Exhibit 14.3

Pre-approval policy

of Magyar Telekom Plc.’s

Audit Committee

1

Pre-approval policy of Magyar Telekom Plc.’s Audit Committee

1. Statement of Principles

Under the Act IV of 2006 on Business Associations (hereinafter referred to as ‘Gt.’), the Sarbanes-Oxley Act of 2002 (hereinafter referred to as ‘SOX’), and the Articles of Association of Magyar Telekom Telecommunications Public Limited Company (hereinafter referred to as ‘Company’) the Audit Committee of the Company is responsible for the oversight of the work of the Company’s independent external auditor.

On the basis of the rules of the US Securities and Exchange Commission (hereinafter referred to as ‘SEC’), types of services can be defined that an independent external auditor may no longer provide in the future and thus cannot be approved. Examples are given in Appendix “E” of the Audit Committee’s Pre-approval policy (hereinafter referred to as ‘Policy’). The following principles shall apply:

· An independent external auditor may not take on any management functions.

· An independent external auditor may not review his/her own work.

· An independent external auditor may not serve in an advocacy role for the auditing client.

All other audit-relevant and non-audit-relevant services to be performed by the independent external auditor for the Company are subject to the Audit Committee’s pre-approval in order to ensure that the independent external auditor does not impair his independence from the Company. Audit-relevant services are services that are directly connected to the preparation of the individual or consolidated financial statements of the Company.

The SEC’s rules establish two different approaches to pre-approving audit and non-audit services, which the SEC considers to be equally valid. Proposed audit and non-audit services either:

· may be pre-approved without consideration of specific case-by-case services by the Audit Committee (“general pre-approval”) or

· require the specific pre-approval of the Audit Committee (“specific pre-approval”).

The Audit Committee assumes that the combination of these two approaches will result in an effective and efficient procedure to pre-approve the respective services.

Appendices “A”, “B”, “C” and “D” to this Policy describe audit, audit-related, tax and all other services that are subject to the Audit Committee’s general pre-approval. The term of any general pre-approval is 12 months from the date of pre-approval, provided that the Audit Committee does not consider it necessary to determine a different period.

The Audit Committee may determine, from time to time, the preliminary approval fee levels for all services to be provided by the independent external auditor. The Audit Committee may determine, for each fiscal year, an appropriate ratio between the total fees for audit, audit-related and tax services and the total amount of fees for certain, permissible non-audit services classified as “all other services”.

Unless a service provided by the independent external auditor has received general pre-approval by the Audit Committee, it will require specific pre-approval by the Audit Committee. The commissioning of any such service that would exceed the pre-determined fee levels or proportions will also require specific pre-approval by the Audit Committee. The specific case-by-case pre-approval of the Audit Committee is required whenever the independent external auditor is commissioned in connection with such services that affect internal controls and are not auditing services. The same applies to SOX 404-related services as well.

The independent external auditor must be commissioned in writing. The independent external auditor cannot provide services before having signed a contract pertaining to the given service.

2

The independent external auditor shall certify to the Committee that he has complied with all applicable external auditor independence rules (including those of the SEC), and whether or not he is aware of any breaches of this Policy.

2. Audit services

Audit services include audits of financial statements, audits or reviews of the annual and quarterly statements and services provided in connection with statutory duties and submissions required for regulatory authorities, including the preparation of audit reports and certificates, approvals, domestic and international statutory audits, tax consulting, to the extent necessary for compliance with generally approved auditing standards, as well as support for the issuance and auditing of the documents to be supplied. Audit services also include information systems and procedural reviews and testing in order to understand and place reliance on the systems of internal control, and consulting for the management if there are any questions relating to invoicing, the preparation of the balance sheets and reporting in connection with the audits.

Regarding the annual audit service fees in connection with the audit of the stand alone financial statements of the parent company prepared according to the Hungarian Accounting Rules (HAR), as well as of the consolidated group-level financial statements of the Company prepared according to International Financial Reporting Standards (IFRS) final approval falls within the authority of the Annual General Meeting, which relies on the preliminary opinion of the Audit Committee and the Supervisory Board. All further audit services to be provided for the Company or its subsidiaries are subject to the general or specific pre-approval of the Audit Committee.

The Audit Committee participates in the preparation of the contract to be entered with the independent external auditor, monitors the execution of the audit contract, and pre-approves, if necessary any changes in terms, conditions and fees resulting from changes in the audit scope, the company structure or other items.

The Audit Committee has granted general pre-approval with respect to the audit services in Appendix “A”. All audit services not listed in Appendix “A” are subject to specific pre-approval by the Audit Committee.

3. Audit-related services

Audit-related services are mainly services that are usually performed by the external auditors in connection with the audit of the annual financial statements. Audit-related services also include due diligence services pertaining to potential business acquisitions/disposals, consultations related to accounting, financial reporting or disclosure matters not classified as audit-relevant services; assistance with understanding and implementing new accounting and financial reporting standards; financial audits of employee benefit plans and assistance with internal control reporting requirements.

The Audit Committee has granted general pre-approval with respect to the audit-related services listed in Appendix “B”. All audit-related services not listed in Appendix “B” are subject to specific pre-approval by the Audit Committee. In case of non-audit services related to internal controls over financial reporting specific pre-approval by the Audit Committee is also required.

4. Tax consulting

The Audit Committee assumes that the independent external auditor can provide the Company with advice on tax issues, such as compliance with tax law, tax planning and tax advice in a narrower sense, without this impairing the external auditor’s independence.

The Audit Committee will not permit the commissioning of the independent external auditor in connection with the provision of tax services, if the only purpose of such services is to avoid taxes or tax treatment that is not supported by tax law and related regulations.

3

The independent external auditor may not provide tax services to persons in a Financial Reporting Oversight Role(1) or to an immediate family member of those persons.

Confidentiality agreements are only allowed for the following tax services:

· Filing, preparation or review of tax return;

· Tax provision reviews completed as part of the financial audit;

· Other services which are part of the financial audit engagement.

The Audit Committee has granted general pre-approval with respect to the tax services listed in Appendix “C”. On the other hand in case of tax services specific pre-approval by the Audit Committee is also required. All tax services not listed in Appendix “C” are subject to specific pre-approval by the Audit Committee.

5. All other services

The Audit Committee has granted general pre-approval for other services according to Appendix “D” that, by their very nature, consist of routine and repetitive tasks and will not impair the independence of the external auditor. All other permitted services not listed in Appendix “D” are subject to specific pre-approval by the Audit Committee.

A list of services banned by the SEC that may no longer be provided by the independent external auditor is attached to this Policy as Appendix “E”; this list is not intended to be exhaustive. The SEC’s rules and relevant implementing instructions should be consulted to rule out the possibility of the commissioning of prohibited services.

6. Other provisions

According to the law and the SEC’s requirements, the Audit Committee has stipulated conditions for the rotation of the audit partners responsible, as well as exclusion criteria for the engagement of former audit partners or the engagement of the independent external auditor, in Appendix “F”.

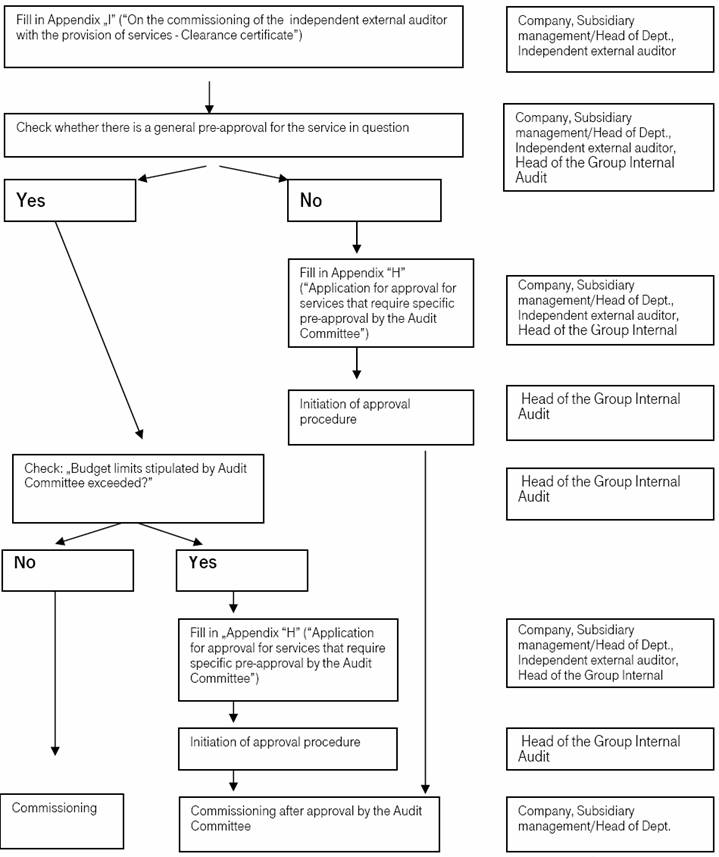

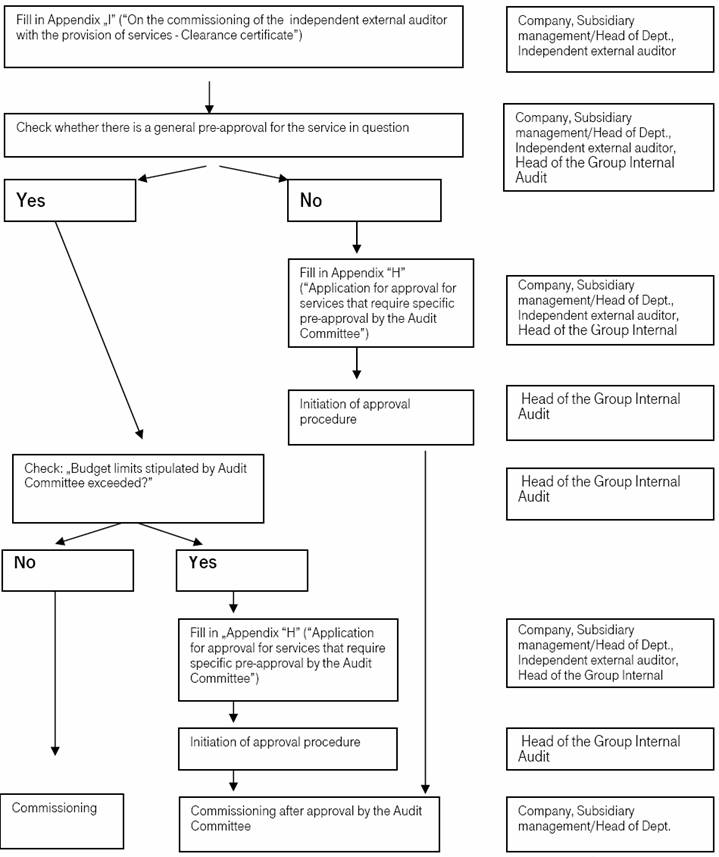

7. Procedures

The rules of procedure of commissioning the independent external auditor are contained in Appendix “G”. Services that can be provided by the independent external auditor may be commissioned exclusively after having completed Appendix “I” (Clearance Certificate). Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee, through the Head of the Group Internal Audit in Hungarian and in English with the content described in Appendix “H”, by the independent external auditor providing such services and the Chief Financial Officer of the Company or subsidiary requesting such services, and must include a joint statement as to whether, in the view of the independent external auditor and the Chief Financial Officer of the Company or subsidiary concerned, the request or application is consistent with this Policy and the SEC’s rules on external auditor independence.

Quarterly, all consolidated companies belonging to the Magyar Telekom Group report to the Head of the Group Internal Audit on the orders for the services provided by the independent external auditor and the fees of these services, including the services generally pre-approved to be performed by the independent external auditor and a detailed description of services. The Head of the Group Internal Audit will check whether such services are conforming to the list. In case of doubt the Head of the Group Internal Audit will inform the Audit Committee. The Audit Committee will be informed at least twice a year about the services provided by the independent external auditor.

(1) The term ‘financial reporting oversight role’ refers to the exercise of oversight responsibilities in connection with financial accounting and reporting and relates to tasks involving direct responsibility for oversight over those employees who prepare financial statements and related information (for example, management’s discussion and analysis/management report) to the extent that these financial statements and information or parts thereof are included in filings with the SEC. Individuals in a financial reporting oversight role are, for example, members of the Board of Directors or of a comparable governing body, as well as the Chief Executive Officer (CEO), President, Chief Financial Officer (CFO), Chief Operating Officer (COO), General Counsel, the Chief Accounting Officer (head of financial accounting and reporting), Controller, head of the Internal Audit function, head of financial reporting, the Treasurer and any equivalent position.

4

The Audit Committee has designated the Head of the Group Internal Audit with the task of monitoring all services provided by the independent external auditor and determining whether such services comply with this Policy. The Head of the Group Internal Audit will report to the Audit Committee at least twice a year in writing about the results of such monitoring.

The Head of the Group Internal Audit will immediately report to the Chairman of the Audit Committee any breach of this Policy that comes to the attention of the Head of the Group Internal Audit.

8. Additional requirements

The Audit Committee takes additional steps on an annual basis to meet its responsibility to monitor the work of the external auditor and his independence. This includes reviewing a formal written statement from the external auditor delineating his relationships with the Company, in line with Standard No. 1 of the Independence Standards Board, and discussing with the external auditor his methods and procedures for ensuring independence.

9. Enclosure

This policy was approved by the Audit Committee at its meeting held as of December 10, 2007 with its Resolution No. 14/8 (12 10 2007).

5

Appendix “A”

Pre-Approved Audit Services

1. Annual audits and other audits for Magyar Telekom Plc. (“Company”), and for its subsidiaries and associated companies based on the statutory requirements of each country. In addition, audits that the independent external auditor is required to perform to be able to render an opinion on the audit of the Company’s consolidated financial statements. Above all, this includes:

(a) Audit of the annual financial statement prepared in compliance with the statutory requirements of the given country and the International Financial Reporting Standards (IFRS)

(b) Review of the quarterly statements/statement packages prepared in compliance with the IFRS and US GAAP

(c) Auditing procedures in order to confirm that the figures submitted to apply for public grants are in conformity with the figures of the annual or interim financial statements

(d) Auditing procedures to confirm that the figures submitted for participation in an invitation to tender or an official contract already awarded are in conformity with the figures of the annual or interim financial statements

(e) Auditing procedures to verify the completeness of a split of a company code or similar organizational or technical IT changes in Accounting

(f) Expanded auditing procedures if the amount of liabilities exceed that of the assets and assistance in ensuring compliance with regulations of insolvency law or similar statutory regulations

(g) Auditing procedures to determine whether the underlying processes are suitable for ensuring the complete determination of other financial obligations

(h) Monitoring changes in software releases to determine whether old data stock is transferred properly

(i) Monitoring the introduction of new software to check whether the software has a negative impact on system procedures for the preparation of financial statements, and thus to ensure that the proper preparation of financial statements by the system is not jeopardized

(j) Implementation of branch office audits to ensure compliance with the generally accepted principles for accounting and preparation of a balance sheet

(k) Auditing procedures to submit a certificate for evidence of use for capital investment projects subject to government subsidies

2. Services in connection with the submission of reports to the SEC. Above all, this includes:

(a) Checking US GAAP reconciliation

(b) Checking the registration statements (e.g. F3, F4 or 144As)

(c) Checking reports to be submitted to the SEC on a regular basis (e.g. Form 20F, Form 6-K, proxy statements etc.)

(d) Checking other documents to be submitted to the SEC and documents published in connection with subscription offers for securities (e.g. comfort letters)

(e) Assistance provided by the independent external auditor in replying to SEC statements, but without serving in an advocacy role and making managerial decisions

3. Auditing procedures in order to confirm management reports on the Company’s internal control system. Above all, this includes:

(a) All auditing procedures in connection with the provisions under Section 404 of the Sarbanes-Oxley Act

4. Consultation services for the Company’s management in the course of the audit of the annual financial statements as to the proper accounting or disclosure of transactions and events and/or the actual or potential impact of final or proposed accounting rules, standards or interpretations by the SEC, FASB or other standard-setting bodies. Above all, this includes the following cases:

(a) Checking the financial handling of complex and difficult transactions that result in additional costs requiring separate accounting, either due to the level of difficulty or the scope

(b) Granting access to the accounting research databases and other databases of an auditing company for a fee, the sale of appropriate licenses and the sale of specialized literature

6

5. Deliberations of the independent external auditor’s accounting technical department or other specialist departments in order to reach a final assessment of a situation. These activities are always defined as being audit-relevant services, irrespective of whether they are charged separately, since they are required to form a final opinion on the Company’s annual financial statements.

6. Review activities at companies in which the Company holds a participating interest (less than majority interest) in order to achieve the level of auditing certainty required for granting an audit report for the consolidated financial statements.

7. Auditing procedures carried out in connection with the annual financial statements on the Company’s information systems and internal controls. In this connection, sufficient auditing certainty must be achieved as to whether information systems and integrated internal controls are suitable for confirming the statements made in the report by the Board of Management on the Company’s internal control system.

8. Auditing procedures in connection with the audit of the annual financial statements that are required for granting an audit certificate for the consolidated financial statements. Above all, this includes:

(a) The auditing of impairment tests

(b) The correct implementation of a change in the presentation of the income statement (e.g. the change from total-cost accounting to cost-of-sales accounting)

(c) Correct presentation of a reclassification/recategorization (e.g. new key to allocate expenses within the divisional structure)

7

Appendix “B”

Pre-Approved Audit-Related Services

9. Implementation of due diligence and similar services pertaining to potential business acquisitions and disposals. This also includes:

(a) Auditing procedures in connection with the prepared interim financial statements of a company that is to be acquired or disposed of or other organizational units of a sub-unit

(b) Review of working documents of another auditing company that has already audited the annual or interim financial statements of a company to be acquired

10. Audits of significant acquiree companies under Rule 3-05

11. Audit services in connection with employee benefit plans

12. Auditing procedures going beyond the originally agreed scope that are required for meeting reporting requirements under public law or internal company regulations. This also includes:

(a) Auditing procedures in connection with the preparation of facultative statements in compliance with IFRS

(b) Auditing procedures on the proper functioning of software applications that have been installed to transfer the figures from the Company’s systems to an IFRS statement

(c) Review of the product cost calculation and IT systems supporting this to check conformity with requirements of the regulatory authority or other supervisory bodies

13. Consultations and recommendations in connection with internal control system requirements. Above all, this includes:

(a) Monitoring process optimization measures

(b) Auditing procedures regarding rights of access to various software applications

14. Consultation services for the Company’s management as to the proper accounting or disclosure of transactions and events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB or other standard-setting bodies. Above all, this includes:

(a) Consultations and recommendations in connection with the clarification of requirements resulting from a change to existing or the introduction of new accounting requirements, recommendations and notes by national and international standard-setting bodies, such as DRSC, SEC, FASB and IASB.

(b) The independent external auditor shall examine a complex and difficult transaction proposed by the Company and shall notify the Company of the consequences that the implementation of this transaction may have on the balance sheet prior to carrying out the transaction. The service billed for this assessment and consultation is an audit-related service.

15. Auditing procedures that are carried out in connection with the audit of the annual financial statements and concern the Company’s information systems. Above all, this includes:

(a) Auditing procedures in connection with the computing centers operated by the Company regarding the proper functioning and security of the infrastructure, systems and networks as well as applications and files installed at such centers (e.g. power supply, fire protection, contingency plans, safety concept etc.)

(b) Consulting and recommendations in connection with IT security requirements as part of the internal control system

8

16. Auditing of closing balance sheets of companies that have been sold

17. Audits and reviews of carve-out financial statements relating to acquisitions or disposals in connection with the audit of the consolidated financial statements of the Company

18. General assistance regarding the interpretation of SEC requirements and rules pursuant to the Sarbanes-Oxley Act

19. Auditing procedures enabling an assessment of risk management controls

20. Expert support in the periodic submission of annual and interim financial statements to foreign authorities, the translation of annual financial statements into foreign languages and the conversion of reported amounts into foreign currencies after completion of the year-end audit or inspection of the financial statements

9

Exhibit 14.3

Appendix “C”

Pre-Approved Tax Services

21. National tax planning and advice but not advocacy

22. Advice on national tax compliance without serving in an advocacy role for the company

23. International tax planning and advice without serving in an advocacy role for the company. Above all, this includes:

(a) Review of the basic features of a business model from a tax perspective

(b) Review of the imminent double taxation risks entailed in a specific case

(c) Providing opinions on how a double taxation avoidance strategy could be designed in existing cases

24. Advice on international tax compliance without serving in an advocacy role for the company. Above all, this includes:

(a) Research work on the different ways of handling VAT issues in various countries

25. Inspection of and assistance in tax returns required to be submitted by the Company both on a national and international basis without serving in an advocacy role for the company

26. Advice on the Company’s national and international tax planning and compliance with national tax regulations without serving in an advocacy role for the company. Above all, this includes:

(a) Providing tax opinions as to whether certain transaction formats are suitable for reaching the aspired goal or whether possible adjustments can be recommended that are more likely to meet tax requirements

(b) Support and assistance in achieving actual agreement as well as drafting advanced pricing agreements or similar agreements that are concluded between the Company and the relevant tax authorities, without direct representation of the Company in interactions with the authorities

(c) Assistance concerning possible tax amendments in EU accession countries after their joining the EU

27. Assistance with tax audits, out-of-court administrative appeals etc. without serving in an advocacy role for the company visa-vis the authorities in charge. Above all, this includes:

(a) Providing opinions on tax issues arising in the course of the tax audit

(b) Providing “second opinions” to support existing lines of argumentation of the Company during a tax audit

28. Assistance regarding the determination of transfer prices and cost allocation studies without serving in an advocacy role for the company. Above all, this includes:

(a) Analysis of existing issues regarding the problems in permanent establishments resulting from such issues and, if appropriate, definition of suitable prevention strategies

(b) Review as to whether the Company’s transfer pricing guideline complies with national tax regulations

(c) Analysis of whether amendments to national tax law on transfer pricing might entail problems regarding the Company’s existing transfer pricing guideline

(d) Analysis of existing transfer prices to determine whether these will stand up to a review by tax authorities

(e) Assistance in documenting the calculated transfer prices to ensure that documentation requirements are met for future tax audits

(f) Checking whether given model situations comply with national tax law from the perspective of transfer prices

29. Tax advice on new statutory developments without serving in an advocacy role for the company. This also includes:

(a) Assistance in compliance with principles on data access and on the ability to check digital documents. In particular, the analysis as to how cases relevant for taxation are filed in the Company’s systems to which access must be ensured for the tax authorities, and assistance in stipulating the basic features of access rights for tax authority employees

10

30. Assistance in the introduction of performance-related compensation schemes (particularly stock options) and their tax implications. Above all, this includes:

(a) The provision of data on the compensation programs of similar companies

(b) Assistance to weigh the pros and cons of each compensation program

(c) Analysis of the current pay structure

(d) Analysis of market trends in the application of performance-related compensation schemes

(e) Analysis and recommendations concerning performance measurement

(f) Analysis and market studies on the use of performance measurements at comparable companies

31. Tax assistance and compliance with tax regulations by the Company’s foreign employees and employees sent on international assignments, without serving in an advocacy role for the company. Above all, this includes:

(a) Assistance for the employees concerned in their correspondence with local tax authorities

(b) Advice on tax obligations that employees on international assignments are required to observe under local tax regulations

(c) Assistance for employees on international assignments who are subject to a local tax authority audit

(d) Assistance in the calculation of tax liabilities originating in the international assignment of employees

32. Training and seminars that serve to teach general tax basics.

11

Appendix “D”

Pre-Approved All Other Services

33. Internal risk management consulting services that are unrelated to the audit. Above all, this includes:

(a) Assessments and tests regarding existing security infrastructure controls

34. Treasury consulting services that are unrelated to the audit. Above all, this includes:

(a) Review of check-clearing and float-management practices and recommendations regarding potential areas of improvement

(b) Analysis of the working capital management process to identify weak points and show areas of improvement

35. Consulting and recommendations in connection with evaluation models and methods prior to an actual evaluation by a third party or the Company, without influencing the actual assessment

36. Review of an evaluation, unrelated to the audit, performed by the Company itself or a third-party expert engaged by the Company to decide how the results of the evaluation can be used in the Company’s annual financial statements

37. Business plan analysis and/or review, provided that the independent external auditor has not prepared or implemented these business plans himself

38. Real estate management services without serving in an advocacy role for the company and without making managerial decisions. Above all, this includes:

(a) Implementation and organization of architectural competitions

(b) Expert’s consulting services in the problematic areas of building costs, contract awarding procedures, invoicing the sequence of construction, drafting of agreements

(c) Consulting services regarding the planning, utilization, optimization and implementation of space and workstation requirements

(d) Consulting services in matters concerning portfolio management and real estate-related IT systems

(e) Assistance in location advice

39. Project steering tasks within the framework of carve-outs, spin-offs and other intra-Group restructuring measures, initial public offerings, company acquisitions and disposals and other transactions, without serving in an advocacy role for the company and without making managerial decisions

40. Analysis and review of planning procedures, provided that the independent external auditor did not prepare or implement these independently

41. Training courses and seminars serving to teach general accounting or employment-law basics (e.g. according to IFRS, U.S. GAAP, generally accepted accounting standards, etc.)

42. Consulting services and assistance in connection with the Company’s compliance with requirements stipulated by the National Communications Authority and other authorities.

43. Human resources consulting services without influencing the decision-making process of the Company’s management. Above all, this includes:

(a) Provision and processing of information and external comparing data on national and international developments and trends in the field of personnel development and compensation schemes

(b) Provision and processing of information and external comparing data on developments and trends in IT systems that support the work of Human Resources

12

(c) Training and seminars that serve to teach general basics in human resources

13

Appendix “E”

Prohibited services for the independent external auditor

· Bookkeeping or other similar services related to the accounting records or financial statements of the audit client

· Financial information systems design and implementation

· Appraisal or valuation services, fairness opinions or contribution-in-kind reports; in particular fair market value opinions, certificates on valuableness, purchase price allocation, real estate valuations

· Actuarial services

· Internal audit outsourcing services

These services listed above are not prohibited if it can legitimately assumed that the results of these services will not be the subject matter of auditing procedures in the course of the audit of the financial statements of the audit client.

However, in this case it is necessary to obtain specific pre-approval before the provision of these services.

· Management functions

· Services with contingent fee arrangements

· Human resources (staff selection or development)

· Broker-dealer, investment adviser or investment banking services

· Legal services

· Expert services unrelated to the audit (providing an expert opinion or other expert advice for the Company or the Company’s legal representative for the purpose of advocating an audit client’s interest in litigation or in a regulatory or administrative proceeding or investigation)

· Tax services relating to a transaction initially recommended by the independent external auditor, the sole business purpose of which may be tax avoidance and the tax treatment of which may not be supported in the tax law and related regulations

· Tax services to persons in a Financial Reporting Oversight Role or to an immediate family member of those persons

14

Appendix “F”

Audit Partner Rotation

According to the law and the requirements of the SEC, the independent external auditor is prohibited from providing any audit-relevant services for the Company if any “leading or coordinating audit partner”(2) (or a “concurring” partner) has performed audit-relevant services for the Company in each of the five previous fiscal years (and has not rotated off the Company’s account for a period of five years thereafter); or if any other audit partner(3) has provided the services set forth in footnote 2 below in each of the seven previous fiscal years (and has not rotated off the Company’s account for a period of two years thereafter). Specialized partners(4) and partners assigned to “national office” duties, including technical partners at a local or national level and those assigned to a centralized quality control function, all of whom do not have significant interaction with management on an ongoing basis, shall not be subject to the rotation requirements. Any discrepancy between this paragraph and the SEC rules shall be resolved in favor of such SEC rules. In determining when audit partners are subject to rotation, the period prior to May 6, 2003 shall be used as a basis with respect to U.S. accounting firms’ audit partners and other audit partners. For non U.S. accounting firms’ audit partners and other audit partners, the period prior to May 6, 2003 shall not be used as a basis.

Employment contracts and similar agreements

According to the law and the requirements of the SEC, the Audit Committee has resolved that a former partner, principal, shareholder, or professional employee of the independent external auditor cannot accept employment with the Company if he or she has a continuing financial interest in the independent external auditor or is in a position to influence the operations or financial policies of the independent external auditor. Further, the independent external auditor cannot perform an audit for the Company if a chief executive officer, controlling director, chief financial officer, accounting director, or any person serving in an equivalent position for the Company, was employed by that independent external auditor and participated in any capacity in the audit of the Company during the one-year period preceding the date of the initiation of the audit.

(2) The term “leading or coordinating audit partner” is defined to mean a partner or a person in an equivalent position who is a member of the audit team and has responsibility for decision-making on significant auditing, accounting and reporting matters that affect the financial statements; or maintains regular contact with management of the Company and the Audit Committee.

(3) The term “other audit partner” is defined to mean audit team partners who: (a) provide more than 10 hours of audit, review or attest services in connection with the annual or interim consolidated financial statements of the Company; or (b) serve as the lead audit partner in connection with any audit or review related to the annual or interim financial statements of a subsidiary whose assets or revenues constitute 20% or more of the Company’s consolidated assets or revenues.

(4) “Specialized partners” are defined as partners who consult other members of the audit team during the audit, review or attestation engagement regarding technical or industry-specific issues, transactions or events.

15

Appendix “G”

Procedure for the commissioning of the independent external auditor

Responsible

16

Appendix “H”

Application for approval for services that require specific pre-approval by the Audit Committee

Submitter of the application |

|

Reason for submission of the application |

|

Description and type of the service |

|

Start and end of service provision |

|

Agreed total fee |

|

Preliminaries (if relevant) |

|

Annexes (Draft Contract and agreement as required by the PCAOB rules) |

|

Statement required by the Policy |

|

Draft Resolution |

| |

Independent external auditor |

(Place/Date/Signature) |

| |

Management of client |

(Place/Date/Signature) |

Position of the Head of the Group Internal Audit |

17

Appendix “I”

On the commissioning of the independent external auditor with the provision of services

Clearance certificate

Company |

|

Name, type and number of service (according to Appendices “A”, “B”, “C” and “D” of the Policy) |

|

Start and end of service provision |

|

Agreed total fee |

|

Annexes (Engagement Letter) |

We hereby declare that the performance of the service named above does not impair the required independence of the external auditor that is commissioned with auditing the annual financial statements. We also declare that no services exceeding the tenor of the engagement letter will be rendered.

| |

Independent external auditor |

(Place/Date/Signature) |

| |

Management of client |

(Place/Date/Signature) |

Position of the Head of the Group Internal Audit

18