- ED Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Consolidated Edison (ED) DEF 14ADefinitive proxy

Filed: 8 Apr 19, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under§240.14a-12 |

CONSOLIDATED EDISON, INC.

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Consolidated Edison, Inc.

4 Irving Place

New York, NY 10003

John McAvoy

Chairman of the Board

April 8, 2019

Dear Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Consolidated Edison, Inc. We hope that you will join the Board of Directors and the Company’s management at the Company’s Headquarters at 4 Irving Place, New York, New York, on Monday, May 20, 2019, at 10:00 a.m.

The accompanying Proxy Statement, provided to stockholders on or about April 8, 2019, contains information about matters to be considered at the Annual Meeting. At the Annual Meeting, stockholders will be asked to vote on the election of Directors, to ratify the appointment of independent accountants for 2019, and to approve, on an advisory basis, named executive officer compensation.

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. It is very important that as many shares as possible be represented at the meeting.

Sincerely,

|

| John McAvoy |

|

Consolidated Edison, Inc.

4 Irving Place, New York, NY 10003

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date: | Monday, May 20, 2019, at 10:00 a.m. | |

| Location: | Company’s Headquarters 4 Irving Place New York, New York | |

| Items of Business: | a. To elect as the members of the Board of Directors the ten nominees named in the Proxy Statement (attached hereto and incorporated herein by reference);

b. To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants for 2019;

c. To approve, on an advisory basis, named executive officer compensation; and

d. To transact such other business as may properly come before the meeting, or any adjournment or postponement of the meeting. | |

By Order of the Board of Directors,

Sylvia V. Dooley

Vice President and Corporate Secretary

Dated: April 8, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDERS’ MEETING TO BE HELD ON MONDAY, MAY 20, 2019. THE COMPANY’S PROXY STATEMENT AND ANNUAL REPORT, PROVIDED TO STOCKHOLDERS ON OR ABOUT APRIL 8, 2019, ARE AVAILABLE AT

CONEDISON.COM/SHAREHOLDERS

IMPORTANT!

Whether or not you plan to attend the meeting in person, we urge you to vote your shares of Company Common Stock by telephone, by Internet, or by completing and returning a proxy card or a voter instruction form, so that your shares will be represented at the Annual Meeting.

| TABLE OF CONTENTS |

|

SUMMARY | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| PROXY STATEMENT | ||||

| ELECTION OF DIRECTORS | 6 | |||

| 6 | ||||

| THE BOARD OF DIRECTORS | 13 | |||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| DIRECTOR COMPENSATION | 20 | |||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| STOCK OWNERSHIP AND SECTION 16 COMPLIANCE | 23 | |||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| INDEPENDENT ACCOUNTANTS RATIFICATION | 25 | |||

Proposal No. 2 Ratification of the Appointment of Independent | 25 | |||

| AUDIT COMMITTEE MATTERS | 26 | |||

| 26 | ||||

| 26 | ||||

| ADVISORY VOTE | 27 | |||

Proposal No. 3 Advisory Vote to Approve Named Executive Officer Compensation | 27 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 28 | |||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 30 | ||||

| PROXY STATEMENT SUMMARY |

|

This section highlights the proposals to be acted upon, as well as information about Consolidated Edison, Inc. (the “Company”) that can be found in this Proxy Statement and does not contain all of the information that you need to consider. Before voting, please carefully review the complete Proxy Statement and the Annual Report to Stockholders of the Company provided to stockholders on or about April 8, 2019, which includes the consolidated financial statements and accompanying notes for the fiscal year ended December 31, 2018, and other information relating to the Company’s financial condition and results of operations.

2019 ANNUAL MEETING OF STOCKHOLDERS (“ANNUAL MEETING”)

• Date and Time: | Monday, May 20, 2019, at 10:00 a.m. | |

• Location: | Company Headquarters, 4 Irving Place, New York, NY 10003. Directions are available atconedison.com/shareholders. | |

• Record Date & Voting: | Stockholders of record at the close of business on March 25, 2019 are entitled to vote. On the record date, 326,946,537 shares of Company Common Stock were outstanding. Each outstanding share of Common Stock is entitled to one vote. | |

• Admission: | Please follow the instructions contained in“Who Can Attend The Annual Meeting?” and“Do I Need A Ticket To Attend The Annual Meeting?” on page 66. | |

| Management Proposals | Board’s Voting Recommendation | Vote Required For Approval* | Page References (for more detail) | |||||

| Proposal No. 1. | Election of Directors | FOR EACH NOMINEE | MAJORITY OF VOTES CAST | 6 to 12 | ||||

| Proposal No. 2. | Ratification of the Appointment of Independent Accountants | FOR | MAJORITY OF VOTES CAST | 25 | ||||

| Proposal No. 3. | Advisory Vote to Approve Named Executive Officer Compensation | FOR | MAJORITY OF VOTES CAST | 27 | ||||

| * | The presence, in person or by proxy, of holders of a majority of the outstanding shares of Company Common Stock is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and brokernon-votes (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its clients) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting but are not considered votes cast with respect to the Election of Directors (Proposal No. 1) and the Advisory Vote to Approve Named Executive Officer Compensation (Proposal No. 3) and have no effect on the vote. |

| CONSOLIDATED EDISON, INC.–Proxy Statement | 1 |

| PROXY STATEMENT SUMMARY |

| • | Proposal No. 1: Election of Directors.The Board of Directors has nominated ten directors for election at the Annual Meeting and recommends the election of each of the ten nominees. The following table provides certain information about the Director nominees. (See “Information About the Director Nominees” on pages 7 to 12 for additional information.) |

| Director Nominees | ||||||||

Name / Age / Tenure / Independence | Primary Occupation / Career Highlight | Committee Membership | Other U.S.-Listed Public Company Boards | |||||

| George Campbell, Jr., 73 Director since 2000 Independent | FormerNon-Executive Chairman, Webb Institute | Corporate Governance and Nominating Executive Management Development and Safety, Environment, Operations and | 1 | ||||

| Ellen V. Futter, 69 Director since 1997 Not Independent | President, American Museum of Natural History | Executive Safety, Environment, Operations and | 1 | ||||

| John F. Killian, 64 Director since 2007 Independent | Former Executive Vice President and Chief Financial Officer, Verizon Communications Inc. | Audit (Chair) Corporate Governance and Nominating Executive Management Development and | 2 | ||||

| John McAvoy, 58 Director since 2013 Not Independent | Chairman, President and Chief Executive Officer, Consolidated Edison, Inc. | Executive (Chair) | 0 | ||||

| William J. Mulrow, 63 Director since 2017 Independent | Senior Advisory Director, The Blackstone Group | Finance Management Development and Safety, Environment, Operations and | 1 | ||||

| Armando J. Olivera, 69 Director since 2014 Independent | Former President and Chief Executive Officer, Florida Power & Light Company | Audit Finance Safety, Environment, Operations and | 2 | ||||

| Michael W. Ranger, 61 Director since 2008 Independent | Senior Managing Director, Diamond Castle Holdings LLC | Audit Corporate Governance and Nominating Executive Management Development and | 1 | ||||

| Linda S. Sanford, 66 Director since 2015 Independent | Former Senior Vice President, Enterprise Transformation, International Business Machines Corporation | Audit Corporate Governance and Nominating Finance | 2 | ||||

| Deirdre Stanley, 54 Director since 2017 Independent | Executive Vice President and General Counsel, Thomson Reuters | Corporate Governance and Nominating Safety, Environment, Operations and | 0 | ||||

| L. Frederick Sutherland, 67 Director since 2006 Independent | Former Executive Vice President and Chief Financial Officer, Aramark Corporation | Audit Finance (Chair) Management Development and | 1 | ||||

| • | Proposal No. 2: Ratification of the Appointment of Independent Accountants.The Board recommends ratification of the appointment of PricewaterhouseCoopers LLP as independent accountants for 2019. (See “Ratification of the Appointment of Independent Accountants” on page 25.) |

| • | Proposal No. 3: Advisory Vote to Approve Named Executive Officer Compensation.The Board recommends the approval of, on an advisory basis, the compensation of the named executive officers. The Company’s Named Executive Officers are identified in the “Compensation Discussion and Analysis–Introduction” on page 28. (See “Advisory Vote to Approve Named Executive Officer Compensation” on page 27.) |

| 2 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| PROXY STATEMENT SUMMARY |

KEY CORPORATE GOVERNANCE PRACTICES

| • | Active, Year-Round,Stockholder Engagement. The Company proactively engages with stockholders and accepts invitations to discuss matters of interest to them. Throughout the year, the Company discussed numerous issues with stockholders including, disclosure practices, corporate governance, political spending and lobbying practices, and environmental, health, and safety matters. The Company shares with the Corporate Governance and Nominating Committee and the Board the feedback it receives from institutional investors and stockholders. During the 2019 engagement season, the Company engaged with seven of our largest institutional stockholders. |

| • | Risk Oversight. The Board and its committees oversee the Company’s policies and procedures for managing risks that are identified through the Company’s enterprise risk management program. |

| • | Strategic Planning. The Board oversees and reviews, at least annually, the Company’s strategic and business plans and objectives. |

| • | Annual Election of Directors. Each Director nominee has been recommended for election by the Corporate Governance and Nominating Committee and approved and nominated for election by the Board. If elected, the Director nominees, all of whom are currently members of the Board, will serve for aone-year term expiring at the Company’s 2020 Annual Meeting of Stockholders. Each Director will hold office until his or her successor has been elected and qualified or until the Director’s earlier resignation or removal. |

| • | Voting.In uncontested elections, each Director nominee may be elected by a majority of the votes cast at a meeting of the Company’s stockholders by the holders of shares entitled to vote in the election. In contested elections, each Director nominee may be elected by a plurality of the votes cast. The Company does not have a super-majority voting provision in its Restated Certificate of Incorporation. |

| • | BoardComposition. The Director nominees have the combination of skills, professional experience, and diversity necessary to oversee the Company’s business. A substantial |

majority (80%) of the Director nominees are independent and have an average age of 64 years. The Board strives to maintain an appropriate balance of tenure among Directors. Of the Director nominees, 50% have been on the Board for six years or less, 30% have been on the Board for seven to sixteen years, and 20% have been on the Board for over sixteen years. |

| • | Independent Lead Director. The Board has an independent Lead Director who is the Chair of the Corporate Governance and Nominating Committee and has numerous duties and significant responsibilities, including acting as a liaison between the independent Directors and the Company’s management, and chairing the executive sessions ofnon-management and independent Directors. |

| • | Frequent Executive Sessions. The Company’s independent Directors andnon-management Directors meet frequently in executive sessions. |

| • | Annual Board and Committee Evaluations. The Board and each of its committees annually evaluate their performance. Each committee reports the results of its self-evaluation to the Board. The Corporate Governance and Nominating Committee coordinates the self-evaluation process and, following the self-evaluations, discusses with the Boardfollow-up matters as appropriate. |

| • | Membership on Public Company Boards. Directors are not permitted to serve on more than four other public company boards and none serve on more than two. |

| • | Proxy Access. The Board has adopted proxy access, which enables certain stockholders of the Company to include their own director nominees in the Company’s Proxy Statement and form of proxy, along with candidates nominated by the Board if the stockholders and the nominees proposed by the stockholders meet the requirements set forth in the Company’sBy-laws. |

| • | Special Meetings. Special meetings may be called by stockholders holding at least 25% of the Company’s outstanding shares of Common Stock entitled to vote at such meeting. |

| CONSOLIDATED EDISON, INC.–Proxy Statement | 3 |

| PROXY STATEMENT SUMMARY |

KEY FEATURES OF THE EXECUTIVE COMPENSATION PROGRAM

| Type | Component | Objective | ||

| Performance-Based Compensation | Annual Incentive Compensation | Achievement of financial and operating objectives for which the Named Executive Officers have individual and collective responsibility. | ||

| Long-Term Incentive Compensation | Achievement, over a multi-year period, of financial and operating objectives critical to the performance of the Company’s business plans and strategies. Achievement, over a three-year period, of the Company’s cumulative total shareholder return relative to the Company’s compensation peer group companies. | |||

| Fixed & Other Compensation | Base Salary, Retirement Programs, Benefits and Perquisites | Differentiate base salary based on individual responsibility and performance. Provide retirement and other benefits that reflect the competitive practices of the industry and provide limited and specific perquisites. |

(See “Compensation Discussion and Analysis—Executive Summary” on pages 28 to 30 for additional information.)

KEY COMPENSATION GOVERNANCE PRACTICES

| • | Long-Term Incentive Compensation. The long term incentive plan: (i) prohibits the repricing of stock options or the buyout of underwater options without stockholder approval; (ii) prohibits recycling of shares for future awards except under limited circumstances; (iii) prohibits accelerated vesting of outstanding equity awards, unless both a change in control occurs and a participant’s employment is terminated under certain circumstances; and (iv) caps the maximum number of shares that may be awarded to a director, officer, or eligible employee in a calendar year. |

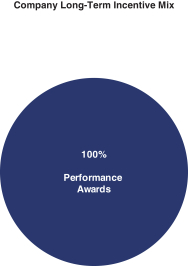

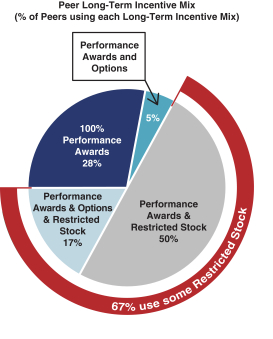

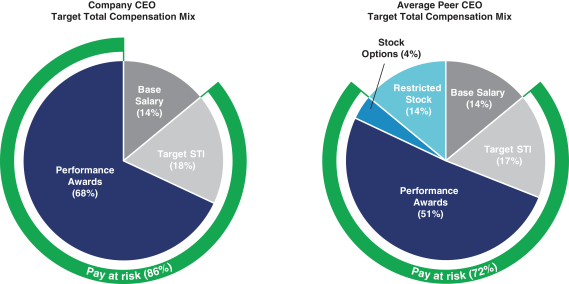

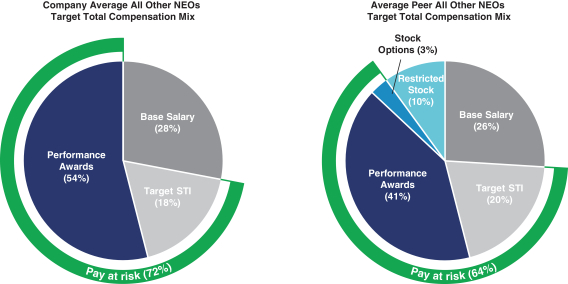

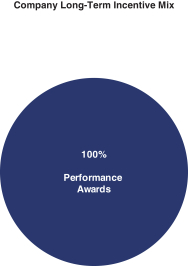

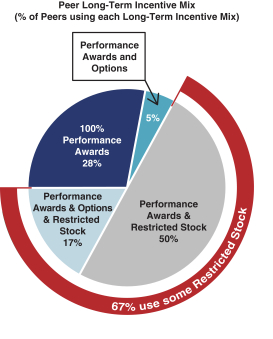

| • | Long-Term Incentive Mix. The charts below illustrate that all Named Executive Officer long-term equity-based incentive compensation is performance-based. As disclosed in proxy statements filed in 2018, over half of the Company’s compensation peer group companies granted some form ofnon-performance-based incentive compensation to their named executive officers. |

|  |

(See “Compensation Discussion and Analysis—Executive Compensation Actions—Annual Incentive Compensation” on pages 35 to 41 and “Compensation Discussion and Analysis—Executive Compensation Actions—Long-Term Incentive Compensation” on pages 41 to 46 for additional information.)

| 4 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| PROXY STATEMENT SUMMARY |

| • | Pay Practices. The Company has no employment agreements, no golden parachute excise taxgross-ups, and no individually negotiated equity awards with special treatment upon a change of control. |

| • | Risk Management. The Company’s compensation programs include various features that have been designed to mitigate risk. (See “Compensation Risk Management” on page 62.) |

| • | Stock Ownership Guidelines. The Company has stock ownership guidelines for its Directors and senior officers, including the Named Executive Officers. (See “Director Compensation—Stock Ownership Guidelines” on page 21 and “Compensation Discussion and Analysis–Stock Ownership Guidelines” on page 48.) |

| • | No Hedging and No Pledging. The Company’s Hedging and Pledging Policy and Insider Trading Policy each prohibit all Directors and officers, financial personnel, and certain |

other individuals, respectively, from shorting, hedging, and pledging Company securities or holding Company securities in a margin account as collateral for a loan. (See “Compensation Discussion and Analysis–No Hedging and No Pledging” on page 48.) |

| • | Recoupment Policy. The Company’s compensation recoupment policy (commonly referred to as a “clawback policy”) applies to all officers of the Company and its subsidiaries with respect to incentive-based compensation. (See “Compensation Discussion and Analysis–Recoupment Policy” on page 49.) |

| • | Annual Advisory Vote to Approve Named Executive Officer Compensation. In 2018, 93.95% of the shares voted were voted to approve the Company’s named executive officer compensation. |

| CONSOLIDATED EDISON, INC.–Proxy Statement | 5 |

| ELECTION OF DIRECTORS |

|

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Ten Directors are to be elected at the Annual Meeting to hold office until the next annual meeting and until their respective successors are elected and qualified. (See “Information About the Director Nominees” on pages 7 to 12.) Directors are permitted to stand for election until they reach the mandatory retirement age of 75. Of the Board members standing for election, John McAvoy is the only member who is an officer of the Company. All of the nominees were elected Directors at the last Annual Meeting.

The Corporate Governance and Nominating Committee recommends candidates for election orre-election to the Board and reviews the qualifications of possible Director candidates. When recommending to the Board the slate of Director nominees for election at the Annual Meeting, the Corporate Governance and Nominating Committee strives to maintain an appropriate balance of tenure, diversity, and skills on the Board. The Corporate Governance and Nominating Committee also strives to ensure that the Board is composed of Directors who bring diverse viewpoints, perspectives, professional experiences and backgrounds, and effectively represent the long-term interests of stockholders. The Board and the Corporate Governance and Nominating Committee believe that striking an appropriate balance between fresh perspectives and ideas and the valuable experience and familiarity contributed by longer-serving Directors is critical to a forward-looking and strategic Board. The Corporate

Governance and Nominating Committee identifies candidates through a variety of means, including professional search firms, recommendations from members of the Board, suggestions from senior management, and submissions by the Company’s stockholders. (See “The Board of Directors—Standing Committees of the Board—Corporate Governanceand Nominating Committee” on page 16 for additional information on the Director nomination process.)

Each nominee was selected by the Corporate Governance and Nominating Committee and approved by the Board for submission to the Company’s stockholders. The Company believes that all of the nominees will be able and willing to serve as Directors of the Company. All of the Directors also serve as Trustees of the Company’s subsidiary, Consolidated Edison Company of New York, Inc. (“Con Edison of New York”). Mr. McAvoy also serves as Chairman of the Board of the Company’s subsidiary, Orange and Rockland Utilities, Inc. (“Orange & Rockland”).

Shares represented by every properly executed proxy will be voted at the Annual Meeting for or against the election of the Director nominees as specified by the stockholder giving the proxy. If one or more of the nominees is unable or unwilling to serve, the shares represented by the proxies will be voted for any substitute nominee or nominees as may be designated by the Board.

The Board Recommends a Vote FOR Proposal No. 1.

Each of the ten Director nominees must receive a majority of the votes cast at the Annual Meeting, in person or by proxy, to be elected (meaning the number of shares voted “for” a Director nominee must exceed the number of shares voted “against” that Director nominee), subject to the Board’s policy regarding resignations by Directors who do not receive a majority of “for” votes. Abstentions and brokernon-votes are voted neither “for” nor “against,” and have no effect on the vote.

| 6 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| ELECTION OF DIRECTORS |

Information About the Director Nominees

The Board and the Corporate Governance and Nominating Committee consider the qualifications of Directors and Director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs. The Board believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. The Board has adopted Corporate Governance Guidelines to assist it in exercising its responsibilities to the Company and its stockholders. In evaluating Director candidates and considering incumbent Directors for renomination to the Board, the Board and the Corporate Governance and Nominating Committee consider various factors. Pursuant to the Guidelines, the Corporate Governance and Nominating Committee reviews with the Board factors relating to the composition of the Board (including its size and structure), the Company’s principles of diversity, and the skills and characteristics of Director

nominees, including independence, integrity, judgment, business experience, areas of expertise, and availability for service to assure that the Board contains an appropriate mix of Directors to best further the Company’s long-term business interests. For incumbent Directors, the Corporate Governance and Nominating Committee also considers past performance of the Director on the Board.

The current Director nominees bring to the Company the benefit of their qualifications, leadership, skills, and the diversity of their experience and backgrounds which provide the Board, as a whole, with the skills and expertise that reflect the needs of the Company. See pages 8 to 12 for information about each Director nominee, including their age as of the date of the Annual Meeting, business experience, period of service as a Director, public or investment company directorships, and other directorships.

The demographic makeup of the Director nominees is set forth in the pie charts below:

The following graph displays information about the skills and experience of the Director nominees:

|

| |

|

| CONSOLIDATED EDISON, INC.–Proxy Statement | 7 |

| ELECTION OF DIRECTORS |

| George Campbell, Jr., Ph.D.

Director since: 2000

Age: 73

Board Committees: • Corporate Governance and Nominating • Executive • Management Development and Compensation (Chair) • Safety, Environment, Operations and Sustainability |

Career Highlights: Dr. Campbell, a physicist, was theNon-Executive Chairman of the Webb Institute, Glen Cove, NY, an all scholarship college offering degrees exclusively in naval architecture and marine engineering, from November 2012 to October 2016. Dr. Campbell was the President of The Cooper Union for the Advancement of Science and Art, New York, NY, a college providing degrees in engineering, architecture, and fine arts, from July 2000 to June 2011. Dr. Campbell also held various research and development and management positions at AT&T Bell Laboratories. Dr. Campbell also served as President and Chief Executive Officer of NACME, Inc., anon-profit corporation focused on engineering education and science and technology policy.

Other Directorships: Dr. Campbell is a Trustee of Con Edison of New York and a Director of Barnes and Noble, Inc. Dr. Campbell is also a Director or Trustee of the Josiah Macy Foundation, The Mitre Corporation, Montefiore Medical Center(Emeritus), Rensselaer Polytechnic Institute, Institute of International Education, Inc., the U.S. Naval Academy Foundation and the Webb Institute.

Attributes and Skills: Dr. Campbell has experience leading premiere colleges and anon-profit corporation, with a focus on engineering and science. Dr. Campbell also has experience in management and research and development at a public company. Dr. Campbell’s experience from his leadership positions at the Webb Institute, The Cooper Union for the Advancement of Science and Art, AT&T Bell Laboratories, and NACME, Inc., and his service on other boards support the Board in its oversight of the Company’s operations and management activities.

| Ellen V. Futter

Director since: 1997

Age: 69

Board Committees: • Executive • Safety, Environment, Operations and Sustainability(Co-Chair) |

Career Highlights: Ms. Futter has been the President of the American Museum of Natural History, New York, NY, since November 1993. Previously, Ms. Futter served as the President of Barnard College, New York, NY and was a corporate attorney at the law firm of Milbank, Tweed, Hadley & McCloy.

Other Directorships: Ms. Futter is a Trustee of Con Edison of New York and a Director of Evercore Inc. Ms. Futter served as a Director and Chairman of the Federal Reserve Bank of New York. Ms. Futter is a Director or Trustee of NYC & Company and the Brookings Institution and a Manager at the Memorial Sloan-Kettering Cancer Center.

Attributes and Skills: Ms. Futter has management and operations experience leading major New Yorknot-for-profit entities that provide services to the public. Ms. Futter also has legal and financial experience. Ms. Futter’s experience from her leadership positions at the American Museum of Natural History and Barnard College and her legal experience support the Board in its oversight of the Company’s operations, planning and regulatory activities and the Company’s relationships with stakeholders.

| 8 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| ELECTION OF DIRECTORS |

| John F. Killian

Director since: 2007

Age: 64

Board Committees: • Audit (Chair) • Corporate Governance and Nominating • Executive • Management Development and Compensation |

Career Highlights: Mr. Killian was the Executive Vice President and Chief Financial Officer of Verizon Communications Inc., a telecommunications company, from March 2009 to November 2010. Mr. Killian was the President of Verizon Business, Basking Ridge, NJ from October 2005 until February 2009, the Senior Vice President and Chief Financial Officer of Verizon Telecom from June 2003 until October 2005, and the Senior Vice President and Controller of Verizon Corporation from April 2002 until June 2003. Mr. Killian also served in executive positions at Bell Atlantic and was the President and Chief Executive Officer of NYNEX CableComms Limited.

Other Directorships: Mr. Killian is a Trustee of Con Edison of New York and Goldman Sachs Trust II and a Director of Houghton Mifflin Harcourt Company. Mr. Killian also served as a Trustee and Chairman of the Board of Providence College.

Attributes and Skills: Mr. Killian has leadership experience at regulated consumer services companies, including experience with financial reporting and internal auditing. Mr. Killian’s experience from his leadership positions at Verizon Communications, Inc., Bell Atlantic and NYNEX CableComms Limited supports the Board in its oversight of the Company’s auditing, financial, operating, and strategic planning activities, and the Company’s relationships with stakeholders.

| John McAvoy

Director since: 2013

Age: 58

Board Committee: • Executive (Chair) |

Career Highlights: Mr. McAvoy has been Chairman of the Board of the Company and Con Edison of New York since May 2014. Mr. McAvoy has been President and Chief Executive Officer of the Company and Chief Executive Officer of Con Edison of New York since December 2013. Mr. McAvoy was President and Chief Executive Officer of Orange and Rockland Utilities, Inc. from January 2013 to December 2013. Mr. McAvoy was Senior Vice President of Central Operations for Con Edison of New York from February 2009 to December 2012. Mr. McAvoy joined Con Edison of New York in 1980.

Other Directorships: Mr. McAvoy is a Trustee of Con Edison of New York. Mr. McAvoy is also a Director or Trustee of the American Gas Association, the Edison Electric Institute, the Intrepid Sea, Air & Space Museum, the Mayor’s Fund to Advance New York City, the Partnership for New York City, Manhattan College, and the Electric Power Research Institute. Mr. McAvoy also served as a Director of the Business Council of New York State, Inc., and New York State Energy Research and Development Authority. Mr. McAvoy is also Chair of the Electricity Information Sharing and Analysis Center Members Executive Committee and Orange & Rockland.

Attributes and Skills: Mr. McAvoy has leadership, engineering, financial, and operations experience, as well as knowledge of the utility industry and the Company’s business. Mr. McAvoy’s experience from his leadership positions at the Company, and his service on other boards, supports the Board in its oversight of the Company’s management, financial, operations, and strategic planning activities, and the Company’s relationships with stakeholders.

| CONSOLIDATED EDISON, INC.–Proxy Statement | 9 |

| ELECTION OF DIRECTORS |

| William J. Mulrow

Director since: 2017

Age: 63

Board Committees: • Finance • Management Development and Compensation • Safety, Environment, Operations and Sustainability |

Career Highlights: Mr. Mulrow is a Senior Advisory Director since May 2017 at The Blackstone Group, the world’s largest alternative asset management firm. Previously, he served as Secretary to New York State Governor Andrew Cuomo from January 2015 to April 2017, and was a Senior Managing Director at Blackstone from April 2011 to January 2015. From 2005 to 2011, he was a Director of Citigroup Global Markets Inc. Mr. Mulrow also held various management positions at Paladin Capital Group, Gabelli Asset Management, Inc., Rothschild Inc., and Donaldson, Lufkin & Jenrette Securities Corporation. In addition, Mr. Mulrow served in a number of other government positions including Chairman of the New York State Housing Finance Agency and State of New York Mortgage Agency.

Other Directorships: Mr. Mulrow is a Trustee of Con Edison of New York, and a Director of JBG Smith Properties since July 2017, and Titan Mining Corporation since 2018. Mr. Mulrow also served as a Director of Arizona Mining, Inc.

Attributes and Skills: Mr. Mulrow has business and leadership experience in both the public and the private sector. He also has financial, accounting and asset management experience from his leadership positions at Blackstone, New York State government, and his service on other boards which supports the Board in its oversight of the Company’s financial and strategic planning activities.

| Armando J. Olivera

Director since: 2014

Age: 69

Board Committees: • Audit • Finance • Safety, Environment, Operations and Sustainability(Co-Chair)

|

Career Highlights: Mr. Olivera was President of Florida Power & Light Company, an electric utility that is a subsidiary of a publicly traded energy company, from June 2003, and Chief Executive Officer from July 2008, until his retirement in May 2012. Mr. Olivera joined Florida Power & Light Company in 1972. Mr. Olivera also served as Chairman of the Boards of twonon-profits: Florida Reliability Coordinating Council that focuses on the reliability and adequacy of bulk electricity in Florida, and Southeastern Electric Exchange that focuses on coordinating storm restoration services and enhancing operational and technical resources. Mr. Olivera is also a consultant to the Ridge Lane Sustainability Practice since 2018.

Other Directorships: Mr. Olivera is a Trustee of Con Edison of New York. Mr. Olivera also serves as a Director of Fluor Corporation and Lennar Corporation. During the past five years, Mr. Olivera served as a Director of AGL Resources, Inc. until July 2016. Mr. Olivera was also a Director of Florida Power & Light Company and a Trustee and Vice Chair of Miami Dade College. Mr. Olivera is Trustee Emeritus of Cornell University.

Attributes and Skills: Mr. Olivera has leadership, engineering, and operations experience, as well as knowledge of the utility industry. Mr. Olivera’s experience from his leadership positions at Florida Power & Light Company, and his service on other boards, supports the Board in its oversight of the Company’s management, financial, operations, and strategic planning activities. Mr. Olivera’s experiences as a consultant on sustainability supports the Board in its oversight of sustainability matters.

| 10 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| ELECTION OF DIRECTORS |

| Michael W. Ranger

Director since: 2008

Age: 61

Board Committees: • Audit • Corporate Governance and Nominating (Chair and Lead Director) • Executive • Finance • Management Development and Compensation

|

Career Highlights: Mr. Ranger has been Senior Managing Director of Diamond Castle Holdings LLC, New York, NY, a private equity investment firm, since 2004 andNon-Executive Chairman of KDC Solar LLC since 2010. Mr. Ranger was an investment banker in the energy and power sector for twenty years, including at Credit Suisse First Boston, Donaldson, Lufkin and Jenrette, DLJ Global Energy Partners, and Drexel Burnham Lambert. Mr. Ranger was also a member of the Utility Banking Group at Bankers Trust.

Other Directorships: Mr. Ranger is a Trustee of Con Edison of New York and a Director of Covanta Holding Corporation. Mr. Ranger is also Chairman of the Board of Trustees and a Trustee of St. Lawrence University and a Director of KDC Solar LLC. Mr. Ranger also served as a Trustee of Morristown-Beard School through 2017 and Director of Bonten Media Group Inc. through 2017 and Professional Directional Enterprises, Inc. through 2018.

Attributes and Skills: Mr. Ranger has investment experience focusing on the energy and power sector, investment banking experience in the energy and power sector, and experience as a member of a utility banking group. Mr. Ranger’s experience from his investment activities in the energy and power sector and his service on other boards supports the Board in its oversight of the Company’s corporate governance and financial and strategic planning activities.

| Linda S. Sanford

Director since: 2015

Age: 66

Board Committees: • Audit • Corporate Governance and Nominating • Finance

|

Career Highlights: Ms. Sanford was Senior Vice President Enterprise Transformation, International Business Machines Corporation (IBM), a multinational technology and consulting corporation, from January 2003 to December 2014. Ms. Sanford joined IBM in 1975. Ms. Sanford was also a consultant to The Carlyle Group serving as an Operating Executive from 2015 to July 2018.

Other Directorships: Ms. Sanford is a Trustee of Con Edison of New York and a Director of Pitney Bowes Inc., and RELX PLC (formerly Reed Elsevier PLC). Ms. Sanford also served as a Director of ITT Corporation. Ms. Sanford is also a Director or Trustee of ION Group and New York Hall of Science. Ms. Sanford also serves as a Trustee Emeriti of St. John’s University and Rensselaer Polytechnic Institute. Ms. Sanford also served as a Director or Trustee of the Partnership for New York City through January 2015, the State University of New York through May 2015 and the Business Council of New York State through May 2015.

Attributes and Skills: Ms. Sanford has leadership experience at an international technology company, including experience with information technology, cybersecurity, manufacturing, customer relations, and corporate planning and transformation. Ms. Sanford’s experience from her leadership positions at IBM and her service on other boards supports the Board in its oversight of technology, relationship with stakeholders, and financial and strategic planning activities.

| CONSOLIDATED EDISON, INC.–Proxy Statement | 11 |

| ELECTION OF DIRECTORS |

| Deirdre Stanley

Director since: 2017

Age: 54

Board Committees: • Corporate Governance and • Safety, Environment, Operations and Sustainability |

Career Highlights: Ms. Stanley has been Executive Vice President and General Counsel to Thomson Reuters, a leading source of news and information for professional markets, since 2008 where she also currently serves as Corporate Secretary to the Board of Directors, chairs the Disclosure Committee, and oversees the company’s enterprise risk management process and reporting. Ms. Stanley was Senior Vice President and General Counsel to The Thomson Corporation from 2002 to 2008, when it combined with Reuters PLC to form Thomson Reuters. Prior to 2002, Ms. Stanley held various legal and senior executive positions at InterActive Corporation (previously USA Networks, Inc.) and GTE Corporation (a predecessor company to Verizon). She was also an attorney with the law firm of Cravath, Swaine & Moore.

Other Directorships: Ms. Stanley is a Trustee of Con Edison of New York. Ms. Stanley is also a Trustee of the Hospital for Special Surgery and a Director of The Dalton School and Refinitiv.

Attributes and Skills: Ms. Stanley has leadership, legal and operations experience at an international news and information company, including experience with mergers and acquisitions, corporate governance, and risk management. Ms. Stanley’s experience from her leadership positions at Thomson Reuters and InterActive Corporation, her legal experience and service on other boards support the Board in its oversight of the Company’s operations, risk management, strategic planning, and relationships with stakeholders.

| L. Frederick Sutherland

Director since: 2006

Age: 67

Board Committees: • Audit • Finance (Chair) • Management Development and Compensation |

Career Highlights: Mr. Sutherland was the Executive Vice President and Chief Financial Officer of Aramark Corporation, Philadelphia, PA, a provider of food services, facilities management and uniform and career apparel, from 1997 to 2015. Prior to joining Aramark in 1980, Mr. Sutherland was Vice President, Corporate Banking, at Chase Manhattan Bank, New York, NY.

Other Directorships: Mr. Sutherland is a Trustee of Con Edison of New York and a Director of Colliers International Group Inc. and Sterling Talent Solutions.Mr. Sutherland is also Chairman of the Board of WHYY, Philadelphia’s public broadcast affiliate, Board President of Episcopal Community Services, a Philadelphia-based anti-poverty agency, a Trustee of Duke University, and a Trustee of Peoples Light, anon-profit theater.

Attributes and Skills: Mr. Sutherland has leadership experience at an international managed services company, including experience with financial reporting, internal auditing, mergers and acquisitions, financing, risk management, corporate compliance, and corporate planning. Mr. Sutherland also has corporate banking experience. Mr. Sutherland’s experience from his leadership positions at Aramark Corporation and Chase Manhattan Bank supports the Board in its oversight of the Company’s financial reporting, auditing, and strategic planning activities.

| 12 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| THE BOARD OF DIRECTORS |

|

MEETINGS AND BOARD MEMBERS’ ATTENDANCE

During 2018, the Board consisted of the following members: Vincent A. Calarco (until his retirement from the Board on May 21, 2018), George Campbell, Jr., Michael J. Del Giudice (until his retirement from the Board on January 18, 2018), Ellen V. Futter, John F. Killian, John McAvoy, William J. Mulrow, Armando J. Olivera, Michael W. Ranger, Linda S. Sanford, Deirdre Stanley, and L. Frederick Sutherland. The Board of Directors held 11 meetings in 2018. At its meetings, the Board considers a wide variety of matters involving such things as the Company’s strategic planning, its financial condition and results of operations, its capital and operating budgets, personnel matters, succession planning, risk management, industry issues, accounting practices and disclosure, and corporate governance practices.

In accordance with the Company’s Corporate Governance Guidelines, the Chair of the Corporate Governance and Nominating Committee (Mr. Ranger) serves as independent Lead Director and, as such, chairs the executive sessions of thenon-management Directors and the independent Directors. The Board routinely holds executive sessions at which onlynon-management Directors are present, and the independent Directors meet in executive session at least once a year. The Company’s independent Directors met three times in executive session and thenon-management Directors met eight times in executive session during 2018.

During 2018, each current member of the Board attended more than 75% of the combined meetings of the Board of Directors and the Board Committees on which he or she served held during the period that he or she served. Directors are expected to attend the Annual Meeting. All of the Directors who then served on the Board attended the 2018 annual meeting of stockholders.

The Company’s corporate governance documents, including its Corporate Governance Guidelines, the charters of the Audit, Corporate Governance and Nominating, and Management Development and Compensation Committees, and the Standards of Business Conduct, are available on the Company’s website atconedison.com/shareholders.The Standards of Business Conduct apply to all Directors, officers and employees. The Company intends to post on its website atconedison.com/shareholders amendments to its Standards

of Business Conduct and a description of any waiver from a provision of the Standards of Business Conduct granted by the Board to any Director or executive officer of the Company within four business days after such amendment or waiver. To date, there have been no such waivers.

The Board consists of a substantial majority of independent Directors. (See “The Board of Directors—Board Members’ Independence” on pages 14 to 15.) As discussed in the Corporate Governance Guidelines, the Board selects the Company’s chief executive officer and chairman of the Board in the manner that it determines to be in the best interest of the Company’s stockholders. The Company’s leadership structure combines the roles of the chairman and chief executive officer. The Board believes that this leadership structure is appropriate for the Company due to a variety of factors, including Mr. McAvoy’s long-standing knowledge of the Company and the utility industry, and his extensive engineering, financial, and operations experience.

The Board has an independent Lead Director who is the Chair of the Corporate Governance and Nominating Committee. The Corporate Governance Guidelines provide that the Lead Director: (i) acts as a liaison between the independent Directors and the Company’s management; (ii) chairs the executive sessions ofnon-management and independent Directors and has the authority to call additional executive sessions as appropriate; (iii) chairs Board meetings in the Chairman’s absence; (iv) coordinates with the Chairman on agendas and schedules for Board meetings, information flow to the Board, and other matters pertinent to the Company and the Board; and (v) is available for consultation and communication with major stockholders as appropriate.

Pursuant to the Company’s Corporate Governance Guidelines, the Board has oversight responsibility for reviewing the Company’s strategic plans, objectives and risks. Each of the standing committees of the Board, other than the Executive Committee, is chaired bynon-management Directors. (See “The Board of Directors—Standing Committees of the Board” on pages 15 to 18).

The Board’s primary function is one of oversight. In connection with its oversight function, the Board oversees the Company’s

| CONSOLIDATED EDISON, INC.–Proxy Statement | 13 |

| THE BOARD OF DIRECTORS |

policies and procedures for managing risk. The Board administers its risk oversight function primarily through its Committees that report to the Board.

Board Committees have assumed oversight of various risks that have been identified through the Company’s enterprise risk management program. The Audit Committee reviews the Company’s risk assessment and risk management policies and reports to the Board on the Company’s risk management program. Management regularly provides reports to the Board and its Committees concerning risks identified through the Company’s enterprise risk management program. Cybersecurity has been identified as a key enterprise risk for the Company. An annual presentation on cybersecurity risks continues to be provided to the Board and the Audit Committee has commenced reviewing morein-depth cybersecurity matters on a semi-annual basis. In addition, the Board receives regular updates as to cybersecurity risks from management.

The Company developed and implemented a proxy access framework that allows a stockholder or a group of up to 20 stockholders who have owned at least three percent (3%) of the outstanding shares of the Company for at least three years to submit nominees for up to twenty percent (20%) of the Board, or two nominees, whichever is greater, for inclusion in the Company’s Proxy Statement and form of proxy, subject to complying with the requirements identified in the Company’sBy-laws.

RELATED PERSON TRANSACTIONS AND POLICY

The Company has adopted a written policy for approval of transactions between the Company and its Directors, Director nominees, executive officers, greater-than-five-percent (5%) beneficial owners, and their respective immediate family members, where the amount involved in the transaction since the beginning of the Company’s last completed fiscal year exceeds or is expected to exceed $100,000.

The policy provides that the Corporate Governance and Nominating Committee review certain transactions subject to the policy and determine whether or not to approve or ratify those transactions. In doing so, the Corporate Governance and Nominating Committee takes into account, among other factors it deems appropriate, whether the transaction is on terms that are no less favorable to the Company than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s

interest in the transaction. In addition, the Board has delegated authority to the Chair of the Corporate Governance and Nominating Committee topre-approve or ratify transactions where the aggregate amount involved is expected to be less than $1.0 million. A summary of any new transactionspre-approved by the Chair is provided to the full Corporate Governance and Nominating Committee for its review in connection with a regularly scheduled committee meeting.

The Corporate Governance and Nominating Committee has considered and adopted standingpre-approvals under the policy for limited transactions with related persons.Pre-approved transactions include:

| (i) | business transactions with other companies at which a related person’s only relationship is as an employee (other than an executive officer), if the amount of business falls below the thresholds in the New York Stock Exchange’s listing standards and the Company’s Director independence standards; and |

| (ii) | contributions tonon-profit organizations at which a related person’s only relationship is as an employee (other than an executive officer) if the aggregate amount involved is less than both $1.0 million and two percent (2%) of the organization’s consolidated gross annual revenues. |

In 2018, Ellen V. Futter’s brother received approximately $135,200 for providing legal services to Con Edison of New York and is providing legal services in 2019. The provision of these services by Ms. Futter’s brother was approved by the Committee.

The Company’s Corporate Governance Guidelines provide that the Board of Directors consist of a substantial majority of Directors who meet the New York Stock Exchange definition of independence, as determined by the Board in accordance with the standards described in the Guidelines below. The Board of Directors has affirmatively determined that the following Directors are “independent” as defined in the New York Stock Exchange’s listing standards: George Campbell, Jr., John F. Killian, William J. Mulrow, Armando J. Olivera, Michael W. Ranger, Linda S. Sanford, Deirdre Stanley, and L. Frederick Sutherland. The Board monitors the independence of its members on an ongoing basis using standards set forth in the Company’s Corporate Governance Guidelines.

To assist it in making determinations of Director independence, the Board has adopted independence standards, which are set forth in its Corporate Governance Guidelines, available on the Company’s website atconedison.com/shareholders. Under these standards, the

| 14 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| THE BOARD OF DIRECTORS |

Board has determined that each of the following relationships is categorically immaterial and therefore, by itself, does not preclude a Director from being independent:

| (i) | (a) the Director has an immediate family member who is a current employee of the Company’s internal or external auditor, but the immediate family member does not personally work on the Company’s audit; or (b) the Director or an immediate family member was, within the last three years, a partner or employee of such a firm but no longer works at the firm and did not personally work on the Company’s audit within that time; |

| (ii) | the Director or an immediate family member is, or has been within the last three years, employed at another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee, but the Director or the Director’s immediate family member is not an executive officer of the other company and his or her compensation is not determined or reviewed by that company’s compensation committee; |

| (iii) | the Director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in any of the last three fiscal years, but the total payments in each year were less than $1.0 million, or two percent (2%) of such other company’s consolidated gross revenues, whichever is greater; |

| (iv) | the Director is a partner or the owner of five percent (5%) or more of the voting stock of another company that has made payments to, or received payments from, the Company for property or services in any of the last three fiscal years, but the total payments in each year were less than $1.0 million, or two percent (2%) of such other company’s consolidated gross revenues, whichever is greater; |

| (v) | the Director is a partner, the owner of five percent (5%) or more of the voting stock or an executive officer of another company which is indebted to the Company, or to which the Company is indebted, but the total amount of the indebtedness in each of the last three fiscal years was less than $1.0 million, or two percent (2%) of such other company’s consolidated gross revenues, whichever is greater; and |

| (vi) | the Director or an immediate family member is a director or an executive officer of anon-profit organization to which the Company has made contributions in any of the last three fiscal years, but the Company’s total |

| contributions to the organization in each year were less than $1.0 million, or two percent (2%) of such organization’s consolidated gross revenues, whichever is greater. |

STANDING COMMITTEES OF THE BOARD

Audit Committee

The Audit Committee, currently John F. Killian (Chair), Armando J. Olivera, Michael W. Ranger, Linda S. Sanford, and L. Frederick Sutherland, is composed of five independent Directors. The Audit Committee is directly responsible for the appointment of the independent accountants for the Company, subject to stockholder ratification at the Annual Meeting. The Audit Committee has appointed PwC as the Company’s independent accountants for the fiscal year 2019. If the appointment of PwC is not ratified, the Audit Committee will take this into consideration in the future selection of independent accountants.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent accountants for the Company. The Audit Committee reviews the proposed auditing andnon-audit fees and approves in advance the proposed auditing andnon-audit services associated with the Company’s retention of the independent accountants. Every five years, the Audit Committee evaluates whether it is appropriate to rotate the Company’s independent accountants and, in conjunction with mandatory rotation of the lead engagement partner, the Audit Committee is directly involved in selecting the lead engagement partner of the independent accountants. The Audit Committee meets with the Company’s management, including Con Edison of New York’s General Auditor, the General Counsel, and the Company’s independent accountants, several times a year to discuss internal controls and accounting matters, the Company’s financial statements, filings with the Securities and Exchange Commission, earnings press releases and the scope and results of the auditing programs of the independent accountants and of Con Edison of New York’s internal auditing department. The Audit Committee also oversees the Company’s risk assessment and risk management policies, and the Company’s management of risks relating to its duties and responsibilities that have been identified through the Company’s enterprise risk management program.

Each member of the Audit Committee is “independent” as defined in the New York Stock Exchange’s listing standards and Rule10A-3 of the Securities Exchange Act of 1934. The Board of Directors of the Company has determined that each

| CONSOLIDATED EDISON, INC.–Proxy Statement | 15 |

| THE BOARD OF DIRECTORS |

of John F. Killian, Armando J. Olivera, Michael W. Ranger, and L. Frederick Sutherland is an “audit committee financial expert” as the term is defined in Item 407(d)(5) of RegulationS-K of the Securities Exchange Act of 1934. The Audit Committee held six meetings in 2018.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee, currently Michael W. Ranger, Chair, George Campbell, Jr., John F. Killian, Linda S. Sanford, and Deirdre Stanley, is composed of five independent Directors. The Corporate Governance and Nominating Committee annually evaluates each Director’s individual performance when considering whether to nominate the Director forre-election to the Board and is responsible for recommending candidates to fill vacancies on the Board. In addition, the Corporate Governance and Nominating Committee assists with respect to the composition and size of the Board and of all Committees of the Board. The Corporate Governance and Nominating Committee also makes recommendations to the Board as to the compensation of Board members, as well as other corporate governance matters, including Board independence criteria and determinations and corporate governance guidelines. Additionally, the Corporate Governance and Nominating Committee oversees the Company’s management of risks relating to its duties and responsibilities that have been identified through the Company’s enterprise risk management program.

Among its duties, the Corporate Governance and Nominating Committee reviews the skills and characteristics of Director candidates, including their independence, integrity, judgment, business experience, areas of expertise and availability for service, factors relating to the composition of the Board (including its size and structure) and the Company’s principles of diversity.

The Corporate Governance and Nominating Committee has the authority under its charter to hire advisors to assist it in its decisions. The Corporate Governance and Nominating Committee identifies director candidates through a variety of means, including professional search firms, recommendations from members of the Board, suggestions from senior management, and submissions by the Company’s stockholders. When using a professional search firm, the firm assists in developing criteria for potential Board members to complement the Board’s existing strengths. Based on such criteria, the firm also provides, for review and consideration, lists of potential candidates with background information. After consulting with the Corporate Governance and Nominating Committee, the firm further screens and interviews candidates as directed to determine their qualifications, interest and any

potential conflicts of interest and provides its results to the Committee. The Corporate Governance and Nominating Committee also considers candidates recommended by stockholders. There are no differences in the manner in which the Corporate Governance and Nominating Committee will evaluate candidates recommended by stockholders versus those recommended through other means. The Corporate Governance and Nominating Committee will make an initial determination as to whether a particular candidate meets the Company’s criteria for Board membership, and will then further consider candidates that do. Stockholder recommendations for candidates, accompanied by biographical material for evaluation, may be sent to the Vice President and Corporate Secretary of the Company. Each recommendation should include information as to the qualifications of the candidate and should be accompanied by a written statement (presented to the Vice President and Corporate Secretary of the Company) from the suggested candidate to the effect that the candidate is willing to serve.

The Corporate Governance and Nominating Committee has also retained Mercer, a wholly-owned subsidiary of Marsh & McLennan Companies, Inc., to provide information, analyses, and objective advice regarding director compensation. The Corporate Governance and Nominating Committee directs Mercer to: (i) assist it by providing competitive market information on the design of the director compensation program; (ii) advise it on the design of the director compensation program and also provide advice on the administration of the program; and (iii) brief it on director compensation trends among the Company’s compensation peer group and broader industry. The Board members, including the chief executive officer, consider the recommendations of the Corporate Governance and Nominating Committee. The decisions may reflect factors and considerations in addition to the information and advice provided by Mercer. All of the members of the Corporate Governance and Nominating Committee are “independent” as defined in the New York Stock Exchange’s listing standards. The Corporate Governance and Nominating Committee held four meetings in 2018.

Environment, Health and Safety Committee

Effective December 31, 2018, the Board of Directors dissolved the Environment, Health and Safety Committee as a standing committee of the Board. The duties and responsibilities of the Environment, Health and Safety Committee were merged with the duties and responsibilities of the Operations Oversight Committee and a new standing committee was formed effective January 1, 2019–the Safety, Environment, Operations and Sustainability Committee. The Environment, Health and

| 16 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| THE BOARD OF DIRECTORS |

Safety Committee provided advice and counsel to the Company’s management on corporate environment, health and safety policies and on such other environment, health, safety, and sustainability matters as it from time to time deemed appropriate.

The Environment, Health and Safety Committee also reviewed significant issues identified by management relating to the Company’s environment, health, and safety programs and its compliance with environment, health, and safety laws and regulations, and made such other reviews and recommended to the Board such other actions as it deemed necessary or desirable to help promote sound planning by the Company with due regard to the protection of the environment, health, and safety. Additionally, the Environment, Health and Safety Committee oversaw the Company’s management of risks relating to its duties and responsibilities that were identified through the Company’s enterprise risk management program. Immediately prior to its dissolution, the Environment, Health and Safety Committee was composed of fournon-management Directors–Ellen V. Futter, Chair, William J. Mulrow, Linda S. Sanford, and Deirdre Stanley. The Environment, Health and Safety Committee held four meetings in 2018.

Executive Committee

The Executive Committee, currently John McAvoy, Chair, and four Directors (three of whom are independent), George Campbell, Jr., Ellen V. Futter, John F. Killian, and Michael W. Ranger, may exercise, during intervals between the meetings of the Board, all the powers vested in the Board, except for certain specified matters. No meetings of the Executive Committee were held in 2018.

Finance Committee

The Finance Committee, currently L. Frederick Sutherland, Chair, William J. Mulrow, Armando J. Olivera, Michael W. Ranger, and Linda S. Sanford, is composed of five independent Directors. The Finance Committee reviews and makes recommendations to the Board with respect to the Company’s financial condition and policies, capital and operating budgets, financial forecasts, major contracts and real estate transactions, financings, investments, bank credit arrangements, its dividend policy, strategic business plan, litigation, and other financial matters. Additionally, the Finance Committee oversees the Company’s management of risks, relating to its duties and responsibilities that have been identified through the Company’s enterprise risk management program. The Finance Committee held nine meetings in 2018.

Management Development and Compensation Committee

The Management Development and Compensation Committee (the “Compensation Committee”), currently George Campbell, Jr., Chair, John F. Killian, William J. Mulrow, Michael W. Ranger, and L. Frederick Sutherland, is composed of five independent Directors. The Compensation Committee makes recommendations to the Board relating to officer and senior management appointments. The Compensation Committee also establishes and oversees the Company’s executive compensation and welfare benefit plans and policies, administers its equity plans and annual incentive plan and reviews and approves annually compensation relating to the Named Executive Officers under the Company’s executive compensation program, with the exception of the salary of the President and Chief Executive Officer of Orange & Rockland which is approved by the Board of Directors of Orange & Rockland. Additionally, the Compensation Committee oversees the Company’s management of risks, relating to its duties and responsibilities that have been identified through the Company’s enterprise risk management program.

The Compensation Committee has the authority, under its charter, to engage the services of outside advisors, experts, and others to assist it. The Compensation Committee engages Mercer to provide information, analyses, and objective advice regarding executive compensation. The Compensation Committee directs Mercer to: (i) assist it in the development and assessment of the compensation peer group for the purposes of providing competitive market information for the design of the executive compensation program; (ii) compare the Company’s chief executive officer’s base salary, annual incentive and long-term incentive compensation to that of the chief executive officers of the identified compensation peer group and broader industry; (iii) advise it on the officers’ base salaries and target award levels within the annual and long-term incentive plans; (iv) advise it on the design of the Company’s annual and long-term incentive plans and on the administration of the plans; (v) brief it on executive compensation trends among the Company’s compensation peer group and broader industry; and (vi) assist with the preparation of the Compensation Discussion and Analysis for this Proxy Statement. The Compensation Committee held five meetings in 2018 and Mercer attended three meetings.

For a discussion of the role of the Compensation Committee and information about the Company’s processes and procedures for the consideration and determination of executive compensation, see the “Compensation Discussion and Analysis” beginning on page 28.

| CONSOLIDATED EDISON, INC.–Proxy Statement | 17 |

| THE BOARD OF DIRECTORS |

In addition, the Compensation Committee also reviews and makes recommendations as necessary to provide for orderly succession and transition in the senior management of the Company and receives reports and makes recommendations with respect to minority and female recruitment, employment and promotion.

The Compensation Committee also oversees and makes recommendations to the Board with respect to the Company’s compliance with the Employee Retirement Income Security Act of 1974 (“ERISA”), and reviews and makes recommendations with respect to benefit plans and plan amendments, the selection of plan trustees and the funding policy and contributions to the funded plans, and reviews the performance of the funded plans.

Each of the members of the Compensation Committee is “independent,” as defined in the New York Stock Exchange’s listing standards under Rule10C-1 of the Securities Exchange Act of 1934, and meets the “outside director” criteria of Section 162(m) of the Internal Revenue Code and the“Non-Employee” Director criteria of Rule16b-3 under the Securities Exchange Act of 1934.

Operations Oversight Committee

Effective December 31, 2018, the Board of Directors dissolved the Operations Oversight Committee as a standing committee of the Board. The duties and responsibilities of the Operations Oversight Committee were merged with the duties and responsibilities of the Environment, Health and Safety Committee and a new standing committee was formed effective January 1, 2019–the Safety, Environment, Operations and Sustainability Committee. The Operations Oversight Committee oversaw the Company’s efforts relating to the Company’s operating systems and their impact on the customer. The Operations Oversight Committee also reviewed significant issues identified by the Company relating to the Company’s subsidiaries’ operating systems and their impact on the customer. The Operations Oversight Committee also reviewed the compliance of the Company’s subsidiaries’ operating systems with laws and regulations and the Company’s corporate policies and procedures, as it deemed necessary or appropriate. Additionally, the Operations Oversight Committee oversaw the Company’s management of risks relating to its duties and responsibilities that were identified through the Company’s enterprise risk management program. Immediately prior to its dissolution, the Operations Oversight Committee was composed of fournon-management Directors–Armando J. Olivera, Chair, George Campbell,

Jr., Ellen V. Futter, and Deirdre Stanley. The Operations Oversight Committee held four meetings in 2018.

Safety, Environment, Operations and Sustainability Committee

Effective January 1, 2019, the Board of Directors established the Safety, Environment, Operations and Sustainability Committee as a standing committee of the Board. The Safety, Environment, Operations and Sustainability Committee, currently Ellen V. Futter,Co-Chair, Armando J. Olivera,Co-Chair, George Campbell, Jr., William J. Mulrow, and Deirdre Stanley, is composed of fivenon-management Directors. The Safety, Environment, Operations and Sustainability Committee oversees the Company’s efforts relating to corporate responsibility and sustainability, which includes operating in a safe, environmentally sensitive and socially responsible manner, guarding the health and safety of Company employees and the public, supporting the development and success of Company employees, delivering value to customers and fostering growth to meet the expectations of investors. The Safety, Environment, Operations and Sustainability Committee reviews significant issues identified by the Company relating to: (i) the Company’s subsidiaries’ environment, health, and safety programs and their compliance with environment, health, and safety laws and regulations, and the Company’s corporate environment, health, and safety policies and procedures, as may be necessary or appropriate; (ii) the Company’s subsidiaries’ operating systems, the operating systems’ impact on the customer, and the operating systems’ compliance with laws and regulations and the Company’s corporate policies and procedures, as may be necessary or appropriate; and (iii) the Company’s subsidiaries’ sustainability priorities, initiatives, and strategies. Additionally, the Safety, Environment, Operations and Sustainability Committee oversees the Company’s management of risks relating to its duties and responsibilities that have been identified through the Company’s enterprise risk management program.

COMPENSATION CONSULTANT DISCLOSURE

The Compensation Committee has retained Mercer, a wholly-owned subsidiary of Marsh & McLennan Companies, Inc., to assist with its responsibilities related to the Company’s executive compensation programs and the Corporate Governance and Nominating Committee has retained Mercer to assist with its responsibilities related to the director compensation program, including the design and structure of the Company’s long term incentive plan. Mercer’s fees for

| 18 | CONSOLIDATED EDISON, INC.–Proxy Statement |

| THE BOARD OF DIRECTORS |

executive and director compensation consulting to the committees in 2018 were approximately $510,340.

During 2018, the Company retained Marsh & McLennan affiliates (other than Mercer) to provide services, unrelated to executive compensation. These services were approved by the Company’s management. The aggregate fees paid for these other services, which include auction services, compensation planning surveys, and employee benefit guides, were approximately $45,050.

The Compensation Committee considered the independence of Mercer under the rules of the Securities and Exchange Commission and the listing standards of the New York Stock Exchange. The Compensation Committee concluded that the services provided by the Marsh & McLennan affiliates (other than Mercer) did not raise any conflicts of interest and did not impair Mercer’s ability to provide independent advice to the Compensation Committee concerning executive or director compensation matters.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

George Campbell, Jr. (Chair), John F. Killian, William J. Mulrow, Michael W. Ranger, and L. Frederick Sutherland were on the Company’s Compensation Committee during 2018. The Company believes that there are no interlocks with the members of the Compensation Committee.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Interested parties may communicate directly with the members of the Company’s Board of Directors, including thenon-management Directors as a group, by writing to them, care of the Company’s Vice President and Corporate Secretary, at the Company’s principal executive office at 4 Irving Place, New York, New York 10003. The Vice President and Corporate Secretary will forward communications to the Director or the Directors indicated.

| CONSOLIDATED EDISON, INC.–Proxy Statement | 19 |

| DIRECTOR COMPENSATION |

|

The Corporate Governance and Nominating Committee reviews director compensationbi-annually. The Corporate Governance and Nominating Committee considers information, analyses, and objective advice regarding director compensation provided by Mercer. Director compensation is assessed relative to the Company’s compensation peer group (the same group used to evaluate executive compensation), general industry trends, and the total cost of governance. The Board reviews the recommendations of the Corporate Governance and Nominating Committee when determining whether changes, if any, will be made.

In February 2018, as part of its review of Director compensation, the Corporate Governance and Nominating Committee requested that Mercer conduct anin-depth analysis of each element of compensation and the compensation program structure relative to the compensation peer group. Mercer’s review found that Committee member meeting fees were on the decline for the assessment group as companies focused more on compensating Directors for their expertise than their time. Following the recommendation of the Corporate Governance and Nominating Committee, effective April 1, 2018, the Board approved the elimination of Committee member meeting fees and an increase to the stock ownership guidelines. Certain retainers and the value of the annual equity award were increased to replace the Committee member meeting fees.

In November 2018, the Board dissolved two committees effective December 31, 2018 and established a new committee effective January 1, 2019. In connection with these committee changes, the Corporate Governance and Nominating Committee requested that Mercer conduct a second, limited analysis of committee chair retainers relative to the compensation peer group. Mercer’s review found that the amount of the retainer provided to the Chair of the Finance Committee was below the median paid tonon-employee directors in the assessment group. Following the recommendation of the Corporate Governance and Nominating Committee, effective January 1, 2019, the Board approved an annual retainer for the Chair of the newly established Safety, Environment, Operations and Sustainability Committee of $15,000 (or $7,500 for eachCo-Chair) and an increase to the annual retainer for the Chair of the Finance Committee to $15,000 (from $5,000). Compensation for individual Directors approximates the median of compensation for Directors in similar positions at the compensation peer group.

In 2018,non-employee Directors were eligible to receive the following:

Amount | ||||

| ($) | ||||

Annual Retainer(1) | 115,000 | |||

Lead Director Retainer | 35,000 | |||

Chair of Audit Committee Retainer(2) | 30,000 | |||

Member of Audit Committee Retainer (excluding the Audit Committee Chair)(3) | 15,000 | |||

Chair of Corporate Governance and Nominating Committee Retainer(4) | 15,000 | |||

Chair of Management Development and Compensation Committee Retainer | 15,000 | |||

Retainer for Chairs of: Environment, Health and Safety Committee; Finance Committee; and Operations Oversight Committee | 5,000 | |||

Acting Committee Chair Fee (where the regular Chair is absent) | 200 | |||

Audit Committee member fee (for each meeting of the Audit Committee attended)(5) | 2,000 | |||