Maxim Growth Conference March 26, 2012 Duane W. Albro President & Chief Executive Officer (NASDAQ : WWVY)

Safe Harbor Statement This presentation and related discussions may contain "forward - looking statements" w ithin the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , including statements, without limitation, regarding expectations, beliefs, intentions or strategies regarding the future . WVT intends that such forward - looking statements be subject to the safe - harbor provided by the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties and other factors that may cause WVT's actual results, performance or achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements . Such factors include, among others, the following : general economic and business conditions, both nationally and in the geographic regions in which WVT operates ; industry capacity ; demographic changes ; technological changes and changes in consumer demand ; the successful integration of WVT's acquired businesses ; goodwill impairment ; resolution of a billing dispute with a long - distance carrier ; existing governmental regulations and changes in, or the failure to comply with, governmental regulations ; legislative proposals relating to the businesses in which WVT operates ; changes to the USF ; reduction in cash distributions from the Orange County - Poughkeepsie Limited Partnership ; risks associated with our unfunded pension liability ; competition ; or the loss of any significant ability to attract and retain qualified personnel . Given these uncertainties, current and prospective investors should be cautioned in their reliance on such forward - looking statements . Except as required by law, WVT disclaims any obligation to update any such factors or to publicly announce the results of any revision to any of the forward - looking statements contained herein to reflect future events or developments . A more comprehensive discussion of risks, uncertainties and forward - looking statements may be seen in WVT's Annual Report on Form 10 - K and other periodic filings with the U . S . Securities and Exchange Commission . 2

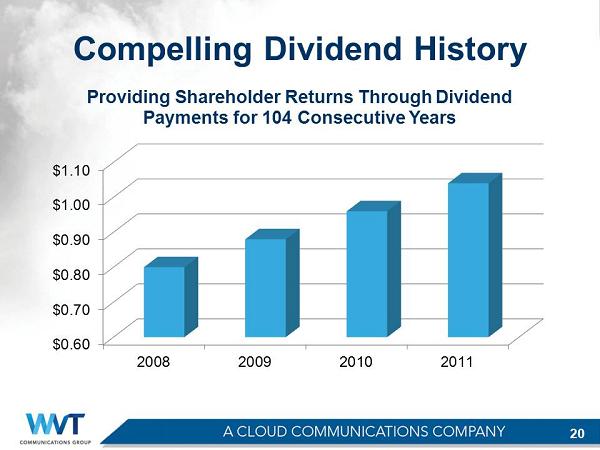

Overview • Founded in 1902 as ILEC in rural NY; publicly traded since 1998 • Transition to Cloud Communications Company commences in 2009 with acquisition of USA Datanet • Accelerates transition with Alteva acquisition in 2011 • Today, a world technology leader in providing cloud - based Unified Communications to SMEs • Significant annual cash payouts from wireless investment • Dividends paid for 104 consecutive years 3

Rural Telecom Business • Warwick Valley Telephone • ILEC services – exceeded 29,000 access lines in 2002 • Customers in upstate NY and northern NJ • Wireless substitution, cable and other competition having negative impact – approx. 14,000 current access lines • Leveraged historically profitable operations to fund growth strategies • Network investments and strategic partnerships enable triple - play and other web - based services • Transition into Cloud Communications company 4

Transition to the Cloud • Cloud communications and computing use scalable IT - related capabilities provided as a service to users via the Internet • Cloud computing market to reach $25 Billion by 2013 (MarketResearch.com) • Opportunities for customer growth, revenue growth, ARPU improvement and margin expansion • WWVY leveraging its 100+ years experience in network management , service quality and customer satisfaction • WWVY platform built with open standards and strategic partnerships for industry’s most powerful and ubiquitous applications 5

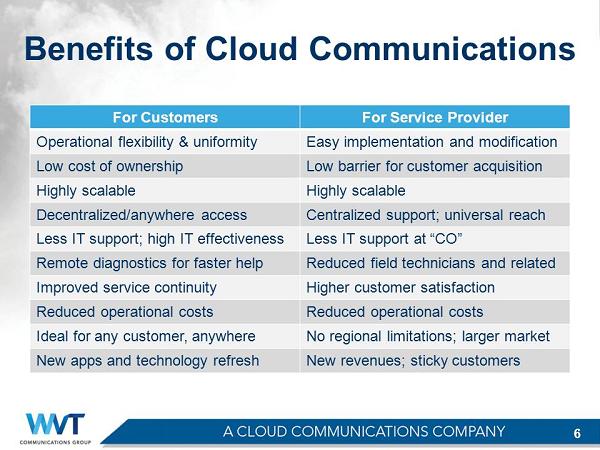

Benefits of Cloud Communications For Customers For Service Provider Operational flexibility & uniformity Easy implementation and modification Low cost of ownership Low barrier for customer acquisition Highly scalable Highly scalable Decentralized/anywhere access Centralized support; u niversal reach Less IT support; high IT effectiveness Less IT support at “CO” Remote diagnostics for faster help Reduced field technicians and related Improved service continuity Higher customer satisfaction Reduced operational costs Reduced operational costs Ideal for any customer, anywhere No regional limitations; larger market New apps and technology refresh New revenues; sticky customers 6

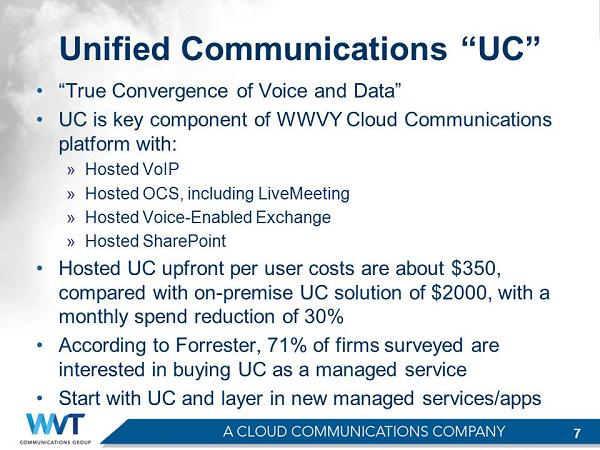

Unified Communications “UC” • “True Convergence of Voice and Data” • UC is key component of WWVY Cloud Communications platform with: » Hosted VoIP » Hosted OCS, including LiveMeeting » Hosted Voice - Enabled Exchange » Hosted SharePoint • Hosted UC upfront per user costs are about $350, compared with on - premise UC solution of $2000, with a monthly spend reduction of 30% • According to Forrester, 71% of firms surveyed are interested in buying UC as a managed service • Start with UC and layer in new managed services/apps 7

WWVY Cloud Companies • USA Datanet , acquired in 2009 • Based in Syracuse, NY • Focus on businesses with 35 or fewer seats 8 • Alteva , acquired in 2011 • Based in Philadelphia, PA • Focus on businesses with 35 or more seats • North America’s largest provider of enterprise hosted VoIP

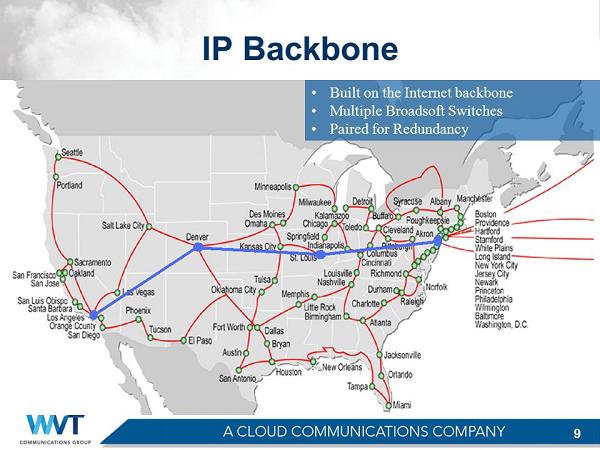

IP Backbone 9 • Built on t he Internet backbone • Multiple Broadsoft Switches • Paired for Redundancy

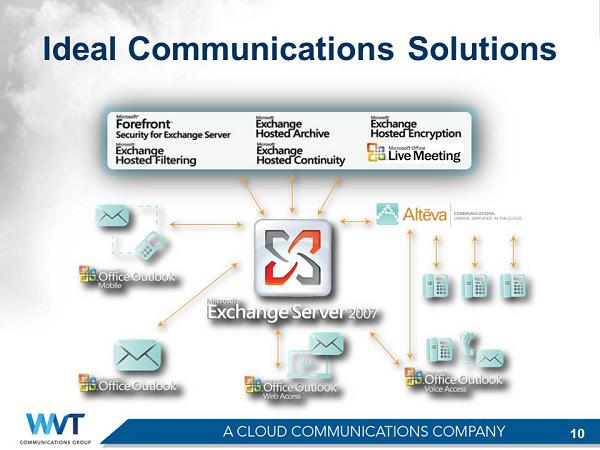

Ideal Communications Solutions 10

Unified Communications Anywhere Access * Continuous Collaboration * Professionally Delivered 11

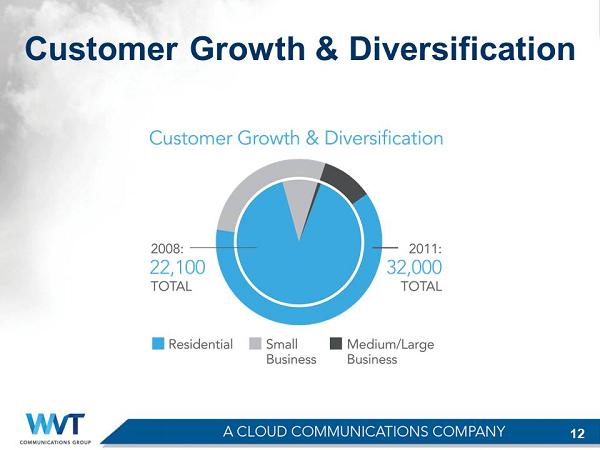

Customer Growth & Diversification 12

Financial Highlights 13

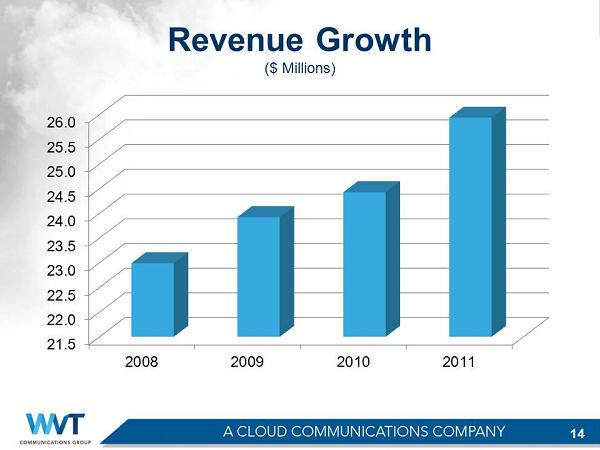

Revenue Growth ($ Millions) Revenue Growth ($ Millions) 21.5 22.0 22.5 23.0 23.5 24.0 24.5 25.0 25.5 26.0 2008 2009 2010 2011 14

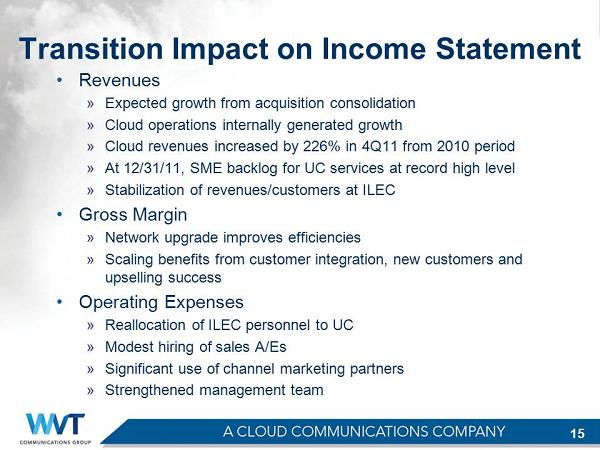

Transition Impact on Income Statement • Revenues » Expected growth from acquisition consolidation » Cloud operations internally generated growth » Cloud revenues increased by 226% in 4Q11 from 2010 period » At 12/31/11, SME backlog for UC services at record high level » Stabilization of revenues/customers at ILEC • Gross Margin » Network upgrade improves efficiencies » Scaling benefits from customer integration, new customers and upselling success • Operating Expenses » Reallocation of ILEC personnel to UC » Modest hiring of sales A/ Es » Significant use of channel marketing partners » Strengthened management team 15

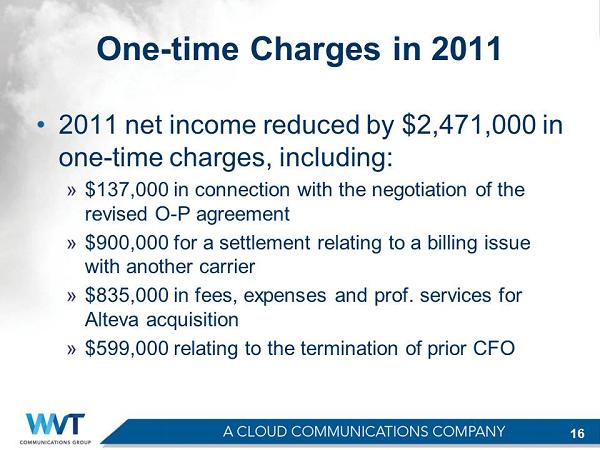

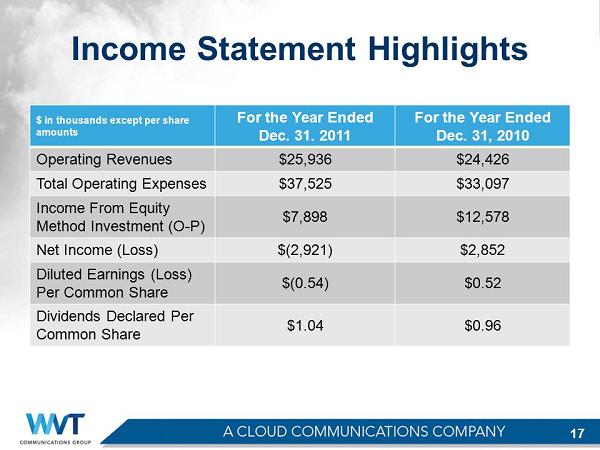

One - time Charges in 2011 • 2011 net income reduced by $2,471,000 in one - time charges, including: » $137,000 in connection with the negotiation of the revised O - P agreement » $900,000 for a settlement relating to a billing issue with another carrier » $835,000 in fees, expenses and prof. services for Alteva acquisition » $599,000 relating to the termination of prior CFO 16

Income Statement Highlights $ in thousands except per share amounts For the Year Ended Dec. 31. 2011 For the Year Ended Dec. 31, 2010 Operating Revenues $25,936 $24,426 Total Operating Expenses $37,525 $33,097 Income From Equity Method Investment (O - P) $7,898 $12,578 Net Income (Loss) $(2,921) $2,852 Diluted Earnings (Loss) Per Common Share $(0.54) $0.52 Dividends Declared Per Common Share $1.04 $0.96 17

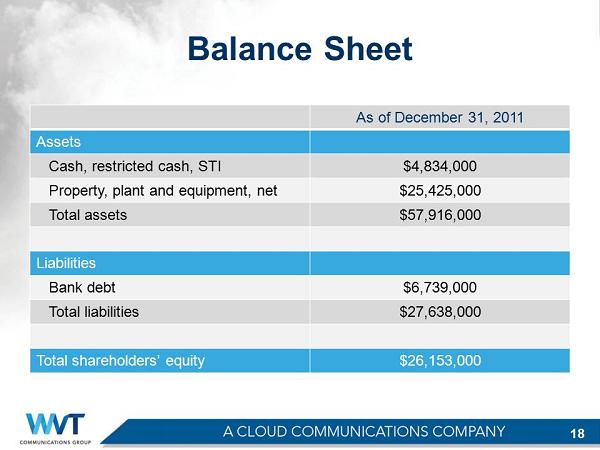

Balance Sheet As of December 31, 2011 Assets Cash, restricted cash, STI $4,834 ,000 Property, plant and equipment, net $25,425,000 Total assets $57,916,000 Liabilities Bank debt $6,739,000 Total liabilities $27,638,000 Total shareholders’ equity $26,153,000 18

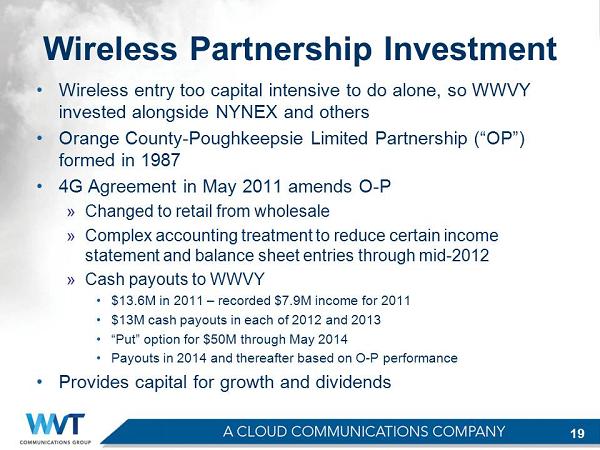

Wireless Partnership Investment • Wireless entry too capital intensive to do alone, so WWVY invested alongside NYNEX and others • Orange County - Poughkeepsie Limited Partnership (“OP”) formed in 1987 • 4G Agreement in May 2011 amends O - P » Changed to retail from wholesale » Complex accounting treatment to reduce certain income statement and balance sheet entries through mid - 2012 » Cash payouts to WWVY • $13.6M in 2011 – recorded $7.9M income for 2011 • $13M cash payouts in each of 2012 and 2013 • “Put” option for $50M through May 2014 • Payouts in 2014 and thereafter based on O - P performance • Provides capital for growth and dividends 19

Compelling Dividend History $0.60 $0.70 $0.80 $0.90 $1.00 $1.10 2008 2009 2010 2011 Providing Shareholder Returns Through Dividend Payments for 104 Consecutive Years 20

Industry Leadership Leadership Team Experience Duane W. Albro, President & CEO Verizon (pred.), Cablevision, Net2000 David Cuthbert, COO Alteva , U.S. Navy - Special Ops Ralph Martucci , EVP & CFO News Corp. (subs.), Frontier Comms . Louis Hayner, EVP & CSO Alteva , ATX John S. Mercer, EVP & CTO Global Crossing, U.S. Air Force Mark Marquez, EVP & CNO Alteva , Exelon (PECO Energy) Patrick W. Welsh, EVP & CAO Verizon, NYNEX Virginia Quackenbush , Pres. WVTele . 30+ years with WVT Communications 21

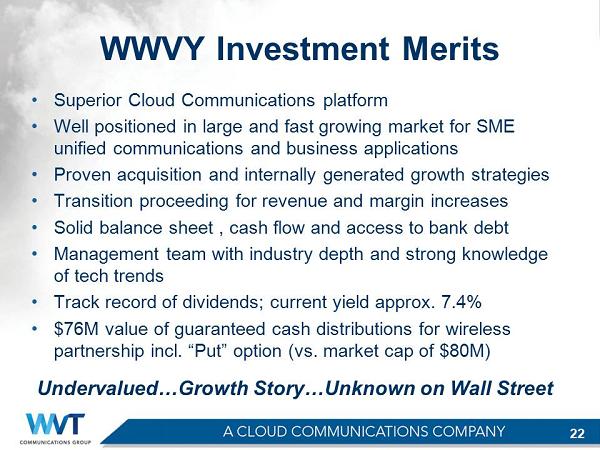

WWVY Investment Merits • Superior Cloud Communications platform • Well positioned in large and fast growing market for SME unified communications and business applications • Proven acquisition and internally generated growth strategies • Transition proceeding for revenue and margin increases • Solid balance sheet , cash flow and access to bank debt • Management team with industry depth and strong knowledge of tech trends • Track record of dividends; current yield approx. 7.4% • $76M value of guaranteed cash distributions for wireless partnership incl. “Put” option (vs. market cap of $80M) Undervalued…Growth Story…Unknown on Wall Street 22

Thank you. Duane W. Albro President & Chief Executive Officer (NASDAQ: WWVY) 47 Main St. | PO Box 592 | Warwick, NY 10990 www.wvtcg.com 23