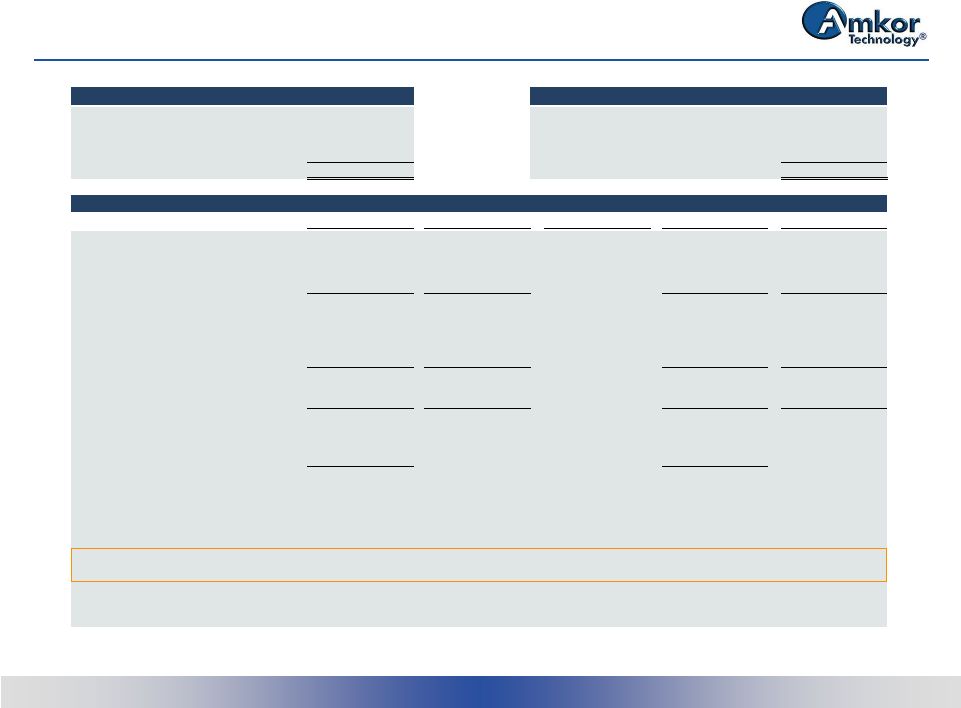

© 2013 Amkor Technology, Inc. Amkor Confidential Information 14 Financial Reconciliation Tables We define free cash flow as net cash provided by operating activities less purchases of property, plant and equipment. Free cash flow is not defined by U.S. generally accepted accounting principles ("U.S. GAAP"). However, we believe free cash flow to be relevant and useful information to our investors because it provides them with additional information in assessing our liquidity, capital resources and financial operating results. Our management uses free cash flow in evaluating our liquidity, our ability to service debt and our ability to fund capital additions. However, free cash flow has certain limitations, including that it does not represent the residual cash flow available for discretionary expenditures since other, non-discretionary expenditures, such as mandatory debt service, are not deducted from the measure. The amount of mandatory versus discretionary expenditures can vary significantly between periods. This measure should be considered in addition to, and not as a substitute for, or superior to, other measures of liquidity or financial performance prepared in accordance with U.S. GAAP, such as net cash provided by operating activities. Furthermore, our definition of free cash flow may not be comparable to similarly titled measures reported by other companies. We define EBIT as net income before interest expense and income tax expense. We define EBITDA as EBIT before depreciation and amortization. EBIT and EBITDA are not defined by U.S. GAAP. However, we believe EBIT and EBITDA to be relevant and useful information to our investors because they provide investors with additional information in assessing our financial operating results. Our management uses EBIT and EBITDA in evaluating our operating performance, our ability to service debt and our ability to fund capital additions. However, these measures should be considered in addition to, and not as a substitute for, or superior to, operating income, net income or other measures of financial performance prepared in accordance with U.S. GAAP, and our definitions of EBIT and EBITDA may not be comparable to similarly titled measures reported by other companies. We define return on invested capital ("ROIC") as net operating profit after tax (the sum of operating income plus equity in earnings of unconsolidated affiliate less income tax expense) divided by average invested capital (the sum of average debt plus average equity less average cash). ROIC is not defined by U.S. GAAP. However, we believe ROIC is relevant and useful information for our investors and management in evaluating whether our capital investments are generating stockholder value. |