Exhibit 10.1

EXECUTION COPY

ASSIGNMENT AND ACCEPTANCE AGREEMENT

AND

AMENDMENT NO. 1 TO

THIRD AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT

THIS ASSIGNMENT AND ACCEPTANCE AGREEMENT AND AMENDMENT NO. 1 TO THIRD AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT (this “Agreement”) is dated as of February 1, 2013 and is entered into by and among UNITED RENTALS RECEIVABLES LLC II, a Delaware limited liability company (the “Seller”), UNITED RENTALS, INC., a Delaware corporation (the “Collection Agent”), LIBERTY STREET FUNDING LLC, a Delaware limited liability company (“Liberty”), MARKET STREET FUNDING LLC, a Delaware limited liability company (“Market Street”), and GOTHAM FUNDING CORPORATION, a Delaware corporation (“Gotham”, and together with Liberty and Market Street, the “Existing Purchasers”), THE BANK OF NOVA SCOTIA (“Scotia Capital”), as a Bank (as defined in the Purchase Agreement referred to below), as administrative agent (the “Administrative Agent”) for the Investors and the Banks (as such terms are defined in the Purchase Agreement referred to below) and as purchaser agent for Liberty (the “Liberty Purchaser Agent”), PNC BANK, NATIONAL ASSOCIATION (“PNC”), as a Bank and as purchaser agent for Market Street (the “Market Street Purchaser Agent”), THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH (“BTMU”), as a Bank and as purchaser agent for Gotham (the “Gotham Purchaser Agent”, and together with the Liberty Purchaser Agent and the Market Street Purchaser Agent, the “Existing Purchaser Agents”), and BANK OF AMERICA, N.A. (“BOA”), as a new Bank and as a new purchaser agent for itself (the “BOA Purchaser Agent”, and together with the Existing Purchaser Agents, the “Purchaser Agents”). Capitalized terms used and not otherwise defined herein are used as defined in the Purchase Agreement (as defined below).

RECITALS

WHEREAS, the Seller, the Collection Agent, the Existing Purchasers, the Existing Purchaser Agents, the Banks party thereto and the Administrative Agent entered into that certain Third Amended and Restated Receivables Purchase Agreement dated as of September 24, 2012 (as amended, supplemented or otherwise modified, the “Purchase Agreement”);

WHEREAS, pursuant to and in accordance with Section 7.03 of the Purchase Agreement, Scotia Capital, as a Bank and as a Purchaser Agent, desires to assign, and BOA desires to accept, a portion of Scotia Capital’s corresponding rights and obligations under the Purchase Agreement;

WHEREAS, each of the Seller, the Administrative Agent, the Gotham Purchaser Agent and the Market Street Purchaser Agent wishes to confirm their consent to such assignment by Scotia Capital to BOA and the addition of BOA as a Bank and as a Purchaser Agent under the Purchase Agreement;

WHEREAS, pursuant to and in accordance with the Purchase Agreement, the Seller desires to (i) increase the Purchase Limit and (ii) in connection with such increase in the Purchase Limit, cause certain of the Banks to increase their respective Bank Commitments in an aggregate amount equal to such increase in the Purchase Limit;

WHEREAS, each of the Administrative Agent, the Purchaser Agents, the Banks, and Liberty wishes to confirm their consent to such increases; and

WHEREAS, in connection with the foregoing assignments and increases, pursuant to Section 7.01 of the Purchase Agreement, the parties wish to make certain amendments to the Purchase Agreement as hereinafter set forth.

NOW, THEREFORE, the parties agree as follows:

Section 1.Assignment and Acceptance.

(a) Pursuant to and in accordance with Section 7.03(b) of the Purchase Agreement, Scotia Capital hereby assigns absolutely to BOA that portion and percentage of its rights and obligations as a Bank such that BOA shall have the Bank Commitment and Percentage as set forth in Section 1(e) below together with all corresponding rights and obligations (the “Assumed Bank Rights and Obligations”); and BOA hereby acknowledges that, upon the execution of this Agreement, it will (i) become a party to the Purchase Agreement as a Bank and (ii) assume, perform and comply with all of the Assumed Bank Rights and Obligations as if originally named as an original party in the Purchase Agreement as a Bank.

(b) Pursuant to and in accordance with Section 7.03(c) of the Purchase Agreement, the Liberty Purchaser Agent hereby assigns absolutely to the BOA Purchaser Agent, as Purchaser Agent for BOA, that portion and percentage of its rights and obligations as a Purchaser Agent corresponding to the Assumed Bank Rights and Obligations (the “Assumed Purchaser Agent Rights and Obligations”), and the BOA Purchaser Agent hereby acknowledges that, upon the execution of this Agreement, it will (i) become a party to the Purchase Agreement as a Purchaser Agent and (ii) assume, perform and comply with all of the Assumed Purchaser Agent Rights and Obligations as if originally named as an original party in the Purchase Agreement as a Purchaser Agent for BOA.

(c) For the avoidance of doubt, upon the effectiveness of this Section 1 and the assumption by BOA of the Assumed Bank Rights and Obligations and the Assumed Purchaser Agent Rights and Obligations, the rights and obligations of Liberty as a Purchaser corresponding to the Assumed Bank Rights and Obligations shall be extinguished and of no further force and effect; provided that the foregoing shall in no event limit or otherwise have any impact on any increased or revised rights and obligations of Liberty corresponding to any increased or revised Bank Commitments and Percentages pursuant to the remaining Sections hereof.

(d) (i) Seller hereby consents to (x) the assignment by Scotia Capital of the Assumed Bank Rights and Obligations to BOA pursuant to Section 7.03(b) of the Purchase Agreement and (y) the assignment by the Liberty Purchaser Agent of the Assumed Purchaser Agent Rights and Obligations to the BOA Purchaser Agent pursuant to Section 7.03(c) of the Purchase Agreement.

(ii) In accordance with Section 1.13(b) of the Purchase Agreement, each of the Existing Purchaser Agents and the Administrative Agent hereby consents to the addition of BOA as a Bank and the BOA Purchaser Agent as a Purchaser Agent, in each case under the Purchase Agreement.

2

(iii) Each of the Seller, the Administrative Agent, the Banks and the Existing Purchaser Agents hereby consents to the addition of BOA as a Bank and a Purchaser Agent and agrees and acknowledges that, notwithstanding anything to the contrary contained in the Purchase Agreement (including, without limitation, the definition of “Eligible Assignee”), each of BOA and the BOA Purchaser Agent shall be an Eligible Assignee for all purposes under the Purchase Agreement.

(iv) BOA hereby appoints the BOA Purchaser Agent to act as its Purchaser Agent under the Purchase Agreement. Each of the parties hereto hereby agrees and acknowledges that, notwithstanding anything to the contrary contained in the Purchase Agreement (including, without limitation, Section 6.01 of the Purchase Agreement), for all purposes of the Purchase Agreement, (x) the Liberty Purchaser Agent shall in no event be deemed to be the Purchaser Agent for BOA, (y) BOA shall in no event be deemed to be a Related Bank or otherwise related to Liberty, Scotia Capital or the Liberty Purchaser Agent and (z) the BOA Purchaser Agent shall be the Purchaser Agent for BOA.

(e) Upon the effectiveness of the assignment of the Assumed Bank Rights and Obligations, the Bank Commitment and Percentage of each of the Banks shall be as follows (which Bank Commitments and Percentages the parties hereto hereby agree and acknowledge shall be immediately superseded by the Bank Commitments and Percentages set forth in Section 3 hereto):

| | | | |

Bank | | Bank Commitment | | Percentage |

BOA | | $10,000,000 | | 2 2/19% |

| | |

BTMU | | $75,000,000 | | 15 15/19% |

| | |

PNC | | $150,000,000 | | 31 11/19% |

| | |

Scotia Capital | | $240,000,000 | | 50 10/19% |

| | |

TOTAL | | $475,000,000.00 | | |

(f) In connection with the assignments in this Section 1, Scotia Capital and/or Liberty, as applicable, shall transfer a Receivable Interest or Receivable Interests to BOA in exchange for a cash payment from BOA in an amount equal to the aggregate Capital of such Receivable Interests so transferred, so that after giving effect to such transfer of Receivable Interests and such cash payment, each of Scotia Capital and Liberty, as applicable, and BOA shall hold aggregate outstanding Capital equal to such Investor’s ratable share of the aggregate outstanding Capital of all Investors as of such time (based on the applicable Bank’s Percentage, set forth in Section 1(e)).

3

Section 2.Increase in Purchase Limit and Bank Commitments. Immediately after giving effect to the assignments set forth in Section 1:

(a) Pursuant to and in accordance with the Purchase Agreement, the Purchase Limit is hereby increased by $75,000,000 and the definition of “Purchase Limit” contained in Exhibit I to the Purchase Agreement is hereby amended by deleting the dollar figure “$475,000,000” contained therein and replacing it with the dollar figure “$550,000,000”. In accordance with Section 7.01 of the Purchase Agreement, each of the Seller, the Administrative Agent, the Banks, and the Purchaser Agents consents to such amendment.

(b) Pursuant to and in accordance with Section 1.13(b) of the Purchase Agreement, in connection with such increase in the Purchase Limit, the Seller desires to cause (i) Scotia Capital to increase its Bank Commitment by $10,000,000 and (ii) BOA to increase its Bank Commitment by $65,000,000, and each of Scotia Capital and BOA agrees to such increase in its respective Bank Commitment. Liberty, the Liberty Purchaser Agent, the BOA Purchaser Agent, the other Purchaser Agents and the Administrative Agent hereby consent to such increase in the respective Bank Commitment of Scotia Capital and BOA.

Section 3.Adjustment of Bank Commitments.

(a) Upon the effectiveness of the assignment in Section 1 and the Bank Commitment increases in Section 2, the Bank Commitment and Percentage of each of the Banks shall be as follows:

| | | | |

Bank | | Bank Commitment | | Percentage |

| | |

BOA | | $75,000,000 | | 13 7/11% |

| | |

BTMU | | $75,000,000 | | 13 7/11% |

| | |

PNC | | $150,000,000 | | 27 3/11% |

| | |

Scotia Capital | | $250,000,000 | | 45 5/11% |

| | |

TOTAL | | $550,000,000.00 | | |

(b) In connection with the foregoing adjustments of the Bank Commitments and the Percentages set forth in Section 3(a), each of the applicable Investors (other than BOA) which holds any Capital shall transfer a Receivable Interest or Receivable Interests to BOA in exchange for a cash payment from BOA in an amount equal to the aggregate Capital of such Receivable Interests so transferred, so that after giving effect to such transfer of Receivable Interests and such cash payment, each applicable Investor shall hold aggregate outstanding Capital equal to such Investor’s ratable share of the aggregate outstanding Capital of all Investors as of such time (based on the applicable Bank’s Percentage, as so adjusted). The parties agree that such transfer and such cash payment to be made between Liberty and/or Scotia Capital and BOA can be aggregated and made together with the cash payment and transfer required to be made pursuant to Section 1(f) above.

4

Section 4.Amendments to the Purchase Agreement.

(a) The Purchase Agreement and certain Exhibits thereto are hereby amended to incorporate the changes shown on the marked pages attached hereto asAnnex A.

(b) The Purchase Agreement is hereby amended by deleting in its entirety the Form of Purchase Request attached asAnnex I thereto and replacing it with the Form of Purchase Request attached hereto asAnnex B.

Section 5.Bank’s Purchase Decision.

BOA acknowledges that it has, independently and without reliance upon the Administrative Agent, any Purchaser Agent, any of their respective Affiliates or any other Bank and based on such documents and information as it has deemed appropriate, made its own evaluation and decision to enter into this Agreement and the Purchase Agreement. BOA also acknowledges that it will, independently and without reliance upon the Administrative Agent, any Purchaser Agent, any of their respective Affiliates or any other Bank and based on such documents and information as it shall deem appropriate at the time, continue to make its own decisions in taking or not taking action under this Agreement and the Purchase Agreement.

Section 6.Notices.

All notices, demands, consents, requests, reports and other communications hereunder shall be provided in accordance with Section 7.02 of the Purchase Agreement, as amended hereby.

Section 7.Assignment and Acceptance.

This Agreement is an Assignment and Acceptance for all purposes under the Purchase Agreement.

Section 8. Effectiveness of this Agreement. This Agreement shall become effective as of the date hereof at such time as:

(a) executed counterparts of this Amendment have been delivered by each party hereto to the other parties hereto;

(b) the BOA Purchaser Agent shall have received evidence of payment by the Seller of all accrued and unpaid fees contemplated by the BOA Fee Agreement;

(c) each of the Purchaser Agents shall have received evidence satisfactory to it that the transfers by the applicable Investors of Receivable Interests to BOA in exchange for a cash payment from BOA in an amount equal to the aggregate Capital of such Receivable Interests so transferred, as contemplated by Sections 1(f) and 3(b) hereof, shall have occurred (or shall occur simultaneously with the effectiveness hereof);

(d) BOA shall have received an executed copy of the BOA Fee Agreement; and

5

(e) the Administrative Agent and the Purchaser Agents shall have received, in form and substance satisfactory to the Administrative Agent and each Purchaser Agent, a certificate of the Secretary or Assistant Secretary of the Seller certifying copies of the resolutions of the Board of Directors of the Seller approving this Agreement and the transactions contemplated hereby.

Section 9.Representations and Warranties. The Seller and the Collection Agent represent and warrant as follows:

(a) The execution, delivery and performance by the Collection Agent and the Seller of this Agreement (i) are within its corporate or limited liability company powers, as applicable, (ii) have been duly authorized by all necessary corporate or limited liability company action, as applicable, and (iii) do not contravene (1) its charter, by-laws or limited liability company agreement, as applicable, (2) any law, rule or regulation applicable to it or (3) any contractual restriction binding on or affecting it or its property, the violation of which could reasonably be expected to have a Material Adverse Effect on the collectibility of any Pool Receivable, on Seller or on the performance of the Collection Agent under the Purchase Agreement. This agreement has been duly executed and delivered by the Seller and the Collection Agent.

(b) No authorization or approval or other action by, and no notice to or filing with, any governmental authority or regulatory body is required for the due execution, delivery and performance by the Seller or the Collection Agent of this Agreement or any other document to be delivered by the Seller or the Collection Agent hereunder other than those already obtained;provided that the right of any assignee of a Receivable the obligor of which is a Government Obligor to enforce such Receivable directly against such obligor may be restricted by the Federal Assignment of Claims Act or any similar applicable Law to the extent the Originator thereof or the Seller shall not have complied with the applicable provisions of any such Law in connection with the assignment or subsequent reassignment of any such Receivable.

(c) This Agreement constitutes the legal, valid and binding obligation of the Seller and the Collection Agent, enforceable against the Seller and the Collection Agent in accordance with its terms subject to bankruptcy, insolvency, reorganization, moratorium and other similar laws affecting creditors’ rights generally and general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

(d) The representations and warranties contained inExhibit III to the Purchase Agreement (with respect to the Seller) and in Section 4.08 of the Purchase Agreement (with respect to the Collection Agent) are correct on and as of the date hereof as though made on and as of the date hereof.

(e) No event has occurred and is continuing, or would result from the transactions contemplated hereby, that constitutes an Event of Termination or an Incipient Event of Termination.

Section 10.Purchase Agreement in Full Force and Effect as Amended.

(a) All of the provisions of the Purchase Agreement, as amended hereby, and all of the provisions of all other documentation required to be delivered with respect thereto shall remain in full force and effect and are ratified and confirmed in all respects.

6

(b) The parties hereto agree to be bound by the terms and conditions of the Purchase Agreement, as amended hereby, as though such terms and conditions were set forth herein.

(c) This Agreement may not be amended or otherwise modified except as provided in the Purchase Agreement.

(d) This Agreement shall constitute a Transaction Document.

Section 11.Reference in Other Documents; Affirmation of Performance Undertaking Agreement.

(a) On and from the date hereof, references to the Purchase Agreement in any agreement or document (including without limitation the Purchase Agreement) shall be deemed to include a reference to the Purchase Agreement, as amended hereby, whether or not reference is made to this Agreement.

(b) United Rentals, Inc. hereby consents to this Agreement and hereby affirms and agrees that the Performance Undertaking Agreement is, and shall continue to be, in full force and effect and is hereby ratified and affirmed in all respects. Upon the effectiveness of, and on and after the date of, this Agreement, each reference in the Performance Undertaking Agreement to the “Receivables Purchase Agreement”, “thereunder”, “thereof” or words of like import shall mean and be a reference to the Purchase Agreement as amended by this Agreement, and as hereafter amended or restated.

Section 12.Costs and Expenses.

The Seller agrees to pay on demand all reasonable and documented costs and expenses in connection with the preparation, execution and delivery of this Agreement and the other documents and agreements to be delivered hereunder and thereunder, including, without limitation, the reasonable and documented fees and out-of-pocket expenses of one firm of primary counsel for the Administrative Agent and the Purchaser Agents, the Purchasers and the Banks.

Section 13.Counterparts.

This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement by facsimile or by electronic mail in portable document format (.pdf) shall be effective as delivery of a manually executed counterpart of this Agreement.

Section 14.Headings.

The descriptive headings of the various sections of this Agreement are inserted for convenience of reference only and shall not be deemed to affect the meaning or construction of any of the provisions hereof.

7

Section 15.Governing Laws.

This Agreement and the rights and obligations of the parties under this Agreement shall be governed by, and construed in accordance with, the laws of the state of New York (without giving effect to the conflict of laws principles thereof, other than Section 5-1401 of the New York General Obligations Law, which shall apply hereto).

The remainder of this page is intentionally left blank.

8

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed by their respective officers thereunto duly authorized, as of the date first above written.

| | | | | | |

| SELLER: | | | | UNITED RENTALS RECEIVABLES LLC II |

| | | |

| | | | By: | | /s/ Irene Moshouris |

| | | | | | Name: Irene Moshouris |

| | | | | | Title: Vice President and Treasurer |

| | |

| COLLECTION AGENT: | | | | UNITED RENTALS, INC. |

| | | |

| | | | By: | | /s/ Irene Moshouris |

| | | | | | Name: Irene Moshouris |

| | | | | | Title: Senior Vice President and Treasurer |

SOLELY FOR PURPOSES OF

SECTION 11(b):

UNITED RENTALS, INC.

| | |

| By: | | /s/ Irene Moshouris |

| | Name: Irene Moshouris |

| | Title: Senior Vice President and Treasurer |

Signature Page – Assignment and Acceptance Agreement

and Amendment No. 1

| | | | | | |

| ADMINISTRATIVE | | | | THE BANK OF NOVA SCOTIA |

| AGENT: | | | | | | |

| | | | By: | | /s/ Norman Last |

| | | | | | Name: Norman Last |

| | | | | | Title: Managing Director |

| | |

| PURCHASER: | | | | LIBERTY STREET FUNDING LLC |

| | | |

| | | | By: | | /s/ Jill A. Russo |

| | | | | | Name: Jill A. Russo |

| | | | | | Title: Vice President |

| | |

| PURCHASER AGENT: | | | | THE BANK OF NOVA SCOTIA |

| | | |

| | | | By: | | /s/ Norman Last |

| | | | | | Name: Norman Last |

| | | | | | Title: Managing Director |

| | | |

| | | | BANK: | | THE BANK OF NOVA SCOTIA |

| | | |

| | | | By: | | /s/ Norman Last |

| | | | | | Name: Norman Last |

| | | | | | Title: Managing Director |

Signature Page – Assignment and Acceptance Agreement

and Amendment No. 1

| | | | | | |

| PURCHASER: | | | | MARKET STREET FUNDING LLC |

| | | |

| | | | By: | | /s/ Doris J. Hearn |

| | | | | | Name: Doris J. Hearn |

| | | | | | Title: Vice President |

| | |

| PURCHASER AGENT: | | | | PNC BANK, NATIONAL ASSOCIATION |

| | | |

| | | | By: | | /s/ William P. Falcon |

| | | | | | Name: William P. Falcon |

| | | | | | Title: Vice President |

| | |

| BANK: | | | | PNC BANK, NATIONAL ASSOCIATION |

| | | |

| | | | By: | | /s/ William P. Falcon |

| | | | | | Name: William P. Falcon |

| | | | | | Title: Vice President |

Signature Page – Assignment and Acceptance Agreement

and Amendment No. 1

| | | | | | |

| PURCHASER: | | | | GOTHAM FUNDING CORPORATION |

| | | |

| | | | By: | | /s/ David V. DeAngelis |

| | | | | | Name: David V. DeAngelis |

| | | | | | Title: Vice President |

| | |

| PURCHASER AGENT: | | | | THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH |

| | | |

| | | | By: | | /s/ Van Dusenbury |

| | | | | | Name: Van Dusenbury |

| | | | | | Title: Managing Director |

| | |

| BANK: | | | | THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH |

| | | |

| | | | By: | | /s/ Alan Reiter |

| | | | | | Name: Alan Reiter |

| | | | | | Title: Vice President |

Signature Page – Assignment and Acceptance Agreement

and Amendment No. 1

| | | | | | |

| PURCHASER AGENT: | | | | BANK OF AMERICA, N.A. |

| | | |

| | | | By: | | /s/ Brendan Feeney |

| | | | | | Name: Brendan Feeney |

| | | | Title: | | Vice President |

| | |

| BANK: | | | | BANK OF AMERICA, N.A. |

| | | |

| | | | By: | | /s/ Brendan Feeney |

| | | | | | Name: Brendan Feeney |

| | | | | | Title: Vice President |

Signature Page – Assignment and Acceptance Agreement

and Amendment No. 1

ANNEX A

CHANGED PAGES TO PURCHASE AGREEMENT

EXECUTION VERSIONCONFORMED COPY INCORPORATING

AMENDMENT NO. 1 DATED AS OF FEBRUARY 1, 2013

THIRD AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT

Dated as of September 24, 2012

Among

UNITED RENTALS RECEIVABLES LLC II,

as Seller,

UNITED RENTALS, INC.,

as Collection Agent,

LIBERTY STREET FUNDING LLC,

as a Purchaser,

MARKET STREET FUNDING LLC,

as a Purchaser,

GOTHAM FUNDING CORPORATION,

as a Purchaser

THE BANK OF NOVA SCOTIA,

as Purchaser Agent for Liberty, as Administrative Agent and as a Bank,

PNC BANK, NATIONAL ASSOCIATION,

as Purchaser Agent for Market Street and as a Bank,

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH,

as Purchaser Agent for Gotham and as a Bank,

BANK OF AMERICA, N.A.,

as a Purchaser Agent for itself and as a Bank

Table of Contents

| | | | |

| | | Page | |

| ARTICLE I | | | | |

| |

| AMOUNTS AND TERMS OF THE PURCHASES | | | | |

| |

SECTION 1.01. Purchase Facility | | | 2 | |

SECTION 1.02. Making Purchases | | | 2 | |

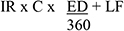

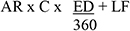

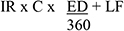

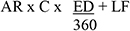

SECTION 1.03. Receivable Interest Computation | | | 34 | |

SECTION 1.04. Settlement Procedures | | | 4 | |

SECTION 1.05. Fees | | | 5 | |

SECTION 1.06. Payments and Computations, Etc. | | | 5 | |

SECTION 1.07. Dividing or Combining Receivable Interests | | | 9 | |

SECTION 1.08. Increased Costs and Requirements of Law | | | 9 | |

SECTION 1.09. Intended Characterization; Security Interest | | | 6 | |

SECTION 1.10. [Reserved] | | | 12 | |

SECTION 1.11. Sharing of Payments | | | 12 | |

SECTION 1.12. Repurchase Option | | | 7 | |

SECTION 1.13. Extension; Additional Purchasers; Increased Commitments | | | 7 | |

| |

| ARTICLE II | | | | |

| |

| REPRESENTATIONS AND WARRANTIES; COVENANTS; EVENTS OF TERMINATION | | | | |

| |

SECTION 2.01. Representations and Warranties; Covenants | | | 1314 | |

SECTION 2.02. Events of Termination | | | 14 | |

| |

| ARTICLE III | | | | |

| |

| INDEMNIFICATION | | | | |

| |

SECTION 3.01. Indemnities by the Seller | | | 14 | |

| |

| ARTICLE IV | | | | |

| |

| ADMINISTRATION AND COLLECTION OF POOL RECEIVABLES | | | | |

| |

SECTION 4.01. Designation of Collection Agent | | | 16 | |

SECTION 4.02. Duties of Collection Agent | | | 17 | |

SECTION 4.03. Certain Rights of the Administrative Agent | | | 18 | |

SECTION 4.04. Rights and Remedies | | | 19 | |

SECTION 4.05. Further Actions Evidencing Purchases | | | 1920 | |

SECTION 4.06. Covenants of the Collection Agent and the Seller | | | 20 | |

SECTION 4.07. Indemnities by the Collection Agent | | | 2122 | |

SECTION 4.08. Representations and Warranties of the Collection Agent | | | 2223 | |

i

| | | | |

| |

| ARTICLE V | | | | |

| |

| THE ADMINISTRATIVE AGENT | | | | |

| |

SECTION 5.01. Authorization and Action | | | 2324 | |

SECTION 5.02. Administrative Agent’s Reliance, Etc. | | | 24 | |

SECTION 5.03. Indemnification of Administrative Agent | | | 248 | |

SECTION 5.04. Scotia Capital and Affiliates | | | 8 | |

SECTION 5.05. Bank’s Purchase Decision | | | 8 | |

SECTION 5.06. [Reserved] | | | 8 | |

SECTION 5.07. Notice of Event of Termination | | | 8 | |

| |

| ARTICLE VI | | | | |

| |

| THE PURCHASER AGENTS | | | | |

| |

SECTION 6.01. Authorization | | | 9 | |

SECTION 6.02. Reliance by Purchaser Agent | | | 2610 | |

SECTION 6.03. Agent and Affiliates | | | 11 | |

SECTION 6.04. Notices | | | 2711 | |

SECTION 6.05. Bank’s Purchase Decision | | | 2711 | |

| |

| ARTICLE VII | | | | |

| |

| MISCELLANEOUS | | | | |

| |

SECTION 7.01. Amendments, Etc. | | | 11 | |

SECTION 7.02. Notices, Etc. | | | 12 | |

SECTION 7.03. Assignability | | | 3115 | |

SECTION 7.04. Costs, Expenses and Taxes | | | 16 | |

SECTION 7.05. No Proceedings | | | 3317 | |

SECTION 7.06. Confidentiality | | | 3317 | |

SECTION 7.07. Governing Law | | | 17 | |

SECTION 7.08. SUBMISSION TO JURISDICTION | | | 35 | |

SECTION 7.09. WAIVER OF JURY TRIAL | | | 3435 | |

SECTION 7.10. Execution in Counterparts | | | 35 | |

SECTION 7.11. Survival of Termination | | | 35 | |

SECTION 7.12. Severability | | | 35 | |

SECTION 7.13. Excess Funds | | | 36 | |

SECTION 7.14. No Recourse | | | 3536 | |

SECTION 7.15. Amendment and Restatement; Acknowledgement | | | 37 | |

ii

THIRD AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT

Dated as of September 24, 2012

UNITED RENTALS RECEIVABLES LLC II, a Delaware limited liability company (the “Seller”), UNITED RENTALS, INC., a Delaware corporation (the “Collection Agent”), LIBERTY STREET FUNDING LLC (“Liberty”), a Delaware limited liability company, MARKET STREET FUNDING LLC (“Market Street”), a Delaware limited liability company, and GOTHAM FUNDING CORPORATION (“Gotham”), a Delaware corporation (each of Liberty, Market Street and Gotham, a “Purchaser”, and together the “Purchasers”), THE BANK OF NOVA SCOTIA (“Scotia Capital”), as a Bank, as administrative agent (the “Administrative Agent”) for the Investors and the Banks (as defined herein) and as purchaser agent for Liberty (the “Liberty Purchaser Agent”), PNC BANK, NATIONAL ASSOCIATION (“PNC”), as a Bank and as purchaser agent for Market Street (the “Market Street Purchaser Agent”),andTHE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH (“BTMU”), as a Bank and as purchaser agent for Gotham (the “Gotham Purchaser Agent”), and BANK OF AMERICA, N.A. (“BOA”), as a Bank and as purchaser agent for itself (the “BOA Purchaser Agent”, and together with the Liberty Purchaser Agent and, the Market Street Purchaser Agent and the Gotham Purchaser Agent, the “Purchaser Agents”), agree as follows:

PRELIMINARY STATEMENTS

Certain terms that are capitalized and used throughout this Agreement are defined inExhibit I to this Agreement. Capitalized terms not defined herein are used as defined in the Purchase Agreement or, if not defined in the Purchase Agreement, the Credit Agreement. References in the Exhibits to the “Agreement” refer to this Agreement, as amended, modified or supplemented from time to time. All interest rate and yield determinations referenced herein shall be expressed as a decimal and rounded, if necessary, to the nearest one hundredth of a percentage point.

The Seller has acquired, and may continue to acquire, Receivables and Related Security from the Originator, either by purchase or by contribution to the capital of the Seller, in accordance with the terms of the Purchase Agreement. The Seller is prepared to sell undivided fractional ownership interests (referred to herein as “Receivable Interests”) in the Pool Receivables. The Purchasers may, in their sole discretion, purchase such Receivable Interests in the Pool Receivables, and the Banks are prepared to purchase such Receivable Interests in the Pool Receivables, in each case on the terms set forth herein.

Certain parties hereto previously entered into that certain Second Amended and Restated Receivables Purchase Agreement, dated as of September 28, 2011, as amended by that certain Assignment and Acceptance and Amendment Agreement, dated as of December 23, 2011 and as further amended and supplemented as of February 2, 2012, May 18, 2012 and September 24, 2012 (the “Existing Agreement”).

The parties hereto now desire to amend and restate the Existing Agreement in its entirety as set forth herein and with effect from the date first set forth above. Accordingly, the parties agree as follows:

ARTICLE I

AMOUNTS AND TERMS OF THE PURCHASES

SECTION 1.01.Purchase Facility.

(a) On the terms and conditions hereinafter set forth, the Purchasers may, in their sole discretion, and the Banks shall, ratably in accordance with their respective Bank Commitments, purchase Receivable Interests in the Pool Receivables from the Seller from time to time during the period from the date hereof through the date immediately preceding the Facility Termination Date, in the case of the Purchasers, and through the date immediately preceding the Commitment Termination Date, in the case of the Banks. Under no circumstances shall the Purchasers make any such purchase, or the Banks be obligated to make any such purchase, if after giving effect to such purchase(x) the aggregate outstanding Capital of Receivable Interests in the Pool Receivables would exceed the Purchase Limit or(y) the aggregate outstanding Capital of Receivable Interests in the Pool Receivables held by any Bank plus, in the event such Bank has any related Purchasers, such Bank’s ratable share of the outstanding Capital of Receivable Interests in the Pool Receivables held byitssuch related Purchasers would exceed its Bank Commitment.

(b) The Seller may, upon at least five Business Days’ notice to the Administrative Agent and each Purchaser Agent, terminate this purchase facility in whole or, from time to time, reduce in part the unused portion of the Purchase Limit, which shall reduce the Bank Commitments ratably in accordance with each Bank’s Percentage;provided that each partial reduction shall be in the amount of at least $1,000,000; andprovidedfurther that the Seller shall pay any related Broken Funding Cost; andprovidedfurther that no partial reduction shall reduce the Purchase Limit below $50,000,000.

(c) Subject to the conditions described in Section 2(b) ofExhibit II to this Agreement, Collections attributable to Receivable Interests in the Pool Receivables shall be automatically reinvested pursuant toSection 1.04(b)(ii) in additional undivided percentage interests in the Pool Receivables by making an appropriate readjustment of the applicable Receivable Interest percentages.

SECTION 1.02.Making Purchases.

(a) Each notice of purchase of a Receivable Interest in the Pool Receivables shall be delivered by the Seller to the Administrative Agent and each Purchaser Agent no later than 10:30 a.m. (New York City time), on the proposed date the purchase is to be made. Each such notice of a purchase shall be in the form of an irrevocable Purchase Request and shall specify (i) the amount requested to be paid to the Seller by eachPurchaser and each Bank which does not have a relatedPurchaser (such amount, which shall not be less than $250,000 in the aggregate (inclusive of any amount being rolled over from a previous purchase), being referred to herein as the initial “Capital” of each Receivable Interest in the Pool Receivables then being purchased), (ii) the date of such purchase (which shall be a Business Day) and (iii) unless the purchase will be funded with Pooled Commercial Paper and except with respect to any purchase being made by BOA, the desired duration of the initial Fixed Period for each such

2

Receivable Interest in the Pool Receivables. Each Purchaser Agent which has a related Purchaser shall promptly thereafter (but in no event later than 11:00 a.m. (New York City time) on the proposed date of purchase) notify the Seller and the Administrative Agent whetherthesuch respective Purchaser has determined to make a purchase and, if so, whether all of the terms specified by the Seller are acceptable to such Purchaser and the yield with respect to such purchase and the amount of interest that will be due for the related Settlement Period. If(a) a Purchaser has determined not to make a proposed purchase,or (b) a Purchaser Agent does not have a related Purchaser,the respective Purchaser Agent shall promptly send notice of the proposed purchase to all of the related Banks of such Purchaser Agent concurrently specifying the date of such purchase, each such Bank’s Percentage multiplied by the aggregate amount of Capital of the Receivable Interests in the Pool Receivables being purchased, and, except with respect to any purchase being made by BOA, the Assignee Rate for the Fixed Period for such Receivable Interest in the Pool Receivables, and the duration of the Fixed Period for such Receivable Interest in the Pool Receivables. The Seller shall indemnify the Purchasers and the Banks against any loss or expense incurred by the Purchasers and/or the Banks, either directly or indirectly, as a result of any failure by the Seller to complete such transfer, including, without limitation, any loss or expense incurred by the Purchasers and/or the Banks by reason of the liquidation or reemployment of funds acquired by the Purchasers or the Banks (including, without limitation, funds obtained by issuing notes, obtaining deposits as loans from third parties and reemployment of funds) to fund such transfer.

(b) On the date of each such purchase of a Receivable Interest in the Pool Receivables, each Purchaser or the Banks, as the case may be, shall, upon satisfaction of the applicable conditions set forth inExhibit II hereto, make available to the Seller by wire transfer in U.S. dollars in same day funds, to the account designated by the Seller, no later than 3:00 p.m. (New York City time) an amount equal to each such Purchaser’s or Bank’s ratable share (based on the applicable Bank’s Percentage) of the initial Capital of such Receivable Interest in the Pool Receivables.

(c) Effective on the date of each purchase pursuant to thisSection 1.02 and each reinvestment pursuant toSection 1.04, the Seller hereby sells and assigns to the Administrative Agent, for the benefit of the parties making such purchase, an undivided percentage ownership interest, to the extent of the Receivable Interests then being purchased, in each Pool Receivable then existing and in the Related Security and Collections with respect to, and other proceeds of, such Pool Receivable and Related Security.

(d) Notwithstanding the foregoing, a Bank shall not be obligated to make purchases under thisSection 1.02 at any time in an amount that would exceed the Bank Commitment with respect to such Bank less, in the event such Bank has any related Purchasers, such Bank’s ratable share of the outstanding and unpaid Capital ofitssuch relatedPurchaserPurchasers. Each Bank’s obligation shall be several, such that the failure of any Bank to make available to the Seller any funds in connection with any purchase shall not relieve any other Bank of its obligation, if any, hereunder to make funds available on the date of such purchase, and if any Bank shall fail to make funds available, each remaining Bank shall (subject to the limitation in the preceding sentence) make available its pro rata portion of the funds required to be funded for such purchase pursuant to clause (b) of this Section 1.02.

3

(g) The Seller shall forthwith deliver (i) to the Collection Agent an amount equal to all Collections deemed received by the Seller pursuant toSection 1.04(e)(i) or(ii) above and the Collection Agent shall hold or reinvest such Collections in accordance withSection 1.04(b), or (ii) if Collections are then being paid to the Administrative Agent or the Controlled Account directly or indirectly owned or controlled by the Administrative Agent, the Seller shall forthwith cause such deemed Collections to be paid to the Administrative Agent or such Controlled Account. So long as the Seller shall hold any Collections or deemed Collections required to be paid to the Collection Agent, the Administrative Agent, a Purchaser Agent, a Purchaser, a Bank, an Indemnified Party, or an Affected Person, it shall hold such Collections in trust (and, at the request of the Administrative Agent or any Purchaser Agent, separate and apart from its own funds and shall clearly mark its records to reflect such trust).

(h) With respect to each Bank that is a Nonrenewing Bank that has not been replaced by another Bank pursuant toSection 1.13 (any suchPurchaserBank, a “Non-Extending Bank”), the Collection Agent shall implement the procedures set forth in thisSection 1.04(h) (a “Partial Liquidation”). On each Business Day prior to such Non-Extending Bank’s Bank Commitment being reduced to zero (provided that no Event of Termination has occurred and is continuing), the Collection Agent shall apply funds out of the Collections represented by the Receivable Interest received and not previously applied in the following manner:

(i) set aside and hold in trust in the Collection Account, for the benefit of the Non-Extending Banks and their related Purchasers, if any, an amount equal to all Yield and fee(s) and other payments owed under the Fee Agreements (based on the Receivable Interest at such time), in each case accrued through such day and not so previously set aside or paid. The Collection Agent shall thereafter pay to each applicable Purchaser Agent (ratably according to accrued Yield and fees and other payments owed under the Fee Agreements) on the last day of each Settlement Period for the Non-Extending Banks the amount of such accrued and unpaid fees and other payments owed under the Fee Agreements and Yield;

(ii) pay to each applicable Purchaser Agent for the account of each Non-Extending Bank, if any, related to such Purchaser Agent (ratably based on the Bank Commitment of the Non-Extending Bank at such time), and,in the event such Non-Extending Bank has any related Purchasers,for the account ofanysuch related Purchasers solely to the extent necessary to reduce any such Purchaser’s pro rata portion of the Purchase Limit to an amount that is equal to or lesser than the amount of any available Bank Commitment of any remaining Banks related toanysuch Purchaser at such time, from such Collections remaining after application pursuant to clause (i) above, the amount of such Bank Commitment of the Non-Extending Bank;provided that, solely for purposes of determining such Non-Extending Bank’s ratable share of such Collections, such Bank Commitment shall be deemed to remain constant from the date such Bank becomes a Non-Extending Bank until the date such Bank Commitment of the Non-Extending Bank has been paid in full; it being understood that if such day is also a Termination Date or a day on which an Event of Termination has occurred, the Bank Commitment of the Non-Extending Bank shall be recalculated at such time (taking into account amounts received by or on behalf of such Bank in respect of its Capital pursuant to this clause (ii)), and thereafter Collections shall be set aside for payment to all Investors (ratably according to the Bank Commitment of such Non-Extending Bank) pursuant to paragraph (d) above; and

4

(iii) reinvest the balance of such Collections in respect of Capital to the acquisition of additional undivided percentage interests pursuant toSection 1.02 hereof.

(i) Within one Business Day after the end of each Fixed Period, each Purchaser Agent shall furnish the Seller with an invoice setting forth the amount of the accrued and unpaid Yield and fees for such Fixed Period with respect to the Receivable Interests held by such Purchaser Agent’s related Investors.

SECTION 1.05.Fees.

(a) The Collection Agent shall be entitled to receive a fee (the “Collection Agent Fee”) of 0.50% per annum on the aggregate Capital of each Receivable Interest owned by each Investor or Bank on the last day of each calendar month, payable in arrears on the first day of each calendar month following each Settlement Period for such Receivable Interest. Upon three Business Days’ notice to the Administrative Agent and the Purchaser Agents, the Collection Agent (if not United Rentals) may elect to be paid, as such fee, a different percentage per annum on the aggregate Capital of such Receivable Interest for such Settlement Period, but in no event in excess for all Receivable Interests relating to a single Receivables Pool of 110% of the reasonable costs and expenses of the Collection Agent in administering and collecting the Receivables in such Receivables Pool. The Collection Agent Fee shall be payable only from Collections pursuant to, and subject to the priority of payment set forth in,Section 1.04.

(b) The Seller agrees to pay to the Administrative Agent and the Purchaser Agents certain fees in the amounts and on the dates set forth in the applicable Fee Agreement with the Administrative Agent and each of the Purchaser Agents, as applicable.

SECTION 1.06.Payments and Computations, Etc.

(a) No later than the first Business Day of each month, each Purchaser Agenton behalf ofthewhich has a related Purchaser shall calculate, on behalf of such related Purchaser, the aggregate amount of Yield applicable to the portion of all Receivable Interests funded with Pooled Commercial Paper for the Settlement Period then most recently ended and shall notify Seller of such aggregate amount.

(b) All amounts to be paid or deposited by the Seller or the Collection Agent, including all Broken Funding Costs, hereunder to or for the account of the Administrative Agent, Purchaser Agents, a Purchaser or any other Investor or Bank shall be paid or deposited no later than 11:00 A.M. (New York City time) on the day when due in same day funds to the Administrative Agent’s Account or the applicable Purchaser Agent’s Account, as applicable.

(c) The Seller and Collection Agent shall, to the extent permitted by law, pay interest on any amount not paid or deposited by the Seller or Collection Agent, as applicable (whether as Collection Agent or otherwise), when due hereunder, at an interest rate per annum equal to 2% per annum above the Alternate Base Rate, payable upon the demand of the related Purchaser Agent.

5

(d) For the avoidance of doubt, any change in national or international generally accepted principles of accounting (whether foreign or domestic) that would require the consolidation of some or all of the assets and liabilities of any Purchaser or Bank, including the assets and liabilities that are the subject of this Agreement and/or other Transaction Documents, but excluding any assets and liabilities that are currently consolidated with those of any Affected Person (other than such Purchaser or Bank), shall constitute a change in the interpretation, administration or application of a law, regulation, guideline or request subject toSection 1.08(a),(b) and(c).

(e) The Administrative Agent shall promptly notify the Seller if any event of which it has knowledge, which will entitle an Affected Person to compensation pursuant to thisSection 1.08. Notwithstanding the foregoing, in the event that such notice is not given to the Seller by the Administrative Agent, such Affected Person shall not be entitled to compensation from the Administrative Agent for any additional costs incurred as a result of such failure to notify.

(f) Notwithstanding any other provision herein, no Affected Person shall demand compensation pursuant to this Section 1.08 if it shall not at the time be the general policy or practice of such Affected Person to demand such compensation in similar circumstances under comparable provisions of other similar agreements, including, but not limited to, credit agreements and receivables purchase agreements, if any (and such Affected Person so certifies to the Seller).

SECTION 1.09.Intended Characterization; Security Interest.

The Seller, the Purchasers, the Administrative Agent, the Investors, the Banks and the Purchaser Agents intend that the sale, assignment and transfer of the Receivable Interests to the Administrative Agent hereunder shall be treated as a true sale for all purposes, other than federal and state income tax purposes and accounting purposes. If, notwithstanding the intent of the parties, the sale, assignment and transfer of the Receivable Interests is not treated as a sale for all purposes, other than federal and state income tax purposes, (i) this Agreement also is intended by the parties to be, and hereby is, a security agreement within the meaning of the UCC; and (ii) the sale, assignment and transfer of the Receivable Interests shall be treated as a grant of, and the Seller does hereby grant to the Administrative Agent, for its benefit and the ratable benefit of the Investors and the Banks, and as collateral security for the performance by the Seller of all the terms, covenants and agreements on the part of the Seller (whether as the Seller or otherwise) to be performed under this Agreement or any document delivered in connection with this Agreement, including the punctual payment when due of all obligations of the Seller hereunder or thereunder, whether for indemnification payments, fees, expenses or otherwise, a security interest in, all of the Seller’s right, title and interest in, to and under (but none of the Seller’s obligations under) all of the following, whether now or hereafter existing or arising:

6

SECTION 1.12.Repurchase Option.

So long as no Event of Termination or Incipient Event of Termination would occur or be continuing after giving effect thereto, the Seller shall have the right to repurchase all, but not less than all, of the Receivable Interests held by the Investors and the Banks upon not less than thirty (30) days prior written notice to the Purchaser Agents. Such notice shall specify the date that the Seller desires that such repurchase occur (such date, the “Repurchase Date”). On the Repurchase Date, the Seller shall transfer to each Purchaser Agent’s Account in immediately available funds an amount equal to (i) the Capital of the Receivable Interests held by the Investors and the Banks, (ii) all accrued and unpaid Yield thereon to the Repurchase Date, (iii) all accrued and unpaid fees owing to the Investors and the Banks under the Fee Agreements, (iv) the Liquidation Fee owing to the Investors and the Banks in respect of such repurchase and (v) all expenses and other amounts payable hereunder to any of the Administrative Agent, the Purchaser Agents, the Investors and the Banks (including, without limitation, reasonable and documented attorneys’ fees and disbursements for a single firm of primary counsel). Any repurchase pursuant to thisSection 1.12 shall be made without recourse to or warranty by the Administrative Agent, the Purchaser Agents, the Investors or the Banks (except for a warranty that all Receivable Interests repurchased are transferred free of any lien, security interest or Adverse Claim created solely by the actions of the Administrative Agent, the Purchaser Agents, the Investors or the Banks). Further, on the Repurchase Date the Bank Commitments for all the Banks shall terminate, each of the Commitment Termination Date and Facility Termination Date shall have occurred, and no further purchases or reinvestments of Collections shall be made hereunder.

SECTION 1.13.Extension; Additional Purchasers; Increased Commitments.

(a)Extension of Term. The Seller may, at any time during the period which is no more than forty-five (45) days or less than thirty (30) days immediately preceding the Commitment Termination Date (as such date may have previously been extended pursuant to thisSection 1.13), request that the then applicable Commitment Termination Date be extended for an additional 364 days. Any such request shall be in writing and delivered to the Purchaser Agents, and shall be subject to the following conditions: (i) no Bank shall have an obligation to extend the Commitment Termination Date at any time, and (ii) any such extension with respect to any Bank shall be effective only upon the written agreement of such Bank and the related Purchaser Agent, the Administrative Agent, the Seller and the Collection Agent. Each Bank will respond to any such request no later than the fifteenth day prior to the Commitment Termination Date (the “Response Deadline”),provided that a failure by any Bank to respond by the Response Deadline shall be deemed to be a rejection of the requested extension. Notwithstanding the foregoing, the Commitment Termination Date shall not occur as a result of any Bank’s failure to agree to any such extension (each such Bank being a “Nonrenewing Bank”) if, on or prior to such date, such Nonrenewing Bank is replaced by another Bank which has a Bank Commitment equal to such Nonrenewing Bank.

(b) The Seller may, with the written consent of the Administrative Agent and each Purchaser Agent, which consent may be granted or withheld in their sole discretion, add additional persons as Banks, Purchasers and Purchaser Agents or cause an existing Bank to increase its Bank Commitment in connection with a corresponding increase in the Purchase Limit;provided, that the Bank Commitment of any Bank may only be increased with the prior written consent of such Bank and, its related Purchaserand PurchaserAgent and, if such Bank has any related Purchasers, such related Purchasers. Each new Bank, Purchaser and Purchaser Agent shall become a party hereto, by executing and delivering to the Administrative Agent, each Purchaser Agent and the Seller, an assumption agreement pursuant to which such Bank, Purchaser and/or Purchaser Agent shall agree to become bound by the terms of this Agreement as a Bank, Purchaser or Purchaser Agent, as applicable.

7

SECTION 5.03.Indemnification of Administrative Agent.

Each Bank agrees to indemnify the Administrative Agent, solely in its capacity as Administrative Agent (to the extent not reimbursed by or on behalf of the Seller), ratably according to its respective Bank Commitment, from and against any and all liabilities, obligations, losses, damages, penalties, actions, judgments, suits, costs, expenses or disbursements of any kind or nature whatsoever that may be imposed on, incurred by, or asserted against the Administrative Agent in any way relating to or arising out of this Agreement or the other transactions related hereto or any action taken or omitted by the Administrative Agent under this Agreement or the other transaction related hereto,provided that no Bank shall be liable for any portion of such liabilities, obligations, losses, damages, penalties, actions, judgments, suits, costs, expenses or disbursements resulting from the Administrative Agent’s gross negligence or willful misconduct.

SECTION 5.04.Scotia Capital and Affiliates.

With respect to any Receivable Interest or interest therein owned by it, Scotia Capital shall have the same rights and powers under this Agreement as any Bank and may exercise the same as though it were not Administrative Agent. Scotia Capital and any of its Affiliates may generally engage in any kind of business with the Seller, the Collection Agent, the Originator or any Obligor, any of their respective Affiliates and any Person who may do business with or own securities of the Seller, the Collection Agent, the Originator or any Obligor or any of their respective Affiliates, all as if Scotia Capital were not the Administrative Agent and without any duty to account therefor to the Investors or the Banks.

SECTION 5.05.Bank’s Purchase Decision.

Each Bank acknowledges that it has, independently and without reliance upon the Administrative Agent, any of its Affiliates or any other Bank and based on such documents and information as they have deemed appropriate, made their own evaluation and decision to enter into this Agreement. Each Bank also acknowledges that it will, independently and without reliance upon the Administrative Agent, any of their Affiliates or any other Bank and based on such documents and information as it shall deem appropriate at the time, continue to make its own decisions in taking or not taking action under this Agreement.

SECTION 5.06.[Reserved]

SECTION 5.07.Notice of Event of Termination.

Neither any Purchaser Agent nor the Administrative Agent shall be deemed to have knowledge or notice of the occurrence of an Event of Termination unless such Person has received notice from another Purchaser Agent, a Purchaser, the Seller or the Collection Agent referring to this Agreement, stating that an Event of Termination has occurred hereunder and describing such Event of Termination. If the Administrative Agent receives such a notice, it shall promptly give notice thereof to each Purchaser Agent whereupon each such Purchaser Agent shall promptly give notice thereof to itsrelatedPurchasers, if any, and its related Banks. In the event that any Purchaser Agent receives such a notice, it shall promptly give notice thereof to the Administrative Agent, the Purchasers and the other Purchaser Agents whereupon eachsuch Purchaser Agent shall promptly give notice thereof to its related Purchasers, if any, and its related Banks. Subject to the waiver provisions set forth inSection 2.02, the Administrative Agent shall take such action concerning an Event of Termination as may be directed by the Purchaser Agents (unless such action otherwise requires the consent of all Purchasers or Banks), but until the Administrative Agent receives such directions, the Administrative Agent may (but shall not be obligated to) take such action, or refrain from taking such action, as the Administrative Agent deems advisable and in the best interests of the Purchasers, Banks and Purchaser Agents.

8

ARTICLE VI

THE PURCHASER AGENTS

SECTION 6.01.Authorization.

(a) Liberty, Scotia Capital, and each Bank or other Person that has entered into an Assignment and Acceptancewith Liberty or Scotia Capital and each assignee (directly or indirectly) of any such Purchaser, Bank or other Person, which assignee has entered intoanand has agreed in such Assignment and Acceptancehas appointed Scotia Capital as its Purchaser Agent to take such action as agent on its behalf and to exercise such powers under this Agreement as are delegated to such Purchaser Agent by the terms hereof, together with such powers as are reasonably incidental thereto.Market Street, PNC, and each Bank or other Person that has entered into an Assignment and Acceptancewith Market Street or PNC and each assignee (directly or indirectly) of any such Purchaser, Bank or other Person, which assignee has entered into an Assignment and Acceptance has appointed PNC as its Purchaser Agent to take such action as agent on its behalf and to exercise such powers under this Agreement as are delegated to such Purchaser Agent by the terms hereof, together with such powers as are reasonably incidental thereto.Gotham, BTMU, and each Bank or other Person that has entered into an Assignment and Acceptancewith Gotham or BTMU and each assignee (directly or indirectly) of any such Purchaser, Bank or other Person, which assignee has entered into an Assignment and Acceptance has appointedBTMUthat Scotia Capital shall act as its Purchaser Agent, has appointed Scotia Capital as its Purchaser Agent to take such action as agent on its behalf and to exercise such powers under this Agreement as are delegated to such Purchaser Agent by the terms hereof, together with such powers as are reasonably incidental thereto.

(b) Market Street, PNC, and each Bank or other Person that has entered into an Assignment and Acceptanceand has agreed in such Assignment and Acceptance that PNC shall act as its Purchaser Agent, has appointed PNC as its Purchaser Agent to take such action as agent on its behalf and to exercise such powers under this Agreement as are delegated to such Purchaser Agent by the terms hereof, together with such powers as are reasonably incidental thereto.

(c) Gotham, BTMU, and each Bank or other Person that has entered into an Assignment and Acceptance and has agreed in such Assignment and Acceptance that BTMU shall act as its Purchaser Agent, has appointed BTMU as its Purchaser Agent to take such action as agent on its behalf and to exercise such powers under this Agreement as are delegated to such Purchaser Agent by the terms hereof, together with such powers as are reasonably incidental thereto.

9

(d) BOA and each Bank or other Person that has entered into an Assignment and Acceptance and has agreed in such Assignment and Acceptance that BOA shall act as its Purchaser Agent, has appointed BOA as its Purchaser Agent to take such action as agent on its behalf and to exercise such powers under this Agreement as are delegated to such Purchaser Agent by the terms hereof, together with such powers as are reasonably incidental thereto.

As to any matters not expressly provided for by this Agreement (including, without limitation, enforcement of this Agreement), a Purchaser Agent shall not be required to exercise any discretion or take any action, but shall be required to act or to refrain from acting (and shall be fully protected in so acting or refraining from acting) upon the instructions of the majority of its related Banks, and such instructions shall be binding upon all of its related Investors and Banks;provided,however, that such Purchaser Agent shall not be required to take any action which exposes such Purchaser Agent to personal liability or which is contrary to this Agreement or applicable law.

SECTION 6.02.Reliance by Purchaser Agent.

No Purchaser Agent or any of its respective directors, officers, agents, representatives, employees, attorneys-in-fact or Affiliates shall be liable for any action taken or omitted to be taken by it or them (in their capacity as or on behalf of such Purchaser Agent) under or in connection with this Agreement, except for its or their own gross negligence or willful misconduct. Without limitation of the generality of the foregoing, a Purchaser Agent:

(a) may consult with legal counsel, independent certified public accountants and other experts selected by it and shall not be liable for any action taken or omitted to be taken in good faith by it in accordance with the advice of such counsel, accountants or experts;

(b) makes no warranty or representation to the Administrative Agent, any other Purchaser Agent, any Investor or Bank (whether written or oral) and shall not be responsible to the Administrative Agent, any other Purchaser Agent, any Investor or Bank for any statements, warranties or representations (whether written or oral) made in or in connection with this Agreement;

(c) shall not have any duty to ascertain or to inquire as to the performance or observance of any of the terms, covenants or conditions of this Agreement or any other Transaction Document on the part of the Seller, the Originator, the Banks or the Collection Agent or to inspect the property (including the books and records) of the Seller, the Originator, the Banks or the Collection Agent;

(d) shall not be responsible to the Administrative Agent, any other Purchaser Agent, any Investor or Bank for the due execution, legality, validity, enforceability, genuineness, sufficiency or value of this Agreement or any other instrument or document furnished pursuant hereto; and

10

(e) shall incur no liability under or in respect of this Agreement by acting upon any notice (including notice by telephone), consent, certificate or other instrument or writing (which may be by telecopier or telex) believed by it to be genuine and signed or sent by the proper party or parties.

SECTION 6.03.Agent and Affiliates.

With respect to any Receivable Interest or interest therein owned by a Purchaser Agent, such Purchaser Agent shall have the same rights and powers under this Agreement as would any Bank and may exercise the same as though it were not a Purchaser Agent. A Purchaser Agent and its respective Affiliates may generally engage in any kind of business with the Seller, the Collection Agent, the Banks, the Originator or any Obligor, any of their respective Affiliates and any Person who may do business with or own securities of the Seller, the Collection Agent, the Banks, the Originator or any Obligor or any of their respective Affiliates, all as if such Purchaser Agent were not a Purchaser Agent and without any duty to account therefor to the Investors or the Banks. If any Purchaser Agent is removed as a Purchaser Agent, such removal will not affect the rights and interests of such Purchaser Agent as a Bank.

SECTION 6.04.Notices.

A Purchaser Agent shall give each of its related Investors and Banks prompt notice of each written notice received by it from the Seller or the Administrative Agent pursuant to the terms of this Agreement.

SECTION 6.05.Bank’s Purchase Decision.

Each Bank acknowledges that it has, independently and without reliance upon any Purchaser Agent, any of its Affiliates or any other Bank and based on such documents and information as it has deemed appropriate, made its own evaluation and decision to enter into this Agreement. Each Bank also acknowledges that it will, independently and without reliance upon any Purchaser Agent, any of its Affiliates or any other Bank and based on such documents and information as it shall deem appropriate at the time, continue to make its own decisions in taking or not taking action under this Agreement.

ARTICLE VII

MISCELLANEOUS

SECTION 7.01.Amendments, Etc.

Subject to the waiver provisions set forth inSection 2.02, no amendment or waiver of any provision of this Agreement and no consent to any departure by the Seller or the Collection Agent therefrom shall be effective unless in a writing signed by the Administrative Agent, the Banks, and each of the Purchaser Agents,for itself and, as applicable,as agent fortheits relatedPurchaserPurchasers, and, in the case of any amendment, also signed by the Seller;provided,however, that no amendment shall, unless signed by the Collection Agent in addition to the Administrative Agent and the Purchaser Agents, affect the rights or duties of the Collection Agent under this Agreement andprovidedfurther that any such amendment, waiver or consent shall be effective only in the specific instance and for the specific purpose for which given;provided,however, that, if required by the securitization program documents governing any Purchaser’s commercial paper program, no such amendment shall be effective until each rating agency rating the Commercial Paper has received written notice of such amendment and, in the case of material amendments, notified the related Purchaser Agent in writing that such action will not result in a reduction or withdrawal of the rating of any Commercial Paper. No failure on the part of the Investors, the Banks, the Administrative Agent or the Purchaser Agents to exercise, and no delay in exercising, any right hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right hereunder preclude any other or further exercise thereof or the exercise of any other right.

11

SECTION 7.02.Notices, Etc.

All notices, demands, consents, requests, reports and other communications provided for hereunder shall, unless otherwise stated herein, be in writing (which shall include electronic transmission), shall be personally delivered, express couriered, electronically transmitted (in which case receipt shall be confirmed by telephone or return electronic transmission) or mailed by registered or certified mail and shall, unless otherwise expressly provided herein, be effective when received at the address specified below for the listed parties or at such other address as shall be specified in a written notice furnished to the other parties hereunder.

If to the Seller:

UNITED RENTALS RECEIVABLES LLC II

5 Greenwich Office Park

Greenwich, CT 06830

Attention: Treasurer or Assistant Treasurer

Tel. No.: (203) 618-7202

Facsimile No.: (203) 622-4325

If to the Collection Agent:

UNITED RENTALS, INC.

5 Greenwich Office Park

Greenwich, CT 06830

Attention: Treasurer or Assistant Treasurer

Tel. No.: (203) 618-7202

Facsimile No.: (203) 622-4325

If to the Liberty Purchaser Agent or the Administrative Agent:

THE BANK OF NOVA SCOTIA

1 Liberty Plaza, 26th Floor

New York, NY 10006

Attention: Luke Evans / Alexander Jurecky

Tel. No.: (212) 225-5118 / (212) 225-5087

Facsimile No.: (212) 225-52905274

12

If to the Market Street Purchaser Agent:

PNC BANK, NATIONAL ASSOCIATION

Three PNC Plaza

225 Fifth Avenue Pittsburgh,

Pennsylvania 15222

Attention: PNC Conduit Group

Facsimile No.: (412) 762-9184

If to the Gotham Purchaser Agent:

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.

34 Exchange Place, Plaza III 5th Floor

Jersey City, NJ 07311

Attention: John Donoghue

Facsimile No.: (201) 369-2149

Email: securitization_reporting@us.mufg.jp

With a copy to:

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.

1251 Avenue of the Americas

New York, NY 10020

Attention: The Securitization Group

Facsimile No.: (212) 782-6448

Emails: securitization_reporting@us.mufg.jp

vdusenbury@us.mufg.jp

If to the BOA Purchaser Agent:

BANK OF AMERICA, N.A.

214 North Tryon Street, 21st Floor

NC1-027-2101

Charlotte, North Carolina 28255

Attention:Securitization Finance Group

Facsimile No.: (704) 388-9169

Email:

If to a Purchaser:

LIBERTY STREET FUNDING LLC

Global Securitization

445 Broad Hollow Rd.

Melville, NY 11747

Tel. No.: (631) 587-4700

Facsimile No.: (212) 302-8767

13

MARKET STREET FUNDING LLC

c/o AMACAR Group, L.L.C.

6525 Morrison Blvd., Suite 318

Charlotte, North Carolina 28211

Attention: Doris J. Hearn

Tel. No.: (704) 365-0569

Facsimile No.: (704) 365-1362

Email: djhearn@amacar.com

GOTHAM FUNDING CORPORATION

c/o Global Securitization Services, LLC

114 West 47th Street, Suite 2310

New York, NY 10036

Tel. No.: (212) 295-2777

Facsimile No.: (212) 302-8767

Attention: Frank B. Bilotta

If to the Banks:

THE BANK OF NOVA SCOTIA

1 Liberty Plaza, 26th Floor

New York, NY 10006

Attention: Luke Evans / Alexander Jurecky

Tel. No.: (212) 225-5118 / (212) 225-5087

Facsimile No.: (212) 225-52905274

PNC BANK, NATIONAL ASSOCIATION

Three PNC Plaza

225 Fifth Avenue

Pittsburgh, Pennsylvania 15222

Attention: William Falcon and Tony Stahley

Tel. No.: (412) 762-5442 and (412) 768-2266

Facsimile No.: (412) 762-9184

Emails: ralph.stahley@pnc.com

pncconduitgroup@pnc.com

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH

1251 Avenue of the Americas

New York, NY 10020

Attention: Nicolas Mounier / Van Dusenbury / Ayaka Ishikawa

Tel. No.: (212) 782-5980 / (212) 782-6964 / (212) 782-6986

Facsimile No.: (212) 782-6448

Emails: securitization_reporting@us.mufg.jp

vdusenbury@us.mufg.jp

14

BANK OF AMERICA, N.A.

214 North Tryon Street, 21st Floor

NC1-027-2101

Charlotte, North Carolina 28255

Attention:Securitization Finance Group

Facsimile No.: (704) 388-9169

Email:

SECTION 7.03.Assignability.

(a) This Agreement and the Investors’ rights and obligations herein (including ownership of each Receivable Interest in the Pool Receivables) shall be assignable by participation or otherwise in whole or in part by the Investors and their successors and assigns with the prior written consent of the Seller, which consent shall not be unreasonably withheld or delayed;provided,however, that the Seller’s consent shall not be required for any assignment or participation from an Investor pursuant to the terms of its applicable liquidity agreement. Each assignor of a Receivable Interest in the Pool Receivables or any interest therein shall notify the applicable Purchaser Agent, the Administrative Agent and the Seller of any such assignment. Each assignor of a Receivable Interest in the Pool Receivables may, in connection with the assignment or participation, disclose to the assignee or participant any information relating to the Seller or the Receivables that was furnished to such assignor by or on behalf of the Seller or by the Administrative Agent and the related Purchaser Agent;provided that prior to any such disclosure, the assignee or participant agrees to preserve the confidentiality of any confidential information relating to the Seller received by it from any of the foregoing entities on terms substantially similar to those set forth inSection 7.06.

(b) Each Bank may assign, with the prior written consent of the Seller, which consent shall not be unreasonably withheld or delayed, to any Eligible Assignee or to any other Bank all or a portion of its rights and obligations under this Agreement (including, without limitation, all or a portion of its Bank Commitment and any Receivable Interests in the Pool Receivables or interests therein owned by it). The parties to each such assignment shall execute and deliver to the Administrative Agent and the related Purchaser Agent for each such party an Assignment and Acceptance. In addition,Scotia Capital, PNC,BTMUeach Bank or any oftheirits respective Affiliates may assign any oftheirits rights (including, without limitation, rights to payment of Capital and Yield) under this Agreement to any Federal Reserve Bank without notice to or consent of the Seller, the Administrative Agent or the Purchaser Agent.

(c) Subject to the prior written consent of the Seller, which consent shall not be unreasonably withheld or delayed, this Agreement and the rights and obligations of each Purchaser Agent and the Administrative Agent herein shall be assignable by each Purchaser Agent and the Administrative Agent and its successors and assigns.

(d) Neither the Seller nor the Collection Agent may assign its rights or obligations hereunder or any interest herein without the prior written consent of the Administrative Agent and each Purchaser Agent, which consent shall not be unreasonably withheld or delayed.

15

(e) Without limiting any other rights that may be available under applicable law, the rights of the Investors may be enforced through them or by their agents.

SECTION 7.04.Costs, Expenses and Taxes.

(a) In addition to the rights of indemnification granted underSection 3.01 hereof, the Seller agrees to pay on demand all reasonable and documented costs and expenses in connection with the preparation, execution, delivery and administration (including periodic auditing of Pool Receivables) of this Agreement, any asset purchase agreement or similar agreement relating to the sale or transfer of interests in Receivable Interests in the Pool Receivables and the other documents and agreements to be delivered hereunder and thereunder, including, without limitation, the reasonable and documented fees and out-of-pocket expenses of one firm of primary counsel for the Administrative Agent and the Purchaser Agents, the Purchasers, Scotia Capital, PNC and, BTMUand BOAand their respective Affiliates and agents with respect thereto and with respect to advising the Administrative Agent and the Purchaser Agents, the Purchasers, Scotia Capital, PNC and, BTMU and BOA and their respective Affiliates and agents as to their rights and remedies under this Agreement, the fees of the Rating Agencies associated with reviewing the Transaction Documents and providing the rating confirmations of each Purchaser’s Commercial Paper required in connection with the execution of this Agreement, and all costs and expenses, if any (including reasonable and documented attorneys’ fees and expenses of one firm of primary counsel), of the Administrative Agent and the Purchaser Agents, the Investors, the Banks and their respective Affiliates and agents, in connection with the enforcement of this Agreement and the other documents and agreements to be delivered hereunder.

(b) To the extent not otherwise included in the Investor Rate, the Seller shall pay, promptly upon the receipt of an invoice, (i) any and all commissions of placement agents and commercial paper dealers in respect of commercial paper notes issued to fund the purchase or maintenance of any Receivable Interest in the Pool Receivables, (ii) all reasonable costs and expenses of any issuing and paying agent or other Person responsible for the administration of the Purchasers’ commercial paper program in connection with the preparation, completion, issuance, delivery or payment of commercial paper notes issued to fund the purchase or maintenance of any Receivable Interest in the Pool Receivables and (iii) any and all stamp and other taxes and fees payable in connection with the execution, delivery, filing and recording of this Agreement or the other documents or agreements to be delivered hereunder. The Seller agrees to save each Indemnified Party harmless from and against any liabilities with respect to or resulting from any delay by the Seller in paying or omission to pay such taxes and fees.

(c) The Seller also shall pay on demand all other reasonable and documented costs, expenses and taxes (excluding income taxes) incurred by a Purchaser or any stockholder or agent of a Purchaser (“Other Costs”), including the reasonable cost of administering the operations of such Purchaser, the reasonable cost of auditing such Purchaser’s books by certified public accountants, the cost of rating such Purchaser’s commercial paper by independent financial Rating Agencies, the taxes (excluding income taxes) resulting from such Purchaser’s operations, and the reasonable and documented fees and out-of-pocket expenses of counsel for any stockholder or agent of such Purchaser with respect to advising as to rights and remedies under this Agreement, the enforcement of this Agreement or advising as to matters relating to such Purchaser’s operations;provided that the Seller and any other Persons who from time to time sell receivables or interests therein to a Purchaser (“Other Sellers”) each shall be liable for such Other Costs ratably in accordance with such Person’s usage under its respective facility; andprovidedfurther that if such Other Costs are attributable to the Seller and not attributable to any Other Seller, the Seller shall be solely liable for such Other Costs.

16

SECTION 7.05.No Proceedings.