UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant o |

Filed by a Party other than the Registrant x |

Check the appropriate box: |

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

SOVEREIGN BANCORP, INC. |

(Name of Registrant as Specified In Its Charter) |

RELATIONAL INVESTORS LLC |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

PRELIMINARY COPY

FOR INFORMATION ONLY—NO PROXIES ARE BEING SOUGHT AT THIS TIME

RELATIONAL INVESTORS LLC

PROXY STATEMENT

IN CONNECTION WITH THE

2006 ANNUAL MEETING OF SHAREHOLDERS

OF

SOVEREIGN BANCORP, INC.

This preliminary proxy statement (the “Statement”) will be furnished to the shareholders of Sovereign Bancorp, Inc., a Pennsylvania corporation with its principal executive offices at 1130 Berkshire Boulevard, Wyomissing, Pennsylvania 19610 (the “Company”), in connection with the solicitation of WHITE proxies by the Relational Funds(1) for use at the 2006 Annual Meeting of Shareholders of the Company (including any adjournments, continuations or postponements thereof, the “2006 Annual Meeting”). The Relational Funds intend to use the WHITE proxy to elect David H. Batchelder and Ralph V. Whitworth (the “Shareholder Nominees”) as directors of the Company. More information about the Shareholder Nominees can be found below in the section titled “THE RELATIONAL FUNDS NOMINEES”. The Relational Funds, collectively the Company’s largest shareholder, beneficially own an aggregate of 26,357,189 shares of the Company’s common stock, no par value (the “Common Stock”), representing approximately 7.29% of the 361,669,914 shares of Common Stock reported to be outstanding as of July 31, 2005 in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2005.(2) The Relational Funds are seeking to elect these directors to improve (as described below) the Company’s operating performance, risk profile, corporate governance, credibility with the investment community and, ultimately, its stock price, all of which our research and analyses indicate are well below that of the Company’s peers.

The date of this Statement is October 20, 2005, and the Relational Funds expect to make this Statement available to certain shareholders with whom they discuss the 2006 Annual Meeting and the Shareholder Nominees. This Statement will be provided in definitive form to all Company shareholders to whom forms of WHITE proxies are furnished by the Relational Funds, or from whom WHITE proxies are requested by the Relational Funds, no later than the time that WHITE proxies are furnished or such requests are made.

(1) As used herein, the terms “Relational Funds”, “we”, “us” and “our” refer to Relational Investors LLC, Relational Investors, L.P., Relational Partners, L.P., Relational Fund Partners, L.P., Relational Coast Partners, L.P., RH Fund 1, L.P., RH Fund 2, L.P., RH Fund 4, L.P., RH Fund 6, L.P., RH Fund 7, L.P., Relational Investors III, L.P., Relational Investors VIII, L.P., Relational Investors IX, L.P., Relational Investors X, L.P., Relational Investors XI, L.P., Relational Investors XII, L.P., Relational Investors XIV, L.P., Relational Investors XV, L.P., David H. Batchelder, Joel L. Reed, Ralph V. Whitworth and James J. Zehentbauer. Additional information about the Relational Funds is provided in Appendix A to this Statement.

(2) We note that since July 31, 2005, the Company has announced the repurchase of approximately 8 million shares of Common Stock, which would increase the percentage of outstanding Common Stock held by the Relational Funds.

1

On October 20, 2005, Relational Investors LLC will submit an application to the Pennsylvania Department of Banking under Section 112 of the Pennsylvania Banking Code of 1965 (the “Section 112 Application”), seeking approval, insofar as required under Section 112, to solicit proxy authority to vote more than ten percent (10%) of the outstanding shares of Common Stock for the purpose of electing two nominees to the Company’s board of directors.

No proxy card for use at the 2006 Annual Meeting is included with this Statement. The Relational Funds will not seek or accept any WHITE proxy cards for the Company’s 2006 Annual Meeting until the Section 112 Application is approved by the Pennsylvania Department of Banking. A WHITE proxy card will be provided by the Relational Funds with the definitive proxy materials distributed by the Relational Funds to the shareholders of the Company once such approval has been obtained.

SHAREHOLDERS CAN VOTE FOR THE SHAREHOLDER NOMINEES BY SIGNING AND

RETURNING WHITE PROXY CARDS.

Shareholders who execute and deliver a WHITE proxy may revoke it at any time before it is voted:

· By delivering an instrument revoking the earlier WHITE proxy, or a duly executed later dated proxy for the same shares, to:

· D.F. King & Co., Inc., the Relational Funds’ proxy solicitor, at 48 Wall Street, New York, New York 10005; or

· to the Secretary of the Company at its principal executive offices at 1130 Berkshire Boulevard, Wyomissing, Pennsylvania 19610; or

· By voting in person at the 2006 Annual Meeting.

If you hold your shares through a bank, broker or other nominee holder, only that nominee holder can vote your shares, and only after receiving voting instructions from you. Please contact all nominee holders of your shares and instruct them to vote a WHITE proxy card FOR the Shareholder Nominees.

If you previously voted for the Company’s nominees, you can change your vote by signing, dating and returning the Relational Funds’ WHITE proxy card to D.F. King & Co., Inc. at its address set forth above. We strongly urge you to vote FOR the Shareholder Nominees. Only your latest signed and dated proxy will count at the 2006 Annual Meeting.

If you hold your shares through a bank, broker or other nominee holder, you will need to contact your nominee and follow your nominee’s instructions if you want to revoke a proxy or change your vote.

PROPOSAL FOR ELECTION OF DIRECTORS

The Relational Funds intend to nominate David H. Batchelder and Ralph V. Whitworth as the Shareholder Nominees for election to the Company’s board of directors at the 2006 Annual Meeting.

The Company announced in its proxy materials for its 2005 annual meeting (the “2005 Proxy Statement”)(3) that the 2006 Annual Meeting will be held on or about April 20, 2006, but has not yet announced the record date, time or location of the 2006 Annual Meeting, and has not yet filed proxy materials identifying how many board seats will be up for election, who the Company’s nominees will be, or what other matters might be brought before shareholders at the 2006 Annual Meeting. We presently believe, based on the 2005 Proxy Statement and other Company public filings made with the Securities and

(3) See the Company’s proxy statement on Form DEF 14A filed on March 22, 2005.

2

Exchange Commission (the “SEC”), that two director positions will be open for election at the 2006 Annual Meeting. We further believe that the Company will nominate incumbent directors Brian Hard and Cameron C. Troilo, Sr. for re-election. In any event, once the Company files its proxy materials and announces its nominees, the Relational Funds will amend these proxy materials and the related WHITE proxy card to the extent appropriate or required by applicable law.

According to the Company’s Bylaws (as amended as of June 24, 2004), annual meetings of Company shareholders are held on a date designated by the Company’s board of directors.(4) Only shareholders of record at the close of business on the record date fixed by the board will be entitled to notice of, and be permitted to vote at, the 2006 Annual Meeting.

With respect to any WHITE proxies as to which no explicit voting instructions are given, the Relational Funds intend to vote such proxies FOR the Shareholder Nominees. However, the Relational Funds’ WHITE proxy card will also allow shareholders to vote individually on each matter to be acted upon at the 2006 Annual Meeting, as well as withhold authority to vote for one or both of the Shareholder Nominees.

BACKGROUND OF AND REASONS FOR THIS SOLICITATION

The Relational Funds are convinced that significant independent shareholder representation on the Company’s board of directors is necessary to restore confidence in the Company and increase shareholder value. That is why we are asking you to vote the WHITE proxy FOR the Shareholder Nominees, Messrs. Batchelder and Whitworth.

After extensive analysis and interpretation of the Company’s public filings, we have concluded that the Company’s board of directors (the “Board”)(5) has failed to properly represent and protect the Company and its shareholders. Consequently, we believe the Company and its shareholders have suffered from inadequate operating performance, undue risk, poor corporate governance, loss of investor confidence and, ultimately, an undervalued stock price. Mr. Brian Hard, a director of Sovereign Bank, a wholly owned subsidiary of the Company, since 1996 and a director of the Company since 1999, and Mr. Cameron C. Troilo, Sr., a director of Sovereign Bank and its predecessor since 1974 and a director of the Company since 1997, should not be re-elected.(6) They were both members of key committees of the Board when the actions and failings described below occurred.

(4) See Exhibit 3.2 on Form S-3 filed on July 23, 2004.

(5) In this Statement the terms “Board,” “Board members” or “directors” shall mean the Board as it was composed as of the date of any fact, decision or action referred to in this Statement. We note that Ms. Marian Heard was elected to the Board in 2005 and therefore was not involved in many of the actions described in this Statement.

(6) See page 5 of the Company’s proxy statement on Form DEF 14A filed on March 19, 1997 and pages 6 and 8 of the Company’s proxy statement on Form DEF 14A filed on March 24, 2000.

3

Undervalued Share Price

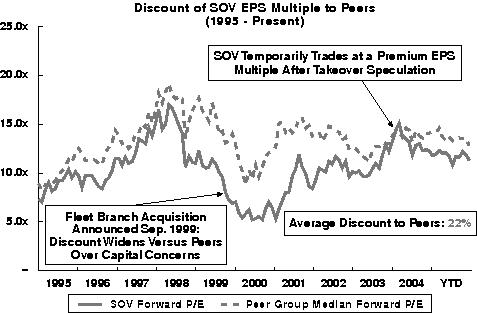

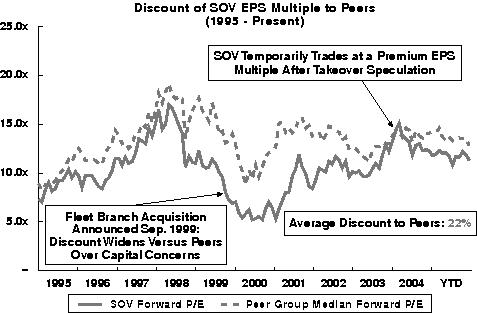

Our analysis has convinced us that for over a decade, the Company’s share price has been undervalued compared to the share price of comparable banks and thrifts (the “Peer Group”).(7) As Table 1 below depicts, the Company’s earnings per share multiple has been, on average, approximately 22%(8) lower than the median earnings per share multiple of the Peer Group since January 1995.(9)

Table 1

Conflicts of Interest Between the Directors, the Company and its Shareholders

We have concluded that certain directors have recklessly allowed their personal interests in receiving money, perquisites and other benefits from the Company to override their responsibility to serve the Company and represent shareholder interests. We believe that the independence and credibility of the Board, including Messrs. Hard and Troilo, have been irreversibly compromised by their active creation of, and failure to correct, many serious conflicts of interest.

(7) Peer Group refers to the Lehman Brothers Mid-Cap Bank Universe as modified by the Company and set forth on page 27 of the Company’s presentation at the Friedman Billings Ramsey European Investor Conference on June 28, 2005. This presentation is available in the “Investor Relations” section of the Company’s website (www.sovereignbank.com).

(8) As determined by Relational Investors Analytics using data from Thomson Baseline.

(9) Earnings per share multiple is defined as price/forward earnings per share.

4

According to the Company’s Code of Conduct and Ethics posted on its website,(10) “a ‘conflict of interest’ occurs when an individual’s private interest interferes in a quantitatively or qualitatively material way or appears from the perspective of a reasonable person to interfere in a qualitatively or quantitatively material way, with the interests of Sovereign as a whole.” The policy goes on to say that “[o]rdinarily, a conflict exists when an outside interest could actually or potentially influence the judgment or actions of an individual in the conduct of Sovereign’s business.”(11)

As the Company’s Code of Conduct and Ethics supports, it is well established that good corporate directors avoid conflicts arising from their own personal interests in receiving money, perquisites and other benefits from the companies they serve. Directors applying good judgment strive to avoid even those situations that create the appearance of such conflicts. This is particularly true when such conflicts involve directors’ personal financial interests.

Unfortunately, as outlined below, we have determined after extensive research and analysis (including consultation with legal counsel) that the Board, including Messrs. Hard and Troilo, repeatedly failed to avoid such conflicts. These directors created numerous direct conflicts of interest by their efforts to consistently increase the money, perquisites and other benefits that they receive from the Company.

As members of the Board, Messrs. Hard and Troilo must share personal and direct responsibility for creating these conflicts. Mr. Hard has served on the Board’s Compensation Committee for the past five years, the Ethics and Corporate Governance Committee for the past four years and chaired the Audit Committee since 2000. Mr. Troilo has served on the Board’s Compensation Committee for the past six years and has been its Chairman for the past five years, has served as a member of the Ethics and Corporate Governance Committee for the past six years, and was a member of the Audit Committee from 1998 to 2000.(12)

Director Loan Disclosure

Though the references are vague and confusing, our careful analysis of regulatory filings by the Company and its wholly owned subsidiary, Sovereign Bank, reveals that the Board has established a practice whereby Board members can receive money from the Company’s subsidiaries in the form of loans and other extensions of credit (“Loans”). The directors can receive consumer and residential mortgage loans at preferential terms(13) and directors and/or their affiliates can receive commercial loans that are approved by a “committee” of fellow Board members. The Company purports to disclose the amount of these Loans in the Company’s proxy filings with the SEC and in Sovereign Bank’s (a subsidiary of the Company) regulatory filings with the Office of Thrift Supervision (“OTS”).

(10) The Company’s Code of Conduct and Ethics is available in the “Investor Relations” section of the Company’s website (www.sovereignbank.com).

(11) See page 10 of the Company’s Code of Conduct and Ethics (revised as of December 2004). (Emphasis added.)

(12) See the Company’s proxy statements on Form DEF 14A for the respective years.

(13) See page 20 of the Company’s proxy statement on Form DEF 14A filed on March 24, 2000.

5

It is not uncommon in the banking industry for banks to loan money to their directors. While some may question the propriety of such practices, our primary concern is the growth in the amount of Loans to directors, and the lack of disclosure regarding the Loans. During the past six years, the amount of Loans approved by the Board for its members and the Company’s executive officers has soared by 1,922%, from $4.7 million to $94.1 million.(14) This increase and the overall amount of Loans, absent disclosure to the contrary, must be assumed to seriously undermine director independence and objectivity. The Company’s public disclosures, some of which are directly approved by the Board, provide insufficient, vague and confusing information about the Loans. For example, the Company’s public filings do not disclose such basic information as the amount of Loans made to individual directors, payment terms, interest rates, the nature of collateral (if any), or collectibility (including whether or not the loans are in default).

Even the total amount of these Loans varies materially between reports filed with each regulatory agency. The Company’s Form 10-Q filed with the SEC on August 9, 2005 disclosed total related party loans of $69.5 million as of June 30, 2005.(15) Sovereign Bank’s most recent Thrift Financial Report filed with the OTS for the same period, however, states that total extensions of credit to executive officers, principal shareholders, directors, and their related interests were $94.1 million.(16) According to conversations we have had with the Company’s Chief Financial Officer, the large disparity between the amounts reported in the SEC and OTS filings is because the SEC filings exclude undrawn extensions of credit available to the Board members. While the Company may have determined that the disclosure requirements of the federal securities laws did not apply to undrawn extensions of credit, we as shareholders believe that this information is material to our investment decision and evaluation of candidates for election to the Board.

Based on our analysis of the Company’s filings with the SEC and the OTS, and our conversations with the Company’s Chief Financial Officer, we have confirmed that virtually all the Loans—over 95%—were made to directors. Board members were privy to this loan information and the cost, if any, of additional disclosure would have been miniscule. Therefore, we can only assume that the Company’s disclosures were designed to hide the magnitude of the conflicts of interest. We can conceive of no other reason for the Board to withhold this information from the very shareholders that have elected these directors as our representatives. We believe the Loan information to be material to shareholders’ investment decisions and their decisions on Board member elections. We consider the Board’s lack of disclosure to be a potentially material misrepresentation to shareholders.

The Company’s Chief Financial Officer has indicated to us that a significant portion of the approximately $90 million of Loans to directors are related to real estate development projects. This particular lending area has a history of contributing to large loan losses in the banking industry. We are especially concerned because Mr. Troilo, a likely incumbent director nominee, is actively involved in real estate development projects. Again, the Board’s disclosures do not reveal which directors the loans are made to, but if Mr. Troilo received substantial amounts of real estate development loans, we believe that he is not independent. We have concluded that these loans, combined with the other substantial amounts of money the Company and its subsidiaries have paid to Mr. Troilo, including the large rental payments discussed below, have created substantial conflicts of interest rendering him unworthy of chairing the Board’s Ethics and Corporate Governance Committee and unworthy of re-election.

(14) As determined by Relational Investors Analytics using data from SNL Datasource and Schedule SI of Sovereign Bank’s Thrift Financial Reports filed with the OTS for each of the applicable periods.

(15) See page 14 of the Company’s quarterly report on Form 10-Q filed on August 9, 2005.

(16) See Schedule SI of Sovereign Bank’s Thrift Financial Report for the quarter ended June 30, 2005.

6

Business Transactions and Relationships between the Directors and the Company

The Company’s public filings provide sparse and vague information regarding business transactions and relationships between the Company and its directors. Based on a close reading of the Company’s filings, we have concluded that there have been, and likely continue to be, substantial business transactions between the Company and its subsidiaries and members of the Board. Moreover, it is clear to us that these transactions have not been adequately disclosed to shareholders.

For example, one troubling situation of which we are aware relates to money in the form of rental payments that Mr. Troilo receives from the Company and/or its subsidiaries. When Mr. Troilo joined the Board in 1997, he had an existing landlord/tenant relationship with the Company.(17) As shown below, after Mr. Troilo joined the Board, rental payments to him skyrocketed. From 1996 to 2001, rental payments received by Mr. Troilo from the Company increased by an astonishing 803%, from $68,500 to $618,700 per annum.(18)

| | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | |

Annual Rent Paid to Mr. Troilo: | | $ | 68,544 | | $ | 119,088 | | $ | 169,356 | | $ | 406,458 | | $ | 439,151 | | $ | 618,700 | |

| | | | | | | | | | | | | | | | | | | |

After 2002, the Company stopped disclosing the amount of rental payments to Mr. Troilo, although it continues to acknowledge the relationship. For example, the 2005 Proxy Statement notes only that the Board concluded the landlord/tenant relationship between Mr. Troilo and Sovereign Bank did not affect Mr. Troilo’s independence because “the amount of rent paid by Sovereign Bank in 2004 was not material to Sovereign and not material to the director based on the director’s total income in 2004 . . . .”(19) If Mr. Troilo is still receiving significant rental payments from the Company, we do not understand how this can be considered immaterial to him. Conversely, if the payments are indeed so small as not to be meaningful to Mr. Troilo, we ask why he and the Board continue this confidence-eroding practice.

Considering the history of significant cash flows from the rental payments, as well as the loans mentioned above, we do not see how Mr. Troilo can be independent with respect to evaluating management’s performance or any decision to merge or sell the Company. We also do not see how he can be considered an independent director for the purposes of his position on the Ethics and Corporate Governance Committee. If our concerns are unfounded, the Company could easily allay them by thoroughly disclosing Mr. Troilo’s past and present business relationships with the Company in full. That disclosure should include information regarding the timing between Mr. Troilo’s taking title to the relevant properties and the subsequent rental agreements with the Company.

(17) See page 17 of the Company’s proxy statement on Form DEF 14A filed on March 19, 1997.

(18) See the Company’s proxy statements on Form DEF 14A filed on March 19, 1997, March 16, 1998, March 22, 1999, March 24, 2000, March 26, 2001, and March 22, 2002.

(19) See page 13 of the 2005 Proxy Statement. (Emphasis added.)

7

Another troubling business relationship of which we are aware relates to payments made to the Company’s lead director, Mr. Daniel K. Rothermel. The Company’s proxy statement filed on March 21, 2003 (the “2003 Proxy Statement”) refers vaguely to “certain buildings and grounds maintenance related services provided by an affiliate of a non-management director to Sovereign Bank . . . .”(20) We believe that this unusual reference relates to a company affiliated with Mr. Rothermel. Mr. Rothermel’s biographical information refers to him as “President and Chief Executive Officer of Cumru Associates, Inc., a private holding company . . . .”(21) There is no reference to the nature of Cumru Associates, Inc.’s business or its holders. Our search of the Dunn and Bradstreet Corp. database revealed that Cumru Associates, Inc., also “does business” under the name Green Giant Lawn and Tree Care (“Green Giant”). A representative of Green Giant confirmed to us by telephone that Mr. Rothermel “owned” Green Giant. Information on Green Giant’s website states that its services include small residential and commercial lawn clipping, fertilization, tree trimming, and insect and crab grass control.(22)

If we are correct, the Board must have known that Mr. Rothermel was the unnamed “non-management” director referred to in the 2003 Proxy Statement and it approved this disclosure to shareholders, which omitted the critical information about payments to the Board’s lead director. We consider the details of this relationship to be materially important to shareholders, particularly given Mr. Rothermel’s role as a lead director. Given the cryptic nature of the Company’s disclosure, we can only conclude that the primary purpose in withholding this information was to hide the payments to Mr. Rothermel and his related business relationship with the Company.

Excessive Compensation for Board Members

The total value of money and other compensation the Board members awarded themselves is many times greater than the director compensation at comparable companies. Based on the Company’s disclosures that were approved by the Board, we have calculated that the average compensation of the Company’s directors in 2004 was $313,127.(23) This is more than double the median of average annual director compensation for America’s 25 largest publicly-held banks and thrifts, and more than five times the median of average annual director compensation for the Company’s Peer Group.(24) In fact, the Board members, including Messrs. Hard and Troilo, approved higher pay for themselves than the pay received by directors of every other public bank and thrift in the United States. That includes huge international money center banks like Citigroup and Bank of America.(25) We are convinced that when directors are paid such over-generous sums, their willingness and ability to objectively oversee management is inherently compromised. This also severely impairs the directors’ objectivity in evaluating strategic alternatives, which may involve eliminating their positions.

(20) See page 11 of the 2003 Proxy Statement. (Emphasis added.)

(21) See page 19 of the 2005 Proxy Statement.

(22) See http://www.greengiantlawncare.com

(23) As determined by Relational Investors Analytics using data from SNL Datasource and the 2005 Proxy Statement.

(24) As determined by Relational Investors Analytics using data from SNL Datasource, Bloomberg, the 2005 Proxy Statement and proxy materials for each of the Peer Group banks and the 25 largest banks and thrifts.

(25) As determined by Relational Investors Analytics using data from SNL Datasource, Bloomberg, the 2005 Proxy Statement and proxy materials for each of the Peer Group banks and the 25 largest banks and thrifts.

8

Unusual Director “Bonus” Program

In June 2002, the Board established, for itself, the Non-Employee Directors Stock Bonus Program, a special bonus program that was highly unusual, if not unique (the “Director Bonus Program”).(26) The Director Bonus Program granted directors contingent compensation if the Company achieved certain “cash earnings targets” as defined.(27) The cash earnings targets were established by the Board.

We believe that the Director Bonus Program was so unusual and over-generous that it inherently compromised the independence of the directors, particularly those, such as Messrs. Hard and Troilo, who serve on the Compensation Committee. This conflict infected many of the Board’s most fundamental duties and responsibilities. For example, the Director Bonus Program was contingent on “cash earnings targets’’ that were the same as those used for the Senior Officers Stock Bonus Program (the “Executive Bonus Program”).(28) Due to this conflict, we believe the Board could not objectively set executive management compensation targets. We believe that even the Board’s objectivity in approving the Company’s annual budget was compromised by this program. We question the judgment of directors that would put themselves in this compromising position purely for personal financial gain. Moreover, we believe that other aspects of the Director Bonus Program compounded the conflicts of interest and, therefore, raise more questions about the incumbent directors’ commitment to full and fair disclosure.

As shown in Table 2, the cash earnings targets established by the directors to “earn” their bonuses were well below the Company’s publicly disclosed cash earnings targets. Yes, the directors set their own bonus targets lower than the Company’s guidance to shareholders for the same metrics that the Company had consistently disclosed to shareholders and the investment community. Put another way, the directors could “earn” their bonuses under the Director Bonus Program even when the Company did not exceed, or meet, its announced goals. The Company and the Board did not offer any explanation or justification as to why they would take the highly unusual, if not unprecedented, action of establishing the Board’s own bonus targets below the earnings targets disclosed to investors. Indeed, the Company did not adequately explain that such a relationship existed.

Table 2

Fiscal Year | | | | Publicly Disclosed Cash

Earnings Targets(29) | | Director Bonus Program and

Executive Bonus Program

Cash Earnings Targets(30) | | Approximate % Below

Publicly

Disclosed Target | |

2004 | | | $ | 1.75-$1.85 | | | | $ | 1.70 | | | | 3%-8% | | |

2005 | | | $ | 2.10-$2.15 | | | | $ | 1.95 | | | | 7%-9% | | |

(26) This definition includes the Non-Employee Directors Stock Bonus Program, amended and restated as the Non-Employee Directors Bonus Program (see page 21 of the Company’s preliminary proxy statement on Form PRE 14A filed on March 9, 2004).

(27) See page 18 of the 2003 Proxy Statement.

(28) See page 21 of the 2003 Proxy Statement.

(29) See page E of the Company’s 2001 Annual Report.

(30) See pages 18 and 21 of the 2003 Proxy Statement.

9

In January 2004, the Board amended the Director Bonus Program and the Executive Bonus Program such that bonuses previously payable in Common Stock would be paid in risk-free cash.(31) Interestingly, the timing of the Board’s decision coincided contemporaneously with the Company’s all-time high share price of $24.51 on January 16, 2004. The Board’s decision benefited directors and management by eliminating the risk of receiving Common Stock that might (and did) depreciate. The Board’s disclosure did not include an explanation or justification for the changes. This is not the only action the Board members took to increase the likelihood that they and management would receive bonuses.

Director Approved Changes to Enrich the Director Bonus Program

The Board and management have a long history of adjusting earnings in order to achieve their earnings goals. These adjustments would also appear to benefit management and the Board by enabling them more readily to reach compensation-related earnings targets. During the period of 2000 through 2004, the Company generated GAAP earnings of approximately $1.3 billion.(32) During this same period, the Board approved and authorized “adjustments” and “add-backs” of approximately $571 million, or 45% of GAAP earnings.(33) The Board members received bonus compensation based on these adjusted earnings. The Relational Funds believe that the Board’s actions with respect to “adjustments” and “add-backs” have misaligned executive and Board member compensation.

In addition, in the Company’s 2004 fourth quarter and year-end press release, management and the Board disclosed that the Board had approved a change in the definition of operating earnings to exclude the after-tax effect of intangible asset amortization. With this change, operating earnings approximate the Company’s previous definition of “cash earnings”.(34) The Board’s disclosure did not include an explanation or justification for this change. We can only conclude that this change was designed to somehow increase the likelihood of executives and directors receiving bonuses.

Discriminatory Two-Tiered Board Compensation Scheme

The extraordinary nature of the Board’s compensation structure is further illustrated by an unprecedented and discriminatory two-tier board compensation scheme (the “Two-Tiered Plan”) that was in place until mid-2005. This scheme was adopted by the Board before the appointment of Ms. Marian Heard as a director. The Two-Tiered Plan was approved by the Board’s Compensation Committee (chaired by Mr. Troilo and of which Mr. Hard was also a member). The Two-Tiered Plan divided the directors into two classes, depending on when they were elected or appointed to the Board.(35) One class of directors (the “First Class”) was distinguished by having been elected or appointed to the Board prior to March 24, 2004. The First Class directors were entitled to receive total average annual compensation under the Two-Tiered Plan of $313,127 in 2004.(36) In stark contrast, directors elected or appointed after March 24, 2004 (the “Second Class”) were entitled to receive an annual retainer of only $63,000 plus applicable meeting fees.(37) This was true

(31) See pages 21 and 24 of the Company’s preliminary proxy statement on Form PRE 14A filed on March 9, 2004.

(32) See page 13 of the Company’s 2004 Annual Report.

(33) See page 13 of the Company’s 2004 Annual Report.

(34) See the Company’s current report on Form 8-K filed on January 19, 2005.

(35) See page 20 of the 2005 Proxy Statement.

(36) As determined by Relational Investors Analytics using data from SNL Datasource and pages 20-21 of the 2005 Proxy Statement.

(37) See page 20 of the 2005 Proxy Statement.

10

even though the First and Second Class directors had the same obligations, liabilities, responsibilities and overall workload. Mr. Rothermel, Mr. Troilo, Mr. Hard, Mr. P. Michael Ehlerman and Mr. Andrew C. Hove, Jr. were First Class Directors, and Ms. Heard was a Second Class Director.

We could not find any other company that has adopted a similarly discriminatory director compensation scheme. The Board’s action in creating this program seriously calls into question their business judgment and sense of fairness.

The Board’s Reactive Measures

On May 23, 2005, the Relational Funds met with the entire Board. During the meeting, we respectfully requested that the Board engage a nationally recognized compensation expert and undertake a comprehensive review of director compensation. We also requested that the Board immediately eliminate the Director Bonus Program. Finally, we requested that the Board immediately eliminate its two-tiered compensation scheme. We emphasized the risk the Board had taken by adopting the Two-Tiered Plan, and how it exposed the Company to severe public criticism, if not litigation.

The next day the Board eliminated the discriminatory Two-Tiered Plan. The Board also announced that it “[was] in the process of engaging an independent nationally recognized compensation consulting firm to review Sovereign’s existing compensation system . . . .”(38) On August 1, 2005 the Company eliminated, effective October 1, 2005,(39) the objectionable Director Bonus Program and reduced their pay to an amount near the median director compensation(40) we presented on May 23, 2005.

We welcomed these changes. We also appreciated the Board’s implied acknowledgment that the previous programs were over-generous. Despite their reaction to our constructive criticism, we consider their continued service as Board members a major risk given the poor judgment reflected in the directors’ decisions relating to their compensation.

Corporate directors are among the few people in our society who are trusted with the authority to set their own pay. Because of the interplay between personal temptation and solemn duties to others inherent in this unusual authority, directors’ fair and responsible exercise of this authority requires great discipline and integrity. In that regard, we believe the Board members have obviously failed and therefore should not be re-elected.

Unusual Board Approved Entrenchment Devices

In recent years the Board has taken actions that, while ostensibly taken to enhance the Company’s so-called takeover defenses, also further entrenched management and the Board. In essence, these devices made it more difficult for third parties to purchase control of the Company without the Board’s approval, even at a premium price. We believe that the particular devices adopted by the Board are rare and extreme when measured against trends in corporate governance. In our opinion, these actions may very well have left the investment community with the impression that the Board would be unwilling to sell the Company.

(38) See the Company’s current report on Form 8-K filed on May 25, 2005.

(39) See the Company’s current report on Form 8-K filed on August 5, 2005.

(40) The median of average director compensation for the top 25 U.S. public banks and thrifts by asset size as determined by Relational Investors Analytics using data from SNL Datasource, Bloomberg, Thomson Baseline and public filings.

11

Since 1995, the Board has twice amended the Company’s poison pill to include unusually extreme provisions. In September 1995, the Board lowered the trigger percentage from a typical 20% to an unusual 9.9% level.(41) In June 2001, the Board adopted a so-called “dead hand” provision. This provision prevented the poison pill from being eliminated or amended even when approved by a vote of shareholders, unless the action was approved by incumbent board members. This was true even if the incumbent directors had already been removed by a vote of shareholders.(42) Such provisions are referred to as “dead hand” poison pills because all future shareholders and duly elected board members must live under the threat of the ousted directors’ “dead hands.” Because these “dead hand” arrangements effectively and severely undermine shareholders’ fundamental right to elect board members, several courts have declared them illegal (although in one Pennsylvania case, involving circumstances not present here, the court upheld a similar arrangement).

When the Board adopted the Company’s poison pill it chose to include a so-called “adverse person” provision.(43) By including this provision, the Board gave itself the rare and, in our minds, highly objectionable power to unilaterally label a holder of more than 4.9% of the Company’s stock an “adverse person.” The majority of poison pills are triggered by the acquisition of stock at a pre-specified level between 15% and 20%.(44) Under the Company’s poison pill, the Board had the power, in its sole discretion and without prior notice, to effectively dilute the voting rights of the shares of any shareholder that owned as little as 4.9% of the Company’s Common Stock. Because no reasonable investor would risk being deemed an “adverse person”, this provision effectively prevented any shareholder from acquiring more than 4.9% of the Company’s shares without obtaining prior approval from the Board or assuming the risk of having its voting rights significantly diluted.

We wrote the Board’s Chairman on November 9, 2004, and provided the Board with empirical data and analysis which demonstrated the extreme and rare nature of the “dead hand” and 4.9% “adverse person” provisions of the Company’s poison pill. In the same letter we respectfully requested that the Board take immediate action to eliminate these and other entrenchment devices. On January 24, 2005, the Company answered our request by announcing that the Board had removed both objectionable provisions.(45) Our research demonstrated that many companies in the banking industry enjoy the support of large stable shareholders with over 5% ownership. Not surprisingly, while these entrenchment devices were in effect, no outside shareholder acquired more than 4.9% of the Company’s shares. We believe that in the absence of such prohibitive entrenchment devices, companies in the banking industry may enjoy the benefit of large, stable shareholders with over 5% ownership.(46)

(41) See Amendment to Rights Agreement dated as of September 27, 1995, attached to the Company’s current report on Form 8-K/A filed on January 22, 1996.

(42) See Amended and Restated Rights Agreement dated as of June 21, 2001, attached to the Company’s current report on Form 8-K/A filed on July 3, 2001.

(43) See Amendment to Rights Agreement dated as of September 27, 1995, attached to the Company’s current report on Form 8-K/A filed on January 22, 1996.

(44) As determined by Relational Investors Analytics based on publicly available information.

(45) See the Company’s current report on Form 8-K filed on January 24, 2005.

(46) As determined by Relational Investors Analytics based on publicly available information for a broad peer group in the Company’s industry.

12

Misrepresentations Regarding the Company’s Acquisition Strategy

In January of 2002, management presented its top priorities for the future at the Salomon Smith Barney 2002 Financial Services Conference. Management stated verbally, and in its slide presentation, that one of its top priorities was to avoid material acquisitions.(47) Throughout 2002, and most of 2003, management reiterated its commitment to avoid material acquisitions.

At the Keefe Bruyette & Woods Eastern Regional Bank Symposium on March 6, 2003, Chairman and CEO Jay Sidhu stated, “You should not expect us to do any material acquisitions. For those of you who keep thinking we might do that, you are totally misinformed.”(48) On June 13, 2003, approximately three months after Mr. Sidhu’s scolding statement, the Company announced the purchase of First Essex Bancorp for $400 million in cash and stock.(49) The consideration to be paid by the Company for this acquisition equaled approximately 9.3%(50) of the Company’s then-current total equity market capitalization, which we understand to be material by any commonly accepted definition.

At the Friedman Billings Ramsey Investor Conference (the “FBR Conference”) on December 2, 2003, Chairman and CEO Jay Sidhu, verbally, and in the Company’s investor presentation, reaffirmed his promise that management would not engage in any material acquisitions.(51)

Six days later, at the Lehman Brothers Conference on December 8, 2003, management had inconspicuously removed the statement regarding “no material acquisitions” from the otherwise same presentation.(52) Despite this omission, the Company gave no indication that what had been a central part of their stated plan had been changed.

On January 26, 2004, less than 50 days after the FBR Conference, the Company announced the purchase of Seacoast Financial for $1.1 billion.(53) This acquisition, the consideration for which equaled approximately 14.5% of the Company’s then-current equity market capitalization, was also material.(54)

(47) See page 29 of the Company’s presentation at the Salomon Smith Barney 2002 Financial Services Conference on January 31, 2002.

(48) See news release from SNL on March 6, 2003 titled “SOV Looks Inward to Improve Balance Sheet, Earnings and Ratings in 2003.’’ (Emphasis added.)

(49) See the Company’s current report on Form 8-K filed on June 18, 2003.

(50) As determined by Relational Investors Analytics using data from SNL Datasource, Thomson Baseline and public filings.

(51) See page 43 of the Company’s presentation at the Friedman Billings Ramsey Investor Conference on December 2, 2003.

(52) See page 44 of the Company’s presentation at the Lehman Brothers Themes & Top Picks Conference on December 8, 2003.

(53) See the Company’s current report on Form 8-K filed on January 28, 2004.

(54) As determined by Relational Investors Analytics using data from SNL Datasource, Thomson Baseline and public filings.

13

Only 43 days later, on March 9, 2004, the Company announced yet another material acquisition, the acquisition of Waypoint Financial Corporation, for $1.0 billion.(55) The purchase price was equal to approximately 12.9% of the Company’s then-current equity market capitalization.(56)

In less than ten months, the Company had committed to acquire companies with a combined purchase price equaling almost 40% of its equity market capitalization.

On October 5, 2004, we met with Mr. Sidhu. At this meeting we expressed disappointment with the Company’s inconsistent statements and actions regarding acquisitions. We expressed our view that the broken promises regarding acquisitions had negatively impacted management’s already weak credibility. In response, Mr. Sidhu assured us that he had not broken his promises because the Company’s, until then secret, definition of materiality was 25% percent of the Company’s equity market capitalization.

We were taken aback by Mr. Sidhu’s statement, as we were confident that his definition was clearly at odds with the SEC’s pronouncements regarding the standard for materiality, as well as other definitions found in court decisions and accounting bulletins. We urged him to immediately disclose his special definition of materiality to all shareholders.

On the Company’s October 20, 2004 third-quarter earnings conference call, Chairman and CEO Jay Sidhu stated “material acquisitions by us is defined as greater than 25% of market cap,” referring to the Company’s total equity market capitalization. He did not explain that multiple acquisitions within a twelve month period would not be considered material if they exceeded 25% of the Company’s market capitalization in the aggregate.

The Board failed in its duties to the Company and its shareholders by not properly overseeing the Company’s compliance with clearly established standards of disclosure. We believe the Board’s failure to ensure timely disclosure of the Company’s secret and highly unusual definition of materiality seriously damaged the Company’s credibility and its reputation with shareholders and the investment community.

(55) See the Company’s current report on Form 8-K filed on March 11, 2004.

(56) As determined by Relational Investors Analytics using data from SNL Datasource, Thomson Baseline and public filings.

14

POSSIBLE FURTHER DEFENSIVE ACTIONS BY THE BOARD

On July 20, 2005, Chairman and CEO Jay Sidhu revealed an expansion of the strategic options that the Company would consider to include “partner[ing] with someone … overseas….”(57) This statement closely followed our announcement of our intention to seek board representation. While, of course, there could be a legitimate reason for such an arrangement or transaction, the timing of this vague statement increased our concerns that the Company may, in response to our announcement, seek such a partnership. While a transaction of this nature may serve to make management’s and the Board’s jobs more secure, it may not be in the best interests of the Company and its shareholders. Transactions of the type described by Mr. Sidhu often involve dilution of existing shareholders’ voting powers and/or rights.

We will vigorously protect our shareholder rights and the Company’s value by opposing any transaction or other similar step which frustrates or dilutes the shareholders’ ability to elect independent directors. It behooves the Board to disclose to any prospective minority investor or partner the risks of a transaction that may not be in the best interests of the Company and that may impair current shareholders’ voting power or rights.

The Board and management may seek to make other structural changes to the Company’s Bylaws or its policies and practices with the effect of making it more difficult for the Shareholder Nominees or other persons to be elected to the Board unless they are nominated by current directors and acceptable to management. We hope, but cannot ensure, that the Company’s management and the Board will refrain from taking any action, including any transactions or sales, that are designed to solidify the current Board’s and management’s control, and to prevent or impede our efforts to elect the Shareholder Nominees.

ELECTION OF DIRECTORS AT THE 2006 ANNUAL MEETING

In light of the issues presented above, the Relational Funds have concluded that the current Board is conflicted, unable to objectively evaluate management’s performance and incapable of fairly overseeing the business and affairs of the Company and analyzing strategic alternatives, including a sale or merger of the Company.

The patterns of behavior outlined above indicate that your directors, including the incumbents, Messrs. Hard and Troilo, have not been held accountable and they have not applied proper principles of stewardship. We believe that the election of directors at the 2006 Annual Meeting presents an opportunity to send a clear message to the current Board: shareholders will no longer tolerate the high cost of a persistent trading discount of their shares caused by a lack of proper stewardship by the Board. Directors must be held accountable. We believe the addition of independent directors, nominated and elected by the shareholders, can bring the required positive changes to this Board.

The Incumbent Nominees

Messrs. Hard and Troilo bear particular responsibility for the Board’s failures, given their lengthy tenures on the Compensation Committee, the Audit Committee, and the Ethics and Corporate Governance Committee.

(57) Comments by Jay Sidhu on the Company’s second quarter earnings call on July 20, 2005.

15

Mr. Troilo has chaired the Compensation Committee since 2000, and Mr. Hard has served as a member of the Compensation Committee for five years. As such, they bear substantial accountability for the excessive compensation of directors and any director bonus programs (from which they also benefited).(58)

Mr. Hard has chaired the Audit Committee since 2001, and Mr. Troilo was a member of the Audit Committee from 1998 to 2000. The charter of the Audit Committee, which has been approved annually by Messrs. Hard and Troilo and the rest of the Board, states the Audit Committee has a duty to review reports and disclosures of insider and affiliated party transactions.(59)

Messrs. Hard (since 1999) and Troilo (since 2001) both sit on the Ethics and Corporate Governance Committee. As members of this Committee, they bear substantial accountability for the impairment of independence that likely has resulted from excessive loans to directors and other business relationships, and the inadequate disclosure relating to each of these matters.(60) During their tenure, the Board adopted radical defensive devices that are far out of step with corporate governance trends. Messrs. Hard and Troilo have also failed to eliminate or even disclose certain conflicts of interest and related party transactions.

The Board’s vague disclosure policy prevents shareholders from knowing whether Mr. Hard has loans, including preferential loans, from the Company or its subsidiaries. It appears likely to us, however, that Mr. Troilo has substantial loans from, and substantial business relations with, the Company and its subsidiaries.

The Relational Funds believe that Messrs. Hard and Troilo should not be re-elected. We urge you to carefully and critically consider the history of conflicts of interest, poor corporate governance practices, misstatements and omissions to shareholders before casting your vote. If you are concerned about these matters, and are not satisfied with the Board’s performance in recent years, please promote positive change by voting the WHITE card FOR the Shareholder Nominees.

The Shareholder Nominees

If elected, the Shareholder Nominees, Messrs. Batchelder and Whitworth, intend to be actively engaged and fully-informed directors. They will recommend and seek to accomplish such actions as may be necessary to assure that shareholders receive complete and accurate information concerning the Company’s compensation, management and business practices. Messrs. Batchelder and Whitworth will work to ensure that the Company’s business and affairs are free from conflicts of interest and conducted in the best interests of the Company and our fellow shareholders. Neither the Shareholder Nominees nor the Relational Funds will have or will enter into any financial or business interests or arrangements with or involving the Company.

The Relational Funds believe that the Company should initiate a comprehensive program to improve the Company’s trading multiple and reduce business risk. While the Shareholder Nominees have familiarized themselves with the business of the Company and the challenges it faces, if elected to the Board, they will urge the Board to initiate a shareholder value improvement program. Such a program cannot be initiated until the Shareholder Nominees are elected to the Board and gain access to

(58) See page 1 of the Company’s Compensation Committee Charter.

(59) See page 3 of the Company’s Audit Committee Charter.

(60) See page 1 of the Company’s Ethics and Corporate Governance Committee Charter.

16

additional information. The Shareholder Nominees expect that such a review would include the following steps:

· Reducing balance sheet leverage.

· Curtailing acquisitions.

· Improving operating metrics.

· Improving capital ratios.

· Establishing and strictly enforcing sound capital allocation discipline that focuses on long-term shareholder value.

· Realigning board and management incentives to emphasize each group’s distinctive roles and duties and long-term shareholder value.

· Eliminating inconsistent and misleading communications with investors.

· Performing a comprehensive and independent analysis of the Company’s strategic alternatives.

If elected, Messrs. Batchelder and Whitworth will have access to the Company’s books and records, and will advocate for a thorough review and analysis of such materials to formulate a specific and detailed program for realizing shareholder value. Even though it would be unlikely that, as directors, Messrs. Batchelder and Whitworth could single-handedly implement a comprehensive program without the cooperation of other board members, Messrs. Batchelder and Whitworth will zealously advocate that the Company take the steps necessary to unlock shareholder value.

THE RELATIONAL FUNDS NOMINEES

Each Shareholder Nominee has given his consent to be named in this Statement and any other proxy statement for the 2006 Annual Meeting and has confirmed his intent to serve on the Board if elected. If the Shareholder Nominees are elected, they intend to discharge their duties as directors of the Company consistent with all applicable legal requirements, including the general fiduciary obligations imposed upon corporate directors. The Shareholder Nominees will act in the best interests of the Company, as provided under Pennsylvania law, and as they have done while serving on a combined total of 14 public company boards of directors over the past 21 years. The information below concerning the age, principal occupation, directorships and beneficial ownership of Common Stock has been furnished by the respective Shareholder Nominees.

Name and Age | | | | Present Principal Occupation and Principal

Occupations During Last Five (5) Years; Directorships | | Shares of

Common Stock

Owned | | Percent of

Common Stock |

David H. Batchelder, 55 | | Principal of Relational Investors LLC, an investment advisory firm, since March 1996 and a principal of Relational Advisors LLC, a financial advisory and consulting firm, since establishing the firm in 1988. Mr. Batchelder serves as a director of Washington Group International, Inc. and ConAgra Foods, Inc. He is a former director of Apria Healthcare Group Inc., ICN Pharmaceuticals, Inc., and Nuevo Energy Company. Mr. Batchelder also serves as a director of privately held Titan Investment Partners, LLC, and Seaspan International Ltd. (including a number of its affiliate companies). Mr. Batchelder has never served as an officer or director of the Company. | | 26,357,189* | | 7.29% |

17

Ralph V. Whitworth, 50 | | Principal of Relational Investors LLC since March 1996 and a principal of Relational Advisors LLC, a financial advisory and consulting firm, since January 1997. He is the former chairman of the board of Apria Healthcare Group, Inc., and a former director of Mattel, Inc., Waste Management, Inc., Tektronix, Inc., and Sirius Satellite Radio, Inc. Mr. Whitworth is also a director of privately held Titan Investment Partners, LLC. Mr. Whitworth has never served as an officer or director of the Company. | | 26,357,189* | | 7.29% |

* Consists of an aggregate of 26,357,189 shares of Common Stock beneficially owned by Relational Investors, L.P., Relational Investors LLC (including 64,047 shares owned by the David H. Batchelder Trust), Relational Partners, L.P., Relational Fund Partners, L.P., Relational Coast Partners, L.P., RH Fund 1, L.P., RH Fund 2, L.P., RH Fund 4, L.P., RH Fund 6, L.P., RH Fund 7, L.P., Relational Investors III, L.P., Relational Investors VIII, L.P., Relational Investors IX, L.P., Relational Investors X, L.P., Relational Investors XI, L.P., and Relational Investors XII, L.P., Relational Investors XIV, L.P., Relational Investors XV, L.P. of which Messrs. Batchelder and Whitworth may be deemed to be beneficial owners.

There are no arrangements or understandings between the Shareholder Nominees and any other person pursuant to which they were selected as a nominee for director. However, certain partnerships in the Relational Funds provide an indemnity for the general partner of such partnerships and its affiliates, controlling persons, members, employees, and other specified persons (which would include Messrs. Batchelder and Whitworth) for any losses and liabilities arising from their activities relating to such partnerships.

INFORMATION ABOUT THE RELATIONAL FUNDS

The Relational Funds beneficially own an aggregate of 26,357,189 shares of the Common Stock, representing approximately 7.29% of the 361,669,914 shares of Common Stock reported to be outstanding as of July 31, 2005 in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2005. Unless otherwise indicated, percentages of the outstanding shares of Common Stock reported in this Statement were computed based upon the July 31, 2005 number of outstanding shares reported by the Company.(61)

The Relational Funds have been shareholders of the Company since June 3, 2004, and currently hold approximately 7.29% of the Common Stock outstanding. Certain Relational Funds also held Common Stock from April 2002 to September 2003. The Relational Funds acquired the Common Stock because, in our opinion, the Common Stock was undervalued by the market after taking into account the potential for improvement in financial performance and investor confidence. We believe it is still undervalued.

The Relational Funds do not seek to take control of any company and do not participate in leveraged buyouts of any company. Further, under the terms of certain agreements with their investors, the Relational Funds have voluntarily agreed not to engage in change of control transactions. The Relational Funds do not intend to participate in the management of the Company, other than at the board level.

(61) We note that since July 31, 2005, the Company has announced the repurchase of approximately 8 million shares of Common Stock, which would increase the percentage of Common Stock held by the Relational Funds.

18

Security Ownership of the Relational Funds

As of October 20, 2005 direct beneficial ownership of Common Stock by Relational Funds entities was as follows:

Relational Funds

Entity | | | | Direct Beneficial

Ownership of

Common Stock | | Relational Funds

Entity | | Direct Beneficial

Ownership of

Common Stock | |

Relational Investors LLC | | 3,661,969 | | RH Fund 7, L.P. | | | 166,221 | | |

Relational Investors, L.P | | 4,907,609

(including 100 shares

owned of record) | | Relational Investors III, L.P. | | | 229,212 | | |

Relational Partners, L.P. | | 99,773 | | Relational Investors VIII, L.P. | | | 4,720,856 | | |

Relational Fund Partners, L.P. | | 106,221 | | Relational Investors IX, L.P. | | | 1,925,255 | | |

Relational Coast Partners, L.P. | | 225,875 | | Relational Investors X, L.P. | | | 2,050,188 | | |

RH Fund 1, L.P. | | 2,458,721 | | Relational Investors XI, L.P. | | | 1,217,938 | | |

RH Fund 2, L.P. | | 2,200,552 | | Relational Investors XII, L.P. | | | 241,885 | | |

RH Fund 4, L.P | | 549,431 | | Relational Investors XIV, L.P. | | | 855,408 | | |

RH Fund 6, L.P. | | 282,326 | | Relational Investors XV, L.P. | | | 457,749 | | |

Relational Investors LLC, in its capacity as an investment advisor, may be deemed to possess direct beneficial ownership of 26,357,189 shares of Common Stock that are owned by its clients and held in accounts that it manages. Relational Investors LLC, as the sole general partner of Relational Investors, L.P., Relational Partners, L.P., Relational Fund Partners, L.P., Relational Coast Partners, L.P., RH Fund 1, L.P., RH Fund 2, L.P., RH Fund 4, L.P., RH Fund 6, L.P., RH Fund 7, L.P., Relational Investors VIII, L.P., Relational Investors IX, L.P., Relational Investors XI, L.P., Relational Investors XII, L.P. Relational Investors XIV, L.P. and Relational Investors XV, L.P. (collectively, the “Relational LPs”) and as the sole managing member of Relational Asset Management LLC and Relational Investors X GP LLC, which serve as the general partner of Relational Investors III, L.P. and Relational Investors X, L.P., respectively, may be deemed to beneficially own (as that term is defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) the 26,357,189 shares of Common Stock beneficially owned by the Relational Funds, because the limited partnership agreements of the Relational LPs and the investment management agreement for the accounts managed by Relational Investors LLC specify that Relational Investors LLC has sole investment discretion and voting authority with respect to those shares.

Messrs. Batchelder, Whitworth, Reed and Zehentbauer, in their capacities as principals of Relational Investors LLC, share voting and dispositive power over the 26,357,189 shares of Common Stock beneficially owned by the Relational Funds. As a result, Messrs. Batchelder, Whitworth, Reed and Zehentbauer may be deemed to share indirect beneficial ownership of those shares.

The Relational Funds may be deemed to be a “person” under Section 13(d)(3) of the Exchange Act, possessing beneficial ownership of 26,357,189 shares of Common Stock.

All transactions in securities of the Company engaged in by the Relational Funds and the Shareholder Nominees during the past two years are summarized in Appendix B, attached.

19

ADDITIONAL INFORMATION REQUESTED FROM THE COMPANY

BY THE RELATIONAL FUNDS

Relational Investors LLC has formally requested in writing that the Board and management provide public disclosure of, among other things, the following information: (1) the names of the directors and executive officers (and their affiliates) that have received loans from the Company or Sovereign Bank, (2) the size and amount of each loan, (3) whether the loans were granted on market terms and conditions, (4) whether any of the loans currently are or in the past have been in default of any of their terms and (5) if the loans were granted at rates and terms more favorable than the rates and terms offered to un-related third parties for similar transactions, a description of those terms. We believe that this information may be material to shareholders and should be disclosed by the Company. In the event that management and the Board do not provide the requested information, the Relational Funds may exercise their right to submit a formal books and records request.

VOTE REQUIRED AND VOTES PER SHARE

The presence, in person or by proxy, of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast will constitute a quorum at the 2006 Annual Meeting. Based on the 2005 Proxy Statement, the Company will treat abstentions as shares present at the 2006 Annual Meeting and will count them in determining the presence of a quorum.

Based on the 2005 Proxy Statement, the two nominees for director who receive the highest number of votes cast at the 2006 Annual Meeting will be elected as directors. Based on the 2005 Proxy Statement, abstentions and broker non-votes will not constitute or be counted as “votes” cast for purposes of the 2006 Annual Meeting. Each outstanding share of Common Stock is entitled to one vote on the election of directors and each other matter submitted to vote at the 2006 Annual Meeting.

CERTAIN INFORMATION CONCERNING THE RELATIONAL FUNDS

AND THE OTHER PARTICIPANTS IN THE SOLICITATION

Information concerning the Relational Funds, each of whom may be deemed “participants in the solicitation” as defined in the proxy rules promulgated by the SEC under the Exchange Act, and their affiliates and associates, is set forth in Appendix A attached hereto. Appendix A also sets forth other persons who may be deemed “participants in the solicitation”.

The Relational Funds, and each of their affiliates and associates, intend to vote the shares of Common Stock beneficially owned by them FOR the Shareholder Nominees.

CERTAIN INTERESTS IN THE PROPOSAL AND

WITH RESPECT TO SECURITIES OF THE ISSUER

To the knowledge of the Relational Funds, no Relational Fund nor any associates or controlling persons thereof or other persons who may be deemed participants in the solicitation of proxies for the Relational Funds for the 2006 Annual Meeting are or have within the past year been parties to any contracts, arrangements, understandings or relationships (legal or otherwise) with respect to any securities of the Company, except as described in Appendix A attached hereto.

To the knowledge of the Relational Funds, no Relational Fund nor any associates or controlling persons thereof or other persons who are or may be deemed participants in the solicitation of proxies for the Relational Funds for the 2006 Annual Meeting has any arrangement or understanding with any person with respect to future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

20

PRINCIPAL SHAREHOLDERS

Based solely upon the 2005 Proxy Statement, as of March 22, 2005, no person was deemed to be the beneficial owner of more than five percent of the outstanding shares of Common Stock. Individual and aggregate beneficial ownership of Common Stock by the Relational Funds is described in detail elsewhere in this Statement.

21

SECURITY OWNERSHIP BY DIRECTORS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of shares of Common Stock of the Company outstanding as of the record date for the Company’s 2005 Annual Meeting of Shareholders (the “2005 Record Date”), based solely upon the information provided in the Company’s proxy statement for the 2005 Annual Meeting of Shareholders. Except as otherwise indicated, according to the 2005 Proxy Statement, as of the 2005 Record Date each identified director and each named executive officer of the Company held sole voting and investment power over the shares listed as beneficially owned and the shares listed constituted less than 1% of the outstanding shares. Unless otherwise indicated in a footnote, shares indicated as being subject to options were shares issuable pursuant to options outstanding and vested under the Company’s stock option plans as of the 2005 Record Date.

Name of Beneficial Owner | | | | Amount and Nature

of Beneficial

Ownership(1) | | Percent

of Class | |

P. Michael Ehlerman | | | 29,685 | | | | * | | |

Marian L. Heard | | | 1,100 | | | | * | | |

Jay S. Sidhu | | | 4,261,684 | (2) | | | 1.13 | % | |

Brian Hard | | | 110,702 | (3) | | | * | | |

Cameron C. Troilo, Sr. | | | 805,757 | (4) | | | * | | |

Andrew C. Hove, Jr. | | | 29,826 | | | | * | | |

Daniel K. Rothermel | | | 272,094 | (5) | | | * | | |

Joseph P. Campanelli(6) | | | 497,157 | (7) | | | * | | |

John P. Hamill(8) | | | 329,186 | (9) | | | | | |

James D. Hogan(10) | | | 172,471 | (11) | | | * | | |

Lawrence M. Thompson, Jr.(12) | | | 913,851 | (13) | | | * | | |

All directors and executive officers of the Company as a group (11 persons) | | | 7,423,513 | (14) | | | 1.97 | % | |

All Sovereign Bank directors (excluding Company directors and executive officers listed above) and team members of Sovereign Bank as a group | | | 23,670,177 | (15) | | | 6.10 | % | |

Total aggregate stock ownership of the above persons | | | 31,631,117 | (16)(17) | | | 8.07 | % | |

* Less than 1%

(1) The table reflects data supplied by each director and executive officer. The table also reflects shares of Common Stock held by the trustee of the Company Retirement Plan which have been allocated to the accounts of the executive officers identified in the table, and as a group.

(2) Mr. Sidhu holds shared voting or investment power over 690,148 shares. The number and percentage of shares beneficially owned by Mr. Sidhu include 1,206,348 shares subject to vested options and 56,051 shares held by the Company’s Retirement Plan that are allocated to Mr. Sidhu’s account and over which he exercises voting power. The number and percentage of shares beneficially owned by Mr. Sidhu also include 199,587 shares of Company common stock awarded as restricted stock under one or more of the Company’s stock incentive plans. The number and percentage of shares beneficially owned by Mr. Sidhu also include 405,308 shares under the Company’s Bonus Deferral Program.

(3) The number and percentage of shares beneficially owned by Mr. Hard include 72,000 shares subject to vested options.

22

(4) Mr. Troilo holds shared voting or investment power over 496,054 shares. The number and percentage of shares beneficially owned by Mr. Troilo include 120,000 shares subject to vested options.

(5) Mr. Rothermel holds shared voting and investment power over 20,939 shares. The number and percentage of shares includes 3,557 shares held by Mr. Rothermel’s spouse and 9,242 shares held by an estate for which Mr. Rothermel acts as executor, with respect to which Mr. Rothermel disclaims beneficial ownership. The number and percentage of shares beneficially owned by Mr. Rothermel also include 120,000 shares subject to vested options.

(6) Mr. Campanelli was named President and Chief Executive Officer of the Sovereign Bank New England Division effective January 1, 2005.

(7) The number and percentage of shares beneficially owned by Mr. Campanelli include 353,500 shares subject to vested options and 14,483 shares held by the Company’s Retirement Plan which are allocated to Mr. Campanelli’s account and over which he exercises voting power. The number and percentage of shares beneficially owned by Mr. Campanelli also include 23,793 shares of Company common stock awarded as restricted stock under one or more of the Company’s stock incentive plans. The number and percentage of shares beneficially owned by Mr. Campanelli also include 53,379 shares of Company common stock under the Company’s Bonus Deferral Program.

(8) Mr. Hamill served as Chairman and Chief Executive Officer of the Sovereign Bank New England Division of Sovereign Bank from January 2000, until relinquishing his role as Chief Executive Officer effective January 1, 2005. Mr. Hamill continues to serve as the Non-Executive Chairman of the Sovereign Bank New England Division of Sovereign Bank.

(9) The number and percentage of shares beneficially owned by Mr. Hamill include 225,000 shares subject to vested options and 26,195 shares of Company common stock awarded as restricted stock under one or more of the Company’s stock incentive plans. The number and percentage of shares beneficially owned by Mr. Hamill also include 1,147 shares held by the Company Retirement Plan that are allocated to Mr. Hamill’s account and over which he exercises voting power. The number and percentage of shares beneficially owned by Mr. Hamill also includes 20,020 shares under the Company Bonus Deferral Program.

(10) Mr. Hogan was the Company’s Chief Financial Officer and Executive Vice President. Before joining the Company in 2001, he served as Executive Vice President and Controller of Firststar Corporation; formerly Star Bancorp, Inc. Mr. Hogan elected to retire effective May 13, 2005.

(11) The number and percentage of shares beneficially owned by Mr. Hogan include 85,000 shares subject to vested options and 15,392 shares of Company common stock awarded as restricted stock under one or more of the Company’s stock incentive plans. The number and percentage of shares beneficially owned by Mr. Hogan also include 5,353 shares held by the Company’s Retirement Plan which are allocated to Mr. Hogan’s account and over which he exercises voting power. The number and percentage of shares beneficially owned by Mr. Hogan include 38,534 shares of Company common stock under the Company Bonus Deferral Program.

(12) Mr. Thompson is Vice Chairman and Chief Administrative Officer of the Company. He is also Chief Operating Officer of Sovereign Bank.

(13) Mr. Thompson holds shared voting or investment power over 130,566 shares. The number and percentage of shares beneficially owned by Mr. Thompson include 548,105 shares subject to vested options and 28,082 shares held by the Company’s Retirement Plan which are allocated to Mr. Thompson’s account and over which he exercises voting power. The number and percentage of shares beneficially owned by Mr. Thompson also include 33,998 shares of Company common stock awarded as restricted stock under one or more of the Company’s stock incentive plans. The number

23

and percentage of shares beneficially owned by Mr. Thompson include 35,550 shares of Company common stock under the Company Bonus Deferral Program.

(14) In the aggregate, these persons hold shared voting or investment power over 1,337,707 shares. The number and percentage of shares beneficially owned by them include 2,729,953 shares subject to vested options and 105,116 shares held by the Company’s Retirement Plan allocated to the executive officers’ accounts and over which they exercise voting power. The number and percentage of shares beneficially owned by them also include 298,965 shares of Company common stock awarded as restricted stock under one or more of the Company’s stock incentive plans. The number and percentage of shares beneficially owned by them also include 552,791 shares under the Company Bonus Deferral Program.

(15) Shares include 7,505,302 shares allocated under the Company’s Retirement Plan and acquired plans, 186,978 shares under the Company Bonus Deferral Program, and approximately 12,730,156 shares subject to the exercise of both vested and non-vested options granted under one or more of the Company’s stock incentive plans and 1,361,573 shares of restricted stock awarded under such plans, representing approximately 6.10% in the aggregate of the Company’s outstanding shares, after giving effect to the applicable vesting of plan shares and the exercise of options and the lapse of restrictions with respect to restricted stock awards.

(16) Shares include 7,610,418 shares allocated under the Company’s Retirement Plan and acquired plans, 739,769 shares under the Company Bonus Deferral Program, and approximately 15,997,536 shares subject to the exercise of both vested and non-vested options granted under one or more of the Company’s stock incentive plans and 1,660,538 shares of restricted stock awarded under such plans, representing approximately 8.07% in the aggregate of the Company’s outstanding shares, after giving effect to the applicable vesting of plan shares and the exercise of options and the lapse of restrictions with respect to restricted stock awards.

(17) Under a policy adopted by the Company’s Board in January 1998, and amended in 2002, the Company’s non-employee directors, the Company’s CEO and the Company’s executive management are required to beneficially own shares of Company common stock having a value of $100,000, six times base salary and three times base salary, respectively. Company non-employee directors and Mr. Sidhu met the ownership requirement before the applicable deadlines. Members of the Company’s executive management who are named in this Statement met the ownership requirement before the applicable deadline. Shares of Company common stock subject to unexercised stock options, unvested restricted stock awards, unvested Company matching account shares held under the Bonus Deferral Program, and certain shares allocated to the account of a Company employee under the Company’s Retirement Plan are not considered beneficially owned for the purposes of the policy.

PROXY SOLICITATION EXPENSES