Exhibit 99.7

Royal Group Technologies Limited

NOTICEand MANAGEMENT

PROXY CIRCULAR

for the

Annual and Special Meeting of Shareholders

May 25, 2005

April 22, 2005

ROYAL GROUP TECHNOLOGIES LIMITED

INVITATION TO SHAREHOLDERS

Dear Shareholder:

On behalf of the board of directors, management and employees, I invite you to attend our Annual and Special Meeting of Shareholders on Wednesday, May 25, 2005.

At this meeting, we will review our business, activities and financial results for fiscal 2004 as well as our plans for the future. You will also have an opportunity to ask questions and to meet our directors and executives. The items of business to be considered at this meeting are described in the Notice and Management Proxy Circular included in this package. For more information, please see our 2004 Annual Report, quarterly results and other corporate information also available at www.royalgrouptech.com in the “Investor Relations” sector.

Importantly, at the meeting you will be asked to vote on a special resolution to eliminate our Multiple Voting Shares and Subordinate Voting Shares and replace them with a single class of common shares with equal voting rights.

No matter how many shares you hold, your participation at this meeting is very important. We hope you will be able to join us, in person, or through our webcast, which will be available live at www.royalgrouptech.com in the “Investor Relations” section. If you are unable to attend the meeting in person, we encourage you to vote by following the voting instructions included on the enclosed proxy form.

A recorded version of the meeting will be available at www.royalgrouptech.com until our next annual meeting of shareholders.

Yours truly,

-s- Robert E. Lamoureux

Robert E. Lamoureux

Lead Director

April 22, 2005

ROYAL GROUP TECHNOLOGIES LIMITED

Notice Of Annual And Special Meeting Of Shareholders

You are invited to our annual and special shareholders’ meeting. |

| |

When |

| May 25, 2005 |

| 4:15 p.m. (local time). |

| |

Where |

| Metro Toronto Convention Centre |

| South Building |

| Meeting Room 701 |

| 222 Bremner Blvd. |

| Toronto, Ontario |

| |

You have the Right to Vote |

| |

| You are entitled to receive notice of and vote at our annual and special shareholders’ meeting or any adjournment if you were a holder of Multiple Voting Shares or Subordinate Voting Shares on April 19, 2005. |

| |

Your Vote is Important |

| |

| It is very important that you read this material carefully and then vote your shares, either by proxy or in person at the meeting. The Management Information Circular sent with this notice tells you more about the matters to be considered at the meeting and how to vote your shares. |

| |

What the Meeting is About |

| |

| 1. Receiving our consolidated financial statements for the 15 month period ended December 31, 2004, including the auditors’ report. |

| 2. Electing directors to serve until the end of our next annual shareholder meeting. |

| 3. Appointing auditors to serve until the end of our next annual shareholder meeting. |

| 4. In connection with the holders of our Multiple Voting Shares agreeing, subject to certain conditions, to convert such shares into Subordinate Voting Shares, considering the special resolution set out in Appendix A to the Management Proxy Circular authorizing: |

• an amendment to our Articles to permit an increase in the stated capital of only our Multiple Voting Shares; |

• the addition of not more than $10.00 per share to the stated capital account we maintain in respect of the Multiple Voting Shares; |

• an amendment to our Articles to (i) remove the Multiple Voting Shares and the Subordinate Voting Shares as well as the rights, privileges, restrictions and conditions attaching thereto, (ii) replace all references to “subordinate voting shares” with “common shares”, and (iii) make such consequential amendments as may be necessary to provide for one class of voting common shares. |

| |

| 5. Considering other business that may properly come before the meeting. |

| |

By order of the board of directors of Royal Group Technologies Limited |

| |

-s- Scott D. Bates Scott D. Bates |

| Vice President, General Counsel |

| and Corporate Secretary |

| |

| Vaughan, Ontario |

| April 22, 2005 |

TABLE OF CONTENTS

| | Page |

| THINGS YOU SHOULD KNOW BEFORE YOU BEGIN YOUR REVIEW OF THIS INFORMATION | 2 |

| Information for Meeting | 2 |

| Meaning of Certain Terms Used in this Circular | 2 |

| Currency Presentation | 2 |

| Date of Circular Information | 2 |

| Where You Can Find More Information | 2 |

| Documents Incorporated by Reference | 2 |

| What the Meeting will Cover | 3 |

| HOW TO VOTE YOUR SHARES | 4 |

| Your Vote is Important | 4 |

| How to Vote - Registered Shareholders | 5 |

| How to Vote - Non-Registered Shareholders | 5 |

| Completing the Proxy Form | 6 |

| Changing Your Vote | 6 |

| How the Votes Are Counted | 6 |

| Effective Date of Share Conversion | 7 |

| Share Certificates | 7 |

| Attendance by Non-Shareholders at Meeting | 7 |

| PRINCIPAL HOLDERS OF VOTING SECURITIES | 8 |

| SUBORDINATE VOTING SHARE TAKE-OVER PROTECTION | 8 |

| MATTERS TO BE VOTED ON AT THE MEETING | 9 |

| Election of Directors | 9 |

| Appointment and Compensation of Auditors | 14 |

| Proposed Share Conversion | 15 |

| EXECUTIVE COMPENSATION | 18 |

| Summary Compensation | 18 |

| Stock-Based Compensation Plans | 20 |

| Securities Authorized for Issuance Under Equity Compensation Plans | 23 |

| REPORT ON EXECUTIVE COMPENSATION | 24 |

| Base Salaries | 24 |

| Bonus Awards | 24 |

| Stock Options | 25 |

| Senior Management Incentive Plan | 25 |

| Compensation of the Chief Executive Officer | 25 |

| Interim President and Chief Executive Officer and Chief Financial Officer Compensation | 25 |

| Termination of Employment, Change in Responsibilities and Employment Agreements | 26 |

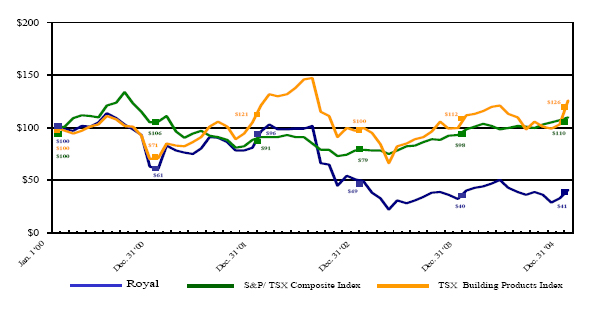

| Performance Graph | 26 |

| (1) Royal Group has previously compared against the TSX Construction Materials Index which is no longer published. | |

| Commencing fiscal 2004, Royal Group references the TSX Building Products Index in the alternative. | 27 |

| INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS | 27 |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 27 |

| DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE AND INDEMNIFICATION | 27 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 27 |

| RECEIPT OF SHAREHOLDER PROPOSALS FOR NEXT ANNUAL MEETING | 27 |

| DIRECTORS’ APPROVAL | 28 |

| | |

| APPENDIX A - SPECIAL RESOLUTION | A-1 |

| APPENDIX B - CORPORATE GOVERNANCE REPORT | B-1 |

THINGS YOU SHOULD KNOW BEFORE YOU BEGIN YOUR REVIEW OF THIS INFORMATION

Information for Meeting

This Circular is for our annual and special shareholders’ meeting to be held on May 25, 2005.

As a shareholder, you have the right to vote your shares on the matters described in the notice of the meeting and any other matter that may properly come before the meeting or any adjournment. To help you make informed decisions, please read this circular and the other documents referred to under the heading “Documents Incorporated by Reference”.

Your proxy is being solicited by Royal Group management. In addition to solicitation by mail, our employees or agents may solicit proxies by telephone or other ways at a nominal cost.

Meaning of Certain Terms Used in this Circular

In this Circular,you,yourandshareholderrefer to a holder of Multiple Voting Shares or Subordinate Voting Shares.We,us,ourandRoyal Grouprefer to Royal Group Technologies Limited and, unless the context otherwise suggests, all of its subsidiaries and affiliates.

We refer to the proposal to amend our Articles to remove the Multiple Voting Shares and Subordinate Voting Shares and change all of outstanding shares to common shares in this Circular as the proposedShare Conversion.

Currency Presentation

All dollar amounts referred to in this Circular unless otherwise indicated are expressed in Canadian dollars.

Date of Circular Information

The information in this Circular is at April 22, 2005, unless otherwise indicated.

Where You Can Find More Information

Copies of documents that are incorporated by reference in this circular are available on SEDAR atwww.sedar.com and on EDGAR atwww.sec.gov or may be obtained upon request sent to: Royal Group Technologies Limited, Attention: Corporate Secretary, 1 Royal Gate Boulevard, Vaughan, Ontario, L4L 8Z7.

Documents Incorporated by Reference

The documents described below have been filed with the securities regulatory authorities in each province of Canada and furnished, on Form 6-K, to the U.S. Securities and Exchange Commission (SEC) are specifically incorporated by reference in this circular.

• | Material Change Report dated April 1, 2004. |

| | |

| • | The agreement among Royal Group, Vic De Zen, De Zen Holdings Limited, 3901602 Canada Inc., De Zen Investments Canada Limited, Fortunato Bordin and Domenic D’Amico dated March 23, 2005. |

Any statement contained in a document incorporated by reference in this Circular is deemed to be modified or superseded for the purposes of this Circular to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated by reference herein, modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this Circular.

What the Meeting will Cover

Five items of business will be covered at the meeting.

As of the date of this Circular, we are not aware of any changes to these items, and do not expect any other items to be brought forward at the meeting. If there are changes or new items, your proxyholder can vote your shares on these items as he or she sees fit.

1. Receiving our financial statements

We will place before the meeting our consolidated financial statements, including the auditor’s report thereon, for the 15 month period ended December 31, 2004. Our financial statements are included in our 2004 Annual Report, which accompanies this Circular.

On December 12, 2003, we announced a change in our fiscal year end from September 30 to December 31. As a result, our financial statements cover the 15 months ended December 31, 2004 compared to the 12 months ended September 30, 2003.

2. Electing directors

You will be electing a board of directors of 10 members. Please see the more detailed information under the heading “Nominees for Election of Directors” in this Circular. Directors appointed at the meeting will serve until the end of our next annual meeting of shareholders.

If you do not specify how you want your shares voted, the directors named as proxyholders in the enclosed proxy form intend to cast the votes represented by proxy at the meeting FOR the election of the director nominees identified in this Circular.

3. Appointing auditors

You will be appointing our auditors. Our board, on the advice of the Audit Committee, recommends that KPMG LLP be reappointed as auditors. KPMG LLP have been our auditors since 1987. The audit firm appointed at the meeting will serve until the end of our next annual shareholder meeting.

If you do not specify how you want your shares voted, the directors named as proxyholders in the enclosed proxy form intend to cast the votes represented by proxy at the meeting FOR the appointment of KPMG LLP as auditors.

4. Share Conversion

You will be asked to approve the special resolution set out in Appendix A authorizing:

| • | an amendment to our Articles to permit an increase in the stated capital of only our Multiple Voting Shares; |

| | |

| • | the addition of not more than $10.00 per share to the stated capital account we maintain in respect of the Multiple Voting Shares; |

| | |

| • | an amendment to our Articles to (i) remove the Multiple Voting Shares and Subordinate Voting Shares as well as the rights, privileges, restrictions and conditions attaching thereto, (ii) replace all references to “subordinate voting shares” with “common shares”, and (iii) make such consequential amendments as may be necessary to provide for one class of voting common shares. |

If you approve the special resolution, the holders of all outstanding Multiple Voting Shares have agreed to convert such shares to Subordinate Voting Shares. As a result, we will no longer have a dual class capital structure and will have only one class of voting common shares with equal voting rights.

Detailed information regarding the proposed Share Conversion is included in this Circular and the other documents incorporated in this Circular by reference.

The board recommends that you vote for the special resolution to amend our Articles to effect the Share Conversion.

If you do not specify how you want your shares voted, the directors named as proxyholders in the enclosed proxy form intend to cast the votes represented by proxy at the meeting FOR the special resolution.

5. Other Business

We will report on recent events that are significant to our business, report on other items that are of interest to our shareholders and invite questions and comments from shareholders.

HOW TO VOTE YOUR SHARES

Your Vote is Important

All holders of Multiple Voting Shares and Subordinate Voting Shares are entitled to vote on the matters placed before the meeting.

It is very important that you read this information carefully and then vote your shares, either by proxy or in person at the meeting.

Voting by proxy is the easiest way to vote. Voting by proxy means that you are giving the person or people named on your proxy form (proxyholder) the authority to vote your shares at the meeting or any adjournment. A proxy form is included in this package.

The directors who are named on the proxy form will vote your shares for you unless you appoint someone else to be your proxyholder. If you appoint someone else, he or she must be present at the meeting to vote your shares.

If you are voting your shares by proxy, our transfer agent, Computershare, or other agents we appointmust receive your signed proxy form by 5:00 p.m. (Toronto time) on May 23, 2005.

A list of shareholders who are holders of record on April 19, 2005 will be available for inspection on and after such date, during usual business hours at Computershare’s principal Toronto office and at the meeting.

You are a registered shareholderif your name appears on your share certificate. Your proxy form tells you whether you are a registered shareholder.

You are a non-registered (or beneficial) shareholderif your bank, trust company, securities broker or other financial institution holds your shares for you (your nominee). For most of you, your proxy form tells you whether you are a non-registered (or beneficial) shareholder.

If you are not sure whether you are a registered or non-registered shareholder, please contact Computershare.

Computershare Trust Company of Canada

100 University Avenue

9th Floor

Toronto, Ontario, Canada M5J 2Y1

Telephone

1-800-564-6253 (toll-free in Canada and the U.S.)

514-982-7555 (outside Canada and the U.S.)

Fax

1-888-453-0330 (toll-free in Canada and the U.S.)

416-263-9394 (outside Canada and the U.S.)

E-mail

service@computershare.com

How to Vote - Registered Shareholders

By proxy

By mail

Sign and date your proxy form and return it in the envelope we have provided. See “Completing the Proxy Form” for more information.

By fax

Sign and date your proxy form and send both pages (in one transmission) by fax to 1-866-249-7775 (toll-free in Canada and the United States) or 416-263-9524 (outside Canada and the United States). See “Completing the Proxy Form” for more information.

By appointing another person to go to the meeting and vote your shares for you

This person does not have to be a shareholder.

Strike out the two names that are printed on the proxy form and write the name of the person you are appointing in the space provided. Complete your voting instructions, date and sign the form.

Make sure that the person you appoint is aware that he or she has been appointed and attends the meeting. At the meeting, he or she should see a representative of Computershare at the table marked “Alternate attorneys/External proxyholders.” See “Completing the Proxy Form” for more information.

In person at the meeting

You do not need to complete or return your proxy form.

Voting in person at the meeting will automatically cancel any proxy you completed earlier.

How to Vote - Non-Registered Shareholders

By proxy

Your nominee is required to ask for your voting instructions before the meeting. Please contact your nominee if you did not receive a request for voting instructions or a proxy form in this package.

In most cases, non-registered shareholders will receive a voting instruction form which allows you to provide your voting instructions by mail or by fax.

Alternatively, non-registered shareholders may receive a voting instruction form which:

• is to be completed and returned, as directed in the included instructions; and

• has been pre-authorized by your nominee with a notation of the number of shares to be voted, which is to be completed, dated, signed and returned to Computershare, by mail or fax.

In person at the meeting

We do not have access to the names or holdings of our non-registered shareholders. That means you can only vote your shares in person at the meeting if you have instructed your nominee to appoint you as proxyholder.

To do this, write your name in the space provided on the voting instruction form and follow the instructions of your nominee.

You do not have to complete the rest of the form - your vote will be taken and counted at the meeting.

At the meeting, you should see a representative of Computershare at the table marked “Alternate attorneys/External proxyholders.”

Completing the Proxy Form

When you sign the proxy form, you authorize Robert Lamoureux or James Sardo, both directors of Royal Group, to vote your shares for you at the meeting according to your instructions.If you return your proxy form and do not tell us how you want to vote your shares, your vote will be counted FOR each of the matters to be voted on at the meeting, including the special resolution to effect the Share Conversion.

If you are appointing someone else to vote your shares for you at the meeting, strike out the two names of the directors and write the name of the person voting for you in the space provided.If you do not specify how you want your shares voted, your proxyholder will vote your shares as he or she sees fit on each item and on any other matter that may properly come before the meeting.

If you are an individual shareholder, you or your authorized attorney must sign the form. If you are a corporation or other legal entity, an authorized officer or attorney must sign the form.

Changing Your Vote

You can revoke a vote you made by proxy by:

• completing a proxy form that is dated later than the proxy form you are changing and mailing it to Computershare so that it is received before5:00 p.m. (Toronto time) on May 24, 2005;

• sending a notice in writing to our Corporate Secretary so that it is received before5:00 p.m. (Toronto time) on May 24, 2005. The notice can be from you or your authorized attorney; or

• giving a notice in writing to the Chairman of the meeting, at the meeting or any adjournment. The notice can be from you or your authorized attorney.

How the Votes Are Counted

Our authorized capital currently consists of an unlimited number of Multiple Voting Shares, an unlimited number of Subordinate Voting Shares and an unlimited number of First Preferred Shares and Second Preferred Shares, issuable in series. There are no First Preferred Shares or Second Preferred Shares outstanding.

Holders of Multiple Voting Shares have 20 votes for each such share held. Holders of Subordinate Voting Shares have one vote for each such share held. At April 19, 2005, there were 15,935,444 Multiple Voting Shares and 77,509,058 Subordinate Voting Shares outstanding. Outstanding Multiple Voting Shares represent approximately 80.5% of the votes attaching to all of our outstanding voting shares.

Resolutions to appoint auditors and elect directors will be determined by a majority of the votes cast at the meeting. Holders of Multiple Voting Shares vote together with the holders of Subordinate Voting Shares on these matters.

The proposed Share Conversion cannot be effected without the approval of (i) at least two-thirds of the votes cast at the meeting in person or by proxy by the holders of Multiple Voting Shares, and (ii) at least two-thirds of the votes cast at the meeting in person or by proxy by the holders of Subordinate Voting Shares.

All holders of Multiple Voting Shares have agreed to vote in favour of the special resolution to effect the Share Conversion.

Computershare counts and tabulates the votes. It does this independently of us to make sure that the votes of individual shareholders are confidential.

Effective Date of Share Conversion

If shareholders approve the Share Conversion, we will file Articles of Amendment in accordance with the special resolution as soon as practicable after the meeting. The effective date of the Share Conversion will be determined by our board of directors and set out in the Articles of Amendment but, in any event, will be at least one business day after the relevant amount is added to the state capital account for the Multiple Voting Shares pursuant to the special resolution and not more than 10 business days after the meeting.

Share Certificates

If the special resolution to effect the Share Conversion is approved by the holders of Multiple Voting Shares and by the holders of Subordinate Voting Shares, voting separately by class, the holders of all outstanding Multiple Voting Shares will convert such shares to Subordinate Voting Shares prior to the filing of Articles of Amendment. Upon the filing of Articles of Amendment in accordance with the special resolution, all outstanding Subordinate Voting Shares will be designated as common shares.

Share certificates representing Subordinate Voting Shares will be deemed to represent common shares from and after the effective date specified in the Articles of Amendment. Delivery of Subordinate Voting Share certificates will continue to be good delivery for settlement of trades through the facilities of the Toronto and New York stock exchanges. There will be no need to exchange your existing share certificates for new share certificates.

If you wish to exchange Subordinate Voting Share certificates for common share certificates, contact Computershare. See Computershare’s contact details on page 4 of this circular.

Attendance by Non-Shareholders at Meeting

If you are not a shareholder, you may be allowed into the meeting after speaking with a representative of Computershare, our transfer agent, and if the Chairman of the meeting allows it.

PRINCIPAL HOLDERS OF VOTING SECURITIES

As of April 22, 2005, to the knowledge of our directors and officers, the only persons who beneficially own, directly or indirectly, or exercise control or direction over securities carrying more than 10% of the voting rights attached to any class of our voting securities are set out in the table below:

Name | Type of Shares | Number of shares | % of class | % of all voting rights |

| Vic De Zen | Multiple Voting Shares Subordinate Voting Shares | 15,935,444 6,035(1) | 100% 0.01% | 80.5% 0.01% |

| Brandes Investment Partners, L.P. | Subordinate Voting Shares | 8,748,714 | 11.30% | 2.2% |

(1) Excludes Subordinate Voting Shares issuable on exercise of stock options.

SUBORDINATE VOTING SHARE TAKE-OVER PROTECTION

A Stock Control Agreement among the holders of the Multiple Voting Shares, Royal Group and Computershare Trust Company of Canada, as trustee, for the holders from time to time of the Subordinate Voting Shares, provides certain take-over bid protections to the holders of the Subordinate Voting Shares and imposes other restrictions on the transfer of Multiple Voting Shares.

The Stock Control Agreement provides that if the trustee becomes aware of the transfer of any Multiple Voting Shares to a purchaser who has not made an identical offer in all material respects to purchase all of the Subordinate Voting Shares and all of the Multiple Voting Shares, then the trustee will cause the Multiple Voting Shares so transferred to be converted into Subordinate Voting Shares in accordance with our articles unless such transfer is aPermitted Transfer as described below.

Permitted Transfers include a transfer of Multiple Voting Shares to aPermitted Holder. Permitted Holders are Vic De Zen, one of our directors, members of Mr. De Zen’s immediate family, entities which are directly or indirectly wholly-owned by Mr. De Zen or his immediate family, and trusts all the beneficiaries of which are any of the foregoing. The granting of a security interest over Multiple Voting Shares to an arm’s length Canadian financial institution in connection with bona fide obligations of the holder of such shares or of Royal Group is also a Permitted Transfer, provided however that if the security granted is to be realized upon, such Multiple Voting Shares will be first converted into an equal number of Subordinate Voting Shares.

No transfer of Multiple Voting Shares may be effected without the transferee of such shares (including Canadian financial institutions that are Permitted Holders) agreeing to be bound by the terms of the Stock Control Agreement.

A Permitted Holder of Multiple Voting Shares may at any time convert its shares to Subordinate Voting Shares provided the prior approval of Mr. De Zen or his family representative is obtained. Such shares so converted to Subordinate Voting Shares will thereafter no longer be subject to the terms of the Stock Control Agreement.

If at any time the trustee determines that a holder of Multiple Voting Shares has ceased to be a Permitted Holder (aNon-Permitted Holder), such Multiple Voting Shares will either be converted to Subordinate Voting Shares or the Non-Permitted Holder will be required to sell the Multiple Voting Shares held by it to a Permitted Holder designated by Mr. De Zen or his family representative at a price equal to the fair value of such shares on the date the sale is completed. Under the Stock Control Agreement, the fair value per share is determined to be the simple average of the closing prices of the Subordinate Voting Shares on the published market in Canada on which the greatest volume of trading in such shares occurred over the 20 trading days preceding the date of the sale or, in circumstances where the Subordinate Voting Shares have not traded at least 10 days during such period, the simple average of the closing prices, where applicable, and the closing bid and asked prices for the days on which no trading occurred.

The Stock Control Agreement may be amended without the approval of the holders of Subordinate Voting Shares only to make corrections or rectifications, to facilitate the provisions thereof or to comply with law or stock exchange rules, provided that in each case the trustee is of the opinion that the rights of the holders of Subordinate Voting Shares are not prejudiced, in any material respect, by such amendment. Otherwise, the Stock Control Agreement may not be amended without the approval of at least two-thirds of the votes cast by holders of the Subordinate Voting Shares at a meeting called to consider the amendment or the written consent of holders of at least two-thirds of the Subordinate Voting Shares.

Holders of all outstanding Multiple Voting Shares have agreed to convert such shares to Subordinate Voting Shares in accordance with the Stock Control Agreement and our Articles if the proposed Share Conversion is approved by shareholders. Upon completion of such conversion, the Stock Control Agreement will terminate.

MATTERS TO BE VOTED ON AT THE MEETING

Election of Directors

Subject to our Articles and General By-law, our board of directors must consist of a number of directors not fewer than three and not more than 25 as the board may from time to time determine. Our board has determined that the number of directors to be elected at the meeting will be 10. Currently, we have seven directors. For most of 2004 fiscal year, we had nine directors.

Board Committees

Our board has established three standing committees: the Audit Committee, the Nomination and Corporate Governance Committee and the Human Resources and Compensation Committee. The current members of each of these committees are Ralph Brehn, Irvine Hollis and Ronald Slaght. The mandate for each of these committees can be accessed at www.royalgrouptech.com in the “Investor Relations” section.

See “-- Proposed Share Conversion - Background to the Proposed Share Conversion” for information regarding a Special Committee established by the board in connection with certain transactions involving Royal Group and certain of its executive officers.

Nominees for Election to the Board

The Nomination and Corporate Governance Committee of the board of directors is authorized to engage the services of outside consultants to assist it in identifying qualified candidates to be nominated as directors. Before recommending a candidate to the board as a nominee, the committee reviews the consultant’s recommendations, meets with prospective candidates and assesses the results of internal and external due diligence reviews on candidates. The committee has paid an external consultant to assist in identifying and evaluating new director candidates proposed for this meeting. The committee considers additional factors when identifying directors for re-election, including but not limited to qualifications under applicable law, material change in employment, contribution and meeting attendance record.

The persons named below have been nominated for election as directors. The term of office of each director expires at the close of our next annual meeting of shareholders. Messrs. De Zen, Hollis, Lamoureux, Sardo and Slaght are currently directors of Royal Group. Messrs. Hacking, Ross, Savage and Sheffield and Ms. Hansell are standing for election to our board for the first time.

Mr. DeZen has agreed to retire as a director following the meeting if the Share Conversion is approved by shareholders. See “-- Proposed Share Conversion”. The board expects that upon the appointment of a new President and Chief Executive Officer, to replace our Interim President and Chief Executive Officer, that such officer will be appointed to the board to fill the vacancy.

Unless otherwise instructed by a shareholder, the persons named in the accompanying proxy form will vote FOR the election of these nominees. If any of the above nominees is for any reason unavailable to serve as a director, proxies in favour of management will be voted for another nominee in their discretion unless you have specified on your proxy that your shares are to be withheld from voting on the election of directors. We have no reason to believe that any of these nominees will be unable to exercise his or her function as a director.

Name of Nominee Place of Residence Share Ownership(1) DSU Ownership(2) | Present Principal Occupation and Positions Held in the Last Five Years | Board and Board Committee Meeting Attendance for Fiscal 2004 (15 months)(3) |

| | | |

| Carol Hansell | Ms. Hansell is a partner in the law firm Davies, Ward, Phillips & Vineberg LLP. | N/A |

| Toronto, Ontario | | |

| Age: 47 | | |

| | Ms. Hansell serves on the board of directors of the Public Sector Pension Investment Board, a Crown corporation that invests cash flows from the pension plans of the federal public service, and on the corporate governance commit teeof the board of directors of Toronto East General Hospital and of Altruvest Charitable Services as well as on the Advisory Board of the Literary Review of Canada. | |

| Nil SVS | |

| Nil MVS | |

| Nil DSU | |

| | |

| | |

| | | |

| | Ms. Hansell is a past director and Vice Chair of the Institute of Corporate Directors and a past director of the Centre of Ethics and Corporate Policy in Canada. She teaches securities law at Osgoode Hall and is a member of the faculty of the ICD Director College (Rotman School) and the National Association of Corporate Directors, a Washington-based organization focusing on board leadership issues. Ms. Hansell has written several leading texts on corporate governance. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| James Hacking | Mr. Hacking is the Chief Executive Officer of IMT Corporation, a major manufacturer and supplier to the truck-trailer, OEM and defence industries. Mr. Hacking is adirector of Armada Group, a private plastic injection molder. | N/A |

| Waterloo, Ontario | |

| Age: 48 | |

| | |

| Nil SVS | | |

| Nil MVS | From 2001 to 2002, Mr. Hacking was the Chief Executive Officer of Skyjack Inc., a manufacturer of elevating work platforms. | |

| Nil DSU | |

| | |

| Irvine Hollis | Mr. Hollis is presently a management consultant with I. Hollis Management Consultants Inc., providing strategic planning, organizational structure and business plan advisory services to small and medium sized companies. | Board (14 of 14): |

| Chatsworth, Ontario | |

| Director since May 2, 1995 | Nomination and Corporate |

| Age: 66 | Governance Committee (Chair) |

| | | (6 of 6) |

| 1,946 SVS | Mr. Hollis is currently on an advisory board at Mortile Industries, a small supplier of specialty additives to the plastics industry. Mr. Hollis is also a volunteer on an advisory board to attract business to the City of Owen Sound and is the Past President and Director of Sudden Arrhythmia Death (SADS) Canada. | |

| Nil MVS | Human Resources and |

| 3,542 DSU | Compensation Committee |

| | (14 of 14) |

| | |

| | Audit Committee (1 of 1) |

| | | Special Committee (35 of 36) |

Name of Nominee Place of Residence Share Ownership(1) DSU Ownership(2) | Present Principal Occupation and Positions Held in the Last Five Years | Board and Board Committee Meeting Attendance for Fiscal 2004 (15 months)(3) |

| Robert Lamoureux | Lead Director and Interim Chief Financial Officer of Royal | Board (Lead Director) (11 of 11) |

| Toronto, Ontario | Group. | |

| Director since Nov. 18, 2003 | | Audit Committee (4 of 4) |

| Age: 58 | Mr. Lamoureux was appointed a partner of PricewaterhouseCoopers in 1981. During his tenure, Mr. Lamoureux was audit partner of numerous corporations, public and private, including certain of Canada’s majorcorporations in both the manufacturing and financial services industries. | Nomination and Corporate |

| | Governance Committee (5 of 5) |

| Nil SVS | Special Committee (36 of 36) |

| Nil MVS | |

| 15,311 DSU | |

| | |

| | | |

| | Mr. Lamoureux initiated and led, until he retired from PricewaterhouseCoopers in 2004, PricewaterhouseCoopers’ Canadian corporate governance practice. | |

| | |

| | |

| | | |

| | In 2001, Mr. Lamoureux joined the Institute of Corporate Directors, where he is currently a director, Chair of the Ontario Chapter and a member of its Communications and Membership committees. | |

| | |

| | |

| | |

| | | |

| | Mr. Lamoureux is currently a director of SR Telecom Inc. which designs, manufactures and deploys Broadband Fixed Wireless Access solutions. | |

| | |

| | |

| Richard Ross | Mr. Ross is the Chairman and Chief Executive Officer and a director of Inmet Mining Corporation. | N/A |

| Nobleton, Ontario | |

| Age: 47 | | |

| | Mr. Ross is the Chairman of the board of the Mining Association of Canada. Mr. Ross sits on the board of directors of St. Joseph’s Health Centre and the Canadian Turkish Business Council. Mr. Ross is a chartered accountant. | |

| Nil SVS | |

| Nil MVS | |

| Nil DSU | |

| | |

| | | |

| James Sardo | Interim Chief Executive Officer of Royal Group. | Board (11 of 11) |

| Mississauga, Ontario | | Nomination and Corporate |

| Director Since Nov. 18, 2003 | Mr. Sardo has been since 2003 a director of Hydrogenics Corporation, a fuel cell technology company, a trustee of Union Waterheater Income Trust, a water heater rental company and a trustee of Custom Direct Income Fund. In 2004, Mr. Sardo became the Chairman of the Board of Trustees of Countryside Power Income Fund, a power generation company. Mr. Sardo is also a member of the Institute of Corporate Directors. | Governance Committee (5 of 5) |

| Age: 61 | Human Resources and |

| | Compensation Committee |

| 2000 SVS | (14 of 14) |

| Nil MVS | Special Committee (36 of 36) |

| 25,521 DSU | |

| | |

| | |

| | | |

| | Mr. Sardo was President, Canadian Operations of Moore Corporation Limited, a business forms and communication company from 1999 to 2001 and President and Chief Executive Officer and a director of SMK Speedy International Inc., an international automotive repair company, from 1997 to 1999. | |

| | |

| | |

| | |

| | |

| | |

| Name of Nominee Place of Residence Share Ownership(1) DSU Ownership(2) | Present Principal Occupation and Positions Held in the Last Five Years | Board and Board Committee Meeting Attendance for Fiscal 2004 (15 months)(3) |

| Graham Savage | Mr. Savage has been a managing director of Callisto Capital LP, a merchant banking partnership, since October 2002 and has been chairman since 2003, he was a managing director of Savage Walker Capital Inc. from October 1998 to October 2002 and is a managing partner of Savage Walker Capital L.P. | N/A |

| Toronto, Ontario | |

| Age: 56 | |

| | |

| Nil SVS | |

| Nil MVS | |

| Nil DSU | | |

| | Mr. Savage was previously Chief Financial Officer and a director of Rogers Communications Inc. | |

| | |

| | | |

| | Mr. Savage is also a director of each of Canadian Tire Corp., Hollinger International Inc., Leitch Technology Corporation and Vitran Corporation. Mr. Savage is a member of the Special Investigative Committee of Hollinger International Inc. | |

| | |

| | |

| | |

| | |

| William Sheffield | Mr. Sheffield is a member of the newly reconstituted board of Ontario Power Generation (formerly Ontario Hydro) and a director of Velan, Inc., a leading producer of industrial steel valves in North America, Europe and Asia. | N/A |

| Toronto, Ontario | |

| Age: 56 | |

| | |

| Nil SVS | | |

| Nil MVS | From 2001 to 2003, Mr. Sheffield was the Chief Executive Officer of Sappi Fine Paper, the world’s leading manufacturer and marketer of coated fine sheet paper. | |

| Nil DSU | |

| | |

| | | |

| | From 1987 to 2000, Mr. Sheffield was an Executive Vice President of Abitibi Consolidated Inc., the world’s largest manufacturer and marketer of newsprint. | |

| | |

| | |

| | |

| | |

| Ronald Slaght | Mr. Slaght is a Partner of Lenczner Slaght Royce Smith Griffin (Barristers). | Board (13 of 14) |

| Toronto, Ontario | | |

| Director Since Nov. 25, 1994 | | Human Resources and |

| Age: 61 | Mr. Slaght is a Past President of The Advocates’ Society and a member of the Civil Rules Committee. He is a Fellow of the American College of Trial Lawyers. Mr. Slaght continues to serve on a number of committees and task forces concerned with the administration of justice in Ontario. Mr. Slaght is former head of the Trial Practice Program at the Faculty of Law at the University of Toronto. | |

| | |

| 26,843 SVS | Compensation Committee (Chair) |

| Nil MVS | (13 of 14) |

| 2,542 DSU | |

| | Audit Committee (4 of 5) |

| | Special Committee (26 of 36) |

| Vic De Zen | Mr. De Zen owns and operates a real estate development company. | |

| Vaughan, Ontario | |

| Director since Nov. 25, 1994 | | Board (11 of 14) |

| Age: 63 | Mr. De Zen was Chairman and Chief Executive Officer of Royal Group from November 30, 1994 until September 15, 2003. He was the Chairman and Co-Chief Executive Officer Royal Group from September 15, 2003 to December 18, 2003. Mr. De Zen retired as Co-Chief Executive Officer on December 18, 2003 and remained Chairman of Royal Group until November 26, 2004. | |

| | |

| 15,935,444 MVS | |

| 6,035 SVS | |

| Nil DSU | |

| | |

| | |

| | | |

| (1) | SVSmeans Subordinated Voting Shares andMVSmeans Multiple Voting Shares. |

| (2) | DSUmeans Deferred Stock Units. See “-- Directors Stock Unit Plan”. |

| (3) | Indicates attendance at meetings held during the time that the director was a member of the board or a member of a committee, as the case may be. In fiscal 2004 (15 months), we held 14 board meetings, five Audit Committee meetings, 14 Human Resources and Compensation Committee meetings, six Nomination and Corporate Governance Committee meetings and 36 Special Committee Meetings. |

Director Share Ownership Guidelines

We believe that directors can more effectively represent your interests if they have a significant investment in our shares. Therefore, we adopted in May 2004 minimum share ownership guidelines for our directors. Each director is expected to own Subordinate Voting Shares or DSU having a value equal to at least five times the value of their annual cash retainer for sitting on our board by the later of May, 2009 or five years after the date of their election to the board.

Compensation of Directors

Our directors’ compensation program is designed to:

| • | Attract and retain the most qualified people to serve on our board and its committees. |

| • | Align the interests of the directors with your interests as shareholders. |

| • | Provide appropriate compensation relative to the risks and responsibilities of being an effective director. |

The table below sets out the fees payable to non-management directors. Generally, directors who are also officers of Royal Group do not receive fees for sitting on our board or any board committee. Mr. Sardo and Mr. Lamoureux received no directors’ fees after their appointment on November 29, 2004 as our Interim President and Chief Executive Officer and Interim Chief Financial Officer, respectively, but continue to receive Special Committee fees and, in Mr. Lamoureux’s case, continue to receive the Lead Director retainer.

| Annual Board Member Fee | $40,000 cash $30,000 DSU(1) |

Board and Committee Meeting Fees • Per meeting attended in person • Per meeting attended by telephone | $1,500 $1,000 |

| Additional Annual Fees | |

• Lead Director | $40,000 |

• Audit Committee | |

- Chair | $15,000 |

- Member | $ 7,500 |

• Nomination and Corporate Governance Committee | |

- Chair - Member | |

• Human Resources and Compensation Committee - Chair | $10,000 |

- Member | $ 5,000 |

(1) $7,500 of DSU (value determined at the time of allocation) are allocated to each director at the end of each financial quarter. See “Directors Deferred Stock Unit Plan”.

In late 2003, the board established a Special Committee (see “Proposed Share Conversion - Background to the Proposed Share Conversion”). Each member of such committee is paid $750 per meeting attended. The Chair of the Special Committee receives an additional retainer of $5,000 per month.

For fiscal 2004 (15 months), we paid our non-management directors (but including our Interim President and Chief Executive Officer and our Interim Chief Financial Officer) an aggregate of $579,584 in annual retainer and meeting attendance fees.

All directors are reimbursed for travel and other reasonable expenses incurred in attending board or committee meetings.

Directors Deferred Stock Unit Plan

On February 2, 2005, we established a Directors Deferred Stock Unit Plan (theDirectors DSU Plan) to provide an equity-based incentive to our non-management directors to further align their interests with yours as shareholders. The plan is administered by our Human Resources and Compensation Committee.

Under the Directors DSU Plan, directors may elect to defer all or any portion of the cash fees paid to them. A number of notional deferred stock units (DSUs) equal to the dollar value of deferred fees divided by the market price of our Subordinate Voting Shares, determined by reference to the Toronto Stock Exchange (TSX) trading price of such shares at the allocation time (unless otherwise determined by the Human Resources and Compensation Committee), is allocated to the director. Upon ceasing to be a director for any reason, all DSUs allocated to such director are redeemed by the payment to the director of an amount in cash equal to the number of such DSUs multiplied by the market value of our Subordinate Voting Shares, determined by reference to the TSX trading price of such shares at the redemption time. No shares are issuable by Royal Group under the Directors DSU Plan.

As indicated above, generally directors are allocated $30,000 of DSUs annually. They may also choose to receive their other fees in any combination of cash and/or DSUs. See also “Executive Compensation -Interim President and Chief Executive Officer and Interim Chief financial Officer Compensation”.

Appointment and Compensation of Auditors

We propose that KPMG LLP be appointed as auditors for fiscal 2005 and that their remuneration therefor be fixed by the directors.

In order to be effective, the resolution appointing KPMG LLP as auditors and authorizing the directors to fix their remuneration, must receive the affirmative vote of a majority of votes cast by those shareholders in person and represented by proxy.Unless you otherwise instruct, the persons named in the accompanying proxy form will vote FOR the appointment of KPMG LLP as auditors for fiscal 2005 and that their remuneration by fixed by the directors for such fiscal year.

KPMG LLP have acted as our auditors since 1987. Representatives of KPMG LLP will be present at the meeting with an opportunity to make a statement if they so desire and to respond to appropriate questions.

All services provided by KPMG LLP and their fees in connection with services provided to us require the approval of the Audit Committee.Fees charged to us by KPMG LLP for audit and related services were $1,421,000 in fiscal 2004 (15 months) and $1,395,000 in fiscal 2003 (12 months). Additional services provided by KMPG LLP include tax-related compliance and related matters as well as assignments pertaining to regulatory filings, accounting matters and the issuance of securities.

A summary of fees that we paid to our auditors in fiscal 2004 and fiscal 2003 is set out below. Our Audit Committee has considered whether the magnitude and nature of these services is compatible with maintaining the independence of the external auditors and is satisfied that they are.

| | Fiscal 2004 (15 months) | Fiscal 2003 (12 months) |

Audit Fees(1) | $1,274,000 | $829,000 |

Audit Related Fees(2) | $29,000 | $93,000 |

Tax Fees(3) | $118,000 | $436,000 |

All Other Fees(4) | Nil | $37,000 |

Total | $1,421,000 | $1,395,000 |

(1) Comprised of audit fees for year end and quarterly reviews.

(2) Comprised of fees for 401(k) plan audit and workers compensation review.

(3) Comprised of fees for U.S. tax compliance services.

(4) Comprised of fees for transfer pricing study and assistance in response to regulatory inquiries.

Proposed Share Conversion

At the meeting, you will be asked to approve the special resolution set out in Appendix A to authorize:

• | an amendment to our Articles to permit an increase in the stated capital of our only Multiple Voting Shares; |

| • | the addition of not more than $10.00 per share to the stated capital account we maintain in respect of the Multiple Voting Shares; and |

| • | an amendment to our Articles to (i) remove the Multiple Voting Shares and Subordinate Voting Shares as well as the rights, privileges, restrictions and conditions attaching thereto, (ii) replace all references to “subordinate voting shares” with “common shares”, and (iii) make such consequential amendments as may be necessary to provide for one class of voting common shares. |

Our board has concluded that the proposed Share Conversion is in the best interests of Royal Group and its shareholders and recommends that you vote in favour of the special resolution.

Unless you give contrary instructions in your proxy form, the persons designated in the enclosed form of proxy intend to voteFORthe approval of such special resolution.

Background to the Proposed Share Conversion

A Special Committee of our board of directors, comprised of James Sardo, Robert Lamoureux and Ronald Slaght, each of whom was, at the time such committee was established, independent of and unrelated to Royal Group, its management and Mr. De Zen, was formed in late 2003 as a result of Royal Group being advised that the Ontario Securities Commission (OSC) was conducting a regulatory investigation of Royal Group. Ralph Brehn and Irvine Hollis, both of whom are independent and unrelated to Royal Group, joined the Special Committee on October 21, 2004. Since establishment of the Special Committee, Mr. Sardo and Mr. Lamoureux have been appointed our Interim Chief Executive Officer and Interim Chief Financial Officer, respectively. The Special Committee retained Goodmans LLP as its independent legal counsel and Goodmans (on behalf of the Special Committee) retained Kroll Lindquist Avey (Kroll), independent forensic auditors, to investigation transactions between Royal Group and the Royal St. Kitts beach resort development (theSt. Kitts Project) which is majority owned by Mr. De Zen, our controlling shareholder and former Chairman and Chief Executive Officer.

Kroll completed its initial investigation in April 2004 and we disclosed the findings in a Material Change Report dated May 6, 2004, which may be accessed atwww.sedar.com orwww.sec.gov.

In November 2004, the Special Committee asked Kroll to broaden its forensic work to include investigations of, among other things, transactions entered into by Royal Group with related parties. Kroll’s review of related-party transactions focussed on three main areas: real estate transactions, corporate acquisitions and divestitures, and other likely areas of overlap between private and public interests.

Kroll completed this second phase of its review in March 2005 and we disclosed Kroll’s findings in a Material Change Report dated April 1, 2005, which report is incorporated in its entirety in this Circular by reference. The key concerns raised by Kroll are summarized below.

| • | Kroll identified and brought to the attention of the Special Committee information regarding a related-party land transaction completed in 1998 (theVaughan West Lands Transaction), involving Vic De Zen (our controlling shareholder and, at the relevant time, our Chief Executive Officer), Douglas Dunsmuir (our Executive Vice President and General Counsel at the relevant time), and others, and which Ron Goegan (our Vice President, Corporate Finance at the relevant time) facilitated. The transaction concerned the purchase in Woodbridge, Ontario of approximately 185 acres of land by a numbered company owned by Mr. De Zen and certain other associates, including Mr. Dunsmuir, for $20.5 million. Immediately after the closing of that purchase, the property was sold to Royal Group for approximately $27 million. The fact that the land purchase was a related-party transaction was not brought to the attention of the board of directors in 1998. The board also was not informed about the profit that the related parties realized on the purchase. |

| | |

| • | Royal Group received a warrant for 200,000 shares of another public company, Premdor Inc. (now known as Masonite International Corporation) (Masonite) as partial consideration for the sale of a Royal Group subsidiary to Premdor in early 2000. In early 2002, Royal Group exercised the warrant when Masonite’s shares were trading at approximately $21.75, which was $8.50 more than the exercise price (resulting in a gain of approximately $1.7 million). Royal Group’s exercise of the warrant was funded by five then senior executives of Royal Group (including Messrs. De Zen and Dunsmuir) and one other individual who was then an employee of Royal Group who deposited a total of $2.65 million which Royal Group paid to Masonite to exercise the warrant. The Masonite shares obtained were then distributed by Royal Group to the six individuals. It appears that the six individuals subsequently sold their shares netting proceeds of approximately $1.7 million. The warrant and the transfer of the Masonite shares to the individuals were not recorded in the accounting records of Royal Group. However, an amount approximating the gain made by the senior executives on the Masonite shares was included for each of them in the bonus amount shown as paid to such senior executives in our Management Proxy Circular dated January 1, 2003. |

In discussions with the Special Committee, Mr. De Zen maintained that following completion of Kroll’s investigation and the determination of whether any prior transactions were inappropriate, he would act as necessary with respect to such transactions to ensure that appropriate arrangements are made with Royal Group that are in the best interests of our shareholders.

There have been ongoing discussions for some time between representatives of the board of directors and Mr. De Zen with respect to the termination of our existing two-tiered shareholder system. These discussions have included the means by which Mr. De Zen will convert his Multiple Voting Shares to single-voting shares. The Special Committee understands that such conversions are often made at a premium ratio (i.e., each multiple voting share is exchanged for more than one common share) and that a premium of approximately 5% would be reasonable in these circumstances.

Conversion Agreement

Following delivery of Kroll’s report, discussions continued towards an overall resolution. As a result of such discussions, pursuant to an agreement (theConversion Agreement) dated March 23, 2005 between Vic De Zen, De Zen Holdings Limited, 3901602 Canada Inc., De Zen Investments Canada Limited, Fortunato Bordin and Domenic D’Amico (collectively, theDe Zen Group) and Royal Group, subject to shareholder approval of the Share Conversion:

| • | the De Zen Group represents and warrants that collectively they are the holders of all outstanding Multiple Voting Shares; |

| | |

| • | the full amount of the gain earned by all parties on the Vaughan West Lands Transaction ($6.5 million) plus interest (totalling $2.2 million) will be repaid to us by Mr. De Zen and, for the purposes thereof, Mr. De Zen will convert his Multiple Voting Shares to common shares on a one-for-one basis (i.e., without a premium) to satisfy this obligation, which amount is within the range that the Special Committee has determined is reasonable in the circumstances; |

| • | the Multiple Voting Shares will receive an increase in their adjusted cost base for tax purposes (at no cost to Royal Group or any of our shareholders), which will reduce Mr. De Zen’s gain for tax purposes if he disposes of his shares after conversion, the actual amount of such increase to be determined by KPMG LLP pursuant to the Conversion Agreement; |

| | |

| • | further to a previous agreement of Mr. De Zen to repay to us part of his bonus for fiscal 2002 out of future bonus entitlements (see footnote 11 to the Summary Compensation Table under “Executive Compensation”), Mr. De Zen will pay the approximately $1.13 million that he owes in respect of such agreement on or before the day that is 14 days after the Multiple Voting Shares are converted to Subordinate Voting Shares; |

| | |

| • | the De Zen Group will release us from all claims, which they may have against Royal Group existing at the date of the Conversion Agreement (subject to certain exceptions relating to pre-existing litigation and a pre-existing indemnity given by us to all of our directors, including Mr. De Zen); |

| | |

| • | Messrs. De Zen, Bordin and D’Amico (each of whom are former executive officers or employees of Royal Group) covenant not to compete with Royal Group or solicit any employees of Royal Groups, which covenants to extend to December 18, 2006, which is three years from the date of Mr. De Zen’s resignation as our Chief Executive Officer; |

| | |

| • | Messrs. De Zen, Bordin and D’Amico will not disclose any confidential information, including technology and trade secrets, proprietary to Royal Group; |

| | |

| • | Mr. De Zen will retire as a director of Royal Group effective at the time that the Share Conversion is approved by our shareholders; |

| | |

| • | the De Zen Group will vote all Multiple Voting Shares and all Subordinate Voting Shares that they hold in favour of the Share Conversion; |

| | |

| • | the term of the options held by Mr. De Zen, which are exercisable for 1,360,000 Subordinate Voting Shares (common shares if the Share Conversion is approved) and which would have expired in accordance with the terms thereof three months after Mr. De Zen ceased to be an employee of Royal Group, will be extended and will expire on the earlier of December 18, 2006 and the original expiry date of such options none of which options are currently in-the-money; |

| | |

| • | the term of the options held by Mr. Bordin, which are exercisable for 50,000 Subordinate Voting Shares (common shares if the Share Conversion is approved) and which would have expired in accordance with the terms thereof three months after Mr. Bordin ceased to be an employee of Royal Group, will be extended and will expire on the earlier of December 18, 2006 and the original expiry date of such options none of which options are currently in-the-money; and |

| | |

| • | we will release the De Zen Group and their affiliates from any potential claims that we may have that we are currently aware of, including in respect of the Vaughan West Lands Transaction. |

Effective Date

If shareholders approve the Share Conversion, we will file Articles of Amendment in accordance with the special resolution as soon as practicable after the meeting. The effective date of the amendment:

| • | to permit an increase in the stated capital of only our Multiple Voting Shares will be determined by our board of directors and set out in the Articles of Amendment but, in any event, will be not more than 10 business days after the meeting; and |

| | |

| • | to (i) remove the Multiple Voting Shares and Subordinate Voting Shares, as well as the rights, privileges, restrictions and conditions attaching thereto, (ii) replace all references to “subordinate voting shares” with “common shares”, and (iii) to make such consequential amendments as may be necessary to provide for one class of voting common shares, will be at least one business day after the relevant amount is added to the stated capital amount for the Multiple Voting Shares and after the De Zen Group has converted all Multiple Voting Shares to Subordinate Voting Share but, in any event, will be not more than 10 business days after the meeting. |

Treatment of Outstanding Options and DSUs

Adjustment provisions included in our Directors DSU Plan, LTIP and SMIP (see “Executive Compensation”) will operate to ensure that references to Subordinate Voting Shares therein will mean common shares upon completion of the Share Conversion.

Share Certificates

Share certificates representing Subordinate Voting Shares will be deemed to represent common shares from and after the effective date specified in the Articles of Amendment to be filed as contemplated by the special resolution to effect the Share Conversion. Delivery of Subordinate Voting Share certificates will continue to be good delivery for settlement of trades through the facilities of the TSX and the NYSE. There will be no need to exchange existing share certificates for new share certificates.

Impact of Addition to Stated Capital Account for Multiple Voting Shares

The increase to the stated capital account of the Multiple Voting Shares will increase the adjusted cost base of such shares for Canadian income tax purposes. As a result, the amount of gain realized for income tax purposes on a disposition of such shares will be reduced. The amount of the increase is designed to be less than or equal to the safe income of the Multiple Voting Shares. In general terms, safe income represents the portion of the consolidated after-tax retained earnings, computed on an income tax basis, of Royal Group that can reasonably be considered to have contributed to the gain on such shares. Income rules accommodate this type of planning in order to minimize double taxation of income that would otherwise arise due to the fact that corporate income is reflected in the gain on shares of a company and would otherwise be taxable on a disposition of such shares.

The addition to the stated capital account we maintain in respect of our Multiple Voting Shares as provided for in the special resolution will have no adverse effect on the Subordinate Voting Shares.

Holders of Subordinate Voting Shares who wish, at their own cost, to effect an increase in the stated capital of their shares and thereby reduce capital gains under theIncome TaxAct (Canada) upon subsequent disposition of such shares, may make arrangements to do so by contacting our Corporate Secretary at Royal Group Technologies Limited, 1 Royal Gate Boulevard, Vaughan, Ontario, L4L 8Z7.

EX ECUTIVE COMPENSATION

The fiscal 2004 compensation of our senior executives was determined by our Human Resources and Compensation Committee and approved by our board of directors. Our policy is to provide a compensation package that will attract and retain qualified and experienced executives.

Summary Compensation

The following table sets out all compensation paid in fiscal 2004, comprised of the 15 months ended December 31, 2004, and in fiscal 2003 and fiscal 2002, comprised of the 12 months ended September 30, 2003 and 2002, respectively, for the individuals who were at December 31, 2004 ourNamed Executive Officers, as determined in accordance with applicable securities laws.

Summary Compensation Table

| | | | Long-Term Compensation | |

| | | Annual Compensation | Awards | Payouts | |

| Name and Principal Position as at December 31, 2004 | Fiscal Year | Salary ($) | Bonus ($) | Other Annual compensation(1) ($) | Securities(2) Under Options granted (#) | Shares or Units Subject to Resale Restrictions ($) | LTIP Payouts ($) (3) | All Other Compensation |

| James Sardo(4) Interim President and Chief Executive Officer | 2004 | $58,333 | Nil | $1,200 | Nil | $79,607(5) | Nil | Nil |

| Robert Lamoureux(6) Interim Chief Financial Officer | 2004 | $33,333 | Nil | $1,200 | Nil | $45,488(5) | Nil | Nil |

| Angelo Bitondo President, Custom Profiles, Outdoor Products, Royal Building Technologies Divisions | 2004 2003 2002 | $516,154 $218,000 $165,000 | $203,571 $169,500 $70,000 | $14,770 $12,000 $12,000 | Nil Nil 25,000 | $1,440,000(7) Nil Nil | Nil | Nil |

| Larry Meehan President, Exterior Cladding Division | 2004 2003 2002 | $481,250 $312,500 $250,000 | $364,146 $85,968 $86,200 | $15,000 $12,000 $12,000 | Nil Nil 25,000 | $600,000(7) Nil Nil | Nil | Nil |

| Enzo Macri President, Housewares Division | 2004 2003 2002 | $294,060 $232,820 $232,820 | $30,000 $27,000 $104,600 | $15,000 $12,000 $12,000 | Nil | $300,000(7) Nil Nil | Nil | Nil |

| Vic De Zen(8) Former Co-Chief Executive Officer | 2004 2003 2002 | $245,308 $900,000 $500,000 | $25,000 $780,250 $3,829,548(9) | $3,000 $20,536 $20,234 | Nil Nil 320,000 | Nil | Nil | Nil |

| Douglas Dunsmuir(11) Former President and Chief Executive Officer | 2004 2003 2002 | $1,200,731 $900,000 $358,000 | $119,262 $780,250 $2,221,820(9) | $13,000 $13,707 $13,647 | Nil Nil 200,000 | $2,400,000(10) Nil Nil | Nil | Nil |

| Ron Goegan(12) Former Chief Financial Officer, Senior Vice President | 2004 2003 2002 | $655,385 $500,000 $204,000 | $268,095 $728,150(13) $487,728 | $14,318 $12,000 $12,000 | Nil 25,000 60,000 | $1,980,000(10) Nil Nil | Nil | Nil |

| Lu Galasso(14) Former Vice President and Director of Taxation | 2004 2003 2002 | $294,616 $300,000 $204,000 | $47,500 $216,050 $487,728 | $12,273 $12,000 $12,000 | Nil 25,000 60,000 | Nil | Nil | $550,000(14) |

| Gwain Cornish(15) Former Senior Vice President | 2004 2003 2002 | $377,885 $425,000 $280,000 | $150,000 $166,050 $922,728 | $3,000 $12,000 $12,000 | Nil | $480,000(7) Nil Nil | Nil | $2,000,000(15) |

| (1) | Other Annual Compensation consists of a car allowance. In the case of Mr. De Zen and Mr. Dunsmuir, it also includes directors’ fees from two Italian subsidiaries of Royal Group which have minority shareholders. |

| | |

| (2) | Options exercisable for Subordinate Voting Shares. |

| | |

| (3) | There have been no payouts under our SMIP. |

| (4) | Mr. Sardo was appointed as our Interim President and Chief Executive Officer on November 26, 2004. Table discloses all Mr. Sardo’s compensation paid in respect of fiscal 2004. |

| | |

| (5) | DSU representing an entitlement to, in the case of Mr. Sardo, 79,607 Subordinate Voting Shares and, in the case of Mr. Lamoureux, 45,488 Subordinate Voting Shares. Represents the value of DSU granted pursuant to the Directors Deferred Stock Unit Plan. See “-- Election of Directors - Directors Deferred Stock Unit Plan” and “Report on Executive Compensation - Interim President and Chief Executive Officer and Interim Chief Financial Officer Compensation”. Value based on the $12.59 closing price of Subordinate Voting Shares on November 26, 2004. |

| | |

| .(6) | Mr. Lamoureux was appointed as our Interim Chief Financial Officer on November 26, 2004. Table discloses all Mr. Lamoureux’s compensation paid in respect of fiscal 2004. |

| | |

| (7) | RSU representing an entitlement to, in the case of Mr. Bitondo, 120,000 Subordinate Voting Shares, in the case of Mr. Meehan, 50,000 Subordinate Voting Shares, in the case of Mr. Macri, 25,000 Subordinate Voting Shares, and in the case of Mr. Cornish, 40,000 Subordinate Voting Shares. Represents the value of RSU granted pursuant to the SMIP (see “-- Stock-based Compensation Plans - Senior Management Incentive Plan”). Such RSU will vest in 2007 if specified 2006 earnings per share and consolidated return on invested capital targets are met. The achievement of one of the targets will result in the vesting of 50% of the RSU granted. Value based on the $12 closing price of Subordinate Voting Shares on the TSX on July 1, 2004, the trading day prior to the grant date. |

| | |

| (8) | Mr. De Zen retired as our Co-Chief Executive Officer on December 18, 2003. Table discloses all Mr. De Zen’s compensation paid in respect of fiscal 2004. |

| | |

| (9) | In fiscal 2003, our board established the Human Resources and Compensation Committee for the review of executive compensation, commencing with the retroactive review of bonuses paid to Mr. De Zen and Mr. Dunsmuir for fiscal 2002. As a result of that review, the fiscal 2002 bonuses awarded to such individuals were reduced by $1,800,000 in respect of Mr. De Zen and $1,000,000 in respect of Mr. Dunsmuir. The reductions of the fiscal 2002 bonuses previously paid to such individuals have been recorded as receivables by Royal Group. Accordingly, the above table reflects their net bonuses awarded for fiscal 2002 after deducting the reductions (the pre-reduction bonuses were $5,629,548 for Mr. De Zen and $3,221,820 for Mr. Dunsmuir). Such receivables were to be collected from Mr. De Zen and Mr. Dunsmuir by offset to subsequent incentive bonuses awarded and otherwise payable to them and as determined by the committee. In fiscal 2003, the committee reviewed and approved new salary and bonus amounts for our executive officers. As directed by the committee, each of Mr. De Zen and Mr. Dunsmuir offset $670,250 of their fiscal 2003 bonus award against their outstanding receivables. Mr. Dunsmuir repaid the remainder of such receivable to Royal Group in fiscal 2004. As at December 31, 2004, the remaining amount receivable in respect of Mr. De Zen’s fiscal 2002 bonus was $1,129,750. Such amount will be repaid by Mr. De Zen pursuant to the Conversion Agreement following conversion of all outstanding Multiple Voting Shares to Subordinate Voting Shares. |

| | |

| (10) | All such RSU granted to Mr. Dunsmuir and Mr. Goegan in 2004 were cancelled effective November 26, 2004. |

| | |

| (11) | During fiscal 2004, Mr. Dunsmuir acted as our President and Co-Chief Executive Officer from September 15, 2003 to December 18, 2003 and as our President and sole Chief Executive Officer from December 18, 2003 to November 26, 2004. Mr. Dunsmuir’s employment with Royal Group was terminated on November 26, 2004. Table discloses all Mr. Dunsmuir’s compensation paid in respect of fiscal 2004. |

| | |

| (12) | Mr. Goegan was terminated as our Chief Financial Officer on November 26, 2004. |

| | |

| (13) | Mr. Goegan was paid a special bonus of $250,000 in fiscal 2003, as recommended by a Special Committee of independent directors and approved by the Human Resources and Compensation Committee, in recognition of Mr. Goegan’s assistance with the Special Committee’s review of shareholder value maximization alternatives. |

| | |

| (14) | Mr. Galasso retired on October 1, 2004 and received $550,000 payable in six equal monthly instalments. See “Report on Executive Compensation - Termination of Employment, Change in Responsibilities and Employment Agreements”. |

| | |

| (15) | Mr. Cornish retired on July 5, 2004 and received $2,000,000 upon his retirement. See “Report on Executive Compensation. - Termination of Employment, Change in Responsibilities and Employment Agreements”. |

Stock-Based Compensation Plans

We have two stock-based compensation plans: our Long-Term Incentive Plan (LTIP) and our Senior Management Incentive Plan (SMIP), both of which have been approved by shareholders. The LTIP and SMIP resulted from an initiative undertaken by our board to design an overall long-term compensation and incentive regime for our officers and employees consistent with our interests and those of our shareholders. Our Human Resources and Compensation Committee is responsible for the administration of both the LTIP and the SMIP.

Under the LTIP and the SMIP and any other stock-based compensation plan that we may adopt:

| • | the aggregate number of Subordinate Voting Shares initially reserved for issuance was 9,328,855 shares; |

| • | the aggregate number of Subordinate Voting Shares reserved for issuance to insiders (excluding those who are insiders solely by virtue of being a director or senior officer of Royal Group) may not exceed 10% of our outstanding Subordinate Voting Shares; |

| | |

| • | the number of Subordinate Voting Shares issued within a one-year period to insiders (excluding those who are insiders solely by virtue of being a director or senor officer of Royal Group) may not exceed 10% of our outstanding Subordinate Voting Shares; |

| | |

| • | the aggregate number of Subordinate Voting Shares authorized for issuance to any one insider (excluding those who are insiders solely by virtue of being a director or senior officer of Royal Group) within a one-year period is limited to 5% of our outstanding Subordinate Voting Shares; |

| | |

| • | the aggregate number of Subordinate Voting Shares reserved for issuance may not exceed 10% of our outstanding voting shares; |

| | |

| • | the number of Subordinate Voting shares issuable in a one-year period may not exceed 10% of our outstanding voting shares; |

| | |

| • | as at April 22, 2005, since shareholder approval of such plans in January 2004, a total of 10,000 Subordinate Voting Shares have been issued under the LTIP, 88,322 Subordinate Voting Shares were issued in connection with a restricted stock unit plan approved by shareholders in February 2004 which is no longer in effect, and no Subordinate Voting Shares have been issued under the SMIP; and |

| | |

| • | as at April 22, 2005, an aggregate of 9,230,533 Subordinate Voting Shares remain available for issuance under such plans. |

Long-Term Incentive Plan

The LTIP was initially adopted as a stock option plan in 1994 and was amended in January 2004 to provide for performance vesting criteria. The key features of the LTIP are set out below.

| • | The maximum number of Subordinate Voting Shares issuable under the LTIP is 7,830,533 (representing 8.4% of our outstanding voting shares as at April 22, 2005). |

| | |

| • | The aggregate number of Subordinate Voting Shares reserved to any one person under any stock option may not exceed 5% of the outstanding Subordinate Voting Shares. |

| | |

| • | As at April 22, 2005, there were options exercisable for an aggregate of 3,067,953 Subordinate Voting Shares outstanding representing approximately 3.3% of our outstanding voting shares as at April 22, 2004. |

| | |

| • | Officers, employees and certain consultants of Royal Group are eligible to participate in the LTIP. Commencing January 2004 non-management directors are no longer eligible for grants under the LTIP. |

| | |

| • | The maximum term of each option is nine years from the date of grant. |

| | |

| • | The exercise price of each option granted is the closing market price of our Subordinate Voting Shares on the day prior to the date of grant on (a) the TSX generally, or (b) the New York Stock Exchange in the case of options granted to U.S. residents. |

| | |

| • | The Human Resources and Compensation Committee may establish performance-based vesting criteria based on performance objectives for Royal Group and/or individual optionees and any options in respect of which the performance vesting criteria is not satisfied are cancelled unless the committee determines otherwise. |

| • | Subject to the satisfaction of applicable performance criteria, if any, options issued after the 2004 amendments to the LTIP vest on the third anniversary of the grant date; |

| | |

| • | In respect of options granted prior to January 2004, generally, 50% of the options awarded pursuant to a specific grant become exercisable at any time after the third anniversary of the grant date and the remaining 50% of such options become exercisable at any time after the sixth anniversary of the grant date. |

| | |

| • | Options are not assignable or transferable by an optionee except to a trust, the sole trustee and beneficiary of which is the optionee, or by will or the laws of devolution and distribution in accordance with the LTIP. |

| | |

| • | Although the LTIP permits our board to provide financial assistance to an optionholder to enable the exercise some or all of such holder’s options, no such assistance was provided in fiscal 2004. |

| | |

| • | Upon termination of an optionholders’ employment, options are exercisable, subject to satisfaction of any vesting requirements, until the earlier of their expiry date and the date that is three months after the optionee’s employment ceased (or one year from the optionee’s death or long-term disability) unless the Human Resources and Compensation Committee determines otherwise except that, if an optionee resigns or is terminated for cause, all unexercised options granted to the optionee, whether vested or unvested, terminate as at the date of resignation or notice of termination of employment, as the case may be, unless the committee determines otherwise. |

| | |

| • | The LTIP may not be amended without the prior regulatory and shareholder approval. |

No options were granted under the LTIP in fiscal 2004. In fiscal 2004, a total of 135,553 options issued under the LTIP were exercised. The following table shows options exercised by Name of Executive Officers in fiscal 2004 and the value of unexercised options held by such officers.

Aggregated Option Exercises During the Financial Year Ended December 31, 2004 and Financial Year End Option Values

Name | Securities(1)Acquired on Exercise (Number) | Aggregate Value Realized | Unexercised Options at December 31, 2004 (Number) | Value of Unexercised In-The-Money Options at December 31, 2004(2) |

Exercisable | Unexercisable | Exercisable | Unexercisable |

| James Sardo | Nil | Nil | Nil | Nil | Nil | Nil |

| Robert Lamoureux | Nil | Nil | Nil | Nil | Nil | Nil |

| Angelo Bitondo | Nil | Nil | 25,000 | 25,000 | Nil | Nil |

| Larry Meehan | Nil | Nil | 30,000 | 25,000 | Nil | Nil |

| Enzo Macri | Nil | Nil | 30,000 | Nil | Nil | Nil |

| Vic De Zen | Nil | Nil | 1,360,000 | Nil | Nil | Nil |

| Douglas Dunsmuir | Nil | Nil | Nil | Nil | Nil | Nil |

| Ron Goegan | 9,333 | $12,870 | Nil | Nil | Nil | Nil |

| Lu Galasso | 9,333 | $12,870 | 42,500 | 42,500 | Nil | Nil |

Gwain Cornish | 21,777 | $70,775 | Nil | Nil | Nil | Nil |

| (1) | Subordinate Voting Shares. |