1 Annual Meeting of Shareholders April 25, 2012

Annual Meeting of Shareholders Agenda April 25, 2012 • Call to Order • Statements of Rules and Procedural Matters • Appointment of the Secretary of the Meeting and Corporate Formalities • Introduction of the Board of Directors and Others • Appointment of Meeting Moderator • Presentation of Proposals Set Forth in the Proxy Statement • Shareholder Questions Regarding Proposals • Closing of the Polls • President and CEO’s Report on 2011 and Recent Events • Shareholder General Questions and Comments • Other Business • Adjournment of the Meeting

3 Annual Meeting of Shareholders April 25, 2012

4 President and CEO’s Report on 2011 and Recent Events

5 Forward Looking Statement Note Certain statements contained in this presentation, including, without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects” and words of similar import, constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements . Such factors include, among others, the following : general economic and business conditions, both nationally and in the geographic regions in which we operate ; industry capacity ; demographic changes ; technological changes and changes in consumer demand ; existing governmental regulations and changes in or the failure to comply with, governmental regulations ; legislative proposals relating to the businesses in which we operate ; competition ; or the loss of any significant ability to attract and retain qualified personnel and any other factors that are described in “Risk Factors . ” Given these uncertainties, current and prospective investors should be cautioned in their reliance on such forward - looking statements . Except as required by law we disclaim any obligation to update any such factors or to publicly announce the results of any revision to any of the forward - looking statements contained herein to reflect future events or developments .

6 Signature Events – 2011 to Date + 16% Financial Headline - Total Shareholder Return (January 1, 2011 through March 31, 2012) Corporate Development Headline - Transformational Acquisition • Significantly strengthens UC/Cloud business • Impressive management team and sales/marketing channels • North America’s largest enterprise hosted Voice over Internet Protocol (“VoIP”) provider • Deal for approx. $17 million in cash & stock

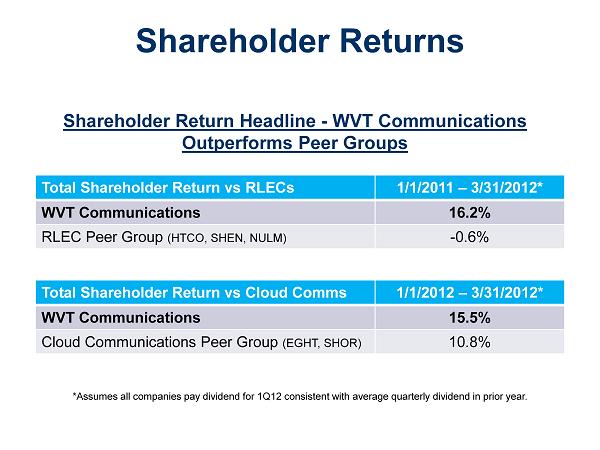

7 Shareholder Returns Shareholder Return Headline - WVT Communications Outperforms Peer Groups Total Shareholder Return vs RLECs 1/1/2011 – 3/31/2012* WVT Communications 16.2% RLEC Peer Group (HTCO, SHEN, NULM) - 0.6% Total Shareholder Return vs Cloud Comms 1/1/2012 – 3/31/2012* WVT Communications 15.5% Cloud Communications Peer Group (EGHT, SHOR) 10.8% *Assumes all companies pay dividend for 1Q12 consistent with average quarterly dividend in prior year.

Corporate Development Headline • But it is our transformational acquisition that positions us for greater future returns • Introducing Alteva …and an acceleration of our Cloud Communications strategy • Welcome Alteva shareholders …and a changing mix for our ownership base • Expanding our markets , our depth and our investment appeal 8

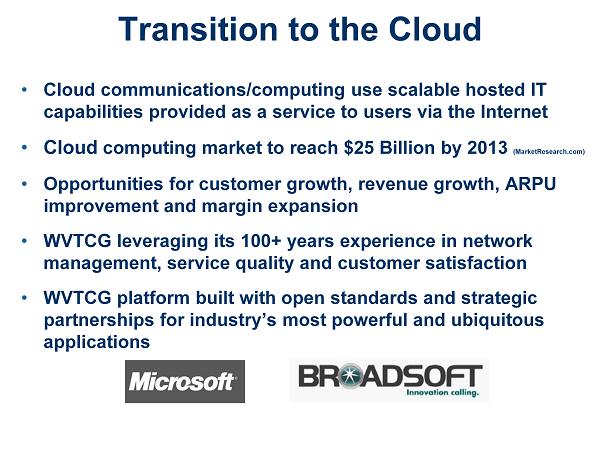

Transition to the Cloud • Cloud communications/computing use scalable hosted IT capabilities provided as a service to users via the Internet • Cloud computing market to reach $25 Billion by 2013 (MarketResearch.com) • Opportunities for customer growth, revenue growth, ARPU improvement and margin expansion • WVTCG leveraging its 100+ years experience in network management, service quality and customer satisfaction • WVTCG platform built with open standards and strategic partnerships for industry’s most powerful and ubiquitous applications 9

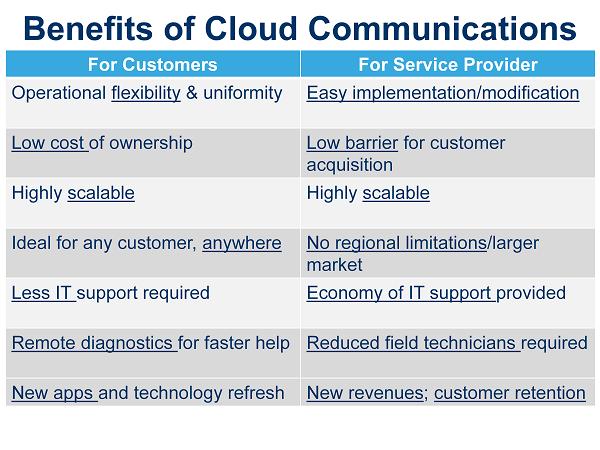

Benefits of Cloud Communications For Customers For Service Provider Operational flexibility & uniformity Easy implementation/ modification Low cost of ownership Low barrier for customer acquisition Highly scalable Highly scalable Ideal for any customer, anywhere No regional limitations /larger market Less IT support required Economy of IT support provided Remote diagnostics for faster help Reduced field technicians required New apps and technology refresh New revenues ; customer retention 10

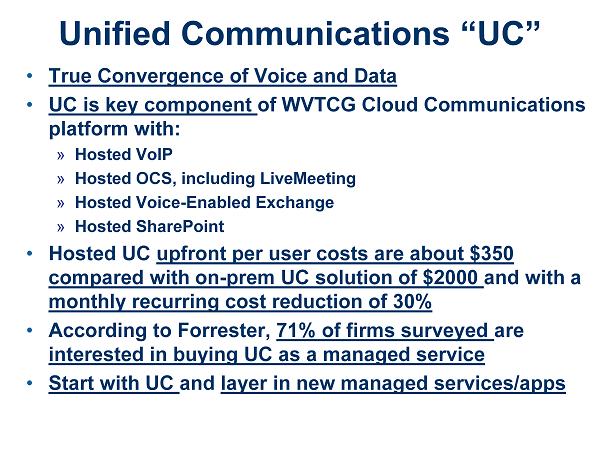

Unified Communications “UC” • True Convergence of Voice and Data • UC is key component of WVTCG Cloud Communications platform with: » Hosted VoIP » Hosted OCS, including LiveMeeting » Hosted Voice - Enabled Exchange » Hosted SharePoint • Hosted UC upfront per user costs are about $ 350 compared with on - prem UC solution of $ 2000 and with a monthly recurring cost reduction of 30% • According to Forrester, 71% of firms surveyed are interested in buying UC as a managed service • Start with UC and layer in new managed services/apps 11

Our Cloud Companies • USA Datanet , acquired in 2009 • Based in Syracuse, NY • Focus on businesses with 35 or fewer seats 12 • Alteva, acquired in 2011 • Based in Philadelphia, PA • Focus on businesses with 35 or more seats • North America’s largest provider of enterprise hosted VoIP

Our Rural Telecom Business • Warwick Valley Telephone ILEC services • Customers in Mid - Hudson NY and Northern NJ • Negative impact from wireless substitution, cable and other competition – currently approx. 13,000 access lines • Leveraged historically profitable operations to fund growth strategies • Network investments and strategic partnerships enable triple - play, high broadband speeds and web - based services • Preparing for transition into Cloud Communications 13

14 State of New York Department of Public Service Public Service Commission Four Consecutive Annual Service Commendations WVT Communications Group Continues Excellent Service

15

Strengthened Leadership Leadership Team Experience Duane Albro, CEO Verizon (pred.), Cablevision, Net2000 David Cuthbert, COO Alteva, U.S. Navy - Special Ops Ralph Martucci, CFO News Corp. (subs.), Frontier Comm. Louis Hayner, CSO Alteva, ATX Jay Mercer, EVP – Wholesale Carrier Services Global Crossing, U.S. Air Force Mark Marquez, CNO Alteva, Exelon (PECO Energy) Patrick Welsh, CAO Verizon, NYNEX Virginia Quackenbush, President – Warwick Valley Tel. 30+ years with WVT Communications 16 The team executed a quick, efficient integration of Alteva to realize business unit alignment and synergistic qualities A Shared Culture of Collaborative Leadership

WVT Communications Group, Inc. • Modification to holding company with WVT Communications Group, Inc. as parent » NJ BPU approval pending » NY PSC approval pending • Operating units shifting from regulated to deregulated sectors • Total employees – highest since 2001 » 101 non - union employees » 44 union employees » 145 total employees 17

2011 Financial Performance Efforts • Drove top - line results • Positioned for margin and profit expansion • Absorbed charges/costs associated with acceleration of Cloud Communications strategy • Addressed changes in balance sheet/O - P Agreement • Increased dividend 18

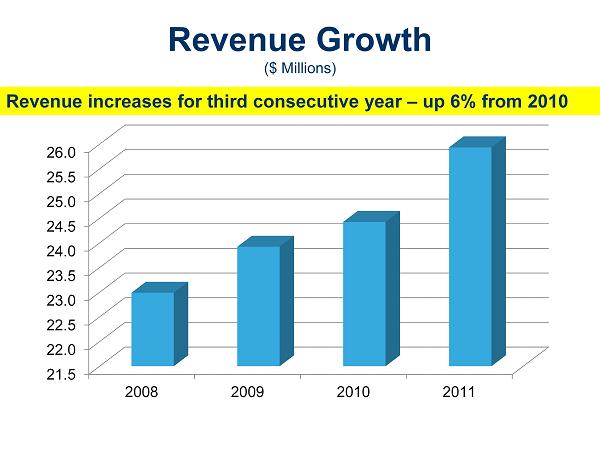

Revenue Growth ($ Millions) 21.5 22.0 22.5 23.0 23.5 24.0 24.5 25.0 25.5 26.0 2008 2009 2010 2011 19 Revenue increases for third consecutive year – up 6% from 2010

Delivering on Expectations for Alteva Acquisition • Strengthens UC platform • Legacy ILEC leverages UC to enhance competitive position • Improves financial performance - WVT consolidated revenues increase by approx. 30% on an annual basis • Cash flow accretive acquisition • Integrated with existing UC; benefits from synergies and increases in business volume • Enhances sales and channel partner efforts 20

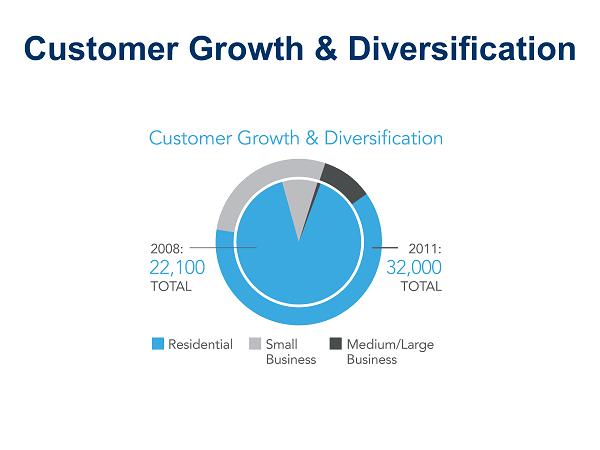

Customer Growth & Diversification 21

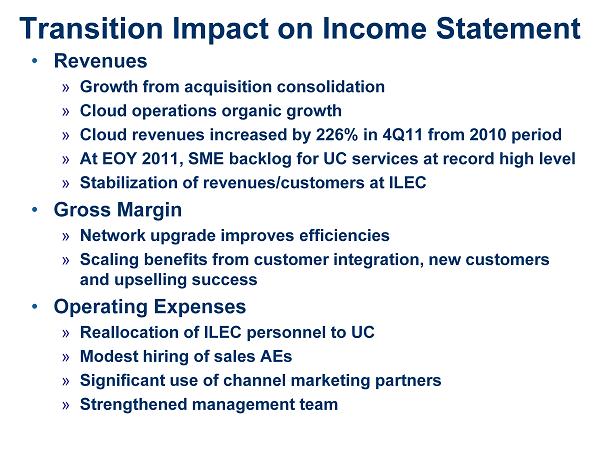

Transition Impact on Income Statement • Revenues » Growth from acquisition consolidation » Cloud operations organic growth » Cloud revenues increased by 226% in 4Q11 from 2010 period » At EOY 2011, SME backlog for UC services at record high level » Stabilization of revenues/customers at ILEC • Gross Margin » Network upgrade improves efficiencies » Scaling benefits from customer integration, new customers and upselling success • Operating Expenses » Reallocation of ILEC personnel to UC » Modest hiring of sales AEs » Significant use of channel marketing partners » Strengthened management team 22

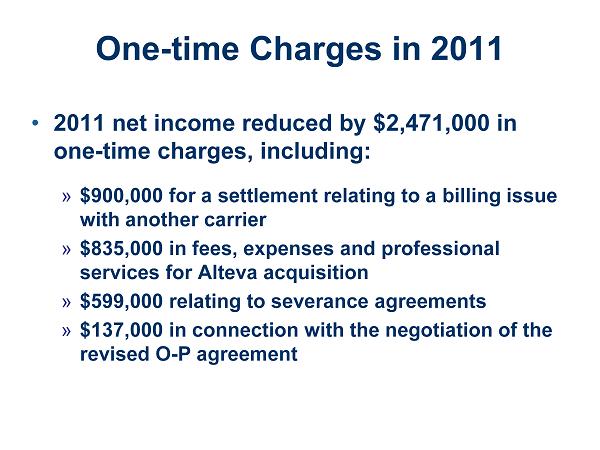

One - time Charges in 2011 • 2011 net income reduced by $2,471,000 in one - time charges, including: » $ 900,000 for a settlement relating to a billing issue with another carrier » $835,000 in fees, expenses and professional services for Alteva acquisition » $599,000 relating to severance agreements » $137,000 in connection with the negotiation of the revised O - P agreement 23

Orange County - Poughkeepsie Limited Partnership (“ O - P ”) • 4G Agreement in May 2011 amends O - P » Changed from wholesale to retail » Complex accounting treatment reduces net income and increases balance sheet through mid - 2012 » Cash payouts to WVTCG • $13.6M in 2011 – recorded $7.9M income for 2011 • $13M cash payouts in each of 2012 and 2013 • “Put” option for $50M through May 2014 • Payouts in 2014 and thereafter based on O - P performance • Provides capital for growth and dividends 24

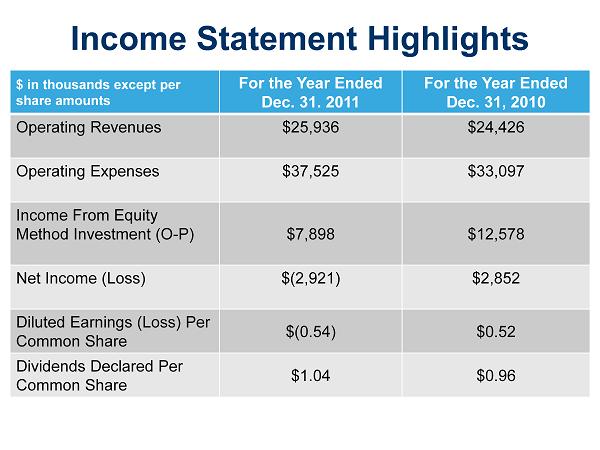

Income Statement Highlights $ in thousands except per share amounts For the Year Ended Dec. 31. 2011 For the Year Ended Dec. 31, 2010 Operating Revenues $25,936 $24,426 Operating Expenses $37,525 $33,097 Income From Equity Method Investment (O - P) $7,898 $12,578 Net Income (Loss) $(2,921) $2,852 Diluted Earnings (Loss) Per Common Share $(0.54) $0.52 Dividends Declared Per Common Share $1.04 $0.96 25

Compelling Dividend History $0.60 $0.70 $0.80 $0.90 $1.00 $1.10 2008 2009 2010 2011 Providing Shareholder Returns Through Dividend Payments for 104 Consecutive Years 26

Growth Company 2012 Business Plan Goals • Capitalize on new Cloud/UC growth orientation • Improve Broadband ILEC • Align costs and invest in productivity to yield improved profitability • Emphasis on corporate values amid expansion • Continue to maximize shareholder returns 27

28 2012 Business Unit Goals • Grow Cloud/UC businesses • Expand 2011 market penetration ‾ 2011: 324% increase in VoIP/Hosted IP seats in svc ‾ 2011: 49% increase in wholesale revenue • Continue growth of hosted services/data products • Expand marketing/advertising • Expand wholesale carrier services • Broadband ILEC • Continue DIRECTV growth • Broadband infrastructure upgrade: » 15Mb+ available nearly everywhere • Offer UC to ILEC customers • Sustain excellent customer experience

29 Alignment of Costs & Productivity Enhancements Align Costs • Manage carrier and supplier vendors • Manage bundled product profitability • Increase payroll process efficiency Productivity Enhancements • Provide technical training and professional development • Expand succession and mentoring programs • Promote healthy lifestyle • Increase employee communications

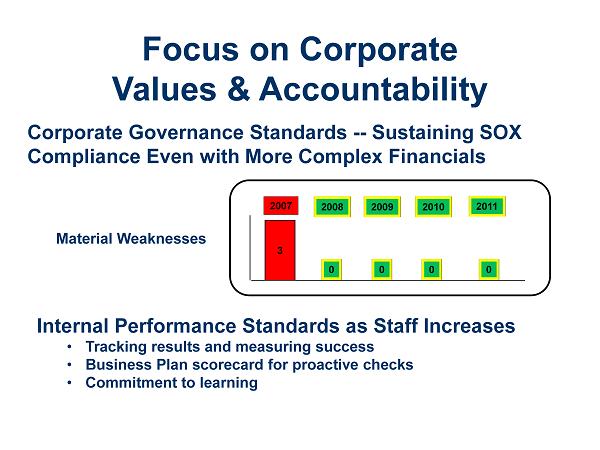

30 Corporate Governance Standards -- Sustaining SOX Compliance Even with More Complex Financials Material Weaknesses 3 2009 2008 2007 0 0 2010 0 2011 0 Focus on Corporate Values & Accountability Internal Performance Standards as Staff Increases • Tracking results and measuring success • Business Plan scorecard for proactive checks • Commitment to learning

Maximize Shareholder Returns • Organic business growth initiatives • Acquisitions – opportunistic and accretive • Commitment to dividend payments • Increased investor relations efforts (commenced in late 2011) » Wall Street conferences » Institutional investor/analyst outreach » Financial and corporate development press releases and conference calls 31

WWVY Investment Merits • Superior Cloud Communications platform • Top 10 UC provider in US Frost and Sullivan April 2012 • Well positioned in large and fast growing market for SME UC and business applications • Proven acquisition and organic growth strategies • Continued transformation delivers revenue and margin increases • Solid balance sheet, cash flow and access to bank debt • Management team with industry depth and strong knowledge of tech trends • Track record of dividends (current yield approx. 7.5%) • $89.6M value of guaranteed cash distributions for wireless partnership including “Put” option (vs. market cap of $80M) 32

33 WVT Communications Group President and CEO’s Report Summary x Transformational acquisition completed x Increased shareholder value including dividend x Transitioning to the cloud x Continued commitment to excellent service x Experienced and collaborative leadership team x 2011 financials impacted by O - P change & one - time acquisition costs x 2012 business plan goals continue transformation of our business x Solid value for investors

47 Main St. | PO Box 592 | Warwick, NY 10990 www.wvtcg.com 34