2024 Earnings Release Presentation February 20, 2025

Available Information On February 20, 2025, Consolidated Edison, Inc. issued a press release reporting its 2024 earnings and filed with the Securities and Exchange Commission the company’s 2024 Form 10-K. This presentation should be read together with, and is qualified in its entirety by reference to, the earnings press release and the Form 10-K. Copies of the earnings press release and the Form 10-K are available at: www.conedison.com/en/. (Select “For Investors” and then select “Press Releases” and “SEC Filings,” respectively.) Forward-Looking Statements This presentation contains forward-looking statements that are intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectations and not facts. Words such as “forecasts,” “expects,” “estimates,” “anticipates,” “intends,” “believes,” “plans,” “will,” “target,” “guidance,” “potential,” “goal,” “consider” and similar expressions identify forward-looking statements. The forward-looking statements reflect information available and assumptions at the time the statements are made, and accordingly speak only as of that time. Actual results or developments might differ materially from those included in the forward-looking statements because of various factors such as those identified in reports Con Edison has filed with the Securities and Exchange Commission, including that Con Edison's subsidiaries are extensively regulated and may be subject to substantial penalties; its utility subsidiaries' rate plans may not provide a reasonable return; it may be adversely affected by changes to the utility subsidiaries' rate plans; the failure of, or damage to, its subsidiaries' facilities could adversely affect it; a cyber-attack could adversely affect it; the failure of processes and systems, the failure to retain and attract employees and contractors, and their negative performance could adversely affect it; it is exposed to risks from the environmental consequences of its subsidiaries' operations, including increased costs related to climate change; its ability to pay dividends or interest depends on dividends from its subsidiaries; changes to tax laws could adversely affect it; it requires access to capital markets to satisfy funding requirements; a disruption in the wholesale energy markets, increased commodity costs or failure by an energy supplier or customer could adversely affect it; it faces risks related to health epidemics and other outbreaks; its strategies may not be effective to address changes in the external business environment; it faces risks related to supply chain disruptions, inflation and the imposition of tariffs; and it also faces other risks that are beyond its control. This list of factors is not all-inclusive because it is not possible to predict all factors that could cause actual results or developments to differ from the forward-looking statements. Con Edison assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures This presentation also contains financial measures, adjusted earnings and adjusted earnings per share (adjusted EPS), that are not determined in accordance with generally accepted accounting principles in the United States of America (GAAP). These non-GAAP financial measures should not be considered as an alternative to net income for common stock or net income per share, respectively, each of which is an indicator of financial performance determined in accordance with GAAP. Adjusted earnings and adjusted earnings per share exclude from net income for common stock and net income per share, respectively, certain items that Con Edison does not consider indicative of its ongoing financial performance such as adjustments to the gain and other impacts related to the sale of all of the stock of its former subsidiary, the Clean Energy Businesses, in 2023, the effects of HLBV accounting for tax equity investments, mark-to-market accounting and accretion of the basis difference of Con Edison's equity investment in Mountain Valley Pipeline, LLC (MVP). Management uses these non-GAAP financial measures to facilitate the analysis of Con Edison's financial performance as compared to its internal budgets and previous financial results and to communicate to investors and others Con Edison's expectations regarding its future earnings and dividends on its common stock. Management believes that these non-GAAP financial measures are also useful and meaningful to investors to facilitate their analysis of Con Edison's financial performance. See slides 26, 30, 31, 35, 39, 40 and 41 for a reconciliation of non-GAAP financial measures to their GAAP equivalent. For more information, contact: Jan Childress, Director, Investor Relations Caroline Elsasser, Section Manager, Investor Relations Allison Duignan, Sr. Analyst, Investor Relations Tel: 212-460-6611 Tel: 212-460-4431 Tel: 212-460-6912 Email: childressj@coned.com Email: elsasserc@coned.com Email: duignana@coned.com Investor Relations conEdison.com 2

3 Our Story Con Edison is focused on building and maintaining safe and reliable regulated energy infrastructure to support New York State's ambitious clean energy goals 3 • Long-term value creation for shareholders ◦ Delivered on five-year EPS CAGR target initiated in 2019 ◦ Achieved 51st year of consecutive dividend increases ◦ Fully regulated business model ◦ Transparent regulatory process in New York with revenue predictability • Future growth opportunities ◦ $38 billion in capital investments forecasted from 2025 - 2029 ◦ Forecasted 8.2% annual utility rate base growth target from 2025 - 2029 ◦ Growth financed through a simplified capital structure with no long-term holding company debt • Industry-leading safe and reliable service ◦ Nation-leading electric system reliability ◦ Incorporating science-based resilience into future build and design of our underground and overhead electric transmission and distribution systems ◦ Industry leaders in monitoring our gas system We are a policy-aligned partner with New York State and New York City and investments in our system are essential to meeting their clean energy goals

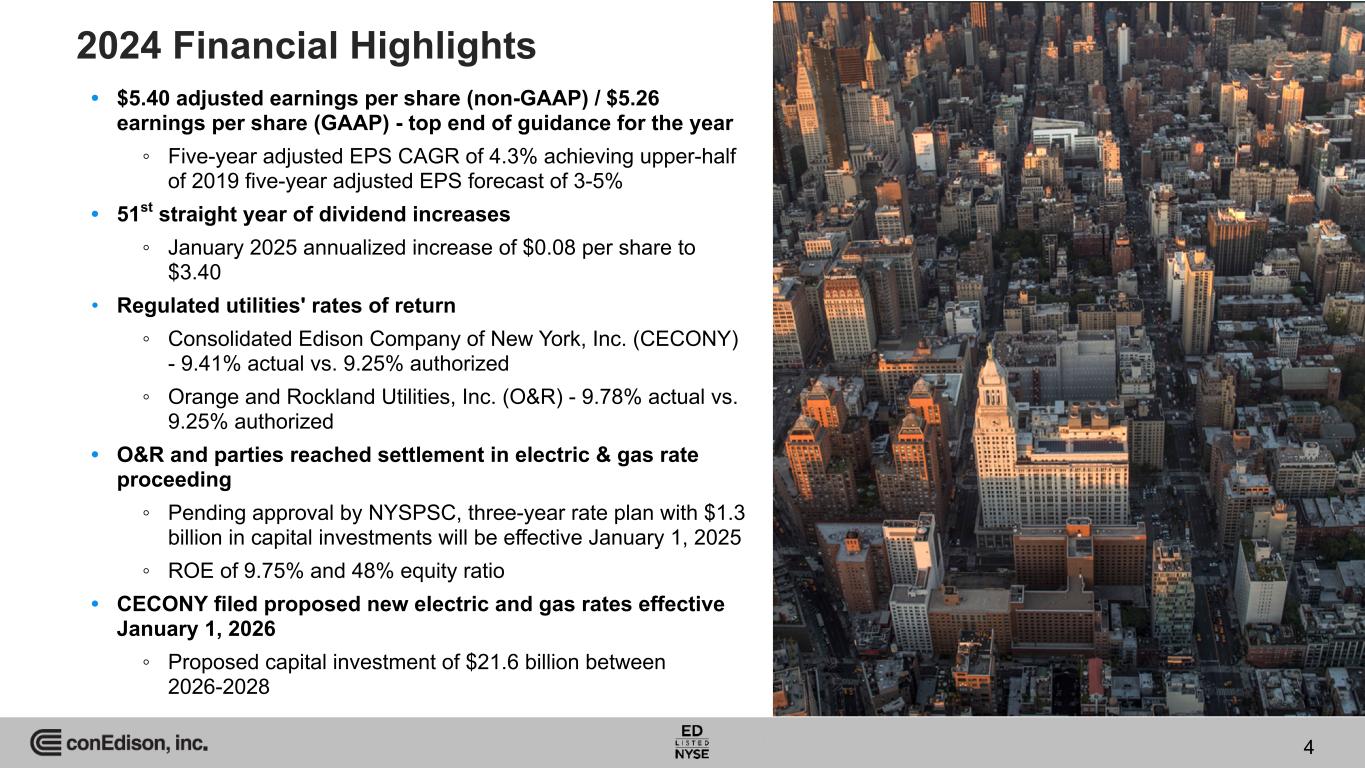

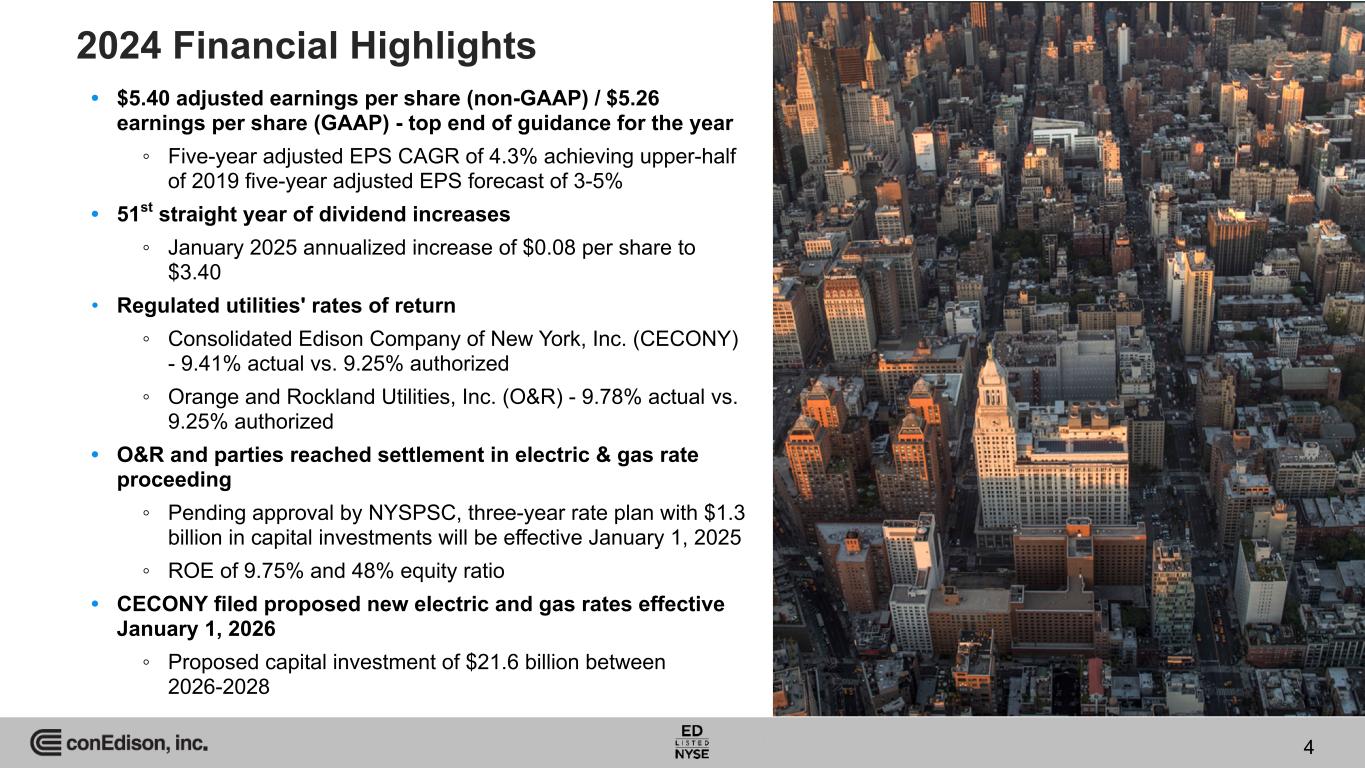

2024 Financial Highlights • $5.40 adjusted earnings per share (non-GAAP) / $5.26 earnings per share (GAAP) - top end of guidance for the year ◦ Five-year adjusted EPS CAGR of 4.3% achieving upper-half of 2019 five-year adjusted EPS forecast of 3-5% • 51st straight year of dividend increases ◦ January 2025 annualized increase of $0.08 per share to $3.40 • Regulated utilities' rates of return ◦ Consolidated Edison Company of New York, Inc. (CECONY) - 9.41% actual vs. 9.25% authorized ◦ Orange and Rockland Utilities, Inc. (O&R) - 9.78% actual vs. 9.25% authorized • O&R and parties reached settlement in electric & gas rate proceeding ◦ Pending approval by NYSPSC, three-year rate plan with $1.3 billion in capital investments will be effective January 1, 2025 ◦ ROE of 9.75% and 48% equity ratio • CECONY filed proposed new electric and gas rates effective January 1, 2026 ◦ Proposed capital investment of $21.6 billion between 2026-2028 4

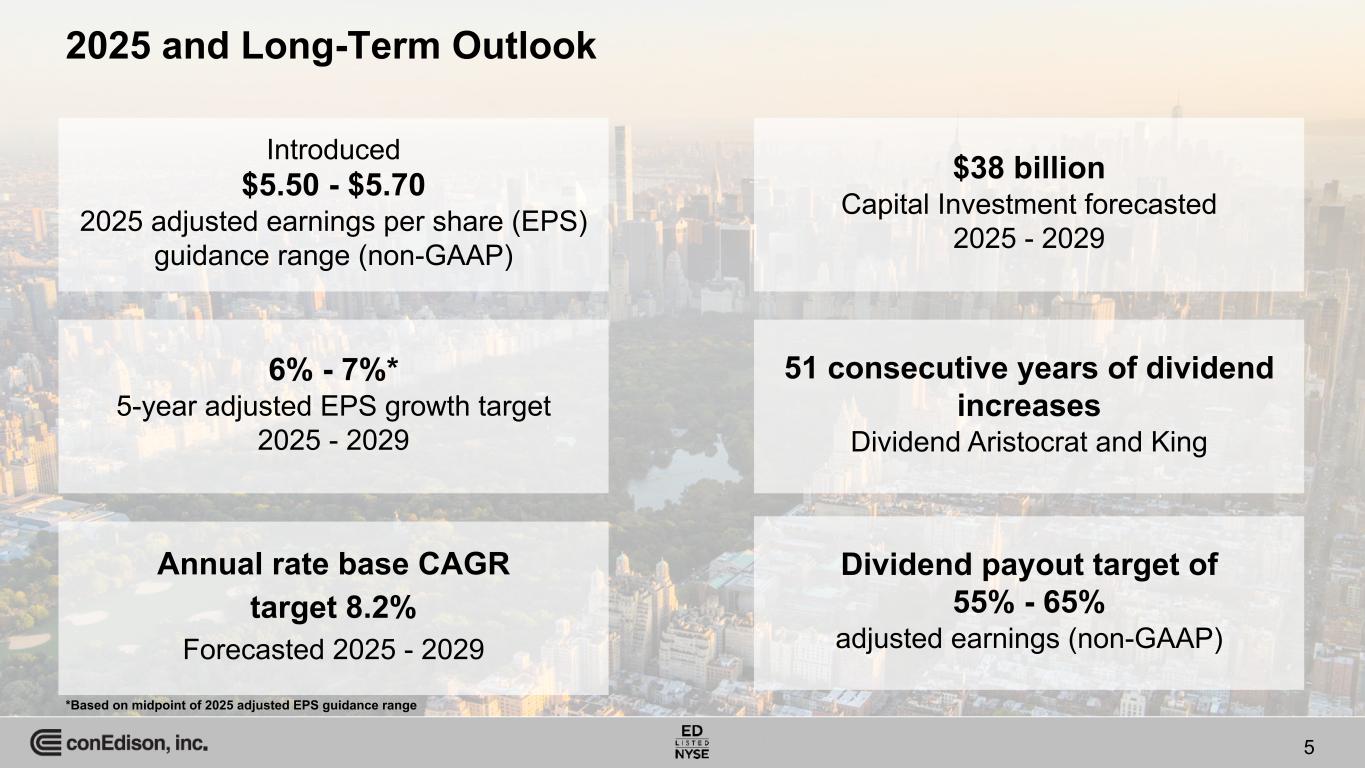

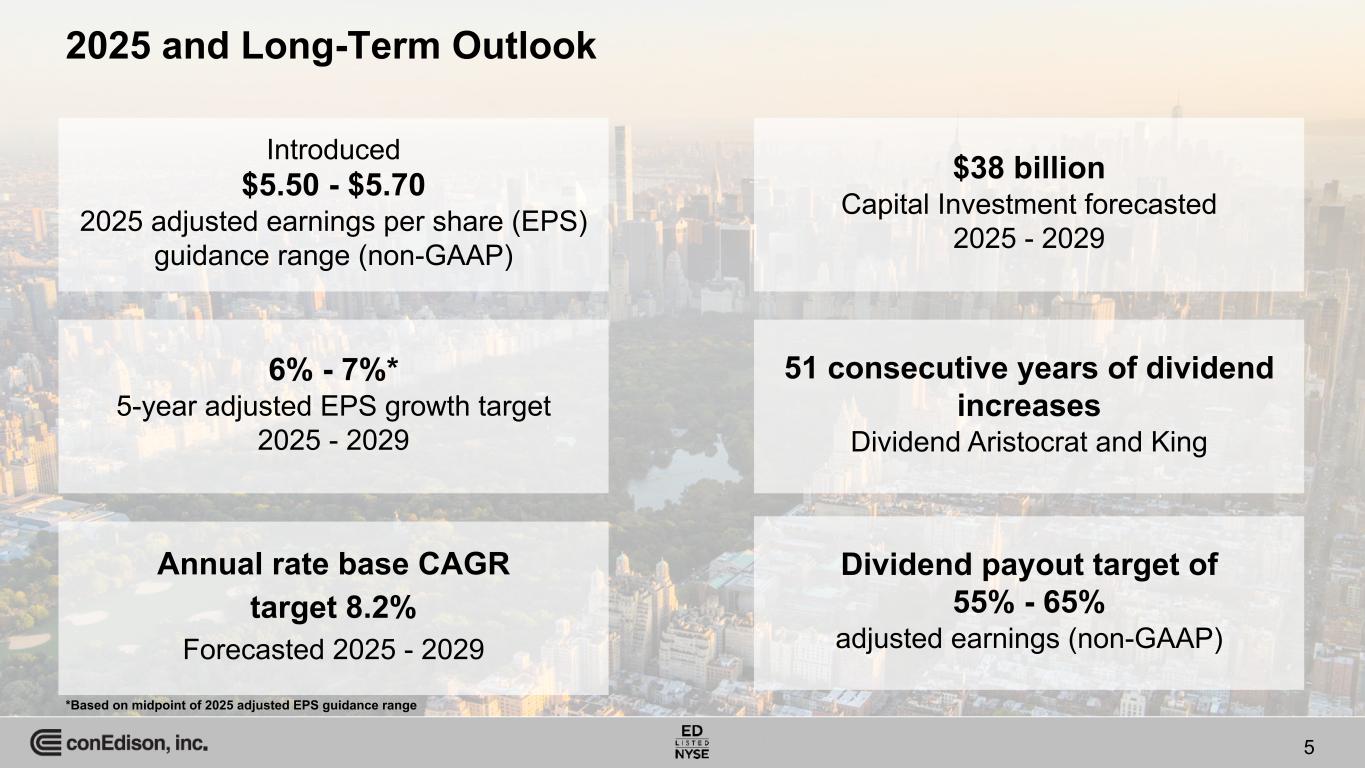

2025 and Long-Term Outlook 5 Introduced $5.50 - $5.70 2025 adjusted earnings per share (EPS) guidance range (non-GAAP) 6% - 7%* 5-year adjusted EPS growth target 2025 - 2029 Annual rate base CAGR target 8.2% Forecasted 2025 - 2029 $38 billion Capital Investment forecasted 2025 - 2029 51 consecutive years of dividend increases Dividend Aristocrat and King Dividend payout target of 55% - 65% adjusted earnings (non-GAAP) *Based on midpoint of 2025 adjusted EPS guidance range

6 Setting Industry Standards for Safety, Operational Excellence and the Customer Experience 6 World Class Reliability • CECONY's service is about 9 times more reliable than the U.S. average • O&R won PA Consulting 2024 ReliabilityOne® Award for Northeast Region Suburban service area Resilient Build and Design • ~72% of CECONY's electric T&D system is underground • Over 1.2 million weather related customer outages have been avoided as a result of the resilience investments Con Edison continues to make post Sandy Safety • CECONY pioneered state of the art natural gas detectors with 70% penetration in our system • CECONY’s monthly leak surveys on its entire gas distribution system exceeds the regulatory requirement of annual surveys in business districts • Industry leading leak repair schedules enhances safety and reduces methane emissions Customer Focused • CECONY #1 in J.D. Power’s 2024 Electric Utility Business Customer Satisfaction Study for large electric utilities in the East • Our Energy Affordability Programs aim to keep energy affordable for vulnerable customers, targeting utility costs to 6% of average annual income • In 2024, CECONY supported more than 352,000 customers through energy efficiency programs

7 Meeting Load Growth and Customer Demand for Electrification 7 Investments in substations and transmission essential to meet customer needs • Progress on key infrastructure projects to support clean energy sources and our customers’ growing electrification needs – Brooklyn Clean Energy Hub targeting in-service date of December 2027 – Idlewild Substation on track to support the electrification of JFK airport and MTA fleets – Targeting in-service dates in 2025 for the Goethals to Fox Hills and Greenwood to Gowanus transmission projects – Eastern Queens and Gateway Substations are targeting in-service dates in 2028 Supporting our customers’ clean heating needs, new tech adoption • CECONY and O&R have supported 14,868 heat pump installations in 2024 – There was a 77% increase in the installation of heat pumps across the service territory from Q3 to Q4 2024 • In 2024, over $183 million was been invested throughout CECONY and O&R's service territory to support Clean Heat Programs Meeting our customers’ demand for EV infrastructure • More than 90,000 light-duty Electric Vehicles registered in the CECONY service area, with 2024 seeing a 36% increase • Since the program's inception, CECONY and O&R have paid out over $108 million in incentives under the PowerReady program, which has helped support the installation of over 12,493 EV charging plugs in our service territory • Of the charging plugs installed as of December 31, 2024 in CECONY and O&R's service territories, 4,934 EV chargers are in disadvantaged communities and 3,361 are publicly accessible • As of December 31, 2024, 27,237 CECONY and O&R customers have enrolled in the company’s Residential Management Charging Program

$72 Billion Investment Identified in CECONY Integrated Long- Range Plan for Electric, Gas and Steam Services Source: Long Range Plans | Con Edison Strategic framework and roadmap guides programs and investments of an additional $34 billion for CECONY beyond our five-year forecast to achieve four strategic objectives • Core Service: Provide world-class safety, reliability, and security, while managing the customer rate impacts and equity challenges of the energy transition • Clean Energy: Support economy-wide net zero greenhouse gas emissions in our service territories by 2050 • Climate Resilience: Increase the resilience of our energy infrastructure to adapt to the impacts of climate change • Customer Engagement: Deliver an industry- leading customer experience throughout the energy transition $72 billion in investments from 2025 - 2034 8

Customer Affordability CECONY electric customer bills are lower than our proxy peer average on both a total bill and share of wallet basis 9 Source: S&P Market Intelligence, EIA. Three-year (2021 - 2023) average customer bills are annualized full-service residential bills. Share of wallet calculated as annual bill over median household income.

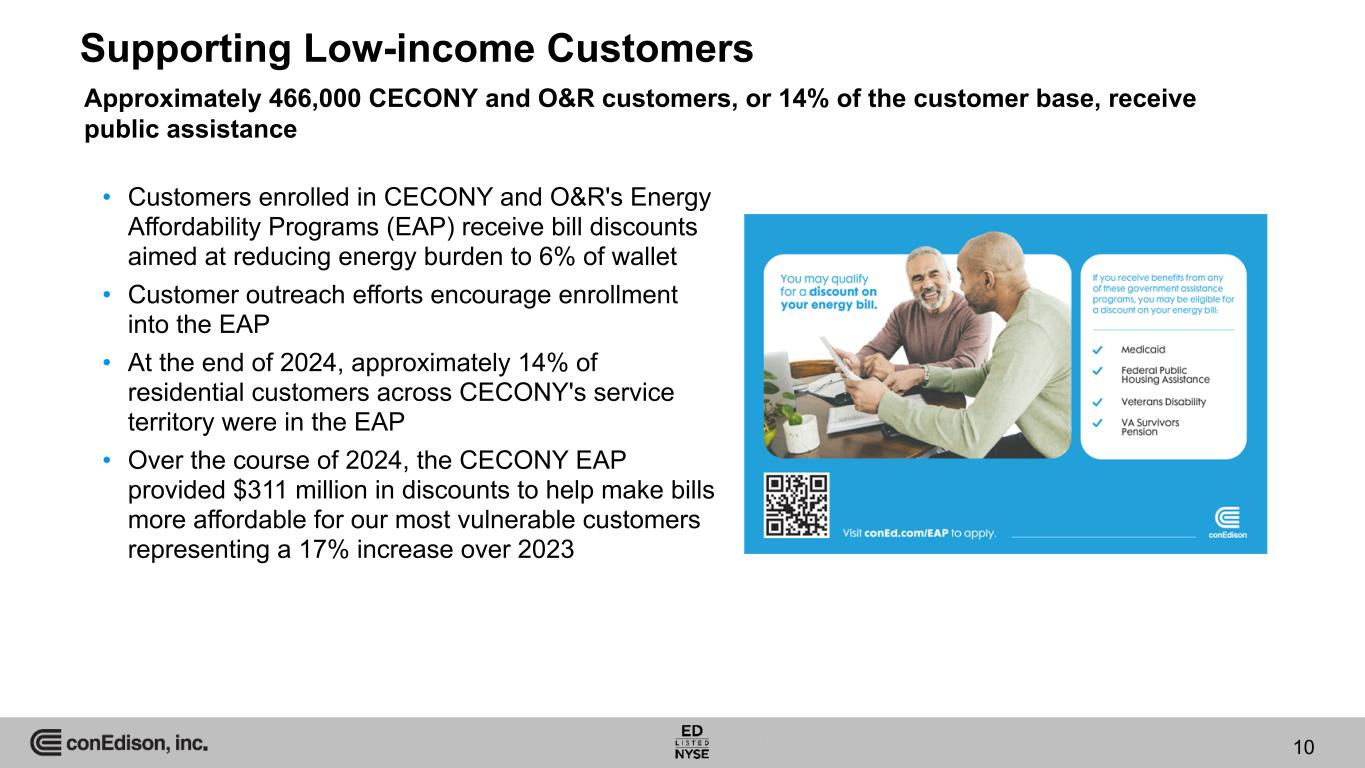

Supporting Low-income Customers Approximately 466,000 CECONY and O&R customers, or 14% of the customer base, receive public assistance 10 • Customers enrolled in CECONY and O&R's Energy Affordability Programs (EAP) receive bill discounts aimed at reducing energy burden to 6% of wallet • Customer outreach efforts encourage enrollment into the EAP • At the end of 2024, approximately 14% of residential customers across CECONY's service territory were in the EAP • Over the course of 2024, the CECONY EAP provided $311 million in discounts to help make bills more affordable for our most vulnerable customers representing a 17% increase over 2023

Capital Investments to Maintain Reliability, Meet Growing Demand and Enhance Resiliency $4,085 $3,964 $4,465 $4,509 $4,728 $5,122 $8,067 $8,268 $8,423 $7,778 $3,466 $3,635 $4,001 $4,379 $4,699 $5,079 $7,973 $8,161 $8,310 $7,665$616 $298 $399 $81 $3 $31 $65 $49 $29 $43 $94 $107 $113 $113 2020 2021 2022 2023 2024 2025E 2026E 2027E 2028E 2029E Actual Forecast (a)(d) CECONY & O&R - actual Con Edison Transmission, Inc. (CET) - actual Clean Energy Businesses - actual CECONY & O&R - forecast Con Edison Transmission - forecast a. Amounts reflect the company's five-year forecast as of January 2025. b. Forecast for 2026, 2027 and 2028 reflects CECONY’s January 2025 electric and gas rate filings that are subject to approval by the NYSPSC. c. Forecast for 2025, 2026 and 2027 reflects O&R’s November 2024 Joint Proposal that is subject to approval by the NYSPSC. d. 2024 Form 10-K, page 30. ($ in millions) 11 (b)(c) (b)(c)(c) (b)

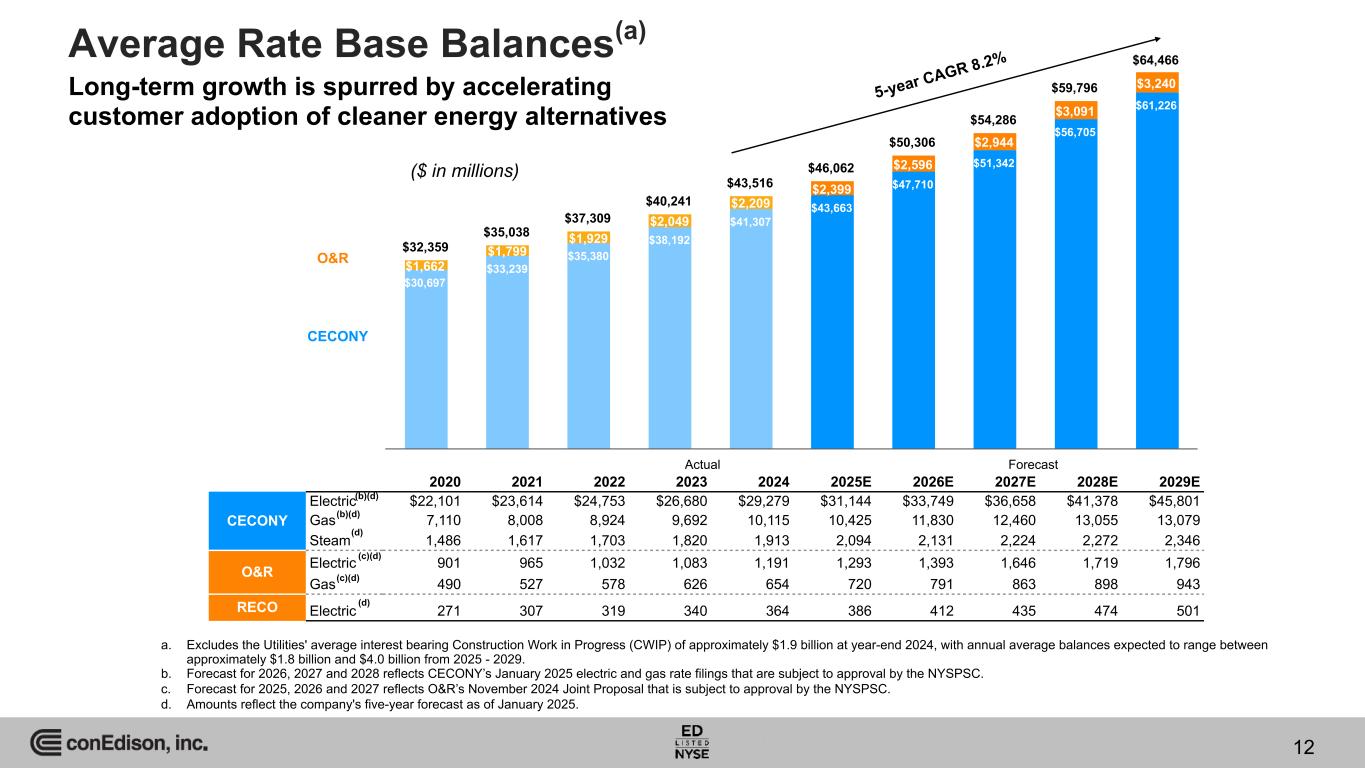

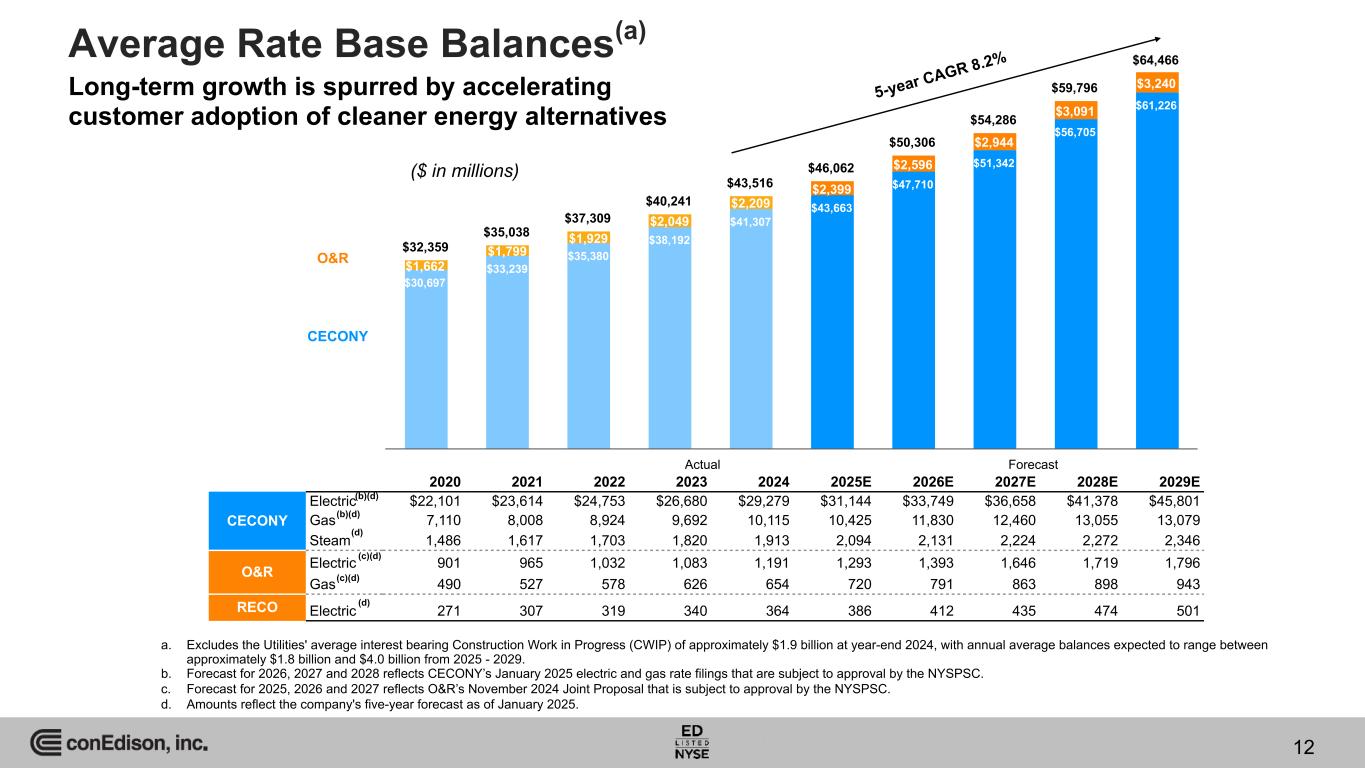

$32,359 $35,038 $37,309 $40,241 $43,516 $46,062 $50,306 $54,286 $59,796 $64,466 $30,697 $33,239 $35,380 $38,192 $41,307 $43,663 $47,710 $51,342 $56,705 $61,226 $1,662 $1,799 $1,929 $2,049 $2,209 $2,399 $2,596 $2,944 $3,091 $3,240 Average Rate Base Balances(a) O&R CECONY 5-year CAGR 8.2% 2020 2021 2022 2023 2024 2025E 2026E 2027E 2028E 2029E CECONY Electric $22,101 $23,614 $24,753 $26,680 $29,279 $31,144 $33,749 $36,658 $41,378 $45,801 Gas 7,110 8,008 8,924 9,692 10,115 10,425 11,830 12,460 13,055 13,079 Steam 1,486 1,617 1,703 1,820 1,913 2,094 2,131 2,224 2,272 2,346 O&R Electric 901 965 1,032 1,083 1,191 1,293 1,393 1,646 1,719 1,796 Gas 490 527 578 626 654 720 791 863 898 943 RECO Electric 271 307 319 340 364 386 412 435 474 501 ForecastActual a. Excludes the Utilities' average interest bearing Construction Work in Progress (CWIP) of approximately $1.9 billion at year-end 2024, with annual average balances expected to range between approximately $1.8 billion and $4.0 billion from 2025 - 2029. b. Forecast for 2026, 2027 and 2028 reflects CECONY’s January 2025 electric and gas rate filings that are subject to approval by the NYSPSC. c. Forecast for 2025, 2026 and 2027 reflects O&R’s November 2024 Joint Proposal that is subject to approval by the NYSPSC. d. Amounts reflect the company's five-year forecast as of January 2025. . (c)(d) (c)(d) (d) (b)(d) (b)(d) (d) ($ in millions) 12 Long-term growth is spurred by accelerating customer adoption of cleaner energy alternatives

CECONY and O&R Average Investment Earnings Base(a) 13 In addition to our traditional rate base, our earnings base includes cumulative program investments for transportation electrification, innovation energy networks and energy storage dispatching ($ in millions) Surcharge recovery programs (not in base rates) are primarily comprised of Transportation Electrification (Electric Vehicles Make Ready Program), Utility Thermal Energy Networks, and Utility Storage Dispatch Rights and associated capital investments with those programs. a. Excludes utilities average interest bearing CWIP

Financing Plan for 2025-2029(a) ($ in millions) Equity 2025 2026 2027 - 2029 Common Equity Issuance(b) up to $1,350(c) up to $1,850 up to $4,300 Debt 2025 2026 2027 - 2029 Long-term Debt up to $1,750 up to $3,800 up to $9,100 a. Con Edison’s estimates of its capital requirements and related financing plans reflect information available and assumptions at the time the statements are made and include, among other things, the assumptions that the Utilities’ forecasted capital investments and financing plans through 2029 are approved by the NYSPSC. Actual developments and the timing and amount of funding may differ materially. b. Excludes common equity issued under the dividend reinvestment, employee stock purchase and long-term incentive plans. c. Includes an estimated $677 million of net proceeds to be received in 2025 upon physical settlement of the 7 million shares under an equity forward sale agreement that was entered into in December 2024. d. Includes $500 million and $200 million borrowed under a 364-day Term Loan agreement in November 2024 and January 2025, respectively. Debt Maturities 2025 2026 2027 2028 2029 Con Edison $— $— $— $— $— CECONY 700 (d) 250 700 800 — O&R — — 80 — 44 Total $700 $250 $780 $800 $44 14 • Equity guidance for 2025 includes ~$677 million of equity executed as a forward sale in December 2024 • The financing plans do not include the impact, if any, that may result from the evaluation of strategic alternatives with respect to MVP or Honeoye Storage Corporation

Dividend Aristocrat and King Focusing on long-term shareholder value has yielded 51 consecutive years of dividend increases with a CAGR of 5.59% 15

Regulatory Updates 16

17 Utility Regulation in New York State 17 • Revenue predictability ◦ Revenue decoupling mechanism in place for CECONY and O&R electric and gas ◦ Weather normalization adjustment in CECONY steam rate plan began November 1, 2023 • Formulaic approach to return on equity ◦ 2/3 Discounted Cash Flow Model ◦ 1/3 Capital Asset Pricing Model • Reduced regulatory lag ◦ Fully-forecasted rate case test year ◦ Timely recovery of most fuel and commodity costs ◦ True-ups (reconciliations) for major costs including pensions, environmental costs, property taxes (partial), and variable-rate debt

18 18 Summary of CECONY Electric & Gas Rate Filings Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. Electric Case number 25-E-0072 Gas Case number 25-G-0073 ($ in millions) Rate Change Average Rate Base Capital Investments Total Bill Impact Rate Change Average Rate Base Capital Investments Total Bill Impact Rate Year 1: 2026 $1,612 $33,750 $5,814 11% $441 $11,830 $1,288 13% Rate Year 2: 2027 932 36,660 5,905 6% 266 12,460 1,253 7% Rate Year 3: 2028 880 41,380 6,139 5% 166 13,055 1,221 4% Annual levelized rate increase $1,263 9% $337 10% In January 2025, CECONY submitted to the New York Public Service Commission (NYSPSC) rate cases in support of new electric and gas rates to become effective January 1, 2026 Summary ◦ True-up of costs of pension and other post employment benefits (OPEBs), environmental remediation, and storms (electric) ◦ Requesting full reconciliation of property taxes, municipal infrastructure support costs, uncollectibles, late payment charges, and long-term debt cost rate ◦ Requesting to reduce certain gas asset service lives by 5 years in alignment with the gas transition that is expected to result from Climate Leadership & Community Protection Act (CLCPA) implementation ◦ Continuing the revenue decoupling mechanism for electric and gas service ◦ Continuing provision for recovery of cost of purchased power, gas, and fuel ◦ Continuation of earning opportunities from Earnings Adjustment Mechanisms (EAMs) for meeting energy efficiency goals and other potential incentives Return on equity……………..10.10% Equity ratio……………………48% Proposed Return on Equity and Equity Ratio Proposed Rate Changes and Capital Investments

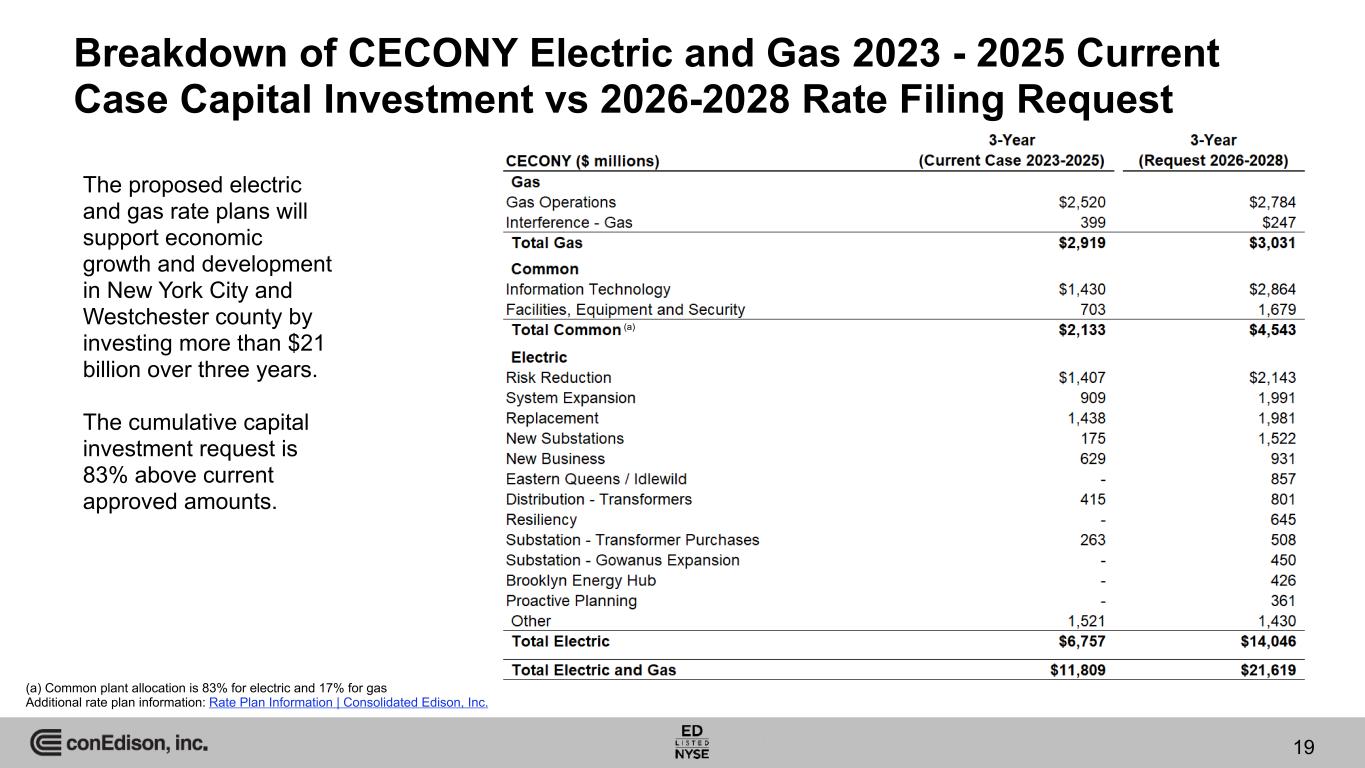

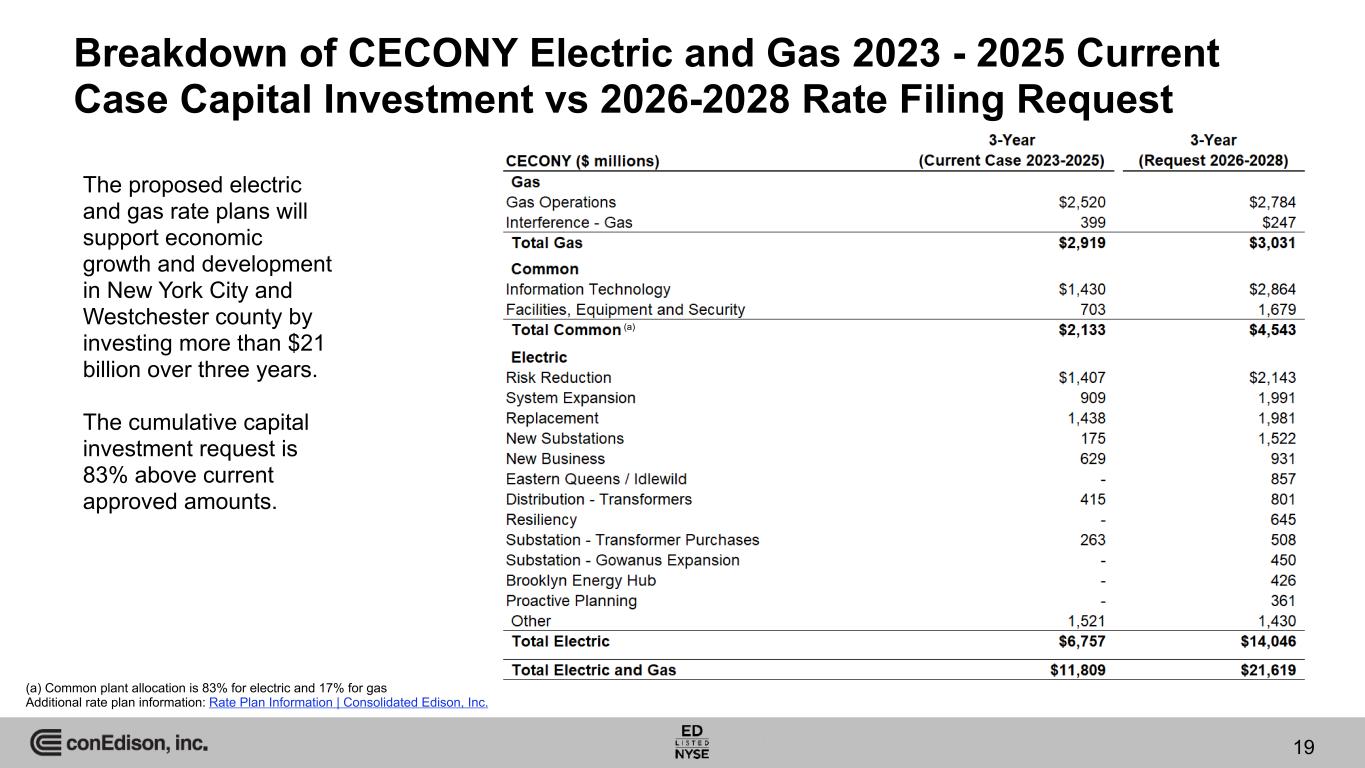

19 19 Breakdown of CECONY Electric and Gas 2023 - 2025 Current Case Capital Investment vs 2026-2028 Rate Filing Request (a) Common plant allocation is 83% for electric and 17% for gas Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. The proposed electric and gas rate plans will support economic growth and development in New York City and Westchester county by investing more than $21 billion over three years. The cumulative capital investment request is 83% above current approved amounts. (a)

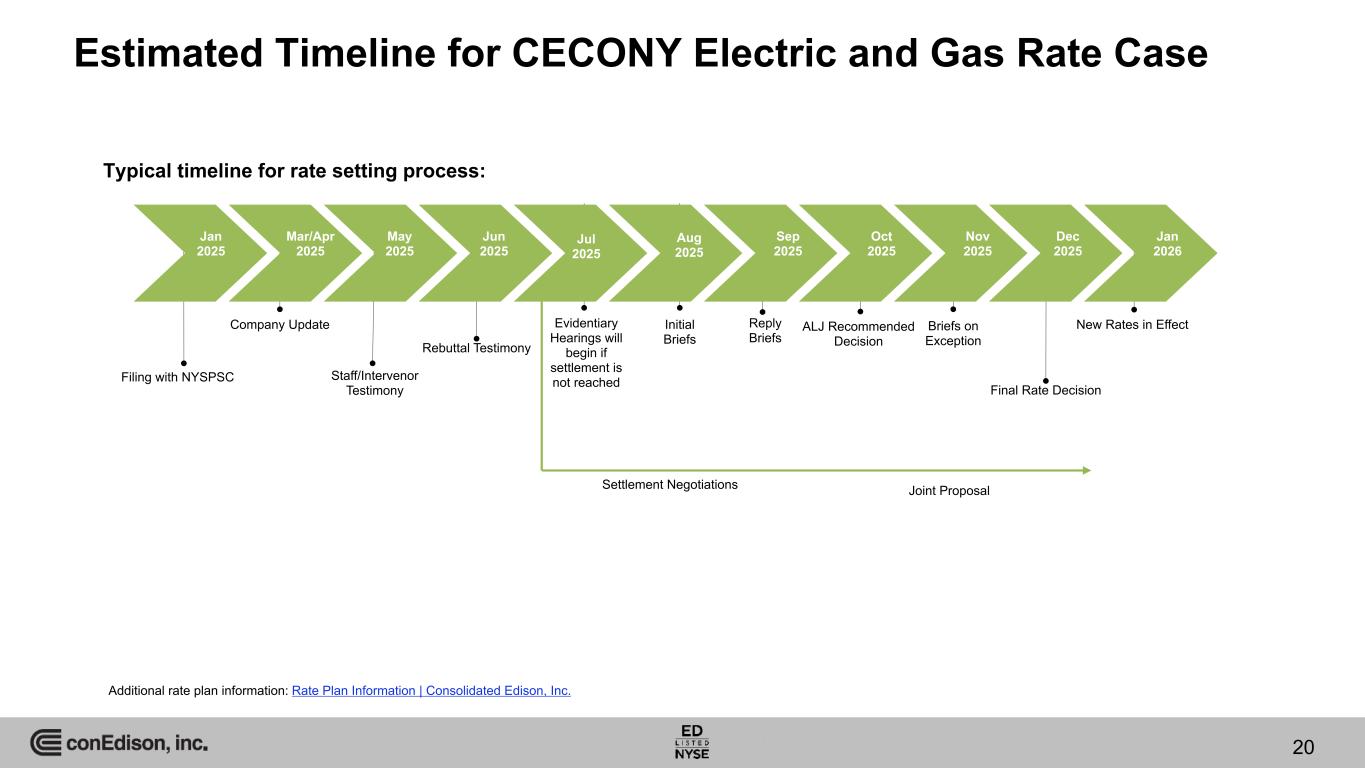

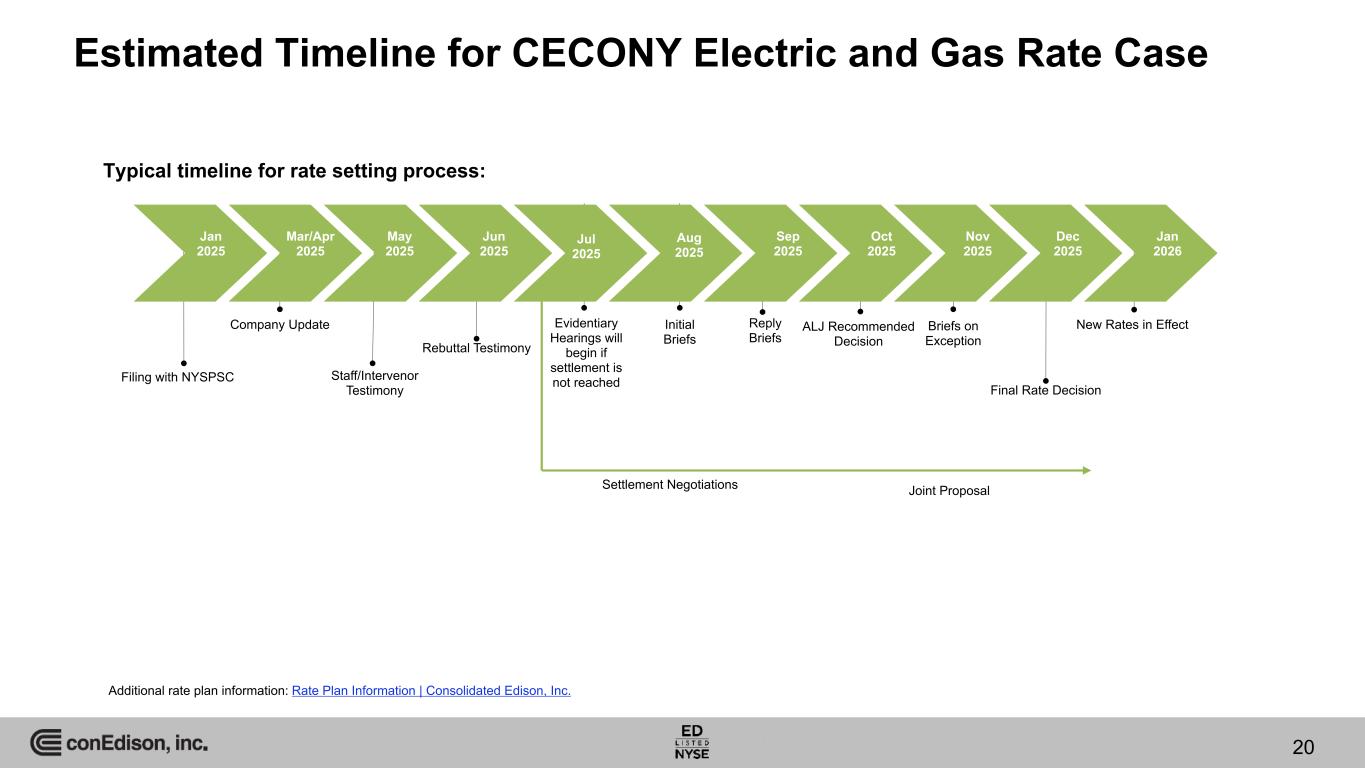

20 20 Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. Estimated Timeline for CECONY Electric and Gas Rate Case Jan 2025 Mar/Apr 2025 May 2025 Jun 2025 Jul 2025 Aug 2025 Sep 2025 Oct 2025 Nov 2025 Dec 2025 Jan 2026 Filing with NYSPSC Company Update Staff/Intervenor Testimony Rebuttal Testimony Settlement Negotiations New Rates in Effect Joint Proposal Typical timeline for rate setting process: Evidentiary Hearings will begin if settlement is not reached Initial Briefs Reply Briefs ALJ Recommended Decision Briefs on Exception Final Rate Decision

INTERNAL Summary of O&R Electric & Gas Joint Proposal Return on equity……………..9.75% Equity ratio……………………48% Proposed Rate Changes and Capital Investments Proposed Return on Equity and Equity Ratio Electric Case number 24-E-0060 Gas Case number 24-G-0061 ($ in millions) Rate Change(a) Average Rate Base Capital Investments Rate Change(a) Average Rate Base Capital Investments Rate Year 1: 2025 $(13) $1,293 $311 $4 $720 $121 Rate Year 2: 2026 25 1,393 349 18 791 127 Rate Year 3: 2027 44 1,646 315 16 863 110 Summary ◦ Electric and gas capital investment of $975 million and $358 million over three years, respectively ◦ True up of costs for pension and OPEBs, environmental remediation, major storms, and low-income bill credits ◦ Partial true-up of property taxes, uncollectibles, and late payment charges ◦ Continuation of decoupling of electric and gas revenues from electric and gas consumption ◦ Continuation of earnings opportunities from Earnings Adjustment Mechanisms (EAMs) and other positive incentives In November 2024, O&R, the New York State Department of Public Service and other parties entered into a joint proposal for new electric and gas rate plans for the three-year period January 2025 through December 2027, which is subject to New York State Public Service Commission approval Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. 21 (a) The Joint Proposal recommends that the electric base rate changes will be implemented with no change in 2025 and annual increases of approximately $17.7 million in each of 2026 and 2027. The Joint Proposal recommends that the gas base rate increase will be implemented with annual increases of approximately $10.4 million in each of 2025, 2026 and 2027. .

Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. O&R Electric & Gas Rate Case Filing Comparison(a) 22 Electric Gas ($ in millions) Case number 24-E-0060 Case number 24-G-0061 Rate Year 1: Jan 2025 - Dec 2025 Jan 2024 Filing Apr 2024 Update May 2024 Staff/ Intervenor Testimony Nov 2024 Joint Proposal Jan 2024 Filing Apr 2024 Update May 2024 Staff/ Intervenor Testimony Nov 2024 Joint Proposal New infrastructure investment, including return, depreciation and property taxes $17 $14 $11 $13 $6 $7 $7 $10 ROE/Financing 15 15 7 8 7 8 4 4 Depreciation changes due to proposed rates 2 2 (1) — 9 10 1 — Sales revenue change (9) (9) (15) (13) 4 5 4 4 Operations & maintenance expenses 8 8 (8) (1) (5) (5) (10) (6) Regulatory amortization (10) (11) (12) (11) (8) (8) (8) (8) Other revenues (7) (7) (7) (7) — — — — Income taxes 2 (1) (2) (2) 1 — (1) — Total Rate Increase (Decrease) $18 $11 $(27) $(13) $14 $17 $(3) $4 Rate Base $1,324 $1,305 $1,286 $1,293 $695 $711 $707 $720 ROE 10.25% 10.25% 9.50% 9.75% 10.25% 10.25% 9.50% 9.75% Equity Ratio 50% 50% 48% 48% 50% 50% 48% 48% (a) The Joint Proposal is subject to approval by the NYSPSC .

NYSPSC & NYISO Proceedings and Developments NYISO 23 a. NYSPSC docket number 22-E-0236 • In October 2024, the New York Independent System Operator (NYISO) published the Viability and Sufficiency Assessment, confirming that the 28 proposed Public Policy Transmission projects, submitted by four developers, including NY Transco, are viable and sufficient. The proposed projects will be evaluated by the NYISO, with final project selection by the NYISO board expected to occur by Q4 2025. • CECONY monitors the adequacy of the electric capacity resources and related developments in its service area, and works with other parties on long-term resource adequacy and transmission security within the framework of the NYISO reliability planning process. In November 2024, the NYISO published the 2024 Reliability Needs Assessment. The biennial assessment, which examines bulk-power system needs over the upcoming ten years, found that there will be reliability violations in New York City starting in summer 2033 by as much as 17 MW for 1 hour and increasing to 97 MW for 3 hours in summer 2034 on the peak day during expected weather conditions. In addition to soliciting a market solution to address this NYC Reliability Need, the NYISO will request a Backstop Solution from CECONY as the Responsible Transmission Owner, that will be triggered if there is no viable market solution. Electric Vehicles • In October 2024, the NYSPSC issued an order(a) approving electric vehicle (EV) Phase-In Rates for commercial EV charging. The new rates will become available to customers within 12 months of the order’s effective date. Proactive Planning Proceeding to Address Local Electrification • In November and December 2024, New York utilities, including CECONY and O&R, pursuant to the Proactive Planning Proceeding for building and vehicle electrification: (1) filed a proposed framework for the NYSPSC to use in evaluating proposed urgent projects, cost allocation and cost recovery, and (2) proposed a long-term coordinated planning process framework to study and identify necessary upgrades to support electrification. ◦ As part of the Proactive Planning Proceeding(b), in November 2024, CECONY requested that the NYSPSC approve nine Urgent Projects totaling $856 million to accommodate transportation and building electrification. The projects are primary distribution feeder upgrades in electric vehicle hotpots, area substation and sub-transmission upgrades, and additional funding for relevant distribution system programs. O&R did not make an urgent project filing because its November 2024 joint proposal included projects that would have otherwise been considered urgent. Climate Change Resilience Plans • In February 2025, CECONY and O&R filed(c) updated climate change resilience plans with the NYSPSC in compliance with an order that directed CECONY and O&R to re-submit their November 2023 plans to exclude proposed projects that the NYSPSC determined are not climate resilience investments. CECONY’s and O&R’s updated climate change resilience plans propose investments of $645.4 million and $184.1 million, respectively, between 2025 and 2029 to enhance the resilience of their electric systems against extreme weather events brought about by climate change. The total cost of CECONY’s and O&R’s climate resilience investments from 2025 through 2044 are currently projected to be $5,294 million and $900.4 million, respectively. These investments are subject to approval by the NYSPSC through the base rate case process. b. NYSPSC docket number 24-E-0364 c. NYSPSC docket number 22-E-0222

Strong Economic Performance in 2024 24

Dividend and Earnings Announcements • On January 16, 2025, the company declared a quarterly dividend of 85 cents a share on its common stock. • On February 20, 2025, the company issued a press release forecasting its adjusted earnings per share for the year 2024 to be in the range of $5.50 to $5.70 a share.(a) Reported EPS (GAAP) Adjusted EPS (Non-GAAP) $0.90 $0.97 $0.98 $1.00 2024 2023 2024 2023 4Q 2024 vs. 4Q 2023 Reported EPS (GAAP) Adjusted EPS (Non-GAAP) $5.26 $7.25 $5.40 $5.07 2024 2023 2024 2023 2024 vs. 2023 25 a. Con Edison’s forecast of adjusted earnings per share for the year of 2025 excludes accretion of the basis difference of Con Edison's equity investment in MVP (approximately $(0.03) a share after-tax) and adjustments to the gain and other impacts related to the sale of all of the stock of the Clean Energy Businesses in 2023 and impacts resulting from the evaluation of strategic alternatives with respect to MVP and Honeoye Storage Corporation (Honeoye), the amounts of which, if any, will not be determinable until year-end. Accordingly, the company is unable to provide equivalent measures determined in accordance with generally accepted accounting principles in the United States of America (GAAP). b. Adjusted earnings and adjusted earnings per share in 2024 exclude adjustments to the gain and other impacts related to the sale of all of the stock of Con Edison's former subsidiary, Con Edison Clean Energy Businesses, Inc. (the Clean Energy Businesses) in 2023 and the effects of hypothetical liquidation at book value (HLBV) accounting for tax equity investments. Adjusted earnings and adjusted earnings per share in 2023 exclude the gain and other impacts related to the sale of all of the stock of the Clean Energy Businesses in 2023 and the effects of HLBV accounting for tax equity investments. Adjusted earnings and adjusted earnings per share in 2024 exclude accretion of the basis difference of Con Edison's equity investment in Mountain Valley Pipeline, LLC (MVP) and in 2023 exclude the net mark-to-market effects of the Clean Energy Businesses. (b) (b)

4Q 2024 EPS to Adjusted EPS (non-GAAP) Reconciliation Earnings per Share Net Income for Common Stock ($ in Millions) 2024 2023 2024 2023 Reported EPS and Net Income for Common Stock – GAAP basis $0.90 $0.97 $310 $335 Loss (gain) and other impacts related to the sale of the Clean Energy Businesses (pre-tax) (a) 0.09 — 33 1 Income taxes (b) (0.01) 0.01 (5) 6 Loss (gain) and other impacts related to the sale of the Clean Energy Businesses (net of tax) 0.08 0.01 28 7 Accretion of the basis difference of Con Edison's equity investment in MVP (0.01) — (3) — Income taxes (c) — — 1 — Accretion of the basis difference of Con Edison's equity investment in MVP (net of tax) (0.01) — (2) — HLBV effects (pre-tax) 0.01 0.02 5 5 Income taxes (d) — — (1) (1) HLBV effects (net of tax) 0.01 0.02 4 4 Adjusted EPS and Adjusted Earnings – non-GAAP basis $0.98 $1.00 $340 $346 a. On March 1, 2023, Con Edison completed the sale of the all of the stock of the Clean Energy Businesses. The loss (gain) and other impacts related to the sale of all of the stock of the Clean Energy Businesses were adjusted during the three months ended December 31, 2024 ($0.09 a share and $0.07 a share net of tax or $33 million and $25 million net of tax). The loss (gain) and other impacts related to the sale of the Clean Energy Businesses were adjusted during the three months ended December 31, 2023 ($0.05 a share net of tax or $1 million and $17 million net of tax). b. Amounts shown include the impact of the changes in state unitary tax apportionments ($0.01 a share net of federal taxes or $3 million net of federal taxes) for the three months ended December 31, 2024. The amount of income taxes for other accruals had an effective tax rate of 24% for the three months ended December 31, 2024. Amounts shown include changes in state unitary tax apportionments ($(0.04) a share net of federal taxes or $(10) million net of federal taxes) for the three months ended December 31, 2023. The amount of income taxes for other accruals had an effective tax rate of 48% for the three months ended December 31, 2023. c. The amount of income taxes was calculated using a combined federal and state income tax rate of 22% for the three months ended December 31, 2024. d. The amount of income taxes was calculated using a combined federal and state income tax rate of 24% and 29% for the three months ended December 31, 2024 and 2023, respectively. 26

Variance in Reported EPS (GAAP) Variance in Adjusted EPS (non-GAAP) 4Q 2023 Reported EPS CECONY O&R CEBs CET Other 4Q 2024 Reported EPS $0.97 $0.09 $— $— $(0.05) $0.90 4Q 2023 Adjusted EPS CECONY O&R CEBs CET Other 4Q 2024 Adjusted EPS $1.00 $0.09 $— $(0.05) $0.98 $— (a) (a) $(0.06) $(0.11) a. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. Walk from 4Q 2023 EPS to 4Q 2024 EPS and 4Q 2023 Adjusted EPS (non-GAAP) to 4Q 2024 Adjusted EPS (non-GAAP) 27

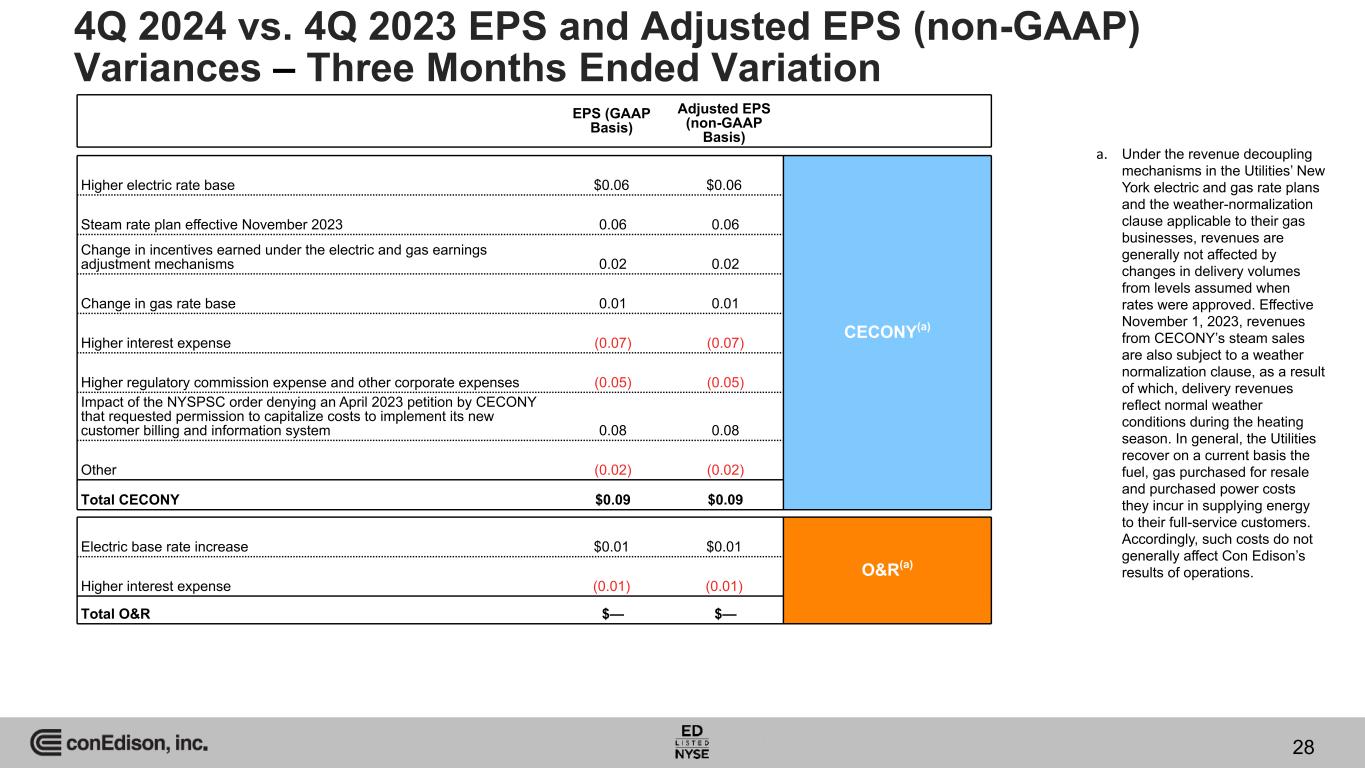

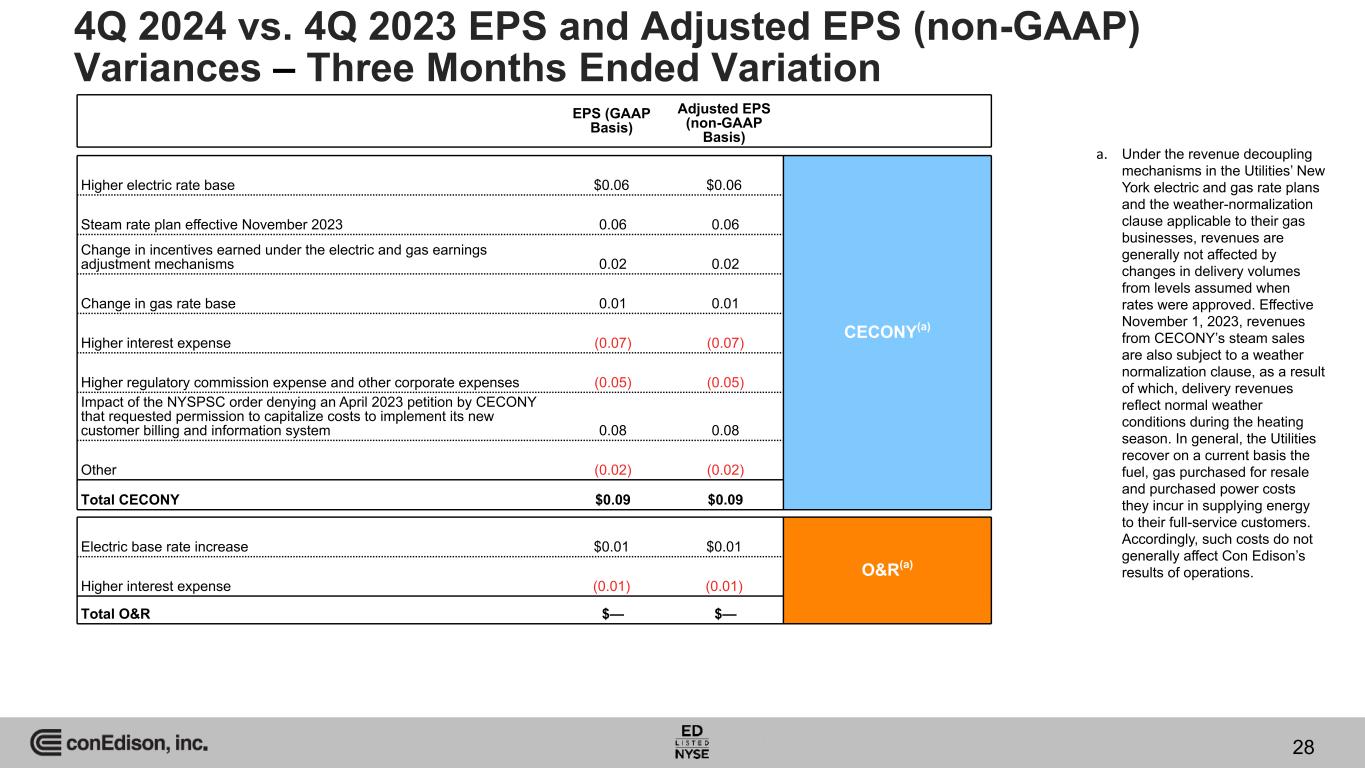

EPS (GAAP Basis) Adjusted EPS (non-GAAP Basis) Higher electric rate base $0.06 $0.06 CECONY(a) Steam rate plan effective November 2023 0.06 0.06 Change in incentives earned under the electric and gas earnings adjustment mechanisms 0.02 0.02 Change in gas rate base 0.01 0.01 Higher interest expense (0.07) (0.07) Higher regulatory commission expense and other corporate expenses (0.05) (0.05) Impact of the NYSPSC order denying an April 2023 petition by CECONY that requested permission to capitalize costs to implement its new customer billing and information system 0.08 0.08 Other (0.02) (0.02) Total CECONY $0.09 $0.09 Electric base rate increase $0.01 $0.01 O&R(a) Higher interest expense (0.01) (0.01) Total O&R $— $— 4Q 2024 vs. 4Q 2023 EPS and Adjusted EPS (non-GAAP) Variances – Three Months Ended Variation a. Under the revenue decoupling mechanisms in the Utilities’ New York electric and gas rate plans and the weather-normalization clause applicable to their gas businesses, revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. Effective November 1, 2023, revenues from CECONY’s steam sales are also subject to a weather normalization clause, as a result of which, delivery revenues reflect normal weather conditions during the heating season. In general, the Utilities recover on a current basis the fuel, gas purchased for resale and purchased power costs they incur in supplying energy to their full-service customers. Accordingly, such costs do not generally affect Con Edison’s results of operations. 28

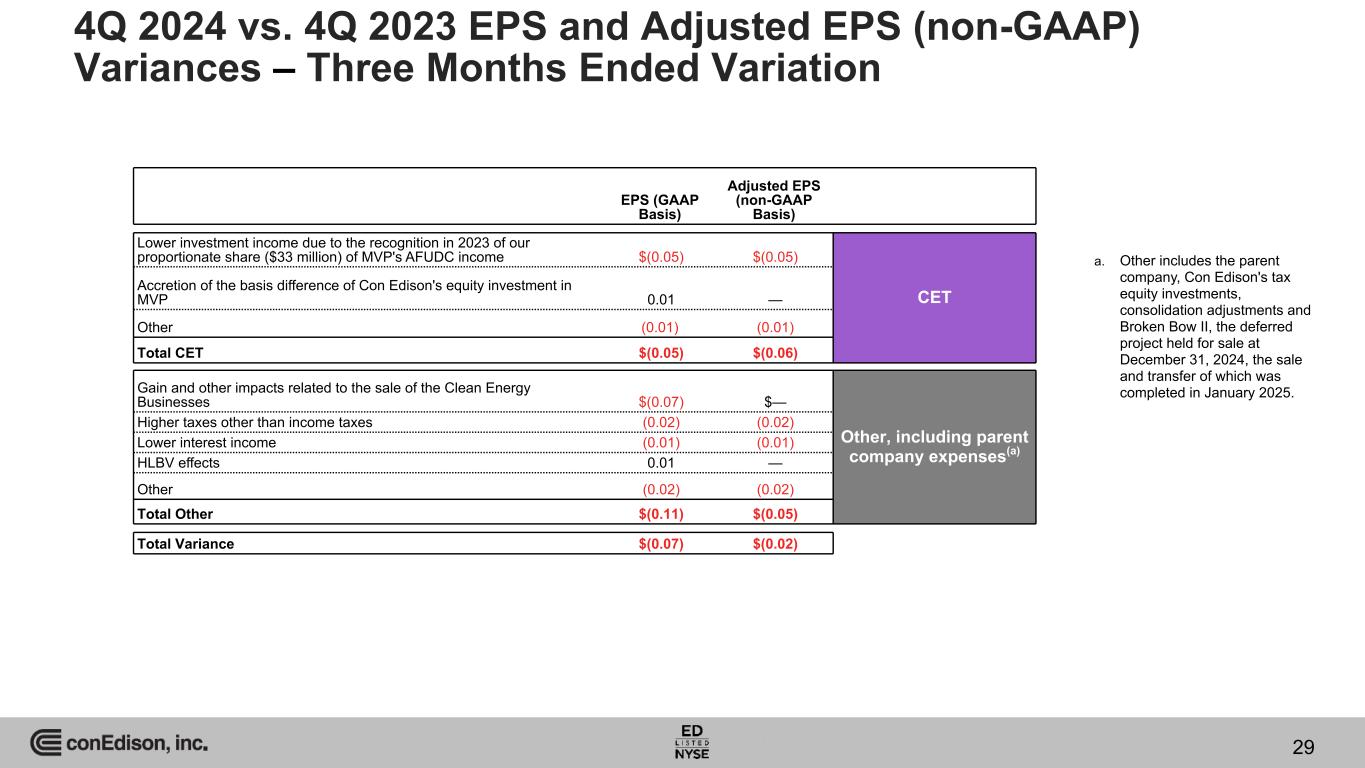

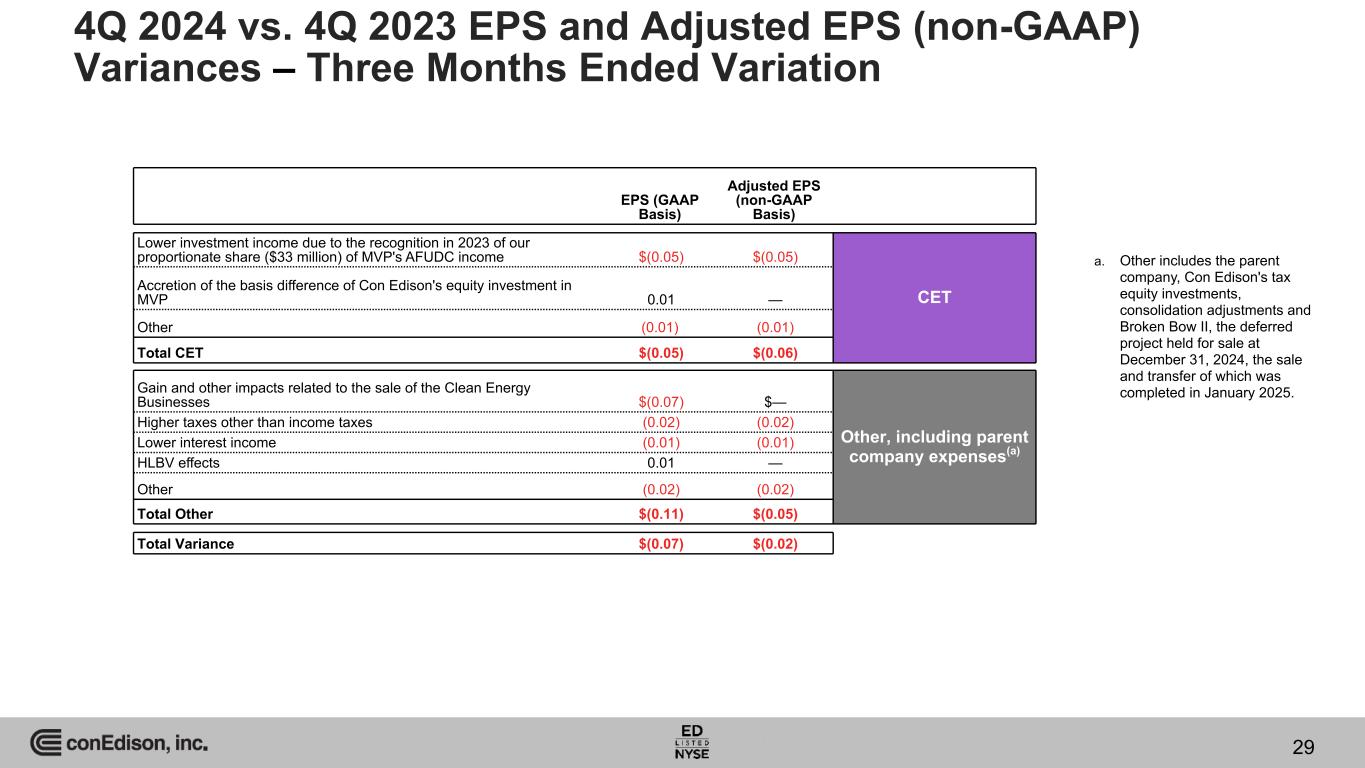

EPS (GAAP Basis) Adjusted EPS (non-GAAP Basis) Lower investment income due to the recognition in 2023 of our proportionate share ($33 million) of MVP's AFUDC income $(0.05) $(0.05) CET Accretion of the basis difference of Con Edison's equity investment in MVP 0.01 — Other (0.01) (0.01) Total CET $(0.05) $(0.06) Gain and other impacts related to the sale of the Clean Energy Businesses $(0.07) $— Other, including parent company expenses(a) Higher taxes other than income taxes (0.02) (0.02) Lower interest income (0.01) (0.01) HLBV effects 0.01 — Other (0.02) (0.02) Total Other $(0.11) $(0.05) Total Variance $(0.07) $(0.02) 4Q 2024 vs. 4Q 2023 EPS and Adjusted EPS (non-GAAP) Variances – Three Months Ended Variation 29 a. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025.

4Q 2024 vs. 4Q 2023 EPS to Adjusted EPS (non-GAAP) Reconciliation by Company CECONY O&R CET Other(c) Total Reported EPS – GAAP basis $0.96 $0.06 $0.03 $(0.15) $0.90 Loss (gain) on Sale of the Clean Energy Businesses (pre-tax) — — — 0.09 0.09 Income taxes — — — (0.02) (0.02) Loss (gain) on Sale of the Clean Energy Businesses (net of tax) — — — 0.07 0.07 Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — 0.01 0.01 Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — 0.01 0.01 HLBV effects (pre-tax) — — — 0.01 0.01 Income taxes (a) — — — — — HLBV effects (net of tax) — — — 0.01 0.01 Accretion of the basis difference of Con Edison's equity investment in MVP — — (0.01) — (0.01) Income taxes (b) — — — — — Accretion of the basis difference of Con Edison's equity investment in MVP (net of tax) — — (0.01) — (0.01) Adjusted EPS – non-GAAP basis $0.96 $0.06 $0.02 $(0.06) $0.98 Three Months Ended December 31, 2024 a. The amount of income taxes was calculated using a combined federal and state income tax rate of 24% for the three months ended December 31, 2024. b. The amount of income taxes was calculated using a combined federal and state income tax rate of 22% for the three months ended December 31, 2024. c. Other includes the parent company, Con Edison's tax adjustments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. 30

4Q 2024 vs. 4Q 2023 EPS to Adjusted EPS (non-GAAP) Reconciliation by Company (Cont'd) CECONY O&R CET Other(b) Total Reported EPS – GAAP basis $0.87 $0.06 $0.08 $(0.04) $0.97 Loss (gain) on Sale of the Clean Energy Businesses (pre-tax) — — — — — Income taxes — — — 0.05 0.05 Loss (gain) on Sale of the Clean Energy Businesses (net of tax) — — — 0.05 0.05 Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — (0.04) (0.04) Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — (0.04) (0.04) HLBV effects (pre-tax) — — — 0.02 0.02 Income taxes (a) — — — — — HLBV effects (net of tax) — — — 0.02 0.02 Adjusted EPS – non-GAAP basis $0.87 $0.06 $0.08 ($0.01) $1.00 Three Months Ended December 31, 2023 a. The amount of income taxes was calculated using a combined federal and state income tax rate of 29% for the three months ended December 31, 2023. b. Other includes the parent company, Con Edison's tax adjustments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. 31

4Q 2024 Developments(a) CECONY & O&R In November 2024, O&R, the New York State Department of Public Service (NYSDPS) and other parties entered into a joint proposal for new electric and gas rate plans for the three-year period January 1, 2025 through December 31, 2027. The joint proposal is subject to NYSPSC approval. (pages 9, 125-128) In November 2024, the FERC approved an August 2024 settlement agreement regarding CECONY’s return on equity for transmission projects. The settlement agreement provides for a formula rate to the NYISO tariff to enable CECONY to recover the costs and a return on equity of: (1) 10.6 percent for transmission projects that CECONY exercises its right of first refusal; (2) 10.85 percent for all other transmission projects selected by the NYISO to meet a public policy transmission need; and (3) the lower of the NYSPSC-determined rates or 10.6 percent for transmission projects needed to meet local New York State climate and renewable energy goals. Parties to the settlement agreement are restricted from seeking to challenge the return on equity levels for five years. (page 35) Also in November 2024, CECONY, pursuant to the NYSPSC’s August 2024 order instituting a proceeding that directed New York utilities, including CECONY and O&R, to proactively identify grid upgrades needed to meet new demand from transportation and building heating electrification across New York State (the Proactive Planning Proceeding), requested that the NYSPSC approve nine urgent projects totaling $856 million. CECONY requested that the NYSPSC authorize the urgent projects no later than March 2025. O&R did not make an urgent project filing because its November 2024 Joint Proposal included projects that would have otherwise been considered urgent. (page 35) In November and December 2024, New York utilities, including CECONY and O&R, pursuant to the Proactive Planning Proceeding for building and vehicle electrification: (1) filed a proposed framework for the NYSPSC to use in evaluating proposed urgent projects, cost allocation and cost recovery, (2) proposed (for CECONY) nine urgent projects for approval by the NYSPSC and (3) proposed a long-term coordinated planning process framework to study and identify necessary upgrades to support electrification. (page 35) At December 31, 2024, CECONY’s and O&R’s customer accounts receivables balances of $2,947 million and $113 million, respectively, included aged accounts receivables (balances outstanding in excess of 60 days) of $1,652 million and $32 million, respectively. In comparison, CECONY’s and O&R’s customer accounts receivable balances at February 28, 2020 were $1,322 million and $89 million, respectively, including aged accounts receivables (balances outstanding in excess of 60 days) of $408 million and $15 million, respectively. In particular, CECONY, in an effort to reduce aged accounts receivables balances, plans to continue to execute on its integrated collections strategy, which includes, among other things, implementation of payment arrangements, enhanced digital and mail communications to customers regarding collections, increased field collections by hiring new field collectors and increasing collector efficiency and employing additional call center representatives to handle in-bound call volumes. O&R's collection strategy aligns with that of CECONY's in many respects. (pages 55-56) In December 2024, Con Edison entered into a forward sale agreement relating to 7,000,000 of its common shares. The company expects the common shares under the forward sale agreement to settle by December 31, 2025. For additional information please see 2024 Form 10-K. (page 133) Also in December 2024, the FERC approved a September 2024 settlement agreement regarding O&R’s return on equity for transmission projects. The settlement agreement provides for a formula rate to the NYISO tariff to enable O&R to recover the costs and a return on equity of: (1) 10.5 percent for transmission projects that O&R exercises its right of first refusal; (2) 10.85 percent for all other transmission projects selected by the NYISO to meet a public policy transmission need; and (3) the lower of the NYSPSC-determined rates or 10.6 percent for transmission projects needed to meet local New York State climate and renewable energy goals. Parties to the settlement agreement are restricted from seeking to challenge the return on equity levels for five years. (page 35) a. Page references to 2024 Form 10-K unless noted otherwise. 32

4Q 2024 Developments(a) CECONY & O&R The subset of distributed energy resources (DER) that produce electricity is collectively called distributed generation (DG). DG includes solar energy production facilities, fuel cells, and micro-turbines, and provides an alternative source of electricity for the Utilities’ electric delivery customers. Energy storage, though not a form of DG, is also a source of electricity for the Utilities’ electric delivery customers. Typically, customers with DG remain connected to the utility’s delivery system and do not pay a different rate. Gas delivery customers have electricity, oil and propane as alternatives, and steam customers have electricity, oil and natural gas as alternative sources for heating and cooling their buildings. Micro-grids and community-based micro-grids enable DG to serve multiple locations and multiple customers. Demand reduction and energy efficiency investments provide ways for energy consumers within the Utilities’ service areas to lower their energy usage. The Companies expect DERs and electric alternatives to gas and steam, to increase, and for gas and steam usage to decrease, as the Climate Leadership and Community Protection Act (CLCPA) enacted by New York State and the Climate Mobilization Act enacted by New York City continue to be implemented. CECONY’s smart solutions for gas customers include energy efficiency and heating electrification programs. The following table shows the aggregate capacities of the DG projects connected to the Utilities’ distribution systems at December 31, 2024 was as follows: (pages 19-20) The Utilities' estimate that, under Design Weather Conditions, the 2025 service area electric hourly peak demand, the 2025/2026 service area peak day demand for firm gas customers and the winter of 2025/2026 hourly peak demand of its steam customers are as follows: The electric peak demand typically occurs during the summer air conditioning season, and the gas peak and steam actual hourly peak demand occurs during the winter heating season (pages 21, 24, 26-29) The Utilities' current five-year forecasts for 2025 - 2029 average annual change in electric and gas peak demand, and in steam peak demand in its service area at design weather conditions are below (pages 9, 21, 24, 26-29) • CECONY electric forecasted increase is due to the anticipated increase in electric vehicles in CECONY's service territory, among other things, offset by the effect of certain energy efficiency programs • O&R electric forecasted increase is due to electric vehicles and anticipated load growth from data centers, among other things, offset by the effect of certain electric energy efficiency programs 33 Total Distribution - Level DG Number of DG Projects CECONY 1,085 75,845 O&R 358 15,849 Electric Projected Hourly Peak Demand Gas Projected Peak Day Demand Steam Projected Hourly Peak Demand CECONY 12,610 MW 1,650 MDt 7.6 MMlb O&R 1,600 MW 235 MDt Electric Gas Steam CECONY 1 percent 0.1 percent (0.4) percent O&R 3.6 percent (0.1) percent a. Page references to 2024 Form 10-K unless noted otherwise.

4Q 2024 Developments (continued)(a) a. Page references to 2024 Form 10-K unless noted otherwise. 34 CECONY & O&R In December 2024, the NYSPSC issued an order approving CECONY’s May 2024 petition seeking $6 million for certain unaddressed costs that are necessary to complete Stage 2 of its utility thermal energy network pilot projects. (page 37). In January 2025, CECONY filed a request with the NYSPSC for an electric rate increase of $1,612 million, and a gas rate increase of $441 million, effective January 1, 2026. The filing reflects a return on common equity of 10.1 percent and a common equity ratio of 48 percent. The filing includes supplemental information regarding electric and gas rate plans for 2027 and 2028, which the company is not requesting, but would consider through settlement discussions. (pages 9, 119, 121) In January 2025, CECONY published its integrated long-range plan (ILRP) for the clean energy transition. The ILRP sets forth CECONY’s planning and investment strategy to provide safe, reliable and resilient service to customers and to support the decarbonization of energy use for electric, gas and steam customers, aligning with the greenhouse gas emissions reduction targets mandated by the CLCPA. Meeting the goals of the CLCPA will require capital expenditures above historic norms. While the details of CECONY’s investments will continue to be addressed in its rate cases or other filings, subject to the approval of the NYSPSC, CECONY projects that $72 billion of capital expenditures will be needed between 2025 and 2034 to implement its strategy. (pages 35-36) In February 2025, CECONY and O&R filed updated climate change resilience plans with the NYSPSC in compliance with an order that directed CECONY and O&R to re-submit their November 2023 plans to exclude proposed projects that the NYSPSC determined are not climate resilience investments. CECONY’s and O&R’s updated climate change resilience plans propose investments of $645.4 million and $184.1 million, respectively, between 2025 and 2029 to enhance the resilience of their electric systems against extreme weather events brought about by climate change. The total cost of CECONY’s and O&R’s climate resilience investments from 2025 through 2044 are currently projected to be $5,294 million and $900.4 million, respectively. These investments are subject to approval by the NYSPSC through the base rate case process. CECONY’s January 2025 electric rate case filing requested approval for climate resilience investments of $448.5 million from 2026 through 2028 and O&R’s November 2024 joint proposal for electric rates included climate resilience investments of $110.4 million from 2025 through 2027. (page 38) Con Edison Transmission Con Edison Transmission is considering strategic alternatives with respect to its investment in Mountain Valley Pipeline, LLC (MVP) and both Con Edison Transmission and CECONY are considering strategic alternatives with respect to their investments in Honeoye Storage Corporation (Honeoye). (page 8, 16, 29) MVP is a joint venture among five partners, including Con Edison Transmission, that constructed and operates the Mountain Valley Pipeline, a 303-mile gas transmission project in West Virginia and Virginia that entered service in June 2024. The project operator is continuing restoration of the right of way and estimates a total project cost of approximately $8,100 million (excluding allowance for funds used during construction (AFUDC)). At December 31, 2024, the carrying value of Con Edison Transmission's investment in MVP was $166 million, and its cash contributions to the joint venture amounted to $530 million. As of December 31, 2024, Con Edison Transmission's interest in MVP, the company that developed the project, is 6.7 percent and is expected to be reduced to approximately 6.6 percent upon completion of the restoration of the right of way and based on Con Edison Transmission's previous capping of its cash contributions. (pages 29, 111)

2024 EPS to Adjusted EPS (non-GAAP) Reconciliation Earnings per Share Net Income for Common Stock ($ in Millions) 2024 2023 2024 2023 Reported Net Income for Common Stock and EPS – GAAP basis $5.26 $7.25 $1,820 $2,519 Loss (gain) and other impacts related to the sale of the Clean Energy Businesses (pre-tax) (a) 0.18 (2.55) 63 (887) Income taxes (a)(b) (0.04) 0.33 (13) 113 Loss (gain) and other impacts related to the sale of the Clean Energy Businesses (net of tax) 0.14 (2.22) 50 (774) Accretion of the basis difference of Con Edison's equity investment in MVP (0.01) — (6) — Income taxes (c) — — 1 — Accretion of the basis difference of Con Edison's equity investment in MVP (net of tax) (0.01) — (5) — HLBV effects (pre-tax) 0.01 0.02 4 11 Income taxes (d) — (0.01) (1) (3) HLBV effects (net of tax) 0.01 0.01 3 8 Net mark-to-market effects (pre-tax) — 0.04 — 13 Income taxes (e) — (0.01) — (4) Net mark-to-market effects (net of tax) — 0.03 — 9 Adjusted Earnings and Adjusted EPS – non-GAAP basis $5.40 $5.07 $1,868 $1,762 a. The loss (gain) and other impacts related to the sale of all of the stock of the Clean Energy Businesses were adjusted during the year ended December 31, 2024 ($0.18 a share and $0.13 a share net of tax or $62 million and $46 million net of tax) to reflect closing adjustments. The loss (gain) and other impacts related to the sale of the Clean Energy Businesses for the year ended December 31, 2023 is comprised of the gain on the sale of the Clean Energy Businesses ($(2.49) a share and $(2.21) a share net of tax or $(865) million and $(767) million net of tax), transaction costs and other accruals ($0.05 a share and $0.04 a share net of tax or $19 million and $14 million net of tax) and the effects of ceasing to record depreciation and amortization expenses on the Clean Energy Businesses’ assets ($(0.11) a share and $(0.07) a share net of tax or $(41) million and $(28) million net of tax). b. Amounts shown include the impact of the changes in state unitary tax apportionments ($0.01 a share net of federal taxes or $3 million net of federal taxes) for the year ended December 31, 2024 . The amount of income taxes for the adjustment on the gain on the sale of all of the stock of the Clean Energy Businesses had an effective tax rate of 26% and 11% for the year ended December 31, 2024 and December 31, 2023, respectively. Amounts shown include impact of changes in state apportionments ($0.02 a share net of federal taxes or $7 million net of federal taxes) for the year ended December 31, 2023. The amount of income taxes for transaction costs and other accruals and the effects of ceasing to record depreciation and amortization expenses was calculated using a combined federal and state income tax rate of 27% and 32%, respectively for the year ended December 31, 2023. c. The amount of income taxes was calculated using a combined federal and state income tax rate of 22% for the year ended December 31, 2024. d. The amount of income taxes was calculated using a combined federal and state income tax rate of 24% and 25% for the year ended December 31, 2024 and 2023, respectively. e. The amount of income taxes was calculated using a combined federal and state income tax rate of 32% for the year ended December 31, 2023. 35

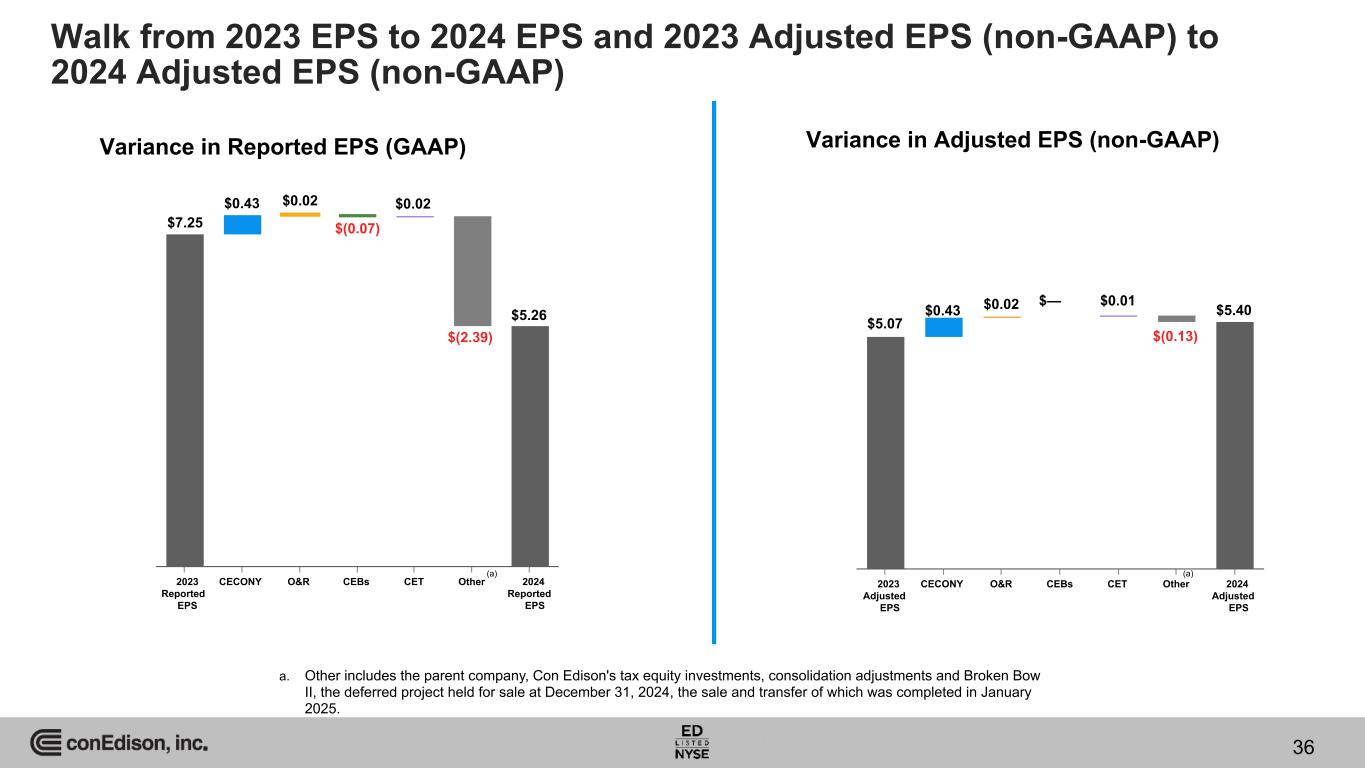

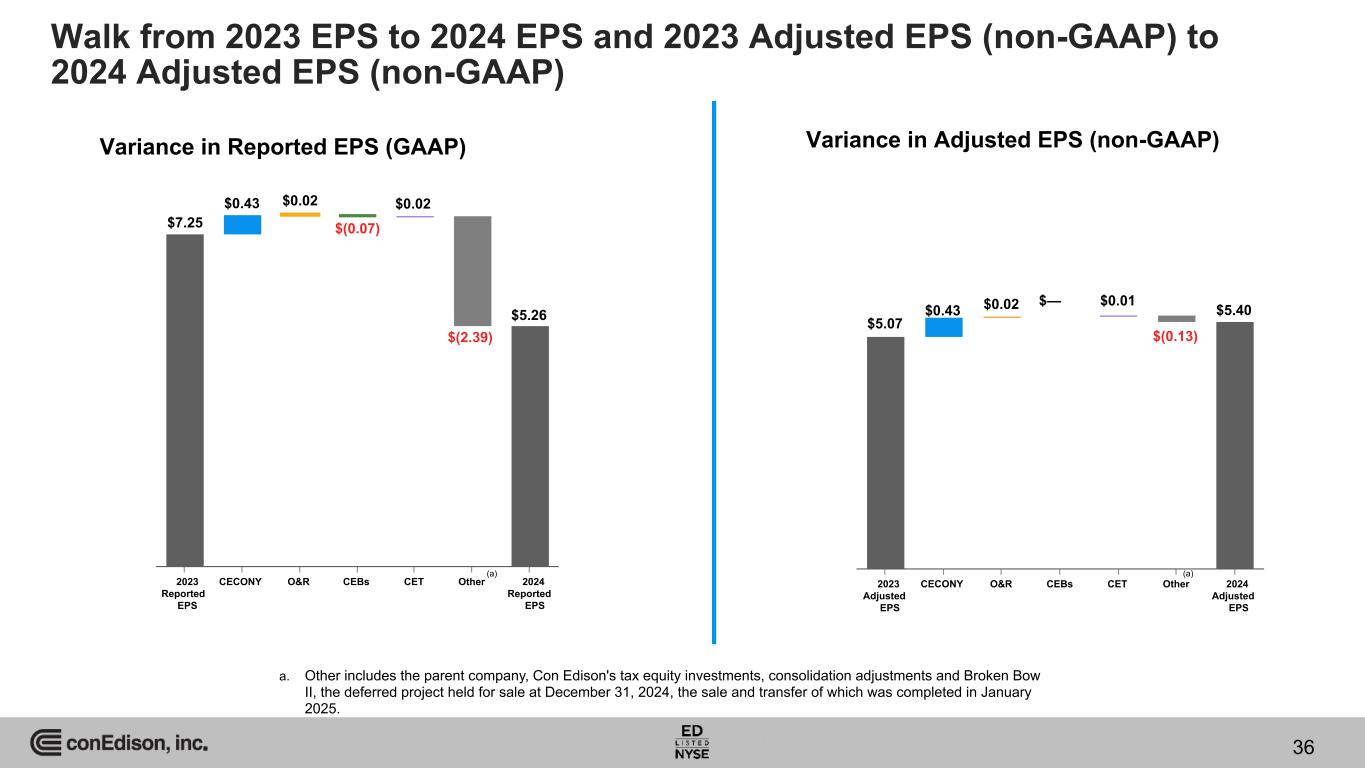

2023 Adjusted EPS CECONY O&R CEBs CET Other 2024 Adjusted EPS Variance in Reported EPS (GAAP) Variance in Adjusted EPS (non-GAAP) 2023 Reported EPS CECONY O&R CEBs CET Other 2024 Reported EPS $7.25 $0.43 $0.02 $(0.07) $0.02 $(2.39) $5.26 $5.07 $0.43 $0.02 $— $0.01 $(0.13) $5.40 (a) (a) a. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. Walk from 2023 EPS to 2024 EPS and 2023 Adjusted EPS (non-GAAP) to 2024 Adjusted EPS (non-GAAP) 36

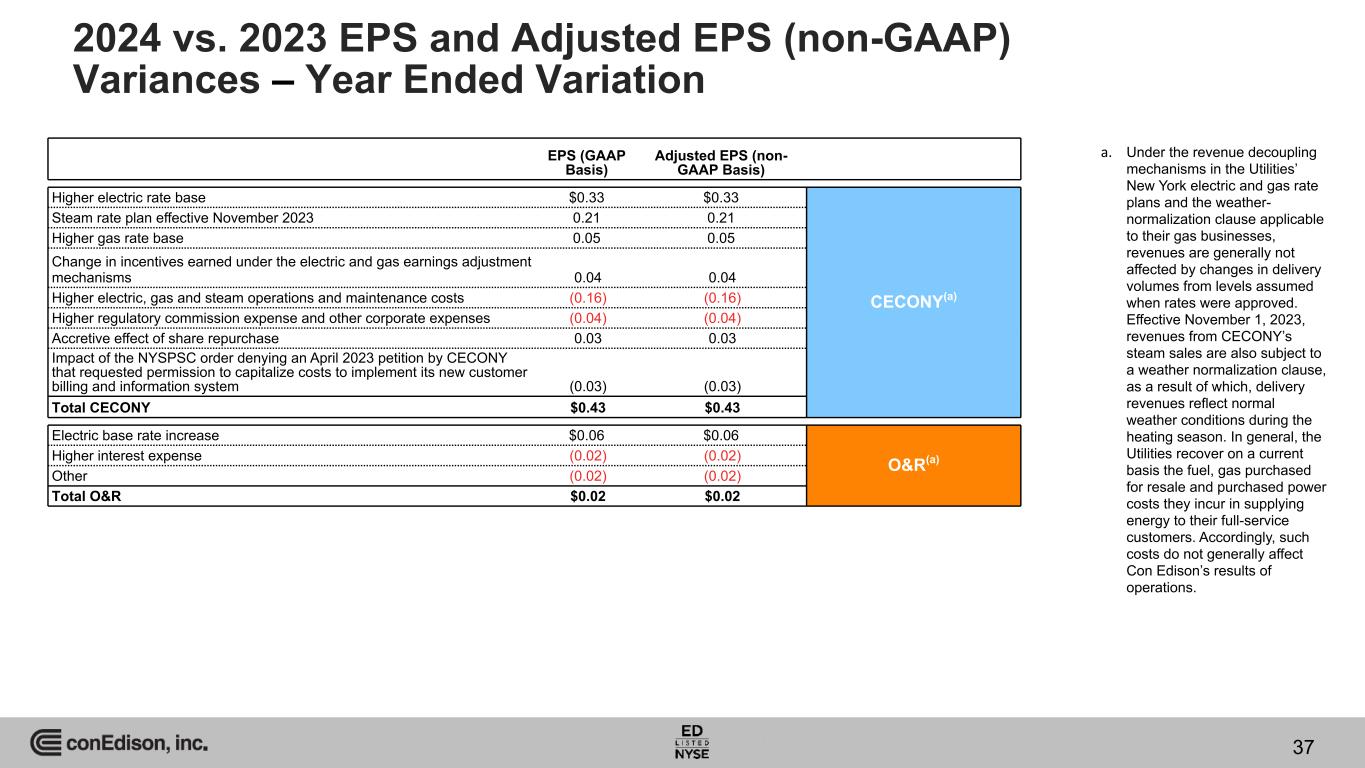

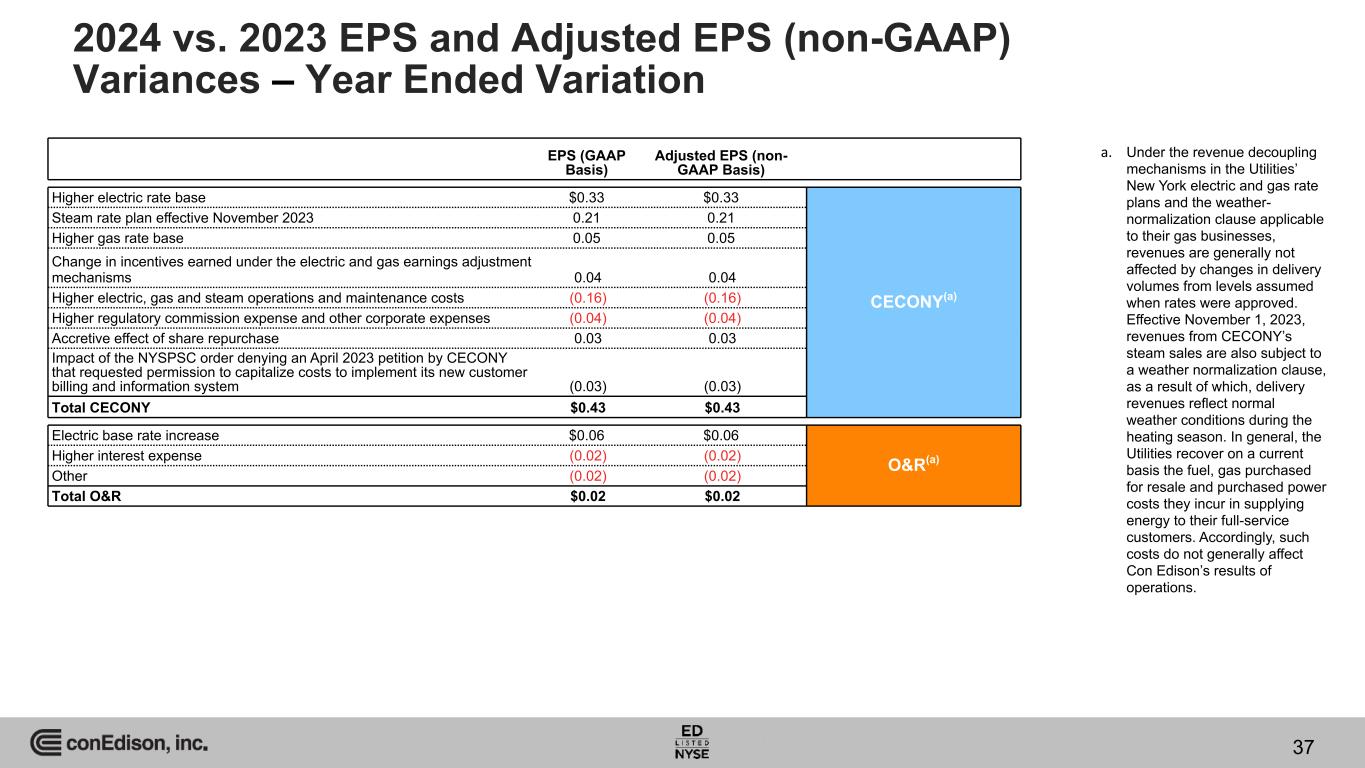

EPS (GAAP Basis) Adjusted EPS (non- GAAP Basis) Higher electric rate base $0.33 $0.33 CECONY(a) Steam rate plan effective November 2023 0.21 0.21 Higher gas rate base 0.05 0.05 Change in incentives earned under the electric and gas earnings adjustment mechanisms 0.04 0.04 Higher electric, gas and steam operations and maintenance costs (0.16) (0.16) Higher regulatory commission expense and other corporate expenses (0.04) (0.04) Accretive effect of share repurchase 0.03 0.03 Impact of the NYSPSC order denying an April 2023 petition by CECONY that requested permission to capitalize costs to implement its new customer billing and information system (0.03) (0.03) Total CECONY $0.43 $0.43 Electric base rate increase $0.06 $0.06 O&R(a)Higher interest expense (0.02) (0.02) Other (0.02) (0.02) Total O&R $0.02 $0.02 a. Under the revenue decoupling mechanisms in the Utilities’ New York electric and gas rate plans and the weather- normalization clause applicable to their gas businesses, revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. Effective November 1, 2023, revenues from CECONY’s steam sales are also subject to a weather normalization clause, as a result of which, delivery revenues reflect normal weather conditions during the heating season. In general, the Utilities recover on a current basis the fuel, gas purchased for resale and purchased power costs they incur in supplying energy to their full-service customers. Accordingly, such costs do not generally affect Con Edison’s results of operations. 2024 vs. 2023 EPS and Adjusted EPS (non-GAAP) Variances – Year Ended Variation 37

EPS (GAAP Basis) Adjusted EPS (non- GAAP Basis) Total Clean Energy Businesses $(0.07) $— CEBs(a) Income tax adjustment due to AFUDC from MVP $0.01 $0.01 CETAccretion of the basis difference of Con Edison's equity investment in MVP 0.01 — Total CET $0.02 $0.01 Gain and other impacts related to the sale of the Clean Energy Businesses $(2.28) $— Other, including parent company expenses(b) Lower interest income (0.07) (0.07) Higher taxes other than income taxes (0.03) (0.03) Higher interest expense (0.01) (0.01) HLBV effects 0.02 — Other (0.02) (0.02) Total Other $(2.39) $(0.13) Total $(1.99) $0.33 a. On March 1, 2023, Con Edison completed the sale of all of the stock of the Clean Energy Businesses and therefore 2023 reflects the financial results for the two months ended February 2023. b. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. 2024 vs. 2023 EPS and Adjusted EPS (non-GAAP) Variances – Year Ended Variation 38

2024 vs. 2023 EPS to Adjusted EPS (non-GAAP) Reconciliation by Company CECONY O&R CET Other(d) Total Reported EPS – GAAP basis $5.05 $0.30 $0.13 ($0.22) $5.26 Loss (gain) on Sale of the Clean Energy Businesses (pre-tax) — — — 0.18 0.18 Income taxes (a) — — — (0.05) (0.05) Loss (gain) on Sale of the Clean Energy Businesses (net of tax) — — — 0.13 0.13 Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — 0.01 0.01 Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — 0.01 0.01 Accretion of the basis difference of Con Edison's equity investment in MVP — — (0.01) — (0.01) Income taxes (b) — — — — — Accretion of the basis difference of Con Edison's equity investment in MVP (net of tax) — — (0.01) — (0.01) HLBV effects (pre-tax) — — — 0.01 0.01 Income taxes (c) — — — — — HLBV effects (net of tax) — — — 0.01 0.01 Adjusted EPS – non-GAAP basis $5.05 $0.30 $0.12 ($0.07) $5.40 Year Ended December 31, 2024 a. The amount of income taxes was calculated using a combined federal and state income tax rate of 26% for the year ended December 31, 2024. b. The amount of income taxes was calculated using a combined federal and state income tax rate of 22% for the year ended December 31, 2024. c. The amount of income taxes was calculated using a combined federal and state income tax rate of 24% for the year ended December 31, 2024. d. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. 39

2024 vs. 2023 EPS to Adjusted EPS (non-GAAP) Reconciliation by Company (Cont'd) CECONY O&R CEBs CET Other(f) Total Reported EPS – GAAP basis $4.62 $0.28 $0.07 $0.11 $2.17 $7.25 Loss (gain) on Sale of the Clean Energy Businesses (pre-tax) — — — — (2.49) (2.49) Income taxes (a) — — — — 0.28 0.28 Loss (gain) on Sale of the Clean Energy Businesses (net of tax) — — — — (2.21) (2.21) Transaction costs and other accruals related to the sale of the Clean Energy Businesses (pre-tax) — — — — 0.05 0.05 Income taxes (b) — — — — (0.01) (0.01) Transaction costs and other accruals related to the sale of the Clean Energy Businesses (net of tax) — — — — 0.04 0.04 Ceasing recording of depreciation and amortization expenses related to the sale of the Clean Energy Businesses (pre-tax) — — (0.11) — — (0.11) Income taxes (c) — — 0.03 — 0.01 0.04 Ceasing recording of depreciation and amortization expenses related to the sale of the Clean Energy Businesses (net of tax) — — (0.08) — 0.01 (0.07) Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — — 0.02 0.02 Impact of the sale of the Clean Energy Businesses on the changes in state apportionments (net of federal taxes) — — — — 0.02 0.02 HLBV effects (pre-tax) — — (0.02) — 0.04 0.02 Income taxes (d) — — — — (0.01) (0.01) HLBV effects (net of tax) — — (0.02) — 0.03 0.01 Net mark-to-market effects (pre-tax) — — 0.04 — — 0.04 Income taxes (e) — — (0.01) — — (0.01) Net mark-to-market effects (net of tax) — — 0.03 — — 0.03 Adjusted EPS – non-GAAP basis $4.62 $0.28 $— $0.11 $0.06 $5.07 Year Ended December 31, 2023 a. The income taxes on the loss (gain) on sale of the Clean Energy Businesses had an effective tax rate of 11% for the year ended December 31, 2023. b. The amount of income taxes was calculated using a combined federal and state income tax rate of 27% for the year ended December 31, 2023. c. The amount of income taxes was calculated using a combined federal and state income tax rate of 32% for the year ended December 31, 2023. d. The amount of income taxes was calculated using a combined federal and state income tax rate of 25% for the year ended December 31, 2023. e. The amount of income taxes was calculated using a combined federal and state income tax rate of 32% for the year ended December 31, 2023. f. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. 40

Three-Year Reconciliation of Reported EPS (GAAP) to Adjusted EPS (non-GAAP) 2022 2023 2024 Reported EPS – GAAP basis $4.68 $7.21 $5.26 Loss (gain) and other impacts related to the sale of the Clean Energy Businesses (pre-tax) (a) (0.03) (2.53) 0.18 Income taxes (a) 0.35 0.32 (0.03) Loss (gain) and other impacts related to the sale of the Clean Energy Businesses (net of tax) 0.32 (2.21) 0.15 Accretion of basis difference of Con Edison's equity investment in the Mountain Valley Pipeline (pre-tax) — — (0.03) Income taxes (a) — — 0.01 Accretion of basis difference of Con Edison's equity investment in the Mountain Valley Pipeline (net of tax) — — (0.02) HLBV effects (pre-tax) (0.17) 0.04 0.01 Income taxes (a) 0.05 (0.01) — HLBV effects (net of tax) (0.12) 0.03 0.01 Net mark-to-market effects (pre-tax) (0.51) 0.04 — Income taxes (a) 0.16 (0.01) — Net mark-to-market effects (net of tax) (0.35) 0.03 — Remeasurement of deferred state taxes related to dispositions prior to 2022 (net of federal taxes) 0.04 — — Remeasurement of deferred state taxes related to dispositions prior to 2022 (net of federal taxes) 0.04 — — Adjusted EPS – non-GAAP basis $4.57 $5.06 $5.40 12 Months Ending December 31, 41 a. The amount of income taxes was calculated using applicable combined federal and state income tax rates for the year ended December 31, 2022 - 2024.

Earnings Adjustment Mechanisms (EAMs) and Positive Incentives Earnings Adjustment Mechanisms ($ in millions) $43 $41 $63 $40 $40 $59 $3 $1 $4 CECONY O&R 2022 2023 2024 $13 $3 $3$13 $3 $3 CECONY O&R 2022 2023 2024 Positive Incentives(a) ($ in millions) a. Does not reflect negative revenue adjustments for CECONY of $11 million, $3 million and $5 million recorded in 2022, 2023 and 2024, respectively, and immaterial amounts recorded in 2022, 2023 and 2024 for O&R. In 2024, CECONY reversed a negative revenue adjustment from a prior period of $3 million. b. In 2022, CECONY recorded a reduction in the amount of previously recorded earnings adjustment mechanisms of $4.9 million. c. In 2024, CECONY recorded a reduction in the amount of previously recorded earnings adjustment mechanisms of $2.5 million. (c)(b) 42

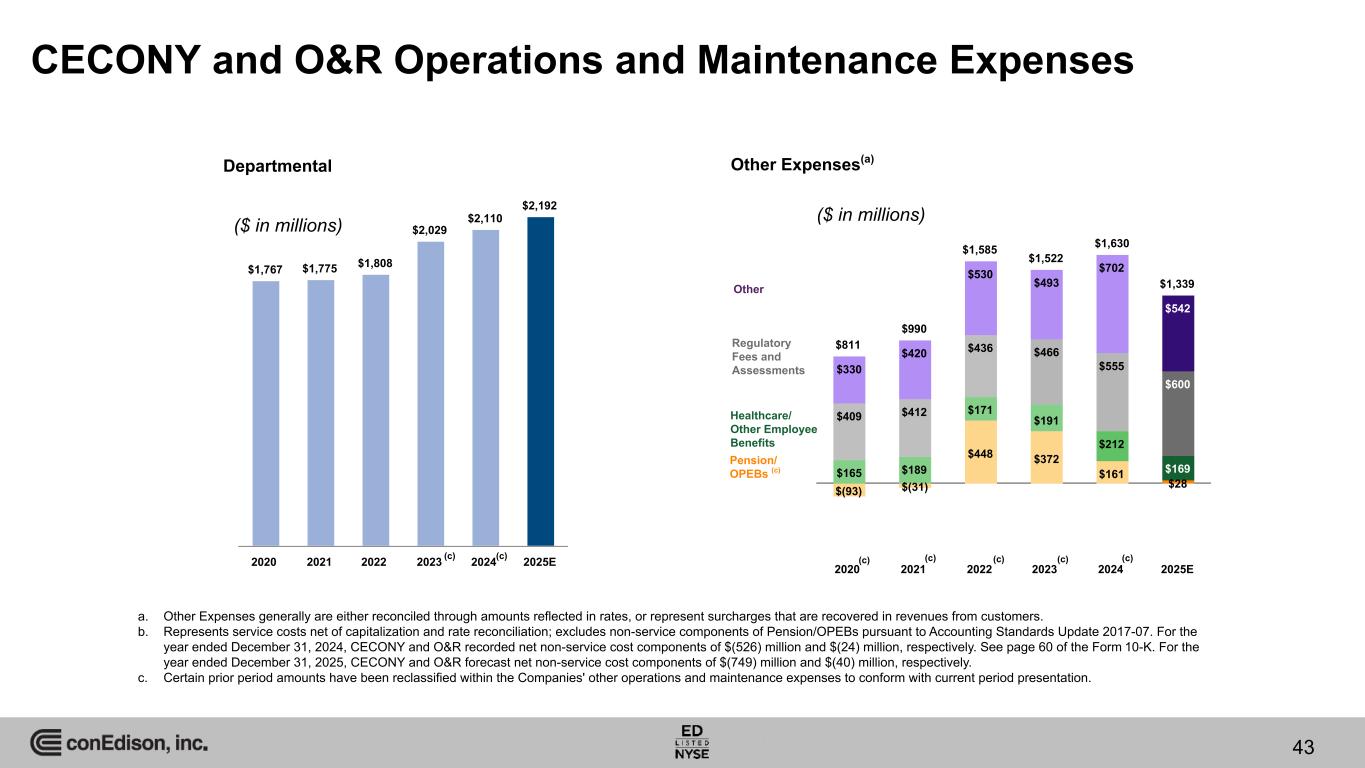

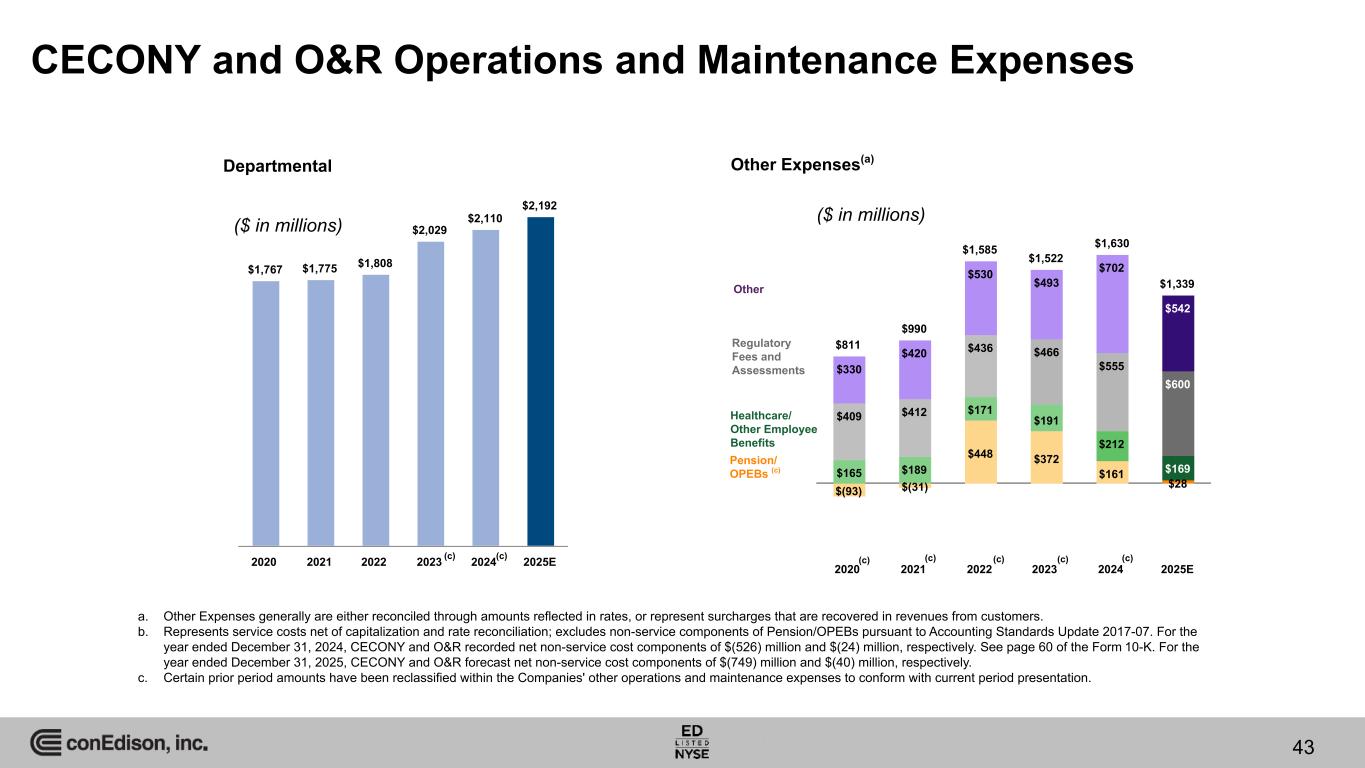

$811 $990 $1,585 $1,522 $1,630 $1,339 $(93) $(31) $448 $372 $161 $28 $165 $189 $171 $191 $212 $169 $409 $412 $436 $466 $555 $600 $330 $420 $530 $493 $702 $542 2020 2021 2022 2023 2024 2025E CECONY and O&R Operations and Maintenance Expenses a. Other Expenses generally are either reconciled through amounts reflected in rates, or represent surcharges that are recovered in revenues from customers. b. Represents service costs net of capitalization and rate reconciliation; excludes non-service components of Pension/OPEBs pursuant to Accounting Standards Update 2017-07. For the year ended December 31, 2024, CECONY and O&R recorded net non-service cost components of $(526) million and $(24) million, respectively. See page 60 of the Form 10-K. For the year ended December 31, 2025, CECONY and O&R forecast net non-service cost components of $(749) million and $(40) million, respectively. c. Certain prior period amounts have been reclassified within the Companies' other operations and maintenance expenses to conform with current period presentation. Other Expenses(a) $1,767 $1,775 $1,808 $2,029 $2,110 $2,192 2020 2021 2022 2023 2024 2025E Departmental Pension/ OPEBs (c) Regulatory Fees and Assessments Healthcare/ Other Employee Benefits Other ($ in millions) ($ in millions) 43 (c)(c) (c) (c)(c)(c) (c)

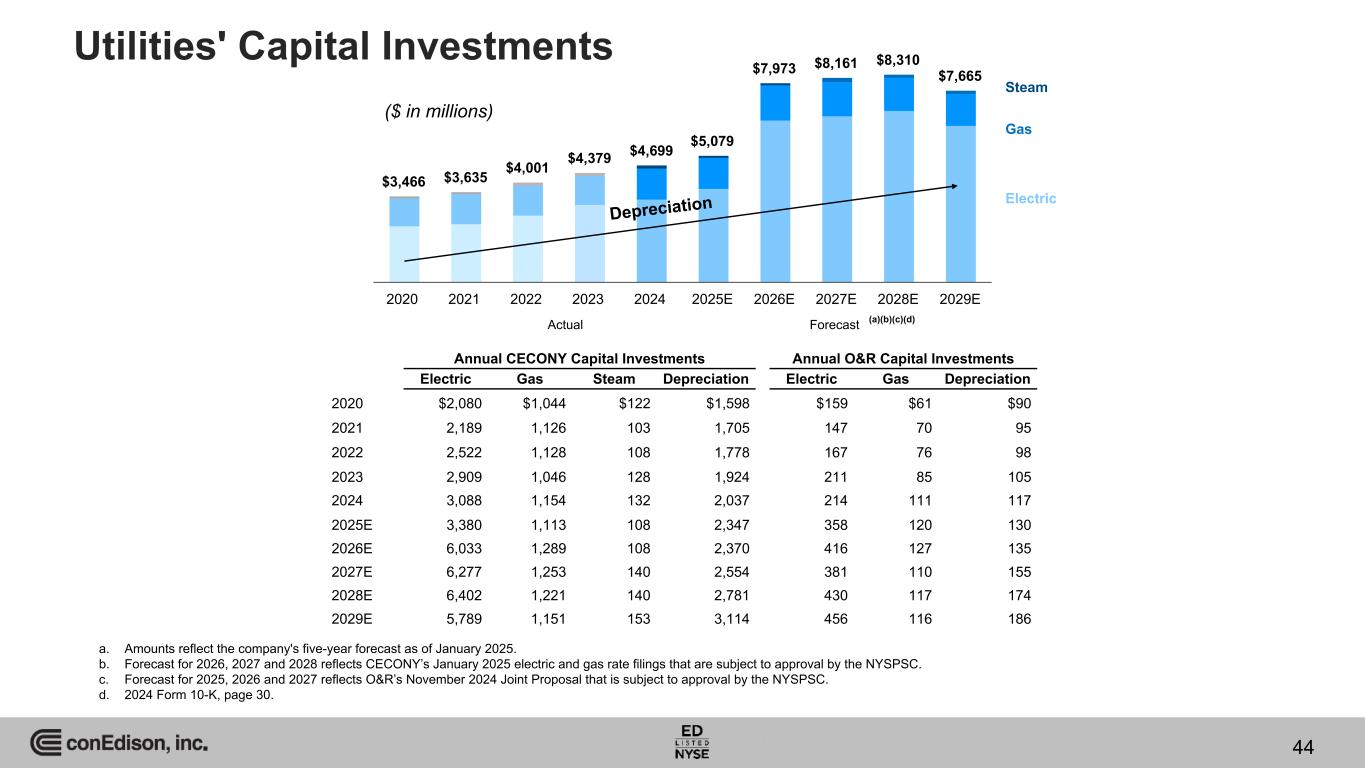

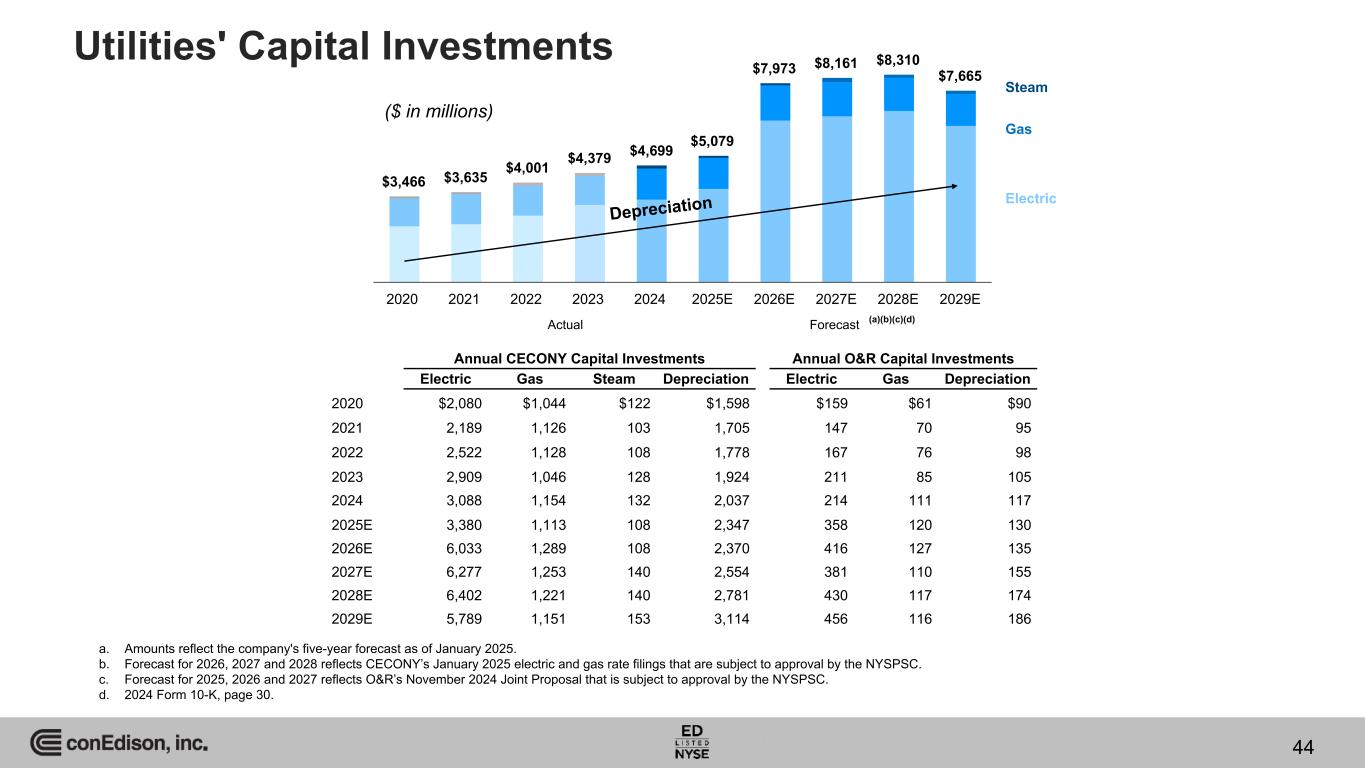

$3,466 $3,635 $4,001 $4,379 $4,699 $5,079 $7,973 $8,161 $8,310 $7,665 2020 2021 2022 2023 2024 2025E 2026E 2027E 2028E 2029E Utilities' Capital Investments Gas Electric Annual CECONY Capital Investments Annual O&R Capital Investments Electric Gas Steam Depreciation Electric Gas Depreciation 2020 $2,080 $1,044 $122 $1,598 $159 $61 $90 2021 2,189 1,126 103 1,705 147 70 95 2022 2,522 1,128 108 1,778 167 76 98 2023 2,909 1,046 128 1,924 211 85 105 2024 3,088 1,154 132 2,037 214 111 117 2025E 3,380 1,113 108 2,347 358 120 130 2026E 6,033 1,289 108 2,370 416 127 135 2027E 6,277 1,253 140 2,554 381 110 155 2028E 6,402 1,221 140 2,781 430 117 174 2029E 5,789 1,151 153 3,114 456 116 186 Steam Depreciation Actual Forecast a. Amounts reflect the company's five-year forecast as of January 2025. b. Forecast for 2026, 2027 and 2028 reflects CECONY’s January 2025 electric and gas rate filings that are subject to approval by the NYSPSC. c. Forecast for 2025, 2026 and 2027 reflects O&R’s November 2024 Joint Proposal that is subject to approval by the NYSPSC. d. 2024 Form 10-K, page 30. (a)(b)(c)(d) ($ in millions) 44

Composition of Average Rate Base(a) (as of December 31, 2024) a. Average rate base for 12 months ended December 31, 2024. CECONY ($ in millions) Electric New York $29,279 Gas New York 10,115 Steam New York 1,913 Total CECONY $41,307 O&R ($ in millions) O&R Electric New York $1,191 O&R Gas New York 654 RECO New Jersey 364 Total O&R $2,209 Total Rate Base $43,516 CECONY Electric CECONY Gas CECONY Steam O&R Electric and Gas RECO 45

$141 $221 $556 $940 $1,163 $1,343 $1,571 $1,833 $2,070 $2,291 139 220 553 928 1,133 1,295 1,510 1,761 1,988 2,200 2 1 3 12 30 48 61 72 82 91 2020 2021 2022 2023 2024 2025E 2026E 2027E 2028E 2029E Clean Energy Regulatory Asset Spend Contributing to Average Rate Base O&R CECONY ForecastActual ($ in millions) 46 Regulatory assets grow in support of New York State's climate policies and include New Efficiency New York, Reforming the Energy Vision Demo, Brooklyn Queens Demand Management and Non-Wires Alternatives

Regulated Utilities' Rates of Return and Equity Ratios (12 Months ended December 31, 2024) ROE Regulated Basis Equity Ratio Authorized Actual Rate Effective Date Authorized Actual CECONY Electric 9.25% 9.42% January 1, 2023 Gas 9.25 9.87 January 1, 2023 Steam 9.25 6.72 November 1, 2023 Overall 9.25% 9.41% 48.00% 46.26% O&R Electric 9.20% 10.05% January 1, 2022 Gas 9.20 10.14 January 1, 2022 RECO 9.60 8.24 January 1, 2022 Overall 9.25% 9.78% 48.00% 47.38% a. Weighted by rate base. (a) (a) 47 Execution on rate plans assures safe, reliable service and strong financial results

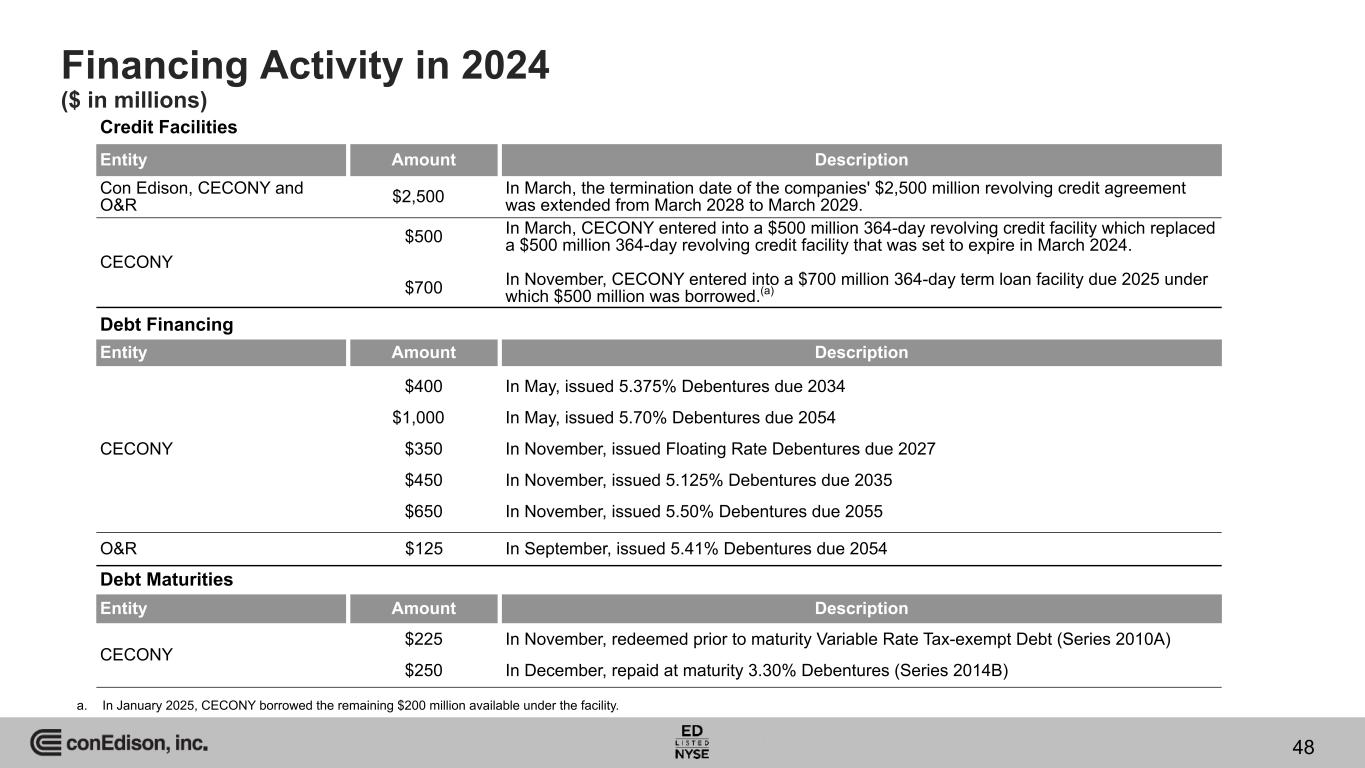

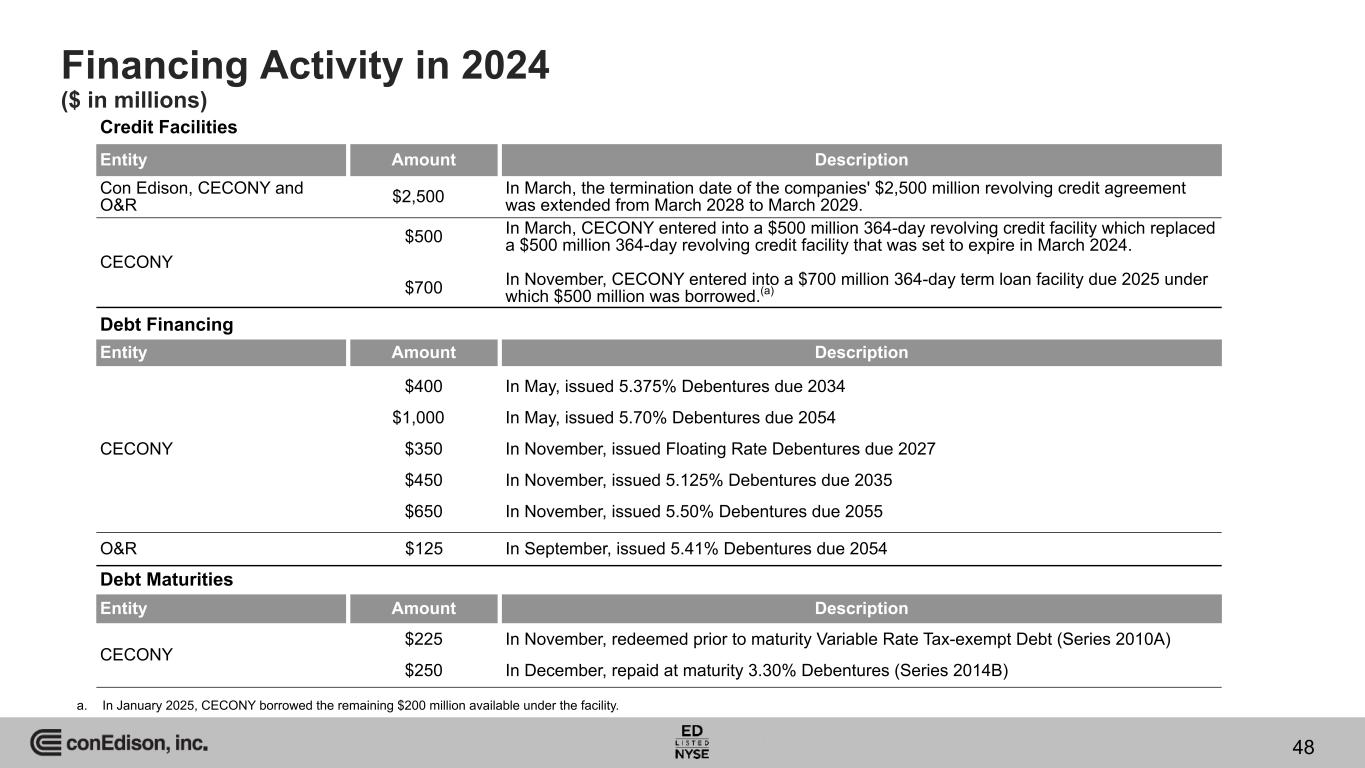

Financing Activity in 2024 ($ in millions) Credit Facilities Entity Amount Description Con Edison, CECONY and O&R $2,500 In March, the termination date of the companies' $2,500 million revolving credit agreement was extended from March 2028 to March 2029. CECONY $500 $700 In March, CECONY entered into a $500 million 364-day revolving credit facility which replaced a $500 million 364-day revolving credit facility that was set to expire in March 2024. In November, CECONY entered into a $700 million 364-day term loan facility due 2025 under which $500 million was borrowed.(a) 48 Debt Financing Entity Amount Description CECONY $400 $1,000 $350 $450 $650 In May, issued 5.375% Debentures due 2034 In May, issued 5.70% Debentures due 2054 In November, issued Floating Rate Debentures due 2027 In November, issued 5.125% Debentures due 2035 In November, issued 5.50% Debentures due 2055 O&R $125 In September, issued 5.41% Debentures due 2054 a. In January 2025, CECONY borrowed the remaining $200 million available under the facility. Debt Maturities Entity Amount Description CECONY $225 $250 In November, redeemed prior to maturity Variable Rate Tax-exempt Debt (Series 2010A) In December, repaid at maturity 3.30% Debentures (Series 2014B)

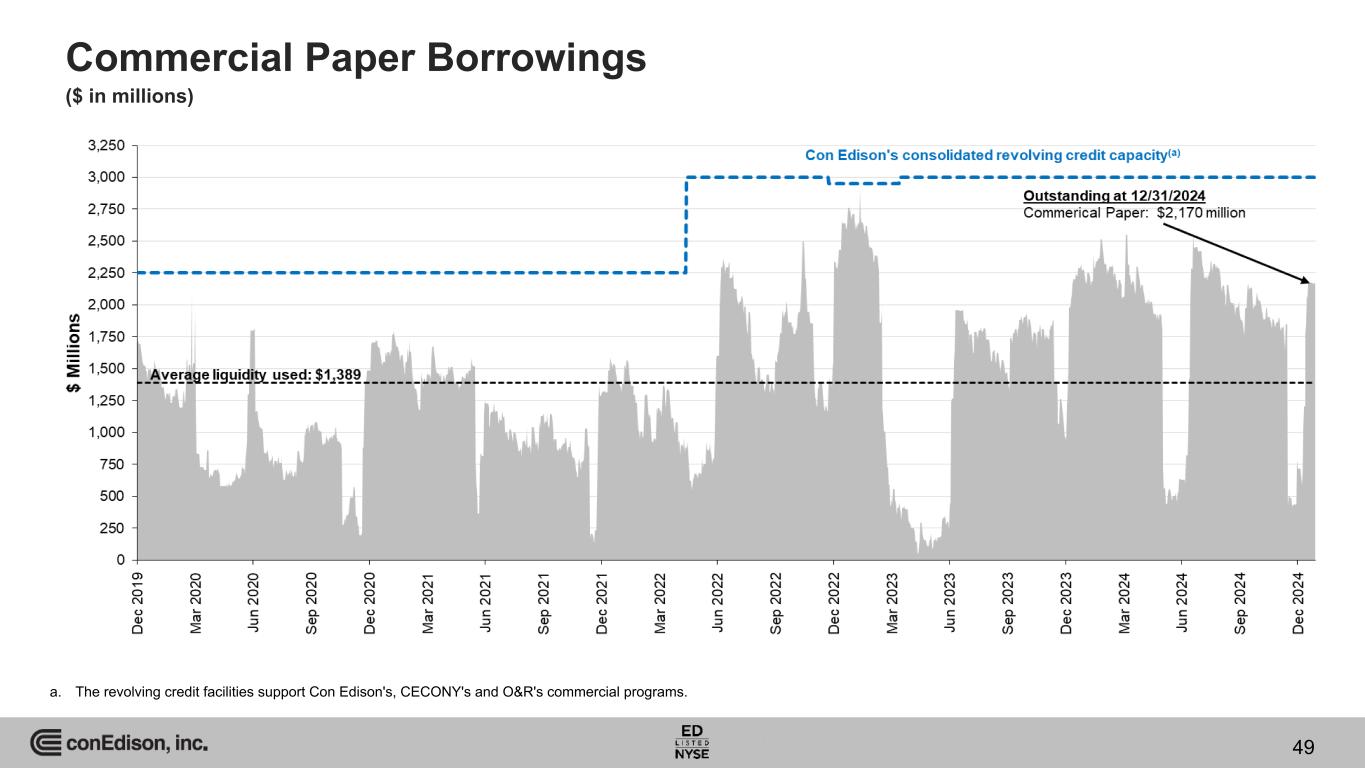

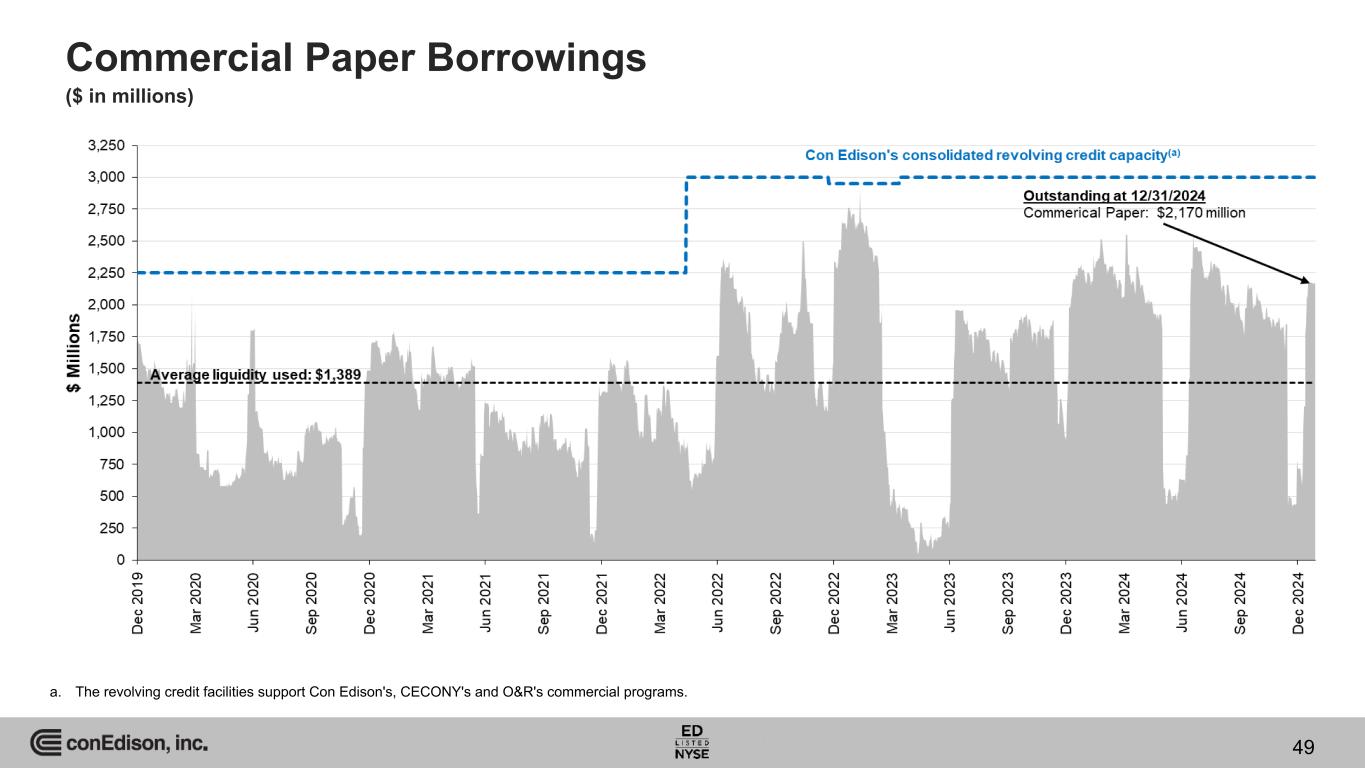

Commercial Paper Borrowings ($ in millions) a. The revolving credit facilities support Con Edison's, CECONY's and O&R's commercial programs. 49

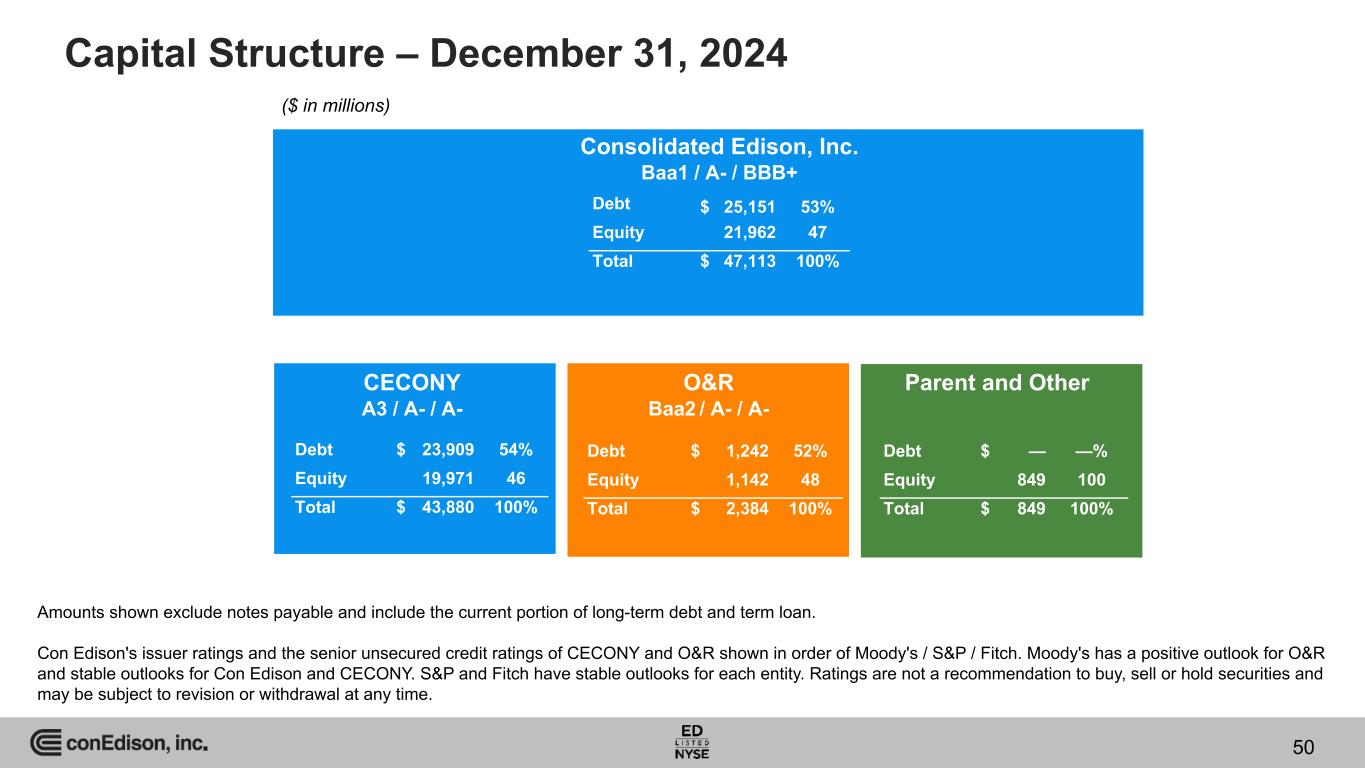

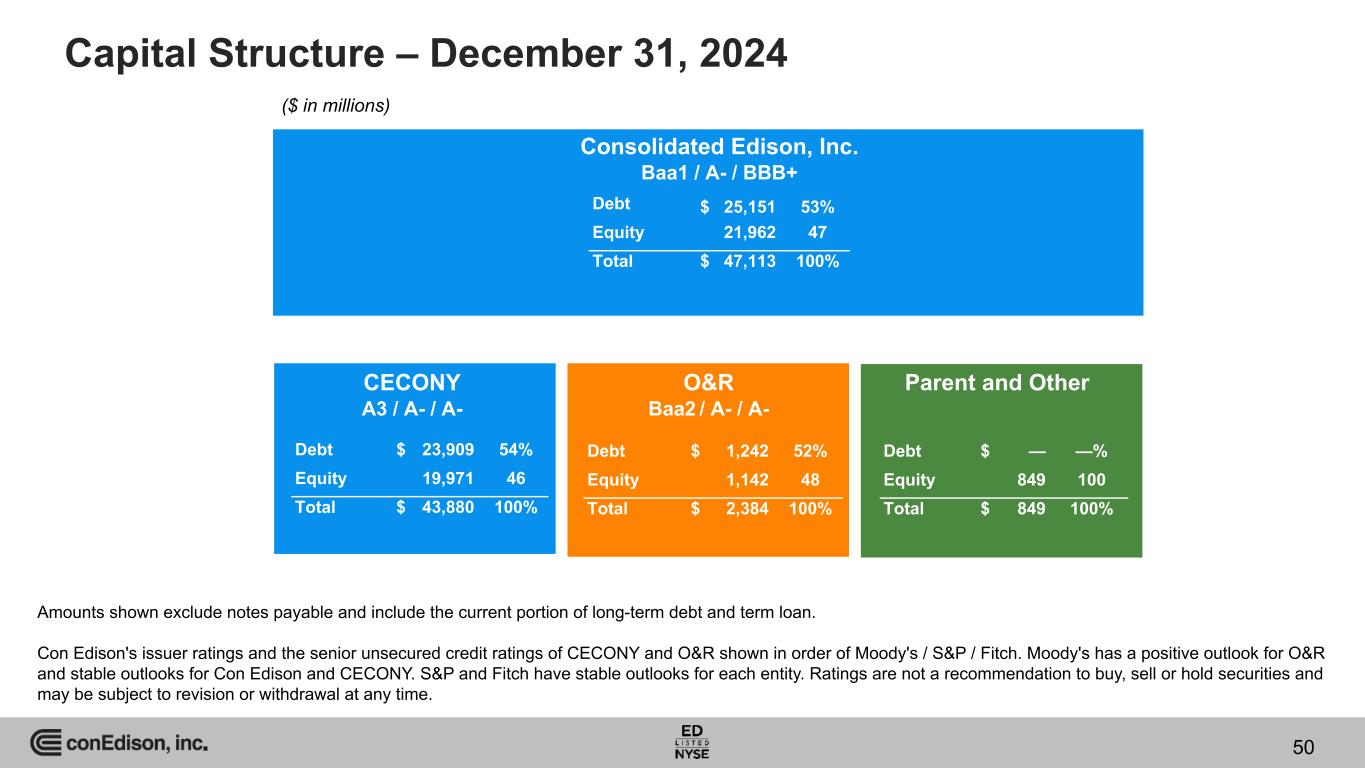

Capital Structure – December 31, 2024 Consolidated Edison, Inc. Baa1 / A- / BBB+ CECONY A3 / A- / A- O&R Baa2 / A- / A- Parent and Other Debt $ 25,151 53% Equity 21,962 47 Total $ 47,113 100% Debt $ 23,909 54% Equity 19,971 46 Total $ 43,880 100% Debt $ 1,242 52% Equity 1,142 48 Total $ 2,384 100% Debt $ — —% Equity 849 100 Total $ 849 100% Amounts shown exclude notes payable and include the current portion of long-term debt and term loan. Con Edison's issuer ratings and the senior unsecured credit ratings of CECONY and O&R shown in order of Moody's / S&P / Fitch. Moody's has a positive outlook for O&R and stable outlooks for Con Edison and CECONY. S&P and Fitch have stable outlooks for each entity. Ratings are not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. ($ in millions) 50

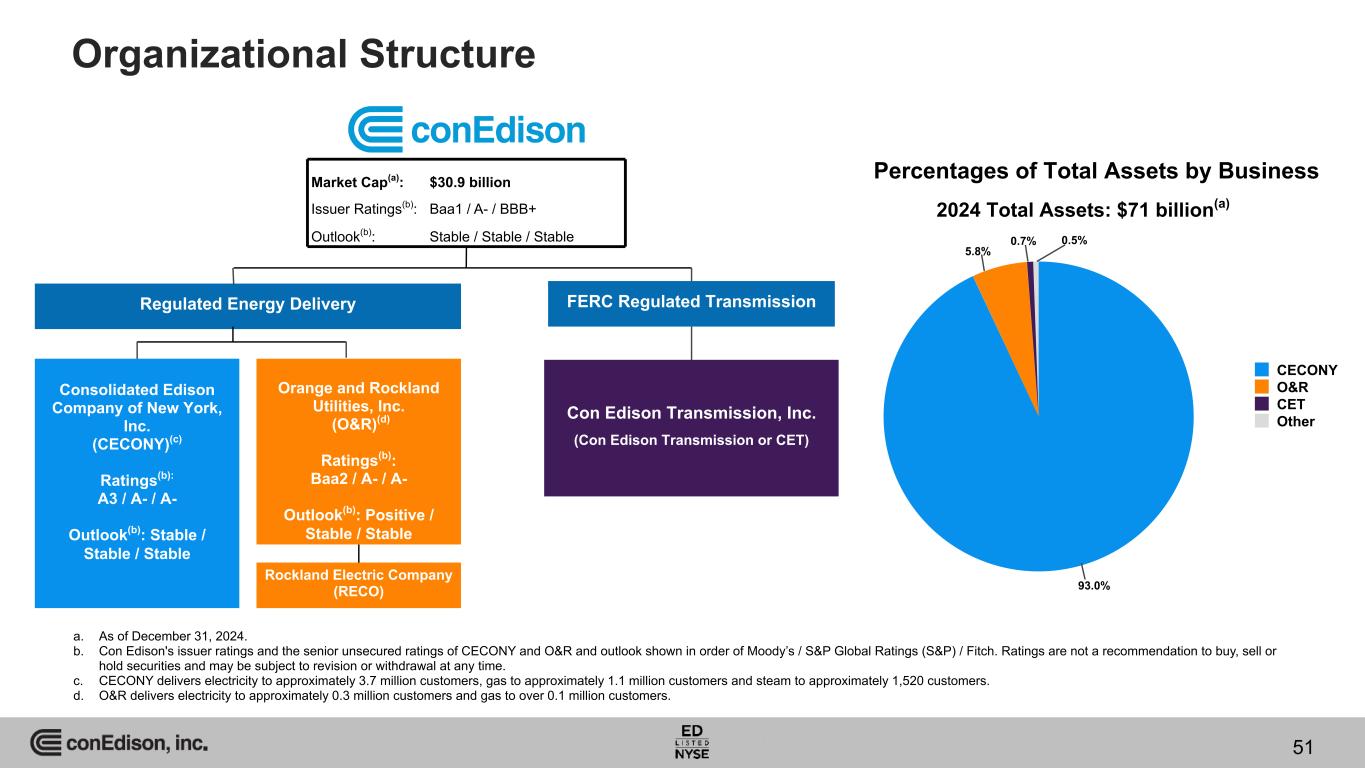

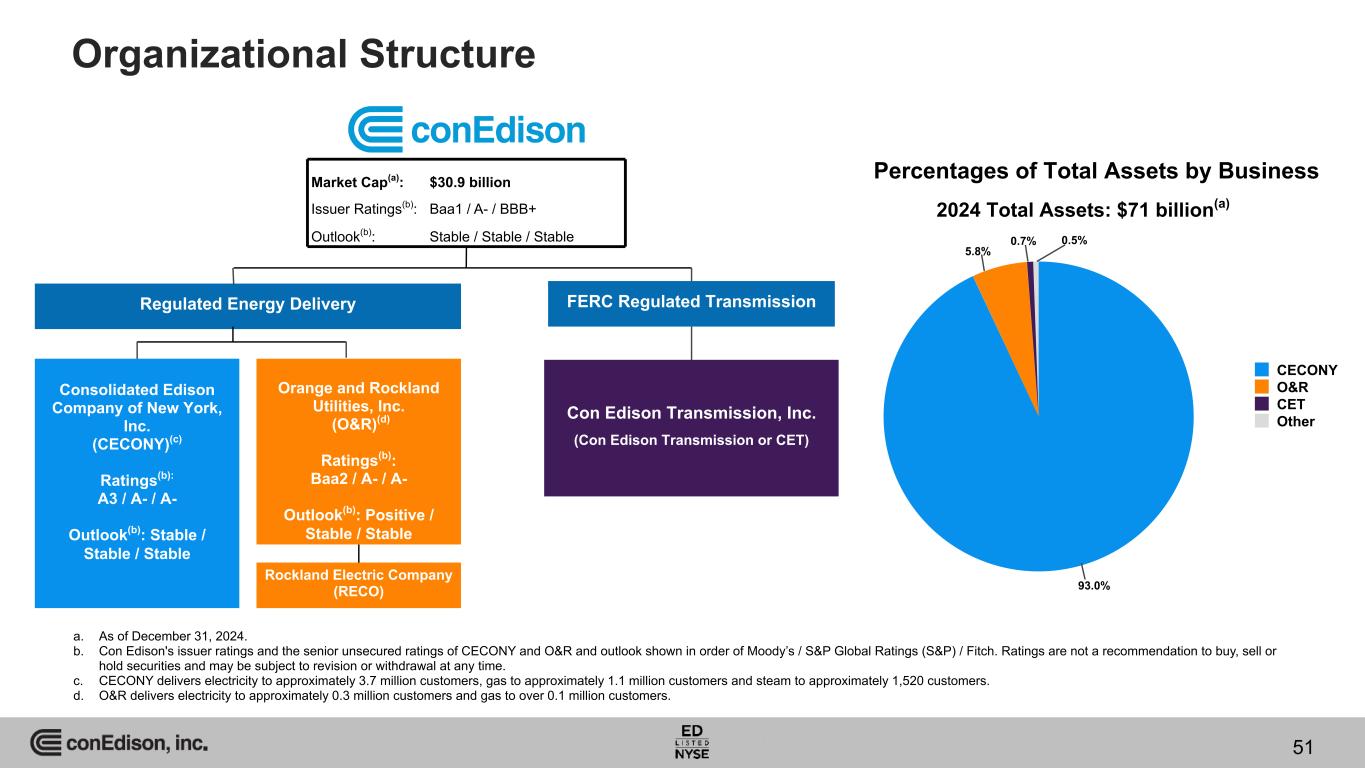

51 Organizational Structure a. As of December 31, 2024. b. Con Edison's issuer ratings and the senior unsecured ratings of CECONY and O&R and outlook shown in order of Moody’s / S&P Global Ratings (S&P) / Fitch. Ratings are not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. c. CECONY delivers electricity to approximately 3.7 million customers, gas to approximately 1.1 million customers and steam to approximately 1,520 customers. d. O&R delivers electricity to approximately 0.3 million customers and gas to over 0.1 million customers. Regulated Energy Delivery Orange and Rockland Utilities, Inc. (O&R)(d) Ratings(b): Baa2 / A- / A- Outlook(b): Positive / Stable / Stable Consolidated Edison Company of New York, Inc. (CECONY)(c) Ratings(b): A3 / A- / A- Outlook(b): Stable / Stable / Stable FERC Regulated Transmission Market Cap(a): $30.9 billion Issuer Ratings(b): Baa1 / A- / BBB+ Outlook(b): Stable / Stable / Stable Con Edison Transmission, Inc. (Con Edison Transmission or CET) Rockland Electric Company (RECO) Percentages of Total Assets by Business 93.0% 5.8% 0.7% 0.5% CECONY O&R CET Other 2024 Total Assets: $71 billion(a) 51

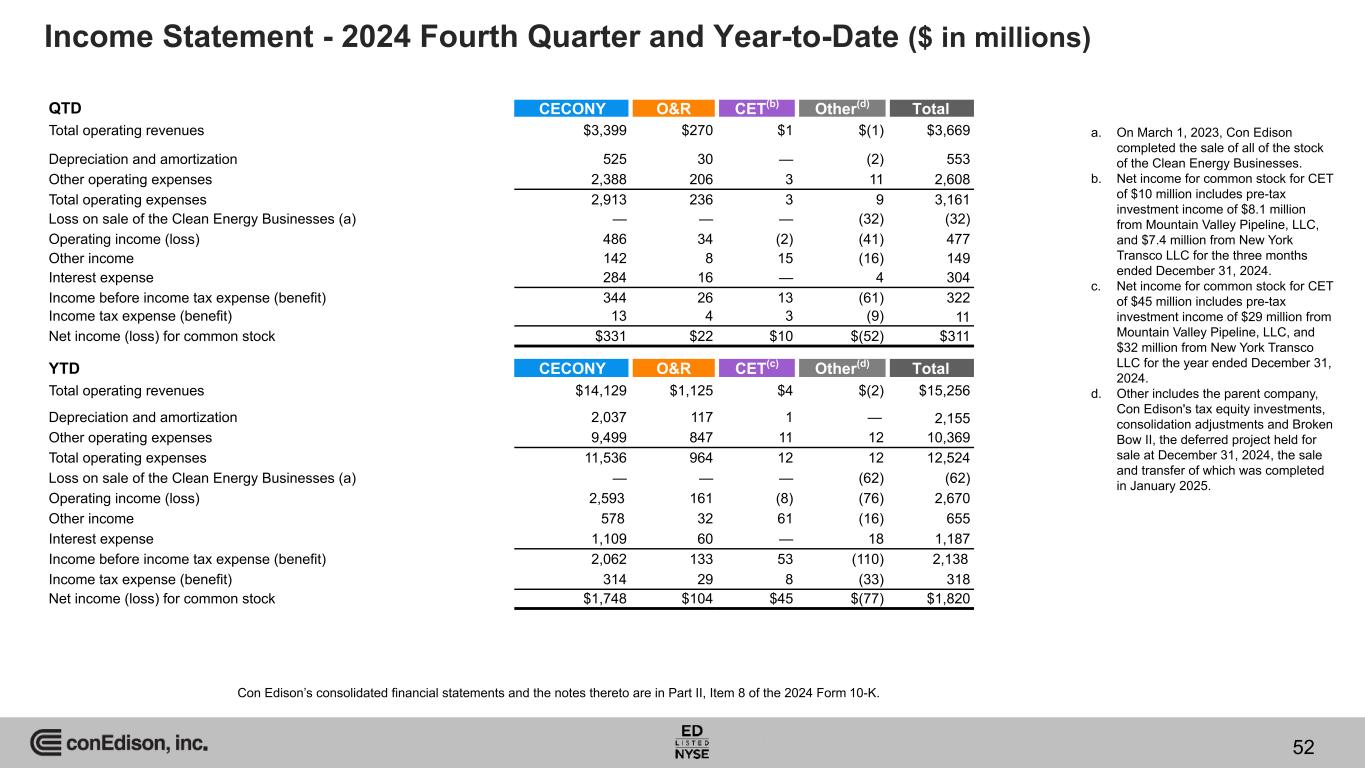

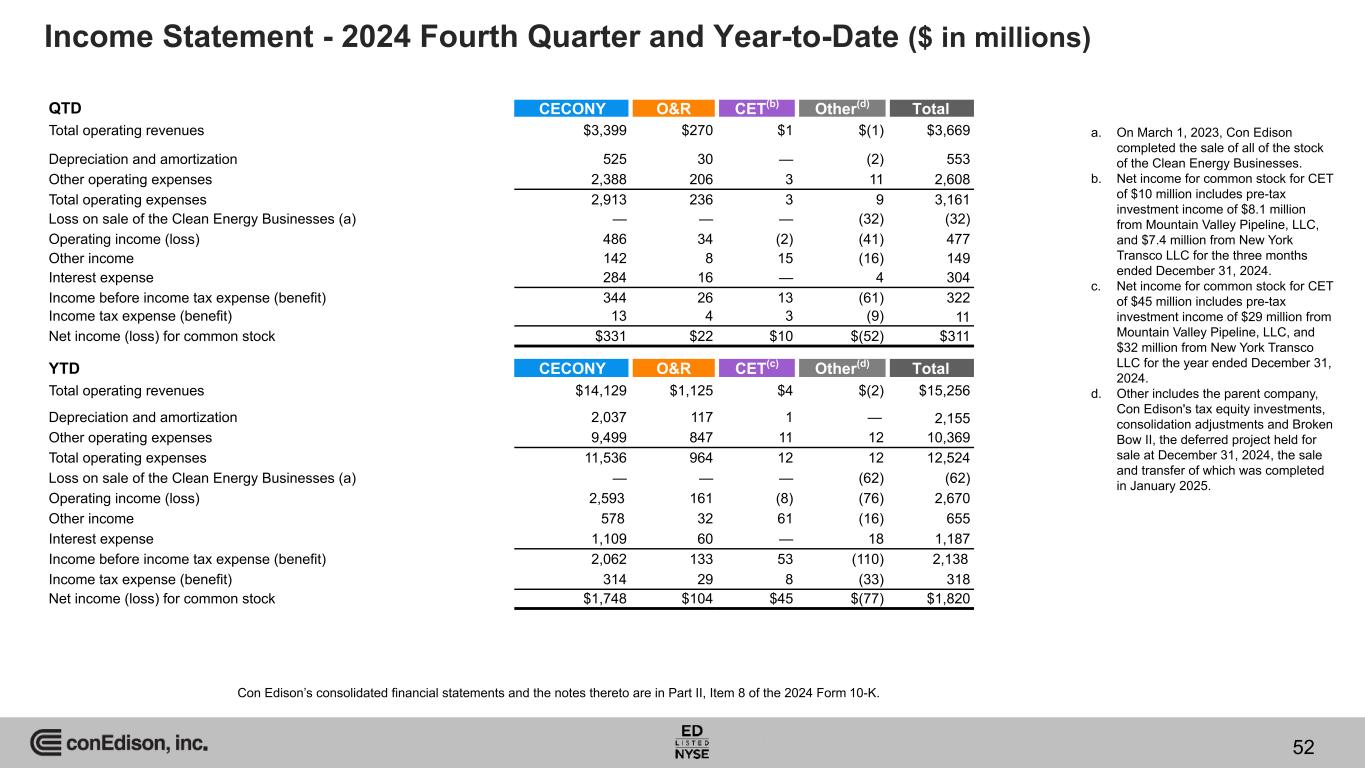

Income Statement - 2024 Fourth Quarter and Year-to-Date ($ in millions) QTD CECONY O&R CET(b) Other(d) Total Total operating revenues $3,399 $270 $1 $(1) $3,669 Depreciation and amortization 525 30 — (2) 553 Other operating expenses 2,388 206 3 11 2,608 Total operating expenses 2,913 236 3 9 3,161 Loss on sale of the Clean Energy Businesses (a) — — — (32) (32) Operating income (loss) 486 34 (2) (41) 477 Other income 142 8 15 (16) 149 Interest expense 284 16 — 4 304 Income before income tax expense (benefit) 344 26 13 (61) 322 Income tax expense (benefit) 13 4 3 (9) 11 Net income (loss) for common stock $331 $22 $10 $(52) $311 YTD CECONY O&R CET(c) Other(d) Total Total operating revenues $14,129 $1,125 $4 $(2) $15,256 Depreciation and amortization 2,037 117 1 — 2,155 Other operating expenses 9,499 847 11 12 10,369 Total operating expenses 11,536 964 12 12 12,524 Loss on sale of the Clean Energy Businesses (a) — — — (62) (62) Operating income (loss) 2,593 161 (8) (76) 2,670 Other income 578 32 61 (16) 655 Interest expense 1,109 60 — 18 1,187 Income before income tax expense (benefit) 2,062 133 53 (110) 2,138 Income tax expense (benefit) 314 29 8 (33) 318 Net income (loss) for common stock $1,748 $104 $45 $(77) $1,820 a. On March 1, 2023, Con Edison completed the sale of all of the stock of the Clean Energy Businesses. b. Net income for common stock for CET of $10 million includes pre-tax investment income of $8.1 million from Mountain Valley Pipeline, LLC, and $7.4 million from New York Transco LLC for the three months ended December 31, 2024. c. Net income for common stock for CET of $45 million includes pre-tax investment income of $29 million from Mountain Valley Pipeline, LLC, and $32 million from New York Transco LLC for the year ended December 31, 2024. d. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. Con Edison’s consolidated financial statements and the notes thereto are in Part II, Item 8 of the 2024 Form 10-K. 52

Condensed Statement of Cash Flows – Year Ended December 31, 2024 ($ in millions) CECONY O&R CET Other(a)(c) Total Net cash flows from operating activities $3,358 $153 $30 $73 $3,614 Net cash flows from (used in) investing activities (4,923) (321) (29) — (5,273) Net cash flows from (used in) financing activities 1,681 183 (3) (64) 1,797 Net change for the period 116 15 (2) 9 138 Balance at beginning of period 1,138 23 25 9 1,195 Balance at end of period (b) 1,254 38 23 18 1,333 Less: Balance held for sale (c) — — — 9 9 Balance at end of period excluding held for sale $1,254 $38 $23 $9 $1,324 a. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. b. See "Reconciliation of Cash, Temporary Cash Investments and Restricted Cash" in Note A in Item 8 of the 2024 Form 10-K. c. On March 1, 2023, Con Edison completed the sale of all of the stock of the Clean Energy Businesses. Con Edison’s consolidated financial statements and the notes thereto are in Part II, Item 8 of the 2024 Form 10-K. 53

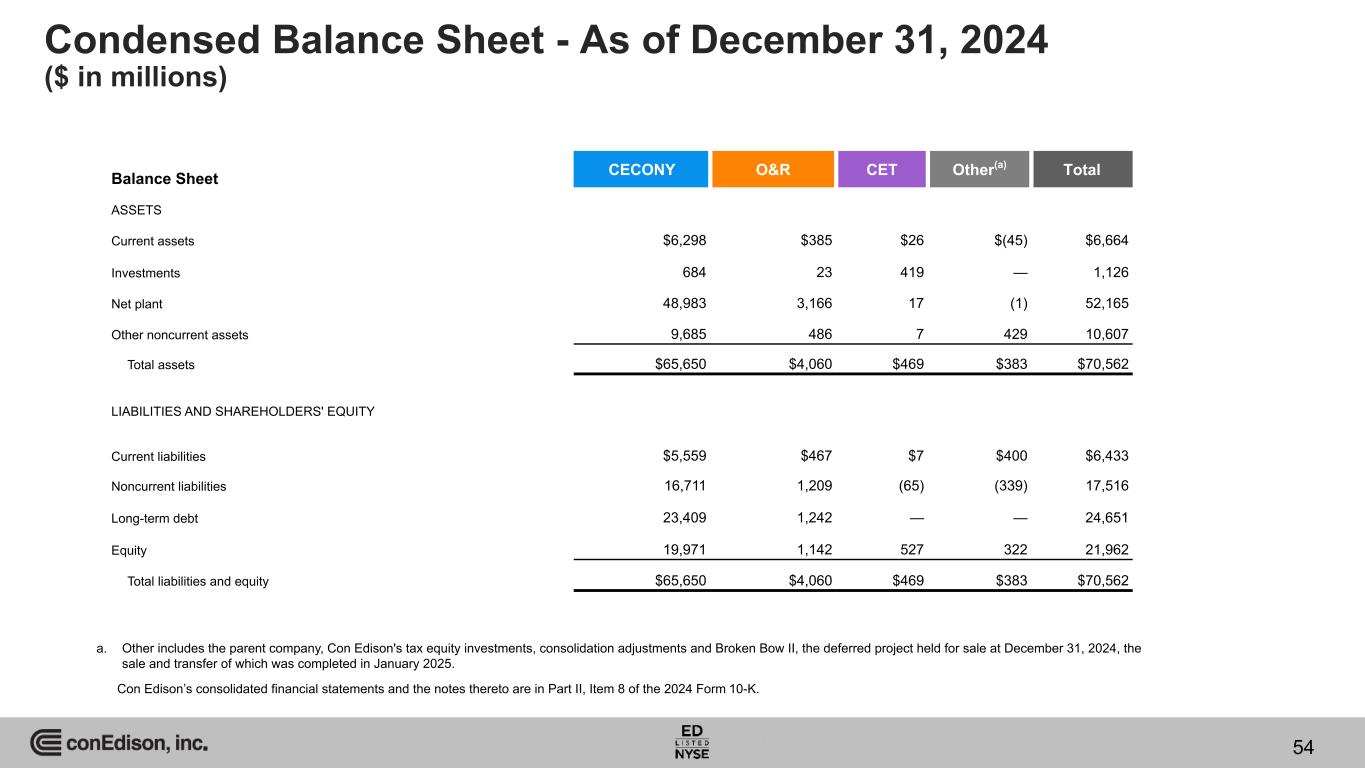

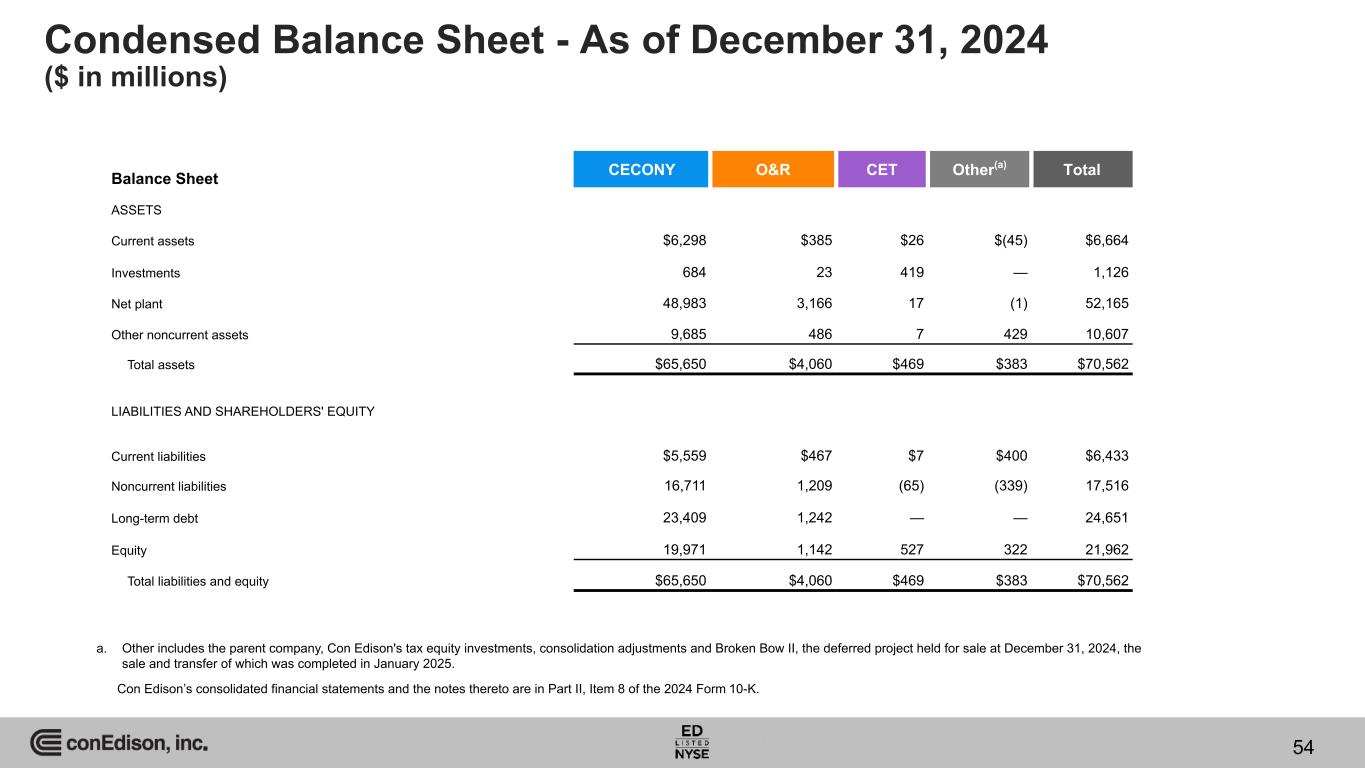

Condensed Balance Sheet - As of December 31, 2024 ($ in millions) Balance Sheet CECONY O&R CET Other(a) Total ASSETS Current assets $6,298 $385 $26 $(45) $6,664 Investments 684 23 419 — 1,126 Net plant 48,983 3,166 17 (1) 52,165 Other noncurrent assets 9,685 486 7 429 10,607 Total assets $65,650 $4,060 $469 $383 $70,562 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities $5,559 $467 $7 $400 $6,433 Noncurrent liabilities 16,711 1,209 (65) (339) 17,516 Long-term debt 23,409 1,242 — — 24,651 Equity 19,971 1,142 527 322 21,962 Total liabilities and equity $65,650 $4,060 $469 $383 $70,562 a. Other includes the parent company, Con Edison's tax equity investments, consolidation adjustments and Broken Bow II, the deferred project held for sale at December 31, 2024, the sale and transfer of which was completed in January 2025. Con Edison’s consolidated financial statements and the notes thereto are in Part II, Item 8 of the 2024 Form 10-K. 54

Con Edison Environmental, Social & Governance Resources • Policy Statement on Environmental Justice • 2023 Disadvantaged Communities Report • CECONY Climate Change Vulnerability Study and Climate Change Resilience and Adaptation Plan • O&R Climate Change Vulnerability Study and Climate Change Resilience and Adaptation Plan • Diversity and Inclusion Report examines Con Edison's diverse and inclusive culture • 2024 Proxy Statement • Highlighting how the Company supports our communities through Community Partnerships • Our Standards of Business Conduct guide our Political Engagement • Con Edison’s Clean Energy Vision looking toward a clean energy future • Sustainability Report - Con Edison's Sustainability report • 2024 Consolidated Edison Clean Energy Webinar Our ESG reporting standards: • Global Reporting Initiative Content Index • Edison Electric Institute / American Gas Association ESG templates – Industry reporting standards • Sustainability Accounting Standards Board (SASB) – Broad ESG reporting standard • Task Force on Climate-Related Financial Disclosures (TCFD) – Broad ESG reporting standard • Equal Employment Opportunity Component 1 Report (EEO-1) – Federal employer information report • Our environmental impacts including carbon emissions disclosures are filed with the Carbon Disclosure Project (CDP) Link to more ESG resources: https://conedison.gcs-web.com/environmental-social-and-governance-esg-resources 55

INTERNAL 2024 Earnings Release Presentation February 20, 2025