SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x Preliminary Proxy Statement | ¨ Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

¨ Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Under Rule 14a-12 |

ANWORTH MORTGAGE ASSET CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required. |

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies:

|

(2) Aggregate number of securities to which transaction applies:

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) Proposed maximum aggregate value of transaction:

|

(5) Total fee paid:

|

¨ Fee paid previously with preliminary materials: |

¨ Checkbox if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

|

(2) Form, Schedule or Registration Statement No.:

|

(3) Filing Party:

|

(4) Date Filed:

|

May , 2003

Dear Stockholder:

Our annual meeting of stockholders will be held at the principal offices of our company, located at 1299 Ocean Avenue, Suite 250 , Santa Monica, California, at 10:00 a.m. on Thursday, June 12, 2003. The formal meeting notice and our proxy statement for the meeting are attached.

Each of the proposals to be presented at the annual meeting are described in the accompanying proxy statement. We urge you to carefully review the proxy statement and accompanying appendices, which discuss each of the proposals in more detail.

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to sign, date and promptly return the enclosed proxy in the enclosed postage-paid envelope. Returning your completed proxy will ensure your representation at the annual meeting.

We look forward to seeing you on June 12.

Sincerely,

/s/ Lloyd McAdams

Lloyd McAdams

Chairman and Chief Executive Officer

ANWORTH MORTGAGE ASSET CORPORATION

1299 Ocean Avenue, Suite 250

Santa Monica, California 90401

(310) 255-4493

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 12, 2003

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Anworth Mortgage Asset Corporation, a Maryland corporation, will be held on Thursday, June 12, 2003 at 10:00 a.m. at our principal offices located at 1299 Ocean Avenue, Suite 250, Santa Monica, California 90401, for the following purposes:

| 1. | To elect six (6) directors to serve for the ensuing year and until their successors are duly elected and qualified; |

| 2. | To approve amendments to our articles of incorporation to comply with the listing requirements of the New York Stock Exchange by providing that nothing contained in our articles will prohibit the settlement of transactions effected through the facilities of the NYSE or any other national securities exchange or automated inter-dealer quotation system; |

| 3. | To approve amendments to our 1997 Stock Option and Awards Plan to establish an annual limit on the number of shares for which options and other awards may be granted to any participant; |

| 4. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending December 31, 2003; and |

| 5. | To transact such other business as may properly come before the annual meeting or at any adjournment or postponement thereof. |

Your board recommends that you vote for each of the proposals. Stockholders of record at the close of business on April 28, 2003 are entitled to vote at the annual meeting or any adjournment or postponement thereof.

All stockholders are cordially invited to attend the annual meeting in person. To assure your representation at the annual meeting, you are urged to mark, sign, date and return the enclosed proxy card promptly in the postage-paid envelope enclosed for that purpose. Any stockholder attending the annual meeting may vote in person even if he or she previously returned a proxy.

Sincerely,

/s/ Thad M. Brown

Thad M. Brown

Secretary

Santa Monica, California

May , 2003

ANWORTH MORTGAGE ASSET CORPORATION

1299 Ocean Avenue, Suite 250

Santa Monica, California 90401

(310) 255-4493

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 12, 2003

INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement contains information related to the annual meeting of Anworth Mortgage Asset Corporation, which will be held on Thursday, June 12, 2003, at the principal offices of our company located at 1299 Ocean Avenue, Suite 250, Santa Monica, California 90401, or at any adjournment or postponement thereof.

What is the purpose of the annual meeting?

At the annual meeting, stockholders will be consider and vote upon the following matters:

| Ÿ | The election of six directors to serve as members of our board of directors; |

| Ÿ | The approval of amendments to our articles of incorporation to comply with the listing requirements of the New York Stock Exchange; |

| Ÿ | The approval of amendments to our 1997 Stock Option and Awards Plan to establish an annual limit on the number of shares for which options and other awards may be granted to any participant; and |

| Ÿ | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending December 31, 2003; and |

| Ÿ | Such other matters as may properly come before the annual meeting or any adjournments or postponements thereof. |

We sent you these proxy materials because our board is requesting that you allow your common shares to be represented at the meeting by the proxyholders named in the enclosed proxy card. This proxy statement contains information that we are required to provide you under the rules of the Securities and Exchange Commission, or the SEC, and that is designed to assist you in voting your shares. On May , 2003, we began mailing these proxy materials to all shareholders of record at the close of business on April 28, 2003.

Who is entitled to vote at the annual meeting?

Holders of record of our common stock at the close of business on April 28, 2003 are entitled to vote at the annual meeting. As of April 28, 2003, there were 27,408,279 shares of our common stock outstanding. Stockholders are entitled to cast one vote per share on each matter presented for consideration and action at the annual meeting.

Your vote is important. Stockholders can vote in person at the annual meeting or by proxy. If you vote by proxy, the individuals named on the proxy card as representatives will vote your shares in the manner you indicate. You may specify whether your shares should be voted for all, some or none of the nominees for director and whether your shares should be voted for or against the other proposals.

What votes are needed to hold the annual meeting?

The presence, in person or by proxy, of stockholders entitled to cast at least a majority of the votes entitled to be cast by all stockholders will constitute a quorum for the transaction of business at the annual meeting. Votes cast by proxy or in person at the annual meeting will be tabulated by the inspectors of election appointed for the meeting who will determine whether or not a quorum is present. For purposes of determining whether a quorum is present, abstentions and broker non-votes are counted as present.

How does the Board recommend that I vote on the proposals?

If no instructions are indicated on your valid proxy, the proxyholders will vote in accordance with the recommendations of our board. Our board recommends a vote:

| Ÿ | “FOR” each of the nominees for director listed in this proxy statement; |

| Ÿ | “FOR” approving amendments to our articles of incorporation to comply with the listing requirements of the NYSE; |

| Ÿ | “FOR” approving amendments to our 1997 Stock Option and Awards Plan to establish an annual limit on the number of shares for which options and other awards may be granted to any participant; and |

| Ÿ | “FOR” the ratification of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending December 31, 2003. |

With respect to any other matter that properly comes before the meeting or any adjournment or postponement thereof, the proxyholders will vote as recommended by our board, or if no recommendation is given, in their own discretion.

If my shares are held in “street name” by my broker, will my broker vote my shares for me?

Your broker will vote your shares only if you provide instructions to your broker on how to vote. You should contact your broker and ask what directions your broker will need from you. Your broker will not be able to vote your shares without instructions from you.

Can I change my vote after I have mailed my signed proxy card?

There are three ways in which you can change your vote before your proxy is voted at the annual meeting. First, you can send our secretary a written notice stating that you revoke your proxy. Second, you can complete and submit a new proxy card, dated a later date than the first proxy card. Third, you can attend the annual meeting and vote in person. Your attendance at the annual meeting will not, however, by itself revoke your proxy. If you hold your shares in “street name” and have instructed your broker to vote your shares, you must follow directions received from your broker to change those instructions.

What vote is required to approve each proposal?

The directors receiving the most votes at a meeting at which a quorum is present will be elected. The affirmative vote of a majority of the outstanding shares of our common stock is required to amend our articles of incorporation. The affirmative vote of a majority of all votes cast on the matter at a meeting at which a quorum is present is necessary to amend our 1997 Stock Option and Awards Plan, to ratify the appointment of PricewaterhouseCoopers LLP as our independent accountants and to approve any other proposals to be brought before the annual meeting.

What is the effect of abstentions and broker non-votes?

For the election of directors, amending our 1997 Stock Option and Awards Plan and ratifying the appointment of our independent accountants, abstentions will not be counted as votes cast and will have no effect on the result of the vote. For approving the amendments to our articles of incorporation, abstentions will have the effect of a “no” vote.

For the election of directors, approving the amendments to our 1997 Stock Option and Awards Plan and ratifying our independent accountants, broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. For amending our articles of incorporation, broker non-votes will have the effect of a “no” vote.

2

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Our board of directors consists of six members. The size of our board was increased from four to five members in June 2002 upon the merger with our external manager, and from five to six members in October 2002 for the purpose of adding a fourth independent director. On the recommendation of our nominating and corporate governance committee, we are proposing to re-elect all six of our existing board members. Consequently, at the annual meeting, a total of six directors will be elected to hold office until the next annual meeting of stockholders and until their successors have been elected and qualified.

Unless otherwise instructed, the proxyholders will vote the proxies received by them for the six nominees named below. If any of our nominees is unable or declines to serve as a director at the time of the annual meeting, the proxies will be voted for any nominee designated by the present board of directors to fill the vacancy. It is not presently expected that any of the nominees named below will be unable or will decline to serve as a director. If additional persons are nominated for election as directors, the proxyholders intend to vote all proxies received by them in a manner to assure the election of as many of the nominees listed below as possible. In such event, the specific nominees to be voted for will be determined by the proxyholders.

Information Regarding Nominees for Director

Biographical summaries and ages as of the date hereof of individuals nominated by our board of directors for election as directors are provided below.

Lloyd McAdams, age 57, has been our Chairman of the Board, President and Chief Executive Officer since our formation in 1997. Mr. McAdams served in those capacities at Anworth Mortgage Advisory Corporation, our management company, from its formation in 1997 until its merger with our company in June 2002. Mr. McAdams is also the Chairman of the Board, Chief Investment Officer and co-founder of Pacific Income Advisers, Inc., or PIA, an investment advisory firm organized in 1986 that manages an investment portfolio for institutional and individual clients. Mr. McAdams is also the President of Syndicated Capital, Inc., a registered broker-dealer. Before joining PIA, Mr. McAdams held the position of President of Security Pacific Investment Managers, Inc. from 1981 to 1987, Senior Vice President of Trust Company of the West from 1975 to 1981, and an Investment Officer with the State of Tennessee from 1973 to 1975. In 1983, Mr. McAdams served as a board member of the California Public Employees Retirement System. Mr. McAdams also serves as a director of PIA Mutual Fund. Mr. McAdams holds a Bachelor of Science in Statistics from Stanford University and a Masters in Business Administration from the University of Tennessee. Mr. McAdams is a Chartered Financial Analyst charterholder, Chartered Investment Counselor and a Certified Employee Benefit Specialist.

*Charles H. Black, age 76, has been a director of our company since its formation. Since 1985, Mr. Black has been a private investor and financial consultant. From 1985 to 1987, he served as Vice Chairman and Director of Pertron Controls Corporation. From 1982 to 1985, Mr. Black served as the Executive Vice President, Director, Chief Financial Officer and Chairman of Investment Committee for Kaiser Steel Corporation. From 1980 to 1982, Mr. Black served as Executive Vice President and Chief Financial Officer of Great Western Financial Corporation. From 1957 to 1980, Mr. Black served at Litton Industries, where he ultimately held the position of Corporate Vice President and Treasurer. Mr. Black is a member of the Board of Governors of the Pacific Exchange, Inc. Mr. Black serves as a director of Investment Company of America, Orincon Industries, Inc. and Wilshire Technologies, Inc. and as an advisory director of Windsor Capital Group, Inc.

*Joe E. Davis, age 68, has been a director of our company since its formation. Since 1982, Mr. Davis has been a private investor. From 1974 to 1982, Mr. Davis served as President and Chief Executive Officer of National Health Enterprises, Inc. Mr. Davis also serves as a director of BMC Industries, Inc., Wilshire Technologies, Inc., Natural Alternatives, Inc. and American Funds Insurance Series and as a trustee of American Variable Insurance Trust.

3

*Charles F. Smith, age 70, has been a director of our company since April 2001. Since 1984, Mr. Smith has served as President of Charles F. Smith & Co., Inc., an investment banking firm. Mr. Smith serves as a trustee of St. John’s Hospital Foundation and Marymount High School. Mr. Smith also serves as a director of FirstFed Financial Corp., Trans Ocean Distribution, Ltd. and Sizzler International, Inc.

Joseph E. McAdams, age 34, has been a director and Executive Vice President of our company since June 2002 and Chief Investment Officer of our company since January 2003. Mr. McAdams joined our company as a Vice President in June 1998. Mr. McAdams joined PIA in 1998 and holds the position of Vice President. Mr. McAdams serves as Fixed Income Portfolio Manager with a specialty in mortgage-backed securities and is also responsible for PIA’s fixed income trading. Prior to joining PIA, from 1993 to 1998, Mr. McAdams was employed by Donaldson, Lufkin & Jenrette Securities Corp. as a mortgage-backed security trader and analyst. Mr. McAdams holds a Master of Arts degree in Economics from the University of Chicago and a Bachelor of Science degree in Economics from the Wharton School of the University of Pennsylvania. Mr. McAdams is also a Chartered Financial Analyst charterholder.

*Lee A. Ault, III, age 66, has been a director of our company since October 2002. Mr. Ault has been Chairman of the Board of In-Q-Tel, Inc. since August, 1999. He is also a Director of Equifax, Office Depot and American Insurance Services. He was a Director of Bankers Trust Corporation prior to its sale to Deutsche Bank and of Alex. Brown Incorporated prior to its merger with Bankers Trust. Mr. Ault was Chief Executive Officer of Telecredit, Inc., a publicly traded company which was a leader in the payment services industry, for 23 years from November 1968 until January 1992. He also served as President of Telecredit from 1968 until 1983 and as Chairman of the Board from 1983 until 1992. In January 1990, Telecredit merged with Equifax, Inc.

| * | Member of the audit committee, compensation committee, and nominating and corporate governance committee |

Corporate Governance

General. Our board of directors believes we have observed sound corporate governance practices in the past. Nevertheless, during the past year, and particularly following enactment of the Sarbanes-Oxley Act of 2002, we, like many public companies, have addressed the changing environment by reviewing our policies and procedures and, where appropriate, adopting new practices. In connection with these corporate governance initiatives, and based on a review of our current practices, current and pending laws and regulations, evolving corporate practices and standards and other factors, we have further formalized our principles of corporate governance by taking the following actions:

| Ÿ | adopted a revised written charter for our audit committee; |

| Ÿ | upon the merger with our external manager, formed a compensation committee and adopted a written charter for such committee; |

| Ÿ | formed a nominating and corporate governance committee and adopted a written charter for such committee; |

| Ÿ | adopted a corporate code of conduct; and |

| Ÿ | nominated four of six directors for election who qualify as “independent” as defined in the New York Stock Exchange Rules. |

Charters for the audit, compensation and nominating and corporate governance committees and our code of conduct may be viewed on our website atwww.anworth.com under the Investor Relations section. Our audit committee charter is also attached hereto as Appendix A.

Board Committees and Meetings.During 2002, our board of directors had an audit committee and, effective June 13, 2002, the date of the merger with our external manager, a compensation committee. In addition, in April 2003, our board of directors formed a nominating and corporate governance committee.

4

Audit Committee. Our audit committee’s primary function is to assist our board of directors in fulfilling its oversight responsibilities by reviewing the financial information that will be provided to the stockholders and others, the adequacy of systems of internal controls that management and the board have established, and our audit and financial reporting process, and to maintain free and open lines of communication among the committee, our independent auditors and management. It is not the duty of our audit committee to determine that our financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for preparing our financial statements, and our independent auditors are responsible for auditing those financial statements. Our audit committee does, however, consult with management and our independent auditors prior to the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into various aspects of our financial affairs. In addition, our audit committee is responsible for retaining, evaluating and, if appropriate, recommending the termination of our independent certified public accountants, and approving professional services provided by the independent public accountants. Our audit committee is currently comprised of Messrs. Black, Davis, Smith and Ault, with Mr. Davis serving as chairman.

Compensation Committee.Our compensation committee is primarily responsible for determining the our executive compensation policy and incentive compensation for our employees and consultants. Our compensation committee determines our compensation policies and all forms of compensation to be provided to our executive officers and directors, including, among other things, annual salaries and bonuses, and stock option and other incentive compensation arrangements. In addition, our compensation committee reviews bonus and stock and incentive compensation arrangements for our other employees. In addition, our compensation committee administers our 1997 Stock Option and Awards Plan and our 2002 Incentive Compensation Plan. Our compensation committee is currently comprised of Messrs. Black, Davis, Smith and Ault, with Mr. Black serving as chairman.

Nominating and Corporate Governance Committee. Our nominating and corporate governance committee is responsible for identifying individuals qualified to become Board members, recommending to the Board the director nominees for the annual meeting of stockholders, developing and recommending to the Board a set of corporate governance principles, and playing a general leadership role in our corporate governance. Our corporate governance and nominating committee is currently comprised of Messrs. Black, Davis, Smith and Ault, with Mr. Ault serving as chairman.

During 2002, our board of directors held five meetings, our audit committee held two meetings and our compensation committee held one meeting. During 2002, each director attended each of the meetings of our board of directors, each member of the audit committee attended the meeting held by the audit committee and each member of the compensation committee attended each of the meetings held by the compensation committee.

Compensation Committee Interlocks and Insider Participation

No officer or employee participated in deliberations of our board of directors concerning executive officer compensation. None of our executive officers has served on the board of directors or on the compensation committee of any other entity which had officers who served on our board of directors on our compensation committee.

Certain Relationships

Lloyd McAdams and Heather U. Baines are husband and wife and Lloyd McAdams and Joseph E. McAdams are father and son.

Director Compensation

Unaffiliated directors receive a fee of $10,000 per year, payable semiannually, $1,000 for each meeting of our board of directors attended, $500 for each meeting of our audit committee, our compensation committee and

5

nominating and corporate governance committee attended in person, and $100 for each meeting of our audit committee, compensation committee and nominating and corporate governance committee attended telephonically. Directors are reimbursed reasonable expenses incurred in attending board and committee meetings.

Our unaffiliated directors do not receive automatic option grants under our 1997 Stock Option and Awards Plan, but are eligible to receive option grants under such plan from time to time. In 2002, we granted each unaffiliated director, other than Mr. Ault, an option to purchase 10,000 shares of our common stock under our 1997 Stock Option and Awards Plan at an exercise price of $11.20 per share. Such options will vest 100% on October 4, 2003. We also granted Mr. Ault an option to purchase 10,000 shares of our common stock under our 1997 Stock Option and Awards Plan at an exercise price of $11.25 per share. Such options will vest 100% on October 14, 2003.

Vote Required

The directors receiving the most votes at a meeting at which a quorum is present will be elected.

Our board of directors recommends that you vote FOR the election of each of the nominees listed above. Proxies received will be so voted unless stockholders specify otherwise in the proxy.

6

EXECUTIVE OFFICERS

Executive Officers

All of our officers serve at the discretion of our board of directors. The persons listed below are the executive officers of our company:

Name | Age | Positions with our Company | ||

Lloyd McAdams | 57 | Chairman of the Board, President and Chief Executive Officer | ||

Thad M. Brown | 53 | Chief Financial Officer, Treasurer and Secretary | ||

Joseph E. McAdams | 34 | Executive Vice President | ||

Heather U. Baines | 61 | Executive Vice President | ||

Evangelos Karagiannis | 41 | Vice President |

Biographical information regarding each executive officer other than Lloyd McAdams and Joseph McAdams is set forth below. Lloyd McAdams’ and Joseph McAdams’ biographical information is set forth above under “Election of Directors.”

Thad M. Brown has been the Chief Financial Officer, Treasurer and Secretary of our company since June 2002. Mr. Brown has also been the Chief Operating Officer, Secretary and Treasurer of Pacific Income Advisers, Inc., or PIA, since June 2002. From 1999 to 2002, Mr. Brown was President and Chief Executive Officer of Wealthpoint, a financial consulting and investment advisory firm. From 1987 until 1999, Mr. Brown associated with Provident Investment Counsel, eventually becoming its Chief Operating Officer and Senior Vice President. Mr. Brown began his career with Touché Ross & Co. Mr. Brown graduated magna cum laude from Metropolitan State College, holds a master’s degree in tax law from the University of Denver, is a Certified Public Accountant, and received the Personal Financial Specialist designation from the American Institute of Certified Public Accountants.

Heather U. Baineshas been an Executive Vice President of our company since its formation. Ms. Baines served as an Executive Vice President of our management company from its formation until its merger with our company. Since 1987, Ms. Baines has held the position of President and Chief Executive Officer of PIA. From 1978 to 1987, Ms. Baines was employed by Security Pacific Investment Managers, Inc., ultimately holding the position of Senior Vice President and Director. Ms. Baines holds a bachelors degree from Antioch College.

Evangelos Karagiannishas been a Vice President of our company since its formation. Mr. Karagiannis served as a Vice President of our management company from its formation until its merger with our company. Mr. Karagiannis joined PIA in 1992 and holds the position of Vice President. Mr. Karagiannis serves as Fixed Income Portfolio Manager with a specialty in mortgage-backed securities and is also responsible for PIA’s quantitative research. Mr. Karagiannis has been the author, and co-author with Mr. McAdams, of articles on fixed income portfolio management and for PIA’s internal research. Mr. Karagiannis holds a Doctor of Philosophy degree in physics from the University of California at Los Angeles, or UCLA, and, prior to joining PIA, was a postdoctoral fellow at UCLA, where he was a Fulbright Scholar. Mr. Karagiannis is also a Chartered Financial Analyst charterholder.

Executive Compensation And Related Matters

The following table provides certain summary information concerning the compensation earned by our Chief Executive Officer and each of our four other most highly compensated executive officers whose aggregate salary and bonus for the 2002 Fiscal Year were in excess of $100,000, for services rendered in all capacities to us and our subsidiaries for the fiscal years ended December 31, 2000, 2001 and 2002. Prior to the Merger, however, we did not pay any annual cash compensation to our executive officers for their services as executive officers. Following the Merger, we are required to pay our executive officers compensation, including those executive officers whose employment agreements we assumed.

7

SUMMARY COMPENSATION TABLE

Annual Compensation | Long-Term Compensation | ||||||||||||

Name and Principal Position | Year (1) | Salary ($) | Bonus ($) | Restricted Stock Awards ($)(2) | Securities Underlying Options (#) | All Other Compensation ($) | |||||||

Lloyd McAdams President, Chief Executive Officer and Chairman | 2002 | 135,416 | 1,619,258 | (3) | 265,000 | 119,725 | |||||||

Thad M. Brown (4) Chief Financial Officer, Treasurer and Secretary | 2002 | 27,083 | 81,724 |

| — | 30,000 | — | ||||||

Joseph E. McAdams Executive Vice President | 2002 | 133,283 | 1,120,753 | (5) | 265,000 | 140,000 | — | ||||||

Heather U. Baines Executive Vice President | 2002 | 27,083 | 183,918 | (6) | 265,000 | 64,520 | — | ||||||

Evangelos Karagiannis Vice President | 2002 | 39,985 | 622,155 | (7) | — | 30,000 | — | ||||||

Pamela J. Watson (8) Chief Financial Officer and Secretary | 2002 | — | — |

| — | — | — | ||||||

| (1) | Prior to our merger with our external manager on June 13, 2002, we did not pay any annual compensation to our executive officers for their services as executive officers. All compensation shown is for the period from June 13, 2002 until December 31, 2002. |

| (2) | Represents restricted stock grants of 20,000 shares each, which grants vest in equal, annual installments over ten years following the date of the merger with our external manager on June 13, 2002. |

| (3) | Represents amounts earned under our 2002 Incentive Compensation Plan, of which $200,003 was paid through the issuance of 17,778 shares of common stock pursuant to our 1997 Stock Option and Awards Plan. |

| (4) | Mr. Brown became an executive officer of our company upon the merger with our external manager on June 13, 2002. $35,424 of Mr. Brown’s bonus was earned under our 2002 Incentive Compensation Plan. |

| (5) | Represents amounts earned under our 2002 Incentive Compensation Plan, of which $150,008 was paid through the issuance of 13,334 shares of common stock pursuant to our 1997 Stock Option and Awards Plan. |

| (6) | Represents amounts earned under our 2002 Incentive Compensation Plan. |

| (7) | Represents amounts earned under our 2002 Incentive Compensation Plan. |

| (8) | Ms. Watson resigned as an executive officer of our company upon the merger with our external manager on June 13, 2002. |

8

Options Granted in 2002

The following table sets forth information regarding stock options granted to our executive officers during 2002:

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants | |||||||||||||

Name | Number of Securities Underlying Options Granted (#)(2) | Percent of Total Options Granted to Employees in Fiscal Year (3) | Exercise or Base Price ($/Sh) | Expiration Date | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term (1) | ||||||||

5%($) | 10%($) | ||||||||||||

Lloyd McAdams | 29,725 90,000 | 6.0 18.1 | % % | 9.45 11.20 | 1/21/12 10/4/12 | 176,567 633,600 | 447,659 1,606,500 | ||||||

Thad M. Brown | 30,000 | 6.1 | % | 11.20 | 10/4/12 | 211,200 | 535,500 | ||||||

Joseph E. McAdams | 65,000 75,000 | 13.2 15.2 | % % | 9.45 11.20 | 1/21/12 10/4/12 | 386,100 528,000 | 978,900 1,338,750 | ||||||

Heather U. Baines | 43,520 21,000 | 8.8 4.2 | % % | 9.45 11.20 | 1/21/12 10/4/12 | 258,509 147,840 | 655,411 374,850 | ||||||

Evangelos Karagiannis | 30,000 | 6.1 | % | 11.20 | 10/4/12 | 211,200 | 535,500 | ||||||

Pamela J. Watson | — | — |

| — | — | — | — | ||||||

| (1) | The amounts under the columns labeled “5%” and “10%” are included pursuant to certain rules promulgated by the Securities and Exchange Commission and are not intended to forecast future appreciation, if any, in the price of our common stock. The amounts are calculated by using the closing market price of a share of common stock on the grant date as reported by the American Stock Exchange and assuming annual compounded stock appreciation rates of 5% and 10% over the full term of the option. The reported amounts are based on the assumption that the named persons hold the options granted for their full term. The actual value of the options will vary in accordance with the market price of our common stock. |

| (2) | Options granted on January 21, 2002 vested six months after the date of grant and options granted on October 4, 2002 vest one year after the date of the grant. |

| (3) | Based on options to purchase an aggregate of 494,245 shares of common stock granted to our employees and directors during the year ended December 31, 2002. |

9

2002 Year-End Option Values

The following table provides information with respect to our executive officers concerning the exercise of options during 2002 and unexercised options held by them at the end of the year.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END VALUES

Name | Shares Acquired on Exercise(#) | Value Realized($)(1) | Number of Securities Underlying Unexercised Options at 2002 Year-End(#)(2) | Value of Unexercised in-the-Money Options at 2002 Year-End($)(3) | ||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

Lloyd McAdams | 13,225 | 97,072 | 110,544 | 90,000 | 836,151 | 1,008,000 | ||||||

Thad M. Brown | — | — | — | 30,000 | — | 336,000 | ||||||

Joseph E. McAdams | 18,580 | 125,017 | 76,296 | 75,000 | 697,501 | 840,000 | ||||||

Heather U. Baines | 5,290 | 45,970 | 88,175 | 21,000 | 699,264 | 235,200 | ||||||

Evangelos Karagiannis | 98,755 | 436,998 | — | 30,000 | — | 336,000 | ||||||

Pamela J. Watson | 98,755 | 436,998 | — | — | — | — | ||||||

| (1) | Based upon the market price of the purchased shares on the exercise date less the exercise price paid for those shares. |

| (2) | Includes shares issuable upon the exercise of options pursuant to accrued dividend equivalent rights, or DERs, granted in conjunction with such options. During 2001, all DERs were truncated and ceased to accrue. |

| (3) | Determined on the basis of the closing sales price per share of our common stock on the American Stock Exchange on December 31, 2002 ($12.57 per share), less the option exercise price payable per share. |

Employment Agreements

Upon the closing of the merger with our external manager, Anworth Mortgage Advisory Corporation, we assumed the existing employment agreements of Lloyd McAdams, Joseph McAdams and Heather U. Baines. Such agreements were modified by the addenda entered into between us and each of the executives as described below. Pursuant to the terms of the employment agreements, Lloyd McAdams serves as our Chairman and Chief Executive Officer, and Heather U. Baines and Joseph McAdams serve as Executive Vice Presidents. Heather U. Baines receives a $50,000 annual base salary, Lloyd McAdams receives a base salary equal to the greater of (i) $120,000 per annum, or (ii) a per annum amount equal to 0.125% of our book value, not to exceed $250,000. Joseph McAdams receives a base salary equal to the greater of (i) $100,000 per annum, or (ii) a per annum amount equal to 0.10% of our book value, not to exceed $250,000.

These employment agreements, as modified by the addenda, also have the following provisions:

| Ÿ | the three executives are entitled to participate in the 2002 Incentive Compensation Plan and each of these individuals are provided a minimum percentage of the amounts earned under such plan. Lloyd McAdams is entitled to 45% of all amounts paid under the plan; Joe McAdams is entitled to 25% of all amounts paid under the plan, and Heather U. Baines is entitled to 5% of all amounts paid under the plan. The three executives may be paid up to 50% of their respective incentive compensation earned under such plan in the form of common stock; |

| Ÿ | the incentive compensation plan may not be amended without the consent of the three executives; |

| Ÿ | in the event of a registered public offering of our shares, the three executives are entitled to piggyback registration rights in connection with such offering; |

10

| Ÿ | in the event any of the three executives is terminated without “cause” or if they terminate for “good reason”, or in the case of Lloyd McAdams or Joseph McAdams, their employment agreements are not renewed, then the executives would be entitled to: (1) all base salary due under the contracts, (2) all discretionary bonus due under the contracts, (3) a lump sum payment of an amount equal to three years of the executive’s then-current base salary, (4) payment of COBRA medical coverage for eighteen months, (5) immediate vesting of all pension benefits, (6) all incentive compensation to which the executives would have been entitled to under the contract prorated through the termination date, and (7) all expense reimbursements and benefits due and owing the executives through the termination. In addition, under these circumstances Lloyd McAdams and Joseph McAdams would each be entitled to a lump sum payment equal to 150% of the greater of (i) the highest amount paid or payable to all employees under the 2002 Incentive Compensation Plan during any one of the three fiscal years prior to their termination, and (ii) the highest amount paid, or that would be payable, under the plan during any of the three fiscal years following their termination. Ms. Baines would also be entitled to a lump sum payment equal to all incentive compensation that Ms. Baines would have been entitled to under the plan during the three year period following her termination; |

| Ÿ | the three executives received restricted stock grants of 20,000 shares each, which grants vest in equal, annual installments over ten years following the effective date of the merger; and |

| Ÿ | the three executives are each subject to a one-year non-competition provision following termination of their employment. |

11

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Management Fees and Merger with the Manager

From the time of our inception through June 13, 2002, we were externally managed pursuant to a management agreement with Anworth Morgtage Advisory Corporation, or the manager. As an externally managed company, we had no employees of our own and relied on the manager to conduct our business and operations.

Under the terms of the management agreement, we paid the manager an annual base management fee equal to 1% of the first $300 million of average net invested assets (as defined in the management agreement), plus 0.8% of the portion above $300 million. In addition to the base management fee, the manager received as incentive compensation for each fiscal quarter an amount equal to 20% of the amount of our taxable net income, before incentive compensation, for such fiscal quarter in excess of the amount that would produce an annualized return on equity (calculated by multiplying the return on equity for such fiscal quarter by four) equal to the Ten-Year U.S. Treasury Rate for such fiscal quarter plus 1%. For 2002 (through June 13), we paid the manager $400,000 in base management fees and $1,741,000 in incentive compensation.

On June 13, 2002, the manager merged with and into our company. The merger was approved by a special committee consisting solely of our independent directors, our full board of directors and the vote of a majority of our stockholders. The stockholder of the manager, a trust controlled by Lloyd McAdams, our president, chairman and chief executive officer, and Heather U. Baines, one of our executive vice presidents, received 240,000 shares of our common stock as merger consideration, which was worth approximately $3.2 million based on the closing price of our common stock on June 13, 2002.

As a result of the merger, we are now an internally managed company, and certain of the manager’s employees have become our employees. As a condition to the merger, we entered into direct employment contracts with Lloyd McAdams, Heather U. Baines and Joseph McAdams, adopted an incentive compensation plan for key employees, increased the size of our 1997 Stock Option and Awards Plan and provided for future automatic increases in the size of that plan. Upon the closing of the merger, the management agreement terminated.

The market value of our common stock issued, valued as of the consummation of the merger, in excess of the fair value of the net tangible assets acquired, has been accounted for as a non-cash charge to operating income. Since we did not acquire tangible net assets from the manager in the merger, the non-cash charge equaled the value of the consideration paid in the merger, which was approximately $3.2 million. This non-cash charge does not reduce our taxable income of which at least 90% must be paid as dividends to stockholders to maintain our status as a REIT. It does, however, reduce our reportable net income. In addition, we incurred $249,000 in merger related expenses.

Agreements with Pacific Income Advisers, Inc.

On June 13, 2002, we entered into a sublease with Pacific Income Advisers, Inc., or PIA, a company owned by a trust controlled by Lloyd McAdams, our president, chairman and chief executive officer, and Heather U. Baines, one of our executive vice presidents. Under the sublease, we lease approximately 5,500 square feet of office space from PIA and currently pay $44.04 per square foot in rent to PIA. The sublease runs through June 120, 2012 unless earlier terminated pursuant to the master lease. During 2002, we paid $133,221 rent to PIA.

The future minimum lease commitment is as follows:

Year | 2003 | 2004 | 2005 | 2006 | 2007 | Thereafter | Total Commitment | ||||||||||||||

Commitment Amount | $ | 249,480 | $ | 256,960 | $ | 264,660 | $ | 272,580 | $ | 280,775 | $ | 1,209,890 | $ | 2,534,345 | |||||||

12

On October 14, 2002, we entered into an administrative agreement with PIA. Under the administrative agreement, PIA provides administrative services and equipment to us in the nature of accounting, human resources, operational support and information technology, and we pay an annual fee of 7 basis points on the first $225 million of stockholder equity and 3.5 basis points thereafter (paid quarterly in advance) for those services. The administrative agreement is for an initial term of one year and will renew for successive one year terms thereafter unless either party gives notice of termination at least 90 days before the expiration of the then current annual term. We may also terminate the administrative agreement upon 30 days notice for any reason and immediately if there is a material breach by PIA. We paid fees of $39,059 to PIA in 2002 in connection with this agreement.

Indemnification Agreements

In addition to the indemnification provisions contained in our articles of incorporation and bylaws, we have entered into separate indemnification agreements with each of our directors and officers. These agreements require us, among other things, to indemnify each such director or officer to the fullest extent permitted by Maryland law against expenses (including attorneys’ fees), judgments, fines and settlements incurred by such individual in connection with any action, suit or proceeding by reason of such individual’s status or service as a director or officer (other than liabilities with respect to which such individual receives payment from another source, arising in connection with certain final legal judgments, arising from knowing fraud, deliberate dishonesty, willful misconduct, in connection with assertions by such individuals not made in good faith or which are frivolous or which we are prohibited by applicable law from paying) and to advance expenses incurred by such individual in connection with any proceeding against such individual with respect to which such individual may be entitled to indemnification by us.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of April 28, 2003, there were 27,408,279 shares of our common stock outstanding. The following table sets forth certain information known to us with respect to the beneficial ownership of our common stock as of April 28, 2003, the record date of the annual meeting, by (i) each of our directors, (ii) each of our executive officers, (iii) each person who is known to us to beneficially own more than 5% of our common stock and (iv) all of our directors and executive officers as a group. The number of shares beneficially owned by each director or executive officer is determined under rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days of April 28, 2003 through the exercise of any stock option or other right. Unless otherwise noted, we believe that each person has sole investment and voting power (or shares such powers with his or her spouse) with respect to the shares set forth in the following table.

Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||

Directors and Officers | |||||

Lloyd McAdams (1) | 751,714 | 2.7 | % | ||

Thad M. Brown | 278 | * |

| ||

Joseph E. McAdams (2) | 159,330 | * |

| ||

Heather U. Baines (3) | 679,145 | 2.5 | % | ||

Evangelos Karagiannis | 0 | * |

| ||

Charles H. Black (4) | 15,582 | * |

| ||

Joe E. Davis (5) | 14,582 | * |

| ||

Charles F. Smith (6) | 3,000 | * |

| ||

Lee A. Ault III | 0 | * |

| ||

All Directors and Officers as a Group (9 Persons) (7) | 1,018,879 | 3.7 | % | ||

5% Stockholders | |||||

Mark E. Brady (8) | 1,606,990 | 5.9 | % | ||

Robert J. Suttman, II (8) | 1,605,340 | 5.9 | % | ||

Ronald L. Eubel (8) | 1,605,990 | 5.9 | % | ||

Bernie Holtgreive (8) | 1,577,340 | 5.8 | % | ||

William Hazel (8) | 1,577,340 | 5.8 | % | ||

Eubel Brady & Suttman Asset Management, Inc. (8) | 1,577,340 | 5.8 | % |

| * | Less than 1% |

| (1) | Includes (i) 559,470 shares held by Lloyd McAdams and Heather U. Baines as community property, (ii) 110,544 shares subject to stock options exercisable within 60 days of April 28, 2003 and (iii) 30,700 shares owned by the McAdams Family Foundation of which Lloyd McAdams is a director. Mr. McAdams shares voting and investment power over the shares held by the Foundation and disclaims any beneficial interest in the shares held by this entity. |

| (2) | Includes 76,926 shares subject to stock options exercisable within 60 days of April 28, 2003. Includes 30,700 shares owned by the McAdams Family Foundation of which Joseph McAdams is a director. Mr. McAdams shares voting and investment power over the shares held by the Foundation and disclaims any beneficial interest in the shares held by this entity. |

| (3) | Includes (i) 559,470 shares held by Lloyd McAdams and Heather U. Baines as community property and (ii) 88,175 shares subject to stock options exercisable within 60 days of April 28, 2003. |

14

| (4) | Includes 10,582 shares subject to stock options exercisable within 60 days of April 28, 2003. |

| (5) | Includes 10,582 shares subject to stock options exercisable within 60 days of April 28, 2003. |

| (6) | Includes 3,000 shares subject to stock options exercisable within 60 days of April 28, 2003. |

| (7) | Each of our directors and officers may be reached at 1299 Ocean Avenue, Suite 250, Santa Monica, California 90401, telephone (310) 255-4493. |

| (8) | Based on Schedule 13G/A filed on February 14, 2003 by Eubel Brady & Suttman Asset Management, Inc. (the “Schedule 13G/A”). According to the Schedule 13G/A, (i) Mr. Brady has shared power to direct the vote of and dispose or to direct the disposition of 1,605,340 shares and sole power to direct the vote of and dispose or to direct the disposition of 1,650 shares, (ii) Mr. Suttman has shared power to direct the vote of and dispose or to direct the disposition of 1,605,340 shares, (iii) Mr. Eubel has shared power to direct the vote of and dispose or to direct the disposition of 1,605,340 shares and sole power to direct the vote of and dispose or to direct the disposition of 650 shares, (iv) Mr. Holtgreive has shared power to direct the vote of and dispose or to direct the disposition of 1,577,340 shares, and (v) Eubel Brady & Suttman Asset Management has shared power to direct the vote of and dispose or to direct the disposition of 1,577,340 shares. The address of each of the parties listed is 7777 Washington Village Drive, Ste. 210 Dayton, Ohio 45459. |

15

AUDIT COMMITTEE REPORT

The following is the report of the audit committee with respect to our audited financial statements for 2002, which include our consolidated balance sheets as of December 31, 2002 and 2001, and the related consolidated statements of operations, shareholders’ equity and cash flows for each of the three years in the period ended December 31, 2002, and the notes thereto.

Composition.The audit committee of the board of directors is comprised of four directors and operates under a written charter adopted by the board of directors, a copy of which is attached as Appendix A to this proxy statement. All members of the audit committee are “independent”, as defined in SEC Release 34-47137 proposing new Rule 10A-3 under the Securities Exchange Act of 1934 and the rules of the New York Stock Exchange and financially literate.

Responsibilities.The responsibilities of the audit committee include recommending to the board of directors an accounting firm to be engaged as our independent accountants. Management has primary responsibility for our internal controls and financial reporting process. The independent accountants are responsible for performing an independent audit of our consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The audit committee’s responsibility is to oversee these processes and the activities of our internal audit department.

Review with Management and Independent Accountants.The audit committee has reviewed our consolidated audited financial statements and met separately, and held discussions with, management and PricewaterhouseCoopers LLP, our independent accountants. Management represented to the audit committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles. The audit committee discussed with PricewaterhouseCoopers LLP matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees.”

Our independent accountants also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the audit committee discussed with the independent accountants, PricewaterhouseCoopers LLP, the firm’s independence.

Conclusion.Based upon the audit committee’s discussions with management and the independent accountants, the audit committee’s review of the representations of management and the report of the independent accountants to the audit committee, the audit committee recommended that the board of directors include the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2002, as filed with the SEC.

Reappointment of Independent Auditors.In March 2003, the audit committee recommended to the board of directors the reappointment of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending December 31, 2003.

Respectfully submitted by the Audit

Committee of the Board of Directors.

Charles H. Black

Joe E. Davis

Charles F. Smith

Lee A. Ault, III

16

Audit and Related Fees

Audit Fees. The aggregate fees billed by PricewaterhouseCoopers for professional services for the audit of our annual consolidated financial statements for fiscal 2002 and the review of the consolidated financial statements included in our Form 10-K for fiscal 2002 were $98,842.

Financial Information Systems Design and Implementation Fees.There were no fees billed by PricewaterhouseCoopers to us for financial information systems design and implementation fees for fiscal 2002.

All Other Fees.The aggregate fees billed to us for all other services rendered by PricewaterhouseCoopers for fiscal 2002 were $14,258. Fees in this category were for services in connection with registration statements we filed with the SEC, tax compliance and accounting advice.

Our audit committee has determined that the provision of services rendered above for all other fees is compatible with maintaining PricewaterhouseCoopers’ independence.

17

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Our executive compensation program is administered by the compensation committee of the board of directors. The compensation committee is responsible for approving the compensation package of each executive officer as well as administering our 1997 Stock Option and Awards Plan and our 2002 Incentive Compensation Plan. In making decisions regarding executive compensation, the compensation committee considers the input of our management and other directors.

Management Incentives to Maximize Performance.The compensation committee’s primary objective in designing our executive compensation policy is to provide the proper incentives to management to maximize our performance in order to serve the best interests of our stockholders. We have sought to achieve this objective through the granting of stock options and awards under our 1997 Stock Option and Awards Plan, the award of compensation pursuant to our 2002 Incentive Compensation Plan, and employment agreements with certain of our executive officers.

In determining the total amount and mixture of the compensation package for each executive officer, the compensation committee subjectively considers individual performance, including past and expected contribution to our goals of each executive officer, our overall performance, our long-term needs and goals, and such other factors as the compensation committee determines to be appropriate. Compensation may be in the form of cash, stock options or other awards or other forms of compensation determined appropriate by our compensation committee, subject to the rights of certain executives to be paid a minimum percentage of amounts earned pursuant to our 2002 Incentive Compensation Plan. In addition, pursuant to employment agreements with certain of our executive officers, annual base compensation for those officers equals the greater of a minimum dollar amount or a percentage of our book value, with a maximum limit. This arrangement was established based upon our view that successful performance by our company would result in our ability to raise additional capital.

Our 2002 Incentive Compensation Plan is tied directly to the performance of our company and is designed to incentivize our key employees to maximize our return on equity. The total aggregate amount of compensation that may be earned quarterly by all employees under the plan equals a percentage of taxable net income, before incentive compensation, in excess of the amount that would produce an annualized return on average net worth equal to the ten-year US Treasury Rate plus 1%, or the threshold return. In any quarter in which our taxable net income is an amount less than the amount necessary to earn the threshold return, we will calculate negative incentive compensation for that fiscal quarter which will be carried forward and will offset future incentive compensation earned under the incentive plan with respect to participants who were participants during the fiscal quarter(s) in which negative incentive compensation was generated.

Long-Term Management Performance.The compensation committee believes that the long-term commitment of our current management team is a crucial factor in our future performance. To ensure the long-term commitment of our management team, we assumed and modified employment contracts with certain of our executive officers upon the merger with our external manager. This employment agreements are described in detail under “Employment Agreements.” Consistent with the foregoing, we have structured our executive compensation policies to promote the long-term performance and commitment of our management.

Long-term incentive compensation is realized through granting of stock options and other awards to executive officers. Stock options and other awards are granted by us to aid in the retention and to align the interests of our executive officers with those of our stockholders. In addition, the compensation committee believes that the grant of an equity interest serves to link management interests with stockholder interests and to motivate executive officers to make long-term decisions that are in the best interests of our company and our stockholders and also provides an incentive to maximize stockholder value.

Compensation of Chief Executive Officer. The total compensation for 2002 of Lloyd McAdams, our chairman and chief executive officer, was established pursuant to his employment agreement which was assumed and modified upon the merger with our external manager. Mr. McAdams’ compensation for 2002 was

18

established using substantially the same criteria used to determine compensation levels for our other executive officers which are discussed in this report. The amounts paid to Mr. McAdams in the form of base salary and incentive compensation was determined by the compensation committee subject to a requirement in Mr. McAdams’ employment contract that he be paid at least 45% of amounts earned under our 2002 Incentive Compensation Plan. The compensation committee believes that the compensation arrangements with Mr. McAdams provide a incentive to Mr. McAdams to increase the long-term value of our company to our stockholders.

Section 162(m) of the Internal Revenue Code.The compensation committee periodically reviews the potential implications of Section 162(m) of the tax code. This section precludes a public corporation from taking a tax deduction for individual compensation in excess of $1 million for its named executive officers unless the compensation is performance-based within the meaning of Section 162(m). Although the compensation committee will consider various alternatives for preserving the deductibility of compensation payments, the committee reserves the right to award compensation to our executives that may not qualify under Section 162(m) as deductible compensation. Alternatively, such compensation may be deferred pursuant to our Deferred Compensation Plan until future periods to mitigate the effects of Section 162(m). In order to assure that future grants of stock options and other awards to our executive officers qualify as performance-based compensation, certain amendments to our 1997 Stock Option and Awards Plan are being submitted to you at the annual meeting. See “Proposal No. 3: Amendment to 1997 Stock Option and Awards Plan.”

Conclusion.It is the opinion of the compensation committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align the interests of each executive officer and the interests of our stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long-term.

Respectfully Submitted by the Compensation

Committee of the Board of Directors,

Charles H. Black

Joe E. Davis

Charles F. Smith

Lee A. Ault, III

19

TOTAL RETURN COMPARISON

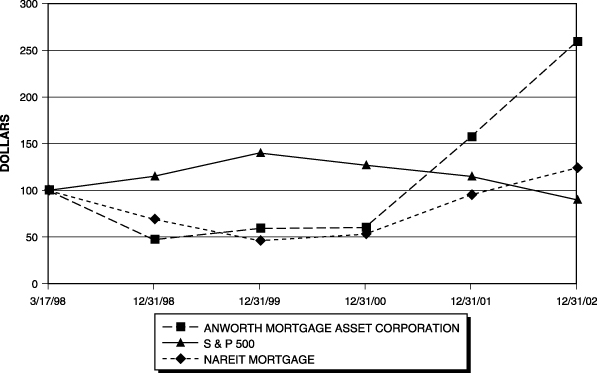

The following graph presents a total return comparison of our common stock with the Standard & Poor’s 500 Index and the National Association of Real Estate Investment Trusts, Inc. Mortgage REIT Index.

TOTAL RETURN COMPARISON SINCE OUR COMMENCEMENT OF OPERATIONS

THROUGH DECEMBER 31, 2002

3/17/98 | 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | |||||||

ANWORTH MORTGAGE ASSET CORPORATION | 100 | 47 | 59 | 60 | 157 | 259 | ||||||

S & P 500 | 100 | 115 | 140 | 127 | 115 | 90 | ||||||

NAREIT MORTGAGE | 100 | 69 | 46 | 53 | 95 | 124 |

The total return reflects stock price appreciation, if any, and the value of dividends for our common stock and for each of the comparative indices. The graph assumes that $100 was invested on March 17, 1998 (the date of our commencement of operations) in our common stock, that $100 was invested in each of the indices on February 28, 1998 and that all dividends were reinvested. The total return performance shown in this graph is not necessarily indicative of and is not intended to suggest future total return performance. Measurement points are at the last trading day of the fiscal years represented above.

The preceding Stock Performance Graph, Audit Committee Report and Compensation Committee Report are not considered proxy solicitation materials and are not deemed filed with the SEC. Notwithstanding anything to the contrary set forth in any of our previous filings made under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings made by us under those statutes, the Stock Performance Graph, Audit Committee Report and Compensation Committee Report shall not be incorporated by reference into any such prior filings or into any future filings made by us under those statutes.

20

PROPOSAL NO. 2:

APPROVAL OF AMENDMENTS TO ARTICLES OF INCORPORATION

At our annual meeting, stockholders will be asked to approve amendments adopted by our board of directors to our articles of incorporation in the form attached as Appendix B. The amendments make certain changes to the our articles of incorporation in connection with compliance with the listing requirements of the New York Stock Exchange, or the NYSE.

In April 2003, we received approval to list our common stock for trading on the NYSE, and we anticipate that on May 9, 2003, our common stock will begin trading on the NYSE and we will de-list our shares from the American Stock Exchange. As a condition to clearance of our common stock for trading, the NYSE required, and we agreed, subject to stockholder approval, to make certain amendments to our articles of incorporation.

Our articles of incorporation currently contains certain provisions, referred to herein as the share transfer restrictions, that restrict the transfer of our common stock, if, following such transfer, any person would own at any time, directly or indirectly, in the aggregate more than 9.8% of our outstanding common stock, including any shares deemed to be constructively owned by such person under applicable provisions of the tax code. This limitation is referred to as the ownership limit. The share transfer restrictions, which are similar to provisions of the charter documents of many REITs, are designed, in part, to ensure compliance with certain REIT tax law requirements which provide that not more than 50% of the our outstanding common stock can be owned, directly or indirectly, by five or fewer persons.

The proposed amendments to our articles of incorporation clarify that nothing in the articles would prohibit the settlement of any transactions entered into through the facilities of the NYSE or any other national securities exchange or automated inter-dealer quotation system, while maintaining the authority of the board of directors to take all action necessary to maintain our status as a REIT under the tax code.

Our board of directors believes that it is important to assure the investment community and the NYSE that our remedies under the share transfer restrictions in our articles of incorporation do not prohibit the settlement of any transactions on the NYSE. The NYSE has advised us that the NYSE currently requires any REIT listed on the NYSE that has share transfer restrictions in its charter to include provisions similar to those proposed to be included in our articles of incorporation.

Pursuant to our articles of incorporation, amendments to our articles of incorporation must be approved by the affirmative vote of a majority of all of the common stock entitled to vote at the annual meeting of stockholders. If approved, the amendments would become effective upon filing with the Secretary of State of the State of Maryland, which would take place as soon as practicable following the Meeting.

Required Vote

The affirmative vote of a majority of the outstanding shares of our common stock is required to amend our articles of incorporation.

Our board of directors recommends that you vote FOR the amendments to our articles of incorporation. Proxies received will be so voted unless stockholders specify otherwise in the proxy.

21

PROPOSAL NO. 3:

APPROVAL OF AMENDMENTS TO STOCK OPTION AND AWARDS PLAN

On April 16, 2003, our board of directors adopted amendments to our 1997 Stock Option and Awards Plan to establish an annual limit on the number of shares for which options or other awards may be granted to any participant. Because the amendments are intended to allow grants made under the plan to qualify as “performance-based” compensation under Section 162(m) of the tax code, we are asking you to approve the amendments to the plan. The 1997 Stock Option and Awards Plan, as previously amended and as modified by the amendments, is referred to herein as the “1997 Option Plan.”

General

There is currently no limit on the number of stock options and other awards that may be granted to any individual under our 1997 Option Plan during any year. We have adopted amendments to the plan to:

| Ÿ | establish an annual limit of 360,000 on the number of shares of our common stock for which stock options and other awards may be granted to any participant under our stock option and awards plan during any year; and |

| Ÿ | provide that any future changes to the annual limit will require the approval of our stockholders. |

The annual limit is subject to customary adjustments for recapitalizations and similar events. If this proposal is approved by our stockholders, the annual limit will become effective for calendar year 2003.

As mentioned above, we adopted the amendments to our 1997 Option Plan so that grants made under the plan after stockholder approval will qualify as “performance-based” compensation under Section 162(m) of the tax code. Under Section 162(m), we may not receive a federal income tax deduction for compensation paid to our chief executive officer or any of the four other most highly compensated executive officers to the extent that any of these persons receives more than $1 million in compensation in any one year. However, if we pay compensation that is “performance-based” under Section 162(m), we can receive a federal income tax deduction for the compensation paid even if such compensation exceeds $1 million in a single year. The limits set forth in the amendments allow compensation realized upon the exercise of stock options or stock appreciation rights granted after stockholder approval to meet the requirements for “performance-based compensation” under Section 162(m).

Following is a brief summary of our 1997 Option Plan, a copy of which is attached hereto as Appendix C.

Purpose

The purpose of our 1997 Option Plan is to provide a means of compensation in order to attract and retain qualified personnel and to provide an incentive to others whose job performance affects our company.

Awards

Our 1997 Option Plan provides for the following grants:

| Ÿ | qualified incentive stock options, or ISOs, which meet the requirements of Section 422 of the tax code; |

| Ÿ | stock options not so qualified, or NQSOs; |

| Ÿ | deferred stock, in which delivery of common stock occurs upon expiration of a deferral period; |

| Ÿ | restricted stock, in which common stock is granted to participants subject to restrictions on transferability and other restrictions, which lapse over time; |

22

| Ÿ | performance shares, consisting of a right to receive common stock subject to restrictions based upon the attainment of specified performance criteria; |

| Ÿ | stock appreciation rights, whether in conjunction with the grant of stock options or independently, or stock appreciation rights that are only exercisable in the event of a change in control of our company or upon other events; and |

| Ÿ | dividend equivalent rights, or DERs, consisting of a right to receive cash or stock equal in value to dividends paid with respect to a specified number of shares of common stock, or other periodic payments. |

Eligibility

Officers, employees and consultants of our company and its subsidiaries are eligible to receive options and other awards under our 1997 Option Plan at the discretion of the plan administrator.

Administration

Our 1997 Option Plan is administered by our compensation committee. The committee is composed of individuals who meet the qualifications to be a “non-employee director” as defined in Rule 16b-3 as promulgated under the Exchange Act. Grants made by the committee are discretionary, although the committee may consider such factors as a grantee’s ability, ingenuity and industry. The committee has the authority under our 1997 Option Plan, among other things, to:

| Ÿ | determine which eligible employees will participate in our 1997 Option Plan; |

| Ÿ | determine the form of options or awards, and whether such options or awards will be granted on a tandem basis or in conjunction with other options and awards; |

| Ÿ | determine the number of shares of common stock or rights covered by an option or award; and |

| Ÿ | determine the terms and conditions of any options or awards granted under our 1997 Option Plan. |

Stock Options

Options become exercisable in accordance with the terms of the grant made by the administrator. The administrator has discretionary authority to determine at the time an option or award is granted when and in what increments shares covered by the option may be purchased and, in the case of options, whether it is intended to be an ISO or a NQSO.

Certain restrictions applicable to ISOs are mandatory, including a requirement that ISOs not be issued for less than 100% of the then fair market value of the common stock (110% in the case of a grantee who holds or is deemed to hold more than 10% of the total combined voting power of our outstanding stock) and a maximum term of ten years (five years in the case of a grantee who holds or is deemed to hold more than 10% of the total combined voting power of our outstanding stock). Moreover, ISOs may not be granted to any of our directors who is not also an employee, or to directors, officers and other employees of entities unrelated to us. Additionally, without approval of our board of directors, no options or awards may be granted under our 1997 Option Plan to any person who, assuming exercise of all options held by such person, would own or be deemed to own more than 9.8% of the outstanding shares of our common stock.

Options terminate no more than 10 years from the date of grant (or five years in the case of ISOs granted to an employee who owns or is deemed to own in excess of 10% of the total combined voting power of our outstanding stock). Options may be granted on terms providing for exercise either in whole or in any part at any time or times during their terms, or only in specified percentages at stated time periods or intervals during the term of the option.

23

The exercise price of any option granted under our 1997 Option Plan is payable in full in cash, or its equivalent as determined by the administrator. We may make loans available to option holders, other than officers and directors, to exercise options evidenced by a promissory note executed by the option holder and secured by a pledge of common stock with fair market value at least equal to the principal amount of the promissory note unless otherwise determined by the administrator.

Stock Appreciation Rights

The administrator may grant SARs in connection with related options or free-standing SARs that are not associated with an option. SARs entitle the holder to receive, upon exercise, an amount of cash, shares of our common stock or both (as determined by the administrator), equal in value to the excess of the fair market value of the shares covered by the SAR on the date of exercise over (i) the exercise price of the related option for such shares if the SAR is related to an option, or (ii) the price specified in the SAR, if the SAR is a free-standing SAR. The exercise price of a free-standing SAR cannot be less than the per share fair market value of our common stock on the grant date. If an SAR is related to an option, the exercise of the SAR results in cancellation of the related option or, conversely, the exercise of the related option will result in cancellation of the SAR. SARs which are related to options may only be exercised to the extent the related option is then exercisable. Free-standing SARs become exercisable at the times determined by the administrator on or after the grant date. Generally, however, no free-standing SARs may be exercised within six months following the grant date.

The administrator may also grant limited SARs in connection with related options or as free-standing limited SARs. Limited SARs may only be exercised within thirty days after a change in control of our company. Upon the exercise of a limited SAR, the holder will receive an amount of cash equal to the excess of the “change of control price” (as defined below under the heading “Change of Control”) of the shares covered by the SAR, over the exercise price of the related option. In the case of a free-standing limited SAR, the holder will receive an amount of cash equal to the excess of the change of control price of the shares over the price per share specified in the SAR. Generally, limited SARs may not be exercised within six months after the grant date.

No SARs or limited SARs have been granted under the Plan.

Stock Purchase Rights

The administrator may issue shares of our common stock to eligible persons through direct issuances in amounts to be determined by the administrator. The administrator determines when the shares will vest. The vesting schedule may be based on the passage of time or the attainment of designated performance goals. Shares may also be issued pursuant to deferred stock awards that entitle the recipients to receive shares after the passage of a certain period of time, or upon the attainment of designated performance goals. The administrator determines the price, if any, that a recipient shall pay for the award. If a recipient’s service with us terminates, any unvested shares or awards held by the recipient will be forfeited and the recipient will only receive the amount, if any, paid by the recipient for the shares, plus interest on such amount at eight percent per year.

DERs

Dividend equivalent rights, or DERs, may be granted in tandem with options granted under our 1997 Option Plan, at the discretion of the administrator. Such DERs accrue for the account of the optionee shares of common stock upon the payment of cash dividends on outstanding shares of common stock. The number of shares accrued is determined by a formula and such shares are transferred to the optionee only upon exercise of the related option.

The plan permits DERs to be granted under the plan with various characteristics. First, DERs can be issued in “current-pay” form so that payment can be made to the optionee at the same time as dividends are paid to holders of outstanding common stock. Second, DERs can be made eligible to participate not only in cash distributions but also distributions of stock or other property made to holders of outstanding common stock.

24

Shares of common stock accrued for the account of the optionee pursuant to a DER grant may also be made eligible to receive dividends and distributions. Finally, DERs can be made “performance based” by conditioning the right of the holder of the DER to receive any dividend equivalent payment or accrual upon the satisfaction of specified performance objectives.

Shares

Our 1997 Option Plan currently authorizes the grant of options to purchase, and awards of, an aggregate of 1,800,000 shares, plus annual increases in the authorized number of shares in an aggregate amount of two percent (2%) of the outstanding shares of our common stock, subject to a maximum annual increase of 300,000 shares and a maximum number of aggregate shares available under the plan of 3,000,000 shares. If an option granted under our plan expires or terminates, or an award is forfeited, the shares subject to any unexercised portion of such option or award will again become available for the issuance of further options or awards under our plan.