UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or

| X__ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2004

or

| ___ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _________________ to __________________

Commission file number 0-29500

| ARGOSY MINERALS INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Yukon Territory, Canada |

| (Jurisdiction of incorporation or organization) |

| |

20607 Logan Avenue Langley, BC Canada V3A 7R3 |

| (Address of principal executive offices) |

| |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Common Shares, Without Par Value |

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 X Item 18

Table of Contents

Table of Contents | 3 |

Glossary Of Technical Terms | 5 |

| NOTE TO UNITED STATES READERS – DIFFERENCES REGARDING THE DEFINITIONS OF RESOURCE AND RESERVE ESTIMATES IN THE UNITED STATES AND CANADA | 6 |

Special Note Regarding Forward Looking Statements | 7 |

Metric Equivalents | 8 |

Part I | 9 |

| Item 1 – | Identity of Directors, Senior Management and Advisors | 9 |

| Item 2 – | Offer Statistics and Expected Timetable | 9 |

| Item 3 – | Key Information | 9 |

A. | Selected Financial Data | 9 |

B. | Capitalization and Indebtedness | 10 |

C. | Reasons for the Offer and Use of Proceeds | 10 |

D. | Risk Factors | 10 |

| Item 4 – | Information on the Company | 17 |

A. | History and Development of the Company | 17 |

B. | Business Overview | 21 |

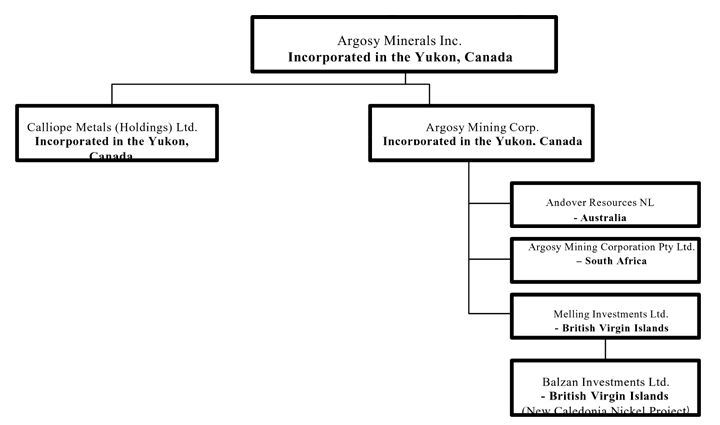

C. | Organizational Structure | 32 |

D. | Property, Plant and Equipment | 33 |

| Item 5 – | Operating and Financial Review and Prospects | 35 |

A. | Operating Results | 35 |

B. | Liquidity and Capital Resources | 42 |

C. | Research and Development, Patents and Licences, etc. | 43 |

D. | Trend information | 43 |

| Item 6 – | Directors, Senior Management and Employees | 44 |

A. | Directors and Senior Management | 44 |

B. | Compensation | 44 |

C. | Board Practices | 47 |

D. | Employees | 48 |

E. | Share Ownership | 48 |

| Item 7 – | Major Shareholders and Related Party Transactions | 50 |

A. | Major shareholders | 50 |

B. | Related Party Transactions | 50 |

C. | Interests of Experts and Counsel | 51 |

| Item 8 – | Financial Information | 51 |

| Item 9 – | The Offer and Listing | 51 |

A. | Offer and Listing Details | 51 |

B. | Plan of Distribution | 52 |

C. | Markets | 52 |

D. | Selling shareholders. | 52 |

E. | Dilution | 52 |

F. | Expenses of the Issue | 52 |

| Item 10 – | Additional Information | 52 |

A. | Share Capital | 52 |

B. | Memorandum and Articles of Association | 52 |

C. | Material Contracts | 55 |

D. | Exchange Controls | 57 |

E. | Taxation | 57 |

F. | Dividends and Paying Agents | 69 |

G. | Statement by Experts | 69 |

H. | Documents on display | 69 |

I. | Subsidiary Information | 69 |

| Item 11 – | Quantitative and Qualitative Disclosures about Market Risk | 70 |

| Item 12 – | Description of Securities other than Equity Securities | 70 |

Part II | 70 |

| Item 13 – | Defaults, Dividend Arrearages and Delinquencies | 70 |

| Item 14 – | Material Modifications to the Rights of Security Holders and Use of Proceeds | 70 |

| Item 15 – | Controls and Procedures | 70 |

| Item 16A – | Audit Committee Financial Expert | 71 |

| Item 16B – | Code of Ethics | 71 |

| Item 16C – | Principal Accountant Fees and Services | 71 |

Audit Fees | 72 |

Audit-Related Fees | 72 |

Tax Fees | 72 |

All other Fees | 72 |

| Item 16D – | Exemptions from the Listing Standards for Audit Committees. | 72 |

| Item 16E – | Purchases of Equity Securities by the Issuer and Affiliated Purchasers. | 73 |

Part III | 73 |

| Item 17 – | Financial Statements | 73 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 78 |

| Item 18 – | Financial Statements | 84 |

| Item 19 – | Exhibits | 85 |

SIGNATURES | 86 |

Glossary Of Technical Terms

The following is a glossary of mining terms used in this document:

alluvial | - | Resulting from erosion and weathering of primary occurrences and later transported, relocated and concentrated by a river. |

assays | - | Metallurgical procedure for determining grade of sample. |

basal | - | Lowermost layer or horizon. |

breccia | - | rock consisting of fragments, more or less angular, in a matrix of finer-grained material. |

concentrate | - | a product containing valuable minerals from which most of the waste material in the ore has been separated, usually by a flotation technique. |

decantation | - | Metallurgical process where solutions flow or pumped from one process to another. |

development | - | the preparation of a mining property for production. |

diamond drilling | - | a type of rotary core drilling in which diamonds are used as the cutting tool. |

diamondiferous | - | Containing diamond. |

epithermal | - | applied to hydrothermal deposits formed at low temperature and pressure. |

fault | - | a fracture in a rock along which there has been displacement. |

fault system | - | two or more interconnecting faults. |

flotation | - | a metallurgical process involving air bubbles to recover a specific mineral from an ore. |

grade | - | the proportion of an element (or substance) in an ore body - commonly expressed as a percentage for base metals and grams/tonne or oz/ton for precious metals. |

g/t | - | Grams per tonne. |

gravels | - | Coarse alluvially derived sediments. |

km | - | kilometres (1000 metres). |

laterite | - | a residual deposit derived from the weathering of ultrabasic rocks by the drainage of meteoric water through fractures. |

lateritic ore | - | laterite containing nickel and cobalt values in economic concentrations. |

leaching | - | the dissolution stage of a hydrometallurgical process. |

limonite | - | a hydrated oxide of iron which, in the context of a laterite orebody represents the most heavily weathered portion of the laterite profile, lying closest to surface with high concentrations of contained iron and low concentrations of contained magnesium. |

m | - | Metres. |

measured resource | - | the estimated quantity and grade of that part of a deposit for which the size, configuration, and grade have been very well-established by observation and sampling of outcrops, drill holes, trenches and mine workings. |

mineralization | - | the presence of minerals of possible economic value. |

mineralogy | - | the study of minerals. |

mineral resource | - | a deposit or concentration of natural, solid, inorganic or fossilised organic substance in such quantity and at such a grade or quality that extraction of the material at a profit is potentially viable. |

ore | - | a body of rock from which it is or may be possible to extract minerals profitably. |

oxide | - | a mineral compound of an element (or elements) with oxygen. |

palaeochannel | - | Ancient river course, usually filled in with overburden. |

refinery | - | a plant or processing facility where ore, concentrates, mixed sulphides or matte are processed into partially or fully refined metals. |

reserves | - | Proven, probable, possible. |

resources | - | measured, indicated,drill-inferred,inferred. |

saprolite | - | weathered rock in which the original minerals have been almost completely replaced (e.g. by clays) but the original texture of the rock type is preserved. |

saprolitic ore | - | saprolite containing nickel and cobalt values in economic concentrations. |

serpentinised dunite | - | Altered mafic rock. |

strike | - | the course or bearing of a bed or layer of rock. |

stoping | - | Underground mining activity to remove ore. |

structural corridor | - | Regional lineations of geological structures such as faults. |

vein | - | an occurrence of ore with a regular development in length, width and depth. |

NOTE TO UNITED STATES READERS - DIFFERENCES REGARDING THE DEFINITIONS OF RESOURCE AND RESERVE ESTIMATES IN THE UNITED STATES AND CANADA

Mineral Reserve | The definitions of “mineral reserves”, “proven mineral reserves” and “probable mineral reserves,” as used in this report, are Canadian mining terms as defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves Definitions and guidelines adopted by the CIM Council on August 20, 2000. CIM standards differ from the standards in the United States. |

| | Under United States standards, a “mineral reserve” is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, where: |

| | “reserve” means that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination; |

| | “economically” implies that profitable extraction or production has been established or analytically demonstrated to be viable and justifiable under reasonable investment and market assumptions; and |

| | while “legally” does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved, for a reserve to exist, there should be a reasonable certainty based on applicable laws and regulations that issuance of permits or resolution of legal issues can be accomplished in a timely manner. |

| | Mineral reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit. Under United States standards, proven or measured reserves are defined as reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geographic character is so well defined that size, shape,depth and mineral content of reserves are well established. |

| | Under United States standards, probable reserves are defined as reserves for which quantity and grade and/or quality are computed from information similar to that of proven reserves (under United States standards), but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven mineral reserves, is high enough to assume continuity between points of observation. |

Mineral Resource | While the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. As such, information contained in this report concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the Securities and Exchange Commission. “Indicated mineral resource” and “inferred mineral resource” have a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It can not be assumed that all or any part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. |

Special Note Regarding Forward Looking Statements

Certain statements in this document constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Some, but not all, forward-looking statements can be identified by the use of words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” and “intend,” statements that an action or event “may,” “might,” “could,” “should,” or “will” be taken or occur, or other similar expressions.Forward-looking statements in this report include, but are not limited to, (i) the likelihood the Registrant will be granted a permit by the United States Forest Service to commence its drilling program in the spring of 2005 related to the Nevada Gold Project (as defined herein) and the Registrant’s proposed activities after receiving such permit, and (ii) the extent of the nickel deposits related to the Burundi Nickel Project (as defined herein) and the projected life of any mining project related to such deposits.Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Registrant, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks:the risks associated with the Tripartite Agreement arbitration; risks associated with project development; the Registrant’s history of losses and lack of revenues; the Registrant’s lack of mineral producing properties; the potential inability of investors to enforce U.S. judgments against the Registrant or its officers or directors; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in diamond and metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; political risks and political risk insurance; environmental liability claims and insurance; infrastructure issues; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters of the Registrant with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the Registrant’s common share price andvolume; and adverse tax consequences to U.S. Shareholders resulting from the Registrant’s PFIC status. Additional information concerning these and other factors that could affect the operations or financial results of the Registrant are included in this document under“Item 3. - Risk Factors”. Although the Registrant believes that the expectations reflected in its forward-looking statements are reasonable, it cannot guarantee future results, performance and achievements or other future events. The Registrant is under no duty to update any of its forward-looking statements after the date of this report. Investors should not place undue reliance on such forward-looking statements.

Metric Equivalents

For ease of reference, the following factors for converting metric measurements into imperial equivalents are provided:

To Convert From Metric | To Imperial | Multiply By |

| | | |

| hectares | acres | 2.471 |

| metres | feet | 3.281 |

| kilometres | miles | 0.621 |

| tonnes | tons (2000 pounds) | 1.102 |

In this Annual Report on Form 20-F, unless otherwise specified, all monetary amounts are expressed in Canadian dollars. The following table sets out the exchange rates, based on the noon buying rate in New York City for cable transfer in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York, for the conversion of Canadian dollars (CDN$) into United States dollars (US$) in effect for each of the following periods, and the average exchange rates (based on the average of the exchange rates on the last day of each month) and the high and low exchange rates for each of the previous six months:

Year Ended December 31 | | | | |

| | 2004 | 2003 | 2002 | 2001 | 2000 |

| Average for Period | 0.772 | 0.7205 | 0.6369 | 0.6446 | 0.6726 |

Month Ended | | | | | | |

| | 28-Feb-05 | 31-Jan-05 | 31-Dec-04 | 30-Nov-04 | 31-Oct-04 | 30-Sep-04 |

| High for Period | 0.8134 | 0.8346 | 0.8435 | 0.8493 | 0.8201 | 0.7906 |

| Low for Period | 0.7961 | 0.805 | 0.8064 | 0.8155 | 0.7858 | 0.7651 |

Exchange rates are based upon the noon buying rate in New York City for cable transfers in foreign currencies for customs purposes by the Federal Reserve Bank of New York. The noon rate of exchange on February 28, 2005 as reported by the United States Federal Reserve Bank of New York for the conversion of Canadian dollars into United States dollars was 0.8133 (US$1.00 = CDN$1.2295) and for the conversion of Australian dollars into United States dollars was 0.7940 (US$1.00 = AUS$1.2594).

The information set forth in this Form 20-F is as atFebruary 28,2005 unless an earlier or later date is indicated.

Part I

Item 1 - Identity of Directors, Senior Management and Advisors

Not applicable.

Item 2 - Offer Statistics and Expected Timetable

Not applicable.

Item 3 - Key Information

A. Selected Financial Data

The following table summarizes selected consolidated financial data for the Registrant (stated in Canadian dollars) prepared in accordance with Canadian Generally Accepted Accounting Principles (“Canadian GAAP”). The table also summarizes certain corresponding information prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). The information in the table was extracted or derived from the more detailed audited consolidated financial statements and related notes included herein and should be read in conjunction with such financial statements and with the information appearing under the heading “Item 5. - Operating and Financial Review and Prospects”. Reference is made to Note 10 of the December 31, 2004 consolidated financial statements of the Registrant, included herein, for a discussion of the material differences between Canadian GAAP and US GAAP, and their effects on the Registrant’s financial statements.

To date, the Registrant has not generated any cash flow from operations to fund ongoing operational requirements and cash commitments. The Registrant has financed its operations principally through the sale of its equity securities, and reimbursement of prior expenditures. The Registrant currently has sufficient funds to maintain operations for the remainder of its fiscal year at its current level of activity. In the event that activities increase or new projects are acquired, the Registrant’s ability to continue operations will be dependent on its ability to obtain additional financing. For particulars, see “Item 4. - Business Overview”and “Item 5 - Operating and Financial Review and Prospects - Liquidity and Capital Resources”.

| | | Year Ended Dec. 31, 2004 | | Year Ended Dec. 31, 2003 | | Year Ended Dec. 31, 2002 | | Year Ended Dec. 31, 2001 | | Year Ended Dec. 31, 2000 | |

Statement Of Operations And Deficit | | | | | | | | | | | |

Operating Revenues | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

Net Loss for the Period | | | | | | | | | | | | | | | | |

Canadian GAAP | | $ | 3,148,252 | | $ | 2,493,133 | | $ | 11,079,339 | | $ | 9,188,012 | | $ | 1,055,049 | |

U.S. GAAP | | $ | 3,148,252 | | $ | 2,402,621 | | $ | 10,486,769 | | $ | 664,697 | | $ | 2,417,915 | |

| | | | | | | | | | | | | | | | | |

Basic & Diluted Loss per Common Share | | | | | | | | | | | | |

Canadian GAAP | | $ | 0.03 | | $ | 0.03 | | $ | 0.12 | | $ | 0.10 | | $ | 0.01 | |

U.S. GAAP | | $ | 0.03 | | $ | 0.03 | | $ | 0.11 | | $ | 0.01 | | $ | 0.03 | |

| | | | | | | | | | | | | | | | | |

Dividends Declared | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| | | | | | | | | | | | | | | | | |

Balance Sheet | | | | | | | | | | | | | | | | |

Total Assets | | | | | | | | | | | | | | | | |

Canadian GAAP | | $ | 4,812,927 | | $ | 8,261,351 | | $ | 10,628,717 | | $ | 21,901,677 | | $ | 30,609,994 | |

U.S. GAAP | | $ | 4,812,927 | | $ | 8,261,351 | | $ | 10,538,205 | | $ | 21,218,595 | | $ | 21,403,597 | |

| | | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | | | |

Canadian GAAP | | $ | 4,661,926 | | $ | 7,810,178 | | $ | 10,303,311 | | $ | 21,382,650 | | $ | 30,524,151 | |

U.S. GAAP | | $ | 4,661,926 | | $ | 7,810,178 | | $ | 10,212,799 | | $ | 20,699,568 | | $ | 21,317,754 | |

| | | | | | | | | | | | | | | | | |

Shareholders’ Equity | | | | | | | | | | | | | | | | |

Canadian GAAP | | $ | 4,661,926 | | $ | 7,810,178 | | $ | 10,303,311 | | $ | 21,382,650 | | $ | 30,524,151 | |

U.S. GAAP | | $ | 4,661,926 | | $ | 7,810,178 | | $ | 10,212,799 | | $ | 20,699,568 | | $ | 21,317,754 | |

| | | | | | | | | | | | | | | | | |

Weighted Average Number of Shares Outstanding | | | 95,969,105 | | | 95,969,105 | | | 95,969,105 | | | 95,894,105 | | | 95,781,605 | |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

An investment in theCommon SharesCommon Sharesof the Registrant should be considered to be highly speculative due to the nature of the Registrant’s business, the present stage of its projects and the risks inherent in the development, construction, commissioning of mines and the processing and the sale of diamonds, nickel, cobalt, gold and silver products.

Some of the risks associated with an investment in the Common Shares of the Registrant include, but are not limited to, the following:

| i. | Lack of Revenues; History of Losses |

The Registrant has not recorded any revenues or net income from its operations nor has the Registrant commenced commercial production on any of its properties over the Registrant’s twenty (20) year existence. The Registrant has accumulated net losses of approximately $39,413,000 through December 31, 2004. There can be no assurance that significant additional losses will not occur in the near future or that the Registrant will generate any revenues from mining operations or be profitable in the future. The Registrant anticipates that its operating expenses and capital expenditures may increase significantly in subsequent years if it adds the consultants, personnel and equipment associated with advancing exploration, development and possible commercial production of its properties should it decide to put a property into production. The amounts and timing of expenditures will depend on the Registrant’s ability to obtain financing on acceptable terms, the progress of ongoing exploration and development, the results of consultant analysis and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners, the Registrant’sacquisition of additional properties and other factors, many of which are beyond the Registrant’s control.

The Registrant does not expect to receive revenues from operations in the foreseeable future, if at all. The Registrant expects to continue to incur losses unless and until such time as properties enter into commercial production, if at all, and generate sufficient revenues to fund its continuing operations. The development of the Registrant’s properties will require the commitment of substantial resources to conduct the time-consuming exploration and development of properties. There can be no assurance that the Registrant will generate any revenues or achieve profitability.

| ii. | No Mineral Producing Properties; Registrant is in Exploration Stage |

The Registrant is an exploration-stage company. There are no known ore reserves on the Registrant’s properties and any work program on a property would be an exploratory search for ore grade mineralization. There can be no assurance that the current exploration programs planned by the Registrant will result in a profitable commercial mining operation.

The exploration for and development of mineral deposits is a speculative venture necessarily involving substantial risks. There is no certainty that the expenditures to be made by the Registrant will result in discoveries of commercially viable mineral deposits. Few properties which are explored are ultimately developed into producing mines. The Registrant has no plant or equipment located on any of its sites. Major expenses may be required to establish ore reserves, develop metallurgical processes, construct mining and processing facilities at a particular site and establish the required infrastructure (i.e., electricity and roads). In exploring its properties, the Registrant may be subjected to an array of complex economic factors and accordingly, there can be no assurance that feasibility studies will be carried out on any of its properties or that results projected by any feasibility study will be attained in the event that the Registrant commences production on any of its properties.

The Registrant has not brought any property in which it had an interest into commercial production. As such, the Registrant’s ability to meet production, timing and cost estimates for properties cannot be assured. Technical considerations, delays in obtaining government approvals, the inability to obtain financing or other factors could cause delays in developing properties. Such delays could materially adversely affect the financial performance of the Registrant.

| iv. | Additional Financing Requirements |

The Registrant’s operations currently do not provide any cash flow. In the past the Registrant has relied on sales of equity securities to meet its cash requirements. There can be no assurance that future operations will provide cash flow sufficient to satisfy operational requirements and cash commitments, or that additional equity financing will be available on terms acceptable to the Registrant, or at all.

The Registrant presently has sufficient financial resources to maintain its current level of operations for at least the remainder of its fiscal year. Property acquisitions or changes in the scope of the Registrant’s operations may require additional funding. The Registrant’s operational budget is based in part on estimates provided by independent contractors. In the past these estimates have proven to be less than amounts ultimately paid by theRegistrant, largely resulting from changes in the project. Failure of the Registrant to obtain additional financing, if and as required, on a timely basis could delay some or all of the Registrant’s projects.

Construction of any of the projects may require that the Registrant raise substantial project financing. The Registrant has not previously completed financing of a development project and a financing of this magnitude will be dependent on a large number of factors beyond the Registrant’s control, including the state of financial and equity markets, interest rates, currency exchange rates, commodity prices for diamonds, nickel, cobalt, sulphur, gold and silver, energy prices and other factors. Failure by the Registrant to finance any of the projects could materially adversely affect the Registrant’s future financial performance.

The business of mining and processing is generally subject to certain types of risks and hazards, including fires, power outages, labour disruptions, the inability to obtain suitable or adequate land, machinery, equipment, or labour, environmental hazards, industrial accidents, unusual or unexpected rock formations, cave-ins, flooding, finished product losses, theft, periodic interruptions due to inclement or hazardous weather conditions and political risk. Such risks could result in damage to, destruction of or expropriation of mineral properties or production facilities, personal injury, environmental damage, delays in mining, monetary losses and possible legal liability. Projects may also be affected by risks of fluctuations in exchange rates and inflation. No assurance can be given that insurance to cover these risks will be available at economically feasible premiums or at all. Insurance against environmental risks (including potential for pollution or other hazards as a result of the disposal of waste products occurring from production) is not generally available to the Registrant or to other companies within the industry. To the extent that the Registrant is subject to environmental liabilities, the payment of such liabilities would reduce or exhaust the funds available to the Registrant. Should the Registrant be unable to fund fully the cost of remedying an environmental problem, the Registrant might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy.

| vi. | Fluctuations in Commodity Prices |

The mining industry in general is intensely competitive and there is no assurance that, even with commercial quantities of mineral deposits discovered, a profitable market will exist for the sale of any metals and diamonds produced. Factors beyond the control of the Registrant may affect the marketability of any substances discovered. The prices of rough diamonds and various metals have experienced significant movement over short periods of time, and are affected by numerous factors beyond the control of the Registrant, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining production methods. The supply of and demand for rough diamonds and metals are affected by various factors, including political events, economic conditions and production costs in major producing regions. There can be no assurance that the price of rough diamonds or any metal will be such that the Registrant’s properties can be mined at a profit.

The Registrant does not currently hedge any of its proposed future production, but may do so in the future.

Third parties may dispute the Registrant’s rights to its mining and other interests. While the Registrant has investigated title to all its property interests and, to the best of its knowledge, title to all properties is in good standing or are subject to permit renewal application, this should not be construed as a guarantee of title.

Potential project sites in Burundi, South Africa and Nevada, USA may be subject to dispute, prior unregistered claims, or native land claims and ultimate transfer to the Registrant may be affected by undetected defects. Such claims or defects could materially adversely affect one or more of the projects and the Registrant’s financial performance.

| viii. | Foreign Countries and Regulatory Requirements |

The current or future operations of the Registrant, including development activities and commencement of production on its properties, require permits from various foreign, federal, state and local government authorities and such operations are and will be governed by existing and possible future laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits for exploration and permit renewals. Permitting for the commencement of mining operations on any of the properties in which the Registrant has an interest will require further processing by government agencies, however, the Registrant does not anticipate being in a position to apply for any of the required permits to commence mining operations on its properties until the end of 2005 at the earliest. Applications for the renewal of prospecting permits are made as and when required. The Registrant’s management does not expect that any of its properties will have progressed to completion of a feasibility study prior to such time, and the Registrant would not commence operations on any property until a feasibility study has been prepared on that property.

The Registrant believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There can be no assurance, however, that all permits which the Registrant may require for prospecting or the construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations would not have an adverse effect on any mining project which the Registrant might undertake.

| ix. | Political Risk and Political Risk Insurance |

The Registrant is exposed to political risk as it has projects in areas which may be subject to unstable political situations. The Registrant has not applied for political risk insurance through the Canadian Export Development Corporation. Should the Registrant apply for such insurance there can be no assurance that insurance will be available at economically feasible premiums or available at all.

The Canadian government, through the Export Development Corporation, may provide insurance to cover unforeseen political risk. In deciding whether to provide insurance coverage, the Canadian government considers the following factors: whether the Registrant’s activities involve economic advantages to Canada, such as the development and preservation of foreign markets or the securing of sources of raw materials not available in Canada; whether there are economic advantages to the host country, such as expansion of employment; whether there is host government approval of the proposed activity; and the size and nature of the activity; however, as a matter of policy, the Canadian government’s insurance program covers almost any right that a Canadian company may acquire in a foreign enterprise, including equity, loans, management contracts and royalty and licensing agreements.

Specifically, the Registrant’s BurundinNickelPproject is located at Musongati in Burundi in Central Africawhere (the “Burundi Nickel Project”) wherethere has been a recent history of political conflict between the various tribal groups. These groups are seeking to share political and military power. Attempts have been made by the international community to broker an agreement which will allow for an end to the conflict and a peaceful transition of power. The instability within the country gave rise to a declaration of force majeure by the Registrant’s subsidiary in April 2000. Following the implementation of a transitional government in Burundi in November 2001 as a result of the peace accord signed by most of the parties and a subsequent improvement in general security, the declaration of force majeure was lifted on March 28, 2002. Force majeure was re-imposed in August 2002 following a significant deterioration in security in Burundi. The project has remained under force majeure since August 2002 except for a brief period in July 2004. In the event that the political and security situation does not improve the Registrant’s ability to proceed with the Burundi Nickel Project will be materially adversely affected.

While the Registrant has reviewed the existing environmental legislation of each country in which it has a project, these assessments are preliminary. The Registrant’s projects are at an early stage and will require substantially more work regarding environmental matters and will be required to meet World Bank standards or regulations of the local governments, whichever is more stringent. Therefore, existing and possible future environmental legislation, regulations and actions in Burundi, South Africa and the USA could cause additional expense, capital expenditures, restrictions and delays in the Registrant’s activities undertaken in connection with the projects. The continued conduct of each of the Registrant’s projects depends, to a large extent, on the obtaining and maintaining of environmental approvals and there is no assurance that such approvals will be granted when requested. Delays in the granting of such approvals and/or changes in environmental legislation and regulations could materially adversely affect the Registrant’s operations and financial performance.

The Burundi Nickel Project will require significant infrastructure upgrades, particularly relating to transportation (rail, road and neighbouring country harbour facilities) as well as the provision of additional electrical power. Delays in infrastructure upgrades or the requirement for the Registrant to finance such upgrades may materially adversely affect the Registrant’s financial performance.

| xii. | Reliance on Key Personnel |

The Registrant is heavily dependent upon the expertise of certain of its own or its subsidiaries’ key officers. The loss of the services of one or more of these individuals could have a material adverse effect on the Registrant. The Registrant’s ability to recruit and retain highly qualified management personnel is critical to its success. There can be no assurance that the Registrant will be successful in attracting and retaining skilled and experienced management; if it is unable to do so this may materially adversely affect the Registrant’s financial performance.

| xiii. | Conflicts of Interest |

Certain directors, officers or promoters of the Registrant are directors, officers, significant shareholders or promoters of other publicly listed companies. As a result, potential conflicts of interest may arise with respect to the exercise by such persons of their respective duties for the Registrant. In the event that such a conflict of interest arises at a meeting of the directors of the Registrant, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In the appropriate cases, the Registrant will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. Other than as indicated, the Registrant has no other procedures or mechanisms to deal with conflicts of interest.

The Registrant has never declared or paid cash dividends on its Common Shares and does not anticipate doing so in the foreseeable future. There can be no assurance that the Registrant’s board of directors (the “Board”) will ever declare cash dividends, which action is exclusively within its discretion. Investors cannot expect to receive a dividend on the Registrant’s Common Shares in the foreseeable future, if at all.

The Registrant currently maintains its banking accounts mostly in Canadian dollars. The Registrant’s office in Canada (using Canadian dollars) and office in Australia (using Australian Dollars) and proposed operations in Burundi (using Burundian francs), in South Africa (using Rands) and in the USA, and the proposed sale of metals and diamonds which are priced in U.S. dollars make it subject to foreign currency fluctuations and such fluctuations may materially affect the Registrant’s financial position and results from operations. The Registrant does not currently engage in hedging activities.

The Registrant competes with other development companies which have similar operations, and many such competitor companies have operations and financial resources and industry experience far greater than those of the Registrant. Nevertheless, the market for the Registrant’s potential future production of diamonds, nickel, cobalt, gold and silver tends to be commodity-oriented rather than company-oriented. If it successfully reaches commercial production, the Registrant will still be subject to competition from much larger and financially stronger competitors and such competition may materially adversely affect the Registrant’s financial performance.

The Registrant may attempt to raise additional capital in the future from the issue of new Common Shares and grant to some or all of its own and its subsidiaries’ directors, officers, insiders and key employees options to purchase the Registrant’s Common Shares as non-cash incentives to those employees. Such capital raisings may be at prices below or equal to market prices and such options may be granted at exercise prices equal to market prices at times when the public market is depressed. To the extent that significant numbers of new Common Shares are issued or such options may be granted and exercised, the interests of then existing shareholders of the Registrant will be subject to additional dilution.

The Registrant is currently without a source of revenue and will most likely be required to issue additional shares to finance its operations and, depending on the outcome of the feasibility studies, may also issue substantial additional shares to finance the construction of any or all of its projects.

| xviii. | Volatility of Common Share Price and Volume; Lack of Liquidity |

The Registrant’s Common Shares are listed for trading on the Australian Stock Exchange (“ASX”). The Registrant’s listing on the CDNX, in Canada, was voluntarily terminated on October 4, 2001 due to lack of trading volume. Shareholders of the Registrant may still be unable to sell significant quantities of the Common Shares into the public trading markets without a significant reduction in the price of the shares, if at all. Furthermore, there can be no assurance that the Registrant will continue to be able to meet the listing requirements of the ASX or achieve listing on any other public trading exchange. The market price of the Common Shares may be affected significantly by factors such as changes in the Registrant’s operating results, the completion or delay of a positive feasibility study, the availability of construction financing, fluctuations in the price of metals and diamonds, the interest of investors, traders and others in small exploration stage public companies such as the Registrant and general market conditions. In recent years the securities markets in Australia have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small capitalisation exploration companies similar to the Registrant, have experienced wide fluctuations which have not necessarily been related to the operating performances, underlying asset values or future prospects of such companies. There can be no assurance that future fluctuations in the price of the Registrant’s shares will not occur.

| xix. | Adverse Tax Consequences to U.S. Shareholders Resulting From the Registrant’s PFIC Status |

The Registrant believes that it qualified as a passive foreign investment company (“PFIC”) for the fiscal year ended December 31, 2004 and may qualify as a PFIC in the future with respect to U.S. Holders of the Registrant’s Common Shares because the only source of income is interest, a passive source of income under the PFIC rules.

See “Item 10.E. Taxation - United States Federal Income Tax Consequences” for a more detailed discussion of material United States federal income tax consequences for U.S. shareholders.

xx. | Potential Inability to Enforce U.S. Judgements against the Registrant or its Officers and Directors |

The Registrant is incorporated under the laws of the Yukon Territory, Canada and, all of the Registrant’s directors and officers are residents of either Canada or Australia.Consequently, it may be difficult for United States investors to effect service of process within the United States upon the Registrant or upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). A judgement of a U.S. court predicated solely upon such civil liabilities may be enforceable in Canada by a Canadian court if the U.S. court in which the judgement was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Registrant predicated solely upon such civil liabilities.

Item 4 - Information on the Company

| A. | History and Development of the Company |

The Registrant was incorporated in the Province of Alberta pursuant to the Business Corporations Act (Alberta) on December 17, 1985, was continued under the Canada Business Corporations Act on September 24, 1987 and was continued pursuant to theBusiness Corporations Act (Yukon) on June 17, 1997.

The head office and address for service of the Registrant is 20607 Logan Avenue, Langley, British Columbia, V3A 7R3, Canada - tel. (604) 530-8436 and its registered and records office in Canada is located at 3081 Third Avenue, The Drury Building, Whitehorse, Yukon, Y1A 4Z7, Canada - tel. (867) 668-4405. Its registered office in Australia is Suite 3, Parkview, 23 Richardson Street, South Perth, Western Australia, Australia 6151 - tel. (011) 618-9474-4178.

Since inception, the Registrant has been involved in exploration for metals, minerals and diamonds and in the feasibility study for the potential development of a nickel processing facility initially in Australia and subsequently in New Caledonia in the South Pacific (the “New Caledonia Nickel Project).

In May 1998, the Registrant revised the scope of its nickel project to improve the economics of the project by reducing the anticipated costs associated with transporting ore from New Caledonia to Australia. The revised scope included a joint venture equity participation in Societe des Mines de la Tontouta’s (“SMT”) Nakety concessions, whereby the Registrant would complete a feasibility study for the mining and processing of the ore in New Caledonia. A Heads of Agreement was signed, subject to further negotiation and finalisation, to form a joint venture company that would undertake the construction of a mine and processing facility to be located in the Canala region of New Caledonia.

Effective May 7, 1999, the Registrant entered into a Plan of Arrangement (the “Plan”) whereby the Registrant acquired Argosy Mining Corp (“AMC”). Pursuant to the Plan, the shareholders of AMC exchanged their shares for shares of the Registrant on the basis of 5 AMC shares for 3 new shares of the Registrant, the Registrant changed its name from Calliope Metals Corporation to Argosy Minerals Inc. and changed its year end to December 31 from April 30. As the shareholders of AMC as a group acquired control of the Registrant, the transaction was accounted for as a reverse takeover.

The heads of agreement, signed in May 1998, was superseded by a Tripartite agreement between the Registrant, SMT and Norilsk Nickel’s subsidiary, NN Invest Holdings SA (“NNIH”), signed in October 2001, under which NNIH re-imbursed the Registrant US$7,166,000 for a portion ofits expenditure previously incurred on the New Caledonia Nickel Project, and would complete a Bankable Feasibility Study by December 2004. On August 5, 2002 the Registrant received a termination notice from NNIH terminating its involvement in the New Caledonia Nickel Project. The termination by NNIH effectively terminated the Registrant’s interest in the New Caledonia Nickel Project. In addition NNIH, through the International Court of Arbitration of the International Chamber of Commerce (“ICC”), issued a request for arbitration for the return of US$7,166,000 paid to the Registrant on signing of the Tripartite Agreement plus expenditures of US$1,368,222 and the costs of arbitration.

In March 2003, the Registrant entered into an option agreement, with subsequent amendments for the acquisition of 85% of Albetros Inland Diamond Exploration Pty Ltd. (“Albetros”), the owner of a prospecting permit in Namaqualand, South Africa (the “Albetros Diamond Project”).See Item 4B Business Overview

In December 2003 and May 2004, the Registrant entered into option agreements over the Gold Creek properties in Nevada, USA.See Item 4B Business Overview, Gold in Nevada, USA

In December 2004, The Registrant announced that the arbitration initiated by NNIH in September 2002 over the New Caledonianickel lateriteNickel pProject had been discontinued and is now settled.The Settlement Agreement, the terms of which are bound by a confidentiality agreement signed between the parties, follows a meeting held in Paris on the 25th of November, 2004. Each party will remain responsible for its costs incurred in the arbitration process and neither party has any claim outstanding against the other.

Principal Capital Expenditures and Divestitures

The Registrant’s Principal Accounting Policies for Project Assessment and Mineral Properties and Deferred Costs are as follows:

Project assessment costs consist of expenditures to evaluate new projects. These expenditures are charged to income when incurred. Once the Registrant decides to acquire the property, costs associated with further exploration or development are accounted for as described under Mineral Properties and Deferred Costs below. Included in project assessment expenditures are option payments for mineral properties, these payments are charged to income when incurred.

| ii. | Mineral Properties and Deferred Costs |

The costs of acquiring mineral properties, and related exploration and development costs, are deferred until the property to which they relate is placed into production, sold or abandoned. Deferred costs will be amortized over the estimated useful life of the ore body following commencement of production, or written off if the property is sold or abandoned.

The Registrant will reduce the carrying value of mineral properties and deferred costs by any amount received from the introduction of a joint venture partner.

Management's estimate of carrying values, if any, is subject to risks and uncertainties affecting the recoverability of the Registrant’s investment in mineral properties. Although management makes its best estimate of these factors based on current conditions, it is possible that changes could occur in the near term which could adverselyaffect management's estimate of the recoverability of mineral properties and deferred costs, if any, and the need for asset impairment write-downs.

Although the Registrant has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Registrant’s title. Such properties may be subject to prior undetected agreements or transfers and title may be affected by such defects.

The Registrant has financed capital expenditures on its mineral resource projects from funds available after completion of the Plan and receipt of funds from NNIH as follows:

Project | | Location | | 2004 | | 2003 | | 2002 | |

| | | | | | | | | | | | | | |

Burundi Nickel Project | | | Burundi, Central Africa | | | Nnil | | $ | 19,783 | | $ | 50,662 | |

Kremnica Gold Project | | | Slovak Republic, Central Europe | | | n/a | | $ | 33,988 | | $ | 99,036 | |

New Caledonia Nickel Project | | | New Caledonia, South Pacific | | | n/a | | | n/a | | $ | 90,512 | |

Where exploration on its mineral projects prove unsatisfactory, the Registrant disposes of the project and writes off expenses and deferred costs associated with that project. No expenditures were written off over the last 3 years due to unsatisfactory exploration results. In addition, the Registrant reviews the carrying costs, if any, of each of its investments quarterly and writes down mineral properties and deferred costs associated with projects whose carried costs may not be recoverable. Mineral properties and deferred costs written down over the last 3 years due to continued low metals prices, political instability, the loss of the project or the inability to introduce a joint venture partner or sell the underlying project are as follows:

Project | | Location | | 2004 | | 2003 | | 2002 | |

Burundi Nickel Project (1) | | | Burundi | | $ | nil | | $ | 19,783(2) | | $ | 7,973,049(4) | |

New Caledonia Nickel Project | | | New Caledonia | | | n/a | | | n/a(3) | | $ | 2,539,625(5) | |

Kremnica Gold Project (1) | | | Slovak Republic, Central Europe | | | n/a | | $ | nil(3) | | | nil | |

| | 1. | . | The Registrant acquired the Kremnica Gold Project and the Burundi Nickel Project during the year ended December 31, 1999 following the completion of the Plan whereby Argosy Mining Corp. (“AMC”) became a wholly-owned subsidiary of the Registrant. |

| | 2. | . | During the year ended December 31, 2003 the Registrant wrote off $19,783 expended on the Burundi Nickel Project during the year. |

| | 3. | . | The Registrant sold the Kremnica Gold Project in July 2003. |

| | 4. | . | During the year ended December 31, 2002 the Registrant wrote down its investment in the Burundi Nickel Project by $7,973,049 to $nil due to the ongoing political and security problems in the country. |

| | 5. | . | On August 5, 2002, NNIH terminated its involvement in the New Caledonia Nickel Project which resulted in the loss of the project. Consequently, during the year ended December 31, 2002, the Registrant wrote off its remaining investment in the project in the amount of $2,539,625. |

Divestiture of assets over the last 3 years are as follows:

| | | Proceeds |

Project | Location | 2004 | 2003 | 2002 |

| Kremnica Gold Project | Slovak Republic | - | $500,000 | - |

In July 2003, the Registrant completed the sale of its Slovak subsidiary Kremnica Gold a.s., theowner of the Kremnica Gold Project for $500,000. Previously, during the year ended December 31, 2001, the Registrant wrote down its investment in the project by $7,533,332 to recognize the difficulty in being able to sell the project or introduce a joint venture partner. Deferred expenditures during 2002 and 2003 amounted to $374,500 resulting in a gain on disposal of $125,500.

Details of Project Assessment Expenditures during the years ended December 31, 2004 and 2003 are as follows:

Albetros Diamond Project | | 2004 | | 2003 | |

| Geological Consulting, Supervision and Legal | | $ | 44,565 | | $ | 218,115 | |

| Drilling | | | 80,207 | | | 486,693 | |

| Gravel Processing and Sorting | | | 57,020 | | | 147,866 | |

| Travel and Accommodation | | | 55,220 | | | 129,608 | |

| Option Fees | | | 117,158 | | | 469,000 | |

| Rehabilitation | | | 30,934 | | | - | |

| | | | 385,104 | | | 1,451,282 | |

Nevada Gold Project | | | | | | | |

| Geological Consulting, Supervision and Legal | | | 81,995 | | | - | |

| Assessment and Data | | | 8,894 | | | - | |

| Option Fees | | | 59,317 | | | - | |

| Claim Fees | | | 12,904 | | | - | |

| Travel and Accommodation | | | 53,135 | | | - | |

| | | | 216,245 | | | - | |

Other Projects | | | | | | | |

| Legal, Consulting | | | 40,331 | | | 142,216 | |

| Data Acquisition | | | - | | | 74,463 | |

| Travel, Accommodation and other | | | 62,367 | | | 53,402 | |

| Expenses Recovered | | | (116,804 | ) | | - | |

| | | | (14,106 | ) | | 270,081 | |

Total | | $ | 587,243 | | $ | 1,721,363 | |

Over the next year, the Registrant proposes to finance the following project assessment and capital expenditures on its projects:

Project | | Location | | 2005 (Proposed) | |

| Nevada Gold Project | | | Nevada, USA | | $ | 250,000 | |

Burundi Nickel Project(1) | | | Burundi, Central Africa | | $ | nil | |

Albetros Diamond Project(2) | | | Namaqualand, South Africa | | $ | nil | |

Note: (1) The Registrant is seeking new opportunities and project assessment or capital expenditures will vary depending on the nature of new projects acquired or the results of assessments of current projects, as well as any change in the security situation in Burundi.

(2) Subsequent to December 31, 2004, the Registrant terminated the agreement to acquire the Albetros Diamond Project.

These expenditures are being financed from the Registrant’s working capital.

The Registrant is currently re-evaluating its ongoing involvement in theMusongatiBurundi Nickel Project.

There has been no indication of any public takeover offers by third parties in respect of the Registrant’scommon sharesCommon Shares or by it in respect of other companies’ shares during the last or in the current financial year.

The Registrant was not involved in any bankruptcy, receivership or similar proceedings, nor was it a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets, since December 31, 2003 through the date of this Annual Report.

The Registrant is a Yukon corporation involved in the exploration and possible future development of mineral resources. Its Common Shares are listed for trading on the ASX under the trading symbol “AGY”.

At December 31, 2004, the Registrant had three projects namely:

| | - | The Nevada Gold Project (as defined below) in Nevada, USA, |

| | - | TheMusongatiBurundi Nickel Project in Burundi, which is subject to force majeure, and |

| | - | The Albetros Diamond Project in South Africa. Subsequent to December 31, 2004 the Registrant terminated the agreement to acquire this project. |

Apart from the Nevada Gold Project, all of the Registrant’s projects are located outside North America and none of the projects are currently in production, consequently the Registrant does not have a source of revenue other than interest income from cash balances.

To date, the Registrant has not earned any revenues.

Gold Creek

In November 2003, the Registrant entered into an option agreement over a gold-rich vein system (“Gold Creek”) in Elko County, Nevada, U.S.A. (the “Nevada Gold Project”). The property is located within the southern boundary area of Humboldt National Forest, some 100 km north of the town of Elko, and NE of Jerritt Canyon Gold Mine. Access to the property is via secondary gravel road to the entrance to the national forest and then on tracks which criss cross the area.

The Gold Creek property is covered by 37 unpatented mining claims of 3.1 km2 total area. An additional 2 claims (16.7 hectares) cover water rights. Mineral rights on the claims are held by Happy Tracks Mining Company (“Happy Tracks”). The option agreement with Happy Tracks initially covered 31 unpatented lode claims and a n additional sixfurther 6were staked in 2004, and have become subject to the same option agreement. The option agreement provides for annual payments over 3.5 years totalling US$66,000 with an exercise price of US$1,250,000 for 100% of the mining claims.

The Gold Creek claims cover two past producing mines: Rosebud and St. Elmo. Gold was reportedly first discovered in the district in the late 1800’s when placer mining produced at least 40,000 ounces of gold. The Rosebud and St. Elmo mines were probably discovered around the same time. Accurate production figures for the Rosebud underground silver - lead - zinc - copper mine are not known. Much of the underground development work at the St. Elmo gold mine reportedly took place in the 1940’s although there are no records of production. The main St. Elmo vein system was mined underground along a strike distance of 165m and a limited amount of raising and stoping was carried out in the ore. It has been estimated that some 3,200 tonnes was mined at this time.

The existing high grade gold mineralization at St. Elmo will be the main focus for future work by the Registrant. Gold is hosted by sulphide-bearing quartz veins and breccias emplaced along NNW- to NE-trending high angle structures within the Cambrian age Prospect Mountain Quartzite.

Past Exploration

In terms of recent exploration activity, some 6 companies conducted evaluation work in the Gold Creek area between 1962 and 2000. During 1988, Newmont Exploration Ltd completed chip-channel sampling of the accessible underground workings at St. Elmo, returning assaysranging from 0.05 g/tupto 213g/t. Newmont noted that “native gold is commonly seen in oxidized cavities within the quartz vein” and that “very flashy ore grades (>22oz/t gold)” do occur.

In 1990, Harrison Western mined about 1,400 tonnes from 90m of drift development within St. Elmo. The weighted average grade for this material was reported to be~approximately10g/t gold. Harrison Western supplied a 360 kg sample for metallurgical testwork by Hazen Research Inc. Hazen reported that this sample had an average grade of 8g/t.

Surface sampling of exposed vein/breccia at St. Elmo by Neil and Associates Ltd in 1996 returned assaysupranging from 5 ppb to 28.5g/t gold. Further surface sampling by MasonExploration Associates Ltd in 1997-99 along a 350m strike over St. Elmo returned assaysupranging from 5 ppb to 73g/t.

Golden Hope Mines Limited in 1998 completed an Induced Polarisation(“IP”)survey(“IP”)to help define the vein system at St. Elmo. The IP revealed a well defined resistivity high suggesting that quartz vein/breccia mineralization has a strike length of 600m to 800m with the anomaly open to the north and possibly to the south as well. “Realsection profiles” across the resistivity anomaly suggest that the veins continue below surface to +300m depth.

In 1999, Mason Exploration Associates Ltd completed 3 diamond drill holes at St.Elmo. Covering a strike extent of 200m the three holes returned best results of 2m at 17g/t gold, 0.5m at 6.7g/t gold, and 0.5m at 0.5g/t gold. The hole with the latter of the above results targeted the northern extension of the IP resistivity anomaly with a 73g/t gold rock chip sample at the surface.

Diamond Jim

In December 2003, the Registrant announced another option agreement over additional claims covering the northern extension of this gold rich system. The northern extension is covered by 33 unpatented mining claims (“Diamond Jim Mine Claims”), total area 2.2 km2 that adjoins the Gold Creek claims located to the south. Mineral rights on the claims are held by a private individual. The option agreement, at no cost, allowed the Registrant until May 2004 to decide on whether to continue exploring the Diamond Jim claim block and to negotiate terms that would govern any extension to the option. In June 2004, the Registrant announced that it had entered into an option agreement over the Diamond Jim Mine Claims. The terms of the 3 year option agreement required the Registrant to pay US $20,000 on signature and equal payments of US $20,000 at the end of the first and second years. The option grants the Registrant the right to purchase the property outright for US $1,500,000 with option payments being credited towards the purchase price.

The claims cover a past producing mine, the Diamond Jim Mine, which is located 2 km northwest of St. Elmo Mine. The earliest development at Diamond Jim probably commenced soon after 1873. It has been estimated that less than 9,000 tonnes were mined at Diamond Jim prior to 1954. Recorded production from 1954 to 1985 is: 23,108 oz silver, 152,350 kg lead with minor gold, zinc and copper.

Of interest to the Registrantisare believed to beknown high grade gold mineralisation outcropping to the east of the mine and the likelihood that this mineralisation may be a northerly extension to that at St. Elmo. An IP completed by Golden Hope Mines Limited in 1998 identified a half km long roughly SSE - trending resistivity high on the eastern slopes of Rosebud Peak (0.5km NE of Diamond Jim mine). The resistivity high on Rosebud Peak has been described as being coincident with a fault zone that may be closely related to the fault controlling the gold mineralisation at St. Elmo. Surface rock chip sampling by Mason Exploration Associates Ltd. along a 100m N-S zone above the resistivity high on the eastern slopes of Rosebud Peak returned highest assays ranging from 5ppb to: 6.25, 7.85, 9.3, 9.8, 11.97, 12.03, 15.15 and15.43 g/t gold within quartz veins and breccia in quartzite.

Geology and Mineralisation

The main rock units in the project area are the Cambrian aged Prospect Mountain Quartzite and a shale plus sandstone sequence belonging to the Cambro-Ordovician Tennessee Mountain Formation.

Gold mineralisation within the Gold Creek Project area has been described from 3 areas: the St. Elmo mine area, Rosebud Peak and from the “saddle zone” between Rosebud Peak and St. Elmo. By far the most prospective area at this time is that surrounding the St. Elmo mine area. Gold mineralisation in the St. Elmo mine area is high grade, fault-controlled epithermal-style gold-silver in close association with quartz - pyrite - sericite alteration of the quartzite wallrocks. Sulphide minerals identified at St. Elmo include pyrite, chalcopyrite, galena, sphalerite, covellite, chalcocite, digenite, enargite and tetrahedrite. The vein system is a series of roughly north-trending anastomosing quartz veins that dip between 55o and 65o eastwards and which have been traced 230m along strike by drilling. Geophysical surveys completed by previous explorers suggesting that quartz vein/breccia mineralisation has a strike length of 600m to 800m with the possibility of extensions to the north and possibly to the south as well.

Surface sampling of exposed vein/breccia at St. Elmo by previous explorers returned assays up to 73 g/t Au and assays up to 213 g/t gold, with visible gold, from their sampling of the underground workings.

A geophysical survey completed by an earlier explorer on Rosebud Peak identified a half km long roughly SSE - trending anomaly on the eastern slopes of Rosebud Peak (0.5km NE of Diamond Jim mine); this anomaly was described as being associated with a fault zone that may be closely related to the fault controlling the gold mineralisation at St. Elmo.

The “saddle zone” is located in a topographic saddle between Rosebud Peak and St. Elmo. Past rock chip sampling returned 1.03 g/t gold and 0.82 g/t gold.

2004 Sampling by the Registrant

Assay results, from samples provided by the Registrant, reported by ALS Chemex in Vancouver, confirm the encouraging results reported by previous explorers.

Gold gradesranging from 0.01 g/t,reaching 145.5 g/t gold were received from the sampling of outcrop, sub-crop and stockpiles above the St. Elmo vein system. The 145.5 g/t gold sample and an accompanying 19.15 g/t gold result are both from outcrops of breccia and quartz veining, respectively, both trending at almost right angles to the main, roughly north-south, structural trend through St. Elmo. The combined width of the vein and adjacent breccia is 3.1 m.

Reconnaissance sampling by the Registrant in the area surrounding Diamond Jim mine returned rock chip assaysranging from less than 0.5 g/t andreaching 9.06 g/t gold and 1,500 ppm silver. Anomalous gold grades in rock chip samples are dispersed along a 300m long, roughly north-south trending crest zone through Rosebud Mountain where the highest elevation reaches 2,489 metres. Together with sample results reported by earlier explorers, grades within the 300m long zone range up to 15.4 g/t gold with 11 samples returning more than 4 g/t gold. This zone is interpreted to be one of silicified and quartz stockwork veined quartzite along a possible fault zone.

The above areas will be targeted in the planned core drilling program.

Environmental

During the second half of 2004, the Registrant commissioned consultants to complete an environmental audit across the area that would be subject to a proposed drilling program. The audit is complete and has been lodged with the US Forest Service (“USFS”).TherRegistrant believes it will obtain permit approval prior to the spring of 2005 from the USFS. There can be no assurance however that such permit will be granted or the scope of such permit will allow the Registrant to conduct its proposed drilling program.Permit approval is expected in advance of Spring 2005.

Plan of Operations

Subject to receiving the necessary permits,Ccommencing in lateSspringof2005 proposed work will include a diamond drilling program that will test the 3 areas of gold anomalism sampled by the Registrant during the 2004 program.. The drilling program is subject to the Registrant receiving a permit from the US Forest Service to carry out the program. This permit is expected by April-May 2005.

| 2. | Burundi Nickel Project - Musongati |

The Burundi Nickelproject (the “Burundi NickelProject”) is a proposed venture to mine and process lateritic nickel-cobalt ore to produce nickel and cobalt metal in Burundi. The Registrant expects that the nickel laterite deposits at Musongati, identified by previous exploration work conducted between 1972 and 1990 by other parties, are sufficiently large to support a mining operation with a life exceeding 20 years - see “Special Note Regarding Forward-Looking Statements”. Testwork by Universal Oil Products in 1978-79 indicated the ore is amenable to leaching using thepressure acid leach (“PAL”) process, followed by counter current decantation and iron precipitation, prior to the precipitation of an intermediate product which may then be further refined to produce LME grade nickel and LMB grade cobalt.

The Burundi Nickel Project is based on three nickel cobalt laterite deposits. Considerable exploration and engineering work was completed on the deposits in the period 1972 to 1990. The major deposit known as Musongati was drilled and evaluated the most. The other two deposits, Waga and Nyabikere are far less advanced but have potential to supply the project with quantities of high-grade saprolite ore. The Musongati deposit also has anomalous platinum-group-metal concentrations, along with indications of sulphide mineralisation underlying the laterites.

Musongati lies at an elevation of 1700 m, in the tropical highlands of Burundi, about 1000 m above Lake Tanganyika. The outlying Waga deposit is 30 km west of Musongati and the Nyabikere deposit is 40 km north.

The Musongati laterites are derived from the weathering of an ultrabasic complex, particularly, serpentinised dunite with a primary nickel content of about 0.3%. Two types of mineralisation are present in approximately equal proportions: limonite and saprolite (a less weathered laterite rock type generally found beneath limonite). Nickel in the limonite mineralisation is tied to goethite whereas in the saprolite mineralisation it is related to serpentine group and clay minerals. The typical weathering profile is canga (iron caprock), the limonite zone (averaging 15 m thick), the saprolite zone (averaging 12 m thick) and ultrabasic bedrock.

The Musongati nickel/cobalt deposit is situated within the MusongatiEexplorationLlicence on three adjacent plateaux as a result of erosion of a single layer of laterite. The plateaux are referred to from west to east as the Geyuka, Rubara and Buhinda zones, of which Buhinda is the most significant and best defined. Historical exploration (by diamond drilling) was completed in three stages from 1975 to 1990, by different parties with different objectives. A total of 237 holes were drilled at Musongati, while 81 holes were drilled at Waga and Nyabikere. Due to the large size of the mineralised area, an effort directed to identifying zones with a high nickel content resulted in a greater focus on the Buhinda Zone.

Mining Convention

In 1998, Andover Resources N.L. (“Andover”), now a wholly-owned subsidiary of the Registrant, negotiated a Mining Convention (the “Convention”) with the Government of Burundi to explore and develop the Musongati deposits. The Convention was ratified by the Burundian National Assembly on March 10, 1999, giving the Registrant the exclusive right to develop theMusongati deposit. The Convention is a comprehensive agreement that awards mineral rights to the Registrant and sets out a work program and a detailed framework for future development and operation of a mine. During the initial 3-year exploration period, geological and engineering studies were to be completed, leading to a full project feasibility study. The Registrant planned a staged exploration program including scoping and pre-feasibility studies that would lead to a full feasibility study. The program included drilling, ore reserve estimations, metallurgical testing, infrastructure studies and an environmental impact study. Upon completion of the feasibility study and a decision to proceed, the agreement provides for the awarding of a mining title known as a Mining Concession. The term of the Mining Concession is 25 years, renewable twice for successive periods of 10 years. If the project proceeds, a new Burundian company in which the Burundian government will have 15% interest, will be incorporated to develop and operate the project. Within 30 days of receipt of project finance for full mine development, the government will be reimbursed their previous expenditure of US$8.3 million. A 5-year tax holiday will apply to the project, followed by a 35% income tax rate. Mine equipment, materials and fuels will be tax and duty exempt. Force majeure and international arbitration provisions normal to the industry apply.

Technology

Previous metallurgical studies identified PAL as a suitable process technology for Musongati. These studies provide initial benchmark results, which will require further testwork to optimise the specific PAL process plant design.

Project Information

The proposed mine and plant is to be situated at the Musongati deposit located approximately 120 km east-southeast of Bujumbura, the capital of Burundi. Burundi is a small country located in Central Africa and borders the western edge of Tanzania.

An exploration licence covering 171.1 km2 was granted March 18, 1999 for three years covering the Musongati deposit; the Waga and Nyabikere deposits are reserved for Andover pending the completion of a feasibility study at Musongati. On April 19, 2000, Andover declared force majeure and curtailed operations in Burundi due to the deteriorating security situation. In March 2002, the declaration of force majeure was lifted due to improved security conditions in Burundi; however, due to the deterioration in security in Burundi, force majeure was re-imposed on August 1, 2002.The project has been subject to force majeure since August 2002 except for a brief period during 2004.The exploration licence is extended for the duration of force majeure and has a remaining term of approximately 18 months once force majeure is lifted. The Musongati licence area is sparsely populated due in part to the poor lateritic soil.

The Burundi Nickel Project is accessed by roads which are mostly in good condition. A network of trails and roads crosses the main areas of the licence. During construction and operation, the Burundi Nickel Project will require the importation of significant quantities of goods not locally available. As Burundi is a landlocked country, approximately 1100 km from the Indian Ocean, transportation infrastructure is a key issue to the economics of the project. Initial investigations have determined both the preferred route, as well as which consumables will need to imported. The preferred transportation corridor is from the port of Dar es-Salaam in Tanzania on the east coast of Africa, by the existing railway to Kigoma, just south of Burundi. From there, a regional road network will be utilised totruck material north to Musongati. Most of the parts necessary to construct the plant will have to be imported and transported along this route. The major consumables once production commences will be fuel, sulphur (for acid) and dolomite (as a neutralising agent). Fuel and sulphur will be sourced on the world markets and shipped via the above route, while dolomite will be sourced locally within Burundi and trucked to Musongati. There can be no assurance that such consumables will be available or deliverable to the Registrant at prices that would make the Burundi Nickel Project economically feasible.

The Burundi Nickel Project has access to electricity via hydroelectric facilities in the country and elsewhere in the region. The existing national electricity grid does not currently have enough capacity to provide power to the Burundi Nickel Project. The Registrant intends to generate electricity via fuel-powered generator sets or alternatively to utilise new sources of electricity. There is potential to generate electricity by steam co-generators powered by the sulphuric acid plant. A number of independent proposals to create or expand hydroelectric facilities in the country and in the region, which could be advantageous to the project, are at the planning stage. There can be no assurance that sufficient access to electricity will exist in the future or can be created to power the Burundi Nickel Project.

The process residue (or tailings) that remains after the production of nickel and cobalt will be safely stored in tailings impoundment areas in the general vicinity of the processing plant. The Registrant began to identify suitable areas in 1999 which would require further study as part of the feasibility study.