Exhibit 99.2

1 I © 2023 United Rentals, Inc. All rights reserved. United Rentals to Acquire H&E Equipment Services January 14, 2025

2 I This presentation contains forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 , known as the PSLRA . Forward - looking statements involve significant risks and uncertainties that may cause actual results to differ materially from such forward - looking statements . These statements are based on current plans, estimates and projections, and, therefore, you should not place undue reliance on them . No forward - looking statement, including any such statement concerning the completion and anticipated benefits of the proposed transaction, can be guaranteed, and actual results may differ materially from those projected . Forward - looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and future financial results of the equipment rental industries, and other legal, regulatory and economic developments . We use words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “targets,” “potential,” “continue,” “guidance” and similar expressions to identify these forward - looking statements that are intended to be covered by the safe harbor provisions of the PSLRA . Actual results could differ materially from the results contemplated by these forward - looking statements due to a number of factors, including, but not limited to, those described in the SEC reports filed by United Rentals and H&E Equipment Services, as well as the possibility that ( 1 ) United Rentals may be unable to obtain regulatory approvals required for the proposed transaction or may be required to accept conditions that could reduce the anticipated benefits of the acquisition as a condition to obtaining regulatory approvals ; ( 2 ) the length of time necessary to consummate the proposed transaction may be longer than anticipated ; ( 3 ) problems may arise in successfully integrating the businesses of United Rentals and H&E Equipment Services, including, without limitation, problems associated with the potential loss of any key employees of H&E Equipment Services ; ( 4 ) the proposed transaction may involve unexpected costs, including, without limitation, the exposure to any unrecorded liabilities or unidentified issues that we failed to discover during the due diligence investigation of H&E Equipment Services or that are not covered by insurance, as well as potential unfavorable accounting treatment and unexpected increases in taxes ; ( 5 ) our business may suffer as a result of uncertainty surrounding the proposed transaction or any adverse effects on our ability to maintain relationships with customers, employees and suppliers ; ( 6 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the failure of the closing conditions included in the merger agreement to be satisfied, or any other failure to consummate the proposed transaction ; ( 7 ) any negative effects of the announcement of the proposed transaction or the financing thereof on the market price of United Rentals or H&E Equipment Services common stock or other securities ; and ( 8 ) the industry may be subject to future risks that are described in the “Risk Factors” section of the Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and other documents filed from time to time with the SEC by United Rentals and H&E Equipment Services . United Rentals gives no assurance that it will achieve its expectations and does not assume any responsibility for the accuracy and completeness of the forward - looking statements . The foregoing list of factors is not exhaustive . You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of United Rentals and H&E Equipment Services described in the “Risk Factors” section of the Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and other documents filed from time to time with the SEC by United Rentals and H&E Equipment Services . The forward - looking statements contained herein speak only as of the date hereof . United Rentals undertakes no obligation to publicly update or revise any forward - looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws . This presentation is for informational purposes only and is not intended to be a recommendation to buy, sell or hold securities and does not constitute an offer for the sale of, or the solicitation of an offer to buy securities in any jurisdiction, including the United States . Any such offer will only be made by means of a prospectus or offering memorandum, and in compliance with applicable securities laws . This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities . Our tender offer has not commenced . At the time the tender offer is commenced, we will file, or will cause to be filed, tender offer materials on Schedule TO with the SEC and H&E Equipment Services will file a Solicitation/Recommendation Statement on Schedule 14 D - 9 with the SEC, in each case with respect to the tender offer . The tender offer materials (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement, as they may be amended from time to time, will contain important information that should be read carefully when they become available and considered before any decision is made with respect to the tender offer . Those materials and all other documents filed by, or caused to be filed by, United Rentals and H&E Equipment Services with the SEC will be available at no charge on the SEC’s website at www . sec . gov . The tender offer materials and related materials also may be obtained for free (when available) under the “Financials — SEC Filings” section of our investor website at https : //investors . unitedrentals . com/, and the Solicitation/Recommendation Statement and such other documents also may be obtained for free (when available) from H&E Equipment Services under the “Financial Information — SEC Filings” section of H&E Equipment Services’ investor website at https : //investor . he - equipment . com/ . Note : This presentation provides information about H&E Equipment Services’ adjusted EBITDA, which is a non - GAAP financial measure . United Rentals believes that this non - GAAP financial measure provides useful information about the proposed transaction ; however, it should not be considered as an alternative to GAAP net income . A reconciliation between H&E Equipment Services’ adjusted EBITDA and GAAP net income is provided in the appendix to this presentation . Introductory Information

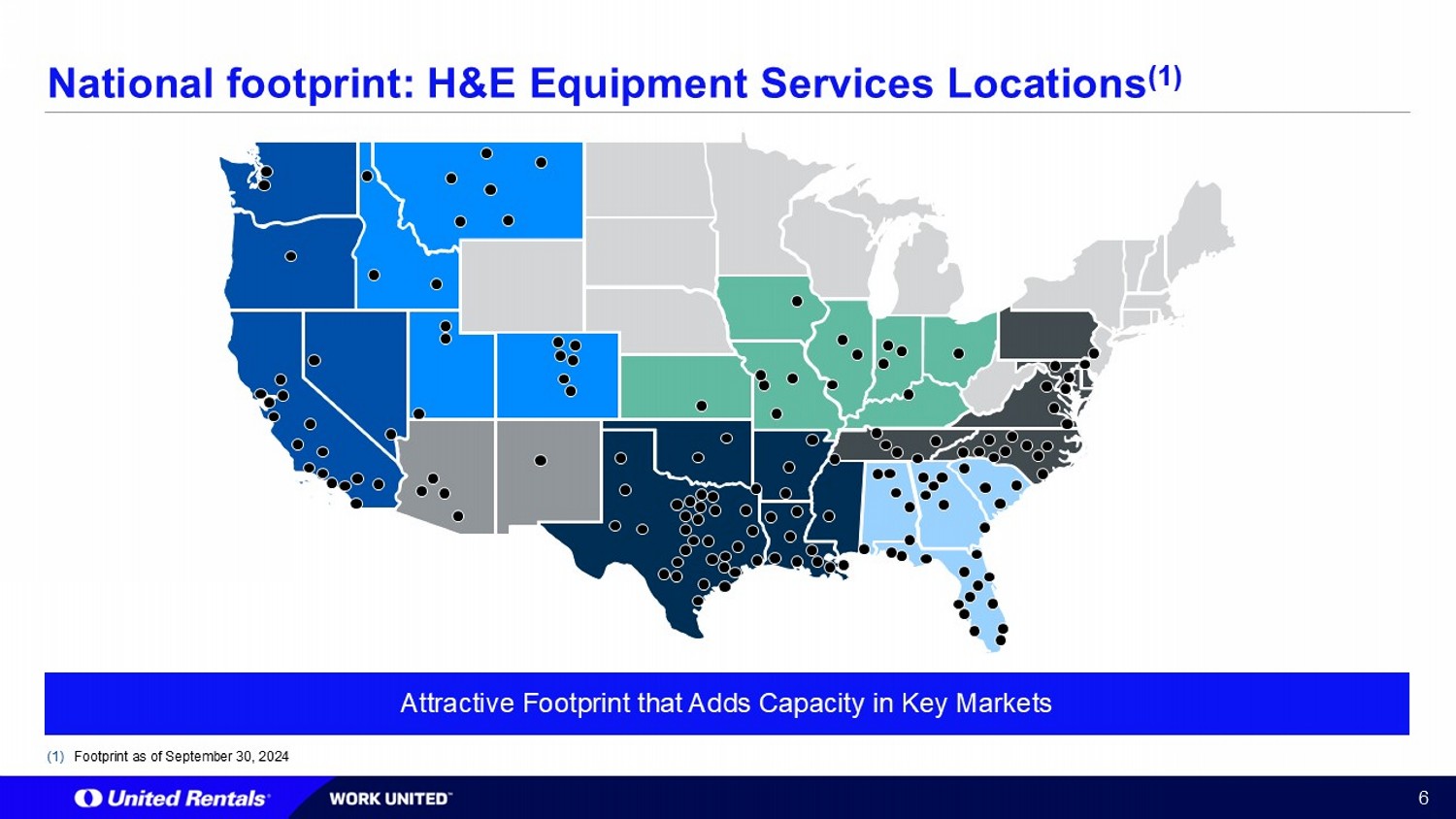

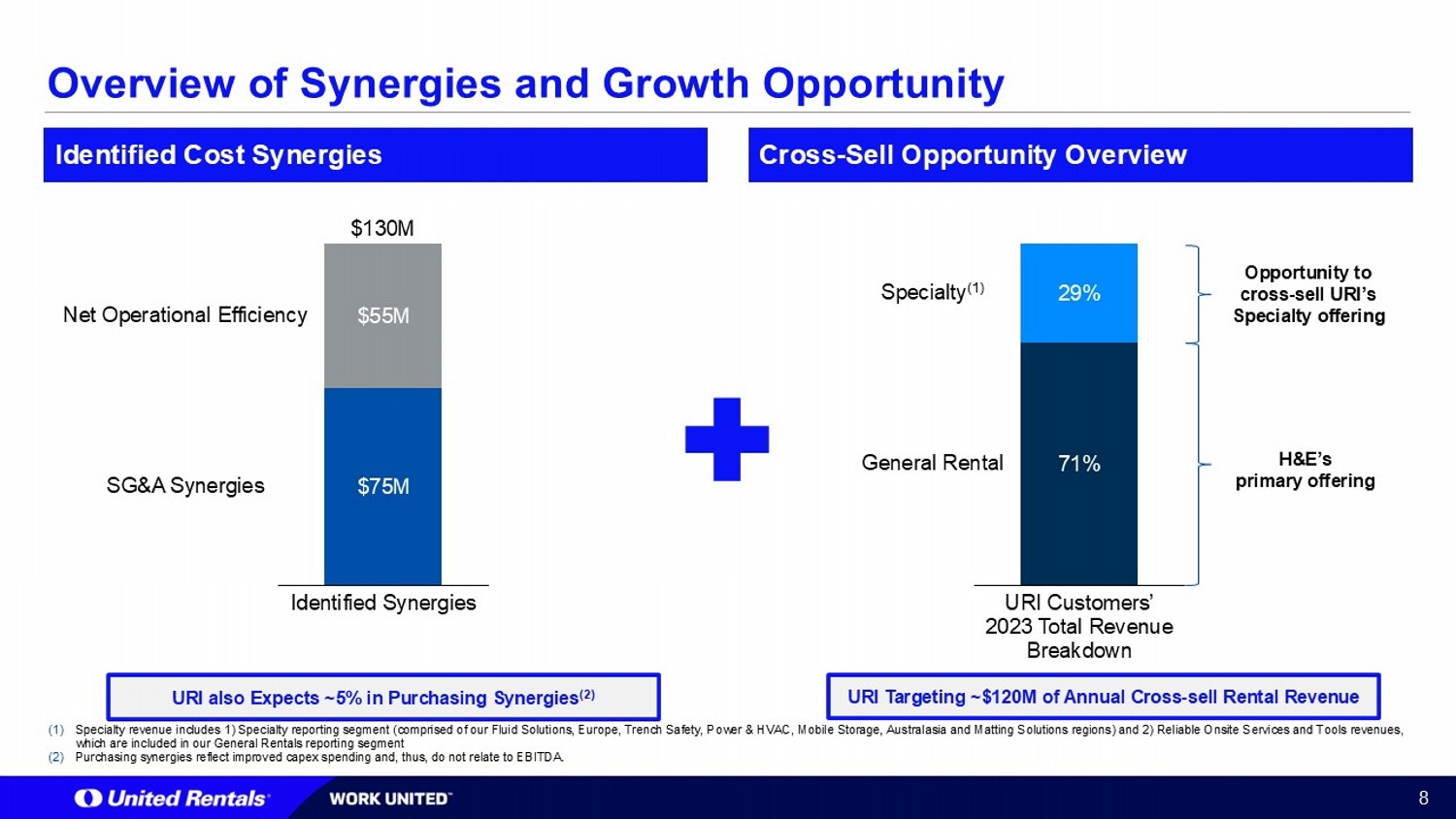

3 Transaction Highlights (1) Adjusted EBITDA is a non - GAAP financial measure. See appendix to this presentation for a reconciliation between H&E Equipment S ervices net income (loss) and H&E Equipment Services adjusted EBITDA. URI acquiring a leading domestic General Rental provider with LTM September 2024 revenue of $1.5B and Adjusted EBITDA of $ 696M (1 ) Strategic Overview Financial Overview • Consistent with United Rentals’ “Grow the Core” strategy: − Adds critical capacity in key categories to support long - term growth: people, rental fleet, real estate, etc. − Increases efficiencies with an attractive footprint of ~160 locations across key markets in over 30 U.S. States − H&E Equipment Services brings a national presence, strong customer relationships, and ~2,900 valuable employees in key field rol es − Attractive fleet mix with ~$2.9B in rental OEC with an average age of only ~41 months − Compelling cross - sell opportunity supported by URI’s one - stop shop strategy • Leverages United Rentals’ core competency in M&A integration • Opportunity to utilize URI’s processes and technology to improve productivity and efficiency in operations and sales • $ 4.8B cash purchase price, structured as a tender offer for shares • Purchase multiple of 6.9x LTM September 2024 Adj. EBITDA, 5.8x net of synergies and tax benefits • $130M of identified annual cost synergies expected to be realized within 24 months of closing • $120M of targeted cross - sell opportunity by year 3 across Power & HVAC, Fluid Solutions, Trench Safety, Portable Storage & Modul ar Space, Onsite Services, Tool Solutions, & Matting Solutions • The acquisition is expected to be accretive to EPS and FCF in the first year, with an attractive internal rate of return and NPV , and a run rate ROIC that reaches cost of capital within 36 months of closing on a run - rate basis; compelling return profile across a range of macro scenarios • Expected to be funded through ABL borrowings and newly issued debt and/or borrowings • Pro Forma Q3 2024 net leverage ratio of 2.3x with goal of reducing to ~2.0x within 12 months of close • Pause share repurchase program to support deleveraging goals • Expected to close during Q1 2025

4 Note: Financial benefits are not exhaustive and exclude the net present value of related tax benefits. Cost and revenue syner gie s reflect targeted levels. Proven Ability to Create Value Through GenRent M&A M&A is a Core Competency that Benefits Both Customers and Shareholders 2012 2017 2017 2018 2022 Key Acquisitions Positions URI as leader in North American rental industry Strengthened aerial capabilities; added two - way cross - sell opportunities New capabilities in infrastructure; added two - way cross - sell opportunities Bolstered NA rental position; increased local and mid - sized presence Bolstered NA rental position; increased local and mid - sized presence Strategic Value $200M of cost synergies $35M of cost synergies, $15M of revenue synergies $45M of cost synergies, $35M of revenue synergies $40M of cost synergies, $60M of revenue synergies Financial Benefits Cultural Alignment $40M of cost synergies, $35M of revenue synergies

5 H&E Equipment Services Overview • H&E is a leading U.S. General Rental provider offering equipment across four key categories: aerial work platforms, earthmoving, material handing, and general equipment • Founded in 1961 and headquartered in Baton Rouge, LA • ~2,900 employees and ~160 locations across the U.S serving approximately 44,000 customers • Scaled equipment rental portfolio consisting of ~$2.9B of OEC (1) with almost 64,000 units at an attractive overall average age of ~41 months. Assets also include ~$230M of non - rental fleet (i.e., autos, trucks, forklifts, etc.) • LTM September 2024 total revenue of $1.5B with an Adj. EBITDA margin of 45.8 % (2) Business Description Fleet Mix (% OEC ) (1) Customer Vertical Mix (% Revenue ) (2) (1) As of September 30, 2024 (2) LTM through September 30, 2024 33% 30% 25% 12% Aerial Material Handling Earthmoving General / Other 69% 9% 9% 4% 9% Non - Residential Industrial Residential Oil & Gas Other

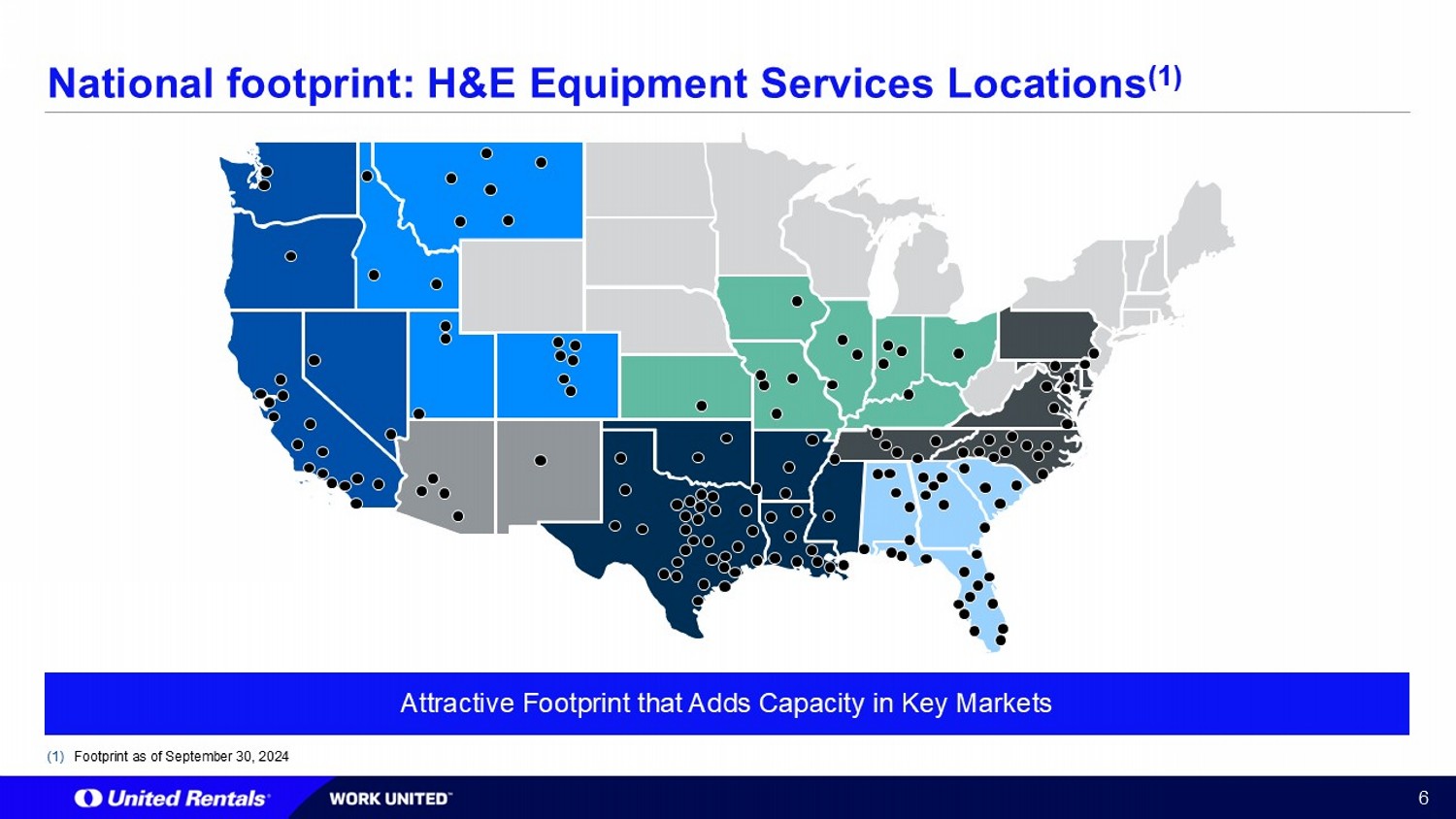

6 National footprint: H&E Equipment Services Locations (1) Attractive Footprint that Adds Capacity in Key Markets (1) Footprint as of September 30, 2024

7 Compelling Financial Opportunity • Core business well aligned with URI’s General Rental business • Meaningful opportunity for cost synergies • Significant opportunity for cross - selling of United Rentals’ Specialty offerings • Rapid integration will enable fleet sharing across the combined customer base Financial Profile Key Highlights 37.0% 43.6% 46.8% 45.8% 60% $200M $400M 10% $800M $1,000M $1,200M $1,400M $1,600M 20% 30% 40% 50% $600M 2023 2022 2021 $1,063M $1,245M $1,469M $1,518M LTM September 2024 Opportunity to Create More Value (1) Adjusted EBITDA is a non - GAAP financial measure. See appendix to this presentation for a reconciliation between H&E Equipment S ervices net income (loss) and H&E Equipment Services adjusted EBITDA. Adj. EBITDA margin Revenue

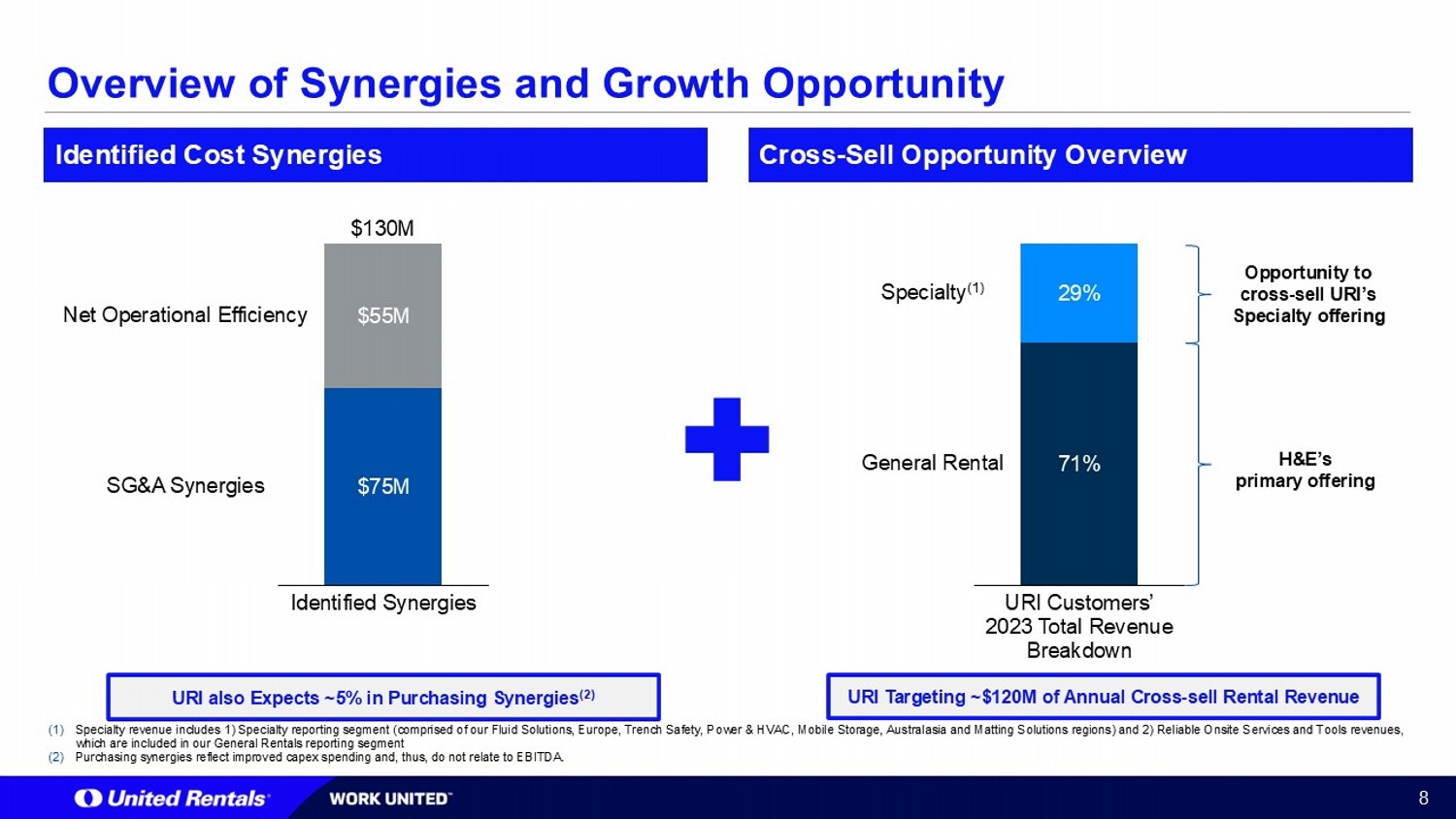

8 Overview of Synergies and Growth Opportunity Identified Cost Synergies Cross - Sell Opportunity Overview $75M $55M Identified Synergies Net Operational Efficiency SG&A Synergies $130M 71% 29% URI Customers’ 2023 Total Revenue Breakdown Specialty (1) General Rental H&E’s primary offering Opportunity to cross - sell URI’s Specialty offering (1) Specialty revenue includes 1) Specialty reporting segment (comprised of our Fluid Solutions, Europe, Trench Safety, Power & H VAC , Mobile Storage, Australasia and Matting Solutions regions) and 2) Reliable Onsite Services and Tools revenues, which are included in our General Rentals reporting segment (2) Purchasing synergies reflect improved capex spending and, thus, do not relate to EBITDA. URI also Expects ~5% in Purchasing Synergies (2) URI Targeting ~$120M of Annual Cross - sell Rental Revenue

APPENDIX

10 Reconciliation of H&E Equipment Services Net Income to Adjusted EBITDA (1) Adjustment includes goodwill impairment charges in the third quarter ended September 30, 2023. H&E Equipment Services EBITDA represents the sum of net income, interest expense, provision for income taxes, rental deprecia tio n and amortization expense and non - rental depreciation and amortization expense. H&E Equipment Services adjusted EBITDA represents EBITDA plus certain expenses detailed within the rec onciliation below. EBITDA and adjusted EBITDA are non - GAAP financial measures. LTM Fiscal Year Ending December 31, September 2024 2023 2022 2021 ($000s) $143,742 $169,293 $133,694 $60,564 Net Income $71,713 $60,891 $54,033 $53,758 Interest expense $47,292 $53,904 $47,036 $21,160 Provision for income taxes $412,386 $381,959 $296,310 $254,158 Depreciation $9,075 $6,455 $4,660 $3,970 Amortization of intangibles $684,208 $672,502 $535,733 $393,610 EBITDA $0 $5,714 $0 $0 Impairment of goodwill( 1) $11,328 $10,026 $7,263 $0 Non - cash stock - based compensation expense $695,536 $688,242 $542,996 $393,610 Adjusted EBITDA