File Pursuant to Rule 424(b)(3)

Registration No. 333-159645

PROSPECTUS

AMBIENT CORPORATION

279,650 shares of Common Stock

This Prospectus relates to the resale by the selling stockholders of up to 279,650 shares of our common stock, par value $0.001 (the "Common Stock") issuable upon exercise of currently exercisable warrants.

We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

The selling stockholders may sell the shares from time to time at the prevailing market price or in negotiated transactions. Each of the selling stockholders may be deemed to be an "underwriter," as such term is defined in the Securities Act of 1933, as amended (the "Act").

As of August 3, 2011, our Common Stock is quoted on the NASDAQ Capital Market under the trading symbol “AMBT”. Prior to such time, our Common Stock was quoted on the OTC Bulletin Board under the trading symbol "ABTG". The last reported sales price per share of our Common Stock as quoted by the NASDAQ Capital Market on March 23, 2012 was $4.59.

AS YOU REVIEW THIS PROSPECTUS, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DESCRIBED IN THE SECTION OF THIS PROSPECTUS TITLED "RISK FACTORS" BEGINNING ON PAGE 8.

NEITHER THE SECURITIES EXCHANGE AND COMMISSION (THE "SEC") NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED ON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is March 29, 2012

PRINCIPAL EXECUTIVE OFFICE:

Ambient Corporation

7 Wells Avenue

Newton, Massachusetts 02459

(617) 332-0004

TABLE OF CONTENT

| PROSPECTUS SUMMARY | | | 3 | |

| RISK FACTORS | | | 4 | |

| USE OF PROCEEDS | | | 21 | |

| AGREEMENTS WITH THE SELLING STOCKHOLDERS | | | 21 | |

| DIVIDEND POLICY | | | 22 | |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | | | 22 | |

| SELECTED FINANCIAL DATA | | | | |

| MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | | | 23 | |

| DESCRIPTION OF OUR BUSINESS | | | 32 | |

| DESCRIPTION OF PROPERTY | | | 45 | |

| LEGAL PROCEEDINGS | | | 45 | |

| MANAGEMENT | | | 45 | |

| EXECUTIVE COMPENSATION | | | 51 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | 59 | |

| STOCK OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL HOLDERS | | | 61 | |

| SELLING STOCKHOLDERS | | | 63 | |

| PLAN OF DISTRIBUTION | | | 64 | |

| DESCRIPTION OF CAPITAL STOCK | | | 65 | |

| DISCLOSURE OF SEC POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | | | 67 | |

| LEGAL MATTERS | | | 67 | |

| EXPERTS | | | 67 | |

| WHERE YOU CAN FIND MORE INFORMATION | | | 67 | |

| INDEX TO FINANCIAL STATEMENTS | | | F-2 | |

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this Prospectus. The selling stockholders are offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of Common Stock.

PROSPECTUS SUMMARY

THIS IS ONLY A SUMMARY AND DOES NOT CONTAIN ALL OF THE INFORMATION THAT MAY BE IMPORTANT TO YOU. YOU SHOULD READ THE ENTIRE PROSPECTUS, ESPECIALLY THE SECTION TITLED "RISK FACTORS" AND OUR FINANCIAL STATEMENTS AND THE RELATED NOTES INCLUDED IN THIS PROSPECTUS, BEFORE DECIDING TO INVEST IN SHARES OF OUR COMMON STOCK.

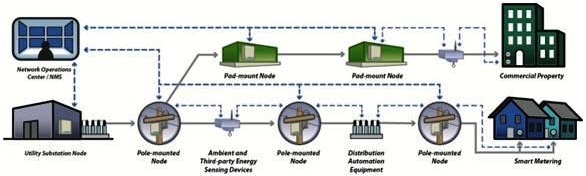

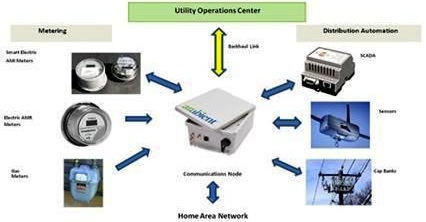

We are a leading provider of a smart grid communications platform designed to enable utilities to effectively deploy, integrate and communicate with multiple devices creating smart grid applications within the electric power grid. Our smart grid communications platform significantly improves the ability of utilities to use advanced technologies to upgrade their electric power grids, effectively making the grids more intelligent.

The term “smart grid” refers to the use of advanced technologies to upgrade the electric power grid, or the grid, effectively making the grid more intelligent and efficient. The grid was largely designed and built decades ago to reliably distribute electricity from generators to customers in a manner resulting in sizable capital investments and operating costs. A number of factors are increasingly straining the grid, including growing electricity demand, two-way power flow, the implementation of renewable and distributed energy sources and advanced pricing plans. As such, the aging grid is prone to reliability, security, availability and power quality issues, costing utilities and consumers billions of dollars each year. Technology is now revolutionizing the grid and transforming it into an efficient, communicating energy service platform. We believe that the smart grid will address the current shortcomings of the grid and deliver significant benefits to utilities and consumers of energy, including reduced costs, increased power reliability and quality, accommodation of renewable energy technologies, consumer empowerment over energy consumption and a platform for continued integration of new technologies.

The Ambient Smart Grid® communications platform, which includes hardware, software and firmware, enables utilities to effectively manage smart grid applications. Our communications platform provides utilities with a secure, two-way, flexible and open Internet protocol, or IP, architecture that efficiently networks smart grid applications and different technologies within each application and supports multiple communications technologies currently used by utilities, such as Wi-Fi, radio frequency, cellular technologies, power line communications, serial and Ethernet. Today, our communications platform enables the simultaneous integration and parallel communication of multiple smart grid applications provided by a variety of vendors, including smart metering, demand response and distribution automation. We believe that the Ambient Smart Grid® communications platform delivers significant benefits to utilities, including support of a single network; an open, scalable and interoperable platform; preservation of utility investments; third-party application hosting; remote and distributed intelligence; secure communications; and reduced overall implementation and operating costs.

The Ambient Smart Grid® products and services include communications nodes; a network management system, AmbientNMS®; integrated applications; and maintenance and consulting services. The communications nodes, our principal product, are physical boxes that contain the hardware and software needed for communications and data collection in support of smart grid assets. We have configured our communications nodes to act as individual data processors and collectors that receive signals from other networked devices, enabling smart grid applications. Duke Energy, our sole customer, to date has deployed approximately 75,000 of our communications nodes that receive data from smart electric and gas meters, using a variety of communications technologies, and process and transmit these data to the utility back office over a cellular carrier network for further processing. Furthermore, our communications nodes, in the fourth generation of development, also accommodate integrated applications that include our own developed technology and third-party technology, thereby substantially increasing their functionality. By enabling such system interoperability, our communications platform both reduces implementation and ongoing communications costs and improves overall power management efficiencies. We believe that, to date, no other single solution or technology has provided the necessary flexibility in a cost-effective manner, enabling a comprehensive digital communications platform while leveraging standards-based technologies. We developed our communications platform to fill this void.

Our long-standing relationship with Duke Energy, which we believe has one of the most forward-looking smart grid initiatives in North America, has led to rapid growth in our business. We entered into a long-term agreement in September 2009 with Duke Energy to supply the utility with our Ambient Smart Grid® communications platform and license our AmbientNMS® through 2015. We increased revenue from $2.2 million in 2009 to $20.4 million in 2010 to $62.3 million in 2011. We believe that there are opportunities for additional sales of our products and services with Duke Energy. Furthermore, we also intend to leverage our success with the utility to secure additional customers in the global utility market place.

On July 18, 2011, we effected a reverse stock split of our outstanding shares of common stock at a ratio of 1-for-100 shares. Following the implementation of the reverse split, the number of shares of common stock that we are authorized to issue from time to time was updated to 100,000,000 shares.

Since inception, we have primarily funded our operations with proceeds from the sale of our securities and, most recently, with revenue from sales of our products.

CORPORATE INFORMATION

Our principal offices are located 7 Wells Avenue, Newton, Massachusetts 02459, and our telephone number is (617) 332-0004. We maintain a website at www.ambientcorp.com. Information contained on our website is not part of this Prospectus.

RISK FACTORS

Investing in shares of our Common Stock involves significant risk. You should consider the information under the caption "RISK FACTORS" beginning on page 8 of this Prospectus in deciding whether to purchase the Common Stock offered under this Prospectus.

THE OFFERING

| Securities offered by the selling stockholders | | 279,650 shares of Common Stock. (1) |

| Shares outstanding before the Offering | | 16,587,384 (2) |

| Use of Proceeds | | We will not receive any proceeds from the sale of the Common Stock by the selling stockholders |

____________

| (1) | Refers to shares issuable upon exercise of warrants issued to Kuhns Brothers (“Kuhns”), an investment firm and a registered broker dealer, or its designees, in connection with certain financings that we consummated between July 2007 and November 2008 and is comprised of the following: to (i) 7,500 shares of Common Stock issuable upon exercise of warrants issued in January 2007 in connection with the retainer of Kuhns as investment advisor to us and (ii) 272,150 shares of Common Stock issuable upon exercise of warrants issued as compensation for placement agent services rendered in connection with the above referenced financings. For a description of the agreement between us and the holders of the Warrants and the Other Warrants, see "DESCRIPTION OF THE AGREEMENTS WITH SELLING STOCKHOLDERS". |

| | |

| (2) | As of March 23, 2012. Does not include (i) up to an aggregate of 2,763,540 shares of Common Stock issuable upon exercise of options granted under our 2000 Equity Incentive Stock Option Plan and our 2002 Non-Employee Director Stock Option Plan, (ii) any of the shares described in footnote (1) above and (iii) 663,834 additional shares of Common Stock issuable upon exercise of other outstanding warrants. |

SUMMARY FINANCIAL DATA

The following financial data should be read together with our financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this Prospectus.

We have derived the following statement of operations data and cash flow data for the years ended December 31, 2009, 2010 and 2011 and balance sheet data as of December 31, 2010 and 2011 from our audited financial statements included elsewhere in this Prospectus. We have derived the following statement of operations data and cash flow data for the years ended December 31, 2007 and 2008 and balance sheet data as of December 31, 2007, 2008 and 2009 from our audited financial statements which are not included in this Prospectus. Share and per share information has been adjusted to reflect the 1-for-100 reverse stock split of our common stock that became effective on July 18, 2011. Our historical results are not necessarily indicative of our results to be expected in any future period.

| | | For the Years Ending December 31, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| STATEMENT OF OPERATIONS DATA: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total revenue | | $ | 2,265 | | | $ | 12,622 | | | $ | 2,193 | | | $ | 20,358 | | | $ | 62,306 | |

| Cost of revenue | | | 1,806 | | | | 9,942 | | | | 1,836 | | | | 12,023 | | | | 35,490 | |

| Gross profit | | | 459 | | | | 2,680 | | | | 357 | | | | 8,335 | | | | 26,816 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Research and development expenses | | | 3,675 | | | | 4,351 | | | | 4,946 | | | | 6,314 | | | | 12,223 | |

| Selling, general and administrative expenses | | | 4,012 | | | | 3,600 | | | | 4,662 | | | | 5,239 | | | | 9,638 | |

| Total operating expenses | | | 7,687 | | | | 7,951 | | | | 9,608 | | | | 11,553 | | | | 21,861 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating (loss) income | | | (7,228 | ) | | | (5,271 | ) | | | (9,251 | ) | | | (3,218 | ) | | | 4,955 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest (expense) income, net | | | (1,102 | ) | | | (3,116 | ) | | | (4,963 | ) | | | (214 | ) | | | 19 | |

| Amortization of beneficial conversion feature of convertible debt | | | (2,657 | ) | | | - | | | | - | | | | - | | | | - | |

| Amortization of deferred financing costs | | | (4,943 | ) | | | - | | | | - | | | | - | | | | - | |

| Loss on extinguishment of debt | | | - | | | | (2,789 | ) | | | - | | | | - | | | | - | |

| Other income (expense), net | | | 174 | | | | (118 | ) | | | (32 | ) | | | 246 | | | | - | |

| Total other (loss) income | | | (8,528 | ) | | | (6,023 | ) | | | (4,995 | ) | | | 32 | | | | 19 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | - | | | | - | | | | - | | | | - | | | | 204 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income | | $ | (15,756 | ) | | $ | (11,294 | ) | | $ | (14,246 | ) | | $ | (3,186 | ) | | $ | 4,770 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income per share (basic) | | $ | (6.55 | ) | | $ | (3.75 | ) | | $ | (1.81 | ) | | $ | (0.21 | ) | | $ | 0.29 | |

| Net (loss) income per share (diluted) | | $ | (6.55 | ) | | $ | (3.75 | ) | | $ | (1.81 | ) | | $ | (0.21 | ) | | $ | 0.28 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares used in computing basic net (loss) income per share | | | 2,405 | | | | 3,016 | | | | 7,891 | | | | 15,385 | | | | 16,515 | |

| Weighted average shares used in computing diluted net (loss) income per share | | | 2,405 | | | | 3,016 | | | | 7,891 | | | | 15,385 | | | | 16,905 | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH FLOW DATA: | | | | | | | | | | | | | | | | | | | | |

| Cash flows (used in) provided by operating activities | | | (6,697 | ) | | | (5,549 | ) | | | (7,720 | ) | | | (1,592 | ) | | | 12,069 | |

| Cash flows provided by (used in) investing activities | | | 50 | | | | (576 | ) | | | (269 | ) | | | (527 | ) | | | (962 | ) |

| Cash flows provided by (used in) financing activities | | | 4,807 | | | | 13,591 | | | | 964 | | | | 8,119 | | | | (129 | ) |

| | | As of December 31, | |

| | | | 2007 | | | | 2008 | | | | 2009 | | | | 2010 | | | | 2011 | |

| BALANCE SHEET DATA: | | | | | | | | �� | | | | | | | | | | | | |

| Cash, cash equivalents and marketable securities | | $ | 546 | | | $ | 8,137 | | | $ | 987 | | | $ | 6,987 | | | $ | 17,965 | |

| Total assets | | | 2,816 | | | | 10,622 | | | | 3,393 | | | | 10,573 | | | | 21,874 | |

| Working capital, net (1) | | | (253 | ) | | | 7,688 | | | | (225 | ) | | | 5,577 | | | | 15,327 | |

| Convertible debt (current & long-term portion) | | | 2,672 | | | | 755 | | | | 9,816 | | | | - | | | | - | |

| Total stockholders' (deficit) equity | | | (1,465 | ) | | | 7,454 | | | | (9,535 | ) | | | 6,136 | | | | 16,866 | |

______

(1) Excluding current portion of convertible debt

RISK FACTORS

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE RISKS AND UNCERTAINTIES DESCRIBED BELOW BEFORE YOU PURCHASE ANY OF OUR COMMON STOCK. IF ANY OF THESE RISKS OR UNCERTAINTIES ACTUALLY OCCURS, OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY AFFECTED, AND YOU COULD LOSE ALL OR PART OF YOUR INVESTMENT.

RISKS RELATED TO OUR BUSINESS

We currently depend on one customer for substantially all of our revenue, and any material delay, reduction or cancellation of orders from this customer would significantly reduce our revenue and have a material negative impact on our business.

Duke Energy accounted for all of our revenue for each of our last three fiscal years. Any material delay, reduction or cancellation of orders from Duke Energy would have a material adverse effect on our business, including significantly reduced revenue, unabsorbed overhead and incurred net losses.

Although we have a long-term contract that stipulates the general terms of our relationship, Duke Energy does not provide us with firm purchase commitments for the duration of the contract. Instead, Duke Energy provides us with 12-month rolling order forecasts and periodic purchase orders. Duke Energy can delay, reduce or cancel purchase orders at any time prior to the anticipated lead time for delivery of the products (typically three months), subject to Duke Energy’s payment of a cancellation fee not to exceed the price of the products cancelled. Duke Energy may also delay, reduce or cancel its purchase orders without penalty if we are unable to deliver the products ordered thereunder within a specified time from the scheduled delivery date.

Our immediate business opportunities continue to be primarily dependent on the success of our deployments with Duke Energy and the future decisions of Duke Energy relating to its smart grid deployment in its service territories. Our goal is to increase our business with Duke Energy and to attract new customers. We may not achieve this goal within an acceptable period of time or at all. The failure to increase our business with Duke Energy or to attract new customers would have a material adverse effect on our business and prospects.

In January 2011, Duke Energy and Progress Energy announced a proposed merger that is subject to stockholder and regulatory approval. Since the merger of Duke Energy and Progress Energy is complex and each company has its own smart grid related investment plans, we are unable to assess the effects, if any, that the proposed merger, or delays in the proposed merger, will have on our business. The proposed merger has taken longer to consummate than originally planned. We cannot assure you that the post-merger entity will continue or expand its business with us.

We have a limited history of profitability on an annual basis, and we may be unable to achieve or maintain profitability in future periods.

Fiscal year 2011 was our first full year of profitability. We may not, however, be able to maintain profitability in future fiscal years. At December 31, 2011, we had an accumulated deficit of $138.7 million. To grow our revenue and customer base, we also plan to increase spending associated with research and development and business development, thereby increasing our operating expenses. These increased costs may cause us to incur net losses in the foreseeable future, and we may be unable to grow our revenue and expand our customer base to maintain profitability on an annual basis.

We depend on factors affecting the utility industry.

We expect to continue to derive substantially all of our revenue from sales of products to utilities. Purchases of our products may be deferred as a result of many factors, including economic downturns, slowdowns in new residential and commercial construction, access to capital at acceptable terms, utility specific financial circumstances, mergers and acquisitions, regulatory decisions, weather conditions and interest rates. We may experience variability in operating results on an annual and a quarterly basis as a result of these factors.

Utility industry sales cycles can be lengthy and unpredictable, which can negatively impact our ability to expand the deployment of our products with Duke Energy and to secure new customers.

Sales cycles for smart grid projects are generally long and unpredictable due to budgeting, procurement and regulatory approval processes that can take up to several years to complete. Utility customers typically issue requests for quotes and proposals, establish evaluation committees, review different technical options, require pilot programs prior to commercial deployments, analyze cost and benefit metrics, consider regulatory factors and follow their normal budget approval processes. In addition, many electric utilities tend to be risk averse and tend to follow industry trends rather than be the first to purchase new products or services. These tendencies can extend the lead time for, or prevent acceptance of, new products or services, including those for smart grid initiatives despite the support of the federal government through grants and other incentives.

Accordingly, potential customers may take longer to reach a decision to initiate smart grid programs or to purchase our products or services. It is not unusual for a utility customer to go through the entire sales process and not accept any proposal or quote. This extended sales process requires the dedication of significant time by our personnel to develop relationships at various levels and within various departments of utilities and our use of significant financial resources, with no certainty of success or recovery of our related expenses. Long and unpredictable sales cycles with utility customers could have a material adverse effect on our business, operating results or our financial condition.

The market for our products and services, and smart grid technology generally, is still developing and we will have difficulty expanding our business and securing new customers if the market develops less extensively or more slowly than we expect.

The market for our products and services, and smart grid technology generally, is still developing, and it is uncertain whether our products and services will achieve and sustain high levels of demand and market acceptance. Our success will depend to a substantial extent on the willingness and ability of utilities to implement smart grid technology. Many utilities lack the financial resources and/or technical expertise required to evaluate, deploy and operate smart grid technology. Regulatory agencies, including public utility commissions, govern utilities’ activities, and they may not create a regulatory environment that is conducive to the implementation of smart grid technologies in a particular jurisdiction. Furthermore, some utilities may be reluctant or unwilling to adopt smart grid technology because they may be unable to develop a business case to justify the up-front and ongoing expenditures. If utilities do not widely adopt smart grid technologies or do so more slowly than we expect, we will have difficulty expanding our business and securing new customers, which will adversely affect our business and operating results.

Because the markets for our products are highly competitive, we may lose sales to our competitors, which would harm our revenue and operating results.

Competition in the smart grid market is intense and involves rapidly changing technologies, evolving industry standards, frequent new product introductions, changes in customer or regulatory requirements and localized market requirements. Competitive pressures require us to keep pace with the evolving needs of utilities; to continue to develop and introduce new products, features and services in a timely, efficient and cost-effective manner; and to stay abreast of regulatory factors affecting the utility industry.

We compete with a wide array of manufacturers, vendors, strategic alliances, systems developers and other businesses, including other smart grid communications technology companies, ranging from relatively smaller companies focusing mainly on communications technology to large Internet and software-based companies. In addition, some providers of smart meters may add communications capabilities to their existing business in the future, which could decrease our base of potential customers and could decrease our revenue and profitability. “Early adopters,” or customers that have sought out new technologies and services, have largely comprised the target market for our products. Because the number of early adopters is limited, we will need to expand our target markets by marketing and selling our products to mainstream customers to continue our growth.

Some of our present and potential future competitors have, or may have, greater name recognition, experience and customer bases as well as substantially greater financial, technical, sales, marketing, manufacturing and other resources than we possess and that afforded them competitive advantages. These potential competitors may undertake more extensive marketing campaigns, adopt more aggressive pricing policies, obtain more favorable pricing from suppliers and manufacturers and exert more influence on sales channels than we do. Competitors may sell products at lower prices in order to obtain market share. Competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements. Competitors may also be able to devote greater resources to the development, promotion and sale of their products and services than we can. Competitors may introduce products and services that are more cost-efficient, provide superior performance or achieve greater market acceptance than our products and services. Our competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties that enhance their ability to address the needs of our prospective customers. It is possible that new competitors or alliances among current and new competitors may emerge and rapidly gain significant market share. Other companies may also drive technological innovation and develop products that are equal or superior in quality and performance to our products and render our products non-competitive or obsolete.

Any of these competitive factors could make it more difficult for us to attract and retain customers, cause us to lower our prices in order to compete and reduce our market share and revenue, any of which could have a material adverse effect on our operating results and financial condition. If we fail to compete successfully with current or future competitors, we could experience material adverse effects on our business, financial condition, results of operations and cash flows.

If we are unable to keep pace with technological innovations and are unable to continue to develop new products and product enhancements, we may be unable to expand our business with Duke Energy or secure new customers.

We operate in a new and evolving market. Technological advances, the introduction of new products, evolving industry standards, changing industry preferences and changes in utility industry regulatory requirements could adversely affect our business unless we are able to adapt to the changing conditions. Technological advances or changing industry preferences could render our products less desirable or obsolete, and we may not be able to respond effectively to the requirements of evolving market conditions. As a result, we may need to commit significant financial and other resources to the following:

| | ● | engaging additional engineering and other technical personnel; |

| | ● | continuing research and development activities on existing and potential products; |

| | ● | maintaining and enhancing our technological capabilities; |

| | ● | pursuing innovative development of new products and technologies; |

| | ● | designing and developing new products and product enhancements that appeal to customers; |

| | ● | meeting the expectations of our customers in terms of product design, cost, performance and service; |

| | ● | responding to changing industry preferences; |

| | ● | maintaining efficient, timely and cost-effective manufacturing resources of our products; and |

| | ● | achieving customer acceptance of our products and technologies. |

Our future success depends on our ability to address the changing market needs by developing and introducing new products and product updates that compare favorably on the basis of timely introduction, cost and performance with the products of competitive suppliers and evolving technologies. We must also extend and keep pace with technological developments and emerging industry standards that address the needs of customers. We intend to commit substantial resources to developing new products, product enhancements and technological advances for the smart grid market. The smart grid market is relatively new, and industry standards for this market are evolving and changing. If the smart grid market does not develop as anticipated, or if demand for our products in this market does not materialize or occurs more slowly than we expect, we will have expended substantial resources and capital without realizing sufficient revenue, which will adversely affect our business and operating results.

Existing and future regulations concerning the electric utility industry may present technical, regulatory and economic barriers that may significantly impact future demand for our products.

International, federal, state and local government regulations and policies, as well as internal policies and regulations promulgated by electric utilities, heavily influence the market for the electric utility industry. These regulations and policies often relate to investment initiatives, including decisions relating to investment in smart grid technologies, as well as building codes, public safety regulations and licensing requirements. In addition, certain of our contracts with our potential utility customers may be subject to approval by federal, state or local regulatory agencies, which may not be obtained or be issued on a timely basis. In the United States and in a number of other countries, these regulations and policies are being modified and may continue to be modified and have a substantial impact on the market for our and other smart grid related technologies. If such regulations or policies do not continue to gain acceptance for smart grid initiatives or the adoption of such initiatives takes substantially longer than expected, our prospects for developing new customers could be significantly limited.

Duke Energy and some potential utility customers have applied for government grants and may also seek to participate in other government incentive programs, and if those grants or other incentives are not received or are significantly delayed, our results of operations could suffer.

Many utilities, including Duke Energy and some of our potential utility customers, have applied for grants and may seek to participate in other government incentive programs designed to stimulate the U.S. economy and support environmental initiatives, including smart grid technologies. In certain cases, such as with the American Reinvestment and Recovery Act of 2009, or ARRA, the U.S. government has approved the funds, and the government and the utilities have entered into agreements under which the government has agreed to award funds to the utilities, but significant portions of the funds have not yet been distributed. Furthermore, such funds must be spent by the end of 2013 or awards will not be further funded, which could reduce the demand for smart gird related products beyond 2013. Duke Energy has applied for and been granted funding under ARRA programs, which may account for a significant portion of our current and anticipated future revenue and billings. Duke Energy and our potential utility customers that seek these government grants or incentives may delay or condition the purchase of our products and services upon receipt of such funds or upon their confidence in the future disbursement and tax treatment of those funds. If Duke Energy and our potential utility customers do not receive these funds or if their receipt of funds is significantly delayed, our operating results could suffer. Similarly, the receipt of government funds or incentives may be conditioned upon utilities meeting milestones and other requirements, some of which may not be known until a future point in time. If our products and services do not meet the requirements necessary for receipt of government funds or other incentives, Duke Energy and our potential utility customers may delay or condition the purchase of our products and services until they meet these requirements, and our results of operations could suffer. Furthermore, there may not be government funds or incentives for utilities in future periods. As a result, Duke Energy and our potential utility customers may not have the resources or incentives to purchase our products and services in those future periods.

The adoption of industry standards applicable to our products or services could limit our ability to compete in the marketplace.

Standards bodies, which are formal and informal associations that seek to establish voluntary, non-governmental product and technology standards, are influential in the United States and abroad. We participate in voluntary standards organizations in order to both help promote non-proprietary, open standards for interoperability with our products and to prevent the adoption of exclusionary standards. However, we are not able to control the content of adopted voluntary standards and do not have the resources to participate in all voluntary standards processes that may affect our markets. The adoption, or expected adoption, of voluntary standards that are incompatible with our products or technology or that favor our competitors’ products or technology could limit the market opportunity for our products and services or render them obsolete, any of which could materially and adversely affect our revenue, results of operations and financial condition.

If we become subject to product returns and product liability claims resulting from defects in our products, we may fail to achieve market acceptance of our products, and our business could be harmed.

We develop complex products for use in an evolving marketplace and generally warrant our products for a period of 12 months from the date of sale. Despite testing by us and customers, our products may contain or may be alleged to contain undetected errors or failures. In addition, a customer or its installation partners may improperly install or implement our products. The integration of our products in smart grid networks or applications may entail the risk of product liability or warranty claims based on disruption to these networks or applications. Any such manufacturing errors or product defects could result in a delay in recognition or loss of revenue, loss of market share or failure to achieve market acceptance. Additionally, these defects could result in financial or other damages to a customer; cause us to incur significant warranty, support and repair costs; and divert the attention of our engineering personnel from our product development efforts. A product liability claim brought against us, even if unsuccessful, would likely be time-consuming and costly to defend. The occurrence of these problems would likely harm our business.

We currently maintain property, general commercial liability, errors and omissions and other lines of insurance. Such insurance may be insufficient in amount to cover any particular claim, or we might not carry insurance that covers a specific claim. In addition, such insurance may not be available in the future or the cost of such insurance may increase substantially.

Our ability to provide bid bonds, performance bonds or letters of credit may be limited and could negatively affect our ability to bid on or enter into significant long-term agreements.

We may be required to provide bid bonds or performance bonds to secure our performance under customer contracts or, in some cases, as a prerequisite to submit a bid on a potential project. Our ability to obtain such bonds will depend upon our capitalization, working capital, past performance, management expertise and reputation, and external factors beyond our control, including the overall capacity of the surety market. Surety companies consider those factors in relation to the amount of our tangible net worth and other underwriting standards that may change from time to time. Surety companies may require that we collateralize a percentage of the bond with our cash or other form of credit enhancement. Events that affect surety markets generally may result in bonding becoming more difficult to obtain in the future, or being available only at a significantly greater cost. In addition, utilities may require collateral guarantees in the form of letters of credit to secure performance or to fund possible damages as the result of an event of default under any contracts with them. If we enter into significant long-term agreements that require the issuance of letters of credit, our liquidity could be negatively impacted. Our inability to obtain adequate bonding or letters of credit and, as a result, to bid or enter into significant long-term agreements, could have a material adverse effect on our ability to effectively compete and could impact our future business.

We currently rely on a single contract manufacturer to produce our products, and a loss of our sole contract manufacturer or its inability to satisfy our quality and other requirements could severely disrupt the production and supply of our products.

We utilize one contract manufacturer for all of our production requirements. This manufacturing is conducted in China by a U.S.-based company that also performs services for numerous other companies. We depend on our manufacturer to maintain high levels of productivity and satisfactory delivery schedules. Our reliance on our manufacturer reduces our control over the manufacturing process, exposing us to risks, including reduced control over quality assurance, product costs and product supply. Any financial, operational or other difficulties involving our manufacturer could adversely affect us. We provide our manufacturer with up to 12-month rolling forecasts of our production requirements. We do not, however, have long-term agreements with our manufacturer that guarantees production capacity, prices, lead times or delivery schedules. Since our manufacturer serves other customers, a number of which have greater production requirements than we do, our manufacturer could determine to prioritize production capacity for other customers or reduce or eliminate production for us on short notice. We could also encounter lower manufacturing productivity and longer delivery schedules in commencing volume production of new products. Any of these problems could result in our inability to deliver our products in a timely manner and adversely affect our operating results. The loss of our relationship with our manufacturer or its inability to conduct its manufacturing services for us as anticipated in terms of cost, quality and timeliness could adversely affect our ability to fill customer orders in accordance with required delivery, quality and performance requirements. If this were to occur, the resulting decline in revenue would harm our business.

If any one of these risks materializes, it could significantly impact our operations and our ability to fulfill our obligations under purchase orders with Duke Energy as well as future orders from Duke Energy or other customers. Qualifying new manufacturers is time consuming and might result in unforeseen manufacturing and operational problems. If we had to transition to an alternative contract manufacturer we could experience operational delays, increased product costs and increased operating costs which could irreparably harm our relationship with Duke Energy, harm our reputation and could potentially impact our ability to secure new customers.

Shortages of components and materials may delay or reduce our sales and increase our costs, thereby harming our results of operations.

The inability of our manufacturer to obtain sufficient quantities of components and other materials necessary for the production of our products could result in reduced or delayed sales or lost orders. Any delay in or loss of sales could adversely impact our operating results. Some of the materials used in the production of our products are available from a limited number of foreign suppliers, particularly suppliers located in Asia. In most cases, neither we nor our manufacturer has long-term supply contracts with these suppliers. As a result, we are subject to increased costs, supply interruptions and difficulties in obtaining materials.

Security breaches involving our smart grid products or services, publicized breaches in smart grid products and services offered by others or the public perception of security risks or vulnerability created by the deployment of the smart grid in general, whether or not valid, could harm our business.

The security technologies we have integrated into our communications platform and products that are designed to detect unauthorized activity and prevent or minimize security breaches may not function as expected and our products and services, those of other companies with whose products our products and services are integrated or interact, or even the products of other smart grid solutions providers may be subject to significant real or perceived security breaches.

Our communications platform allows utilities to monitor, compile and analyze sensitive information related to consumers’ energy usage, as well as the performance of different parts of the electric power distribution grid. As part of our data transfer and managed services, we may store and/or come into contact with sensitive consumer information and data when we perform operational, installation or maintenance functions for a utility customer. If, in handling this information, we, our partners or a utility customer fails to comply with privacy or security laws, we could face significant legal and financial exposure to claims of government agencies, utility customers and consumers whose privacy is compromised. Even the perception that we, our partners or a utility customer has improperly handled sensitive, confidential information could have a negative effect on our business. In addition, third parties may, through computer viruses, physical or electronic break-ins and other means, attempt to breach our security measures or inappropriately use or access our AmbientNMS® or the communications nodes we have in the field. If a breach is successful, sensitive information may be improperly obtained, manipulated or corrupted, and we may face legal and financial exposure. In addition, a breach could lead to a loss of confidence in our products and services, and our business could suffer.

Our current and anticipated future products and services allow authorized personnel to remotely control equipment at residential and commercial locations, as well as at various points on the grid. For example, our software could allow a utility to remotely connect and disconnect electricity at specific customer locations. If an unauthorized third party were to breach our security measures and disrupt, gain access to, or take control of, any of our products or services, our business and reputation could be severely harmed.

Our products and services may also be integrated or interface with products and services sold by third parties, and rely on the security of those products and their secure transmission of proprietary data over the Internet and other networks. Because we do not have control over the security measures implemented by third parties in their products or in the transmission of data over the Internet and other networks, we cannot ensure the complete integrity or security of such third-party products and transmissions.

Concerns about security or customer privacy may result in the adoption of state or federal legislation that restricts the implementation of smart grid technology or requires us to make modifications to our products, which could significantly limit the deployment of our technologies or result in significant expense to modify our products.

Any real or perceived security breach could seriously harm our reputation and result in significant legal and financial exposure, inhibit market acceptance of our products and services, halt or delay the deployment by utilities of our products and services, cause us to lose sales, trigger unfavorable legislation and regulatory action and inhibit the growth of the overall market for smart grid products and services. Any of these risks could have a material adverse effect on our business, operating results and financial condition.

Developments in data protection laws and regulations may affect technology relating to smart grid products and solutions, which could adversely affect the demand for our products and services.

Our products and services may be subject to data protection laws and regulations that impose a general framework for the collection, processing and use of personal data. Our communications platform relies on the transfer of data relating to individual energy use and may be affected by these laws and regulations. It is unclear how the regulations governing the transfer of personal data in connection with privacy requirements will further develop in the United States and internationally, and to what extent this may affect technology relating to smart grid products and services. This could have a material adverse effect on our business, financial condition and results of operations.

We use some open source software in our products and services that may subject our products and services to general release or require us to re-engineer our products and services, which may cause harm to our business.

We use some open source software in connection with our products and services. From time to time, companies that incorporate open source software into their products have faced claims challenging the ownership of open source software and/or compliance with open source license terms. Therefore, we could be subject to suits by parties claiming ownership of what we believe to be open source software or noncompliance with open source licensing terms. Some open source software licenses require users who distribute open source software as part of their software to publicly disclose all or part of the source code to such software and/or make available any derivative works of the open source code on unfavorable terms or at no cost. We monitor the use of open source software in our products and services and try to ensure that none of the open source software is used in a manner that would require us to disclose the source code to the related product or that would otherwise breach the terms of an open source agreement. However, such use could inadvertently occur and we may be required to release our proprietary source code, pay damages for breach of contract, re-engineer our products, discontinue the sale of our products in the event re-engineering cannot be accomplished on a timely basis or take other remedial action that may divert resources away from our development efforts, any of which could adversely affect our business, operating results and financial condition.

Our quarterly results are inherently unpredictable and subject to substantial fluctuations, and, as a result, we may fail to meet the expectations of securities analysts and investors, which could adversely affect the trading price of our common stock.

Our revenue and other operating results may vary significantly from quarter to quarter as a result of a number of factors, many of which are outside of our control. While our revenue has increased in recent periods, there can be no assurances that our revenue will continue to increase or will not decrease on a quarterly or annual basis.

The factors that may affect the unpredictability of our quarterly results and cause our stock price to fluctuate include the following:

| | ● | long, and sometimes unpredictable, sales and customer deployment cycles; |

| | ● | changes in the mix of products and services sold; |

| | ● | our dependence on a single customer; |

| | ● | changing market conditions; |

| | ● | changes in the competitive environment; |

| | ● | failures of our products or components that we use in our products that delay deployments, harm our reputation or result in high warranty costs, contractual penalties or terminations; |

| | ● | product or project failures by third-party vendors, utility customers or competitors that result in the cancellation, slowing down or deferring of projects; |

| | ● | liquidated damage provisions in our current or future contracts, which could result in significant penalties if triggered or, even if not triggered, could affect our ability to recognize revenue in a given period; |

| | ● | the ability of our suppliers and manufacturers to deliver supplies and products to us on a timely basis; |

| | ● | delays associated with government funding programs for smart grid projects; |

| | ● | political and consumer sentiment and the related impact on the scope and timing of smart grid deployment; and |

| | ● | economic, regulatory and political conditions in the markets where we operate or anticipate operating. |

As a result, we believe that quarter to quarter comparisons of operating results are not necessarily indicative of what our future performance will be. In future quarters, our operating results may be below the expectations of securities analysts or investors, in which case the price of our common stock may decline.

Negative economic conditions in the United States and globally may have a material and adverse effect on our operating results, cash flow and financial condition.

The economies in the United States and countries around the world have been recovering from a global financial crisis and recession, which began in 2008, but financial markets and world economies continue to be volatile. Significant long-term effects will likely result from the financial crisis and recession, including slower and more volatile future global economic growth than during the years prior to the financial crisis of 2008. A lower future economic growth rate could result in reductions in sales of our products and services, slower adoption of new technologies and an increase price competition. Any of these events would likely harm our business, results of operations and financial condition.

International manufacturing and sales risks could adversely affect our operating results.

Our products are produced in China by a U.S.-based, third-party contract manufacturer. We may also expand our addressable market by pursuing opportunities to sell our products in international markets. We have had no experience operating in markets outside of the United States. Accordingly, new markets may require us to respond to new and unanticipated regulatory, marketing, sales and other challenges. We may not be successful in responding to these and other challenges that we may face as we enter and attempt to expand in international markets. International operations also entail a variety of other risks. The manufacture of our products abroad and our potential expansion into international markets expose us to various economic, political and other risks that could adversely affect our operations and operating results, including the following:

| | ● | potentially reduced protection for intellectual property rights; |

| | ● | political, social or economic instability in certain parts of the world; |

| | ● | unexpected changes in legislature or regulatory requirements of foreign countries; |

| | ● | differing labor regulations; |

| | ● | tariffs and duties and other trade barrier restrictions; |

| | ● | possible employee turnover or labor unrest; |

| | ● | the burdens and costs of compliance with a variety of foreign laws; |

| | ● | currency exchange fluctuations; |

| | ● | potentially adverse tax consequences; and |

| | ● | potentially longer payment cycles and greater difficulty in accounts receivable collections. |

International operations are also subject to general geopolitical risks, such as political, social and economic instability and changes in diplomatic and trade relations. One or more of these factors could adversely affect any international operations and result in lower revenue than we expect and could significantly affect our profitability.

Growth in our business may be impacted if international trade is hindered, disrupted or economically disadvantaged.

Political and economic conditions abroad may adversely affect the foreign production of our products as well as the sale of our products if we expand our business internationally. Protectionist trade legislation in either the United States or foreign countries, such as a change in the current tariff structures, export or import compliance laws or other trade policies, could adversely affect our ability to obtain product production from foreign manufacturers and to sell our products in foreign countries.

Changes in policies by the U.S. or foreign governments resulting in, among other things, higher taxation, currency conversion limitations, restrictions on the transfer of funds or the expropriation of private enterprises also could have a material adverse effect on us. Any actions by countries in which we conduct business to reverse policies that encourage foreign investment or foreign trade also could adversely affect our operating results. In addition, U.S. trade policies, such as “most favored nation” status and trade preferences for certain Asian nations, could affect the attractiveness of our services to our U.S. customers and adversely impact our operating results.

Our operating results could be adversely affected by fluctuations in the value of the U.S. dollar against foreign currencies.

We currently transact business in U.S. dollars with our U.S.-based manufacturer that produces our products in China. A weakening of the dollar could cause our overseas manufacturer to require renegotiation of either the prices or currency we pay for its services. In the future, our manufacturer and international customers, if any, could negotiate pricing and make or require payments in non-U.S. currencies.

If our overseas vendors or customers require us to transact business in non-U.S. currencies, fluctuations in foreign currency exchange rates could affect our cost of goods, operating expenses and operating margins and could result in exchange losses. In addition, currency devaluation can result in a loss to us if we hold deposits of that currency. Hedging foreign currencies can be difficult, especially if the currency is not freely traded. We cannot predict the impact of future exchange rate fluctuations on our operating results. We currently do not hedge any foreign currencies.

Our inability to protect our intellectual property could impair our competitive advantage, reduce our revenue and increase our costs.

Our success and ability to compete depend in part on our ability to maintain the proprietary aspects of our technologies and products. We rely on a combination of trade secrets, patents, copyrights, trademarks, confidentiality agreements and other contractual provisions to protect our intellectual property, but these measures may provide only limited protection. We generally enter into written confidentiality and non-disclosure agreements with our employees, consultants, customers, manufacturers and other recipients of our technologies and products and assignment of invention agreements with our employees and consultants. We may not always be able to enforce these agreements and may fail to enter into any such agreement in every instance when appropriate. We license from third parties certain technology used in and for our products. These third-party licenses are granted with restrictions; therefore, such third-party technology may not remain available to us on terms beneficial to us. Our failure to enforce and protect our intellectual property rights or obtain from third parties the right to use necessary technology could have a material adverse effect on our business, operating results and financial condition. In addition, the laws of some foreign countries do not protect proprietary rights as fully as do the laws of the United States.

Patents may not issue from the patent applications that we have filed or may file in the future. Our issued patents may be challenged, invalidated or circumvented, and claims of our patents may not be of sufficient scope or strength, or issued in the proper geographic regions, to provide meaningful protection or any commercial advantage. We have not applied for, and do not have, any copyright registration on our technologies or products. We have applied to register certain of our trademarks in the United States and other countries. We cannot assure you that we will obtain registrations of principle or other trademarks in key markets. Failure to obtain registrations could compromise our ability to protect fully our trademarks and brands and could increase the risk of challenge from third parties to our use of our trademarks and brands.

We may be required to incur substantial expenses and divert management attention and resources in defending intellectual property litigation against us.

We cannot be certain that our technologies and products do not and will not infringe issued patents or other proprietary rights of others. While we are not currently subject to any infringement claim, any future claim, with or without merit, could result in significant litigation costs and diversion of resources, including the attention of management, and could require us to enter into royalty and licensing agreements, any of which could have a material adverse effect on our business. We may not be able to obtain such licenses on commercially reasonable terms, if at all, or the terms of any offered licenses may be unacceptable to us. If forced to cease using such technology, we may be unable to develop or obtain alternate technology. Accordingly, an adverse determination in a judicial or administrative proceeding or failure to obtain necessary licenses could prevent us from manufacturing, using or selling certain of our products, which could have a material adverse effect on our business, operating results, and financial condition.

Furthermore, parties making such claims could secure a judgment awarding substantial damages, as well as injunctive or other equitable relief that could effectively block our ability to make, use or sell our products in the United States or abroad. Such a judgment could have a material adverse effect on our business, operating results and financial condition. In addition, we are obligated under certain agreements to indemnify the other party in connection with infringement by us of the proprietary rights of third parties. In the event we are required to indemnify parties under these agreements, it could have a material adverse effect on our business, financial condition and results of operations.

We may incur substantial expenses and divert management resources in prosecuting others for their unauthorized use of our intellectual property rights.

Other companies, including our competitors, may develop technologies that are similar or superior to our technologies, duplicate our technologies or design around our patents and may have or obtain patents or other proprietary rights that would prevent, limit or interfere with our ability to make, use or sell our products. Effective intellectual property protection may be unavailable or limited in some foreign countries in which we may do business, such as China. Unauthorized parties may attempt to copy or otherwise use aspects of our technologies and products that we regard as proprietary. Our means of protecting our proprietary rights in the United States or abroad may not be adequate or competitors may independently develop similar technologies. If our intellectual property protection is insufficient to protect our intellectual property rights, we could face increased competition in the market for our technologies and products.

Should any of our competitors file patent applications or obtain patents that claim inventions also claimed by us, we may choose to participate in an interference proceeding to determine the right to a patent for these inventions because our business would be harmed if we fail to enforce and protect our intellectual property rights. Even if the outcome is favorable, this proceeding could result in substantial cost to us and disrupt our business.

In the future, we also may need to file lawsuits to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. This litigation, whether successful or unsuccessful, could result in substantial costs and diversion of resources, which could have a material adverse effect on our business, financial condition and results of operations.

We depend on key personnel who would be difficult to replace, and our business will likely be harmed if we lose their services or cannot hire additional qualified personnel.

Our success depends substantially on the efforts and abilities of our senior management and key personnel. The competition for qualified management and key personnel, especially engineers, is intense. Although we maintain noncompetition and nondisclosure covenants with most of our key personnel, we do not have employment agreements with most of them. The loss of services of one or more of our key employees or the inability to hire, train and retain key personnel, especially engineers and technical support personnel, could delay the development and sale of our products, disrupt our business and interfere with our ability to execute our business plan.

Potential strategic alliances may not achieve their objectives, and the failure to do so could impede our growth.

We anticipate that we will enter into strategic alliances. Among other matters, we continually explore strategic alliances designed to enhance or complement our technology or to work in conjunction with our technology; to provide necessary know-how, components or supplies; to attract additional customers; and to develop, introduce and distribute products utilizing our technology. Any strategic alliances may not achieve their intended objectives, and parties to our strategic alliances may not perform as contemplated. The failure of these alliances may impede our ability to introduce new products and expand our business.

Any acquisitions that we undertake could be difficult to integrate, disrupt our business, dilute stockholder value and harm our operating results.

We may pursue opportunities to acquire other businesses and technologies in order to complement our products, expand the breadth of our business, enhance our technical capabilities or otherwise grow our business. While we have no current definitive agreements underway, we may acquire businesses, products or technologies in the future. If we make any future acquisitions, we could issue stock that would dilute existing stockholders’ percentage ownership, incur substantial debt, assume contingent liabilities or experience higher operating expenses. We have no experience in acquiring other businesses or technologies. Potential acquisitions also involve numerous risks, including the following:

| | ● | problems assimilating the purchased operations, technologies or products; |

| | ● | unanticipated costs associated with the acquisition; |

| | ● | diversion of management’s attention from our core businesses; |

| | ● | adverse effects on existing business relationships with suppliers and customers; |

| | ● | risks associated with new ventures with respect to which we have little or no prior experience; and |

| | ● | potential loss of key employees of purchased organizations. |

We cannot assure you that we would be successful in overcoming problems encountered in connection with any acquisitions, and our inability to do so could disrupt our operations and adversely affect our business.

Our compliance with the Sarbanes-Oxley Act of 2002 and SEC rules concerning internal controls may be time consuming, difficult and costly, and the failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our ability to produce accurate financial statements and on our stock price.

Under SEC regulations adopted pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we are required to maintain internal controls over financial reporting and to report any material weaknesses in such internal controls. In addition, we anticipate that at some point in the near future, we will be required to furnish a report by our management on our internal control over financial reporting that includes a statement that our independent auditors have issued an attestation report on management’s assessment of internal control over financial reporting. While we have spent considerable time and effort in designing, documenting and testing our internal control procedures, we may need to spend additional financial and other resources improving our processes, which may result in increased general and administrative expenses and may shift management time and attention from revenue-generating activities to compliance activities. Despite our efforts, we can provide no assurance as to our independent auditor’s conclusion with respect to the effectiveness of our internal control over financial reporting.

If we fail to comply in a timely manner with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information, limit our ability to raise needed capital and have a negative effect on the trading price of our common stock.

We may not be able to secure additional financing on favorable terms, or at all, to meet our future capital needs.

In the future, we may require additional capital to respond to business opportunities, challenges, acquisitions or unforeseen circumstances and may determine to engage in equity or debt financings or enter into credit facilities for other reasons. We may not be able to secure additional debt or equity financing in a timely basis or on favorable terms, or at all. Any debt financing obtained by us in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. If we raise additional funds through further issuances of equity, convertible debt securities or other securities convertible into equity, our existing stockholders could suffer significant dilution in their percentage ownership of our company, and any new equity securities we issue could have rights, preferences and privileges senior to those of holders of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to grow or support our business and to respond to business challenges could be significantly limited.

Risks Related to Our Common Stock

Our principal stockholder exerts substantial influence over us.

Vicis Capital Master Fund, or Vicis, owns approximately 84% of the outstanding shares of our common stock as of December 31, 2011. Consequently, Vicis is able to exert substantial influence over our company and control matters requiring approval by our stockholders, including the election of all our directors, approving any amendments to our certificate of incorporation, increasing our authorized capital stock, effecting a merger or sale of our assets and determining the number of shares available for issuance under our stock plans. As a result of Vicis’ control, no change of control of our company can occur without Vicis’ consent.

Vicis’ voting control may discourage transactions involving a change of control of our company, including transactions in which you as a holder of our common stock might otherwise receive a premium for your shares over the then current market price. Vicis is not prohibited from selling a controlling interest in our company to a third party and may do so without stockholder approval and without providing for a purchase of any stockholder’ shares of common stock. Accordingly, shares of common stock may be worth less than they would be if Vicis did not maintain voting control over us.

We may issue additional common stock in the future, which would dilute our existing stockholders.

In the future, we may issue our previously authorized and unissued securities, including shares of our common stock or securities convertible into or exchangeable for our common stock, resulting in the dilution of the ownership interests of our stockholders. We are authorized under our amended and restated certificate of incorporation to issue 100,000,000 shares of common stock and 5,000,000 shares of preferred stock with such designations, preferences, and rights as may be determined by our Board of Directors. As of March 23, 2012, there were 16,572,384 shares of our common stock issued and outstanding and there were no shares of our preferred stock issued and outstanding.

While we filed with the Securities and Exchange Commission in August 2011 a registration statement on Form S-1 for a proposed public offering of our common stock, we currently do not have any commitments for funding. In addition, we may also issue additional shares of our common stock or securities convertible into or exchangeable for our common stock in connection with the hiring of personnel, future acquisitions, future private placements of our securities for capital raising purposes or for other business purposes. Future issuances of our common stock, or the perception that such issuances could occur, could have a material adverse effect on the price of our common stock.

The market price of our common stock may be volatile, which could result in substantial losses for investors.

The market price of our common stock is likely to be volatile and could fluctuate widely in response to various factors, many of which are beyond our control, including the following:

| | ● | our ability to execute our business plan; |

| | ● | the gain or loss of significant orders; |

| | ● | volume and timing of customer orders; |

| | ● | actual or anticipated changes in our operating results; |

| | ● | changes in expectations relating to our products, plans and strategic position or those of our competitors or customers; |

| | ● | market conditions and trends within the utilities industry and the smart grid market; |

| | ● | introductions of new products of new pricing policies by us or by our competitors; |

| | ● | the gain or loss of significant customers; |

| | ● | industry developments; |

| | ● | regulatory, legislative or other developments affecting us or the utilities industry in general or the smart grid market in particular; |

| | ● | economic and other external factors; |

| | ● | general global economic and political instability; |

| | ● | changes in laws or regulations affecting the utilities industry; |

| | ● | announcements of technological innovations or new products by us or our competitors; |

| | ● | acquisitions or strategic alliances by us or by our competitors; |

| | ● | litigation involving us, the utilities industry or the smart grid market; |

| | ● | recruitment or departure of key personnel; |

| | ● | future sales of our common stock; |

| | ● | price and volume fluctuations it the overall stock market from time to time; |

| | ● | changes in investor perception; |

| | ● | the level and quality of any research analyst coverage of our common stock; |

| | ● | changes in earnings estimates or investment recommendations by securities analysts; |

| | ● | the financial guidance we may provide to the public, any changes in such guidance or our failure to meet such guidance; and |

| | ● | trading volume of our common stock or the sale of stock by our parent, management team or directors. |

In addition, the securities markets have experienced extreme price and volume fluctuations that often have been unrelated or disproportionate to the operating performance of particular companies. Public announcements by various companies concerning, among other things, their performance, accounting practices or legal problems could cause the market price of our common stock to decline regardless of our actual operating performance.

Future sales of common stock by Vicis or others or other dilutive events may adversely affect the market price of our common stock, even if our business is doing well.

Our existing stockholders could sell any or all of the shares of common stock owned by them from time to time for any reason. Future sales of substantial amounts of our common stock in the public market, or the perception that such sales could occur, could adversely affect prevailing trading prices of our common stock and could impair our ability to raise capital through future offerings of equity or equity-related securities. We cannot predict what effect, if any, future sales of our common stock, or the availability of shares for future sales, will have on the market price of our stock. As of December 31, 2011, we had the following outstanding securities:

| | ● | Approximately 16.6 million shares of common stock outstanding; |

| | ● | Approximately 2.7 million shares of common stock issuable upon the exercise of then outstanding stock options at a weighted average exercise price of $8.16 per share; |

| | ● | Approximately 1.1 million shares of common stock issuable upon the exercise of then outstanding warrants at a weighted average exercise price of $16.61 per share; and |

| | ● | Approximately 725,000 shares of common stock reserved for issuance under our 2000 Equity Incentive Plan and 2002 Non-Employee Directors Stock Option Plan. |

We do not expect to pay any dividends for the foreseeable future; hence stockholders must look solely to appreciation of our common stock to realize a gain on their investments.

We have never declared or paid cash dividends on our common stock, and we do not anticipate doing so in the foreseeable future. We currently intend to retain future earnings, if any, to fund our operations and support our growth strategies. Any determination to pay dividends in the future will be made at the discretion of our Board of Directors and will depend on our results of operations, financial conditions, contractual restrictions, restrictions imposed by applicable law, capital requirements and other factors our Board of Directors deems relevant. Accordingly, stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may not occur.

Our ability to use U.S. net operating loss carryforwards might be limited, subjecting our corporate income to earlier taxation.

At December 31, 2011, we had available approximately $68.3 million of net operating loss carryforwards, for U.S. income tax purposes which expire in the years 2016 through 2030. However, due to changes in stock ownership resulting from historical investments provided by Vicis, we expect that the use of the U.S. net operating loss carryforwards are significantly limited under Section 382 of the Internal Revenue Code. As such, approximately $56.2 million of our net operating loss carryforwards will expire and will not be available to use against future tax liabilities. In addition, our ability to utilize the current net operating loss carryforwards might be further limited by the issuance of common stock in future offerings. To the extent our use of net operating loss carryforwards is significantly limited, our income could be subject to corporate income tax earlier than it would if we were able to use net operating loss carryforwards, which could result in lower profits.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS