As filed with the Securities and Exchange Commission on June 29, 2018

Securities Act File No. 333- 225357

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment

Post-Effective Amendment

(Check appropriate box or boxes)

The Marsico Investment Fund

(Exact Name of Registrant as Specified in Charter)

1200 17th Street, Suite 1600 Denver, Colorado 80202 (Address of Principal Executive Offices) (Zip Code) Registrant’s Telephone Number, including Area Code: 1-888-860-8686 The Corporation Trust Company The Marsico Investment Fund Corporation Trust Center 1209 Orange Street Wilmington, Delaware 19802 (Name and Address of Agent for Service of Process) |

Copies to: Anthony H. Zacharski, Esq. Dechert LLP 90 State House Square Hartford, Connecticut 06103 (860) 524-3937 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

This Registration Statement shall hereafter become effective in accordance with the provisions of section 8(a) of the Securities Act of 1933.

No filing fee is due because an indefinite number of shares of beneficial interest have been deemed to be registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

The Marsico Investment Fund

Marsico Flexible Capital Fund

1200 17th Street, Suite 1600

Denver, Colorado 80202

July 2, 2018

Dear Shareholder:

The Board of Trustees (the “Board”) of The Marsico Investment Fund (the “Trust”) has unanimously approved an agreement and plan of reorganization (“Plan of Reorganization”) relating to your fund, the Marsico Flexible Capital Fund (the “Acquired Fund” or “Fund”), a series of the Trust. The Reorganization is expected to occur on or about August 3, 2018.

Under the Plan of Reorganization, the Flexible Capital Fund/Acquired Fund will be combined with the Marsico Global Fund (the “Surviving Fund” or “Fund”), another series of the Trust (the “Reorganization”). The Reorganization is expected to be tax-free for federal income tax purposes, and no redemption fee or other transactional fee will be charged to shareholders as part of the Reorganization. The Flexible Capital Fund/Acquired Fund (and indirectly its shareholders), however, will incur transaction costs, such as brokerage commissions, associated with the Funds repositioning of its holdings. Upon completion of the Reorganization, you will become a shareholder of the Global Fund/Surviving Fund, and you will receive shares of the Global Fund/Surviving Fund equal in value to your shares of the Flexible Capital Fund/Acquired Fund at the valuation time on the Reorganization date. The Board unanimously determined that the Reorganization is in the best interests of both Funds.

You are not being asked to vote on the Reorganization, as shareholder approval is not required. We do, however, ask that you carefully review the enclosed Information Statement/Prospectus, which contains important information about the Reorganization and each Fund. If you have any questions, please call us at 1-888.860.8686.

Thank you for your continued support and the confidence you have placed in us.

Sincerely,

Thomas F. Marsico

Trustee, President and Chief Executive Officer

The Marsico Investment Fund

INFORMATION STATEMENT/PROSPECTUS

July 2, 2018

INFORMATION STATEMENT FOR:

Marsico Flexible Capital Fund

1200 17th Street, Suite 1600

Denver, Colorado 80202

1-888.860.8686

PROSPECTUS FOR:

Marsico Global Fund

1200 17th Street, Suite 1600

Denver, Colorado 80202

1-888.860.8686

INTRODUCTION

This combined information statement and prospectus (“Information Statement/Prospectus”) is being furnished to shareholders of the Marsico Flexible Capital Fund (the “Acquired Fund” or “Fund”), a series of The Marsico Investment Fund (the “Trust”) in connection with the upcoming reorganization (the “Reorganization”) of the Acquired Fund with and into the Marsico Global Fund (the “Surviving Fund” or “Fund”), another series of the Trust. The Reorganization is expected to occur on or about August 3, 2018.

This Information Statement/Prospectus provides information about the Reorganization and each Fund. Because shareholders of the Acquired Fund will ultimately hold shares of the Surviving Fund, it also serves as a prospectus for the Surviving Fund.

This Information Statement/Prospectus is for informational purposes only and you do not need to do anything in response to receiving it. We are not asking you for a proxy or written consent, and you are requested not to send us a proxy or written consent.

This Information Statement/Prospectus, which should be read and retained for future reference, sets forth concisely the information about the Surviving Fund that a shareholder should know before investing. A Statement of Additional Information (the “SAI”) relating to this Information Statement/Prospectus dated July 2, 2018, containing additional information about the Reorganization and the Funds, has been filed with the U.S. Securities and Exchange Commission (the “SEC”) (File No. 333-225357) and is incorporated herein by reference. You may receive a copy of the SAI without charge by contacting the Funds at Marsico Funds c/o UMB Fund Services, Inc., P.O. Box 3210, Milwaukee, WI 53201-3210, or calling 1-888-860-8686.

For more information regarding the Surviving Fund, see the Prospectus and SAI for the Surviving Fund dated January 31, 2018 as filed with the SEC and supplemented (File Nos. 333-36975 and 811-08397), which are incorporated herein by reference. The Annual Report of each of the Funds for the fiscal year ended September 30, 2017, and the Semi-Annual Report of each of the Funds for the six-month period ended March 31, 2018, which highlight certain important information such as investment results and financial information for the Funds, and which have been filed with the SEC (File No. 811-08397), are incorporated herein by reference. You may receive copies of each of the Prospectuses, SAIs and shareholder reports mentioned in this paragraph without charge by contacting the Funds directly at 1-888-860-8686 or visiting the Trust’s website at marsicofunds.com.

You also can copy and review information about the Funds (including the SAI) at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at 202-551-8090 or 1-800-SEC-0330. Reports and other information about the Funds are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street N.E., Washington, D.C. 20549-0102.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR

DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS INFORMATION

STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| INTRODUCTION | 1 |

| COMPARISON OF INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES | 1 |

| COMPARISON OF FEES AND EXPENSES | 6 |

| COMPARISON OF SALES LOAD, DISTRIBUTION AND SHAREHOLDER SERVICING ARRANGEMENTS | 7 |

| COMPARISON OF PURCHASE, REDEMPTION AND EXCHANGE POLICIES AND PROCEDURES | 8 |

| COMPARISON OF PRINCIPAL RISKS OF INVESTING IN THE FUNDS | 8 |

| COMPARISON OF PERFORMANCE | 9 |

| INFORMATION ABOUT THE REORGANIZATION | 12 |

| The Agreement and Plan of Reorganization | 12 |

| Reasons for the Reorganization and Board Considerations | 12 |

| Tax Considerations | 15 |

| Expenses of the Reorganization | 16 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 16 |

| Investment Adviser | 16 |

| Administrative Services | 17 |

| Other Service Providers | 18 |

| Form of Organization | 18 |

| Capitalization | 18 |

| Security Ownership of Certain Beneficial Owners | 18 |

| Financial Highlights of the Surviving Fund | 20 |

EXHIBIT A - AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| EXHIBIT B – MARSICO FUNDS’ SHAREHOLDER INFORMATION | B-1 |

INTRODUCTION

The Board of Trustees (the “Board”) of The Marsico Investment Fund (the “Trust”) has unanimously approved an agreement and plan of reorganization (“Plan of Reorganization”) relating to your fund, the Marsico Flexible Capital Fund (the “Acquired Fund” or “Fund”), a series of the Trust. Under the Plan of Reorganization, the Acquired Fund will be combined with and into the Marsico Global Fund (the “Surviving Fund” or “Fund”), another series of the Trust (the “Reorganization”). The Reorganization is scheduled to occur effective upon the close of business on August 3, 2018 or such other date as the parties may agree (the “Closing Date”).

The Plan of Reorganization provides for the following:

| ● | the transfer of all of the assets of the Acquired Fund to the Surviving Fund in exchange for shares of the Surviving Fund having an aggregate value equal to the net assets of the Acquired Fund at the valuation time of the Reorganization; |

| ● | the assumption by the Surviving Fund of all of the liabilities of the Acquired Fund; |

| ● | the distribution of Surviving Fund shares to the shareholders of the Acquired Fund; and |

| ● | the complete liquidation of the Acquired Fund. |

As a result of the Reorganization, each shareholder of the Acquired Fund will become the owner of the number of full and fractional shares of the Surviving Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shareholder’s shares of the Acquired Fund as of the close of business on the Closing Date.

The Reorganization is expected to be tax-free for federal income tax purposes, and no redemption fee or other transactional fee will be charged to shareholders as a result of the Reorganization. Marsico Capital Management, LLC (“MCM”) the Funds’ investment adviser, has agreed to bear Reorganization expenses (excluding brokerage commissions and other transaction costs incurred by a Fund for repositioning its holdings).

The Board, including all of the Trustees who are not “interested persons” of the Trust, as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees”), has concluded that the Reorganization is in the best interest of each Fund, and that the interests of each Fund’s existing shareholders will not be diluted as a result of the Reorganization. The Plan of Reorganization does not require shareholder approval.

COMPARISON OF INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES

This section will help you compare the investment objectives and principal investment strategies of the Acquired Fund and the Surviving Fund.

Investment Objectives and Principal Investment Strategies

Both the Acquired Fund and the Surviving Fund have the same investment objective: to seek long-term growth of capital.

The principal investment strategies of the Acquired Fund and the principal investment strategies of the Surviving Fund also are similar, with limited exceptions. There are certain differences, as reflected in the comparison table below. Each Fund invests primarily in the common stocks (or equity securities) of U.S. and foreign companies that are selected primarily for their long-term growth potential. However, one significant difference between the Surviving Fund and the Acquired Fund is that the Acquired Fund’s principal investment strategies permit the Fund to invest in other investments, including investing up to 40% of its total assets in fixed or variable income securities that may offer current income or potential growth of capital, including, without limitation, corporate bonds (including high-yield bonds), preferred stocks, trust-preferred securities, Treasury securities, U.S. government agency securities, asset-backed securities, and other income-producing investments. The Surviving Fund, in contrast, is subject to a 10% limitation with respect to fixed or variable income securities. Additionally, under normal market conditions, the Surviving Fund will invest significantly (generally, at least 40% of its net assets) in the securities of issuers organized or located outside the U.S. or doing business outside the U.S. or other foreign securities. Although the Acquired Fund may also make significant non-U.S. investments, it does not have a similar strategy to generally invest at least 40% of its assets in non-U.S. issuers under normal market conditions. As of March 31, 2018, neither Fund had any exposure to such fixed or variable income securities, and the Funds’ portfolios were similar in terms of the number of positions held and the amount of exposure to foreign securities. In addition, a large majority of each Fund’s security holdings overlapped with the holdings of the other Fund. Additionally, the Acquired Fund’s principal investment strategies provide that the Acquired Fund will normally hold a core position of between 20 and 50 securities or other investments while the Surviving Fund’s principal investment strategies do not include a similar provision. As of March 31, 2018, the Acquired Fund held 31 securities and the Surviving Fund held 34 securities.

Set forth below is a side-by-side comparison of the investment objectives and principal investment strategies of each of the Funds.

| | Marsico Flexible Capital Fund/Acquired Fund | Marsico Global Fund/Surviving Fund |

| Investment Objective | The Fund’s goal is to seek long-term growth of capital. | The Fund’s goal is to seek long-term growth of capital. |

| Principal Investment Strategies | The Marsico Flexible Capital Fund is a “diversified” portfolio and invests primarily in equity securities, and other investments that are selected primarily for their long-term growth potential. The Fund’s holdings may include, without limitation, securities of companies that may be experiencing a significant positive transformation or a favorable catalyst impacting their potential growth, may be underappreciated by other investors, may be trading at compelling valuations in light of their potential growth, or may offer current income, or other securities or investments. The Fund may invest in issuers of any size throughout the world, and will normally hold a core position of between 20 and 50 securities or other investments. The number of securities or other investments held by the Fund may occasionally exceed this range at times such as when the investment adviser to the Fund, Marsico Capital Management, LLC, is accumulating new positions, phasing out and replacing existing positions, or responding to exceptional market conditions. | The Marsico Global Fund is a “diversified” portfolio and invests primarily in the common stocks of U.S. and foreign companies that are selected for their long-term growth potential. The Fund may invest in an unlimited number of companies of any size that are economically tied to any countries or markets throughout the world, including securities of companies economically tied to emerging markets. Under normal market conditions, the Fund will invest significantly (generally, at least 40% of its net assets) in the securities of issuers organized or located outside the U.S. or doing business outside the U.S. or other foreign securities further described in this Prospectus (unless market conditions are not deemed favorable by the investment adviser to the Fund, Marsico Capital Management, LLC, in which case the Fund generally will invest at least 30% of its assets in such foreign securities). The Fund will invest its assets in various regions and countries, including the U.S., that encompass not less than three different countries overall. |

| | In selecting investments for the Fund, the investment adviser uses an approach that emphasizes the selection of what the investment adviser believes are stocks of high-quality companies with compelling potential for long-term capital appreciation. The investment approach combines “top-down” macro-economic analysis with “bottom-up” company and security analysis. The “top-down” approach generally considers certain macro-economic factors to formulate the strategic backdrop for security selection. These factors may include, without limitation, interest rates, inflation, monetary policy, fiscal policy, trade policy, currency movements, demographic trends, the regulatory environment, and the global competitive landscape. The investment adviser may also examine other factors that may include, without limitation, the most attractive global investment opportunities, sector and industry trends, industry consolidation, and the sustainability of financial trends. Through this “top-down” analysis, the investment adviser seeks to create a strategic backdrop for actual portfolio construction by identifying sectors, industries and companies that may benefit from the overall trends the investment adviser has observed. | In selecting investments for the Fund, the investment adviser uses an approach that emphasizes the selection of what the investment adviser believes are stocks of high-quality companies with compelling potential for long-term capital appreciation. The investment approach combines “top-down” macro-economic analysis with “bottom-up” company and security analysis. The “top-down” approach generally considers certain macro-economic factors to formulate the strategic backdrop for security selection. These factors may include, without limitation, interest rates, inflation, monetary policy, fiscal policy, trade policy, currency movements, demographic trends, the regulatory environment, and the global competitive landscape. The investment adviser may also examine other factors that may include, without limitation, the most attractive global investment opportunities, sector and industry trends, industry consolidation, and the sustainability of financial trends. Through this “top-down” analysis, the investment adviser seeks to create a strategic backdrop for actual portfolio construction by identifying sectors, industries and companies that may benefit from the overall trends the investment adviser has observed. |

| | In the bottom-up analysis, the investment adviser looks for individual companies or securities (including, without limitation, equity securities and fixed or variable income securities) that are expected to offer earnings growth potential that may not be recognized by the market at large, or that may offer dividend or other income. The investment adviser also may consider whether a particular security or other investment potentially offers current income, and may invest up to 40% of its total assets in various types of fixed income and variable income securities, including up to 25% in securities rated below investment grade (commonly called “high yield securities,” also often referred to as “junk bonds”). In selecting fixed income and variable income securities, the investment adviser will also focus on the potential for growth of capital. In determining whether a particular company or security may be a suitable investment, the investment adviser may focus on any of a number of different attributes that may include, without limitation, the company’s specific market expertise or dominance; its market-share position, franchise durability, and pricing power; solid fundamentals (e.g., a strong balance sheet, improving profit margins and returns on equity, the ability to generate free cash flow, apparent use of conservative accounting standards, and transparent financial disclosure); strong and ethical management; commitment to shareholder interests; reasonable current valuations in the context of projected growth rates and peer group comparisons; current income; and other positive transformational catalysts or indications that a company or security may be an attractive investment prospect. This process is called “bottom-up” company and security analysis. | In the bottom-up analysis, the investment adviser looks for individual companies or securities (including, without limitation, equity securities and fixed or variable income securities) that are expected to offer earnings growth potential that may not be recognized by the market at large. In determining whether a particular company or security may be a suitable investment, the investment adviser may focus on any of a number of different attributes that may include, without limitation, the company’s specific market expertise or dominance; its market-share position, franchise durability, and pricing power; solid fundamentals (e.g., a strong balance sheet, improving profit margins and returns on equity, the ability to generate free cash flow, apparent use of conservative accounting standards, and transparent financial disclosure); strong and ethical management; commitment to shareholder interests; reasonable current valuations in the context of projected growth rates and peer group comparisons; current income; and other positive transformational catalysts or indications that a company or security may be an attractive investment prospect. This process is called “bottom-up” company and security analysis. |

| | As part of this fundamental, “bottom-up” research, the investment adviser may visit a company’s management, and conduct other research to gain thorough knowledge of the company. The investment adviser also may prepare detailed earnings and cash flow models of companies. | As part of this fundamental, “bottom-up” research, the investment adviser may visit a company’s management, and conduct other research to gain thorough knowledge of the company. The investment adviser also may prepare detailed earnings and cash flow models of companies. |

| | Examples of core investments in which the Fund may invest (i.e., the primary investments held by the Fund over time) include, without limitation, securities of companies undergoing positive, transformational change in their business model, such as, without limitation, the introduction of a new product, the appointment of a new management team, or a merger or acquisition. In addition, the Fund’s portfolio may include the securities of established companies that are expected to offer long-term growth potential, less mature companies, or securities with more aggressive growth characteristics. | The core investments of the Fund (i.e., the primary investments held by the Fund over time) generally may include established companies and securities that are expected to offer long-term growth potential. However, the Fund’s portfolio also may typically include securities of less mature companies, securities with more aggressive growth characteristics, and securities of companies undergoing positive, transformational change in their business model, such as, without limitation, the introduction of a new product, the appointment of a new management team, or a merger or acquisition. |

| | Equity securities in which the Fund may invest include, without limitation, common stocks, including those that pay dividends or other distributions, securities that are convertible into common stocks or other equity securities, depositary receipts or shares, warrants, rights, real estate investment trusts, partnership securities, and other securities with equity characteristics as further described in the Fund’s Prospectus dated January 31, 2018. The fixed or variable income securities in which the Fund may invest include, without limitation, corporate bonds (including high-yield bonds), preferred stocks, trust-preferred securities, Treasury securities, U.S. government agency securities, asset-backed securities, and other income-producing investments as further described in the Fund’s Prospectus dated January 31, 2018. The Fund is not required to seek current income or to maintain any portion of its total assets in fixed or variable income securities. | |

| The investment adviser may reduce or sell a Fund’s investments in portfolio securities if, in the opinion of the investment adviser, a security’s fundamentals change substantially, its price appreciation leads to overvaluation in relation to the investment adviser’s estimates of future earnings and cash flow growth, the company appears unlikely to realize its growth potential or current income potential, more attractive investment opportunities appear elsewhere or for other reasons. | The investment adviser may reduce or sell the Fund’s investments in portfolio securities if, in the opinion of the investment adviser, a security’s fundamentals change substantially, its price appreciation leads to overvaluation in relation to the investment adviser’s estimates of future earnings and cash flow growth, the company appears unlikely to realize its growth potential or current income potential, more attractive investment opportunities appear elsewhere or for other reasons. |

| | The Fund may invest without limitation in foreign securities further described in this Prospectus depending on market conditions. These securities may be traded in the U.S. or in foreign markets, and may be economically tied to emerging markets. The investment adviser generally selects foreign securities on a security-by-security basis based primarily on considerations such as growth potential rather than geographic location or similar considerations. | |

| | The investment adviser has discretion to hedge exposures to currencies, markets, interest rates and any other variables that could potentially affect returns to investors. The Fund may use derivative investments or instruments such as futures, options, swaps, or forward currency contracts to attempt to hedge the Fund’s portfolio, or to serve other investment purposes as discussed further in the Fund’s Prospectus dated January 31, 2018 under “More Information about the Funds.” The Fund is not intended as a vehicle for investing substantially in derivatives, and tends to hold such investments only infrequently. The Fund is not required to hedge its investments and historically has rarely done so. | The investment adviser has discretion to hedge exposures to currencies, markets, interest rates and any other variables that could potentially affect returns to investors. The Fund may use derivative investments or instruments such as futures, options, swaps, or forward currency contracts to attempt to hedge the Fund’s portfolio, or to serve other investment purposes as discussed further in the Fund’s Prospectus dated January 31, 2018 under “More Information about the Funds.” The Fund is not intended as a vehicle for investing substantially in derivatives, and tends to hold such investments only infrequently. The Fund is not required to hedge its investments and historically has rarely done so. |

| Investment Adviser | Marsico Capital Management, LLC | Marsico Capital Management, LLC |

| Portfolio Manager | Thomas F. Marsico (since March 6, 2018) | Thomas F. Marsico (since June 29, 2007) |

COMPARISON OF FEES AND EXPENSES

The following discussion compares the fees and expenses of the Funds and pro forma estimates of the fees and expenses of the combined Surviving Fund. The Annual Fund Operating Expenses and Example tables shown below are based on actual expenses incurred by the Funds for the twelve-month period ended March 31, 2018. Pro forma figures for the combined Surviving Fund are based on data for the twelve-month period ended March 31, 2018, are presented as if the Reorganization had been consummated on April 1, 2017 and are estimated in good faith.

Annual Fund Operating Expenses

| | Marsico

Flexible Capital

Fund/Acquired Fund* | Marsico Global

Fund/Surviving Fund* | Pro Forma

Estimates for

Marsico Global

Fund/Combined

Surviving Fund** |

| Management fees | 0.80% | 0.80% | 0.79%** |

| Distribution and Service (12b-1) fees | 0.25% | 0.25% | 0.25% |

| Other expenses | 0.40% | 0.63% | 0.53% |

| Total Annual Fund Operating Expenses | 1.45% | 1.68% | 1.57% |

| Fee Waiver and/or Expense Reimbursement | 0.00%(1) | (0.18%)(1) | (0.12%)(1) |

| Net Expenses | 1.45%(1)(2) | 1.50%(1)(2) | 1.45% |

| * | Based on actual expenses incurred for the twelve-month period ended March 31, 2018, taking into account the current contractual expense limitation agreement that took effect on December 1, 2017 as if it was in effect for the full twelve-month period. Prior to December 1, 2017, the investment adviser had agreed to limit the total expenses of each Fund to an annual rate of 1.60% of the average net assets of the Acquired Fund and the Surviving Fund. |

| ** | Pro forma estimates of expenses expected to be incurred are based on data for the twelve-month period ended March 31, 2018, are presented as if the Reorganization had been consummated on April 1, 2017, and are estimated in good faith. All pro forma estimates are approximate, based on factors that could change, and subject to potential revision. |

| (1) | The investment adviser has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of the Acquired Fund and the Surviving Fund (excluding taxes, interest, acquired fund fees and expenses, litigation, extraordinary expenses, brokerage and other transaction expenses relating to the purchase or sale of portfolio investments) to an annual rate of 1.45% of the Acquired Fund’s average net assets, and 1.50% of the Surviving Fund’s average net assets, until January 31, 2019. (MCM has agreed to reduce its current contractual net expense cap of 1.50% for the Surviving Fund to 1.45% upon the closing of the Reorganization at least through September 30, 2019 or one year after the effective date of the Reorganization, whichever is later, to ensure that Acquired Fund shareholders currently benefiting from the contractual 1.45% cap on that Fund, which has a current term through January 2019, will not experience a higher net expense cap due to the Reorganization, through and beyond the end of the current contractual term.) Each expense limitation and fee waiver agreement may be terminated by the investment adviser at any time after the expiration date upon 15 days prior notice to each Fund and its administrator. The investment adviser may recoup from each Fund fees previously waived or expenses previously reimbursed by the investment adviser with respect to that Fund pursuant to this agreement (or a previous expense limitation agreement) if: (1) such recoupment by the investment adviser does not cause the Fund, at the time of recoupment, to exceed the lesser of (a) the expense limitation in effect at the time the relevant amount was waived and/or reimbursed, or (b) the expense limitation in effect at the time of the proposed recoupment, and (2) the recoupment is made within three years after the fiscal year end date as of which the amount to be waived or reimbursed was determined and the waiver or reimbursement occurred. |

| (2) | Total Annual Fund Operating Expenses do not correlate to the “ratio of expenses to average net assets” provided in the Financial Highlights of the March 31, 2018 Marsico Funds Semi-Annual Report or the September 30, 2017 Marsico Funds Annual Report (“Reports”) because the information above is presented for the twelve-month period ended March 31, 2018 rather than the specific periods addressed in those Reports. The information in the Reports does not include the restatement of the expense limitation and fee waiver agreement amount applicable to each Fund for the respective entire applicable periods. The impact of the reduced expense limitation is reflected in the “Fee Waiver and/or Expense Reimbursement” and “Net Expenses” line items above. |

Examples

The following examples are intended to help you compare the costs of investing in each Fund and the combined Fund. The examples are based on the table above showing actual fees and expenses incurred by the Funds for the twelve-month period ended March 31, 2018 and pro forma estimates for the combined Surviving Fund, and assume that you invest $10,000 in each Fund and in the combined Fund after the Reorganization for the time periods indicated and reflect what you would pay if you close your account at the end of each of the time periods shown. The examples also assume that your investment has a 5% return each year, that all distributions are reinvested and that each Fund’s operating expenses remain the same (except that the example reflects the current expense limitation (or assumed expense limitation for the Combined Surviving Fund) for the 1-year period, and only for the first year of each additional period, because of the limited contractual period of each expense limitation agreement(1)). Your actual costs may be higher or lower than those presented.

Fund | 1 year | 3 years | 5 years | 10 years |

| Marsico Flexible Capital Fund/Acquired Fund * (2) | $148 | $459 | $792 | $1,735 |

Marsico Global Fund/Surviving Fund* (2) | $153 | $512 | $896 | $1,972 |

Pro Forma Estimates for Marsico Global Fund/Combined Surviving Fund** | $148 | $484 | $844 | $1,857 |

| (1) | See Note (1) above regarding certain written expense limitation and fee waiver agreements. |

| * | Based on actual expenses incurred for the twelve-month period ended March 31, 2018 , taking into account the current contractual expense limitation agreement that took effect on December 1, 2017 as if it was in effect for the full twelve-month period. Prior to December 1, 2017, the investment adviser had agreed to limit the total expenses of each Fund to an annual rate of 1.60% of the average net assets of the Acquired Fund and the Surviving Fund. |

| (2) | See Note (2) above regarding the lack of correlation with the “ratio of expenses to average net assets” provided in the Financial Highlights of the Reports. Data presented for all time periods commences as of the beginning of the twelve-month period ended March 31, 2018. |

| ** | See Note ** above regarding pro forma estimates. |

COMPARISON OF SALES LOAD, DISTRIBUTION AND SHAREHOLDER SERVICING ARRANGEMENTS

Each Fund is sold at NAV without any sales charge being imposed. The Funds have adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act, and effective December 1, 2017, the Board of Trustees approved a Second Amended and Restated Distribution and Service Plan (the “Plan”). Each Fund is subject to a distribution fee pursuant to the Plan of 0.25% per annum of each Fund's average daily net assets.

COMPARISON OF PURCHASE, REDEMPTION AND EXCHANGE POLICIES AND PROCEDURES

The Funds have the same policies with respect to purchases, redemptions and exchanges by shareholders. More complete information regarding the Funds’ purchase, redemption and exchange policies and procedures may be found in Exhibit B to this Information Statement/Prospectus.

COMPARISON OF PRINCIPAL RISKS OF INVESTING IN THE FUNDS

As discussed above, the Acquired Fund and the Surviving Fund have the same investment objectives, and they have similar principal investment strategies, with limited exceptions. In addition, the Acquired Fund and the Surviving Fund have the same fundamental and non-fundamental investment restrictions, as disclosed in each Fund’s Statement of Additional Information dated January 31, 2018. Because of the similarities between the investment objectives, strategies and limitations of the Funds, and current holdings of each Fund, the risks of investing in the Acquired Fund are similar to the risks of investing in the Surviving Fund. Due to certain differences in the principal investment strategies of each Fund, however, the overall risk profile of each Fund could potentially differ. The Acquired Fund could be subject to greater risks associated with fixed income investments than the Surviving Fund if the Acquired Fund were to invest significantly in those types of investments in accordance with its more flexible investment strategy (although the Acquired Fund is not currently investing significantly in fixed income securities), and the Surviving Fund could be subject to greater foreign investment risk than the Acquired Fund in light of the Surviving Fund’s investment strategy to generally invest at least 40% of its assets in non-U.S. securities under normal market conditions and the Acquired Fund’s flexibility to maintain lower exposure to non-U.S. securities (although the Acquired Fund is not currently maintaining substantially lower exposure to non-U.S. securities).

Similar Principal Risks and Investment Restrictions of the Funds

As with any mutual fund, you may lose money on your investment in the Acquired Fund or Surviving Fund. The value of each Fund’s shares may go up or down, sometimes rapidly and unpredictably. Market conditions, financial conditions of issuers represented in a Fund, investment strategies, portfolio management, and other factors affect the volatility of each Fund’s shares. There is no guarantee that either Fund will achieve its investment objective.

Both the Acquired Fund and the Surviving Fund are subject to the following principal risks:

Equity Securities, Markets, and Investment Risks Generally. Each Fund is subject to the broad risks associated with investing in equity securities markets generally, including, without limitation, the risks that the securities and markets in which the Fund invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that the investment adviser may select investments for the Fund that do not perform as anticipated.

Foreign Investment Risk. Investments in foreign securities generally, and emerging markets in particular, may be riskier than U.S. investments for a variety of reasons such as, without limitation, unstable international, political and economic conditions, currency fluctuations, foreign controls on investment and currency exchange, foreign governmental control of some issuers, potential confiscatory taxation or nationalization of companies by foreign governments, sovereign solvency considerations, withholding taxes, a lack of adequate company information, less liquid and more volatile exchanges and/or markets, ineffective or detrimental government regulation, varying accounting standards, political or economic factors that may severely limit business activities, legal systems or market practices that may permit inequitable treatment of minority and/or non-domestic investors, immature economic structures, and less developed and more thinly-traded securities markets.

Currency Risk. The performance of each Fund may be materially affected positively or negatively by foreign currency strength or weakness relative to the U.S. dollar, particularly if the Fund invests a significant percentage of its assets in foreign securities or other assets denominated in currencies not tightly pegged to the U.S. dollar. Changes in foreign currency exchange rates will affect the value of a Fund’s securities and the price of the Fund’s shares. Generally, when the value of the U.S. dollar rises relative to another currency of a foreign country, an investment in an issuer whose securities are denominated in that country’s currency (or whose business is conducted principally in that country’s currency) loses value, because that currency is worth fewer U.S. dollars. Devaluation of a currency by a country’s government or banking authority also may have a significant impact on the value of any investments denominated in that currency. The risk that these events could occur may be heightened in emerging markets. A Fund generally purchases or sells foreign currencies when it purchases or sells securities denominated in those currencies, and may make other investments in foreign currencies for hedging purposes, or to serve other investment purposes. Currency markets generally are not as regulated as securities markets.

Sector Risk. While each Fund does not have a principal investment strategy to focus its investments in any particular sector, a Fund from time to time may have significant exposure to one or more sectors, and in those circumstances would be subject to risks associated with those sectors. These include the risk that the stocks of multiple companies within a sector could simultaneously decline in price because of an event that affects the entire sector.

Additional Principal Risks Specific to the Acquired Fund

The Acquired Fund may also be affected by the following principal risks (which generally are not principal risks of the Surviving Fund):

Credit Risk. The Fund could lose money if the issuer of a fixed or variable income security cannot meet its financial obligations and renegotiates terms that are less favorable to investors, or defaults or goes bankrupt.

Interest Rate Risk. The value of investments in fixed or variable income securities may fall substantially if interest rates rise.

High-Yield Risk. High-yield corporate debt securities with credit ratings that are below investment grade (also often referred to as “junk bonds”) may be subject to potentially higher risks of default and greater volatility than other debt securities.

Additional Principal Risks Specific to the Surviving Fund

None.

Additional Risk Information

The principal risks discussed above and additional risks applicable to both Funds are discussed in more detail in the section of the Funds’ Prospectus titled “The Principal Risks of Investing in the Funds” and in the Statement of Additional Information, each dated January 31, 2018.

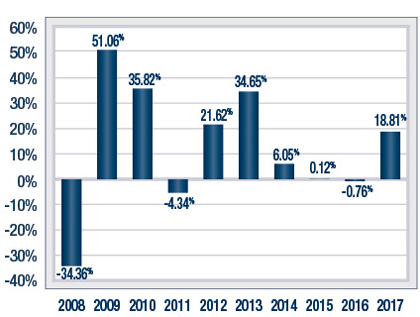

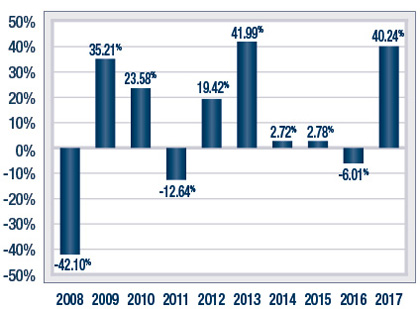

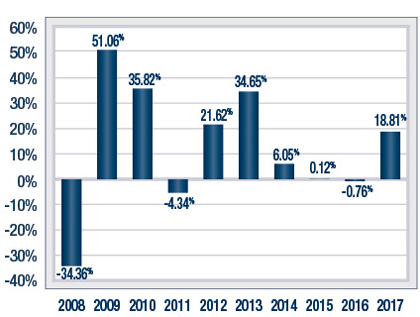

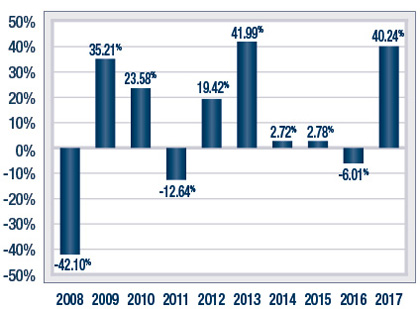

COMPARISON OF PERFORMANCE

Set forth below is performance information for the Acquired Fund and the Surviving Fund for each of the past ten calendar years. The following performance information provides some indication of the risks of investing in each of the Funds. The bar charts below show changes in each Fund’s performance from calendar year to year for the past ten years, together with the best and worst quarters during that time. The tables below show how each Fund’s average annual total returns (before and after taxes) for the periods of one year, five years, ten years, and since inception, compared with those of each Fund’s respective applicable broad-based securities market index. All presentations assume reinvestment of dividends and distributions. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of future results. You can obtain updated performance information on the Trust’s website at marsicofunds.com, or by calling 888-860-8686.

Acquired Fund

Calendar Year Total Returns

| | Best Quarter | (06/30/09): | 25.04% | |

| | Worst Quarter | (12/31/08): | -19.56% | |

| Average Annual Total Returns (for periods ended 12/31/17) |

| Marsico Flexible Capital Fund (Acquired Fund) | One Year | Five Years | Ten Years | Since Inception (12/29/06) |

| Return before taxes | 18.81% | 11.01% | 10.20% | 10.63% |

| Return after taxes on distributions* | 15.49% | 8.02% | 8.42% | 8.80% |

| Return after taxes on distributions and sale of shares* | 13.37% | 8.26% | 8.07% | 8.41% |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | 21.83% | 15.79% | 8.50% | 8.22% |

| * | After-tax returns are calculated using the historical highest individual federal marginal income tax rates currently in effect and do not reflect the impact of state and local taxes. Actual after-tax returns will depend on an investor’s tax situation, which may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Surviving Fund

Calendar Year Total Returns

| | Best Quarter | (06/30/09): | 22.11% | |

| | Worst Quarter | (12/31/08): | -23.34% | |

| Average Annual Total Returns (for periods ended 12/31/17) |

| Marsico Global Fund (Surviving Fund) | One Year | Five Years | Ten Years | Since Inception (06/29/07) |

| Return before taxes | 40.24% | 14.59% | 7.15% | 8.66% |

| Return after taxes on distributions* | 37.37% | 12.17% | 5.96% | 7.45% |

| Return after taxes on distributions and sale of shares* | 25.06% | 11.28% | 5.56% | 6.84% |

| Morgan Stanley Capital International All Country World Index (reflects no deduction for fees, expenses or taxes) | 23.97% | 10.80% | 4.65% | 4.58% |

| * | After-tax returns are calculated using the historical highest individual federal marginal income tax rates currently in effect and do not reflect the impact of state and local taxes. Actual after-tax returns will depend on an investor’s tax situation, which may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

INFORMATION ABOUT THE REORGANIZATION

The Agreement and Plan of Reorganization

Significant provisions of the Plan of Reorganization are summarized below. For more information about the Reorganization, please refer to the copy of the Plan of Reorganization attached to this Information Statement/Prospectus as Exhibit A.

The Plan of Reorganization provides for: (i) the transfer of all of the assets of the Acquired Fund to the Surviving Fund, in exchange for shares of the Surviving Fund (“Surviving Fund Shares”) having an aggregate value equal to the net assets of the Acquired Fund at the valuation time of the Reorganization on the Closing Date; (ii) the assumption by the Surviving Fund of all of the liabilities of the Acquired Fund; and (iii) the distribution of Surviving Fund Shares to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund in accordance with the terms and conditions in the Plan of Reorganization.

Immediately following the Reorganization, each shareholder of the Acquired Fund will own Surviving Fund Shares having an aggregate net asset value equal to the aggregate net asset value of the shares in the Acquired Fund owned by that shareholder on the Closing Date. In the interest of economy and convenience, the Surviving Fund shall not issue certificates representing such Surviving Fund Shares in connection with such exchange.

The Surviving Fund and the Acquired Fund have adopted the same valuation policies and procedures and therefore there are no differences between their respective valuation policies and procedures for purposes of valuing assets in each respective Fund.

The obligations of the Funds under the Plan of Reorganization are subject to various conditions, including receipt of an opinion from legal counsel that the Reorganization will qualify as a tax-free reorganization for U.S. federal income tax purposes. The Plan of Reorganization may be terminated by resolution of the Board, on behalf of either the Surviving Fund or the Acquired Fund, at any time prior to the Closing Date, if circumstances should develop that, in the opinion of the Board, make proceeding with the Reorganization inadvisable.

Reasons for the Reorganization and Board Considerations

The proposed Reorganization was presented to the Board of Trustees of the Trust for consideration at a meeting held on May 9, 2018. At this meeting, representatives of Marsico Capital Management, LLC (“MCM”) provided, and the Board reviewed, information about the proposed Reorganization. Written materials were furnished to the Board in advance of the meeting, and supplemental information was provided at the meeting. Representatives of MCM informed the Board of Trustees that they had determined that the Reorganization would be advisable and in the best interests of the Acquired Fund and the Surviving Fund, for the following reasons, among others:

| ● | MCM believes the Reorganization would provide an opportunity to implement an investment program seeking to generate long-term growth of capital using the most successful elements of the Funds, including emphasizing global growth securities and de-emphasizing income securities and equity securities with income characteristics; |

| ● | The principal investment strategies and principal risks of the Surviving Fund will not change in connection with the Reorganization; |

| ● | Investors have shown more interest in the Surviving Fund’s investment strategy over recent periods, as reflected in its steady or increased assets, while the Acquired Fund’s assets have decreased; |

| ● | The Surviving Fund has outperformed the Acquired Fund over recent and medium-term periods based on average annual total returns (the Surviving Fund has higher average annual total returns than the Acquired Fund for the one- and five-year periods ending December 31, 2017, and lower average annual total returns than the Acquired Fund for the ten-year and since-inception periods ending December 31, 2017); |

| ● | The Surviving Fund has outperformed both its benchmark and its Lipper category peers over each of the one-, three-, five- and ten-year periods based on average annual total returns ending December 31, 2017; |

| ● | The Acquired Fund has exhibited slightly less volatility than the Surviving Fund over portions of the ten-year period ending December 31, 2017, as reflected in the Calendar Year Total Returns tables above; |

| ● | The Acquired Fund’s shareholders may benefit from the Reorganization through increased operating and portfolio management efficiencies as a result of combining the two Funds’ assets, including Surviving Fund expense efficiencies relating to an increase in overall assets, which could lead to a lower expense ratio over time; and |

| ● | Depending on the combined Fund’s assets at the time of the Reorganization, the shareholders of both Funds may benefit from their combined assets exceeding a $250 million management fee breakpoint, which initially may slightly reduce the Surviving Fund’s blended management fee rate after the Reorganization compared to the fee rate currently paid by both Funds separately, and could further reduce the blended management fee rate if the Surviving Fund’s assets continue to grow. |

The Board of each Fund met telephonically on May 4, 2018 to discuss information provided by MCM and Fund counsel and requested and received additional information. At the May 9, 2018 meeting, the Board of each Fund considered matters relating to the Reorganization. During the course of these meetings, the Board of each Fund requested, received and discussed information regarding the Reorganization, including presentations from MCM regarding the rationale for the Reorganization and potential benefits and costs that may accrue to the Funds as a result. The Board of each Fund also received a memorandum from Fund counsel with information provided by MCM outlining, among other things, the legal standards and certain other considerations relevant to the Board’s deliberations. During the course of the Board’s deliberations, the Independent Trustees of each Fund were represented by independent counsel.

At the Board’s May 9, 2018 Meeting, the Board of each Fund, including the Independent Trustees, unanimously concluded that completion of the Reorganization would be in the best interests of such Fund and that the interests of its existing shareholders would not be diluted with respect to NAV as a result of the Reorganization. The Board’s determinations were made on the basis of each Trustee’s business judgment after consideration of relevant factors taken as a whole with respect to each Fund and its shareholders, although individual Trustees may have placed different weight and assigned different degrees of importance to various factors. In reaching its determinations, the Board of each Fund considered a number of factors, including, but not limited to, the factors discussed below.

Continuity in Investment Program. The Board considered that the Reorganization would maintain substantial continuity of the Funds’ overall investment objectives and strategies. The Acquired Fund and Surviving Fund have the same investment objective and fundamental and non-fundamental investment policies and restrictions. The Board noted that the Funds also have similar principal investment strategies and principal risks, although there are some differences.

Consistency of Day-to-Day Portfolio Management. The Board noted that, after the Reorganization, MCM would continue its current role as investment manager and Thomas F. Marsico, who oversees the daily investment operations of each Fund, will continue to serve as the portfolio manager of the Surviving Fund following the Reorganization. As a result, each Fund’s shareholders are expected to benefit from the continuing experience and expertise of the same portfolio manager. The Board considered that the Surviving Fund (following the Reorganization) expects to continue to receive all required services from its current service providers with no anticipated change or interruption of service and on current fee terms.

Potential for Improved Economies of Scale and Potential for a Lower Total Expense Ratio for the Surviving Fund. The Board considered the fees and total expense ratio of each Fund. The Board noted that the Funds had estimated that the completion of the Reorganization would result in a lower total annual expense ratio (before waivers) for the Surviving Fund and the same total annual expense ratio (after waivers) for the Acquired Fund. MCM confirmed that it is willing to reduce its current contractual net expense cap of 1.50% for the Surviving Fund to 1.45% upon the closing of the Reorganization at least through September 30, 2019 or one year after the effective date of the Reorganization, whichever is later, to ensure that Acquired Fund shareholders currently benefiting from the contractual 1.45% cap on that Fund, which has a current term through January 2019, will not experience a higher net expense cap due to the Reorganization, through and beyond the end of the current contractual term. The Board noted, however, that there can be no assurance that future expenses will not increase or that any expense savings will be realized. The Board also noted that, depending on the combined Fund’s assets at the time of the Reorganization, the shareholders of both Funds may benefit from their combined assets exceeding a $250 million management fee breakpoint, which initially may slightly reduce the Surviving Fund’s blended management fee rate after the Reorganization.

Fund Performance. The Board considered the relative performance of each Fund, including the performance of the Acquired Fund and Surviving Fund in comparison to their benchmarks and Lipper category peer funds for periods ended March 31, 2018. The Board noted that the Surviving Fund has outperformed the Acquired Fund over recent and medium-term periods, and has outperformed both its benchmark and its Lipper category peers over each of the calendar year-to-date, one-, three-, five-, ten-year and since-inception periods

Potential for Operating and Administrative Efficiencies. The Board noted that the Surviving Fund (when combined with the Acquired Fund) may achieve certain operating and administrative efficiencies from its larger net asset size. The Board also noted that such a combined fund may experience potential benefits from having fewer similar funds in the same fund complex, including a simplified operational model and potential benefits from the elimination of complexities involved with having similar funds, including easier product differentiation for shareholders and potential investors and reduced risk of operational, legal and financial errors. While there are anticipated to be certain ancillary benefits to MCM as a result of streamlining the management of the Funds, the Board noted that the primary beneficiaries will be the Funds’ shareholders.

Anticipated Tax-Free Reorganization. The Board noted that it is anticipated that shareholders of each Fund will recognize no gain or loss for federal income tax purposes as a result of the Reorganizations (except with respect to distributions of undistributed net investment income, if any), as the Reorganization is intended to qualify as a “reorganization” within the meaning of the Internal Revenue Code of 1986.

Terms of the Reorganization and Impact on Shareholders. The Board noted that the aggregate NAV of the shares of the Surviving Fund that Acquired Fund shareholders will receive in the Reorganization is expected to equal the aggregate NAV of the Acquired Fund shares that Acquired Fund shareholders owned immediately prior to the Reorganization, and the NAV of Acquired Fund shares will not be diluted as a result of the Reorganization.

Expected Costs of the Reorganization. The Board considered that MCM had agreed to bear the costs and expenses of the Reorganizations, excluding brokerage commissions and other transaction costs incurred by a Fund for repositioning of its holdings.

Portfolio Repositioning. The Board considered that the Reorganization was expected to result in minimal portfolio repositioning.

Potential Benefits to MCM. The Board recognized that the Reorganization may result in some limited benefits and economies of scale for MCM. These may include, for example, small administrative and operational efficiencies or a reduction in certain operational expenses as a result of the elimination of the Acquired Fund as a separate series of the Trust. The Board was advised by MCM that such benefits and economies of scale are expected to be minimal. The Board noted that MCM expects to experience a reduction in management fees as a result of the combined Surviving Fund having aggregate assets above a breakpoint level. MCM is also reducing its contractual expense cap for the Surviving Fund.

Alternatives to the Reorganization. In reaching its decision to approve the Reorganization of each Fund, the Board considered alternatives, including continuing to operate each Fund as a separate Fund.

Requirements under the 1940 Act. The Board also took note of the fact that the Reorganization is being conducted in accordance with applicable rules under the 1940 Act that permit affiliated mutual funds to be reorganized without obtaining the vote of shareholders if certain conditions are met, and the Board considered that the relevant conditions were satisfied in connection with the Reorganization and that shareholders of the Acquired Fund would receive prior notice of the Reorganization. Those conditions included: (i) the fundamental policies of the Acquired Fund are the same as those of the Surviving Fund; (ii) the investment advisory agreement between the Acquired Fund and MCM is not materially different from the investment advisory agreement between the Surviving Fund and MCM; (iii) the independent board members overseeing the Acquired Fund who were elected by shareholders of the Trust at a meeting held in 2006 comprise a majority of the independent board members who oversee the Surviving Fund; and (iv) the distribution fees authorized to be paid by the Surviving Fund pursuant to the Surviving Fund’s distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act are no greater than the distribution fees authorized to be paid by the Acquired Fund pursuant to the Acquired Fund’s distribution plan adopted pursuant to Rule 12b-1.

Conclusion. The Board, including the Independent Trustees, separately approved the Reorganization for each Fund, concluding that the Reorganization is in the best interests of the Fund and that the interests of existing shareholders of such Fund will not be diluted as a result of the Reorganization. The Board’s determinations were made on the basis of each Trustee’s business judgment after consideration of relevant factors taken as a whole with respect to each Fund and its shareholders, although individual Trustees may have placed different weight on various factors and assigned different degrees of importance to various factors.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Acquired Fund nor its shareholders, nor the Surviving Fund nor its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Plan of Reorganization, excluding any net capital gains that may arise from the sale of investment securities related to portfolio realignment. As a condition precedent to the closing of the Reorganization, the Funds will receive an opinion from the law firm of Dechert LLP, counsel to the Trust, to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Funds.

Prior to the Reorganization, the Acquired Fund will be required to make a special distribution or distributions to its shareholders, which will have the effect of distributing to its shareholders all of the Acquired Fund’s investment company taxable income for the taxable period ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gains, if any, realized in the taxable period ending on or prior to the Reorganization (after reduction for any available capital loss carry forwards). Depending on each shareholder’s tax status, such distributions may be included in the taxable income of Acquired Fund shareholders.

The Funds have not identified any portfolio securities that either of them currently expects to sell in connection with the Reorganization. As of the date of this Information Statement/Prospectus, all securities held by the Acquired Fund comply with the compliance guidelines and/or the investment restrictions of the Surviving Fund. Any sales of portfolio securities could, under certain circumstances, cause limited potentially adverse tax results for certain taxable investors because such sales could potentially result in the recognition of capital gains by the Fund that sells the securities, depending upon the specific circumstances of the portfolio security, which could then be passed through to shareholders. As of the date of this Information Statement/Prospectus, no such sales are expected to be made. Accordingly, no Reorganization-related brokerage fees, other transaction costs and capital gains distributions relating to sales of portfolio securities are expected.

At present, there are no capital loss carryover amounts that may be transferred from the Acquired Fund to the Surviving Fund.

You should consult your tax advisor regarding the effect, if any, of the Reorganization in light of your individual circumstances. Since the foregoing discussion only relates to the federal income tax consequences of the Reorganization, you should also consult your tax advisor as to state and other local tax consequences, if any, of the Reorganization.

Expenses of the Reorganization

MCM has agreed to bear Reorganization costs (excluding brokerage commissions and other transaction costs incurred by a Fund for repositioning its holdings, as discussed above). MCM expects that Reorganization costs will include, but not be limited to: (i) legal fees and accounting fees with respect to the Reorganization; (ii) any and all necessary taxes in connection with the delivery of the Acquired Fund assets, including all applicable federal and state stock transfer stamps; (iii) Reorganization-related expenses related to matters such as fund administration, transfer agency, distribution, fund accounting and custody services; the preparation and assembly of this Information Statement/Prospectus and all mailing and other expenses associated therewith; and (iv) miscellaneous expenses associated with the Reorganization.

ADDITIONAL INFORMATION ABOUT THE FUNDS

Investment Adviser

Marsico Capital Management, LLC (“MCM”), located at 1200 17th Street, Suite 1600, Denver, CO 80202, serves as the investment adviser to the Funds under certain Investment Advisory and Management Agreements (the “Advisory Agreements”) with the Trust. MCM is an indirect, wholly-owned subsidiary of Marsico Holdings, LLC (“Holdings”). Holdings, in turn, is owned by Marsico Group, LLC (“Group”) and by third parties. Group controls Holdings as its managing member, holds 100% of the voting rights in Holdings, and owns approximately 38% of the equity interests of Holdings, the largest block of equity interests held by any single entity. Group, in turn, is owned by management of MCM, including certain employees and their family interests. The principal owner and managing member of Group is a partnership controlled by Thomas F. Marsico. Through the partnership's control of Group, it retains 100% of voting rights and control over the ongoing management and day-to-day operations of Holdings and its subsidiaries, including MCM. In addition to advising the Funds, MCM provides investment services to other mutual funds and separate accounts and, as of December 31, 2017, had approximately $3.03 billion in assets under management.

Thomas F. Marsico has served as the portfolio manager of the Acquired Fund since March 6, 2018. Mr. Marsico has served as a portfolio manager of the Surviving Fund since its inception in June 2007. Mr. Marsico is the founder, Chief Executive Officer, and Chief Investment Officer of MCM. The Surviving Fund’s SAI dated January 31, 2018, as supplemented, provides additional information about the Portfolio Manager’s compensation, other accounts managed and the Portfolio Manager’s ownership of shares in the Surviving Fund.

MCM manages the investment portfolios of the Funds, subject to policies adopted by the Board. Under the Advisory Agreements, the Adviser, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and personnel necessary for managing the Funds. MCM also pays the salaries and fees of all officers and Trustees of the Trust who are also officers or employees of MCM, except for a portion of the compensation of the Trust’s Chief Compliance Officer as authorized by the Board. The Trust pays the compensation and fees of the Independent Trustees. The Surviving Fund pays MCM a fee calculated using the following rates: 0.80% per year of its average daily net assets up to $250 million, 0.75% per year of its average daily net assets for the next $250 million, 0.70% per year of its average daily net assets for the next $250 million, and 0.65% per year of its average daily net assets exceeding $750 million. In each case, the percentages noted do not account for the effect of any recoupment of any fees previously waived or expenses previously reimbursed.

As of December 1, 2017, MCM entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of the Surviving Fund (excluding taxes, interest, acquired fund fees and expenses, litigation, extraordinary expenses, brokerage and other transaction expenses relating to the purchase or sale of portfolio investments) to an annual rate of 1.50% of the average net assets of the Surviving Fund. As noted above, MCM has agreed to reduce its current contractual net expense cap of 1.50% for the Surviving Fund to 1.45% upon the closing of the Reorganization at least through September 30, 2019 or one year after the effective date of the Reorganization, whichever is later, to ensure that Acquired Fund shareholders currently benefiting from the contractual 1.45% cap on that Fund, which has a current term through January 2019, will not experience a higher net expense cap due to the Reorganization, through and beyond the end of the current contractual term. Each expense limitation and fee waiver agreement may be terminated by MCM at any time after the expiration date, upon 15 days prior notice to the Surviving Fund and its administrator. The Adviser may recoup from a Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to that Fund pursuant to this agreement (or a previous expense limitation agreement) if: (1) such recoupment by the Adviser does not cause the Fund, at the time of recoupment, to exceed the lesser of (a) the expense limitation in effect at the time the relevant amount was waived and/or reimbursed, or (b) the expense limitation in effect at the time of the proposed recoupment, and (2) the recoupment is made within three years after the fiscal year end date as of which the amount to be waived or reimbursed was determined and the waiver or reimbursement occurred.

A discussion regarding the basis for the Board’s approval of the Advisory Agreements between the Marsico Funds (including the Global Fund) and MCM is available in the Marsico Funds’ Semi-Annual Report to shareholders dated March 31, 2018.

Administrative Services

Pursuant to an Administration Agreement (the “Administration Agreement”), UMB Fund Services, Inc. (the “Administrator”), 235 West Galena Street, Milwaukee, WI, 53212, serves as the Administrator of the Funds. The Funds pay the Administrator a fee, computed daily and payable monthly, based on the Funds’ average net assets at an annual rate beginning at 0.13% and decreasing as the net assets reach certain levels, subject to a minimum annual fee of $50,000 for the Surviving Fund for administrative services.

Other Service Providers

UMB Fund Services, Inc., located at 235 West Galena Street, Milwaukee, WI 53212, also serves as the Trust’s transfer agent (the “Transfer Agent”).

UMB Distribution Services, LLC (the “Distributor”), located at 235 West Galena Street, Milwaukee, WI 53212, acts as the principal underwriter of shares of the Funds pursuant to an Distribution Agreement with the Trust.

State Street Bank and Trust Company (the “Custodian”), located at One Lincoln Street, Boston, MA 02111, provides fund accounting services for the Funds and custody services for the securities and cash of the Funds.

PricewaterhouseCoopers LLP (“PwC”), located at 1900 16th Street, Suite 1600, Denver, CO 80202, serves as the Funds’ independent registered public accounting firm, audits the Funds’ annual financial statements, and reviews the Funds’ tax returns.

Dechert LLP, located at 90 State House Square, Hartford, CT 06103, serves as counsel to the Funds.

Form of Organization

The Funds are series of the Trust, which is an open-end management investment company organized as a Delaware statutory trust. The Trust is governed by a Board of Trustees consisting of six members, four of whom are Independent Trustees.

Capitalization

The following table shows the capitalization of each of the Funds as of March 31, 2018, and on a pro forma basis as of March 31, 2018 giving effect to the Reorganization as if it had occurred on that date:

| (Amounts in thousands) | Marsico

Flexible Capital

Fund/Acquired

Fund | Marsico Global

Fund/Surviving

Fund | Adjustments | Pro Forma

Marsico Global

Fund/Combined

Fund |

| Net Assets | $ 223,517 | $ 51,814 | $ -- | $ 275,331 |

| Shares Outstanding | 15,843 | 3,370 | (1,306) | 17,907 |

| Net Asset Value Per Share* | $ 14.11 | $ 15.38 | $ (14.11) | $ 15.38 |

| * | Not in thousands, based on unrounded net assets and shares outstanding. |

Security Ownership of Certain Beneficial Owners

As of May 15, 2018, the following persons owned beneficially or of record 5% or more of the outstanding shares of the Surviving Fund:

| Principal Holders of Securities | Number of Shares Held | Percentage of the

Outstanding Shares |

| NATIONAL FINANCIAL SERVICES CORP | 835,946 | 23.83% |

| CHARLES SCHWAB | 795,347 | 22.68% |

| THOMAS F. MARSICO | 387,145 | 11.04% |

| TD AMERITRADE INC | 297,177 | 8.47% |

As of May 15, 2018, the following persons owned beneficially or of record 5% or more of the outstanding shares of the Acquired Fund:

| Principal Holders of Securities | Number of Shares Held | Percentage of the

Outstanding Shares |

| NATIONAL FINANCIAL SERVICES CORP | 7,015,492 | 45.60% |

| CHARLES SCHWAB | 2,234,031 | 14.52% |

| PERSHING LLC | 1,124,234 | 7.31% |

Financial Highlights of the Surviving Fund The Financial Highlights table below is meant to help you understand the financial performance of the Surviving Fund over the period of the Fund’s operations. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that you would have earned (or lost) on an investment in the Surviving Fund, assuming reinvestment of all dividends and distributions. The information for each fiscal year through the fiscal year ended September 30, 2017, has been audited by PricewaterhouseCoopers LLP, an Independent Registered Public Accounting Firm, whose report, along with the Surviving Fund’s financial statements, are included in the Trust’s Annual Report, which is available upon request and which are incorporated by reference herein. The information for the six-month period ended March 31, 2018 is unaudited and is included, along with the Surviving Fund’s financial statements, in the Trust’s Semi-Annual Report, which is also available upon request and is incorporated by reference herein. |

| Financial Highlights | |

| | | Six-Month Period Ended 03/31/18 (Unaudited) | | | Year Ended 09/30/17 | | | Year Ended 09/30/16 | | | Year Ended 09/30/15 | | | Year Ended 09/30/14 | | | Year Ended 09/30/13 | |

| For a Fund Share Outstanding Throughout the Period | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 15.13 | | | $ | 12.03 | | | $ | 12.37 | | | $ | 14.45 | | | $ | 14.74 | | | $ | 11.51 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.05 | ) | | | (0.14 | ) | | | (0.16 | ) | | | (0.10 | ) | | | (0.05 | ) | | | (0.02 | ) |

| Net realized and unrealized gain (losses) on investments | | | 1.64 | | | | 3.24 | | | | 1.14 | | | | (0.32 | ) | | | 1.93 | | | | 3.25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | 1.59 | | | | 3.10 | | | | 0.98 | | | | (0.42 | ) | | | 1.88 | | | | 3.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions & Other: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | --- | | | | --- | | | | --- | | | | --- | | | | --- | | | | --- | |

| Net realized gains | | | (1.34 | ) | | | --- | | | | (1.32 | ) | | | (1.66 | ) | | | (2.17 | ) | | | --- | |

| Redemption fees | | | --- | | | | --- | | | | --- | | | | --- | | | | --- | (1) | | | --- | (1) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total distributions and other | | | (1.34 | ) | | | --- | | | | (1.32 | ) | | | (1.66 | ) | | | (2.17 | ) | | | --- | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 15.38 | | | $ | 15.13 | | | $ | 12.03 | | | $ | 12.37 | | | $ | 14.45 | | | $ | 14.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 11.08 | %(2) | | | 25.77 | % | | | 8.05 | % | | | (3.51 | )% | | | 13.23 | % | | | 28.06 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s) | | $ | 51,814 | | | $ | 44,493 | | | $ | 44,273 | | | $ | 66,612 | | | $ | 73,475 | | | $ | 61,383 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets, less waivers and before expenses paid indirectly, plus recoupment of previously waived fees or expenses paid | | | 1.53 | %(3) | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % |

| Ratio of net investment income (loss) to average net assets, net of waivers, recoupment of previously waived fees or expenses paid and expenses paid indirectly | | | (1.03 | )%(3) | | | (0.82 | )% | | | (0.60 | )% | | | (0.80 | )% | | | (0.42 | )% | | | (0.06 | )% |

| Ratio of expenses to average net assets, before waivers, recoupment of previously waived fees or expenses paid and expenses paid indirectly | | | 1.63 | %(3) | | | 1.80 | % | | | 1.69 | % | | | 1.54 | % | | | 1.66 | % | | | 1.86 | % |

| Ratio of net investment income (loss) to average net assets, before waivers, recoupment of previously waived fees or expenses paid and expenses paid indirectly | | | (1.13 | )%(3) | | | (1.02 | )% | | | (0.69 | )% | | | (0.74 | )% | | | (0.48 | )% | | | (0.32 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 45 | %(2) | | | 79 | % | | | 82 | % | | | 110 | % | | | 129 | % | | | 134 | % |

| (1) | Less than $0.01. |

| (2) | Not annualized. |

| (3) | Annualized. |

EXHIBIT A

AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (“Plan of Reorganization”), is made as of the ninth day of May, 2018, by The Marsico Investment Fund, a Delaware statutory trust with its principal place of business at 1200 17th Street, Suite 1600, Denver, Colorado 80202, on behalf of each of two of its separate series, the Marsico Flexible Capital Fund (“Acquired Fund”) and the Marsico Global Fund (“Surviving Fund”), and, solely with respect to Paragraph 10.2, Marsico Capital Management, LLC.