UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10−Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: March 31, 2008

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File Number: 333-83125

YUHE INTERNATIONAL, INC.

(Exact name of Registrant as Specified in its Charter)

| Nevada | | 33-0215298 |

| (State or other jurisdiction of | | (I.R.S. Employer Identification. No.) |

| incorporation or organization) | | |

301 Hailong Street

Hanting District, Weifang, Shandong Province

The People’s Republic of China

(Address of principal executive offices)

86 536 736 3688

(Registrant’s Telephone Number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months or for such shorter period that the registrant was required to file such reports, and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares outstanding of each of the issuer’s classes of common equity, as of March 31, 2008 is as follows:

| Class of Securities | | Shares Outstanding |

| Common Stock, $0.001 par value | | 15,543,330 (on a post split basis) |

TABLE OF CONTENTS

| | | | Page |

| | PART I | | |

| | | | |

| Item 1. | Condensed Financial Statements | | F-1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 1 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | | 9 |

| Item 4. | Controls and Procedures | | 9 |

| | | | |

| | PART II | | |

| | | | |

| Item 1. | Legal Proceedings | | 10 |

| Item 1A. | Risk Factors | | 10 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | | 10 |

| Item 3. | Defaults Upon Senior Securities | | 11 |

| Item 4. | Submission of Matters to a Vote of Securities Holders | | 11 |

| Item 5. | Other Information | | 11 |

| Item 6. | Index to Exhibits | | 11 |

PART I

FINANCIAL INFORMATION

ITEM 1. CONDENSED FINANCIAL STATEMENTS.

YUHE INTERNATIONAL INC.

(Formerly known as First Growth Investors Inc.)

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2008 AND 2007

Index to condensed consolidated financial statements

| | | Page |

| Condensed Consolidated Balance Sheets | | F-2 |

| Condensed Consolidated Statements of Operations and Comprehensive Income | | F-3 |

| Condensed Consolidated Statements of Changes in Stockholders’ Equity | | F-4 |

| Condensed Consolidated Statements of Cash Flows | | F5 - F6 |

| Notes to Condensed Consolidated Financial Statements | | F7 - F32 |

YUHE INTERNATIONAL INC.

(Formerly known as First Growth Investors Inc.)

CONDENSED CONSOLIDATED BALANCE SHEETS

(Stated in US Dollars)

| | | March 31, 2008 | | December 31, 2007 | |

| | | (unaudited) | | | |

| ASSETS | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | | | 2,988,595 | | $ | 1,050,168 | |

| Restricted cash | | | 1,750,000 | | | - | |

| Accounts receivables, net of allowances of $17,677 | | | 1,510 | | | - | |

| Prepaid expenses | | | 38,577 | | | - | |

| Inventories | | | 7,149,839 | | | - | |

| Note receivables, net | | | 11,338,839 | | | - | |

| Advances to suppliers | | | 862,088 | | | - | |

| Total current assets | | | 24,129,448 | | | 1,050,168 | |

| | | | | | | | |

| Deposits paid | | | 1,144,790 | | | - | |

| Other receivables, net | | | 266,406 | | | - | |

| Unlisted investments | | | 286,235 | | | - | |

| Plant and equipment, net | | | 15,531,164 | | | - | |

| Intangible assets, net | | | 2,888,025 | | | - | |

| Due from related companies | | | 4,076,065 | | | 1,000,000 | |

| Due from directors | | | 253,558 | | | - | |

| Deferred expenses | | | 588,903 | | | - | |

| Total assets | | | 49,164,594 | | $ | 2,050,168 | |

| | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | | | 4,685,185 | | $ | - | |

| Current portion of long term loans | | | 4,485,774 | | | - | |

| Loan payable | | | 2,408,464 | | | - | |

| Payroll and payroll related liabilities | | | 664,840 | | | - | |

| Accrued expenses | | | 1,066,098 | | | 70 | |

| Advances from customers | | | 156,340 | | | - | |

| Other tax payables | | | 138,152 | | | - | |

| Due to related companies | | | 953,507 | | | 2,210 | |

| Total current liabilities | | | 14,558,360 | | | 2,280 | |

| Non-current liabilities | | | | | | | |

| Long-term loans | | | 6,308,564 | | | - | |

| Total liabilities | | | 20,866,924 | | | 2,280 | |

| | | | | | | | |

| Shareholders' Equity | | | | | | | |

Preferred stock, $.001 par value, 1,000,000 shares authorized, no shares issued and outstanding | | | - | | | | |

| Common stock at $.001 par value; authorized 500,000,000 shares authorized, 15,543,330 and 8,626,318 equivalent shares issued and outstanding | | | 15,543 | | | 8,626 | |

| Additional paid-in capital | | | 29,542,836 | | | 2,041,474 | |

| Stock Subscription Receivable | | | (1,403,937 | ) | | - | |

| Accumulated deficits | | | (274,693 | ) | | (2,212 | ) |

| Accumulated other comprehensive income | | | 417,921 | | | - | |

| Total stockholders’ equity | | | 28,297,670 | | | 2,047,888 | |

| Total liabilities and stockholders’ equity | | | 49,164,594 | | $ | 2,050,168 | |

See accompanying notes to condensed consolidated financial statements

YUHE INTERNATIONAL INC.

(Formerly known as First Growth Investors Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Stated in US Dollars)

| | | For The Three Months Ended | |

| | | March 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Net revenues | | $ | 1,103,551 | | $ | - | |

| | | | | | | | |

| Cost of revenue | | | (874,707 | ) | | - | |

| Gross profit | | | 228,844 | | | - | |

| | | | | | | | |

| Operating Expenses | | | | | | | |

| Selling expenses | | | (48,540 | ) | | - | |

| General and administrative expenses | | | (247,824 | ) | | - | |

| | | | | | | | |

| Total operating expenses | | | (296,364 | ) | | - | |

| | | | | | | | |

| Loss from operations | | | (67,520 | ) | | - | |

| | | | | | | | |

| Non-operating income | | | | | | | |

| Interest income | | | 158 | | | - | |

| Other income | | | 5,900 | | | - | |

| Interest expenses | | | (180,474 | ) | | - | |

| Other expenses | | | (30,545 | ) | | - | |

| | | | | | | | |

| Total other expenses | | | (204,961 | ) | | - | |

| | | | | | | | |

| Net loss before income taxes | | | (272,481 | ) | | - | |

| Income taxes | | | - | | | - | |

| | | | | | | | |

| Net loss | | $ | (272,481 | ) | $ | - | |

| | | | | | | | |

| Other comprehensive income | | | | | | | |

| Foreign currency translation | | | 417,921 | | | - | |

| Comprehensive income | | $ | 145,440 | | $ | - | |

| | | | | | | | |

| Loss per share | | $ | (0.03 | ) | $ | - | |

| | | | | | | | |

| Weighted average shares outstanding | | | 10,146,353 | | | 8,626,318 | |

See accompanying notes to condensed consolidated financial statements

YUHE INTERNATIONAL INC.

(Formerly known as First Growth Investors Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Stated in US Dollars)

| | | Common stock | | | | Stock | | | | Accumulated other | | Total | |

| | | Shares outstanding | | Amount | | Additional paid-in capital | | subscription receivable | | Retained Earnings | | comprehensive income | | shareholders’ Equity | |

| Balance at December 31, 2007 | | | 8,626,318 | | | 8,626 | | $ | 2,041,474 | | $ | | | $ | (2,212 | ) | $ | | | $ | 2,047,888 | |

| Additional capital contribution | | | | | | | | | 12,149,750 | | | | | | | | | | | | 12,149,750 | |

| Recapitalization | | | 1,087,994 | | | 1,088 | | | (2,082 | ) | | | | | | | | | | | (994 | ) |

| Pre-acquisition contingency adjustment (See (i) below) | | | | | | | | | (377,543 | ) | | | | | | | | | | | (377,543 | ) |

| Share issued in private placement at $0.21 per share | | | | | | 5,829 | | | 17,994,171 | | | | | | | | | | | | 18,000,000 | |

| Cost of raising capital | | | 5,829,018 | | | | | | (2,262,934 | ) | | | | | | | | | | | (2,262,934 | ) |

| Stock subscription receivable | | | | | | | | | | | | (1,403,937 | ) | | | | | | | | (1,403,937 | ) |

| Warrants issued in connection with private placement | | | | | | | | | 2,398,975 | | | | | | | | | | | | 2,398,975 | |

| Cost of raising capital - issuance of warrants | | | | | | | | | (2,398,975 | ) | | | | | | | | | | | (2,398,975 | ) |

| Net loss for the period | | | | | | | | | | | | | | | (272,481 | ) | | | | | (272,481 | ) |

| Foreign currency translation adjustment | | | | | | | | | | | | | | | | | | 417,921 | | | 417,921 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2008 | | $ | 15,543,330 | | $ | 15,543 | | $ | 29,542,836 | | $ | (1,403,937 | ) | $ | (274,693 | ) | $ | 417,921 | | $ | 28,297,670 | |

(i) Being adjustment of overstated net asset value relating to reversal of waiver of debt payable in respect of Yuhe Poultry group after acquisition date of January 31, 2008 as a pre-acquisition contingency.

YUHE INTERNATIONAL INC.

(Formerly known as First Growth Investors Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Stated in US Dollars)

| | | For The Three Months Ended | |

| | | March 31 | |

| | | 2008 | | 2007 | |

| Cash flows from operating activities | | | | | |

| Net loss | | $ | (272,481 | ) | $ | - | |

| | | | | | | | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | | | | | |

| Depreciation | | | 244,464 | | | - | |

| Amortization | | | 10,414 | | | - | |

| Allowances for bad debt | | | (13,145 | ) | | - | |

| Changes in operating assets and liabilities: | | | | | | | |

| Advances to suppliers | | | (538,226 | ) | | - | |

| Prepaid expenses | | | (10,333 | ) | | - | |

| Deposits paid | | | (2,801 | ) | | - | |

| Inventories | | | (2,366,280 | ) | | - | |

| Accounts payable | | | (222,125 | ) | | - | |

| Payroll and payroll related liabilities | | | 104,323 | | | - | |

| Accrued expenses | | | 569,571 | | | - | |

| Advances from customers | | | (56,979 | ) | | - | |

| Other tax payables | | | 9,383 | | | - | |

| | | | | | | | |

| Net cash used in operating activities | | | (2,544,215 | ) | | - | |

| | | | | | | | |

| Cash flows from investing activities | | | | | | | |

| Deposits paid and acquisition of property, plant and equipment | | | (248,616 | ) | | - | |

| Acquisition of subsidiaries | | | (10,255,416 | ) | | - | |

| Advances to notes receivables | | | (11,726,770 | ) | | - | |

| Advances to related parties receivables | | | (208,458 | ) | | - | |

| | | | | | | | |

| Net cash used in investing activities | | | (22,439,260 | ) | | - | |

YUHE INTERNATIONAL INC.

(Formerly known as First Growth Investors Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Stated in US Dollars)

| Cash flows from financing activities | | | | | |

| Proceeds from loan payable | | | 778,870 | | | - | |

| Proceeds from related party | | | 1,285,168 | | | - | |

| Capital contribution by shareholder | | | 12,149,750 | | | - | |

| Proceeds from common stock sale - net of offering costs | | | 12,583,129 | | | - | |

| | | | | | | | |

| Net cash flows provided by financing activities: | | | 26,796,917 | | | - | |

| | | | | | | | |

| Effect of foreign currency translation on cash and cash equivalents | | | 124,985 | | | - | |

| | | | | | | | |

| Net increase in cash | | | 1,938,427 | | | - | |

| | | | | | | | |

| Cash- beginning of period | | | 1,050,168 | | | - | |

| | | | | | | | |

| Cash- end of period | | $ | 2,988,595 | | $ | - | |

| | | | | | | | |

| Supplemental disclosure of non cash investing and financing activities: | | | | | | | |

| Interest paid | | $ | 181,474 | | $ | - | |

| Income taxes paid | | $ | - | | $ | - | |

See accompanying notes to condensed consolidated financial statements

The interim condensed consolidated financial statements included herein, presented in accordance with United States generally accepted accounting principles and stated in US dollars, have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading. These statements reflect all adjustments, consisting of normal recurring adjustments, which, in the opinion of management, are necessary for fair presentation of the information contained therein. It is suggested that these interim condensed consolidated financial statements be read in conjunction with the financial statements of the Company for the year ended December 31, 2007 and notes thereto included in S-1 of Yuhe International Inc. (Formerly known as First Growth Investors Inc.) filed on May 12, 2008. The Company follows the same accounting policies in the preparation of interim reports.

Results of operations for the interim periods are not indicative of annual results.

2. Organization and Basis of Preparation of Financial Statements

Yuhe International Inc.

Yuhe International Inc., formerly known as First Growth Investors Inc., “Yuhe” or “the Company,” was originally organized under the laws of the State of Nevada on September 9, 1997. The Company was not presently engaged in any business activities and had no operations, income producing assets or significant operating capital. At December 31, 2007, the Company was at development stage until its business combination with Bright Stand on March 12, 2008.

2. Organization and Basis of Preparation of Financial Statements - continued

On March 12, 2008, the Company completed a reverse acquisition transaction with Bright Stand International Co., Ltd., “Bright Stand,” and Kunio Yamamoto, a Japanese person and the sole former shareholder of Bright Stand. Pursuant to the terms of the Equity Transfer Agreement, the Company acquired all of the outstanding capital stock of Bright Stand from Mr. Yamamoto in exchange for 126,857,134 shares of its common stock, equivalent to 8,626,236 post-split shares. As a result of the transaction, Mr. Yamamoto held 126,857,134 shares, equivalent to 8,626,236 post-split shares, or 88.8% of our 142,857,134 shares of common stock then outstanding, equivalent to 9,714,230 post-split shares, following the completion of all matters referred to above. At the closing, Bright Stand became a wholly-owned subsidiary of the Company. Accordingly, all references to common shares of Bright Stand’s common stock have been restated to reflect the equivalent numbers of Yuhe International Inc. equivalent shares. Bright Stand thereby became the Company’s wholly-owned subsidiary and the former shareholder of Bright Stand became the Company’s controlling stockholder.

This share exchange transaction resulted in Bright Stand’s former shareholder obtaining a majority voting interest in the Company. Generally accepted accounting principles require that the company whose shareholders retain the majority interest in a combined business be treated as the acquirer for accounting purposes, resulting in a reverse acquisition with Bright Stand as the accounting acquiror and Yuhe International Inc. as the acquired party. Accordingly, the share exchange transaction has been accounted for as a recapitalization of the Company. The equity section of the accompanying financial statements have been restated to reflect the recapitalization of the Company due to the reverse acquisition as of the first day of the first period presented. The assets and liabilities acquired that, for accounting purposes, were deemed to have been acquired by Bright Stand were not significant.

On March 12, 2008, the Company closed a Securities Purchase Agreement with certain investors, the “Financing”. Pursuant to the terms of such Securities Purchase Agreement, such investors collectively invested $18,000,000 into Yuhe at the price of $0.21, $3.088 post-split, per share in exchange for our issuance of 85,714,282 shares, equivalent to approximately 5,829,018 post-split shares, to such investors. Mr. Yamamoto also sold 14,285,710 shares of common stock to such investors, equivalent to 971,423 post-split shares, for $3,000,000. Immediately following the closing of the Securities Purchase Agreement, Mr. Yamamoto owned 112,571,424 shares of our common stock, equivalent to 7,654,815 post-split shares, and the investors owned 99,999,992 shares of our common stock, equivalent to 6,799,962 post-split shares.

2. Organization and Basis of Preparation of Financial Statements - continued

In connection with the private placement on March 12, 2008, as part of the compensation to the placement agent, Roth Capital Partners, LLC, in connection with their services under the Securities Purchase Agreement, the Company issued to Roth Capital Partners, LLC and WLT Brothers Capital, Inc. warrants to acquire an aggregate of 6,999,999 shares of common stock, equivalent to 476,014 post-split shares, exercisable at any time after the date falling 6 months after their issuance. The warrants have a strike price equal to $0.252, $3.705 post-split, have a term of three years starting from March 12, 2008 and permit cashless or cash exercise at all times after they are exercisable until they expire on March 12, 2011. The shares of common stock issuable upon the exercise of the warrants have registration rights. In addition, Roth Capital Partners, LLC and WLT Brothers Capital, Inc. received cash compensation in the amount of $1.47 million.

From the private placement arrangement, the Company raised gross proceeds of $18,000,000.

Also, on March 12, 2008, our majority stockholder, Mr. Yamamoto, entered into an escrow agreement with the private placement investors. Mr. Yamamoto will deliver a certain number of shares of our common stock owned by him to the investors pro-rata in accordance with their respective investment amount for no additional consideration if:

| | (i) | our after tax net income for our fiscal year ending on December 31, 2008 is less than $9,000,000 and fiscal year ending on December 31, 2009 is less than 95% of $12,350,000; and |

| | (ii) | our earnings per share reported in the fiscal year ending on December 31, 2009 is less than $0.74 on a fully diluted basis, the “Low Performance Events”. |

Mr. Yamamoto has placed an aggregate of 49,411,763 shares of common stock, equivalent to 3,359,889 post-split shares, “Make Good Shares,” into an escrow account pursuant to the terms of the Make Good Escrow Agreement by and among us, Mr. Yamamoto, the Investors and the escrow agent named therein. In the event we do not achieve the Targets in 2008 and 2009, Make Good Shares will be conveyed to the Investors pro-rata in accordance with their respective investment amount for no additional consideration. In the event that the foregoing Low Performance Events do not occur, the Make Good Shares will be transferred to Mr. Yamamoto.

After the reverse acquisition, the total common stock issued and outstanding of the Company is 15,543,330 post-split shares.

The Company amended its articles of incorporation on April 4, 2008 and changed its name into Yuhe International Inc.

2. Organization and Basis of Preparation of Financial Statements - continued

Bright Stand International Limited, “Bright Stand”

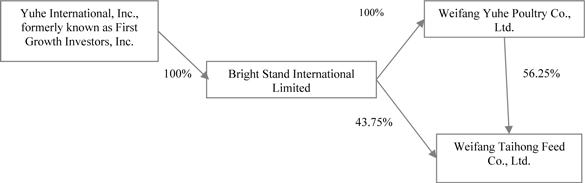

On August 3, 2007, Bright Stand International Limited, “Bright Stand,” was incorporated with limited liability in the British Virgin Islands. On January 31, 2008, Bright Stand International Limited completed the acquisition (note 4) of 100% common stock of Weifang Yuhe Poultry Co., Limited, “Weifang,” and 43.75% of Weifang Taihong Feed Co., Ltd., “Taihong”. As a result, Bright Stand owned 100% of Weifang and owned 43.75% direct interest of Taihong and 56.25% indirect interest of Taihong through Weifang. Weifang and Taihong became the wholly-owned subsidiaries of Bright Stand.

Weifang Yuhe Poultry Co., Ltd, “Weifang”

Weifang Yuhe Poultry Co., Ltd, “Weifang”, was established in Weifang, Shandong of the People’s Republic of China, the “PRC”, as a limited company on March 8, 1996. The Company currently operates through itself and owned 56.25% of Weifang Taihong Feed Co., Ltd. Weifang is a supplier of day-old chickens raised for meat production, or broilers, in the People’s Republic of China.

Weifang Taihong Feed Co., Ltd., “Taihong”

Weifang Taihong Feed Co., Ltd. was established in Weifang, Shandong of the PRC as a limited company on May 26, 2003. Taihong is a feed stock company whose primary purpose is to supply feed stock for Weifang’s breeder chickens.

The Company’s operations are conducted through its subsidiaries in the PRC, Weifang Yuhe Poultry Co. Ltd., “Weifang,” and Weifang Taihong Feed Co. Ltd., “Taihong”. The Company and its subsidiary, hereinafter, collectively referred to as “the Group,” are engaged in the business of chick and feed production.

3. Summary of significant accounting policies

(a) Principles of consolidation

The condensed consolidated financial statements, prepared in accordance with generally accepted accounting principles in the United States of America, include the assets, liabilities, revenues, expenses and cash flows of the Company and all its subsidiaries. This basis of accounting differs in certain material respects from that used for the preparation of the books and records of the Company’s principal subsidiaries, which are prepared in accordance with the accounting principles and the relevant financial regulations applicable to enterprises with limited liabilities established in the PRC, “PRC GAAP,” the accounting standards used in the place of their domicile. The accompanying consolidated financial statements reflect necessary adjustments not recorded in the books and records of the Company’s subsidiaries to present them in conformity with US GAAP.

The condensed consolidated financial statements of the Company include the accounts of Yuhe International Inc., Bright Stand International Limited, Weifang Yuhe Poultry Co., Ltd and Weifang Taihong Feed Co., Ltd. after the date of acquisitions. All significant intercompany accounts, transactions and cash flows are eliminated on consolidation.

The following table depicts the identity of the subsidiary:

Name of Company | | Place & date of Incorporation | | Attributable Equity Interest % | | Registered Capital | | | |

| | | | | | | | | | |

Weifang Yuhe Poultry Co., Ltd | | | PRC/ March 8, 1996 | | | 100 | % | $ | 11,045,467 | | | (equivalent to RMB77,563,481 | ) |

| | | | | | | | | | | | | | |

Weifang Taihong Feed Co., Ltd. | | | PRC/ May 26 2003 | | | 100 | % | $ | 965,379 | | | (equivalent to RMB8,000,000 | ) |

(b) Use of estimates

The preparation of the financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ materially from those estimates.

3. Summary of significant accounting policies - continued

(c) Intangible assets

Intangible assets represent land use rights in the PRC. Land use rights are carried at cost and amortized on a straight-line basis over the period of rights of 50 years commencing from the date of acquisition of equitable interest. According to the laws of PRC, the government owns all of the land in PRC. Companies or individual are authorized to possess and use the land only through land usage rights approved by the PRC government.

(d) Economic and political risks

The Company’s operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

(e) Plant and equipment

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using the straight-line method. Estimated useful lives of the plant and equipment are as follows:

| Buildings | | 20 years |

| Machinery | | 10 years |

| Vehicle | | 5 years |

| Furniture and equipment | | 3 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the statement of income. The cost of maintenance and repairs is charged to income as incurred, whereas significant renewals and betterments are capitalized.

3. Summary of significant accounting policies - continued

(f) Accounting for the impairment of long-lived assets

The long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. It is reasonably possible that these assets could become impaired as a result of technology or other industry changes. Determination of recoverability of assets to be held and used is done by comparing the carrying amount of an asset to future net undiscounted cash flows to be generated by the assets.

If such assets are considered to be impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell. During the reporting periods, there was no impairment loss.

(g) Inventories

Inventories consisting of raw materials, work in progress and finished goods are stated at lower of cost or net realizable value. The cost of inventories is determined using weighted average cost method, and includes expenditure incurred in acquiring the inventories and bringing them to their existing location and condition. Net realizable value is the estimated selling price in the ordinary course of business less any applicable selling expenses. Finished goods are comprised of direct materials, direct labor and an appropriate proportion of overhead. At each balance sheet date, inventories that are worth less than cost are written down to their net realizable value, and the difference is charged to the cost of revenues of that period.

(h) Trade receivables

Trade receivables are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An estimate for doubtful accounts is made when collection of the full amount is no longer probable. Bad debts are written off as incurred.

3. Summary of significant accounting policies - continued

(i) Cash and cash equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. The Company maintains bank accounts only in the PRC. The Company does not maintain any bank accounts in the United States of America. Cash deposits in PRC banks are not insured by any government agency or entity.

(j) Revenue recognition

Net revenue is recognized when the customer takes delivery and acceptance of products, the price is fixed or determinable as stated in the sales contract, and the collectibility is reasonably assured.

Customers do not have a general right of return on products delivered.

(k) Cost of revenues

Cost of revenues consists primarily of material costs, employee compensation, depreciation and related expenses, which are directly attributable to the production of products. Write-down of inventory to lower of cost or market is also recorded in cost of revenues.

(l) Advertising

The Group expensed all advertising costs as incurred. Advertising expenses for the three months ended March 31, 2008 and 2007 were $0 and $0 respectively.

3. Summary of significant accounting policies - continued

(m) Retirement benefit plans

The employees of the Group are members of a state-managed retirement benefit plan operated by the government of the PRC. The Group is required to contribute a specified percentage of payroll costs to the retirement benefit scheme to fund the benefits. The only obligation of the Group with respect to the retirement benefit plan is to make the specified contributions.

Retirement benefits in the form of contributions under defined contribution retirement plans to the relevant authorities are charged to the statements of income as incurred. The retirement benefit expenses for the three months ended March 31, 2008 and 2007 were $13,345 and $0 respectively.

(n) Income tax

The Company accounts for income taxes using an asset and liability approach and allows for recognition of deferred tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future realization is uncertain.

The Company is operating in the PRC, and in accordance with the relevant tax laws and regulations of PRC, the corporation income tax rate is 33%. However, the Company is a poultry company, and in accordance with the relevant regulations regarding the favorable tax treatment for an outstanding poultry company, the Company is entitled to a tax free treatment until March 31, 2008.

The corporate income tax for the subsidiary, Weifang Taihong Feed Co., Ltd is 33%.

(o) Shipping and handling fees

Shipping and handling fees are expensed when incurred. Shipping and handling charges included in the selling expenses for the three months ended March 31, 2008 and 2007 were $1,861 and $0 respectively.

3. Summary of significant accounting policies - continued

(p) Foreign currency translation

The accompanying financial statements are presented in United States dollars. The functional currency of the Company is the Renminbi, “RMB”. The financial statements are translated into United States dollars from RMB at year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

| March 31, 2008 | |

| Balance sheet | RMB 7.0222 to US$1.00 |

| Statement of income and comprehensive income | RMB 7.1757 to US$1.00 |

| | |

| December 31, 2007 | |

| Balance sheet | RMB 7.31410 to US$1.00 |

| Statement of income and comprehensive income | RMB 7.61720 to US$1.00 |

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US$ at the rates used in translation.

(q) Comprehensive income

Comprehensive income is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, all items that are required to be recognized under current accounting standards as components of comprehensive income are required to be reported in a financial statement that is presented with the same prominence as other financial statements. The Company’s current component of comprehensive income is the foreign currency translation adjustment.

3. Summary of significant accounting policies - continued

(r) Basic and diluted earnings per share

The Company reports basic earnings per share in accordance with SFAS No. 128, “Earnings Per Share”. Basic earnings per share is computed using the weighted average number of shares outstanding during the periods presented. The weighted average number of shares of the Company represents the common stock outstanding during the reporting periods.

Diluted earning per share is based on the assumption that all dilutive options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options are assumed to be exercised at the time of issuance, and as if funds obtained thereby were used to purchase common stock at the average market price during the year.

(s) Recent accounting pronouncements

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations” (“SFAS No. 141R”). SFAS No. 141R amends SFAS 141 and provides revised guidance for recognizing and measuring identifiable assets and goodwill acquired, liabilities assumed, and any noncontrolling interest in the acquiree. It also provides disclosure requirements to enable users of the financial statements to evaluate the nature and financial effects of the business combination. It is effective for fiscal years beginning on or after December 15, 2008 and will be applied prospectively. We are currently evaluating the impact of adopting SFAS No. 141R on our consolidated financial statements.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements — an amendment of ARB No. 51” (“SFAS No. 160”). SFAS No. 160 requires that ownership interests in subsidiaries held by parties other than the parent, and the amount of consolidated net income, be clearly identified, labeled, and presented in the consolidated financial statements. It also requires once a subsidiary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary be initially measured at fair value. Sufficient disclosures are required to clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. It is effective for fiscal years beginning on or after December 15, 2008 and requires retroactive adoption of the presentation and disclosure requirements for existing minority interests. All other requirements shall be applied prospectively. We are currently evaluating the impact of adopting SFAS No. 160 on our consolidated financial statements.

4. Acquisition of subsidiaries

Acquisition of 100% Weifang Yuhe Poultry Co., Limited and 43.75% of Weifang Taihong Feed Co., Ltd

On January 31, 2008, the Group acquired 100% common stock of Weifang Yuhe Poultry Co., Limited and 43.75% of Weifang Taihong Feed Co., Ltd of for $10,255,416 in cash.

The Company adopted SFAS No. 141, Business Combinations, which requires the use of the purchase method of accounting for any business combinations initiated after June 30, 2002 The results of Weifang and Taihong and the estimated fair market values of the assets and liabilities have been included in our consolidated financial statements from the date of acquisition. The purchase price for Weifang and Taihong was allocated to the assets acquired and liabilities assumed of Weifang and Taihong. All assets and liabilities assumed, based on their fair values.

| Accounts receivables | | $ | 1,475 | |

| Other receivables | | | 3,001,699 | |

| Deposits paid | | | 1,084,265 | |

| Deferred expenses | | | 602,918 | |

| Advance to suppliers | | | 305,013 | |

| Inventories | | | 4,624,425 | |

| Due from related companies | | | 4,008,506 | |

| Unlisted investment | | | 279,738 | |

| Plant and equipment | | | 15,125,244 | |

| Intangible assets | | | 2,832,869 | |

| Accounts payable | | | (4,800,664 | ) |

| Accrued expenses | | | (473,020 | ) |

| Payroll and related liabilities | | | (545,565 | ) |

| Other tax payable | | | (125,645 | ) |

| Advances from customers | | | (209,694 | ) |

| Other payables | | | (1,438,990 | ) |

| Due to related co. | | | (515,811 | ) |

| Other long-term payable | | | (136,975 | ) |

| Notes payables | | | (10,549,316 | ) |

| Other assumed liabilities Other payable | | | (2,815,056 | ) |

| | | | | |

| Net assets acquired-net of cash acquired | | $ | 10,255,416 | |

4. Acquisition of subsidiaries - continued

The following table presents the unaudited results of operations of the Company as if the Yuhe acquisitions had been consummated as of January 1, 2008 and 2007 and the results are shown for the three months ended March 31, 2008 and 2007 includes certain pro forma adjustments, including depreciation and amortization on the assets acquired, and other adjustments.

| | | For the three months ended | |

| | | 2008 | | 2007 | |

| Pro forma Information: | | | | | |

| | | | | | |

| Revenues | | $ | 2,596,883 | | $ | 2,835,087 | |

| Net profit | | $ | (129,051 | ) | $ | (650,266 | ) |

| Net profit per share - basic and diluted | | $ | (0.01 | ) | $ | (0.01 | ) |

| Shares used for computing earnings per share | | | 10,146,353 | | | 8,626,318 | |

5. Inventories

Inventories consist of the following:

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Raw materials | | $ | 599,787 | | $ | - | |

| Work in progress | | | 6,447,593 | | | - | |

| Finished goods | | | 102,459 | | | - | |

| | | | | | | | |

| | | $ | 7,149,839 | | $ | - | |

6. Other receivables, net

Other receivables, net consist of the following:

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Other receivables | | $ | 304,033 | | $ | - | |

| Less: Allowances | | | (37,627 | ) | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 266,406 | | $ | - | |

Other receivables are unsecured, interest free and have no fixed repayment date.

Allowance is made when collection of the full amount is no longer probable. Management reviews and adjusts this allowance periodically based on historical experience, current economic climate as well as its evaluation of the collectibility of outstanding accounts. The Group evaluates the credit risks of its customers utilizing historical data and estimates of future performance.

7. Note receivables, net

Note receivables, net consist of the following:

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Weifang Shanhe Zhuzho Diecasting Material Co. Ltd. | | $ | 10,042,815 | | $ | - | |

| Shandong Dingxin Biotechnology Co. Ltd. | | | 1,220,252 | | | - | |

| Others | | | 549,808 | | | - | |

| | | | | | | | |

| | | | 11,812,875 | | | - | |

| Less : Allowances | | | (474,036 | ) | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 11,338,839 | | $ | - | |

Note receivables to unrelated third parties are unsecured, interest free and repaid within one year which is recorded under current assets.

8. Unlisted investments

Unlisted investments at March 31, 2008 are the 3% investments in Hanting Rural Credit Cooperative, “Hanting”. It is stated at cost because the Group does not have significant influence or control over this investment. The management of the Company has reviewed the investment in Hanting for any impairment and determined there is no indication that the carrying amount of Hanting may not be recoverable.

9. Plant and equipment, net

Plant and equipment consists of the following:

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| At cost | | | | | | | |

| Buildings | | $ | 7,653,530 | | $ | - | |

| Machinery | | | 3,335,347 | | | - | |

| Motor vehicles | | | 153,399 | | | - | |

| Furniture and equipment | | | 69,285 | | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 11,211,561 | | $ | - | |

| Less: accumulated depreciation | | | (249,808 | ) | | - | |

| Construction in progress | | | 4,569,411 | | | - | |

| | | $ | 15,531,164 | | $ | - | |

Depreciation expenses amounting to $244,464 included in the cost of sales for the months ended March 31, 2008 and 2007 were $169,311 and $0 respectively, and included in the general and administrative expenses for the months ended March 31, 2008 and 2007 were, $ 75,153 and $0 respectively.

As of March 31, 2008, buildings and machinery of the Group were pledged as collateral under certain loan arrangements.

10. Intangible assets, net

Intangible assets consist of the following:

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Land use rights, at cost | | $ | 2,898,666 | | $ | - | |

| Less: accumulated amortization | | | (10,641 | ) | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 2,888,025 | �� | $ | - | |

As of March 31, 2008, land use rights of the Group were pledged as collateral under certain loan arrangements.

Amortization expenses included in the cost of revenues for the months ended March 31, 2008 and 2007 were $10,414 and $0 respectively.

11. | Due from related companies |

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| Hexing Green Agriculture Co., Ltd – Mr. Gao Zhentao, the director of the company is also the director | | $ | 73,942 | | $ | - | |

| | | | | | | | |

| Shandong Yuhe Food Co., Ltd – Mr. Gao Zhentao, the director of the company is also the director | | | 3,951,703 | | | - | |

| | | | | | | | |

| Shandong Yuhe New Agriculture Academy of Sciences – Mr. Gao Zhentao, the director of the company is also the director | | | 50,395 | | | - | |

| | | | | | | | |

| Weifang Jiaweike Food Co., Ltd – Mr. Gao Zhentao, the director of the company is also the director | | | 25 | | | - | |

| | | | | | | | |

| Weifang Yuhe Poultry Co., Ltd- Gao Zhentao, the director of the company is also the director | | | - | | | 1,000,000 | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 4,076,065 | | $ | 1,000,000 | |

The amounts due from related companies are unsecured, interest free and have no fixed repayment date.

12. Due from directors

Details of due from directors are as follows:

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Mr. Tan Yi | | $ | 81,375 | | $ | - | |

| Mr. Gao Zhenbo | | | 79,941 | | | - | |

| Mr. Gao Zhentao | | | 77,242 | | | - | |

| Mr. Yamamoto | | | 15,000 | | | - | |

| | | | | | | | |

| | | $ | 253,558 | | $ | - | |

The amounts due from directors are unsecured, interest free and have no fixed repayment date.

13. Loans payable

Loans payable are loans from unrelated companies for temporary operation purposes. They are unsecured, interest free and have no fixed repayment date.

14. Due to related companies

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| | | | | | |

| Weifang Hexing Breeding Co., Ltd – Mr. Gao Zhentao, the director of the company is also the director | | $ | 756,655 | | $ | - | |

| | | | | | | | |

| Guangli International Limited – Mr. Gao Zhentao, the director of the company is also the director | | | 19,863 | | | - | |

| | | | | | | | |

| Others | | | 176,989 | | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 953,507 | | $ | - | |

The amounts due to related companies are unsecured, interest free and have no fixed repayment date. These loans are used for working capital purposes.

15. Long-term liabilities

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| Loans from Nansun Rural Credit, interest rate at 9.22% to 10.51% per Annum, due from November 28, 08 to May 17, 10 | | $ | 8,544,331 | | | - | |

| | | | | | | | |

| Loans from Shuangyang Rural Credit interest rate at 9.33% per annum, due on October 12, 08 | | | 925,636 | | | - | |

| | | | | | | | |

| Loans from Hanting Kaiyuan Rural Credit Cooperative, interest rate at 9.22% to 13.31% per annum, due from November 28, 08 to January 10, 09 | | | 1,039,560 | | | - | |

| | | | | | | | |

| Loans from Hanting Rural Credit Cooperative, interest rate at 8.19% per annum, due from November 8, 09 | | | 284,811 | | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | 10,794,338 | | | - | |

| Less: current portion of long-term Liabilities | | | (4,485,774 | ) | | - | |

| | | | | | | | |

| | | $ | 6,308,564 | | | - | |

Future maturities of long-term loans as at March 31, 2008 are as follows:

| | | March 31 | |

| | | 2008 | |

| 2008 | | $ | 4,485,774 | |

| 2009 | | | 2,748,426 | |

| 2010 | | | 3,560,138 | |

| | | | | |

| | | | | |

| | | $ | 10,794,338 | |

16. Income tax

The Company is operating in the PRC, and in accordance with the relevant tax laws and regulations of PRC, the corporation income tax rate is 33%. However, the Company is an agricultural company, and in accordance with the relevant regulations regarding the tax exemption, the Company is tax-exempt as long as it is registered as an agricultural entity.

Taihong is operating in the PRC, and in accordance with the relevant tax laws and regulations of PRC, the corporation income tax rate is 33%. Taihong has net operating losses of $49,570 for the three months ended March 31, 2008, resulting in a deferred tax asset of $16,358 which has been fully reserved.

The Group uses the asset and liability method, where deferred tax assets and liabilities are determined based on the expected future tax consequences of temporary differences between the carrying amounts of assets and liabilities for financial and income tax reporting purposes. There are no material timing differences and therefore no deferred tax asset or liability at March 31, 2008.

The provision for income taxes consists of the following:

| | | 2008 | | 2007 | |

| Current tax | | | | | | | |

- PRC | | $ | - | | $ | - | |

- Deferral tax provision | | | - | | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | - | | $ | - | |

16. Income tax - continued

All of the Group’s income (loss) before income taxes is from PRC sources. Actual income tax expenses reported in the consolidated statements of income and comprehensive income differ from the amounts computed by applying the PRC statutory income tax rate of 25% and 33% for the fiscal year of 2008 and 2007 respectively to income (loss) before income taxes for the three months ended March 31, 2008 and 2007 for the following reasons:

| | | 2008 | | 2007 | |

| | | | | | |

| Income (loss) before income taxes | | $ | (272,481 | ) | $ | - | |

| | | | | | | - | |

Computed “expected” income tax asset at 25% | | $ | 68,120 | | $ | - | |

Valuation allowance for deferred tax Assets | | | - | | | - | |

| Effect of cumulative tax losses | | | - | | | - | |

| Tax holiday | | | (68,120 | ) | | - | |

| | | | | | | | |

| | | | | | | | |

| | | $ | - | | $ | - | |

17. Fair value of financial instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged in a current transaction between willing parties. The carrying amounts of financial assets and liabilities, such as cash and cash equivalents, trade accounts receivable, other receivables, accounts payable, and other payables, approximate their fair values because of the short maturity of these instruments and market rates of interest.

18. Common stock and warrants

On March 12, 2008, the Company issued 126,857,134 shares of its common stock, par value $0.001 per share, equivalent to approximately 8,626,318 post-split shares, to the sole stockholder of Bright Stand to effect the Reverse Merger Acquisition. At the same time, the Company issued 85,714,282 shares of common stock to the investors, equivalent to approximately 5,829,018 post-split shares, for gross proceeds of $18 million in the private placement.

The Company's issued and outstanding number of common stock immediately prior to the Reverse Merger Acquisition is 16,000,000 shares, equivalent to 1,087,994 post-split shares.

Effective on April 4, 2008, the Company effected a 1-for-14.70596492 reverse stock split of our common stock.

After the reverse acquisition, the total common stock issued and outstanding of the Company is 15,543,330 post-split shares.

The Company granted warrants to acquire and aggregate of 6,999,999 shares of common stock, equivalent to 476,014 post-split shares, to Roth Capital Partners, LLC and WLT Brothers Capital, Inc., for the services in connection with the private placement on March 12, 2008. The warrants have a strike price equal to $3.706, have a term of three years starting from March 12, 2008 and permit cashless or cash exercise at all times that they are exercisable. The warrants are exercisable at any time 6 months after their issuance. There are no diluted effects for the three months ended March, 2008 since those warrants are exercisable after September 11, 2008.

The total number of warrants outstanding as at March 31, 2008 was 476,014 shares

19. Stock Subscription Receivable

On March 12, 2008, the Company issued 85,714,282 shares of common stock to the investors, equivalent to approximately 5,829,018 post-split shares, for gross proceeds of $18 million in the private placement. Under the placement, the Company has deposited an aggregate of $1,750,000 as restricted cash (Note 20) and the Company paid $ 2,262,934 in cash as compensation to the related party involved in this private placement. As at March 31, 2008, the Company has not received the funds amounting to $1,403,937 and has recorded the amounts due under the caption “Stock Subscription Receivable” in the accompanying balance sheet.

During the three months ended March 31, 2008, the Company received the funds amounting to $12,583,129 and has recorded the proceeds from common stock sale in the accompanying statements of cash flows.

20. Restricted cash

| | | March 31 | | December 31 | |

| | | 2008 | | 2007 | |

| Cash held by escrow agents | | $ | 1,750,000 | | $ | - | |

On March 12, 2008, the Company consummated with certain accredited investors, the “Investors,” a private placement of 85,714,282 shares of common stock, equivalent to approximately 5,829,018 post-split shares, for an aggregate purchase price of approximately $18,000,000. Under this private placement arrangement, the Company signed three covenants with investors.

20. Restricted cash

Covenants: The Securities Purchase Agreement contains certain covenants on our part, including the following:

(a) Board of Directors. Within 180 days following the closing, the Company is required to nominate a minimum of five members to our Board of Directors, a majority of which must be “independent,” as defined under the Nasdaq Marketplace Rules, and to take all actions and obtain all authorizations, consents and approvals as are required to be obtained in order to effect the election of those nominees.

(b) Chief Financial Officer. Within 180 days following the closing, the Company is required to hire a chief financial officer, “CFO,” who is a certified public accountant, fluent in English and familiar with US GAAP and auditing procedures and compliance for US public companies.

(c) Investor Relations Firm. Within 60 days following the closing, the Company is required to hire one of the following investor relations firms: CCG Elite, Hayden Communications or Integrated Corporate Relations.

In connection with the above three post-closing covenants, the Company has deposited an aggregate of $1,750,000, $750,000 as board holdback escrow amount, $750,000 as CFO holdback escrow amount, and $250,000 as investor relations firm holdback amount, from the gross proceeds of the private placement in the escrow account pursuant to the Holdback Escrow Agreement by and among us, the investors and the escrow agent named therein. In the event the Company fails to comply with any of the above covenants in a timely fashion, it will incur liquidated damages of 1% on a daily pro-rata basis for any portion of a month of the gross proceeds of the private placement, or 2% if it suffer a holdback event relating to Board of Directors or CFO in a 30-day period, to be subtracted from the holdback escrow fund, until its compliance with such covenants.

The Company is required to fulfill the above covenants within 60 days to 180 days, therefore, the deposit of $1,7500,000 to escrow accounts recorded as restricted cash under current assets.

21. Stock-Based Compensation

The Company estimated the fair value of each warrant award on the date of grant using the Black-Scholes option-pricing model and the assumption noted in the following table. Expected volatility is based on the historical and implied volatility of a peer group of publicly traded entities. The expected term of options gave consideration to historical exercises, post-vesting cancellations and the options’ contractual term. The risk-free rate for the expected term of the option is based on the U.S. Treasury Constant Maturity at the time of grant. The assumptions used to value options granted during the three months ended March 31, 2008 were as follows:

| | | Three Months Ended March 31, 2008 | |

| | | | |

| Risk free interest rate | | | 3 | % |

| Expected volatility | | | 109 | % |

| Expected life (years) | | | 3 | |

Stock Compensation-The Company granted warrants to acquire and aggregate of 6,999,999 shares of common stock, equivalent to 476,014 post-split shares, to Roth Capital Partners, LLC and WLT Brothers Capital, Inc., for the services in connection with the private placement on March 12, 2008. The Company valued the options by Black-Scholes option-pricing model with the amount of $2,398,975 which recorded as cost of raising capital against additional paid-in capital.

22. Significant concentrations and risk

(a) Customer Concentrations

The Company has the following concentrations of business with each customer constituting greater than 10% of the Company’s gross sales:

| | | March 31 | | March 31 | |

| | | 2008 | | 2007 | |

| Wang Jianbo | | | 18.98 | % | $ | - | |

| Tin Lizhiu | | | 11.85 | % | | - | |

| Wei Yunchao | | | 17.38 | % | | - | |

The Group has not experienced any significant difficulty in collecting its accounts receivable in the past and is not aware of any financial difficulties being experienced by its major customers.

The Company has the following concentrations of business with each supplier constituting greater than 10% of the Company’s purchase:

| | | March 31 | | March 31 | |

| | | 2008 | | 2007 | |

| Ma Zhuping | | | 27.57 | % | $ | - | |

| Shandong Yikshang Poultry Limited | | | 17.24 | % | | - | |

| Sin Yupin | | | 10.60 | % | | - | |

(b) Credit Risk

Financial instruments that potentially subject the Group to significant concentration of credit risk consist primarily of cash and cash equivalents. As of March 31, 2008, substantially all of the Group’s cash and cash equivalents were held by major financial institutions located in the PRC, which management believes are of high credit quality.

(c) Group’s operations are in China

All of the Group’s products are produced in China. The Group’s operations are subject to various political, economic, and other risks and uncertainties inherent in China. Among other risks, the Group’s operations are subject to the risks of transfer of funds; domestic and international customs and tariffs; changing taxation policies; foreign exchange restrictions; and political conditions and governmental regulations.

23. Business and geographical segments

The Group currently engages in one business segment, the business of chick and feed production. No analysis of the Group's sales and assets by business is presented as most of the feed products are used internally.

24. Commitments and contingencies

Operating Leases - In the normal course of business, the Group leases the land for hen house under operating lease agreements. The Group rents land, primarily for the feeding of the chickens. The operating lease agreements generally contain renewal options that may be exercised at the Groups discretion after the completion of the base rental terms. In addition, many of the rental agreements provide for regular increases to the base rental rate at specified intervals, which usually occur on an annual basis. The Group was obligated under operating leases requiring minimum rentals as follows:

| Up to December 31, | | | |

| | | | |

| 2008 | | $ | 111,171 | |

| 2009 | | | 148,227 | |

| 2010 | | | 136,614 | |

| 2011 | | | 78,548 | |

| 2012 | | | 78,548 | |

| Thereafter | | | 1,460,764 | |

| Total minimum lease payments | | $ | 2,013,872 | |

During the three months ended March 31, 2008, rent expenses amounted to $21,705 was recorded as cost of sales.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Special Note Regarding Forward Looking Statements

This Quarterly Report on Form 10-Q, including the following “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements that are based on the beliefs of the Company’s management and involve risks and uncertainties, as well as assumptions that, if they ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. The words “believe,” “expect,” “anticipate,” “project,” “targets,” “optimistic,” “intend,” “aim,” “will” or similar expressions are intended to identify forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including statements regarding new and existing products, technologies and opportunities; statements regarding market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; any of the factors mentioned in the “Risk Factors” section of the Company’s S-1 or annual report on Form 10-K; and any statements of assumptions underlying any of the foregoing. Except as otherwise indicated by the context, references in this report to “the Company,” “Yuhe International,” “we,” “us,” or “our,” are references to the combined business of Yuhe International, Inc. and its subsidiaries.

Overview

We are a supplier of day-old chickens raised for meat production, or broilers, in the People’s Republic of China, which is also commonly referred to as the PRC or China. Our day-old broilers are primarily sold to broiler farms and integrated chicken companies, which are vertically-integrated companies that engage in the whole broiler supply-chain, for the purpose of raising them to market-weight broilers. Our operations are conducted exclusively by our subsidiaries in China.

We purchase parent breeding stock from breeder farms, raise them to produce hatchling eggs, and hatch the eggs to day-old broilers. Currently, we operate ten breeder farms and two hatcheries with a total annual capacity of 708,000 sets of breeders and 80 hatchers through our wholly owned subsidiary, Weifang Yuhe Poultry Co. Ltd., or Weifang. Our day-old broilers are primarily purchased by broiler farms and integrated chicken companies for the purpose of raising them to market-weight broilers. Our customers are located in the ten provinces and municipal areas centered around Shandong Province. In connection with our day-old broiler business, we also operate a feed stock company named Weifang Taihong Feed Co. Ltd., or Taihong, whose primary purpose is to supply feed stock for our breeders. Our operations are conducted exclusively by our subsidiaries Weifang and Taihong in China.

Our principal executive office is located at 301 Hailong Street, Hanting District, Weifang, Shandong Province, The People’s Republic of China. Our Internet address is http://www.yuhepoultry.com.

Unless otherwise noted, all historical information prior to March 12, 2008 refers to Weifang.

Our Company History

Our company has an offshore holding structure commonly used by foreign investors with operations in China. We are a Nevada corporation which owns 100% of the securities of Bright Stand International Limited, or “Bright Stand”, an international business company incorporated in the British Virgin Islands. Bright Stand owns Weifang Yuhe Poultry Co. Ltd., or “Weifang”, a wholly foreign-owned enterprise established under the laws of the PRC, and Weifang Taihong Feed Co. Ltd., or “Taihong,” a foreign invested enterprise established under the laws of the PRC.

Mr. Kunio Yamamoto, Pinnacle Fund, L.P., Black River Small Capitalization Fund Ltd., Ardsley Partners Fund II, LP and Halter Financial Investments, L.P. are our significant shareholders. As of May 8, 2008, Mr. Yamamoto owned 49.2%, Pinnacle Fund, L.P. owned 15.6%, Black River Small Capitalization Fund Ltd. owned 14.6%, Ardsley Partners Fund II, LP owned 7.3% and Halter Financial Investments, L.P. owned 6.1% of the total outstanding shares of our common stock.

The following chart depicts our organizational structure:

We did not become engaged in the day-old broiler business until March 12, 2008. Effective March 12, 2008, we closed an Exchange Agreement with Bright Stand and Kunio Yamamoto, a citizen of Japan, the sole former shareholder of Bright Stand. Pursuant to the terms of the Exchange Agreement we acquired all of the outstanding capital stock of Bright Stand from Mr. Yamamoto in exchange for 126,857,134 shares, equivalent to 8,626,236 post-split shares, of our common stock. At the closing, Bright Stand became our wholly-owned subsidiary. Immediately following the closing of the Exchange Agreement, Mr. Yamamoto owned 126,857,134 shares, equivalent to 8,626,236 post-split shares, of our common stock.

Upon the closing of the Exchange Agreement we gained operating control over Weifang and Taihong. Weifang has been owned by Bright Stand since January 31, 2008. Taihong has been owned by Weifang and Bright Stand since January 31, 2008. Before the closing of the Exchange Agreement, we were known as First Growth Investors, Inc., and were originally formed for the purposes of buying, selling and investing in vintage wines, which was our business from 1997 through December 31, 2003. We had no operations from January 1, 2004 until the closing of the Exchange Agreement.

Effective April 4, 2008, we amended our articles of incorporation to (i) change our name from “First Growth Investors, Inc.” to “Yuhe International, Inc.”, and (ii) effect a 1-for-14.70596492 reverse stock split of our common stock. Our Board of Directors and shareholders approved the name change and the reverse stock split pursuant to the Nevada Revised Statutes. The name change became effective with NASDAQ’s Over-the-Counter Bulletin Board at the opening for trading on April 7, 2008, under the new stock symbol of “YUII.OB”.

On April 20, 2008, we appointed CCG Elite Investor Relations as our investor relations firm effective on May 1, 2008.

Our Business Operations

Our business is part of the commercial broiler supply chain.

Day-old broilers are one-day-old broilers that are sold to broiler raisers. Day-old broilers sold by our wholly owned subsidiary, Weifang, are our primary source of revenue.

We purchase parent breeding chickens from grandparent breeder farms and raise them to maturity. Once these parent breeding chickens have matured, they produce hatching eggs that we incubate and then sell the resulting day-old broilers chicks to our customers.

Under normal circumstances, female parent breeder chickens become productive from the 26th week, and are no longer commercially productive after the 66th week. Typically a breeder is capable of producing 137 hatching eggs over its production lifetime and the breeders are maintained by us for a period of 420 days. We source our parent breeder chickens from licensed suppliers located in Beijing, and Shandong and Jiangsu provinces and these suppliers are required to have a vaccination certificate and a breeder production certificate for the sale of the breeders. Our hatching eggs typically must be incubated for a period of 21 days. At least 28 weeks usually pass from our receipt of a day-old parent breeder to our sale of the first day-old broiler.

We operate in two elements of the broiler supply chain: day-old broiler production and feed production. These activities are operated under two separate subsidiaries, Weifang and Taihong, respectively.

Competition

The market for day-old broilers in China is highly fragmented. Shandong Province has the highest number of day-old broilers in China.

Day-old broilers are very weak physically and need to be transported in closely controlled temperature conditions during delivery. Therefore, producers of broiler chicks usually only sell locally or to surrounding areas, which limits our current effective sales market and competition to North China.

Shandong Minhe, also located in Shandong Province, is one of our major competitors for sales of day-old broilers. They are slightly larger than us in terms of their annual day-old broiler production volume. Another regional competitor of ours is Jilin Deda, which is located in Jilin Province in north-eastern China and is smaller than us in terms of annual day-old broiler production volume. However, Jilin Deda is an integrated chicken company, so it does not generally sell day-old broilers to unaffiliated third parties.

Results of Operations

We have provided below a discussion of our results of operations, as a result of our control and ownership of our subsidiaries, Weifang and Taihong, and other factors. We have consolidated the results of Weifang and Taihong into our Consolidated Financial Statements from February 1, 2008 to March 31, 2008. For comparison purposes, we have provided a Consolidated Statement of Operations for both three months ended March 31, 2008 and 2007 to provide comparable presentation to our reported results for the three months ended March 31, 2008 and 2007. We believe that providing this financial statement as if we had consolidated Weifang and Taihong may assist investors in assessing performance between periods and in developing expectations of future performance. We use these items in internal performance measures to analyze performance between periods, develop internal projections and measure management performance.

| | | All amounts, other than percentage, in U.S. dollars | | As a percentage of net revenues | | All amounts, other than percentage, in U.S. dollars | | Increase/ (Decrease) Dollar ($) | | Increase/ (Decrease) Percentage | |

| | | For the three months ended March 31 | | For the three months ended March 31 | | For the three months ended March 31 | | For the three months ended March 31 | | For the three months ended March 31 | | For the three months ended March 31 | |

| | | 2008 | | 2008 | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | (As reported) | | | | (Pro forma) | | (Pro forma) | | | | | |

| Sales revenue | | | 1,103,551 | | | 100.00 | % | | 2,596,883 | | | 2,978,138 | | | (381,255 | ) | | -12.80 | % |

| Costs of goods sold | | | 874,707 | | | 79.26 | % | | 2,213,940 | | | 3,052,796 | | | (838,856 | ) | | -27.48 | % |

| Gross profit (loss) | | | 228,844 | | | 20.74 | % | | 382,943 | | | (74,658 | ) | | 457,601 | | | -612.93 | % |

| Selling expenses | | | 48,540 | | | 4.40 | % | | 77,576 | | | 62,160 | | | 15,416 | | | 24.80 | % |

| General and administrative expenses | | | 247,824 | | | 22.46 | % | | 143,178 | | | 204,847 | | | 61,669 | | | -30.10 | % |

| Operating (loss) income | | | (67,520 | ) | | -6.12 | % | | 162,189 | | | (341,665 | ) | | 503,854 | | | -147.47 | % |

| Interest income | | | 158 | | | 0.01 | % | | 162 | | | 16 | | | 146 | | | 912.50 | % |

| Other income | | | 5,900 | | | 0.53 | % | | 5,900 | | | - | | | 5,900 | | | 0 | % |

| Interest expenses | | | 180,474 | | | 16.35 | % | | 266,757 | | | 271,279 | | | (4,522 | ) | | -1.67 | % |

| Other expenses | | | 30,545 | | | 2.77 | % | | 30,545 | | | 37,338 | | | (6,793 | ) | | 0 | % |

| Income taxes | | | - | | | 0.00 | % | | - | | | - | | | - | | | 0 | % |

| Net income (loss) | | | (272,481 | ) | | -24.69 | % | | (129,051 | ) | | (650,266 | ) | | 521,215 | | | -80.15 | % |

Net revenue (As reported). Sales revenue of $1.1 million represents sales of 1.6 million day-old broilers from the period February 1, 2008 to March 31, 2008.

Day-old broiler are one-day old chickens which are specially bred for meat production and sold to broiler farms.

Net revenue (Pro forma). Sales revenue decreased by $0.38 million, or 12.8%, to $2.60 million for the three months ended March 31, 2008 from $2.98 million for the three months ended March 31, 2007. The decrease was driven by the decrease in sales volume of our day-old broilers by 4.00 million birds, or 58.95%, from 8.77 million birds for the three months ended March 31, 2007 to 4.77 million birds for the year ended March 31, 2008. The decrease in sales volume was a result of low productivity level of the breeder stock, which had not grown up to reach maturity level in the first quarter of 2008, therefore, the breeder stock could not produce as much eggs as the breeder stock in the first quarter in 2007. However, the selling price of day-old broilers saw a steady rise from $0.3165 per bird for the three months ended March 31, 2007 to approximately $0.63 per bird for the three months ended March 31, 2008. The price growth was primarily the result of an increase in the general demand for high-grade day-old broilers in North China, which in turn was largely driven by the substantial economic growth that China continued to experience for the three month ended March 31, 2008, and the consequent shortage of broilers in the market. The outbreak of avian flu in 2006 hit the poultry industry badly and the market started to rebound at the beginning of 2007, resulting in a huge demand for our day old broilers. The third generation stock was imported and its import volume was closely controlled by the PRC government. We have not seen an increase in the trend of the import volume. Therefore, while there was a slight decrease of 12.8% in revenue, there was a significant decrease in the sales volume of 58.98%.

In response to these recent increases in consumer demand, we increased our maximum parent breeder stock manufacturing capacity to approximately 0.72 million sets by December 2007. We anticipate that North China’s strong economic growth will continue in 2008 and believe that this growth will drive a strong demand for high-grade, day-old broilers. In response to this strong demand in the market, we hope to increase our market share by increasing our capacity in the next couple of years.

Sales of retired breeder stocks increased $0.18 million, or 337.47%, from $0.051 million for the year ended March 31, 2007 to $0.23 million for the three months ended March 31, 2008. The sales quantity of retired breeder stocks increased 0.13 million kilograms, or 128.02% while the average unit price increased by 92.01%. The increase of revenue from the sale of retired breeder stocks during the three months ended March 31, 2008 was in response to the breeder stock is old enough and the productivity is decreased. As a results, the new breeder stock is growing up which is in early stage and maintain a low productivity level of day old broiler.

Since almost all the products of Taihong were supplied to its parent, Weifang, revenue contributed from Taihong’s external sales comprised only approximately 7% of our total revenues for the three months ended March 31, 2008, and are expected to constitute less than 10% of our annual revenues in the future.

Cost of revenues (As reported). Our cost of revenues amounted to approximately $875,000, or representing approximately 79% of our sales revenue for the three months ended March 31, 2008.

Cost of revenues (Pro forma). Our cost of revenues decreased by $0.84 million, or 27.84%, to $2.21 million for the three months ended March 31, 2008 from $3.05 million for the three months ended March 31, 2007. The main reason for a decrease in the cost of revenues was a decrease in sales volume as we sold 3.6 million birds for the three months ended March 31, 2008 compared with 8.77 million birds for the same period of 2007. As a percentage of net revenues, the cost of revenues decreased by 17.26%, from 102.51% for the three months ended March 31, 2007, to 85.25% for the three months ended March 31, 2008. The decrease in cost of revenues as a percentage of net revenues was mainly due to an increase in the average selling price which we discussed above for the three months ended March 31, 2008.

Gross profits (As reported). Our gross profit amounted to approximately $0.23 million for the three months ended March 31, 2008. Gross profit as a percentage of net revenues was approximately 21% for the three months ended March 31, 2008.

Gross profit (Pro forma). Our gross profit increased by $0.50 million to $0.38 million for the three months ended March 31, 2008 from gross loss of $0.75 million for the three months ended March 31, 2007. Gross profit as a percentage of net revenues was 14.75% for the three months ended March 31, 2008, as compared to (2.5%) for the three months ended March 31, 2007. The increase was mainly attributable to the rise in average selling price of our day-old broilers which we discussed above for the three months ended March 31, 2008.

Both three month periods ended March 31, 2008 and 2007 were unstable periods which saw a low in gross profit margin and gross loss respectively. For the three months ended March 31, 2007, it was the retirement stage of the breeder stock which got old and had low production rate. As the life cycle of the breeder is 66 weeks, one year later for the three months ended March 31, 2008, we are waiting at an early age stage for the breeder stock to grow up. Hence, the breeder stock had lower egg production rates, lower production rates of day-old broilers and consequently comparatively higher absorption of fixed hatching costs.

General and administrative expenses (As reported). Our General and administrative expenses amounted to approximately $248,000 for the three months ended March 31, 2008. It comprised mainly of human resources and related expenses of approximately $70,600—representing 28.5% of total general and administrative expenses, pension costs of $12,400—5.02% of total general and administrative expenses, motor delivery expenses of $17,000—6.84% of total general and administrative expenses, travel expenses of $11,300—4.55% of total general and administrative expenses, entertainment of $19,000—7.64% of total general and administrative expenses, bank charges of $20,500—8.26% of total general and administrative expenses, office expenses of $15,000—5.9% of total general and administrative expenses, and other tax expenses of $9,400—3.79% of total general and administrative expenses.