Argosy Minerals Inc

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

For the Quarter Ended June 30, 2006

(expressed in Canadian dollars)

NOTICE OF NO AUDITOR REVIEW OF INTERIM FINANCIAL STATEMENTS

Under National Instrument 51-102, Part 4, subsection 4.3(3)(a), if an auditor has not performed a review of the interim financial statements, they must be accompanied by a notice indicating that the financial statements have not been reviewed by an auditor.

The accompanying unaudited interim financial statements of the Company have been prepared by and are the responsibility of the Company’s management.

The Company’s independent auditor has not performed a review of these financial statements in accordance with standards established by the Canadian Institute of Chartered Accountants for a review of interim financial statements by an entity’s auditor.

ARGOSY MINERALS INC

(An Exploration Stage Corporation)

CONSOLIDATED BALANCE SHEETS

(Unaudited, Prepared by Management) As at June 30, 2006 and December 31, 2005

(Expressed in Canadian Dollars)

| | | June 30, 2006 | | | Dec. 31, 2005 | |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | $ | 3,010,292 | | $ | 3,626,115 | |

| Accounts receivable and prepaids | | 40,423 | | | 26,389 | |

| | | 3,050,715 | | | 3,652,504 | |

| Office equipment and furniture | | 13,077 | | | 18,657 | |

| | $ | 3,063,792 | | $ | 3,671,161 | |

| LIABILITIES | | | | | | |

| Current Liabilities | | | | | | |

| Accounts payable and accrued liabilities | $ | 233,974 | | $ | 207,872 | |

| SHAREHOLDERS' EQUITY | | | | | | |

| Capital Stock | | | | | | |

| Authorised - unlimited | | | | | | |

| Issued - 95,969,105 common shares (2005: 95,969,105) | | 44,075,384 | | | 44,075,384 | |

| Contributed Surplus | | 439,251 | | | - | |

| Deficit | | (41,684,817 | ) | | (40,612,095 | ) |

| | | 2,829,818 | | | 3,463,289 | |

| | $ | 3,063,792 | | $ | 3,671,161 | |

APPROVED BY THE DIRECTORS

![[quarterly010.gif]](https://capedge.com/proxy/6-K/0001137171-06-001843/quarterly010.gif)

John Maloney, Director Cecil R. Bond, Director

- 3 -

ARGOSY MINERALS INC

(An Exploration Stage Corporation)

CONSOLIDATED STATEMENTS OF OPERATIONS AND DEFICIT

(Unaudited, Prepared by Management)

For the Three Months ended June 30, 2006 and 2005

and the Six Months ended June 30, 2006 and 2005

| | | | Three Months ended June 30 | | | | Six Months ended June 30 | |

| | | | 2006 | | | | 2005 | | | | 2006 | | | | 2005 | |

| Income: | | | | | | | | | | | | | | | | |

| Interest income and other | $ | | 30,488 | | $ | | 23,180 | | $ | | 57,094 | | $ | | 48,886 | |

| Foreign exchange gain / (loss) | | | (6,653 | ) | | | 3,801 | | | | (7,642 | ) | | | 3,475 | |

| | $ | | 23,835 | | $ | | 26,981 | | $ | | 49,452 | | $ | | 52,361 | |

| Expenses: | | | | | | | | | | | | | | | | |

| Accounting and audit | | | 13,473 | | | | 28,530 | | | | 14,973 | | | | 44,058 | |

| Bank charges | | | 476 | | | | 981 | | | | 1,077 | | | | 2,588 | |

| Depreciation | | | 2,572 | | | | 3,040 | | | | 5,580 | | | | 6,080 | |

| Directors' fees | | | 10,416 | | | | 18,750 | | | | 20,833 | | | | 37,500 | |

| Insurance | | | 523 | | | | 2,725 | | | | 3,766 | | | | 17,131 | |

| Legal | | | 36,512 | | | | 13,796 | | | | 39,629 | | | | 41,559 | |

| Management and consulting fees | | 106,629 | | | | 35,280 | | | | 248,394 | | | | 97,945 | |

| Office | | | 3,170 | | | | 3,110 | | | | 7,429 | | | | 7,654 | |

| Project assessment | Note 2 | | 51,128 | | | | 94,784 | | | | 73,157 | | | | 123,265 | |

| Rent | | | 12,549 | | | | 16,090 | | | | 25,989 | | | | 32,959 | |

| Salaries and benefits | | | 61,315 | | | | 109,059 | | | | 117,486 | | | | 223,415 | |

| Shareholder communications | | | 23,417 | | | | 39,563 | | | | 25,091 | | | | 41,123 | |

| Stock based compensation | | | 439,251 | | | | - | | | | 439,251 | | | | - | |

| Telecommunications | | | 4,618 | | | | 7,179 | | | | 8,441 | | | | 8,648 | |

| Transfer agent and stock exchange | | 9,815 | | | | 14,744 | | | | 20,787 | | | | 31,134 | |

| Travel | | | 51,757 | | | | - | | | | 70,291 | | | | 13,599 | |

| | $ | | 827,621 | | $ | | 387,631 | | $ | | 1,122,174 | | $ | | 728,658 | |

| Loss for the period | $ | | (803,786 | ) | $ | | (360,650 | ) | $ | | (1,072,722 | ) | $ | | (676,297 | ) |

| Deficit, beginning of period | $ | | (40,881,031 | ) | $ | | (39,729,105 | ) | $ | | (40,612,095 | ) | $ | | (39,413,458 | ) |

| Deficit, end of period | $ | | (41,684,817 | ) | $ | | (40,089,755 | ) | $ | | (41,684,817 | ) | $ | | (40,089,755 | ) |

| Basic & Diluted Loss per | | | | | | | | | | | | | | | | |

| Common Share | | ($ | 0.01 | ) | | ($ | 0.00 | ) | | ($ | 0.01 | ) | | ($ | 0.01 | ) |

| Weighted Average Number of | | | | | | | | | | | | | | | | |

| Common Shares Outstanding | | | 95,969,105 | | | | 95,969,105 | | | | 95,969,105 | | | | 95,969,105 | |

- 4 -

ARGOSY MINERALS INC

(An Exploration Stage Corporation)

CONSOLIDATED CASH FLOW STATEMENTS

(Unaudited - Prepared by Management)

For the Three Months ended June 30, 2006 and 2005

and the Six Months ended June 30, 2006 and 2005

| | | Three Months Ended June 30 | | | Six months ended June 30 | |

| Cash Provided From (Used For): | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

| Operating Activities | | | | | | | | | | | | |

| Loss for the period | $ | (803,786 | ) | $ | (360,650 | ) | $ | (1,072,722 | ) | $ | (676,297 | ) |

| Adjustments for: | | | | | | | | | | | | |

| Depreciation | | 2,572 | | | 3,040 | | | 5,580 | | | 6,080 | |

| Foreign exchange loss | | 337 | | | 82 | | | 677 | | | 439 | |

| Stock based compensation | | 439,251 | | | - | | | 439,251 | | | - | |

| | | (361,626 | ) | | (357,528 | ) | | (627,214 | ) | | (669,778 | ) |

| Changes in Non-cash working capital | | | | | | | | | | | | |

| (Increase)/decrease in accounts receivable and prepaids | | (18,769 | ) | | 3,735 | | | (14,034 | ) | | 148,142 | |

| Increase/(decrease) in accounts payable & accrued liabilities | | 90,646 | | | (67,919 | ) | | 26,102 | | | (11,224 | ) |

| Cash Flows from Operating Activities | | (289,749 | ) | | (421,712 | ) | | (615,146 | ) | | (532,860 | ) |

| Foreign Exchange Loss on Cash held in Foreign Currency | | (337 | ) | | (82 | ) | | (677 | ) | | (439 | ) |

| Decrease in Cash & Cash Equivalents | | (290,086 | ) | | (421,794 | ) | | (615,823 | ) | | (533,299 | ) |

| Cash & Cash Equivalents at Beginning of Period | | 3,300,378 | | | 4,504,902 | | | 3,626,115 | | | 4,616,407 | |

| Cash & Cash Equivalents at End of Period | $ | 3,010,292 | | $ | 4,083,108 | | $ | 3,010,292 | | $ | 4,083,108 | |

- 5 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited - Prepared by Management)

For the Three Months ended June 30, 2006 and June 30, 2005

1.

These consolidated financial statements have been prepared in accordance with Canadian GAAP and follow the same accounting policies and methods of their application as the most recent annual financial statements of the Corporation dated December 31, 2005 and should therefore be read in conjunction with those statements. These notes do not include all of the information and disclosures required by Canadian GAAP for annual financial statements.

2.

Project assessment expenditures for the 3 months ended June 30, 2006 consist of the following:

| |

Legal, Administrative and Consulting | $ 5,636 |

Assessment | 5,492 |

Project Option Fees | 40,000 |

| | $ 51,128 |

- 6 -

ARGOSY MINERALS INC.

(the “Corporation”)

Management Discussion and Analysis

Second Quarter Ended June 30, 2006

August 10, 2006

The selected consolidated financial information set out below and certain comments which follow are based on, and derived from, the consolidated financial statements of the Corporation, and should be read in conjunction with them. The Management Discussion and Analysis has been prepared as at August 10, 2006.

Description of Business

Since incorporation the Corporation has been exclusively a natural resource Corporation engaged in exploration for precious metals, base metals and diamonds. At this stage of its development the Corporation has no producing properties and, consequently, has no current operating income or cash flow. The Corporation is a reporting issuer in British Columbia, Alberta and Ontario and trades on the Australian Stock Exchange under the symbol AGY.

Projects

LAC PANACHE – Nickel, Copper, Cobalt, Gold, Platinum Group Metals, Canada

Sampling by earlier explorers at Sawmill Bay resulted in the discovery of anomalous concentrations of gold, platinum, palladium, copper and nickel in sulphide-bearing gabbroic rocks belonging to the Nipissing Gabbro. In 2005 Argosy collected a total of 45 grab samples of outcrop/subcrop along a 2.9 km long interval of the gabbro. A central 1km length of strike in which 25 samples were collected returned 11 samples with greater than 0.2% copper (maximum of 0.59% copper), 5 with greater than 0.1% nickel (maximum of 0.17%), and 6 with greater than 1ppm platinum+palladium+gold (maximum of 2.213 ppm).

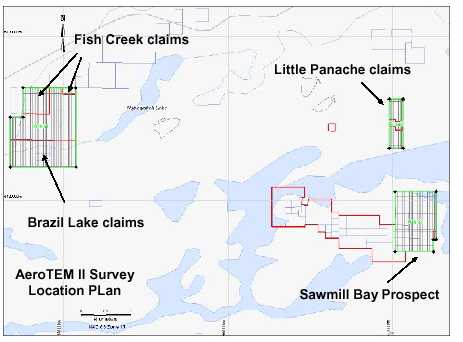

Aeroquest Limited completed a helicopter-borne AeroTEM II geophysical survey over the Sawmill Bay Prospect area as well as the Fish Creek, Brazil Lake and Little Panache claims areas. This survey, including both helicopter EM and magnetics, consisted of some 320 line kilometers. Flying was completed in late July and results will be reported next Quarter.

FISH CREEK – Nickel, Copper, Cobalt, Gold, Platinum Group Metals, Canada

In early April, 2006 Argosy entered into an agreement to acquire a potential offset dike property (“Fish Creek”) in Nairn Township, 50km southwest of Sudbury. Covering 2.88 km2 in area, the property consists of 2 claims containing a total of 18 claims units each 400m by 400m in area. Argosy can earn 100% of the project through staged cash payments totalling $100,000 ($10,000 already paid) and completing staged work commitments over three years of $21,600. On production the vendor will retain a 3% net smelter return (“NSR”). This NSR is subject to buy-back provisions.

The Fish Creek property is positioned over a possible southwest extension of the “Mystery Offset Dike” exposed some 10 km to the northeast. The Mystery Offset Dike, currently being explored by Crowflight Minerals Inc., is described as being an extension of the Worthington Offset Dike on which Inco’s Totten deposit is located.

- 7 -

Offsets are dike-like bodies of quartz diorite that have been interpreted as infilling major fracture zones. These dikes are known to occur both radiating from and concentric to the Sudbury Igneous Complex.

The Aeroquest Limited AeroTEM II helicopter survey, completed in late July, flew both of the Fish Creek blocks. Results, not available as yet, will be reported in the next Quarter. Optimised for the discovery of possible massive sulphides, the EM system will help prioritise areas for follow-up work.

Outlook

Existing Projects

Lac Panache and Fish Creek – The Corporation will evaluate the results of the recently completed helicopter EM and magnetic survey following which it will determine an appropriate exploration program for the Lac Panache and Fish Creek projects.

Musongati - At its Musongati Nickel project in Burundi the Corporation is still waiting for the government to extend the Mining Convention. Should the Mining Convention be extended the Corporation expects to recommence work on a feasibility study for the extraction of nickel and cobalt.

New Projects

The Corporation continues to seek additional projects through which shareholder value may be enhanced and has focused on precious metals and base metals as targets. Projects investigated this quarter were several opportunities in southern Africa (manganese, copper, iron and zinc) and a gold project in Indonesia.

In the event that activities on the projects are greatly increased or if substantial new opportunities are pursued, the Corporation will require additional funds from the sale of equity or the sale of some or all of its projects.

Forward Looking Statements

This MD&A contains forward looking statements and information. Such forward looking statements are based on the Corporation’s plans and expectations and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the

- 8 -

Corporation to be materially different from any performance or achievement expressed or implied by such forward looking statement. See Risk Factors below.

Risk Factors

The exploration and development of mineral deposits involves significant financial risks. The success of the Corporation will be influenced by a number of factors including financing, exploration and extraction risks, political uncertainty and regulatory issues, environmental and other regulations.

In addition, the Corporation will periodically have to raise additional funds to continue operations from the sale of equity or the sale of some or all of its projects and while it has been successful in doing so in the past, there can be no assurance it will be able to do so in the future.

Additional risk factors relating to the Corporation’s activities are discussed in detail in its Annual Information and 20F filings. These filings may be reviewed atwww.sedar.com.

Overall Performance

June 30, 2006 and June 30, 2005

The Corporation incurred a loss of $803,786 for the quarter ended June 30, 2006 compared to a loss of $360,650 for the quarter ended June 30, 2005. The increased loss of $443,136 is mostly attributable to the stock based compensation expense of $439,251 which arises from the grant of incentive stock options to directors and employees; the increase in management and consulting fees of $71,349 and travel of $51,757 due to the Corporation pursuing a number of new projects in Southern Africa, offset by decreased accounting and audit costs of $15,057 and decreased salaries and benefits of $47,744.

The decrease in expenditures is mainly due to the restructuring undertaken during 2005 which resulted in the Corporation amalgamating with various subsidiaries and the deregistration of others, leading to lower administration expenditures. The increase in management and consulting fees is due to higher costs associated with a refocusing of the Corporation following the reorganization noted above.

Interest revenue of $30,488 for the quarter ended June 30, 2006, is higher than interest revenue for the quarter ended June 30, 2005 of $23,180 due to higher interest rates even though cash balances have declined.

During the quarter ended June 30, 2006 cash required for operating activities amounted to $289,749 compared to $421,712 for the quarter ended June 30, 2005.

The decrease in cash required for operations resulted mainly from changes to non cash working capital items.

Results of Operations

Project Assessment

Project assessment expenditures of $51,128 for the quarter ended June 30, 2006 decreased by approximately $43,000 compared to the quarter ended June 30, 2005 mainly due to a decrease in the level of activity on the Lac Panache project due to delays in commencing the planned survey during the quarter.

Second Quarter 2006 to First Quarter 2006

The Corporation incurred a loss of $803,786 for the quarter ended June 30, 2006 compared to a loss of $268,936 for the quarter ended March 31, 2006. The increased loss of approximately $534,000 is

- 9 -

attributable principally to the stock based compensation expense of approximately $439,000, as well as increased project assessment and travel due to the increasing number of projects being evaluated, increased accounting and audit, shareholder communications, travel and legal expenses, offset by reduced management fees. The changes in expenditures relate mainly to the increased level of project evaluation during the quarter and costs associated with the annual general meeting and half year financial statement review.

During the quarter ended June 30, 2006 cash required for operating activities amounted to $289,749 compared to $325,397 for the quarter ended March 31, 2006, a decrease of approximately $35,000.

Summary of Quarterly Results

| | | | | | | | | | | $ | 000 | 's | | | | | | | | | | |

| Year | | 2006 | | | | | | 2005 | | | | | | | | 2004 | |

| 3 Months ended | | Jun-30 | | | Mar-31 | | | Dec-31 | | | Sep-30 | | Jun-30 | | | Mar-31 | | | Dec-31 | | Sep-30 | |

| Interest income | | 31 | | | 27 | | | 24 | | | 23 | | 23 | | | 26 | | | 25 | | 21 | |

| Foreign exchange gain/(loss) | | (7 | ) | | (1 | ) | | 3 | | | (7 | ) | 4 | | | (1 | ) | | 70 | | (86 | ) |

| Total income | | 24 | | | 26 | | | 27 | | | 16 | | 27 | | | 25 | | | 95 | | (65 | ) |

| Administration expenditures | | (777 | ) * | | (273 | ) | | (260 | ) | | (186 | ) | (293 | ) | | (313 | ) | | (404 | ) | (822 | ) |

| Project assessment, net of recoveries | | (51 | ) | | (22 | ) | | (34 | ) | | (84 | ) | (95 | ) | | (28 | ) | | 11 | | (119 | ) |

| Loss | | (804 | ) | | (269 | ) | | (267 | ) | | (254 | ) | (361 | ) | | (316 | ) | | (298 | ) | (1,006 | ) |

| Basic and diluted loss per common | | | | | | | | | | | | | | | | | | | | | | |

| share in dollars/share | ($ | 0.008 | ) | ($ | 0.003 | ) | ($ | 0.003 | ) | ($ | 0.003) | | ($0.005 | ) | ($ | 0.003 | ) | ($ | 0.003) ($0.001) | |

| Weighted Average Number of | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares (000's) | | | | | | | | | | | 95,969 | | | | | | | | | | | |

| * includes stock based compensation of $439,251 | | | | | | | | | | | | | | | | | |

The fluctuation in income over the past eight quarters is mainly due to foreign exchange gains and losses due to the changing rate of exchange between the Australian and Canadian dollar and the Corporation holding a substantial portion of its cash balances in Australian dollars until late December 2004 when it converted its cash holdings to Canadian dollars. The majority of the Corporations cash balances are now held in Canadian dollars which has led to the minimal exchange gain/loss recognized in the quarters ended subsequent to December 31, 2004.

Administrative expenses increased by approximately $504,000, mainly due to the inclusion of stock based compensation of approximately $439,000, incurred on the granting of incentive stock options to directors and employees.

Project assessment expenditures increased in the quarter ended June 30, 2006 compared to March 31, 2006 due to the payment of project option fees on the Lac Panache and Fish Creek properties in Sudbury, Ontario.

Project assessment expenditures decreased in the quarter ended December 31, 2005 mainly due to the field season at Lac Panache coming to an end in October 2005.

Project assessment expenditures increased in the quarter ended March 31, 2005 and increased further in the quarter ended June 30, 2005, remaining fairly consistent in the quarter ended September 30, 2005 as the Corporation commenced activities on the Lac Panache project in Canada and pursued new opportunities in Canada, Mexico and China, while expenditures declined over each quarter up to December 31, 2004 reflecting a recovery of expenditure in the quarter ended December 31, 2004 due to the Corporation completing its exploration program at the Albetros Project during the 2nd quarter and

- 10 -

no substantial new exploration program being commenced. The recovery in the December quarter reflects the lower level of assessment expenditures together with the reduction on the settlement of final amounts payable for activities conducted in prior periods.

The quarter ended September 30, 2004 includes arbitration expenditures of $557,860 resulting in a greater loss than in the more recent quarters.

Liquidity and Capital Resources

The Corporation's cash deposits at June 30, 2006 totaled $3,010,292 compared to $3,300,378 at March 31, 2006. The Corporation continues to utilize its cash resources to fund project assessment activities and administrative requirements. Aside from such cash the Corporation has no material unused sources of liquid assets. As the Corporation does not have a source of income, cash balances will continue to decline as the Corporation utilizes these funds to conduct its operations.

The Corporation does not have any loans or bank debt and there are no restrictions on the use of its cash resources.

In 2001, the Corporation received approximately $11,300,000 for re-imbursement of a portion of expenditure incurred on the New Caledonia Nickel Project. The Corporation has utilized these funds to conduct its operations from 2001 to date. With cash balances of approximately $3.0 million and current planned expenditures of approximately $1.5 million, the Corporation has sufficient cash resources for the next 12 months. Should the Corporation acquire new projects, increase its expenditure on existing projects or exercise its options to acquire projects currently under option it will be required to raise additional financing.

Commitments and Property Option Payments

| | | 2006 | | 2007 | | 2008 | | 2009 | | Total1 |

| Property Payments – Fish Creek | $ | 10,0002 | $ | 25,000 | $ | 35,000 | $ | 20,000 | $ | 90,000 |

| Property Expenditure Commitments | | 7,200 | | 7,200 | | 7,200 | | - | | 21,600 |

| – Fish Creek | | | | | | | | | | |

| Property Payments – Lac Panache | | 50,000 | | 120,000 | | 60,000 | | - | | 230,000 |

| Property Expenditure Commitments | | 130,000 | | 260,000 | | - | | - | | 390,000 |

| – Lac Panache | | | | | | | | | | |

| | $ | 197,200 | $ | 412,200 | $ | 102,200 | $ | 20,000 | $ | 731,600 |

1.

The Corporation may withdraw from these agreements at any time.

2.

$10,000 has already been paid.

Related Party Transactions

The Corporation paid $107,363 for management fees and $65,539 for personnel and office facilities in Australia and Canada to two companies, each controlled by a director of the Corporation. Directors’ fees totaling $10,417 were paid to 2 directors of the Corporation and $4,652 was paid to a director for consulting fees. Payments for management and consulting fees, staff and office costs and directors’ fees were $112,015, $65,539, and $10,417 respectively, for a total payment of $187,970 in the Quarter ended June 30, 2006, compared to $80,403 payable for management and consulting fees, directors’ fees and for personnel and office facilities in Canada, for the quarter ended March 31, 2006.

Fees paid to each non-executive director do not exceed $25,000 per annum.

- 11 -

Proposed Transactions

The Corporation is currently evaluating new opportunities. Should it enter into agreements over any of these opportunities it may be required to make cash payments and complete work expenditure commitments.

Critical Accounting Estimates

The detailed accounting policies are discussed in the Corporation’s annual financial statements, however, the following accounting policies require the application of management’s judgment:

Mineral property valuations – Management uses its best estimate for recording any mineral property value based on the results of any exploration conducted, prevailing market conditions, similar transactions and factors such as stability of the country in which the asset may be located.

Contingent Liabilities – Management evaluates any claims against the Corporation and provides for those claims, where necessary, based on information available to it, including in some instances, legal advice.

Changes in Accounting Policies

There have been no changes in accounting policies during the quarter ended June 30, 2006.

Financial Instruments and Other Instruments

The Corporation holds certain cash balances in Australian dollars, which are subject to exchange rate fluctuations and could give rise to exchange losses.

Other

Capitalization

The Corporation had 95,969,105 shares outstanding at August 10, 2006. In addition, the Corporation has 7,100,000 options outstanding and exercisable at A $0.10 per share. These options expire on May 25, 2011.

Management’s Responsibility and Oversight

The disclosures and information contained in this MD&A have been prepared by the management of the Corporation. Management has implemented and maintained a system of controls and procedures to ensure the timeliness and accuracy of information disclosed in the MD&A.

The Corporation’s audit committee and Board of Directors review the disclosures made in the MD&A to ensure the integrity thereof.

List of Directors and Officers at Signature and Filing Date

| |

*Peter H. Lloyd | President and Director |

Cecil R. Bond | Corporate Secretary and Director |

*John Maloney | Non-executive Director and Chairman of the Board |

*Malcolm Smartt | Non-executive Director and Chairman of the Audit Committee |

*Denotes member of audit committee.

Additional information regarding the Corporation is available from its materials filed on Sedar at www.sedar.com.

- 12 -

Form 52-109F2Certification of Interim Filings

I, Peter H. Lloyd, CEO and Director of Argosy Minerals Inc. certify that:

1.

I have reviewed the interim filings (as this term is defined in Multilateral Instrument 52-109Certification of Disclosure in Issuers’ Annual and Interim Filings) of Argosy Minerals Inc., (the issuer) for the interim period ending June 30, 2006;

2.

Based on my knowledge, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings;

3.

Based on my knowledge, the interim financial statements together with the other financial information included in the interim filings fairly present in all material respects the financial condition, results of operations and cash flows of the issuer, as of the date and for the periods presented in the interim filings;

4.

The issuer's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures and internal control over financial reporting for the issuer, and we have:

(a)

designed such disclosure controls and procedures, or caused them to be designed under our supervision, to provide reasonable assurance that material information relating to the issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which the interim filings are being prepared; and

(b)

designed such internal control over financial reporting, or caused it to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP; and

5.

I have caused the issuer to disclose in the interim MD&A any change in the issuer’s internal control over financial reporting that occurred during the issuer’s most recent interim period that has materially affected, or is reasonably likely to materially affect, the issuer’s internal control over financial reporting.

Date: August 10, 2006.

![[quarterly008.gif]](https://capedge.com/proxy/6-K/0001137171-06-001843/quarterly008.gif)

__________________________

Peter H. Lloyd

CEO and Director

- 13 -

Form 52-109F2Certification of Interim Filings

I, Cecil Bond, Director and Acting Chief Financial Officer of Argosy Minerals Inc. certify that:

1.

I have reviewed the interim filings (as this term is defined in Multilateral Instrument 52-109Certification of Disclosure in Issuers’ Annual and Interim Filings) of Argosy Minerals Inc., (the issuer) for the interim period ending June 30, 2006;

2.

Based on my knowledge, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings;

3.

Based on my knowledge, the interim financial statements together with the other financial information included in the interim filings fairly present in all material respects the financial condition, results of operations and cash flows of the issuer, as of the date and for the periods presented in the interim filings;

4.

The issuer's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures and internal control over financial reporting for the issuer, and we have:

(a)

designed such disclosure controls and procedures, or caused them to be designed under our supervision, to provide reasonable assurance that material information relating to the issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which the interim filings are being prepared; and

(b)

designed such internal control over financial reporting, or caused it to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP; and

5.

I have caused the issuer to disclose in the interim MD&A any change in the issuer’s internal control over financial reporting that occurred during the issuer’s most recent interim period that has materially affected, or is reasonably likely to materially affect, the issuer’s internal control over financial reporting.

Date: August 10, 2006.

![[quarterly010.gif]](https://capedge.com/proxy/6-K/0001137171-06-001843/quarterly010.gif)

__________________________

Cecil R. Bond

Director and Acting CFO

- 14 -

![[quarterly010.gif]](https://capedge.com/proxy/6-K/0001137171-06-001843/quarterly010.gif)

![[quarterly008.gif]](https://capedge.com/proxy/6-K/0001137171-06-001843/quarterly008.gif)