Filed by LAN S.A. Pursuant to

Rule 425 under the Securities Act of 1933 and

Rule 14d-2 under the

Securities Exchange Act of 1934

Subject Company:

TAM S.A.

(Commission File No. 333-177984)

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements, including with respect to the negotiation, implementation and effects of the proposed combination of LAN Airlines S.A. and TAM S.A. Such statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “would” or other similar expressions. Forward-looking statements are statements that are not historical facts, including statements about our beliefs and expectations. These statements are based on current plans, estimates and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors and uncertainties include in particular those described in the documents we have filed with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them, whether in light of new information, future events or otherwise.

ADDITIONAL INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND WHERE TO FIND IT

This document relates to a proposed business combination between LAN Airlines S.A. (“LAN”) and TAM S.A. (“TAM”), which is the subject of a registration statement on Form F-4 (Registration No. 333-177984) filed with the SEC by LAN and Holdco II S.A. (“Holdco II”) which has been declared effective by the SEC and the offer to exchange/prospectus included therein. This document is not a substitute for the registration statement, offer to exchange/prospectus or any other offering materials or other documents that LAN and Holdco II have filed or will file with the SEC or send to shareholders in connection with the proposed combination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, OFFER TO EXCHANGE/PROSPECTUS AND ALL OTHER OFFERING MATERIALS AND DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. All such documents, if filed, would be available free of charge at the SEC’s website (www.sec.gov) or by directing a request to LAN Investor Relations, at 56-2-565-8785 or by e-mail at investor.relations@lan.com, or to TAM Investor Relations, at 55-11-5582-9715 or by e-mail at invest@tam.com.br.

This filing shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Support Material May 2012 |

| FORWARD-LOOKING STATEMENTS This document contains forward-looking statements, including with respect to the negotiation, implementation and effects of the proposed combination. Such statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “would” or other similar expressions. Forward-looking statements are statements that are not historical facts, including statements about our beliefs and expectations. These statements are based on current plans, estimates and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors and uncertainties include in particular those described in the documents we have filed with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them, whether in light of new information, future events or otherwise. ADDITIONAL INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND WHERE TO FIND IT This document relates to a proposed business combination between Lan Airlines S.A. (“LAN”) and TAM S.A. (“TAM”), which is the subject of a registration statement on Form F-4 (Registration No. 333-177984) filed with the SEC by LAN and Holdco II S.A. (“Holdco II”), a new entity formed in connection with the combination, which has been declared effective by the SEC and the prospectus included therein. This document is not a substitute for the registration statement, prospectus and offering materials that LAN and Holdco II will file with the SEC or any other documents that they may file with the SEC or send to shareholders in connection with the proposed combination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS, EXCHANGE OFFER DOCUMENTS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. All such documents, if filed, would be available free of charge at the SEC’s website (www.sec.gov) or by directing a request to LAN Investor Relations, at 56-2-565-8785 or by e-mail at investor.relations@lan.com, or to TAM Investor Relations, at 55-11-5582-9715 or by e-mail at invest@tam.com.br. 2 |

| Creating a global airline group 3 Creating the largest airline group in Latin America (1) – Passenger and cargo operations to more than 150 destinations in over 23 countries – Largest frequent flyer program in the region Benefits for clients, shareholders and suppliers – Complementary assets and market positions (almost no network overlap) – More share liquidity, benefiting shareholders Consolidation in the airline industry – Worldwide consolidation of airlines through mergers and acquisitions – Airlines are increasing their presence in Latin America due to the region’s high growth perspective Unique opportunity to become the leading airline in Latin America – One of the world’s fastest growing regions – Strong presence in Latin America’s main markets – Leading position with significant competitive advantages (1) Combined figures calculated as the sum of LAN and TAM figures. Do not represent audited pro- forma or projections |

| LAN and TAM performance in 2011 4 EBITDAR Margin (US$ millions) 1 Operating Margin (US$ millions) 1 Aircraft 3 Revenue (US$ billions) 1 Employees (thousands) 3 % % Net Income (US$ millions) 1, 2 29.8 161 -201 1,288 585 7.8 (4) 7.5% 16.6% 21.8 149 320 1,119 540 5.7 9.4% 19.6% Passengers (millions) 37.7 22.6 (1) TAM’s financials converted into US Dollars at an exchange rate of 1.675 R$/US$ for 2011 (2) TAM’s net income includes a non operating impact due to exchange differences and mark-to-market. (3) Figures as of December 31, 2011 (4) Net Revenues |

| Both companies show a solid financial track record 5 TAM (1) (US$ Millions) LAN (US$ Millions) (1) TAM’s financials converted into US Dollars at an exchange rate of 1.994 R$/US$; 1.759 R$/US$ and 1.675 R$/US$ for 2009, 2010 and 2011, respectively. |

| LATAM will be the largest airline in the region… 6 Passengers (Millions 2011) Fleet Size (Dec 31, 2011) Source: Airline Business, One Source, Annual Reports, Airline Monitor, Euromonitor, (1) Around 15 destinations are served by both TAM and LAN 37.7 36.2 22.6 20.8 7.7 TAM GOL LAN Avianca-Taca COPA 161 149 121 94 73 TAM LAN GOL Avianca-Taca COPA Destinations (2011) (1) 100 100 76 65 59 LAN Avianca-Taca GOL TAM COPA |

| … and in terms of passenger and cargo transported 7 Top 12 airlines in passengers transported Millions of passengers, 2011 Top 12 airlines in cargo transported Thousands of tons, 2011 Source: Company filings. (1) Combined figures calculated as the sum of LAN and TAM figures. Do not represent audited pro-forma or projections * JAL information as of 2010. 1 1 5 1 5 10 52 53 60 69 75 76 81 86 96 101 111 113 IAG US Airways TAM + LAN China Eastern AF-KLM Ryanair China Southern American United Lufthansa Southwest Delta 911 1.116 1.135 1.145 1.156 1.390 1.426 1.443 1.649 1.720 1.767 2.120 JAL* TAM + LAN China Southern China Airlines Singapore United Air China China Eastern Cathay Korean Air Emirates Lufthansa 1 10 |

| 8 LAN Airlines Santiago, 1929 LAN Peru Lima, 1999 LAN Ecuador Guayaquil, 2003 LAN Argentina Buenos Aires, 2005 LAN Colombia Bogota, 2010 Global context has created an opportunity for a Latin American market leader to emerge TAM Linhas Aéreas São Paulo, 1976 TAM Mercosur Asunción, 1996 |

| 9 LATAM will offer the broadest connectivity… LAN TAM GOL COPA Avianca – TACA Aerolineas Argentinas Airline Hubs: TAM + LAN |

| … with strong presence in domestic markets… 10 ASKs Source: Diio Mi: Market Intelligence for the Aviation Industry Note: Information as of 2011 Aerolíneas Argentinas TAM LAN Avianca TACA TAME LAN LAN GOL Sky LAN Avianca TACA Avianca TACA COPA LAN Peruvian Icaro 0% 20% 40% 60% 80% 100% Argentina Brazil Chile Colombia Ecuador Peru |

| … and connecting South America with the world 11 ASKs Source: Diio Mi: Market Intelligence for the Aviation Industry Note: Information as of 2011. LAN American BA - Iberia TAM LAN Air France - KLM Avianca -TACA TAM LAN GOL United-Continental TAM Aerolineas Argentinas Delta Lufthansa-Swiss Pluna Avianca-TACA TAP Others Others Alitalia Air Europa Aerolineas Argentinas Avianca-TACA Others 0% 20% 40% 60% 80% 100% Within South America USA and Canada Europe |

| LAN cargo expertise + TAM market opportunity = potential for cargo growth LAN’s global and diversified cargo network… …with TAM’s Brazilian market presence Brazil is the largest domestic cargo market in Latin America TAM offers significant strengths – Domestic widebody network – Existing cargo operation – Strong European network with growth potential North America to South America Europe to South America Regional (intra) South America 12 |

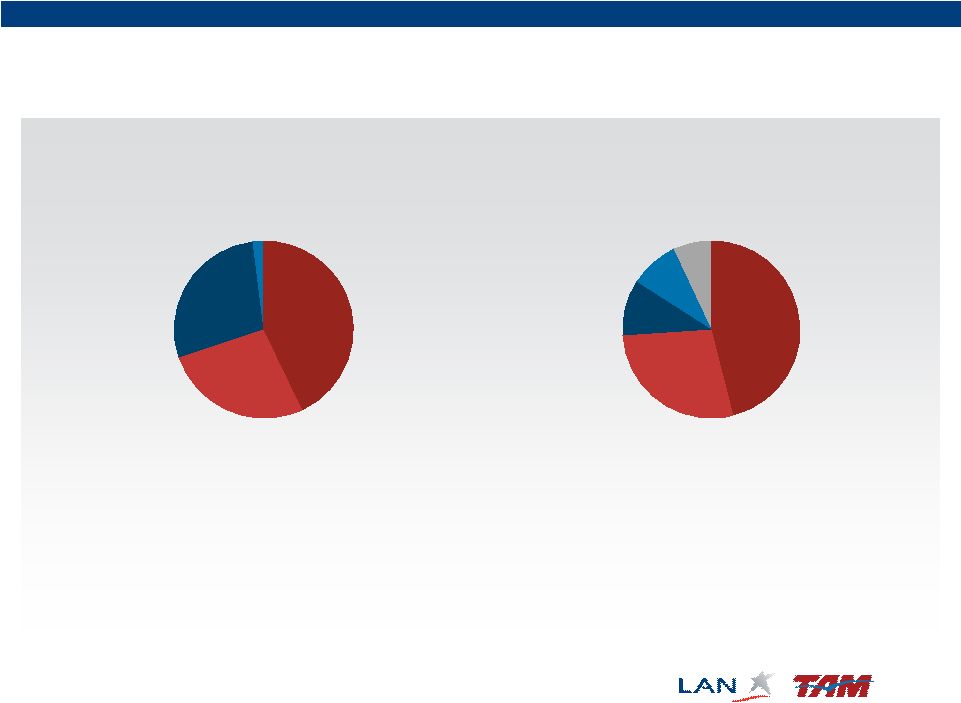

| LATAM will consolidate different business units 13 Source: Company filings (press release 4Q2011) (1) Considers the year ended on December 31 , 2011. TAM’s financials converted into US Dollars at an exchange rate of 1.675 R$/US$ (2) Net revenues LAN Revenues (1) : US$ 5.7 billion TAM Revenues (1)(2) : US$ 7.8 billion International Passengers 43% LAN Domestic Passengers 27% Freight 28% Others 2% TAM Domestic Passengers 46% International Passengers 28% Freight 10% Multiplus 9% Others 7% st |

| LATAM’s leadership within a region with significant growth potential… 14 Ecuador Mexico Chile UK Trips per Capita * (as of 2011) * Note: domestic and international trips by all carriers Source: IATA, Boeing, IMF, CIA, Bloomberg IATA Passenger Traffic Growth (RPKs as of 2011) 0,5% 5,4% 9,1% 11,3% 8,6% 2,2% Africa Asia/Pacific Europe Latin America Middle East North America Latin America was the fastest growing region (measured in RPKs) during 2011 World Average 5.9% 2,74 2,56 0,76 0,49 0,47 0,46 0,46 0,40 0,39 0,0 1,0 2,0 3,0 Argentina Peru Brazil Colombia USA |

| … captured through a modern and efficient fleet plan 15 Narrowbody Fleet: 99 Widebody Fleet: 36 Cargo Fleet: 14 Narrowbody Fleet: 132 Widebody Fleet: 29 (fleet as of Dec 2011) (fleet as of Dec 2011) Source: TAM and LAN (press release 4Q2011) |

| Both Companies operate well established frequent flyer program 16 The new combined program should drive customer loyalty, business growth and ancillary revenue streams Over 9.4 million members (as of Dec 31, 2011) 5.8 million members (as of Feb 29, 2012) |

| 17 LATAM’s business unit structure… Board of Directors LATAM LATAM CEO LAN CEO Domestic Passenger Business Unit C A R G O Cargo Business Unit International Passenger Business Unit Long-haul business Regional business Domestic Brazil Business Unit LAN Chile LAN Peru LAN Argentina LAN Ecuador LAN Colombia TAM CEO MRO Business Unit |

| 18 … will be run by executives with extensive experience in the airline industry A lifetime experience in the airline business, Mr. Mauricio Amaro has been a member of TAM’s Board of Directors since December 2004, serving as Vice President since April 2007. Enrique Cueto LATAM CEO Marco Antonio Bologna TAM CEO Ignacio Cueto LAN CEO Mauricio Amaro LATAM Chairman Mr. Marco Antonio Bologna is TAM’s current CEO and a member of TAM’s Board of Directors, positions he has held since August 2009. His experience in TAM dates back over 10 years during which he was CFO of TAM (2003-2004) among other positions and responsibilities. Mr. Enrique Cueto has been CEO of LAN since 1994, after serving for 10 years as CEO of Fast Air, a Chilean cargo airline. He is an active member of the boards of the Oneworld alliance and of IATA, among other organizations. Mr. Ignacio Cueto Plaza began his career in the aviation industry in 1985 with Fast Air, becoming its CEO in 1993.Since then, he’s been CEO of LAN Cargo (1995- 1998) and CEO of LAN’s passenger business (1999-2005) and is currently COO of LAN Airlines. |

| Employees come from throughout South America 19 Employees By Country (1) (as of Dec 2011) Source: TAM and LAN (press release 4Q2011) (1) Combined figures calculated as the sum of LAN and TAM figures. Do not represent audited pro-forma or projections 21.838 29.728 51.566 56% 44% 28,367 28,882 11,315 11,416 2,370 2,849 3,468 3,497 1,690 1,690 1,702 1,728 1,293 1,361 1,504 LAN TAM LAN + TAM Brazil Chile Argentina Peru Ecuador Colombia Others |

| Appendix 20 |

| Corporate structure after the merger is completed 21 Note: assumes 100% participation of TAM shareholders in the exchange offer All stock transaction: TAM shareholders are offered newly issued LAN shares (1 TAM = 0.9 LAN) Structure designed to comply with foreign ownership restrictions, including 20% foreign ownership restriction in Brazil Economic alignment of all shareholders LATAM AIRLINES GROUP (Currently LAN) Chile TAM S.A. Brazil HoldCo I S.A. Chile TAM Controlling shareholders 13.6% LAN Controlling shareholders 24.1% Others LAN 46.8% 100% ON Shares (voting) Others TAM 15.5% 100% PN Shares (non voting) 80% Voting Shares 20% Voting Shares 100% Non Voting Shares Multiplus Brazil TLA Brazil 100% 73% |

| For additional information see: 22 1. Form F4 Registration Statement, including but not limited to the Q&A on pages 1 through 15 2. Information Agent: D.F. King: Banks and Brokerage Firms, Please Call: (212) 269-5550 Shareholders and All Others Call Toll-Free (800)-676-7437 3. Websites: LAN’s website at www.lan.com, LATAM’s website at www.latamairlines.com TAM’s website at www.tam.com.br. |

|