| | | Solid Company

Timely Investment |

|

|

Financial Community Update

New York City |

|

|

Eugene R. McGrath

Chairman, President and Chief Executive Officer |

|

|

March 8, 2002 |

|

|

[CONEDISON LOGO] |

| | | This presentation contains forward-looking statements, which are

statements of future expectations and not facts. Actual results or

developments might differ materially from those included in the

forward-looking statements because of factors such as competition

and industry restructuring, changes in economic conditions,

changes in historical weather patterns, changes in laws, regulations

or regulatory policies, developments in legal or public policy

doctrines, technological developments and other presently unknown

or unforeseen factors. Other risk factors are detailed from time to

time in the company's SEC reports.

|

[CONEDISON LOGO]

| | | Consolidated Edison, Inc. |

|

|

Business Profile

Long-term Strategy

Financial Strength

Supply/Demand Outlook

Recovery from WTC |

[CONEDISON LOGO]

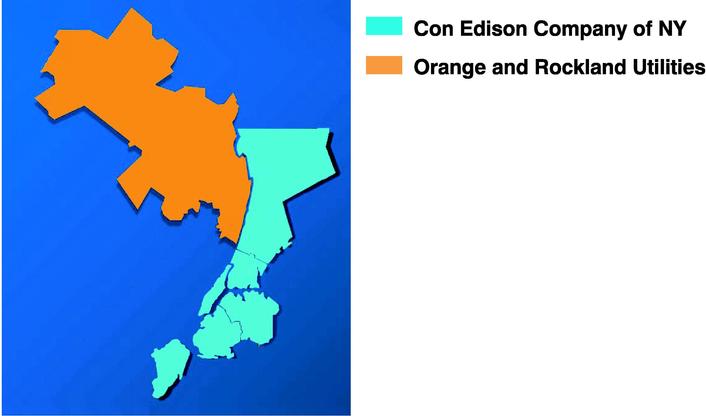

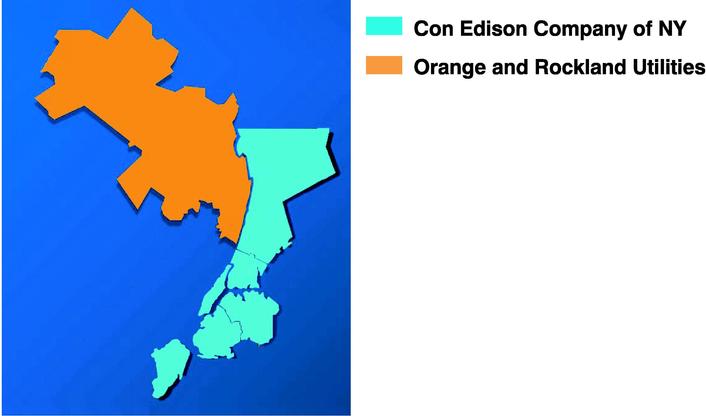

| | | Our Business Profile

Regulated Business Service Area |

|

|

|

| | | Con Edison Company of NY

3.2 million electric customers

1.1 million gas customers

1,850 steam customers |

|

|

Orange and Rockland Utilities

280,000 electric customers

120,000 gas customers

|

[CONEDISON LOGO]

Our Business Profile

A Compelling Investment

Strong financial base

A+ bond rating

Dependable, growing dividend

Good regulatory relations

Solid management team

Experienced, knowledgeable field force

Consistent, disciplined business strategy

[CONEDISON LOGO]

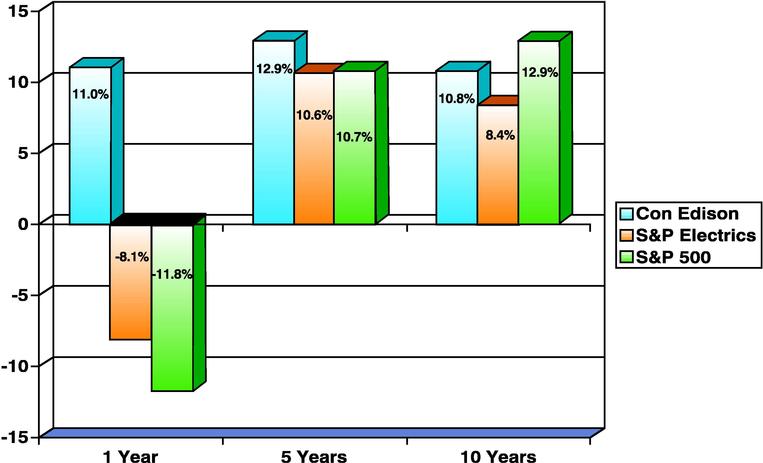

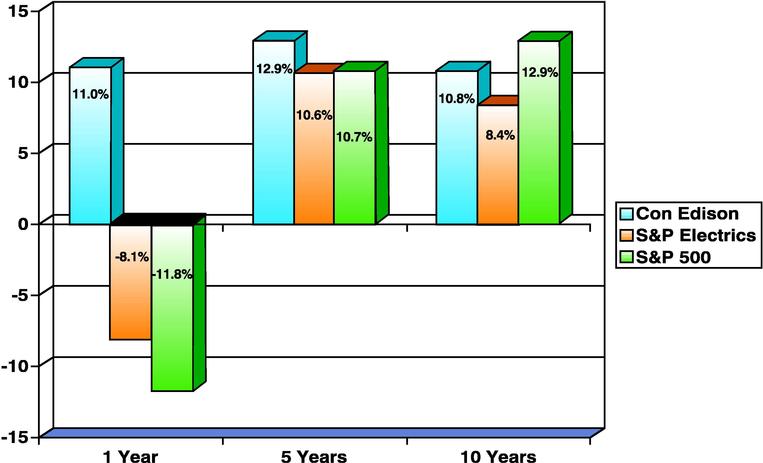

Total Return to Shareholders

Average annual total returns for periods ending December 31, 2001

[CONEDISON LOGO]

Our Long-term Strategy

Maximize value of regulated T&D assets

Focus on infrastructure needs

Leverage strong expertise to create unregulated opportunities

Conservative and disciplined growth strategy

[CONEDISON LOGO]

Long-term Annual Growth Target

3%-5% Growth Target

• Maximize Value of T&D Assets

• Economic Recovery

• Efficiencies

• Unregulated Businesses

[CONEDISON LOGO]

Maximizing the Value of Our Regulated Assets

More than $1 billion in annual infrastructure investment

East River repowering

Net addition of 200 MW of in-city generation

Completion expected in 2003

Sale of First Avenue properties

Net cash proceeds of $396 million

[CONEDISON LOGO]

Rate Agreements Provide Long-term Regulatory Stability

Rate Agreements Ending:

| Con Edison Electric | | March 2005 | |

| Con Edison Gas | | September 2004 | * |

| Con Edison Steam | | September 2004 | |

| O&R Electric | | December 2002 | |

| O&R Gas | | September 2003 | |

*Currently before Administrative Law Judge for approval

[CONEDISON LOGO]

Managing Business Risk

Indian Point sold

Reduced risk from ownership

Attractive energy contract for 3 years

New York supply situation stable

Power prices less volatile

Recovery of purchased power costs

Moderate unregulated investments

[CONEDISON LOGO]

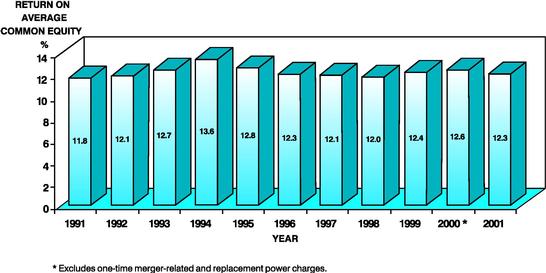

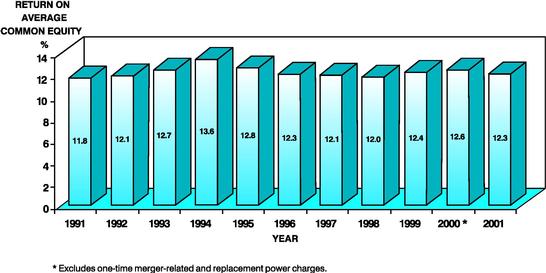

Consolidated Edison, Inc.

Return on Equity

Our Financial Strength

Utilize Strong Capital Structure

![Graph[nc_cad,228]Capital Structure](https://capedge.com/proxy/8-K/0000912057-02-009162/g526425.jpg)

[CONEDISON LOGO]

Our Strategy

Our "Wires and Pipes" Businesses Provide a Strong Foundation for Future Growth

![Graph[nc_cad,228]Future Growth](https://capedge.com/proxy/8-K/0000912057-02-009162/g713104.jpg)

[CONEDISON LOGO]

Strategic Plant Locations

1. Newington, NH

2. Springfield, MA

3. Lakewood, NJ

4. Rock Springs, MD

![GRAPH[nc_cad,228]Plant Locations](https://capedge.com/proxy/8-K/0000912057-02-009162/g543217.jpg)

[CONEDISON LOGO]

CEC Network Map—1Q2002

![GRAPH[nc_cad,228]Network Map](https://capedge.com/proxy/8-K/0000912057-02-009162/g86479.jpg)

1. 60 buildings connected to the network

2. 106 miles of fiber installed

3. 50 miles of fiber acquired through swaps

4. Jersey City ring

[CONEDISON LOGO]

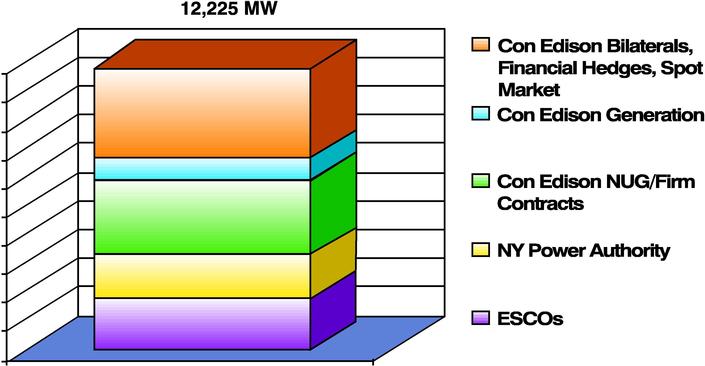

Our Supply/Demand Outlook

New York State

18% capacity reserve in excess of peak load

Status for summer of 2002—adequate

New York City

80% of peak load from in-city supply

Additional 20% plus 18% reserve can be from outside NYC

Status for summer of 2002—tight but adequate

[CONEDISON LOGO]

Our Supply/Demand Outlook

Service Area Peak Load Forecast

![GRAPH[nc_cad,228]Peak Load Forecast](https://capedge.com/proxy/8-K/0000912057-02-009162/g522527.jpg)

[CONEDISON LOGO]

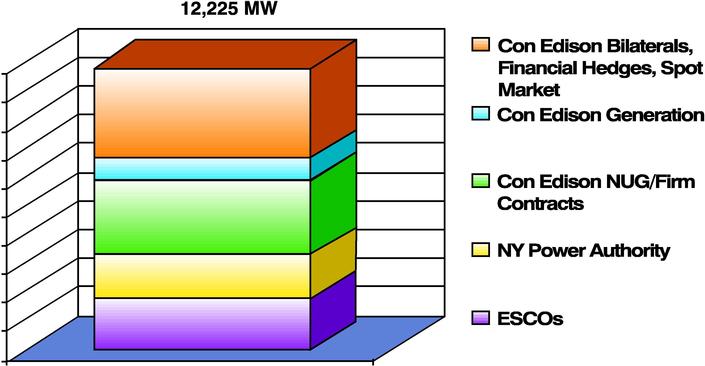

Customer Supply Responsibilities

On 2002 Peak Day

[CONEDISON LOGO]

[CONEDISON LOGO]

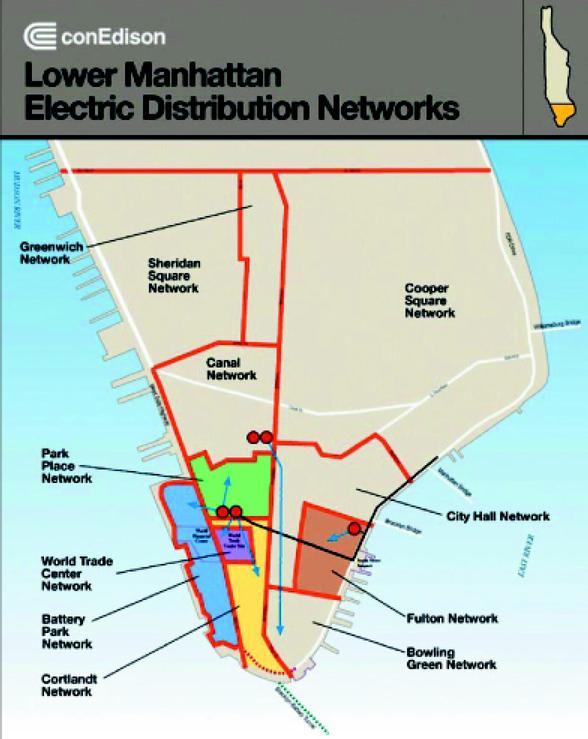

Temporary Restoration Work

[CONEDISON LOGO]

Permanent Restoration Challenges

[CONEDISON LOGO]

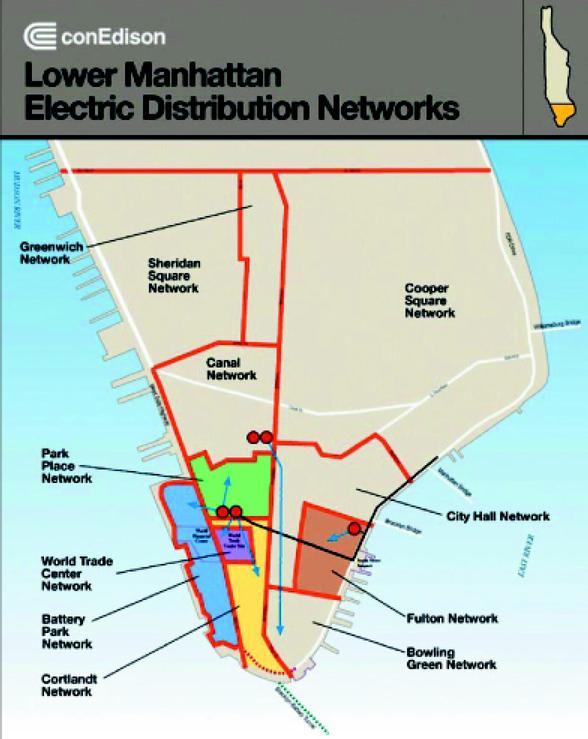

Lower Manhattan Network

Long-term Configuration

[CONEDISON LOGO]

Working 24/7 to Meet Targets

[CONEDISON LOGO]

Response to September 11

Cost of Restoration

$400 million—mostly capital—includes:

Emergency response, temporary restoration and permanent replacement of facilities

Seeking Federal reimbursement

At December 31, 2001:

Our Value

Con Edison's Track Record

Delivered on expectations

28 consecutive years of dividend increases

Most reliable electric delivery system

Accretive acquisition of O&R

Successful transition to restructured marketplace

Disciplined management

[CONEDISON LOGO]

![Graph[nc_cad,228]Capital Structure](https://capedge.com/proxy/8-K/0000912057-02-009162/g526425.jpg)

![Graph[nc_cad,228]Future Growth](https://capedge.com/proxy/8-K/0000912057-02-009162/g713104.jpg)

![GRAPH[nc_cad,228]Plant Locations](https://capedge.com/proxy/8-K/0000912057-02-009162/g543217.jpg)

![GRAPH[nc_cad,228]Network Map](https://capedge.com/proxy/8-K/0000912057-02-009162/g86479.jpg)

![GRAPH[nc_cad,228]Peak Load Forecast](https://capedge.com/proxy/8-K/0000912057-02-009162/g522527.jpg)