UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 12, 2008

Date of Report

(Date of Earliest Event Reported)

FIRST GROWTH INVESTORS, INC.

(Exact name of registrant as specified in its charter)

| NEVADA | | 000-83125 | | 87-0569467 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

301 Hailong Street

Hanting District, Weifang, Shandong Province

The People’s Republic of China

+ 86 536 736 3688

(Address and telephone number of Registrant’s principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a - 12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13d-4(c))

TABLE OF CONTENTS

| | | | | Page | |

| Item 1.01: | | Entry into a Material Definitive Agreement | | | 1 | |

| Item 2.01: | | Completion of Acquisition or Disposition of Assets | | | 1 | |

| Item 5.01: | | Changes in Control of Registrant | | | 1 | |

| Item 5.06: | | Change in Shell Company Status | | | 1 | |

| | | Risk Factors | | | 1 | |

| | | Legal Proceedings | | | 12 | |

| | | Executive Officers, Directors, and Key Employees | | | 13 | |

| | | Security Ownership of Certain Beneficial Owners and Management | | | 14 | |

| | | Description of Capital Stock | | | 16 | |

| | | Experts | | | 18 | |

| | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 18 | |

| | | Related Party Transactions | | | 18 | |

| | | Description of Business | | | 21 | |

| | | Management Discussion and Analysis or Plan of Operation | | | 31 | |

| | | Description of Property | | | 41 | |

| | | Market for Common Equity and Related Shareholder Matters | | | 42 | |

| | | Executive Compensation | | | 43 | |

| Item 9.01 | | Financial Information and Exhibits | | | F-1 | |

Section 1 -- Registrant’s Business and Operations

Section 2 -- Financial Information

Item 2.01: Completion of Acquisition or Disposition of Assets

Section 5 - Corporate Governance and Management

Item 5.01: Changes in Control of Registrant

Item 5.06: Change in Shell Company Status

FORWARD-LOOKING STATEMENTS

This filing contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. In evaluating these statements, you should specifically consider various factors, including the risks outlined in the section of this filing entitled “Risk Factors.” These factors may cause our actual results to differ materially from any forward-looking statement as a result of a number of risks and uncertainties, including without limitation: (a) limited amount of resources devoted to expanding our business plan; (b) our failure to implement our business plan within the time period we originally planned to accomplish; and (c) other risks that are discussed in this Form 8-K and incorporated herein by reference or included in our previous filings with the Securities and Exchange Commission, or the SEC.

Such statements are intended to be covered by the safe harbor created by such provisions. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievements. We are under no duty to update any of the forward-looking statements after the date of this filing to conform such statements to actual results or to changes in our expectations.

RISK FACTORS

Investment in our common stock involves risks. You should carefully consider the risks we describe below before deciding to invest. The market price of our common stock could decline due to any of these risks, in which case you could lose all or part of your investment. In assessing these risks, you should also refer to the other information included in this filing, including our consolidated financial statements and the accompanying notes. You should pay particular attention to the fact that we are a holding company with substantial operations in China and are subject to legal and regulatory environments that in many respects differ from that of the United States. Our business, financial condition or results of operations could be affected materially and adversely by any of the risks discussed below and any others not foreseen. This discussion contains forward-looking statements.

Risks Related to Our Business and Industry

We conduct substantially all of our operations through our subsidiaries, and our performance will depend upon the performance of our subsidiaries.

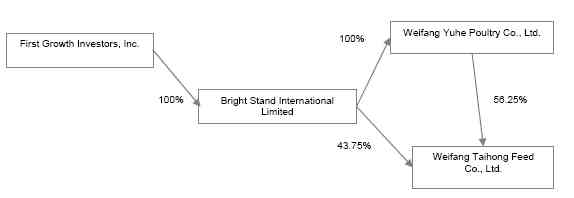

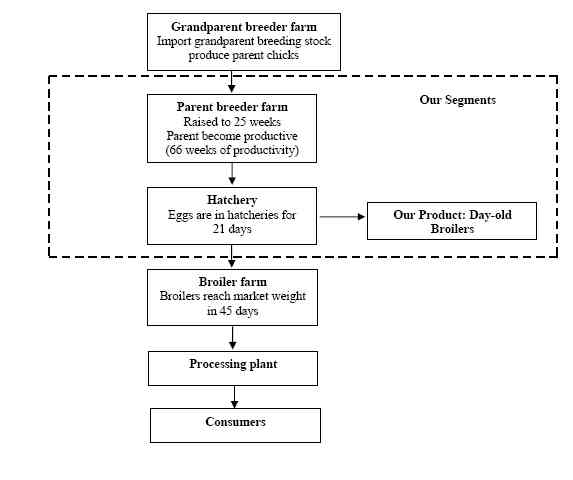

We have no operations independent of those of Bright Stand International Limited, or Bright Stand, and its PRC subsidiaries, Weifang Yuhe Poultry Co. Ltd. (“Yuhe”) and Weifang Taihong Feed Co. Ltd. (“Taihong”). As a result, we are dependent upon the performance of Bright Stand and its subsidiaries and will be subject to the financial, business and other factors affecting such subsidiaries as well as general economic and financial conditions. As substantially all of our operations are conducted through our subsidiaries, we are dependent on the cash flow of our subsidiaries to meet our obligations.

Because virtually all of our assets are held by our operating subsidiaries, the claims of our shareholders will be structurally subordinate to all existing and future liabilities and obligations, and trade payables of such subsidiaries. In the event of a bankruptcy, liquidation or reorganization of us, our assets and those of our subsidiaries will be available to satisfy the claims of our shareholders only after all of Bright Stand and its subsidiaries’ liabilities and obligations have been paid in full.

Competition in the poultry industry with other poultry companies, especially companies with greater resources, may make us unable to compete successfully, which could adversely affect our business.

The Chinese poultry industry is highly competitive. In general, competitive factors in the Chinese broiler, or chicken, industry include price, product quality, brand identification, breadth of product line and customer service. Our success depends in part on our ability to manage costs and be efficient in the highly competitive poultry industry. Some of our competitors have greater financial and marketing resources. Because of this, we may not be able to successfully increase our market penetration or our overall share of the poultry market.

Increased competition may result in price reductions, increased sales incentive offerings, lower gross margins, sales expenses, marketing programs and expenditures to expand channels to market. Our competitors may offer products with better market acceptance, better price or better performance. We may be adversely affected if we are unable to maintain current product cost reductions, or achieve future product cost reductions.

We compete against a number of other suppliers of day-old broilers. Although we attempt to develop and support high-quality products that our customers demand, products developed by competing suppliers could render our products noncompetitive. If we fail to address these competitive challenges, there could be a material adverse effect upon our business, consolidated results of operations and financial condition.

We do not typically have long term purchase contracts with our customers and our customers have in the past and could at any time in the future, reduce or cease purchasing products from us, harming our operating results and business.

We typically do not have long-term volume purchase contracts with our customers, and they are not obligated to purchase products from us. Accordingly, our customers could at any time reduce their purchases from us or cease purchasing our products altogether. In addition, any decline in demand for our products and any other negative development affecting our major customers or the poultry industry in general, would likely harm our results of operations. For example, if any of our customers experience serious financial difficulties, it may lead to a decline in sales of our products to such customers and our operating results could be harmed through, among other things, decreased sales volumes and write-offs of accounts receivables related to sales to such customers.

If demand for our products declines in the markets that we serve, our selling prices and overall sales will decrease. Even if the demand for our products increases, when such increase cannot outgrow the decrease of selling price, our overall sales revenues may decrease.

Demand for our products is affected by a number of factors, including the general demand for the products in the end markets that we serve and the price attractiveness. A vast majority of our sales are derived directly or indirectly from customers who are broiler raisers and large integrated chicken companies whose day-old broiler production is not sufficient for their own use. Any significant decrease in the demand for day-old broilers may result in a decrease in our revenues and earnings. A variety of factors, including economic, health, regulatory, political and social instability, could contribute to a slowdown in the demand for day-old broilers because demand for day-old broilers is highly correlated with general economic activities. As a result, even if the demand for our products increases, when the increase of demand cannot outgrow the decrease of selling price, our overall sales revenues may decrease.

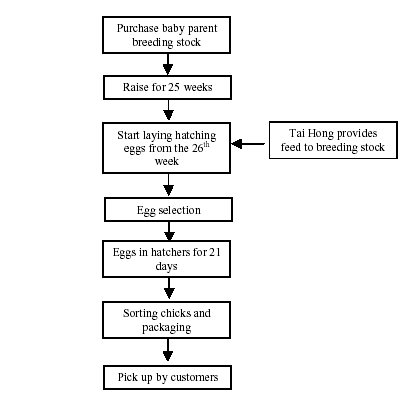

Industry cyclicality can affect our earnings, especially due to fluctuations in commodity prices of feed ingredients and breeding stock.

Currently, all our raw materials are domestically procured. Profitability in the poultry industry is materially affected by the supply of parent breeding stocks and the commodity prices of feed ingredients, including corn, soybean cake, and other nutrition ingredients from numerous sources, mainly from wholesalers who collect the feed ingredients directly from farmers. As a result, the poultry industry is subject to wide fluctuations and cycles. These prices are determined by supply and demand factors. We may reduce, but cannot eliminate, the risk of increased operating costs from commodity price increases. Typically we do well when chicken prices are high and feed prices are low and the feed ingredients are in adequate supply. However, it is very difficult to predict when the feed price spiral cycles will occur.

Various factors can affect the supply of corn and soybean meal, which are the primary ingredients of the feed we use for parent breeding stocks. In particular, weather patterns, the level of supply inventories and demand for feed ingredients, and the agricultural policies of the Chinese government affect the supply of feed ingredients. Weather patterns often change agricultural conditions in an unpredictable manner. A sudden and significant change in weather patterns could affect supplies of feed ingredients, as well as both the industry’s and our ability to obtain feed ingredients, grow chickens or deliver products. Increases in the prices of feed ingredients will result in increases in raw material costs and operating costs.

The supply of parent breeding stocks is also cyclical. We purchase parent breeding stocks from multiple suppliers. Our ability to maintain adequate breeding stock is dependent on our abilities to develop stable supplier relationships and to place large procurement orders. In addition, most primary breeder stock is imported and the import volume is closely controlled by the PRC government. We have not seen a trend of increasing import volumes.

The cessation of tax exemptions and deductions by the Chinese government may affect our profitability.

As a leading agricultural enterprise jointly recognized by eight national authorities in China, we used to enjoy income tax exemption status effective from January 2004 up until November 2007. After the restructuring in 2008, we lost that tax exemption status and were converted into a foreign investment enterprise (“FIE”) 100% owned by Bright Stand. Under the current PRC tax laws, FIEs such as ours are subject to an income tax rate at 33%, while in practice tax reductions or exemptions in various forms are granted by local governments to FIEs.

On March 16, 2007, the National People’s Congress of China enacted a new tax law, or the New Tax Law, whereby both FIEs and domestic companies will be subject to a uniform income tax rate of 25%. On January 28, 2007, the State Council of China promulgated the Implementation Rules of the New Tax Law (the “Implementation Rules”). Both the New Tax Law and the Implementation Rules have become effective on January 1, 2008. Both the New Tax Law and the Implementation Rules provide tax exemption treatment for enterprises engaged in agricultural industries, such as farming, foresting, fishing and animal husbandry. As an enterprise engaged in the farming industry, we believe we are eligible for relevant exemption treatment and do not need to pay company income tax. But as it is in the early stage of the New Tax Law’s implementation, the local tax authorities may have different views as to how the New Tax Law should be implemented. In addition, the local tax authorities have not formally informed us whether we are eligible for relevant preferential tax treatment and we therefore cannot assure you that we are entitled to tax exemption. Any decision or confirmation by relevant tax authorities that we are not eligible for tax exemption treatment may materially and adversely affect our profits, business and financial performance.

Our conversion from an officially recognized leading domestic agricultural enterprise to a FIE and the enactment of the New Tax Law may affect our profits and financial performance in the future because of reduction in tax exemptions.

Outbreaks of poultry disease, such as avian influenza, or the perception that outbreaks may occur, can significantly restrict our ability to conduct our operations.

We take precautions to ensure that our flocks are healthy and that our production facilities operate in a sanitary and environmentally sound manner. While we have ability and experience in product quality improvement as well as poultry disease resistance, events beyond our control, such as the outbreak of avian influenza in 2006, may restrict our ability to conduct our operations and sales. An outbreak of disease could result in governmental restrictions on the import and export of products from our customers, or require us to destroy one or more of our flocks. This could result in the cancellation of orders by our customers and create adverse publicity that may have a material adverse effect on our business, reputation and prospects. In 2006, Yuhe suffered an operating loss of $693,000 after the general decline in consumer demand for poultry products in late 2005 and early 2006 following the outbreak of avian influenza. Our flocks have never been infected with the H5N1 virus.

Worldwide fears about avian diseases, such as avian influenza, have depressed, and may continue to adversely impact our sales. Avian influenza is a respiratory disease of birds. The milder forms occur occasionally around the world. Recently, there has been substantial publicity regarding a highly pathogenic strain of avian influenza, known as H5N1, which has affected Asia since 2002. It is widely believed that H5N1 is spread by migratory birds, such as ducks and geese. There have also been some cases where H5N1 is believed to have passed from birds to humans as humans came into contact with live birds that were infected with the disease. Although there are vaccines available for H5N1 and other forms of avian influenza, and the PRC government mandates, and we vaccinate our breeding stock against avian influenza, there is no guarantee that the disease can be completely prevented as the virus continues to mutate.

Our business may be adversely affected due to our inaccuracy in sales forecasts.

We procure raw materials and produce our day-old broiler based on our sales forecasts. If we do not accurately forecast demand for our products, we may end up with excess breeding stock. If we have excess breeding stock, we may have to lower prices to stimulate demand.

Our products might contain undetected defects that are not discovered until after shipping.

Although we have strict quality control over our products and we produce high-quality day-old broilers supported by our know-how in feed ingredient composition, immunization system and breeding techniques gained through over 10 years of business and continuous research and development, our products may contain undetected problems. Problems could result in a loss or delay in market acceptance of our products and thus harm our reputation and revenues.

We have sustained losses in the past and cannot guarantee profitability in the future.

We were profitable in 2005 and the first 9 months of 2007 but sustained losses in 2006. There is no assurance that we will be profitable in the future. In addition, our business was impacted in 2006 due to the outbreak of avian influenza. A variety of factors may cause our operating results to decline and financial condition to worsen, including:

| | · | Competitors offering comparable products at cheaper prices; |

| | · | Continuing downward pressure on the average selling prices of our products caused by intense competition in our industry and other reasons; |

| | · | Superior product innovations by competitors; |

| | · | Rising raw material costs; |

| | · | Changes to management and key personnel; and |

| | · | Increased operating expenses relating to research and development, sales and marketing efforts and general and administrative expenses as we seek to grow our business. |

As a result of these and additional factors, we could fail to achieve our revenue targets or experience higher than expected operating expenses, or both. As a result, we cannot assure you that we will be profitable in the future.

Our limited operating history may not serve as an adequate basis to judge our future prospects and operating results.

We have a limited operating history with respect to our current business, which may not provide a sufficient basis on which to evaluate our business or future prospects. Although our sales have grown rapidly in recent years, we cannot assure you that we will maintain profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Significant failure to realize anticipated sales growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| | · | Implement our business model and strategy and adapt and modify them as needed; |

| | · | Maintain our current, and develop new, relationships with customers; |

| | · | Manage our expanding operations and product offerings, including the integration of any future acquisitions; |

| | · | Maintain adequate control of expenses; |

| | · | Attract, retain and motivate qualified personnel; |

| | · | Protect our reputation and enhance customer loyalty; and |

| | · | Anticipate and adapt to changing conditions in the poultry industry and other markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

The loss of our major customers could have a material adverse effect on our results of operations.

Approximately forty percent of our sales are to our top five customers. Forty-five percent of our sales volume are to customers with whom we have five to ten years of sales relationship. Our customers include large and small broiler raisers and large integrated chicken companies whose day-old broiler production is not sufficient for their own use. We sell to six of the top ten broiler production provinces. Our sales in Shandong Province accounted for 85% of our total sales in 2006. Shandong Province is the number one broiler and chicken production region in China. If our existing customers significantly reduce or cease their purchases from us with little or no advance notice, it could materially and adversely affect our sales and results of operations.

We may not be able to sustain our current growth rates, and even if we maintain them, we are susceptible to many challenges relating to our growth.

We have experienced fluctuation of growth in the scope and complexity of our business. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, develop new products, enhance our technological capabilities, satisfy customer requirements, execute our business plan or respond to competitive pressures. To successfully manage our growth, we believe we must effectively:

| | · | Hire, train, integrate and manage additional qualified technicians and breeding farm directors and sales and marketing personnel; |

| | · | Implement additional, and improve existing, administrative, financial and operations systems, procedures and controls; |

| | · | Continue to enhance manufacturing and customer resource management systems; |

| | · | Continue to expand and upgrade our feed ingredient composition, poultry immunization system and breeding technology; |

| | · | Manage multiple relationships with distributors, suppliers and certain other third parties; and |

| | · | Manage our financial condition. |

Our success also depends largely on our ability to anticipate and respond to expected changes in future demand for our products, and our broilers’ performance and disease resistance ability. If the timing of our expansion does not match market demand, our business strategy may need to be revised. If we over-expand and demand for our products does not increase as we may have projected, our financial results will be materially and adversely affected. However, if we do not expand, and demand for our products increases sharply, our business could be seriously harmed because we may not be as cost-effective as our competitors due to our inability to take advantage of increased economies of scale. In addition, we may not be able to satisfy the needs of current customers or attract new customers, and we may lose credibility and our relationships with our customers may be negatively affected. Moreover, if we do not properly allocate our resources in line with future demand for our products, we may miss changing market opportunities and our business and financial results could be materially and adversely affected. We cannot assure you that we will be able to successfully manage our growth in the future.

The loss of key personnel or the failure to attract or retain specialized technical and management personnel could impair our ability to grow our business.

We rely heavily on the services of our key employees, including Gao Zhentao, our Chief Executive Officer, Han Chengxiang, our Chief Production Officer, and Jiang Yingjun, our Chief Financial Officer. In addition, our engineers and other key technical personnel are a significant asset and are the source of our technological and product innovations. We depend substantially on the leadership of a small number of farm directors and technicians who are devoted to research and development. Additionally, 85% of our products are sold through third party distributors. Most of them are exclusive distributors and we expect them to be our future main sales force. The loss of these distributors could have a material adverse effect on our business, results of operations and financial condition. We believe our future success will depend upon our ability to retain these key employees and sales distributors. We may not be successful in attracting and retaining sufficient numbers of technical personnel to support our anticipated growth. Despite the incentives we provide, our current employees may not continue to work for us, and if additional personnel are required for our operations, we may not be able to obtain the services of additional personnel necessary for our growth. In addition, we do not maintain “key person” life insurance for any of our senior management or other key employees. The loss of the key employees or the inability to attract or retain qualified personnel, including technicians, could delay the development and introduction of, and have an adverse effect on our ability to sell, our products, as well as our overall growth.

In addition, if any other members of our senior management or any of our other key personnel join a competitor or form a competing company, we may not be able to replace them easily and we may lose customers, business partners, key professionals and staff members.

We do not have any registered patents or other registered intellectual property on our production processes and we may not be able to maintain the confidentiality of our processes.

We have no patents or registered intellectual property covering our processes and we rely on the confidentiality of our processes in producing a competitive product. The confidentiality of our know-how may not be maintained and we may lose any meaningful competitive advantage which might arise through our proprietary processes.

Because we are expanding capacity, we may be forced to make sales to customers whose creditworthiness is not known to us. We may not be able to collect receivables which are incurred by these customers.

Although we currently sell our products on a cash payment basis, our ability to receive payment for our products depends on the continued creditworthiness of our customers. In order to pay our expansion costs, we may be required to make sales to customers who are less creditworthy than our historical customers. Our customer base may change if our sales increase because of our added capacity. If we are not able to collect our receivables, our revenues and profitability will be negatively affected.

We do not have insurance coverage. Any material loss to our properties or assets will have a material adverse effect on our financial condition and operations.

We and our subsidiaries are not covered by any insurance. As a result, any material loss or damage to our properties or other assets, or personal injuries arising from our business operations would have a material adverse affect on our financial condition and operations.

We will incur increased costs as a result of being a public company.

As a public company, we incur significant legal, accounting and other expenses that a private company does not incur. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the Securities and Exchange Commission and stock exchanges have required changes in corporate governance practices of public companies. We expect that these new rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, as a result of becoming a public company, we may need to add independent directors, create additional board committees and adopt additional policies regarding internal controls and disclosure controls and procedures. We will incur additional costs associated with public company reporting requirements and compliance with the internal controls of Section 404 of the Sarbanes-Oxley Act of 2002. We also expect these new rules and regulations will make it more difficult and more expensive for us to obtain directors’ and officers’ liability insurance. As a result, our general and administrative expenses will likely increase and it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Increased water, energy and gas costs would increase our expenses and reduce our profitability.

We require a substantial amount, and as we expand our business we will require additional amounts, of water, electricity and natural gas to produce and process our broiler products. The prices of water, electricity and natural gas fluctuate significantly over time. One of the primary competitive factors in the Chinese broiler market is price, and we may not be able to pass on increased costs of production to our customers. As a result, increases in the cost of water, electricity or natural gas could substantially harm our business and results of operations.

Increased costs of transportation would negatively affect our profitability.

Our transportation costs are a material portion of the cost of our products. We primarily ship our products and receive our inputs via truck and rely on third party transportation companies for the delivery of most of our products and inputs. The costs associated with the transportation of our products and inputs fluctuate with the price of fuel, the costs to our transportation providers of labor and the capacity of our transportation sources. Increases in costs of transportation have and could in the future negatively affect our profitability.

Risks Related to Doing Business in China

Because our operations are all located outside of the United States and are subject to Chinese laws, any change of Chinese laws may adversely affect our business.

All of our operations are in China, which exposes us to risks, such as exchange controls and currency restrictions, currency fluctuations and devaluations, changes in local economic conditions, changes in Chinese laws and regulations and exposure to possible expropriation or other Chinese government actions. These factors may have a material adverse effect on our operations, results of operations and financial condition.

Because Chinese law governs almost all of our material agreements, we may not be able to enforce our legal rights in China or elsewhere, which could result in a significant loss of business, business opportunities, or capital. There is no assurance that we will be able to enforce any of our material agreements or that remedies will be available outside of China. The system of laws and the enforcement of existing laws in China may not be as certain in implementation and interpretation as in the United States. The Chinese judiciary is relatively inexperienced in enforcing corporate and commercial law, leading to a higher than usual degree of uncertainty as to the outcome of any litigation. The inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital.

Additionally, substantially all of our assets are located outside of the United States and most of our officers and directors reside outside of the United States. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of the directors and officers under Federal securities laws. Moreover, we have been advised that China does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States. Further, it is unclear if extradition treaties now in effect between the United States and China would permit effective enforcement of criminal penalties of the federal securities laws.

We may have difficulty establishing adequate management, legal and financial controls in China, which could impair our planning processes and make it difficult to provide accurate reports of our operating results.

China historically has not followed Western-style management and financial reporting concepts and practices, and its access to modern banking, computer and other control systems has been limited. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in China in these areas. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards, making it difficult for our management to forecast our needs and to present the results of operations accurately at all times.

We face risks associated with currency exchange rate fluctuations; any adverse fluctuations may adversely affect our operating margins.

The majority of our revenues are in Chinese currency. Conducting business in currencies other than U.S. dollars subjects us to fluctuations in currency exchange rates that could have a negative impact on our reported operating results. Fluctuations in the value of the U.S. dollar relative to other currencies impact our revenues, cost of revenues and operating margins and result in foreign currency translation gains and losses. Historically, we have not engaged in exchange rate hedging activities. Although we may implement hedging strategies to mitigate this risk, these strategies may not eliminate our exposure to foreign exchange rate fluctuations and may involve costs and risks of their own, such as ongoing management time and expertise, external costs to implement the strategy and potential accounting implications.

If relations between the United States and China worsen, our share price may decrease and we may have difficulty accessing U.S. capital markets.

At various times during recent years, the United States and China have had disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China could adversely affect the market price of our common stock and our ability to access U.S. capital markets.

The Chinese government could change its policies toward private enterprises, which could adversely affect our business.

Our business is subject to political and economic uncertainties in China and may be adversely affected by its political, economic and social developments. Over the past several years, the Chinese government has pursued economic reform policies including the encouragement of private economic activity and greater economic decentralization. The Chinese government may not continue to pursue these policies or may alter them to our detriment from time to time. Changes in policies, laws and regulations, or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on dividend payments to shareholders, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business. Nationalization or expropriation could result in the total loss of our investment in China.

Economic, political and social conditions in China could affect our business.

All of our business, assets and operations are located in China. The economy of China differs from the economies of most developed countries in many respects, including government involvement, level of development, growth rate, control of foreign exchange, and allocation of resources. The economy of China has been transitioning from a planned economy to a more market-oriented economy. Although the Chinese government has implemented measures recently emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Therefore, the Chinese government’s involvement in the economy could adversely affect our business operations, results of operations and/or financial condition.

The Chinese government may implement policies that could have an adverse effect on our business and results of operations.

The Chinese government has implemented various measures from time to time to control the rate of economic growth. Some of these measures benefit the overall economy of China, but may have a negative effect on us.

Government control of currency conversion and future movements in exchange rates may adversely affect our operations and financial results.

We receive substantially all of our revenues in Renminbi, the currency of China. A portion of such revenues may be converted into other currencies to meet our foreign currency obligations. Foreign exchange transactions under our capital account, including principal payments in respect of foreign currency-denominated obligations, continue to be subject to significant foreign exchange controls and require the approval of the State Administration of Foreign Exchange in China. These limitations could affect our ability to obtain foreign exchange through debt or equity financing, or to obtain foreign exchange for capital expenditures.

The Chinese government controls its foreign currency reserves through restrictions on imports and conversion of Renminbi into foreign currency. Although the exchange rate of the Renminbi to the U.S. dollar was stable from January 1, 1994 to July 2005 and the Chinese government has stated its intention to maintain the stability of the value of Renminbi, the exchange rate of the Renminbi to the U.S. dollar is continuously revalued since 2005 and the exchange rates may further change. Our financial condition and results of operations may also be affected by changes in the value of certain currencies, other than the Renminbi, in which our earnings and obligations are denominated.

Our business is regulated by the PRC farming authorities and we need production permit an/or immunization certificate from the farming authorities to carry out our business. Any suspension, discontinuation or revocation of our current production permits and/or immunization certificate may materially and adversely impact our business.

The Farming Bureau of Shandong Province and its local counterpart in Weifang City are the primary governmental regulators and supervisors of both Yuhe and Taihong’s current businesses. Under relevant laws and regulations, both Yuhe and Taihong must obtain production permits from the Farming Bureau of Shandong Province to carry out its current businesses. In addition, Yuhe, as a company engaging in the breeder business, must obtain an immunization certificate from the local Farming Bureau in the Weifang City.

The Farming Bureau authorities have been strengthening their supervision over the breeder and feed businesses in the past years, and new PRC laws, rules and regulations may be introduced to impose additional requirements applicable for the application and obtaining of relevant production permits and/or immunization certificate. We cannot assure you our current production permits and immunization certificate can maintain their full effect in the future, although we will try our best to meet with any new requirement. Any suspension, discontinuation or revocation of our current production permits and/or immunization certificate may cause material and adverse impact on our business, financial performance and prospect.

Because our operations are located in China, information about our operations are not readily available from independent third-party sources.

Because Yuhe and Taihong are based in China, shareholders may have greater difficulty in obtaining information about them on a timely basis than would shareholders of an entirely U.S.-based company. Their operations will continue to be conducted in China and shareholders may have difficulty in obtaining information about them from sources other than the subsidiaries themselves. Information available from newspapers, trade journals, or local, regional or national regulatory agencies such as issuance of construction permits and contract awards for development projects will not be readily available to shareholders. Shareholders will be dependent upon Yuhe and Taihong’s management for reports of their’s progress, development, activities and expenditure of proceeds.

We may in the future be subject to claims and liabilities under environmental, health, safety and other laws and regulations, which could be significant.

Our operations are subject to various laws and regulations, including those governing wastewater discharges and the use, storage, treatment and disposal of hazardous materials. The applicable requirements under these laws are subject to amendment, to the imposition of new or additional requirements and to changing interpretations by governmental agencies or courts. In addition, we anticipate increased regulation by various governmental agencies concerning food safety, the use of medication in feed formulations, the disposal of animal by-products and wastewater discharges. Furthermore, business operations currently conducted by us or previously conducted by others at real property owned or operated by us, business operations of others at real property formerly owned or operated by us and the disposal of waste at third party sites expose us to the risk of claims under environmental, health and safety laws and regulations. We could incur material costs or liabilities in connection with claims related to any of the foregoing. The discovery of presently unknown environmental conditions, changes in environmental, health, safety and other laws and regulations, enforcement of existing or new laws and regulations and other unanticipated events could give rise to expenditures and liabilities, including fines or penalties, that could have a material adverse effect on our business, operating results and financial condition.

Recent PRC regulations relating to the establishment of offshore special purpose companies by PRC domestic residents, mergers with and acquisitions of PRC domestic companies by foreign investors, and relevant approval and registration requirements may subject our PRC resident beneficial owners to personal liability, limit our ability to inject capital into our PRC subsidiaries, limit our subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us.

The China State Administration of Foreign Exchange, “SAFE”, issued a public notice in October 2005 requiring PRC domestic residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” PRC domestic residents who are shareholders of offshore special purpose companies and have completed round trip investments but did not make foreign exchange registrations for overseas investments before November 1, 2005 were retroactively required to register with the local SAFE branch before March 31, 2006. PRC resident shareholders are also required to amend their registrations with the local SAFE in certain circumstances.

Six Chinese ministries jointly promulgated the Rules on Mergers with and Acquisitions of PRC Domestic Companies by Foreign Investors, or “M&A Rules”, on August 8, 2006, which became effective on September 8, 2006. The M&A Rules subject the acquisition of domestic companies by offshore special purpose companies controlled by PRC residents, who at the same time are controlling shareholders of the domestic companies, to the approval of Ministry of Trade. There are also various stringent requirements applicable to foreign acquisition of domestic companies through special purpose companies under the M&A Rules.

We undertook a corporate restructuring in the PRC in January 2008 under which Bright Stand, a company owned by Japanese citizen Mr. Kunio Yamamoto, acquired the control of Yuhe and Taihong from certain PRC resident shareholders. After consultation with China counsel, we do not believe that any of Yuhe’s former PRC resident shareholders or we are subject to the SAFE registration requirement or requirements under the M&A Rules, however, we cannot provide any assurances that we or all of Yuhe’s former shareholders who are PRC residents will not be required to make or obtain any applicable registrations or approvals required by these regulations in the future. The failure or inability of Yuhe’s PRC resident former shareholders to comply with the registration procedures set forth therein may subject us to fines and legal sanctions, restrict our cross-border investment activities, or limit our PRC subsidiaries’ ability to distribute dividends or obtain foreign-exchange-dominated loans to our company.

As it is uncertain how the SAFE regulations and the M&A Rules will be interpreted or implemented, we cannot predict how these regulations will affect our business operations or future strategy. For example, Yuhe’s former PRC resident shareholders may in the future acquire our equity interest, and there is no assurance that Chinese laws and regulations will not be implemented in such a way that in the future, if Yuhe’s former PRC resident shareholders negotiate to buy some or all of our equity interest, Yuhe’s former PRC resident shareholders may not be deemed to have complied fully with SAFE regulations and the M&A Rules. We may be subject to more stringent review and approval process with respect to our foreign exchange activities, such as remittance of dividends and foreign-currency-denominated borrowings, which may adversely affect our results of operations and financial condition. In addition, if we decide to acquire a PRC domestic company, we cannot assure you that we or the owners of such company, as the case may be, will be able to obtain the necessary approvals or complete the necessary filings and registrations required by the SAFE regulations. This may restrict our ability to implement our acquisition strategy and could adversely affect our business and prospects.

Risks Associated with this Offering and Our Common Stock

Our stock is thinly traded and shareholders may not be able to liquidate their investment at all, or may only be able to liquidate the investment at a price less than our value.

Our common stock currently is thinly traded and the price of our common stock may not reflect the value of our company. Consequently, investors may not be able to liquidate their investment at all, or if they are able to liquidate it may only be at a price that does not reflect the value of the business. As the trading volume is thin and the price is volatile, our shareholders may not be able to sell their shares at a price they desire. Because the securities price for our stock is low, many brokerage firms are not willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in our stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of common stock like ours as collateral for any loans.

Because we are subject to the Penny Stock Rules, sale of our stock by investors may be difficult.

We are subject to the “penny stock” rules of the Securities and Exchange Commission, or SEC. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document required by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker and/or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for our common stock. As long as our common stock is subject to the penny stock rules, the holders of such common stock may find it more difficult to sell their securities.

Our stock prices could decrease if a substantial number of shares are sold under Rule 144.

A substantial majority of our outstanding shares of common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended, or the 1933 Act. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the 1933 Act and as required under applicable state securities laws. Rule 144 provides in essence that a person who has held restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1.0% of our outstanding common stock or the average weekly trading volume of the common stock during the four weeks prior to the sale. There is no limit on the amount of restricted securities that may be sold by a non-affiliate after the restricted securities have been held by the owner for a period of one year or more. If a substantial number of shares of our stock are sold under Rule 144 or other exemption, it could cause the price of our stock to go down.

The conversion of outstanding derivative securities could cause your ownership in the Company to be diluted and may decrease the value of your investment.

Outstanding derivative securities and current and future obligations to issue our securities to various parties may dilute the value of your investment. We have issued warrants to Roth Capital Partners, LLC and WLT Brothers Capital, Inc. to purchase 6,999,999 shares of common stock. The warrants have a strike price equal to $0.252, have a term of three years starting from March 12, 2008 and permit cashless or cash exercise at all times that they are exercisable. The warrants are exercisable at any time 6 months after their issuance. For the length of time these warrants are outstanding and exercisable, the warrant holder will have an opportunity to profit from a rise in the market price of our common stock without assuming the risks of ownership. This may have an adverse effect on the terms upon which we can obtain additional capital. It should be expected that the warrant holder would exercise the warrants at a time when we would be able to obtain equity capital on terms more favorable than the exercise prices provided by the warrants. There are no preemptive rights in connection with our common stock.

We do not intend to pay dividends in the foreseeable future.

As a result, a return on an investment in shares of our common stock may be realized only through a sale of such shares if at all. Our board of directors does not intend to pay any dividends in the foreseeable future. We do not plan on making any cash distributions in the manner of a dividend or otherwise. Our board of directors presently intends to follow a policy of retaining all earnings, if any, for use in our business operations. The holders of our common stock are entitled to receive dividends when, as and if declared by our board of directors out of funds legally available therefor. To date, we have paid no dividends.

We have the right to issue additional common stock and preferred stock without the consent of shareholders. This would have the effect of diluting your ownership in us and could decrease the value of your stock.

As of March 12, 2008, we had 500 million shares of common stock authorized for issuance, among which only 228,571,416 shares of common stock were issued and outstanding. We have outstanding warrants to purchase 6,999,999 shares of common stock. Approximately 270 million authorized shares of common stock are available for issuance for any purpose without shareholder approval that would dilute a shareholder’s percentage ownership of us.

In addition, our articles of incorporation authorize the issuance of shares of preferred stock, the rights, preferences, designations and limitations of which may be set by the board of directors. While no preferred stock is currently outstanding or subject to be issued, the articles of incorporation have authorized issuance of up to one million shares of preferred stock in the discretion of the board of directors. Such preferred stock may be issued upon filing of amended Articles of Incorporation and the payment of required fees; no further shareholder action is required. If issued, the rights, preferences, designations and limitations of such preferred stock would be set by the board of directors and could operate to the disadvantage of the outstanding common stock. Such terms could include, among others, preferences as to dividends and distributions on liquidation.

Our major shareholders and their affiliates will control the outcome of matters requiring shareholder approval.

Upon completion of this offering, our major shareholders will beneficially own approximately 92% of our outstanding shares of common stock. Consequently, these shareholders will have the ability, when acting together, to control the election of our directors and the outcome of corporate actions requiring shareholder approval, such as a merger or a sale of our company or a sale of all or substantially all of our assets. This concentration of voting power and control could have a significant effect in delaying, deferring or preventing an action that might otherwise be beneficial to our other shareholders and be disadvantageous to our shareholders with interests different from those of our officers, directors and affiliates. These shareholders will also have significant control over our business, policies and affairs. Additionally, this significant concentration of share ownership may adversely affect the trading price for our common stock because investors often perceive disadvantages in owning stock in companies with controlling shareholders.

LEGAL PROCEEDINGS

From time to time, we may become involved in litigation relating to claims arising from the ordinary course of our business. We believe that there are no claims or actions currently pending or threatened against us, the ultimate disposition of which would have a material adverse effect on us.

EXECUTIVE OFFICERS, DIRECTOR AND KEY EMPLOYEES

Executive Officers, Director and Key Employees

The following table sets forth information about our executive officers, director and key employees as of March 12, 2008:

Name | | Age | | Position |

Executive Officers | | | | |

| Gao Zhentao | | 47 | | Chief Executive Officer and Chairman of the Board of Directors |

| Han Chengxiang | | 44 | | Chief Production Officer |

| Jiang Yingjun | | 33 | | Chief Financial Officer |

Key Employees | | | | |

| Tan Yi | | 52 | | Marketing Director of Yuhe |

| Ding Wengui | | 45 | | Chief Technology Officer of Yuhe |

Gao Zhentao has been our Chief Executive Officer and Chairman of our Board of Directors since March 12, 2008. Prior to joining First Growth, Mr. Gao served as the Chief Executive Officer and Chairman of the Board of Directors of our wholly owned subsidiary, Weifang Yuhe Poultry Co. Ltd., or Yuhe, from 1996 to 2007. He was one of the co-founders of Yuhe and our wholly owned subsidiary Weifang Taihong Feed Co. Ltd., or Taihong. Mr. Gao is a member of the Agricultural Work Committee of the Weifang City People’s Congress and a member of the Standing Committee of the Hanting District People’s Congress. Mr. Gao has also served as the vice-chairman of the Shandong Province Farming Association since 2006, and as vice-chairman of the Poultry Subcommittee of the National Farming Association of China since 2007.

Han Chengxiang has been our Chief Production Officer since March 12, 2008. Prior to joining First Growth, Mr. Han served as the Chief Production Officer of Yuhe from 1998 to 2008. Prior to joining Yuhe in 1998, Mr. Han served as the vice factory manager and then the factory manager of Weifang Zhonglianghua Food Co., Ltd. from 1996 to 1998. Prior to that, Mr. Han served as the chief production officer and then the vice factory manager of Weifang Broiler Group Co., Ltd. from 1990 to 1996.

Jiang Yingjun has been our Chief Financial Office since March 12, 2008. Prior to joining First Growth, Mr. Jiang served as Chief Financial Officer of Yuhe from 2005 to 2008. Prior to 2005, Mr. Jiang served as Chief Accountant of Rongyuan Fabrics Co., Ltd., a fabrics company in Shandong Province from 2003 to 2005. Prior to that, Mr. Jiang served as Chief Accountant of Xingchang Meat Group, a major meat producing company in Shandong Province from 1999 to 2003. Mr. Jiang holds a degree in accounting from Weifang College.

Tan Yi has served as Marketing Director of Yuhe since 1995. Prior to joining Yuhe in 1995, Mr. Tan served in various marketing roles with a gas company located in Harbin Province from 1990 to 1994.

Ding Wengui has been the chief technology officer of our subsidiary Yuhe since 2006. Prior to this he served as the general manager of Yuhe’s production division. Prior to joining Yuhe in 2005, Mr. Ding worked at Qingdao Zhengda Co., Ltd., a broiler chicken company located in Shandong Province from 1993 to 2005, where he ultimately served as the vice general manager of its production division. Prior to joining Qingdao Zhengda Co., Ltd. in 1993, Mr. Ding worked at Heilongjiang Tieli Agricultural Co., Ltd., a company located in Heilongjiang Province from 1983 to 1993. Mr. Ding holds a degree in agriculture from the Heilongjiang Bayi Agricultural University.

Involvement in Certain Legal Proceedings

To our knowledge, during the past five years, none of our directors or executive officers was involved in any of the following: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding, excluding traffic violations and other minor offenses; (3) being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his/her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission, or SEC, or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Board Composition; Director Independence

Our Board of Directors only has one director, Gao Zhentao, who is also an officer of us, and therefore is not “independent” under the rules of the NASDAQ Global Market or any other securities exchange. Since we are not listed on any securities exchange, we are not required to have a board of directors with a majority of independent directors. Mr. Gao will remain a director until the next annual meeting of shareholders and the election and qualification of his successor(s). Officers are elected annually by our board of directors and serve at the discretion of the board.

Our board of directors has established no committees. Because we are not listed on a national securities exchange or an automated inter-dealer quotation system of a national securities association, we are not required to have an audit committee. Although we expect to establish an audit committee at some time in the future, we have not done so yet and we have no firm plans to do so in the near future. Since we have not established such a committee, we have not identified any member of such a committee as a financial expert.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding our common stock beneficially owned on March 12, 2008, and as adjusted after giving effect to the sale of the shares being sold in this offering for (i) each shareholder we know to be the beneficial owner of 5% or more of our common stock, (ii) each of our “named executive officers” and directors, and (iii) all executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. In general, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote or direct the voting of such security, or the power to dispose or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership within 60 days. Unless otherwise indicated by the footnotes below, we believe, based on the information furnished to us and subject to community and marital property laws, all persons named have sole voting and investment power with respect to such shares, except as otherwise noted. Percentage of ownership is based on 228,571,416 shares of our common stock outstanding as of March 12, 2008.

The following table excludes any shares of our common stock which may be issued for the round up of fractional shares and the special treatment to preserve round lot shareholders.

Name of Beneficial Owner | | Number of Shares Beneficially Owned Before Offering | | Percent of Shares Beneficially Owned Before Offering | | Number of Shares Beneficially Owned After Offering | | Percent of Shares Beneficially Owned After Offering | |

Greater than 5% Shareholders | | | | | | | | | |

Kunio Yamamoto 1 | | | 126,857,134 | | | 88.8 | % | | 112,571,424 | | | 49.2 | % |

| | | | | | | | | | | | | | |

Halter Financial Investments, L. P. 2 | | | 14,000,000 | | | 9.8 | % | | 14,000,000 | | | 6.1 | % |

| | | | | | | | | | | | | | |

Pinnacle Fund L.P. 3 | | | 0 | | | * | % | | 35,714,284 | | | 15.6 | % |

| | | | | | | | | | | | | | |

Black River Small Capitalization Fund Ltd. 4 | | | 0 | | | * | % | | 33,333,333 | | | 14.6 | % |

| | | | | | | | | | | | | | |

Ardsley Partners Fund II, LP 5 | | | 0 | | | * | % | | 16,666,665 | | | 7.3 | % |

Directors and Executive Officers | | | | | | | | | | | | | |

Gao Zhen Tao 1 | | | 0 | | | * | % | | 0 | | | * | % |

| | | | | | | | | | | | | | |

Han Chengxiang 1 | | | 0 | | | * | % | | 0 | | | * | % |

| | | | | | | | | | | | | | |

Jiang Yingjun 1 | | | 0 | | | * | % | | 0 | | | * | % |

| | | | | | | | | | | | | | |

Richard Crimmins 2 | | | 0 | | | * | % | | 0 | | | * | % |

| | | | | | | | | | | | | | |

Pam Jowett 6 | | | 35,000 | | | * | % | | 35,000 | | | * | % |

| | | | | | | | | | | | | | |

| All Executive Officers and Directors as a group | | | 35,000 | | | * | % | | 35,000 | | | * | % |

| (1) | Address is c/o Weifang Yuhe Poultry Co. Ltd., 301 Hailong Street, Hanting District, Weifang, Shandong Province, The People’s Republic of China. |

| (2) | Address is 12890 Hilltop Road, Argyle, TX 76226. Includes 7,571,428 shares held by Halter Financial Group, L.P. |

| (3) | Address is 4965 Preston Park Blvd., Suite 240, Plano, TX 75093. Includes 17,857,142 shares held by Pinnacle China Fund L.P. |

| (4) | Address is 12700 Whitewater Drive, Minnetonka, MN 55343-9438. Includes 14,285,714 shares held by Black River Commodity Select Fund Ltd. |

| (5) | Address is 262 Harbor Drive, 4th Floor, Stamford CT 06902. Includes 178,571 shares held by Marion Lynton, 4,910,714 shares held by Ardsley Offshore Fund, Ltd. and 4,538,690 shares held by Ardsley Partners Institutional Fund, LP. |

| (6) | Address is 311 State Street, Suite 460, Salt Lake City, UT 84111. |

DESCRIPTION OF CAPITAL STOCK

As of March 12, 2008, our authorized capital stock consisted of 500 million shares of common stock, par value $0.001 per share. As of March 12, 2008, an aggregate of 228,571,416 shares of common stock were outstanding. There are outstanding warrants to acquire 6,999,999 shares of common stock, exercisable at any time after date 6 months after March 12, 2008. There are no shares of preferred stock outstanding. A description of the material terms and provisions of our articles of incorporation and bylaws affecting the rights of holders of our capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to the form of articles of incorporation and the form of our bylaws that are filed with this filing.

Common Stock

Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of common stock are entitled to receive dividends out of assets legally available therefore at times and in amounts as our board of directors may determine. Each shareholder is entitled to one vote for each share of common stock held on all matters submitted to a vote of the shareholders. Cumulative voting is not provided for in our amended articles of incorporation, which means that the majority of the shares voted can elect all of the directors then standing for election. The common stock is not entitled to preemptive rights and is not subject to conversion or redemption. Upon the occurrence of a liquidation, dissolution or winding-up, the holders of shares of common stock are entitled to share ratably in all assets remaining after payment of liabilities and satisfaction of preferential rights of any outstanding preferred stock. There are no sinking fund provisions applicable to the common stock. The outstanding shares of common stock are fully paid and non-assessable.

Registration Rights of Private Placement Investors

Concurrently with the execution of the Securities Purchase Agreement, we and the investors entered into a Registration Rights Agreement, a copy of which is attached hereto as Exhibit 10.4. The following summary description relating to the registration rights does not purport to be complete and is qualified in its entirety to the related agreements referenced below.

With respect to the 99,999,992 shares purchased by the investors at closing on March 12, 2008, we are required to file a resale registration statement on Form S-1 or any other appropriate form (i) within 60 days following the closing for purposes of registering the resale of these shares, (ii) within 15 days with respect to any additional registration statement, (iii) within 15 days with respect to any additional registration statements required to be filed due to SEC restrictions, (iv) within 30 days following the date on which we become eligible to utilize Form S-3 to register the resale of common stock, or (v) within 45 days following the date the 2008 make good shares or 2009 make good shares (the “Make Good Shares”) as defined in "Description of Business - Securities Purchase Agreement" are delivered by Mr. Yamamoto to the investors.

Among other things, we will be required to pay the investors liquidated damages if we fail to file a registration statement by the above filing deadlines or if we do not promptly respond to comments received from the SEC. The liquidated damages accrue at a rate of 0.5% per month of the aggregate investment proceeds received from the investors, capped at 5% of the total investment proceeds.

The Make Good Shares, when and if released from the escrow account to the investors, will also have registration rights. With respect to the Make Good Shares, we agreed to file a registration statement within 45 days following the respective delivery date of the Make Good Shares and make the registration statement effective no later than the 120th day, or the 150th day in the case that the SEC reviews and has written comments to such file registration statement that would require the filing of a pre-effective amendment thereto with the SEC, following the delivery date or the fifth trading day following the date on which we are notified by the SEC that the registration statement will not be reviewed or is no longer subject to further review and comments, whichever date is earlier.

We are required to keep the registration statement(s) effective during the entire effectiveness period of the registration rights, which commences on the effective date of the registration statement and ends on the earliest to occur of (a) the second anniversary of the date the registration statement becomes effective, (b) such time as all the shares covered by such registration statement have been publicly sold by the holders of such shares, or (c) such time as all of the shares covered by the registration statement may be sold by holders without volume restrictions pursuant to Rule 144.

In addition, the investors have piggy-back registration rights, pursuant to which, if at any time during the effectiveness period of the registration rights there is not an effective registration statement covering all the securities with registration rights and we determine to prepare and file with the SEC a registration statement relating to an offering for its own account or the account of others of any of its equity securities, other than on Form S-4 or S-8 or their equivalents relating to equity securities to be issued solely in connection with any acquisition of any equity issuable in connection with stock options or other employee benefit plans, then we should include the shares of the investors in to the registration statement if the investors so request. See “Description of Business - History and Background - Equity Investment by Certain Investors.”

Registration Rights of Roth Capital/ WLT Brothers

On March 12, 2008, as part of the compensation to our placement agents, Roth Capital Partners, LLC, and WLT Brothers Capital, Inc. in connection with their services under the Securities Purchase Agreement, we issued to Roth Capital Partners, LLC and WLT Brothers Capital, Inc. warrants to acquire an aggregate of 6,999,999 shares of common stock, exercisable at any time after date 6 months after March 12, 2008. The shares of common stock issuable upon the exercise of the warrants have registration rights.

Registration Rights of Halter Financial

Pursuant to the Common Stock Purchase Agreement dated November 6, 2007 by and between us and Halter Financial Investments, L. P., upon the demand of Halter Financial Investments, L.P. and/or Halter Financial Group, L.P., we are required to file a registration statement on Form S-3 (or such other form if Form S-3 is unavailable) within 10 days covering the resale of the aggregate of 14,000,000 shares of our common stock. In addition, Halter Financial has a piggy-back registration right pursuant to which, if we decide to register any of its common stock or securities convertible into or exchangeable for our common stock under the Securities Act on a form which is suitable for an offering for cash or shares of us held by third parties and which is not a registration solely to implement an employee benefit plan, a registration statement on Form S-4 or a transaction to which Rule 145 or any other similar rule of the SEC is applicable, we will include the shares of Halter Financial into the registration statement if Halter Financial so requests.

Registration Rights of Other Shareholders

Pursuant to the Common Stock Purchase Agreement, dated November 6, 2007 as referenced above, certain other former officers, directors and holders of our shares of common stock have the rights to register up to 1,575,000 shares of our common stock.

Registration Expenses

All fees and expenses incident to the registrations will be borne by us whether or not any securities are sold pursuant to a registration statement.

Anti-Takeover Provisions

Our Articles of Incorporation and Bylaws contain certain provisions that are intended to enhance the likelihood of continuity and stability in the composition of our board and in the policies formulated by our board and to discourage certain types of transactions which may involve an actual or threatened change of our control. Our board is authorized to adopt, alter, amend and repeal our Bylaws or to adopt new Bylaws. In addition, our board has the authority, without further action by our stockholders, to issue up to 10 million shares of our preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. The issuance of our preferred stock or additional shares of common stock could adversely affect the voting power of the holders of common stock and could have the effect of delaying, deferring or preventing a change in our control.

NASDAQ Over-the-Counter Bulletin Board

Our common stock is traded in the over-the-counter market and prices are quoted on The NASDAQ Stock Market’s Over-The-Counter Bulletin Board under the symbol “FGIV.OB.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Interwest Transfer Company, Inc. Their phone number is 801.272.9294.

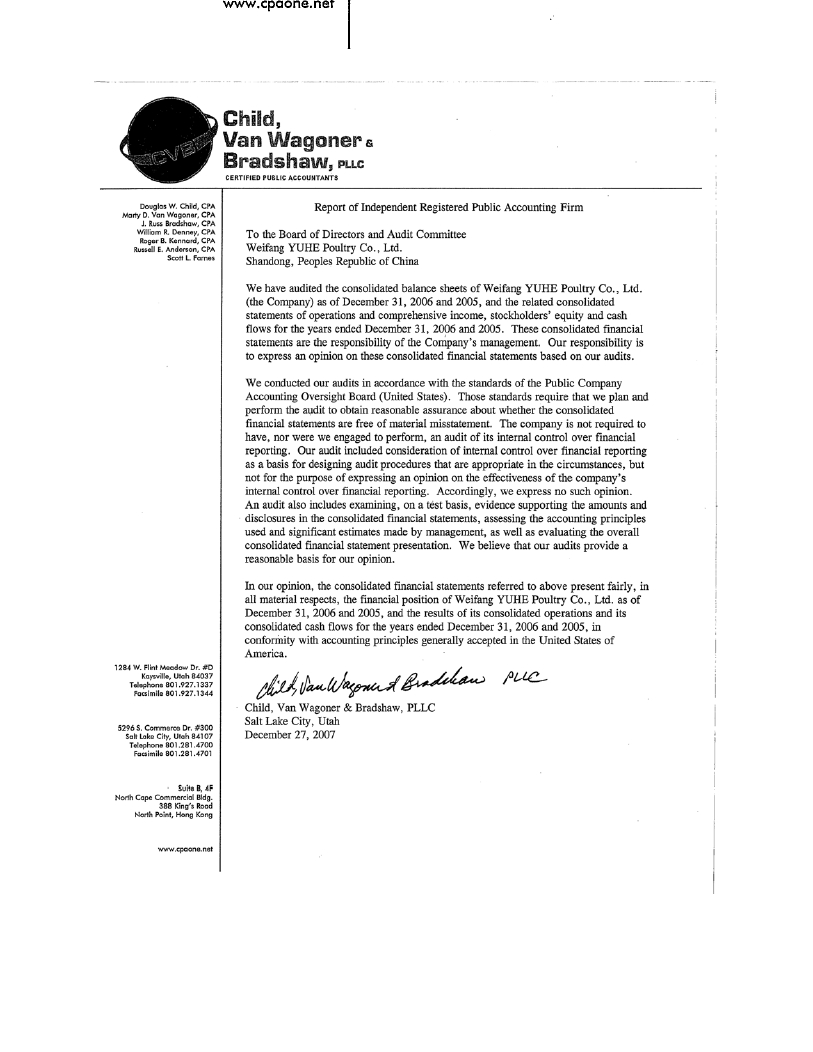

EXPERTS

The consolidated financial statements of Weifang Yuhe Poultry Co. Ltd. and Weifang Taihong Feed Co. Ltd. as of December 31, 2006, and for each of the two years in the period ended December 31, 2006 have been included in this filing in reliance upon the report of Child, Van Wagoner & Bradshaw, PLLC, and upon the authority of said firm as experts in accounting and auditing.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

The reports of Pritchett, Siler & Hardy, P.C. on our financial statements for its fiscal years ended December 31, 2006 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to any uncertainty, audit scope or accounting principles. During our fiscal year ended December 31, 2006 and 2007 and the subsequent interim periods preceding the termination, there were no disagreements with Pritchett, Siler & Hardy, P.C. on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Pritchett, Siler & Hardy, P.C. would have caused Pritchett, Siler & Hardy, P.C. to make reference to the subject matter of the disagreements in connection with its report on the financial statements for such years or subsequent interim periods.

(a) Dismissal of Previous Independent Registered Public Accounting Firm

On March 12, 2008, concurrent with the change in control transaction discussed above, our board of directors approved the dismissal of Pritchett, Siler & Hardy, P.C. as our independent auditor, effective upon the completion of the audit of financial statements of our holding company, First Growth Investors, Inc. as of and for the fiscal year ended December 31, 2007 and the issuance of its report thereon. Upon the effective date of the dismissal, we will file a separate current report on Form 8-K to disclose the effectiveness of the dismissal in accordance with Item 304(a) of Regulation S-K. A copy of the letter from Pritchett, Siler & Hardy, P.C. addressed to the SEC will also be attached by us as Exhibit 16.1 to such current report on Form 8-K.

(b) Engagement of New Independent Registered Public Accounting Firm

Concurrent with the decision to dismiss Pritchett, Siler & Hardy, P.C. as our independent auditor, our board of directors elected to continue the existing relationship of our new subsidiary Bright Stand International Limited with Child, Van Wagoner & Bradshaw, PLLC and appointed Child, Van Wagoner & Bradshaw, PLLC as our independent auditor.