EASTERN VIRGINIA BANKSHARES, INC.

P. O. Box 1455

330 Hospital Road

Tappahannock, Virginia 22560

March 18, 2004

Dear Shareholder:

You are cordially invited to attend the 2004 Annual Meeting of Shareholders of Eastern Virginia Bankshares, Inc. to be held on Thursday, April 15, 2004 at 4:00 p.m. at the Bethpage Conference Center, 679 Browns Lane, Urbanna, Virginia.

At the Annual Meeting, you will be asked to elect nine directors for terms of one year. Enclosed with this letter is a formal notice of the Annual Meeting, a Proxy Statement and a form of proxy.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted. Please complete, sign, date and return the enclosed proxy promptly using the enclosed postage-paid envelope. The enclosed proxy, when returned properly executed, will be voted in the manner directed in the proxy.

We hope you will accept our invitation to join us for a reception and opportunity to meet your EVB management team immediately following the Shareholders’ meeting.

|

Sincerely, |

|

/s/ Joe A. Shearin |

|

Joe A. Shearin President and Chief Executive Officer |

| |

EASTERN VIRGINIA BANKSHARES, INC.

P. O. Box 1455

330 Hospital Road

Tappahannock, Virginia 22560

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders (the “Annual Meeting”) of Eastern Virginia Bankshares, Inc. (the “Company”) will be held on Thursday, April 15, 2004, at 4:00 p.m. at Bethpage Conference Center, 679 Browns Lane, Urbanna, Virginia, for the following purposes:

| | 1. | To elect nine (9) directors to serve for terms of one year each expiring at the 2005 annual meeting of shareholders; |

| | 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only holders of shares of Common Stock of record at the close of business on March 11, 2004, the record date fixed by the Board of Directors of the Company, are entitled to notice of, and to vote at, the Annual Meeting.

|

| By Order of the Board of Directors |

|

| /s/ Stacy Carlson |

|

Stacy Carlson Corporate Secretary |

March 18, 2004

IMPORTANT NOTICE:

Please complete, sign, date, and return the enclosed proxy in the accompanying postage paid envelope whether or not you plan to attend the Annual Meeting. Shareholders attending the meeting may withdraw their proxy and vote their shares on all matters that are considered.

EASTERN VIRGINIA BANKSHARES, INC.

P. O. Box 1455

330 Hospital Road

Tappahannock, Virginia 22560

PROXY STATEMENT

2004 ANNUAL MEETING OF SHAREHOLDERS

April 15, 2004

General

This Proxy Statement is furnished in connection with the solicitation by and on behalf of the Board of Directors of Eastern Virginia Bankshares, Inc. (the “Company”) to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Thursday, April 15, 2004, at 4:00 p.m. atBethpage Conference Center, 679 Browns Lane, Urbana, Virginia, and any duly reconvened meeting after adjournment thereof.

Revocation and Voting of Proxies

Any shareholder who executes a proxy has the power to revoke it at any time by written notice to the Secretary of the Company, or by executing a proxy dated as of a later date. It is expected that this Proxy Statement and the enclosed proxy card will be mailed on or about March 18, 2004, to all shareholders entitled to vote at the Annual Meeting.

Voting Rights of Shareholders

On March 11, 2004, the record date for determining those shareholders entitled to notice of and to vote at the Annual Meeting, there were 4,870,432 shares of Common Stock issued and outstanding. Each outstanding share of Common Stock is entitled to one vote on all matters to be acted upon at the Annual Meeting. A majority of the shares of Common Stock entitled to vote, represented in person or by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. Only shareholders of record at the close of business on March 11, 2004 are entitled to notice and to vote at the Annual Meeting or any adjournment thereof.

A shareholder may abstain or (only with respect to the election of directors) withhold his or her vote (collectively, “Abstentions”) with respect to each item submitted for shareholder approval. Abstentions will be counted for purposes of determining the existence of a quorum. Abstentions will not be counted as voting in favor of the relevant item and will have the same effect as a vote against that proposal.

A broker who holds shares in “street name” has the authority to vote on certain items when it has not received instructions from the beneficial owner. Except for certain items for which brokers are prohibited from exercising their discretion, a broker is entitled to vote on matters put to shareholders without instructions from the beneficial owner. Where brokers do not have such discretion, the inability to vote is referred to as a “broker non-vote.” “Broker shares” that are voted on at least one matter will be counted for purposes of determining the existence of a quorum for the transaction of business at the Annual Meeting. Broker non-votes on a particular matter will be disregarded and will not affect the outcome on that matter.

The Board of Directors is not aware of any matters other than those described in this Proxy Statement that may be presented for action at the Annual Meeting. However, if other matters do properly come before the Annual Meeting, the persons named in the enclosed proxy card possess discretionary authority to vote in accordance with their best judgment with respect to such other matters.

Solicitation of Proxies

The cost of soliciting proxies for the Annual Meeting will be borne by the Company. The Company does not intend to solicit proxies otherwise than by use of the mails, but certain officers and regular employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies. The Company may also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in forwarding proxy materials to the beneficial owners of shares of Common Stock.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nine directors will be elected at the Annual Meeting. The individuals listed below are nominated by the Nominating Committee of the Board of Directors for election at the Annual Meeting. Joe A. Shearin, the President and Chief Executive Officer of the Company, is a nominee as provided in his employment agreement with the Company.

The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of Common Stock cast in the election of directors. If the proxy is executed in such manner as not to withhold authority for the election of any or all of the nominees for directors, then the persons named in the proxy will vote the shares represented by the proxy for the election of the nine nominees named below. If the proxy indicates that the shareholder wishes to withhold a vote from one or more nominees for director, such instructions will be followed by the persons named in the proxy.

Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve. If, at the time of the Annual Meeting, any nominee is unable or unwilling to serve as a director, votes will be cast, pursuant to the enclosed proxy, for such substitute nominee as may be nominated by the Board of Directors. No family relationships exist among any of the directors or between any of the directors and executive officers of the Company.

The following biographical information discloses each nominee’s age and business experience in the past five years and the year each individual was first elected to the Board of Directors.

Nominees for Election Whose Terms Expire in 2005

| | | | |

Name (Age) of Director

| | Director First Elected

| | Principal Occupation During Past 5 Years

|

| | |

W. Rand Cook Age 50 | | 1997 | | Attorney with McCaul, Martin, Evans & Cook, P.C. in Mechanicsville, Virginia. Chairman of the Board of the Company currently and a Director of Hanover Bank from 2000 through 2002. |

| | |

F. L. Garrett, III Age 64 | | 1997 | | Realtor in Essex County, Virginia. Vice Chairman of of the Company and Chairman of the Board of Southside Bank since 1997 and a Director of Southside since 1982. |

| | |

F. Warren Haynie, Jr. Age 65 | | 1997 | | Attorney at Law, Lottsburg, Virginia and a Director of Bank of Northumberland from 1987 through 2002. |

| | |

William L. Lewis Age 53 | | 1997 | | Attorney with William L. Lewis, P.C. in Tappahannock, Virginia and a Director of Southside Bank from 1989 through 2002. |

| | |

Charles R. Revere Age 65 | | 2002 | | President of Revere Gas and Appliance and a Director of Southside Bank from 1988 through 2002. |

| | |

Joe A. Shearin Age 47 | | 2003 | | President and Chief Executive Officer of the Company since August 2002, and President and Chief Executive Officer of Southside Bank since 2001. Previously he was Senior Vice President/City Executive for BB&T and Executive Vice President of First Federal Savings Bank before joining BB&T. |

| | |

Howard R. Straughan, Jr. Age 74 | | 2001 | | Retired banker, and a Director of Bank Northumberland since 1994. |

| | |

Leslie E. Taylor Age 55 | | 2000 | | CPA with Leslie E. Taylor, CPA, PC, Tappahannock, Virginia and a Director of Southside Bank from 1989 through 2002. |

| | |

Jay T. Thompson, III Age 47 | | 2000 | | Owner of Mechanicsville Drug Store, Mechanicsville, Virginia and Chairman of Hanover Bank since 2000. |

3

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE NOMINEES SET FORTH ABOVE.

The Board of Directors and Committees

There were 12 meetings of the Board of Directors in 2003. Each director attended greater than 75% of the aggregate number of meetings of the Board of Directors and meetings of committees of which the director was a member in 2003.

The Board of Directors has, among others, a standing Executive Committee, Audit Committee, Compensation Committee and Nominating Committee.

Executive Committee. The Executive Committee acts for the Board of Directors when the Board is not in session, and consists of Messrs. Cook, Haynie, Lewis, and Revere. The Executive Committee met six times during the year ended December 31, 2003.

Audit Committee. The Audit Committee acts for the Board to recommend the selection of independent certified public accountants and the internal auditors, to approve the scope of the independent and internal auditors’ audits, to review the reports of examination by both independent and internal auditors and regulatory agencies, and to issue periodic reports to the Board of Directors. The Audit Committee consists entirely of directors who meet the independence requirements of the National Association of Securities Dealers’ listing standards and the Securities and Exchange Commission (the “SEC”). The Audit Committee is composed of Chairman Leslie E. Taylor, CPA, F. Warren Haynie, Jr., Charles R. Revere, and Howard R. Straughan, Jr. Audit Committee Chairman Leslie E. Taylor, CPA fulfills the applicable standard as an independent audit committee financial expert. The Audit Committee operates under a Charter adopted by the Board, a copy of which is attached as Appendix A to this Proxy Statement. The Audit Committee met seven times during 2003. For additional information see “Audit Committee Report” below.

Compensation Committee. The Compensation Committee consists of four independent directors—Howard R. Straughan, Jr., F. L. Garrett, III, Charles R. Revere and J. T. Thompson. This committee recommends the compensation to be paid to the executive officers of the Company and administers all incentive and stock plans to the benefit of such officers and directors eligible to participate in such plans. The initial meeting of this Committee occurred in February, 2003, and the Committee met again in January, 2004. For additional information, see “Report on Executive Compensation” below.

Nominating Committee. The Nominating Committee consists of four independent directors—William L. Lewis, F. L. Garrett, III, Leslie E. Taylor and J. T. Thompson. The Nominating Committee operates under a Charter, adopted by the Board. The Nominating Committee Charter is available to any shareholder upon request to the Corporate Secretary at the Headquarters of Eastern Virginia Bankshares at P. O. Box 1455, 330 Hospital Road, Tappahannock, Virginia 22560 and is available on the Company’s web page atwww.evb.org.

The Nominating Committee is charged with the responsibilities of identifying director candidates for the Board, reviewing director candidates suggested by shareholders and making recommendations of candidates to the Board. Potential candidates are evaluated by the Nominating Committee, whether suggested by shareholders or directors, by taking into account many factors, including knowledge of business and financial affairs, understanding of Eastern Virginia Bankshares’ business and the complexities of a large publicly-traded company, personal integrity and

4

judgment, educational background and business or professional experience. No candidate can be nominated who fails to meet all State and Federal banking regulatory requirements.

Shareholder recommendations for candidates must be submitted in writing to the Chairperson of the Nominating Committee or the Corporate Secretary not more than 90 days prior to the Annual Meeting and not less than 60 days prior thereto. Such a shareholder nomination must include the nominee’s written consent to the nomination, sufficient background information with respect to the nominee, sufficient identification of the nominating shareholder and a representation by shareholder of his or her intention to appear an the Annual Meeting (in person or by proxy) to nominate the individual specified in the notice. Nominations must be received by the Nominating Committee Chairperson or the Company’s Corporate Secretary at the Company’s principal office in Tappahannock, Virginia, no later than February 20, 2005 and no earlier than January 21, 2005 in order to be considered for the next annual election of directors.

After evaluation of potential candidates, the Nominating Committee submits a report and recommendations to the Board. The Nominating Committee does not address in its Charter the disclosures of names of persons who have nominated candidates, nor disclosures of the percentage of beneficial ownership of voting common stock of such persons. No fee-based services of third parties are utilized in the evaluation process. Nominating Committee Guidelines to be addressed by the Board at its March, 2004 meeting will address these latter three issues.

Independence of the Directors

The Board of Directors has determined that the following eight individuals of its nine members are independent as defined by the listing standards of the National Association of Securities Dealers: W. Rand Cook, F. L. Garrett III, F. Warren Haynie Jr., William L. Lewis, Charles R. Revere, Howard R. Straughan Jr., Leslie E. Taylor and Jay T. Thompson, III. In reaching this conclusion, the Board considered that the Company and its subsidiary banks conduct business with companies of which certain members of the Board or members of their immediate families are or were directors or officers.

Code of Ethics

The Board of Directors has approved a Code of Ethics for all officers and staff of Eastern Virginia Bankshares, Inc. and its subsidiaries. The Code of Ethics is designed to promote honest and ethical conduct, proper disclosure of financial information in the Company’s periodic reports, and compliance with applicable laws, rules, and regulations by the Company’s senior officers who have financial responsibilities. The Code of Ethics is available on the Company’s web page atwww.evb.org and is attached as Exhibit 14 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2003.

Annual Meeting Attendance

The Company encourages members of the Board of Directors to attend the annual meeting of shareholders. All of the directors attended the 2003 annual meeting.

Communications with Directors

Any director may be contacted by writing to him c/o Eastern Virginia Bankshares, P.O. Box 1455, 330 Hospital Road, Tappahannock, Virginia 22560. Communications to the non-management directors as a group may be sent to the same address, c/o the Secretary of the Company. The Company promptly forwards, without screening, all such correspondence to the indicated directors.

Director Compensation

As compensation for his service to the Company, each member of the Board of Directors receives $500 for each Board meeting attended and $300 for each committee meeting attended plus an annual retainer of 500 shares of Eastern Virginia Bankshares, Inc. common stock. The Chairman of the Board receives an additional $1,000 per month retainer. Board members who are also officers do not receive any additional compensation above their regular salary for attending committee meetings. In 2003, directors received $87,300 in the aggregate as compensation for their services as directors plus 4,000 shares of common stock.

5

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of March 1, 2004, certain information with respect to the beneficial ownership of shares of Common Stock by each of the members of the Board of Directors, all of whom are also director nominees, by each of the current executive officers named in the “Summary Compensation Table” below and by all current directors and executive officers as a group. Beneficial ownership includes shares, if any, held in the name of the spouse, minor children or other relatives of a director living in such person’s home, as well as shares, if any, held in the name of another person under an arrangement whereby the director or executive officer can vest title in himself at once or at some future time.

| | | | | |

Name

| | Beneficial Ownership

| | | Percent of Class (%)

|

W. Rand Cook | | 2,851 | | | * |

F. L. Garrett, III | | 22,652 | | | * |

F. Warren Haynie, Jr. | | 5,076 | | | * |

William L. Lewis | | 23,472 | ** | | * |

Charles R. Revere | | 3,013 | | | * |

Joe A. Shearin | | 595 | | | * |

Howard R. Straughan, Jr. | | 93,934 | | | 1.93% |

Leslie E. Taylor | | 2,054 | | | * |

Jay T. Thompson, III | | 13,564 | | | * |

Ronald L. Blevins | | 1,091 | | | |

Joseph H. James | | 14 | | | * |

William E. Martin, Jr. | | 996 | | | * |

Lewis R. Reynolds | | 18,465 | | | * |

All present executive | | | | | |

officers and directors as a | | | | | |

group (14 persons) | | 187,777 | | | 3.86% |

| * | Percentage of ownership is less than one percent of the outstanding shares of Common Stock. |

| ** | Includes 3,637 shares held in estates and trusts for which Director Lewis has fiduciary responsibility, but not pecuniary interest. |

Security Ownership of Certain Beneficial Owners

As of March 1, 2004, to the Company’s knowledge, no one person beneficially owns more than five percent of the outstanding shares of the Company’s Common Stock.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors and executive officers, and any persons who own more than 10% of the outstanding shares of Common Stock, to file with the SEC reports of ownership and changes in ownership of Common Stock. Officers and directors are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports that they file. Based solely on review of the copies of such reports furnished to the Company or written representation that no other reports were required, the Company believes that, during fiscal year 2003, all filing requirements applicable to its officers and directors were complied with, except for one late Form 4 filing by Director F. L. Garrett, III (six days late) and two failures to file a Form 4, one by Director Howard Straughan who provided the information in Form 5 filed on February 13, 2004 and the second by Director William L. Lewis who provided the information in a late Form 4 filed on February 27, 2004.

6

Executive Compensation

The following table shows, for the fiscal years ended December 31, 2003, 2002 and 2001, the cash compensation paid by the Company and its subsidiaries, as well as certain other compensation paid or accrued for those years, to each of the named executive officers in all capacities in which they served:

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | | Long-Term

Compensation

| | | | |

Name and Position

| | Year

| | Salary

| | Bonus

| | Other Annual Compensation

| | | Securities

Underlying

Options

| | | All Other Compensation

| |

| | | | | | | | | | | (1 | ) | | (2 | ) | | | (3 | ) |

Joe A. Shearin (4) | | 2003 | | $ | 206,873 | | $ | 69,150 | | — | | | 3,165 | | | $ | 4,200 | |

President and Chief Executive | | 2002 | | | 156,000 | | | 30,162 | | — | | | 1,995 | | | $ | 1,877 | |

Officer of the Company | | 2001 | | | 70,295 | | | 150 | | — | | | — | | | | 138 | |

and of Southside Bank | | | | | | | | | | | | | | | | | | |

| | | | | | |

Lewis R. Reynolds | | 2003 | | $ | 118,925 | | $ | 23,625 | | — | | | 2,000 | | | $ | 2,363 | |

Senior Vice President of the | | 2002 | | | 111,815 | | | 21,064 | | — | | | 1,800 | | | $ | 2,519 | |

Company and President of | | 2001 | | | 101,650 | | | 13,425 | | — | | | — | | | | 2,039 | |

Bank of Northumberland | | | | | | | | | | | | | | | | | | |

| | | | | | |

Joseph H. James | | 2003 | | $ | 105,689 | | $ | 28,248 | | — | | | 1,300 | | | $ | 2,118 | |

Senior Vice President and | | 2002 | | | 96,000 | | | 17,358 | | — | | | 1,100 | | | $ | 2,235 | |

Chief Operations Officer | | 2001 | | | 90,457 | | | 15,000 | | — | | | — | | | | 603 | |

| | | | | | |

Ronald L. Blevins | | 2003 | | $ | 97,936 | | $ | 26,282 | | — | | | 1,300 | | | $ | 1,967 | |

Senior Vice President and | | 2002 | | | 75,918 | | | 10,000 | | — | | | 1,100 | | | $ | 1,518 | |

Chief Financial Officer | | 2001 | | | 63,436 | | | — | | | | | — | | | | 1,269 | |

of the Company | | | | | | | | | | | | | | | | | | |

| | | | | | |

William E. Martin, Jr. | | 2003 | | $ | 101,678 | | $ | 10,350 | | — | | | 2,000 | | | $ | 2,119 | |

Senior Vice President of the | | 2002 | | | 96,324 | | | 10,562 | | — | | | 1,800 | | | $ | 3,160 | |

Company and President of | | 2001 | | | 91,804 | | | 9,000 | | | | | — | | | | 2,754 | |

Hanover Bank | | | | | | | | | | | | | | | | | | |

| (1) | The amount of compensation in the form of perquisites or other personal benefits did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported in each year. |

| (2) | Year 2003 options were granted at an exercise price of $28.60 per share. |

| (3) | Amounts presented represent matching contributions by the Company to the Company’s 401 (k) plan. |

| (4) | Mr. Shearin’s employment with the Company commenced in August, 2001. |

Stock Options

The Company’s 2000 Stock Option Plan, amended and restated by the 2003 Stock Incentive Plan, provides for the granting of both incentive and non-qualified stock options to executive officers, key employees and directors of the Company and its subsidiaries.

No restricted stock options awards have been granted to executives or employees of the Company. The following table provides certain information concerning stock options granted during 2003 to the named executive officers.

7

Option Grants in 2003

| | | | | | | | | | | | | | | | | | |

| | | Number of

Shares

Underlying

Options

Granted (1)

| | Percent of

Total

Options

Granted

to

Employees

in 2003

| | | Exercise

Price per

Share

| | Expiration

Date

| | Potential Realizable Value (2)

| |

Name | | | | | | | | | | | | | 5 | % | | | 10 | % |

Joe A. Shearin | | 3,165 | | 10.05 | % | | $ | 28.60 | | 09/15/2014 | | $ | 54,153 | | | $ | 139,830 | |

Lewis R. Reynolds | | 2,000 | | 6.35 | % | | | 28.60 | | 09/15/2014 | | | 34,220 | | | | 88,360 | |

Joseph H. James | | 1,300 | | 4.13 | % | | | 28.60 | | 09/15/2014 | | | 22,243 | | | | 57,434 | |

William E. Martin, Jr. | | 2,000 | | 6.35 | % | | | 28.60 | | 09/15/2014 | | | 34,220 | | | | 88,360 | |

Ronald L. Blevins | | 1,300 | | 4.13 | % | | | 28.60 | | 09/15/2014 | | | 22,243 | | | | 57,434 | |

| (1) | Vesting is as follows: 100% on September 15, 2007. |

| (2) | Potential realizable value at the assumed annual rates of stock price appreciation indicated, based on actual option term (10 Years) and annual compounding, less cost of shares at exercise price. |

The following table shows certain information with respect to the value of unexercised options at year- end 2003 for the named executive officers.

2003 Year-End Option Values

| | | | | | | | | | |

| | | Number of Shares Unexercised Underlying Options

December 31, 2003

| | Value of Unexercised In-the-Money Options at

December 31, 2003 (1)

|

| | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Joe A. Shearin | | — | | 5,160 | | $ | — | | $ | 25,316 |

Lewis R. Reynolds | | — | | 3,800 | | | — | | | 22,448 |

Joseph H. James | | — | | 2,400 | | | — | | | 13,754 |

William E. Martin, Jr. | | — | | 3,800 | | | — | | | 22,448 |

Ronald L. Blevins | | — | | 2,400 | | | — | | | 13,754 |

| (1) | Calculated by subtracting the exercise price from the fair market value of the stock at December 31, 2003. |

Employee Benefit Plans

The Company has a defined-benefit pension plan provided through the Virginia Bankers Association Insurance Trust. Benefits are based on an employee’s salary at the time of retirement, normally at age 65. All active, full-time employees of the Company and its subsidiaries are eligible to participate in the plan at age 21 with one year of service. Employees do not contribute to the plan, and a participant becomes 100% vested upon completion of five years of service. Employees of Hanover Bank and EVB Investments, Inc. became eligible to participate in the Plan as of October 1, 2003. Directors who are full-time employees are eligible for participation.

8

The estimated annual benefits payable upon retirement are as follows:

| | | | | | | | | | | | | | | | | | |

| 5 Year Average | | Years of Service

|

Compensation

| | 10

| | 15

| | 20

| | 25

| | 30

| | 35

|

$25,000 | | $ | 4,188 | | $ | 6,063 | | $ | 7,938 | | $ | 9,813 | | $ | 10,313 | | $ | 11,250 |

$50,000 | | | 8,797 | | | 12,758 | | | 16,719 | | | 20,681 | | | 21,892 | | | 23,978 |

$75,000 | | | 14,735 | | | 21,446 | | | 28,157 | | | 34,868 | | | 37,454 | | | 41,353 |

$100,000 | | | 20,672 | | | 30,133 | | | 39,594 | | | 49,056 | | | 53,017 | | | 58,728 |

$125,000 | | | 26,610 | | | 38,821 | | | 51,032 | | | 63,243 | | | 68,579 | | | 76,103 |

$150,000 | | | 32,547 | | | 47,508 | | | 62,469 | | | 77,431 | | | 84,142 | | | 93,478 |

$175,000 | | | 38,485 | | | 56,196 | | | 73,907 | | | 91,618 | | | 99,704 | | | 110,853 |

$200,000 | | | 44,422 | | | 64,883 | | | 85,344 | | | 105,806 | | | 115,267 | | | 128,228 |

The estimated annual retirement benefit is based on a life annuity assuming full benefit at age 65 with no offsets. For a person age 65 in 2003, compensation is currently limited to $200,000 by IRC Regulation.

The estimated credited years of service for Messrs. Shearin, Reynolds, James and Blevins are 2, 32, 3, and 3 years, respectively. Mr. Martin joined the Plan as of October 1, 2003 and is credited with 0.25 years of service.

The benefits in the table are calculated on the basis of a 50% joint and survivor annuity, assuming that at retirement, the age of the employee’s spouse is 62. Benefits are not subject to deduction for Social Security offset amounts. Benefits are based on an employee’s salary for the five years that precede retirement.

Equity Compensation Plans

The following table summarizes information as of December 31, 2003, relating to the Company’s equity compensation plans.

Equity Compensation Plan Information

(year ended December 31, 2003)

| | | | | | | |

Plan Category

| | Number of Securities to Be

Issued upon Exercise of

Outstanding Options

| | Weighted Average

Exercise Price of

Outstanding Options

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans (1)

|

Equity Compensation Plans | | | | | | | |

Approved by Shareholders | | | | | | | |

2000 Stock Option Plan | | 26,595 | | $ | 16.10 | | — |

2003 Stock Incentive Plan (2) | | 31,500 | | $ | 28.60 | | 336,105 |

Equity Compensation Plans | | | | | | | |

Not Approved by | | | | | | | |

Shareholders (3) | | — | | $ | — | | — |

| | |

| |

|

| |

|

Total | | 58,095 | | $ | 22.88 | | 336,105 |

| | |

| |

|

| |

|

| (1) | Amounts exclude any securities to be issued upon exercise of outstanding options. |

| (2) | The 2003 Stock Incentive Plan, amending and restating the 2000 Stock Option Plan, permits grants of stock options up to 400,000 shares and includes outstanding grants under the 2000 Stock Option Plan |

| (3) | The Company does not have any equity compensation plans that have not been approved by shareholders. |

9

Report on Executive Compensation

The Compensation Committee of the Board of Directors (the “Compensation Committee”) administers the Company’s executive compensation program and establishes the salaries of the Company’s executive officers. The Compensation Committee consists of only non-employee directors, who are appointed by the Board.

Compensation Philosophy

The general philosophy of the Compensation Committee is to provide executive compensation designed to enhance shareholder value, including annual compensation, consisting of salary and bonus awards, and long-term compensation, consisting of stock options. To this end, the Compensation Committee designs compensation plans and incentives to link the financial interests of the Company’s executive officers to the interests of its shareholders, to encourage support of the Company’s long-term goals, to tie compensation to the Company’s performance and to attract and retain talented leadership.

In making decisions affecting executive compensation, the Compensation Committee reviews the nature and scope of the executive officer’s responsibilities as well as his or her effectiveness in supporting the Company’s long-term goals. The Compensation Committee also considers the compensation practices of other Virginia banking companies that compete with the Company. Based on these and other factors which it considers relevant, and in light of the Company’s overall long-term performance, the Committee has considered it appropriate, and in the best interest of the shareholders, to set the overall executive compensation at a level competitive with other Virginia banking companies of similar size to enable the Company to attract, retain and motivate the highest level of executive personnel.

The primary type of compensation provided to the Company’s executive officers is annual compensation, which includes base salary intended to provide a stable annual salary at a level consistent with individual contributions, and annual performance bonuses intended to link officers’ compensation to the Company’s performance. Consistent with its stated philosophy, the Compensation Committee aims to position base salaries for the Company’s executive officers annually at a level competitive with its Virginia peers, with consideration of the performance of the Company, individual performance of each executive and the executive’s scope of responsibility in relation to other officers and key executives within the Company. In selected cases, other factors may also be considered.

The Company’s Annual Incentive Bonus Plan provides for the payment of cash bonuses based on the Company’s performance in relation to predetermined objectives and individual executive performance for the year then ended. Prior to the beginning of the year, the Compensation Committee established objectives related to the Company’s earnings, average asset growth and shareholder value. Based on the Company’s performance during 2003 against these objectives, bonuses were paid under the Annual Bonus Plan as indicated in the Summary Compensation Table.

While annual compensation is the primary type of compensation provided to executive officers, the Company also provides long-term incentive compensation in the form of stock options. The Compensation Committee grants to executive officers options to purchase shares of the Company’s common stock under the Company’s stock option plan that was adopted by the Company in 2000, approved by shareholders in 2001 and amended and restated by the Board and the shareholders in 2003. In 2003, the Compensation Committee granted options to the executives of the Company to purchase an aggregate of 9,765 shares of the Company’s common stock. These options were granted at an exercise price equal to the fair market value of the common stock on September 15, 2003, the date of the grant, and become exercisable four years after the date of the grant and expire ten years from the date of the grant.

Compensation of Chief Executive Officer

During 2003, the Company’s Chief Executive Officer received base annual salary of $206,873 and earned an incentive bonus of $69,150, a 48.3% increase over the amount paid in 2002 when Mr. Shearin served as Chief Executive Officer for only a portion of the year. During 2003, the Chief Executive Officer received stock options to purchase 3,165 shares of the Company’s common stock as shown on the Summary Compensation Table. The Chief Executive Officer’s compensation is based on competitive analysis and performance that exceeded goals for 2003 for both net income and average asset growth.

10

Each bank subsidiary is responsible for establishing salaries and bonuses for their respective executive officers. The respective boards independently establish executive compensation at levels that are competitive in the markets they serve.

Compensation Committee

Howard R. Straughan, Jr., Chairman

F. L. Garrett, III

Charles R. Revere

J. T. Thompson

Compensation Committee Interlocks and Insider Participation

During 2003 and up to the present time, there were transactions between the Company’s banking subsidiaries and certain members of the Compensation Committee or their associates, all consisting of extensions of credit by the banks in the ordinary course of business. Each transaction was made on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with the general public. In the opinion of management and the Company’s Board, none of the transactions involved more than the normal risk of collectibility or present other unfavorable features.

None of the members of the Compensation Committee has served as an officer or employee of the Company or any of its subsidiaries or affiliates. No director may serve as a member of the Committee if he is eligible to participate in the 2003 Stock Incentive Plan or was at any time within one year prior to his appointment to the Committee eligible to participate in the 2003 Stock Incentive Plan. Each subsidiary bank has a separate compensation or salary committee for all employees of the bank, including the CEO of that bank.

Employment Contracts and Termination and Change in Control Arrangements

The Company and each of Joe A. Shearin, Joseph H. James and Ronald L. Blevins are parties to an employment agreement entered into as of January 6, 2003, January 8, 2003 and January 13, 2003, respectively. Mr. Shearin’s employment agreement provides for him to serve as President and Chief Executive Officer of the Company and President of Southside Bank and provides for a base salary of $188,000. His employment agreement is for a rolling three-year term. Mr. James’s employment agreement provides for him to serve in an executive officer capacity and provides for a base salary of $96,000. Mr. Blevins’s employment agreement provides for him to serve in an executive officer capacity and provides for a base salary of $85,000. The Board of Directors, in its discretion, may increase the base salary of each of Messrs. Shearin, James and Blevins. The employment agreements with Mr. James and Mr. Blevins currently terminate on December 31, 2005. On each December 31, beginning with December 31, 2004, the term of their employment agreements will be renewed and extended by one year.

Each employment agreement may be terminated by the Company with or without cause. If the officer resigns for “good reason” or is terminated without “cause” (as those terms are defined in the employment agreement), however, he is entitled to salary and certain benefits for the remainder of his contract. If the officer’s employment terminates for good reason or without cause within one year of a change in control of the Company, he will be entitled to severance payments approximately equal to 299% of his annualized cash compensation for a period that precedes the change in control as determined under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). If termination of employment due to a change in control had occurred as of February 28, 2004, Mr. Shearin would have been entitled to severance payments amounting to approximately$564,817; Mr. James would have been entitled to severance payments amounting to approximately $308,736; and Mr. Blevins would have been entitled to severance payments amounting to approximately $211,084.

Each agreement also contains a covenant not to compete that is in effect while the individual is an officer and employee of the Company and for a 12-month period after the termination of his employment.

The Company’s subsidiary Bank of Northumberland has employment agreements with certain Bank executive officers, including Mr. Reynolds, to serve as officers of Bank of Northumberland. Mr. Reynolds’ contract was initially for a five-year term that expired on November 13, 2001. The contract currently is automatically renewed for successive terms of one year at a time, unless the contract is terminated by Bank of Northumberland or Mr. Reynolds. Mr. Reynolds salary is determined at the sole discretion of Bank of Northumberland’s Board of Directors,

11

with a minimum salary from the original agreement of $72,628. In the event that the officer’s employment is terminated under this agreement within six months before or 18 months after a change of control of Bank of Northumberland, the officer is entitled to receive the greater of (i) his current salary and benefits or (ii) the level of such salary and benefits in effect over the most recent 12 months preceding the date of his termination of employment. The officer would be eligible to receive this compensation subsequent to his termination in these circumstances over the longer of (i) an additional 12 months, or (ii) the remainder of his unexpired term.

Shareholder Return On Investment

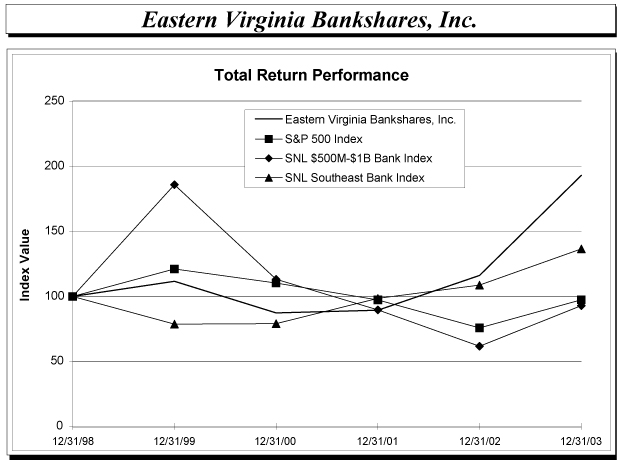

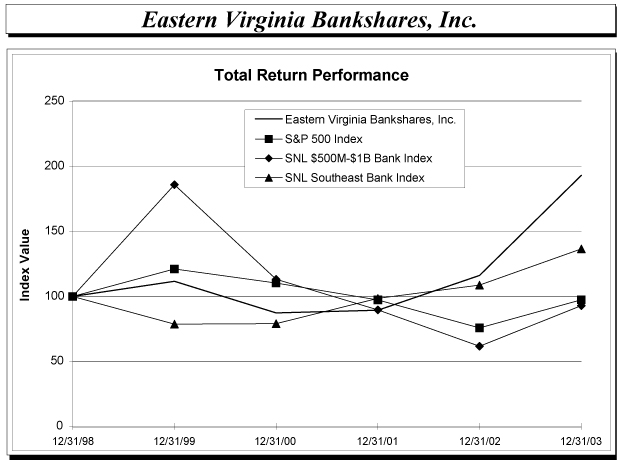

The following graph compares the yearly percentage change in the Company’s cumulative total shareholder return with that of the S & P 500 Index, the SNL $500M-$1 billion Bank Index, and the SNL Southeast Bank Index, assuming $100 investments in each on December 31, 1998, with dividends reinvested. The index categories used in the graph have changed from the prior year to use the SNL $500m-$1B Bank Index rather than the SNL $250m-$500m Bank Index because of growth of the Company, and the SNL Southeast Bank Index replaces the SNL Mid-Atlantic Bank Index formerly used, to incorporate a larger base of banks.

| | | | | | | | | | | | |

| | | Period Ending

|

Index

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

Eastern Virginia Bankshares, Inc. | | 100.00 | | 111.58 | | 87.25 | | 89.32 | | 116.17 | | 193.09 |

S&P 500 Index | | 100.00 | | 121.11 | | 110.34 | | 97.32 | | 75.75 | | 97.40 |

SNL $500M-$1B Bank Index | | 100.00 | | 185.95 | | 113.19 | | 89.65 | | 61.67 | | 92.90 |

SNL Southeast Bank Index | | 100.00 | | 78.69 | | 79.01 | | 98.44 | | 108.74 | | 136.55 |

12

Transactions with Management

Some of the directors and officers of the Company are at present, as in the past, customers of the Company, and the Company has had, and expects to have in the future, banking transactions in the ordinary course of its business with directors, officers, principal shareholders and their associates, on substantially the same terms, including interest rates and collateral on loans, as those prevailing at the same time for comparable transactions with others. These transactions do not involve more than the normal risk of collectibility or present other unfavorable features.

There were no transactions during 2003 between the Company’s directors or officers and the Company’s retirement or profit sharing plans, nor are there any proposed transactions. Additionally, there are no legal proceedings to which any director, officer or principal shareholder, or any affiliate thereof, is a party that would be material and adverse to the Company.

Appointment of Independent Auditors

The Board of Directors has, upon recommendation by the Company’s Audit Committee, appointed the firm of Yount, Hyde & Barbour, P.C. as independent public accountants to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2004. Yount, Hyde & Barbour, P.C. audited the financial statements of the Company for the year ended December 31, 2003.

Representatives of Yount, Hyde & Barbour, P.C. are expected to be present at the Annual Meeting, will have an opportunity to make a statement, if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders.

Fees of Independent Public Accountants

Audit Fees.The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services rendered for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2003 and 2002, and for the review of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, and services that are normally provided in connection with statutory and regulatory filings and engagements, for those fiscal years were $53,575 for 2003 and $51,050 for 2002.

Audit Related Fees.The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services for Federal Home Loan Bank collateral audits and other consulting and research regarding financial accounting and reporting standards that are reasonably related to the performance of the audit or review of the Company’s financial statements and not reported under the heading “Audit Fees” above for the fiscal years ended December 31, 2003 and December 31, 2002 were $8,345 and $4,718, respectively.

Tax Fees.The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services for tax compliance, tax advice and tax planning for the fiscal years ended December 31, 2003 and December 31, 2002 were $4,000 and $4,000, respectively. During 2003 and 2002, these services included preparation of federal and state income tax returns.

All Other Fees.There were no other fees billed by Yount, Hyde & Barbour, P.C. during the fiscal years ended December 31, 2003 and December 31, 2002.

Independent Public Accountants’ Fee Table

| | | | | | | | | | | | |

| | | 2003

| | | 2002

| |

| | | Fees

| | Percentage

| | | Fees

| | Percentage

| |

| | | | |

Audit fees | | $ | 53,575 | | 81.3 | % | | $ | 51,050 | | 85.4 | % |

Audit-related fees | | | 8,345 | | 12.7 | % | | | 4,718 | | 7.9 | % |

Tax fees | | | 4,000 | | 6.1 | % | | | 4,000 | | 6.7 | % |

All other fees | | | — | | 0 | % | | | — | | 0 | % |

| | |

|

| |

|

| |

|

| |

|

|

| | | $ | 65,920 | | 100 | % | | $ | 59,768 | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

|

13

Pre-Approved Services

All services not related to the annual audit and quarterly review of the Company’s financial statements, as described above, were pre-approved by the Audit Committee, which concluded that the provision of such services by Yount, Hyde & Barbour, P.C. was compatible with the maintenance of that firms’ independence in the conduct of their auditing functions. The Audit Committee’s Charter, which is attached as Appendix A to this Proxy Statement, provides for pre-approval of audit, audit-related, tax and other services.The Charter authorizes the Audit Committee to delegate to one or more of its members pre-approval authority with respect to permitted services.

Audit Committee Report

The Audit Committee of Eastern Virginia Bankshares consists entirely of directors who meet the independence requirements of National Association of Securities Dealers, Inc. listing standards. The Audit Committee is composed of Chairman Leslie E. Taylor CPA, F. Warren Haynie, Jr., Charles R. Revere, and Howard R. Straughan, Jr. The Audit Committee operates under a written charter adopted by the Board of Directors.

The Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. Management of the Company has the primary responsibility for the Company’s financial reporting process, principles and internal controls as well as preparation of its financial statements. The Company’s independent auditors are responsible for performing an audit of the Company’s financial statements and expressing an opinion as to the conformity of such financial statements with accounting principles generally accepted in the United States.

Audit Committee Chairman Leslie E. Taylor, CPA, fulfills the applicable standard as an independent financial expert serving on the Audit Committee.

The Audit Committee met a total of seven times during 2003. During the course of those meetings, the Audit Committee:

| | 1. | Reviewed and discussed with management and the independent auditor the audited financial statements for the year ended December 31, 2003. |

| | 2. | Reviewed with the independent auditor the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussion with Audit Committees), as currently in effect. |

| | 3. | Discussed with the independent auditor the independent auditor’s independence from the Company, including the provision of tax and other non-audit services to the Company and the matters required to be discussed by the Statement on Auditing Standards No. 61Communications with Audit Committees and has concluded that the independent auditor is independent from the Company and its management. |

| | 4. | Reviewed and discussed with the independent auditor the overall scope and plans for their respective audits. |

| | 5. | Discussed with the Company’s internal auditor, Cavanaugh, Nelson, & Co., PLC, the scope and plans for their internal audit work, and received and discussed regular reports on the status of the audit work completed. |

| | 6. | Provided Board oversight over the establishment of comprehensive risk management programs throughout the organization. |

| | 7. | Maintained a direct reporting relationship with the Risk Management Officer of Eastern Virginia Bankshares, and received status reports at each meeting related to other on-going risk management activities within the organization, including but not limited to: internal control self-assessment, credit review, compliance, and regulatory activities within the organization. |

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, for filing with the SEC. By recommending to the Board of Directors that the audited financial statements be so included, the Audit Committee is not opining on the accuracy, completeness or presentation of the information contained in the audited financial statements.

Submitted on March 4, 2004 by the members of the Audit Committee of the Corporation’s Board of Directors.

14

The Audit Committee

Leslie E. Taylor, Chairman

F. Warren Haynie, Jr.

Charles R. Revere

Howard R. Straughan, Jr.

PROPOSALS FOR 2005 ANNUAL MEETING OF SHAREHOLDERS

Under the regulations of the Securities and Exchange Commission, any shareholder desiring to make a proposal to be acted upon at the 2005 annual meeting of shareholders must cause such proposal to be received, in proper form, at the Company’s principal executive offices at P. O. Box 1455, 330 Hospital Road, Tappahannock, Virginia 22560, no later than November 18, 2004, in order for the proposal to be considered for inclusion in the Company’s Proxy Statement for that meeting. The Company presently anticipates holding the 2005 annual meeting of shareholders on Thursday, April 21, 2005.

The Company’s Bylaws also prescribe the procedure a shareholder must follow to nominate directors or to bring other business before shareholders’ meetings. For a shareholder to nominate a candidate for director at the 2005 annual meeting of shareholders, notice of nomination must be received by the Secretary of the Company not less than 60 days and not more than 90 days prior to the date of the 2005 annual meeting. The notice must describe various matters regarding the nominee and the shareholder giving the notice. For a shareholder to bring other business before the 2005 annual meeting of shareholders, notice must be received by the Secretary of the Company not less than 60 days and not more than 90 days prior to the date of the 2005 annual meeting. The notice must include a description of the proposed business, the reasons therefor, and other specified matters. Any shareholder may obtain a copy of the Company’s Bylaws, without charge, upon written request to the Secretary of the Company. Based upon an anticipated date of April 21, 2005 for the 2005 annual meeting of shareholders, the Company must receive any notice of nomination or other business no later than February 20, 2005 and no earlier than January 21, 2005.

OTHER MATTERS

THE COMPANY’S ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2003, INCLUDING FINANCIAL STATEMENTS, IS BEING MAILED TO SHAREHOLDERS WITH THIS PROXY STATEMENT. A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR 2003 FILED WITH THE COMMISSION, EXCLUDING EXHIBITS, MAY BE OBTAINED WITHOUT CHARGE BY WRITING TO RONALD L. BLEVINS, WHOSE ADDRESS IS P.O. BOX 1455, TAPPAHANNOCK, VIRGINIA 22560. THE ANNUAL REPORT IS NOT PART OF THE PROXY SOLICITATION MATERIALS.

15

Appendix A

EASTERN VIRGINIA BANKSHARES

AUDIT COMMITTEE CHARTER

March 9, 2004 Revision

Purpose

The Audit Committee (the “Committee”) shall assist the Board of Directors of Eastern Virginia Bankshares (“Board of Directors”) in its oversight of (1) the integrity of the Corporation’s financial statements and its financial reporting and disclosure practices, (2) the appointment, compensation, and oversight of the independent accountants of the Corporation, (3) the soundness of the Corporation’s systems of internal controls regarding finance and accounting compliance, (4) the independence and performance of the Corporation’s internal audit staff, and (5) compliance with applicable legal, ethical, and regulatory requirements. In doing so, it is the responsibility of the Committee to provide an open avenue of communication between the Committee, the Board of Directors, Management, the internal auditor, the Risk Management Officer and the independent accountants. The Committee may adopt such policies and procedures, as it may deem necessary or appropriate to carry out its responsibilities under this charter.

Membership

The Committee shall consist of at least three Directors. The members of the EVB Audit Committee shall meet the independence and experience requirements of the NASDAQ Stock Market, Inc. (the “NASDAQ”) and the U. S. Securities and Exchange Commission (the “SEC”). In particular, each Committee member shall be able to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement. In addition, at least one member of the Committee shall have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background that results in that member’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

The Board of Directors shall appoint members annually, with one of the members appointed by the Committee as Committee Chair. It is the responsibility of the Chairman to schedule and preside at all meetings of the Committee and to ensure the Committee has a written agenda for its meetings.

Meetings and Reports

The EVB Audit Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Committee is to meet in separate executive sessions with Management, its independent accountants, its internal auditor, and the Risk Management Officer at least once each year and at other times when considered appropriate to fulfill its responsibilities.

The Committee shall report regularly to the Board of Directors any material issues that arise with respect to the quality or integrity of the Corporation’s financial statements, the Corporation’s compliance with legal or regulatory requirements, the performance and independence of the Corporation’s independent accountant or the performance of the internal audit function. In addition, the Committee shall annually report to the Board of Directors its conclusions with respect to the performance and independence of the Corporation’s independent accountant.

Authority

In discharging its oversight role, the Committee is empowered to investigate any matters within the Committee’s scope of responsibilities. The Committee shall have unrestricted access to members of Management and relevant information. The Committee may retain independent counsel, accountants or other advisors as it determines necessary to carry out its duties. The Corporation shall provide for appropriate funding, as determined by the Committee, for payment of compensation to the independent accountants for the purpose of rendering or issuing an audit report and other services, and to any advisors employed by the Committee, and for ordinary administrative expenses of the Committee that is necessary or appropriate in carrying out its duties.

A-1

Responsibilities and Duties

The Committee shall review and assess annually the Committee’s formal charter and recommend to the Board of Directors any needed revisions thereto. In performing its oversight responsibilities, the Committee shall:

Independent Accountants

| | 1. | Be directly responsible for the appointment, compensation, and oversight of the work of the independent accountants, for the purpose of preparing or issuing an audit report or related work, and the independent accountants shall report directly to the Committee. |

| | 2. | Pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Corporation by its independent accountants, subject to the de minimus exceptions for permissible non-audit services that are subsequently approved by the Committee. (The Committee may delegate to one or more designated members of the Committee the authority to grant such pre-approvals.) |

| | 3. | Receive a formal written report and other periodic information from the independent accountants regarding the independence of the independent accountants, discuss such information with the independent accountants, and take appropriate actions to satisfy itself of the independent accountants’ independence. |

| | 4. | Review the scope and approach of the annual audit with the independent accountants. |

| | 5. | Instruct the independent accountants to communicate directly to the Committee any serious difficulties or disputes with Management. The independent accountants are responsible to the Committee and, ultimately, to the Board of Directors. |

| | 6. | Obtain and review at least annually a report by the independent accountant describing the independent accountant’s internal quality-control procedures, and any material issues raised by the most recent internal quality-control review or peer review of the independent accountant. |

Financial Statement and Disclosure Matters

| | 7. | Ensure that the independent accountants review the Corporation’s quarterly financial statements prior to the filing of each Quarterly Report on Form 10-Q. |

| | 8. | Advise Management, based upon its review and discussion, whether anything has come to the Committee’s attention that causes it to believe that the audited financial statements included in the Corporation’s Annual Report on Form 10-K contain an untrue statement of material fact or omit the statement of a necessary material fact. |

| | 9. | Provide a report for inclusion in the Corporation’s proxy statement or other SEC filings required by applicable laws and regulations and stating among other things whether the Committee has: |

| | • | Reviewed and discussed the audited financial statements with Management. |

| | • | Discussed with the independent accountants the matters required to be discussed by Auditing Standards No. 61 (Communication with Audit Committees). |

| | • | Received disclosures from the independent accountants regarding their independence as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with the accountants their independence. |

| | • | Recommend to the Board of Directors that the audited financial statements be included in the Form 10-K. |

| | 10. | Review with the independent accountants at the completion of the annual audit: |

| | • | The Corporation’s annual financial statements and related footnotes. |

| | • | The independent accountants’ audit of the financial statements in their report. |

| | • | Any significant changes required in the independent accountants’ audit plan. |

| | • | Any disputes with Management or other problems or difficulties encountered during the audit. |

| | • | Other matters related to conduct that should be communicated to the Committee under generally accepted auditing standards. |

| | 11. | Review and discuss with Management and the independent accountants: |

| | • | Significant accounting principles, financial reporting issues and judgments made in connection with the preparation of the Corporation’s financial statements. |

| | • | All critical accounting policies and practices to be used. |

| | • | All alternative treatments of financial information within generally accepted accounting principles that have been discussed with Management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent accountants. |

| | • | Other material written communications between the independent accountants and Management, such as any management letter or schedule of unadjusted differences. |

| | 12. | Resolve, as it deems appropriate, all disagreements between Management and the independent accountant. |

A-2

| | 13. | Review disclosures made to the Committee by the Corporation’s CEO and CFO during their certification process for the Form 10-K and Form 10-Q about any significant deficiencies in the design or operation of internal controls or material weaknesses therein and any fraud involving Management or other employees who have a significant role in the Corporation’s internal controls. |

| | 14. | Discuss with Management and the independent accountant the types of information to be disclosed and the type of presentation to be made in earnings press releases. |

| | 15. | Review with Management any comment letters received by Management from the NASDAQ or the SEC concerning any filings by the Corporation. |

Internal Audit and Internal Control

| | 16. | Establish and oversee Internal Audit Policy. Administers internal audit activities through the policy, which provides specific guidelines specifically related to internal audit purpose, authority, and responsibilities. |

| | 17. | Consider and review with Management: |

| | • | Significant findings and Management’s response, including the timetable for implementation to correct weaknesses. |

| | • | Any difficulties encountered in the course of internal audits and compliance reviews such as restrictions on the scope of work or access to information. |

| | • | Any changes required in the planned scope of audits and compliance reviews. |

| | • | The evaluation of the audit and compliance staff. |

Internal Controls and Risk Assessment

| | 18. | Review and evaluate the effectiveness of the Corporation’s process for assessing significant risks or exposures and the steps Management has taken to monitor and control such risks to the Corporation. |

| | 19. | Assess the effectiveness of or weaknesses in the Corporation’s internal controls, including the status and adequacy of information systems and security. |

| | 20. | Review any related significant findings and recommendations of the independent accountants, the internal auditor and the compliance officer together with Management’s responses, including the timetable for implementation of recommendations to correct weaknesses in the internal controls. |

| | 21. | Discuss with Management, the internal auditor, the EVB Risk Management Officer and the Corporation’s independent accountants the status and adequacy of management information systems including the significant risks and major controls over such risks. |

Compliance with Laws and Regulations

| | 22. | Ascertain whether the Corporation has an effective process for determining risks and exposure from asserted and unasserted litigation and claims from noncompliance with laws and regulations. |

| | 23. | Review with the Corporation’s counsel and others, as necessary, any legal, tax, or regulatory matters that may have a material impact on the Corporation’s operations and the financial statements. |

Code of Ethical Conduct

| | 24. | Review and monitor, as appropriate, with the independent accountants the administration of and compliance with the Foreign Corrupt Practices Act. |

| | 25. | Periodically review the Corporation’s Code of Conduct to ensure Management has established a system to enforce the Code. |

| | 26. | Establish and maintain procedures for the receipt, retention, and treatment of complaints received by the Corporation regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by the employees of the Corporation of concerns regarding questionable accounting or auditing practices. |

Annual Review

| | 27. | Conduct an annual performance evaluation of the Committee, including, without limitation, an evaluation of the fulfillment of its responsibilities under this charter and applicable laws and regulations. |

The Committee relies on the expertise and knowledge of Management, the internal auditor, the Risk Management Officer, and the independent accountants in carrying out its oversight responsibilities. Management of the

A-3

Corporation is responsible for determining the Corporation’s financial statements are complete, accurate, and in accordance with generally accepted accounting principles. The independent accountants are responsible for auditing the Corporation’s financial statements. It is not the duty of the Committee to plan or conduct audits, to determine that the financial statements are complete and accurate and are in accordance with generally accepted accounting principles, to conduct investigations, or to ensure compliance with laws and regulations of the Corporation’s internal policies, procedures and controls.

A-4

PROXY

EASTERN VIRGINIA BANKSHARES, INC.

P. O. Box 1455

330 Hospital Road

Tappahannock, Virginia 22560

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

The undersigned hereby appoint(s) F. Warren Haynie, Jr. and William L. Lewis, jointly and severally, proxies, with full power to act alone, and with full power of substitution to represent the undersigned and to vote, as designated below, all the shares of common stock of Eastern Virginia Bankshares, Inc. that the undersigned would be entitled to vote as of March 11, 2004, at the annual meeting of shareholders to be held on April 15, 2004, at Bethpage Conference Center, 679 Browns Lane, Urbanna, Virginia, at 4:00 P.M. or any adjournment thereof.

1. TO ELECT AS DIRECTORS ALL NINE NOMINEES LISTED BELOW.

| | |

| INSTRUCTION: | | ¨ FOR all nominees (except as indicated below). To withhold authority to vote for specific nominee(s), strike a line through the nominee’s name(s) in the list below. |

| | | ¨ WITHHOLD AUTHORITY to vote for all nominees listed below. |

| | | ¨ ABSTAIN |

| | |

W. Rand Cook | | Joe A. Shearin |

F. L. Garrett, III | | Howard R. Straughan, Jr. |

F. Warren Haynie, Jr. | | Leslie E. Taylor |

William L. Lewis | | J. T. Thompson, III |

Charles R. Revere | | |

2. To act upon such other matters as may properly come before the meeting or any adjournment thereof. As of the date of this Proxy, management has no knowledge of any matters to be presented for consideration at the Annual Meeting other than those referred to above. If any other matter properly comes before the Annual Meeting, the persons named in the accompanying proxy intend to vote such proxy, to the extent entitled, in accordance with their best judgment.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDERS. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSAL 1.

Please sign exactly as stock is registered. When shares are held by joint tenants, both should sign. When signing as executor, administrator, trustee, or guardian, please give full title as such. If a corporation, please sign full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

|

|

Signature |

|

Signature |

| (if held jointly) |

|

Date: , 2004 |

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD USING THE ENCLOSED ENVELOPE.

| | | | | | | | |

| If you plan to attend the Annual Meeting of Shareholders in person, please indicate the number of individuals |

| planning to attend. | | | | | | | | |

| | |

| | | | | | |

| | | Number planning to attend | | | | | | |