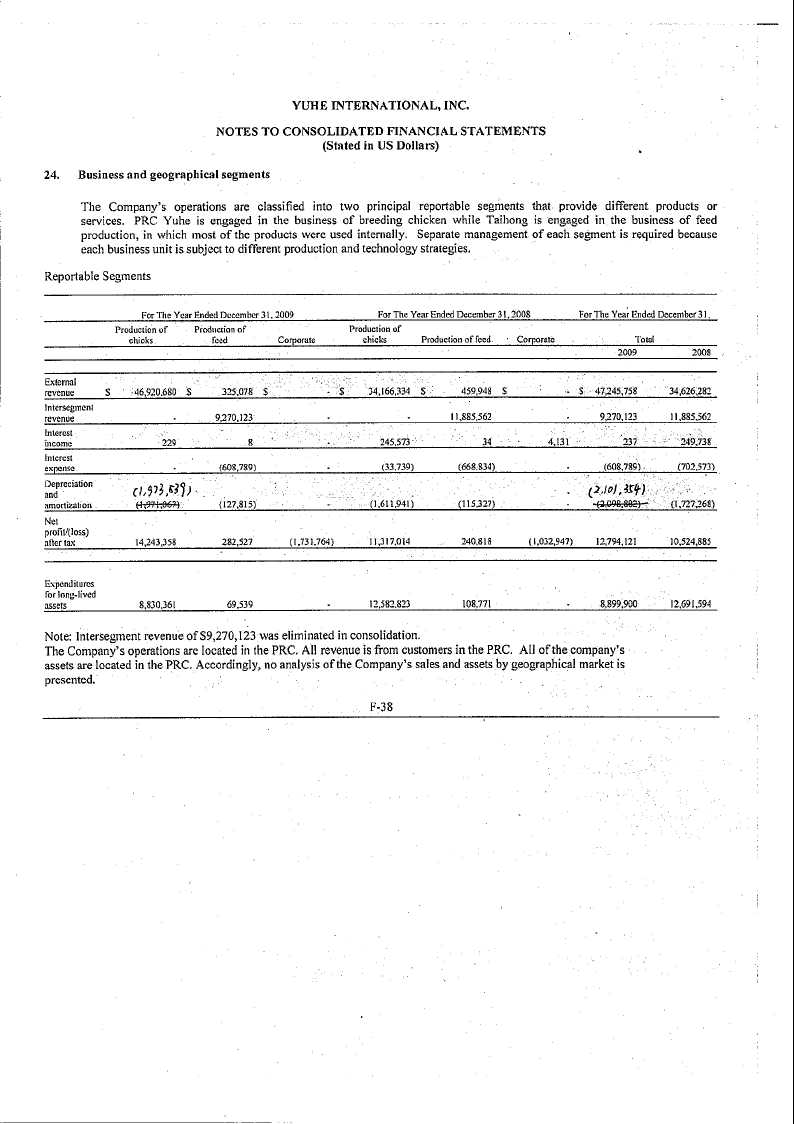

Yuhe International, Inc.

301 Hailong Street, Hanting District

Weifang, Shandong Province

The People’s Republic of China

January 12, 2011

Linda Cvrkel

Branch Chief

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| RE: | Yuhe International, Inc. |

| | Form 10-K for the year ended December 31, 2009 |

| | Form 10-K/A for the year ended December 31, 2009 |

| | Form 10-Q for the quarter ended September 30, 2010 |

File No. 001-34512

Dear Ms. Cvrkel,

On behalf of Yuhe International, Inc. (“Yuhe” or the “Company”), set forth below are the Company’s responses to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) contained in the Staff’s letter dated December 14, 2010 providing the Staff’s comments with respect to the above-referenced Form 10-K for the year ended December 31, 2009, Form 10-K/A for the year ended December 31, 2009 and Form 10-Q for the quarter ended September 30, 2010. As discussed with Ms. Heather Clark on the phone on December 22, 2010 and January 4, 2010, the Staff has granted an extension for the Company’s response until January 12, 2011.

Upon receiving the Staff’s confirmation that the Staff has no further comments to the Company’s responses, the Company will file Amendment No. 2 to its Form 10-K for the year ended December 31, 2009 (the “Amended 10-K”) and Amendment No. 1 to its Form 10-Q for the quarter ended September 30, 2010 (the “Amended 10-Q”) reflecting the Company’s responses to certain of the Staff’s comments.

We hereby confirm that we acknowledge that the Company is responsible for the adequacy and accuracy of the disclosure in the filing, that Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing, and that the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

For the convenience of the Staff, each of the Staff’s comments is included and is followed by the corresponding response of the Company. Unless the context indicates otherwise, references in this letter to “we”, “us” and “our” refer to the Company on a consolidated basis.

Annual Report on Form 10-K for the year ended December 31, 2009

Yuhe International, Inc. Financial Statements, page F-1

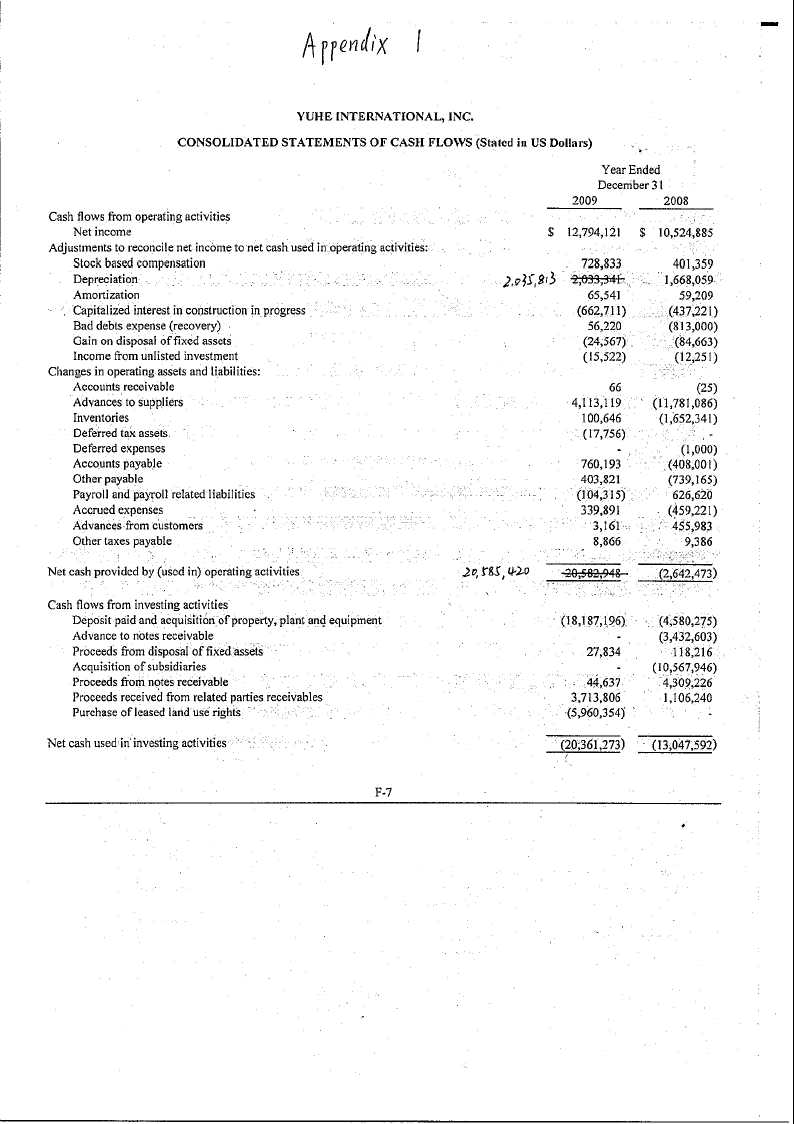

Consolidated Statements of Cash Flows, page F-7

| | 1. | We note the presentation of the line item “Proceeds from capital lease” in the amount of $594,476 in your statement of cash flows for the year ended December 31, 2009. Please tell us and revise the notes to the company’s consolidated financial statements to explain the nature and significant terms of the capital leasing transaction that resulted in these cash inflows. If this amount was received in connection with the leasing transactions disclosed in Note 26, please explain in further detail how the amount disclosed in your cash flow statement relates to the transactions disclosed in Note 26. |

Yuhe’s Response:

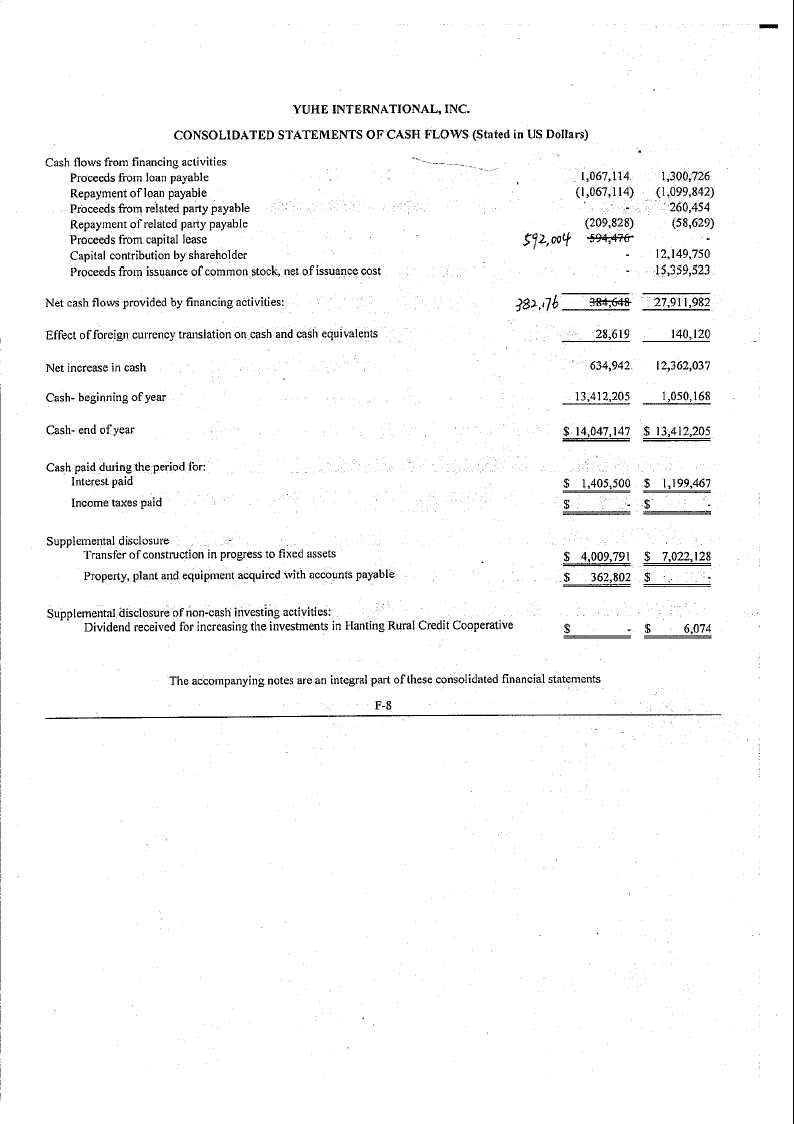

The correct amount for “proceeds from capital lease” for the year ended December 31, 2009 was $592,004. The Company will revise the relevant line items in the consolidated financial statements in the Amended 10-K as marked in Appendix 1 hereto.

The line item “Proceeds from capital lease” in the amount of US$592,004 represents (i) prepaid rent under the equipment lease in an amount of US$608,750 (approximately RMB 4,164,390) less (ii) the recognized capital lease revenue of US$16,746 (approximately RMB 114,560).

We will revise the disclosure in Note 26 to the consolidated financial statements from “The rent payable by Shandong Nongbiao Purina under the rental agreement will be offset against the prepaid equipment rental costs of RMB 10 million, approximately equivalent to $1,462,290.” to “The Company will have received RMB 10 million from the Lessee as rent payment by the end of the 10-year lease term, which amount the Company will use to upgrade the feed facility.”

We will also add the following two paragraphs to Note 26 to the consolidated financial statements:

“On November 11, 2008, Weifang Yuhe Poultry Co., Ltd. (“PRC Yuhe” or the “Lessor”), the Company’s wholly owned subsidiary, entered into a lease contract with Shandong Nongbiao Purina Feed Co., Ltd. (the “Lessee”) for the lease of land, buildings and equipment with a term of 10 years and annual rental payments of RMB 1.5 million (approximately US$219,390). According to the lease contract, the Lessor would purchase new equipment for RMB 10 million (approximately US$1.5 million) to be installed in the leased building, and such RMB 10 million (approximately US$1.5 million) would be paid to the Lessor by the Lessee as rental prepayment under the lease contract.

By December 31, 2009, the Lessee had paid the Lessor RMB 7,863,000 (approximately US$1.2 million) to be used for purchasing equipment and rental payment for land and building, which amount was treated as rental prepayment by the Lessee. This prepayment included two parts: (i) equipment rental, in the amount of RMB 4,164,390 (approximately US$608,750) under “Minimum lease payments receivable” and (ii) rental for land and building, in the amount of RMB 3,698,610 (approximately US$543,913).”

On November 11, 2008, Weifang Yuhe Poultry Co., Ltd. (“PRC Yuhe” or the “Lessor”), the Company’s wholly owned subsidiary, entered into a lease contract with Shandong Nongbiao Purina Feed Co., Ltd. (the ��Lessee”) for the lease of land, buildings and equipment with a term of 10 years and annual rental payments of RMB 1.5 million (approximately US$219,390). According to the lease contract, the Lessor would purchase new equipment for RMB 10 million (approximately US$1.5 million) to be installed in the leased building, and such RMB 10 million (approximately US$1.5 million) would be paid to the Lessor by the Lessee as rental prepayment under the lease contract.

We received prepaid rent of approximately RMB 2.74 million, RMB 1.01 million and RMB 4.11 million in December 2008, the first quarter of 2009 and the second quarter of 2009, respectively. The total prepaid rent was RMB 7,863,000 (approximately US$1.2 million). Such amount was recorded as “cash and cash equivalent” on the debit side and “advance from customers” on the credit side of our consolidated balance sheets.

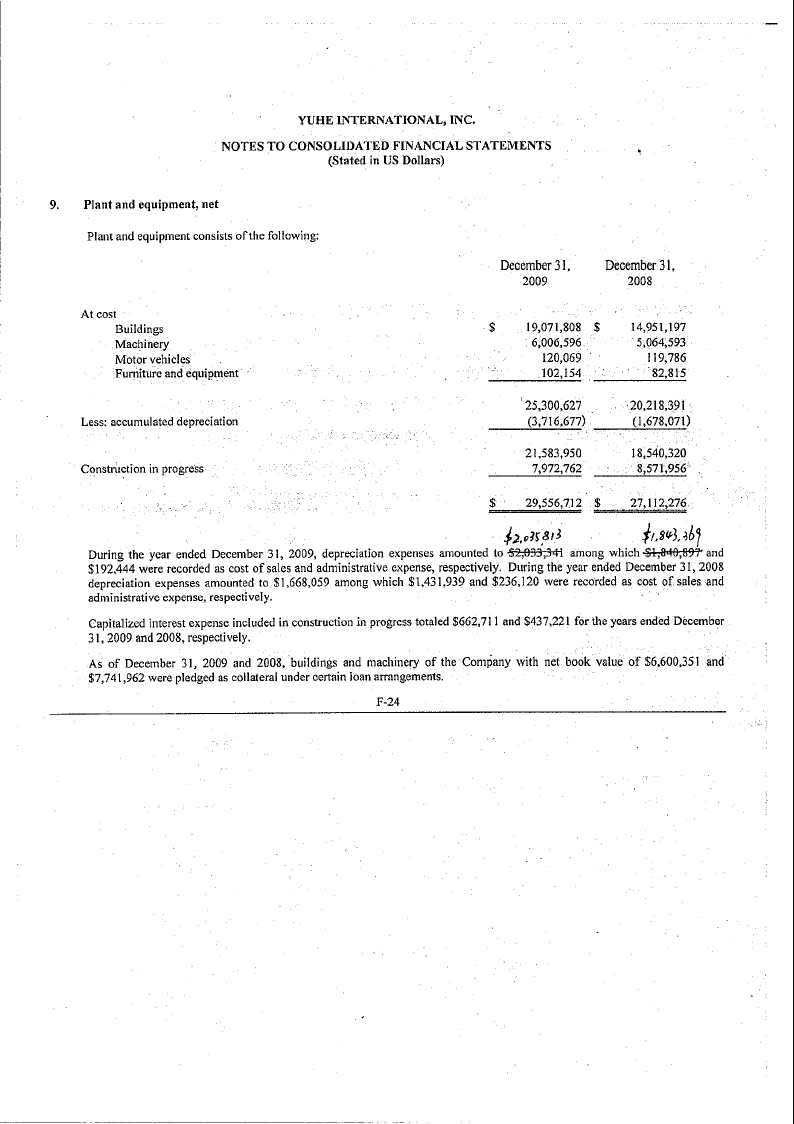

By July 1, 2009, we had used RMB 6,683,621 (approximately US$982,885) of such prepaid rent that we had received to purchase equipment, which was to be leased to the Lessee for its operations. Such amount was recorded as “fixed assets” on the debit side and “cash and cash equivalent” on the credit side of our consolidated balance sheets. In addition, we recorded RMB 296,233 (approximately US$43,563) as “depreciation expenses” on the debit side and “accumulated depreciation” on the credit side of our consolidated balance sheets.

During the audit of our 2009 financial statements, we determined that the equipment lease portion should have been treated as a capital lease. According to ASC 840, Accounting for Leases, the equipment portion of the lease contract meets the criteria for classification as a capital lease because the lease term equals 75% or more of the estimated economic life of the leased property, as the lease term is 10 years and the Company depreciates the equipment over an estimated economic life of 10 years. As such, the equipment portion of the lease should be accounted for as a direct financing lease according to paragraph 6(b)(ii) of ASC 840.

The land and building portion of the lease does not meet any of the four criteria listed in paragraph 7 of ASC 840 and, as such, that portion of the lease is accounted for as an operating lease.

According to paragraph 27 of ASC 840, the minimum lease payments for the equipment lease shall be estimated by whatever appropriate means. The Company’s management has decided to allocate a portion of the annual rent of RMB 1.5 million (approximately US$219,390) to the equipment portion using the relative fair value of land, building and equipment, with the assumption that the net book values at June 30, 2009 (the lease began on July 1, 2009) reflected the fair value of the leased properties. Based on this methodology, our management has determined an allocation of 52.6% and 47.4% to equipment and land/building, respectively. Accordingly, the annual rent allocated to the equipment portion of the lease is RMB 789,000 (approximately US$116,029).

Accordingly, the Company made certain accounting adjustments as follows, each of which is reflected in the Company’s consolidated financial statements (all amounts are in RMB):

Computation of Minimum Lease Payments (annual rent of RMB 1,500,000 to be allocated 52.6% to capital lease and 47.4% to operating lease):

| - Minimum lease payments over lease term (RMB789,000 x10 years) | 7,890,000 |

| - Unguaranteed residual value | 0 |

| - Total minimum lease payments | 7,890,000 |

Adjustment 1

| Debit: Minimum lease payments receivable | 7,890,000 |

| Credit: Equipment (net book value at June 30, 2009) | 6,666,710 |

| (Cost: RMB 6,683,621; depreciation at June 30, 2009: RMB 16,911) | |

| Credit: Unearned income | 1,223,290 |

Note: this adjustment is to record the Lessor’s investment in the direct financing lease.

Adjustment 2

| Debit: Rental Income (other income) | 394,500 |

| (six-month rent already received at December 31, 2009) | |

| Credit: Minimum lease payment receivable: | 394,500 |

Note: this amount represents the initial recognized lease revenue of RMB 750,000 x 52.6% (the portion of the lease income that should have been allocated to the capital lease). An adjustment in this amount was recorded to offset the capital lease portion of the initially recognized lease income.

| Debit: Advance from Supplier | 3,769,890 |

| Credit: Minimum lease payments receivable | 3,769,890 |

Note: this adjustment represents the prepaid rent that the Company received from the Lessee that was allocated to the capital lease as of December 31, 2009, which was approximately 53% of the prepaid rent received from the Lessee as of December 31, 2009. Prepaid rent received from the Lessee as of December 31, 2009 was RMB 7,113,000, representing RMB 7,863,000 (the total prepaid rents the Lessor received as of December 31, 2009) less RMB 750,000 (the initially recognized revenue).

Adjustment 4

| Debit: Unearned income | 114,560 |

| Credit: Revenue from other operation | 114,560 |

Note: this adjustment represents the recognized revenue from the capital lease for the six months ended December 31, 2009 based on the total unearned income of RMB 1,223,290 for the 10-year lease term.

Based on the above adjustments, the Company had received rent in the amount of RMB 7,863,000 (approximately US$1.2 million) as of December 31, 2009. This rental prepayment included two parts: (i) equipment rent in the amount of RMB 4,164,390 (approximately US$608,750), i.e. the sum of RMB394,500 and RMB3,769,890, under “Minimum lease payments receivable” and (ii) rent for land and building in the amount of RMB 3,698,610 (approximately US$543,913). For the operating lease portion, according to U.S. GAAP, the Company recognized RMB 355,500 (approximately US$52,279) as revenue from other operation, and the remaining RMB 3,343,110 (approximately US$491,633) was accounted for as “Advances from customers.”

Notes to Consolidated Financial Statements, page F-9

26. Equipment Leasing and Rental Arrangements, page F-43

| | 2. | We note the disclosure included in Note 26 indicating that the company has entered into an equipment leasing and rental property agreement with Shandong Nongbiao Purina Feed Company under which it will construct a feed production facility on a property leased from PRC Yuhe and become the exclusive feed supplier for PRC Yuhe. We also note that under the arrangement, Shangdong Nongbiao Purina will pay PRC Yuhe an annual rental payment for the leased land of approximately $219,390 and that the rent payable by Shangdong Nongbiao Purina will be offset against prepaid equipment rental costs of $1,462,290. With regards to this arrangement, please clarify the nature of the prepaid rental costs to be incurred under this arrangement and indicate whether PRC Yuhe or Shandong Nongbiao Purina will be responsible for incurring these costs. Also, please explain in further detail why you believe it is appropriate to reflect the annual rental costs received from Shangdong Nongbiao Purina as an offset against prepaid equipment rental costs. We may have further comment upon receipt of your response. |

Yuhe’s Response:

The prepaid rental costs in the amount of RMB7,863,000 (approximately US$1.2 million) were part of the investment the Lessee made in the factory through PRC Yuhe. Pursuant to the lease agreement, the Lessee is obligated to prepay RMB10 million in rent, which PRC Yuhe will use to purchase new equipment for use by the Lessee at the leased facility. All of the purchased assets belong to PRC Yuhe, and we treated them as Lessor’s investment in the direct financing lease according to U.S. GAAP. The Company has paid RMB 6,683,621 (approximately US$0.98 million) in respect of the purchase price of the new equipment and had received payments of RMB 7,863,000 (approximately US$1.2 million) from the Lessee by December 31, 2009. The Lessee is obligated to pay the remaining RMB 2,137,000 in the future.

As described above, we will revise the disclosure in Note 26 from “The rent payable by Shandong Nongbiao Purina under the rental agreement will be offset against the prepaid equipment rental costs of RMB 10 million, approximately equivalent to $1,462,290.” to “The Company will have received RMB 10 million from the Lessee as rent payment by the end of the 10-year lease term, which amount the Company will use to upgrade the feed facility.”

| | 3. | If Shandong Nongbiao Purina has advanced the company $1,040,340 as of December 31, 2009, as your disclosures in Note 26 on page F-43 indicate, please reconcile this amount with the $678,366 advances from customers on your December 31, 2009 balance sheet. |

Yuhe’s Response:

As described in our response to comment 1, of the prepayment by Lessee in the amount of US$1,040,340 (approximately RMB 7,113,000), we recorded $551,379 (approximately RMB 3,769,890) as “Minimum lease payments receivable” with respect to the equipment finance lease. The amount of $488,961 relating to the operating lease of the land and building was recorded as “Advances from customers”, which, together with other normal “advances from customers” for day-old broilers and by-products, resulted in an account balance of $678,366 as of December 31, 2009.

Annual Report on Form 10-K/A for the year ended December 31, 2009

Item 1A. Risk Factors, page 12

We use company-controlled personal bank accounts of certain of our employees, page 14

| | 4. | We note the disclosure in the risk factors on page 12 indicating that the company uses “company-controlled” personal bank accounts of certain employees to transact a substantial portion of the company’s business instead of company bank accounts. We further note that the company does not own such bank accounts and bears the risk of loss if it fails to properly control such bank accounts. Please tell us whether cash is held in these employee bank accounts or whether cash is transferred to such bank accounts for individual transactions. To the extent the company’s primary source of cash is from these employee bank accounts, please tell us whether such accounts are reflected in the company’s cash and cash equivalents balances in its consolidated financial statements. If so, please explain why the company believes this treatment is appropriate and in accordance with US GAAP when the company does not actually have legal title to the accounts. We may have further comment upon receipt of your response. |

Yuhe’s Response:

The personal bank accounts are under the name of an individual, Yi Tan, an employee of the Company, and they are fully controlled by the Company. No individuals have conducted any transaction in those accounts. The employee who is the record owner of those bank accounts cannot use them in practice because the Company controls the bank cards physically and the account passwords. The employee has no possession of the bank card and does not know the password. The cash balances in those accounts are reflected in the “cash and cash equivalents” in the Company’s consolidated financial statements. In addition, they are fully reflected in the Company’s finance management and control system. Cash is held in these accounts or transferred to these accounts solely for the Company’s transactions with its customers and suppliers. Given the fact that the Company has ownership of those accounts in substance and on a legal level (the Company has entered into agreements with the individual employee that specify the rights and obligations of the parties regarding use of such accounts, for example, the bank accounts legally belong to the Company and the individual employee acknowledges that he has no right to such accounts), the Company considers all of the assets in those bank accounts to be assets of the Company, and the Company treats them as cash and cash equivalents in the Company’s consolidated financial statements under U.S. GAAP.

We may have to make up the unpaid social insurance and housing funds for our employees, page 24

| | 5. | We note your statement indicating that the company has not made compulsory social welfare payments for its employees, including payments with respect to housing funds and other social insurance. Please tell us if the company has been delinquent in making these payments during the periods presented in the financial statements within the 10-K, and if so, indicate the dollar amounts of such delinquencies. Your response should also indicate whether the amounts were accrued as a liability until paid and what amounts you have accrued for potential penalties related to the delinquencies. We may have further comment upon receipt of your response. |

Yuhe’s Response:

The Company has been delinquent in making certain social welfare payments to its employees in an amount of approximately US$440,854 as of December 31, 2009. The Company has accordingly made accruals of US$370,387 in “other payable” for employee social insurance and US$70,467 in “accrued expenses and payroll related liabilities” for employee housing fund.

The PRC Labor Contract Law provides that “if an employer fails to pay social insurance for its employees without valid reason, the labor department will order that employer to pay the outstanding amounts within a certain period of time. If the employer fails to pay in that period as required by the order, the labor department has authority to levy penalty.” Therefore, we will be required to pay a penalty after receiving notice from labor department. Only after we fail to pay the social insurance before the deadline as required in the labor department’s order will we face the risk of paying a penalty. We have not received any notice from the government; therefore, the Company is of the view that it faces minimum risk of penalty.

Item 9A. Controls and Procedures, page 26

| | 6. | We note your statement that the chief executive officer and chief financial officer have concluded that the company’s disclosure controls and procedures are effective other than the incomplete disclosure referenced in the third paragraph on page 26. Given the exception noted and the company’s disclosure in the last paragraph on page 26 of its ineffective internal control over financial reporting, it remains unclear as to how your chief executive officer and chief financial officer have concluded that your disclosure controls and procedures are effective. Please revise your disclosure to state, in clear and unqualified language, the conclusions reached by your chief executive officer and your chief financial officer on the effectiveness of your disclosure controls and procedures. Your revised disclosure should clearly state that given the identified matters, your disclosure controls and procedures are not effective as of December 31, 2009. |

Yuhe’s Response:

We will amend the disclosure in the Amended 10-K as follows:

| Disclosure Controls and Procedures |

The Company’s management, under the supervision and with the participation of its chief executive officer and chief financial officer, Messrs. Gao Zhentao and Hu Gang, respectively, evaluated the effectiveness of the Company’s disclosure controls and procedures as of December 31, 2009, the end of the period covered by this Report. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended, or the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports, such as this Form 10-K, that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. Based on that evaluation, Messrs. Gao and Hu concluded that the Company’s disclosure controls and procedures were not effective as of December 31, 2009.

Our disclosure controls and procedures are designed to provide reasonable, not absolute, assurance that the objectives of our disclosure control system are met. Because of inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected.

Subsequent to the filing of the Initial 10-K, the Company’s management determined that the disclosure under Item 1 “Description of Business – History and Background – Corporate Reorganization Transactions” was incomplete because it did not describe the general, verbal and informal understanding that Mr. Kunio Yamamoto and Mr. Gao Zhentao reached at the time of the Company’s corporate restructuring in 2007 pursuant to which all or part of the shares of the Company’s common stock issued to Mr. Kunio Yamamoto would be transferred to Mr. Gao Zhentao in the future in consideration of Mr. Gao Zhentao’s commitment to management of the Company’s business operations and future achievement of the financial targets as set forth in the Make Good Agreement dated March 12, 2008. Accordingly, the Company filed Amendment No. 1 to the Form 10-K in order to, among other things, amend the Initial 10-K by supplementing certain disclosures in Item 1 “Description of Business - History and Background – Corporate Reorganization Transactions.”

| | 7. | We note from the disclosure in the last paragraph on page 26 that the company did not maintain effective internal control over financial reporting as of December 31, 2009. We further note from the discussion on page 27 that this conclusion was due to the fact that management concluded that certain material weaknesses in internal control existed with respect to the company’s ability to comply with Section 402 of Sarbanes-Oxley Act of 2002 and due to certain audit adjustments identified by Grant Thornton which indicated a general weakness of the company’s internal control over financial reporting. Given that you conduct substantially all of your operations outside of the United States but present your financial statements in accordance with US GAAP, as well as the fact that your disclosure indicates that Grant Thornton identified a number of audit adjustments, please explain in detail how the company’s management considered whether a material weakness regarding the ability to prepare financial statements in accordance with U.S. GAAP existed at December 31, 2009. |

Yuhe’s Response:

Our management concluded that certain material weaknesses existed in the Company’s internal control over financial reporting as of December 31, 2009 with respect to the Company’s ability to comply with Section 402 of Sarbanes-Oxley Act of 2002, because certain related party loans between the Company and Shandong Yuhe Food Group Co., Ltd. constituted prohibited transactions under Section 402 of the Sarbanes-Oxley Act of 2002.

In management’s view, the fact that we conduct substantially all of our operations outside the United States did not materially affect our ability to prepare financial statements in accordance with U.S. GAAP given our outside consultant’s extensive familiarity with U.S. GAAP and the consultant’s involvement in the preparation of our U.S. GAAP financial statements. Moreover, management believes that the audit adjustments identified by Grant Thornton relate mainly to differences between U.S. GAAP and PRC GAAP and do not affect our ability to prepare financial statements generally in accordance with U.S. GAAP.

| | 8. | With regards to the above matter, please explain whether you maintain your internal accounting records in accordance with U.S. GAAP and describe the controls you maintain to ensure that the activities you conduct and the transactions you consummate are recorded in accordance with U.S. GAAP. If you do not maintain your books and records in accordance with U.S. GAAP, tell us what basis of accounting you use and describe the process you go through to convert your accounting records to U.S. GAAP for SEC reporting purposes. Also, please describe the controls you maintain to ensure that you have made all necessary and appropriate adjustments in your conversions and US GAAP disclosures. |

Yuhe’s Response:

We do not maintain our internal accounting records in accordance with U.S. GAAP. Our financial reporting procedure is as follows:

| | (1) | The Company’s internal accounting team prepares the PRC GAAP financial statements, which are reviewed by the Company staff members who are qualified as Chinese Institute of Certified Accountants. |

| | (2) | The financial consulting company engaged by the Company reviews the PRC GAAP financial statements and translates them to U.S. GAAP. |

| | (3) | The U.S. GAAP financial statements are reviewed by our CFO and CEO. The CFO sends the reviewed financial statements to our independent auditors. |

| | (4) | The independent auditors review the U.S. GAAP financial statements and provide comments. After several rounds of communications between the Company and the independent auditors, the Company finalizes the U.S. GAAP financial statements. |

| | (5) | The Company’s audit committee chair reviews the U.S. GAAP financial statements before they are finalized. |

| | (6) | The Company’s CAO and CFO closely supervise the entire reporting process. They formulate and circulate a detailed plan in advance regarding each step involved in preparing the financial statements, and the CAO and CFO monitor each step in the preparation of the financial statements. |

| | 9. | Additionally, we would like to understand more about the background of the people who are primarily responsible for preparing and supervising the preparation of your financial statements and evaluating the effectiveness of your internal control over financial reporting and their knowledge of U.S. GAAP and SEC rules and regulations. Do not identify people by name, but for each person, please tell us: |

| | · | what role he or she takes in preparing your financial statements and evaluating the effectiveness of your internal control; |

| | · | what relevant education and ongoing training he or she has had relating to U.S. GAAP; |

| | · | the nature of his or her contractual or other relationship to you; |

| | · | whether he or she holds and maintains any professional designations such as Certified Public Accountant (U.S.) or Certified Management Accountant; and |

| | · | about his or her professional experience, including experience in preparing and/or auditing financial statements prepared in accordance with U.S. GAAP and evaluating effectiveness of internal control over financial reporting. |

Yuhe’s Response:

Our key staff members responsible for preparing and supervising the preparation of our financial statements and evaluating the effectiveness of our internal control over financial reporting include our CFO, CAO and finance analyst. Below is a summary of their roles and backgrounds.

| Post | CFO | CAO | Finance analyst |

| Roles | 1. Review U.S. GAAP & PRC GAAP financial statements | 1. Review U.S. GAAP & PRC GAAP financial statements | 1. Review the PRC GAAP financial statements |

| 2. Evaluate reporting and internal control system | 2. Evaluate reporting and internal control system | 2. Support external consulting company’s preparation of U.S. GAAP financial statements |

| 3. Supervise the reporting procedure | 3. Supervise the reporting procedure | |

| Relationship with company | Full-time employee | Full-time employee | Full-time employee |

| Reporting line | Report to CEO | Report to CEO | Report to audit committee chair directly; report to CFO functionally |

| Education background | Accounting major at a PRC university | Accounting major at a PRC university | Accounting major at a PRC university |

| Qualification | ACCA (Association of Charted Certified Accountants) Affiliate | | CICPA (Chinese Institute of Certified Accountants); ACCA (Association of Charted Certified Accountants) Affiliate |

| On-going training in GAAP | ACCA on-going training program in IFRS; currently no US GAAP training program | | ACCA on-going training program in IFRS; currently no US GAAP training program |

| Experience | 1. Finance director of Fedex Office China for three years, including responsibility for U.S. GAAP reporting, internal control and all other finance management in China. | Over 10 years of finance management experience. | Auditor experience in accounting firm. |

| 2. Three years of finance management/analysis experience, including as head of Dupont China Beijing company finance management. | Over 6 years of finance management experience in the poultry business. | Corporate accounting experience. |

| | 10. | Furthermore, if you retain an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, please tell us: |

| | · | the name and address of the accounting firm or organization; |

| | · | the qualifications of their employees who perform the services for your company; |

| | · | how and why they are qualified to prepare your financial statements or evaluate your internal control over financial reporting; |

| | · | how many hours they spent last year performing these services for you; and |

| | · | the total amount of fees you paid to each accounting firm or organization in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Yuhe’s Response:

The Company engaged Auditprep Limited (“Auditprep”) to help to prepare the Company’s 2009 U.S. GAAP financial statements. Auditprep’s address is 12/F, 99 Hennessy Road, Wan Chai, Hong Kong. The staff and partner of Auditprep in charge of our financial reporting are all qualified U.S. CPAs, and they spent approximately 300 hours in preparing our 2009 U.S. GAAP financial statements. We paid Auditprep $49,300 for preparing our 2009 U.S. GAAP financial statements. We believe that Auditprep is qualified to prepare our financial statements based on its qualified staff members and senior management’s extensive experience with U.S. GAAP financial statement preparation.

The company also engaged Ernst & Young (China) Advisory Limited (the "Internal Control Adviser") to assist the company in evaluating its internal control over financial reporting. The Internal Control Adviser’s address is Floor 5; Ernst & Young Tower; Oriental Plaza; No 1, Changan Ave, Beijing. In 2009, the Internal Control Adviser spent approximately 1,500 hours in evaluating and advising on our internal control over financial reporting, and we paid the Internal Control Adviser an aggregate of approximately $161,764 in 2009 and 2010. We believe they are qualified to help the Company to evaluate the reporting and control function because all of the partners and managers of our Internal Control Adviser possess the Certified Internal Auditors qualification. The team also has extensive experience in serving many PRC companies listed in the U.S.

| | 11. | If you retain individuals who are not your employees and are not employed by an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, do not provide us with their names, but please tell us: |

| | · | why you believe they are qualified to prepare your financial statements or evaluate your internal control over financial reporting; |

| | · | how many hours they spent last year performing these services for you; and |

| | · | the total amount of fees you paid to each individual in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Yuhe’s Response:

We have not retained any such individuals to prepare our financial statements or evaluate our internal control over financial reporting.

| | 12. | We note from the disclosure on page 30 of your Annual Report on Form 10-K/A that you have identified Mr. Peter Li as your audit committee financial expert. Please describe his qualifications, including the extent of his knowledge of U.S. GAAP and internal control over financial reporting. |

Yuhe’s Response:

Mr. Peter Li has been a Director of the Company since June 13, 2008 and serves as chair of the Audit Committee and member of the Compensation and Nominating Committees of the Company. Mr. Li is currently a Senior Advisor with Yucheng Technologies Limited, a NASDAQ-listed leading IT services provider to the Chinese banking industry based in Beijing, the PRC. Between 2004 and 2008, he served as the Chief Financial Officer of Yucheng Technologies Limited. Prior to 2004, Mr. Li served as financial controller to several other companies, including a multi-national computer manufacturing company, an investment holding company and a NASDAQ and Toronto listed company. Mr. Li received a bachelor’s degree in art from Beijing Foreign Studies University and a master degree in education from University of Toronto. Mr. Li is a Certified General Accountant in Canada. Mr. Li has extensive experience with U.S. GAAP financial statements and internal control systems.

Quarterly Report on Form 10-Q for the quarter ended September 30, 2010

Financial Statements, page F-1

Notes to Unaudited Condensed Consolidated Financial Statements, page F-7

Note 23. Subsequent Event, page F-32

| | 13. | We note the disclosure included in Note 23 indicating that on October 11, 2010, Mr. Kunio Yamamoto, the principal shareholder of the company’s common stock (the “Transferor”), entered into an agreement to transfer 7,222,290 shares of the company’s common stock to Mr. Gao Zhentao, the chief executive officer of the company (the “Transferee”), pursuant to a general, verbal and informal understanding between the Transferor and Transferee at the time of the execution of a share transfer agreement between Bright Stand International Co. Ltd. and all of the existing shareholders of Weifang Yuhe Poultry Co. Ltd. on October 18, 2007. Based on that understanding, all or part of the shares of the company’s common stock issued to the Transferor would be transferred to the Transferee in consideration of the Transferee’s commitment to management of the company’s business operations and future achievement of the financial targets as set forth in a Make Good Agreement dated March 12, 2008. With regards to this share transfer arrangement, please tell us and revise the notes to the company’s financial statements to disclose the business purpose of this arrangement. As part of your response, you should also indicate whether the company has recognized or plans to recognize stock-based compensation expense in the company’s financial statements pursuant to the guidance in ASC 718-10-15-4 and SAB Topic 5:T If not, please explain why including the company’s basis or rationale for the planned treatment. We may have further comment upon receipt of your response. |

Yuhe’s Response:

The purpose of the arrangement between Mr. Yamamoto and Mr. Gao Zhentao was to transfer Mr. Yamamoto’s shares to Mr. Gao Zhentao in exchange for the services that Mr. Gao Zhentao has rendered, which resulted in the strong performance of the Company in the years 2008 and 2009. The Company will revise the disclosure in Note 26 to the consolidated financial statements in the amended 10-Q to clarify the purpose of the arrangement.

Pursuant to ASC 718-10-15-4 and SAB Topic 5:T, the Company has determined that the share transfer will require the Company to recognize stock-based compensation expense for the fiscal year 2010. Such expenses will be reflected in the Company’s consolidated financial statements for the year ended December 31, 2010 to be contained in the Company’s annual report on Form

Please contact me at +86 536 736 3688 should you have any questions about this letter.

Thank you for your attention to our filing.

| | Sincerely, |

| | |

| | Yuhe International, Inc. |

| | |

| | |

| | By: | /s/ Zhentao Gao |

| | | Zhentao Gao |

| | | Chief Executive Officer |