A Strategic Alliance Building Virginia’s Next Great Community Bank Exhibit 99.1 |

2 Forward Looking Statements Forward Looking Statements The discussions included in this presentation contain “forward-looking statements” within the meaning of the federal securities laws. These statements may be identified by use of words such as “may”, “could”, “expect”, “believe”, “anticipate”, “intend”, “plan” or variations thereof. These forward-looking statements may contain information related to matters such as Eastern Virginia Bankshares’ intent, belief, or expectation with respect to matters such as financial performance. Such statements are necessarily based on assumptions and estimates and are inherently subject to a variety of risks and uncertainties concerning the company’s operations and business environment, which are difficult to predict and beyond the control of the company. Such risks and uncertainties could cause Eastern Virginia Bankshares’ actual results to differ materially from those matters expressed or implied in such forward- looking statements. For an explanation of certain risks and uncertainties associated with forward- looking statements, please refer to Eastern Virginia Bankshares’ recently filed Registration Statement on Form S-3 as amended, Annual Report on Form 10-K and other SEC filings. |

3 Important Merger Information Important Merger Information Eastern Virginia will file with the Securities and Exchange Commission a registration statement on Form S-4 to register the shares of its common stock to be issued to the shareholders of First Capital in connection with the proposed transaction. The registration statement will include a joint proxy statement/prospectus that will be sent to the shareholders of Eastern Virginia and First Capital seeking their approval of the proposed merger. The joint proxy statement/prospectus will contain important information about Eastern Virginia, First Capital, and the merger and about the persons soliciting proxies from shareholders in the merger, including the officers and directors of Eastern Virginia and First Capital, and their interests in the merger, such as their stock ownership in First Capital. Additional information about First Capital’s directors and executive officers is included in First Capital’s Annual Report on Form 10-K for the year ended December 31, 2008, which was filed with the Securities and Exchange Commission and is available on First Capital’s website at www.1capitalbank.com and at the First Capital address provided below. Additional information about Eastern Virginia’s directors and executive officers is included in Eastern Virginia’s Annual Report on Form 10-K for the year ended December 31, 2008, which was filed with the Securities and Exchange Commission and is available on Eastern Virginia’s website at www.evb.com and at the Eastern Virginia address provided below. Eastern Virginia and First Capital urge their shareholders and other investors to read the registration statement on Form S-4 and the joint proxy statement/prospectus included in the registration statement on Form S-4, and any other relevant documents to be filed with the SEC in connection with the proposed transaction, because they will contain important information about Eastern Virginia, First Capital, and the proposed transaction. Shareholders and investors may obtain free copies of the joint proxy statement/prospectus and other documents related to the merger, once they are filed with the SEC, through the SEC’s website at www.sec.gov. Free copies of the proxy statement/prospectus and other relevant documents also may be obtained by directing a request by telephone or mail to the following: Eastern Virginia Bankshares, Inc. 330 Hospital Road Tappahannock, VA 22560 Attention: Cheryl Wood Telephone Number: (804) 443-8422 First Capital Bancorp, Inc. 4222 Cox Road, Suite 200 Glen Allen, VA 23060 Attention: John Presley Telephone Number: (804) 273-1254 |

4 Transaction Summary Transaction Summary Transaction Value: Exchange Ratio: $27 million based on Eastern Virginia share price of $8.90 (1) Fixed at 0.98x exchange ratio Holding Company: Eight (8) Eastern Virginia board members Five (5) First Capital board members Expected Closing: Year End 2009 Consideration Mix: 100% common stock Pro Forma Ownership: 67% Eastern Virginia / 33% First Capital ( 3.0 million shares issued) Bank: Ten (10) EVB board members Eight (8) First Capital Bank board members Board Representation Cost Savings: Identified $2.5 million in pre-tax cost savings (1) EVBS stock price on 4/2/2009 |

5 Transaction Highlights Transaction Highlights Adds significant size and scale within the Richmond market Pro forma franchise would rank 7th in Richmond MSA by deposits Enhances long-term franchise value Creates earnings momentum through identifiable synergies Accretive to earnings Adds significant management depth Strong pro forma capital position Complementary business mix Retail vs. Commercial Common community banking philosophy and culture Low risk transaction Familiar markets of operation Extensive due diligence performed by management and third party loan review specialists Strong IRR in excess of 15% |

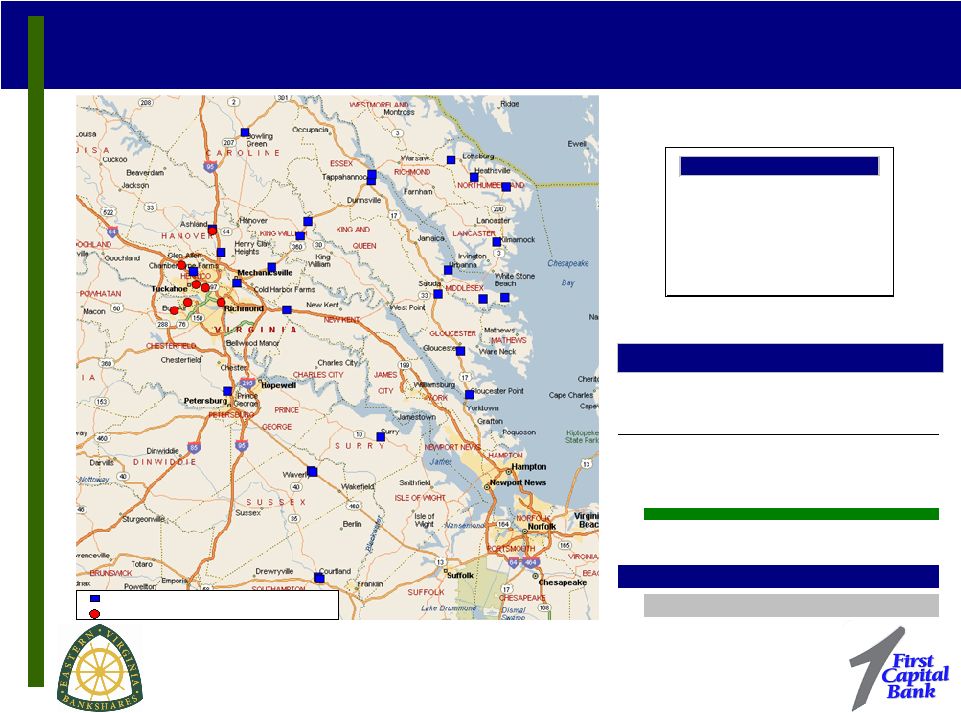

6 Expanding Richmond Area Footprint Expanding Richmond Area Footprint Source: SNL Financial Pro forma financials estimated at close Deposit market share excludes Capital One Financial Corporation due to lack of physical branch presence Data as of 6/30/2008; pro forma for pending and recently completed acquisitions Pro Forma Deposit Market Share MSA: Richmond, VA Total Total Deposits Market Branch in Market Share Rank Institution Count ($000) (%) 1 Bank of America Corp. (NC) 34 7,516,564 28.99 2 Wells Fargo & Co. (CA) 64 6,197,746 23.90 3 BB&T Corp. (NC) 47 2,986,091 11.52 4 SunTrust Banks Inc. (GA) 46 2,883,220 11.12 5 Union Bankshares Corp. (VA) 47 1,484,446 5.73 6 Franklin Financial Corporation (VA) 7 621,707 2.40 Pro Forma 19 604,244 2.33 7 Village Bank & Trust Finl Corp (VA) 15 448,013 1.73 8 C&F Financial Corp. (VA) 11 379,226 1.46 9 Central Virginia Bankshares (VA) 8 367,085 1.42 10 Community Bankers Trust Corp (VA) 8 361,426 1.39 11 Eastern Virginia Bankshares (VA) 12 306,727 1.18 13 First Capital Bancorp Inc. (VA) 7 297,517 1.15 Top 10 287 23,245,524 89.65 Totals 382 25,929,081 100.00 Eastern Virginia Bankshares, Inc. (25) First Capital Bancorp, Inc. (7) Pro Forma Financials Assets $1.6 B Loans 1.2 Deposits 1.2 Equity 145 M Branches 32 |

7 Management Management Source: SNL Financial Holding Company Chairman: W. Rand Cook Current Chairman of Board of Directors of EVBS Vice-Chairman: Grant S. Grayson Current Chairman of the Board of FCVA President and Joe A. Shearin Current President and Chief Executive Officer of EVBS Chief Executive Officer: Current President and Chief Executive Officer of EVB Managing Director and John M. Presley Current Chief Executive Officer and Managing Director of FCVA Chief Financial Officer: Bank Level President and Robert G. Watts Current President of FCVA Chief Executive Officer: Current Chief Executive Officer and President of First Capital Bank Chief Operating Officer: Joseph H. James, Jr. Current Executive Vice President of EVB and Chief Operating Officer of EVBS Current Senior Executive Vice President and Chief Operating Officer of EVB |

1.29 0.89 1.31 0.00 0.50 1.00 1.50 2.00 EVBS Stand Alone EVBS Pro Forma EVBS Pro Forma 1.72 1.38 0.50 1.00 1.50 2.00 2.50 EVBS Stand Alone EVBS Pro Forma Asset Quality Asset Quality Source: SNL Financial (1) Assumes write-down of FCVA’s nonaccrual loans (2) Includes the impact of FAS 141R and FAS 157 (3) Does not include the impact of new accounting guidance under FAS 141R and FAS 157 NPAs / Loans + OREO (%) Reserves / Loans (%) (1) (2) Extensive credit due diligence was conducted by management and third party loan review specialists (3) 8 |

Estimated Capital Ratios at Closing Estimated Capital Ratios at Closing As of 12/31/2008, both companies maintained strong capital levels above well capitalized status Capital levels have since improved as both companies have received TARP funds EVBS: $24 million FCVA: $11 million EVBS and FCVA pro forma for TARP (1) Pro forma capital estimated at close; includes estimated impact of FAS 141R and FAS 157 EVBS Estimated Capital Ratios Stand Alone Pro Forma (1) Tang. Common Equity / Tang. Assets 5.93% 5.25% - 6.00% Leverage Ratio 10.76% 8.75% - 10.25% Tier 1 Capital Ratio 13.12% 10.75% - 12.20% Total Capital Ratio 14.15% 11.50% - 13.25% 9 |

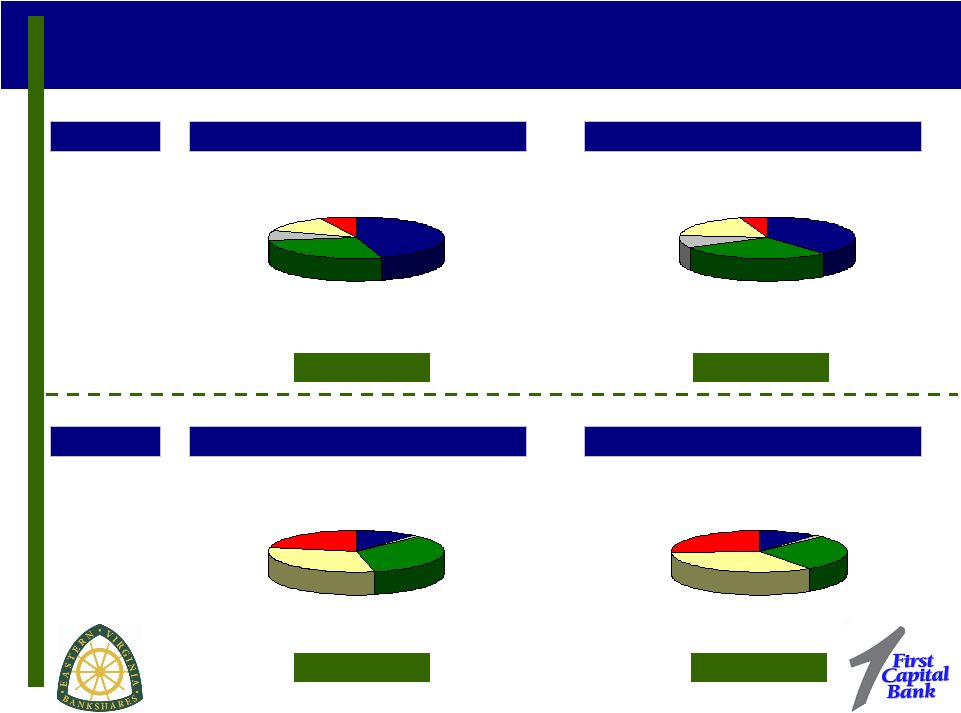

10 Pro Forma Loans and Deposits Pro Forma Loans and Deposits Source: SNL Financial and company filings Loan and deposit data as of 12/31/2008 EVBS Stand Alone EVBS Pro Forma Deposits Loans EVBS Stand Alone EVBS Pro Forma Total: $819M Total: $1.2B Total: $814M Total: $1.1B Consumer & Other 6.5% Construction 12.6% Commercial R.E. 27.1% Commercial 8.4% Residential R.E. 45.4% Consumer & Other 5.0% Construction 18.0% Commercial R.E. 28.1% Commercial 10.1% Residential R.E. 38.9% Jumbo Time Deposits 22.2% Retail Time Deposits 31.1% NOW & Other Trans Accts 1.3% MMDA & Savings 34.3% Demand Deposits 11.1% Jumbo Time Deposits 26.0% Retail Time Deposits 33.7% NOW & Other Trans Accts 1.7% MMDA & Savings 27.6% Demand Deposits 11.0% |

11 Estimated Cost Savings Estimated Cost Savings Identified revenue enhancements may provide additional earnings accretion (2) Cost savings include the potential closure of one branch location (1) Includes advertising costs, D & O insurance, examination fees, etc. (2) In order to be conservative, we did not include revenue enhancements in our analysis of the transaction Pre-Tax Cost Savings Category ($000) Personnel Costs $1,340 Outside Service Fees (Data Processing, etc.) 470 Audit, Tax & Accounting 135 Rent 335 Other (1) 220 Total Estimated Cost Savings $2,500 Percent of FCVA 2008 Expense Base 29% |

12 Virginia Community Banking Landscape Virginia Community Banking Landscape Source: SNL Financial Pro forma financials do not include purchase accounting adjustments List includes all publicly traded banks and thrifts in Virginia with assets greater than $400 million; Data as of most recent quarter available Building a strong platform for future growth Total Total Market Assets Deposits Cap Institution Ticker ($M) ($M) ($M) Union Bankshares Corporation UBSH $3,853 $3,055 $354 TowneBank TOWN 3,134 2,239 455 Hampton Roads Bankshares, Inc. HMPR 3,086 2,296 157 StellarOne Corporation STEL 2,957 2,323 326 Carter Bank & Trust CARE 2,800 2,471 156 Virginia Commerce Bancorp, Inc. VCBI 2,716 2,172 116 First Community Bancshares, Inc. FCBC 2,286 1,631 154 Cardinal Financial Corporation CFNL 1,744 1,180 146 Burke & Herbert Bank & Trust Company BHRB 1,700 1,303 266 Eastern Virginia Bankshares, Inc. EVBS 1,483 1,148 79 Community Bankers Trust Corporation BTC 1,377 1,118 75 Commonwealth Bankshares, Inc. CWBS 1,085 763 34 First Bancorp, Inc. FBLV 999 823 208 Middleburg Financial Corporation MBRG 985 745 57 National Bankshares, Inc. NKSH 935 818 128 C&F Financial Corporation CFFI 856 551 48 Old Point Financial Corporation OPOF 835 647 89 American National Bankshares Inc. AMNB 789 589 92 Access National Corporation ANCX 702 485 51 Valley Financial Corporation VYFC 674 466 22 Highlands Bankshares, Inc. HBKA 673 527 47 Monarch Financial Holdings, Inc. MNRK 597 496 28 Alliance Bankshares Corporation ABVA 573 429 10 Village Bank and Trust Financial Corp. VBFC 572 466 18 First National Corporation FXNC 548 447 48 Chesapeake Financial Shares, Inc. CPKF 538 428 41 Eagle Financial Services, Inc. EFSI 528 387 46 Fauquier Bankshares, Inc. FBSS 515 400 40 Community Financial Corporation CFFC 508 357 17 Central Virginia Bankshares, Inc. CVBK 486 348 10 Bank of Southside Virginia Corporation BSSC 482 420 146 F & M Bank Corp. FMBM 472 342 59 Southern National Bancorp of Virginia, Inc. SONA 432 309 44 |

A Strategic Alliance Building Virginia’s Next Great Community Bank |