Fresh Del Monte Produce Inc. Investor Relations February 2014

This presentation contains certain forward-looking statements regarding the intent, beliefs or current expectations of the Company or its officers with respect to the Company’s plans and future performance. These forward-looking statements are based on information currently available to the Company and the Company assumes no obligation to update these statements. It is important to note that these forward-looking statements are not guarantees of future performance and involve risks and uncertainties. In this press release, these statements appear in a number of places and include statements regarding the intent, belief or current expectations of the Company or its officers (including statements preceded by, followed by or that include the words “believes,” “expects,” “anticipates” or similar expressions). The Company’s plans and performance may differ materially from those in the forward-looking statements as a result of various factors, including (i) the uncertain global economic environment and the timing and strength of a recovery in the markets the Company serves, and the extent to which adverse economic conditions continue to affect its sales volume and results, including the Company’s ability to command premium prices for certain of its principal products, or increase competitive pressures within the industry, (ii) the impact of governmental initiatives in the United States and abroad to spur economic activity, including the effects of significant government monetary or other market interventions on inflation, price controls and foreign exchange rates, (iii) the impact of governmental trade restrictions, including adverse governmental regulation that may impact the Company’s ability to access certain markets, (iv) the Company’s anticipated cash needs in light of its liquidity, (v) the continued ability of the Company’s distributors and suppliers to have access to sufficient liquidity to fund their operations, (vi) trends and other factors affecting the Company’s financial condition or results of operations from period to period, including changes in product mix or consumer demand for branded products such as its, particularly as consumers remain price-conscious in the current economic environment; anticipated price and expense levels; the impact of crop disease, severe weather conditions, such as flooding, or natural disasters, such as earthquakes, on crop quality and yields and on its ability to grow, procure or export its products; the impact of prices for petroleum-based products and packaging materials; and the availability of sufficient labor during peak growing and harvesting seasons, (vii) the impact of pricing and other actions by the Company’s competitors, particularly during periods of low consumer confidence and spending levels, (viii) the impact of foreign currency fluctuations, (ix) the Company’s plans for expansion of its business (including through acquisitions) and cost savings, (x) the Company’s ability to successfully integrate acquisitions into its operations, (xi) the impact of impairment or other charges associated with exit activities, crop or facility damage or otherwise, (xii) the timing and cost of resolution of pending and future legal and environmental proceedings or investigations, (xiii) the impact of changes in tax accounting or tax laws (or interpretations thereof), and the impact of settlements of adjustments proposed by the Internal Revenue Service or other taxing authorities in connection with the Company’s tax audits, and (xiv) the cost and other implications of changes in regulations applicable to its business, including potential legislative or regulatory initiatives in the United States or elsewhere directed at mitigating the effects of climate change. All forward-looking statements in this report are based on information available to the Company on the date hereof, and the Company assumes no obligation to update any such forward-looking statements. The Company’s plans and performance may also be affected by the factors described in Item 1A. – “Risk Factors” in Fresh Del Monte Produce Inc.’s Annual Report on Form 10-K for the year ended December 27, 2013 along with other reports that the Company has on file with the Securities and Exchange Commission. Forward Looking Statement 2

Agenda 3 Fresh Del Monte at a Glance Strengths We Are Building On Growth Strategy Selected Financial Highlights

One of the world’s leading vertically-integrated producers, distributors and marketers of fresh and fresh-cut fruit and vegetables as well as a leading producer and distributor of prepared fruit and vegetables, juices, beverages, snacks and desserts in Europe, Africa, the Middle East and countries formerly part of the Soviet Union. Fresh Del Monte at a Glance South America Sourcing • Avocados • Non-tropicals Asia • Bananas • Pineapples • Fresh-cut fruit • Non-tropicals Colombia, Ecuador, Central America & Brazil Sourcing • Bananas • Pineapples • Melons • Mangos • Plantains •IQF •Coconuts • Greenhouse: Tomatoes, Bell Peppers, Cucumbers and Other Vegetables North America • Fresh & Fresh-cut fruit and vegetables • Prepared Food Africa Sourcing • Bananas • Pineapples • Prepared Food Europe • Fresh & Fresh-cut fruit and vegetables • Prepared Food Middle East & North Africa • Fresh & Fresh-cut fruit and vegetables • Prepared Food • Poultry & Meat 4

5 Brand established 1892 Fresh business separated from canned in 1989 Del Monte Fresh Produce acquired by current management in 1996; IPO 1997 NYSE Introduced the first new pineapple variety in more than 15 years in 1996; the Del Monte Gold® Extra Sweet Pineapple In 1999, expanded “value-added” to include fresh-cut fruit and vegetables Acquired Del Monte Foods Europe in 2004 In 2008, acquired Caribana, substantially increasing Del Monte® branded banana and DM Gold pineapple production in Costa Rica Acquired tomato agricultural production land in Florida and Virginia in 2013 In 2013 and 2014, acquired additional production land in Costa Rica and Nicaragua and expanded Philippine banana production Fresh Del Monte at a Glance

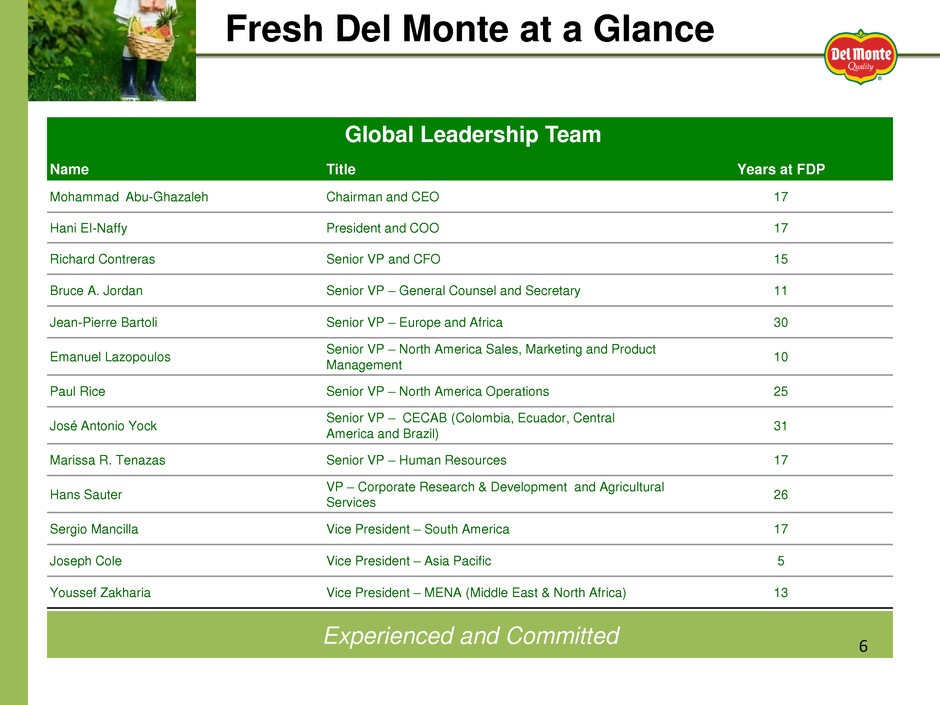

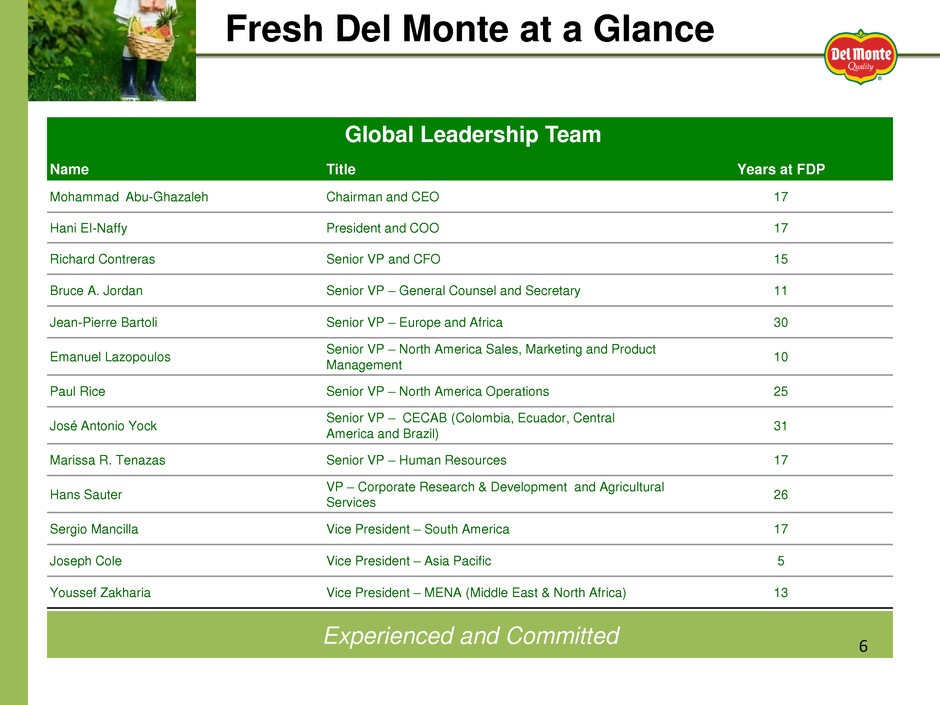

Global Leadership Team Name Title Years at FDP Mohammad Abu-Ghazaleh Chairman and CEO 17 Hani EI-Naffy President and COO 17 Richard Contreras Senior VP and CFO 15 Bruce A. Jordan Senior VP – General Counsel and Secretary 11 Jean-Pierre Bartoli Senior VP – Europe and Africa 30 Emanuel Lazopoulos Senior VP – North America Sales, Marketing and Product Management 10 Paul Rice Senior VP – North America Operations 25 José Antonio Yock Senior VP – CECAB (Colombia, Ecuador, Central America and Brazil) 31 Marissa R. Tenazas Senior VP – Human Resources 17 Hans Sauter VP – Corporate Research & Development and Agricultural Services 26 Sergio Mancilla Vice President – South America 17 Joseph Cole Vice President – Asia Pacific 5 Youssef Zakharia Vice President – MENA (Middle East & North Africa) 13 Experienced and Committed Fresh Del Monte at a Glance 6

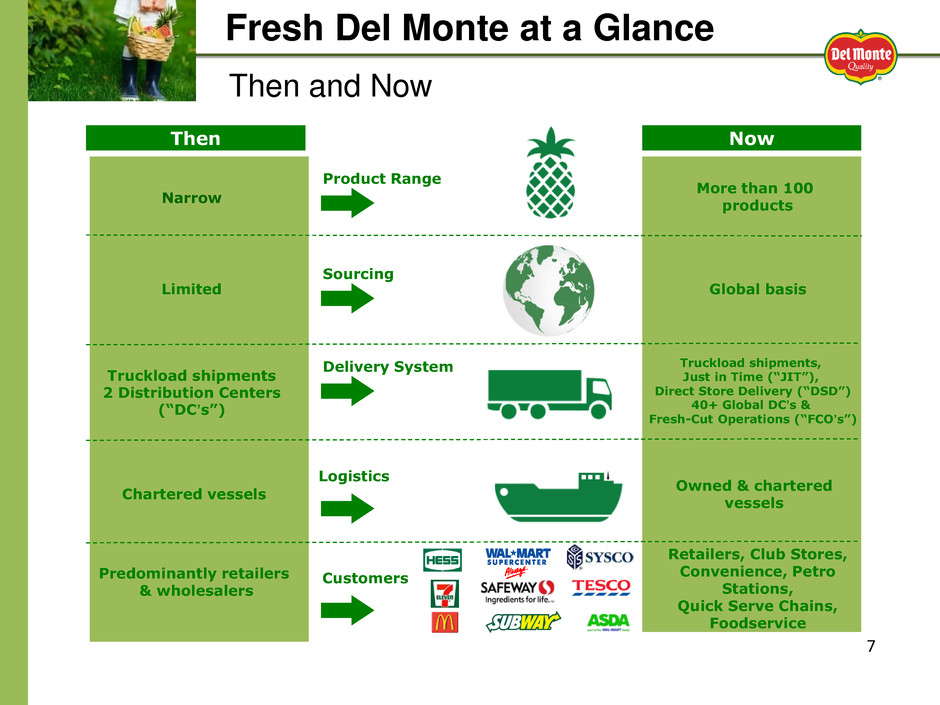

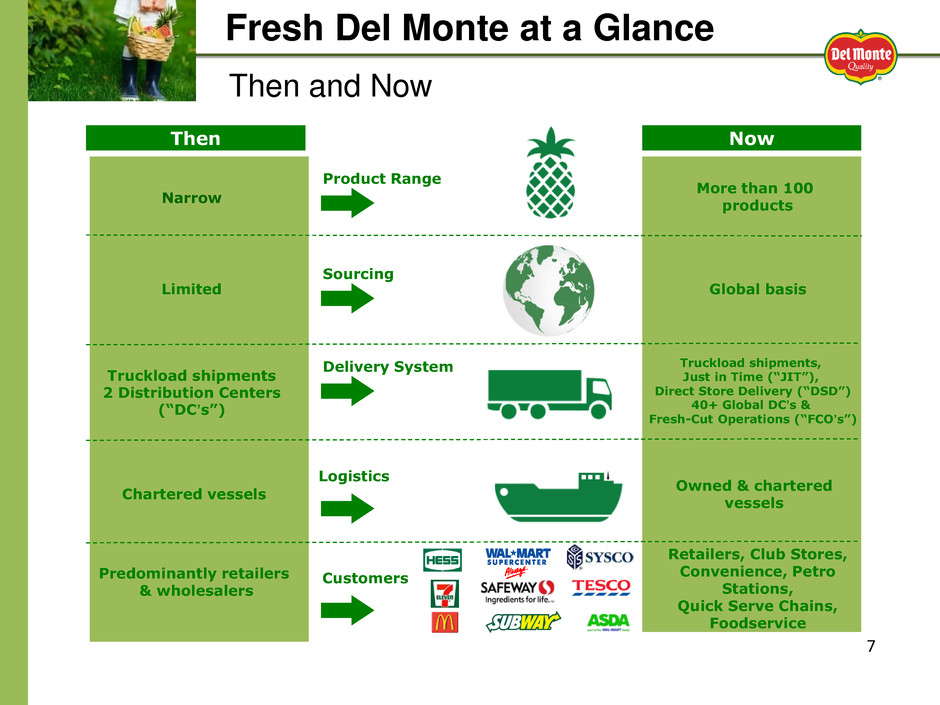

Then and Now 7 Then Now Delivery System Truckload shipments 2 Distribution Centers (“DC’s”) Truckload shipments, Just in Time (“JIT”), Direct Store Delivery (“DSD”) 40+ Global DC’s & Fresh-Cut Operations (“FCO’s”) Sourcing Limited Global basis Narrow More than 100 products Logistics Chartered vessels Owned & chartered vessels Customers Predominantly retailers & wholesalers Retailers, Club Stores, Convenience, Petro Stations, Quick Serve Chains, Foodservice Fresh Del Monte at a Glance Product Range

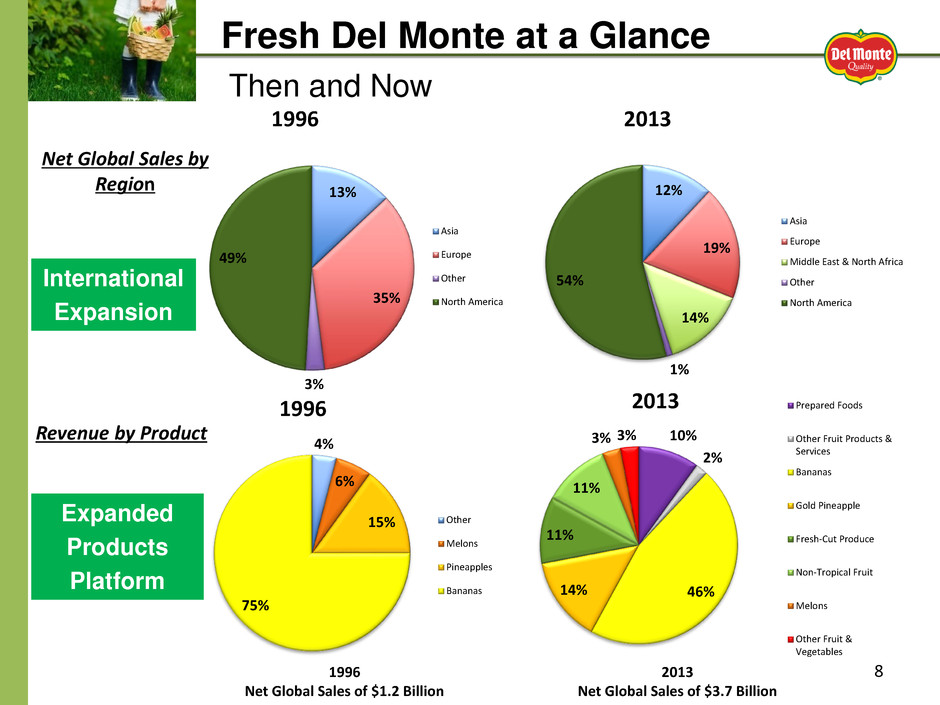

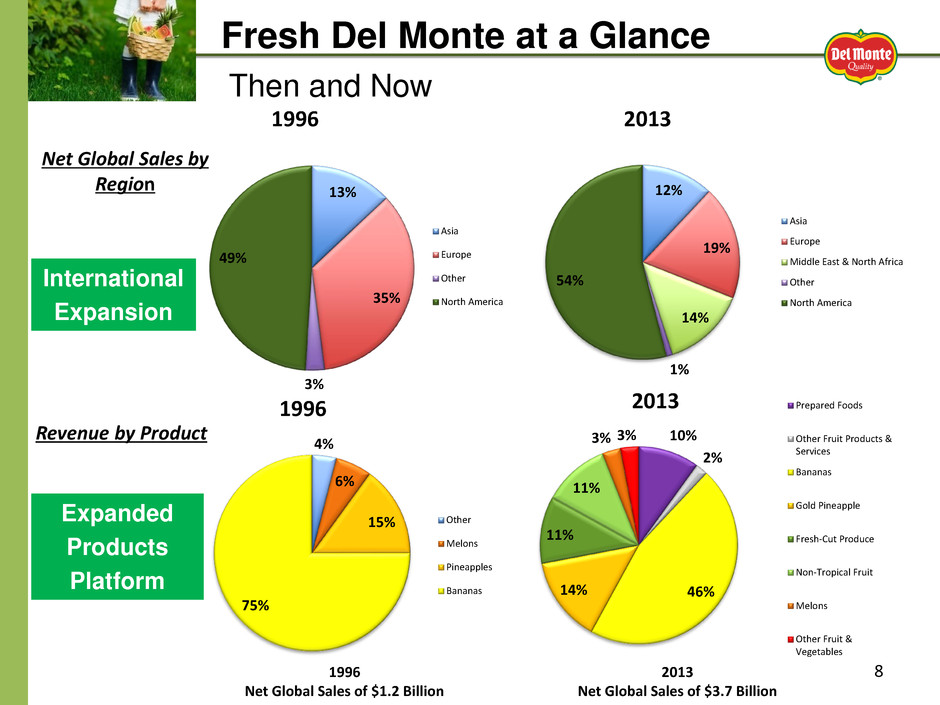

8 Net Global Sales by Region 1996 Net Global Sales of $1.2 Billion 2013 Net Global Sales of $3.7 Billion Revenue by Product Fresh Del Monte at a Glance International Expansion Expanded Products Platform 13% 35% 3% 49% 1996 Asia Europe Other North America 4% 6% 15% 75% 1996 Other Melons Pineapples Bananas 12% 19% 14% 1% 54% 2013 Asia Europe Middle East & North Africa Other North America 10% 2% 46% 14% 11% 11% 3% 3% 2013 Prepared Foods Other Fruit Products & Services Bananas Gold Pineapple Fresh-Cut Produce Non-Tropical Fruit Melons Other Fruit & Vegetables Then and Now

Investment Highlights 9 Global brand with leadership across categories Experienced and committed global management team Unique vertical integration strategy Leader and industry pioneer in consumer and industry trends Financial strength Why Invest in Fresh Del Monte Produce?

Strengths We Are Building On

“By 2050, demand for food will rise 70 per cent yet our capacity to increase food production is declining.” Source: Oxfam International, June 1, 2011 “We will need to double irrigation by 2050 to grow enough food to meet demand of an estimated population of 9 billion people” Source: WWF (http://wwf.panda.org/what_we_do/how_we_work/conservation/freshwater/) CONCLUSION “Land is scarce and will become scarcer as the world has to double food output to satisfy increased demand by 2050. With limited land and water resources, this will automatically lead to increased valuations of productive land.” Source: Joachin von Braun, International Food Policy Research Institute Strengths We Are Building On Looking into the future 11

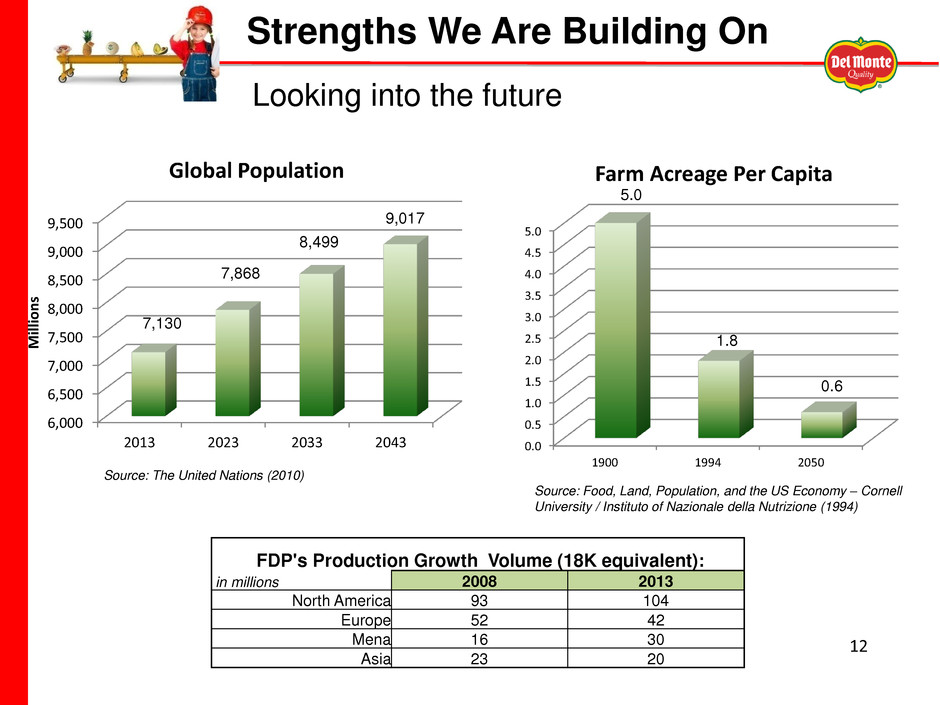

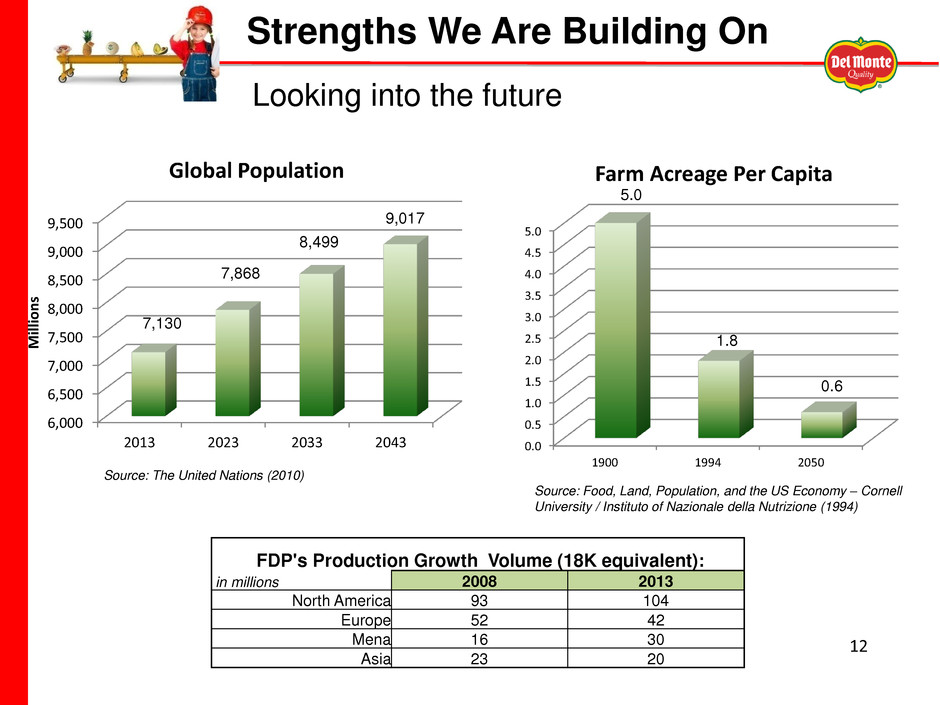

Strengths We Are Building On Looking into the future FDP's Production Growth Volume (18K equivalent): in millions 2008 2013 North America 93 104 Europe 52 42 Mena 16 30 Asia 23 20 Source: The United Nations (2010) 6,000 6,500 7,000 7,500 8,000 8,500 9,000 9,500 2013 2023 2033 2043 M ill ion s Global Population 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 1900 1994 2050 Farm Acreage Per Capita Source: Food, Land, Population, and the US Economy – Cornell University / Instituto of Nazionale della Nutrizione (1994) 7,130 7,868 8,499 9,017 5.0 1.8 0.6 12

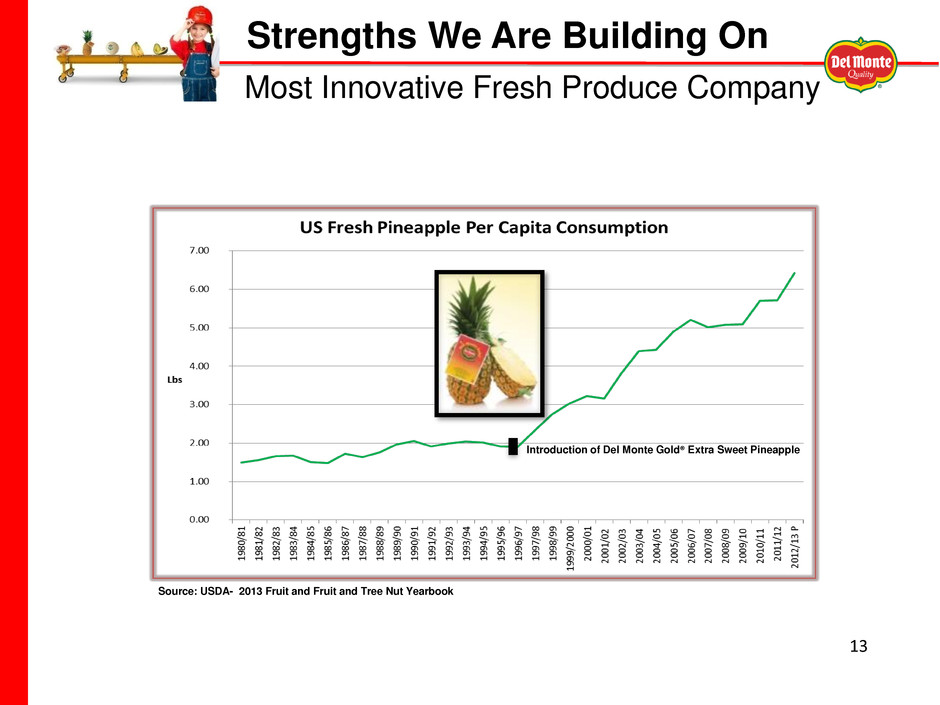

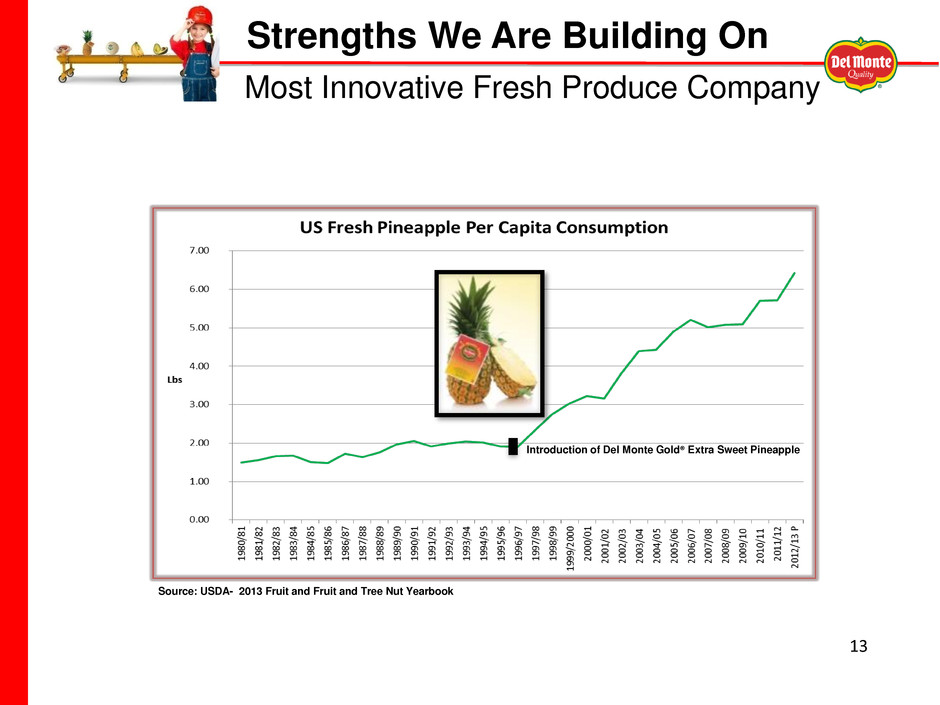

Strengths We Are Building On Most Innovative Fresh Produce Company Source: USDA- 2013 Fruit and Fruit and Tree Nut Yearbook Introduction of Del Monte Gold® Extra Sweet Pineapple 13

Strengths We Are Building On Leading Market Positions Marketer of fresh pineapples worldwide Marketer of bananas worldwide A leading grower, re-packer and marketer of tomatoes in the U.S. A leading marketer of branded grapes in the U.S. A leading marketer of branded canned pineapple and canned fruit in European markets and the Middle East A leading marketer of bananas, pineapples and deciduous fruit in the Kingdom of Saudi Arabia A leading marketer of poultry and meat products in Jordan Marketer of fresh-cut fruit in the U.S., Japan, U.K., UAE and Saudi Arabia #1 #3 #1 14 * Source: Company generated information

15 Unmatched Scale and Scope Strengths We Are Building On

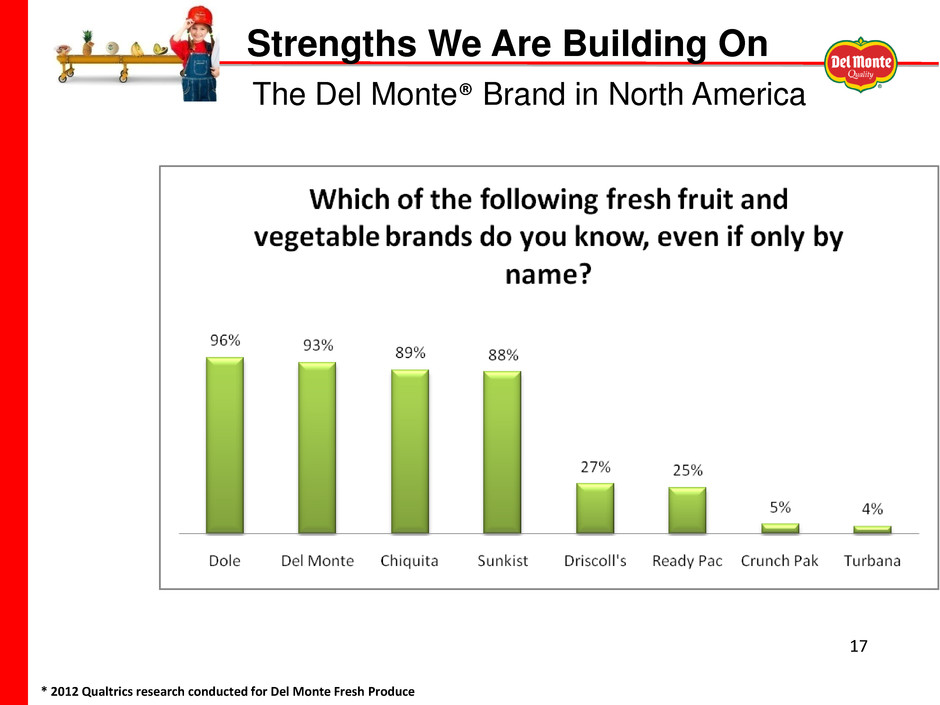

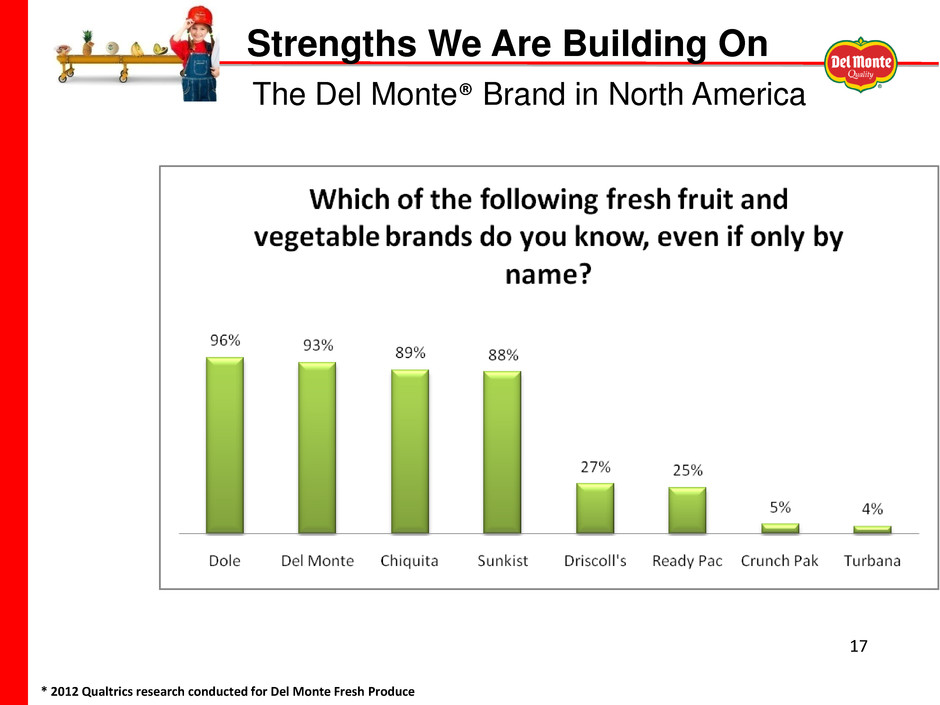

• Del Monte is one of the 2 top of mind brands when consumers are asked to recall a fresh produce brand. • Del Monte total brand awareness is nearly universal with 93% brand recognition. • 80% of consumers recall purchasing a Del Monte Fresh product. • 29% of consumers choose Del Monte when asked what fresh cut fruit brand they prefer. This is more than any other fresh cut fruit brand. • Del Monte is ALWAYS one of the top 3 preferred brands when asked brand preference for fresh pineapple, bananas, fresh melons, fresh grapes, avocados, fresh tomatoes, and overall fresh produce. * 2012 Qualtrics research conducted for Del Monte Fresh Produce Strengths We Are Building On The Del Monte® Brand 16

* 2012 Qualtrics research conducted for Del Monte Fresh Produce Strengths We Are Building On The Del Monte® Brand in North America 17

Growth Strategy

1. Grow existing products 2. New products – R&D and acquisitions 3. Expanding geographic presence 4. Entering new distribution channels 5. Leverage infrastructure 6. Drive cost controls and efficiencies Investing for Long-Term Growth Our Growth Strategy 19

Strategy in Action – Fresh cut Del Monte® North America Fresh-cut Growth Strategy #1 : Grow Existing Products $200 $220 $240 $260 $280 $300 $320 2008 2009 2010 2011 2012 2013 N et Sale s In mil lio n s Year 20

CONSUMER S Drivers of fresh-cut growth Strategy in Action – Fresh cut Strategy #1 : Grow Existing Products FO O D S E R VIC E • Premeasured and customized packaging • Health and wellness • Food safety • Desire for convenience • Pre-washed and pre-packaged • On-the-go • Ready-to-eat/use 21

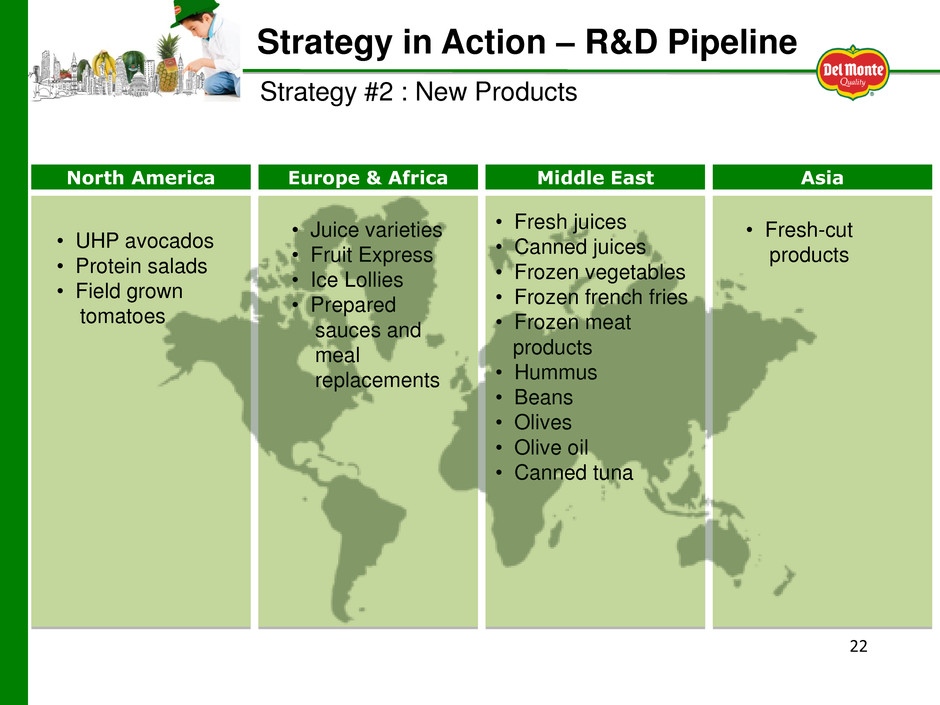

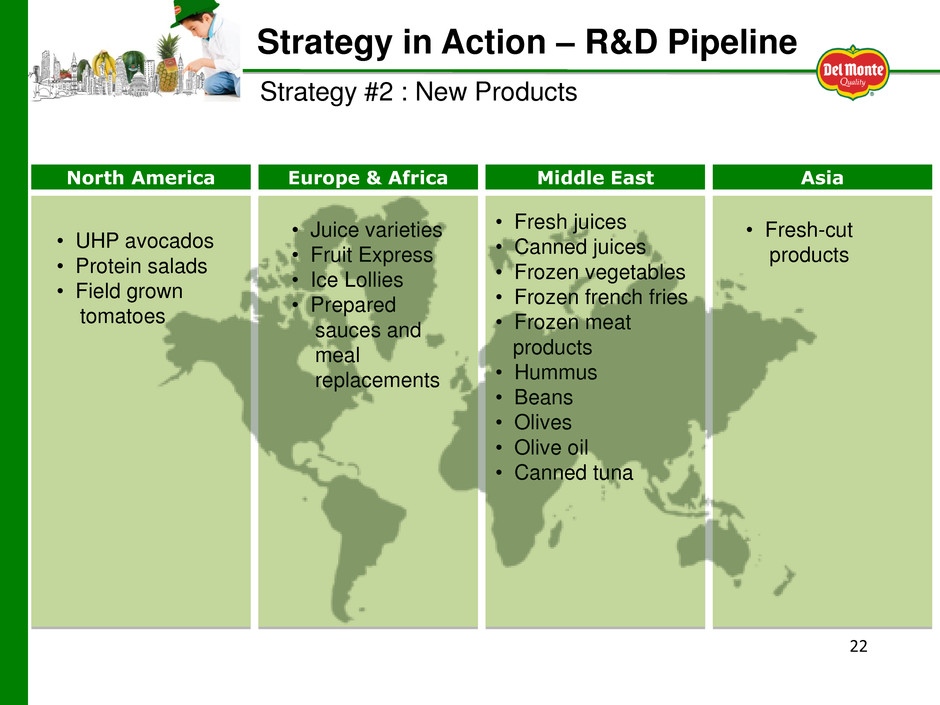

North America • UHP avocados • Protein salads • Field grown tomatoes Europe & Africa • Juice varieties • Fruit Express • Ice Lollies • Prepared sauces and meal replacements Middle East • Fresh juices • Canned juices • Frozen vegetables • Frozen french fries • Frozen meat products • Hummus • Beans • Olives • Olive oil • Canned tuna Asia • Fresh-cut products Strategy in Action – R&D Pipeline Strategy #2 : New Products 22

Strategy in Action – R&D Pipeline Strategy #2 : New Products 23

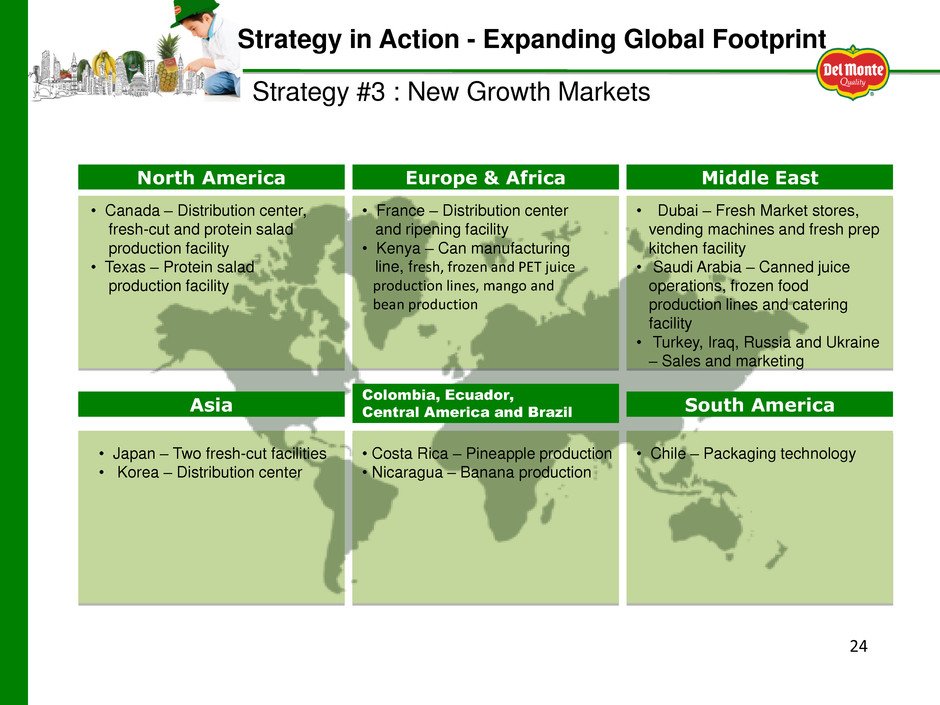

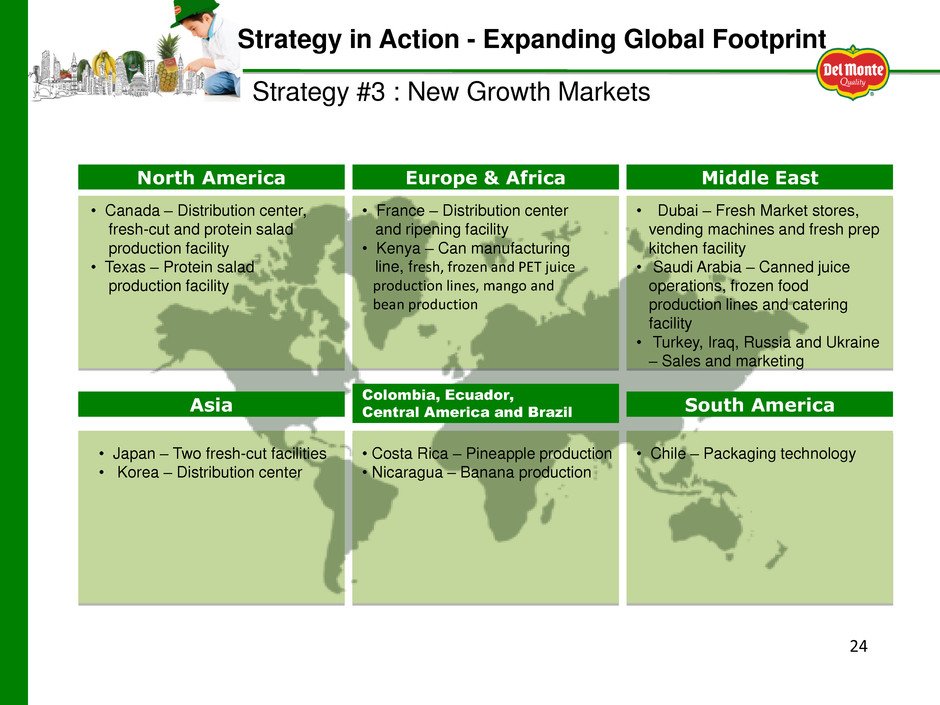

Strategy in Action - Expanding Global Footprint North America Europe & Africa Middle East Asia Colombia, Ecuador, Central America and Brazil South America • Canada – Distribution center, fresh-cut and protein salad production facility • Texas – Protein salad production facility • France – Distribution center and ripening facility • Kenya – Can manufacturing line, fresh, frozen and PET juice production lines, mango and bean production • Dubai – Fresh Market stores, vending machines and fresh prep kitchen facility • Saudi Arabia – Canned juice operations, frozen food production lines and catering facility • Turkey, Iraq, Russia and Ukraine – Sales and marketing • Japan – Two fresh-cut facilities • Korea – Distribution center • Costa Rica – Pineapple production • Nicaragua – Banana production • Chile – Packaging technology Strategy #3 : New Growth Markets 24

Fresh Market Stores Vending Machines Packaging for Convenience stores and Petrol stations Strategy in Action – Meeting Evolving Customer Needs Strategy #4 : New Distribution Channels 25

Strategy in Action – Build Relationships Strategy #5 : Leverage Infrastructure Retailers Foodservice Casual Dining & Quicks Serve Chain Convenience Stores Warehouse 26

Streamline operations Maximize logistics utilization Increase our production versus independent growers Focus on cash generation Prioritize capital Leverage our sales capabilities Strategy in Action – Priorities Strategy #6 : Drive Cost Controls and Efficiencies 27

Selected Financial Highlights

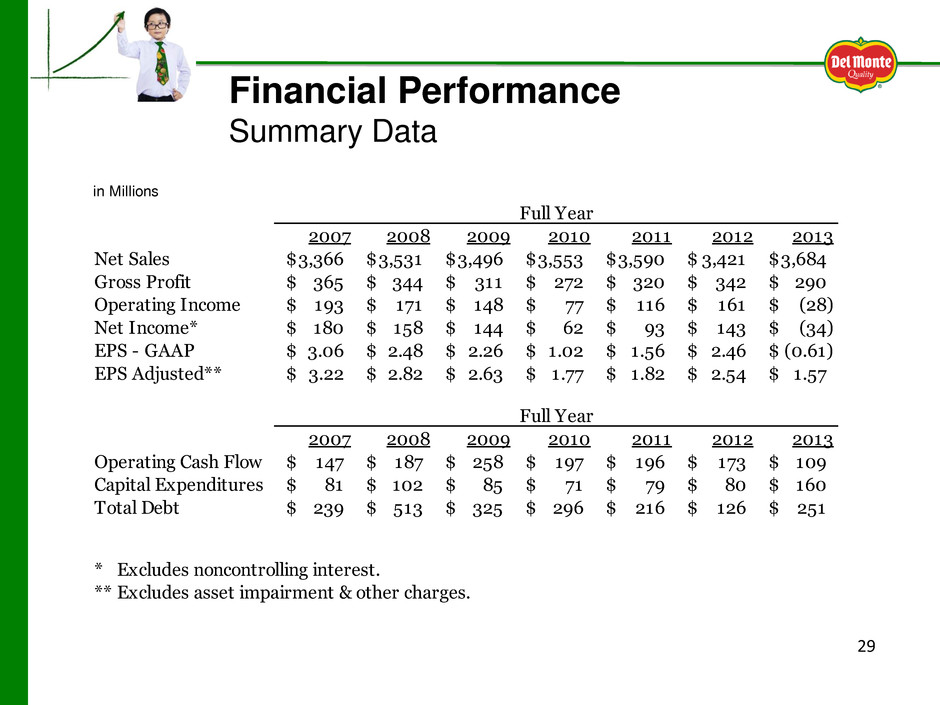

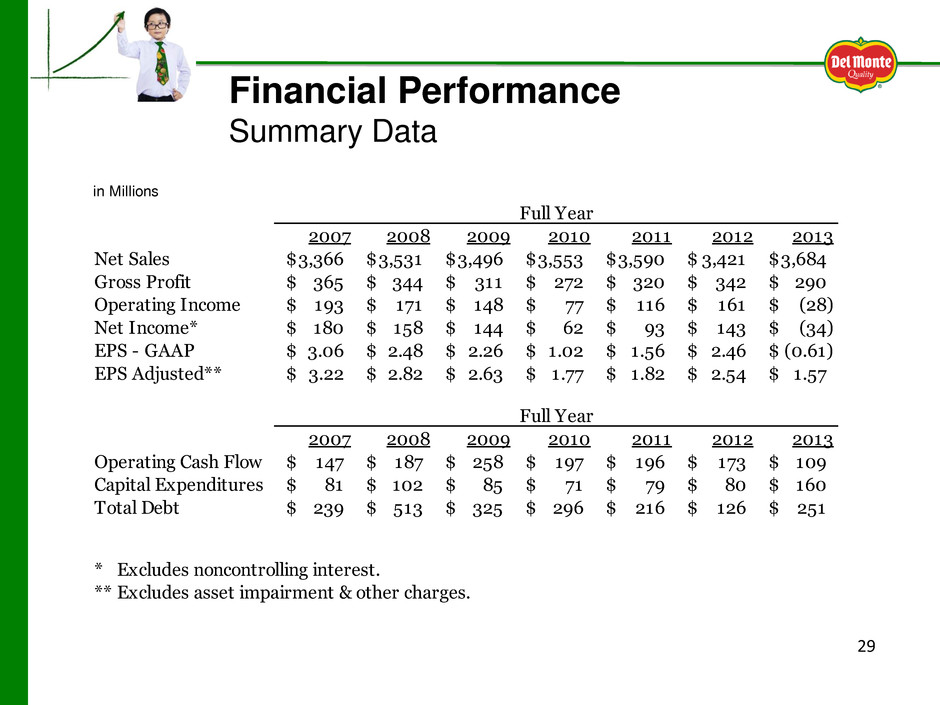

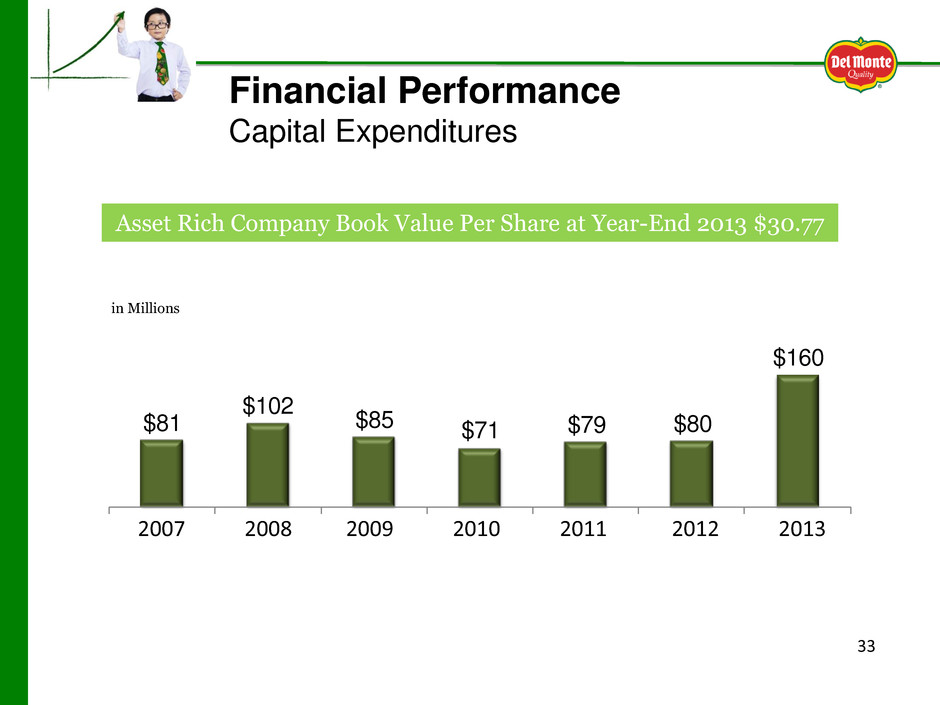

Financial Performance Summary Data 29 in Millions 2007 2008 2009 2010 2011 2012 2013 Net Sales 3,366$ 3,531$ 3,496$ 3,553$ 3,590$ 3,421$ 3,684$ Gross Profit 365$ 344$ 311$ 272$ 320$ 342$ 290$ Operating Income 193$ 171$ 148$ 77$ 116$ 161$ (28)$ Net Income* 180$ 158$ 144$ 62$ 93$ 143$ (34)$ EPS - GAAP 3.06$ 2.48$ 2.26$ 1.02$ 1.56$ 2.46$ (0.61)$ EPS Adjusted** 3.22$ 2.82$ 2.63$ 1.77$ 1.82$ 2.54$ 1.57$ 2007 2008 2009 2010 2011 2012 2013 Operating Cash Flow 147$ 187$ 258$ 197$ 196$ 173$ 109$ Capital Expenditures 81$ 102$ 85$ 71$ 79$ 80$ 160$ Total Debt 239$ 513$ 325$ 296$ 216$ 126$ 251$ * Excludes noncontrolling interest. ** Excludes asset impairment & other charges. Full Year Full Year

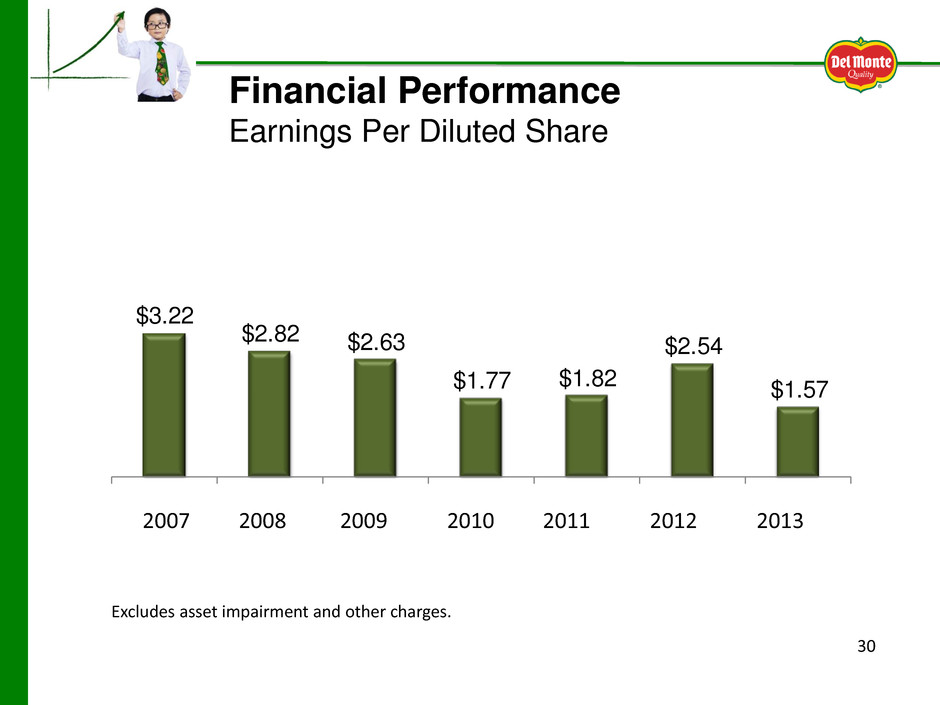

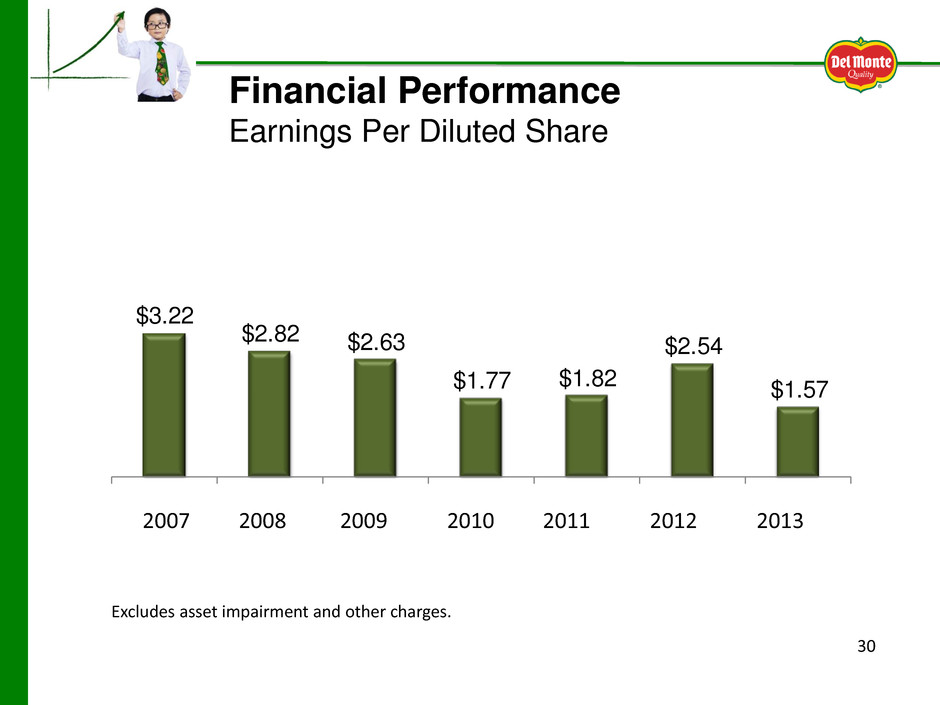

30 $3.22 $2.82 $2.63 $1.77 $1.82 $2.54 $1.57 Excludes asset impairment and other charges. 2007 2008 2009 2010 2011 2012 2013 Financial Performance Earnings Per Diluted Share

Financial Performance Operating Cash Flow 31 in Millions $147 $187 $258 $197 $196 $173 $109 2007 2008 2009 2010 2011 2012 2013

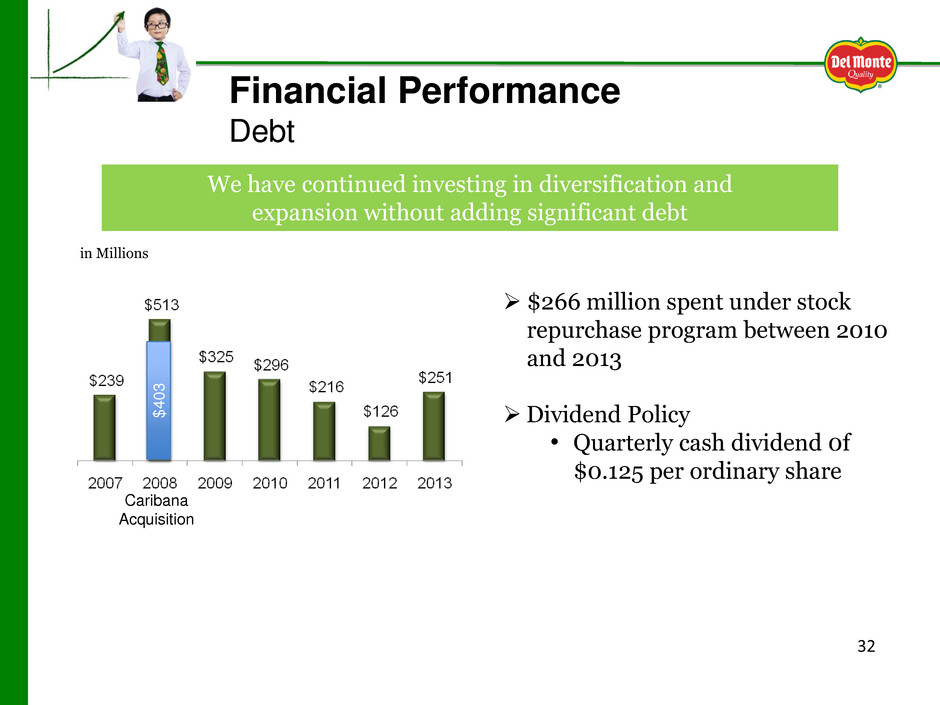

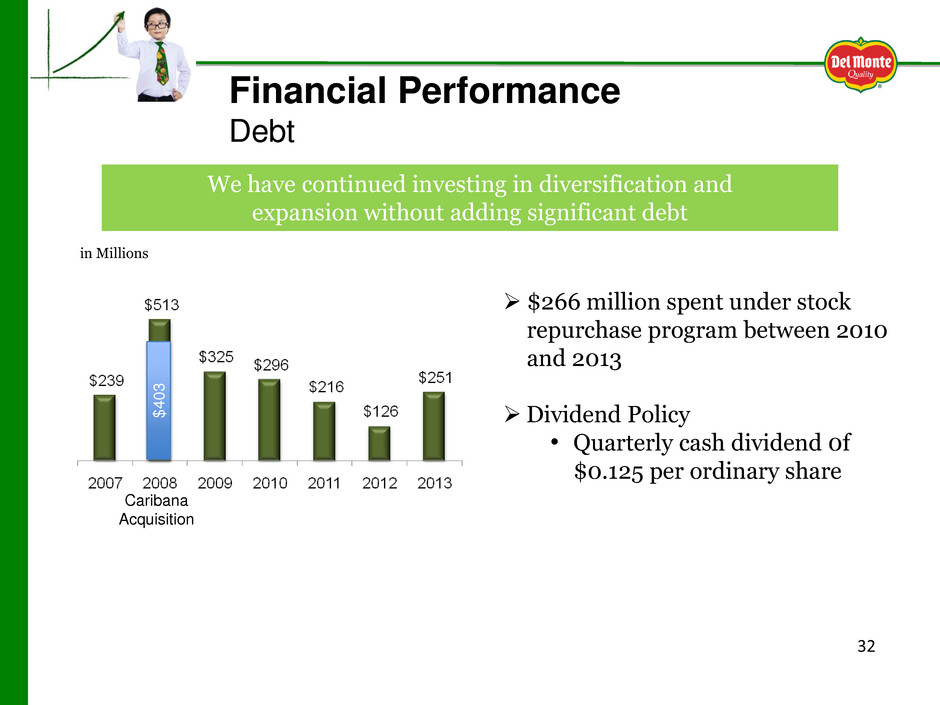

32 We have continued investing in diversification and expansion without adding significant debt $266 million spent under stock repurchase program between 2010 and 2013 Dividend Policy • Quarterly cash dividend 0f $0.125 per ordinary share in Millions Financial Performance Debt $ 4 0 3 Caribana Acquisition

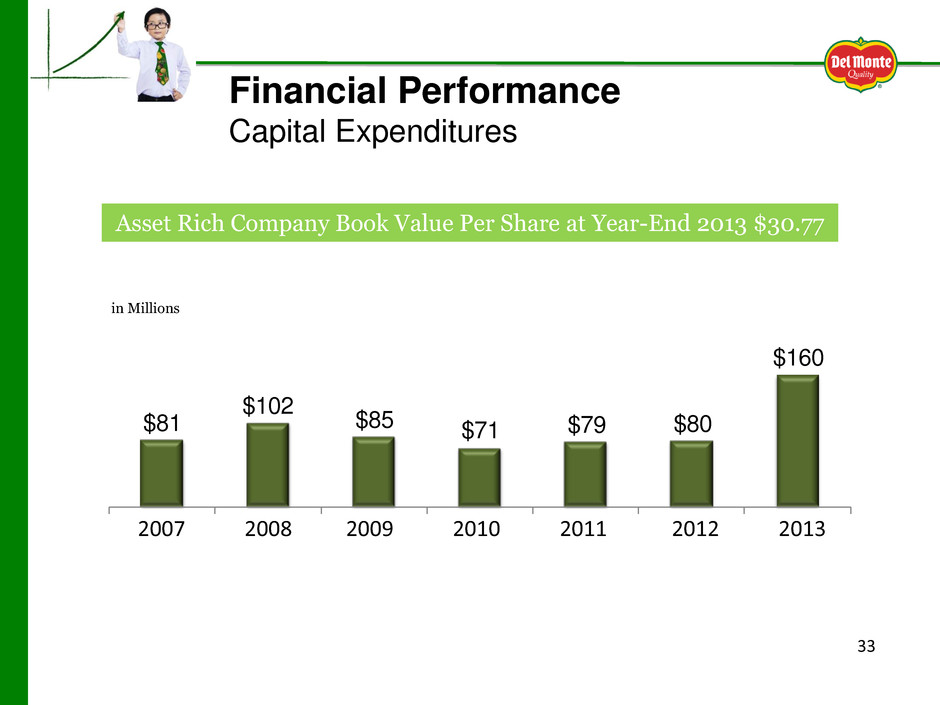

33 in Millions Financial Performance Capital Expenditures $81 $102 $85 $71 $79 $80 $160 2007 2008 2009 2010 2011 2012 2013 Asset Rich Company Book Value Per Share at Year-End 2013 $30.77

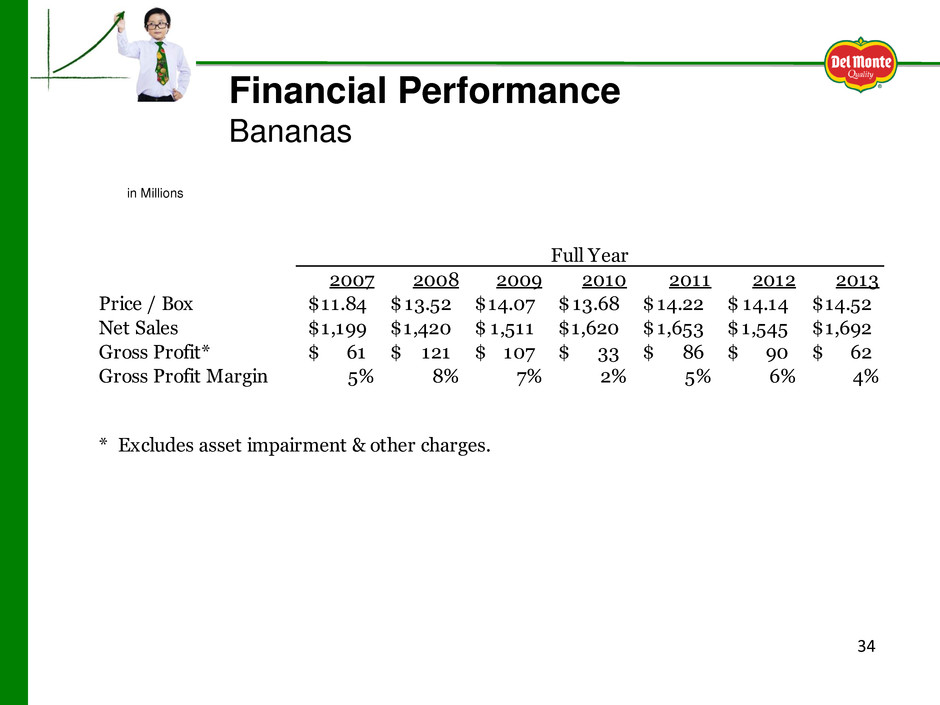

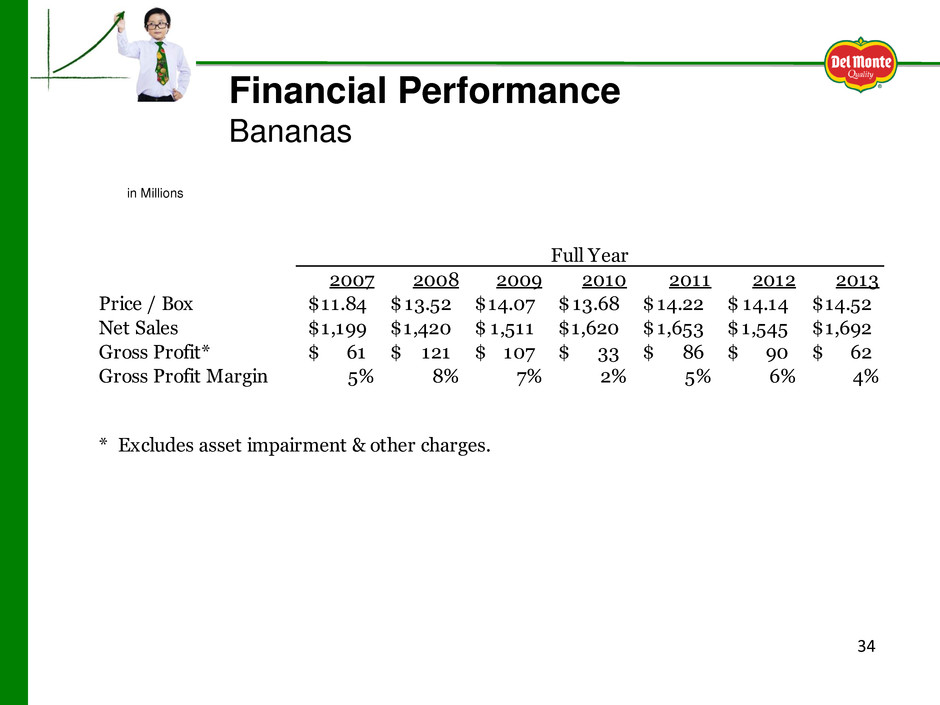

34 Financial Performance Bananas 2007 2008 2009 2010 2011 2012 2013 Price / Box 11.84$ 13.52$ 14.07$ 13.68$ 14.22$ 14.14$ 14.52$ Net Sales 1,199$ 1,420$ 1,511$ 1,620$ 1,653$ 1,545$ 1,692$ Gross Profit* 61$ 121$ 107$ 33$ 86$ 90$ 62$ Gross Profit Margin 5% 8% 7% 2% 5% 6% 4% * Excludes asset impairment & other charges. Full Year in Millions

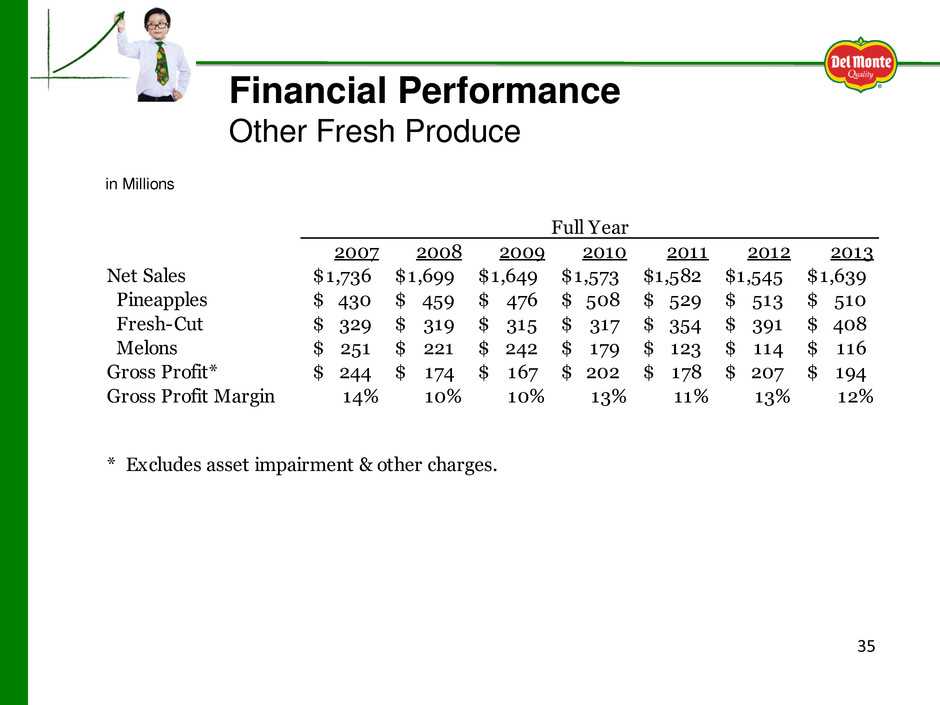

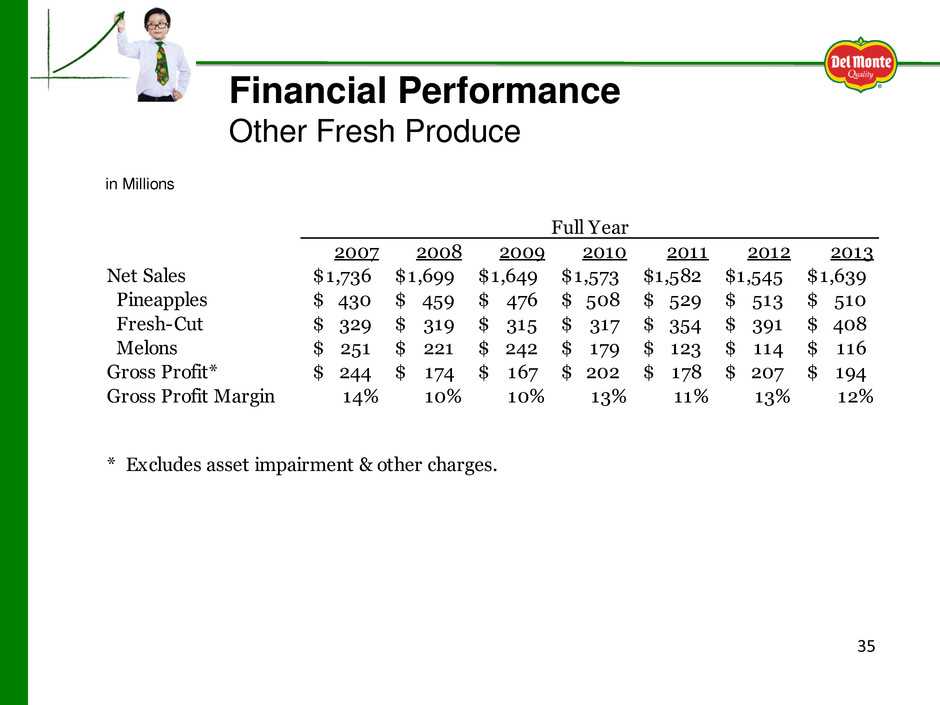

35 Financial Performance Other Fresh Produce in Millions 2007 2008 2009 2010 2011 2012 2013 Net Sales 1,736$ 1,699$ 1,649$ 1,573$ 1,582$ 1,545$ 1,639$ Pineapples 430$ 459$ 476$ 508$ 529$ 513$ 510$ Fresh-Cut 329$ 319$ 315$ 317$ 354$ 391$ 408$ Melons 251$ 221$ 242$ 179$ 123$ 114$ 116$ Gross Profit* 244$ 174$ 167$ 202$ 178$ 207$ 194$ Gross Profit Margin 14% 10% 10% 13% 11% 13% 12% * Excludes asset impairment & other charges. Full Year

36 Financial Performance Prepared Food in Millions 2007 2008 2009 2010 2011 2012 2013 Sales 429$ 412$ 337$ 360$ 355$ 332$ 353$ Gross Profit* 57$ 52$ 52$ 46$ 54$ 46$ 35$ Gross Profit Margin 13% 13% 15% 13% 15% 14% 10% * Excludes asset impairment & other charges. Full Year

Fresh Del Monte Produce Inc. Appendix

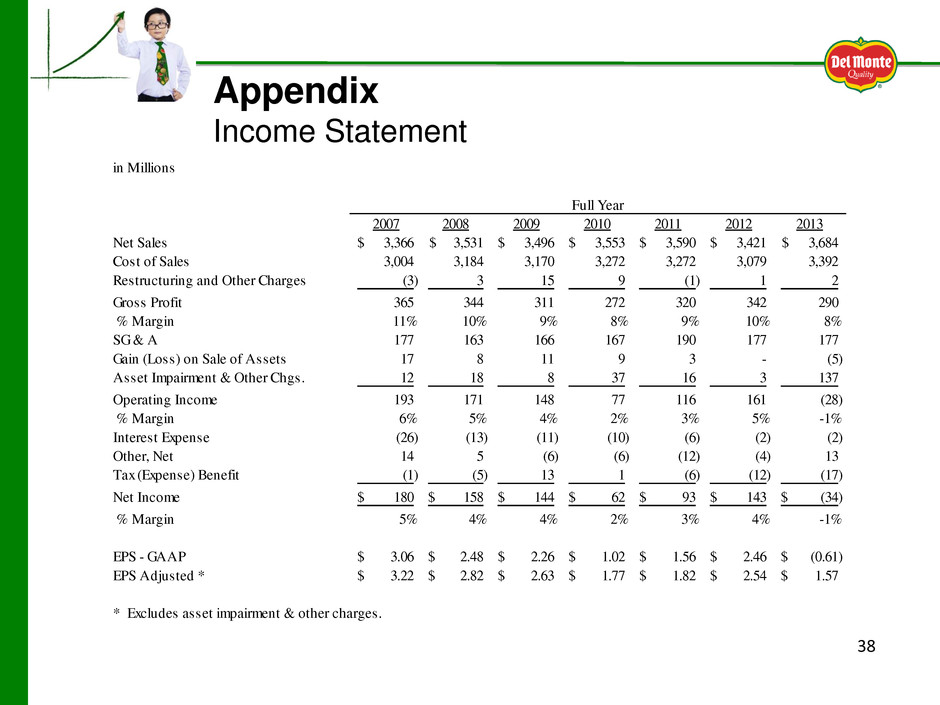

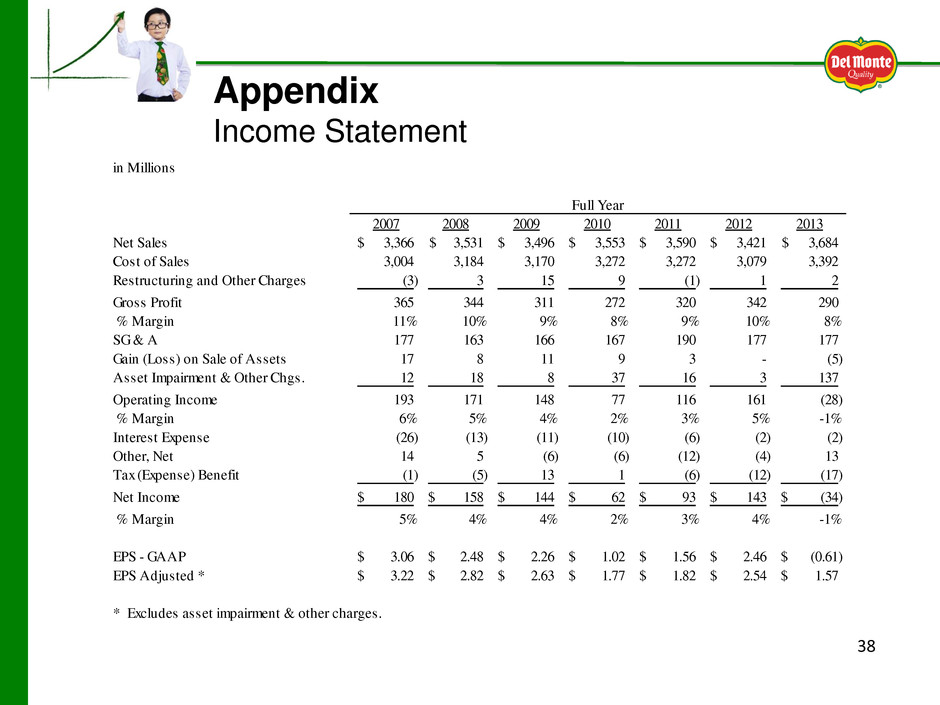

Appendix Income Statement 38 in Millions 2007 2008 2009 2010 2011 2012 2013 Net Sales 3,366$ 3,531$ 3,496$ 3,553$ 3,590$ 3,421$ 3,684$ Cost of Sales 3,004 3,184 3,170 3,272 3,272 3,079 3,392 Restructuring and Other Charges (3) 3 15 9 (1) 1 2 Gross Profit 365 344 311 272 320 342 290 % Margin 11% 10% 9% 8% 9% 10% 8% SG & A 177 163 166 167 190 177 177 Gain (Loss) on Sale of Assets 17 8 11 9 3 - (5) Asset Impairment & Other Chgs. 12 18 8 37 16 3 137 Operating Income 193 171 148 77 116 161 (28) % Margin 6% 5% 4% 2% 3% 5% -1% Interest Expense (26) (13) (11) (10) (6) (2) (2) Other, Net 14 5 (6) (6) (12) (4) 13 Tax (Expense) Benefit (1) (5) 13 1 (6) (12) (17) Net Income 180$ 158$ 144$ 62$ 93$ 143$ (34)$ % Margin 5% 4% 4% 2% 3% 4% -1% EPS - GAAP 3.06$ 2.48$ 2.26$ 1.02$ 1.56$ 2.46$ (0.61)$ EPS Adjusted * 3.22$ 2.82$ 2.63$ 1.77$ 1.82$ 2.54$ 1.57$ * Excludes asset impairment & other charges. Full Year

Appendix Income Statement – Non-GAAP Measures 39 December 27, December 28, 2013 2012 Non-GAAP Measures: Reported net (loss) income per share - Diluted (0.61)$ 2.46$ Other charges, net (1) 0.03$ 0.02$ Asset impairment and other charges, net (2) 2.42$ 0.06$ Unfavorable (favorable) items included in other expense (income), net (3) (0.27)$ -$ Comparable net (loss) income per share - Diluted (4) 1.57$ 2.54$ Year Ended (1) For the year ended December 27, 2013, other charges, net related principally to inventory write-offs due to unfavorable weather conditions in Chile. For 2012, other charges, net related principally to inventory write-offs in our previously discontinued melon and pineapple operations in Brazil and inventory write-offs and clean-up costs due to flooding in Costa Rica. (2) For 2013, asset impairment and other charges, net, includes charges related to goodwill and trademark impairment of $75.7 million and $23.9 million, respectively, related to the 2004 acquisition of our Prepared Food business, exit activities in our Brazil operations of $11.4 million, unfavorable litigation of $10.2 million and other charges of $3.4 million primarily relating to restructuring activities in Europe, $7.1 million related to previously announced exit activities in Brazil, asset impairments of $4.3 million related to underperforming assets in Costa Rica, a (gain) on sale of assets previously impaired in 2012 of $(2.5) million related to an under-utilized facility in the United Kingdom, asset impairments of $1.7 million related to the closure of an underutilized distribution center in Germany, unfavorable litigation of $1.0 million, asset impairments of $0.7 million for underperforming assets in the Philippines and other net (credits) of $(0.2) million. For 2012, asset impairment and other charges, net, related principally to underutilized facilities in the United Kingdom, flooding in Costa Rica and other costs in Hawaii, partially offset by insurance proceeds related to floods in Guatemala and Costa Rica. (3) The year ended December 27, 2013 includes financial charges of $1.6 million resulting from an unfavorable court ruling related to value added tax reporting in South America, and a favorable judgment awarded in litigation of $16.6 million related to the Del Monte brand. (4) Management reviews comparable net (loss) income, comparable net (loss) income per share and comparable gross profit and considers these measures relevant to investors because management believes they better represent the underlying business trends and performance of the Company.

40 Appendix Cash Flow in Millions 2007 2008 2009 2010 2011 2012 2013 Net Income* 180$ 157$ 145$ 61$ 95$ 145$ (34)$ Non-Cash Charges 91 93 85 114 91 73 211 Working Capital (124) (63) 28 22 10 (45) (68) Operating Cash Flow 147 187 258 197 196 173 109 Capital Expenditures (81) (102) (85) (71) (79) (80) (160) Acquisitions/Disposals 30 (398) 18 16 5 10 (10) Changes in Debt (242) 272 (198) (31) (81) (88) 127 Dividends - - - (3) (18) (23) (28) Share Repurchase - - - (108) (50) (13) (95) Equity Securities - - - - - (3) 8 Proceeds From Share Issuance 118 - - - - - - Proceeds from Stock Options 12 22 1 2 23 10 44 Other, Net 6 16 13 13 2 7 9 Net Change in Cash (10)$ (3)$ 7$ 14$ (2)$ (7)$ 3$ * Excludes noncontrolling interest. Full Year

41 Appendix Balance Sheet in Millions 2007 2008 2009 2010 2011 2012 2013 ASSETS Cash & Short Term Investments 30$ 28$ 35$ 49$ 47$ 40$ 43$ Accounts Receivable 414 410 375 377 355 354 398 Inventory & Other 444 537 499 455 490 532 575 CURRENT ASSETS 888 975 909 881 892 926 1,015 Property, Plant & Equipment 852 1,085 1,069 1,033 1,023 1,025 1,101 All Other Assets 446 591 618 604 589 583 473 TOTAL ASSETS 2,186$ 2,651$ 2,596$ 2,518$ 2,504$ 2,533$ 2,589$ LIABILITIES Current Liabilities 397$ 774$ 357$ 368$ 370$ 362$ 383$ Long Term Debt 232 155 320 290 213 124 249 Other Liabilities 177 208 224 228 206 216 206 TOTAL LIABILITIES 806 1,137 901 886 789 702 838 SHAREHOLDER'S EQUITY 1,380 1,514 1,695 1,632 1,715 1,831 1,751 LIAB. & SHAREHOLDER'S EQUITY 2,186$ 2,651$ 2,596$ 2,518$ 2,504$ 2,533$ 2,589$ Full Year