3rd Quarter 2018 Earnings Release and Clean Energy Businesses Update Presentation November 1, 2018

Available Information On November 1, 2018, Consolidated Edison, Inc. issued a press release reporting its third quarter 2018 earnings and filed with the Securities and Exchange Commission the company’s third quarter 2018 Form 10-Q. This presentation should be read together with, and is qualified in its entirety by reference to, the earnings press release and the Form 10-Q. Copies of the earnings press release and the Form 10-Q are available at: www.conedison.com. (Select "For Investors" and then select "Press Releases“ and “SEC Filings”, respectively.) Forward-Looking Statements This presentation contains forward-looking statements that are intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectations and not facts. Words such as "forecasts," "expects," "estimates," "anticipates," "intends," "believes," "plans," "will" and similar expressions identify forward-looking statements. The forward-looking statements reflect information available and assumptions at the time the statements are made, and speak only as of that time. Actual results or developments may differ materially from those included in the forward-looking statements because of various factors such as when the acquisition of Sempra Solar Holdings, LLC is completed, if at all, and those factors identified in reports the company has filed with the Securities and Exchange Commission, including that the company's subsidiaries are extensively regulated and are subject to penalties; its utility subsidiaries' rate plans may not provide a reasonable return; it may be adversely affected by changes to the utility subsidiaries' rate plans; the intentional misconduct of employees or contractors could adversely affect it; the failure of, or damage to, its subsidiaries' facilities could adversely affect it; a cyber-attack could adversely affect it; it is exposed to risks from the environmental consequences of its subsidiaries' operations; a disruption in the wholesale energy markets or failure by an energy supplier could adversely affect it; it has substantial unfunded pension and other postretirement benefit liabilities; its ability to pay dividends or interest depends on dividends from its subsidiaries; it requires access to capital markets to satisfy funding requirements; changes to tax laws could adversely affect it; its strategies may not be effective to address changes in the external business environment; and it also faces other risks that are beyond its control. Con Edison assumes no obligation to update forward-looking statements. Non-GAAP Financial Measure This presentation also contains a financial measure, adjusted earnings, that is not determined in accordance with generally accepted accounting principles in the United States of America (GAAP). This non-GAAP financial measure should not be considered as an alternative to net income, which is an indicator of financial performance determined in accordance with GAAP. Adjusted earnings excludes from net income certain items that the company does not consider indicative of its ongoing financial performance. Management uses this non-GAAP financial measure to facilitate the analysis of the company's financial performance as compared to its internal budgets and previous financial results. Management also uses this non-GAAP financial measure to communicate to investors and others the company's expectations regarding its future earnings and dividends on its common stock. Management believes that this non-GAAP financial measure is also useful and meaningful to investors to facilitate their analysis of the company's financial performance. For more information, contact: Jan Childress, Director, Investor Relations Olivia M. Webb, Manager, Investor Relations Tel.: 212-460-6611, Email: childressj@coned.com Tel.: 212-460-3431, Email: webbo@coned.com www.conEdison.com 2

Table of Contents 3rd Quarter 2018 Earnings Release Page Organizational Structure and Plan 5-6 Dividend and Earnings Announcements 7 3Q 2018 Earnings 8-11 3Q 2018 Developments 12-13 Utility Rate Adjustments for Tax Cuts and Jobs Act of 2017 14-15 YTD 2018 Earnings 16-19 Five-Year Reconciliation of Reported EPS (GAAP) to Adjusted EPS (Non-GAAP) 20 CECONY Operations and Maintenance Expenses 21 Composition of Regulatory Rate Base 22 Average Rate Base Balances 23 Regulated Utility Rates of Return and Equity Ratio 24 Earnings Adjustment Mechanisms and Positive Incentives 25 Capital Expenditures and Utility Capital Expenditures 26-27 2018 Financing Plan and Activity 28 Capital Structure and Liquidity Profile 29-30 Utility Sales and Revenues 31-36 List of Notes to 2018 Form 10-Q Financial Statements 37 3

Table of Contents Clean Energy Businesses Update Page Sempra Solar Holdings Transaction 38 Sempra Solar Holdings Operating Assets 39 CEBs' Pro Forma Portfolio of Renewable Assets 40 Sources and Uses of Funds in Transaction 41 Accounting Considerations for Sempra Solar Holdings Acquisition 42 Forecasted GAAP Net Income from Sempra Solar Holdings Acquisition 43 Forecasted Return of Equity Used for Sempra Solar Holdings Acquisition 44 CEBs' Utility Scale Pro Forma Portfolio 45 Investment Highlights 46 4

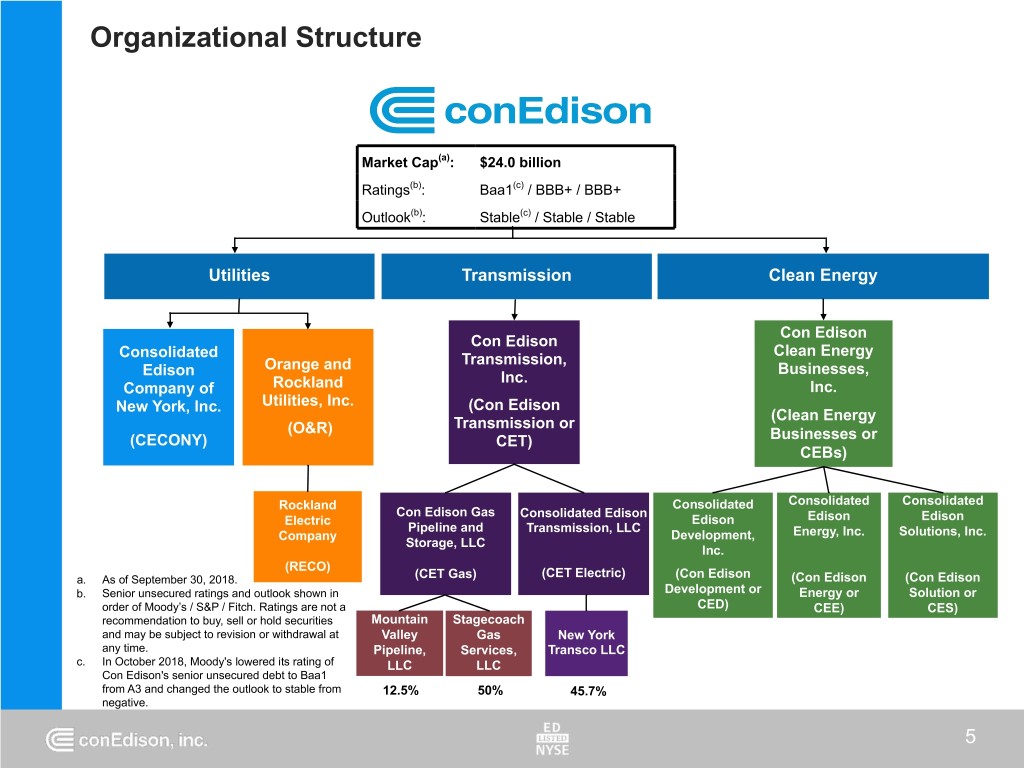

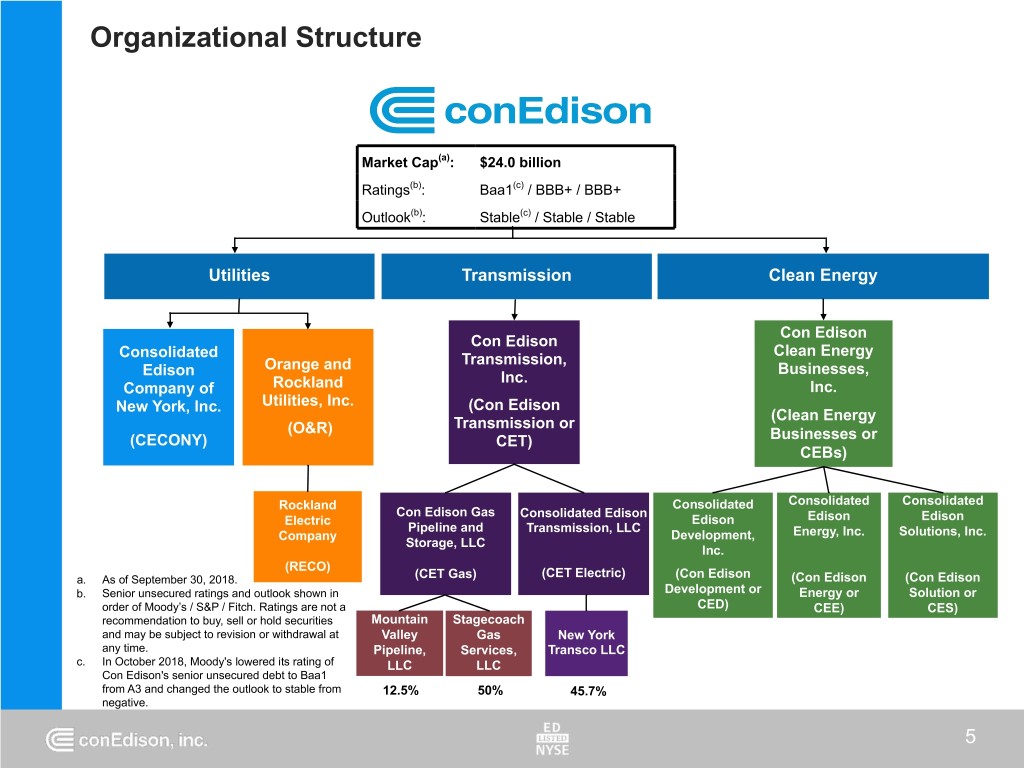

Organizational Structure Market Cap(a): $24.0 billion Ratings(b): Baa1(c) / BBB+ / BBB+ Outlook(b): Stable(c) / Stable / Stable Utilities Transmission Clean Energy Con Edison Con Edison Clean Energy Consolidated Transmission, Orange and Businesses, Edison Inc. Company of Rockland Inc. New York, Inc. Utilities, Inc. (Con Edison (Clean Energy (O&R) Transmission or (CECONY) CET) Businesses or CEBs) Rockland Consolidated Consolidated Consolidated Con Edison Gas Consolidated Edison Electric Edison Edison Edison Pipeline and Transmission, LLC Company Development, Energy, Inc. Solutions, Inc. Storage, LLC Inc. (RECO) (CET Electric) a. As of September 30, 2018. (CET Gas) (Con Edison (Con Edison (Con Edison b. Senior unsecured ratings and outlook shown in Development or Energy or Solution or order of Moody’s / S&P / Fitch. Ratings are not a CED) CEE) CES) recommendation to buy, sell or hold securities Mountain Stagecoach and may be subject to revision or withdrawal at Valley Gas New York any time. Pipeline, Services, Transco LLC c. In October 2018, Moody's lowered its rating of LLC LLC Con Edison's senior unsecured debt to Baa1 from A3 and changed the outlook to stable from 12.5% 50% 45.7% negative. 5

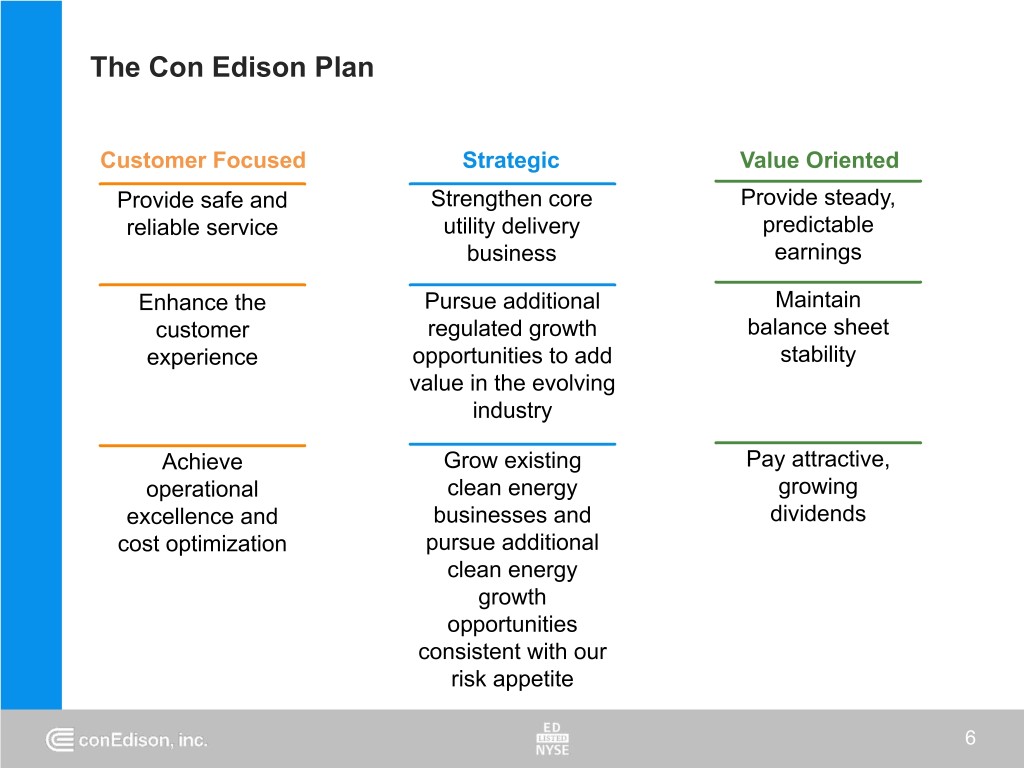

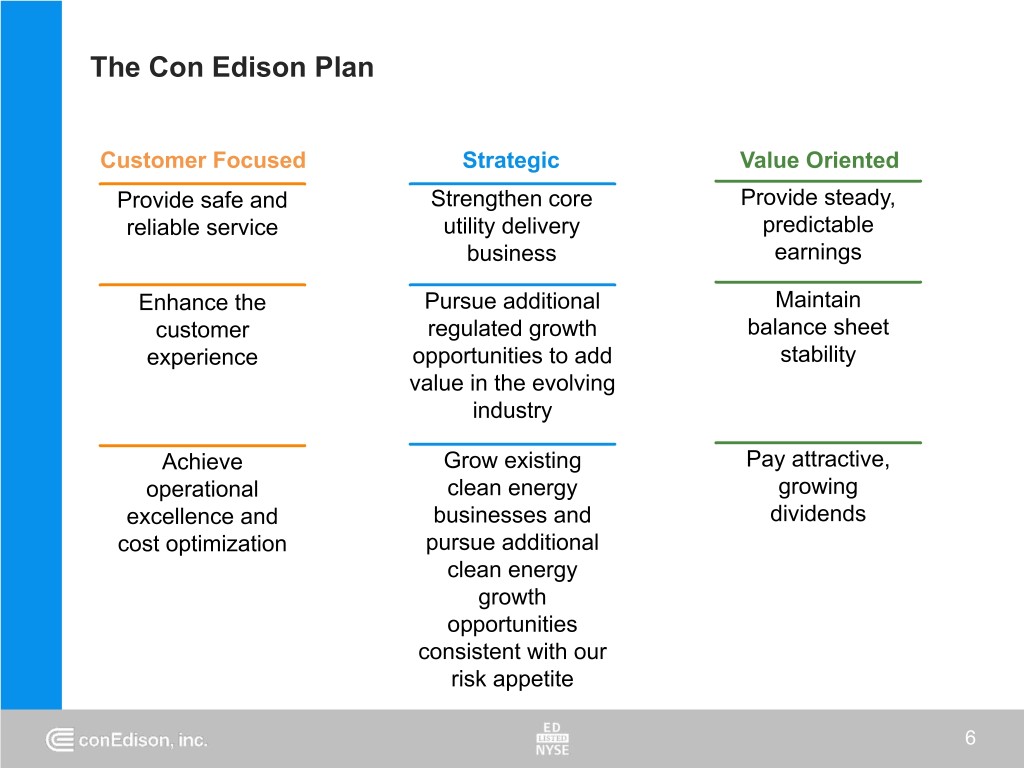

The Con Edison Plan Customer Focused Strategic Value Oriented Provide safe and Strengthen core Provide steady, reliable service utility delivery predictable business earnings Enhance the Pursue additional Maintain customer regulated growth balance sheet experience opportunities to add stability value in the evolving industry Achieve Grow existing Pay attractive, operational clean energy growing excellence and businesses and dividends cost optimization pursue additional clean energy growth opportunities consistent with our risk appetite 6

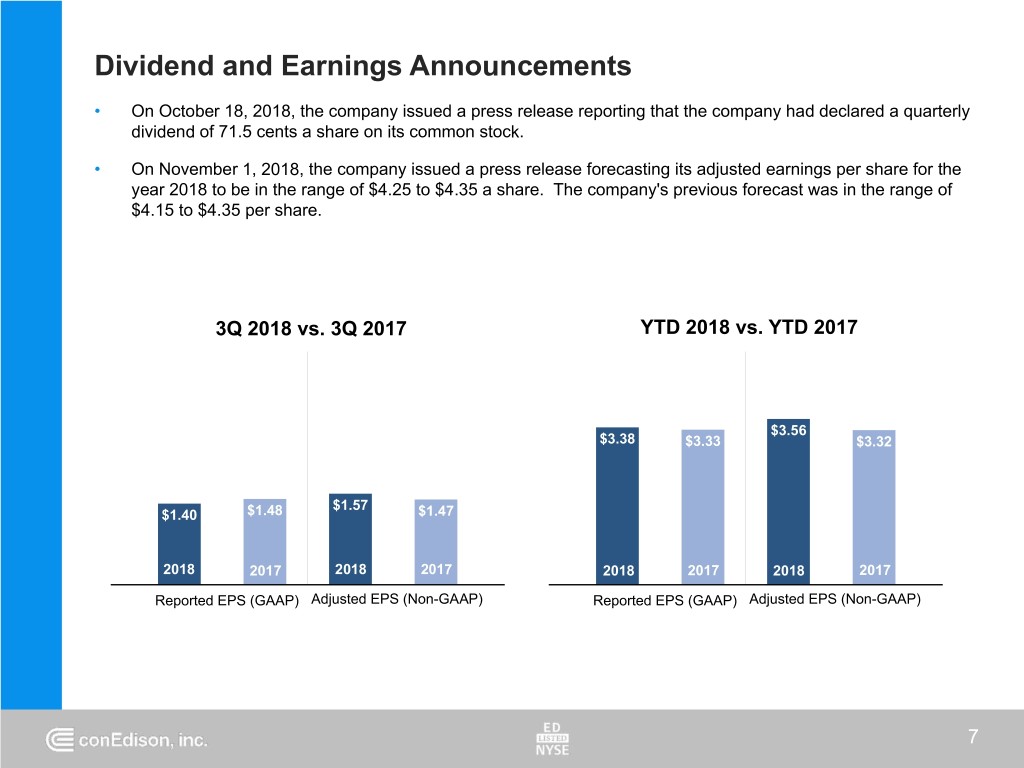

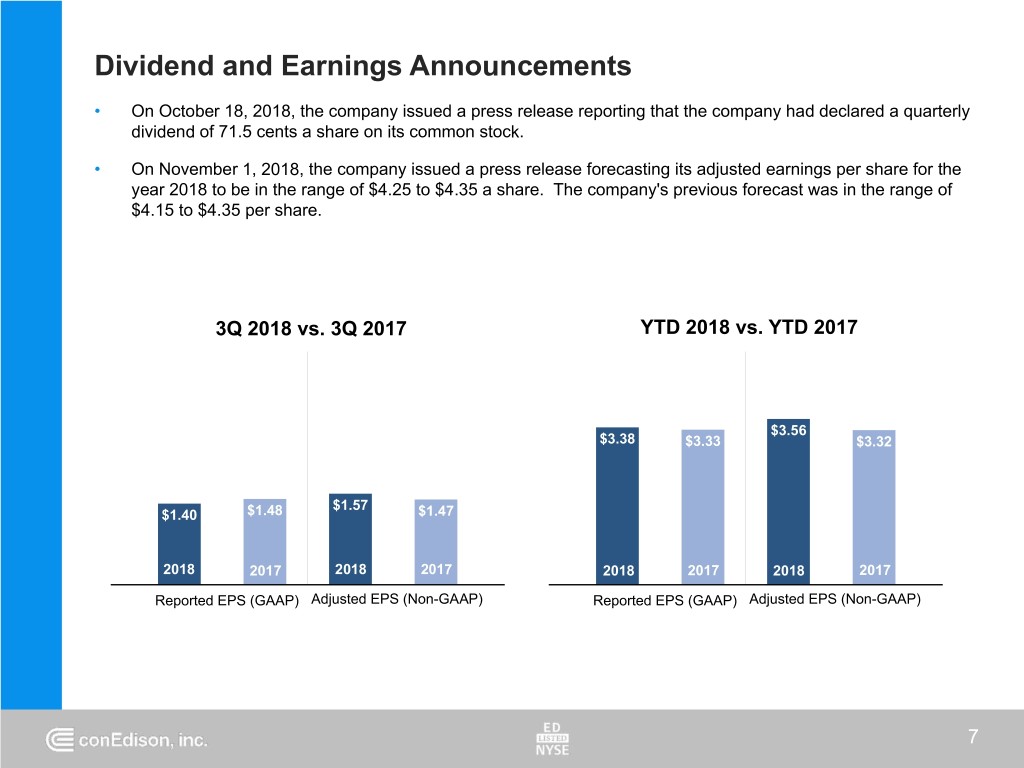

Dividend and Earnings Announcements • On October 18, 2018, the company issued a press release reporting that the company had declared a quarterly dividend of 71.5 cents a share on its common stock. • On November 1, 2018, the company issued a press release forecasting its adjusted earnings per share for the year 2018 to be in the range of $4.25 to $4.35 a share. The company's previous forecast was in the range of $4.15 to $4.35 per share. 3Q 2018 vs. 3Q 2017 YTD 2018 vs. YTD 2017 $3.56 $3.38 $3.33 $3.32 $1.57 $1.40 $1.48 $1.47 2018 2017 2018 2017 2018 2017 2018 2017 Reported EPS (GAAP) Adjusted EPS (Non-GAAP) Reported EPS (GAAP) Adjusted EPS (Non-GAAP) 7

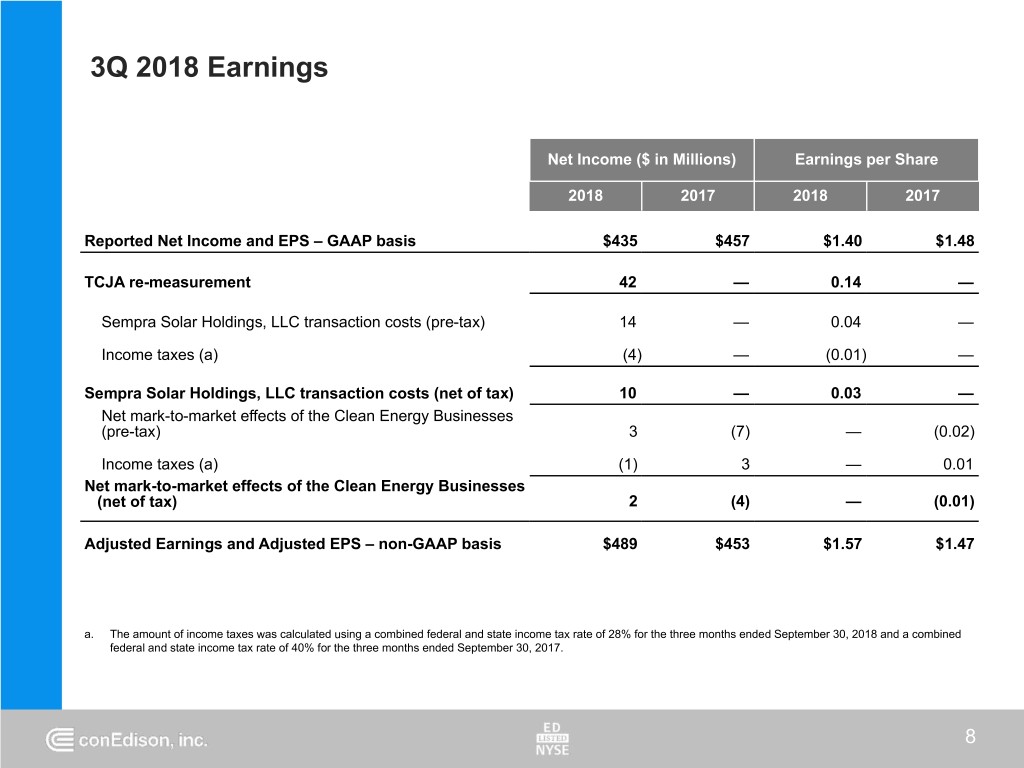

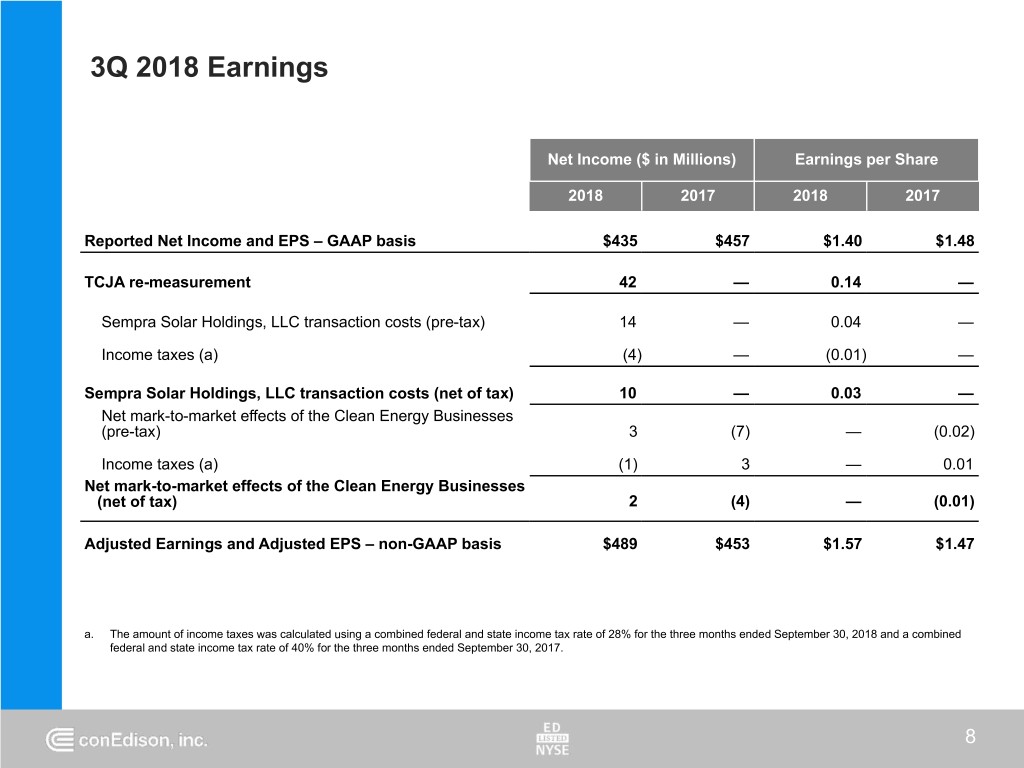

3Q 2018 Earnings Net Income ($ in Millions) Earnings per Share 2018 2017 2018 2017 Reported Net Income and EPS – GAAP basis $435 $457 $1.40 $1.48 TCJA re-measurement 42 — 0.14 — Sempra Solar Holdings, LLC transaction costs (pre-tax) 14 — 0.04 — Income taxes (a) (4) — (0.01) — Sempra Solar Holdings, LLC transaction costs (net of tax) 10 — 0.03 — Net mark-to-market effects of the Clean Energy Businesses (pre-tax) 3 (7) — (0.02) Income taxes (a) (1) 3 — 0.01 Net mark-to-market effects of the Clean Energy Businesses (net of tax) 2 (4) — (0.01) Adjusted Earnings and Adjusted EPS – non-GAAP basis $489 $453 $1.57 $1.47 a. The amount of income taxes was calculated using a combined federal and state income tax rate of 28% for the three months ended September 30, 2018 and a combined federal and state income tax rate of 40% for the three months ended September 30, 2017. 8

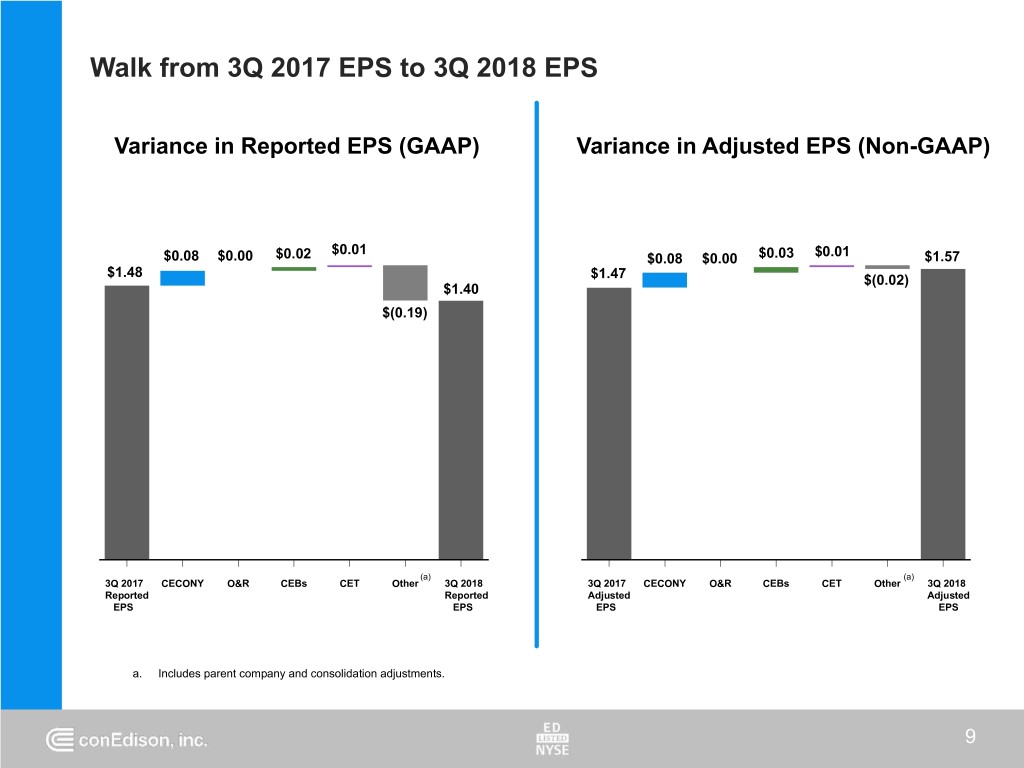

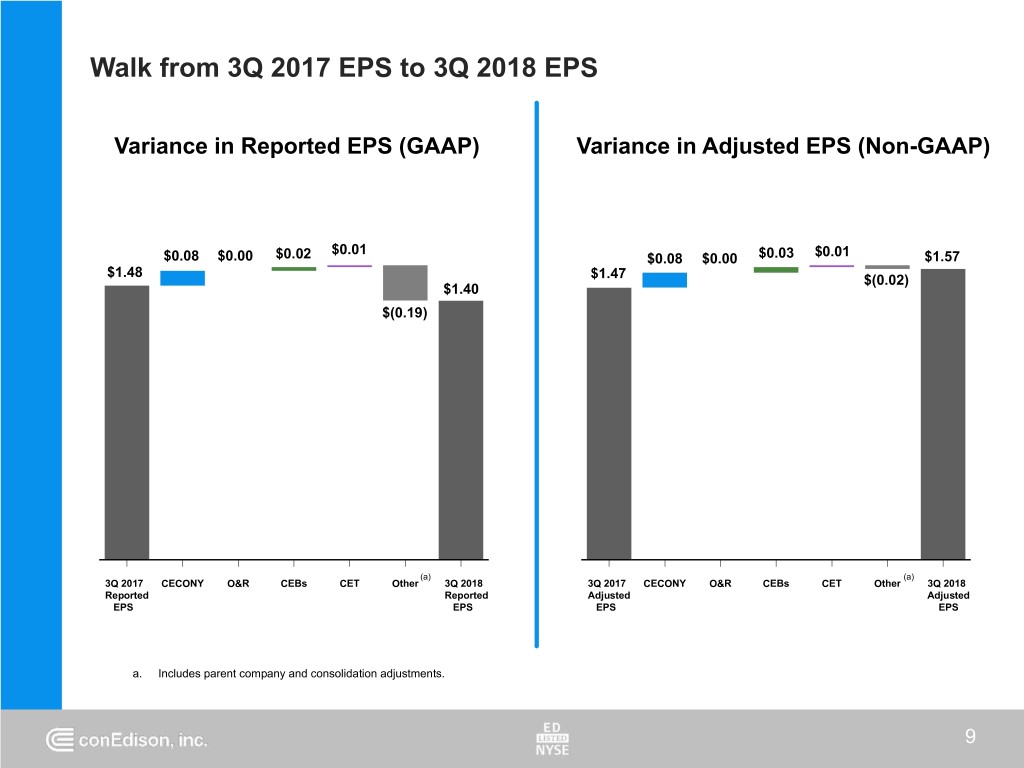

Walk from 3Q 2017 EPS to 3Q 2018 EPS Variance in Reported EPS (GAAP) Variance in Adjusted EPS (Non-GAAP) $0.01 $0.01 $0.08 $0.00 $0.02 $0.08 $0.00 $0.03 $1.57 $1.48 $1.47 $(0.02) $1.40 $(0.19) (a) (a) 3Q 2017 CECONY O&R CEBs CET Other 3Q 2018 3Q 2017 CECONY O&R CEBs CET Other 3Q 2018 Reported Reported Adjusted Adjusted EPS EPS EPS EPS a. Includes parent company and consolidation adjustments. 9

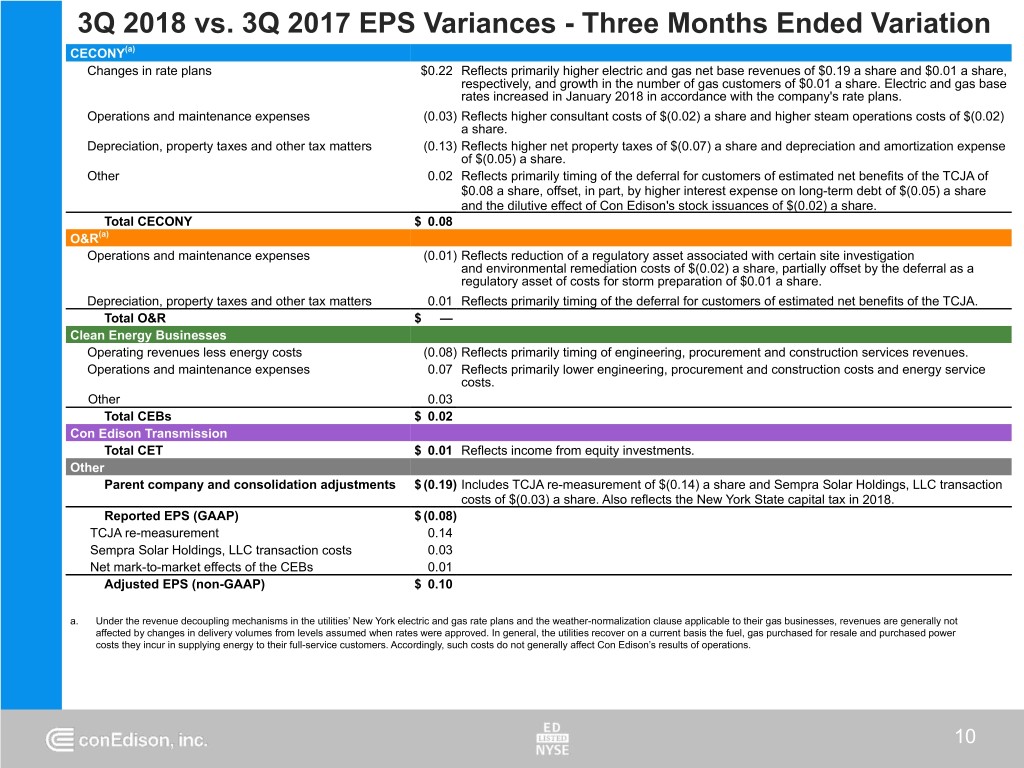

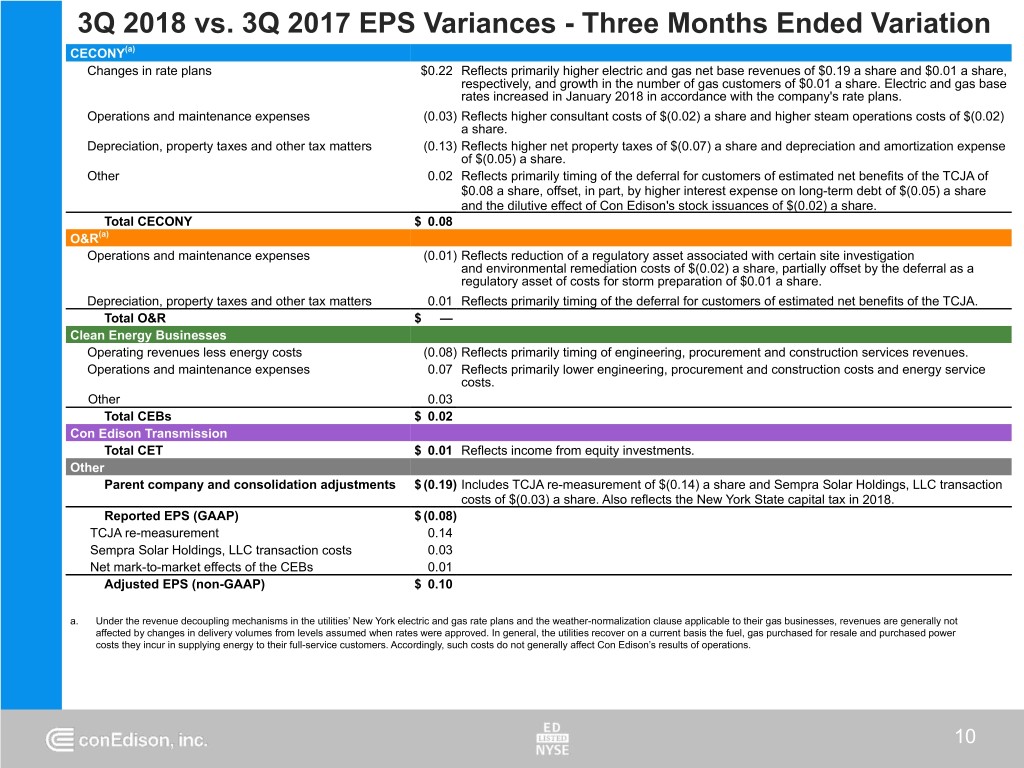

3Q 2018 vs. 3Q 2017 EPS Variances - Three Months Ended Variation CECONY(a) Changes in rate plans $0.22 Reflects primarily higher electric and gas net base revenues of $0.19 a share and $0.01 a share, respectively, and growth in the number of gas customers of $0.01 a share. Electric and gas base rates increased in January 2018 in accordance with the company's rate plans. Operations and maintenance expenses (0.03) Reflects higher consultant costs of $(0.02) a share and higher steam operations costs of $(0.02) a share. Depreciation, property taxes and other tax matters (0.13) Reflects higher net property taxes of $(0.07) a share and depreciation and amortization expense of $(0.05) a share. Other 0.02 Reflects primarily timing of the deferral for customers of estimated net benefits of the TCJA of $0.08 a share, offset, in part, by higher interest expense on long-term debt of $(0.05) a share and the dilutive effect of Con Edison's stock issuances of $(0.02) a share. Total CECONY $ 0.08 O&R(a) Operations and maintenance expenses (0.01) Reflects reduction of a regulatory asset associated with certain site investigation and environmental remediation costs of $(0.02) a share, partially offset by the deferral as a regulatory asset of costs for storm preparation of $0.01 a share. Depreciation, property taxes and other tax matters 0.01 Reflects primarily timing of the deferral for customers of estimated net benefits of the TCJA. Total O&R $ — Clean Energy Businesses Operating revenues less energy costs (0.08) Reflects primarily timing of engineering, procurement and construction services revenues. Operations and maintenance expenses 0.07 Reflects primarily lower engineering, procurement and construction costs and energy service costs. Other 0.03 Total CEBs $ 0.02 Con Edison Transmission Total CET $ 0.01 Reflects income from equity investments. Other Parent company and consolidation adjustments $ (0.19) Includes TCJA re-measurement of $(0.14) a share and Sempra Solar Holdings, LLC transaction costs of $(0.03) a share. Also reflects the New York State capital tax in 2018. Reported EPS (GAAP) $ (0.08) TCJA re-measurement 0.14 Sempra Solar Holdings, LLC transaction costs 0.03 Net mark-to-market effects of the CEBs 0.01 Adjusted EPS (non-GAAP) $ 0.10 a. Under the revenue decoupling mechanisms in the utilities’ New York electric and gas rate plans and the weather-normalization clause applicable to their gas businesses, revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. In general, the utilities recover on a current basis the fuel, gas purchased for resale and purchased power costs they incur in supplying energy to their full-service customers. Accordingly, such costs do not generally affect Con Edison’s results of operations. 10

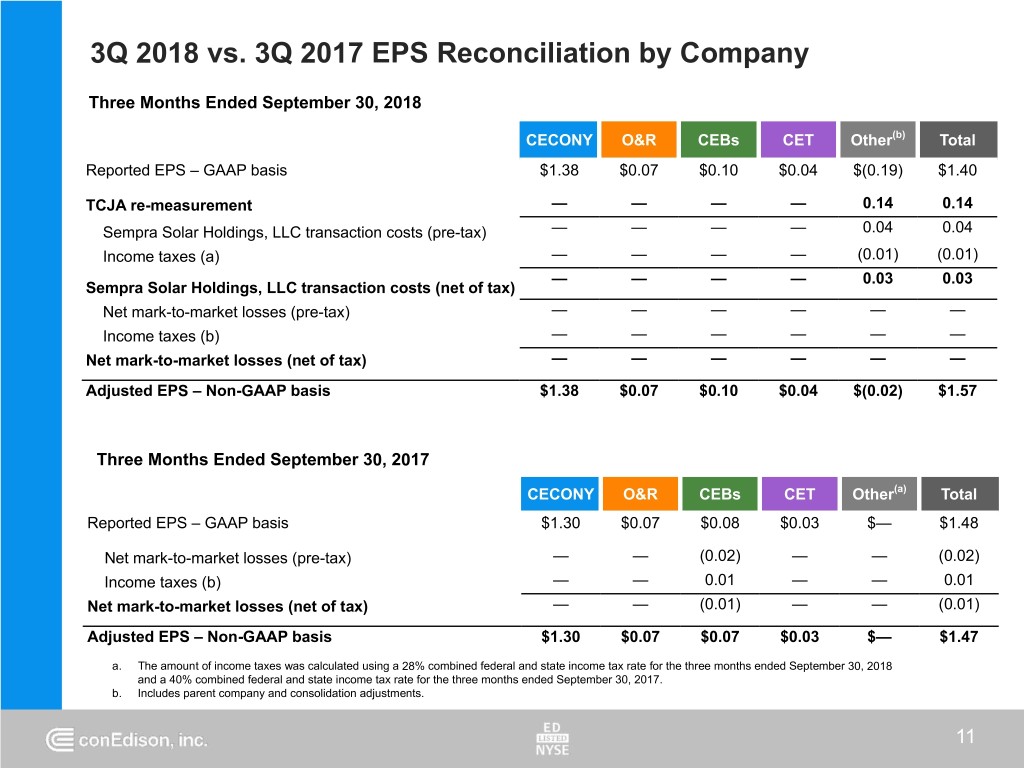

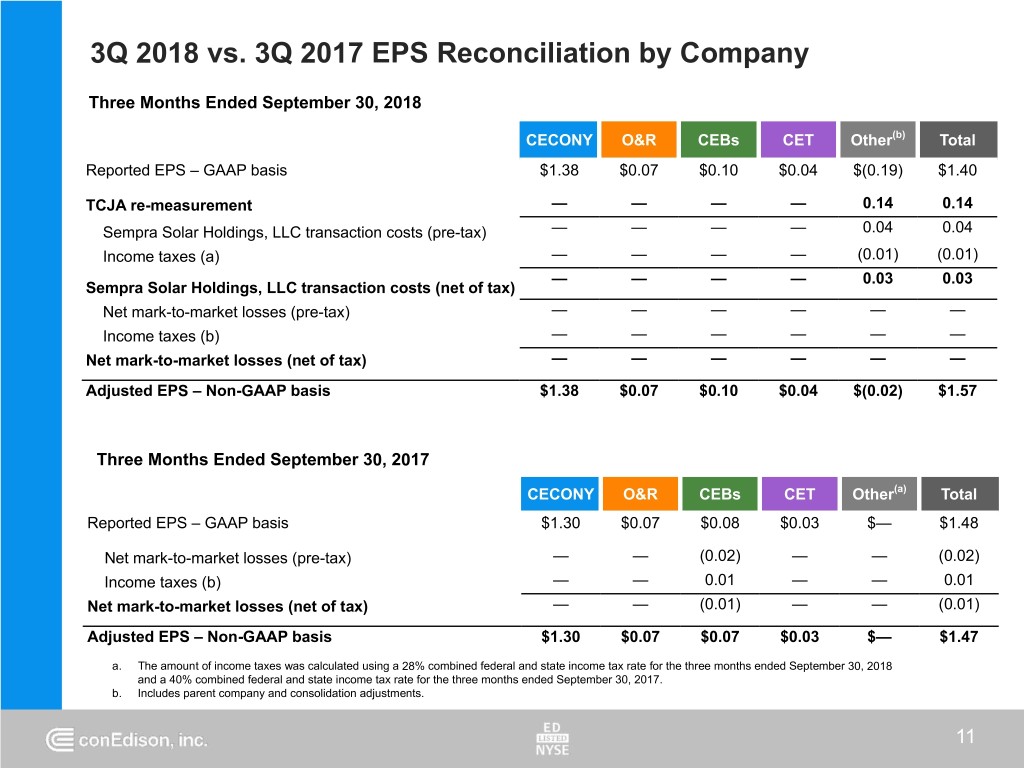

3Q 2018 vs. 3Q 2017 EPS Reconciliation by Company Three Months Ended September 30, 2018 CECONY O&R CEBs CET Other(b) Total Reported EPS – GAAP basis $1.38 $0.07 $0.10 $0.04 $(0.19) $1.40 TCJA re-measurement — — — — 0.14 0.14 Sempra Solar Holdings, LLC transaction costs (pre-tax) — — — — 0.04 0.04 Income taxes (a) — — — — (0.01) (0.01) — — — — 0.03 0.03 Sempra Solar Holdings, LLC transaction costs (net of tax) Net mark-to-market losses (pre-tax) — — — — — — Income taxes (b) — — — — — — Net mark-to-market losses (net of tax) — — — — — — Adjusted EPS – Non-GAAP basis $1.38 $0.07 $0.10 $0.04 $(0.02) $1.57 Three Months Ended September 30, 2017 CECONY O&R CEBs CET Other(a) Total Reported EPS – GAAP basis $1.30 $0.07 $0.08 $0.03 $— $1.48 Net mark-to-market losses (pre-tax) — — (0.02) — — (0.02) Income taxes (b) — — 0.01 — — 0.01 Net mark-to-market losses (net of tax) — — (0.01) — — (0.01) Adjusted EPS – Non-GAAP basis $1.30 $0.07 $0.07 $0.03 $— $1.47 a. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the three months ended September 30, 2018 and a 40% combined federal and state income tax rate for the three months ended September 30, 2017. b. Includes parent company and consolidation adjustments. 11

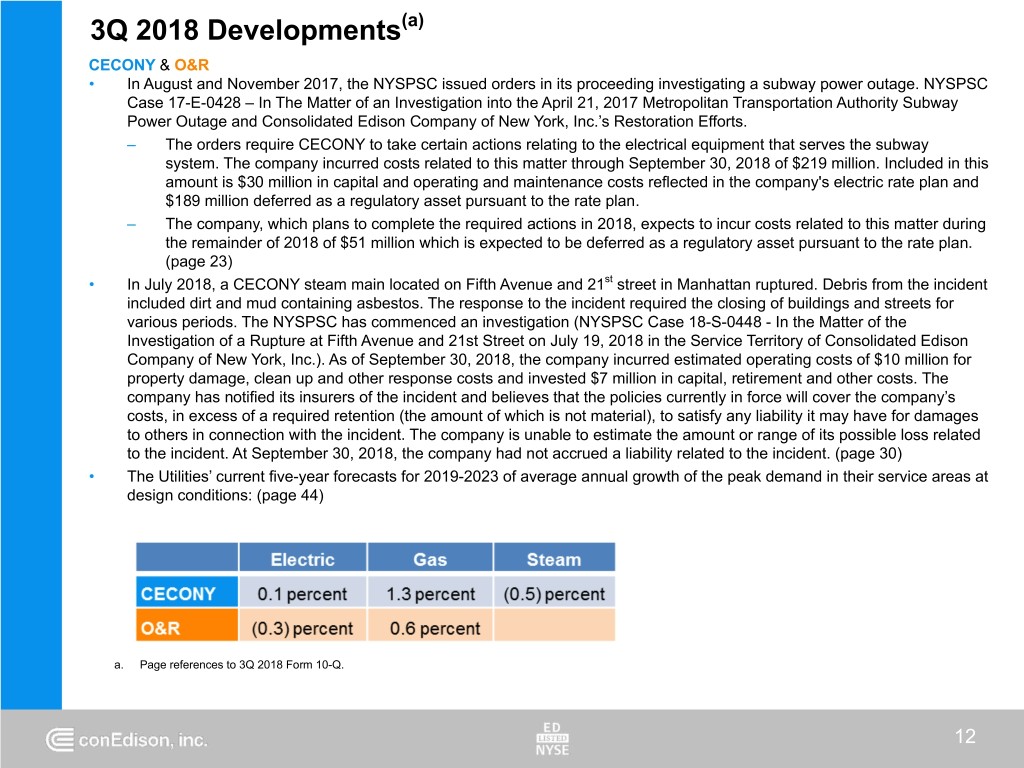

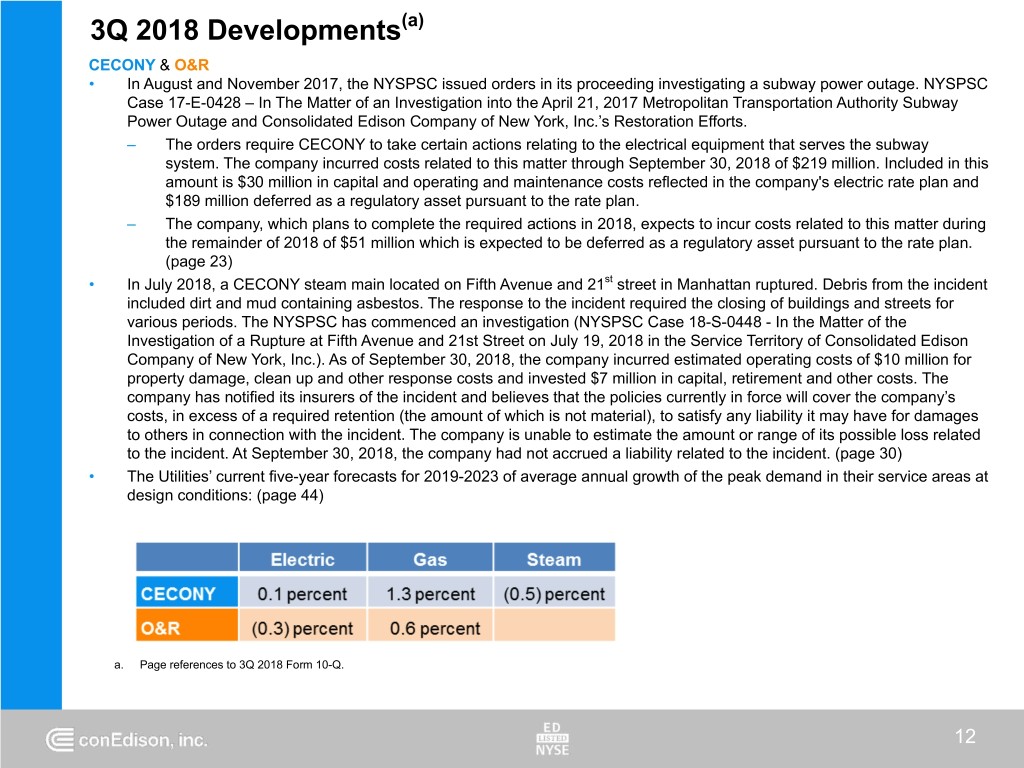

3Q 2018 Developments(a) CECONY & O&R • In August and November 2017, the NYSPSC issued orders in its proceeding investigating a subway power outage. NYSPSC Case 17-E-0428 – In The Matter of an Investigation into the April 21, 2017 Metropolitan Transportation Authority Subway Power Outage and Consolidated Edison Company of New York, Inc.’s Restoration Efforts. – The orders require CECONY to take certain actions relating to the electrical equipment that serves the subway system. The company incurred costs related to this matter through September 30, 2018 of $219 million. Included in this amount is $30 million in capital and operating and maintenance costs reflected in the company's electric rate plan and $189 million deferred as a regulatory asset pursuant to the rate plan. – The company, which plans to complete the required actions in 2018, expects to incur costs related to this matter during the remainder of 2018 of $51 million which is expected to be deferred as a regulatory asset pursuant to the rate plan. (page 23) • In July 2018, a CECONY steam main located on Fifth Avenue and 21st street in Manhattan ruptured. Debris from the incident included dirt and mud containing asbestos. The response to the incident required the closing of buildings and streets for various periods. The NYSPSC has commenced an investigation (NYSPSC Case 18-S-0448 - In the Matter of the Investigation of a Rupture at Fifth Avenue and 21st Street on July 19, 2018 in the Service Territory of Consolidated Edison Company of New York, Inc.). As of September 30, 2018, the company incurred estimated operating costs of $10 million for property damage, clean up and other response costs and invested $7 million in capital, retirement and other costs. The company has notified its insurers of the incident and believes that the policies currently in force will cover the company’s costs, in excess of a required retention (the amount of which is not material), to satisfy any liability it may have for damages to others in connection with the incident. The company is unable to estimate the amount or range of its possible loss related to the incident. At September 30, 2018, the company had not accrued a liability related to the incident. (page 30) • The Utilities’ current five-year forecasts for 2019-2023 of average annual growth of the peak demand in their service areas at design conditions: (page 44) a. Page references to 3Q 2018 Form 10-Q. 12

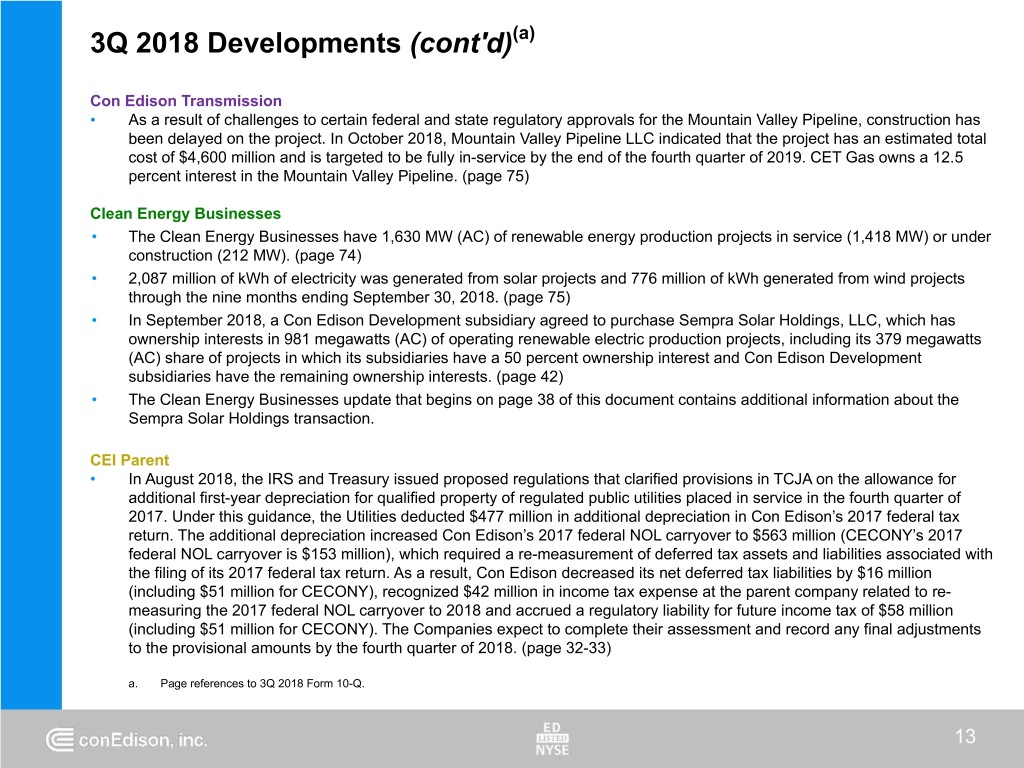

3Q 2018 Developments (cont'd)(a) Con Edison Transmission • As a result of challenges to certain federal and state regulatory approvals for the Mountain Valley Pipeline, construction has been delayed on the project. In October 2018, Mountain Valley Pipeline LLC indicated that the project has an estimated total cost of $4,600 million and is targeted to be fully in-service by the end of the fourth quarter of 2019. CET Gas owns a 12.5 percent interest in the Mountain Valley Pipeline. (page 75) Clean Energy Businesses • The Clean Energy Businesses have 1,630 MW (AC) of renewable energy production projects in service (1,418 MW) or under construction (212 MW). (page 74) • 2,087 million of kWh of electricity was generated from solar projects and 776 million of kWh generated from wind projects through the nine months ending September 30, 2018. (page 75) • In September 2018, a Con Edison Development subsidiary agreed to purchase Sempra Solar Holdings, LLC, which has ownership interests in 981 megawatts (AC) of operating renewable electric production projects, including its 379 megawatts (AC) share of projects in which its subsidiaries have a 50 percent ownership interest and Con Edison Development subsidiaries have the remaining ownership interests. (page 42) • The Clean Energy Businesses update that begins on page 38 of this document contains additional information about the Sempra Solar Holdings transaction. CEI Parent • In August 2018, the IRS and Treasury issued proposed regulations that clarified provisions in TCJA on the allowance for additional first-year depreciation for qualified property of regulated public utilities placed in service in the fourth quarter of 2017. Under this guidance, the Utilities deducted $477 million in additional depreciation in Con Edison’s 2017 federal tax return. The additional depreciation increased Con Edison’s 2017 federal NOL carryover to $563 million (CECONY’s 2017 federal NOL carryover is $153 million), which required a re-measurement of deferred tax assets and liabilities associated with the filing of its 2017 federal tax return. As a result, Con Edison decreased its net deferred tax liabilities by $16 million (including $51 million for CECONY), recognized $42 million in income tax expense at the parent company related to re- measuring the 2017 federal NOL carryover to 2018 and accrued a regulatory liability for future income tax of $58 million (including $51 million for CECONY). The Companies expect to complete their assessment and record any final adjustments to the provisional amounts by the fourth quarter of 2018. (page 32-33) a. Page references to 3Q 2018 Form 10-Q. 13

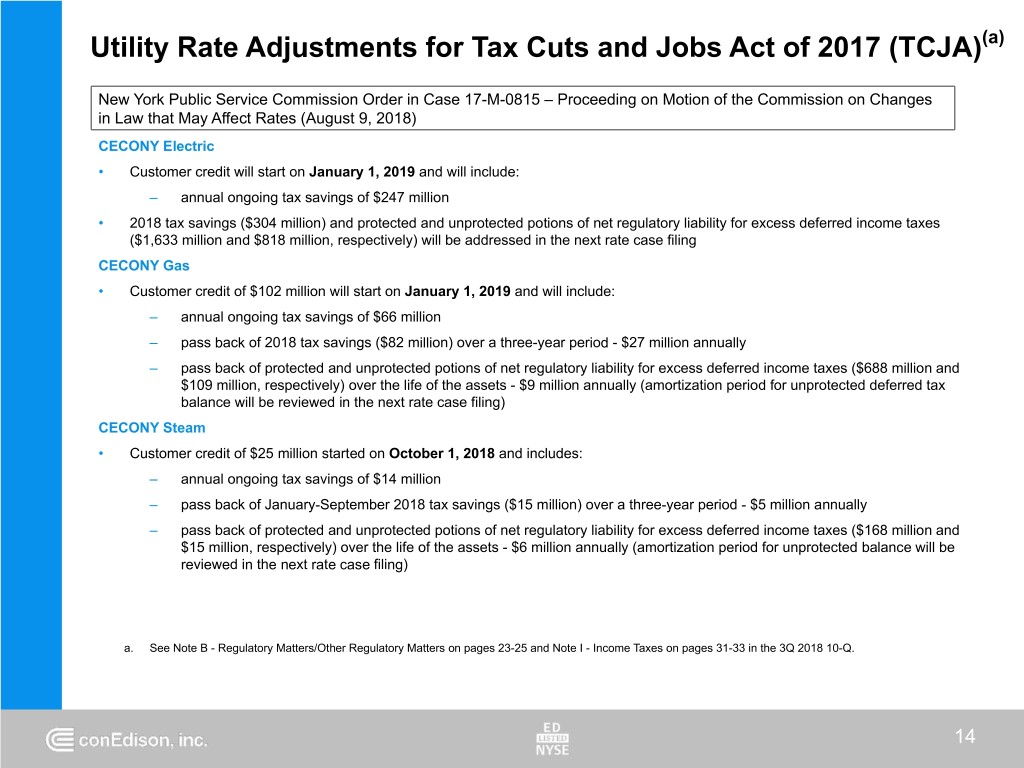

Utility Rate Adjustments for Tax Cuts and Jobs Act of 2017 (TCJA)(a) New York Public Service Commission Order in Case 17-M-0815 – Proceeding on Motion of the Commission on Changes in Law that May Affect Rates (August 9, 2018) CECONY Electric • Customer credit will start on January 1, 2019 and will include: – annual ongoing tax savings of $247 million • 2018 tax savings ($304 million) and protected and unprotected potions of net regulatory liability for excess deferred income taxes ($1,633 million and $818 million, respectively) will be addressed in the next rate case filing CECONY Gas • Customer credit of $102 million will start on January 1, 2019 and will include: – annual ongoing tax savings of $66 million – pass back of 2018 tax savings ($82 million) over a three-year period - $27 million annually – pass back of protected and unprotected potions of net regulatory liability for excess deferred income taxes ($688 million and $109 million, respectively) over the life of the assets - $9 million annually (amortization period for unprotected deferred tax balance will be reviewed in the next rate case filing) CECONY Steam • Customer credit of $25 million started on October 1, 2018 and includes: – annual ongoing tax savings of $14 million – pass back of January-September 2018 tax savings ($15 million) over a three-year period - $5 million annually – pass back of protected and unprotected potions of net regulatory liability for excess deferred income taxes ($168 million and $15 million, respectively) over the life of the assets - $6 million annually (amortization period for unprotected balance will be reviewed in the next rate case filing) a. See Note B - Regulatory Matters/Other Regulatory Matters on pages 23-25 and Note I - Income Taxes on pages 31-33 in the 3Q 2018 10-Q. 14

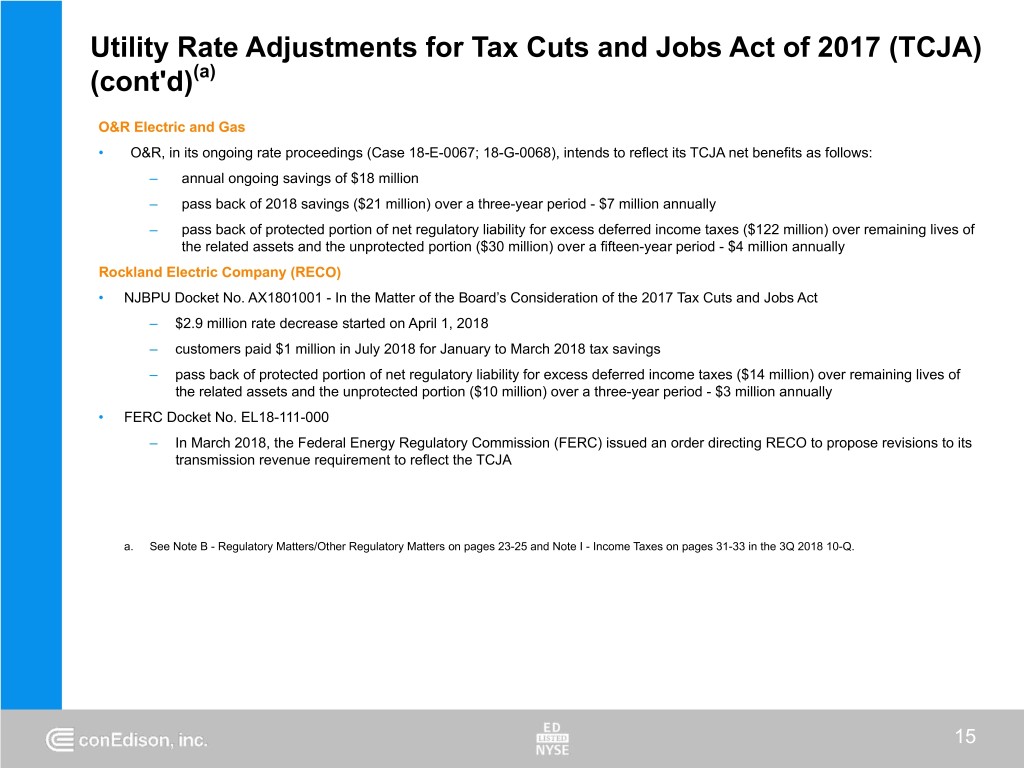

Utility Rate Adjustments for Tax Cuts and Jobs Act of 2017 (TCJA) (cont'd)(a) O&R Electric and Gas • O&R, in its ongoing rate proceedings (Case 18-E-0067; 18-G-0068), intends to reflect its TCJA net benefits as follows: – annual ongoing savings of $18 million – pass back of 2018 savings ($21 million) over a three-year period - $7 million annually – pass back of protected portion of net regulatory liability for excess deferred income taxes ($122 million) over remaining lives of the related assets and the unprotected portion ($30 million) over a fifteen-year period - $4 million annually Rockland Electric Company (RECO) • NJBPU Docket No. AX1801001 - In the Matter of the Board’s Consideration of the 2017 Tax Cuts and Jobs Act – $2.9 million rate decrease started on April 1, 2018 – customers paid $1 million in July 2018 for January to March 2018 tax savings – pass back of protected portion of net regulatory liability for excess deferred income taxes ($14 million) over remaining lives of the related assets and the unprotected portion ($10 million) over a three-year period - $3 million annually • FERC Docket No. EL18-111-000 – In March 2018, the Federal Energy Regulatory Commission (FERC) issued an order directing RECO to propose revisions to its transmission revenue requirement to reflect the TCJA a. See Note B - Regulatory Matters/Other Regulatory Matters on pages 23-25 and Note I - Income Taxes on pages 31-33 in the 3Q 2018 10-Q. 15

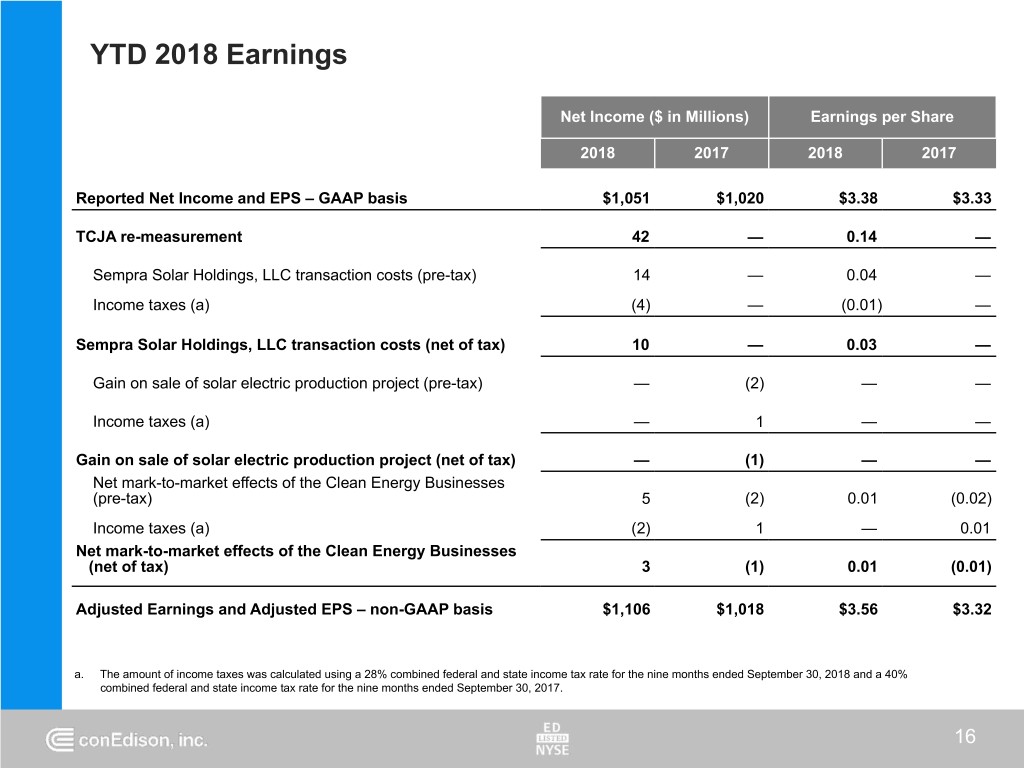

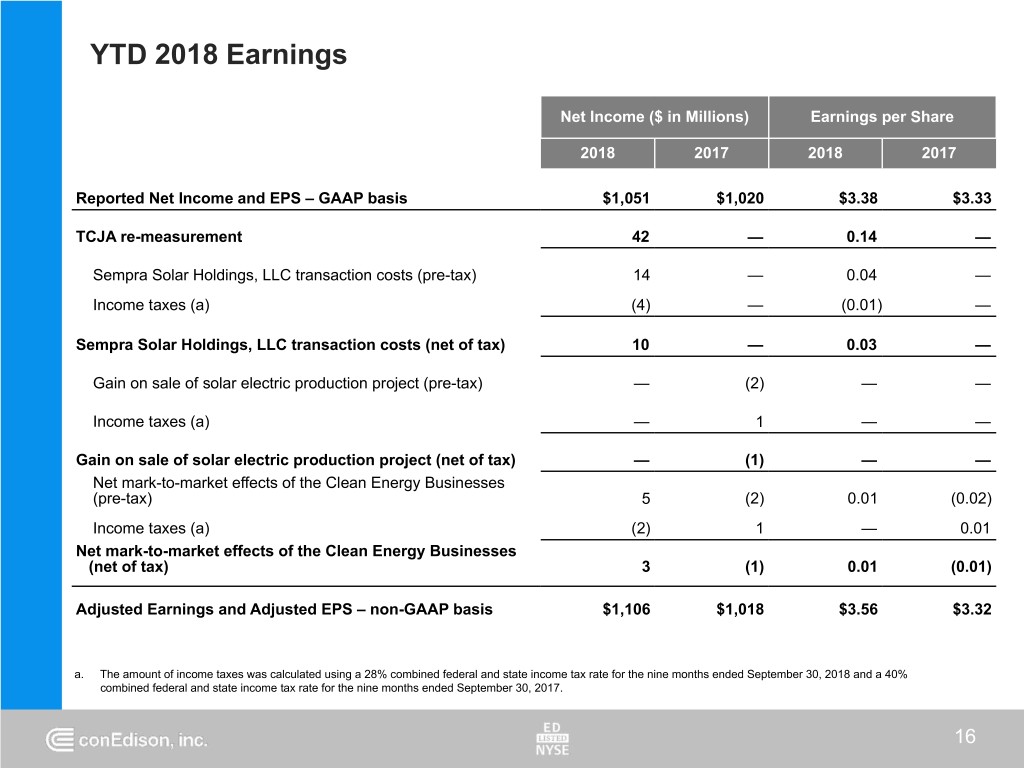

YTD 2018 Earnings Net Income ($ in Millions) Earnings per Share 2018 2017 2018 2017 Reported Net Income and EPS – GAAP basis $1,051 $1,020 $3.38 $3.33 TCJA re-measurement 42 — 0.14 — Sempra Solar Holdings, LLC transaction costs (pre-tax) 14 — 0.04 — Income taxes (a) (4) — (0.01) — Sempra Solar Holdings, LLC transaction costs (net of tax) 10 — 0.03 — Gain on sale of solar electric production project (pre-tax) — (2) — — Income taxes (a) — 1 — — Gain on sale of solar electric production project (net of tax) — (1) — — Net mark-to-market effects of the Clean Energy Businesses (pre-tax) 5 (2) 0.01 (0.02) Income taxes (a) (2) 1 — 0.01 Net mark-to-market effects of the Clean Energy Businesses (net of tax) 3 (1) 0.01 (0.01) Adjusted Earnings and Adjusted EPS – non-GAAP basis $1,106 $1,018 $3.56 $3.32 a. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the nine months ended September 30, 2018 and a 40% combined federal and state income tax rate for the nine months ended September 30, 2017. 16

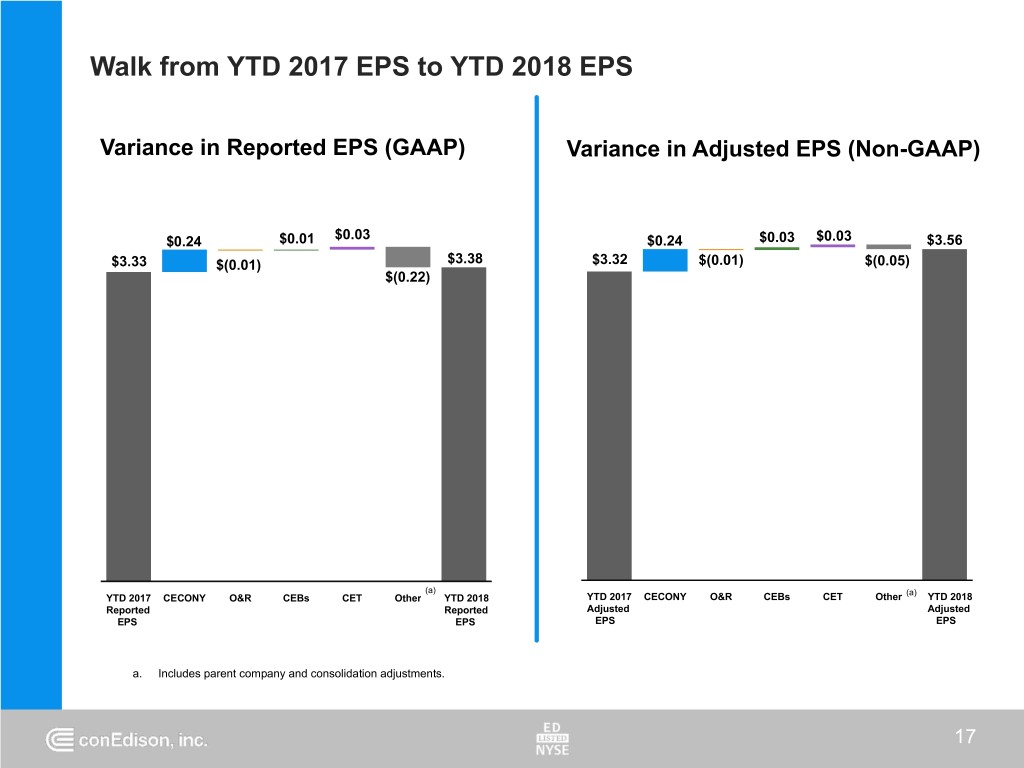

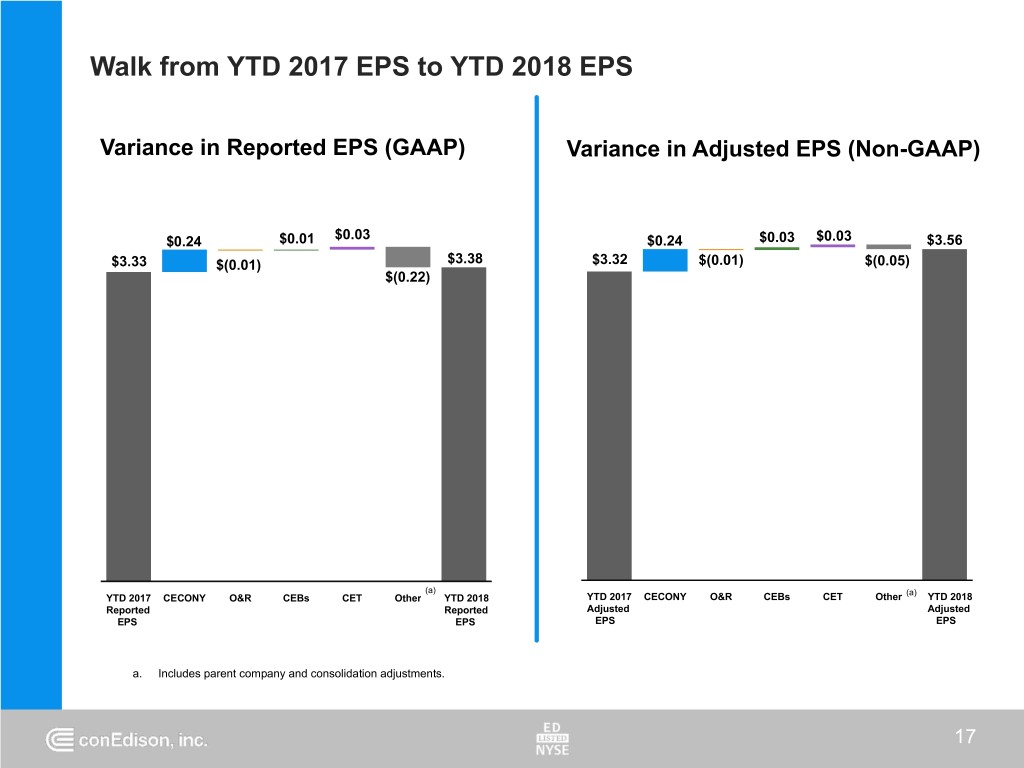

Walk from YTD 2017 EPS to YTD 2018 EPS Variance in Reported EPS (GAAP) Variance in Adjusted EPS (Non-GAAP) $0.03 $0.24 $0.01 $0.24 $0.03 $0.03 $3.56 $3.33 $(0.01) $3.38 $3.32 $(0.01) $(0.05) $(0.22) (a) (a) YTD 2017 CECONY O&R CEBs CET Other YTD 2018 YTD 2017 CECONY O&R CEBs CET Other YTD 2018 Reported Reported Adjusted Adjusted EPS EPS EPS EPS a. Includes parent company and consolidation adjustments. 17

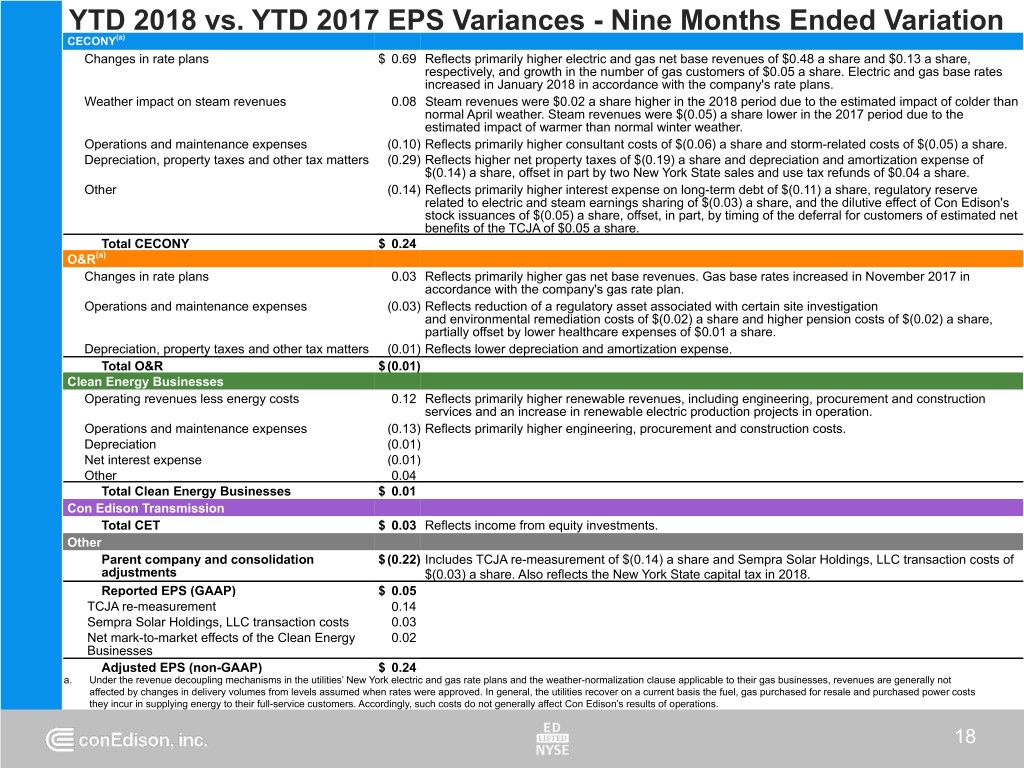

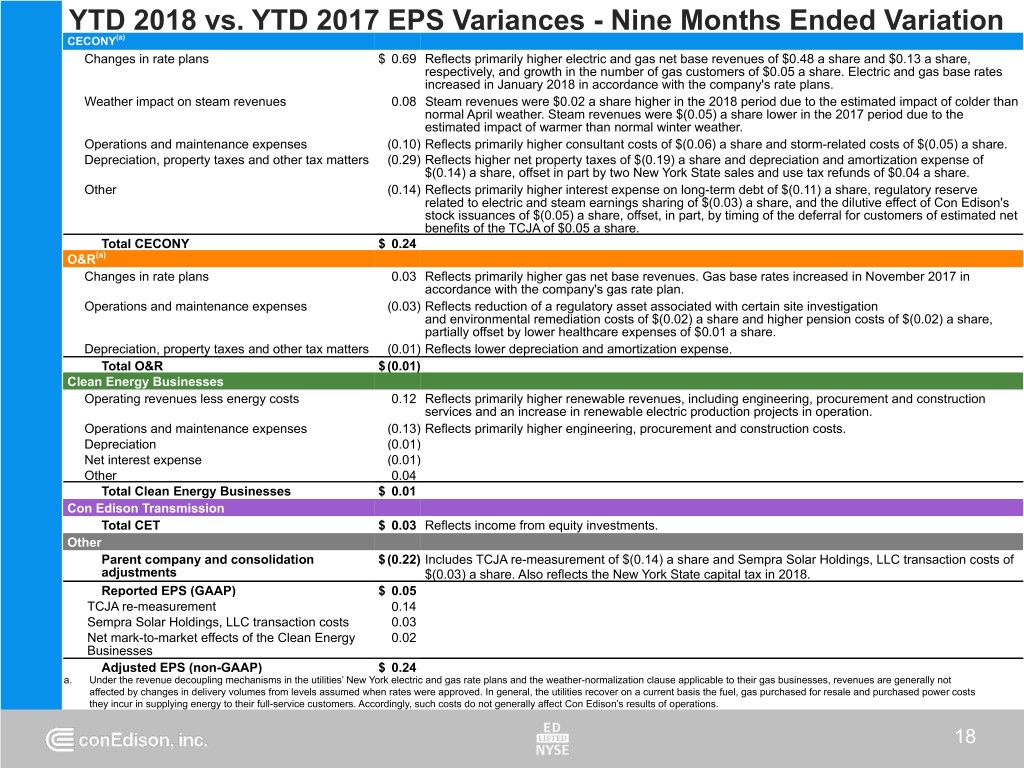

YTD 2018 vs. YTD 2017 EPS Variances - Nine Months Ended Variation CECONY(a) Changes in rate plans $ 0.69 Reflects primarily higher electric and gas net base revenues of $0.48 a share and $0.13 a share, respectively, and growth in the number of gas customers of $0.05 a share. Electric and gas base rates increased in January 2018 in accordance with the company's rate plans. Weather impact on steam revenues 0.08 Steam revenues were $0.02 a share higher in the 2018 period due to the estimated impact of colder than normal April weather. Steam revenues were $(0.05) a share lower in the 2017 period due to the estimated impact of warmer than normal winter weather. Operations and maintenance expenses (0.10) Reflects primarily higher consultant costs of $(0.06) a share and storm-related costs of $(0.05) a share. Depreciation, property taxes and other tax matters (0.29) Reflects higher net property taxes of $(0.19) a share and depreciation and amortization expense of $(0.14) a share, offset in part by two New York State sales and use tax refunds of $0.04 a share. Other (0.14) Reflects primarily higher interest expense on long-term debt of $(0.11) a share, regulatory reserve related to electric and steam earnings sharing of $(0.03) a share, and the dilutive effect of Con Edison's stock issuances of $(0.05) a share, offset, in part, by timing of the deferral for customers of estimated net benefits of the TCJA of $0.05 a share. Total CECONY $ 0.24 O&R(a) Changes in rate plans 0.03 Reflects primarily higher gas net base revenues. Gas base rates increased in November 2017 in accordance with the company's gas rate plan. Operations and maintenance expenses (0.03) Reflects reduction of a regulatory asset associated with certain site investigation and environmental remediation costs of $(0.02) a share and higher pension costs of $(0.02) a share, partially offset by lower healthcare expenses of $0.01 a share. Depreciation, property taxes and other tax matters (0.01) Reflects lower depreciation and amortization expense. Total O&R $ (0.01) Clean Energy Businesses Operating revenues less energy costs 0.12 Reflects primarily higher renewable revenues, including engineering, procurement and construction services and an increase in renewable electric production projects in operation. Operations and maintenance expenses (0.13) Reflects primarily higher engineering, procurement and construction costs. Depreciation (0.01) Net interest expense (0.01) Other 0.04 Total Clean Energy Businesses $ 0.01 Con Edison Transmission Total CET $ 0.03 Reflects income from equity investments. Other Parent company and consolidation $ (0.22) Includes TCJA re-measurement of $(0.14) a share and Sempra Solar Holdings, LLC transaction costs of adjustments $(0.03) a share. Also reflects the New York State capital tax in 2018. Reported EPS (GAAP) $ 0.05 TCJA re-measurement 0.14 Sempra Solar Holdings, LLC transaction costs 0.03 Net mark-to-market effects of the Clean Energy 0.02 Businesses Adjusted EPS (non-GAAP) $ 0.24 a. Under the revenue decoupling mechanisms in the utilities’ New York electric and gas rate plans and the weather-normalization clause applicable to their gas businesses, revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. In general, the utilities recover on a current basis the fuel, gas purchased for resale and purchased power costs they incur in supplying energy to their full-service customers. Accordingly, such costs do not generally affect Con Edison’s results of operations. 18

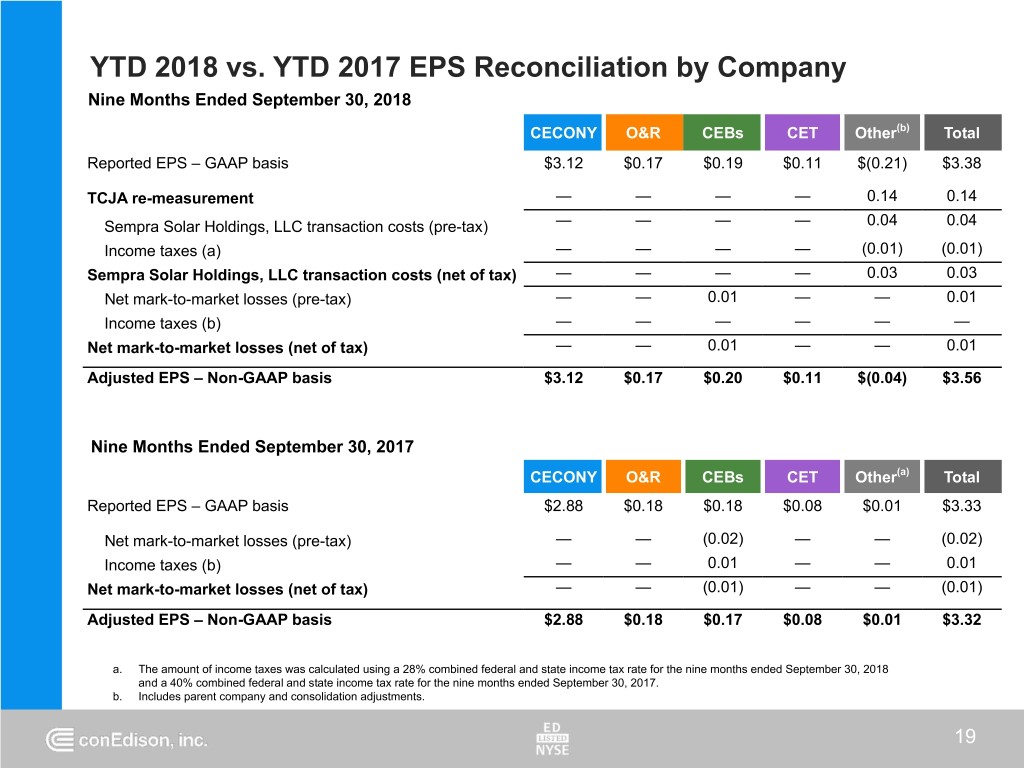

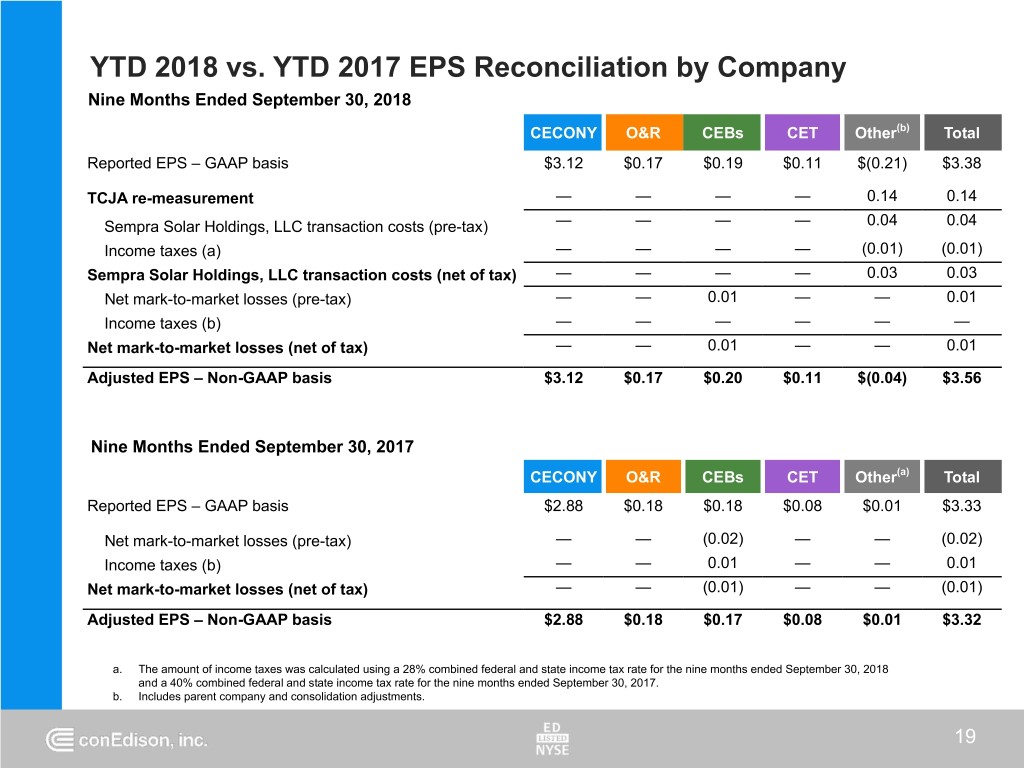

YTD 2018 vs. YTD 2017 EPS Reconciliation by Company Nine Months Ended September 30, 2018 CECONY O&R CEBs CET Other(b) Total Reported EPS – GAAP basis $3.12 $0.17 $0.19 $0.11 $(0.21) $3.38 TCJA re-measurement — — — — 0.14 0.14 Sempra Solar Holdings, LLC transaction costs (pre-tax) — — — — 0.04 0.04 Income taxes (a) — — — — (0.01) (0.01) Sempra Solar Holdings, LLC transaction costs (net of tax) — — — — 0.03 0.03 Net mark-to-market losses (pre-tax) — — 0.01 — — 0.01 Income taxes (b) — — — — — — Net mark-to-market losses (net of tax) — — 0.01 — — 0.01 Adjusted EPS – Non-GAAP basis $3.12 $0.17 $0.20 $0.11 $(0.04) $3.56 Nine Months Ended September 30, 2017 CECONY O&R CEBs CET Other(a) Total Reported EPS – GAAP basis $2.88 $0.18 $0.18 $0.08 $0.01 $3.33 Net mark-to-market losses (pre-tax) — — (0.02) — — (0.02) Income taxes (b) — — 0.01 — — 0.01 Net mark-to-market losses (net of tax) — — (0.01) — — (0.01) Adjusted EPS – Non-GAAP basis $2.88 $0.18 $0.17 $0.08 $0.01 $3.32 a. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the nine months ended September 30, 2018 and a 40% combined federal and state income tax rate for the nine months ended September 30, 2017. b. Includes parent company and consolidation adjustments. 19

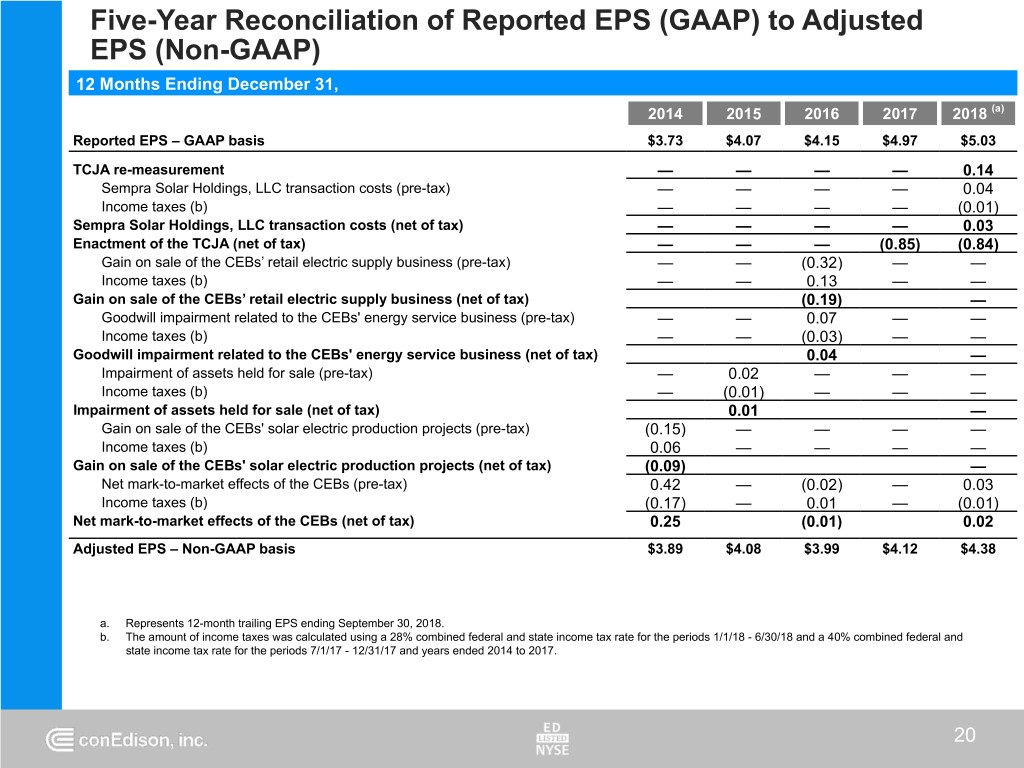

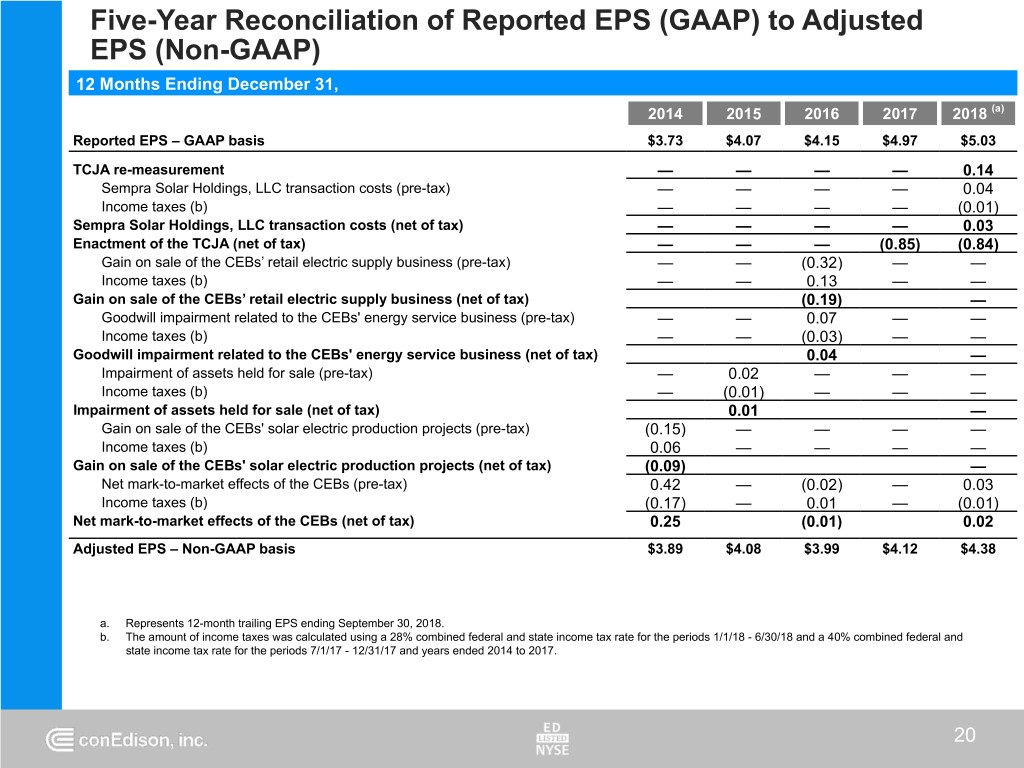

Five-Year Reconciliation of Reported EPS (GAAP) to Adjusted EPS (Non-GAAP) 12 Months Ending December 31, 2014 2015 2016 2017 2018 (a) Reported EPS – GAAP basis $3.73 $4.07 $4.15 $4.97 $5.03 TCJA re-measurement — — — — 0.14 Sempra Solar Holdings, LLC transaction costs (pre-tax) — — — — 0.04 Income taxes (b) — — — — (0.01) Sempra Solar Holdings, LLC transaction costs (net of tax) — — — — 0.03 Enactment of the TCJA (net of tax) — — — (0.85) (0.84) Gain on sale of the CEBs’ retail electric supply business (pre-tax) — — (0.32) — — Income taxes (b) — — 0.13 — — Gain on sale of the CEBs’ retail electric supply business (net of tax) (0.19) — Goodwill impairment related to the CEBs' energy service business (pre-tax) — — 0.07 — — Income taxes (b) — — (0.03) — — Goodwill impairment related to the CEBs' energy service business (net of tax) 0.04 — Impairment of assets held for sale (pre-tax) — 0.02 — — — Income taxes (b) — (0.01) — — — Impairment of assets held for sale (net of tax) 0.01 — Gain on sale of the CEBs' solar electric production projects (pre-tax) (0.15) — — — — Income taxes (b) 0.06 — — — — Gain on sale of the CEBs' solar electric production projects (net of tax) (0.09) — Net mark-to-market effects of the CEBs (pre-tax) 0.42 — (0.02) — 0.03 Income taxes (b) (0.17) — 0.01 — (0.01) Net mark-to-market effects of the CEBs (net of tax) 0.25 (0.01) 0.02 Adjusted EPS – Non-GAAP basis $3.89 $4.08 $3.99 $4.12 $4.38 a. Represents 12-month trailing EPS ending September 30, 2018. b. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the periods 1/1/18 - 6/30/18 and a 40% combined federal and state income tax rate for the periods 7/1/17 - 12/31/17 and years ended 2014 to 2017. 20

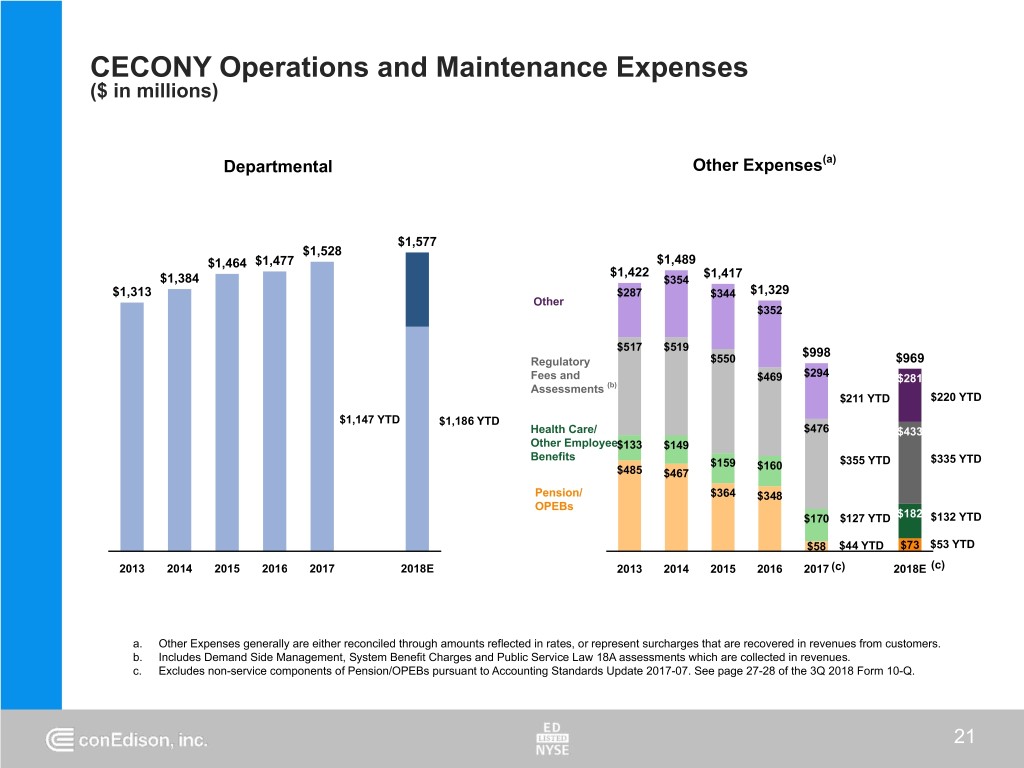

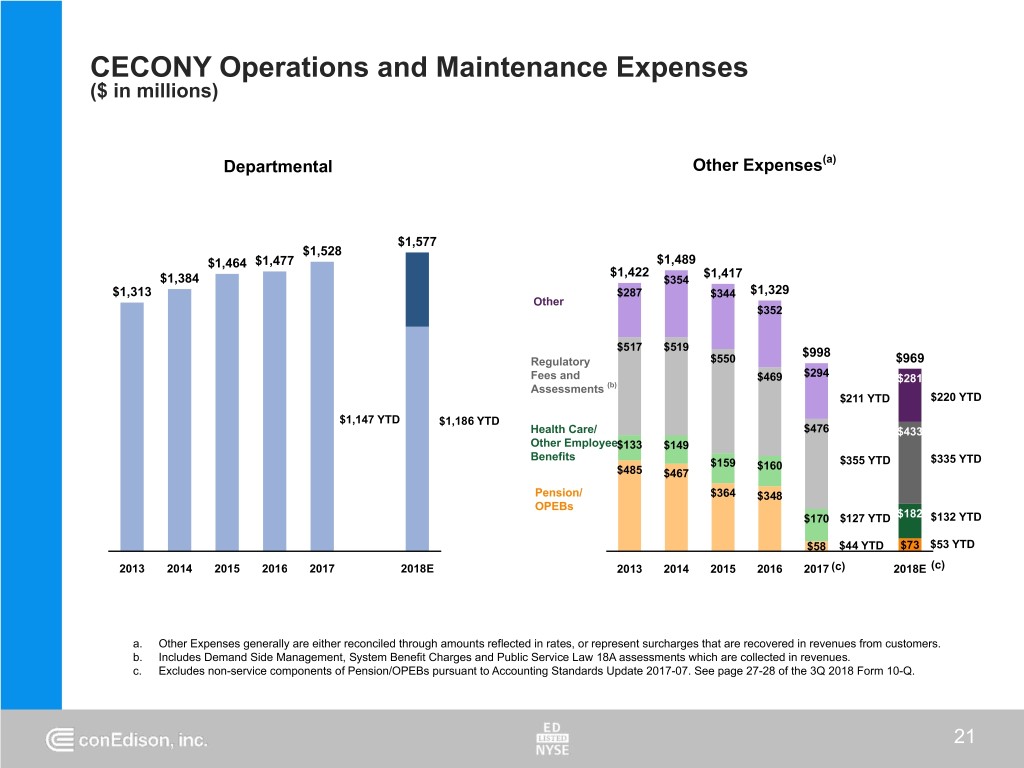

CECONY Operations and Maintenance Expenses ($ in millions) Departmental Other Expenses(a) $1,577 $1,528 $1,464 $1,477 $1,489 $1,422 $1,417 $1,384 $354 $1,313 $287 $344 $1,329 Other $352 $517 $519 $998 Regulatory $550 $969 Fees and $469 $294 $281 Assessments (b) $211 YTD $220 YTD $1,147 YTD $1,186 YTD Health Care/ $476 $433 Other Employee$133 $149 Benefits $335 YTD $159 $160 $355 YTD $485 $467 Pension/ $364 $348 OPEBs $170 $127 YTD $182 $132 YTD $58 $44 YTD $73 $53 YTD 2013 2014 2015 2016 2017 2018E 2013 2014 2015 2016 2017 (c) 2018E (c) a. Other Expenses generally are either reconciled through amounts reflected in rates, or represent surcharges that are recovered in revenues from customers. b. Includes Demand Side Management, System Benefit Charges and Public Service Law 18A assessments which are collected in revenues. c. Excludes non-service components of Pension/OPEBs pursuant to Accounting Standards Update 2017-07. See page 27-28 of the 3Q 2018 Form 10-Q. 21

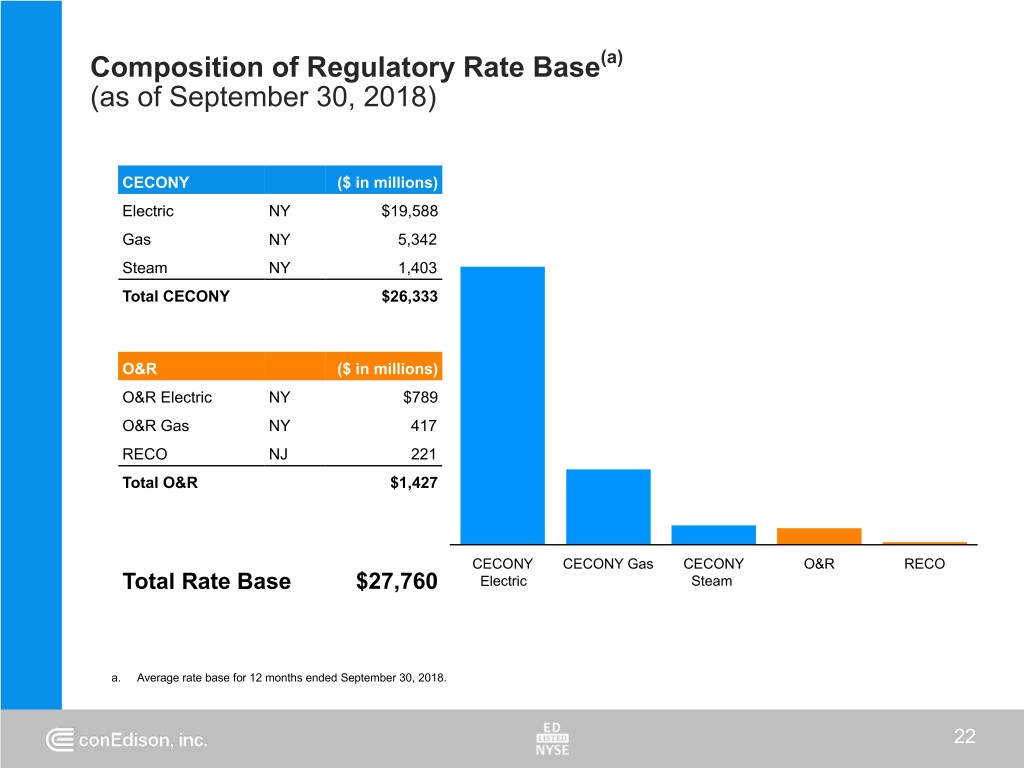

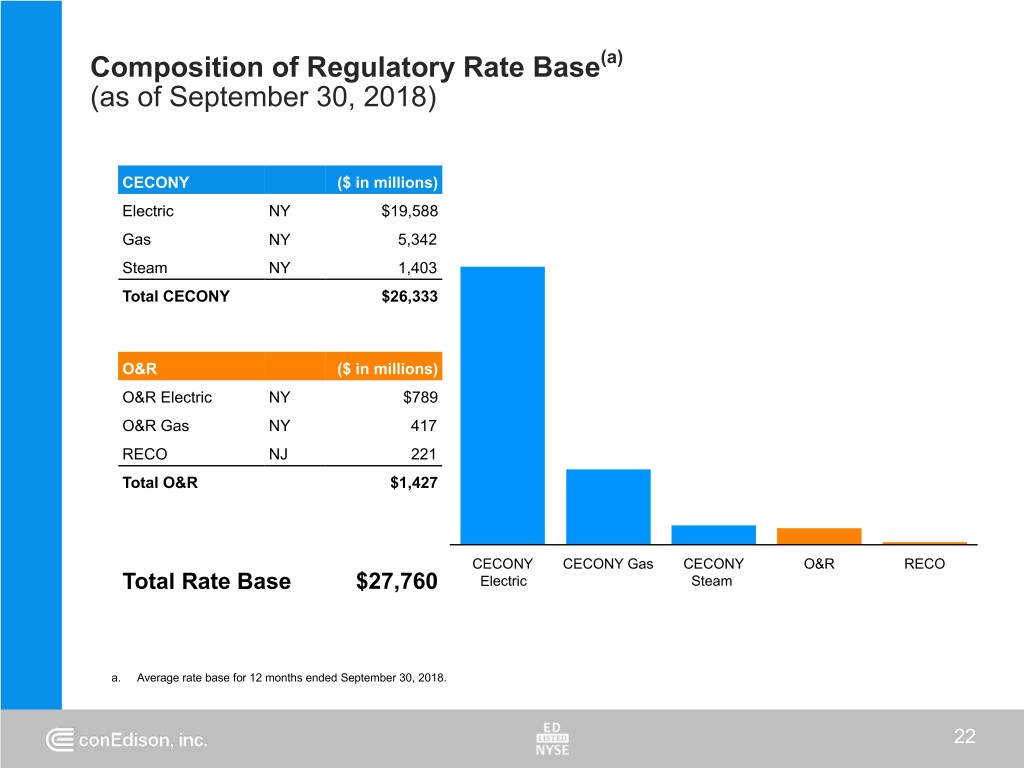

Composition of Regulatory Rate Base(a) (as of September 30, 2018) CECONY ($ in millions) Electric NY $19,588 Gas NY 5,342 Steam NY 1,403 Total CECONY $26,333 O&R ($ in millions) O&R Electric NY $789 O&R Gas NY 417 RECO NJ 221 Total O&R $1,427 CECONY CECONY Gas CECONY O&R RECO Total Rate Base $27,760 Electric Steam a. Average rate base for 12 months ended September 30, 2018. 22

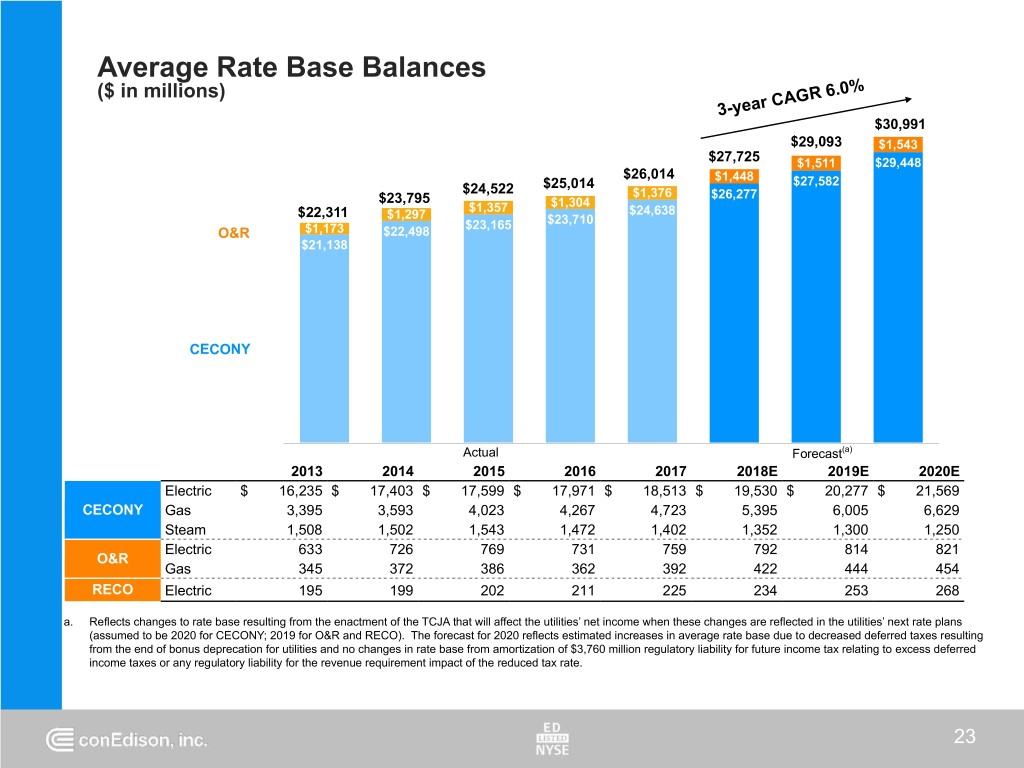

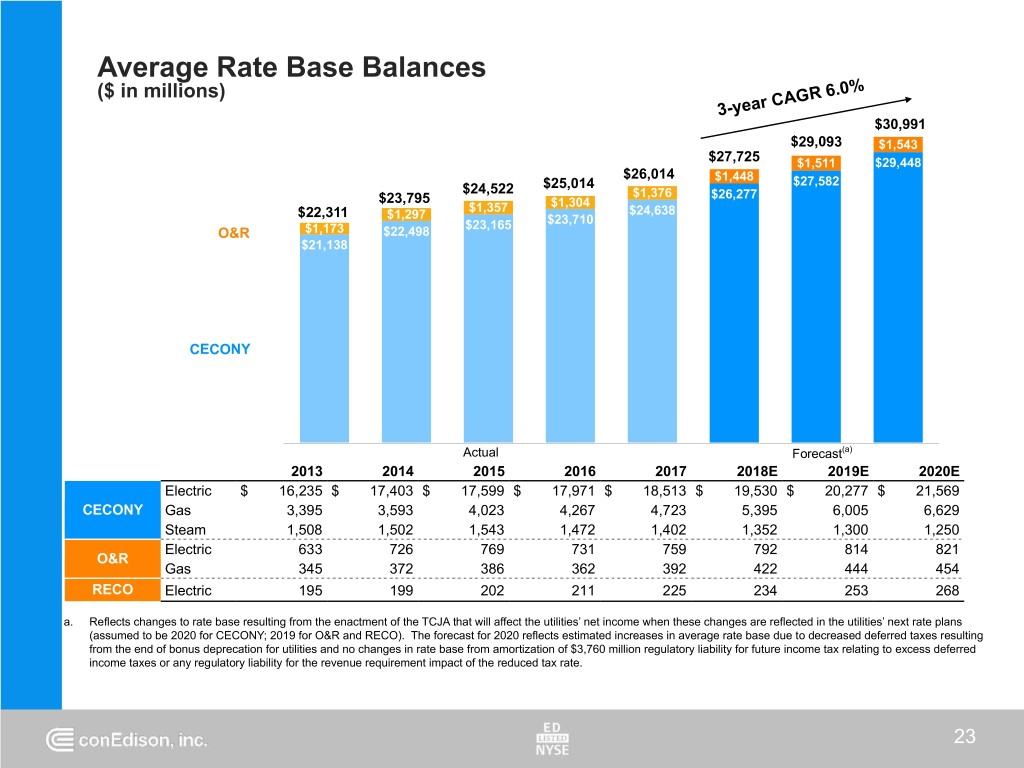

Average Rate Base Balances ($ in millions) 3-year CAGR 6.0% $30,991 $29,093 $1,543 $27,725 $1,511 $29,448 $26,014 $1,448 $27,582 $24,522 $25,014 $23,795 $1,376 $26,277 $1,357 $1,304 $22,311 $1,297 $24,638 $23,165 $23,710 O&R $1,173 $22,498 $21,138 CECONY Actual Forecast(a) 2013 2014 2015 2016 2017 2018E 2019E 2020E Electric $ 16,235 $ 17,403 $ 17,599 $ 17,971 $ 18,513 $ 19,530 $ 20,277 $ 21,569 CECONY Gas 3,395 3,593 4,023 4,267 4,723 5,395 6,005 6,629 Steam 1,508 1,502 1,543 1,472 1,402 1,352 1,300 1,250 Electric 633 726 769 731 759 792 814 821 O&R Gas 345 372 386 362 392 422 444 454 RECO Electric 195 199 202 211 225 234 253 268 a. Reflects changes to rate base resulting from the enactment of the TCJA that will affect the utilities’ net income when these changes are reflected in the utilities’ next rate plans (assumed to be 2020 for CECONY; 2019 for O&R and RECO). The forecast for 2020 reflects estimated increases in average rate base due to decreased deferred taxes resulting from the end of bonus deprecation for utilities and no changes in rate base from amortization of $3,760 million regulatory liability for future income tax relating to excess deferred income taxes or any regulatory liability for the revenue requirement impact of the reduced tax rate. 23

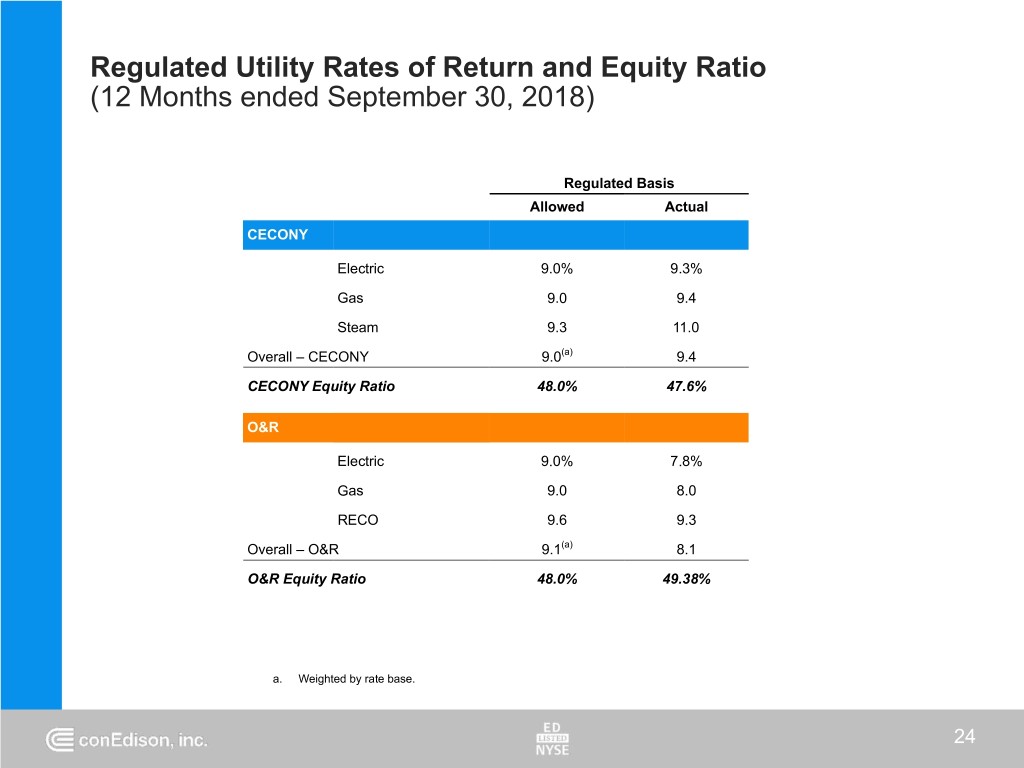

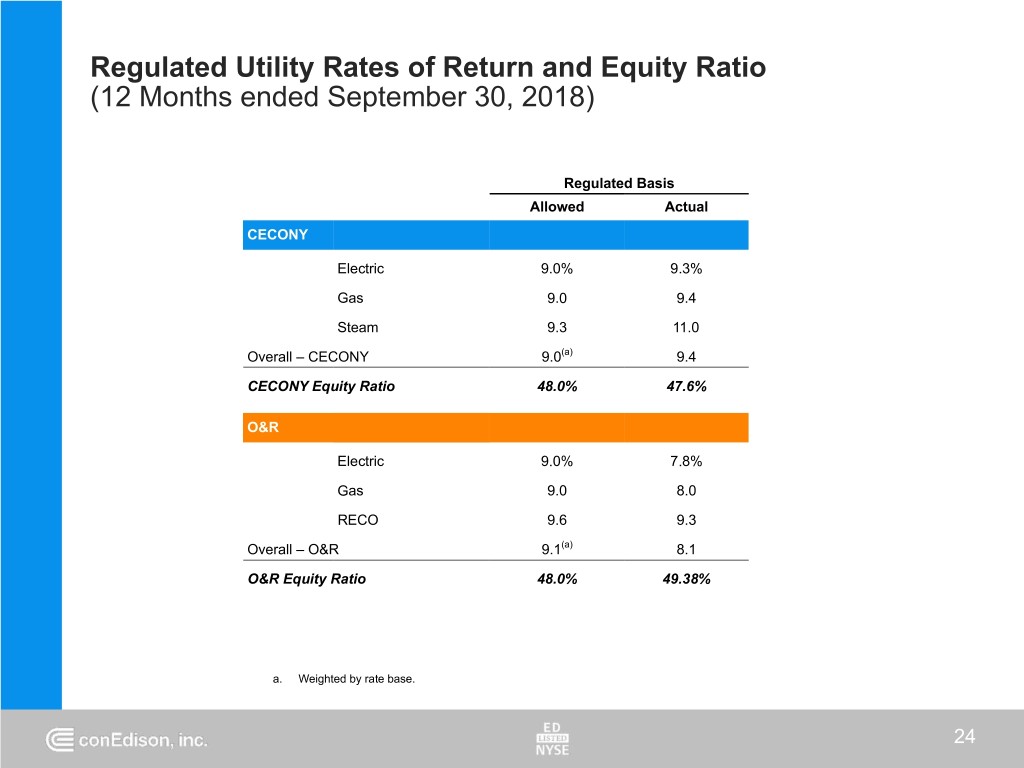

Regulated Utility Rates of Return and Equity Ratio (12 Months ended September 30, 2018) Regulated Basis Allowed Actual CECONY Electric 9.0% 9.3% Gas 9.0 9.4 Steam 9.3 11.0 Overall – CECONY 9.0(a) 9.4 CECONY Equity Ratio 48.0% 47.6% O&R Electric 9.0% 7.8% Gas 9.0 8.0 RECO 9.6 9.3 Overall – O&R 9.1(a) 8.1 O&R Equity Ratio 48.0% 49.38% a. Weighted by rate base. 24

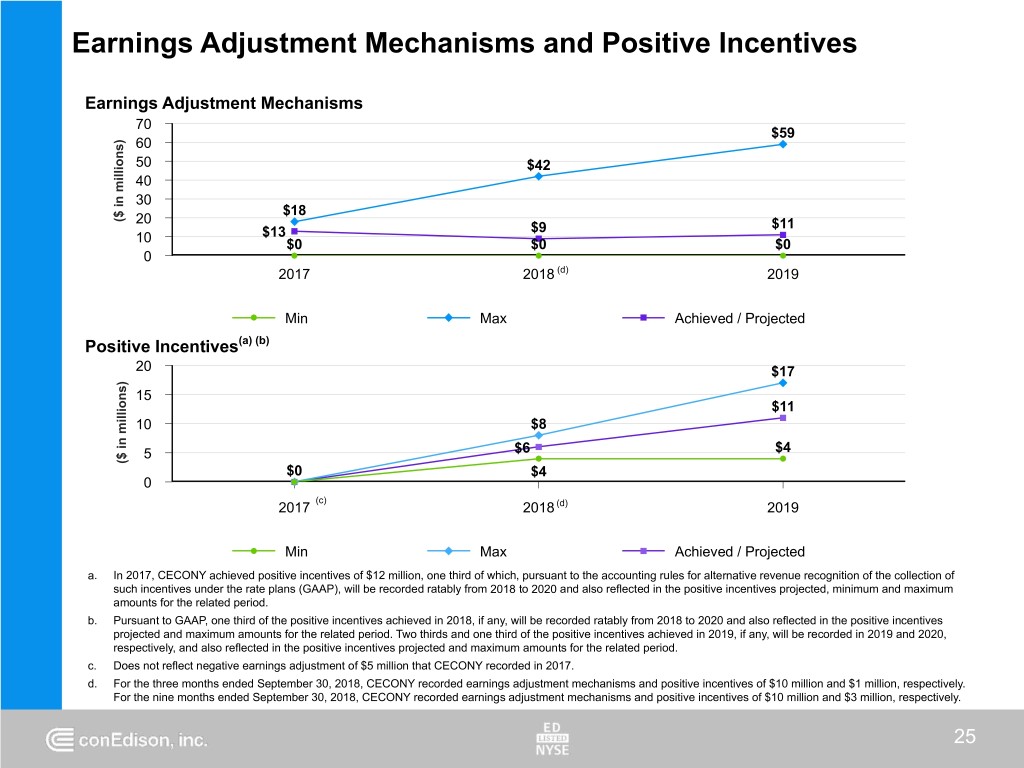

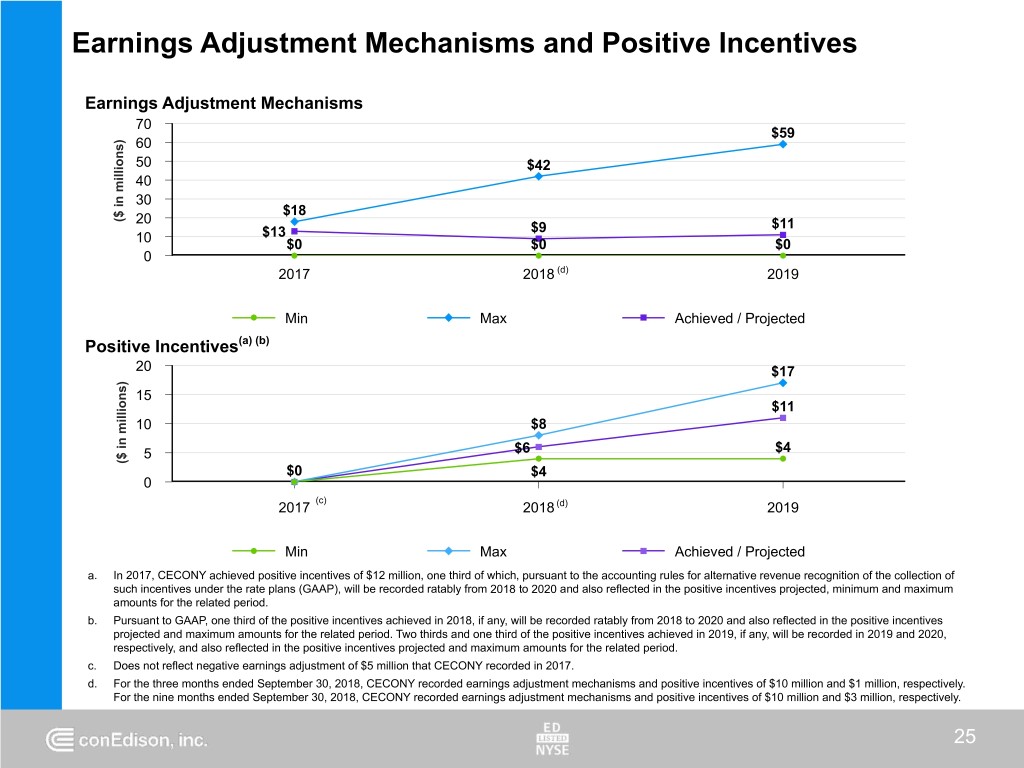

Earnings Adjustment Mechanisms and Positive Incentives Earnings Adjustment Mechanisms 70 $59 60 50 $42 40 30 $18 ($ in millions) 20 $11 $13 $9 10 $0 $0 $0 0 2017 2018 (d) 2019 Min Max Achieved / Projected Positive Incentives(a) (b) 20 $17 15 $11 10 $8 5 $6 $4 ($ in millions) $0 $4 0 (c) 2017 2018 (d) 2019 Min Max Achieved / Projected a. In 2017, CECONY achieved positive incentives of $12 million, one third of which, pursuant to the accounting rules for alternative revenue recognition of the collection of such incentives under the rate plans (GAAP), will be recorded ratably from 2018 to 2020 and also reflected in the positive incentives projected, minimum and maximum amounts for the related period. b. Pursuant to GAAP, one third of the positive incentives achieved in 2018, if any, will be recorded ratably from 2018 to 2020 and also reflected in the positive incentives projected and maximum amounts for the related period. Two thirds and one third of the positive incentives achieved in 2019, if any, will be recorded in 2019 and 2020, respectively, and also reflected in the positive incentives projected and maximum amounts for the related period. c. Does not reflect negative earnings adjustment of $5 million that CECONY recorded in 2017. d. For the three months ended September 30, 2018, CECONY recorded earnings adjustment mechanisms and positive incentives of $10 million and $1 million, respectively. For the nine months ended September 30, 2018, CECONY recorded earnings adjustment mechanisms and positive incentives of $10 million and $3 million, respectively. 25

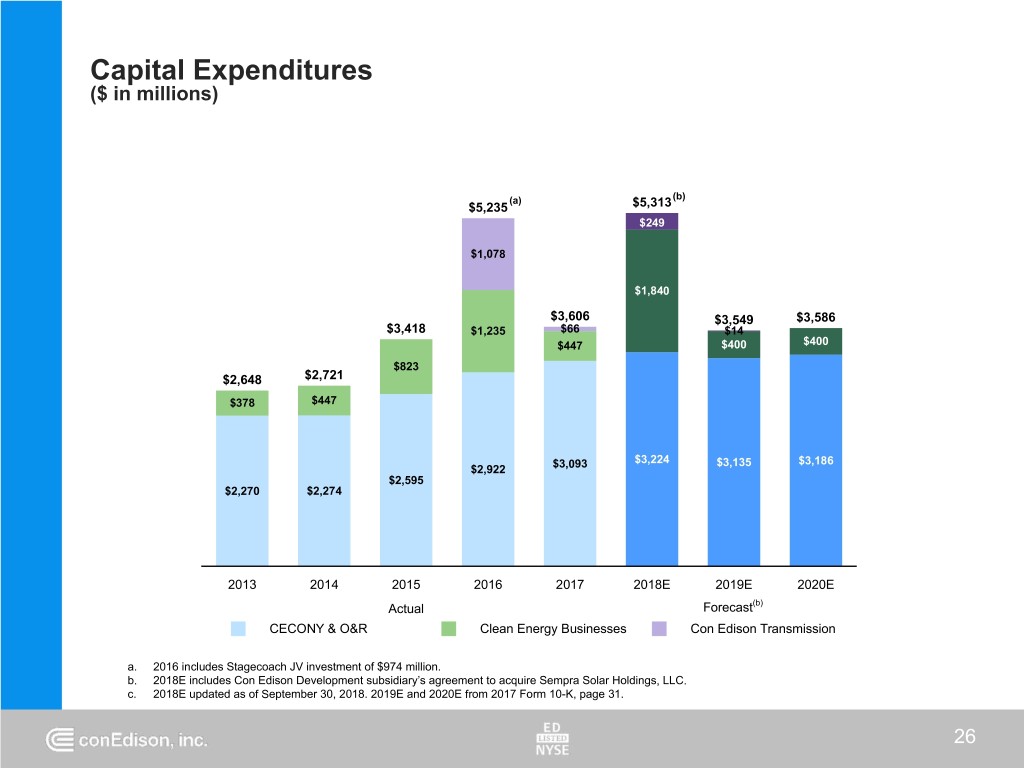

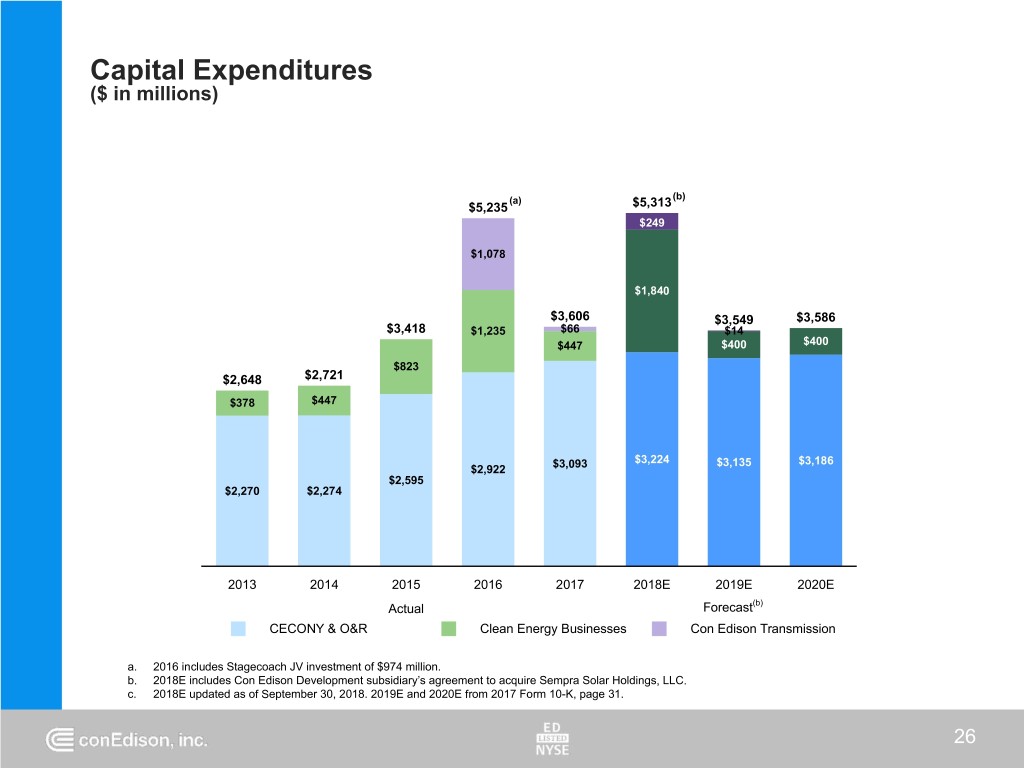

Capital Expenditures ($ in millions) (a) (b) $5,235 $5,313 $249 $1,078 $1,840 $3,606 $3,549 $3,586 $3,418 $1,235 $66 $14 $447 $400 $400 $823 $2,648 $2,721 $378 $447 $3,093 $3,224 $3,135 $3,186 $2,922 $2,595 $2,270 $2,274 2013 2014 2015 2016 2017 2018E 2019E 2020E Actual Forecast(b) CECONY & O&R Clean Energy Businesses Con Edison Transmission a. 2016 includes Stagecoach JV investment of $974 million. b. 2018E includes Con Edison Development subsidiary’s agreement to acquire Sempra Solar Holdings, LLC. c. 2018E updated as of September 30, 2018. 2019E and 2020E from 2017 Form 10-K, page 31. 26

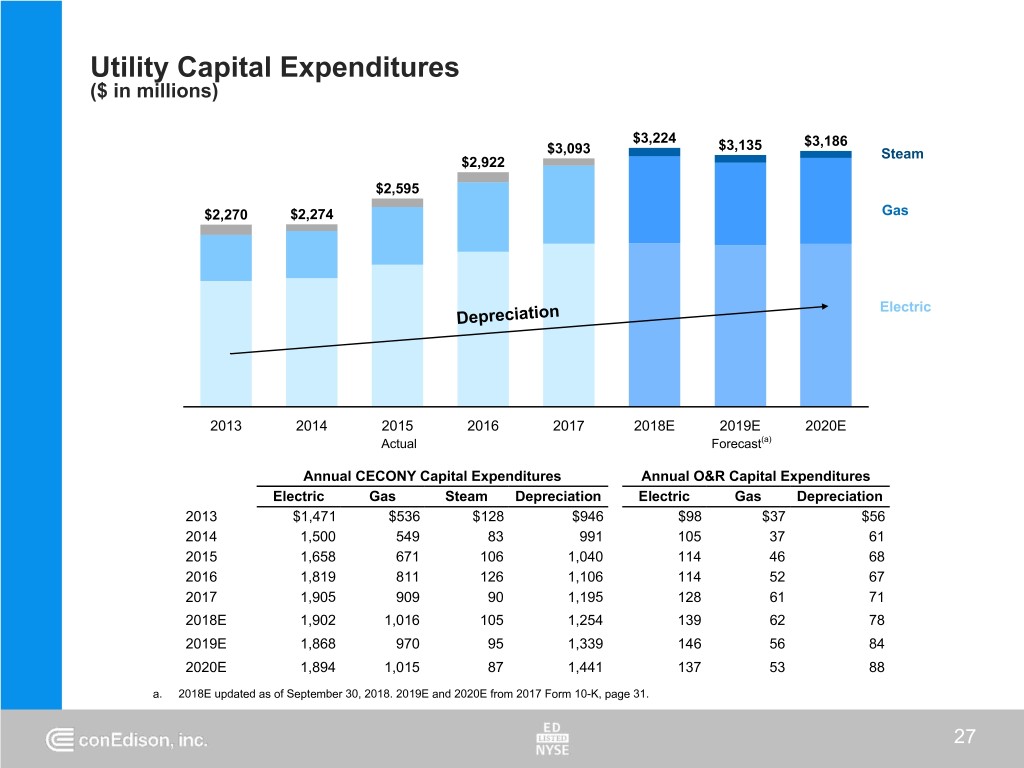

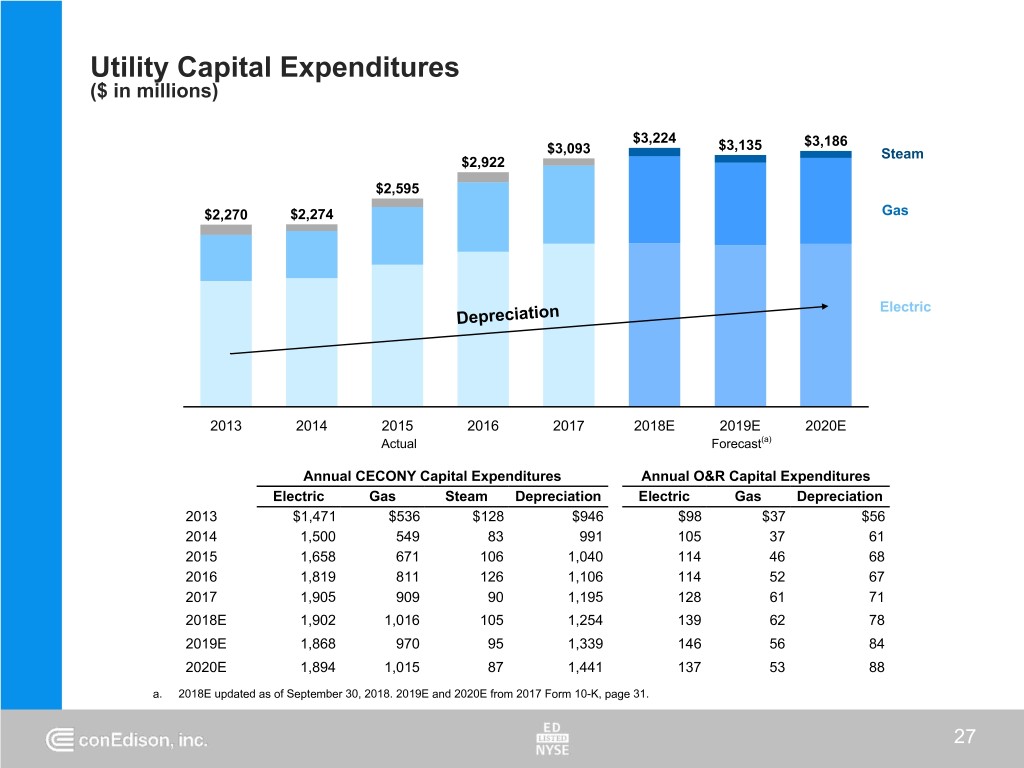

Utility Capital Expenditures ($ in millions) $3,224 $3,135 $3,186 $3,093 Steam $2,922 $2,595 $2,270 $2,274 Gas Electric Depreciation 2013 2014 2015 2016 2017 2018E 2019E 2020E Actual Forecast(a) Annual CECONY Capital Expenditures Annual O&R Capital Expenditures Electric Gas Steam Depreciation Electric Gas Depreciation 2013 $1,471 $536 $128 $946 $98 $37 $56 2014 1,500 549 83 991 105 37 61 2015 1,658 671 106 1,040 114 46 68 2016 1,819 811 126 1,106 114 52 67 2017 1,905 909 90 1,195 128 61 71 2018E 1,902 1,016 105 1,254 139 62 78 2019E 1,868 970 95 1,339 146 56 84 2020E 1,894 1,015 87 1,441 137 53 88 a. 2018E updated as of September 30, 2018. 2019E and 2020E from 2017 Form 10-K, page 31. 27

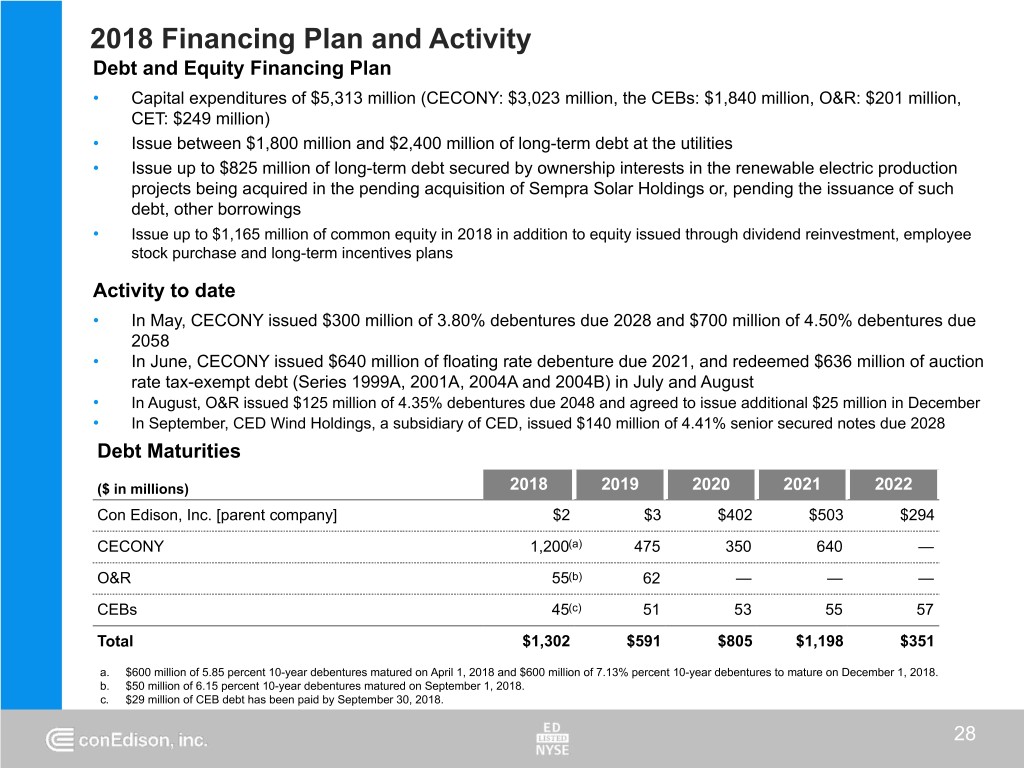

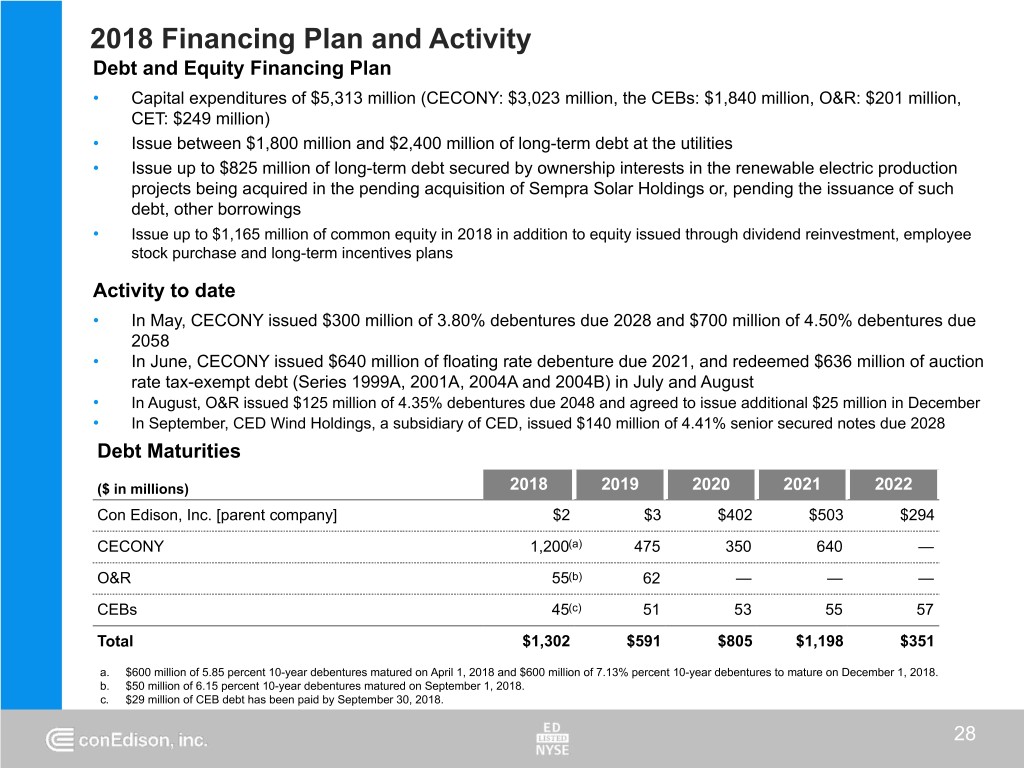

2018 Financing Plan and Activity Debt and Equity Financing Plan • Capital expenditures of $5,313 million (CECONY: $3,023 million, the CEBs: $1,840 million, O&R: $201 million, CET: $249 million) • Issue between $1,800 million and $2,400 million of long-term debt at the utilities • Issue up to $825 million of long-term debt secured by ownership interests in the renewable electric production projects being acquired in the pending acquisition of Sempra Solar Holdings or, pending the issuance of such debt, other borrowings • Issue up to $1,165 million of common equity in 2018 in addition to equity issued through dividend reinvestment, employee stock purchase and long-term incentives plans Activity to date • In May, CECONY issued $300 million of 3.80% debentures due 2028 and $700 million of 4.50% debentures due 2058 • In June, CECONY issued $640 million of floating rate debenture due 2021, and redeemed $636 million of auction rate tax-exempt debt (Series 1999A, 2001A, 2004A and 2004B) in July and August • In August, O&R issued $125 million of 4.35% debentures due 2048 and agreed to issue additional $25 million in December • In September, CED Wind Holdings, a subsidiary of CED, issued $140 million of 4.41% senior secured notes due 2028 Debt Maturities ($ in millions) 2018 2019 2020 2021 2022 Con Edison, Inc. [parent company] $2 $3 $402 $503 $294 CECONY 1,200(a) 475 350 640 — O&R 55(b) 62 — — — CEBs 45(c) 51 53 55 57 Total $1,302 $591 $805 $1,198 $351 a. $600 million of 5.85 percent 10-year debentures matured on April 1, 2018 and $600 million of 7.13% percent 10-year debentures to mature on December 1, 2018. b. $50 million of 6.15 percent 10-year debentures matured on September 1, 2018. c. $29 million of CEB debt has been paid by September 30, 2018. 28

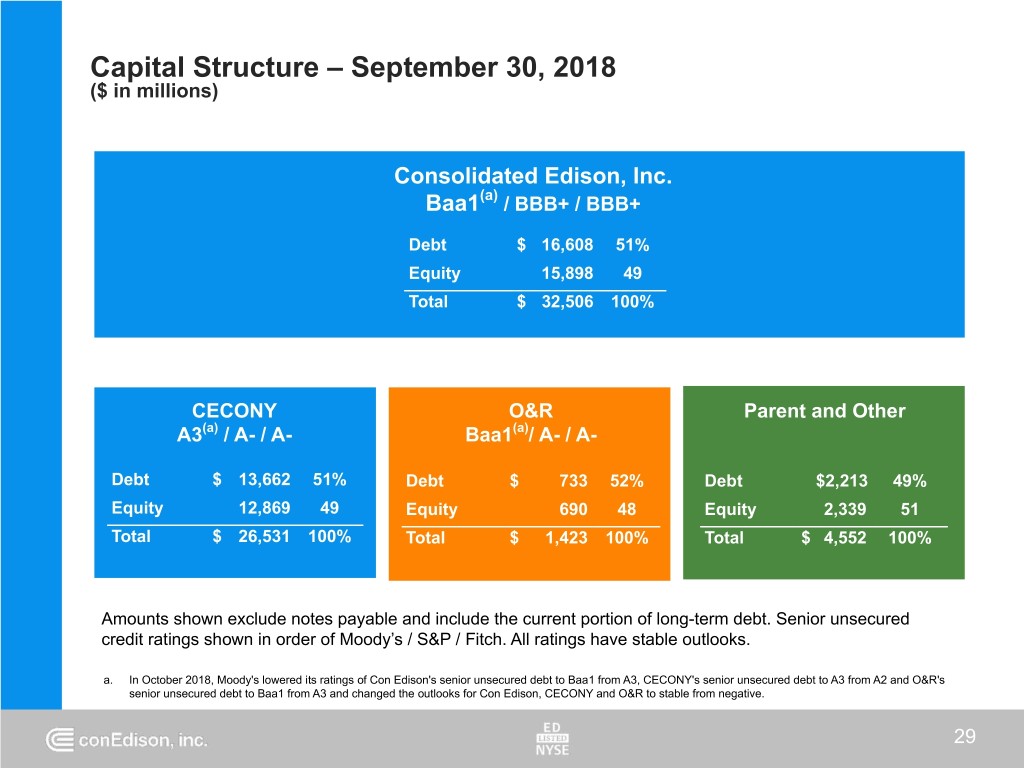

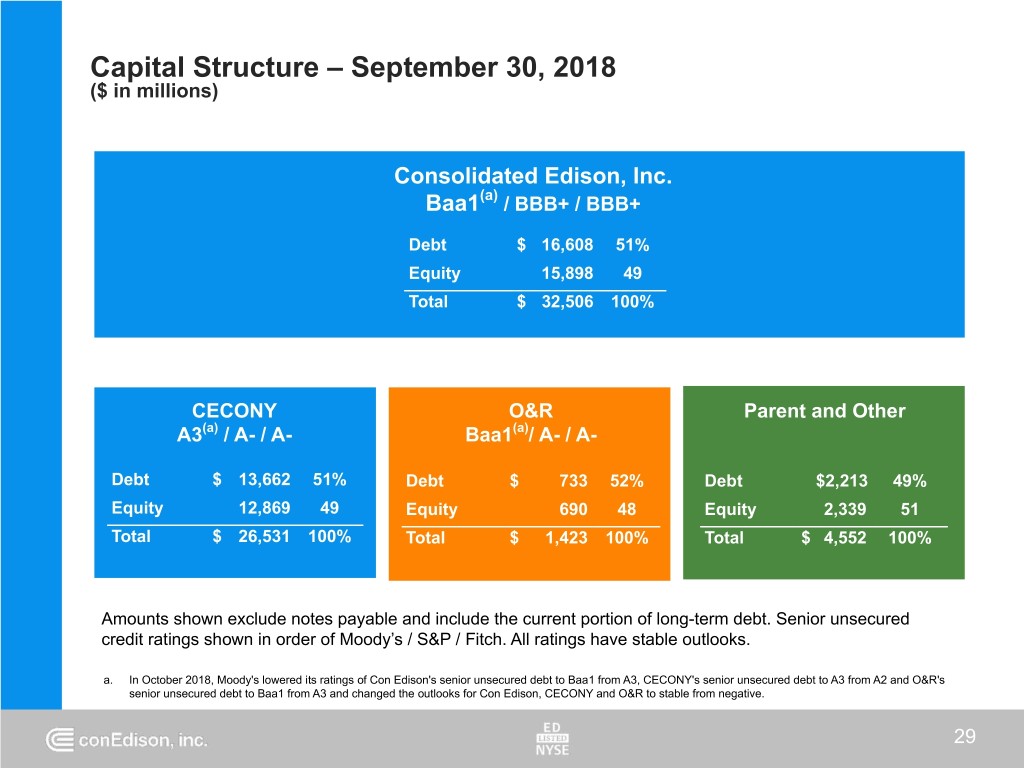

Capital Structure – September 30, 2018 ($ in millions) Consolidated Edison, Inc. Baa1(a) / BBB+ / BBB+ Debt $ 16,608 51% Equity 15,898 49 Total $ 32,506 100% CECONY O&R Parent and Other A3(a) / A- / A- Baa1(a)/ A- / A- Debt $ 13,662 51% Debt $ 733 52% Debt $2,213 49% Equity 12,869 49 Equity 690 48 Equity 2,339 51 Total $ 26,531 100% Total $ 1,423 100% Total $ 4,552 100% Amounts shown exclude notes payable and include the current portion of long-term debt. Senior unsecured credit ratings shown in order of Moody’s / S&P / Fitch. All ratings have stable outlooks. a. In October 2018, Moody's lowered its ratings of Con Edison's senior unsecured debt to Baa1 from A3, CECONY's senior unsecured debt to A3 from A2 and O&R's senior unsecured debt to Baa1 from A3 and changed the outlooks for Con Edison, CECONY and O&R to stable from negative. 29

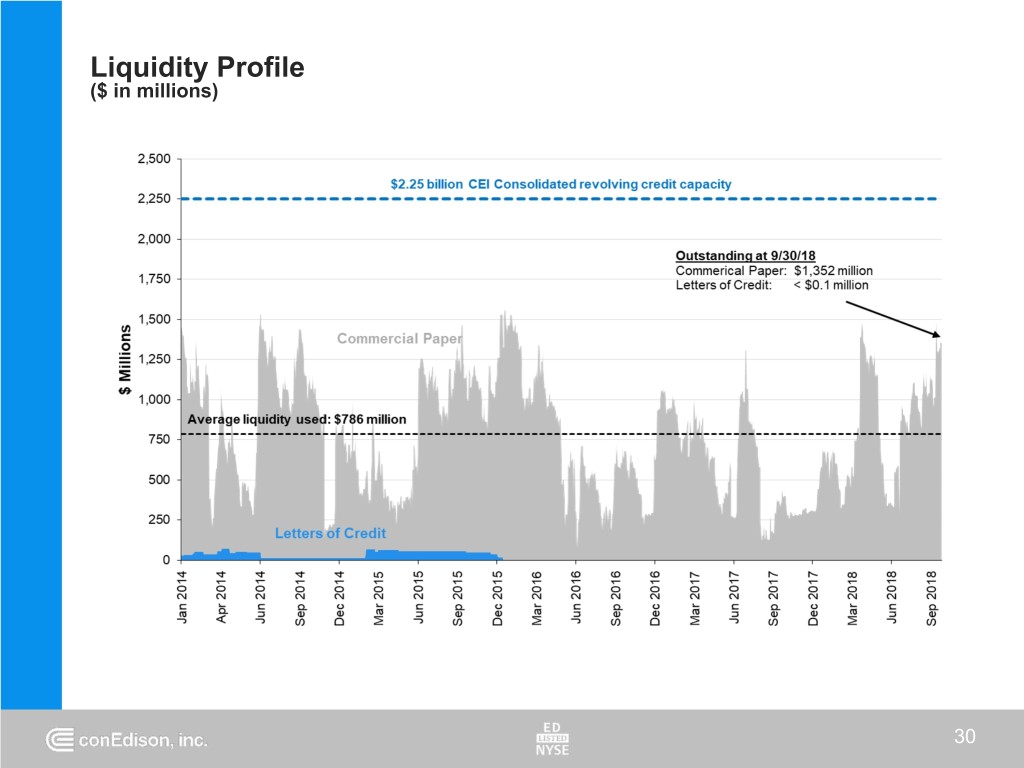

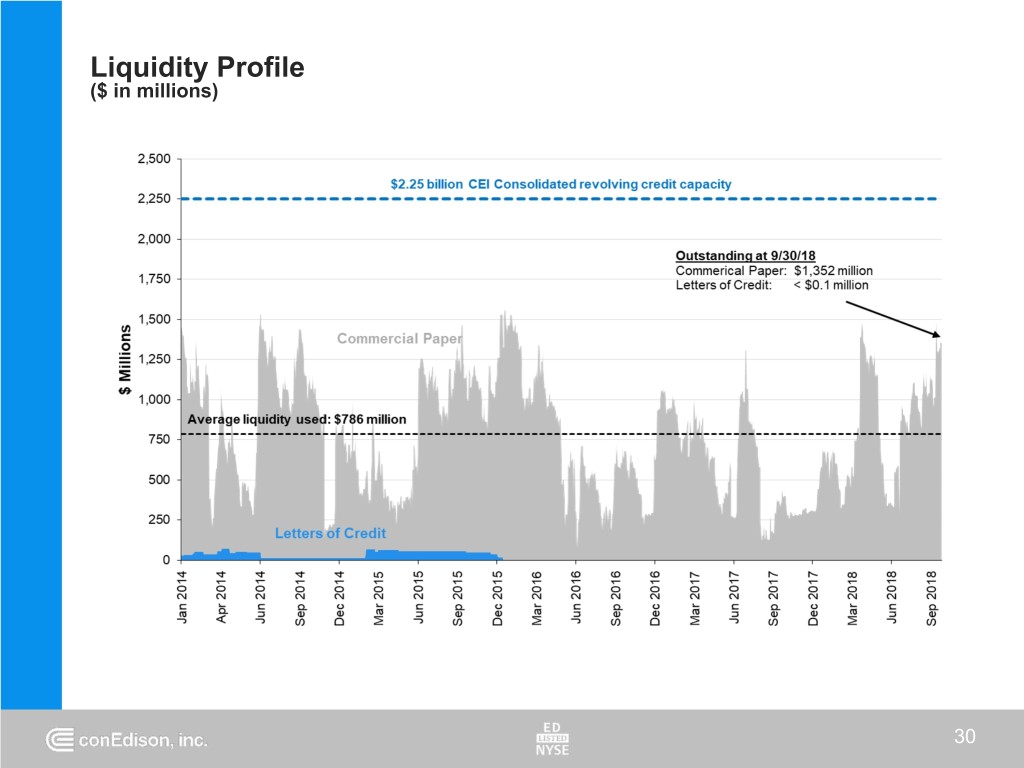

Liquidity Profile ($ in millions) 30

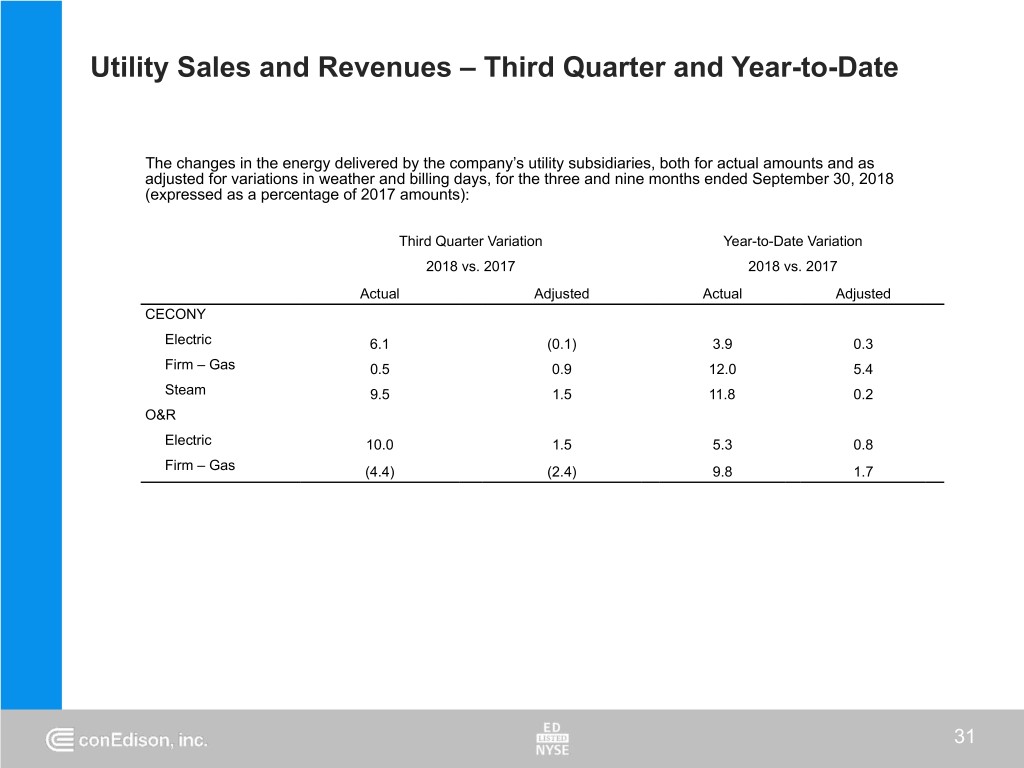

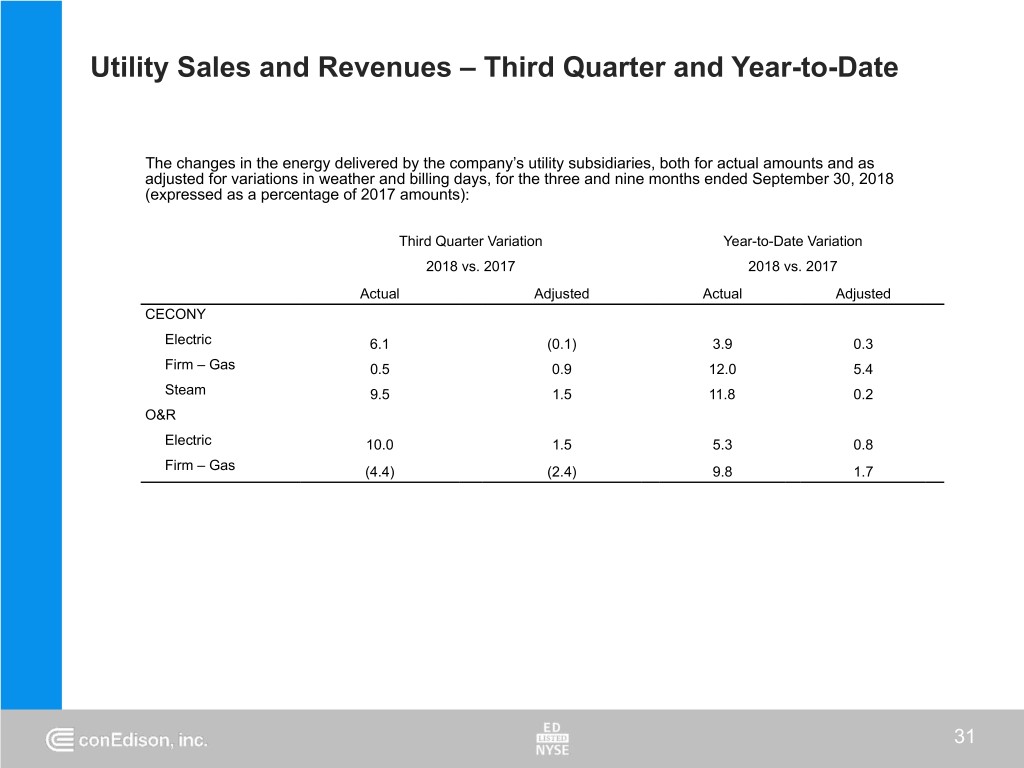

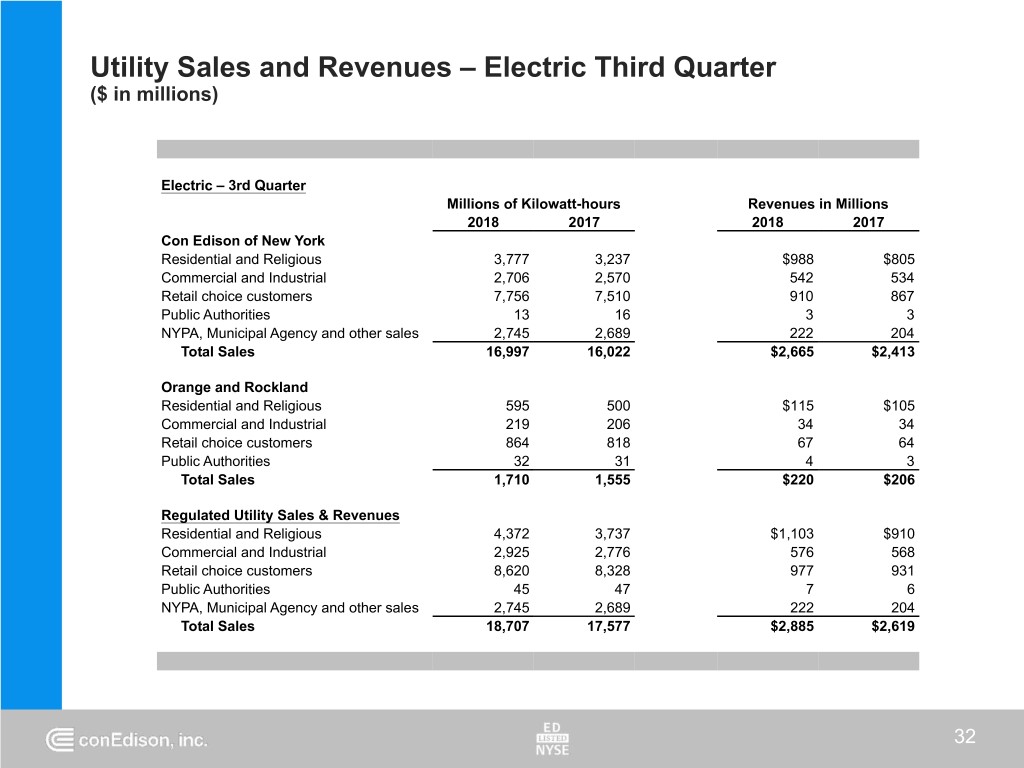

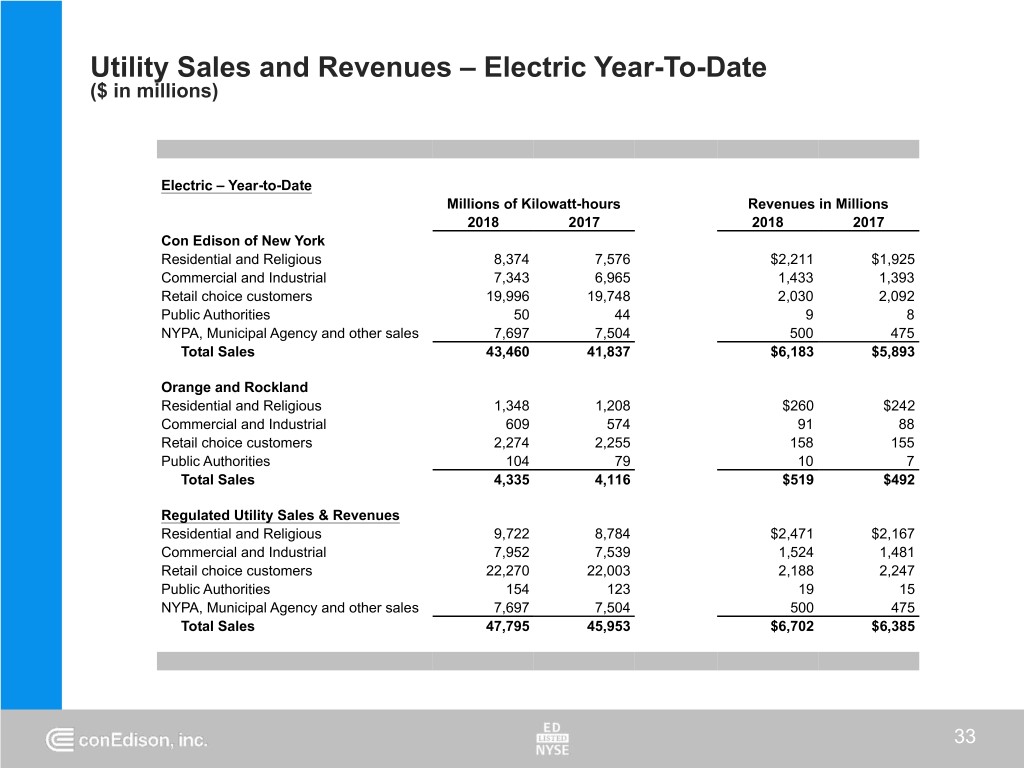

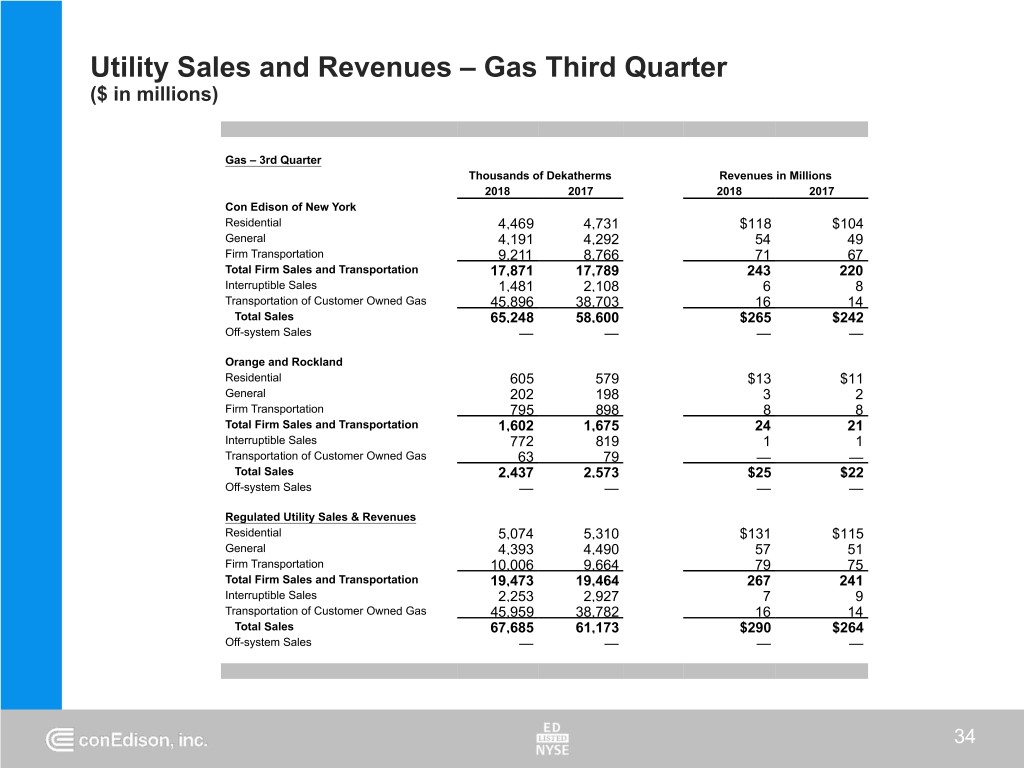

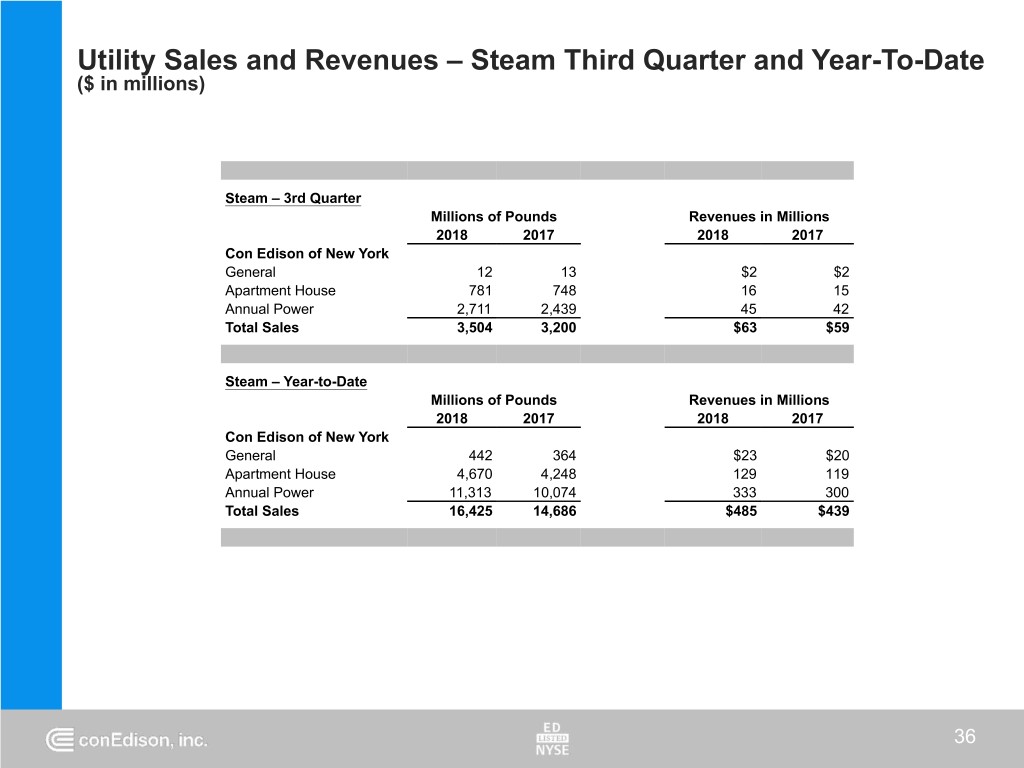

Utility Sales and Revenues – Third Quarter and Year-to-Date The changes in the energy delivered by the company’s utility subsidiaries, both for actual amounts and as adjusted for variations in weather and billing days, for the three and nine months ended September 30, 2018 (expressed as a percentage of 2017 amounts): Third Quarter Variation Year-to-Date Variation 2018 vs. 2017 2018 vs. 2017 Actual Adjusted Actual Adjusted CECONY Electric 6.1 (0.1) 3.9 0.3 Firm – Gas 0.5 0.9 12.0 5.4 Steam 9.5 1.5 11.8 0.2 O&R Electric 10.0 1.5 5.3 0.8 Firm – Gas (4.4) (2.4) 9.8 1.7 31

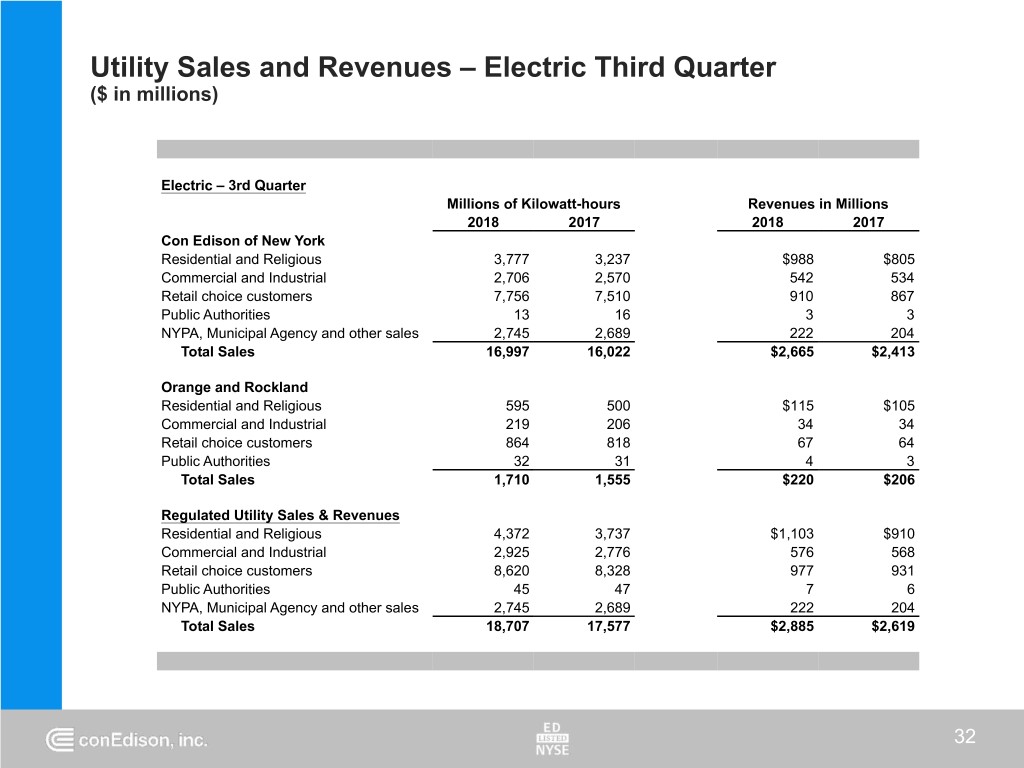

Utility Sales and Revenues – Electric Third Quarter ($ in millions) Electric – 3rd Quarter Millions of Kilowatt-hours Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential and Religious 3,777 3,237 $988 $805 Commercial and Industrial 2,706 2,570 542 534 Retail choice customers 7,756 7,510 910 867 Public Authorities 13 16 3 3 NYPA, Municipal Agency and other sales 2,745 2,689 222 204 Total Sales 16,997 16,022 $2,665 $2,413 Orange and Rockland Residential and Religious 595 500 $115 $105 Commercial and Industrial 219 206 34 34 Retail choice customers 864 818 67 64 Public Authorities 32 31 4 3 Total Sales 1,710 1,555 $220 $206 Regulated Utility Sales & Revenues Residential and Religious 4,372 3,737 $1,103 $910 Commercial and Industrial 2,925 2,776 576 568 Retail choice customers 8,620 8,328 977 931 Public Authorities 45 47 7 6 NYPA, Municipal Agency and other sales 2,745 2,689 222 204 Total Sales 18,707 17,577 $2,885 $2,619 32

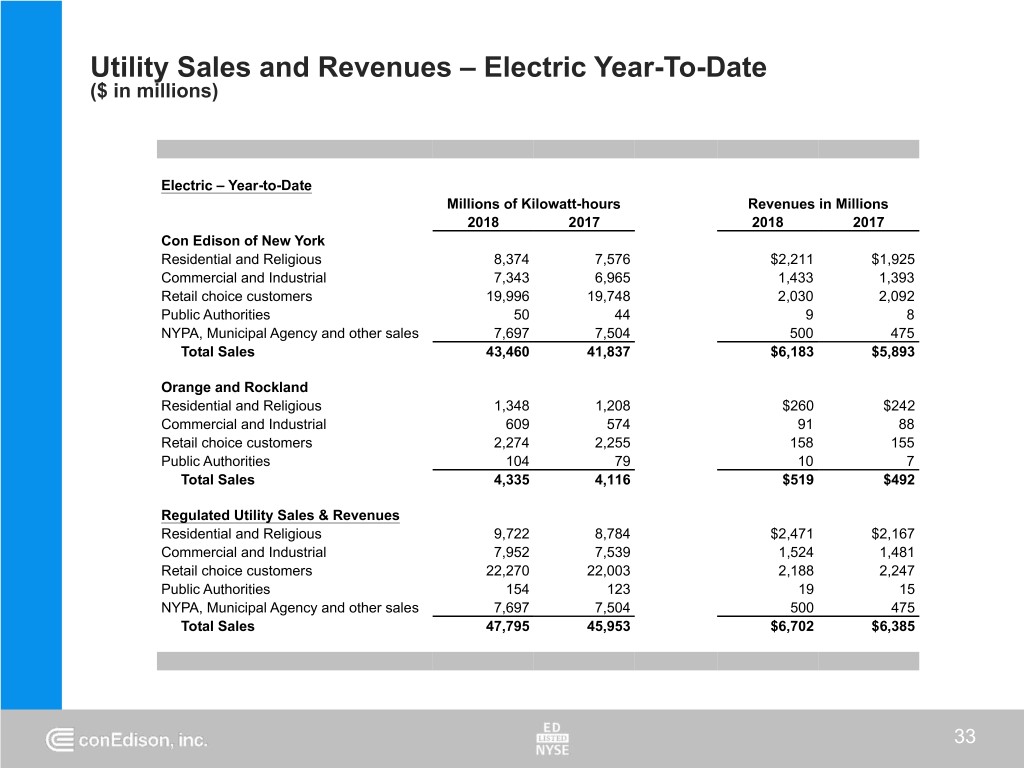

Utility Sales and Revenues – Electric Year-To-Date ($ in millions) Electric – Year-to-Date Millions of Kilowatt-hours Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential and Religious 8,374 7,576 $2,211 $1,925 Commercial and Industrial 7,343 6,965 1,433 1,393 Retail choice customers 19,996 19,748 2,030 2,092 Public Authorities 50 44 9 8 NYPA, Municipal Agency and other sales 7,697 7,504 500 475 Total Sales 43,460 41,837 $6,183 $5,893 Orange and Rockland Residential and Religious 1,348 1,208 $260 $242 Commercial and Industrial 609 574 91 88 Retail choice customers 2,274 2,255 158 155 Public Authorities 104 79 10 7 Total Sales 4,335 4,116 $519 $492 Regulated Utility Sales & Revenues Residential and Religious 9,722 8,784 $2,471 $2,167 Commercial and Industrial 7,952 7,539 1,524 1,481 Retail choice customers 22,270 22,003 2,188 2,247 Public Authorities 154 123 19 15 NYPA, Municipal Agency and other sales 7,697 7,504 500 475 Total Sales 47,795 45,953 $6,702 $6,385 33

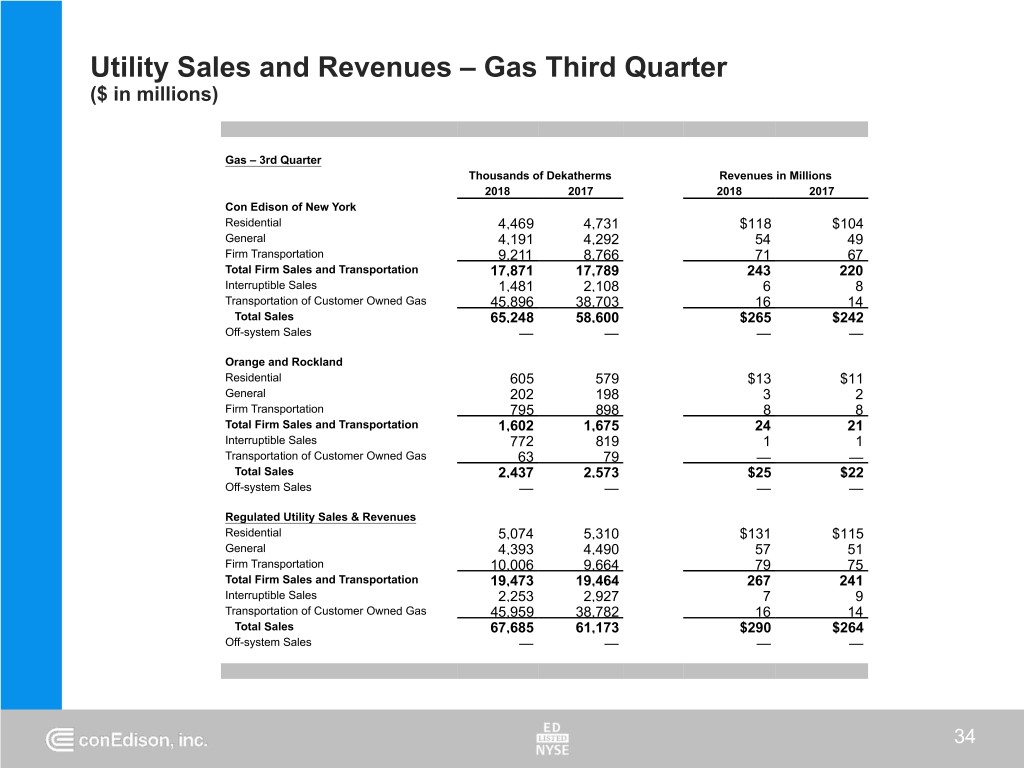

Utility Sales and Revenues – Gas Third Quarter ($ in millions) Gas – 3rd Quarter Thousands of Dekatherms Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential 4,469 4,731 $118 $104 General 4,191 4,292 54 49 Firm Transportation 9,211 8,766 71 67 Total Firm Sales and Transportation 17,871 17,789 243 220 Interruptible Sales 1,481 2,108 6 8 Transportation of Customer Owned Gas 45,896 38,703 16 14 Total Sales 65,248 58,600 $265 $242 Off-system Sales — — — — Orange and Rockland Residential 605 579 $13 $11 General 202 198 3 2 Firm Transportation 795 898 8 8 Total Firm Sales and Transportation 1,602 1,675 24 21 Interruptible Sales 772 819 1 1 Transportation of Customer Owned Gas 63 79 — — Total Sales 2,437 2,573 $25 $22 Off-system Sales — — — — Regulated Utility Sales & Revenues Residential 5,074 5,310 $131 $115 General 4,393 4,490 57 51 Firm Transportation 10,006 9,664 79 75 Total Firm Sales and Transportation 19,473 19,464 267 241 Interruptible Sales 2,253 2,927 7 9 Transportation of Customer Owned Gas 45,959 38,782 16 14 Total Sales 67,685 61,173 $290 $264 Off-system Sales — — — — 34

Utility Sales and Revenues – Gas Year-To-Date ($ in millions) Gas – Year-to-Date Thousands of Dekatherms Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential 43,731 39,814 $728 $613 General 25,894 23,427 298 255 Firm Transportation 61,628 53,952 448 390 Total Firm Sales and Transportation 131,253 117,193 1,474 1,258 Interruptible Sales 4,956 6,526 31 30 Transportation of Customer Owned Gas 98,876 95,978 46 45 Total Sales 235,085 219,697 $1,551 $1,333 Off-system Sales — 41 — — Orange and Rockland Residential 6,503 5,556 $96 $79 General 1,502 1,447 18 16 Firm Transportation 6,867 6,543 57 50 Total Firm Sales and Transportation 14,872 13,546 171 145 Interruptible Sales 2,842 2,966 5 5 Transportation of Customer Owned Gas 637 595 1 1 Total Sales 18,351 17,107 $177 $151 Off-system Sales — — — — Regulated Utility Sales & Revenues Residential 50,234 45,370 $824 $692 General 27,396 24,874 316 271 Firm Transportation 68,495 60,495 505 440 Total Firm Sales and Transportation 146,125 130,739 1,645 1,403 Interruptible Sales 7,798 9,492 36 35 Transportation of Customer Owned Gas 99,513 96,573 47 46 Total Sales 253,436 236,804 $1,728 $1,484 Off-system Sales — 41 — — 35

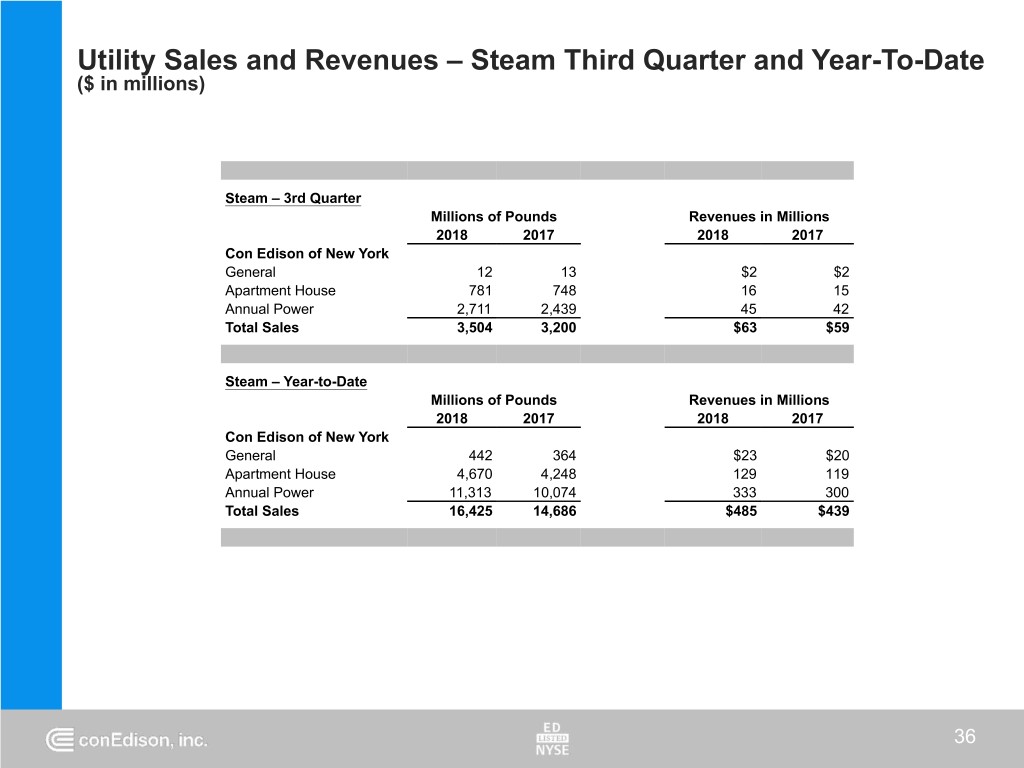

Utility Sales and Revenues – Steam Third Quarter and Year-To-Date ($ in millions) Steam – 3rd Quarter Millions of Pounds Revenues in Millions 2018 2017 2018 2017 Con Edison of New York General 12 13 $2 $2 Apartment House 781 748 16 15 Annual Power 2,711 2,439 45 42 Total Sales 3,504 3,200 $63 $59 Steam – Year-to-Date Millions of Pounds Revenues in Millions 2018 2017 2018 2017 Con Edison of New York General 442 364 $23 $20 Apartment House 4,670 4,248 129 119 Annual Power 11,313 10,074 333 300 Total Sales 16,425 14,686 $485 $439 36

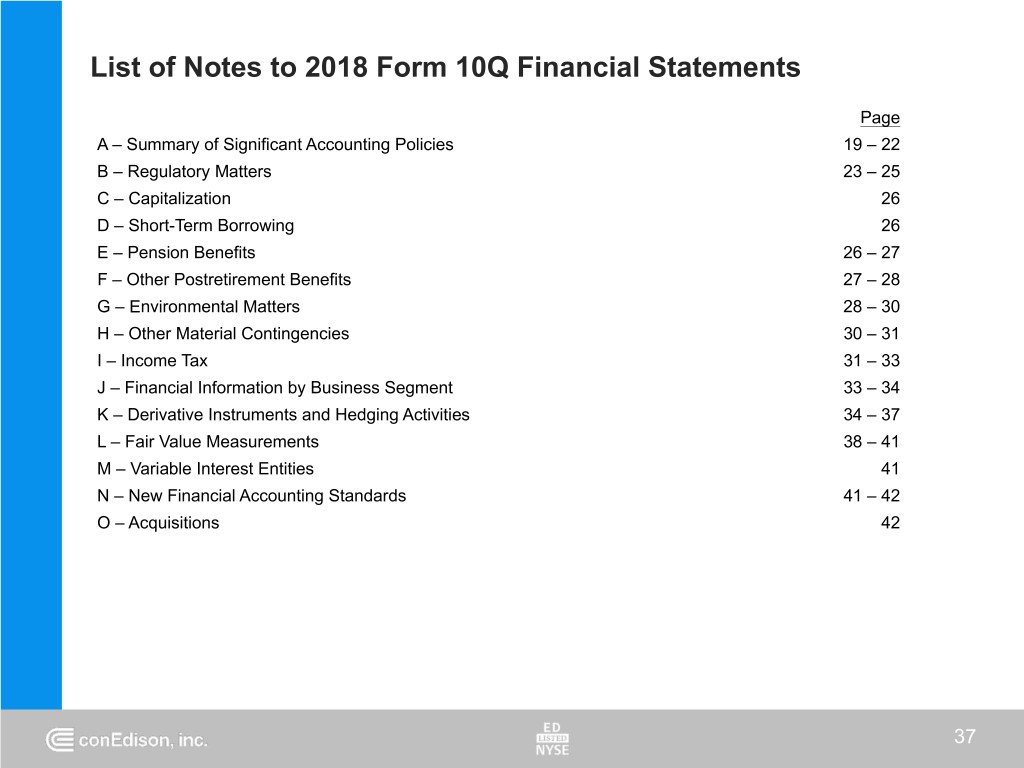

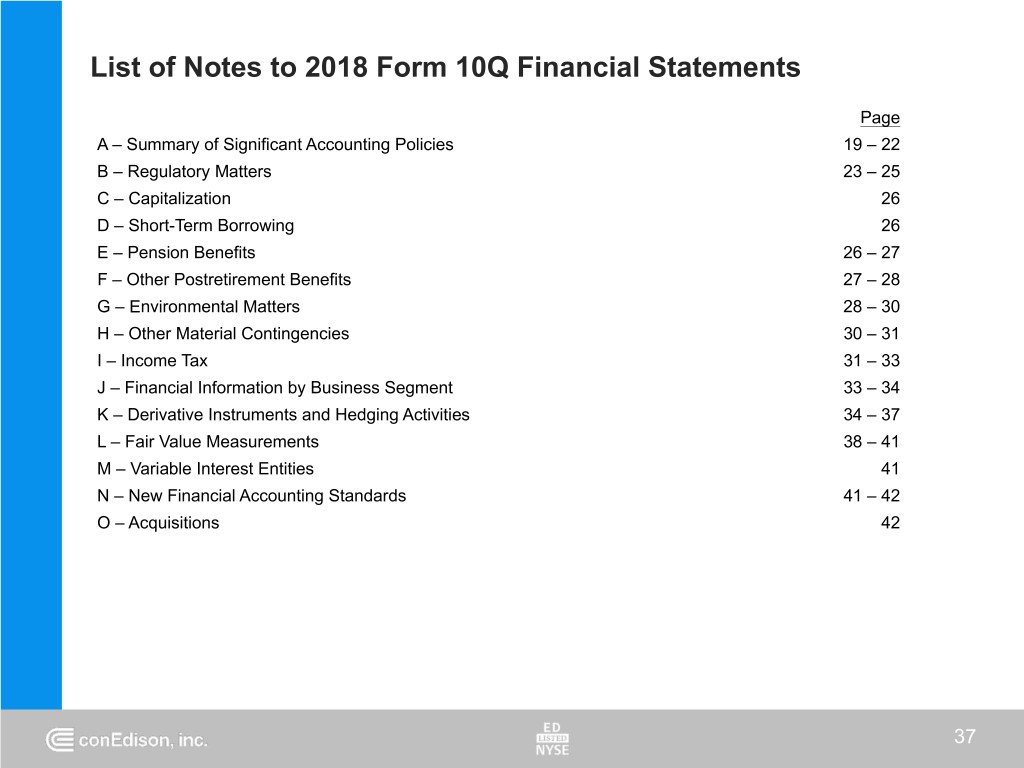

List of Notes to 2018 Form 10Q Financial Statements Page A – Summary of Significant Accounting Policies 19 – 22 B – Regulatory Matters 23 – 25 C – Capitalization 26 D – Short-Term Borrowing 26 E – Pension Benefits 26 – 27 F – Other Postretirement Benefits 27 – 28 G – Environmental Matters 28 – 30 H – Other Material Contingencies 30 – 31 I – Income Tax 31 – 33 J – Financial Information by Business Segment 33 – 34 K – Derivative Instruments and Hedging Activities 34 – 37 L – Fair Value Measurements 38 – 41 M – Variable Interest Entities 41 N – New Financial Accounting Standards 41 – 42 O – Acquisitions 42 37

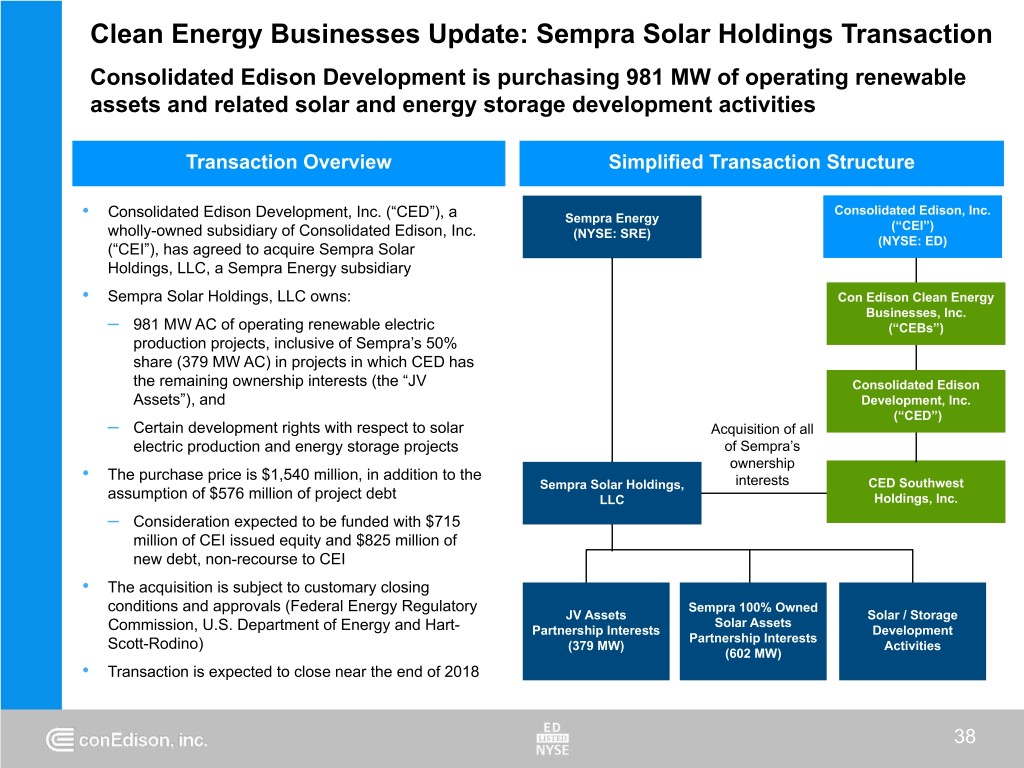

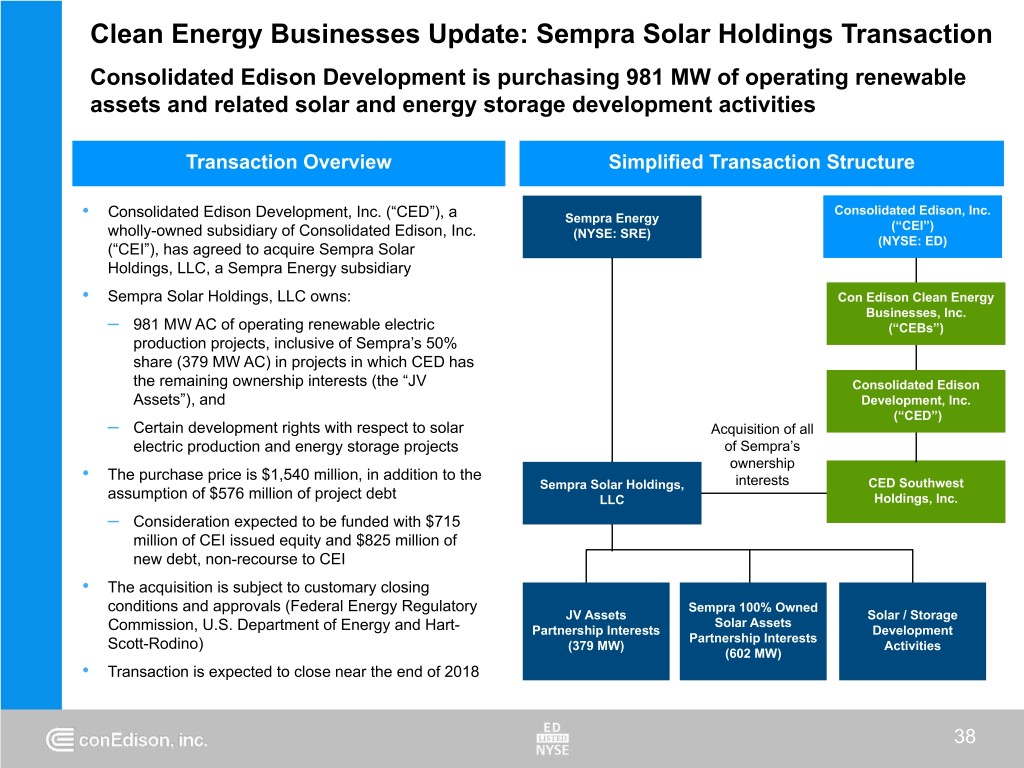

Clean Energy Businesses Update: Sempra Solar Holdings Transaction Consolidated Edison Development is purchasing 981 MW of operating renewable assets and related solar and energy storage development activities Transaction Overview Simplified Transaction Structure Consolidated Edison, Inc. • Consolidated Edison Development, Inc. (“CED”), a Sempra Energy (“CEI”) wholly-owned subsidiary of Consolidated Edison, Inc. (NYSE: SRE) (NYSE: ED) (“CEI”), has agreed to acquire Sempra Solar Holdings, LLC, a Sempra Energy subsidiary • Sempra Solar Holdings, LLC owns: Con Edison Clean Energy Businesses, Inc. – 981 MW AC of operating renewable electric (“CEBs”) production projects, inclusive of Sempra’s 50% share (379 MW AC) in projects in which CED has the remaining ownership interests (the “JV Consolidated Edison Assets”), and Development, Inc. (“CED”) – Certain development rights with respect to solar Acquisition of all electric production and energy storage projects of Sempra’s ownership • The purchase price is $1,540 million, in addition to the Sempra Solar Holdings, interests CED Southwest assumption of $576 million of project debt LLC Holdings, Inc. – Consideration expected to be funded with $715 million of CEI issued equity and $825 million of new debt, non-recourse to CEI • The acquisition is subject to customary closing conditions and approvals (Federal Energy Regulatory Sempra 100% Owned JV Assets Solar / Storage Solar Assets Commission, U.S. Department of Energy and Hart- Partnership Interests Development Partnership Interests Scott-Rodino) (379 MW) Activities (602 MW) • Transaction is expected to close near the end of 2018 38

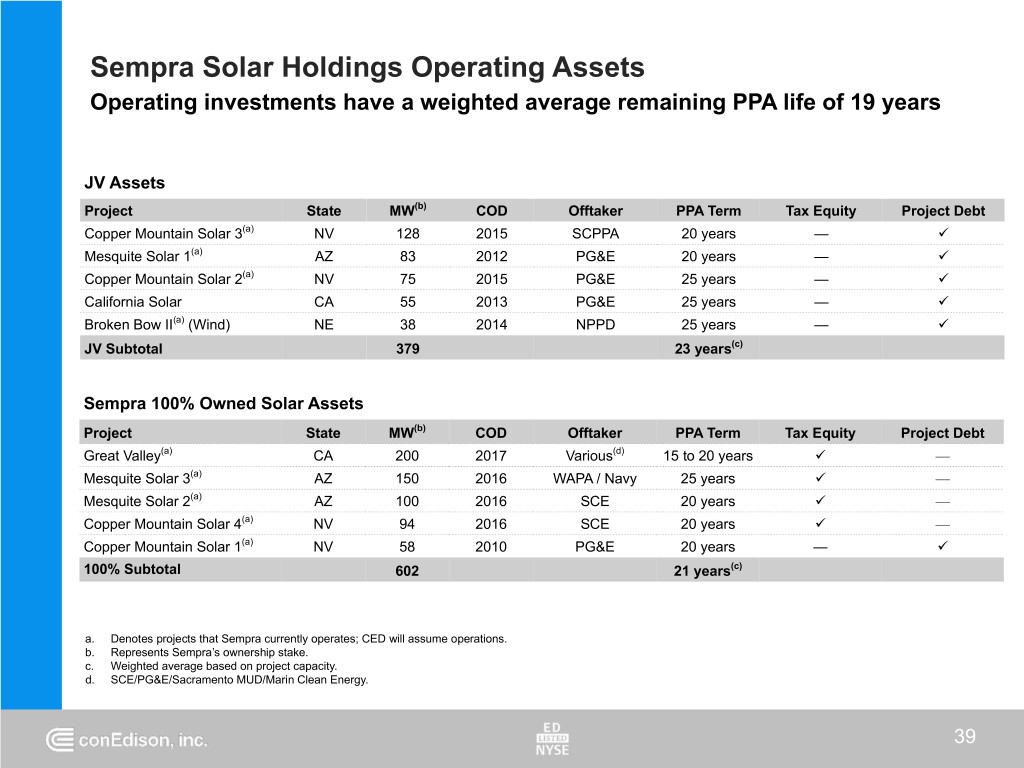

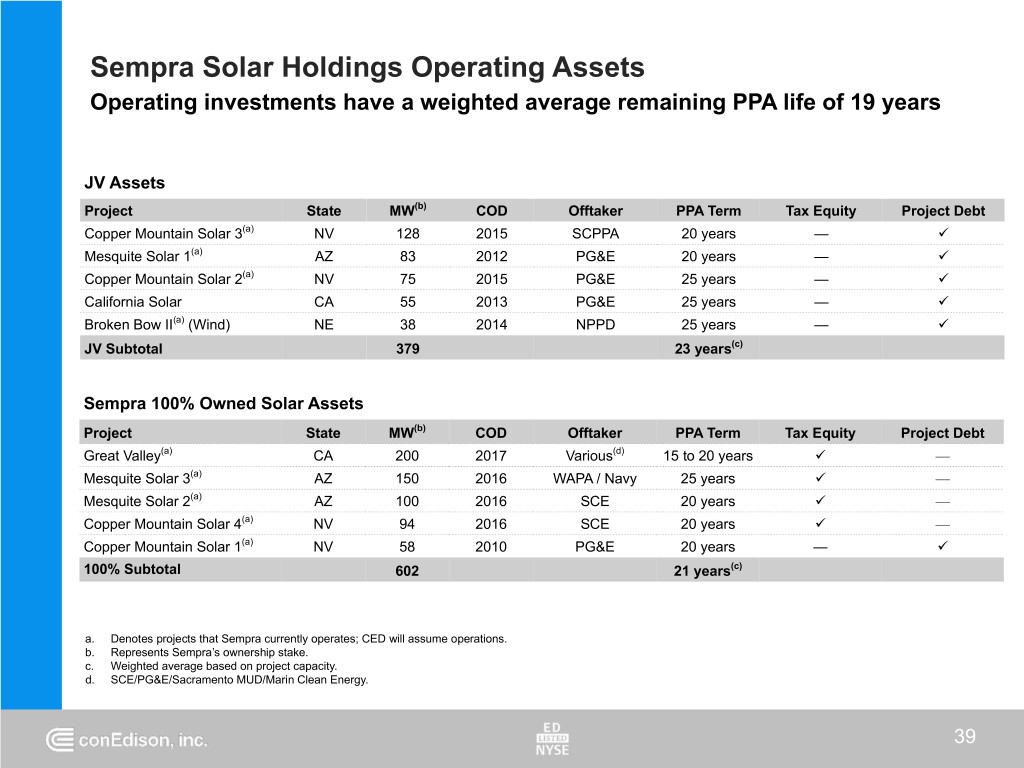

Sempra Solar Holdings Operating Assets Operating investments have a weighted average remaining PPA life of 19 years JV Assets Project State MW(b) COD Offtaker PPA Term Tax Equity Project Debt Copper Mountain Solar 3(a) NV 128 2015 SCPPA 20 years — ü Mesquite Solar 1(a) AZ 83 2012 PG&E 20 years — ü Copper Mountain Solar 2(a) NV 75 2015 PG&E 25 years — ü California Solar CA 55 2013 PG&E 25 years — ü Broken Bow II(a) (Wind) NE 38 2014 NPPD 25 years — ü JV Subtotal 379 23 years(c) Sempra 100% Owned Solar Assets Project State MW(b) COD Offtaker PPA Term Tax Equity Project Debt Great Valley(a) CA 200 2017 Various(d) 15 to 20 years ü — Mesquite Solar 3(a) AZ 150 2016 WAPA / Navy 25 years ü — Mesquite Solar 2(a) AZ 100 2016 SCE 20 years ü — Copper Mountain Solar 4(a) NV 94 2016 SCE 20 years ü — Copper Mountain Solar 1(a) NV 58 2010 PG&E 20 years — ü 100% Subtotal 602 21 years(c) a. Denotes projects that Sempra currently operates; CED will assume operations. b. Represents Sempra’s ownership stake. c. Weighted average based on project capacity. d. SCE/PG&E/Sacramento MUD/Marin Clean Energy. 39

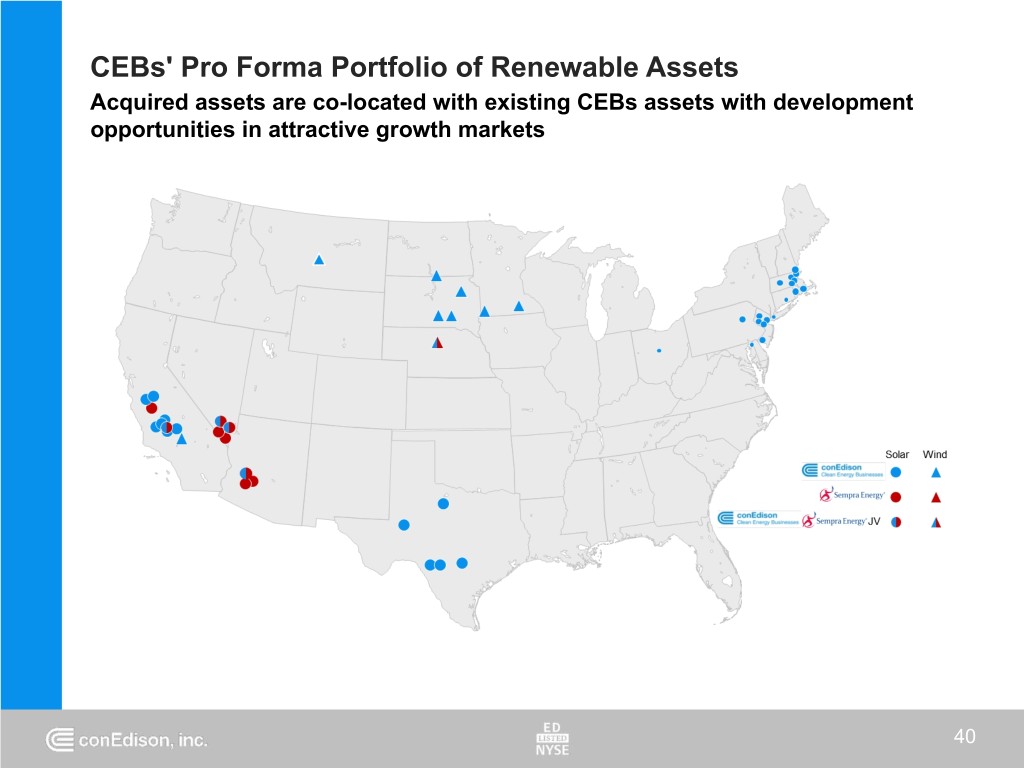

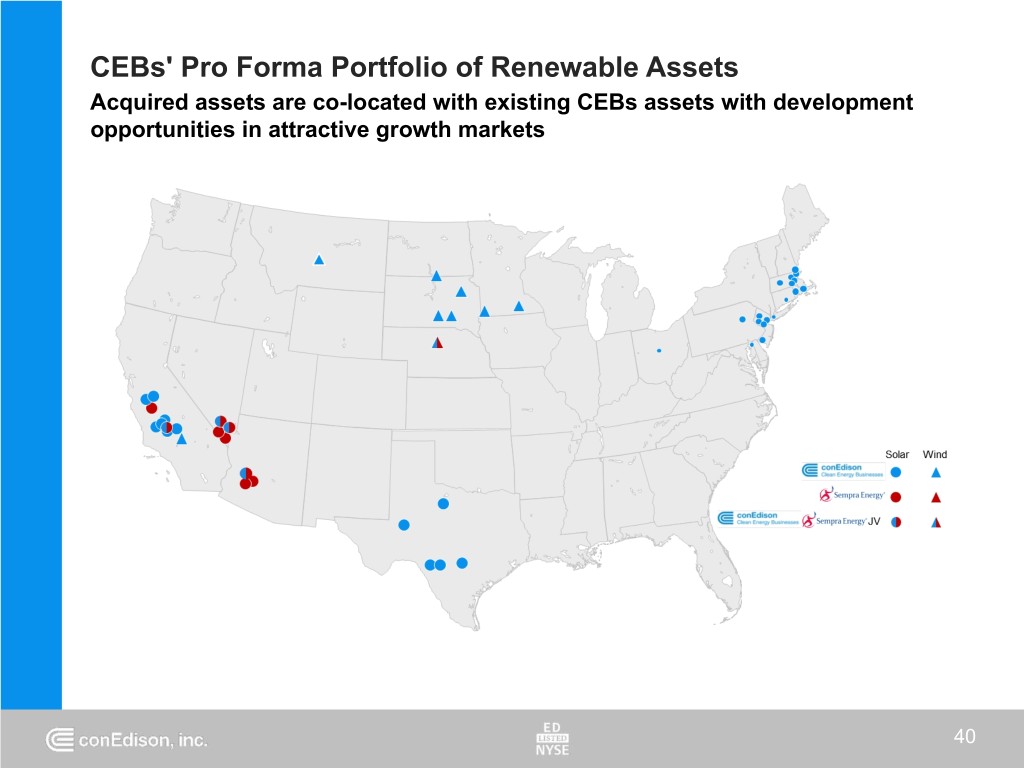

CEBs' Pro Forma Portfolio of Renewable Assets Acquired assets are co-located with existing CEBs assets with development opportunities in attractive growth markets 40

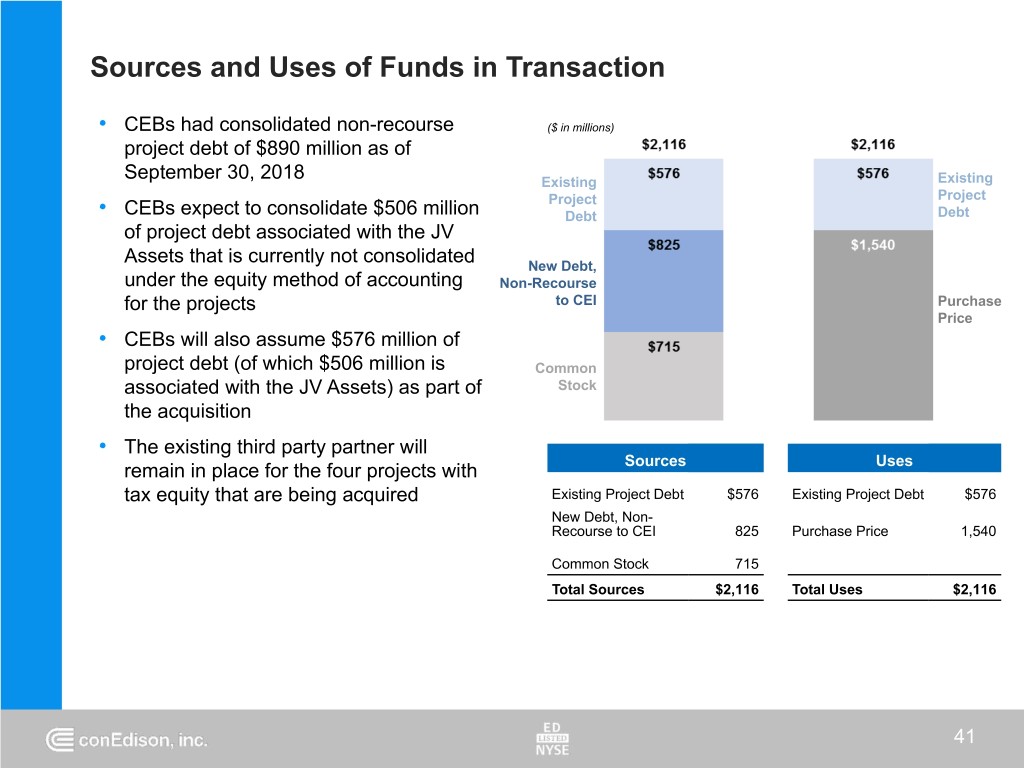

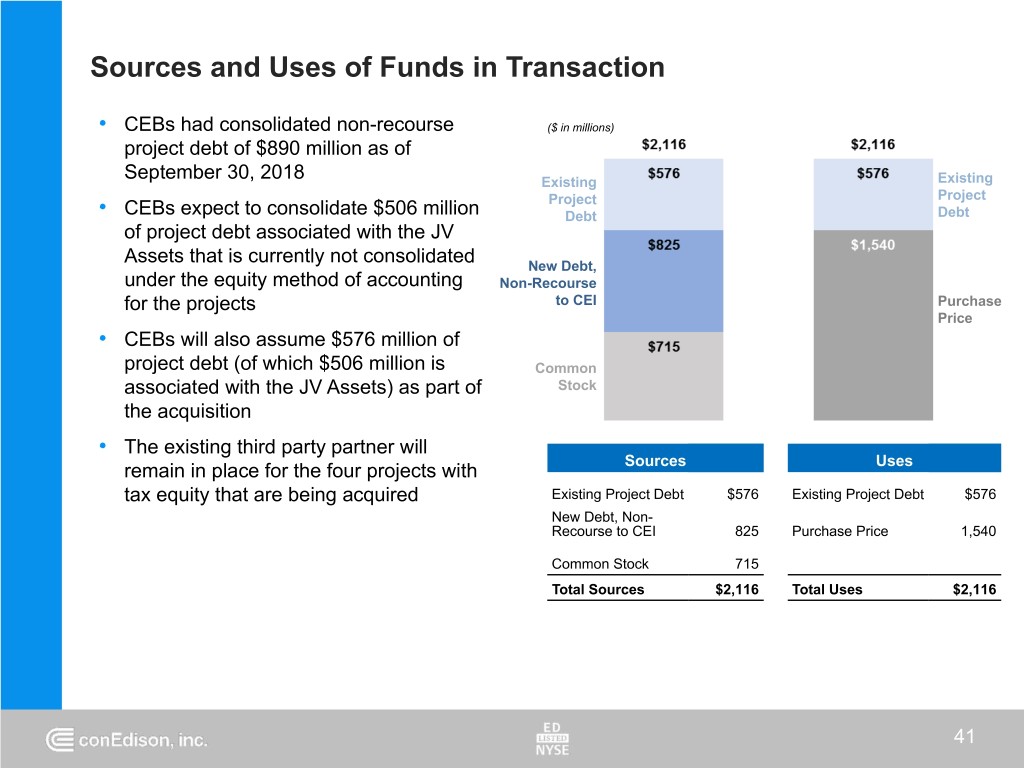

Sources and Uses of Funds in Transaction • CEBs had consolidated non-recourse ($ in millions) project debt of $890 million as of September 30, 2018 Existing Existing Project Project • CEBs expect to consolidate $506 million Debt Debt of project debt associated with the JV Assets that is currently not consolidated New Debt, under the equity method of accounting Non-Recourse for the projects to CEI Purchase Price • CEBs will also assume $576 million of project debt (of which $506 million is Common associated with the JV Assets) as part of Stock the acquisition • The existing third party partner will Sources Uses remain in place for the four projects with tax equity that are being acquired Existing Project Debt $576 Existing Project Debt $576 New Debt, Non- Recourse to CEI 825 Purchase Price 1,540 Common Stock 715 Total Sources $2,116 Total Uses $2,116 41

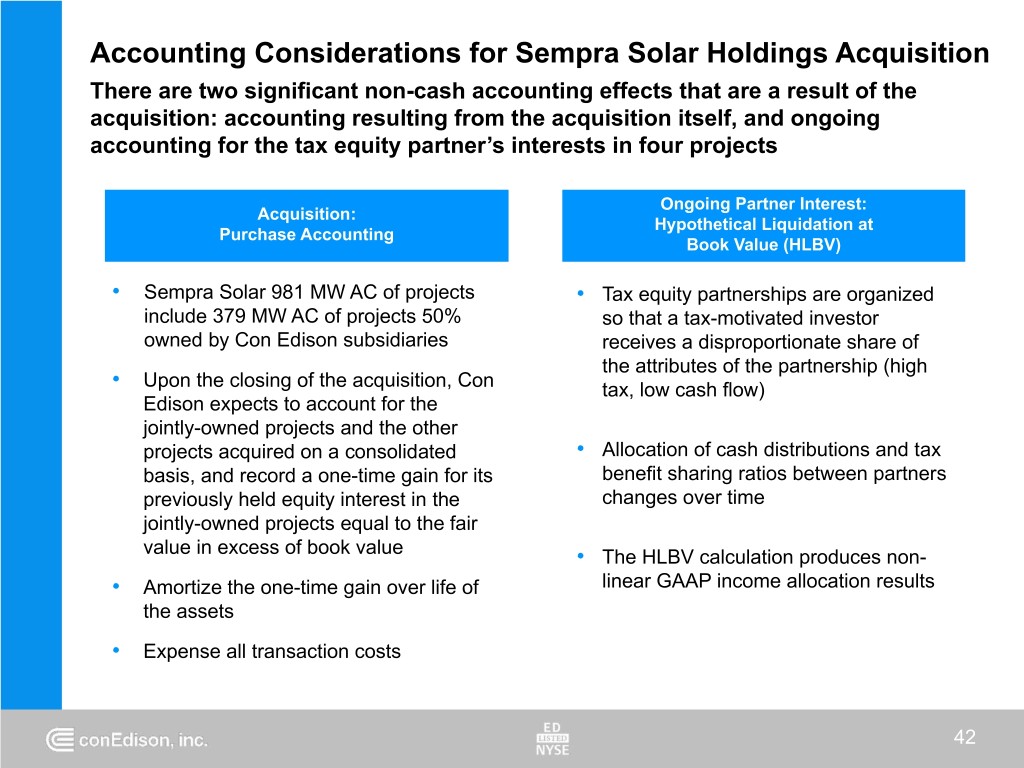

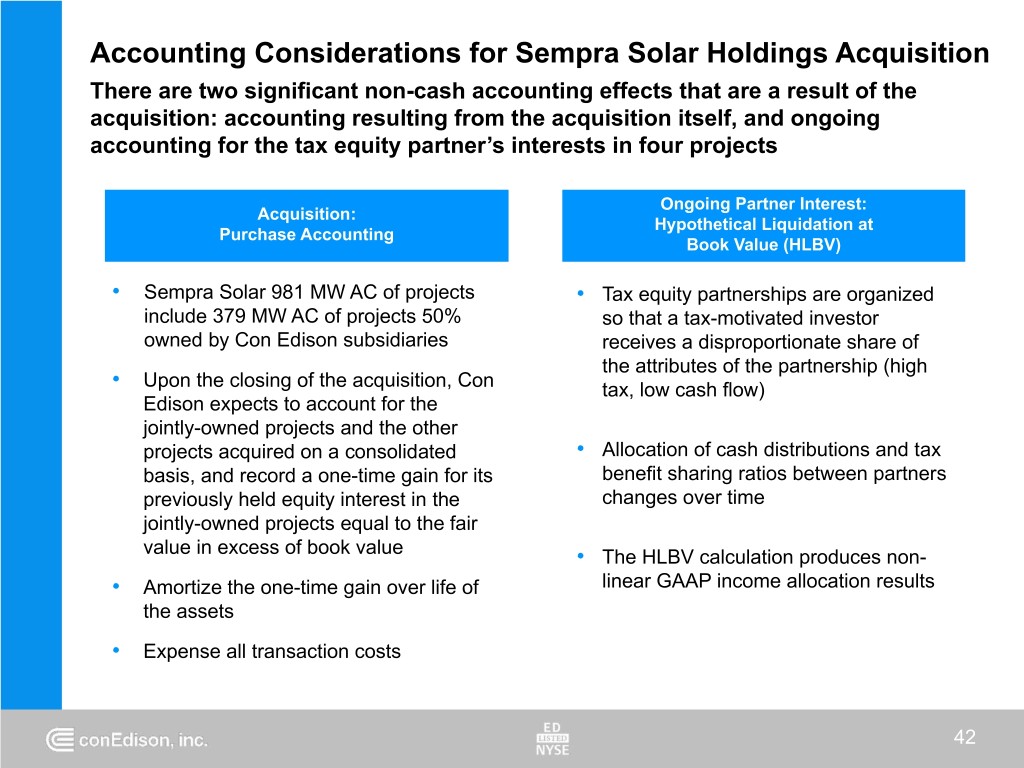

Accounting Considerations for Sempra Solar Holdings Acquisition There are two significant non-cash accounting effects that are a result of the acquisition: accounting resulting from the acquisition itself, and ongoing accounting for the tax equity partner’s interests in four projects Ongoing Partner Interest: Acquisition: Hypothetical Liquidation at Purchase Accounting Book Value (HLBV) • Sempra Solar 981 MW AC of projects • Tax equity partnerships are organized include 379 MW AC of projects 50% so that a tax-motivated investor owned by Con Edison subsidiaries receives a disproportionate share of the attributes of the partnership (high • Upon the closing of the acquisition, Con tax, low cash flow) Edison expects to account for the jointly-owned projects and the other projects acquired on a consolidated • Allocation of cash distributions and tax basis, and record a one-time gain for its benefit sharing ratios between partners previously held equity interest in the changes over time jointly-owned projects equal to the fair value in excess of book value • The HLBV calculation produces non- • Amortize the one-time gain over life of linear GAAP income allocation results the assets • Expense all transaction costs 42

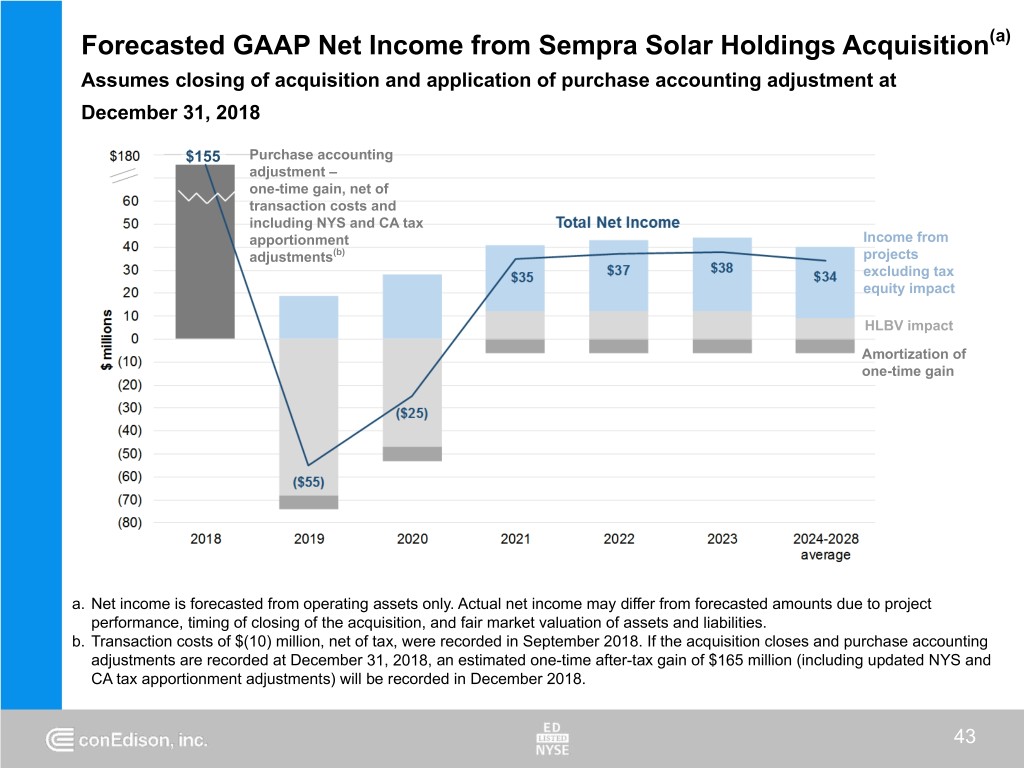

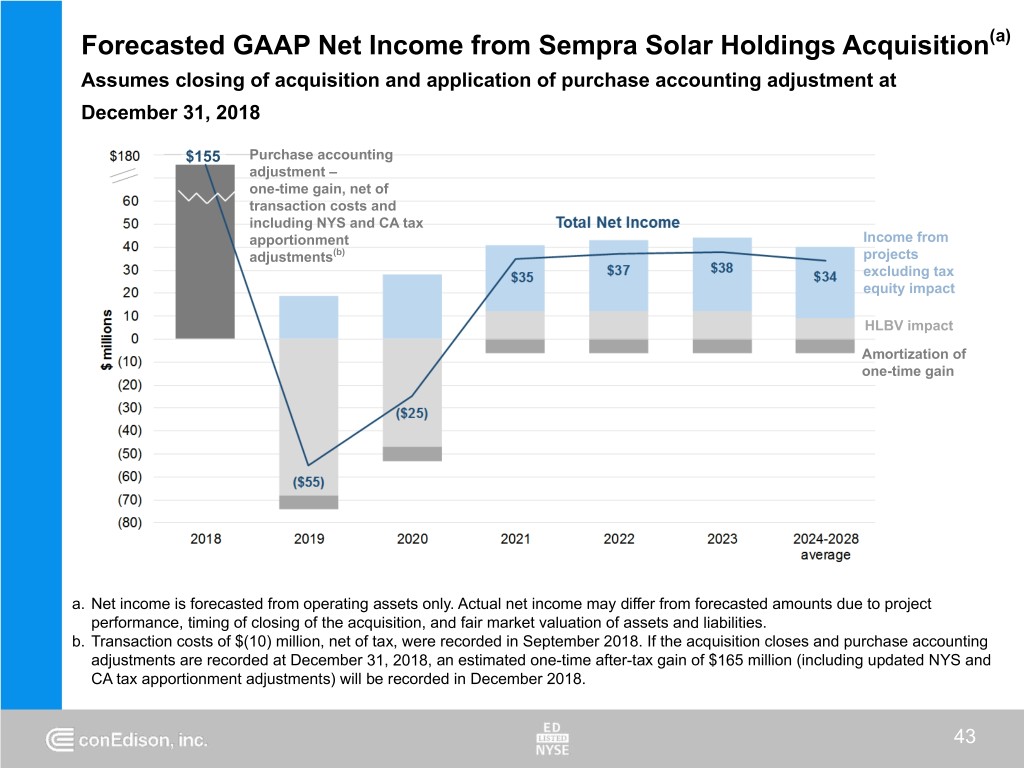

Forecasted GAAP Net Income from Sempra Solar Holdings Acquisition(a) Assumes closing of acquisition and application of purchase accounting adjustment at December 31, 2018 $155 Purchase accounting adjustment – one-time gain, net of transaction costs and including NYS and CA tax apportionment Income from adjustments(b) projects excluding tax equity impact HLBV impact Amortization of one-time gain a. Net income is forecasted from operating assets only. Actual net income may differ from forecasted amounts due to project performance, timing of closing of the acquisition, and fair market valuation of assets and liabilities. b. Transaction costs of $(10) million, net of tax, were recorded in September 2018. If the acquisition closes and purchase accounting adjustments are recorded at December 31, 2018, an estimated one-time after-tax gain of $165 million (including updated NYS and CA tax apportionment adjustments) will be recorded in December 2018. 43

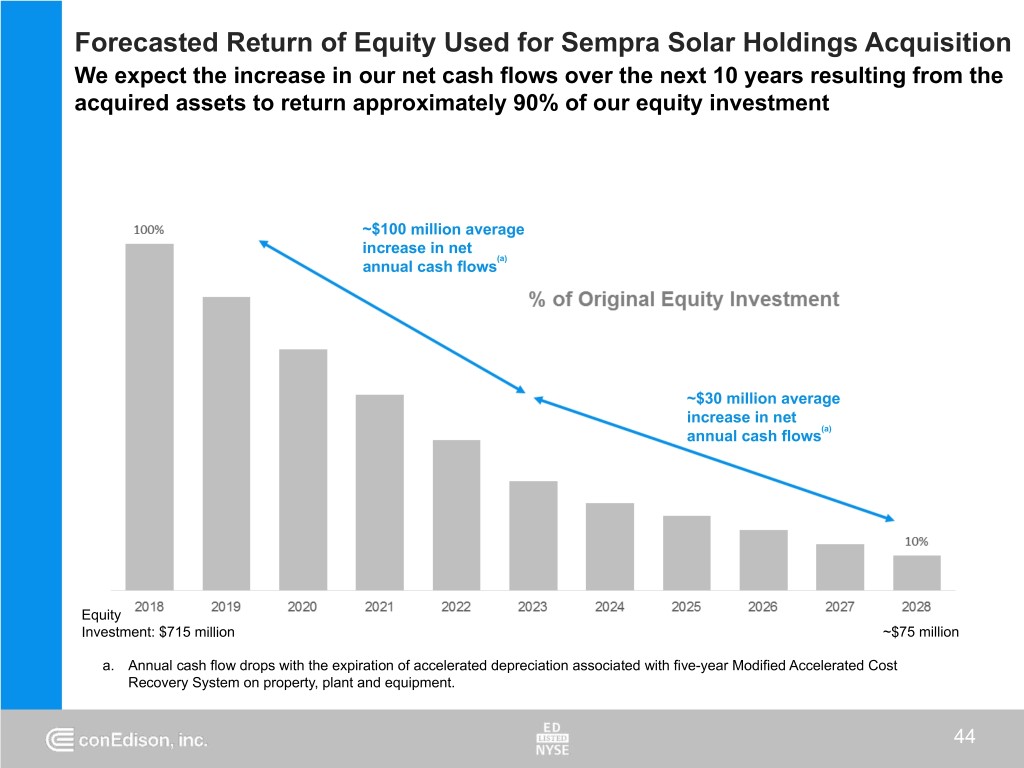

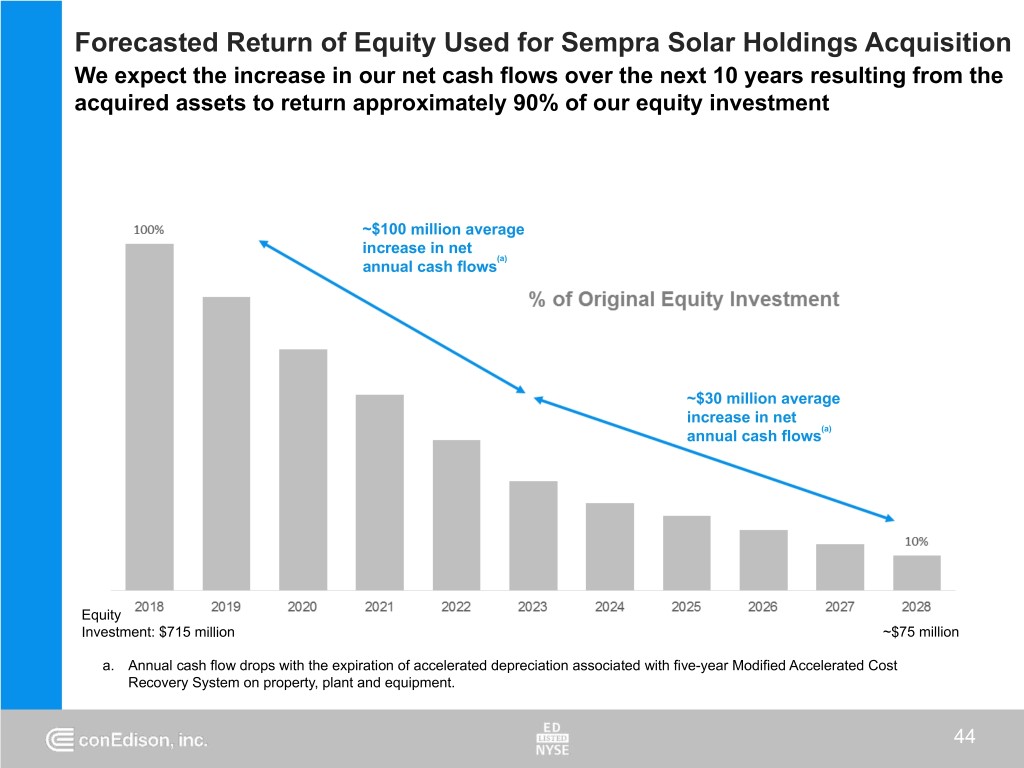

Forecasted Return of Equity Used for Sempra Solar Holdings Acquisition We expect the increase in our net cash flows over the next 10 years resulting from the acquired assets to return approximately 90% of our equity investment ~$100 million average increase in net (a) annual cash flows ~$30 million average increase in net annual cash flows(a) Equity Investment: $715 million ~$75 million a. Annual cash flow drops with the expiration of accelerated depreciation associated with five-year Modified Accelerated Cost Recovery System on property, plant and equipment. 44

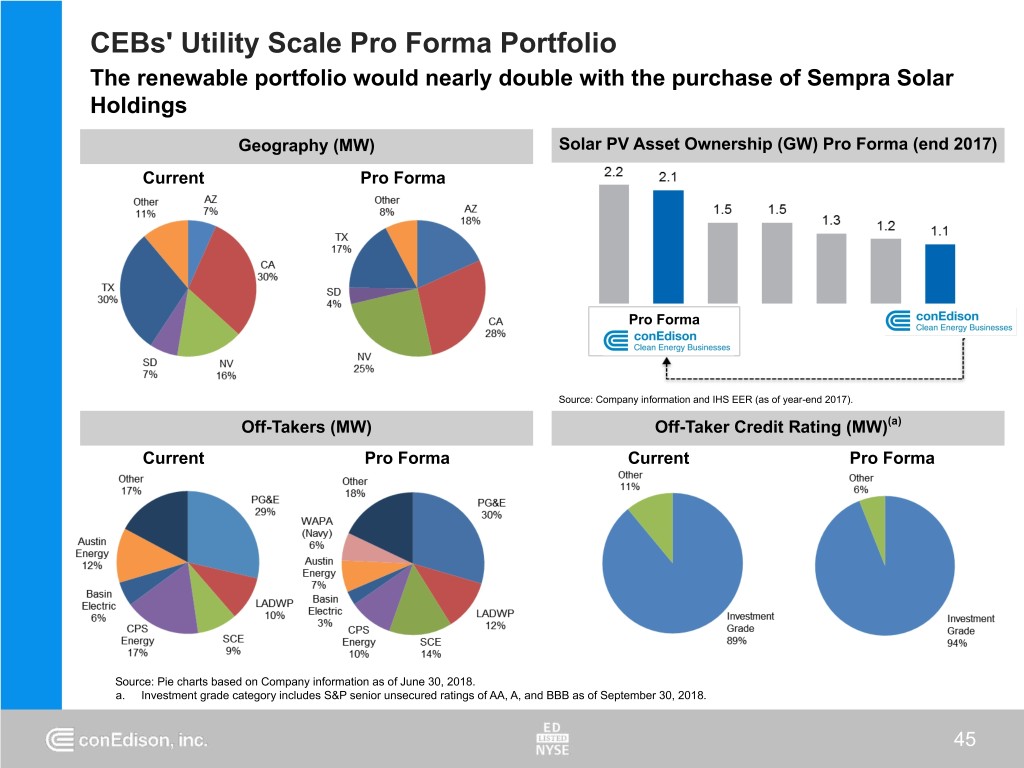

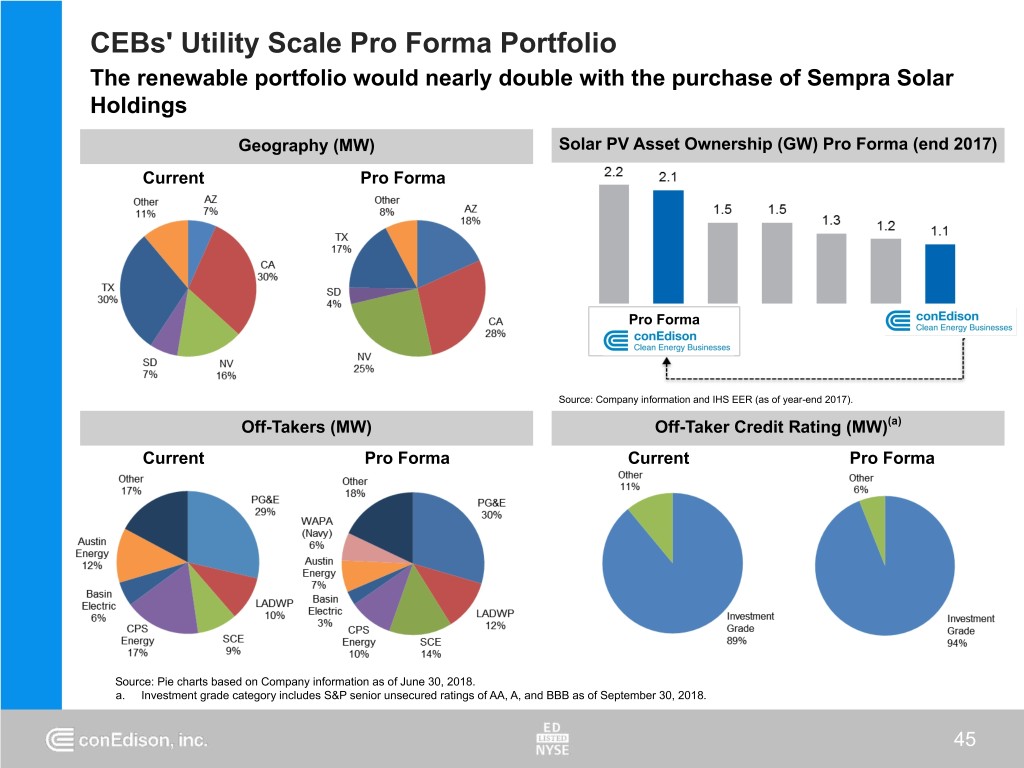

CEBs' Utility Scale Pro Forma Portfolio The renewable portfolio would nearly double with the purchase of Sempra Solar Holdings Geography (MW) Solar PV Asset Ownership (GW) Pro Forma (end 2017) Current Pro Forma Pro Forma Source: Company information and IHS EER (as of year-end 2017). Off-Takers (MW) Off-Taker Credit Rating (MW)(a) Current Pro Forma Current Pro Forma Source: Pie charts based on Company information as of June 30, 2018. a. Investment grade category includes S&P senior unsecured ratings of AA, A, and BBB as of September 30, 2018. 45

Investment Highlights • Forecasted returns expected to exceed regulatory return • Long-term, contracted cash flows with creditworthy counterparties • Efficiencies from operating co-owned and co-located assets • Familiarity with assets and markets of operation • Consistent with CEI’s strategy of growing our renewables footprint • Enhances our development platform to enable further growth, including battery storage and repowering • Reinforces the corporate goal of responsible environmental stewardship 46