Searchable text section of graphics shown above

Glass Lewis & Co.

Proxy Talk: Sovereign Bancorp, Inc.

Presented by

Ralph V. Whitworth

Relational Investors LLC

March 22, 2006

Disclaimer

The analyses presented in this document are based on information published by Sovereign Bancorp and others. Relational Investors LLC has relied upon these public disclosures without any ability or opportunity for independent verification.

On October 20, 2005, Relational, together with a number of affiliated persons and entities that may be deemed “participants” for purposes of the solicitation rules of the Securities and Exchange Commission (“SEC”), filed a preliminary proxy statement on Schedule 14A with the SEC relating to a possible solicitation of proxies from the shareholders of Sovereign Bancorp, Inc. (“Sovereign”) in connection with Relational’s nomination of Ralph Whitworth and David Batchelder for election to Sovereign’s board of directors at Sovereign’s 2006 Annual Meeting of shareholders. On December 13, 2005 and again on March 3, 2006, Relational filed with the SEC a revised preliminary proxy statement. Relational will prepare and file with the SEC a definitive proxy statement relating to its nomination of Messrs. Whitworth and Batchelder and its proposal to remove Jay Sidhu as a Sovereign director and may file other proxy solicitation materials. RELATIONAL ANTICIPATES THAT IT WILL FURTHER REVISE AND FILE THE PRELIMINARY PROXY STATEMENT AND SHAREHOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT AS REVISED (AND THE DEFINITIVE PROXY STATEMENT, WHEN IT BECOMES AVAILABLE) BECAUSE IT CONTAINS IMPORTANT INFORMATION REGARDING RELATIONAL’S NOMINATION OF MESSRS. WHITWORTH AND BATCHELDER FOR ELECTION AS DIRECTORS AND ITS PROPOSAL TO REMOVE JAY SIDHU AS A SOVEREIGN DIRECTOR. The preliminary proxy statement is, and the definitive proxy statement (when it becomes available) will be, available for free at www.sec.gov, along with any other relevant documents. You may also obtain a free copy of the preliminary proxy statement, or the definitive proxy statement (when it becomes available), by contacting Maudie Holland of Relational at (858) 704-3321, or by sending an email to maudie@rillc.com. Information regarding the names, affiliation, and interests of persons who may be deemed to be participants in our solicitation of proxies of Sovereign’s shareholders is available in the preliminary proxy statement filed with the SEC on March 3, 2006.

1

Investment in Sovereign Bancorp, Inc.:

Chronology of key events

June 3, 2004 | | Relational initiates purchase of Sovereign shares |

| | |

October 5, 2004 | | Relational meets with Sovereign CEO Jay Sidhu to discuss Sovereign’s trading discount, capital allocation, and management credibility |

| | |

November 9, 2004 | | Relational writes Mr. Sidhu recommending improvements to Sovereign’s corporate governance |

| | |

January 31, 2005 | | Relational meets with Mr. Sidhu and Lead Director Dan Rothermel to discuss Sovereign’s continued share price discount |

| | |

May 23, 2005 | | Relational meets with Sovereign’s board of directors and recommends reducing Sovereign’s excessive director compensation and eliminating the discriminatory director compensation structure and unusual director bonus plan |

| | |

May 24, 2005 | | Sovereign announces that the directors have removed the discriminatory two-tiered director compensation structure and engaged a consulting firm to review its director compensation system |

| | |

May 26, 2005 | | Relational files its 13-D announcing that if Sovereign’s board does not improve Relational would seek board representation |

| | |

August 1, 2005 | | Sovereign announces that the directors have removed the director bonus compensation plan and reduced their compensation levels |

| | |

October 20, 2005 | | Relational files a preliminary proxy statement signaling its intention to nominate two directors for election at Sovereign’s 2006 annual shareholder meeting |

| | |

October 24, 2006 | | Sovereign announces the dilutive Santander and Independence transactions |

| | |

November 8, 2005 | | • Relational holds a Shareholder Value Forum in New York City |

| | • Relational petitions the New York Stock Exchange to require Sovereign to subject the Santander transaction to a shareholder vote |

| | |

November 10, 2005 | | Sovereign sues Relational opposing its request to examine Sovereign’s books and records |

| | |

November 22, 2005 | | • New York Stock Exchange requires Santander and Sovereign to restructure their transaction |

| | • Santander transaction to proceed without shareholder approval

• Sovereign files an 8-K verifying many of Relational’s assertions regarding director business dealings with the company |

2

December 12, 2005 | | Relational sues Sovereign and Santander under Pennsylvania’s control transaction statute. If Sovereign and Santander are found to have violated this law, Santander would be required to offer “fair value” for all Sovereign shares. |

| | |

December 13, 2005 | | Relational files a revised preliminary proxy statement |

| | |

December 20, 2005 | | Relational petitions the SEC seeking its determination that the New York Stock Exchange improperly allowed the Santander transaction to proceed without shareholder approval |

| | |

December 22, 2005 | | Relational announces that it may seek to remove the entire board of directors of Sovereign |

| | |

December 23, 2005 | | Sovereign sues Relational seeking a determination that shareholders do not have a right to remove Sovereign directors labeling as “scrivener’s errors” its many years of promises that shareholders had this right |

| | |

December 27, 2005 | | Relational counter sues Sovereign seeking a determination that shareholders have a right to remove Sovereign directors |

| | |

January 4, 2006 | | Sovereign announces that it is delaying its 2006 annual shareholders meeting to an undetermined date |

| | |

January 5, 2006 | | Relational amends its lawsuit to request that the court block Sovereign’s proposed postponement of the 2006 annual meeting |

| | |

January 12, 2006 | | Relational announces that it will seek the removal of CEO Jay Sidhu as a director of Sovereign |

| | |

February 2, 2006 | | Sovereign lobbies the Pennsylvania state legislature which approves a bill eliminating two Pennsylvania shareholder rights upon which Relational’s lawsuits relied |

| | |

February 16, 2006 | | Relational drops a lawsuit requiring Santander to offer “fair value” for all Sovereign shares due to the impact of the new Pennsylvania law |

| | |

March 2, 2006 | | Relational files suit challenging the constitutionality of the Pennsylvania Legislature’s elimination of shareholder rights |

| | |

March 2, 2006 | | New York District Court rules that despite the Pennsylvania Legislature’s action Sovereign shareholders have the right to remove directors |

3

Why We Invested

Investment considerations:

• Long-term share price discount

• Management credibility gap

• Enterprise risk

• Operating performance

• Clear paths to improvement

4

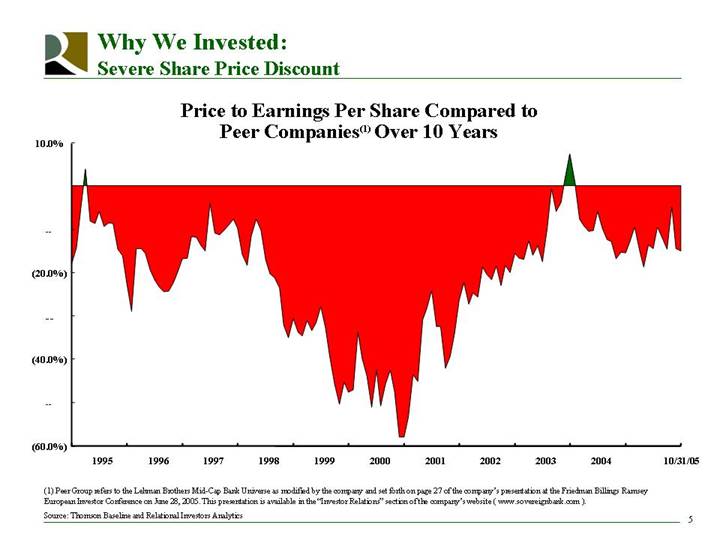

Why We Invested:

Severe Share Price Discount

Price to Earnings Per Share Compared to

Peer Companies(1) Over 10 Years

[CHART]

(1) Peer Group refers to the Lehman Brothers Mid-Cap Bank Universe as modified by the company and set forth on page 27 of the company’s presentation at the Friedman Billings Ramsey European Investor Conference on June 28, 2005. This presentation is available in the “Investor Relations” section of the company’s website ( www.sovereignbank.com ).

Source: Thomson Baseline and Relational Investors Analytics

5

Why Seek Board Representation

Directors can help address:

• Corporate governance concerns

• Conflicts of interest

• Board and management unresponsive to shareholders

6

Why Seek Board Representation:

Corporate governance and conflicts of interest concerns

We believe the following are indicative of corporate governance failings:

• Board approved unprecedented director “bonus” plan tied to CEO’s goals set by the board; allowed to persist for several years until we brought it to the board’s attention

• Board allowed Lead Director to provide landscaping and building maintenance services to the company

• Board allowed Compensation Committee Chairman to buy bank properties with prices approved by management

• Board failed to require appropriate proxy statement disclosure of rent payments to Compensation Committee Chairman

• Board approved discriminatory board compensation policy; allowed to persist between March 2004 and May 2005

7

Why Seek Board Representation:

Unresponsive board and management

We believe directors should be held accountable to the shareholders for the following:

• Board has not properly monitored management’s public disclosures

• Board has tolerated a management that has not improved the company’s profitability

• Board has allowed company’s customer satisfaction to be worst among industry peers (1)

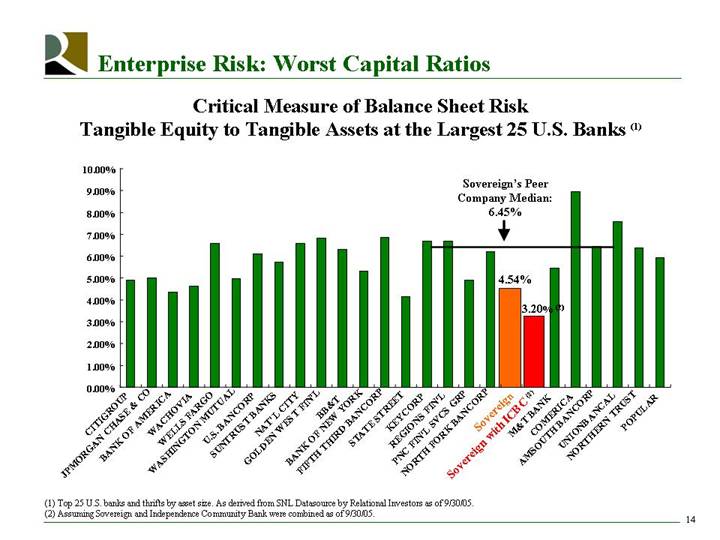

• Board has approved acquisition that will push company’s critical capital ratios to the worst of industry peers (2)

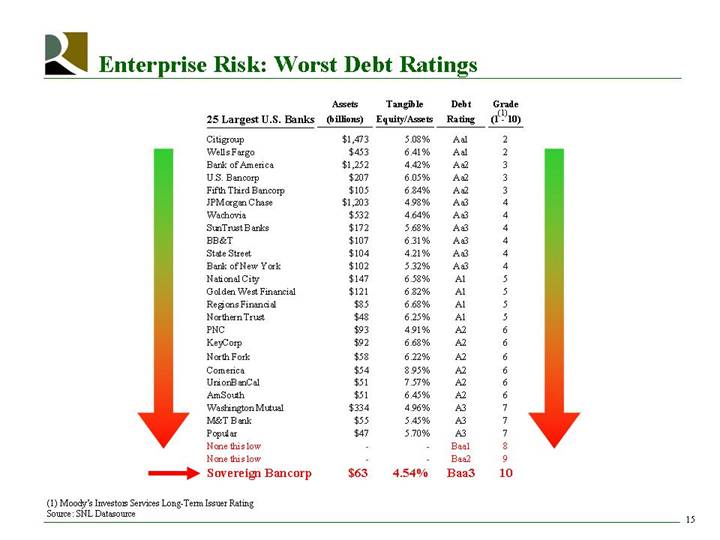

• Board has allowed company’s debt rating to languish as the worst among industry peers (3)

(1) Source: Retail Banking Satisfaction Study ©2006 J.D. Power and Associates, The McGraw Hill Companies, Inc. as published in BAI Banking Strategies, March/April 2006

(2) See page 14 of this presentation

(3) See page 15 of this presentation

8

Compensation Committee Chairman Conflicts

Rent Payments by Sovereign Bancorp to Mr. Troilo, While the Board’s Compensation Committee Chairman

• From 1996 to 2001, rent paid to Troilo and affiliates increased 803%

• The board suddenly stopped reporting the amount of rent paid to Mr. Troilo after 2002

• The 2004 Proxy Statement reported the relationship as follows:

“The Board also concluded that a landlord and tenant relationship between another non-management director and Sovereign Bank did not affect the independence of that director …”

9

Annual Rent Payments By Sovereign Bancorp To Mr. Troilo, The Board’s Compensation Committee Chairman (1)

[CHART]

(1) Includes amounts disclosed to shareholders in Sovereign’s annual proxy statements for corresponding periods.

(2) As projected by Sovereign in their December 8, 2005 8K filing.

10

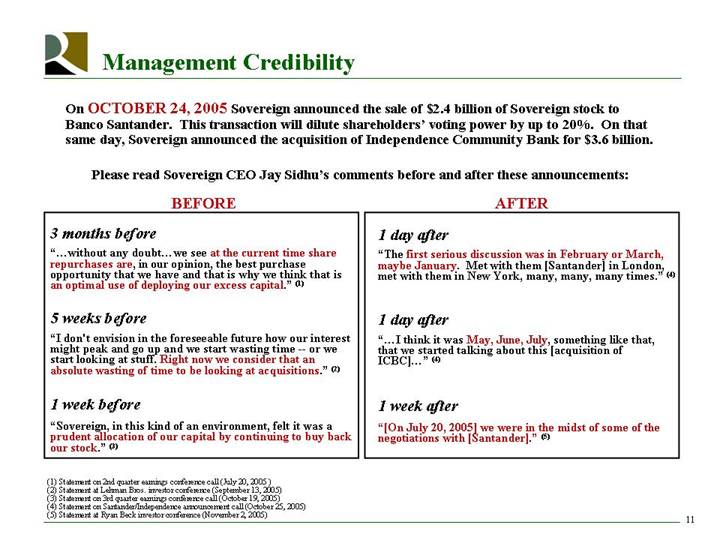

Management Credibility

On OCTOBER 24, 2005 Sovereign announced the sale of $2.4 billion of Sovereign stock to Banco Santander. This transaction will dilute shareholders’ voting power by up to 20%. On that same day, Sovereign announced the acquisition of Independence Community Bank for $3.6 billion.

Please read Sovereign CEO Jay Sidhu’s comments before and after these announcements:

BEFORE

3 months before

“…without any doubt…we see at the current time share repurchases are, in our opinion, the best purchase opportunity that we have and that is why we think that is an optimal use of deploying our excess capital.” (1)

5 weeks before

“I don’t envision in the foreseeable future how our interest might peak and go up and we start wasting time — or we start looking at stuff. Right now we consider that an absolute wasting of time to be looking at acquisitions.” (2)

1 week before

“Sovereign, in this kind of an environment, felt it was a prudent allocation of our capital by continuing to buy back our stock.” (3)

AFTER

1 day after

“The first serious discussion was in February or March, maybe January. Met with them [Santander] in London, met with them in New York, many, many, many times.” (4)

1 day after

“…I think it was May, June, July, something like that, that we started talking about this [acquisition of ICBC]…” (4)

1 week after

“[On July 20, 2005] we were in the midst of some of the negotiations with [Santander].” (5)

(1) Statement on 2nd quarter earnings conference call (July 20, 2005 )

(2) Statement at Lehman Bros. investor conference (September 13, 2005)

(3) Statement on 3rd quarter earnings conference call (October 19, 2005)

(4) Statement on Santander/Independence announcement call (October 25, 2005)

(5) Statement at Ryan Beck investor conference (November 2, 2005)

11

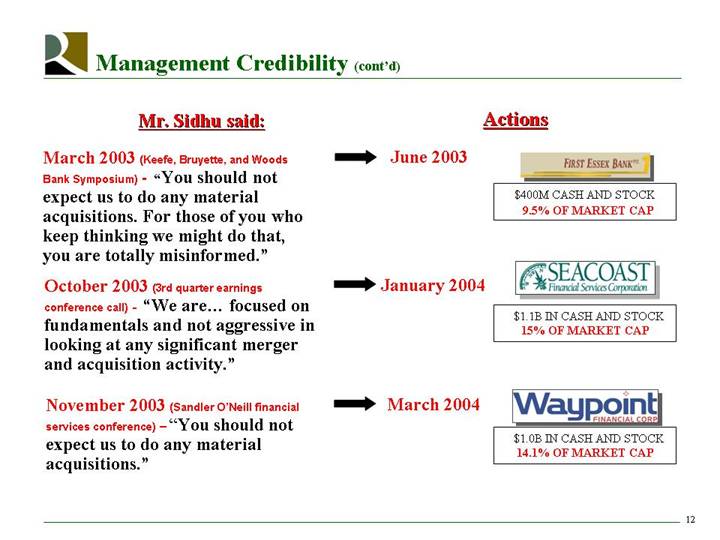

Mr. Sidhu said: | | Actions |

| | | |

March 2003 (Keefe, Bruyette, and Woods Bank Symposium) - “You should not expect us to do any material acquisitions. For those of you who keep thinking we might do that, you are totally misinformed.” | => | June 2003 | [LOGO]

$400M CASH AND STOCK

9.5% OF MARKET CAP |

| | | |

October 2003 (3rd quarter earnings conference call) - “We are... focused on fundamentals and not aggressive in looking at any significant merger and acquisition activity.” | => | January 2004 | [LOGO]

$1.1B IN CASH AND STOCK

15% OF MARKET CAP |

| | | |

November 2003 (Sandler O’Neill financial services conference) – “You should not expect us to do any material acquisitions.” | => | March 2004 | [LOGO]

$1.0B IN CASH AND STOCK

14.1% OF MARKET CAP |

12

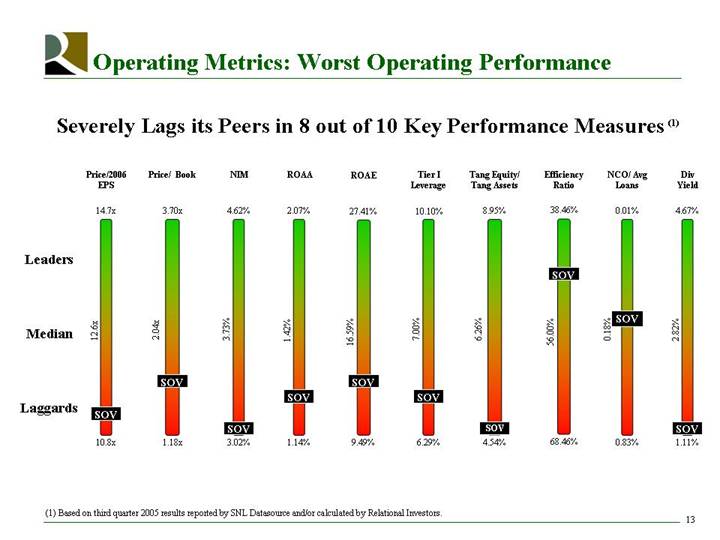

Operating Metrics: Worst Operating Performance

Severely Lags its Peers in 8 out of 10 Key Performance Measures (1)

[CHART]

(1) Based on third quarter 2005 results reported by SNL Datasource and/or calculated by Relational Investors.

13

Enterprise Risk: Worst Capital Ratios

Critical Measure of Balance Sheet Risk

Tangible Equity to Tangible Assets at the Largest 25 U.S. Banks (1)

[CHART]

(1) Top 25 U.S. banks and thrifts by asset size. As derived from SNL Datasource by Relational Investors as of 9/30/05.

(2) Assuming Sovereign and Independence Community Bank were combined as of 9/30/05.

14

Enterprise Risk: Worst Debt Ratings

| | | | | | | | | | Grade | |

|

| | | Assets | | Tangible | | Debt | | (1) | |

| 25 Largest U.S. Banks | | (billions) | | Equity/Assets | | Rating | | (1 - 10) | |

| | | | | | | | | | |

| Citigroup | | $ | 1,473 | | 5.08 | % | Aa1 | | 2 | |

| Wells Fargo | | $ | 453 | | 6.41 | % | Aa1 | | 2 | |

| Bank of America | | $ | 1,252 | | 4.42 | % | Aa2 | | 3 | |

| U.S. Bancorp | | $ | 207 | | 6.05 | % | Aa2 | | 3 | |

| Fifth Third Bancorp | | $ | 105 | | 6.84 | % | Aa2 | | 3 | |

| JPMorgan Chase | | $ | 1,203 | | 4.98 | % | Aa3 | | 4 | |

| Wachovia | | $ | 532 | | 4.64 | % | Aa3 | | 4 | |

| SunTrust Banks | | $ | 172 | | 5.68 | % | Aa3 | | 4 | |

| BB&T | | $ | 107 | | 6.31 | % | Aa3 | | 4 | |

| State Street | | $ | 104 | | 4.21 | % | Aa3 | | 4 | |

| Bank of New York | | $ | 102 | | 5.32 | % | Aa3 | | 4 | |

| National City | | $ | 147 | | 6.58 | % | A1 | | 5 | |

| Golden West Financial | | $ | 121 | | 6.82 | % | A1 | | 5 | |

| Regions Financial | | $ | 85 | | 6.68 | % | A1 | | 5 | |

| Northern Trust | | $ | 48 | | 6.25 | % | A1 | | 5 | |

| PNC | | $ | 93 | | 4.91 | % | A2 | | 6 | |

| KeyCorp | | $ | 92 | | 6.68 | % | A2 | | 6 | |

| North Fork | | $ | 58 | | 6.22 | % | A2 | | 6 | |

| Comerica | | $ | 54 | | 8.95 | % | A2 | | 6 | |

| UnionBanCal | | $ | 51 | | 7.57 | % | A2 | | 6 | |

| AmSouth | | $ | 51 | | 6.45 | % | A2 | | 6 | |

| Washington Mutual | | $ | 334 | | 4.96 | % | A3 | | 7 | |

| M&T Bank | | $ | 55 | | 5.45 | % | A3 | | 7 | |

| Popular | | $ | 47 | | 5.70 | % | A3 | | 7 | |

| None this low | | — | | — | | Baa1 | | 8 | |

| None this low | | — | | — | | Baa2 | | 9 | |

=> | Sovereign Bancorp | | $ | 63 | | 4.54 | % | Baa3 | | 10 | |

(1) Moody’s Investors Services Long-Term Issuer Rating

Source: SNL Datasource

15