Searchable text section of graphics shown above

[LOGO] | Relational Investors LLC |

Welcome

Shareholder Value Forum

Sovereign Bancorp, Inc.

November 8, 2005

Disclaimer

The analyses presented in this document are based on information published by Sovereign Bancorp and others. Relational Investors LLC has relied upon these public disclosures without any ability or opportunity for independent verification.

On October 20, 2005, Relational Investors LLC (“Relational”), together with a number of affiliated persons and entities that may be deemed “participants” for purposes of the solicitation rules of the Securities and Exchange Commission (“SEC”), filed a preliminary proxy statement on Schedule 14A with the SEC relating to a possible solicitation of proxies from the shareholders of Sovereign Bancorp, Inc. (“Sovereign”) in connection with Relational’s nomination of Ralph Whitworth and David Batchelder for election to Sovereign’s board of directors at Sovereign’s 2006 Annual Meeting of shareholders. Relational will prepare and file with the SEC a definitive proxy statement relating to their nomination of Messrs. Whitworth and Batchelder and may file other proxy solicitation materials. RELATIONAL ANTICIPATES THAT IT WILL REVISE AND FILE THE PRELIMINARY PROXY STATEMENT IN RESPONSE TO SEC COMMENTS AND SHAREHOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT AS REVISED (AND THE DEFINITIVE PROXY STATEMENT, WHEN IT BECOMES AVAILABLE) BECAUSE IT CONTAINS IMPORTANT INFORMATION REGARDING RELATIONAL’S NOMINATION OF MESSRS. WHITWORTH AND BATCHELDER FOR ELECTION AS DIRECTORS. The preliminary proxy statement is, and the revised preliminary proxy statement and the definitive proxy statement (when they become available) will be, available for free at www.sec.gov, along with any other relevant documents. You may also obtain a free copy of the preliminary proxy statement, or the definitive proxy statement (when it becomes available), by contacting Maudie Holland of Relational at (858) 704-3321, or by sending an email to maudie@rillc.com. Information regarding the names, affiliation, and interests of persons who may be deemed to be participants in our solicitation of proxies of Sovereign’s shareholders is available in the preliminary proxy statement filed with the SEC on October 20, 2005.

2

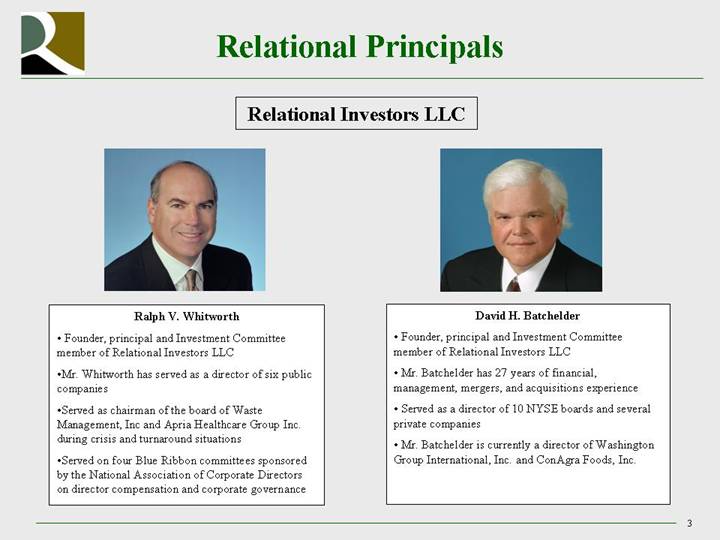

Relational Principals

Relational Investors LLC

[GRAPHIC] | | [GRAPHIC] |

| | |

Ralph V. Whitworth | | David H. Batchelder |

| | |

• Founder, principal and Investment Committee member of Relational Investors LLC • Mr. Whitworth has served as a director of six public companies • Served as chairman of the board of Waste Management, Inc and Apria Healthcare Group Inc. during crisis and turnaround situations • Served on four Blue Ribbon committees sponsored by the National Association of Corporate Directors on director compensation and corporate governance | | • Founder, principal and Investment Committee member of Relational Investors LLC • Mr. Batchelder has 27 years of financial, management, mergers, and acquisitions experience • Served as a director of 10 NYSE boards and several private companies • Mr. Batchelder is currently a director of Washington Group International, Inc. and ConAgra Foods, Inc. |

3

Forum Panel Members

[GRAPHIC] | | [GRAPHIC] |

| | |

John Eggemeyer | | Mark Merlo |

| | |

• Founder and CEO of Castle Creek Financial • 35 years experience in the banking industry • Involved in over $3 billion of mergers/acquisitions • Chairman of First Community Bancorp • Chairman and CEO of Centennial Bank Holdings, Inc. • Director of TCF Financial | | • Senior Vice President of Castle Creek Financial • Over 20 years of experience in the banking industry • Worked on over 150 different M&A transactions since 1996 • Previously worked at Mercantile Bancorp and United Postal Bancorporation • Director of State National Bancshares, Inc. |

4

[GRAPHIC]

Tony Terracciano

• Over 40 years experience in the banking industry

• Former Chairman, Riggs Corporation and Dime Bancorporation

• �� Former President and director of First Union Bank

• Former Chairman, President and CEO of First Fidelity

• Former President and COO of Mellon Bank

• Former Vice Chairman and CFO of Chase Manhattan Bank

• Director of Avaya, IKON, and Knoll Furniture

5

Relational Investors LLC

• Founded in 1996 – $6 billion AUM; focus on equity market caps of $3 billion+

• 8 to 12 portfolio companies, proactive engagement

• Board representation at 7 companies, chaired 2 boards

• Voluntarily restricted from participating in leveraged buyouts, takeovers, and change in control initiatives

6

Investment Characteristics

• Strong defensible franchises

• Business lines, products, services, or footprints

• Not distressed

• Mature, positive cash flows

• Shares trade at a discount to comparable business solutions

• Factors causing the discount resolvable within 1 to 3 years

7

Why Sovereign?

• Defensible, geographically concentrated franchise

• Mature cash flows - $800 million of tangible equity per year

• Excessively leveraged compared to peers(1) but not distressed

• Shares are discounted

• Factors contributing to discount are readily addressable in the near term

(1) Except as otherwise noted, “Peer Group” or the “Peers” is defined as the Lehman Bros. Mid-Cap Bank Universe as modified by SOV in its June 28, 2005 investor presentation. Peer group includes ASO, CBSS, CMA, CNB, FHN, MI, MTB, NFB, RF, SNV, TCB, ZION.

8

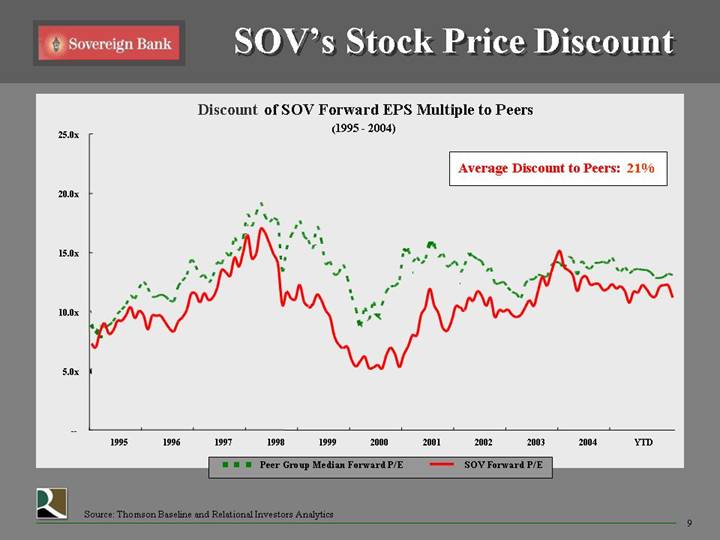

[LOGO] SOV’s Stock Price Discount

Discount of SOV Forward EPS Multiple to Peers

(1995 - 2004)

[CHART]

[LOGO] Source: Thomson Baseline and Relational Investors Analytics

9

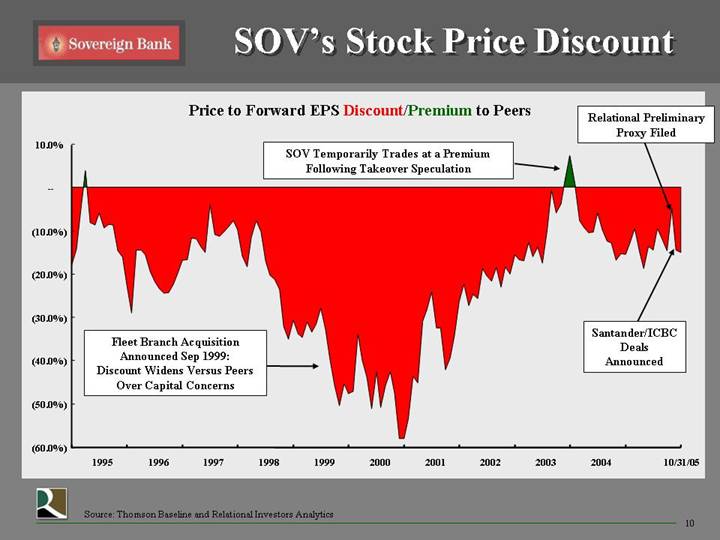

Price to Forward EPS Discount/Premium to Peers

[CHART]

Source: Thomson Baseline and Relational Investors Analytics

10

Why we believe Sovereign shares are discounted

• Enterprise risk

• Operating performance

• Director conflicts of interest

• Management credibility

11

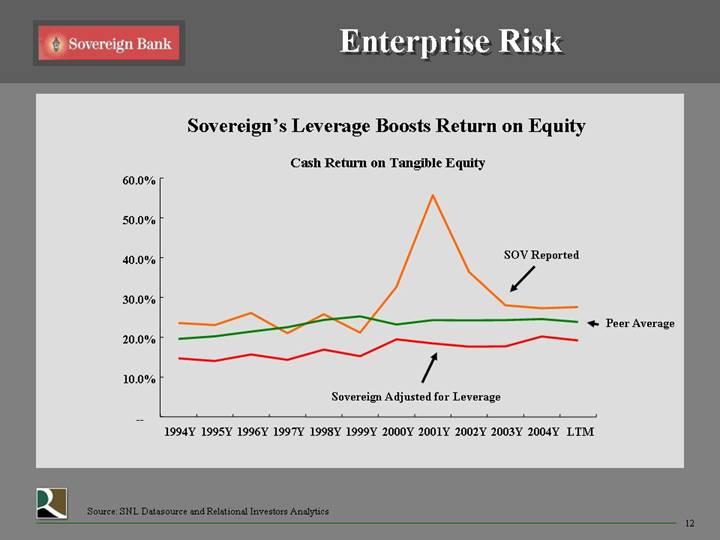

Enterprise Risk

Sovereign’s Leverage Boosts Return on Equity

Cash Return on Tangible Equity

[CHART]

Source: SNL Datasource and Relational Investors Analytics

12

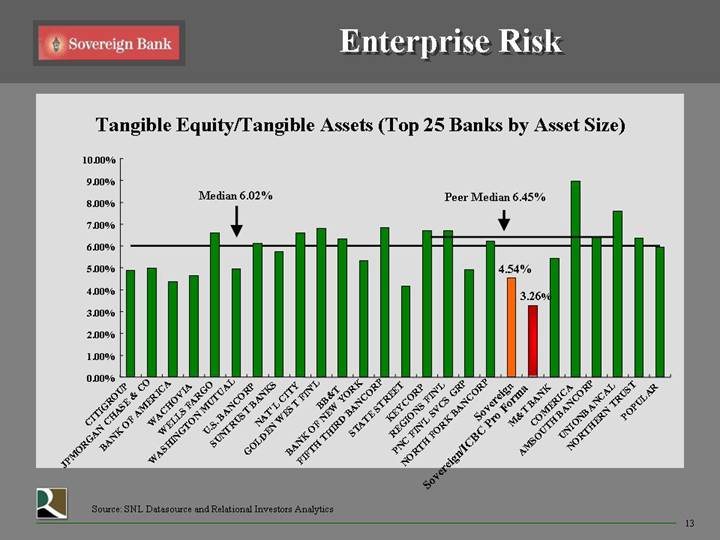

Tangible Equity/Tangible Assets (Top 25 Banks by Asset Size)

[CHART]

Source: SNL Datasource and Relational Investors Analytics

13

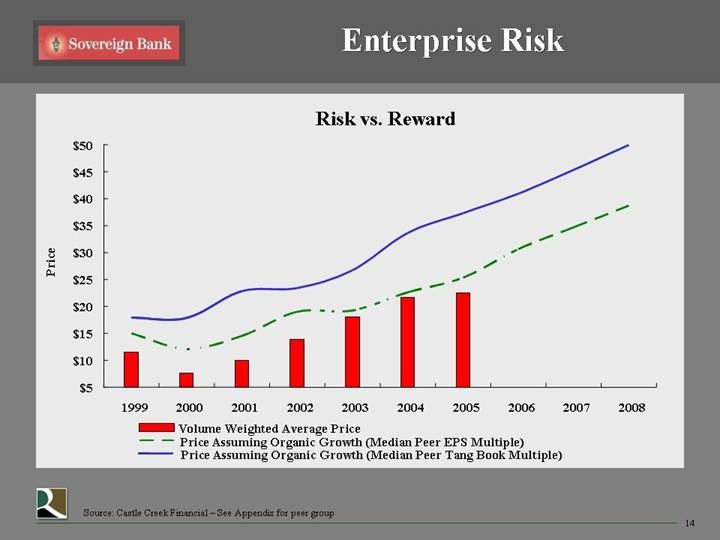

Risk vs. Reward

[CHART]

Source: Castle Creek Financial – See Appendix for peer group

14

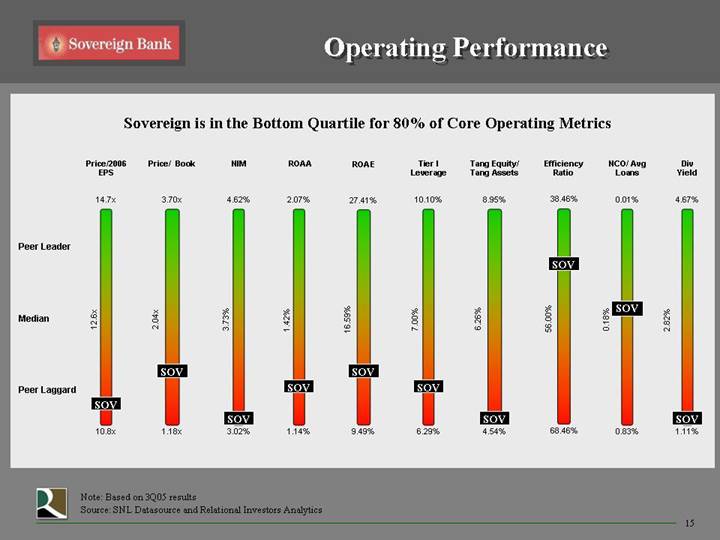

Operating Performance

Sovereign is in the Bottom Quartile for 80% of Core Operating Metrics

[CHART]

Note: Based on 3Q05 results

Source: SNL Datasource and Relational Investors Analytics

15

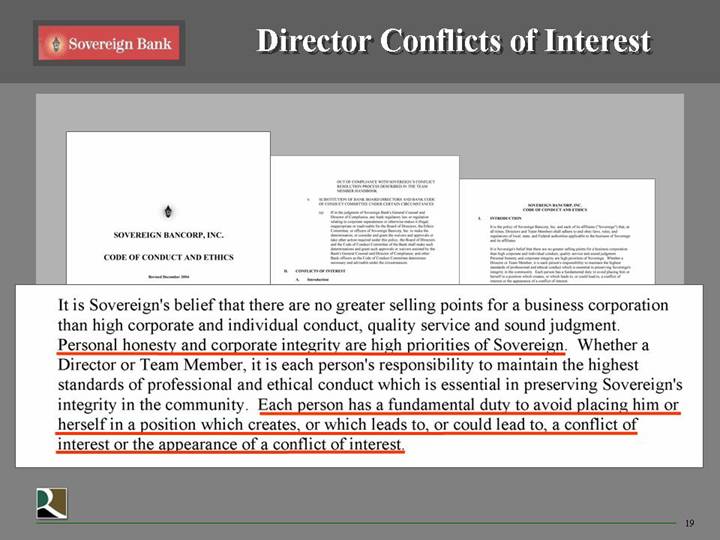

Director Conflicts of Interest

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

Daniel K. | | Cameron C. | | Brian Hard | | Jay S. Sidhu | | Michael P. | | Andrew C. |

Rothermel | | Troilo, Sr. | | | | | | Ehlerman | | Hove, Jr. |

Breach of Trust with Shareholders

16

Sovereign’s Board 1999 -2005

| | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | |

Current | | | | | | | | | | | | | |

Committee | | Daniel K. | | Cameron C. | | Brian Hard | | Jay S. Sidhu | | Michael P. | | Andrew C. | |

Memberships | | Rothermel | | Troilo, Sr. | | | | | | Ehlerman | | Hove, Jr. | |

Ethics & Corporate Governance | | X | | X | | X | | | | | | C | |

| | | | | | | | | | | | | |

Compensation | | X | | C | | X | | | | X | | X | |

| | | | | | | | | | | | | |

Audit | | X | | | | C | | | | X | | X | |

| | | | | | | | | | | | | |

Executive | | C | | X | | X | | X | | | | X | |

| | | | | | | | | | | | | |

Mergers and Acquisitions | | X | | X | | X | | C | | | | | |

| | | | | | | | | | | | | |

Nominating | | C | | X | | X | | | | X | | X | |

| X: Committee Member | | C: Committee Chairman |

17

[GRAPHIC]

B. General Policy

Sovereign must have the confidence of its customers and the public. Directors and Team Members must avoid conflicts or the appearance of conflicts, as discussed above.

18

[GRAPHIC]

It is Sovereign’s belief that there are no greater selling points for a business corporation than high corporate and individual conduct, quality service and sound judgment. Personal honesty and corporate integrity are high priorities of Sovereign. Whether a Director or Team Member, it is each person’s responsibility to maintain the highest standards of professional and ethical conduct which is essential in preserving Sovereign’s integrity in the community. Each person has a fundamental duty to avoid placing him or herself in a position which creates, or which leads to, or could lead to, a conflict of interest or the appearance of a conflict of interest.

19

[GRAPHIC]

Act as a Fiduciary

As a fiduciary, you must think and act independently and in the best interests of the association. When acting in an official capacity, your personal interests and those of your family and associates must be subordinate to the best interests of the association. You should evaluate issues in terms of the associations resources and capabilities, the reasonableness of risk and returns, and any potential adverse

Department of the Treasury

20

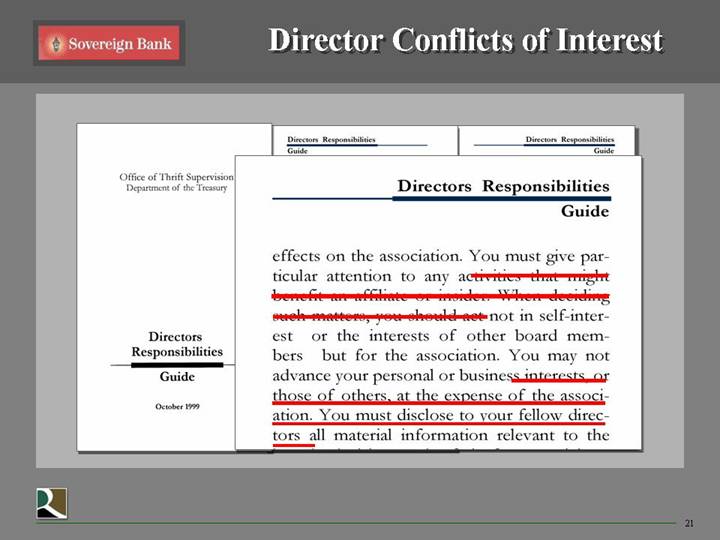

[GRAPHIC]

Directors Responsibilities

Guide

effects on the association. You must give particular attention to any activities that might benefit an affiliate or insider. When deciding such matters, you should act not in self-interest or the interests of other board members but for the association. You may not advance your personal or business interests, or those of others, at the expense of the association. You must disclose to your fellow directors all material information relevant to the

21

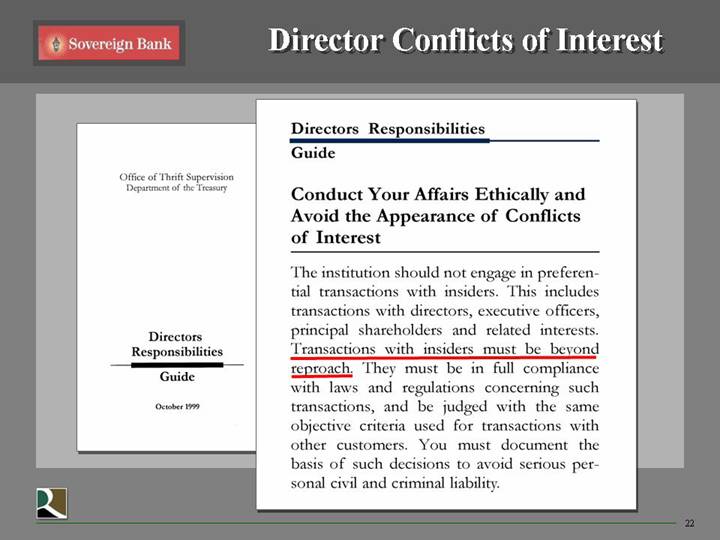

[GRAPHIC]

Conduct Your Affairs Ethically and Avoid the Appearance of Conflicts of Interest

The institution should not engage in preferential transactions with insiders. This includes transactions with directors, executive officers, principal shareholders and related interests. Transactions with insiders must be beyond reproach. They must be in full compliance with laws and regulations concerning such transactions, and be judged with the same objective criteria used for transactions, with other customers. You must document the basis of such decisions to avoid serious personal civil and criminal liability.

22

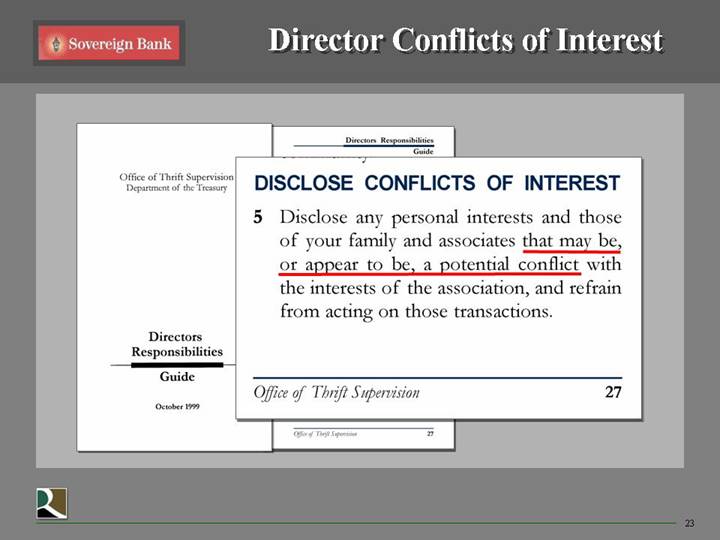

[GRAPHIC]

DISCLOSE CONFLICTS OF INTEREST

5 Disclose any personal interests and those of your family and associates that may be, or appear to be, a potential conflict with the interests of the association, and refrain from acting on those transactions.

Office of Thrift Supervision

23

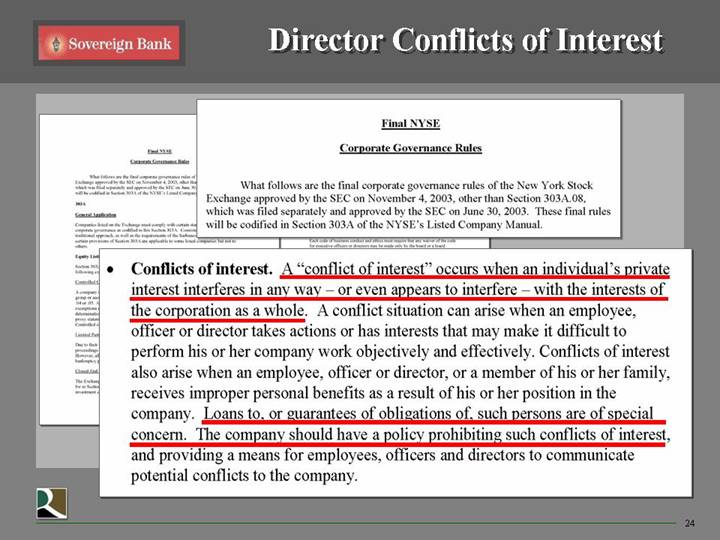

[GRAPHIC]

• Conflicts of interest. A “conflict of interest” occurs when an individual’s private interest interferes in any way – or even appears to interfere – with the interests of the corporation as a whole. A conflict situation can arise when an employee, officer or director takes actions or has interests that may make it difficult to perform his or her company work objectively and effectively. Conflicts of interests also arise when an employee, officer or director, or a member of his or her family, receives improper personal benefits as a result of his or her position in the company. Loans to, or guarantees of obligations of, such persons are of special concern. The company should have a policy prohibiting such conflicts of interest, and providing a means for employees, officers and directors to communicate potential conflicts to the company.

24

Skyrocketing Related Party Loans

1999 - 2004

[CHART]

Source: SOV’s Thrift Financial Reports filed with the OTS for corresponding periods

25

Escalating Rent Payments to Mr. Troilo

[GRAPHIC]

Cameron C. Troilo, Sr.

Compensation Committee Chairman

26

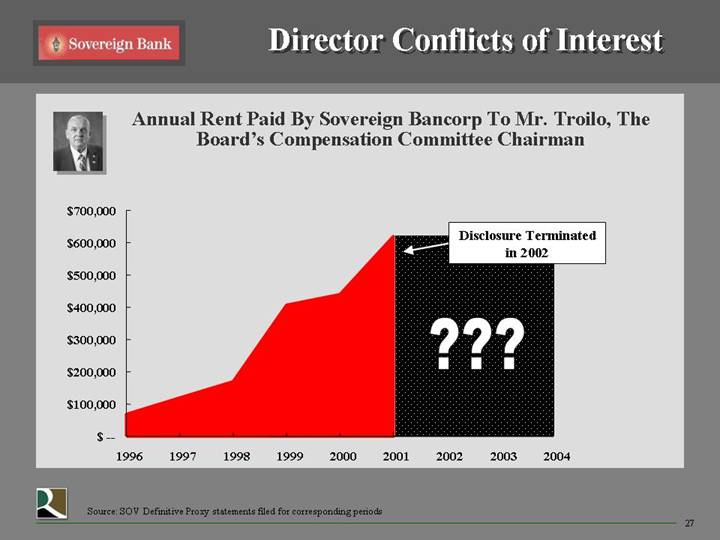

[GRAPHIC] | Annual Rent Paid By Sovereign Bancorp To Mr. Troilo, The Board’s Compensation Committee Chairman | |

[CHART]

Source: SOV Definitive Proxy statements filed for corresponding periods

27

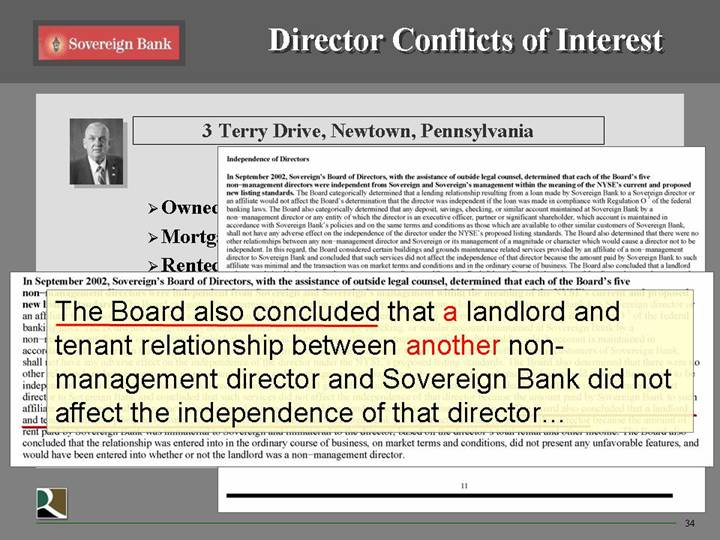

• From 1996 to 2001, rent paid to Troilo and affiliates increased 803%

• The board suddenly stopped reporting the amount of rent paid to Mr. Troilo after 2002

• The 2003 Proxy Statement reported the relationship as follows:

“The Board also concluded that a landlord and tenant relationship between another non-management director and Sovereign Bank did not affect the independence of that director …”

28

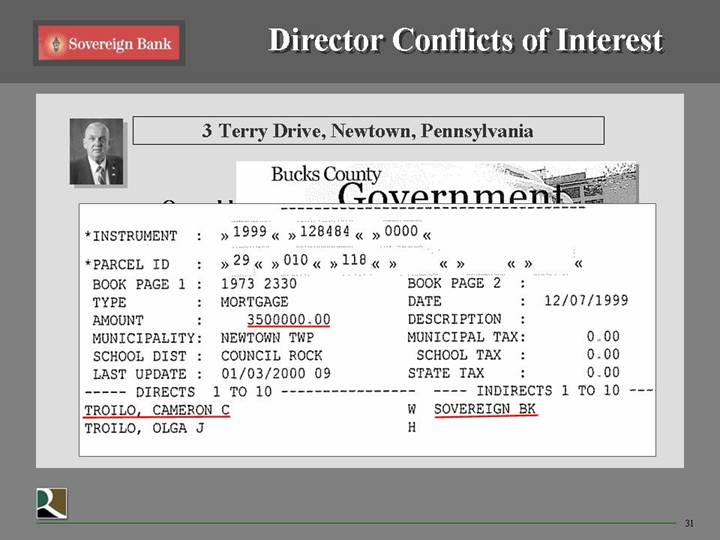

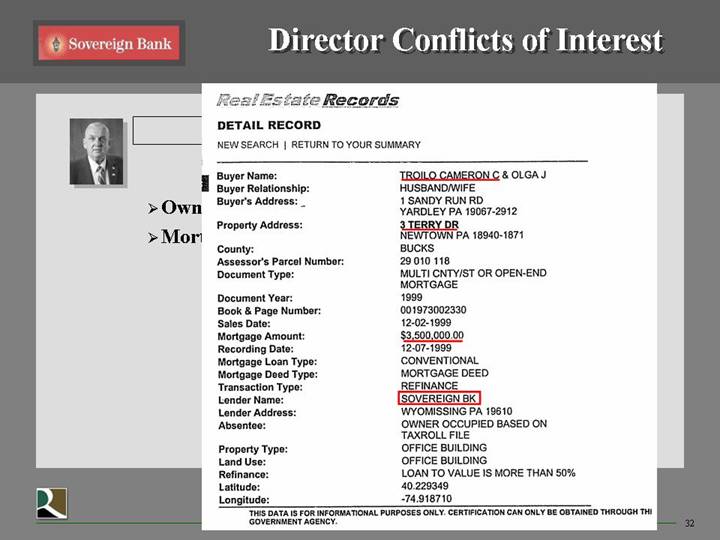

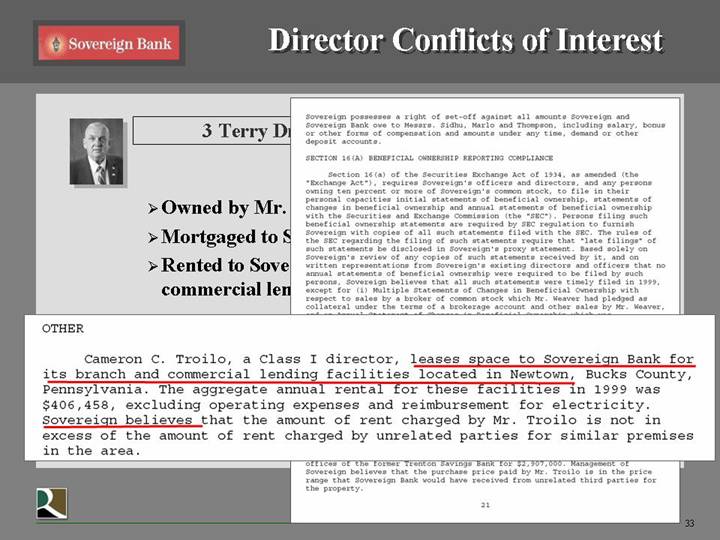

3 Terry Drive, Newtown, Pennsylvania

• Owned by Mr. Troilo

• Mortgaged to Sovereign to secure $3.5 Million loan

• Rented to Sovereign for use as a loan service center and a branch

• The proxy failed to mention that Sovereign also held a mortgage against the property

• In 2003 disclosure deteriorated

30

[GRAPHIC]

* INSTRUMENT | : | 1999 | | 128484 | | 0000 | | |

* PARCEL ID | | 29 | | 010 | | 118 | | |

BOOK PAGE 1 | : | 1973 2330 | | | | BOOK PAGE 2 | : | |

TYPE | : | MORTGAGE | | | | DATE | : | 12/07/1999 |

AMOUNT | : | 3500000.00 | | | | DESCRIPTION | : | |

MUNICIPALITY | : | NEWTOWN TWP | | | | MUNICIPAL TAX | : | 0.00 |

SCHOOL DIST | : | COUNCIL ROCK | | | | SCHOOL TAX | : | 0.00 |

LAST UPDATE | : | 01/03/2000 09 | | | | STATE TAX | : | 0.00 |

DIRECTS 1 TO 10 | | INDIRECTS 1 TO 10 |

TROILO, CAMERON C | | | | | | W | SOVEREIGN BK | |

TROILO, OLGA J | | | | | | H | | |

| | | | | | | | | | |

31

[GRAPHIC]

Real Estate Records

DETAIL RECORD

NEW SEARCH / RETURN TO YOUR SUMMARY

Buyer Name: | | TROILO CAMERON C & OLGA J |

Buyer Relationship: | | HUSBAND/WIFE |

Buyer’s Address: | | 1 SANDY RUN RD |

| | YARDLEY PA 19067-2912 |

| | |

Property Address: | | 3 TERRY DR |

| | NEWTOWN PA 18940-1871 |

County: | | BUCKS |

Assessor’s Parcel Number: | | 29 010 118 |

Document Type: | | MULTI CNTY/ST OR OPEN-END |

| | MORTGAGE |

Document Year: | | 1999 |

Book & Page Number: | | 001973002330 |

Sales Date: | | 12-02-1999 |

Mortgage Amount: | | $3,500,000.00 |

Recording Date: | | 12-07-1999 |

Mortgage Loan Type: | | CONVENTIONAL |

Mortgage Deed Type: | | MORTGAGE DEED |

Transaction Type: | | REFINANCE |

Lender Name: | | SOVEREIGN BK |

Lender Address: | | WYOMISSING PA 19610 |

Absentee: | | OWNER OCCUPIED BASED ON |

| | TAXROLL FILE |

Property Type: | | OFFICE BUILDING |

Land Use: | | OFFICE BUILDING |

Refinance: | | LOAN TO VALUE IS MORE THAN 50% |

Latitude: | | 40.229349 |

Longitude: | | -74.918710 |

THIS DATA IS FOR INFORMATIONAL PURPOSES ONLY. CERTIFICATION CAN ONLY BE OBTAINED THROUGH THIS GORVERNMENT AGENCY.

32

[GRAPHIC]

OTHER

Cameron C. Troilo, a Class I director, leases space to Sovereign Bank for its branch and commercial lending facilities located in Newtown, Bucks County, Pennsylvania. The aggregate annual rental for these facilities in 1999 was $406,458, excluding operating expenses and reimbursement for electricity. Sovereign believes that the amount of rent charged by Mr. Troilo is not in excess of the amount of rent charged by unrelated parties for similar premises in the area.

33

[GRAPHIC]

The Board also concluded that a landlord and tenant relationship between another non-management director and Sovereign Bank did not affect the independence of that director…

34

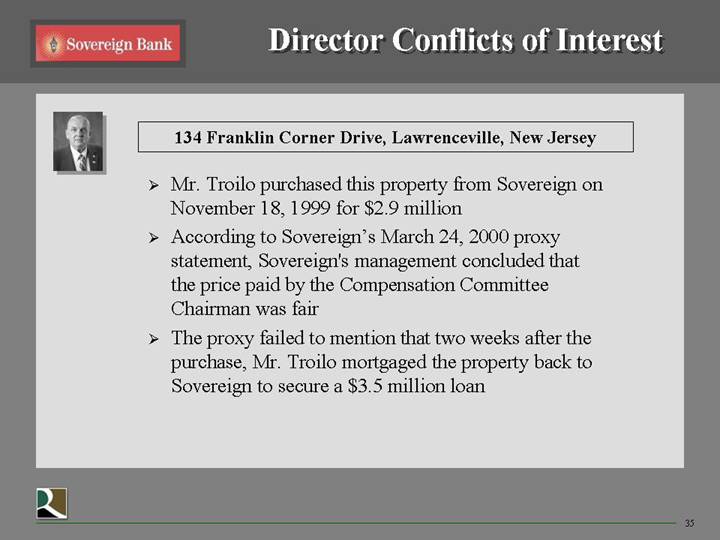

134 Franklin Corner Drive, Lawrenceville, New Jersey

• Mr. Troilo purchased this property from Sovereign on November 18, 1999 for $2.9 million

• According to Sovereign’s March 24, 2000 proxy statement, Sovereign’s management concluded that the price paid by the Compensation Committee Chairman was fair

• The proxy failed to mention that two weeks after the purchase, Mr. Troilo mortgaged the property back to Sovereign to secure a $3.5 million loan

35

[GRAPHIC]

DEED

THIS DEED is dated November 10, 1999,

BETWEEN | SOVEREIGN BANK (successor by merger to Trenton Savings Bank), a bank organized under the laws of the United States of America, having an address of 1130 Berkshire Boulevard, Wyomissing, Pennsylvania 19610 (the “Grantor”). |

| |

AND | CAMERON C. TROILO and OLGA JEAN TROILO, individuals, having an address of 1 Sandy Rim Road, Yardley, Pennsylvania 19067 (the “Grantee”). |

1. Transfer of Ownership. In consideration for the sum of Two Million Nine Hundered Seven Thousand ($2,907,000,00) Dollars, the receipt and sufficiency of which are hereby acknowledged, the Grantor hereby sells, grants and conveys the Property (as defined below) to the Grantee.

36

[GRAPHIC]

In December 1999, Mr. Troilo purchased from Sovereign Bank the corporate offices of the former Trenton Savings Bank for $2,907,000. Management of Sovereign believes that the purchase price paid by Mr. Troilo is in the price range that Sovereign Bank would have received from unrelated third parties for the property.

37

[GRAPHIC]

MORTGAGE AND SECURITY AGREEMENT

THIS MORTGAGE AND SECURITY AGREEMENT (the “Mortgage”) is made on December 2, 1999, by CAMERON C. TROILO AND OLGA J. TROILO, husband and wife (jointly and severally, the “Mortgagor”), in favor of SOVEREIGN BANK, a federal savings bank (the “Mortgage”). Intending To Mortgagor hereby agrees as follows:

ARTICLE I - OBLIGATIONS SECURED

1.01 Loan. Mortgagor has borrowed and is indebted to Mortgagee in the Principal Sum of THREE MILLION FIVE HUNDRED THOUSAND DOLLARS ($3,500,000,00) (the “Loan”) to be repaid to Mortgagee with interest thereon, pursuant to a promissory note of even [ILLEGIBLE] herewith, and any renewals, extensions or modifications thereof, the terms of which are hereby incorporated herein by reference thereto (the “Note”). The Loan has been, or will be, advanced to the Mortgagor by the Mortgagee in accordance with the terms of a loan agreement between Mortgagor and Mortgagee executed on or about the date hereof (the “Loan Agreement”). The Mortgagor has also executed and delivered to the Mortgagee other documents pertaining to the Loan and the repayment thereof, including, but not limited to assignments, certifications, indemnifications and other Loan Documents (as defined below).

38

[GRAPHIC]

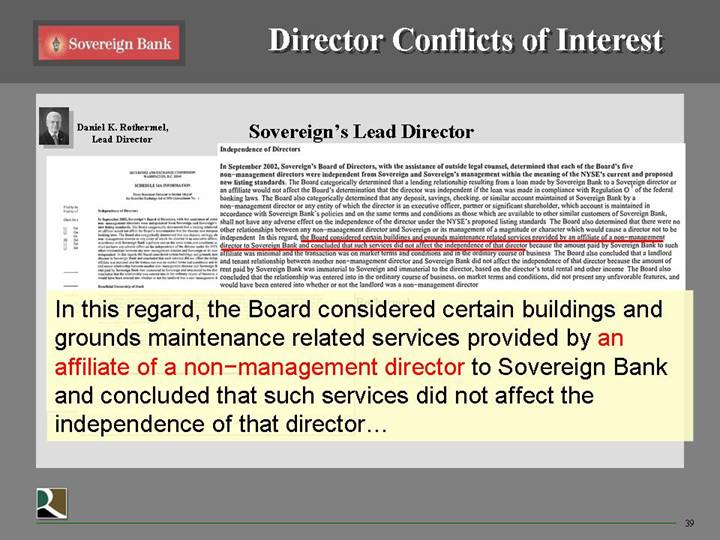

In this regard, the Board considered certain buildings and grounds maintenance related services provided by an affiliate of a non-management director to Sovereign Bank and concluded that such services did not affect the independence of that director…

39

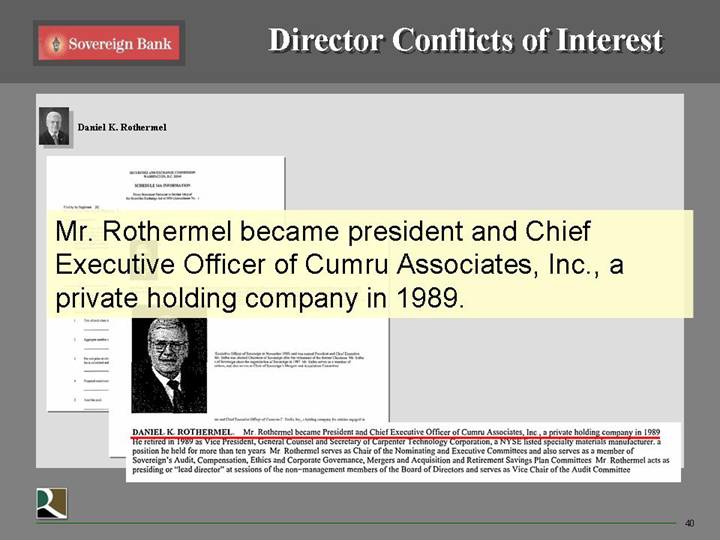

[GRAPHIC]

Mr. Rothermel became president and Chief Executive Officer of Cumru Associates, Inc., a private holding company in 1989.

40

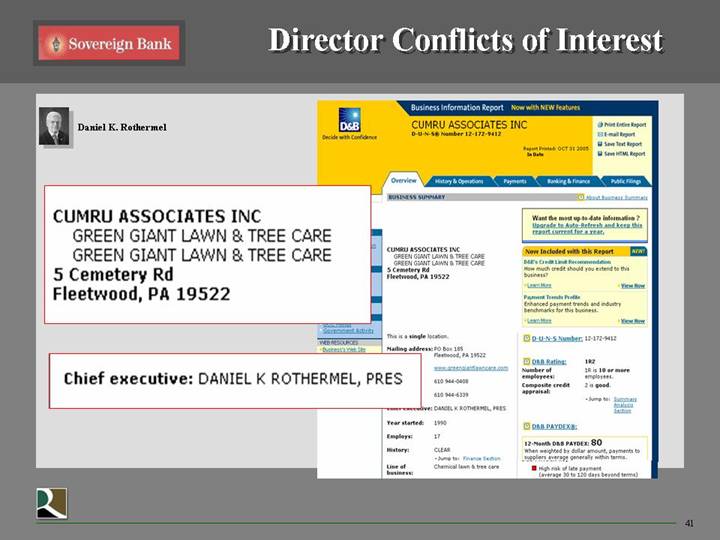

[GRAPHIC]

CUMRU ASSOCIATES INC

GREEN GIANT LAWN & TREE CARE

GREEN GIANT LAWN & TREE CARE

5 Cemetery Rd

Fleetwood, PA 19522

Chief executive: DANIEL K ROTHERMEL, PRES

41

[GRAPHIC]

Mr. Jay Sidhu

Sovereign Chairman, President, and CEO

“You all know it is very healthy to have your directors try your product. Is it inappropriate for a Coke director to drink Coke? Is it inappropriate for a Home Depot director to visit their stores and buy from Home Depot and come up with an opinion? We don’t think it’s inappropriate at all to have— it would be inappropriate in our opinion to have our directors do all their business with other banks.”

43

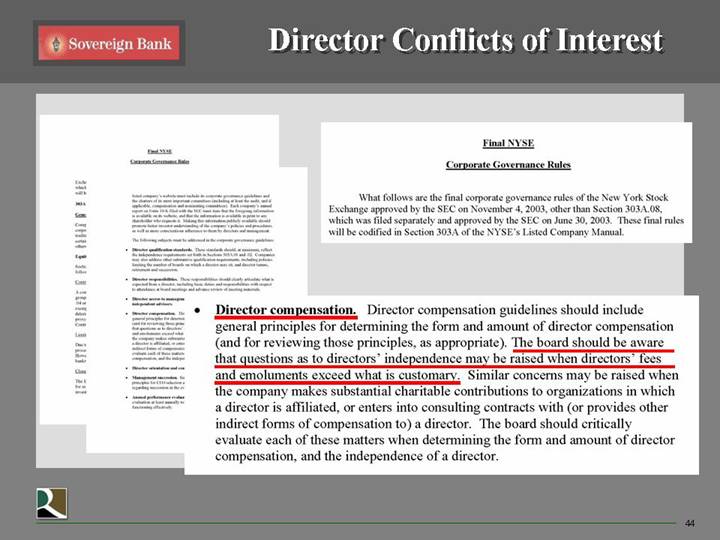

[GRAPHIC]

• Director compensation. Director compensation guidelines should include general principles for determining the form and amount of director compensation (and for reviewing those principles, as appropriate). The board should be aware that questions as to directors’ independence may be raised when directors’ fees and emoluments exceed what is customary. Similar concerns may be raised when the company makes substantial charitable contributions to organizations in which a director is affiliated, or enters into consulting contracts with (or provides other indirect forms of compensation to) a director. The board should critically evaluate each of these matters when determining the form and amount of director compensation, and the independence of a director.

44

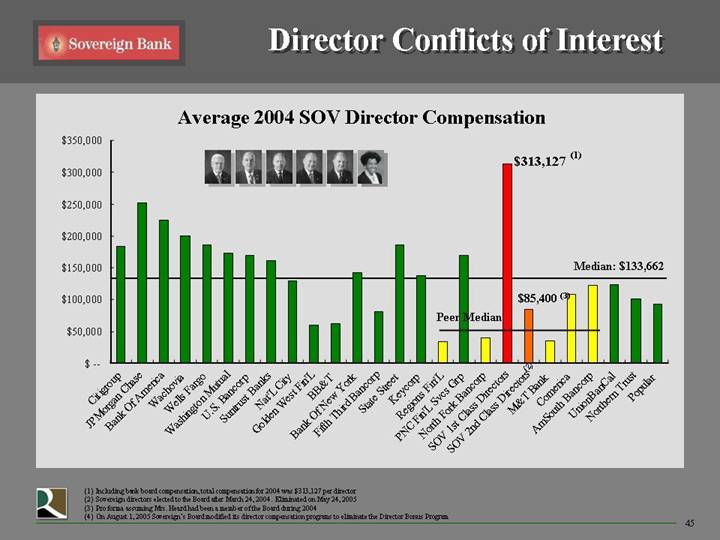

Average 2004 SOV Director Compensation

[CHART]

(1) Including bank board compensation, total compensation for 2004 was $313,127 per director

(2) Sovereign directors elected to the Board after March 24, 2004. Eliminated on May 24, 2005

(3) Pro forma assuming Mrs. Heard had been a member of the Board during 2004

(4) On August 1, 2005 Sovereign’s Board modified its director compensation programs to eliminate the Director Bonus Program

45

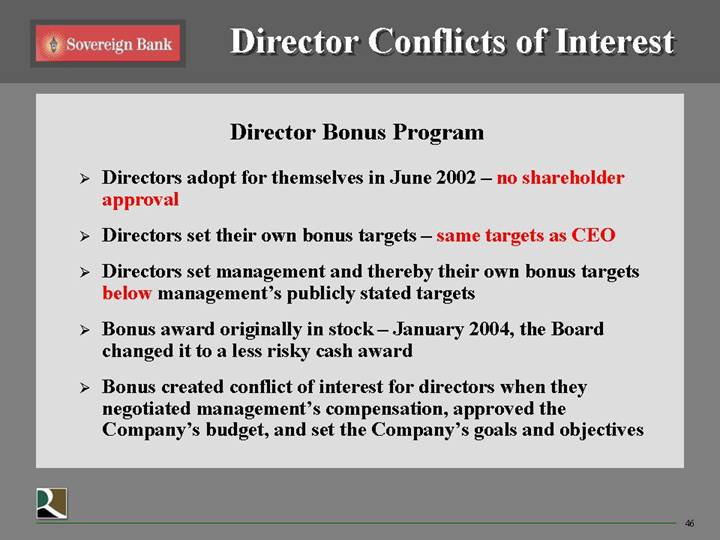

Director Bonus Program

• Directors adopt for themselves in June 2002 – no shareholder approval

• Directors set their own bonus targets – same targets as CEO

• Directors set management and thereby their own bonus targets below management’s publicly stated targets

• Bonus award originally in stock – January 2004, the Board changed it to a less risky cash award

• Bonus created conflict of interest for directors when they negotiated management’s compensation, approved the Company’s budget, and set the Company’s goals and objectives

46

2004 Director Compensation Compared to Peers

[CHART]

47

Sovereign and its Shareholders

Sovereign’s Approach To Shareholder Rights

• Mr. Sidhu’s response to shareholder questions:

• Mr. Sidhu was quoted in the May 2005 issue of Institutional Investor Magazine as having stated: “If [shareholders] don’t trust us, then they should sell the goddamned stock and never ask another question! We will always do what is right… And those who don’t believe that, they should…get the hell out of our stock!”

• Mr. Sidhu said at Ryan Beck Investor Conference on November 2, 2005: “…when you don’t require a shareholder vote, then you have to spend all the extra money, all the extra expense to make all the decisions that need to be made. You don’t have a shareholder vote.”

48

Management Credibility

[GRAPHIC]

Mr. Jay Sidhu

Sovereign Chairman, President, and CEO

Statements about Acquisitions

49

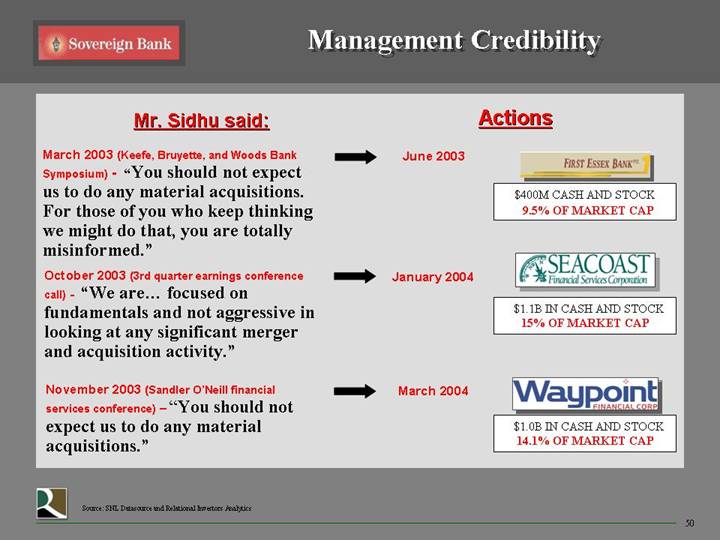

Mr. Sidhu said: | | Actions | |

| | | | | |

March 2003 (Keefe, Bruyette, and Woods Bank Symposium) - “You should not expect us to do any material acquisitions. For those of you who keep thinking we might do that, you are totally misinformed.” | | June 2003 | | [LOGO]

$400M CASH AND STOCK

9.5% OF MARKET CAP | |

| | | | | |

October 2003 (3rd quarter earnings conference call) - “We are… focused on fundamentals and not aggressive in looking at any significant merger and acquisition activity.” | | January 2004 | | [LOGO]

$1.1B IN CASH AND STOCK

15% OF MARKET CAP | |

| | | | | |

November 2003 (Sandler O’Neill financial services conference) - “You should not expect us to do any material acquisitions.” | | March 2004 | | [LOGO]

$1.0B IN CASH AND STOCK

14.1% OF MARKET CAP | |

Source: SNL Datasource and Relational Investors Analytics

50

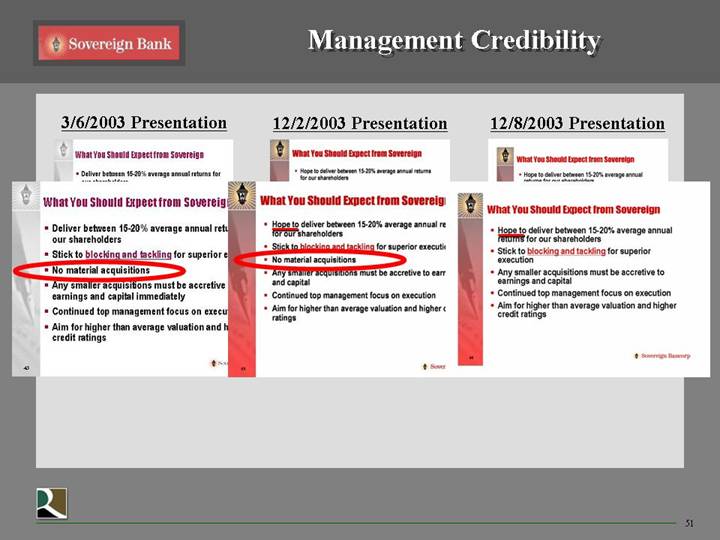

3/6/2003 Presentation | 12/2/2003 Presentation | 12/8/2003 Presentation |

[GRAPHIC] | [GRAPHIC] | [GRAPHIC] |

51

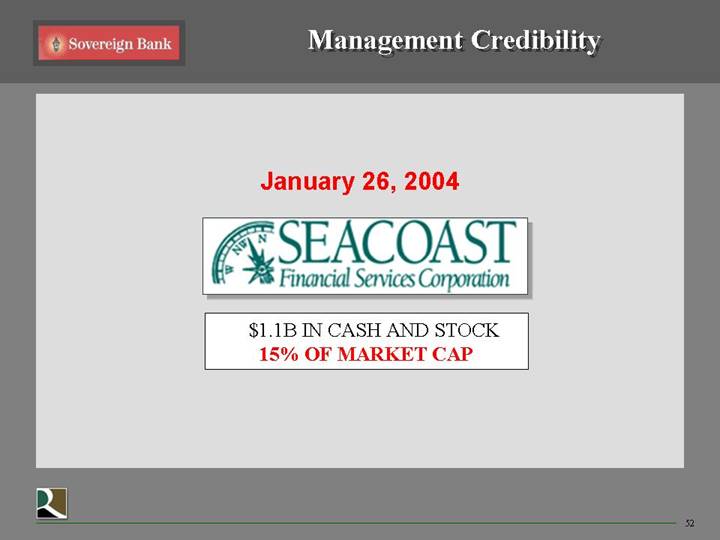

January 26, 2004

[LOGO]

$1.1B IN CASH AND STOCK

15% OF MARKET CAP

52

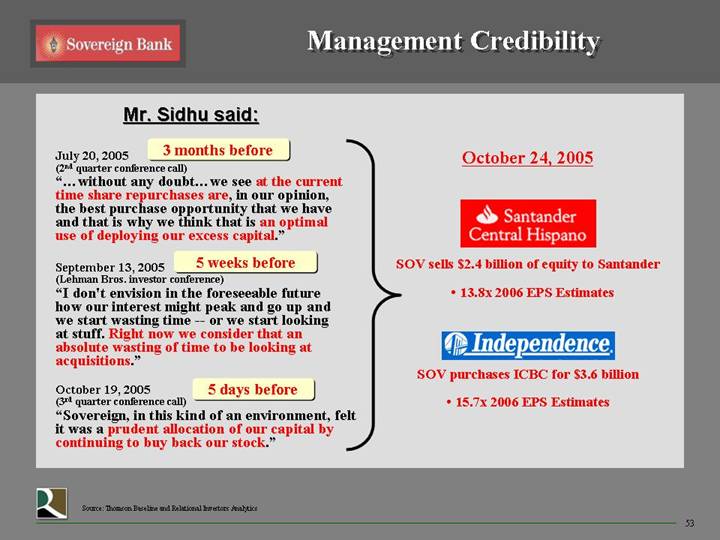

Mr. Sidhu said: | | |

| | |

3 months before | | October 24, 2005 [LOGO] SOV sells $2.4 billion of equity to Santander • 13.8x 2006 EPS Estimates [LOGO] SOV purchases ICBC for $3.6 billion • 15.7x 2006 EPS Estimates |

| |

July 20, 2005

(2nd quarter conference call)

“…without any doubt…we see at the current time share repurchases are, in our opinion, the best purchase opportunity that we have and that is why we think that is an optimal use of deploying our excess capital.” | |

| |

5 weeks before | |

| |

September 13, 2005

(Lehman Bros. investor conference)

“I don’t envision in the foreseeable future how our interest might peak and go up and we start wasting time — or we start looking at stuff. Right now we consider that an absolute wasting of time to be looking at acquisitions.” | |

| |

5 days before | |

| |

October 19, 2005

(3rd quarter conference call)

“Sovereign, in this kind of an environment, felt it was a prudent allocation of our capital by continuing to buy back our stock.” | |

Source: Thomson Baseline and Relational Investors Analytics

53

Mr. Sidhu said: | | |

| | |

1 day after | | October 24, 2005 [LOGO] SOV sells $2.4 billion of equity to Santander • 13.8x 2006 EPS Estimates [LOGO] SOV purchases ICBC for $3.6 billion • 15.7x 2006 EPS Estimates |

| |

October 25, 2005 | |

“The first serious discussion was in February or March, maybe January. Met with them [Santander] in London, met with them in New York, many, many, many times.” | |

| |

1 week after | |

| |

November 2, 2005 | |

“[On July 20, 2005] we were in the midst of some of the negotiations with [Santander].” | |

| |

| |

Source: Thomson Baseline and Relational Investors Analytics

54

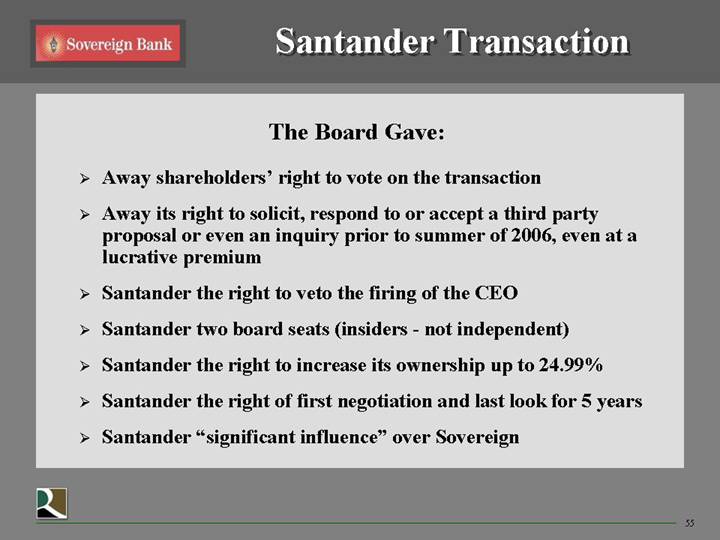

Santander Transaction

The Board Gave:

• Away shareholders’ right to vote on the transaction

• Away its right to solicit, respond to or accept a third party proposal or even an inquiry prior to summer of 2006, even at a lucrative premium

• Santander the right to veto the firing of the CEO

• Santander two board seats (insiders - not independent)

• Santander the right to increase its ownership up to 24.99%

• Santander the right of first negotiation and last look for 5 years

• Santander “significant influence” over Sovereign

55

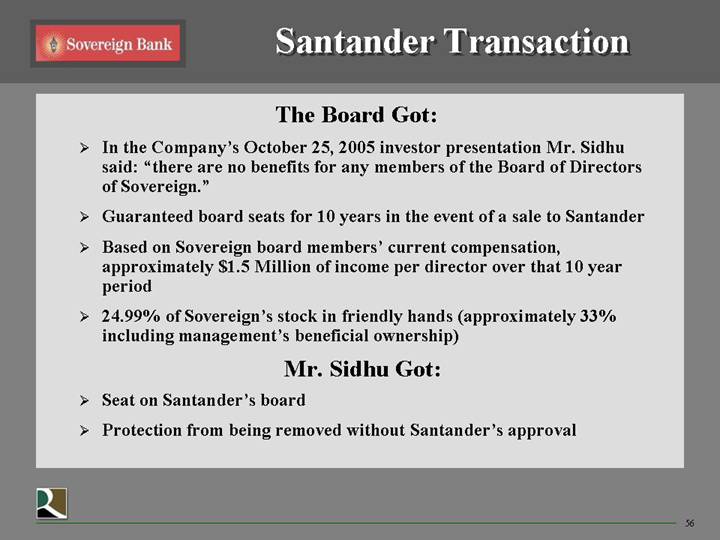

The Board Got:

• In the Company’s October 25, 2005 investor presentation Mr. Sidhu said: “there are no benefits for any members of the Board of Directors of Sovereign.”

• Guaranteed board seats for 10 years in the event of a sale to Santander

• Based on Sovereign board members’ current compensation, approximately $1.5 Million of income per director over that 10 year period

• 24.99% of Sovereign’s stock in friendly hands (approximately 33% including management’s beneficial ownership)

Mr. Sidhu Got:

• Seat on Santander’s board

• Protection from being removed without Santander’s approval

56

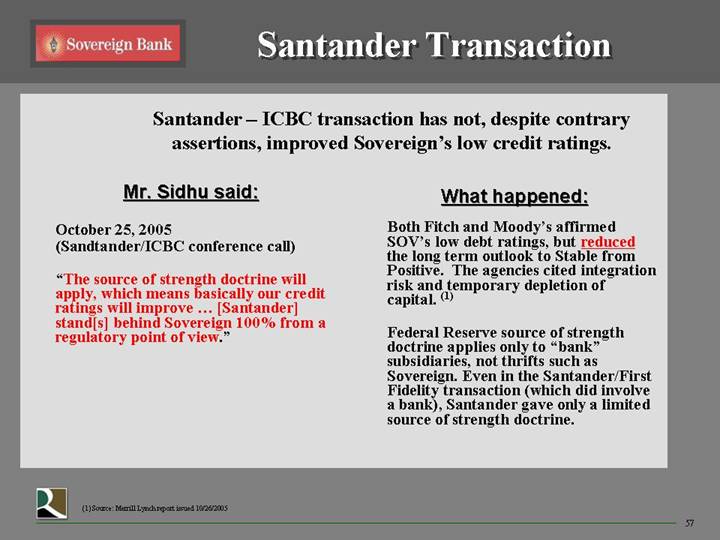

Santander – ICBC transaction has not, despite contrary assertions, improved Sovereign’s low credit ratings.

Mr. Sidhu said: | | What happened: |

| | |

October 25, 2005

(Sandtander/ICBC conference call)

“The source of strength doctrine will apply, which means basically our credit ratings will improve … [Santander] stand[s] behind Sovereign 100% from a regulatory point of view.” | | Both Fitch and Moody’s affirmed SOV’s low debt ratings, but reduced the long term outlook to Stable from Positive. The agencies cited integration risk and temporary depletion of capital. (1)

Federal Reserve source of strength doctrine applies only to “bank” subsidiaries, not thrifts such as Sovereign. Even in the Santander/First Fidelity transaction (which did involve a bank), Santander gave only a limited source of strength doctrine. |

(1) Source: Merrill Lynch report issued 10/26/2005

57

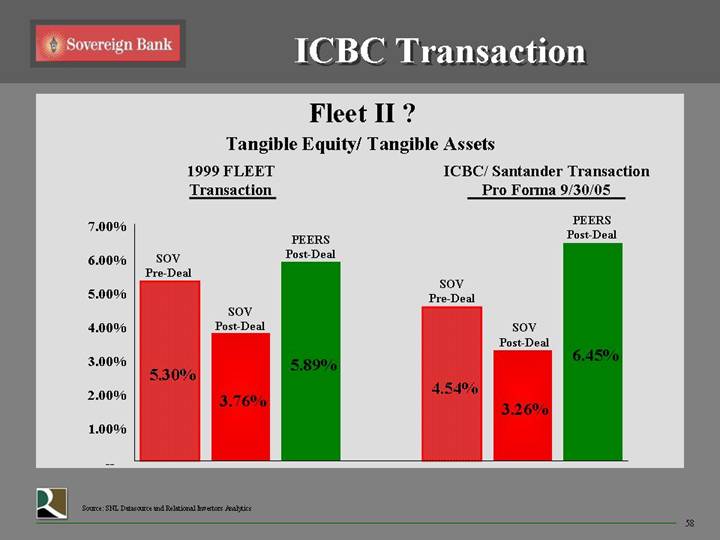

ICBC Transaction

Fleet II ?

Tangible Equity/ Tangible Assets

1999 FLEET

Transaction | ICBC/ Santander Transaction

Pro Forma 9/30/05 |

[CHART] | [CHART] |

Source: SNL Datasource and Relational Investors Analytics

58

SOV’s Stock Price Discount

Price to Forward EPS Discount/Premium to Peers

[CHART]

Source: Thomson Baseline and Relational Investors Analytics

59

Santander Transaction

Sovereign’s View

[GRAPHIC]

60

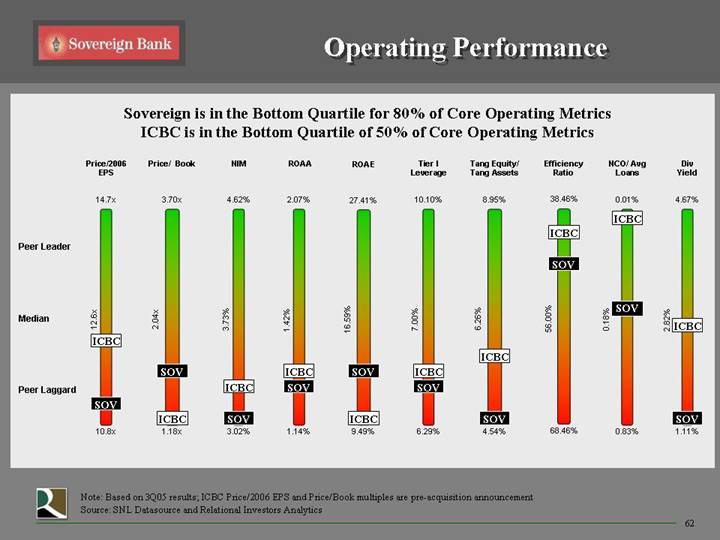

Operating Performance

Sovereign is in the Bottom Quartile for 80% of Core Operating Metrics

ICBC is in the Bottom Quartile of 50% of Core Operating Metrics

[CHART]

Note: Based on 3Q05 results; ICBC Price/2006 EPS and Price/Book multiples are pre-acquisition announcement

Source: SNL Datasource and Relational Investors Analytics

62

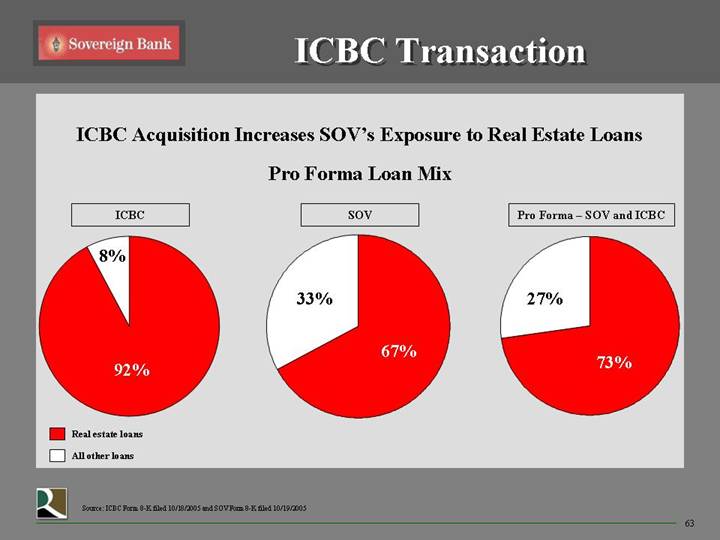

ICBC Transaction

ICBC Acquisition Increases SOV’s Exposure to Real Estate Loans

Pro Forma Loan Mix

ICBC | SOV | Pro Forma – SOV and ICBC |

| | |

[CHART] | [CHART] | [CHART] |

Source: ICBC Form 8-K filed 10/18/2005 and SOV Form 8-K filed 10/19/2005

63

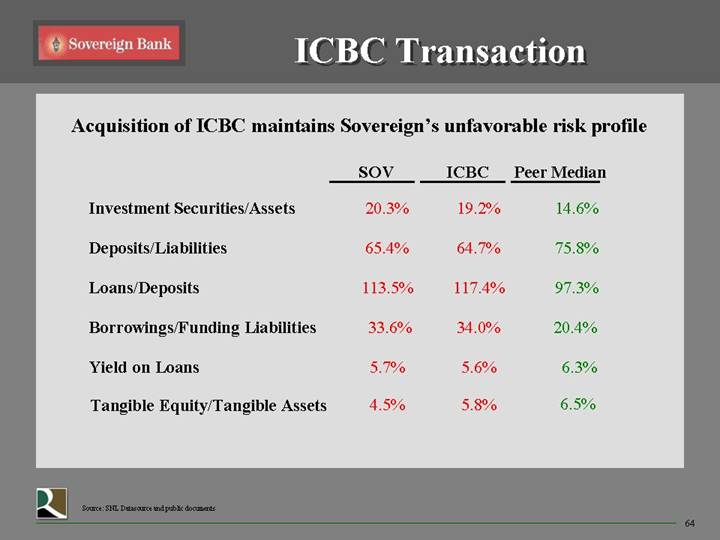

Acquisition of ICBC maintains Sovereign’s unfavorable risk profile

| | SOV | | ICBC | | Peer Median | |

| | | | | | | |

Investment Securities/Assets | | 20.3 | % | 19.2 | % | 14.6 | % |

| | | | | | | |

Deposits/Liabilities | | 65.4 | % | 64.7 | % | 75.8 | % |

| | | | | | | |

Loans/Deposits | | 113.5 | % | 117.4 | % | 97.3 | % |

| | | | | | | |

Borrowings/Funding Liabilities | | 33.6 | % | 34.0 | % | 20.4 | % |

| | | | | | | |

Yield on Loans | | 5.7 | % | 5.6 | % | 6.3 | % |

| | | | | | | |

Tangible Equity/Tangible Assets | | 4.5 | % | 5.8 | % | 6.5 | % |

Source: SNL Datasource and public documents

64

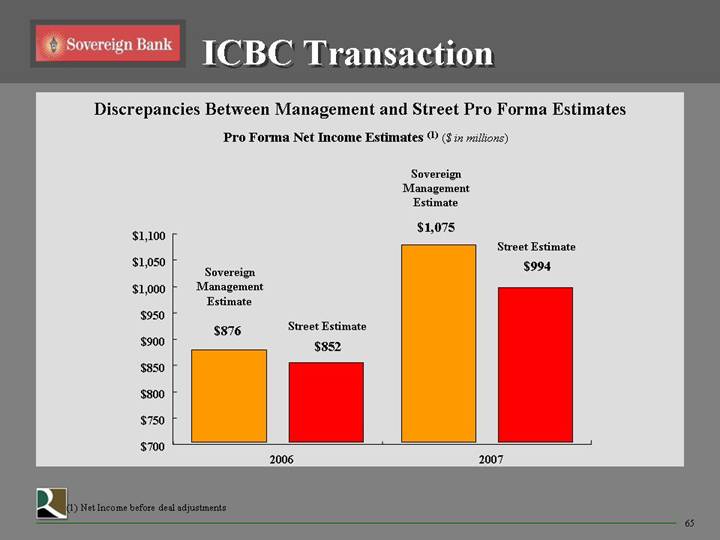

Discrepancies Between Management and Street Pro Forma Estimates

Pro Forma Net Income Estimates (1) ($ in millions)

[CHART]

(1) Net Income before deal adjustments

65

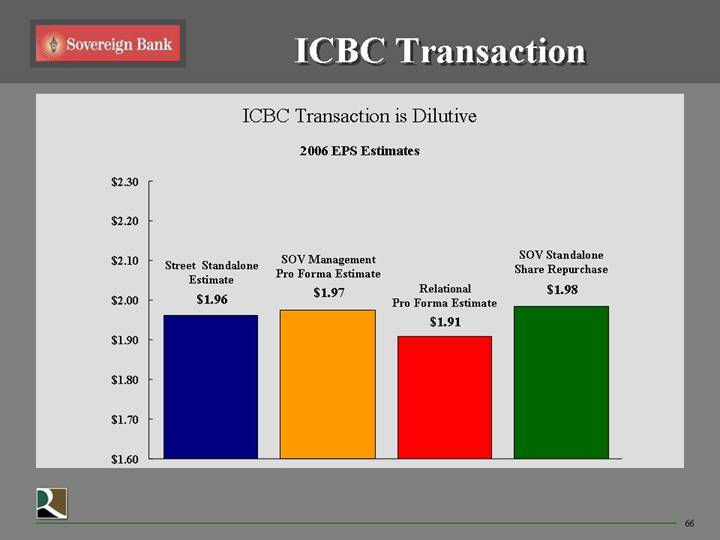

ICBC Transaction is Dilutive

2006 EPS Estimates

[CHART]

66

ICBC Transaction is Dilutive

2007 EPS Estimates

[CHART]

67

Relational’s Action Plan

• Shareholder vote request delivered to NYSE

• Submitted formal Books and Records demand to Sovereign

• Global campaign to bring investor awareness and scrutiny of the Santander transaction

• Appeal to regulatory authorities

• All other appropriate steps are under consideration with none having been ruled out

68

[LOGO] Relational Investors LLC

Q&A

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Relational Investors LLC

Shareholder Value Forum Appendix

Pages 9-10, 59:

Forward EPS Discount Charts were constructed using data from Thomson Baseline

Discount Calculated as follows:

Time Period: Ending Day of Each Month from December 31, 1994 to October 31, 2005*

Historical Month End Forward Twelve Months EPS Forecast: Thomson Baseline

Month End Closing Price: Thomson Baseline

Price to Forward EPS Multiple: Month End Closing Price/ EPS Forecast (as calculated by Relational Investors Analytics)

Discount: SOV Price to Forward EPS/Peer Median Price to Forward EPS (as calculated by Relational Investors Analytics)

*Chart also includes two data points for weeks ending 10/21/2005 and 10/28/2005 to show effects of Relational Investors Preliminary Proxy Filing and SOV announcement of Santander/ICBC transaction

1

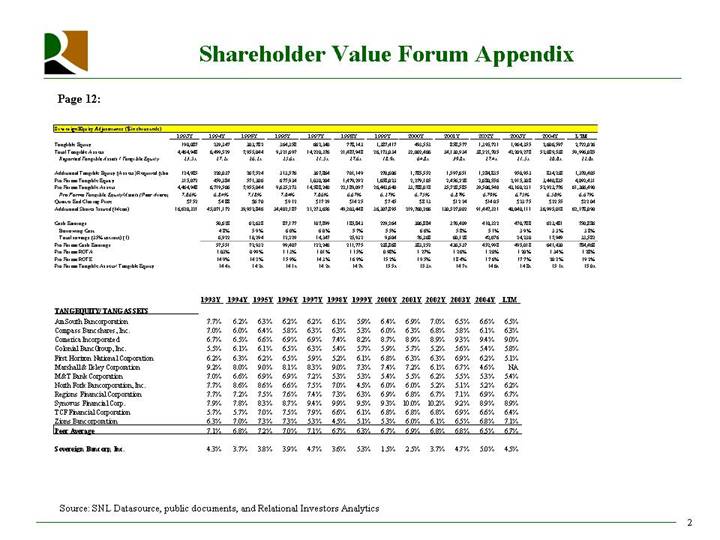

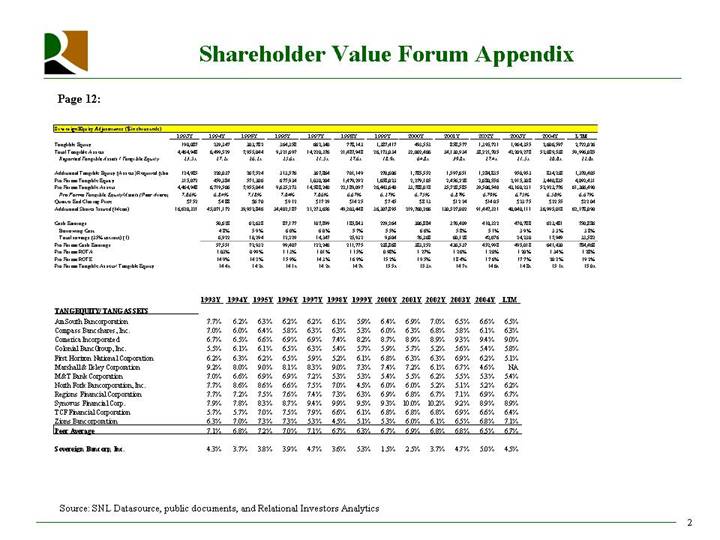

Page 12:

Sovereign Equity Adjustments ($ in thousands)

| | 1993Y | | 1994Y | | 1995Y | | 1996Y | | 1997Y | | 1998Y | | 1999Y | |

Tanglible Equity | | 190,087 | | 239,347 | | 303,782 | | 364,358 | | 662,340 | | 778,143 | | 1,387,417 | |

Total Tangible Assets | | 4,464,948 | | 6,499,529 | | 7,955,044 | | 9,321,697 | | 14,220,376 | | 21,487,948 | | 26,173,034 | |

Reported Tangible Assets / Tangible Equity | | 23.5 | x | 27.2 | x | 26.2 | x | 25.6 | x | 21.5 | x | 27.6 | x | 18.9 | x |

| | | | | | | | | | | | | | | |

Additional Tangible Equity (Assets) Required (tho | | 124,985 | | 220,037 | | 267,524 | | 313,576 | | 367,864 | | 701,149 | | 270,606 | |

Pro Forma Tangible Equity | | 315,072 | | 459,384 | | 571,306 | | 677,934 | | 1,030,204 | | 1,479,292 | | 1,658,023 | |

Pro Forma Tangible Assets | | 4,464,948 | | 6,719,566 | | 7,955,044 | | 9,635,273 | | 14,588,240 | | 22,189,097 | | 26,443,640 | |

Pro Forma Tangible Equity/Assets (Peer Avera | | 7.06 | % | 6.84 | % | 7.18 | % | 7.04 | % | 7.06 | % | 6.67 | % | 6.27 | % |

Quarter End Closing Price | | $ | 7.52 | | $ | 4.88 | | $ | 6.70 | | $ | 9.12 | | $ | 17.29 | | $ | 14.25 | | $ | 7.45 | |

Additional Shares Issued (Mean) | | 16,620,321 | | 45,071,172 | | 39,952,846 | | 34,402,187 | | 21,273,656 | | 49,203,448 | | 36,307,895 | |

| | | | | | | | | | | | | | | |

Cash Earnings | | | | 50,628 | | 62,638 | | 87,177 | | 107,899 | | 185,843 | | 229,264 | |

Borrowing Cost | | | | 4.8 | % | 5.9 | % | 6.0 | % | 6.0 | % | 5.7 | % | 5.5 | % |

Total savings (35% tax rate) (1) | | | | 6,922 | | 10,294 | | 12,229 | | 14,347 | | 25,932 | | 9,604 | |

Pro Forma Cash Earnings | | | | 57,551 | | 72,932 | | 99,407 | | 122,246 | | 211,775 | | 238,868 | |

Pro Forma ROTA | | | | 1.03 | % | 0.99 | % | 1.13 | % | 1.01 | % | 1.15 | % | 0.98 | % |

Pro Forma ROTE | | | | 14.9 | % | 14.2 | % | 15.9 | % | 14.3 | % | 16.9 | % | 15.2 | % |

Pro Forma Tangible Assets/ Tangible Equity | | | | 14.4 | x | 14.2 | x | 14.1 | x | 14.2 | x | 14.7 | x | 15.5 | x |

| | | | | | | | | | | | | | | | | | | | | | |

| | 2000Y | | 2001Y | | 2002Y | | 2003Y | | 2004Y | | LTM | |

Tanglible Equity | | 493,553 | | 858,577 | | 1,395,721 | | 1,964,355 | | 2,606,597 | | 2,722,026 | |

Total Tangible Assets | | 32,002,466 | | 34,130,934 | | 38,221,705 | | 42,209,278 | | 52,089,538 | | 59,996,085 | |

Reported Tangible Assets / Tangible Equity | | 64.8 | x | 39.8 | x | 27.4 | x | 21.5 | x | 20.0 | x | 22.0 | x |

| | | | | | | | | | | | | |

Additional Tangible Equity (Assets) Required (tho | | 1,785,552 | | 1,597,651 | | 1,284,835 | | 950,953 | | 834,238 | | 1,370,405 | |

Pro Forma Tangible Equity | | 2,279,105 | | 2,456,228 | | 2,680,556 | | 2,915,308 | | 3,440,835 | | 4,092,431 | |

Pro Forma Tangible Assets | | 33,788,018 | | 35,728,585 | | 39,506,540 | | 43,160,231 | | 52,923,776 | | 61,366,490 | |

Pro Forma Tangible Equity/Assets (Peer Avera | | 6.75 | % | 6.87 | % | 6.79 | % | 6.75 | % | 6.50 | % | 6.67 | % |

Quarter End Closing Price | | $ | 8.13 | | $ | 12.24 | | $ | 14.05 | | $ | 23.75 | | $ | 22.55 | | $ | 22.04 | |

Additional Shares Issued (Mean) | | 219,760,266 | | 130,527,002 | | 91,447,321 | | 40,040,111 | | 36,995,018 | | 62,178,090 | |

| | | | | | | | | | | | | |

Cash Earnings | | 306,884 | | 376,409 | | 410,322 | | 470,788 | | 623,481 | | 750,886 | |

Borrowing Cost | | 6.6 | % | 5.8 | % | 5.1 | % | 3.9 | % | 3.3 | % | 3.8 | % |

Total savings (35% tax rate) (1) | | 76,368 | | 60,128 | | 42,676 | | 24,230 | | 17,949 | | 33,582 | |

Pro Forma Cash Earnings | | 383,252 | | 436,537 | | 452,998 | | 495,018 | | 641,430 | | 784,468 | |

Pro Forma ROTA | | 1.27 | % | 1.26 | % | 1.20 | % | 1.20 | % | 1.34 | % | 1.28 | % |

Pro Forma ROTE | | 19.5 | % | 18.4 | % | 17.6 | % | 17.7 | % | 20.2 | % | 19.2 | % |

Pro Forma Tangible Assets/ Tangible Equity | | 15.3 | x | 14.7 | x | 14.6 | x | 14.8 | x | 15.1 | x | 15.0 | x |

| | | | | | | | | | | | | | | | | | | |

| | 1993Y | | 1994Y | | 1995Y | | 1996Y | | 1997Y | | 1998Y | | 1999Y | | 2000Y | | 2001Y | | 2002Y | | 2003Y | | 2004Y | | LTM | |

TANG EQUITY/ TANG ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AmSouth Bancorporation | | 7.7 | % | 6.2 | % | 6.3 | % | 6.2 | % | 6.2 | % | 6.1 | % | 5.9 | % | 6.4 | % | 6.9 | % | 7.0 | % | 6.5 | % | 6.6 | % | 6.5 | % |

Compass Bancshares, Inc. | | 7.0 | % | 6.0 | % | 6.4 | % | 5.8 | % | 6.3 | % | 6.3 | % | 5.3 | % | 6.0 | % | 6.3 | % | 6.8 | % | 5.8 | % | 6.1 | % | 6.3 | % |

Comerica Incorporated | | 6.7 | % | 6.5 | % | 6.6 | % | 6.9 | % | 6.9 | % | 7.4 | % | 8.2 | % | 8.7 | % | 8.9 | % | 8.9 | % | 9.3 | % | 9.4 | % | 9.0 | % |

Colonial BancGroup, Inc. | | 5.5 | % | 6.1 | % | 6.1 | % | 6.5 | % | 6.3 | % | 5.4 | % | 5.7 | % | 5.9 | % | 5.7 | % | 5.2 | % | 5.6 | % | 5.4 | % | 5.8 | % |

First Horizon National Corporation | | 6.2 | % | 6.3 | % | 6.2 | % | 6.5 | % | 5.9 | % | 5.2 | % | 6.1 | % | 6.8 | % | 6.3 | % | 6.3 | % | 6.9 | % | 6.2 | % | 5.1 | % |

Marshall & Ilsley Corporation | | 9.2 | % | 8.0 | % | 9.0 | % | 8.1 | % | 8.3 | % | 9.0 | % | 7.3 | % | 7.4 | % | 7.2 | % | 6.1 | % | 6.7 | % | 4.6 | % | NA | |

M&T Bank Corporation | | 7.0 | % | 6.6 | % | 6.9 | % | 6.9 | % | 7.2 | % | 5.3 | % | 5.3 | % | 5.4 | % | 5.5 | % | 6.2 | % | 5.5 | % | 5.3 | % | 5.4 | % |

North Fork Bancorporation, Inc. | | 7.7 | % | 8.6 | % | 8.6 | % | 6.6 | % | 7.5 | % | 7.0 | % | 4.5 | % | 6.0 | % | 6.0 | % | 5.2 | % | 5.1 | % | 5.2 | % | 6.2 | % |

Regions Financial Corporation | | 7.7 | % | 7.2 | % | 7.5 | % | 7.6 | % | 7.4 | % | 7.3 | % | 6.3 | % | 6.9 | % | 6.8 | % | 6.7 | % | 7.1 | % | 6.9 | % | 6.7 | % |

Synovus Financial Corp. | | 7.9 | % | 7.8 | % | 8.3 | % | 8.7 | % | 9.4 | % | 9.9 | % | 9.5 | % | 9.3 | % | 10.0 | % | 10.2 | % | 9.2 | % | 8.9 | % | 8.9 | % |

TCF Financial Corporation | | 5.7 | % | 5.7 | % | 7.0 | % | 7.5 | % | 7.9 | % | 6.6 | % | 6.1 | % | 6.8 | % | 6.8 | % | 6.8 | % | 6.9 | % | 6.6 | % | 6.4 | % |

Zions Bancorporation | | 6.3 | % | 7.0 | % | 7.3 | % | 7.3 | % | 5.3 | % | 4.5 | % | 5.1 | % | 5.3 | % | 6.0 | % | 6.1 | % | 6.5 | % | 6.8 | % | 7.1 | % |

Peer Average | | 7.1 | % | 6.8 | % | 7.2 | % | 7.0 | % | 7.1 | % | 6.7 | % | 6.3 | % | 6.7 | % | 6.9 | % | 6.8 | % | 6.8 | % | 6.5 | % | 6.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sovereign Bancorp, Inc. | | 4.3 | % | 3.7 | % | 3.8 | % | 3.9 | % | 4.7 | % | 3.6 | % | 5.3 | % | 1.5 | % | 2.5 | % | 3.7 | % | 4.7 | % | 5.0 | % | 4.5 | % |

Source: SNL Datasource, public documents, and Relational Investors Analytics

2

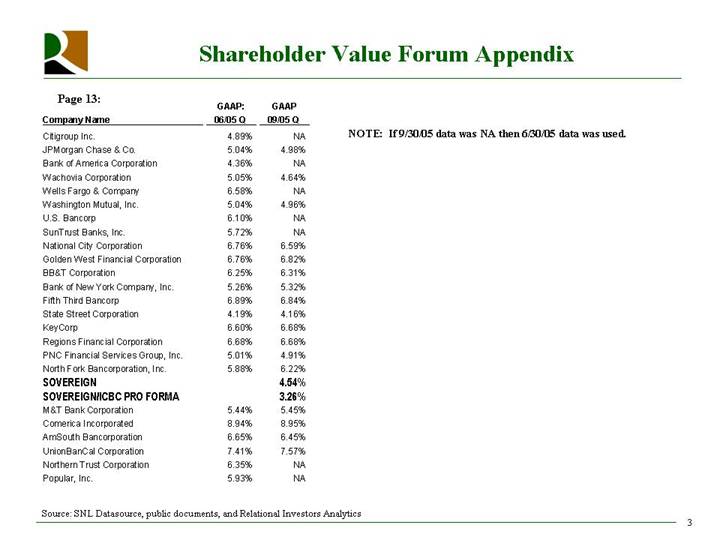

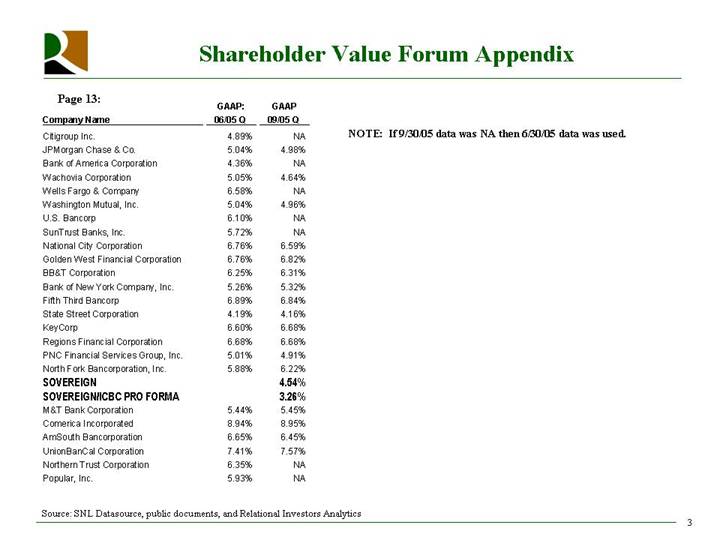

Page 13:

Company Name | | GAAP:

06/05 Q | | GAAP

09/05 Q | |

| | | | | |

Citigroup Inc. | | 4.89 | % | NA | |

JPMorgan Chase & Co. | | 5.04 | % | 4.98 | % |

Bank of America Corporation | | 4.36 | % | NA | |

Wachovia Corporation | | 5.05 | % | 4.64 | % |

Wells Fargo & Company | | 6.58 | % | NA | |

Washington Mutual, Inc. | | 5.04 | % | 4.96 | % |

U.S. Bancorp | | 6.10 | % | NA | |

SunTrust Banks, Inc. | | 5.72 | % | NA | |

National City Corporation | | 6.76 | % | 6.59 | % |

Golden West Financial Corporation | | 6.76 | % | 6.82 | % |

BB&T Corporation | | 6.25 | % | 6.31 | % |

Bank of New York Company, Inc. | | 5.26 | % | 5.32 | % |

Fifth Third Bancorp | | 6.89 | % | 6.84 | % |

State Street Corporation | | 4.19 | % | 4.16 | % |

KeyCorp | | 6.60 | % | 6.68 | % |

Regions Financial Corporation | | 6.68 | % | 6.68 | % |

PNC Financial Services Group, Inc. | | 5.01 | % | 4.91 | % |

North Fork Bancorporation, Inc. | | 5.88 | % | 6.22 | % |

SOVEREIGN | | | | 4.54 | % |

SOVEREIGN/ICBC PRO FORMA | | | | 3.26 | % |

M&T Bank Corporation | | 5.44 | % | 5.45 | % |

Comerica Incorporated | | 8.94 | % | 8.95 | % |

AmSouth Bancorporation | | 6.65 | % | 6.45 | % |

UnionBanCal Corporation | | 7.41 | % | 7.57 | % |

Northern Trust Corporation | | 6.35 | % | NA | |

Popular, Inc. | | 5.93 | % | NA | |

NOTE: If 9/30/05 data was NA then 6/30/05 data was used.

Source: SNL Datasource, public documents, and Relational Investors Analytics

3

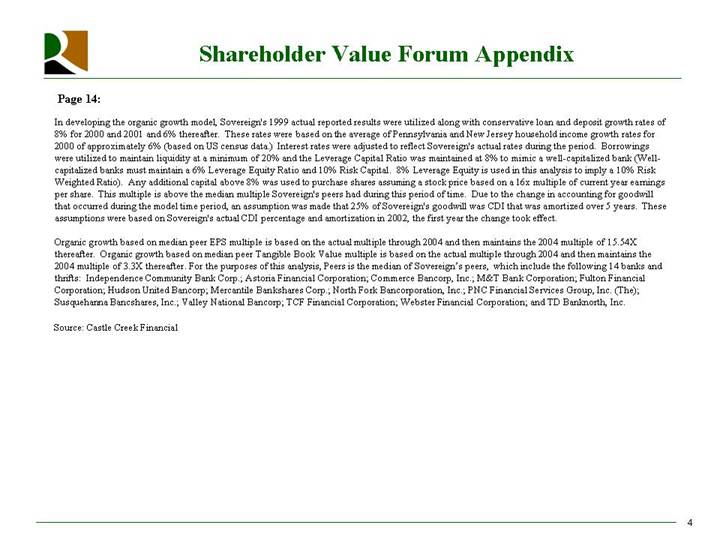

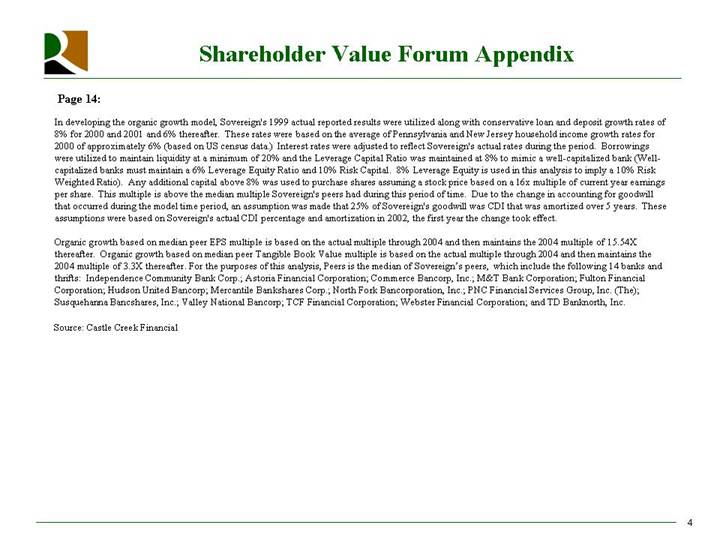

Page 14:

In developing the organic growth model, Sovereign’s 1999 actual reported results were utilized along with conservative loan and deposit growth rates of 8% for 2000 and 2001 and 6% thereafter. These rates were based on the average of Pennsylvania and New Jersey household income growth rates for 2000 of approximately 6% (based on US census data.) Interest rates were adjusted to reflect Sovereign’s actual rates during the period. Borrowings were utilized to maintain liquidity at a minimum of 20% and the Leverage Capital Ratio was maintained at 8% to mimic a well-capitalized bank (Well-capitalized banks must maintain a 6% Leverage Equity Ratio and 10% Risk Capital. 8% Leverage Equity is used in this analysis to imply a 10% Risk Weighted Ratio). Any additional capital above 8% was used to purchase shares assuming a stock price based on a 16x multiple of current year earnings per share. This multiple is above the median multiple Sovereign’s peers had during this period of time. Due to the change in accounting for goodwill that occurred during the model time period, an assumption was made that 25% of Sovereign’s goodwill was CDI that was amortized over 5 years. These assumptions were based on Sovereign’s actual CDI percentage and amortization in 2002, the first year the change took effect.

Organic growth based on median peer EPS multiple is based on the actual multiple through 2004 and then maintains the 2004 multiple of 15.54X thereafter. Organic growth based on median peer Tangible Book Value multiple is based on the actual multiple through 2004 and then maintains the 2004 multiple of 3.3X thereafter. For the purposes of this analysis, Peers is the median of Sovereign’s peers, which include the following 14 banks and thrifts: Independence Community Bank Corp.; Astoria Financial Corporation; Commerce Bancorp, Inc.; M&T Bank Corporation; Fulton Financial Corporation; Hudson United Bancorp; Mercantile Bankshares Corp.; North Fork Bancorporation, Inc.; PNC Financial Services Group, Inc. (The); Susquehanna Bancshares, Inc.; Valley National Bancorp; TCF Financial Corporation; Webster Financial Corporation; and TD Banknorth, Inc.

Source: Castle Creek Financial

4

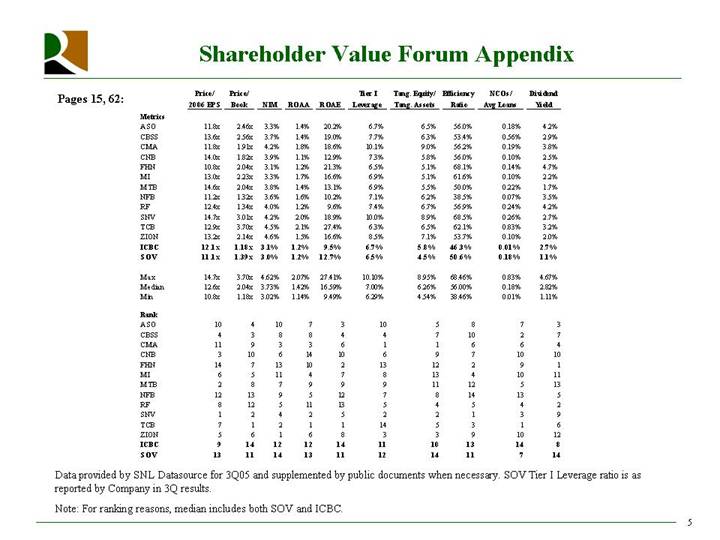

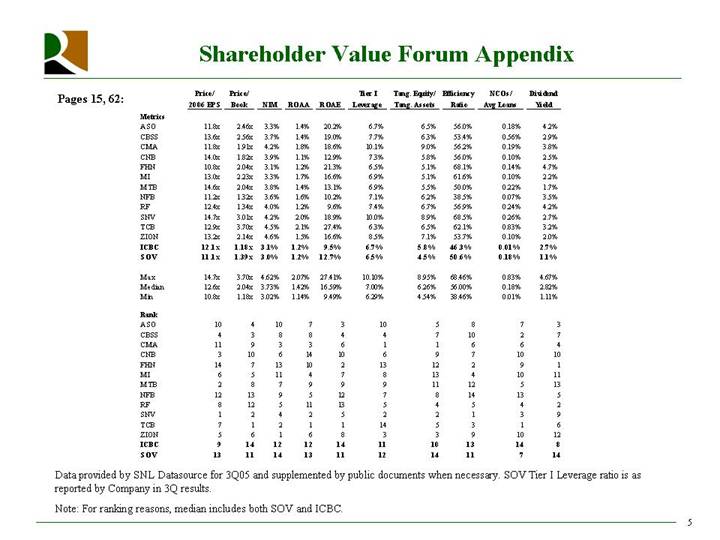

Pages 15, 62:

| | Price/

2006 EPS | | Price/

Book | | NIM | | ROAA | | ROAE | | Tier I

Leverage | | Tang. Equity/

Tang. Assets | | Efficiency

Ratio | | NCOs/

Avg Loans | | Dividend

Yield | |

Metrics | | | | | | | | | | | | | | | | | | | | | |

ASO | | 11.8 | x | 2.46 | x | 3.3 | % | 1.4 | % | 20.2 | % | 6.7 | % | 6.5 | % | 56.0 | % | 0.18 | % | 4.2 | % |

CBSS | | 13.6 | x | 2.56 | x | 3.7 | % | 1.4 | % | 19.0 | % | 7.7 | % | 6.3 | % | 53.4 | % | 0.56 | % | 2.9 | % |

CMA | | 11.8 | x | 1.91 | x | 4.2 | % | 1.8 | % | 18.6 | % | 10.1 | % | 9.0 | % | 56.2 | % | 0.19 | % | 3.8 | % |

CNB | | 14.0 | x | 1.82 | x | 3.9 | % | 1.1 | % | 12.9 | % | 7.3 | % | 5.8 | % | 56.0 | % | 0.10 | % | 2.5 | % |

FHN | | 10.8 | x | 2.04 | x | 3.1 | % | 1.2 | % | 21.3 | % | 6.5 | % | 5.1 | % | 68.1 | % | 0.14 | % | 4.7 | % |

MI | | 13.0 | x | 2.23 | x | 3.3 | % | 1.7 | % | 16.6 | % | 6.9 | % | 5.1 | % | 61.6 | % | 0.10 | % | 2.2 | % |

MTB | | 14.6 | x | 2.04 | x | 3.8 | % | 1.4 | % | 13.1 | % | 6.9 | % | 5.5 | % | 50.0 | % | 0.22 | % | 1.7 | % |

NFB | | 11.2 | x | 1.32 | x | 3.6 | % | 1.6 | % | 10.2 | % | 7.1 | % | 6.2 | % | 38.5 | % | 0.07 | % | 3.5 | % |

RF | | 12.4 | x | 1.34 | x | 4.0 | % | 1.2 | % | 9.6 | % | 7.4 | % | 6.7 | % | 56.9 | % | 0.24 | % | 4.2 | % |

SNV | | 14.7 | x | 3.01 | x | 4.2 | % | 2.0 | % | 18.9 | % | 10.0 | % | 8.9 | % | 68.5 | % | 0.26 | % | 2.7 | % |

TCB | | 12.9 | x | 3.70 | x | 4.5 | % | 2.1 | % | 27.4 | % | 6.3 | % | 6.5 | % | 62.1 | % | 0.83 | % | 3.2 | % |

ZION | | 13.2 | x | 2.14 | x | 4.6 | % | 1.5 | % | 16.6 | % | 8.5 | % | 7.1 | % | 53.7 | % | 0.10 | % | 2.0 | % |

ICBC | | 12.1 | x | 1.18 | x | 3.1 | % | 1.2 | % | 9.5 | % | 6.7 | % | 5.8 | % | 46.3 | % | 0.01 | % | 2.7 | % |

SOV | | 11.1 | x | 1.39 | x | 3.0 | % | 1.2 | % | 12.7 | % | 6.5 | % | 4.5 | % | 50.6 | % | 0.18 | % | 1.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

Max | | 14.7 | x | 3.70 | x | 4.62 | % | 2.07 | % | 27.41 | % | 10.10 | % | 8.95 | % | 68.46 | % | 0.83 | % | 4.67 | % |

Median | | 12.6 | x | 2.04 | x | 3.73 | % | 1.42 | % | 16.59 | % | 7.00 | % | 6.26 | % | 56.00 | % | 0.18 | % | 2.82 | % |

Min | | 10.8 | x | 1.18 | x | 3.02 | % | 1.14 | % | 9.49 | % | 6.29 | % | 4.54 | % | 38.46 | % | 0.01 | % | 1.11 | % |

| | | | | | | | | | | | | | | | | | | | | |

Rank | | | | | | | | | | | | | | | | | | | | | |

ASO | | 10 | | 4 | | 10 | | 7 | | 3 | | 10 | | 5 | | 8 | | 7 | | 3 | |

CBSS | | 4 | | 3 | | 8 | | 8 | | 4 | | 4 | | 7 | | 10 | | 2 | | 7 | |

CMA | | 11 | | 9 | | 3 | | 3 | | 6 | | 1 | | 1 | | 6 | | 6 | | 4 | |

CNB | | 3 | | 10 | | 6 | | 14 | | 10 | | 6 | | 9 | | 7 | | 10 | | 10 | |

FHN | | 14 | | 7 | | 13 | | 10 | | 2 | | 13 | | 12 | | 2 | | 9 | | 1 | |

MI | | 6 | | 5 | | 11 | | 4 | | 7 | | 8 | | 13 | | 4 | | 10 | | 11 | |

MTB | | 2 | | 8 | | 7 | | 9 | | 9 | | 9 | | 11 | | 12 | | 5 | | 13 | |

NFB | | 12 | | 13 | | 9 | | 5 | | 12 | | 7 | | 8 | | 14 | | 13 | | 5 | |

RF | | 8 | | 12 | | 5 | | 11 | | 13 | | 5 | | 4 | | 5 | | 4 | | 2 | |

SNV | | 1 | | 2 | | 4 | | 2 | | 5 | | 2 | | 2 | | 1 | | 3 | | 9 | |

TCB | | 7 | | 1 | | 2 | | 1 | | 1 | | 14 | | 5 | | 3 | | 1 | | 6 | |

ZION | | 5 | | 6 | | 1 | | 6 | | 8 | | 3 | | 3 | | 9 | | 10 | | 12 | |

ICBC | | 9 | | 14 | | 12 | | 12 | | 14 | | 11 | | 10 | | 13 | | 14 | | 8 | |

SOV | | 13 | | 11 | | 14 | | 13 | | 11 | | 12 | | 14 | | 11 | | 7 | | 14 | |

Data provided by SNL Datasource for 3Q05 and supplemented by public documents when necessary. SOV Tier I Leverage ratio is as reported by Company in 3Q results.

Note: For ranking reasons, median includes both SOV and ICBC.

5

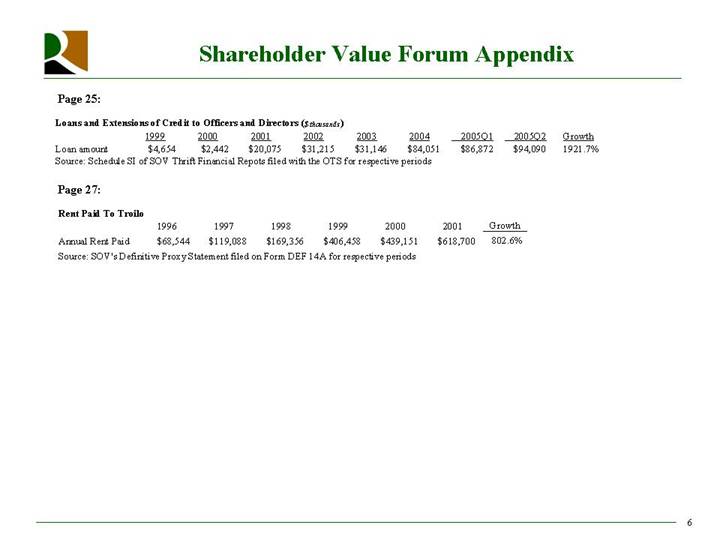

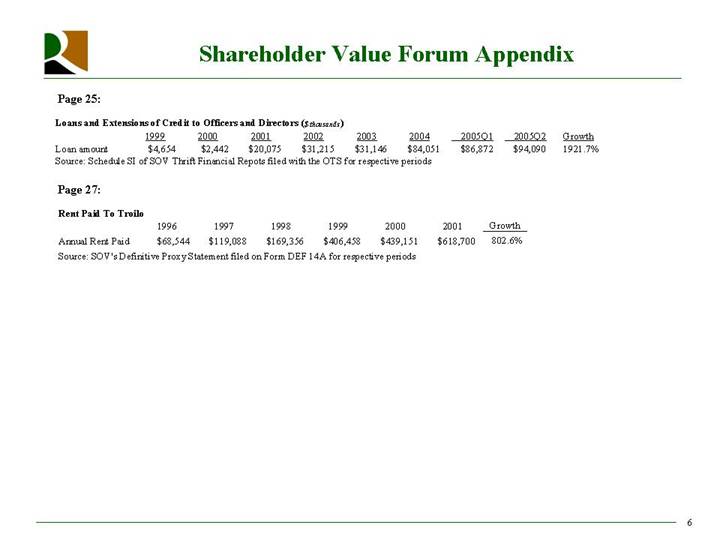

Page 25:

Loans and Extensions of Credit to Officers and Directors ($ thousands )

| | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005Q1 | | 2005Q2 | | Growth | |

Loan amount | | $ | 4,654 | | $ | 2,442 | | $ | 20,075 | | $ | 31,215 | | $ | 31,146 | | $ | 84,051 | | $ | 86,872 | | $ | 94,090 | | 1921.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Schedule SI of SOV Thrift Financial Repots filed with the OTS for respective periods

Page 27:

Rent Paid To Troilo

| | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | Growth | |

Annual Rent Paid | | $ | 68,544 | | $ | 119,088 | | $ | 169,356 | | $ | 406,458 | | $ | 439,151 | | $ | 618,700 | | 802.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

Source: SOV’s Definitive Proxy Statement filed on Form DEF 14A for respective periods

6

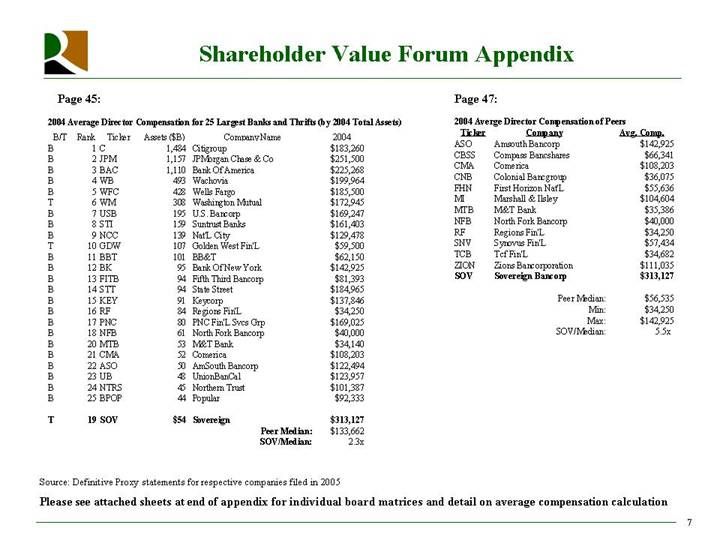

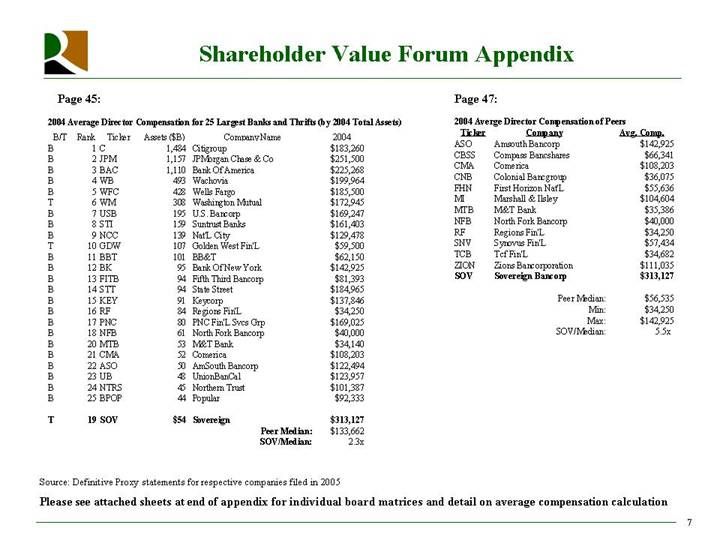

Page 45:

2004 Average Director Compensation for 25 Largest Banks and Thrifts (by 2004 Total Assets)

B/T | | Rank | | Ticker | | Assets ($B) | | Company Name | | 2004 | |

B | | 1 | | C | | 1,484 | | Citigroup | | $ | 183,260 | |

B | | 2 | | JPM | | 1,157 | | JPMorgan Chase & Co | | $ | 251,500 | |

B | | 3 | | BAC | | 1,110 | | Bank Of America | | $ | 225,268 | |

B | | 4 | | WB | | 493 | | Wachovia | | $ | 199,964 | |

B | | 5 | | WFC | | 428 | | Wells Fargo | | $ | 185,500 | |

T | | 6 | | WM | | 308 | | Washington Mutual | | $ | 172,945 | |

B | | 7 | | USB | | 195 | | U.S. Bancorp | | $ | 169,247 | |

B | | 8 | | STI | | 159 | | Suntrust Banks | | $ | 161,403 | |

B | | 9 | | NCC | | 139 | | Nat’L City | | $ | 129,478 | |

T | | 10 | | GDW | | 107 | | Golden West Fin’L | | $ | 59,500 | |

B | | 11 | | BBT | | 101 | | BB&T | | $ | 62,150 | |

B | | 12 | | BK | | 95 | | Bank Of New York | | $ | 142,925 | |

B | | 13 | | FITB | | 94 | | Fifth Third Bancorp | | $ | 81,393 | |

B | | 14 | | STT | | 94 | | State Street | | $ | 184,965 | |

B | | 15 | | KEY | | 91 | | Keycorp | | $ | 137,846 | |

B | | 16 | | RF | | 84 | | Regions Fin’L | | $ | 34,250 | |

B | | 17 | | PNC | | 80 | | PNC Fin’L Svcs Grp | | $ | 169,025 | |

B | | 18 | | NFB | | 61 | | North Fork Bancorp | | $ | 40,000 | |

B | | 20 | | MTB | | 53 | | M&T Bank | | $ | 34,140 | |

B | | 21 | | CMA | | 52 | | Comerica | | $ | 108,203 | |

B | | 22 | | ASO | | 50 | | AmSouth Bancorp | | $ | 122,494 | |

B | | 23 | | UB | | 48 | | UnionBanCal | | $ | 123,957 | |

B | | 24 | | NTRS | | 45 | | Northern Trust | | $ | 101,387 | |

B | | 25 | | BPOP | | 44 | | Popular | | $ | 92,333 | |

| | | | | | | | | | | |

T | | 19 | | SOV | | $ | 54 | | Sovereign | | $ | 313,127 | |

| | | | | | | | Peer Median: | | $ | 133,662 | |

| | | | | | | | SOV/Median: | | 2.3x | |

| | | | | | | | | | | | | |

Page 47:

2004 Averge Director Compensation of Peers

Ticker | | Company | | Avg. Comp. | |

ASO | | Amsouth Bancorp | | $ | 142,925 | |

CBSS | | Compass Bancshares | | $ | 66,341 | |

CMA | | Comerica | | $ | 108,203 | |

CNB | | Colonial Bancgroup | | $ | 36,075 | |

FHN | | First Horizon Nat’L | | $ | 55,636 | |

MI | | Marshall & Ilsley | | $ | 104,604 | |

MTB | | M&T Bank | | $ | 35,386 | |

NFB | | North Fork Bancorp | | $ | 40,000 | |

RF | | Regions Fin’L | | $ | 34,250 | |

SNV | | Synovus Fin’L | | $ | 57,434 | |

TCB | | Tcf Fin’L | | $ | 34,682 | |

ZION | | Zions Bancorporation | | $ | 111,035 | |

SOV | | Sovereign Bancorp | | $ | 313,127 | |

| | | | | |

| | Peer Median: | | $ | 56,535 | |

| | Min: | | $ | 34,250 | |

| | Max: | | $ | 142,925 | |

| | SOV/Median: | | 5.5 | x |

Source: Definitive Proxy statements for respective companies filed in 2005

Please see attached sheets at end of appendix for individual board matrices and detail on average compensation calculation

7

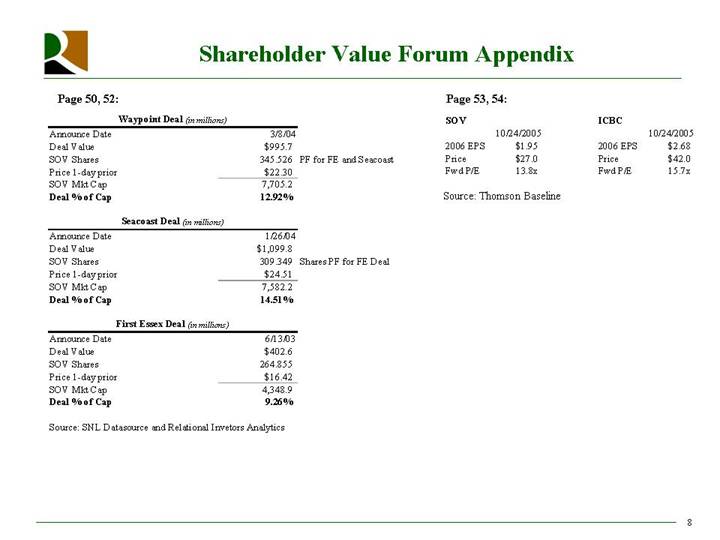

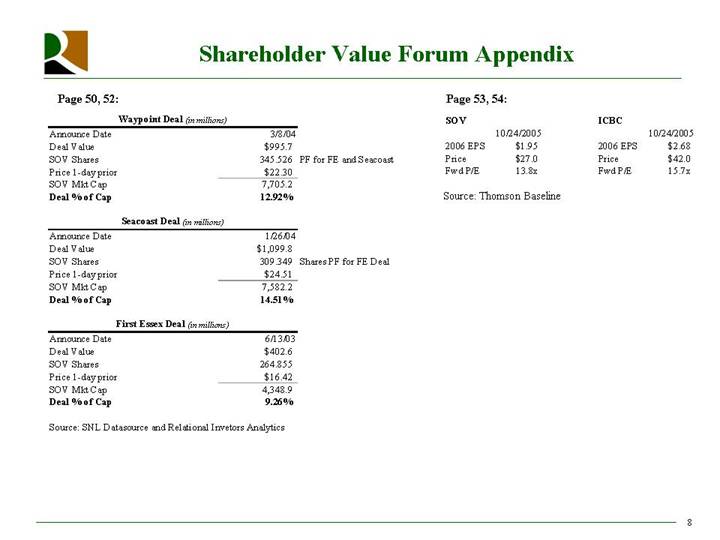

Page 50, 52:

Waypoint Deal (in millions)

Announce Date | | 3/8/04 | | | |

Deal Value | | $ | 995.7 | | | |

SOV Shares | | 345.526 | | PF for FE and Seacoast | |

Price 1-day prior | | $ | 22.30 | | | |

SOV Mkt Cap | | 7,705.2 | | | |

Deal % of Cap | | 12.92 | % | | |

Seacoast Deal (in millions)

Announce Date | | 1/26/04 | | | |

Deal Value | | $ | 1,099.8 | | | |

SOV Shares | | 309.349 | | Shares PF for FE Deal | |

Price 1-day prior | | $ | 24.51 | | | |

SOV Mkt Cap | | 7,582.2 | | | |

Deal % of Cap | | 14.51 | % | | |

First Essex Deal (in millions)

Announce Date | | 6/13/03 | | | |

Deal Value | | $ | 402.6 | | | |

SOV Shares | | 264.855 | | | |

Price 1-day prior | | $ | 16.42 | | | |

SOV Mkt Cap | | 4,348.9 | | | |

Deal % of Cap | | 9.26 | % | | |

Source: SNL Datasource and Relational Invetors Analytics

Page 53, 54:

SOV

| | 10/24/2005 | |

2006 EPS | | $ | 1.95 | |

Price | | $ | 27.0 | |

Fwd P/E | | 13.8 | x |

ICBC

| | 10/24/2005 | |

2006 EPS | | $ | 2.68 | |

Price | | $ | 42.0 | |

Fwd P/E | | 15.7 | x |

Source: Thomson Baseline

8

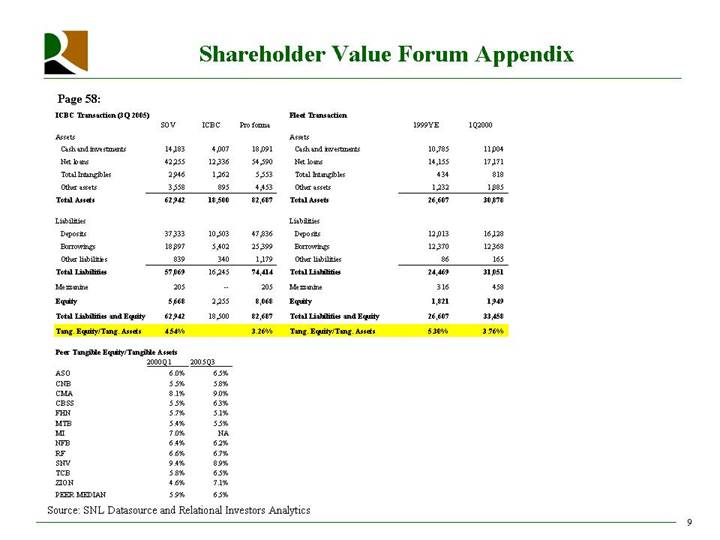

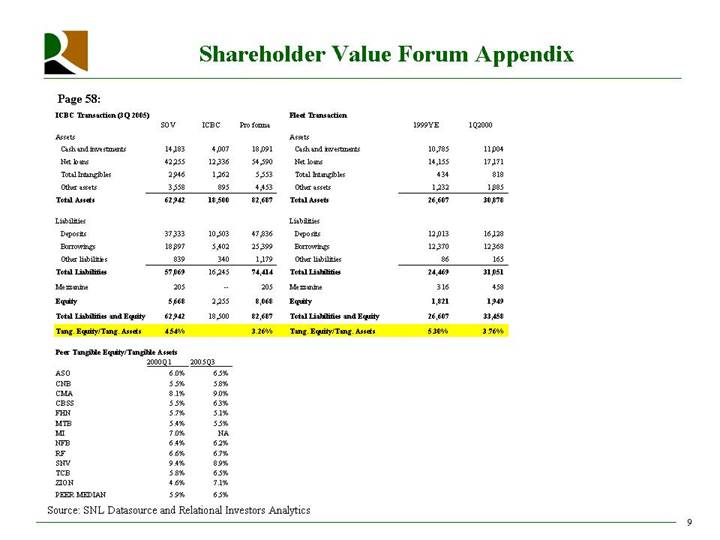

Page 58:

ICBC Transaction (3Q 2005)

| | SOV | | ICBC | | Pro forma | |

Assets | | | | | | | |

Cash and investments | | 14,183 | | 4,007 | | 18,091 | |

Net loans | | 42,255 | | 12,336 | | 54,590 | |

Total Intangibles | | 2,946 | | 1,262 | | 5,553 | |

Other assets | | 3,558 | | 895 | | 4,453 | |

Total Assets | | 62,942 | | 18,500 | | 82,687 | |

| | | | | | | |

Liabilities | | | | | | | |

Deposits | | 37,333 | | 10,503 | | 47,836 | |

Borrowings | | 18,897 | | 5,402 | | 25,399 | |

Other liabilities | | 839 | | 340 | | 1,179 | |

Total Liabilities | | 57,069 | | 16,245 | | 74,414 | |

Mezzanine | | 205 | | — | | 205 | |

Equity | | 5,668 | | 2,255 | | 8,068 | |

Total Liabilities and Equity | | 62,942 | | 18,500 | | 82,687 | |

Tang. Equity/Tang. Assets | | 4.54 | % | 3.26 | % | | |

Fleet Transaction

| | 1999YE | | 1Q2000 | |

Assets | | | | | |

Cash and investments | | 10,785 | | 11,004 | |

Net loans | | 14,155 | | 17,171 | |

Total Intangibles | | 434 | | 818 | |

Other assets | | 1,232 | | 1,885 | |

Total Assets | | 26,607 | | 30,878 | |

| | | | | |

Liabilities | | | | | |

Deposits | | 12,013 | | 16,128 | |

Borrowings | | 12,370 | | 12,368 | |

Other liabilities | | 86 | | 165 | |

Total Liabilities | | 24,469 | | 31,051 | |

Mezzanine | | 316 | | 458 | |

Equity | | 1,821 | | 1,949 | |

Total Liabilities and Equity | | 26,607 | | 33,458 | |

Tang. Equity/Tang. Assets | | 5.30 | % | 3.76 | % |

Peer Tangible Equity/Tangible Assets

| | 2000Q1 | | 2005Q3 | |

ASO | | 6.0 | % | 6.5 | % |

CNB | | 5.5 | % | 5.8 | % |

CMA | | 8.1 | % | 9.0 | % |

CBSS | | 5.5 | % | 6.3 | % |

FHN | | 5.7 | % | 5.1 | % |

MTB | | 5.4 | % | 5.5 | % |

MI | | 7.0 | % | NA | |

NFB | | 6.4 | % | 6.2 | % |

RF | | 6.6 | % | 6.7 | % |

SNV | | 9.4 | % | 8.9 | % |

TCB | | 5.8 | % | 6.5 | % |

ZION | | 4.6 | % | 7.1 | % |

PEER MEDIAN | | 5.9 | % | 6.5 | % |

Source: SNL Datasource and Relational Investors Analytics

9

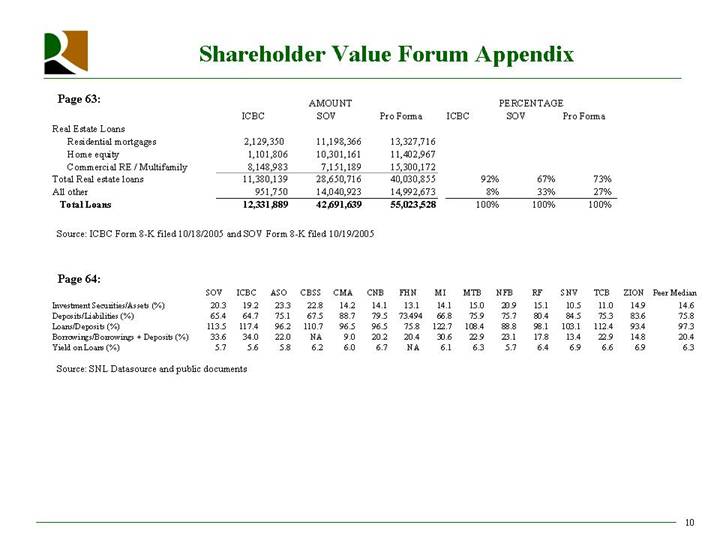

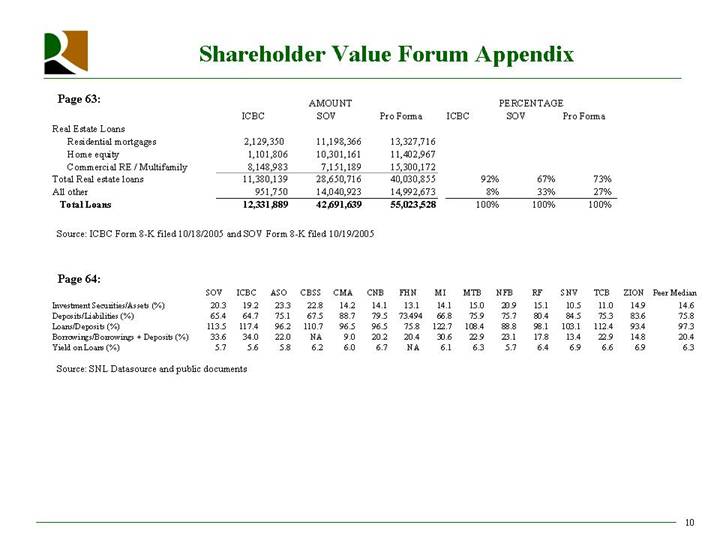

Page 63:

| | AMOUNT | | PERCENTAGE | |

| | ICBC | | SOV | | Pro Forma | | ICBC | | SOV | | Pro Forma | |

Real Estate Loans | | | | | | | | | | | | | |

Residential mortgages | | 2,129,350 | | 11,198,366 | | 13,327,716 | | | | | | | |

Home equity | | 1,101,806 | | 10,301,161 | | 11,402,967 | | | | | | | |

Commercial RE / Multifamily | | 8,148,983 | | 7,151,189 | | 15,300,172 | | | | | | | |

Total Real estate loans | | 11,380,139 | | 28,650,716 | | 40,030,855 | | 92 | % | 67 | % | 73 | % |

All other | | 951,750 | | 14,040,923 | | 14,992,673 | | 8 | % | 33 | % | 27 | % |

Total Loans | | 12,331,889 | | 42,691,639 | | 55,023,528 | | 100 | % | 100 | % | 100 | % |

Source: ICBC Form 8-K filed 10/18/2005 and SOV Form 8-K filed 10/19/2005

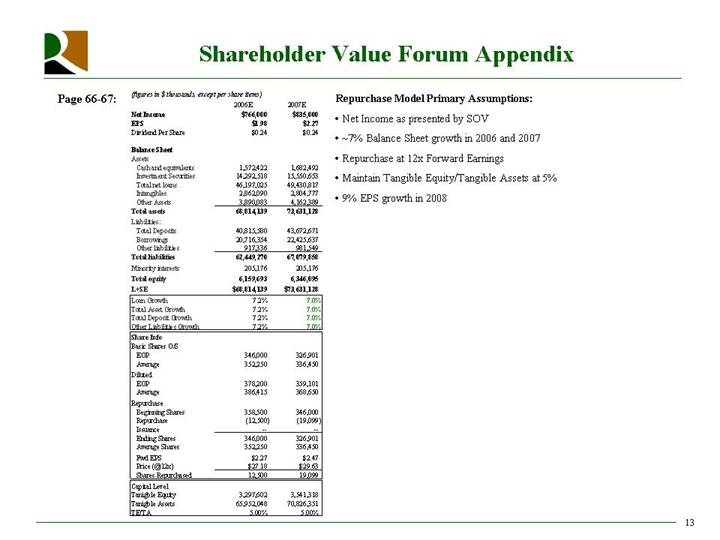

Page 64:

| | SOV | | ICBC | | ASO | | CBSS | | CMA | | CNB | | FHN | | MI | | MTB | | NFB | | RF | | SNV | | TCB | | ZION | | Peer Median | |

Investment Securities/Assets (%) | | 20.3 | | 19.2 | | 23.3 | | 22.8 | | 14.2 | | 14.1 | | 13.1 | | 14.1 | | 15.0 | | 20.9 | | 15.1 | | 10.5 | | 11.0 | | 14.9 | | 14.6 | |

Deposits/Liabilities (%) | | 65.4 | | 64.7 | | 75.1 | | 67.5 | | 88.7 | | 79.5 | | 73.494 | | 66.8 | | 75.9 | | 75.7 | | 80.4 | | 84.5 | | 75.3 | | 83.6 | | 75.8 | |

Loans/Deposits (%) | | 113.5 | | 117.4 | | 96.2 | | 110.7 | | 96.5 | | 96.5 | | 75.8 | | 122.7 | | 108.4 | | 88.8 | | 98.1 | | 103.1 | | 112.4 | | 93.4 | | 97.3 | |

Borrowings/Borrowings + Deposits (%) | | 33.6 | | 34.0 | | 22.0 | | NA | | 9.0 | | 20.2 | | 20.4 | | 30.6 | | 22.9 | | 23.1 | | 17.8 | | 13.4 | | 22.9 | | 14.8 | | 20.4 | |

Yield on Loans (%) | | 5.7 | | 5.6 | | 5.8 | | 6.2 | | 6.0 | | 6.7 | | NA | | 6.1 | | 6.3 | | 5.7 | | 6.4 | | 6.9 | | 6.6 | | 6.9 | | 6.3 | |

Source: SNL Datasource and public documents

10

Page 65-67:

ICBC Forecasts

| | Net Income | | Shares | | EPS | |

| | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | |

Bear Stearns | | 205 | | No Estimate | | 77.1 | | No Estimate | | $ | 2.66 | | — | |

Keefe Bruyette Woods | | 202 | | No Estimate | | 80.1 | | No Estimate | | $ | 2.52 | | — | |

Sandler O’Neill | | 208 | | No Estimate | | 78.4 | | No Estimate | | $ | 2.65 | | — | |

Moors & Cabot | | 200 | | No Estimate | | 78.6 | | No Estimate | | $ | 2.55 | | — | |

Lehman Bros. | | 227 | | No Estimate | | 78.6 | | No Estimate | | $ | 2.89 | | — | |

Freidman Billings Ramsey | | 204 | | No Estimate | | 75.8 | | No Estimate | | $ | 2.69 | | — | |

RBC Capital | | NA | | No Estimate | | NA | | No Estimate | | NA | | — | |

Janney Montgomerey | | 210 | | No Estimate | | 76.4 | | No Estimate | | $ | 2.75 | | — | |

CL King | | NA | | No Estimate | | NA | | No Estimate | | NA | | — | |

FTN Midwest | | 203 | | 224 | | 77.0 | | 75.2 | | $ | 2.64 | | $ | 2.98 | |

Average | | 208 | | 224 | | 77.7 | | 75.2 | | $ | 2.67 | | $ | 2.98 | |

SOV Forecasts

| | Net Income | | Shares | | EPS | |

| | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | |

Bear Stearns | | 748 | | No Estimate | | 392 | | No Estimate | | $ | 1.91 | | — | |

Cohen Bros. | | NA | | No Estimate | | NA | | No Estimate | | NA | | — | |

Ryan Beck | | 788 | | No Estimate | | 385 | | No Estimate | | $ | 2.05 | | — | |

JP Morgan | | 730 | | No Estimate | | 375 | | No Estimate | | $ | 1.95 | | — | |

Sandler O’Neill | | NA | | No Estimate | | NA | | No Estimate | | NA | | — | |

Banc of America | | 754 | | No Estimate | | 386 | | No Estimate | | $ | 1.95 | | — | |

Advest | | 752 | | No Estimate | | 389 | | No Estimate | | $ | 1.94 | | — | |

RBC Capital | | NA | | No Estimate | | NA | | No Estimate | | NA | | — | |

AG Edwards | | 767 | | No Estimate | | 393 | | No Estimate | | $ | 1.95 | | — | |

Susquehanna | | 735 | | No Estimate | | 375 | | No Estimate | | $ | 1.96 | | — | |

Keefe Bruyette Woods | | 739 | | No Estimate | | 379 | | No Estimate | | $ | 1.95 | | — | |

Moors & Cabot | | 714 | | No Estimate | | 375 | | No Estimate | | $ | 1.90 | | — | |

Freidman Billings Ramsey | | 741 | | No Estimate | | 385 | | No Estimate | | $ | 1.92 | | — | |

CL King | | NA | | No Estimate | | NA | | No Estimate | | NA | | — | |

Lehman Bros. | | 789 | | No Estimate | | 381 | | No Estimate | | $ | 2.07 | | �� | |

UBS | | 714 | | 736 | | 376 | | 368 | | $ | 1.90 | | $ | 2.00 | |

Citigroup | | 748 | | 804 | | 383 | | 374 | | $ | 1.95 | | $ | 2.15 | |

Average | | 748 | | 770 | | 383 | | 371 | | $ | 1.96 | | $ | 2.08 | |

Note: All forecasts are most recent forecasts prior to ICBC/Santander announcement. SOV I/B/E/S 2007 EPS forecast is $2.08 compared to $2.14 which SOV presented. Most recent I/B/E/S 2007 EPS estimate priorto ICBC/Santander announcement was $2.08 (updated 10/6/05). Although some estimates are missing due to limited availability, all average EPS match I/B/E/S EPS as presented by Sovereign, with the exception of SOV 2007 EPS.

Source: Thomson Baseline, Bloomberg I/B/E/S Estimates, analyst research reports and discussions with analysts

11

Page 66-67:

($ in millions, except per share amounts)

| | SOV Presentation | | Actual Analyst

Net Income Projections | |

| | Year Ended December 31, | | Year Ended December 31, | |

Earnings Projections | | 2006 | | 2007 | | 2006 | | 2007 | |

SOV Earnings | | 766 | | 835 | | 748 | | 770 | |

ICBC Earnings | | 109 | | 240 | | 104 | | 224 | |

ICBC Expected Costs Saves | | 11 | | 28 | | 11 | | 28 | |

SOV Financing Cost | | (19 | ) | (38 | ) | (19 | ) | (38 | ) |

ICBC Core Deposit Intangible Amortization | | (14 | ) | (26 | ) | (14 | ) | (26 | ) |

Elimination of ICBC CDI and Other Amortization | | 3 | | 6 | | 3 | | 6 | |

ICBC Opportunity Cost of Restructuring Charge | | (2 | ) | (5 | ) | (2 | ) | (5 | ) |

Cumulative Mark-to-Market Adjustments Impact | | (2 | ) | 4 | | (2 | ) | 4 | |

Impact of Exploding ESOP | | 1 | | 2 | | 1 | | 2 | |

| | | | | | | | | |

Pro forma Net Income | | 854 | | 1,046 | | 830 | | 965 | |

Pro forma Cash Net Income | | 904 | | 1,100 | | 880 | | 1,019 | |

| | | | | | | | | |

Sovereign Stand-alone EPS | | $ | 1.96 | | $ | 2.14 | | $ | 1.96 | | $ | 2.08 | |

Acquirer Pro forma EPS | | $ | 1.97 | | $ | 2.18 | | $ | 1.91 | | $ | 2.01 | |

GAAP Accretion / dilution to Sovereign shareholders | | 0.1 | % | 2.1 | % | (2.4 | )% | (3.1 | )% |

| | | | | | | | | |

Stand-alone cash EPS | | $ | 2.06 | | $ | 2.23 | | $ | 2.08 | | $ | 2.20 | |

Acquirer Pro forma Cash EPS | | $ | 2.08 | | $ | 2.30 | | $ | 2.03 | | $ | 2.13 | |

Cash Accretion / dilution to Sovereign shareholders | | 0.8 | % | 3.1 | % | (2.4 | )% | (3.1 | )% |

Note: SOV presented 2007 Consensus EPS of $2.14. The most recentI/B/E/S SOV 2007EPS estimate prior to announcement was $2.08 (as of 10/6/05). Although SOV states $2.14 is the I/B/E/S consensus, analysis has been done using corrected $2.08 EPS and associated consensus net income projections.

12

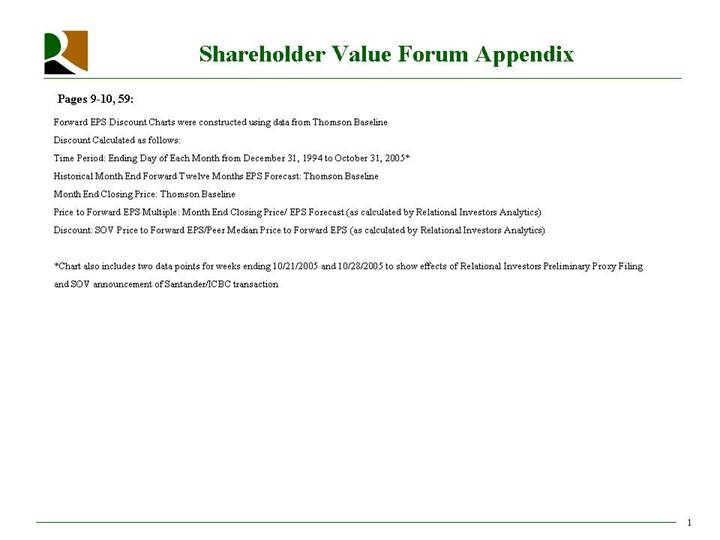

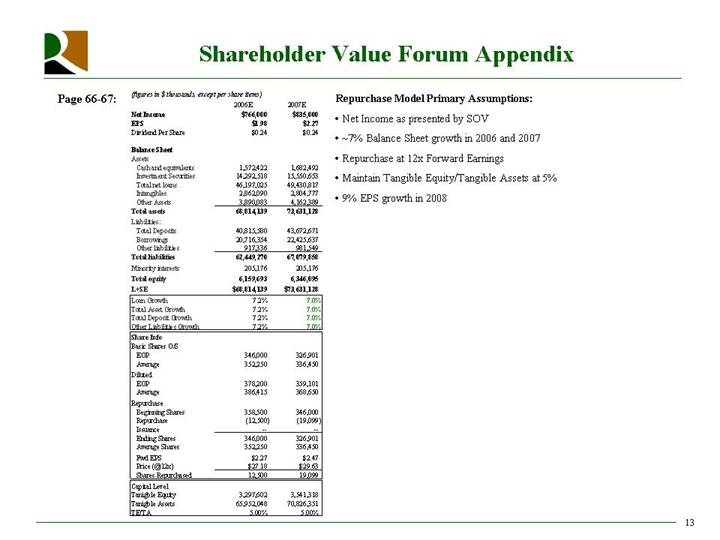

Page 66-67:

(figures in $ thousands, except per share items)

| | 2006E | | 2007E | |

Net Income | | $ | 766,000 | | $ | 835,000 | |

EPS | | $ | 1.98 | | $ | 2.27 | |

Dividend Per Share | | $ | 0.24 | | $ | 0.24 | |

| | | | | |

Balance Sheet | | | | | |

Assets | | | | | |

Cash and equivalents | | 1,572,422 | | 1,682,492 | |

Investment Securities | | 14,292,518 | | 15,550,653 | |

Total net loans | | 46,197,025 | | 49,430,817 | |

Intangibles | | 2,862,090 | | 2,804,777 | |

Other Assets | | 3,890,083 | | 4,162,389 | |

Total assets | | 68,814,139 | | 73,631,128 | |

Liabilities: | | | | | |

Total Deposits | | 40,815,580 | | 43,672,671 | |

Borrowings | | 20,716,354 | | 22,425,637 | |

Other liabilities | | 917,336 | | 981,549 | |

Total liabilities | | 62,449,270 | | 67,079,858 | |

Minority interests | | 205,176 | | 205,176 | |

Total equity | | 6,159,693 | | 6,346,095 | |

L+SE | | $ | 68,814,139 | | $ | 73,631,128 | |

Loan Growth | | 7.2 | % | 7.0 | % |

Total Asset Growth | | 7.2 | % | 7.0 | % |

Total Deposit Growth | | 7.2 | % | 7.0 | % |

Other Liabilities Growth | | 7.2 | % | 7.0 | % |

Share Info | | | | | |

Basic Shares O/S | | | | | |

EOP | | 346,000 | | 326,901 | |

Average | | 352,250 | | 336,450 | |

Diluted | | | | | |

EOP | | 378,200 | | 359,101 | |

Average | | 386,415 | | 368,650 | |

Repurchase | | | | | |

Beginning Shares | | 358,500 | | 346,000 | |

Repurchase | | (12,500 | ) | (19,099 | ) |

Issuance | | — | | — | |

Ending Shares | | 346,000 | | 326,901 | |

Average Shares | | 352,250 | | 336,450 | |

Fwd EPS | | $ | 2.27 | | $ | 2.47 | |

Price (@12x) | | $ | 27.18 | | $ | 29.63 | |

Shares Repurchased | | 12,500 | | 19,099 | |

Capital Level | | | | | |

Tanigble Equity | | 3,297,602 | | 3,541,318 | |

Tanigble Assets | | 65,952,048 | | 70,826,351 | |

TE/TA | | 5.00 | % | 5.00 | % |

Repurchase Model Primary Assumptions:

• Net Income as presented by SOV

• ~7% Balance Sheet growth in 2006 and 2007

• Repurchase at 12x Forward Earnings

• Maintain Tangible Equity/Tangible Assets at 5%

• 9% EPS growth in 2008

13

Sovereign Bancorp 2004 Compensation

Class | | | | Board Payment ($1000 per Board or Executive Cmte

Mtg) (1)(2) | | Bank Board Payment ($600 per Bank Board

Mtg) (1)(2) | | Chairman Comp (250 shares/Q per committee) (3) | | Audit and Lead Director Comp (250

Shares/Q) (3) | | Quarterly Comp (1,250

shares/Q) (3) | | Bank Director Quarterly Comp (375

shares/Q) (3) | | Non-Employee Directors Bonus Award | | Retainer | | Total | |

| | Non-Management Directors | | | | | | | | | | | | | | | | | | | |

III | | Michael P. Ehlerman | | $ | 14,000 | | $ | 8,400 | | $ | 21,973 | | | | $ | 109,863 | | $ | 32,959 | | $ | 112,750 | | | | $ | 299,944 | |

I | | Brian Hard | | $ | 14,000 | | $ | 8,400 | | $ | 21,973 | | $ | 21,973 | | $ | 109,863 | | $ | 32,959 | | $ | 112,750 | | | | $ | 321,916 | |

II | | Andrew C. Hove, Jr. | | $ | 14,000 | | $ | 8,400 | | $ | 21,973 | | | | $ | 109,863 | | $ | 32,959 | | $ | 112,750 | | | | $ | 299,944 | |

II | | Daniel K. Rothermel (lead director) | | $ | 14,000 | | $ | 8,400 | | $ | 43,945 | | $ | 21,973 | | $ | 109,863 | | $ | 32,959 | | $ | 112,750 | | | | $ | 343,889 | |

I | | Cameron C. Troilo | | $ | 14,000 | | $ | 8,400 | | $ | 21,973 | | | | $ | 109,863 | | $ | 32,959 | | $ | 112,750 | | | | $ | 299,944 | |

| | Average Non-Management Director Pay (4) | | | | | | | | | | | | | | | | | | $ | 313,127 | |

| | | | | | | | | | | | | | | | | | | | | |

| | Management Directors | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

III | | Jay Sidhu (Chairman) | | | | | | | | | | | | | | | | | | | |

Class | | | | Audit

(met 12x) | | Nominating

(met 6x) | | Ethics & Corporate Governance

(met 5x) | | Compensation

(met 7x) | | Mergers & Acquisition

(met 1x) | | Retirment Savings Plan

(met 4x) | | Executive

(met 0x) | |

| | Non-Management Directors | | | | | | | | | | | | | | | |

III | | Michael P. Ehlerman | | X | | X | | | | X | | | | X | (C) | | |

I | | Brian Hard | | X | (C) | X | | X | | X | | X | | X | | X | |

II | | Andrew C. Hove, Jr. | | X | | X | | X | (C) | X | | | | | | X | |

II | | Daniel K. Rothermel (lead director) | | X | (VC) | X | (C) | X | | X | | X | | X | | X | (C) |

I | | Cameron C. Troilo | | | | X | | X | | X | (C) | X | | X | | X | |

| | Average Non-Management Director Pay (4) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | Management Directors | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

III | | Jay Sidhu (Chairman) | | | | | | | | | | X | (C) | X | | X | |

(1) Assumes attendance to all meetings

(2) Assumes equal number of Sovereign Bancorp and Sovereign Bank Board Meetings

(3) Shares are priced at the end of each quarter, 1Q: $21.42, 2Q: $22.10, 3Q: $21.82, 4Q: $22.55

(4) Does not include Marian L. Heard who joined the Board in 2005

C = Chairperson

VC = Vice Chairperson

COMPENSATION PAID TO DIRECTORS

All non-employee directors of Sovereign elected or appointed prior to March 24, 2004, receive $1,000 cash for each Sovereign Board or Executive Committee meeting which the director attends and an additional $600 cash for which Sovereign Bank Board meeting which the director attends if the director is also a director of Sovereign Bank. Chairpersons for each committee of Sovereign’s Board receive 250 shares of Sovereign common stock per quarter per service as a committee chairperson. All non-employee directors elected or appointed prior to march 24, 2004, receive compensation in the amount of 1,250 shares of Sovereign common stock per quarter, plus an additional 375 shares per quarter if the director is also a director of Sovereign Bank. For the year ended December 31, 2004, each individual elected or appointed prior to March 24, 2004, who served as a non-employee director of Sovereign for the full year received 5,000 shares of Sovereign common stock, $1,000 for each Board and Executive Committee meeting attended and 1,000 shares of Sovereign common stock for each committee for which such person served as chairperson. In addition, the Chairperson of the Audit Committee and the presiding or “lead director” of the Board, each received an additional 250 shares of Sovereign common stock per quarter for their services.

A non-employee director appointed or elected after March 24, 2004 receives, as payment for services as a director, an annual cash retainer of $63,000, an additional cash payment of $1,000 for each Sovereign Board meeting attended and $600 for attendance at each Sovereign Bank Board meeting if the director is also director of Sovereign Bank. After completion of five years of service as a non-employee director, a director appointed or elected after March 24, 2004, is eligible to receive 100% of the amount of compensation payable to non-employee directors appointed or elected prior to March 24, 2004.

In June 2002, Sovereign’s Board of Directors adopted the Non-Employee Directors Bonus Award Program. The program was amended in January 2004 to provide that any bonus earned under the program will be determined and paid as hereinafter described. The program provides that each individual who is serving as a non-employee director of Sovereign as of December 31, 2003 will be entitled to participate and, therefore, be entitled to bonuses, payable in cash, if certain financial objectives are met or exceeded for calendar years 2004, 2005, 2006 or 2007 and the non-employee director satisfies the program’s continued services requirements.....The Compensation Committee determined, after review of all relevant information with respect to the 2004 cash earnings target and the additional financial objectives, that the specified cash earnings target for 2004 as well as the additional financial objectives for 2004 were achieved. Each non-employee director received a cash payment of $112,750 based on the value of 5,000 shares of Sovereign common stock on December 31, 2004. The program was further amended in February 2005 to limit the amount of a cash bonus that may be earned for each of 2005, 2006 and 2007 to $112,750.

Citigroup

2004 Director Compensation

Class | | | | Retainer | | Stock Options (5,000 shares)(1) | | Committee Chairs

($15,000/Y) | | Audit Committee Chair ($25,000/Y) | | Total | | Executive | | Audit & Risk Mgmt | | Personnel & Compensation | | Nomination & Governance | | Public Affairs | |

| | Non-Management Directors | | | | | | | | | | | | | | | | | | | | | |

| | C. Michael Armstrong | | $ | 125,000 | | $ | 51,177 | | | | $ | 25,000 | | $ | 201,177 | | | | x | (c) | | | x | | | |

| | Alain J.P. Belda | | $ | 125,000 | | $ | 51,177 | | $ | 15,000 | | | | $ | 191,177 | | x | | x | | x | | x | (c) | | |

| | George David | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | | | x | | | | | | | |

| | Kenneth T. Derr | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | x | | | | x | | x | | | |

| | John M. Deutch | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | | | x | | | | x | | x | |

| | Ann Dibble Jordan | | $ | 125,000 | | $ | 51,177 | | $ | 15,000 | | | | $ | 191,177 | | | | | | | | | | x | (c) |

| | Dudley C. Mecum | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | x | | | | | | | | x | |

| | Richard D. Parsons | | $ | 125,000 | | $ | 51,177 | | $ | 15,000 | | | | $ | 191,177 | | | | | | x | (c) | x | | | |

| | Andrall E. Pearson | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | | | | | x | | | | | |

| | Robert E. Rubin | | $ | 125,000 | | $ | 51,177 | | $ | 15,000 | | | | $ | 191,177 | | x | (c) | | | | | | | | |

| | Franklin A. Thomas | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | x | | | | | | | | x | |

| | Gerald R. Ford* | | $ | 125,000 | | $ | 51,177 | | | | | | $ | 176,177 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Average Non-Management Director Pay | | | | | | | | | | $ | 183,260 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Management Directors | | | | | | | | | | | | | | | | | | | | | |

| | Charles Prince | | Chief Executive Officer, Citigroup Inc. | | | | | | | | | | | | | |

| | Sanford I. Weill | | Chairman, Citigroup Inc. | | | | | | | | | | | | | | | |

| | Robert B. Willumstad (COO) | | President and Chief Operating Officer, Citigroup Inc., President and Chief Executive Officer, Citicorp and Citibank, N.A. | | | | | |

| | Roberto Hernandez Ramirez | | Chairman of the Board, Banco Nacional de Mexico | | | | | | | | | | | | | |

*Honorary director. 0.02881

C = Chairperson 0.03004

(1) Option Assumptions and Source

Grant Date | | 1/20/04 | | Proxy (Executive Grant Date) | | | | | | | | | | | | |

Exercise Price | | $ | 49.50 | | Proxy (exercise price = market price) | | | | | | | | | | | |

Market Price | | $ | 49.50 | | Closing price one-day prior to grant date | | | | | | | | | | |

Volatility | | 25.98 | % | 10-K | | | | | | | | | | | | | | | | | |

Risk-free rate | | 2.84 | % | 10-K | | | | | | | | | | | | | | | | | |

Dividend Yield | | 2.96 | % | 10-K | | | | | | | | | | | | | | | | | |

Vest Period (days) | | 365 | | Proxy | | | | | | | | | | | | | | | | | |

Life (days) | | 2,190 | | Proxy | | | | | | | | | | | | | | | | | |

Value | | $ | 10.24 | | BSM | | | | | | | | | | | | | | | | | |

COMPENSATION PAID TO DIRECTORS

Directors’ compensation is determined by the board. Since its initial public offering in 1986, Citigroup has paid outside directors all or a portion of their compensation in common stock, to assure that the directors have an ownership interest in common with other stockholders. Non-employee directors, other than Roberto Hernández who, except as described below, has waived receipt of compensation for his services as a director, and the honorary director currently receive an annual retainer of $125,000, payable either 100% in common stock, receipt of which may be deferred at the director’s election, or up to 50% in cash to cover taxes and the remainder in common stock. Directors may elect to receive all or a portion of this compensation in the form of an option to purchase shares of Citigroup common stock. The number of shares in the option grant are calculated by dividing the dollar amount elected by one-quarter of the fair market value of Citigroup common stock on the grant date. The fair market value is defined as the closing price of Citigroup common stock on the NYSE on the trading day immediately preceding the grant date.

The options vest and become exercisable in two equal annual installments beginning one year from the grant date and expire six years after the grant date. In addition, the outside directors and the honorary director receive an annual option grant to purchase 5,000 shares of Citigroup common stock. The calculation of the exercise price and other terms of these options are identical to those described above.

Except as described below, directors receive no additional compensation for participation on board committees and subcommittees. Committee and subcommittee chairs receive additional compensation of $15,000, except for the chair of the audit and risk management committee, who receives $25,000.

JPMorgan Chase & Co.

2004 Director Compensation

| | Annual Retainer ($75,000) | | Common Stock Grant (valued at $170,000) | | Audit Committee Retainer ($10,000) | | Chairman Retainer ($15,000) | | TOTAL | | Audit Committee (met 12x) | | Comp & Mgmt Committee (met 6x) | | Corp Governance & Nominating Committee (met 3x) | | Public Responsibility Committee (met 3x) | | Risk Policy Committee (met 7x) | |

Non-Management Directors | | | | | | | | | | | | | | | | | | | | | |

Hans W. Becherer | | $ | 75,000 | | $ | 170,000 | | $ | 10,000 | | | | $ | 255,000 | | x | | | | | | x | | | |

Riley P. Bechtel | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | | | | |

Frank A. Bennack, Jr. | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | | | | |

John H. Biggs | | $ | 75,000 | | $ | 170,000 | | $ | 10,000 | | | | $ | 255,000 | | x | | | | x | | | | | |

Lawrence A. Bossidy | | $ | 75,000 | | $ | 170,000 | | | | $ | 15,000 | | $ | 260,000 | | | | | | | | x | | x | (c) |

M. Anthony Burns | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | | | | |

Stephen B. Burke | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | x | | x | | | | | |

James S. Crown | | $ | 75,000 | | $ | 170,000 | | | | $ | 15,000 | | $ | 260,000 | | | | | | | | x | (c) | x | |

James Dimon | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | | | | |

H. Laurance Fuller | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | | | | |

Ellen V. Futter | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | x | | x | |

William H. Gray, III | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | x | | | | x | | | |

Laban P. Jackson | | $ | 75,000 | | $ | 170,000 | | $ | 10,000 | | $ | 15,000 | | $ | 270,000 | | x | (c) | | | x | | | | | |

Helene L. Kaplan | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | | | | |

John W. Kessler | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | x | | | | x | | | |

Robert I. Lipp | | $ | 75,000 | | $ | 170,000 | | | | | | $ | 245,000 | | | | | | | | x | | x | |

Richard A. Manoogian | | $ | 75,000 | | $ | 170,000 | | $ | 10,000 | | | | $ | 255,000 | | x | | | | | | x | | | |

David C. Novak | | $ | 75,000 | | $ | 170,000 | | | | $ | 15,000 | | $ | 260,000 | | | | x | | x | (cc) | | | | |

Lee R. Raymond | | $ | 75,000 | | $ | 170,000 | | | | $ | 15,000 | | $ | 260,000 | | | | x | | x | (cc) | | | | |

John R. Stafford | | $ | 75,000 | | $ | 170,000 | | | | $ | 15,000 | | $ | 260,000 | | | | x | (c) | x | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Average Non-Management Director Pay | | | | | | | | | | $ | $251,500 | | | | | | | | | | | |

Management Directors | | | | | | | | | | | | | | | | | | | | | |

William B. Harrison, Jr. | | Chairman and Chief Executive Officer, JPMorgan Chase and Co. | | | | | | | | | | | | | |

C = Chairperson

CC = Co-Chairman

COMPENSATION PAID TO DIRECTORS

Directors who are officers of the Firm do not receive any fees for their service as directors. Each non-management director receives an annual cash retainer of $75,000 and an annual grant of common stock equivalents valued at $170,000 on the date of grant. Each director who is a member of the Audit Committee receives an additional annual cash retainer of $10,000. Each chairman of a Board committee receives an additional fee of $15,000 per year.

The annual grant of common stock equivalents earns dividend equivalents and remains indexed to the Firm’s common stock until a director’s termination of service, at which time it is paid in cash or reallocated in accordance with elections permitted for deferred cash compensation. As stated in the Corporate Governance Principles, directors pledge that, for as long as they serve, they will retain all shares of the Firm’s common stock purchased on the open market or received pursuant to their service as a Board member.