SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | | |

Filed by the Registrant x Filed by a Party other than the Registrant ¨ Check the appropriate box: | | | | |

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | | ¨ | | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

Getty Images, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials: |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

June 19, 2007

Dear Shareholder:

You are cordially invited to attend the 2007 annual meeting of shareholders of Getty Images, Inc. The meeting will be held at the headquarters of Getty Images at 601 North 34th Street, Seattle, Washington 98103, on August 2, 2007 at 11:00 a.m. (Pacific Daylight Time). We hope that you will be able to attend.

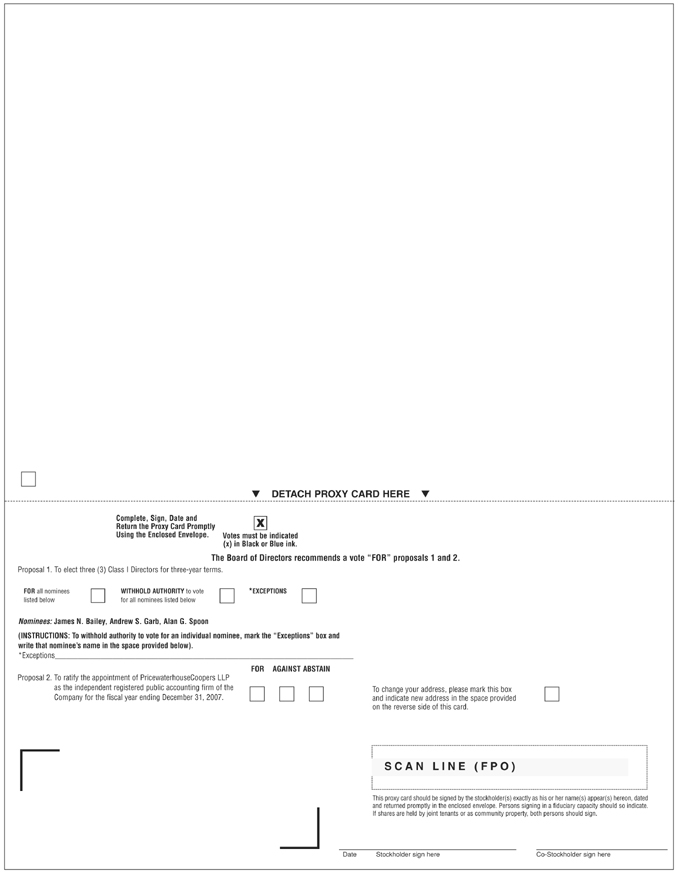

At the annual meeting, you will be asked (i) to elect three Class I Directors to serve three-year terms, (ii) to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2007, and (iii) to transact such other business as may properly come before the annual meeting.

More details about the business to be conducted at the annual meeting and about the meeting itself are presented in the attached Notice of Annual Meeting and Proxy Statement.

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. After reading the enclosed proxy statement, kindly complete, sign, date, and promptly return the enclosed proxy in the enclosed postage-paid envelope. Returning the proxy will not preclude you from voting in person at the meeting should you later decide to attend, as your proxy is revocable at or prior to the meeting at your discretion.

The Board of Directors of Getty Images unanimously recommends that you vote FOR all of the nominees for Director, and FOR the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2007.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Getty Images.

|

| Sincerely, |

|

| Mark H. Getty |

| Chairman of the Board of Directors |

GETTY IMAGES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held August 2, 2007

Notice is hereby given that the annual meeting of shareholders of Getty Images, Inc., a Delaware corporation (“Getty Images” or “we” or “us”), will be held at our headquarters, 601 North 34th Street, Seattle, Washington 98103, on August 2, 2007 at 11:00 a.m. (Pacific Daylight Time) for the following purposes:

| | 1. | To elect three Class I Directors to serve until the 2010 annual meeting of shareholders and until their respective successors are duly elected and qualified; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2007; and |

| | 3. | To transact such other business as may properly come before the annual meeting and at any adjournments or postponements of the meeting. |

The Board of Directors set June 18, 2007 as the record date of the meeting. This means that owners of shares of our stock at the close of business on that date are entitled to receive this notice of the annual meeting, and to attend and to vote at the meeting and at any adjournments or postponements of the meeting. Additional information regarding the matters to be acted on at the annual meeting may be found in the accompanying proxy statement.

|

By Order of the Board of Directors, |

|

|

John McKay |

| Senior Vice President, General Counsel and Secretary |

Seattle, Washington

June 19, 2007

YOUR VOTE IS IMPORTANT

Whether or not you expect to attend the annual meeting in person, we urge you to complete, sign, date and return the enclosed proxy at your earliest convenience. This will ensure the presence of a quorum at the meeting. An addressed envelope for which no postage is required if mailed in the United States is enclosed for that purpose. Sending in your proxy will not prevent you from voting your shares at the annual meeting if you desire to do so, as your proxy is revocable at or prior to the meeting at your discretion.

TABLE OF CONTENTS

i

GETTY IMAGES, INC.

601 North 34th Street

Seattle, Washington 98103

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD AUGUST 2, 2007

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Getty Images, Inc., a Delaware corporation (“Getty Images” or “we” or “us”), from the holders of the issued and outstanding shares of common stock, par value $0.01 per share, of Getty Images, to be voted at the annual meeting of shareholders to be held at 11:00 a.m. (Pacific Daylight Time) on August 2, 2007 at our headquarters located at 601 North 34th Street, Seattle, Washington.

This proxy statement contains information related to the annual meeting. We hope that you will be able to attend.

All properly executed written proxies that are delivered pursuant to this solicitation will be voted at the meeting in accordance with the directions given in the proxy, unless the proxy is revoked at or prior to the meeting. The proxies also may be voted at any adjournments or postponements of the meeting.

Only owners of record of shares of common stock at the close of business on the record date of June 18, 2007, are entitled to vote at the annual meeting, or at adjournments or postponements of the meeting. Each owner of record on the record date is entitled to one vote for each share of common stock held. On June 18, 2007, there were 59,245,891 shares of common stock issued and outstanding.

The purpose of the annual meeting is to consider and act on the following proposals:

| | 1. | To elect three Class I Directors to serve until the 2010 annual meeting of shareholders and until their respective successors are duly elected and qualified; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as Getty Images’ independent registered public accounting firm for the fiscal year ending December 31, 2007; and |

| | 3. | To transact such other business as may properly come before the annual meeting and any adjournments or postponements thereof. |

The proxy materials are being mailed to the shareholders entitled to vote at the meeting on or about June 26, 2007.

QUESTIONS AND ANSWERS ABOUT

THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | Why am I receiving these materials? |

| A: | Our Board of Directors is providing these proxy materials to you in connection with the solicitation of proxies for use at Getty Images’ 2007 annual meeting of shareholders, which will take place on August 2, 2007 at 11:00 a.m., Pacific Daylight Time, at our corporate headquarters located at 601 North 34th Street, Seattle, Washington 98103. As a shareholder holding shares of our common stock, as recorded in our stock register on June 18, 2007 (the “record date”), you are invited to attend the annual meeting and requested to vote on the proposals described in this proxy statement. |

As of the record date, 59,245,891 shares of Getty Images’ common stock were issued and outstanding. There were 66 shareholders holding our common stock as of the record date.

| Q: | What information is contained in this proxy statement? |

| A: | The information in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of our directors and most highly paid executive officers in 2006, and certain other required information. |

| Q: | How may I obtain a separate set of proxy materials or Annual Report for 2006? |

| A: | If you share an address with another, only one copy of this proxy statement will be delivered to you. A shareholder at a shared address who received a single copy of this proxy statement may request to receive a separate copy either by calling the number provided below or mailing a written request to the address below: |

Corporate Secretary

Getty Images, Inc.

601 North 34th Street

Seattle, Washington 98103

1-866-275-4389

We will promptly mail a separate copy of this proxy statement upon such request, but any such request should be made as soon as possible to ensure timely delivery.

| Q: | What items of business will be voted on at the annual meeting? |

| A: | The items of business scheduled to be voted on at the annual meeting are: |

| | • | | the election of three Class I Directors; |

| | • | | the ratification of the appointment of PricewaterhouseCoopers LLP as Getty Images’ independent registered public accounting firm for the fiscal year ending December 31, 2007; and |

| | • | | such other items of business as may properly come before the annual meeting and at any adjournments or postponements of the meeting. |

| Q: | What are the requirements for admission to the meeting? |

| A: | Only shareholders holding shares of Getty Images’ common stock as of the record date or their proxy holders and Getty Images’ guests may attend the meeting. Admission to the meeting will be on a first-come, first-served basis. Registration and seating will begin at 11:00 a.m. (Pacific Daylight Time). Cameras and other recording devices will not be permitted at the meeting. |

If you attend, please note that you may be asked to present valid picture identification, such as a driver’s license or passport. If you hold your shares as a beneficial owner through a broker, trustee or nominee, you will need to ask your broker, trustee or nominee for an admission card in the form of a legal proxy. You will

2

need to bring the legal proxy with you to the meeting. If you do not receive the legal proxy in time, bring your most recent brokerage statement (reflecting your share ownership as of June 18, 2007, the record date) with you to the meeting. We can use that to verify your ownership of shares of Getty Images’ common stock and admit you to the meeting; however, as discussed below, you will not be able to vote your shares at the meeting without a legal proxy.

| Q: | How does the board of directors recommend that I vote? |

| A: | Our Board of Directors recommends that you vote your shares (1) “FOR” each of the nominees to the Board of Directors and (2) “FOR” the ratification of our independent registered public accounting firm for the 2007 fiscal year. |

| Q: | How many votes do I have? |

| A: | On each proposal to be voted upon, you have one vote for each share of Getty Images’ common stock you own as of the record date, June 18, 2007. |

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | Many Getty Images shareholders hold their shares through a broker or other nominees rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Shareholder of Record: If your shares are registered directly in your name with our transfer agent, Bank of New York, as of the record date, you are considered, with respect to those shares, theshareholder of record, and these proxy materials are being sent directly to you by Getty Images. As theshareholder of record, you have the right to grant your voting proxy directly to Getty Images or to vote in person at the annual meeting. Getty Images has enclosed a proxy card for your use.

Beneficial Owner: If your shares are held in a brokerage account, trust or by another nominee, you are considered thebeneficial owner of shares heldin street name, and these proxy materials are being forwarded to you together with a voting instruction card by your broker, trustee or nominee, as the case may be. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote your shares, and you are also invited to attend the annual meeting. Since abeneficial owner is not theshareholder of record, you may not vote your shares in person at the annual meeting unless you obtain a legal proxy from the broker, trustee or nominee who holds your shares giving you the right to vote the shares at the meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or other nominee how to vote your shares.

| Q: | How can I vote my shares in person at the annual meeting? |

| A: | Shares held in your name as the shareholder of record may be voted by you in person at the annual meeting. Shares held beneficially in street name may be voted by you in person at the annual meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. |

Even if you plan to attend the annual meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

| Q: | How can I vote my shares without attending the annual meeting? |

| A: | Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the annual meeting. If you are a shareholder of record, you can submit a proxy to us, which will be voted according to your directions by the proxy holders. Three of our executive officers (one of whom is a member of our Board of Directors) have been designated as proxy holders for our 2007 annual meeting. These three executive officers are Jonathan D. Klein, our Chief |

3

| | Executive Officer, John L. McKay, our General Counsel and Thomas Oberdorf, our Chief Financial Officer. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. For directions on how to vote, please refer to the instruction below and those included on your proxy card or, for shares held beneficially in street name, the voting instruction card provided by your broker, trustee or nominee. |

Instructions: Shareholders of record of Getty Images may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Your proxy card must be received by the time of the meeting in order for your shares to be voted. Getty Images shareholders who hold shares beneficially in street name may vote by mail by completing, signing and dating the voting instruction cards provided by their brokers, trustees or nominees and mailing them in the accompanying pre-addressed envelopes.

| Q: | Can I vote by telephone or via the internet? |

No, you cannot. However, shareholders who hold shares beneficially in street name should check with their broker, trustee or nominee to see whether phone or internet voting is offered.

| A: | You may change your vote at any time prior to the vote at the annual meeting. If you are the shareholder of record, you may change your vote by (1) delivering to Getty Images’ Corporate Secretary at 601 North 34th Street, Seattle, Washington 98103 a written notice of revocation or a duly executed proxy bearing a later date prior to the date of the annual meeting, or (2) attending the annual meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee following the instruction they provided, or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person. |

| Q: | What happens if I deliver a signed proxy without specifying how my shares should be voted? |

| A: | If you deliver your proxy without instructions and do not later revoke the proxy, the proxy will be voted “FOR” the slate of nominees to the Board described in this proxy statement and “FOR” Proposal No. 2. As to any other matter that may properly come before the annual meeting, the proxy will be voted according to the judgment of the proxy holders. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. An independent tabulator, not Getty Images, will count the votes, and your individual vote will be kept confidential from us or third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote and (3) to facilitate a successful proxy solicitation. Occasionally, shareholders provide on their proxy card written comments, which are then forwarded to Getty Images. |

| Q: | How many shares must be present or represented to conduct business at the annual meeting? |

| A: | The quorum requirement for holding the annual meeting and transacting business is that holders of a majority of the voting power of the issued and outstanding common stock of Getty Images as of the record date must be present in person or represented by proxy. Both abstentions and broker non-votes (described below) are counted for the purpose of determining the presence of a quorum. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | In the election of directors, the three nominees receiving the highest number of affirmative “FOR” votes at the annual meeting will be elected. |

4

The proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2007 requires the affirmative “FOR” vote of a majority of the total number of shares present in person or represented by proxy and entitled to vote on the proposal at the annual meeting. If the shareholders fail to vote in favor of the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, the Audit Committee of our Board of Directors will reconsider whether to retain PricewaterhouseCoopers LLP, and may retain that firm or another without re-submitting the matter to Getty Images’ shareholders.

| Q: | What are my voting choices? |

| A: | Election of Directors: You may vote “FOR” or “WITHHOLD AUTHORITY” with regards to all or some of the nominees. Votes “WITHHELD AUTHORITY” with respect to the election of directors will be counted for purposes of determining the presence or absence of a quorum at the annual meeting but will have no other legal effect upon election of directors. As further discussed below, there can be no broker non-votes on the election of Directors because brokers who hold shares for the accounts of their clients have discretionary authority to vote such shares with respect to the election of Directors.The Board of Directors recommends a vote “FOR” all of the nominees. |

Ratification of Independent Registered Public Accounting Firm and Other Business: For the other item of business, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention has the same effect as a vote “AGAINST.” As further discussed below, there can be no broker non-votes on this proposal because brokers who hold shares for the accounts of their clients have discretionary authority to vote such shares with respect to the ratification of the appointment of the independent registered public accounting firm.The Board of Directors recommends a vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as Getty Images’ independent registered public accounting firm.

| Q: | Is cumulative voting permitted for the election of directors? |

| A: | No. You may not cumulate your votes for the election of directors. |

| Q: | What is the effect of broker non-votes and abstentions? |

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered votes cast on that proposal. However, because brokers have discretion to vote without instructions from beneficial holders on the election of Directors and the ratification of the appointment of the independent registered public accounting firm, there can be no broker non-votes with respect to the proposals described in this proxy statement.

Abstentions are considered votes cast and thus have the same effect as votes against the matter. However, in the election of Directors, the vote “WITHHOLD AUTHORITY” will have no effect on the outcome as such election only requires a plurality of affirmative “FOR” votes.

| Q: | What happens if additional matters are presented at the annual meeting? |

| A: | Other than the two items of business described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the persons named as proxy holders, or any of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. |

| Q: | Who will serve as inspector of elections? |

| A: | The inspector of elections will be a representative from the Bank of New York. |

5

| Q: | Who will bear the cost of soliciting votes for the annual meeting? |

| A: | Getty Images will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person or by telephone, telex, facsimile or electronic means by our officers and employees, who will not receive any additional compensation for such solicitation activities. We will, on request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our common stock. |

| Q: | Where can I find the voting results of the annual meeting? |

| A: | We intend to announce preliminary voting results at the annual meeting and publish final results in our quarterly report on Form 10-Q for the third quarter ending September 30, 2007. |

| Q: | What is the deadline for submission of shareholder proposals for consideration at the annual meeting? |

| A: | Any shareholder who intends to present a proposal for consideration at the 2007 annual meeting of shareholders must ensure that the notice of such proposal prepared in accordance with the provisions of the bylaws is received by Getty Images within ten days of the mailing date of this proxy statement, June 26, 2007. Notice of such proposals should be addressed to: |

Corporate Secretary

Getty Images, Inc.

601 North 34th Street

Seattle, Washington 98103

1-866-275-4389

| Q: | What is the deadline for submission of shareholder proposals for consideration at the 2008 annual meeting of shareholders? |

| A: | Proposal Under Rule 14a-8: For a shareholder proposal to be considered for inclusion in our proxy statement for the annual meeting next year, the Corporate Secretary of Getty Images must receive the written proposal at our principal executive offices no later than February 26, 2008.Such proposals also must comply with Securities and Exchange Commission regulations under Rule 14a-8 regarding the inclusion of shareholder proposals in company-sponsored proxy materials. Proposals should be addressed to: |

Corporate Secretary

Getty Images, Inc.

601 North 34th Street

Seattle, Washington 98103

1-866-275-4389

Proposal Under the Bylaws: For a shareholder proposal that is not intended to be included in Getty Images’ proxy statement under Rule 14a-8, the shareholder must give timely notice to the Corporate Secretary of Getty Images in accordance with our bylaws, which, in general, require that the notice be received by Getty Images on or after May 4, 2008, and on or before June 3, 2008. If the notice is not received by May 12, 2008, it will be considered untimely under Rule 14a-4(c)(1) promulgated under the Securities Exchange Act of 1934, as amended, and the proxy holders designated by Getty Images will have discretionary voting authority under proxies solicited for the 2008 annual meeting of shareholders with respect to such proposal, if properly presented at the meeting.

6

If the date of the shareholder meeting in 2008 is moved more than 30 days before or after the anniversary of the 2007 annual meeting, then notice of a shareholder proposal that is not intended to be included in Getty Images’ proxy statement must be received no later than the close of business on the earlier of the following two dates:

| | • | | the tenth day following the day on which notice of the meeting date is mailed, or |

| | • | | the tenth day following the day on which public disclosure of the meeting is made. |

Copy of Bylaw Provisions: A copy of our bylaws can be found in the Corporate Governance section of Getty Images’ website. Log on to www.gettyimages.com and click “About Us,” then “Investors,” and then “Corporate Governance.” Our bylaws are also available in print to any shareholder who requests it by emailinginvestorrelations@gettyimages.com. You may also contact our Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making shareholder proposals.

PROPOSAL NO. 1

ELECTION OF CLASS I DIRECTORS

Getty Images has a classified Board of Directors, consisting of Class I Directors, Class II Directors and Class III Directors, the members of which serve staggered three-year terms. The full Board currently consists of seven Directors: three Class I and two in each of Class II and III. The terms of the Class II and Class III Directors will terminate on the date of the annual meeting of shareholders in the years 2008 and 2009, respectively.

Messrs. Bailey, Garb and Spoon currently are Class I Directors of Getty Images. Pursuant to Section 8.02 of our Restated Certificate of Incorporation, the term of the Class I Directors terminates on the date of the 2007 annual meeting of shareholders and when their successors are elected and qualified. The Board of Directors has nominated Messrs. Bailey, Garb and Spoon for election at the annual meeting, and upon such election, to continue to serve as Class I Directors and hold office until the annual meeting of shareholders to be held in 2010 and until their successors have been duly elected and qualified.

The Board of Directors does not anticipate that any of Messrs. Bailey, Garb or Spoon will be unable or unwilling to serve, but if any one of them should be unable or unwilling to serve, the proxies granted to proxy holders will be voted for the election of such other person as is designated by the Board of Directors, if any. Set forth below is a brief description of the background of each nominee for election as a Director and of each of the four other Directors continuing in office.

7

Nominees for Class I Directors

| | | | | | |

Name

| | Age

| | Business Experience

| | Director

Since

|

James N. Bailey (Class I) | | 60 | | Mr. Bailey has been a Director since February 1998 and served as a Director of Getty Communications Limited, our predecessor, from September 1996 to February 1998. Mr. Bailey co-founded Cambridge Associates LLC, an investment consulting firm, in May 1973 and currently serves as its Senior Managing Director and Treasurer. He also is co-founder, Treasurer and a Director of The Plymouth Rock Company, SRB Corporation, Inc., Direct Response Corporation and Homeowners Direct Company, all four of which are insurance companies and insurance company affiliates. Additionally, Mr. Bailey serves as a Director of Apartment Investment & Management Company (AIMCO), a multi-family dwelling real estate investment trust. | | 1998 |

| | | |

Andrew S. Garb (Class I) | | 64 | | Mr. Garb has been a Director since February 1998 and served as a Director of Getty Communications Limited, our predecessor, from May 1996 to February 1998. Mr. Garb also served as a Director of Getty Investments L.L.C. from June 1996 until October 2003. Mr. Garb currently is of counsel to the law firm of Loeb & Loeb LLP, where he has practiced since 1968. Mr. Garb is also a Trustee of the J. David Gladstone Institutes, a nonprofit medical research organization. | | 1998 |

| | | |

Alan G. Spoon (Class I) | | 55 | | Mr. Spoon has been a Director since May 2006. Mr. Spoon has been a managing general partner of Polaris Ventures since 2000, where he focuses on investments in digital media, e-commerce and distance learning. Mr. Spoon has held senior leadership positions at the Washington Post Company, where he worked for 18 years, including President, Chief Operating Officer, board member, Chief Financial Officer, President of Newsweek, Head of Newspaper Marketing and Head of Corporate Business Development. Prior to his tenure at the Washington Post, Mr. Spoon was an officer at the Boston Consulting Group. Mr. Spoon also serves as a Director of Danaher Corporation and IAC/InterActiveCorp, and is a member of the Smithsonian Institution Board of Regents, the Massachusetts Institute of Technology Corporation and The Council on Foreign Relations. | | 2006 |

Vote Required

The three persons who receive the greatest number of affirmative “FOR” votes present in person or represented by proxy at the meeting will be elected to the Board of Directors. Votes “WITHHOLD AUTHORITY” with respect to one or more Directors will be counted for purposes of determining the presence or absence of a quorum at the annual meeting but will have no other legal effect on the election of Directors. There can be no broker non-votes on the election of Directors because brokers who hold shares for the accounts of their clients have discretionary authority to vote such shares with respect to election of Directors.

8

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES LISTED ABOVE TO THE BOARD OF DIRECTORS.

Directors Continuing in Office1

| | | | | | | | |

Name

| | Age

| | Business Experience

| | Director

Since

| | Term

Expires

|

Christopher H. Sporborg (Class II) | | 67 | | Mr. Sporborg has been a Director since February 1998 and served as a Director of Getty Communications Limited, our predecessor, from May 1996 to February 1998. Mr. Sporborg held various positions at Hambros Bank Limited from 1962 to 1998, including Deputy Chairman of Hambros PLC and Hambros Bank Limited, Chairman and Chief Executive of Hambros Group Investments Ltd. and Chairman of Hambros Insurance Services Group PLC. Mr. Sporborg founded and was Chairman of the Board of Directors of Countrywide plc, a real estate agency and financial services company from 1987 until May 2007. He is the Chairman of the Board of Directors of Chesnara plc, a life assurance company. Mr. Sporborg also serves as a Director of Lindsey Morden Group Inc., an insurance services company. | | 1998 | | 2008 |

| | | | |

Mark H. Getty (Class II) | | 46 | | Mr. Getty is a co-founder of Getty Images, and has been a Director since February 1998, serving as our Executive Chairman from September 1998 to May 2004. In May 2004, Mr. Getty relinquished his role as an executive officer of Getty Images but remains as (non-executive) Chairman of the Board. Mr. Getty served as Co-Chairman of Getty Images from February 1998 to September 1998. He served as Executive Chairman of Getty Communications Limited, our predecessor, from April 1996 to February 1998. From March 1995 to April 1996, Mr. Getty served as the Joint Chairman of Getty Communications Limited. Mr. Getty also is the Chairman of the Board of Directors of Getty Investments L.L.C. | | 1998 | | 2008 |

1 | Dr. David Landau served as a Class I director since September 2003, but resigned his position from the Board of Directors in May 2006. |

9

| | | | | | | | |

Name

| | Age

| | Business Experience

| | Director

Since

| | Term

Expires

|

Jonathan D. Klein (Class III) | | 47 | | Mr. Klein is a co-founder of Getty Images and has been our Chief Executive Officer and a Director since February 1998. Mr. Klein served as Chief Executive Officer and as a Director of Getty Communications Limited, our predecessor, from April 1996 to February 1998. From March 1995 to April 1996, Mr. Klein served as the Joint Chairman of Getty Communications Limited. Mr. Klein serves on the Board of Directors of Getty Investments L.L.C. and as a Director of RealNetworks, Inc. a leading creator of digital media services and software. He also serves on the Board of Trustees of the Groton School, on the Board of Directors of Friends of the Global Fight Against Aids, Tuberculosis and Malaria, one of the leading organizations working to educate, engage and mobilize Americans on the fight to end the worldwide burden of these diseases by focusing its efforts on decision-makers in Washington, D.C., and on the Advisory Board of the Global Business Coalition on HIV/AIDS, Tuberculosis and Malaria, the pre-eminent organization leading the business fight against HIV/AIDS and a mission to harness the power of the global business community to end the HIV/AIDS, tuberculosis and malaria epidemics. | | 1998 | | 2009 |

| | | | |

Michael A. Stein (Class III) | | 57 | | Mr. Stein has been a Director since June 2002. Mr. Stein served as Senior Vice President and Chief Financial Officer of ICOS Corporation, a biotechnology company, from January 2001 to January 2007. Prior to that, Mr. Stein was Executive Vice President and Chief Financial Officer of Nordstrom, Inc., a leading fashion specialty retailer, from October 1998 to September 2000. Mr. Stein served as Executive Vice President and Chief Financial Officer of Marriott International, Inc. from 1993 to 1998. Prior to his work at Marriott, he spent eighteen years at Arthur Andersen as a partner in their Washington, D.C. office. Mr. Stein also serves on the Board of Directors of Apartment Investment & Management Company (AIMCO), a multi-family dwelling real estate investment trust. He also serves on the Board of Trustees of the Fred Hutchinson Cancer Research Center. | | 2002 | | 2009 |

10

CORPORATE GOVERNANCE

We have adopted Corporate Governance Guidelines which are available by logging on towww.gettyimages.comand by first clicking “About Us,” then “Investors,” then “Corporate Governance.” These Corporate Governance Guidelines are also available in print to any shareholder who requests it by emailinginvestorrelations@gettyimages.com. These principles were adopted by the Board to best ensure that the Board is independent from management, that the Board adequately performs its function as the overseer of management and to help ensure that the interests of the Board and management align with the interests of the shareholders.

Director Independence

No Director will be deemed to be independent unless the Board affirmatively determines that the Director has no material relationship with Getty Images, directly or as an officer, shareowner or partner of an organization that has a relationship with us. The Board observes all criteria for independence established by the Securities and Exchange Commission (“SEC”), the New York Stock Exchange (“NYSE”) and other applicable laws and regulations.

On an annual basis, each Director and executive officer is obliged to complete a Director and Officer Questionnaire which requires disclosure of any transactions with us in which the Director or executive officer, or any member of his or her immediate family, as such term is defined by applicable SEC rules, have a direct or indirect material interest. Pursuant to the “Code of Business Conduct,” the Board or any committee so appointed by it is charged with resolving any conflict of interest involving senior executives or directors.

The Board determined, after a review of relevant information and upon advice from legal counsel to Getty Images, that (a) no Director has a material relationship with us and (b) the following majority of Board members, which includes all non-management members other than Mark H. Getty, are currently and were, during 2006, independent: James N. Bailey, Andrew S. Garb, Alan G. Spoon, Christopher H. Sporborg, and Michael A. Stein. Consequently, all members of the Audit, Nominating and Corporate Governance, and Compensation Committees are independent pursuant to NYSE listing standards, the SEC rules and all other applicable rules and standards. The Board has not made a determination regarding Mr. Getty’s independence.

In addition, based on these standards, the Board determined that Mr. Klein is not independent because he is our Chief Executive Officer.

Communications with the Board of Directors

Shareholders and other interested parties may communicate with the Board of Directors or specific Directors by emailingboardofdirectors@gettyimages.com. Submissions may also be mailed to:

Board of Directors

c/o General Counsel

Getty Images, Inc.

601 North 34th Street

Seattle, Washington 98103

The communications from shareholders are screened by our General Counsel for appropriateness and relevance, and forwarded to the Board or individual members of the Board pursuant to the guidelines set by Getty Images’ Board of Directors.

11

Code of Ethics/Code of Business Conduct/Corporate Governance Guidelines

Getty Images has adopted the following codes and guidelines applicable to our business conduct: (1) Code of Business Conduct, (2) Code of Ethics for Getty Images’ management and Board of Directors, (3) Corporate Governance Guidelines, and (4) the Leadership Principles. These codes and guidelines can be found on the Corporate Governance section of Getty Images’ website. Log on towww.gettyimages.comand click “About Us,” then “Investors,” then “Corporate Governance.” These documents are also available in print to any shareholder who makes a request in writing to:

Investor Relations Department

Getty Images, Inc.

601 North 34th Street

Seattle, Washington 98103

1-866-275-4389

investorrelations@gettyimages.com

The above codes and guidelines have been adopted in order to deter corporate wrongdoing and promote: (1) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, (2) full, fair, accurate and timely disclosure in reports and documents we file with the SEC and in other public communications, (3) compliance with applicable governmental laws, rules and regulations, (4) accountability for adherence to our ethical standards, codes and guidelines, and (5) the prompt internal reporting of any violation thereof.

If any material provisions of our Code of Ethics or our Code of Business Conduct are waived for any member of our management or Board of Directors, or if any substantive changes are made to our codes as they relate to any Director or member of management, we will disclose that fact on our website or in a Current Report on Form 8-K that would be filed with the SEC. In addition, any other material amendments to our Codes will be disclosed. There were no waivers of any of our codes relating to executives or directors in 2006. There has been one waiver made and disclosed in 2007 with respect to Mr. Livingstone as discussed further in the“Transactions with Related Parties” section of this proxy statement.

The Board has established a mechanism by which any employee, shareholder, vendor, customer or other interested party may submit confidential or anonymous reports of suspected or actual violations of our Code of Business Conduct or Code of Ethics relating to financial, accounting, auditing or internal controls matters or procedures. Individuals wishing to submit such reports may do so by calling 1-800-425-0889 or logging on towww.resultor.com/gettyimages, both of which are available 24 hours, seven days a week.

BOARD COMMITTEES AND MEETINGS

The Board

Each Director is expected to attend all Board meetings and all meetings of committees on which they serve, to review materials in advance of such meetings, to participate in such meetings, and to meet as frequently as necessary to discharge properly their responsibilities.The Board of Directors held twelve meetings during 2006. Each member of the Board of Directors attended at least 75% of the aggregate number of meetings of the Board of Directors and the Committees of which he was a member during the last year. Mr. Klein attended the 2006 annual shareholders meeting and acted as Chairman of the meeting. He was the only Board member in attendance. We invite the members of the Board to attend the annual meeting of shareholders, but we do not have a policy that requires them to attend the meeting.

12

Committees of the Board

The Board of Directors has standing Audit, Compensation, Nominating and Corporate Governance, and Executive Committees. Additionally, in 2006, the Board had an Equity Compensation Committee, as well, which was formally disbanded in April 2007. The Board of Directors has adopted written charters for the Audit, Compensation and Nominating and Corporate Governance Committees. These charters can be found on the Corporate Governance section of Getty Images’ website. Log on towww.gettyimages.comand click “About Us,” then “Investors,” then “Corporate Governance.” The Executive Committee operates pursuant to a specific delegation of authority by the Board of Directors.

The membership of these Committees and a brief statement of their principal responsibilities are presented below:

| | | | | | | | |

Director

| | Audit

| | Compensation

| | Executive

| | Nominating & Corporate

Governance

|

James N. Bailey | | X | | X | | X | | Chair |

Andrew S. Garb | | X | | Chair | | X | | |

Mark H. Getty | | | | | | | | |

David Landau(1) | | | | | | | | |

Jonathan D. Klein | | | | | | X | | |

Alan G. Spoon(2) | | | | | | | | |

Christopher H. Sporborg | | | | X | | | | X |

Michael A. Stein | | Chair | | | | X | | |

| (1) | Dr. Landau resigned his position from the Board effective May 17, 2006. |

| (2) | Mr. Spoon was appointed to the Board at the May 16, 2006 meeting of the Board of Directors. |

Audit Committee

The Audit Committee consists of Messrs. Bailey, Garb and Stein. Mr. Stein has served as the chairman of the Audit Committee since 2002. The Audit Committee is comprised solely of non-employee, independent Directors. The Board of Directors determined that each member of the Audit Committee is financially literate and that Mr. Stein is an “Audit Committee financial expert” as defined under applicable rules of the SEC. The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its responsibility relating to the shareholders, potential shareholders, and investment community relating to oversight of:

| | • | | the integrity of our financial statements; |

| | • | | Getty Images’ compliance with legal and regulatory requirements; |

| | • | | the independent auditors engagement, qualifications, performance, compensation and independence; |

| | • | | the performance of our internal audit function; |

| | • | | compliance with our Code of Ethics and Code of Business Conduct; and |

| | • | | our control environment and internal control over financial reporting. |

The members of the Audit Committee meet regularly with senior management of Getty Images, the internal auditors and our independent registered public accounting firm to review: the scopes, plans and results of the external and internal audits; the evaluations by management, the internal auditors and the independent registered public accounting firm of Getty Images’ internal control over financial reporting; and the quality of our financial reporting and disclosure practices. The Audit Committee held 13 meetings during 2006. The Audit Committee also engages in annual self-performance evaluations. The Board of Directors has adopted a charter for the Audit

13

Committee, which was revised by the Audit Committee and approved by the Board of Directors at its January 22, 2007 meeting. The revised charter can be found on the Corporate Governance section of Getty Images’ website. Log on towww.gettyimages.comand click “About Us,” then “Investors,” then “Corporate Governance.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Messrs. Bailey and Sporborg. Mr. Bailey has served as the Chairman of that Committee since 2003. The Nominating and Corporate Governance Committee is comprised solely of non-employee, independent Directors. The primary purpose of the Nominating and Corporate Governance Committee is to identify individuals qualified to become members of the Board of Directors and to recommend such candidates to the Board and shareholders for consideration. Additionally, this Committee is responsible for, among other things, evaluating the effectiveness of the Board and its Committees; developing, updating as necessary, and recommending to the Board corporate governance principles and policies applicable to Getty Images; and monitoring compliance with such principles and policies. While the Committee does not have formal criteria established for the selection of new candidates, the Board and Nominating and Corporate Governance Committee have agreed that any possible candidate should have, at a minimum, media industry experience, experience as an entrepreneur, and previous experience with a public company. Nominees are typically identified by current Committee or Board members. A search firm may be used on an ad hoc basis if the Committee is unsuccessful in its efforts to find qualified nominees. To date, that has not been necessary. In 2006, the Committee had four meetings during which its members discussed and decided matters before the Committee. The Nominating and Corporate Governance Committee’s Charter can be found on the Corporate Governance section of Getty Images’ website. Log on towww.gettyimages.comand click “About Us,” then “Investors,” then “Corporate Governance.”

This Committee will consider qualified candidates for Directorships suggested by shareholders in written submissions to the Nominating and Corporate Governance Committee, c/o General Counsel, Getty Images, 601 North 34th Street, Seattle, Washington 98103, or tonominations@gettyimages.com. The Committee will evaluate persons recommended by shareholders in the same manner as other candidates.

Compensation Committee

The Compensation Committee’s membership is comprised of Messrs. Bailey, Garb and Sporborg. Mr. Garb has served as the Chairman of that Committee since 1998. The Committee is composed entirely of non-employee, independent directors. None of the Committee members has ever been an officer or employee of Getty Images or any of its subsidiaries, and none has ever been paid for services provided to us (other than in their roles as members of the Board).

The Compensation Committee has oversight responsibility for Getty Images’ executive compensation policy, including that pertaining to the compensation of the Chief Executive Officer. In this regard, the role of the Compensation Committee is to oversee our compensation plans and policies, annually review and approve all executive officers’ compensation, and administer our incentive plans (including reviewing and approving stock incentive grants to executive officers). The Committee’s charter reflects these various responsibilities, among others, and the Committee and the Board periodically review and revise the charter. The Committee’s Charter can be found on the Corporate Governance section of Getty Images’ website. Log on towww.gettyimages.comand click “About Us,” then “Investors,” then “Corporate Governance.”

In 2006, the Compensation Committee had eight meetings during which its members discussed and decided matters before it. The Committee also considers and takes action by written consent. The Committee Chairman reports on Committee actions and recommendations at Board meetings. Getty Images’ management, including its Human Resources and Legal Departments, supports the Committee in its work and in some cases acts pursuant to delegated authority to administer Getty Images’ compensation programs.

14

The Committee also has engaged Towers Perrin, a leading compensation consulting firm to assist it in the performance of its duties, the scope of which are described in detail in the Compensation Discussion and Analysis section below.

Compensation Committee Interlocks and Insider Participation

As noted above, the Compensation Committee is composed of three independent Directors, Messrs. Bailey, Garb and Sporborg. None of Messrs. Bailey, Garb or Sporborg has been an officer or employee of Getty Images at any time or is an executive officer of an entity for which an executive officer of Getty Images served as a member of a compensation committee or as a director during the last fiscal year. During 2006, none of our executive officers served as a member of the board of directors or compensation committee of any other entity whose executive officer(s) served on our Board of Directors or Compensation Committee.

Executive Committee

The Executive Committee consists of Messrs. Bailey, Garb, Klein and Stein. This Committee was formed in December 2005 and met only once in 2006. This Committee has a limited delegation of authority from the Board of Directors to exercise the authority of the Board during the intervals between meetings of the Board, except for matters that cannot be delegated by law or pursuant to Getty Images’ Restated Certificate of Incorporation or by-laws and except for those matters expressly delegated to another committee of the Board of Directors.

Presiding Director; Executive Sessions of Independent Directors

In 2006, the independent directors of the Board met in executive session four times to discuss such topics as the independent directors determined appropriate, including evaluation of the performance of the chief executive officer. In 2006, Mr. Bailey was selected by the independent members of the Board to chair these sessions and to be the lead independent director.

Equity Compensation Committee (formerly known as the Stock Option Committee)

The Equity Compensation Committee consisted of Mr. Klein. The Equity Compensation Committee was responsible for the administration of Getty Images’ 2005 Incentive Plan for those employees who were not one of our executive officers. The Equity Compensation Committee took action two times during 2006. The Equity Compensation Committee was disbanded in April, 2007 as a result of the Special Committee’s2 recommendation to that effect.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors of Getty Images, Inc. has reviewed and discussed the following Compensation Discussion and Analysis section of this proxy statement with Getty Images’ management. Based on such review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis section be included in Getty Images’ Annual Report on Form 10-K for the year ended December 31, 2006 and in this proxy statement. The members of Getty Images’ Compensation Committee during 2006 and as of the date of this proxy statement are:

Andrew S. Garb (Chairman)

James N. Bailey

Christopher H. Sporborg

2 | The Special Committee and its function are described more fully in the Compensation Discussion and Analysis section of this proxy in the subsection titled“Restatement of Financial Statements.” |

15

COMPENSATION DISCUSSION AND ANALYSIS

Our compensation programs are designed to attract and retain highly qualified employees and to motivate them to maximize shareholder returns by achieving annual and long-term financial goals. Our compensation programs also allow the performance of individual employees against non-financial targets (such as adherence to our Leadership Principles3) to play a role in determining total compensation. Our leadership principles define the kind of company we want to be by setting forth leadership behaviors that form the cornerstone of everything we do. Our compensation programs are intended to be competitive with prevailing market practices and to link each employee’s compensation directly to our financial performance. The following discussion addresses the following aspects of our compensation programs and policies:

| | • | | Our executive compensation program objectives and what the program is designed to reward. |

| | • | | The role of the Compensation Committee, our executive officers and our compensation consultant in the development and administration of the executive compensation program. |

| | • | | The details of our executive compensation program, including: |

| | • | | The elements of the program, why we choose to pay each element, and how each element fits into our overall compensation objectives. |

| | • | | How we determine the amounts to pay. |

I. Compensation Programs—Objectives and Design

The primary basis of our general compensation philosophy and practice is that total compensation should vary along with the success of Getty Images in achieving its financial objectives and of the individual employee in achieving his or her non-financial objectives, and that long-term incentive compensation should be closely aligned with the shareholders’ interests. This approach applies to all of our employees, with a more significant portion of compensation being variable (that is, at-risk and tied to Getty Images’ financial performance) as an employee’s level of responsibility increases.

Another important aspect of our compensation philosophy and practice is that our compensation programs should be straightforward in their design and application. We believe that this approach has the benefit of allowing employees to understand clearly how they will be compensated. This approach also makes it easier to predict and measure the compensation that employees have realized and will realize in the future, and to reduce the chance of the compensation programs having unintended consequences.

II. Role of the Compensation Committee, our Executive Officers and our Compensation Consultant

The Compensation Committee has oversight responsibility for our compensation plans, policies and programs both for our executive officers and for our other employees. Our management team, in particular our Human Resources Department, works with our Chief Executive Officer and our other executive officers to develop and design our compensation plans, policies and programs. The more significant plans, policies and programs, including all in which any executive officer participates, then are reviewed with the Compensation Committee at formal meetings and via informal discussions in order to provide the information necessary, or requested by the Committee to evaluate, modify as needed, and ultimately approve the plans, policies and programs. The Compensation Committee also has engaged Towers Perrin, a leading compensation consulting firm, to assist the Compensation Committee in the performance of its duties. On decisions regarding the compensation of specific executive officers, the Compensation Committee works closely with the Chief Executive Officer, with the Chief Executive Officer making recommendations regarding each of the other executive officer’s compensation for discussion with and, ultimately, approval by the Committee. On the Chief

3 | Our Leadership Principles can be found in the Corporate Governance section of our website. Log on towww.gettyimages.com and first click “About Us,” then “Investors,” then “Corporate Governance.” |

16

Executive Officer’s compensation, the Compensation Committee works with Towers Perrin to obtain the information and advice necessary for it to make the decisions.

Towers Perrin reports directly to the Compensation Committee, which has authority to engage and retain any outside advisors to provide advice regarding all aspects of executive compensation and benefits. We have not commissioned a custom survey from Towers Perrin in the past nor do we have current plans to request such a survey. Rather, we have relied upon the Towers Perrin Executive Compensation Survey, which provides Getty Images with market data for our executive positions, including the Chief Executive Officer. Towers Perrin provides us with comparative compensation information for equivalent positions from peer companies, using benchmark and market practice data for base salaries, incentives, and stock awards. Towers Perrin has also supplied relevant and timely information to the Compensation Committee and management on such matters as regulatory changes and updates, current industry practices relating to executive compensation and other such issues. This information is utilized by the Chief Executive Officer when making executive compensation recommendations to the Compensation Committee and by the Committee when evaluating these recommendations. In addition to the services provided to the Compensation Committee, Towers Perrin also has advised management on our sales commission programs and on our long-term incentive compensation program for all other employees. The Compensation Committee believes that Towers Perrin has provided valuable independent advice to the Compensation Committee that is untainted by its other engagements. Nevertheless, the Compensation Committee believes that best practices dictate that the Committee should have a consultant that does not do any other work for Getty Images. As a result, going forward management will retain another compensation consultant and Towers Perrin will provide advice only to the Compensation Committee. The Compensation Committee also believes that Towers Perrin’s advice was enhanced by its in-depth knowledge of our culture and compensation programs that it gained as a result of the work it did on these other projects. The Human Resources and Legal Departments also work with Towers Perrin as required in performing certain of the tasks assigned to Towers Perrin by the Compensation Committee. Such work includes, for example, providing information on our current practices, advising on proposals that may be considered regarding executive or other compensation, and providing detail on our compensation structure such as current and historical salaries, benefits, bonus and equity compensation so that, as required, Towers Perrin can provide us with relevant feedback and comparative data.

III. Elements of Compensation—Identification and Selection; Benchmarking and Determination of Amounts; Other Benefits

| A. | Identification and Selection of Elements of Compensation |

The total compensation for our employees, including our executive officers, consisted of the following components in 2006 (and will consist of these elements in 2007 as well):

| | |

Element

| | Description and Objective

|

Base salary | | We provide base salaries that are competitive with those companies with whom we compete for talented employees. We set our target base salaries at the 50th percentile for comparable jobs at comparable companies nationwide, in order to provide our employees with competitive base salaries. We believe our target base salaries are an important part of an attractive overall compensation and benefits package. |

17

| | |

Element

| | Description and Objective

|

Cash bonus Non-Sales Employees | | We offer an annual pay-for-performance cash incentive plan dependent on our annual financial performance and the individual employee’s performance against specific performance objectives and our Leadership Principles. A greater percentage of an employee’s award is determined by performance against financial objectives as the employee’s level of responsibility increases. The objective of this plan is to provide a means to align the interests of our non-sales employees to our critical annual financial objectives and to reward all non-sales employees for achieving these objectives. This plan covers all executive officers, except the Senior Vice President, Global Sales. |

| |

Sales Employees | | For non-executive Sales employees, their cash commission plan payout is solely dependent upon individual and/or group sales targets. For the more senior employees in the Sales function (including our Senior Vice President, Global Sales), a part of variable cash compensation is determined by personal performance against specific performance objectives and our Leadership Principles. Our sales commission plan is designed to provide significant incentives for Sales employees at all levels to achieve the monthly, quarterly and annual sales targets. |

| |

Long-Term / Equity Compensation | | Our long-term compensation is in the form of equity awards, primarily in the form of restricted stock units, although the Compensation Committee likely will continue to make awards of stock options to the Chief Executive Officer. A restricted stock unit award is a grant of a right to receive shares of our common stock that vests over time. As the restricted stock unit awards vest, employees receive shares that they own outright. In contrast, stock options are options to purchase shares of our common stock upon the payment of the award exercise price, with the recipient being able to exercise the options only as the award vests over time. The exercise price for a stock option award is no less than the fair market value of our common stock on the date of the award, which we define as the average of the high and low trading prices of our common stock on the date |

18

| | |

Element

| | Description and Objective

|

| | | of the award. This means that the award recipient receives value from the stock option award only if the price of our common stock appreciates. The long-term compensation program is designed to allow annual awards of restricted stock units for a significant number of our employees, although our executive officers may not receive awards each year. The use of equity as the vehicle for our long-term compensation program builds on the annual cash incentive programs by rewarding key employees for their efforts in achieving our financial objectives. In addition, equity incentive awards may be able to tie our employees’ compensation (that of our more senior employees, in particular) more closely to shareholder returns than cash incentives. The time-based vesting schedules (back-end loaded in the case of the Chief Executive Officer as described below in this Compensation Discussion and Analysis under the subheadingEquity Compensation) are intended to support retention. |

| |

Benefits | | We aim to provide our employees with a competitive, comprehensive and well-balanced compensation package. While the specifics of the benefits programs vary by country, we typically provide health, disability and life insurance, as well as defined contribution retirement plans. We also provide limited additional benefits for the executive officers and other senior management, such as supplemental life and disability insurance. |

| B. | Benchmarking and Determination of Amounts of Each Element of Compensation |

In setting each executive’s base salary and target annual cash incentive bonus, and in awarding any long-term incentive compensation, the Compensation Committee considers comparative compensation levels for equivalent positions at peer companies using benchmark and market practice data collected and prepared both by our Human Resources group and by Towers Perrin.

The executive compensation benchmarking surveys provide information on levels of total compensation, total cash compensation, base salary, target annual incentive compensation, and long-term incentive compensation (including equity-based compensation) for comparable executive positions at organizations similar to ours nationwide. Using these surveys and other data, Towers Perrin provides benchmark information on compensation levels and practices, such as the types and prevalence of various compensation plans and the elements thereof, the mix of pay among these elements, and market trends. The Compensation Committee

19

believes it is critical to understand executive compensation practices and levels among all potential competitors for senior management talent. Accordingly, the compensation surveys used by the Compensation Committee represent both general industry and other media-related organizations.4 The most recent surveys provided by Towers Perrin were from 2005, and there were no updates or new surveys provided to us in 2006. Getty Images has not yet determined whether an update to the survey or other data provided by Towers Perrin will be required in 2007.

Given that the scope of executive responsibilities is largely influenced by the size of the organization and associated complexity, the Compensation Committee also believes that it is important to consider the compensation trends of similarly-sized organizations. We evaluated the compensation trends of companies in both the media and general industry, which were selected based on their revenues and market capitalization (two broadly accepted measures of organizational size and scope that are associated with senior management pay levels). Specifically, the compensation comparison groups represent companies with $500 million to $2 billion in annual revenues and a median market capitalization that approximates that of Getty Images.

This comparator grouping is not identical to those companies represented in the performance graph included in the Annual Report on Form 10-K for the year ended December 31, 2006. While management and the Compensation Committee believe that it is best to reference the well-known published indices used in the performance graph to measure the performance of our shareholder return, the Committee, with the concurrence of management and Towers Perrin, believes that our competitors for employees (including executive officers) are not limited to the specific companies in those indices.5

With the relevant market data, the Compensation Committee, with management’s assistance, annually reviews all elements of each executive officer’s total compensation, including each officer’s current and historical base salary, actual and target annual cash incentive bonus payouts, equity compensation (including accumulated, realized and unrealized stock option, restricted stock and restricted stock unit gains), relevant internal equities (which involves a comparison of total compensation of employees at all levels of the company), and the cost of the benefits and perquisites. This review also considers the potential accounting impact of Statement of Financial Accounting Standards (“SFAS”) No. 123R (revised 2004), “Share-Based Payment” on compensation programs in general and our long-term incentive compensation program in particular.

While taken into account in making any additional equity awards, the size of past awards is less important in the overall mix of considerations than are the executive officer’s expected future contributions, level of responsibility and the data on market compensation practices. The Compensation Committee also is cognizant of the accounting cost and dilutive impact of equity awards, and works with management to establish approximate limits of overall equity compensation program costs during our annual budgeting process.

In addition to relevant market compensation data and each executive officer’s total compensation information described above, the Compensation Committee considers the following factors in reviewing and determining compensation levels for our senior management:

| | • | | Overall performance of Getty Images, especially as compared to pre-established operating measures and other indicators of shareholder value creation. |

| | • | | Individual performance; in particular, each individual executive’s contribution to successful implementation of our short-term performance goals and long-term strategic direction, and adherence to |

4 | As the financial analysts who cover us have discovered over the years, there are a very limited number of companies, if any, that have operations that are closely comparable to ours. As a result, the Compensation Committee, management and Towers Perrin all believe that we must use comparator groups that include companies that are outside of our industry. |

5 | This view is supported by the diverse backgrounds of our executive officers, which are described elsewhere in this proxy statement. |

20

| | our Leadership Principles. As noted above, our Leadership Principles define the kind of company we want to be by setting forth leadership behaviors that form the cornerstone of everything we do.6 |

| | • | | Our overall executive compensation philosophy, including consideration of how pay compares across various organizational levels (i.e., internal pay equity) and the mix between fixed and variable compensation. |

With the assistance of our Human Resources Department, our management (including, but not limited to our executive officers) undertakes a similar benchmarking process for determining the compensation of those employees who are not executive officers. While the Compensation Committee is not involved in the process, the studies used for our other employees include companies that are outside of our industry, as is the case with the benchmarking studies used for the executive officers.

| | 1. | Mix of Elements—Fixed versus Variable Compensation; Cash versus Equity |

Both the Compensation Committee and management believe that the above-written compensation elements are necessary elements of a complete and competitive compensation program. This program allows us to offer compensation packages to our employees that are comparable to those offered by employers with whom we compete for talented employees. We believe that our compensation program is effective at attracting, motivating and retaining employees, while at the same time being easy to understand and manage.

The Compensation Committee does not target a specific ratio between fixed and variable compensation for the executive officers. However, in performing the periodic reviews (including the benchmarking exercises) discussed above, the Compensation Committee does consider market practices regarding the mix of total compensation between fixed and variable elements, and believes that a significant percentage of the executive officer’s total compensation should be variable (that is, at-risk and tied to Getty Images’ financial performance). The actual ratio between fixed and variable compensation will depend upon our financial performance and stock price.

In evaluating and determining the mix between fixed and variable compensation, and between cash and equity, the Compensation Committee is mindful that, from October 2001 until September 2005, it did not make significant equity awards to executive officers due to the limited number of shares remaining available for grant under its then-existing equity compensation plan. Awards granted typically were limited to employment inducement awards or awards that were part of a compensation package offered to a newly-promoted executive. Following the shareholder approval of the 2005 Incentive Plan, the Compensation Committee was able to resume its commitment to making appropriate equity award grants and began its current practice of granting restricted stock units as the primary form of equity compensation, with the specific intent of increasing both the variable and equity components of the executive’s compensation packages. The equity compensation program was implemented after considerable work by the Compensation Committee and our executive officers, with assistance from Towers Perrin, to develop a broad-based long-term equity compensation plan. It is important to note that while Getty Images’ executives were involved in, and integral to, the development of this long-term equity compensation plan for all employees, they do not determine their own compensation.

| | 2. | Mix of Chief Executive Officer Pay Elements |

In 2005, the Compensation Committee conducted a review of Mr. Klein’s current and historical compensation, including annual pay, annual cash incentive bonuses, and equity compensation (including accumulated, realized and unrealized stock option and restricted stock gains). As a result of this review, the Compensation Committee determined that, due to a lack of equity-based awards over the previous four years (excepting an award of 15,000 restricted stock units in December 2002), Mr. Klein’s total compensation was not

6 | You can learn more about our Leadership Principles at our website. Log on towww.gettyimages.comand click “About Us,” then “Investors,” then “Corporate Governance.” |

21

sufficiently weighted toward “at risk” elements. Particularly, the level of equity compensation over the period between 2000 and 2004 was significantly below the targeted 75th percentile of total chief executive officer compensation for comparable general industry and media companies. This was despite the fact that we had exceptional performance (both in terms of share price appreciation and operational performance) during that period and that our executive compensation program and philosophy emphasize pay for performance. The Compensation Committee also considered the fact that all of Mr. Klein’s then outstanding equity awards were fully vested and, therefore, Mr. Klein’s compensation package did not provide the desired retention incentives.

At the conclusion of this review, the Compensation Committee decided to make a grant of a fully vested option to acquire 350,000 shares of our common stock to Mr. Klein in September 2005 to account for the limited equity awards granted since 2001. The immediate vesting was designed to bring Mr. Klein’s equity compensation in line with chief executive officer compensation for comparable general industry and media companies and address the pending requirement to recognize an expense for stock option awards (which for us began on January 1, 2006). Similar awards with immediate vesting were made to certain of the other long-serving executive officers in September 2005.7 Executive officers were granted options to acquire shares of our common stock in the following amounts:

| | |

Mr. Beyle | | 45,000 |

Mr. Ellis | | 20,000 |

Mr. Evans-Lombe | | 50,000 |

Mr. Gurke | | 45,000 |

Ms. Huebner | | 50,000 |

Mr. Olofsson | | 20,000 |

The Compensation Committee also made an award of 80,000 restricted stock units to Mr. Klein in January 2006 in order to recognize our outstanding performance, especially over the period between 2002 and 2005, to provide him with a meaningful retention-based award that would encourage on-going engagement even if our share price were to decline, and to address the lack of regular stock option awards during a period of significant stock price appreciation (a result of our exceptional financial performance). Awards of restricted stock units also were made to all other executive officers and approximately 25% of our employee population in January 2006.8 The Compensation Committee also granted to Mr. Klein an option to purchase 250,000 shares of our common stock in May 2006 as the first in what is intended to be a program of regular annual stock option awards that will be meaningful for Mr. Klein and will ensure alignment between his total compensation and shareholder value creation. The specific size of the awards will be determined by reference to Mr. Klein’s performance, our financial performance and competitive market data. Both the January and May 2006 grants to Mr. Klein were weighted with back-end vesting of 40% of the shares in year four of the vesting cycle. In April 2006, the Compensation Committee also increased Mr. Klein’s at-target annual cash incentive bonus from 70% to 90% of his base salary in order to put even more of his potential cash compensation at-risk.9

Each year, the Compensation Committee reviews the base salary compensation of each executive officer in the manner described above. The Compensation Committee may make changes to base salaries based on an