL REPORT

MARCH 31, 2011

DEAR SHAREHOLDER:

Enclosed is your semi-annual report for The Marsico Investment Fund, encompassing the six-month fiscal period from October 1, 2010 to March 31, 2011.

The purpose of this report is to provide a retrospective for the Marsico Funds’ six-month investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as compared to the Funds’ performance benchmark indexes. For updated information regarding the market environment and the Funds’ overall investment postures and performance, please refer to the Funds’ most recent monthly fact sheets and quarterly investment updates, which are available under the name of each Fund on the Funds’ website at www.marsicofunds.com.

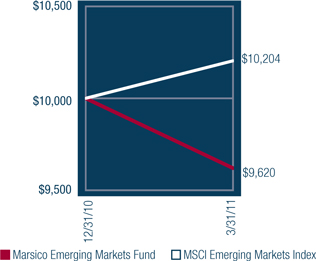

NOTE REGARDING THE NEW MARSICO EMERGING MARKETS FUND

The Marsico Emerging Markets Fund (ticker: MERGX) is a new mutual fund portfolio that was added to the Marsico Funds family on December 31, 2010. The Emerging Markets Fund has three co-managers: Munish Malhotra, CFA, Joshua Rubin, and Charles Wilson of Marsico Capital Management, the investment adviser to the Fund. The performance of the Emerging Markets Fund during the three-month period ended March 31, 2011 and other matters are discussed later in this Semi-Annual Report. Please see the Marsico Funds’ Prospectus dated February 1, 2011 for more information about the Emerging Markets Fund.

| KEY FUND STATISTICS | 2 |

| MARKET ENVIRONMENT | 5 |

| | |

| MARSICO FOCUS FUND |

| Investment Review | 8 |

| Fund Overview | 11 |

| Schedule of Investments | 12 |

| | |

| MARSICO GROWTH FUND |

| Investment Review | 8 |

| Fund Overview | 13 |

| Schedule of Investments | 14 |

| | |

MARSICO 21st CENTURY FUND |

| Investment Review | 16 |

| Fund Overview | 18 |

| Schedule of Investments | 19 |

| | |

| MARSICO INTERNATIONAL OPPORTUNITIES FUND |

| Investment Review | 20 |

| Fund Overview | 22 |

| Schedule of Investments | 23 |

| | |

| MARSICO FLEXIBLE CAPITAL FUND |

| Investment Review | 25 |

| Fund Overview | 27 |

| Schedule of Investments | 28 |

| | |

| MARSICO GLOBAL FUND |

| Investment Review | 30 |

| Fund Overview | 32 |

| Schedule of Investments | 33 |

| | |

| MARSICO EMERGING MARKETS FUND |

| Investment Review | 35 |

| Fund Overview | 37 |

| Schedule of Investments | 38 |

| | |

| FINANCIAL STATEMENTS | 40 |

| NOTES TO FINANCIAL STATEMENTS | 50 |

| EXPENSE EXAMPLE | 59 |

CONSIDERATION OF INVESTMENT ADVISORY AGREEMENTS | 60 |

| OTHER INFORMATION | 63 |

| KEY FUND STATISTICS (UNAUDITED) |

| | | | | Marsico |

| Marsico | | Marsico | | 21st Century |

| Focus Fund | | Growth Fund | | Fund |

| MFOCX | | MGRIX | | MXXIX |

| | | | | |

| For additional disclosures, please see page 11. | | For additional disclosures, please see page 13. | | For additional disclosures, please see page 18. |

| | | | | |

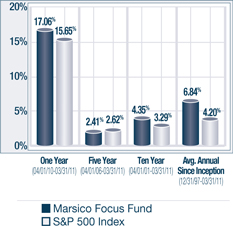

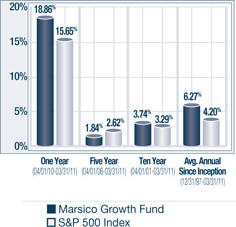

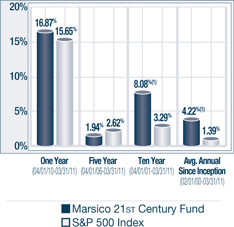

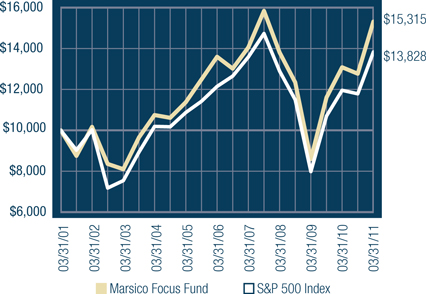

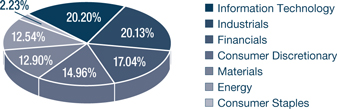

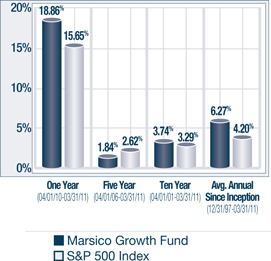

PERFORMANCE COMPARISON(1) | | PERFORMANCE COMPARISON(1) | | PERFORMANCE COMPARISON(1) |

| | | | | |

| | | | |

| | | | | |

TOTAL ANNUAL OPERATING EXPENSES* 1.34% | | TOTAL ANNUAL OPERATING EXPENSES* 1.34% | | TOTAL ANNUAL OPERATING EXPENSES* 1.38% |

| | | | | |

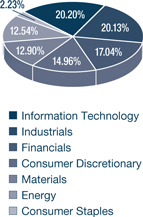

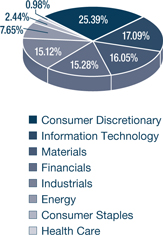

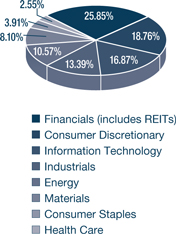

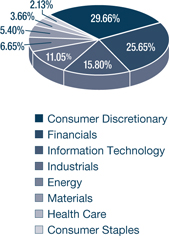

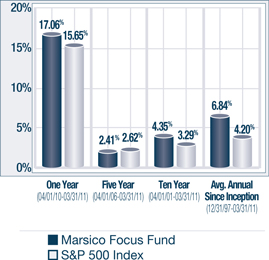

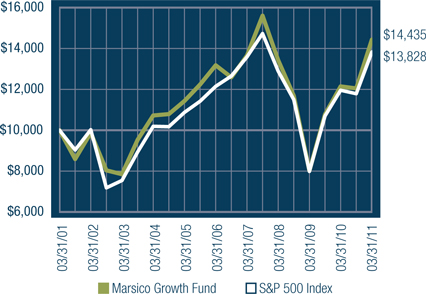

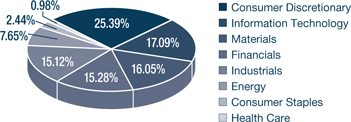

SECTOR ALLOCATION(2) | | SECTOR ALLOCATION(2) | | SECTOR ALLOCATION(2) |

| | | | | |

| | | | |

| | | | | |

| TOP FIVE HOLDINGS | | TOP FIVE HOLDINGS | | TOP FIVE HOLDINGS |

| | | | | |

| APPLE, INC. | 8.35% | | APPLE, INC. | 5.49% | | THE WALT DISNEY COMPANY | 5.33% |

| BAIDU, INC. SPON. ADR | 5.79% | | BAIDU, INC. SPON. ADR | 4.58% | | WELLS FARGO & COMPANY | 5.20% |

| ORACLE CORPORATION | 5.52% | | ORACLE CORPORATION | 4.17% | | WILLIAMS-SONOMA, INC. | 5.14% |

| EATON CORPORATION | 5.34% | | THE DOW CHEMICAL COMPANY | 3.83% | | THE PNC FINANCIAL SERVICES GROUP, INC. | 5.00% |

| MONSANTO COMPANY | 4.58% | | PRICELINE.COM, INC. | 3.72% | | INTUITIVE SURGICAL, INC. | 4.06% |

For additional disclosures about the Marsico Funds, please see page 4. The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| KEY FUND STATISTICS (UNAUDITED) |

| Marsico | | | | |

| International | | Marsico | | Marsico |

| Opportunities Fund | | | | Global Fund |

| MIOFX | | MFCFX | | MGLBX |

| | | | | |

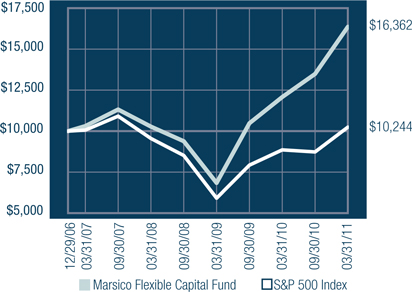

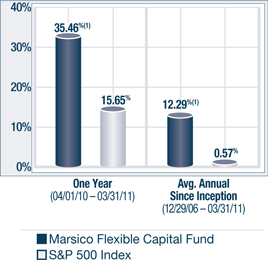

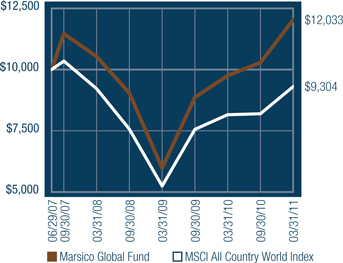

| For additional disclosures, please see page 22. | | For additional disclosures, please see page 27. | | For additional disclosures, please see page 32. |

| | | | | |

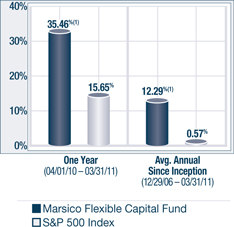

PERFORMANCE COMPARISON(1) | | PERFORMANCE COMPARISON(1) | | PERFORMANCE COMPARISON(1) |

| | | | | |

| | | | |

| | | | | |

TOTAL ANNUAL OPERATING EXPENSES* 1.54% | | TOTAL ANNUAL OPERATING EXPENSES* 1.49% | | TOTAL ANNUAL OPERATING EXPENSES* 1.56% |

| | | | | |

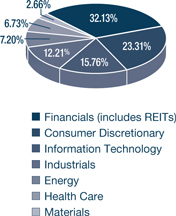

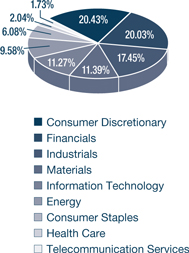

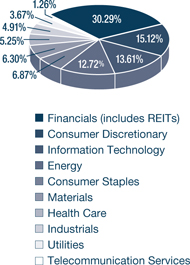

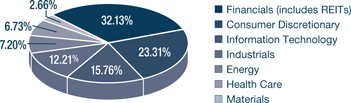

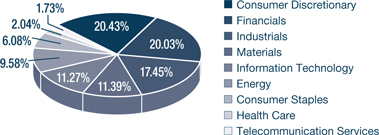

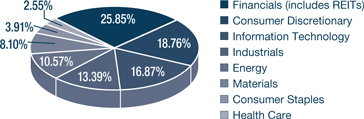

SECTOR ALLOCATION(2) | | SECTOR ALLOCATION(2) | | SECTOR ALLOCATION(2) |

| | | | | |

| | | | |

| | | | | |

| TOP FIVE HOLDINGS | | TOP FIVE HOLDINGS | | TOP FIVE HOLDINGS |

| | | | | |

| OGX PETRÓLEO E GÁS PARTICIPAÇÕES S.A. | 5.02% | | SENSATA TECHNOLOGIES HOLDING N.V. | 6.28% | | WELLS FARGO & COMPANY | 5.14% |

| BASF S.E. | 3.39% | | TARGA RESOURCES CORPORATION | 3.60% | | INDUSTRIA DE DISENO TEXTILE S.A. (INDITEX) | 4.82% |

| LI & FUNG LTD. | 3.20% | | LI & FUNG LTD. | 3.35% | | COMPAGNIE FINANCIÈRE RICHEMONT SA | 4.24% |

| SWATCH GROUP AG | 3.14% | | THE TJX COMPANIES, INC. | 3.20% | | THE PNC FINANCIAL SERVICES GROUP, INC. | 4.22% |

| SCHNEIDER ELECTRIC S.A. | 2.78% | | ORACLE CORPORATION | 3.18% | | OGX PETRÓLEO E GÁS PARTICIPAÇÕES S.A. | 3.76% |

Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

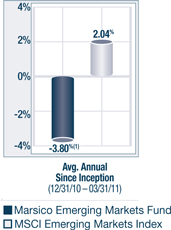

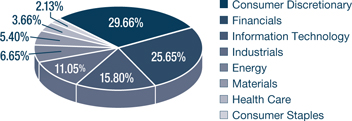

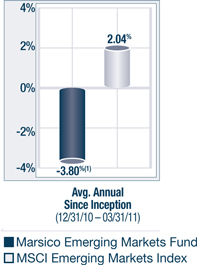

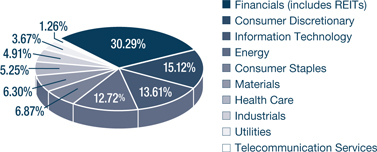

| KEY FUND STATISTICS (UNAUDITED) |

Marsico

Emerging

Markets Fund

MERGX

For additional disclosures, please see page 37.

PERFORMANCE COMPARISON(1)

TOTAL ANNUAL OPERATING EXPENSES* 3.36%

NET EXPENSE*† 1.75%

| | |

| OGX PETRÓLEO E GÁS PARTICIPAÇÕES S.A. | 7.41% |

| BR MALLS PARTICIPACOES S.A. | 5.08% |

| ODONTOPREV S.A. | 3.19% |

| PT BANK RAKYAT INDONESIA PERSERO TBK | 3.16% |

| ICICI BANK LTD. SPON. ADR | 3.09% |

ADDITIONAL DISCLOSURES ABOUT THE MARSICO FUNDS

| * | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2011. The information may differ from the expense ratios disclosed in this report. |

| † | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation agreement under which it has agreed to limit the total expenses (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.75% of the Emerging Markets Fund’s average net assets until January 31, 2012. This fee waiver may be terminated at any time after January 31, 2012. The Adviser may recoup any waived amount from a Fund pursuant to this arrangement if such reimbursement does not cause the Fund to exceed existing expense limitations and the reimbursement is made within three years after the year in which the Adviser incurred the expense. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less. |

The performance included in the chart does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

The performance returns for the 21st Century Fund (for the period prior to March 31, 2004), the International Opportunities Fund (for the period prior to September 30, 2004), the Flexible Capital Fund (for the period prior to February 1, 2011), the Global Fund (for the period prior to January 1, 2009 and from April through May 2009), and the Emerging Markets Fund (for the periods ended March 31, 2011) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. The performance returns for the 21st Century Fund (for the period beginning April 2004 through January 2005), the International Opportunities Fund (for the period beginning October 2004 through December 2005) and the Global Fund (for the one-month period June 2009) would have been higher but for the reimbursement of fees waived previously.

| (2) | Sector weightings represent the percentage of the respective Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARKET ENVIRONMENT: OCTOBER 2010 – MARCH 2011 (UNAUDITED)

Broad equity market indices posted strong returns for the six-month period ended March 31, 2011. US and international equities demonstrated considerable fortitude during the period, undeterred by a number of headwinds and “black swan” events – including the tragic earthquake and tsunami in Japan, geopolitical unrest in the Middle East and North Africa, higher oil prices, global inflationary pressures, record-high food costs, a still-struggling US housing market, rekindled worries about the financial health of some Eurozone countries, central bank tightenings in many countries, and federal budget controversy in Washington.

Equities shook off these issues and were bolstered by a generally sanguine outlook for the global economy, highlighted by still-robust levels of growth in developing economies and increasing signs that the glide path for the US economy continued to improve. However, that positive view was challenged as a result of the potential for a sustained increase in oil prices to dampen that growth.

US equity markets were bolstered by a variety of factors, chief among them additional signs of a resilient economy and a recovery that appeared to be both broadening out and gaining momentum. That positive perspective seemed to be anchored by indications of healing in the labor markets, increased bank lending activity, a constructive outlook for corporate earnings and evidence that massive cash positions on corporate balance sheets were starting to be deployed into productive activities such as dividend increases, share buybacks, accretive acquisitions and capital spending projects. Investors in general seemed to be more favorably disposed to equities; net inflows into equity mutual funds turned positive for the first time in several years. At period-end, both the S&P 500 Index and Russell 1000 Index had rallied more than 100% off their March 2009 “lows.”

International equities posted more muted gains than their US counterparts. Although a global growth recovery seemed on balance to be gaining further traction, international markets faced renewed concerns regarding the Eurozone’s financial stability, nascent signs of higher inflation in some countries (especially those whose inflation indexes are significantly influenced by food prices), and fiscal and monetary policy tightening measures undertaken – or being contemplated – in China, India and Brazil. Rapidly-escalating geopolitical developments in the Middle East and North Africa, the disastrous earthquake and tsunami in Japan, and fears of a major nuclear crisis there, were further areas of concern.

As depicted in the table below, US markets, led by small and medium-capitalization equities, posted strong returns, while international markets experienced more muted gains:

| | Universe of | Six-Month |

Index Name(1) | Equities Represented | Total Return |

| US | | |

| | | |

| S&P 500 | US large-capitalization equities | +17.31% |

| | | |

| Russell 3000 | US publicly-traded equities of all sizes | +18.71% |

| | | |

| Russell 2000 | US small-capitalization equities | +25.48% |

| | | |

| Russell Mid-Cap | US medium-capitalization equities | +21.70% |

| | | |

| INTERNATIONAL | | |

| | | |

| MSCI EAFE (US$) | Equities in developed international equity markets, including Japan, Western Europe, and Australasia | +10.20% |

| | | |

MSCI Emerging Markets (US$) | Equities in developing international equity markets, including China, India, Eastern Europe, and Latin America | +9.53% |

| | | |

| MSCI ACWI (US$) | Equities in the global developed and emerging markets | +13.54% |

US LARGE-CAPITALIZATION EQUITIES

US large-cap stocks posted strong returns for the six-month period ended March 31, 2011. Stock price appreciation was broad-based; all of the ten S&P 500 Index economic sectors, as defined under the Global Industry Classification Standard (“GICS”)(2), posted positive returns. Energy (+42%), Materials (+24%), Industrials (+22%) and Consumer Discretionary (+18%) were the strongest-performing sectors. Financials (+15%), Information Technology (+14%) and Telecommunication Services (+13%) also registered double-digit gains. Health Care (+9%), Consumer Staples (+9%) and Utilities (+4%) were the laggards.

All industry groups had positive performance, though the results ranged widely. Pharmaceuticals, Biotechnology & Life Sciences (+4%) and Household & Personal Products (+5%) were among the weakest-performing industry groups. Automobiles & Components (+29%) and Media (+27%) were among the strongest-performing industry groups.

US ALL-CAPITALIZATION EQUITIES

Performance of the broad US equity market, as measured by the Russell 3000 Index which encompasses publicly-traded companies of all sizes, was strong for the six-month period. Similar to the S&P 500 Index, sector- and industry-level performance was positive across the board within the Russell 3000 Index. Energy (+43%), Materials (+26%) and Industrials (+24%) were the best-performing sectors of the Russell 3000 Index. Utilities and Consumer Staples sectors, however, posted gains of just +6% and +10%, respectively.

At an industry group-level within the Russell 3000 Index, Automobiles & Components soared +31%. Capital Goods and Media each rose +26%. Household & Personal Products was the weakest-performing industry group, with a return of +5%.

The mid-capitalization and small-capitalization areas of the US equity market were comparatively stronger than large-capitalization equities. Smaller-capitalization equities sometimes outperform large-capitalization equities as investors’ risk appetite increases.

INTERNATIONAL EQUITIES

Developed market international equities posted solid gains for the six-month period ended March 31, 2011.

The MSCI EAFE Index posted positive performance across the ten GICS sectors. Energy (+22%) and Materials (+20%) were the strongest-performing sectors of the Index. Industrials (+17%), Telecommunication Services (+11%) and Information Technology (+10%) also experienced double-digit gains. Utilities (+3%) and Consumer Staples (+4%) were the weakest-performing sectors. All other sectors posted returns ranging from +5% to +9%.

Many GICS industry groups in the MSCI EAFE Index experienced positive returns. The most significant gains included: Semiconductors & Semiconductor Equipment (+33%), Capital Goods (+21%), Insurance (+14%) and Automobiles & Components (+13%). Several industries posted negative results, including Retailing (-4%), Food & Staples Retailing (-1%), Commercial Services & Supplies (-1%) and Pharmaceuticals & Biotechnology and Life Sciences (-0.1%).

All of the MSCI EAFE Index’s country-level constituents posted positive returns for the period. Norway (+19%), Austria (+18%) and Germany (+18%) were the strongest country-level performers. Belgium and Israel were the weakest-performing countries; each registered returns of just +2%. Japan and the United Kingdom, which together comprise approximately 39% of the MSCI EAFE Index, posted returns of +7% and +10%, respectively.

Emerging markets, meanwhile, slightly trailed their developed-market counterparts. As noted above, the MSCI Emerging Markets Index posted a six-month return of +9.53%. Emerging market performance was weaker on fears of inflationary factors, slower growth in China and unrest in the Middle East.

Overall, US-based investors in international equities benefitted from a currency lift during the six-month period, as the US dollar weakened as compared to certain foreign currencies including the euro, the Australian dollar and Canadian dollar, thereby effectively increasing returns from foreign securities as expressed in US dollars.

THE MARSICO INVESTMENT TEAM

| (1) | All indices are unmanaged and investors cannot invest directly in an index. |

| (2) | The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by Marsico Capital Management, LLC (“MCM”). Neither MSCI, S&P, nor MCM or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, MCM, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

INVESTMENT REVIEW BY TOM MARSICO, DOUG RAO AND CORALIE WITTER (UNAUDITED)

The Marsico Focus Fund and the Marsico Growth Fund outperformed their primary benchmark index for the six-month fiscal period ended March 31, 2011. The Marsico Focus Fund generated a total return of +19.95% and the Marsico Growth Fund posted a return of +19.83%. For comparative purposes, the S&P 500 Index – which we consider to be the Funds’ primary benchmark index – had a total return of +17.31% for the period ended March 31, 2011. Please see the Funds’ Overviews for more detailed information about each Fund’s longer-term performance for various periods ended March 31, 2011.

The performance data for the Funds quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Funds are intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Funds may not necessarily hold these securities or investments today. Please see the accompanying Schedules of Investments for the percentage of each Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Focus Fund is non-diversified and may hold fewer securities than a diversified fund. Holding fewer securities increases the risk that the value of the Fund could go down because of the poor performance of a single investment. Stocks and markets in which the Focus Fund and the Growth Fund invest may experience periods of turbulence and instability, and the general risk that domestic and global economies and stock markets may go through periods of decline and cyclical change.

The Focus Fund and the Growth Fund often invest in similar growth companies. Their performance may differ at times, however, because of a variety of factors. Among other factors, the Focus Fund is a non-diversified mutual fund that may invest in a more concentrated portfolio and may hold the securities of fewer issuers than the Growth Fund. As a result, the Focus Fund may hold some securities that are different from those held by the Growth Fund, and may be more exposed to individual stock volatility than the Growth Fund or other mutual funds that invest in a larger number of securities.

FOCUS FUND

The Marsico Focus Fund outperformed the S&P 500 Index for the six-month fiscal period ended March 31, 2011. The Fund’s performance was positively impacted by stock selection in the Information Technology, Materials and Industrials sectors. Sector positioning also aided performance within the Materials and Industrials sectors.

Information Technology positions were led by Baidu, Inc. Spon. ADR, a China-based website search engine, which posted a return of +35%. Other strong-performing holdings included Apple, Inc., maker of the iPhone and iPad (+23%), and enterprise software company Oracle Corporation (+25%).

The Fund benefitted from stock selection and allocations in the Materials and Industrials sectors. Materials and Industrials were strong-performing sectors for the period and the Fund benefitted from having a substantial portion of its net assets invested in the sectors. Stock selection in the sectors was also strong. The Dow Chemical Company, a leading manufacturer of chemicals, polymers, and agricultural products, gained +39%, while agricultural material company Monsanto Company soared +52%. Leading Industrials positions included railroad operator Union Pacific Corporation (+21%) and power management company Eaton Corporation (+36%).

Certain of the Fund’s Consumer Discretionary holdings posted strong returns, including casino/resort company Wynn Resorts Ltd. (+58%) and online travel reservations retailer priceline.com, Inc. (+46%).

Finally, the Fund benefitted from having few investments in the Consumer Staples, Health Care and Utilities sectors, which were the weakest-performing sectors of the S&P 500 Index.

There were several areas of weakness for the Focus Fund during the semi-annual period. Early in the reporting period, the Fund had few investments in the Energy sector. Energy was the strongest-performing sector of the S&P 500 Index, soaring nearly 42%. While the Fund’s energy-related holdings posted a return that was in-line with the Index sector return, the Fund was penalized versus the benchmark index by not having a higher percentage of its net assets invested in the sector. The Fund’s performance was further impaired by stock selection in the Financials sector. The Fund’s position in Citigroup, Inc. (-4%) and India-based ICICI Bank Ltd. Spon. ADR (-6% prior to being sold) detracted from performance results. Other positions having a material drag on performance included Intuitive Surgical, Inc., a manufacturer of robotic systems for assisting in minimally invasive surgeries, and athletic apparel company Nike, Inc. – Cl.B. Both Intuitive Surgical and Nike posted negative returns and were sold from the Fund.

During the period, the Fund reduced its exposure to the Consumer Discretionary and Health Care sectors, while increasing its exposure to the Energy sector.

GROWTH FUND

The Marsico Growth Fund shared several of the Focus Fund’s performance attributes for the six-month fiscal period ended March 31, 2011. Like the Focus Fund, certain of the Growth Fund’s Information Technology positions posted strong gains, most notably Baidu, Inc. Spon. ADR (+34%), Apple, Inc. (+23%) and Oracle Corporation (+25%).

Also similar to the Focus Fund, the Growth Fund benefitted from stock selection and allocation to the Materials sector. Monsanto Company (+53%), The Dow Chemical Company (+38%) and specialty materials company PPG Industries, Inc. (+33%) each registered strong stock price gains.

The Fund did well to underweight Health Care, Utilities and Consumer Staples stocks, which were the weakest performers within the index. Among these weak performing sectors however, was another positive contributor, one of the Fund’s largest Consumer Staples holdings, The Estee Lauder Companies, Inc. – Cl. A, a leader in skin care and cosmetics products, which posted a return of +54%.

The Growth Fund had significantly less exposure than the S&P 500 Index to energy-related investments. The Fund lost some ground by not investing more in the Energy sector, as it was the strongest performing sector of the Index with a return of nearly +42%.

Performance in the Consumer Discretionary sector was held back by investments in athletic apparel company Nike, Inc. – Cl. B (-5%) and restaurant operator McDonald’s Corporation (+3%). The Fund trimmed its investments in Nike and McDonald’s during the period.

While stock selection in the Information Technology sector was generally strong, two of the Fund’s technology positions posted disappointing returns. Enterprise network companies F5 Networks, Inc. and Cisco Systems, Inc. each posted double-digit declines during the periods they were held by the Fund. The Fund sold its position in Cisco Systems during the period and maintained a small investment in F5 Networks as of March 31, 2011.

The Fund increased its exposure to the Financials and Energy sectors during the period, while trimming exposure to the Consumer Discretionary sector. During the period, the Fund reduced its Health Care and Telecommunication Services positions.

Fiscal Period-End Investment Posture

As of March 31, 2011, the Focus Fund’s and the Growth Fund’s primary sector allocations included Information Technology, Industrials, Financials, Materials and Consumer Discretionary. The Funds had no significant exposure to the Utilities, Telecommunication Services, or Health Care sectors.

In closing, we are pleased to note that, as previously communicated to shareholders in 2010, Coralie Witter, CFA was promoted to serve as co-portfolio manager for the Focus Fund and the Growth Fund effective November 1, 2010. Coralie is a senior analyst who joined Marsico Capital Management in June 2004. Like all Marsico Capital Management analysts, Coralie covers a wide array of sectors and industry groups, with an emphasis on global consumer-related companies, transportation and global logistics companies, and aerospace. She has over 15 years of experience in the financial services industry, most of which has involved equity research. Prior to joining Marsico Capital Management, Coralie spent six years with Goldman, Sachs & Co., where she was a Vice President in Equity Research, the lead analyst responsible for the restaurant industry, and covered various internet companies for several years. Coralie graduated from the University of Colorado in 1994 with a Bachelor’s degree in International Affairs. She was awarded the designation of Chartered Financial Analyst (“CFA”) in 1998.

Sincerely,

THOMAS F. MARSICO

A. DOUGLAS RAO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the Prospectus for more information. |

March 31, 2011 (Unaudited)

The Focus Fund invests primarily in the common stocks of large companies, normally a core position of 20–30 common stocks that are selected for their long-term growth potential.

| TOTAL ANNUAL OPERATING EXPENSES* | 1.34% | NET ASSETS | $1,235,893,693 | NET ASSET VALUE PER SHARE | $18.94 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

| | |

| |

| | |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | |

| | APPLE, INC. | 8.35% |

| | BAIDU, INC. SPON. ADR | 5.79% |

| | ORACLE CORPORATION | 5.52% |

| | EATON CORPORATION | 5.34% |

| | MONSANTO COMPANY | 4.58% |

| | | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2011 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent monthend, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| This chart assumes an initial investment of $10,000 made on March 31, 2001. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO FOCUS FUND

SCHEDULE OF INVESTMENTS

March 31, 2011 (Unaudited)

| | | Number | | | | | | Percent | |

| | | of | | | | | | of Net | |

| | | Shares | | | Value | | | Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| General Dynamics Corporation | | | 240,540 | | | $ | 18,415,742 | | | | 1.49 | % |

| Goodrich Corporation | | | 390,607 | | | | 33,408,617 | | | | 2.70 | |

| Precision Castparts Corp. | | | 165,016 | | | | 24,287,055 | | | | 1.97 | |

| | | | | | | | 76,111,414 | | | | 6.16 | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 355,562 | | | | 45,245,264 | | | | 3.66 | |

| | | | | | | | | | | | | |

| Computer Hardware | | | | | | | | | | | | |

| Apple, Inc.* | | | 296,096 | | | | 103,174,651 | | | | 8.35 | |

| | | | | | | | | | | | | |

| Construction & Farm | | | | | | | | | | | | |

| Machinery & Heavy Trucks | | | | | | | | | | | | |

| Cummins, Inc. | | | 408,216 | | | | 44,748,638 | | | | 3.62 | |

| | | | | | | | | | | | | |

| Consumer Finance | | | | | | | | | | | | |

| American Express Company | | | 474,788 | | | | 21,460,418 | | | | 1.74 | |

| | | | | | | | | | | | | |

| Diversified Banks | | | | | | | | | | | | |

| U.S. Bancorp | | | 1,875,727 | | | | 49,575,465 | | | | 4.01 | |

| Wells Fargo & Company | | | 1,347,006 | | | | 42,700,090 | | | | 3.46 | |

| | | | | | | | 92,275,555 | | | | 7.47 | |

| Diversified Chemicals | | | | | | | | | | | | |

| The Dow Chemical Company | | | 1,133,109 | | | | 42,774,865 | | | | 3.46 | |

| | | | | | | | | | | | | |

| Diversified Metals & Mining | | | | | | | | | | | | |

| Freeport-McMoRan | | | | | | | | | | | | |

| Copper & Gold, Inc. | | | 1,004,929 | | | | 55,823,806 | | | | 4.52 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | | | | |

| Monsanto Company | | | 783,185 | | | | 56,592,948 | | | | 4.58 | |

| | | | | | | | | | | | | |

| Industrial Machinery | | | | | | | | | | | | |

| Eaton Corporation | | | 1,190,370 | | | | 65,994,113 | | | | 5.34 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| Amazon.com, Inc.* | | | 233,493 | | | | 42,059,094 | | | | 3.40 | |

| priceline.com, Inc.* | | | 103,895 | | | | 52,616,584 | | | | 4.26 | |

| | | | | | | | 94,675,678 | | | | 7.66 | |

| Internet Software & Services | | | | | | | | | | | | |

| Baidu, Inc. Spon. ADR* | | | 519,394 | | | | 71,577,687 | | | | 5.79 | |

| | | | | | | | | | | | | |

| Investment Banking & Brokerage | | | | | | | | | | | | |

| The Goldman Sachs Group, Inc. | | | 302,583 | | | | 47,950,328 | | | | 3.88 | |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | | | | |

| Halliburton Company | | | 1,050,339 | | | | 52,348,896 | | | | 4.23 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | | | | |

| Anadarko Petroleum Corporation | | | 513,319 | | | | 42,051,092 | | | | 3.40 | |

| EOG Resources, Inc. | | | 318,366 | | | | 37,729,555 | | | | 3.05 | |

| | | | | | | | 79,780,647 | | | | 6.45 | |

| Oil & Gas Storage & Transportation | | | | | | | | | | | | |

| Kinder Morgan, Inc.* | | | 629,103 | | | | 18,646,613 | | | | 1.51 | |

| | | | | | | | | | | | | |

| Other Diversified Financial Services | | | | | | | | | | | | |

| Citigroup, Inc.* | | | 9,800,013 | | | | 43,316,057 | | | | 3.50 | |

| | | | | | | | | | | | | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Mead Johnson Nutrition Company | | | 462,812 | | | | 26,810,699 | | | | 2.17 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| Union Pacific Corporation | | | 561,800 | | | | 55,241,794 | | | | 4.47 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 23,454 | | | | 6,388,166 | | | | 0.52 | |

| Starbucks Corporation | | | 910,585 | | | | 33,646,116 | | | | 2.72 | |

| | | | | | | | 40,034,282 | | | | 3.24 | |

| Systems Software | | | | | | | | | | | | |

| Oracle Corporation | | | 2,044,115 | | | | 68,212,117 | | | | 5.52 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $833,120,039) | | | | | | | 1,202,796,470 | | | | 97.32 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| State Street Institutional | | | | | | | | | | | | |

| U.S. Government Money Market | | | | | | | | | | | | |

| Fund, 0.037% | | | 46,188,397 | | | | 46,188,397 | | | | 3.74 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $46,188,397) | | | | | | | 46,188,397 | | | | 3.74 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $879,308,436) | | | | | | | 1,248,984,867 | | | | 101.06 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (13,091,174 | ) | | | (1.06 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 1,235,893,693 | | | | 100.00 | % |

See notes to financial statements.

March 31, 2011 (Unaudited)

The Growth Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of between 35 and 50 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* | 1.34% | NET ASSETS | $871,928,520 | NET ASSET VALUE PER SHARE | $20.41 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

| | |

| |

| | |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | |

| | APPLE, INC. | 5.49% |

| | BAIDU, INC. SPON. ADR | 4.58% |

| | ORACLE CORPORATION | 4.17% |

| | | 3.83% |

| | | 3.72% |

| | | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2011 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent monthend, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

(1) | This chart assumes an initial investment of $10,000 made on March 31, 2001. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS

March 31, 2011 (Unaudited)

| | | Number | | | | | | Percent | |

| | | of | | | | | | of Net | |

| | | Shares | | | Value | | | Assets | |

| COMMON STOCKS | | | | | | | | | |

| | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| General Dynamics Corporation | | | 229,726 | | | $ | 17,587,823 | | | | 2.02 | % |

| Precision Castparts Corp. | | | 130,067 | | | | 19,143,261 | | | | 2.19 | |

| | | | | | | | 36,731,084 | | | | 4.21 | |

| Apparel Retail | | | | | | | | | | | | |

| The TJX Companies, Inc. | | | 422,235 | | | | 20,997,747 | | | | 2.41 | |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | | | | | | | | |

| Compagnie Financière | | | | | | �� | | | | | | |

| Richemont SA ADR | | | 3,177,189 | | | | 18,300,609 | | | | 2.10 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| salesforce.com, inc.* | | | 67,797 | | | | 9,056,323 | | | | 1.04 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 170,517 | | | | 21,698,288 | | | | 2.49 | |

| | | | | | | | | | | | | |

| Communications Equipment | | | | | | | | | | | | |

| Acme Packet, Inc.* | | | 73,677 | | | | 5,228,120 | | | | 0.60 | |

| F5 Networks, Inc.* | | | 76,880 | | | | 7,885,582 | | | | 0.90 | |

| | | | | | | | 13,113,702 | | | | 1.50 | |

| Computer Hardware | | | | | | | | | | | | |

| Apple, Inc.* | | | 137,254 | | | | 47,826,156 | | | | 5.49 | |

| | | | | | | | | | | | | |

| Construction & Farm | | | | | | | | | | | | |

| Machinery & Heavy Trucks | | | | | | | | | | | | |

| Cummins, Inc. | | | 100,148 | | | | 10,978,224 | | | | 1.26 | |

| | | | | | | | | | | | | |

| Distributors | | | | | | | | | | | | |

| Li & Fung Ltd. | | | 1,018,000 | | | | 5,208,734 | | | | 0.60 | |

| | | | | | | | | | | | | |

| Diversified Banks | | | | | | | | | | | | |

| U.S. Bancorp | | | 1,104,944 | | | | 29,203,670 | | | | 3.35 | |

| Wells Fargo & Company | | | 663,939 | | | | 21,046,866 | | | | 2.41 | |

| | | | | | | | 50,250,536 | | | | 5.76 | |

| Diversified Chemicals | | | | | | | | | | | | |

| PPG Industries, Inc. | | | 259,511 | | | | 24,708,042 | | | | 2.83 | |

| The Dow Chemical Company | | | 883,341 | | | | 33,346,123 | | | | 3.83 | |

| | | | | | | | 58,054,165 | | | | 6.66 | |

| Diversified Metals & Mining | | | | | | | | | | | | |

| BHP Billiton PLC ADR | | | 91,543 | | | | 7,286,823 | | | | 0.84 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 273,940 | | | | 15,217,367 | | | | 1.74 | |

| | �� | | | | | | 22,504,190 | | | | 2.58 | |

| Electrical Components & Equipment | | | | | | | | | | | | |

| Rockwell Automation, Inc. | | | 105,819 | | | | 10,015,768 | | | | 1.15 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | | | | |

| Monsanto Company | | | 376,463 | | | | 27,203,216 | | | | 3.12 | |

| | | | | | | | | | | | | |

| Footwear | | | | | | | | | | | | |

| NIKE, Inc. - Cl. B | | | 282,423 | | | | 21,379,421 | | | | 2.45 | |

| | | | | | | | | | | | | |

| Industrial Gases | | | | | | | | | | | | |

| Praxair, Inc. | | | 316,952 | | | | 32,202,323 | | | | 3.69 | |

| | | | | | | | | | | | | |

| Industrial Machinery | | | | | | | | | | | | |

| Danaher Corporation | | | 312,984 | | | | 16,243,870 | | | | 1.86 | |

| Eaton Corporation | | | 319,178 | | | | 17,695,228 | | | | 2.03 | |

| | | | | | | | 33,939,098 | | | | 3.89 | |

| Integrated Oil & Gas | | | | | | | | | | | | |

| Occidental Petroleum Corporation | | | 63,194 | | | | 6,603,141 | | | | 0.76 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| Amazon.com, Inc.* | | | 156,772 | | | | 28,239,341 | | | | 3.24 | |

| priceline.com, Inc.* | | | 64,103 | | | | 32,464,323 | | | | 3.72 | |

| | | | | | | | 60,703,664 | | | | 6.96 | |

| Internet Software & Services | | | | | | | | | | | | |

| Baidu, Inc. Spon. ADR* | | | 289,775 | | | | 39,933,893 | | | | 4.58 | |

| Youku.com, Inc. Spon. ADR* | | | 58,912 | | | | 2,798,909 | | | | 0.32 | |

| | | | | | | | 42,732,802 | | | | 4.90 | |

| Investment Banking & Brokerage | | | | | | | | | | | | |

| The Goldman Sachs Group, Inc. | | | 170,807 | | | | 27,067,785 | | | | 3.10 | |

| | | | | | | | | | | | | |

| Life Sciences Tools & Services | | | | | | | | | | | | |

| Agilent Technologies, Inc.* | | | 190,868 | | | | 8,547,069 | | | | 0.98 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| Time Warner, Inc. | | | 463,172 | | | | 16,535,241 | | | | 1.90 | |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | | | | |

| Halliburton Company | | | 458,377 | | | | 22,845,510 | | | | 2.62 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | | | | |

| Anadarko Petroleum Corporation | | | 218,837 | | | | 17,927,127 | | | | 2.06 | |

| Continental Resources, Inc.* | | | 93,526 | | | | 6,684,303 | | | | 0.77 | |

| EOG Resources, Inc. | | | 107,029 | | | | 12,684,007 | | | | 1.45 | |

| | | | | | | | 37,295,437 | | | | 4.28 | |

| Other Diversified Financial Services | | | | | | | | | | | | |

| Citigroup, Inc.* | | | 6,079,500 | | | | 26,871,390 | | | | 3.08 | |

| | | | | | | | | | | | | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Mead Johnson Nutrition Company | | | 138,080 | | | | 7,998,975 | | | | 0.92 | |

| | | | | | | | | | | | | |

| Personal Products | | | | | | | | | | | | |

| The Estee Lauder Companies, Inc. - Cl. A | | | 138,012 | | | | 13,298,836 | | | | 1.53 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| Union Pacific Corporation | | | 275,006 | | | | 27,041,340 | | | | 3.10 | |

| | | | | | | | | | | | | |

| Regional Banks | | | | | | | | | | | | |

| The PNC Financial Services Group, Inc. | | | 312,019 | | | | 19,654,077 | | | | 2.25 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| McDonald’s Corporation | | | 195,058 | | | | 14,841,963 | | | | 1.70 | |

| Starbucks Corporation | | | 439,737 | | | | 16,248,282 | | | | 1.86 | |

| YUM! Brands, Inc. | | | 201,315 | | | | 10,343,565 | | | | 1.19 | |

| | | | | | | | 41,433,810 | | | | 4.75 | |

| Specialty Stores | | | | | | | | | | | | |

| Tiffany & Co. | | | 247,628 | | | | 15,214,264 | | | | 1.74 | |

| | | | | | | | | | | | | |

| Systems Software | | | | | | | | | | | | |

| Oracle Corporation | | | 1,089,244 | | | | 36,348,072 | | | | 4.17 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $570,306,525) | | | | | | | 849,650,997 | | | | 97.44 | |

| | | | | | | | | | | | | |

| PREFERRED STOCKS | | | | | | | | | | | | |

| Diversified Banks | | | | | | | | | | | | |

| Wells Fargo & Company, | | | | | | | | | | | | |

| Series J Pref., 8.000% | | | 337,000 | | | | 9,462,960 | | | | 1.09 | |

| | | | | | | | | | | | | |

| TOTAL PREFERRED STOCKS | | | | | | | | | | | | |

| (Cost $5,954,707) | | | | | | | 9,462,960 | | | | 1.09 | |

See notes to financial statements.

| | | Number | | | | | | Percent | |

| | | of | | | | | | of Net | |

| | | Shares/Units | | | Value | | | Assets | |

| UNITS | | | | | | | | | |

| | | | | | | | | | |

| Marine Ports & Services | | | | | | | | | |

| Hutchison Port Holdings | | | | | | | | | |

| Trust - Cl. U* | | | 13,289,000 | | | $ | 13,156,110 | | | | 1.51 | % |

| | | | | | | | | | | | | |

| TOTAL UNITS | | | | | | | | | | | | |

| (Cost $13,388,070) | | | | | | | 13,156,110 | | | | 1.51 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| State Street Institutional | | | | | | | | | | | | |

| Treasury Money Market Fund, | | | | | | | | | | | | |

| 0.004% | | | 344,308 | | | | 344,308 | | | | 0.04 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $344,308) | | | | | | | 344,308 | | | | 0.04 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $589,993,610) | | | | | | | 872,614,375 | | | | 100.08 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (685,855 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 871,928,520 | | | | 100.00 | % |

See notes to financial statements.

INVESTMENT REVIEW BY CORY GILCHRIST (UNAUDITED)

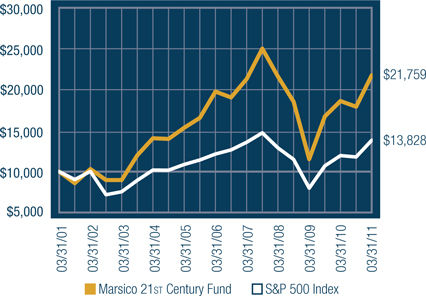

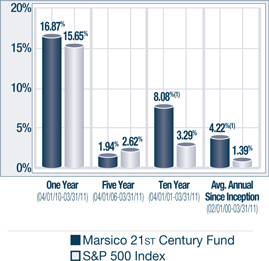

The Marsico 21st Century Fund posted a return of +21.41% for the six-month fiscal period ended March 31, 2011. The Fund substantially outpaced the S&P 500 Index, which we consider to be the Fund’s primary benchmark index and which had a total return of +17.31% over the same time period. For comparative purposes, the Russell 3000 Index, a proxy for the performance of all publicly-traded US equity securities including smaller capitalization companies (which may be a useful representation of the Fund’s ability to invest across the entire market capitalization spectrum), had a total return of +18.71%. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2011.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

Stocks and markets in which the Fund invests may experience periods of turbulence and instability, and the general risk that domestic and global economies and stock markets may go through periods of decline and cyclical change.

The Fund’s six-month performance was primarily aided by stock selection in particular sectors. Information Technology, Industrials, Materials and Consumer Discretionary positions contributed most significantly to the Fund’s performance relative to the S&P 500 Index.

Apple, Inc., maker of the iPhone and iPad, posted a return of +23%. As one of the Fund’s largest individual holdings, Apple had a significant positive effect on performance. Several software and services holdings also performed well. Data integration company Informatica Corporation, online restaurant reservations company OpenTable, Inc., and engineering software provider ANSYS, Inc. each posted returns of over +25%.

In Industrials, shares of Netherlands-based global industrial technology firm Sensata Technologies Holding N.V. soared +76%, while railroad services company CSX Corporation and industrial conglomerate Honeywell International, Inc. rose +43% and +37%, respectively. One of the Fund’s few Materials holdings, Monsanto Company, gained +52% due in part to improved global seeds and related seed-traits products.

Consumer Discretionary holdings also bolstered performance against the Index. An overweight in this strong-performing sector generated positive results, and stock selection also helped return. Resort operators Wynn Resorts Ltd. (+58%) and Vail Resorts, Inc. (+29%) had strong price appreciation during the period. Retailer Williams-Sonoma, Inc. (+29%) and The Walt Disney Company (+32%) were other leading holdings in the sector.

Finally, the Fund benefitted from having few investments in the Consumer Staples, Health Care and Utilities sectors, which were the weakest-performing sectors of the S&P 500 Index.

Energy was a significant area of weakness for the Fund. The Energy sector was the strongest performer within the S&P 500 Index during the time frame. The Fund had less exposure than the Index to Energy, which hurt results. In addition, the Fund’s position in Brazil-based oil and natural gas exploration company OGX Petróleo e Gás Participações S.A. slid -7%.

For some time, the Fund has held a significant percentage of its net assets in the Financials sector, with an emphasis on banking-related companies. The Fund’s positions in the Banks industry focus on what we believe to be the strongest companies with the best balance sheets, liquidity and capital levels. We believe these franchises are positioned to gain market share and grow earnings and dividends. During the six-month period, however, stock selection in the Banks industry detracted from results relative to the benchmark index. First Horizon National Corporation, a core holding of the Fund, eked out a return of just +0.1% and was a significant drag on performance. Regional bank First Midwest Bancorp, Inc. a smaller holding in the Fund, posted a double-digit decline prior to being sold.

Auto manufacturer General Motors Company slid -8% and was one of the largest individual detractors from performance during the period.

During the period, the Fund modestly increased its exposure to the Energy and Information Technology sectors while paring its exposure to the Financials sector. Also during the period, the Fund sold its sole Telecommunication Services holding.

Fiscal Period-End Investment Posture

As of March 31, 2011, the Fund’s primary economic sector allocations were in the Financials, Consumer Discretionary, Information Technology, and Industrials sectors. As of period-end, the Fund had no investments in the Utilities, Telecommunication Services and Consumer Staples sectors.

Sincerely,

CORYDON J. GILCHRIST, CFA

PORTFOLIO MANAGER

| Total returns are based on net change in net asset value assuming reinvestment of distributions. For the period prior to March 31, 2004, the performance returns for the 21st Century Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period beginning April 2004 through January 2005, performance returns for the 21st Century Fund would have been higher but for the reimbursement of fees waived previously. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the Prospectus for more information. |

21st CENTURY FUND OVERVIEW |

March 31, 2011 (Unaudited)

The 21st Century Fund invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size, and will normally hold a core position of between 35 and 50 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* | 1.38% | NET ASSETS | $799,696,546 | NET ASSET VALUE PER SHARE | $15.03 |

| | |

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

| | |

| |

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | 5.33% |

| 5.20% |

| 5.14% |

THE PNC FINANCIAL SERVICES GROUP, INC. | 5.00% |

| 4.06% |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2011 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| The performance returns for the 21st Century Fund (for the period prior to March 31, 2004) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period beginning April 2004 through January 2005, performance returns for the 21st Century Fund would be higher but for the reimbursement of fees waived previously. |

| This chart assumes an initial investment of $10,000 made on March 31, 2001. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS

March 31, 2011 (Unaudited)

| | | Number | | | | | | Percent | |

| | | of | | | | | | of Net | |

| | | Shares | | | Value | | | Assets | |

| COMMON STOCKS | | | | | | | | | |

| | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| Honeywell International, Inc. | | | 491,445 | | | $ | 29,344,181 | | | | 3.67 | % |

| Precision Castparts Corp. | | | 175,945 | | | | 25,895,585 | | | | 3.24 | |

| | | | | | | | 55,239,766 | | | | 6.91 | |

| Apparel Retail | | | | | | | | | | | | |

| rue21, inc.* | | | 224,992 | | | | 6,479,770 | | | | 0.81 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| ANSYS, Inc.* | | | 295,024 | | | | 15,987,351 | | | | 2.00 | |

| Informatica Corporation* | | | 383,720 | | | | 20,041,696 | | | | 2.51 | |

| salesforce.com, inc.* | | | 92,299 | | | | 12,329,300 | | | | 1.54 | |

| | | | | | | | 48,358,347 | | | | 6.05 | |

| Asset Management & Custody Banks | | | | | | | | | | | | |

| State Street Corporation | | | 440,737 | | | | 19,806,721 | | | | 2.48 | |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| General Motors Company* | | | 921,934 | | | | 28,607,612 | | | | 3.58 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 111,416 | | | | 14,177,686 | | | | 1.77 | |

| | | | | | | | | | | | | |

| Communications Equipment | | | | | | | | | | | | |

| Acme Packet, Inc.* | | | 114,693 | | | | 8,138,615 | | | | 1.02 | |

| | | | | | | | | | | | | |

| Computer Hardware | | | | | | | | | | | | |

| Apple, Inc.* | | | 69,310 | | | | 24,151,069 | | | | 3.02 | |

| | | | | | | | | | | | | |

| Diversified Banks | | | | | | | | | | | | |

| Wells Fargo & Company | | | 1,311,303 | | | | 41,568,305 | | | | 5.20 | |

| | | | | | | | | | | | | |

| Electrical Components & Equipment | | | | | | | | | | | | |

| Sensata Technologies Holding N.V.* | | | 600,669 | | | | 20,861,234 | | | | 2.61 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | | | | |

| Monsanto Company | | | 276,399 | | | | 19,972,592 | | | | 2.50 | |

| | | | | | | | | | | | | |

| Health Care Equipment | | | | | | | | | | | | |

| Intuitive Surgical, Inc.* | | | 97,455 | | | | 32,497,344 | | | | 4.06 | |

| | | | | | | | | | | | | |

| Health Care Technology | | | | | | | | | | | | |

| Allscripts Healthcare Solutions, Inc.* | | | 748,160 | | | | 15,703,878 | | | | 1.96 | |

| | | | | | | | | | | | | |

| Homefurnishing Retail | | | | | | | | | | | | |

| Williams-Sonoma, Inc. | | | 1,014,830 | | | | 41,100,615 | | | | 5.14 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| Amazon.com, Inc.* | | | 94,274 | | | | 16,981,576 | | | | 2.12 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | | | | |

| OpenTable, Inc.* | | | 120,165 | | | | 12,779,548 | | | | 1.60 | |

| | | | | | | | | | | | | |

| Investment Banking & Brokerage | | | | | | | | | | | | |

| Jefferies Group, Inc. | | | 504,417 | | | | 12,580,160 | | | | 1.57 | |

| | | | | | | | | | | | | |

| Leisure Facilities | | | | | | | | | | | | |

| Vail Resorts, Inc.* | | | 214,122 | | | | 10,440,589 | | | | 1.31 | |

| | | | | | | | | | | | | |

| Life Sciences Tools & Services | | | | | | | | | | | | |

| Pacific Biosciences of California, Inc.* | | | 166,819 | | | | 2,343,807 | | | | 0.29 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| The Walt Disney Company | | | 988,515 | | | | 42,595,111 | | | | 5.33 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | | | | |

| OGX Petróleo e Gás Participações S.A.* | | | 1,975,700 | | | | 23,778,829 | | | | 2.98 | |

| Ultra Petroleum Corp.* | | | 485,686 | | | | 23,920,035 | | | | 2.99 | |

| | | | | | | | 47,698,864 | | | | 5.97 | |

| Oil & Gas Refining & Marketing | | | | | | | | | | | | |

| Amyris, Inc.* | | | 135,508 | | | | 3,867,398 | | | | 0.48 | |

| Gevo, Inc.* | | | 129,305 | | | | 2,547,309 | | | | 0.32 | |

| | | | | | | | 6,414,707 | | | | 0.80 | |

| Railroads | | | | | | | | | | | | |

| CSX Corporation | | | 198,919 | | | | 15,635,033 | | | | 1.96 | |

| | | | | | | | | | | | | |

| Real Estate Operating Companies | | | | | | | | | | | | |

| BR Malls Participacoes S.A. | | | 818,312 | | | | 8,520,690 | | | | 1.07 | |

| | | | | | | | | | | | | |

| Real Estate Services | | | | | | | | | | | | |

| Jones Lang LaSalle, Inc. | | | 238,959 | | | | 23,833,771 | | | | 2.98 | |

| | | | | | | | | | | | | |

| Regional Banks | | | | | | | | | | | | |

| City National Corporation | | | 158,925 | | | | 9,066,671 | | | | 1.13 | |

| Columbia Banking System, Inc. | | | 311,911 | | | | 5,979,334 | | | | 0.75 | |

| First Horizon National Corporation | | | 2,430,158 | | | | 27,242,071 | | | | 3.41 | |

| Fulton Financial Corporation | | | 795,553 | | | | 8,838,594 | | | | 1.10 | |

| Glacier Bancorp, Inc. | | | 398,029 | | | | 5,990,337 | | | | 0.75 | |

| Park Sterling Bank, Inc.* | | | 419,993 | | | | 2,036,966 | | | | 0.25 | |

| The PNC Financial Services Group, Inc. | | | 634,380 | | | | 39,959,596 | | | | 5.00 | |

| | | | | | | | 99,113,569 | | | | 12.39 | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 13,422 | | | | 3,655,750 | | | | 0.46 | |

| Wendy’s/Arby’s Group, Inc. - Cl. A | | | 2,220,464 | | | | 11,168,934 | | | | 1.39 | |

| | | | | | | | 14,824,684 | | | | 1.85 | |

| Retail REITs | | | | | | | | | | | | |

| Colony Financial, Inc. | | | 247,497 | | | | 4,660,368 | | | | 0.58 | |

| | | | | | | | | | | | | |

| Systems Software | | | | | | | | | | | | |

| Oracle Corporation | | | 748,743 | | | | 24,985,554 | | | | 3.12 | |

| | | | | | | | | | | | | |

| Thrifts & Mortgage Finance | | | | | | | | | | | | |

| First Niagara Financial Group, Inc. | | | 2,309,800 | | | | 31,367,084 | | | | 3.92 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $563,805,027) | | | | | | | 751,438,669 | | | | 93.97 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| State Street Institutional Treasury | | | | | | | | | | | | |

| Money Market Fund, 0.004% | | | 52,248,758 | | | | 52,248,758 | | | | 6.53 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $52,248,758) | | | | | | | 52,248,758 | | | | 6.53 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $616,053,785) | | | | | | | 803,687,427 | | | | 100.50 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (3,990,881 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 799,696,546 | | | | 100.00 | % |

See notes to financial statements.

| INTERNATIONAL OPPORTUNITIES FUND |

INVESTMENT REVIEW BY JIM GENDELMAN AND MUNISH MALHOTRA (UNAUDITED)

The Marsico International Opportunities Fund posted a total return of (US$) +10.18% for the six-month fiscal period ended March 31, 2011. The Fund’s return was in-line with the MSCI EAFE Index, which we consider to be the Fund’s primary benchmark index and which had a total return of (US$) +10.20%. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2011.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, differences in securities regulations and accounting standards, possible changes in taxation, limited public information and other factors.

Stock selection in the Industrials, Information Technology and Materials sectors contributed positively to the Fund’s performance. Strong Industrials performers included Japanese construction equipment company Komatsu Ltd. (+48%), French electrical distribution and equipment firm Schneider Electric S.A. (+35%) and Netherlands-based global industrial technology firm Sensata Technologies Holding N.V. (+43%). Several of the Fund’s Chinese Internet technology companies posted sizeable gains, including SINA Corporation (+55%) and Baidu, Inc. Spon. ADR (+35%). United Kingdom-based semiconductor company ARM Holdings PLC soared +53%. Materials positions were led by German chemical company BASF S.E. (+38%) and German integrated materials and technology group ThyssenKrupp AG (+27%).

The Utilities sector was the weakest-performing sector of the MSCI EAFE Index and the Fund benefitted by abstaining from investments in the sector. Additionally, the Fund’s performance was aided by a specific holding in the Health Care sector. Novo Nordisk A/S - Cl. B, based in Denmark, posted a return of +28%. The company recorded solid results from robust sales of its diabetes treatment products.

There were several areas of weakness during the period. Stock selection in the Energy sector was disappointing. OGX Petróleo e Gás Participações S.A., the Fund’s largest individual holding as of period-end, declined -7%. The Fund continued to maintain its position in OGX due to its impressive oil and natural gas reserves off the coast of Brazil. First production is scheduled to begin later in 2011, which may be an important catalyst for the stock.

Several of the Fund’s Financials positions struggled. Japanese real estate position Sumitomo Realty & Development Co., Ltd. and Singapore real estate company CapitaLand Ltd. skidded -17% and -12%, respectively. The Fund sold its position in CapitaLand during the period. Also during the period, the Fund initiated an investment in Citigroup, Inc. (-8%) due to the company’s growing presence in emerging markets and its efforts to capture market share with affluent consumers.

Individual holdings having a material adverse impact on performance included Hong Kong-based manufacturer, exporter and distributor of retail goods Li & Fung Ltd. (-9%), and United Kingdom-headquartered enterprise technology company Autonomy Corporation PLC (-20% prior to being sold).

| INTERNATIONAL OPPORTUNITIES FUND |

Active currency management is not a central facet of the Fund’s investment process, but fluctuations in major world currencies can affect performance. During this six-month period, US-based investors in international equities benefitted from a currency lift overall as the US dollar weakened as compared to certain foreign currencies including the euro and the Australian dollar, effectively increasing returns from foreign securities as expressed in US dollars. On a narrower dimension, the Fund had no exposure to companies that trade in the Australian dollar, which appreciated substantially compared to the US dollar and many other major world currencies. This positioning detracted from the Fund’s returns relative to its benchmark index, as the MSCI EAFE Index had more than a 9% allocation to Australian equities during the period.

The International Opportunities Fund has tended to have a relatively high portfolio turnover level because of its investment style. Although the Fund may hold core positions for some time, it may change its portfolio composition quickly to take advantage of new opportunities, or to address issues affecting particular holdings.

Fiscal Period-End Investment Posture

As of March 31, 2011, the Fund’s primary economic sector allocations included Consumer Discretionary, Financials, Industrials, Materials, and Information Technology. The Fund had no exposure to the Utilities sector.

In terms of country allocations, the Fund’s most significant weightings at period-end were Japan, the United Kingdom, China/Hong Kong, Germany, France and Brazil, although exposure to the United Kingdom and Japan represented underweighted postures relative to the benchmark index. With respect to Japan, the Fund increased its allocation to Japanese stocks in the aftermath of the earthquake, based on our view that the nuclear crisis would be contained and that the market was over-reacting to the potential negative impact the earthquake and nuclear problem would have on economic activity levels in Japan. Most of the Fund’s purchase activity was associated with adding to existing holdings, consisting predominantly of Industrials (including capital goods) and Consumer Discretionary (primarily retailing and auto manufacturing) companies.

The Fund held several positions domiciled in emerging markets including Brazil, China, India and Argentina. Such emerging markets exposure represented approximately 16% of the Fund’s net assets as of March 31, 2011. Country-level weightings generally should be considered a residual of the Fund’s stock selection process rather than a major, proactive facet of its investment strategy.

In closing, we are pleased to note that, as previously communicated to shareholders in 2010, Munish Malhotra was promoted to serve as co-portfolio manager for the International Opportunities Fund effective November 1, 2010. Munish has over 10 years of experience as a securities analyst. Prior to joining Marsico Capital in 2003, he served as an international equities analyst at Driehaus Capital Management in Chicago. Munish was awarded the designation of Chartered Financial Analyst (“CFA”) in 2006. He holds a Bachelor’s degree in Economics from Loyola University of Chicago.

Sincerely,

JAMES G. GENDELMAN

MUNISH MALHOTRA

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. For the period prior to September 30, 2004, the performance returns for the International Opportunities Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period beginning October 2004 through December 2005, performance returns for the International Opportunities Fund would have been higher but for the reimbursement of fees waived previously. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the Prospectus for more information. |

| INTERNATIONAL OPPORTUNITIES FUND OVERVIEW |

March 31, 2011 (Unaudited)

The International Opportunities Fund invests primarily in common stocks of foreign companies that are selected for their long-term growth potential. The Fund may invest in companies of any size throughout the world. It normally invests in the securities of issuers that are economically tied to one or more foreign countries, and expects to be invested in various issuers or securities that together have ties to at least four different foreign countries. Some issuers or securities in the Fund’s portfolio may be based in or economically tied to the United States. The Fund may hold an unlimited number of common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* | 1.54% | NET ASSETS | $238,360,845 | NET ASSET VALUE PER SHARE | $13.59 |

| | |

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

| | |

| |

SECTOR ALLOCATION(3) | | TOP FIVE HOLDINGS |

| | | |

| | OGX PETRÓLEO E GÁS PARTICIPAÇÕES S.A. | 5.02% |

| | BASF S.E. | 3.39% |

| | LI & FUNG LTD. | 3.20% |

| | SWATCH GROUP AG | 3.14% |

| | SCHNEIDER ELECTRIC S.A. | 2.78% |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2011 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| The performance returns for the International Opportunities Fund (for the period prior to September 30, 2004) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period beginning October 2004 through December 2005, performance returns for the International Opportunities Fund would be higher but for the reimbursement of fees waived previously. |

| This chart assumes an initial investment of $10,000 made on March 31, 2001. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

The MSCI EAFE Index tracks the stocks of about 1,000 companies in Europe, Australasia, and the Far East (EAFE).

MARSICO INTERNATIONAL OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

March 31, 2011 (Unaudited)

| | | Number | | | | | | Percent | |

| | | of | | | | | | of Net | |

| | | Shares | | | Value | | | Assets | |

| COMMON STOCKS | | | | | | | | | |

| | | | | | | | | | |

| Advertising | | | | | | | | | |

| Publicis Groupe S.A. | | | 64,090 | | | $ | 3,594,530 | | | | 1.51 | % |

| | | | | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | | | | |

| Rolls-Royce Group PLC* | | | 268,481 | | | | 2,666,014 | | | | 1.12 | |

| | | | | | | | | | | | | |

| Apparel Retail | | | | | | | | | | | | |

| Industria de Diseno Textile S.A. (Inditex) | | | 76,993 | | | | 6,178,059 | | | | 2.59 | |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | | | | | | | | |

| Adidas A.G. | | | 37,923 | | | | 2,389,210 | | | | 1.00 | |

| Pandora A/S* | | | 47,028 | | | | 2,400,026 | | | | 1.01 | |

| Swatch Group AG | | | 16,951 | | | | 7,494,612 | | | | 3.14 | |

| | | | | | | | 12,283,848 | | | | 5.15 | |

| Asset Management & Custody Banks | | | | | | | | | | | | |

| Julius Baer Group Ltd. | | | 81,087 | | | | 3,518,920 | | | | 1.48 | |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Honda Motor Co., Ltd. | | | 161,000 | | | | 6,048,630 | | | | 2.54 | |

| | | | | | | | | | | | | |

| Brewers | | | | | | | | | | | | |

| Anheuser-Busch InBev N.V. | | | 42,460 | | | | 2,418,706 | | | | 1.02 | |

| | | | | | | | | | | | | |

| Building Products | | | | | | | | | | | | |

| Daikin Industries, Ltd. | | | 43,973 | | | | 1,316,864 | | | | 0.55 | |

| | | | | | | | | | | | | |

| Computer & Electronics Retail | | | | | | | | | | | | |

| Yamada-Denki Co., Ltd. | | | 43,500 | | | | 2,933,818 | | | | 1.23 | |

| | | | | | | | | | | | | |

| Computer Hardware | | | | | | | | | | | | |

| TOSHIBA Corporation | | | 715,000 | | | | 3,498,497 | | | | 1.47 | |

| | | | | | | | | | | | | |

| Construction & Farm | | | | | | | | | | | | |

| Machinery & Heavy Trucks | | | | | | | | | | | | |

| Komatsu Ltd. | | | 176,300 | | | | 5,987,587 | | | | 2.51 | |

| | | | | | | | | | | | | |