SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| | |

| Check the appropriate box: |

| [ ] | | Preliminary Proxy Statement |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | | Definitive Proxy Statement |

| [ ] | | Definitive Additional Materials |

| [ ] | | Soliciting Material Pursuant to Section 240.14a-12 |

PIMCO VARIABLE INSURANCE TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| [ ] | | Fee paid previously with preliminary materials. |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

PIMCO VARIABLE INSURANCE TRUST

650 Newport Center Drive Newport Beach, California 92660

February 19, 2015

Dear Variable Contract Owner:

On behalf of the Board of Trustees of PIMCO Variable Insurance Trust (the “Trust”), I am pleased to invite you to a special meeting of shareholders (the “Meeting”) of the series of the Trust (each a “Portfolio” and collectively, the “Portfolios”), to be held at the Newport Beach Marriott Hotel & Spa, Avalon Room, 900 Newport Center Drive, Newport Beach, California 92660 on April 20, 2015 at 9:00 A.M., Pacific time.

Shares of the Portfolios are currently sold to segregated asset accounts (“Separate Accounts”) of insurance companies to serve as an investment medium for variable annuity contracts and variable life insurance policies (“Variable Contracts”). The Separate Accounts invest in shares of the Portfolios in accordance with allocation instructions received from owners of the Variable Contracts (“Variable Contract Owners”). At the Meeting, Variable Contract Owners of the Trust will be asked to vote on the election of six Trustees to the Board of Trustees of the Trust.

Your vote is important. The proposal has been carefully reviewed by the Board of Trustees. They unanimously recommend that you votefor the proposal. On behalf of the Board of Trustees, I ask you to review the proposal and vote. For more information about the proposal requiring your vote, please refer to the accompanying proxy statement.

No matter how many votes you hold, your timely vote is important. If you are not able to attend the Meeting, then please complete, sign, date and mail the enclosed proxy card(s) promptly in order to avoid the expense of additional mailings. If you have any questions regarding the proxy statement, please call (866) 721-1371.

Thank you in advance for your participation in this important event.

|

| Sincerely, |

|

/s/ Brent R. Harris |

| Brent R. Harris |

| Chairman of the Board |

PIMCO VARIABLE INSURANCE TRUST

650 Newport Center Drive

Newport Beach, California 92660

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held April 20, 2015

Dear Variable Contract Owner:

Notice is hereby given that a special meeting of shareholders of the series of the Trust (each, a “Portfolio” and collectively, the “Portfolios”), will be held at the Newport Beach Marriott Hotel & Spa, Avalon Room, 900 Newport Center Drive, Newport Beach, California 92660 on April 20, 2015 at 9:00 A.M., Pacific time, or as adjourned from time to time (the “Meeting”).

The purpose of the Meeting is to consider and act upon the following proposal for the Trust, and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| | 1. | To elect six Trustees to the Board of Trustees. |

The Board of Trustees has fixed the close of business on February 19, 2015 as the record date for determining Variable Contract Owners entitled to notice of and to vote at the Meeting.

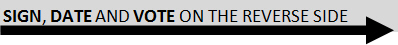

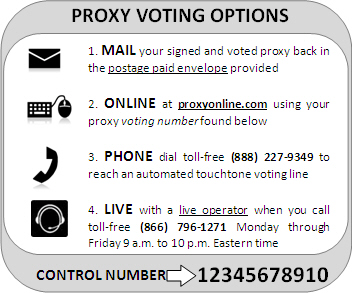

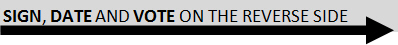

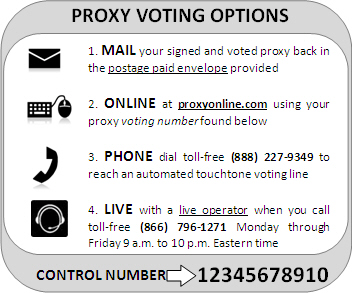

Shareholders may attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is requested to complete, date and sign the enclosed proxy card, and return it in the envelope provided. You also have the opportunity to provide voting instructions via telephone or the Internet. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the meeting to vote your shares, you will need to request a paper ballot at the meeting in order to do so.

If you have any questions regarding the enclosed proxy material or need assistance in voting your shares, please contact DF King & Co. Inc., an ASTOne Company, at (866) 721-1371 Monday through Friday from 9 a.m. to 10 p.m. ET.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on April 20, 2015.This Notice of Special Meeting of Shareholders, the Proxy Statement and the form of proxy cards are available on the Internet at www.proxyonline.com/docs/PIMCOPVIT.pdf. On this website, you will be able to access the Notice of Special Meeting of

Shareholders, the Proxy Statement, the form of proxy cards and any amendments or supplements to the foregoing material that are required to be furnished to shareholders.

|

| By Order of the Board of Trustees |

|

|

| Joshua D. Ratner, Secretary |

| February 19, 2015 |

PORTFOLIOS PARTICIPATING IN THE MEETING

ON APRIL 20, 2015

PIMCO All Asset All Authority Portfolio

PIMCO All Asset Portfolio

PIMCO CommodityRealReturn® Strategy Portfolio

PIMCO Emerging Markets Bond Portfolio

PIMCO Foreign Bond Portfolio (Unhedged)

PIMCO Foreign Bond Portfolio (U.S. Dollar-Hedged)

PIMCO Global Advantage® Strategy Bond Portfolio

PIMCO Global Bond Portfolio (Unhedged)

PIMCO Global Diversified Allocation Portfolio

PIMCO Global Multi-Asset Managed Allocation Portfolio

PIMCO Global Multi-Asset Managed Volatility Portfolio

PIMCO High Yield Portfolio

PIMCO Long-Term U.S. Government Portfolio

PIMCO Low Duration Portfolio

PIMCO Money Market Portfolio

PIMCO Real Return Portfolio

PIMCO Short-Term Portfolio

PIMCO Total Return Portfolio

PIMCO Unconstrained Bond Portfolio

PIMCO VARIABLE INSURANCE TRUST

650 Newport Center Drive

Newport Beach, California 92660

For proxy information call:

(866) 721-1371

For account information call:

(888) 877-4626

If a broker or other nominee holds your shares, you may contact the broker or nominee directly.

PROXY STATEMENT

Special Meeting of Shareholders

To be Held on April 20, 2015

This proxy statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Trustees (the “Board of Trustees” or the “Board”) of PIMCO Variable Insurance Trust (the “Trust”), a Delaware statutory trust and open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) for use at a special meeting of shareholders of each series of the Trust (each a “Portfolio,” and collectively, the “Portfolios”) (the “Meeting”). The Meeting is scheduled to be held at the Newport Beach Marriott Hotel & Spa, Avalon Room, 900 Newport Center Drive, Newport Beach, California 92660 on April 20, 2015 at 9:00 A.M., Pacific time, or as adjourned from time to time. This Proxy Statement, Notice of Meeting and proxy card are first being mailed to shareholders on or about March 12, 2015.

The purpose of the Meeting is to consider and act upon a proposal to elect six Trustees to the Board of Trustees (the “Proposal”) and to transact such other business as may properly come before the Meeting or any adjournments thereof.

Shares of the Portfolios are currently sold to segregated asset accounts (“Separate Accounts”) of insurance companies to serve as an investment medium for variable annuity contracts and variable life insurance policies (“Insurance Companies”). The Separate Accounts invest in shares of the Portfolios in accordance with allocation instructions received from owners of the variable

1

annuity contracts and variable life insurance policies (“Variable Contract Owners”). The Trust is soliciting votes from Variable Contract Owners in connection with the Proposal. As such and for ease of reference, throughout this Proxy Statement, Variable Contract Owners may be referred to as “shareholders” of the series of the Trust.

The record date for determining shareholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof has been fixed at the close of business on February 19, 2015 (the “Record Date”). The total number of shares outstanding as of December 31, 2014 for each Portfolio and for each class of each Portfolio is set forth inExhibit A.

Persons who, to the knowledge of the Trust, beneficially own more than five percent of a Portfolio’s outstanding shares as of December 31, 2014 are listed inExhibit B.

The principal business address of Pacific Investment Management Company LLC (“PIMCO”), each Portfolio’s investment adviser and administrator, is 650 Newport Center Drive, Newport Beach, California 92660. The principal business address of PIMCO Investments LLC (“PIMCO Investments”), each Portfolio’s principal underwriter and distributor, is 1633 Broadway, New York, New York 10019.

All properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked on the proxy card. Unless instructions to the contrary are marked on the proxy card, proxies submitted by holders of each Portfolio’s shares (“Shares”) will be voted“FOR” the Proposal. The persons named as proxy holders on the proxy card will vote in their discretion on any other matters that may properly come before the Meeting or any adjournments or postponements thereof. Any shareholder executing a proxy has the power to revoke it prior to its exercise by submission of a properly executed, subsequently dated proxy, by voting in person, or by written notice to the Secretary of the Trust (addressed to the Secretary at the principal executive office of the Trust, 650 Newport Center Drive, Newport Beach, California 92660). However, attendance at the Meeting, by itself, will not revoke a previously submitted proxy. Unless the proxy is revoked, the Shares represented thereby will be voted in accordance with specifications therein.

Only shareholders or their duly appointed proxy holders can attend the Meeting and any adjournment or postponement thereof. To gain admittance, if you are a shareholder of record, you must bring a form of personal identification to the Meeting, where your name will be verified against the Trust’s shareholder list. If a broker or other nominee holds your Shares and you plan to attend the

2

Meeting, you should bring a recent brokerage statement showing your ownership of the Shares as of the record date, as well as a form of personal identification.

Shareholders can find important information about the Portfolios in the annual and semi-annual reports to shareholders, dated December 31, 2013 and June 30, 2014, respectively, each of which previously has been furnished to shareholders. Shareholders may request another copy of these reports by writing to the Trust at the above address, or by calling the appropriate telephone number above.

PROPOSAL ELECTION OF SIX TRUSTEES TO THE BOARD OF TRUSTEES

The purpose of this proposal is to elect six nominees to the Board of Trustees, four of whom do not currently serve as Trustees of the Trust. Each of the two other nominees, Mr. Douglas M. Hodge and Mr. Ronald C. Parker, currently serves as a Trustee, but was not elected to his position by the shareholders of the Trust. Mr. E. Philip Cannon, Mr. J. Michael Hagan and Mr. Brent R. Harris were previously elected by shareholders.

At the Meeting, Trustees of the Trust are to be elected, each to serve for a term of indefinite duration and until his or her successor is duly elected and qualifies, or until his or her earlier resignation or removal (as provided in the Trust’s Declaration of Trust) or death. It is the intention of the persons named as proxies in the enclosed proxy to vote the shares covered thereby for the election of the six nominees named below, unless the proxy contains contrary instructions.

The nominees for election to the Board of Trustees are Mr. George E. Borst, Ms. Jennifer Holden Dunbar, Mr. Douglas M. Hodge, Mr. Gary F. Kennedy, Mr. Peter B. McCarthy, and Mr. Ronald C. Parker. Messrs. Borst, Kennedy, McCarthy, and Parker and Ms. Dunbar are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the 1940 Act (the “Independent Trustee Nominees”). Each of the Independent Trustee Nominees was recommended for nomination by the Trustees who are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the 1940 Act (the “Independent Trustees”). The Independent Trustees retained a third-party search firm, which compiled a list of potential candidates based upon criteria established by the Independent Trustees. The Independent Trustees considered candidates identified by the third-party search firm as well as candidates identified through other sources. All of the nominees were then approved by the Governance Committee of the Board of Trustees and by the Board of Trustees.

3

Each of the nominees has consented to serve, or to continue to serve in the case of Messrs. Hodge and Parker, as a Trustee. The Board of Trustees knows of no reason why any of the nominees will be unable to serve, but in the event any nominee is unable to serve or for good cause will not serve, the proxies received indicating a vote in favor of such nominee will be voted for a substitute nominee as the Board of Trustees may recommend.

The Declaration of Trust does not provide for the annual election of Trustees. However, in accordance with the 1940 Act, (i) the Trust will hold a shareholders’ meeting for the election of Trustees at such time as less than a majority of Trustees holding office have been elected by shareholders; or (ii) if, as a result of a vacancy in the Board of Trustees, less than two-thirds of the Trustees holding office have been elected by shareholders, that vacancy may only be filled by a vote of the shareholders.

Nominees

Basic information concerning the nominees is set forth below. Unless otherwise indicated, the address of all persons below is 650 Newport Center Drive, Newport Beach, CA 92660.

| | | | | | | | | | | | |

Name and

Year of Birth* | | Position

Held

with

Trust | | Term of

Office and

Length of

Time Served† | | Principal Occupation(s)

During Past 5 Years | | Number

of

Funds

in Fund

Complex**

To Be

Overseen

by

Nominee | | | Other Public

Company and

Investment

Company

Directorships

Held by

Trustee

During the

Past 5 Years |

Interested Nominee1 |

| Douglas M. Hodge (1957) | | Trustee | | 02/2010

to present | | Managing Director, Chief Executive Officer, PIMCO (since 2/14); Chief Operating Officer, PIMCO(7/09-2/14); Member of Executive Committee and Head of PIMCO’s Asia Pacific region. Member Global Executive Committee, Allianz Asset Management. | | | 167 | | | Trustee, PIMCO Funds; Trustee, PIMCO ETF Trust. |

| 1 | Mr. Hodge is an “interested person” of the Trust (as that term is defined in the 1940 Act) because of his affiliation with PIMCO. |

4

| | | | | | | | | | | | |

Name and

Year of Birth* | | Position

Held

with

Trust | | Term of

Office and

Length of

Time Served† | | Principal Occupation(s)

During Past 5 Years | | Number

of

Funds

in Fund

Complex**

To Be

Overseen

by

Nominee | | | Other Public

Company and

Investment

Company

Directorships

Held by

Trustee

During the

Past 5 Years |

Independent Trustee Nominees |

George E. Borst

(1948) | | N/A | | N/A | | Executive Advisor, McKinsey & Company (since 10/14); Executive Advisor, Toyota Financial Services (10/13-12/14); CEO, Toyota Financial Services (1/01-9/13). | | | 167 | | | None |

| | | | | |

| Jennifer Holden Dunbar (1963) | | N/A | | N/A | | Managing Director, Dunbar Partners, LLC (business consulting and investments). | | | 167 | | | Director, PS Business Parks; Director, Big 5 Sporting Goods Corporation. |

| | | | | |

| Gary F. Kennedy (1955) | | N/A | | N/A | | Senior Vice President, General Counsel and Chief Compliance Officer, American Airlines and AMR Corporation (now American Airlines Group) (1/03-1/14). | | | 167 | | | None |

| | | | | |

| Peter B. McCarthy (1950) | | N/A | | N/A | | Formerly, Assistant Secretary and Chief Financial Officer, United States Department of Treasury; Deputy Managing Director, Institute of International Finance. | | | 186 | | | Trustee, PIMCO Equity Series; Trustee, PIMCO Equity Series VIT. |

5

| | | | | | | | | | | | |

Name and

Year of Birth* | | Position

Held

with

Trust | | Term of

Office and

Length of

Time Served† | | Principal Occupation(s)

During Past 5 Years | | Number

of

Funds

in Fund

Complex**

To Be

Overseen

by

Nominee | | | Other Public

Company and

Investment

Company

Directorships

Held by

Trustee

During the

Past 5 Years |

| Ronald C. Parker (1951) | | Trustee | | 07/2009

to present | | Director of Roseburg Forest Products Company. Formerly, Chairman of the Board, The Ford Family Foundation. Formerly President, Chief Executive Officer, Hampton Affiliates (forestry products). | | | 167 | | | Trustee, PIMCO Funds; Trustee, PIMCO ETF Trust. |

| † | Trustees serve until their successors are duly elected and qualified. |

| * | The information for the individuals listed is as of December 31, 2014. |

| ** | The term “Fund Complex” as used herein includes each series of the Trust and the series of PIMCO Funds, PIMCO Equity Series, PIMCO Equity Series VIT and PIMCO ETF Trust. The nominees have also been nominated to the Boards of Trustees of PIMCO Funds and PIMCO ETF Trust. |

Qualifications of Nominees

Each nominee was nominated to join the Board based on a variety of factors, none of which, by itself, was a controlling factor. The Board has concluded that, based on each nominee’s experience, qualifications, attributes and skills, on an individual basis and in combination with those of other nominees, each nominee is qualified to serve as a Trustee of the Trust. Among the attributes common to all the nominees are their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the other Trustees, PIMCO, counsel, the independent registered public accounting firm and other service providers, and to exercise effective business judgment in the performance of their duties as Trustees. A nominee’s ability to perform his or her duties effectively may have been attained through the nominee’s business and/or public service positions, and through experience from service as a Trustee of the Trust, public companies, non-profit entities or other organizations. Each nominee’s ability to perform his or her duties effectively also has been enhanced by his or her educational background or professional training, and/or other life experiences.

6

The following is a summary of qualifications, experiences and skills of each Nominee (in addition to the principal occupation(s) during the past five years noted in the table above) that support the conclusion that each individual is qualified to serve as a Trustee:

Mr. Hodge’s position as Chief Executive Officer and a Managing Director of PIMCO, as well as his former position as Chief Operating Officer of PIMCO, and his position as a Member of the Global Executive Committee of Allianz Asset Management of America L.P. (“Allianz Asset Management”) give him valuable financial and operational experience with the day-to-day management of the Trust and PIMCO, its adviser and administrator, which enable him to provide essential management input to the Board. Mr. Hodge also has valuable experience from his service on the Board of Trustees of the Trust since 2010.

Mr. Borst served in multiple executive positions at a large automotive corporation. Mr. Borst has prior financial experience from his oversight of the chief financial officer, treasury, accounting and audit functions of the corporation. He also served as the general manager of a credit company. Additionally, Mr. Borst has prior experience as a board member of a corporation.

Ms. Dunbar has prior financial experience investing and managing private equity fund assets. Additionally, Ms. Dunbar has previously served on the boards of directors of a variety of public and private companies. She currently serves on the boards of directors of two public companies.

Mr. Kennedy served as general counsel, senior vice president and chief compliance officer for a large airline company. He also has experience in management of the company’s corporate real estate and legal departments.

Mr. McCarthy has experience in the areas of financial reporting and accounting, including prior experience as Assistant Secretary and Chief Financial Officer of the United States Department of the Treasury. He also served as Deputy Managing Director of the Institute of International Finance, a global trade association of financial institutions. Mr. McCarthy also has significant prior experience in corporate banking. Additionally, Mr. McCarthy has valuable experience from his service on the board of trustees of PIMCO Equity Series and PIMCO Equity Series VIT since 2011.

Mr. Parker has prior financial, operations and management experience as the President and Chief Executive Officer of a privately held company. He also has investment experience as the Chairman of a family foundation. Mr. Parker also has valuable experience from his service as Trustee of the Trust since 2009.

7

Trustee and Nominee Ownership of Portfolio Shares

The following table sets forth information describing the dollar range of shares in the Portfolios beneficially owned by each nominee and the aggregate dollar range of shares beneficially owned by them in the same fund family overseen by the nominee as of January 15, 2015.

| | | | | | |

| | | Dollar Range of Equity Securities in the Portfolios | | Aggregate Dollar

Range of Equity

Securities in All Funds

Overseen by Trustee in

Family of Investment

Companies |

| | | Name of Portfolio | | Dollar Range | |

Interested Nominee | | |

| Douglas M. Hodge | | None | | None | | Over $100,000 |

| |

Independent Nominees | | |

| George E. Borst | | None | | None | | Over $100,000 |

| | | |

| Jennifer Holden Dunbar | | None | | None | | None |

| | | |

| Gary F. Kennedy | | None | | None | | Over $100,000 |

| | | |

| Peter B. McCarthy | | None | | None | | Over $100,000 |

| | | |

| Ronald C. Parker | | None | | None | | Over $100,000 |

The following table sets forth information describing the dollar range of shares in the Portfolios beneficially owned by each Trustee, except for Messrs. Hodge and Parker whose information is included in the table above, and the aggregate dollar range of shares beneficially owned by them in the same fund family overseen by the Trustee as of January 15, 2015.

| | | | | | |

| | | Dollar Range of Equity Securities in the Portfolios | | Aggregate Dollar

Range of Equity

Securities in All Funds

Overseen by Trustee in

Family of Investment

Companies |

| | | Name of Portfolio | | Dollar Range | |

Interested Trustee | | |

| Brent R. Harris | | None | | None | | Over $100,000 |

8

| | | | | | |

| | | Dollar Range of Equity Securities in the Portfolios | | Aggregate Dollar

Range of Equity

Securities in All Funds

Overseen by Trustee in

Family of Investment

Companies |

| | | Name of Portfolio | | Dollar Range | |

Independent Trustees | | |

| E. Philip Cannon | | None | | None | | Over $100,000 |

| | | |

| J. Michael Hagan | | None | | None | | Over $100,000 |

As of January 15, 2015, the Trustees and officers of the Trust, as a group, beneficially owned less than 1% of the outstanding shares of each class of the Portfolios.

Compensation Table

The following table sets forth information regarding compensation received by the Trustees from the Trust for the fiscal year ended December 31, 2014, and the aggregate compensation paid by the Fund Complex for fiscal year ended December 31, 2014:

| | | | | | | | | | | | |

Name | | Aggregate

Compensation

from the

Trust1 | | | Pension or

Retirement

Benefits

Accrued | | Estimated

Annual

Benefits Upon

Retirement as

Part of Portfolio

Expenses | | Total

Compensation

from Trust

and Fund

Complex Paid

to Trustees2 | |

Interested Trustees | |

Brent R. Harris | | | N/A | | | N/A | | N/A | | | N/A | |

Douglas M. Hodge | | | N/A | | | N/A | | N/A | | | N/A | |

|

Independent Trustees | |

E. Philip Cannon | | $ | 59,150 | | | N/A | | N/A | | $ | 335,300 | |

J. Michael Hagan | | $ | 60,650 | | | N/A | | N/A | | $ | 340,300 | |

Ronald C. Parker | | $ | 64,150 | | | N/A | | N/A | | $ | 366,550 | |

| 1 | For their services to the Trust, each Trustee, other than those affiliated with PIMCO or its affiliates, receives an annual retainer of $35,000, plus $3,600 for each Board of Trustees meeting attended in person, $750 for each committee meeting attended and $750 for each Board of Trustees meeting attended telephonically, plus reimbursement of related expenses. In addition, the audit committee chair receives an additional annual retainer of $5,000 and each other committee chair receives an additional annual retainer of $1,500. Messrs. Harris and Hodge are interested persons and are compensated by PIMCO, not by the Trust or the Fund Complex. |

9

| 2 | During the one-year period ending December 31, 2014, each Trustee also served as a Trustee of PIMCO Funds, a registered open-end management investment company, and as a Trustee of PIMCO ETF Trust, a registered open-end management investment company. In addition, during the period ending December 31, 2014, Mr. Cannon also served as a Trustee of PIMCO Equity Series, a registered open-end management investment company, and as a Trustee of PIMCO Equity Series VIT, a registered open-end management investment company. |

For their services to PIMCO Funds, each Trustee, other than those affiliated with PIMCO or its affiliates, receives an annual retainer of $145,000, plus $15,000 for each Board of Trustees meeting attended in person, $750 ($2,000 in the case of the audit committee chair with respect to audit committee meetings) for each committee meeting attended and $1,500 for each Board of Trustees meeting attended telephonically, plus reimbursement of related expenses. In addition, the audit committee chair receives an additional annual retainer of $15,000 and each other committee chair receives an additional annual retainer of $2,250.

For their services to PIMCO ETF Trust, each Trustee, other than those affiliated with PIMCO or its affiliates, receives an annual retainer of $35,000, plus $3,600 for each Board of Trustees meeting attended in person, $750 for each committee meeting attended and $750 for each Board of Trustees meeting attended telephonically, plus reimbursement of related expenses. In addition, the audit committee chair receives an additional annual retainer of $5,000 and each other committee chair receives an additional annual retainer of $1,250.

For his service to PIMCO Equity Series, Mr. Cannon receives an annual retainer of $62,000, plus $6,250 for each Board of Trustees meeting attended in person and $375 ($750 in the case of the audit committee chair with respect to audit committee meetings) for each committee meeting attended, plus reimbursement of related expenses. In addition, the audit committee chair receives an additional annual retainer of $9,000 and each other committee chair received an additional annual retainer of $750.

For his service to PIMCO Equity Series VIT, Mr. Cannon receives an annual retainer of $10,500, plus $1,875 for each Board of Trustees meeting attended in person and $250 ($375 in the case of the audit committee chair with respect to audit committee meetings) for each committee meeting attended, plus reimbursement of related expenses. In addition, the audit committee chair receives an additional annual retainer of $2,400 and each other committee chair received an additional annual retainer of $250. Prior to January 1, 2015, the compensation structure for the Board of Trustees of each of PIMCO Equity Series and PIMCO Equity Series VIT was different.

10

Shareholder Communications with the Board of Trustees

The Board of Trustees has adopted procedures by which Shareholders may send communications to the Board. Shareholders may mail written communications to the Board to the attention of the Board, PIMCO Variable Insurance Trust c/o Fund Administration, 650 Newport Center Drive, Newport Beach, CA 92660. When writing to the Board, shareholders should identify themselves, the Portfolio or Portfolios they are writing about, the firm through which they purchased the Portfolio or Portfolios, the share class they own (if applicable), and the number of shares held by the shareholder.

The Trust’s Secretary shall either (i) provide a copy of each properly submitted shareholder communication to the Board at its next regularly scheduled Board meeting or (ii) if the Secretary determines that the communication requires more immediate attention, forward the communication to the Trustees promptly after receipt. The Secretary may, in good faith, determine that a shareholder communication should not be provided to the Board because it does not reasonably relate to the Trust or its operations, management, activities, policies, service providers, Board, officers, shareholders or other matters relating to an investment in a Portfolio or is otherwise routine or ministerial in nature.

These Procedures shall not apply to any communication from an officer or Trustee of a Portfolio or any communication from an employee or agent of the Portfolio, unless such communication is made solely in such employee’s or agent’s capacity as a shareholder, but shall apply to any shareholder proposal submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or any communication made in connection with such a proposal.

The Board of Trustees has designated management’s representative on the Board, if any, or any officer of the relevant Portfolio, as the full Board’s representative to attend meetings of the Portfolio’s shareholders and to otherwise make himself or herself available to shareholders for communications.

Leadership Structure and Risk Oversight Function

The Board is currently composed of five Trustees, three of whom are Independent Trustees. The Trustees meet regularly and periodically throughout the year to discuss and consider matters concerning the Trust and to oversee the Trust’s activities, including its investment performance, compliance program and risks associated with its activities. During the fiscal year ended December 31, 2014, there were six meetings of the Board.

11

The Board has established three standing committees to facilitate the Trustees’ oversight of the management of the Trust: an Audit Committee, a Valuation Committee and a Governance Committee. The scope of each Committee’s responsibilities is discussed in greater detail below. The Board may also establishad hoc committees from time to time. Brent R. Harris, a Managing Director and member of the Executive Committee of PIMCO, and therefore an “interested person” of the Trust, serves as Chairman of the Board. The Board does not have a lead Independent Trustee; however, the Chairs of the Audit Committee and Governance Committee, each of whom is an Independent Trustee, act as liaisons between the Independent Trustees and the Trust’s management between Board Meetings and, with management, are involved in the preparation of agendas for Board and Committee meetings. The Board believes that, as Chairman, Mr. Harris provides skilled executive leadership to the Trust and performs an essential liaison function between the Trust and PIMCO, its investment adviser. The Board believes that its governance structure allows all of the Independent Trustees to participate in the full range of the Board’s oversight responsibilities. The Board reviews its structure regularly as part of its annual self-evaluation. The Board has determined that its leadership structure is appropriate in light of the characteristics and circumstances of the Trust because it allocates areas of responsibility among the Committees and the Board in a manner that enhances effective oversight. The Board considered, among other things, the role of PIMCO in the day-to-day management of the Trust’s affairs; the extent to which the work of the Board is conducted through the Committees; the number of portfolios that comprise the Trust and other Trusts in the Fund Complex overseen by members of the Board; the variety of asset classes those portfolios include; the net assets of each Portfolio, the Trust and the Fund Complex; and the management, distribution and other service arrangements of each Portfolio, the Trust and the Fund Complex.

In its oversight role, the Board has adopted, and periodically reviews, policies and procedures designed to address risks associated with the Trust’s activities. In addition, PIMCO, PIMCO Investments and the Trust’s other service providers have adopted policies, processes and procedures to identify, assess and manage risks associated with the Trust’s activities. The Trust’s senior officers, including, but not limited to, the Chief Compliance Officer (“CCO”) and Treasurer, PIMCO portfolio management personnel and other senior personnel of PIMCO, the Trust’s independent registered public accounting firm (the “independent auditors”) and personnel from the Trust’s third-party service providers make periodic reports to the Board and its Committees with respect to a variety of matters, including matters relating to risk management.

12

Standing Committees of the Trust

Audit Committee. The Board has a standing Audit Committee that currently consists of all of the Independent Trustees (currently Messrs. Cannon, Hagan and Parker (Chair)). The Audit Committee’s responsibilities include, but are not limited to, (i) assisting the Board’s oversight of the integrity of the Trust’s financial statements, the Trust’s compliance with legal and regulatory requirements, the qualifications and independence of the Trust’s independent auditors, and the performance of such firm; (ii) overseeing the Trust’s accounting and financial reporting policies and practices, its internal controls and, as appropriate, the internal controls of certain service providers; (iii) overseeing the quality and objectivity of the Trust’s financial statements and the independent audit thereof; and (iv) acting as liaison between the Trust’s independent auditors and the full Board. The Audit Committee also reviews both the audit and non-audit work of the Trust’s independent auditors, submits a recommendation to the Board of Trustees as to the selection of an independent auditor, and reviews generally the maintenance of the Trust’s records and the safekeeping arrangement of the Trust’s custodian. During the fiscal year ended December 31, 2014, there were four meetings of the Audit Committee.

Valuation Committee. The Board has formed a Valuation Committee to which it has delegated responsibility for overseeing the implementation of the Trust’s valuation procedures and making fair value determinations for the Trust’s portfolio holdings on behalf of the Board. Actions by the Valuation Committee are reported to and/or presented for ratification by the full Board of Trustees at the next regularly scheduled meeting of the Trust’s Board of Trustees. The Valuation Committee currently consists of Messrs. Harris, Hodge, Peter G. Strelow and William G. Galipeau and Ms. Stacie D. Anctil. However, the members of this committee may be changed by the Board of Trustees from time to time. During the fiscal year ended December 31, 2014, there were 12 meetings of the Valuation Committee.

Governance Committee. The Board also has a Governance Committee, which is currently composed of all of the Trustees and which is responsible for the selection and nomination of candidates to serve as Trustees of the Trust. Only members of the Committee who are Independent Trustees (currently Messrs. Cannon, Hagan (Chair) and Parker) vote on the nomination of Independent Trustee candidates.

The Governance Committee requires that each prospective Trustee candidate have a college degree in addition to relevant business experience. In addition, it is the Board’s policy that Trustees may not serve simultaneously in a similar capacity on the board of a registered investment company that is not sponsored or advised by the Portfolios’ investment adviser or its affiliates. The

13

Committee may take into account a wide variety of factors in considering prospective Trustee candidates, including (but not limited to): (i) availability and strong and dedicated commitment of a candidate to attend all meetings and perform his or her Board responsibilities with diligence; (ii) relevant industry and related experience; (iii) educational background; (iv) finance and relevant financial expertise; (v) the candidate’s business abilities, demonstrated quality of judgment and developed expertise; and (vi) overall diversity of the Board’s composition. The Governance Committee takes diversity of a particular nominee and overall diversity of the Board into account when considering and evaluating nominees for Trustees. While the Governance Committee has not adopted a particular definition of diversity, when considering a nominee’s and the Board’s diversity, the Committee generally considers the manner in which each nominee’s professional experience, education, expertise in matters that are relevant to the oversight of the Portfolios (e.g., investment management, distribution, accounting, trading, compliance, legal), general leadership experience, and life experience are complementary and, as a whole, contribute to the ability of the Board to oversee the Portfolios.

The Governance Committee has a policy in place for considering Trustee candidates recommended by shareholders. The Governance Committee may consider potential Trustee candidates recommended by shareholders provided that the proposed candidates: (i) satisfy any minimum qualifications of the Trust for its Trustees and (ii) are not “interested persons” of the Trust or the investment adviser within the meaning of the 1940 Act. The Governance Committee will not consider submissions in which the Nominating Shareholder is the Trustee candidate.

Any shareholder (a “Nominating Shareholder”) submitting a proposed Trustee candidate must continuously own as of record, or beneficially through a financial intermediary, shares of the Trust having a net asset value of not less than $25,000 during the two-year period prior to submitting the proposed Trustee candidate. Each of the securities used for purposes of calculating this ownership must have been held continuously for at least two years as of the date of the nomination. In addition, such securities must continue to be held through the date of the special meeting of shareholders to elect Trustees.

All Trustee candidate submissions by Nominating Shareholders must be received by the Portfolio by the deadline for submission of any shareholder proposals which would be included in the Portfolio’s proxy statement for the next special meeting of shareholders of the Portfolio.

Nominating Shareholders must substantiate compliance with these requirements at the time of submitting their proposed Trustee nominee to the

14

attention of the Trust’s Secretary. Notice to the Trust’s Secretary should be provided in accordance with the deadline specified above and include, (i) the Nominating Shareholder’s contact information; (ii) the number of Portfolio shares that are owned of record and beneficially by the Nominating Shareholder and the length of time which such shares have been so owned by the Nominating Shareholder; (iii) a description of all arrangements and understandings between the Nominating Shareholder and any other person or persons (naming such person or persons) pursuant to which the submission is being made and a description of the relationship, if any, between the Nominating Shareholder and the Trustee candidate; (iv) the Trustee candidate’s contact information, age, date of birth and the number of Portfolio shares owned by the Trustee candidate; (v) all information regarding the Trustee candidate’s qualifications for service on the Board of Trustees as well as any information regarding the Trustee candidate that would be required to be disclosed in solicitations of proxies for elections of Trustees required by Regulation 14A of the Securities Exchange Act of 1934, as amended (the “1934 Act”) had the Trustee candidate been nominated by the Board; (vi) whether the Nominating Shareholder believes the Trustee candidate would or would not be an “interested person” of the Portfolio, as defined in the 1940 Act and a description of the basis for such belief; and (vii) a notarized letter executed by the Trustee candidate, stating his or her intention to serve as a nominee and be named in the Portfolio’s proxy statement, if nominated by the Board of Trustees, and to be named as a Trustee if so elected.

During the fiscal year ended December 31, 2014, there were seven meetings of the Governance Committee.

The Governance Committee charter is attached asExhibit C.

Trustee Retirement Policy

The Board has in place a retirement policy for all Trustees who are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the 1940 Act, that seeks to balance the benefits of the experience and institutional memory of existing Trustees against the need for fresh perspectives, and to enhance the overall the effectiveness of the Board. No later than the date of an Independent Trustee’s 75th birthday, he or she (the “Retiring Trustee”) shall resign from the Board effective as of the first Board meeting occurring after the Retiring Trustee’s 76th birthday. No Independent Trustee shall continue service as a Trustee beyond the first Board meeting occurring after his or her 76th birthday, provided that this policy may be waived or modified from time to time at the discretion of the Governance Committee. The continued appropriateness of the retirement policy is reviewed from time to time by the Governance Committee.

15

Required Vote

Approval of the Proposal requires the affirmative vote of a plurality of the Shares of the entire Trust voted in person or by proxy at the Meeting. With respect to the Proposal, votes to ABSTAIN will have no effect.

The Board of Trustees, including the Independent Trustees, recommends that shareholders vote “FOR” the Proposal.

ADDITIONAL INFORMATION

Expenses and Methods of Proxy Solicitation

The expense of preparation, printing and mailing of the enclosed proxy card and accompanying Notice of Meeting and Proxy Statement will be borne by PIMCO under the terms of the Trust’s Supervision and Administration Agreement, including the costs of retaining DF King & Co. Inc., an ASTOne Company, which are estimated to be approximately $40,000. PIMCO will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of Shares.

Shareholders may sign and mail the proxy card received with the proxy statement or attend the Meeting in person. Any proxy given by a shareholder is revocable. A shareholder may revoke the accompanying proxy at any time prior to its use by submitting a properly executed, subsequently dated proxy, giving written notice to the Secretary of the Trust at 650 Newport Center Drive, Newport Beach, California 92660, or by attending the Meeting and voting in person. However, attendance in person at the Meeting, by itself, will not revoke a previously tendered proxy.

The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy on or about March 12, 2015. In order to obtain the necessary quorum at the Meeting, supplementary solicitation may be made by mail, telephone or personal interview. Such solicitation may be conducted by, among others, officers and regular employees of PIMCO.

With respect to votes recorded by telephone or through the internet, the Trust will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

16

Quorum and Voting Requirements

One third of the outstanding shares of each Portfolio or Class, or one third of the outstanding shares of the Trust, entitled to vote in person or by proxy shall be a quorum for the transaction of business at a shareholders meeting with respect to such Portfolio or Class, or with respect to the entire Trust, respectively. For purposes of determining the presence of a quorum at the Meeting, abstentions will be treated as Shares that are present.

Insurance Companies that use shares of a series as funding media for their insurance products will vote shares of the Portfolio held by their separate accounts in accordance with the instructions received from the Variable Contract Owners. An Insurance Company also will vote shares of a series held in the separate account for which it has not received timely instructions in the same proportion as it votes shares held by that separate account for which it has received instructions. An Insurance Company whose separate account invests in a series will vote shares by its general account and its subsidiaries in the same proportion as other votes cast by its separate account in the aggregate. As a result, a small number of Variable Contract Owners could determine the outcome of the vote if other owners fail to vote.

Approval of the Proposal requires the affirmative vote of a plurality of the Shares of the entire Trust voted in person or by proxy at the Meeting. With respect to the Proposal, votes to ABSTAIN will have no effect.

Adjournment

Any meeting of shareholders may be adjourned from time to time by the vote of the majority of the total shares represented at that meeting, either in person or by proxy. Any adjourned session of a meeting of shareholders may be held within a reasonable time without further notice. In the event of such a proposed adjournment, the persons named as proxies will vote those proxies which they are entitled to vote FOR the proposal in favor of such an adjournment and will vote those proxies required to be voted AGAINST the proposal against any such adjournment. A shareholder vote may be taken prior to any adjournment of the Meeting on any proposal for which there is sufficient votes for approval, even though the Meeting is adjourned as to other proposals.

Beneficial Ownership

As of December 31, 2014, the persons owning of record or beneficially 5% or more of the Portfolios’ Shares are set forth inExhibit B.

17

Trustees and Officers of the Trust

The name, address, position and principal occupations during the past five years of the Trustees and principal executive officers of the Trust other than Mr. Hodge are listed inExhibit D.

Independent Registered Public Accounting Firm

Information related to the Portfolios’ Independent Registered Public Accounting Firm is set out inExhibit E.

Shareholder Proposals

The Trust does not hold regular shareholders’ meetings. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholders’ meeting should send their written proposals to the Secretary of the Trust at the address set forth on the cover of this proxy statement.

Proposals must be received a reasonable time prior to the date of a meeting of shareholders to be considered for inclusion in the proxy materials for a meeting. Timely submission of a proposal does not, however, necessarily mean that the proposal will be included. Persons named as proxies for any subsequent shareholders’ meeting will vote in their discretion with respect to proposals submitted on an untimely basis.

OTHER MATTERS

The proxy holders have no present intention of bringing before the Meeting for action any matters other than the Proposal referred to above, nor has the management of the Trust any such intention. Neither the proxy holders nor the management of the Trust is aware of any matters which may be presented by others. If any other business properly comes before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

18

Notice to Insurance Companies

Please advise the Trust whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the proxy statement and shareholder reports you wish to receive in order to supply copies to the variable contract owners of the respective shares.

|

| By Order of the Board of Trustees |

|

|

| Joshua D. Ratner, Secretary |

| February 19, 2015 |

Please complete, date and sign the enclosed proxy and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED if mailed in the United States.

Copies of the PIMCO Variable Insurance Trust Annual Report for the fiscal year ended December 31, 2013 and the PIMCO Variable Insurance Trust Semi-Annual Report for the period ended June 30, 2014 are available without charge upon request by writing the Trust at 650 Newport Center Drive, Newport Beach, California 92660 or telephoning it at (888) 877-4626.

19

EXHIBIT A

As of December 31, 2014, the total number of shares outstanding for each Portfolio and for each class of each Portfolio is set forth in the table below:

| | | | | | | | | | |

PORTFOLIO NAME | | CLASS | | Shares Outstanding | | | Total Shares

Outstanding for

the Portfolio | |

| All Asset All Authority Portfolio | | Administrative | | | 813,424.128 | | | | 1,275,906.541 | |

| | Advisor | | | 397,877.543 | | | | | |

| | Institutional | | | 64,604.870 | | | | | |

| | | |

| All Asset Portfolio | | Administrative | | | 69,751,973.127 | | | | 110,285,847.451 | |

| | Advisor | | | 31,429,028.559 | | | | | |

| | Institutional | | | 905,319.674 | | | | | |

| | M | | | 8,199,526.091 | | | | | |

| | | |

| CommodityRealReturn® Strategy Portfolio | | Administrative | | | 61,954,092.426 | | | | 87,769,439.184 | |

| | Advisor | | | 25,349,178.180 | | | | | |

| | Institutional | | | 461,357.807 | | | | | |

| | M | | | 4,810.771 | | | | | |

| | | |

| Emerging Markets Bond Portfolio | | Administrative | | | 18,716,167.332 | | | | 22,255,596.280 | |

| | Advisor | | | 3,047,902.110 | | | | | |

| | Institutional | | | 489,430.016 | | | | | |

| | M | | | 2,096.822 | | | | | |

| | | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Administrative | | | 8,172,351.325 | | | | 14,573,067.259 | |

| | Advisor | | | 6,320,553.761 | | | | | |

| | Institutional | | | 80,162.173 | | | | | |

| | | |

| Foreign Bond Portfolio (Unhedged) | | Administrative | | | 985,029.614 | | | | 3,697,854.210 | |

| | Advisor | | | 2,711,903.757 | | | | | |

| | Institutional | | | 920.839 | | | | | |

| | | |

| Global Advantage® Strategy Bond Portfolio | | Administrative | | | 23,199,297.996 | | | | 23,199,297.996 | |

| | | |

| Global Bond Portfolio (Unhedged) | | Administrative | | | 21,508,686.208 | | | | 25,228,891.016 | |

| | Advisor | | | 3,155,743.250 | | | | | |

| | Institutional | | | 564,461.558 | | | | | |

| | | |

Global Diversified | | Administrative | | | 38,191,779.208 | | | | 42,208,341.255 | |

Allocation Portfolio | | Advisor | | | 4,016,562.047 | | | | | |

A-1

| | | | | | | | | | |

PORTFOLIO NAME | | CLASS | | Shares Outstanding | | | Total Shares

Outstanding for

the Portfolio | |

| Global Multi-Asset Managed Allocation Portfolio | | Administrative | | | 21,454,450.227 | | | | 99,133,874.101 | |

| | Advisor | | | 77,501,981.642 | | | | | |

| | Institutional | | | 177,442.232 | | | | | |

| | | |

| Global Multi-Asset Managed Volatility Portfolio | | Administrative | | | 9,560,652.419 | | | | 9,595,046.092 | |

| | Advisor | | | 34,393.673 | | | | | |

| | | |

High Yield Portfolio | | Administrative | | | 142,766,005.107 | | | | 145,741,152.939 | |

| | Advisor | | | 2,373,006.326 | | | | | |

| | Institutional | | | 602,141.506 | | | | | |

| | | |

| Long-Term U.S. Government Portfolio | | Administrative | | | 13,829,084.003 | | | | 15,796,563.247 | |

| | Advisor | | | 1,275,702.915 | | | | | |

| | Institutional | | | 691,776.329 | | | | | |

| | | |

Low Duration Portfolio | | Administrative | | | 139,651,556.021 | | | | 202,085,827.205 | |

| | Advisor | | | 61,152,398.189 | | | | | |

| | Institutional | | | 1,281,872.995 | | | | | |

| | | |

Money Market Portfolio | | Administrative | | | 19,234,518.740 | | | | 35,594,739.670 | |

| | Institutional | | | 16,360,220.930 | | | | | |

| | | |

Real Return Portfolio | | Administrative | | | 186,152,193.007 | | | | 236,422,036.184 | |

| | Advisor | | | 37,647,556.137 | | | | | |

| | Institutional | | | 12,622,287.040 | | | | | |

| | | |

Short-Term Portfolio | | Administrative | | | 10,559,364.518 | | | | 22,073,671.735 | |

| | Advisor | | | 10,894,537.231 | | | | | |

| | Institutional | | | 619,769.986 | | | | | |

| | | |

Total Return Portfolio | | Administrative | | | 557,663,299.814 | | | | 794,134,065.588 | |

| | Advisor | | | 217,316,414.456 | | | | | |

| | Institutional | | | 19,154,351.318 | | | | | |

| | | |

| Unconstrained Bond Portfolio | | Administrative | | | 27,555,171.969 | | | | 28,032,796.541 | |

| | Advisor | | | 440,488.696 | | | | | |

| | Institutional | | | 35,726.332 | | | | | |

| | M | | | 1,409.544 | | | | | |

A-2

EXHIBIT B

As of December 31, 2014, the following persons owned of record or beneficially 5% or more of the shares of a class of the Portfolios:

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| All Asset All Authority Portfolio | | Administrative** | | PIMCO LLC, 1633 Broadway New York, NY 10019 | | | 313,649.68 | * | | | 38.56 | % |

| | | | |

| All Asset All Authority Portfolio | | Administrative** | | Jefferson National Life Insurance Co., Attn Separate Accounts 10350 Ormsby Park Pl Ste 600 Louisville, KY 40223-6175 | | | 499,774.45 | * | | | 61.44 | % |

| | | | |

| All Asset All Authority Portfolio | | Advisor** | | Lincoln National Life Insurance Company 1300 S Clinton St Fort Wayne IN 46802-3506 | | | 82,602.83 | | | | 20.76 | % |

| | | | |

| All Asset All Authority Portfolio | | Advisor** | | Seperate Account A of Pacific Life Insurance Company 700 Newport Center Dr, Newport Beach CA 92660-6397 | | | 282,549.14 | * | | | 71.01 | % |

| | | | |

| All Asset All Authority Portfolio | | Advisor** | | Pacific Select Variable Annuity Seperate Account of Pacific Life Insurance Company 700 Newport Center Dr Newport Beach CA 92660-6397 | | | 21,395.85 | | | | 5.38 | % |

| | | | |

| All Asset All Authority Portfolio | | Institutional** | | Jefferson National Life Insurance Co. Attn Separate Accounts 10350 Ormsby Park Pl Ste 600 Louisville KY 40223-6175 | | | 53,876.77 | * | | | 83.39 | % |

| | | | |

| All Asset All Authority Portfolio | | Institutional** | | Lincoln National Life Insurance Company 1300 S Clinton St Fort Wayne IN 46802-3506 | | | 10,728.10 | | | | 16.61 | % |

B-1

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| All Asset Portfolio | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr Minneapolis MN 55416-1297 | | | 50,338,100.03 | * | | | 72.17 | % |

| | | | |

| All Asset Portfolio | | Administrative** | | Allianz Life of New York 5701 Golden Hills Dr Minneapolis MN 55416-1297 | | | 3,626,313.69 | | | | 5.20 | % |

| | | | |

| All Asset Portfolio | | Advisor** | | Delaware Life Insurance Company Variable Acct F Attn Accounting Control PO Box 9134 Wellesley Hls MA 02481-9134 | | | 2,263,624.56 | | | | 7.20 | % |

| | | | |

| All Asset Portfolio | | Advisor** | | IDS Life Insurance Company Attn Managed Assets Investment Accounting 10468 Ameriprise Financial Center Minneapolis MN55474-0001 | | | 18,474,774.80 | * | | | 58.78 | % |

| | | | |

| All Asset Portfolio | | Advisor** | | Nationwide Life Insurance Company NWVAII c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 4,772,847.09 | | | | 15.19 | % |

| | | | |

| All Asset Portfolio | | Institutional** | | Transamerica Life Insurance Company EM Private Placement 4333 Edgewood Rd NE Cedar Rapids, IA 52499-0001 | | | 134,013.62 | | | | 14.80 | % |

| | | | |

| All Asset Portfolio | | Institutional** | | Symetra Financial Inc Attn Life Finance Sep Accts 777 108th Ave NE Ste 1200 Bellevue WA 98004-5135 | | | 50,317.94 | | | | 5.56 | % |

B-2

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| All Asset Portfolio | | Institutional** | | TIAA-CREF Life Separate Account, VLI-X of TIAA-CREF Life Insurance Company 730 Third Ave New York NY 10017-3206 | | | 86,490.90 | | | | 9.55 | % |

| | | | |

| All Asset Portfolio | | Institutional** | | TIAA-CREF Life Separate Account, VA-X of TIAA-CREF Life Insurance Company Attn Marjorie Pierre-Merritt SEC 730 3rd Ave MSC 14/41 New York NY 10017-3206 | | | 456,033.42 | * | | | 50.37 | % |

| | | | |

| All Asset Portfolio | | Institutional** | | Symetra Life Insurance Company 5801 SW Sixth Ave Topeka KS 66636-1001 | | | 166,338.10 | | | | 18.37 | % |

| | | | |

| All Asset Portfolio | | M** | | John Hancock Life Insurance Co-New York Attn Neil Cronin 601 Congress St Fl 10 Boston MA 02210-2806 | | | 474,952.35 | | | | 5.79 | % |

| | | | |

| All Asset Portfolio | | M** | | John Hancock Life Ins Co USA Annuities Division Attn Neil Cronin 601 Congress St Fl 10 Boston MA 02210-2806 | | | 2,009,586.38 | | | | 24.51 | % |

| | | | |

| All Asset Portfolio | | M** | | John Hancock Distributors USA Attn Neil Cronin 601 Congress St Fl 10 Boston MA 02210-2806 | | | 2,765,188.22 | * | | | 33.72 | % |

| | | | |

| All Asset Portfolio | | M** | | John Hancock Life Insurance Attn Neil Cronin 601 Congress St Fl 10 Boston MA 02210-2806 | | | 2,613,555.43 | * | | | 31.87 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr Minneapolis MN 55416-1297 | | | 17,518,502.03 | * | | | 28.28 | % |

B-3

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

Commodity

RealReturn® Portfolio | | Administrative** | | Delaware Life Insurance Company Variable Acct F Attn Accounting Control PO Box 9134 Wellesley Hls MA 02481-9134 | | | 9,456,602.88 | | | | 15.26 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Administrative** | | Ohio National Life Insurance Company for the Benefit of its Separate Accounts Attn Dennis Taney PO Box 237 Cincinnati OH 45201-0237 | | | 6,757,751.79 | | | | 10.91 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Administrative** | | Lincoln National Life Insurance Company 1300 S Clinton St Fort Wayne IN 46802-3506 | | | 6,004,690.50 | | | | 9.69 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Advisor** | | Massachusetts Mutual Insurance Company Attn RS Funds Operations MIP C105 1295 State St Springfield MA 01111-0001 | | | 2,798,881.86 | | | | 11.04 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Advisor** | | CUNA Mutual Variable Annuity Acct Attn B&C-Vicki Foelske 2000 Heritage Way Waverly IA 50677-9208 | | | 2,245,168.06 | | | | 8.86 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Advisor** | | Lincoln National Life Insurance Company 1300 S Clinton St Fort Wayne IN 46802-3506 | | | 2,310,643.57 | | | | 9.12 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Advisor** | | AXA Equitable Life Insurance Company SA — FP 525 Washington Blvd Fl 35 Jersey City NJ 07310-1606 | | | 1,829,843.30 | | | | 7.22 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Advisor** | | AXA Equitable Life Insurance Company — Separate Account XX 1290 Avenue Of The Americas — FMG New York NY 10019 | | | 3,866,731.31 | | | | 15.25 | % |

B-4

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

Commodity

RealReturn® Portfolio | | Advisor** | | PHL Variable Insurance Company 15 Tech Valley Drive Ste 201 East GreenbushNY 12061-4137 | | | 4,981,802.27 | | | | 19.65 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Institutional** | | Hartford Life Ins Co Separate Account PO Box 2999 Hartford CT 06104-2999 | | | 80,013.13 | | | | 17.34 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Institutional** | | Symetra Financial Inc Attn Life Finance Sep Accts 777 108th Ave NE Ste 1200 Bellevue WA 98004-5135 | | | 89,159.70 | | | | 19.33 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Institutional** | | TIAA-CREF Life Separate Account, VA-X of TIAA-CREF Life Insurance Company Attn Marjorie Pierre-Merritt SEC 730 3rd Ave MSC 14/41 New York NY 10017-3206 | | | 221,428.20 | * | | | 47.99 | % |

| | | | |

Commodity

RealReturn® Portfolio | | Institutional** | | Symetra Life Insurance Company 5801 SW Sixth Ave Topeka KS 66636-1001 | | | 26,878.10 | | | | 5.83 | % |

| | | | |

Commodity

RealReturn® Portfolio | | M** | | Metropolitan Life Insurance Company c/o Separate Account Attn: Bonnie Harris B1-08 13045 Tesson Ferry Rd Saint Louis MO 63128-3499 | | | 306.34 | | | | 6.37 | % |

| | | | |

Commodity

RealReturn® Portfolio | | M** | | PIMCO LLC 1633 Broadway New York, NY 10019 | | | 1,792.07 | * | | | 37.25 | % |

| | | | |

Commodity

RealReturn® Portfolio | | M** | | Metlife Insurance Co of Connecticut Attn Shareholders Acct Dept PO Box 990027 Hartford CT 06199-0027 | | | 2,712.36 | * | | | 56.38 | % |

B-5

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Emerging Markets Bond Portfolio | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr Minneapolis MN 55416-1297 | | | 12,942,273.30 | * | | | 68.81 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Administrative** | | Allianz Life of New York 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 1,021,750.69 | | | | 5.43 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Administrative** | | Delaware Life Insurance Company Variable Acct F Attn Accounting Control PO Box 9134 Wellesley HlsMA 02481-9134 | | | 2,819,285.91 | | | | 14.99 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Administrative** | | Jefferson National Life Insurance Co. Attn Separate Accounts 10350 Ormsby Park Pl Ste 600 Louisville KY 40223-6175 | | | 1,082,496.44 | | | | 5.76 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Advisor** | | Security Benefit Life Insurance Co FBO Unbundled c/o Variable Annuity Dept 1 SW Security Benefit Pl Topeka KS 66636-1000 | | | 380,923.11 | | | | 12.44 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Advisor** | | Nationwide Life Insurance Company NWVAII c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 377,593.20 | | | | 12.33 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Advisor** | | Nationwide Life Insurance Company NWVAX c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 338,846.08 | | | | 11.06 | % |

B-6

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Emerging Markets Bond Portfolio | | Advisor** | | AXA Equitable Life Insurance Company — Separate Account XX 1290 Avenue Of The Americas — FMG New York NY 10019 | | | 1,543,877.59 | * | | | 50.41 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Institutional** | | TIAA-CREF Life Separate Account, VA-X of TIAA-CREF Life Insurance Company Attn Marjorie Pierre-Merritt SEC 730 3rd Ave MSC 14/41 New York NY 10017-3206 | | | 448,063.72 | * | | | 91.11 | % |

| | | | |

| Emerging Markets Bond Portfolio | | Institutional** | | Symetra Life Insurance Company 5801 SW Sixth Ave Topeka KS 66636-1001 | | | 26,891.05 | | | | 5.47 | % |

| | | | |

| Emerging Markets Bond Portfolio | | M** | | Metropolitan Life Insurance Company c/o Separate Account Attn: Bonnie Harris B1-08 13045 Tesson Ferry Rd Saint Louis MO 63128-3499 | | | 150.82 | | | | 7.17 | % |

| | | | |

| Emerging Markets Bond Portfolio | | M** | | PIMCO LLC 1633 Broadway New York, NY 10019 | | | 753.95 | * | | | 35.85 | % |

| | | | |

| Emerging Markets Bond Portfolio | | M** | | Metlife Insurance Co of Connecticut Attn Shareholders Acct Dept PO Box 990027 Hartford CT 06199-0027 | | | 1,198.59 | * | | | 56.98 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Administrative** | | Jefferson National Life Insurance Co. Attn Separate Accounts 10350 Ormsby Park Pl Ste 600 Louisville KY 40223-6175 | | | 509,065.12 | * | | | 51.59 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Administrative** | | Nationwide Life Insurance Company NWVLIX Attn IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 130,480.83 | | | | 13.22 | % |

B-7

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Foreign Bond Portfolio (Unhedged) | | Administrative** | | Nationwide Life Insurance Company NWPP Attn IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 65,762.22 | | | | 6.67 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Administrative** | | Nationwide Life & Annuity, Insurance CompanyNWVL-G c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 87,151.16 | | | | 8.83 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Administrative** | | Nationwide Life Insurance Company NWVLIX c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 77,368.90 | | | | 7.84 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Advisor** | | Nationwide Life Insurance Company NWVAX c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 388,798.04 | | | | 14.31 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Advisor** | | Nationwide Life Insurance Company NWVAII c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 2,102,694.59 | * | | | 77.41 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Advisor** | | Nationwide Life Insurance Company, NWVAX c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 195,765.54 | | | | 7.21 | % |

| | | | |

| Foreign Bond Portfolio (Unhedged) | | Institutional** | | PIMCO LLC 1633 Broadway New York, NY 10019 | | | 922.51 | * | | | 100.00 | % |

| | | | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Advisor** | | New York Life Insurance and Annuity Corporation 51 Madison Ave Bsmt 1B New York NY 10010-1655 | | | 6,333,868.14 | * | | | 100.00 | % |

B-8

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Administrative** | | Lincoln Benefit Life Allstate Financial Attn Product Valuation One Security Benefit Place Topeka KS 66636-1000 | | | 1,039,050.41 | | | | 12.69 | % |

| | | | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Administrative** | | Security Benefit Life Insurance Co SBL Advance Designs c/o Variable Annuity Dept 1 SW Security Benefit Pl Topeka KS 66636-1000 | | | 409,718.33 | | | | 5.00 | % |

| | | | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Administrative** | | Jefferson National Life Insurance Co. Attn Separate Accounts 10350 Ormsby Park Pl Ste 600 Louisville KY 40223-6175 | | | 2,584,077.42 | * | | | 31.55 | % |

| | | | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Administrative** | | Security Benefit Life Insurance Co FBO Unbundled c/o Variable Annuity Dept 1 SW Security Benefit Pl Topeka KS 66636-1000 | | | 1,725,611.76 | | | | 21.07 | % |

| | | | |

| Foreign Bond Portfolio (U.S. Dollar-Hedged) | | Institutional** | | New York Life Insurance And Annuity Corporation 51 Madison Ave Bsmt 1B New York NY 10010-1655 | | | 77,124.19 | * | | | 95.99 | % |

| | | | |

| Global Advantage® Strategy Portfolio | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 8,959,143.25 | * | | | 38.55 | % |

| | | | |

| Global Advantage® Strategy Portfolio | | Administrative** | | USAZ Fusion Moderate Fund Attn Kyle Smith 3435 Stelzer Rd Columbus OH 43219-6004 | | | 8,333,273.26 | * | | | 35.85 | % |

| | | | |

| Global Advantage® Strategy Portfolio | | Administrative** | | USAZ Fusion Growth Fund Attn Kyle Smith 3435 Stelzer Rd Columbus OH 43219-6004 | | | 2,593,357.12 | | | | 11.16 | % |

B-9

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Global Advantage® Strategy Portfolio | | Administrative** | | USAZ Fusion Balanced Fund Attn Kyle Smith 3435 Stelzer Rd Columbus OH 43219-6004 | | | 1,307,697.84 | | | | 5.63 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 8,341,561.19 | * | | | 38.71 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Administrative** | | Ohio National Life Insurance Company for the Benefit of its Separate Accounts Attn Dennis Taney PO Box 237 Cincinnati OH 45201-0237 | | | 10,064,689.32 | * | | | 46.70 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Administrative** | | New York Life Insurance And Annuity Corporation 51 Madison Ave Bsmt 1B New York NY 10010-1655 | | | 1,124,010.90 | | | | 5.22 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Advisor** | | CUNA Mutual Variable Annuity Acct Attn B&C-Vicki Foelske 2000 Heritage Way Waverly IA 50677-9208 | | | 2,548,305.59 | * | | | 80.60 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Advisor** | | Nationwide Life Insurance Company, NWVAX c/o IPO Portfolio Accounting PO Box 182029 Columbus OH 43218-2029 | | | 538,749.91 | | | | 17.04 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Institutional** | | Transamerica Life Insurance Company EM Private Placement 4333 Edgewood Rd NE Cedar RapidsIA 52499-0001 | | | 32,110.22 | | | | 5.68 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Institutional** | | TIAA-CREF Life Separate Account VLI-X of TIAA-CREF Life Insurance Company 730 Third Ave New York NY 10017-3206 | | | 59,393.73 | | | | 10.50 | % |

B-10

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Global Bond Portfolio (Unhedged) | | Institutional** | | TIAA-CREF Life Separate Account VA-X of TIAA-CREF Life Insurance Company Attn Marjorie Pierre-Merritt SEC 730 3rd Ave MSC 14/41 New York NY 10017-3206 | | | 411,963.04 | * | | | 72.83 | % |

| | | | |

| Global Bond Portfolio (Unhedged) | | Institutional** | | JPMorgan Chase Bank Cust FBO M Intelligent Var Univ Life TIAA-CREF Sep A/C VLI-X of TIAA-CREF Life Ins Company 4 New York Plaza

12th Floor New York NY 10004-2413 | | | 38,569.49 | | | | 6.82 | % |

| | | | |

| Global Diversified Allocation Portfolio | | Administrative** | | Ohio National Life Insurance, Company for the Benefit of its Separate Accounts Attn Dennis Taney PO Box 237 Cincinnati OH 45201-0237 | | | 36,520,822.40 | * | | | 95.62 | % |

| | | | |

| Global Diversified Allocation Portfolio | | Advisor** | | Minnesota Life Insurance Company 401 Robert St N Saint Paul MN 55101-2005 | | | 3,874,943.66 | * | | | 96.47 | % |

| | | | |

| Global Multi-Asset Managed Allocation Portfolio | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 19,356,449.50 | * | | | 90.22 | % |

| | | | |

| Global Multi-Asset Managed Allocation Portfolio | | Administrative** | | Allianz Life of New York 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 2,007,224.58 | | | | 9.36 | % |

| | | | |

| Global Multi-Asset Managed Allocation Portfolio | | Advisor** | | Delaware Life Insurance Company Variable Acct F Attn Accounting Control PO Box 9134 Wellesley HlsMA 02481-9134 | | | 54,903,300.48 | * | | | 70.84 | % |

B-11

| | | | | | | | | | | | |

PORTFOLIO

NAME | | CLASS | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | | PERCENTAGE

OF

OUTSTANDING

SHARES OF

CLASS OWNED | |

| Global Multi-Asset Managed Allocation Portfolio | | Advisor** | | Delaware Life Insurance Company of New York Variable Acct C Attn Accounting Control PO Box 9134 Wellesley HlsMA 02481-9134 | | | 6,180,543.82 | | | | 7.97 | % |

| | | | |

| Global Multi-Asset Managed Allocation Portfolio | | Advisor** | | Seperate Account A of Pacific Life Insurance Company 700 Newport Center Dr Newport BeachCA 92660-6397 | | | 14,082,143.10 | | | | 18.17 | % |

| | | | |

| Global Multi-Asset Managed Allocation Portfolio | | Institutional** | | Hartford Life Ins Co Separate Account PO Box 2999 Hartford CT 06104-2999 | | | 131,602.16 | * | | | 74.17 | % |

| | | | |

| Global Multi-Asset Managed Allocation Portfolio | | Institutional** | | Symetra Financial Inc Attn Life Finance Sep Accts 777 108th Ave NE Ste 1200 Bellevue WA 98004-5135 | | | 45,840.07 | * | | | 25.83 | % |

| | | | |

| Global Multi-Asset Managed Volatility Portfolio | | Administrative** | | Allianz Life Ins Co of N America Attn Financial Products Financial 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 8,411,653.82 | * | | | 87.98 | % |

| | | | |

| Global Multi-Asset Managed Volatility Portfolio | | Administrative** | | Allianz Life of New York 5701 Golden Hills Dr MinneapolisMN 55416-1297 | | | 1,148,998.60 | | | | 12.02 | % |

| | | | |