Filed by Raytheon Company

Pursuant to Rule 425 under the Securities Act of 1933

And deemed filed pursuant to Rule14a-12

Under the Securities Exchange Act of 1934

Subject Company: Raytheon Company

Commission File No.:001-13699

Date: July 25, 2019

The following information was made available as part of Raytheon’s Second Quarter 2019 earnings conference call presentation on July 25, 2019:

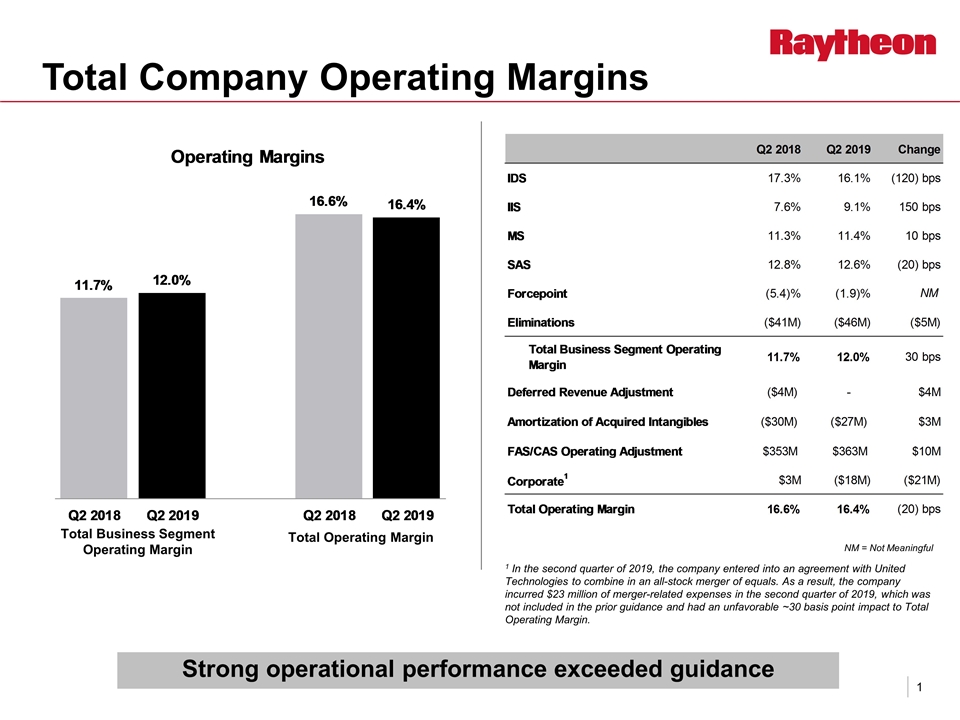

Total Company Operating Margins Total Operating Margin Total Business Segment Operating Margin NM = Not Meaningful Strong operational performance exceeded guidance 1 In the second quarter of 2019, the company entered into an agreement with United Technologies to combine in an all-stock merger of equals. As a result, the company incurred $23 million of merger-related expenses in the second quarter of 2019, which was not included in the prior guidance and had an unfavorable ~30 basis point impact to Total Operating Margin.

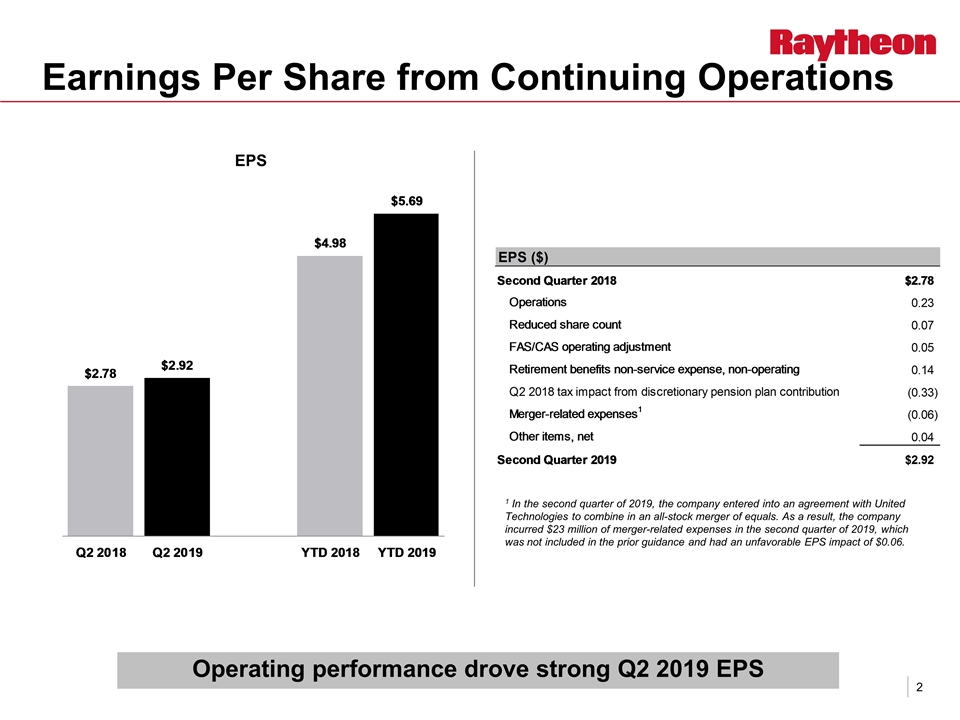

Earnings Per Share from Continuing Operations EPS Operating performance drove strong Q2 2019 EPS 1 In the second quarter of 2019, the company entered into an agreement with United Technologies to combine in an all-stock merger of equals. As a result, the company incurred $23 million of merger-related expenses in the second quarter of 2019, which was not included in the prior guidance and had an unfavorable EPS impact of $0.06.

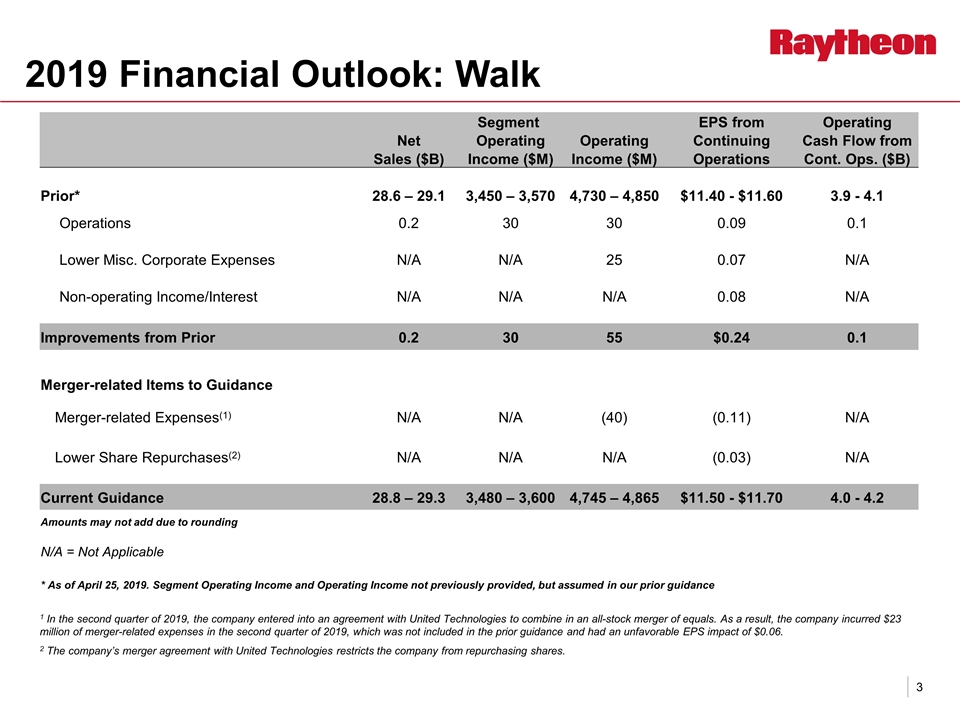

2019 Financial Outlook: Walk Segment EPS from Operating Net Operating Operating Continuing Cash Flow from Sales ($B) Income ($M) Income ($M) Operations Cont. Ops. ($B) Prior* 28.6 – 29.1 3,450 – 3,570 4,730 – 4,850 $11.40 - $11.60 3.9 - 4.1 Operations 0.2 30 30 0.09 0.1 Lower Misc. Corporate Expenses N/A N/A 25 0.07 N/A Non-operating Income/Interest N/A N/A N/A 0.08 N/A Improvements from Prior 0.2 30 55 $0.24 0.1 Merger-related Items to Guidance Merger-related Expenses(1) N/A N/A (40) (0.11) N/A Lower Share Repurchases(2) N/A N/A N/A (0.03) N/A Current Guidance 28.8 – 29.3 3,480 – 3,600 4,745 – 4,865 $11.50 - $11.70 4.0 - 4.2 Amounts may not add due to rounding N/A = Not Applicable * As of April 25, 2019. Segment Operating Income and Operating Income not previously provided, but assumed in our prior guidance 1 In the second quarter of 2019, the company entered into an agreement with United Technologies to combine in an all-stock merger of equals. As a result, the company incurred $23 million of merger-related expenses in the second quarter of 2019, which was not included in the prior guidance and had an unfavorable EPS impact of $0.06. 2 The company’s merger agreement with United Technologies restricts the company from repurchasing shares.

Forward-Looking Statements This presentation contains forward-looking statements, including information regarding the company's financial outlook, future plans, objectives, business prospects and anticipated financial performance. These forward-looking statements are not statements of historical facts and represent only the company's (sometimes referred to as Raytheon) current expectations regarding such matters. These statements inherently involve a wide range of known and unknown risks and uncertainties. The company's actual actions and results could differ materially from what is expressed or implied by these statements. Specific factors that could cause such a difference include, but are not limited to: risks associated with the announcement of the proposed merger with United Technologies Corporation (UTC), including its effect on our customer, supplier and other business relationships, employee retention and hiring, resources and management’s attention, our ability to pursue new business and investment opportunities, our operating results and business generally, and the market price of our common stock; risks associated with the successful and timely completion of the proposed merger with UTC and the related integration, as described in more detail below; the company's dependence on the U.S. government for a significant portion of its business and the risks associated with U.S. government sales, including changes or shifts in defense spending due to budgetary constraints, spending cuts resulting from sequestration, a government shutdown, or otherwise, uncertain funding of programs, potential termination of contracts and performance under undefinitized contract awards; difficulties in contract performance; the resolution of program terminations; the ability to procure new contracts; the risks of conducting business in foreign countries; the unpredictability of timing of international bookings; the ability to comply with extensive governmental regulation, including export and import requirements such as the International Traffic in Arms Regulations and the Export Administration Regulations, anti-bribery and anti-corruption requirements including the Foreign Corrupt Practices Act, industrial cooperation agreement obligations, and procurement and other regulations; dependence on U.S. government approvals for international contracts; changes in government procurement practices; the impact of competition; the ability to develop products and technologies, and the impact of associated investments and costs; the ability to recruit and retain qualified personnel; the impact of potential security and cyber threats, and other disruptions; the risk that actual pension returns, discount rates or other actuarial assumptions, including the long-term return on asset assumption, are significantly different than the company's current assumptions; the risk of cost overruns, particularly for the company's fixed-price contracts; dependence on material and component availability, subcontractor and partner performance and key suppliers; risks of a negative government audit; risks associated with acquisitions, investments, dispositions, joint ventures and other business arrangements; the ability to grow in the government and commercial cybersecurity markets; risks of an impairment of goodwill or other intangible assets; the impact of financial markets and global economic conditions; the use of accounting estimates in the company's financial statements; the outcome of contingencies and litigation matters, including government investigations; the risk of environmental liabilities; changes in tax laws and regulations, or their interpretation; and other factors as may be detailed from time to time in the company's public announcements and Securities and Exchange Commission filings. Risks associated with the successful and timely completion of the proposed merger with UTC and the related integration include (1) the effect of economic conditions in the industries and markets in which UTC and Raytheon operate in the U.S. and globally and any changes therein, including financial market conditions, fluctuations in commodity prices, interest rates and foreign currency exchange rates, levels of end-market demand in construction and in both the commercial and defense segments of the aerospace industry, levels of air travel, financial condition of commercial airlines, the impact of weather conditions and natural disasters, the financial condition of our customers and suppliers, and the risks associated with U.S. government sales (including changes or shifts in defense spending due to budgetary constraints, spending cuts resulting from sequestration, a government shutdown, or otherwise, and uncertain funding of programs); (2) challenges in the development, production, delivery, support, performance and realization of the anticipated benefits (including our expected returns under customer contracts) of advanced technologies and new products and services; (3) the scope, nature, impact or timing of the proposed merger and the spin-offs by UTC of its Otis and Carrier businesses into separate companies (the separation transactions) and other merger, acquisition and divestiture activity, including among other things the integration of or with other businesses and realization of synergies and opportunities for growth and innovation and incurrence of related costs and expenses; (4) future levels of indebtedness, including indebtedness that may be incurred in connection with the proposed merger and the separation transactions, and capital spending and research and development spending; (5) future availability of credit and factors that may affect such availability, including credit market conditions and our capital structure; (6) the timing and scope of future repurchases by the combined company of its common stock, which may be suspended at any time due to various factors, including market conditions and the level of other investing activities and uses of cash; (7) delays and disruption in delivery of materials and services from suppliers; (8) company and customer-directed cost reduction efforts and restructuring costs and savings and other consequences thereof (including the potential termination of U.S. government contracts and performance under undefinitized contract awards and the potential inability to recover termination costs); (9) new

Forward-Looking Statements (continued) business and investment opportunities; (10) the ability to realize the intended benefits of organizational changes; (11) the anticipated benefits of diversification and balance of operations across product lines, regions and industries; (12) the outcome of legal proceedings, investigations and other contingencies; (13) pension plan assumptions and future contributions; (14) the impact of the negotiation of collective bargaining agreements and labor disputes; (15) the effect of changes in political conditions in the U.S. and other countries in which UTC, Raytheon and the businesses of each operate, including the effect of changes in U.S. trade policies or the U.K.’s pending withdrawal from the European Union, on general market conditions, global trade policies and currency exchange rates in the near term and beyond; (16) the effect of changes in tax (including U.S. tax reform enacted on December 22, 2017, which is commonly referred to as the Tax Cuts and Jobs Act of 2017), environmental, regulatory and other laws and regulations (including, among other things, export and import requirements such as the International Traffic in Arms Regulations and the Export Administration Regulations, anti-bribery and anti-corruption requirements, including the Foreign Corrupt Practices Act, industrial cooperation agreement obligations, and procurement and other regulations) in the U.S. and other countries in which UTC, Raytheon and the businesses of each operate; (17) negative effects of the announcement or pendency of the proposed merger or the separation transactions on the market price of UTC’s and/or Raytheon’s respective common stock and/or on their respective financial performance; (18) the ability of the parties to receive the required regulatory approvals for the proposed merger (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and approvals of UTC’s stockholders and Raytheon’s stockholders and to satisfy the other conditions to the closing of the merger on a timely basis or at all; (19) the occurrence of events that may give rise to a right of one or both of the parties to terminate the merger agreement; (20) risks relating to the value of the UTC shares to be issued in the proposed merger, significant transaction costs and/or unknown liabilities; (21) the possibility that the anticipated benefits from the proposed merger cannot be realized in full or at all or may take longer to realize than expected, including risks associated with third-party contracts containing consent and/or other provisions that may be triggered by the proposed transaction; (22) risks associated with transaction-related litigation; (23) the possibility that costs or difficulties related to the integration of UTC’s and Raytheon’s operations will be greater than expected; (24) risks relating to completed merger, acquisition and divestiture activity, including UTC’s integration of Rockwell Collins, including the risk that the integration may be more difficult, time-consuming or costly than expected or may not result in the achievement of estimated synergies within the contemplated time frame or at all; (25) the ability of each of Raytheon, UTC, the companies resulting from the separation transactions and the combined company to retain and hire key personnel; (26) the expected benefits and timing of the separation transactions, and the risk that conditions to the separation transactions will not be satisfied and/or that the separation transactions will not be completed within the expected time frame, on the expected terms or at all; (27) the intended qualification of (i) the merger as a tax-free reorganization and (ii) the separation transactions as tax-free to UTC and UTC’s stockholders, in each case, for U.S. federal income tax purposes; (28) the possibility that any opinions, consents, approvals or rulings required in connection with the separation transactions will not be received or obtained within the expected time frame, on the expected terms or at all; (29) expected financing transactions undertaken in connection with the proposed merger and the separation transactions and risks associated with additional indebtedness; (30) the risk that dissynergy costs, costs of restructuring transactions and other costs incurred in connection with the separation transactions will exceed UTC’s estimates; and (31) the impact of the proposed merger and the separation transactions on the respective businesses of Raytheon and UTC and the risk that the separation transactions may be more difficult, time-consuming or costly than expected, including the impact on UTC’s resources, systems, procedures and controls, diversion of its management’s attention and the impact on relationships with customers, suppliers, employees and other business counterparties. There can be no assurance that the proposed merger, the separation transactions or any other transaction described above will in fact be consummated in the manner described or at all. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see the preliminary joint proxy statement/prospectus (defined below) and the reports of UTC and Raytheon on Forms 10-K, 10-Q and 8-K filed with or furnished to the Securities and Exchange Commission (the “SEC”) from time to time. The company undertakes no obligation to make any revisions to the forward-looking statements contained in this release and the attachments or to update them to reflect events or circumstances occurring after the date of this release, including any acquisitions, dispositions or other business arrangements that may be announced or closed after such date.

Forward-Looking Statements (continued) Additional Information and Where to Find It In connection with the proposed merger, on July 17, 2019, UTC filed with the SEC a registration statement on Form S-4, which includes a preliminary joint proxy statement of UTC and Raytheon that also constitutes a preliminary prospectus of UTC (the “preliminary joint proxy statement/prospectus”), which will be mailed to stockholders of UTC and stockholders of Raytheon once the registration statement becomes effective and the preliminary joint proxy statement/prospectus is in definitive form (the “definitive joint proxy statement/prospectus”), and each party will file other documents regarding the proposed merger with the SEC. In addition, in connection with the separation transactions, subsidiaries of UTC will file registration statements on Form 10 or Form S-1. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain copies of the registration statements and the definitive joint proxy statement/prospectus free of charge from the SEC’s website or from UTC or Raytheon. The documents filed by UTC with the SEC may be obtained free of charge at UTC’s website at www.utc.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from UTC by requesting them by mail at UTC Corporate Secretary, 10 Farm Springs Road, Farmington, CT, 06032, by telephone at 1-860-728-7870 or by email at corpsec@corphq.utc.com. The documents filed by Raytheon with the SEC may be obtained free of charge at Raytheon’s website at www.raytheon.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Raytheon by requesting them by mail at Raytheon Company, Investor Relations, 870 Winter Street, Waltham, MA, 02541, by telephone at 1-781-522-5123 or by email at invest@raytheon.com. Participants in the Solicitation Raytheon and UTC and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information about Raytheon’s directors and executive officers is available in Raytheon’s proxy statement dated April 16, 2019, for its 2019 Annual Meeting of Shareholders. Information about UTC’s directors and executive officers is available in UTC’s proxy statement dated March 18, 2019, for its 2019 Annual Meeting of Shareowners. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the preliminary joint proxy statement/prospectus and will be contained in the definitive joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the transaction when they become available. Investors should carefully read the preliminary joint proxy statement/prospectus and the definitive joint proxy statement/prospectus when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Raytheon or UTC as indicated above. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.