UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-23489

Access Worldwide Communications, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 52-1309227 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S.Employer Identification No.) |

| | |

| 1820 North Fort Myer Drive Arlington, VA | | 22209 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrants telephone number including area code (703) 292-5210

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

| None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 15, 2007, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $13,645,358 based on the closing price as reported on the National Association of Securities Dealers Automated Quotation System National Market System. The number of shares outstanding of the Company’s Common Stock, $0.01 par value per share is 17,679,065 as of March 28, 2007.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement relating to the Registrant’s Annual Meeting of Stockholders to be held on May 24, 2007 are incorporated by reference into Part III of this Form 10-K where indicated.

TABLE OF CONTENTS

i

PART I

For convenience, the terms “Access Worldwide,” “Access,” “we,” “our,” “us” or the “Company” refer to Access Worldwide Communications, Inc. and/or, as the context requires, one or more of our subsidiaries.

The following discussion of our business should be read in conjunction with Selected Financial Data and our Consolidated Financial Statements and the Notes thereto included elsewhere in this Form 10-K.

General

Established in 1983, today Access Worldwide Communications, Inc. has more than 1,000 employees in five locations across the United States (“U.S.”) and the Philippines. Access Worldwide is a premier provider of business process outsourcing (“BPO”) solutions focused on helping our clients cost-effectively acquire, retain, and profitably grow their customer base. We provide a full suite of inbound and outbound sales, customer care, marketing, IT, and back-office services in multiple languages, across all communication channels (e.g. phone, email, Internet, mail). Our clients are in a wide variety of industries including telecommunications, financial services/banks, media/publishing, and consumer product companies.

Given that each of our clients face unique challenges, we combine leading edge technology, a global, well-educated workforce and a value-added approach to provide our clients with optimal scalability and choice. Whether it is a highly targeted sales campaign carried out by one of our U.S. communications centers, or a complex customer care application serviced in the Philippines, Access Worldwide has the resources in place to meet our clients expectations. We specialize in, and have a proven track record of success, supporting the following types of programs:

| | | | |

Customer Acquisition: | | Customer Care: | | Technical Support/Help Desk: |

| Inbound/Outbound Sales | | Customer Service/Retention | | Tier 1 Issue Resolution |

| Order Entry/Up-sell | | Retention Sales | | Hardware/Software Support |

| Lead Generation | | Billing Inquires & Adjustments | | |

| Appointment Setting | | | | |

Our mission at Access Worldwide is to provide our clients with “superior service” by helping them cost-effectively obtain, retain, and profitably grow their businesses though the professional outsourcing services we provide. We accomplish this by helping our clients select the most appropriate location (U.S. or off-shore), agents, and mix of services to meet their unique challenges.

We currently operate five state-of-the-art communication centers worldwide to provide our clients with not only maximum staffing flexibility and scalability, but with specialized resources they need to meet their specific sales and customer service objectives. We have strategically located our communication centers to take advantage of significant labor pools supporting many of the various languages spoken in the U.S.

The Philippines Off-Shore Advantage

The Philippines offers a large pool of highly-skilled and college educated workers. The Philippines is unique compared to other offshore locations, with its strong service oriented society, American English proficiency and great affinity for American culture. In communication centers, Filipinos excel at quickly solving customers’ problems, and then in effectively cross-selling additional products and services.

With a population of approximately 86 million people, the Philippines has the third largest English-speaking population in the world. Each year approximately 500,000 English speaking college graduates enter the workforce and with proper training quickly become highly skilled customer service agents who are career oriented, passionate about their jobs, and great sales generators.

Communication centers are people businesses mixed with advanced technology. The Philippines has an established communications infrastructure with high-speed global communication networks and integrated phone, email and chat systems. Filipino customer service representatives are able to provide superior outsourced services that turn communication centers into profit centers.

Metro Manila, centrally located in the region, is the home of the Philippines national government. This area has developed into a commercial center and is quickly becoming a BPO hub. The city has a large skilled labor resource base, housing 81 higher education institutions and 1,600 other schools and enjoys a literacy rate of approximately 92%. It has a stable power supply, sufficient IT capabilities, a solid public transportation system and a busy international airport.

1

Industry Experience

For nearly 25 years now we have been helping clients ranging from small and mid-size niche providers to Fortune 500 conglomerates acquire, service, retain, and grow their customer base through the high quality, cost-efficient, and scalable outsourcing services we provide.

We have successfully implemented inbound, outbound and blended communication center applications for our clients in the following industries:

| | • | | Financial/Banking Services; |

| | • | | Telecommunications; and |

We have provided support in over 17 different languages, across multiple channels (e.g. phone, email, Internet, mail, etc.), and we constantly add newcomplementary services to the mix (e.g. IVR, back-office processing, transcription, etc.) to meet specific customer needs.

Our Industry

Business Process Outsourcing is the leveraging of technology or specialist process vendors to provide and manage an organization’s critical and/or non-critical enterprise processes and applications. The most common examples of BPO are call/communication centers, human resources, accounting and payroll outsourcing. BPO may involve the use of both on-shore, or U.S. based operations, and off-shore, or operations located in countries outside the U.S., such as the Philippines. BPO allows the company to focus on what it does best, its core business practices, and outsources process driven functions, which others can do more cost effectively and efficiently.

BPO in the Philippines is an emerging industry fueled mostly by customer care, medical transcription, software development, animation, and shared services. In 2005 there were approximately 112,000 people working in call/communication centers bringing in about $1.12 billion in revenue. Though customer care communication centers form the largest part of the BPO boom locally, the Philippines’ language proficient information technology, human resource, and finance/accounting professionals are significant contributing factors as well. The proficiency of many Filipinos in the English language is a major factor in the growth of BPO in the Philippines. BPO is a fast growing industry, and is expected to grow 10 percent per year from $140 billion in 2005 to over $220 billion by 2010 (Logica CMC Study).

Our Services

Our state-of-the-art communications centers in both the U.S. and the Philippines are strategically located to take advantage of significant labor pools supporting many of the various languages spoken in the U.S. We have successfully implemented inbound, outbound and blended sales and customer support applications, hardware and software support, and back-office processing, among others. Based on our experience, we are capable of serving a multitude of markets that include telecommunications, financial services and banking, media/publishing, and consumer product companies.

Multilingual Capabilities

We literally “speak the language” of the marketplace, including: English, Spanish, French, Cantonese, Mandarin, Japanese, Korean, Tagalog, and Vietnamese. Our multicultural and multilingual staff has executed more than 400 marketing campaigns, customer activations, and customer service programs all in the language of cultural origin. This type of target marketing has fueled new growth and delivered increased revenue for a number of our clients.

We have found speaking to prospects and customers in their native language is an often over-looked foundation necessary to successfully service today’s diverse cultural marketplace. Over the years, statistics have shown sales conducted in-language deliver a 20%-30% conversion rate over English used on the same targets. The ability to communicate with a client’s prospects or customers in their native language has proven to deliver: significant retention of existing customer base; increased sales revenues; higher levels of understanding; and effective customer compliance.

By a client outsourcing its multicultural needs, it can reap the following advantages: (a) efficient utilization of its existing in-house resources, (b) access to state-of-the-art technology without capital expenditure, (c) access to a large pool of in-language agents, (d) elimination of the need to hire and train additional staff, (e) increased speed of execution for new products and services, and (f) instant expansion of its existing capacity.

We have a proven track record that clearly demonstrates our ability to deliver the most complex applications, while remaining sensitive to both the client’s and prospects needs. Our philosophy dictates that we establish a comprehensive business relationship with our clients in order to deliver a seamless experience for the external customer that is consistent with their overall vision and expectations.

2

Our Training

For two decades, we have combined proven processes, extensive experience and quality people to deliver the ultimate in telesales and customer care. We create a relationship with our clients in order to understand their business, goals and overall objectives. That information is communicated to the staff to provide a seamless experience for a client’s prospects and customers. If the client has training materials, we review the documents and move directly to a train-the-trainer methodology. If training materials are not available, our team collects the necessary information and develops the required modules to successfully complete the task. It all starts with finding the right people and we do an exceptional job of locating the right talent to support our clients’ applications.

At Access we deploy talented, proactive, and exceptionally well trained people on every campaign in order to deliver our clients the ultimate in performance. We gain a complete understanding of our client needs, goals, and overall program objectives, and then customize the recruiting and selection process to uncover highly-qualified employees who will excel in delivering client-specific solutions.

Whether we utilize existing personnel or recruit new candidates, all candidates are thoroughly screened through written tests, telephone interviews and role-playing scenarios before being deployed to service a program. Each applicant is rigorously tested and their specific customer service or sales experience is then rated to individual client requirements to determine best fit.

Fortunately, Access Worldwide is located in some of the best recruiting markets in the world. Our Philippine-based professionals are college-educated, speak fluent English with an American influence, and have an affinity for the U.S. culture. Our New England-based agents have an exceptionally strong work ethic and are extremely loyal; our agents based in the Mid-Atlantic region (Maryland, Washington DC, Virginia) are culturally diverse and often multi-lingual, and experienced in multiple industries. Our strategically placed centers and high quality reputation produces a steady stream of talented people to deploy on our client’s behalf.

Quality Assurance

To ensure lasting success, our management team continually evaluates the effectiveness of employee training and delivers continuous recurrent training programs. These training areas include our culture and commitment to quality, communication skills, customer care or sales skills, and system capabilities and efficiencies.

Our call monitoring is designed to ensure quality and consistency on each call handled by our agents. We have an independent department comprised of seasoned professionals to guarantee the quality of every application and call. Our Quality Assurance (“QA”) staff works with clients to determine the specific areas of measurement and will implement a monitoring schedule that is mutually agreed upon.

A combined effort between the supervisors and the QA department enables us to monitor each agent a minimum of 10 times per month. Both remote and side-by-side monitoring is utilized. The primary purpose of the observation is to ensure contract compliance, recognize superior performance and identify individual opportunities and training needs. The agents receive immediate feedback and are coached on techniques to improve their call handling skills.

Our remote monitoring function provides real-time remote monitoring capabilities. It is one of the most accessible and user-friendly systems in the industry today. This system will allow our clients to monitor our calls during normal hours of operation without intervention by our staff.

We have a sophisticated call tracking system that allows for flexibility in reporting. Our system has the capability of providing daily, weekly, monthly and cumulative reports. All of our clients receive daily production reports with the prior day’s activities. Additionally, our Internet scripting & data management system stores all data and statistics in an SQL database and allows for almost unlimited variations of reporting criteria.

The Technology and Infrastructure

To provide our clients with maximum flexibility and scalability (i.e. some clients utilize both our U.S. and Filipino resources to support different aspects of their program), we have developed an integrated network of five communication centers using solutions from Cisco (IPCC Enterprise), Rockwell (Spectrum), Microsoft (SQL Server), and Sprint (Voice & Data Network) that is based on an open design employing a multi-tiered client/server architecture. Our open platform architecture allows us to support the complete integration of systems whether internal or external in nature.

We can securely route inbound, multi-channel communications to the optimal location based on the type of interaction and on agent skill sets, and by using the same equipment, systems, and technology at all of our communication centers, we can meet all client disaster recovery and contingency requirements. Our overall system uptime exceeds 99.5% and we feature battery, generator, and data backups as part of our key emergency processes.

3

Our current technology platform delivers Customer Relationship Management (“CRM”) solutions authored in JAVA which fully leverages a browser-based application environment. Our customized CRM system delivers superior quality inbound and outbound communication center solutions which support the business processes of our clients. We are able to adapt our suite of solutions to meet the needs of our most sophisticated client’s requirements.

Our CRM platform is integrated with Concerto Software systems providing our communication centers with a full suite of proprietary Computer Telephony Integrated (“CTI”) functionality. The solution runs on a scaleable multi-server environment running on fault-tolerant LINUX or Microsoft Server platforms.

We employ the latest technology to effectively communicate with our client’s prospects and customers to deliver quality results in the areas of customer service, sales, and support. Our technology solutions are client-tailored allowing us to offer best of breed solutions to our clients. With a mix of customized proprietary system and commercial off the shelf solutions, we are able to provide maximum value to our end-users and customers by reducing costs and improving operational efficiencies.

Business Strategy

Our business strategy is simple; operate and grow the business on a cost-effective basis while positioning the Company to benefit from the continuing trend toward outsourcing. Our goal is to increase client satisfaction while at the same time, improve shareholder value. To obtain our goals we exploit market opportunities, drive internal growth, maintain technological leadership and continue to expand our international presence.

During 2006, we sold a division of the Company and discontinued operations of another. On June 20, 2006, the Board of Directors (the “Board”) approved an asset purchase agreement, to sell all or substantially all the assets of TMS Professional Markets Group (“TMS”), the Company’s Pharmaceutical Services division. On August 3, 2006, after receiving majority consent from our outstanding stockholders, we completed the sale, and the proceeds were used for not only working capital, but to assist us in our expansion into the Philippines. On December 5, 2006, the Board passed a resolution authorizing the Company to wind down the AM Medica Communications Group, the Pharmaceutical education division of the Company, and to discontinue operations on December 31, 2006. The sale and dissolution of the pharmaceutical services and education divisions of the Company will not only provide the Company with needed capital for expansion in the Philippines, but will allow management to focus its attention on BPO, which offers the Company considerable growth opportunities moving forward.

In each industry vertical that we compete, our goal is to build and maintain a leading position through flexibility and specialized services. Whether it is a telecommunications outbound winback campaign or an off-shore software development program we employ the requisite expertise to exploit the opportunity and ensure customer satisfaction. We have an extremely flexible structure, which allows us to work with small, medium and large program opportunities. For years we have demonstrated effectiveness in communicating our clients’ products and services to complex and hard-to-reach markets.

As Access continues to expand, we continue to invest in training and quality support for our staff. Our goal is to provide value added expertise at a competitive price. The investment in our staff translates into consistently high levels of customer satisfaction, which in turn, significantly impacts our client relationships. We will continue to invest in proprietary systems and technologies that will provide us with competitive advantages. Our technology strategy is driven by our objective to maximize reliability, integration and flexibility.

Fiscal 2006 was a big year for Access internationally. It was the first full fiscal year of our off-shore presence and by all accounts we consider it a successful one with revenues exceeding $5 million. With the opening of our second communication center toward the end of our first quarter in 2007, we look forward to continued growth. The Philippines has provided a highly educated work force, employees with excellent English language skills, and an enduring American influence. By the end of 2007 we expect to have three sites fully operational in the Philippines.

4

Patents, Trademarks, Service Marks & Licenses

Our service marks relate to the names, “Access Worldwide” and “Access Worldwide Communications, Inc.” and to our logo. The name, “Access Worldwide Communications, Inc.” and our logo received Certificates of Registration from the U.S. Patent and Trademark Office in 2001.

Our application for the name, “Access Worldwide,” has been registered with the U.S. Patent and Trademark Office since March 23, 2004. There is currently no known opposition to our use of the name Access Worldwide. If we were to lose the right to use the name “Access Worldwide” in our business, it could have a material, adverse effect on us.

Government Regulations

Several industries in which our clients operate are subject to varying degrees of government regulation, particularly the pharmaceutical, healthcare and telecommunications industries. Generally, compliance with these regulations is the responsibility of our client, but with the introduction of new regulations such as the national do-not-call registry in October 2003, it is imperative we stay vigilant in our efforts to comply. We could be subject to a variety of enforcement or private actions for our failure or the failure of our clients to conform to any number of these regulations.

Our communication centers must comply with a variety of regulations enforced by the Federal Communications Commission (“FCC”) and Federal Trade Commission (“FTC”).

The FCC rules under the Federal Telephone Consumer Act of 1991, which, among other things, limits the hours which telemarketers may call consumers and prohibits the use of automated telephone dialing equipment to call certain telephone numbers. The FCC also prohibits the unauthorized switching of subscribers’ long distance carriers, known in the industry as “slamming,” and a fine of up to $100,000 may be imposed for each instance of slamming

The FTC regulates under the Federal Telemarketing and Consumer Fraud and Abuse Protection Act of 1994 (“TCFAPA”) and Telemarketing Sales Rule (“TSR”). The TCFAPA broadly authorizes the FTC to issue regulations prohibiting misrepresentation in telephone sales. In 1995, the FTC issued regulations under the TCFAPA, which, among other things, require telemarketers to make certain disclosures when soliciting sales.

The FTC has amended the TSR and made changes to the regulation of predictive dialers, which is computerized dialing equipment that significantly increases the number of calls that can be generated and completed from a communication center. This technology can sometimes generate unanswered calls or calls that are answered by a person and abandoned. The FTC requires that no more than three percent of calls generated by predictive dials be answered by a person and abandoned, measured per day per calling campaign, and that the consumer’s phone must ring a minimum of 15 seconds (approximately 4 rings) before hang up. This revision went into effect on March 31, 2003.

The FTC has also amended the TSR to require telemarketers to play an identification message to each abandoned call effective October 1, 2003.

The telemarketing legislation that gained significant media attention during 2003 was the introduction of a national do-not-call registry. The registry, created by amending the TSR, went into effect on October 1, 2003. Consumers were invited to register their home telephone number(s) on the registry in an effort to reduce the number of incoming telemarketing solicitations. Telemarketers are required to search the registry at least every three months and remove the phone numbers of consumers who have registered from their databases. However, teleservices providers are allowed to contact consumers with whom they have an established business relationship for up to 18 months after the consumer’s last purchase, delivery or payment, even if the consumer’s telephone number is on the national do-not-call registry. Effective October 1, 2003, a consumer who receives a telemarketing call despite being on the registry is able to file a complaint with the FTC, with violators facing the possibility of being fined up to $11,000 per incident. In addition to federal regulation, teleservices providers must also comply with do-not-call lists that exist on the state level.

In January of 2004, the FTC began requiring that telemarketing firms identify themselves on Caller ID. The name displayed by Caller ID must either be the company trying to make a sale or the firm making the call. The display must also include a phone number that consumers can call during regular business hours and ask that the company no longer call them. Firms operating in geographical locations that do not have Caller ID technology do not have to comply.

We believe our operating procedures comply with the telephone solicitation rules of the FCC and FTC. However, we cannot assure you that additional federal or state legislation, or changes in regulatory implementation, would not limit our activities or our clients in the future or significantly increase the cost of regulatory compliance.

In regards to slamming, we believe that our training and other procedures are designed to prevent unauthorized switching. However, we cannot assure you that each employee will always follow our mandated procedures and applicable law. Accordingly, it is possible that employees may in some instances engage in unauthorized activities, including slamming.

5

We investigate consumer complaints reported to our telecommunications clients and report the results to such clients. To our knowledge, no FCC complaint has been brought against any of our clients as a result of our services. We believe that the FCC generally examines the sales activities of long distance telecommunications providers, including our clients, and the activities of outside vendors, such as the Company. If any complaints were brought against a client of ours, that client might assert that such complaints constituted a breach of its agreement with us and, if material, seek to terminate the contract. Any termination by our largest teleservices clients, two of which are AT&T and E*Trade Financial Corporation, which represent 47% and 12% of our total consolidated revenue for the year ended December 31, 2006, respectively, would likely have a material adverse effect on the Company.

The majority of states require outbound telemarketers to comply with various registration and disclosure requirements. As a publicly traded company, we are exempt from the majority of these filing requirements. However, failure to comply with these requirements could result in fines and/or a ban on calls into states where a violation may occur.

Our Competition

The BPO industry in which we operate is very competitive and highly fragmented. We compete with other outsourced marketing services companies, ranging in size from very small companies offering specialized applications or short-term projects to larger more independent companies. While many companies provide outsourced marketing services, we believe there is no single company that dominates the entire industry.

There are significant barriers to entry into the outsourced marketing services industry. Some of these barriers include (i) large capital investment towards the development and maintenance of the necessary information technology systems; (ii) marketing knowledge and expertise within the market; (iii) the ability to simultaneously manage complex marketing programs in multiple jurisdictions, including off-shore; (iv) the establishment of solid working relationships with clients; and (v) an understanding of the complexities surrounding state, federal and foreign government regulation of the industry. From years of experience in the marketplace, Access has overcome these road blocks and become a strong competitor in the market.

Within the teleservices industry there are many companies offering one or more of the following services: center management, customer service, sales, consulting, lead generation, fulfillment and database management services. Teleservices vendors may be selected based on a number of factors including price, range of services, expertise, speed to program execution, and industry reputation, among others. We compete with both small and large teleservices companies, such as APAC Customer Services, Convergys Corporation, ICT Group, Inc., PeopleSupport, Inc., SITEL Corporation, Sykes Enterprises, TeleTech Holdings, Inc., and West Corporation.

Some clients use more than one teleservices firm at a time and reallocate work among the various providers. This creates a project-by-project comparison of the performance of the various vendors which helps the client maintain a competitive marketplace.

While telephone marketing is only one aspect of BPO, it is still a major factor in the marketing industry. The telephone marketing industry represented 29% ($47 Billion) of the total mix of direct marketing advertising dollars in 2005.

Employees

As of December 31, 2006, the Company had approximately 1,000 employees domestically and overseas. None of our employees are represented by a labor union and we are not aware of any current activity to organize any of the employees. Management considers relations between the Company and its employees to be good.

Availability of Reports and Other Information

Our corporate website is http://www.accessww.com. We make available on this website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 as soon as reasonably practicable after we have electronically submitted such material to the Securities and Exchange Commission (the “Commission”). Our corporate website also contains our Corporate Governance Guidelines, Code of Ethics and Charter of the Audit Committee of the Board of Directors. Information contained in our website is not deemed incorporated into this Annual Report on Form 10K. In addition, the Commission’s website is http://www.sec.gov. The Commission makes available on its website, free of charge, reports, proxy and information statements, and other information regarding issuers, such as us, who file electronically with the Commission. Information on our website or the Commission’s website is not part of this document.

The following are certain risk factors that could affect our business, financial performance, and results of operations. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Form 10-K,

6

as the forward-looking statements are based on current expectations, and actual results and conditions could differ materially from the current expectations. Investing in our securities involves a high degree of risk, and before making an investment decision, you should carefully consider these risk factors as well as other information we include or incorporate by reference in the other reports we file with the Securities and Exchange Commission (“Commission”).

In addition to other information set forth in this report, readers should carefully consider the following risk factors in evaluating Access Worldwide and our business. Any of these risks could materially adversely affect our business, financial condition, or results of operations. These risks could also cause our actual results to differ materially from those indicated in the forward-looking statements contained herein and elsewhere. The risks described below are not the only risks facing us. Additional risks not currently known to us or those we currently deem to be immaterial may also materially and adversely affect our business operations.

Risks Related to Our Business

We have incurred significant losses over the last three years and we may never achieve or sustain profitability.

We have an accumulated deficit of $72.7 million through December 31, 2006, and although we have a net income of $2.9 million for the year ended December 31, 2006, we may never achieve operating profit. We will need to generate significantly higher revenues to sustain profitability, and we cannot be certain that we will realize sufficient revenues or operating profit to sustain our business.

We may not be able to obtain additional capital to fund our operations on reasonable terms and this could hurt our business and negatively impact our stockholders.

If adequate funds in the form of equity or debt are not available on reasonable terms or terms acceptable to us in the future, we may be unable to continue as a going concern. If we raise additional funds through the issuance of convertible debt or additional equity securities, the percentage ownership of our existing stockholders would be reduced, the securities issued may have rights, preferences and privileges senior to those of holders of our common stock, and the terms of the securities may impose restrictions on our operations.

Ability to pay Convertible Notes and possible dilution.

We have limited cash resources and our inability to make principal payments on our Convertible Notes would result in the award of default warrants to each holder of a note, and subsequent dilution. Our Convertible Notes dated December 14, 2004, for $1.15 million (“Convertible Notes II”), will be due during March of 2008. If Convertible Notes II is not repaid or refinanced, then Convertible Notes II will be in default and will accrue interest at the default rate of 16% retroactive to the issuance date and default warrants will become effective. The default interest will continue to accrue until such time that the Convertible Notes II are repaid or converted.

Conversion of the Convertible Notes will significantly dilute the percentage ownership of our existing stockholders.

If shares of our common stock are issued to the investors upon conversion of all our outstanding Convertible Notes, existing stockholders will have their ownership percentage substantially diluted. The number of shares of common stock issuable under the terms of the Convertible Notes will also affect our loss or earnings per share on a going-forward basis. The larger the number of shares deemed outstanding, the lower our earnings per share will be. The actual effect of any conversion on our loss or earnings per share will depend on the level of our losses or earnings in future periods, and the actual amount converted pursuant to the Convertible Notes. At December 31, 2006, $3.14 million in principal under Convertible Notes I, amended June 12, 2006, and Convertible Notes II dated December 14, 2004, are convertible into 3.14 million shares of our common stock. On March 17, 2006, we completed the issuance of Convertible Notes IV for approximately $2.5 million of proceeds which is convertible into 5.0 million shares of our common stock.

We could be severely impacted by the loss of any of our largest clients.

Our three largest clients, AT&T (which consists of AT&T, SBC and Bell South), E*Trade Financial Corporation, and ALL OEM (US Auto Parts Network, Inc.) together accounted for approximately 64% of Access Worldwide’s revenues for the year ended December 31, 2006. There can be no assurance that these clients will continue to do business with us, and the loss of business from any of these clients could have a material adverse effect on us.

Our growth is dependent on various factors.

Our business and future operations depend significantly on our ability to utilize our existing infrastructure and databases to perform services for new clients, as well as on our ability to develop and successfully implement new marketing methods or channels for new services for existing clients.

7

Continued growth will also depend on a number of other factors, including, but not limited to, our ability to:

| | • | | Maintain the high quality of services we provide to customers; |

| | • | | Recruit, motivate and retain qualified personnel; |

| | • | | Train existing sales representatives or recruit new sales representatives to sell various categories of services; and; |

| | • | | Open new service facilities in a timely and cost-effective manner. |

In light of, among other things, our limited resources, we cannot assure you that we will be able to execute our strategy effectively. Any growth that we would be able to attain would require the implementation of enhanced operational and financial systems and resources, as well as additional management of the resources needed for which we may not have available. Any such growth, if not managed effectively, could have a material adverse effect on us.

Our future growth is dependent on the trend toward outsourcing.

Our business and future operations depend largely on the industry trend toward outsourcing marketing services. There can be no assurance that this trend will continue, as companies may elect to perform such services internally. A significant change in the direction of this trend could have a material adverse effect on us.

The sale of all or substantially all the assets of our TMS Professional Markets Group division could negatively impact our future growth.

The TMS Professional Markets Group division was an integral part of Access Worldwide’s operation. Not only did TMS contribute financially to our operations, it also allowed for a more diversified portfolio of service offerings. Without TMS, we will no longer be able to focus on serving the Pharmaceutical Services segment and will therefore lose those potential revenue streams.

We are heavily dependent on the industries we serve, particularly the telecommunications industries.

Our business and future operations are dependent to a great extent on the industries we serve. There can be no assurance that the telecommunications industry will grow or that it will continue to utilize entities such as Access Worldwide for outsourced marketing services. In addition, there can be no assurance that our business will benefit from any growth that these industries experience.

These industries are heavily regulated by federal and state authorities. Existing regulation, or increased regulation in the future, could negatively impact the ability of the industries to operate or grow. Anything that inhibits the operations or growth of the telecommunications industry could have a material adverse effect on us.

We rely on technology and could be adversely affected if we are unable to maintain facilities with the needed equipment.

We have invested significant funds in specialized telecommunications and computer technologies and equipment to provide customized solutions to meet our clients’ needs. In addition, we have invested significantly in sophisticated proprietary databases and software that enable us to market our clients’ products to targeted markets. We anticipate that it will be necessary to continue to select, invest in and develop new and enhanced technology and proprietary databases on a timely basis in the future in order to maintain our competitiveness.

We have leased equipment and have expended substantial time and resources to train our personnel in the operation of our existing equipment and to integrate the operations of our systems and facilities. In the event of substantial improvements in computer technologies and telecommunications equipment, we may be required to acquire such new technologies and equipment at significant cost and/or phase out a portion of our existing equipment. There can be no assurance that our technologies and equipment will not be rendered obsolete or our services rendered less marketable. In addition, we cannot assure you that we will be able to continue to develop and maintain the technology and systems necessary for our business.

We are dependent on key personnel and may be affected by changes in senior management.

Our success depends in large part upon the abilities and continued service of our key management personnel. Our failure to retain the services of all of our key personnel could have a material adverse effect on our business, including our financial condition and results of operations. In addition, in order to support any growth that we are able to effectuate, we will be required to recruit and retain additional qualified management personnel. In light of our limited resources, we cannot assure you that we will be able to recruit and retain such personnel. Our inability to attract and retain such personnel could have a material adverse effect on our business, financial condition and results of operations.

8

We are dependent on our labor force and could be affected by potentially high turnover rates.

Many aspects of our business are labor intensive, and based on the transient nature of our work force, there is a potential for high personnel turnover. Our operations typically require specially trained persons, such as those employees who market services and products in languages other than English. A higher turnover rate among our employees would increase our recruiting and training costs and decrease operating efficiencies and productivity. In addition, any growth in our business will require us to recruit and train qualified personnel at an accelerated rate from time to time. There can be no assurance that we will be able to continue to hire, train and retain a sufficient labor force of qualified persons to meet the needs of our business.

We could be affected by a business interruption.

Our business is highly dependent on our computer, software and telephone equipment. The temporary or permanent loss of such systems or equipment, through casualty or operating malfunction, or a significant increase in the cost of telephone services that is not recoverable through an increase in the price of our services, could have a material adverse affect on us. Our property and business interruption insurance may not adequately compensate us for all losses that we may incur in any such event.

Our stock price has declined substantially at times in the previous year and may become more volatile.

The market price of Access Worldwide’s common stock has fluctuated in the past and is likely to fluctuate in the future as well. During the 2006 fiscal year, our stock’s closing price fluctuated from a low of $0.32 to a high of $1.01. During that time period, the average trading volume was 3,001 shares per day, but the volatility of the price is often driven by trading volumes that can total less than 2,000 shares of common stock per day. With this level of volume, small trades can have a significant impact on the price. Additional factors that may have a significant impact on the market price of the stock include:

| | • | | Future announcements concerning Access Worldwide or our competitors; |

| | • | | Results of technological innovations or service extensions; |

| | • | | Government regulations; and |

| | • | | Changes in general market conditions, particularly in the market for micro-cap stocks. |

Shortfalls in Access Worldwide’s revenues or earnings in any given period relative to any expectations in the securities markets could immediately, significantly and adversely affect the trading price of the common stock. We have experienced and may experience future quarter to quarter fluctuations in our results of operations. Quarterly results of operations may fluctuate as a result of a variety of factors, including, but not limited to, the size and timing of client orders, changes in client budgets, material variations in the cost of telephone services, the demand for our services, the timing of the introduction of new services and service enhancements by us, the market acceptance of new services, competitive conditions in the industries we serve, our ability to effectuate any strategic transactions and general economic conditions. These factors, either individually or in the aggregate, could result in decreasing revenues and earnings, which could, in turn, materially and adversely affect the price of our common stock.

We face risk due to our stock trading on the Over the Counter Bulletin Board (“OTCBB”).

Because our stock trades on the OTCBB and not on an exchange or the NASDAQ National Market or NASDAQ Capital Market, we have less ability to access the public equity and debt markets, should it be necessary or advisable to do so, than if our stock traded on one of those other more recognizable trading venues.

We face a risk that we may not be able to successfully operate our communication center in Manila, Philippines.

Our communication centers in the Philippines have only been open for less than two years, and represent our first off-shore presence. These centers required substantial investment, the establishment of a Philippines management team, and securing contracts to perform work in these facilities. The inability to continue to execute one or all of the above items would have a material adverse effect on us.

Risks Related to Our Industry

We may be adversely impacted by competition, industry consolidation and potential consumer saturation.

The outsourced marketing services industry in which we operate is very competitive and highly fragmented. We compete with other BPO and outsourced marketing services companies, ranging in size from very small companies offering specialized applications or short-term projects to large independent companies. While many companies provide outsourced marketing services, we believe that there is no single company that dominates the entire industry. A significant number of our competitors and potential competitors have more extensive marketing capabilities, more extensive experience and greater financial resources than us. Consolidation among prospective clients also increases competition for buyers of our services. There can be no assurance that we will be able to compete successfully or that competitive pressures will not materially and adversely affect us.

9

We were impacted by the events of September 11, 2001 and may be impacted in the future by events of a similar nature, war and other international conflicts.

Our businesses were impacted by the events of September 11, 2001 when we experienced, among other things, lost production days at our communication centers.

To the extent that there are any further events of a nature similar to that of September 11, 2001, war and other international conflicts, or a prolonged downturn in the U.S. economy, our financial condition and results of operations could be materially adversely affected.

We are subject to extensive regulations and compliance with these regulations can be costly, time consuming and subject us to fines for non-compliance.

Several industries in which our clients operate are subject to varying degrees of governmental regulation, in particular the telecommunications industry. Generally, compliance with these regulations is the responsibility of our clients. However, we are exposed to a variety of enforcement or private actions for our failure or the failure of our clients to comply with such regulations.

Our communication centers must comply with a variety of regulations. We believe our operating procedures comply with the telephone solicitation rules of the FCC and FTC. However, we cannot assure you that additional federal or state legislation, or changes in regulatory implementation, would not limit the activities of the Company or our clients in the future or significantly increase the cost of regulatory compliance.

In addition, the majority of states require outbound telemarketers to comply with various registration and documentation requirements. Failure to comply with the registration requirements could result in fines and call prohibitions which could have a material adverse effect on us.

FORWARD-LOOKING STATEMENTS

From time to time, including in this report, we may publish forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. Those statements represent our current expectations, beliefs, future plans and strategies, anticipated events or trends concerning matters that are not historical facts. Such forward-looking statements include, among others:

| | • | | Statements regarding proposed activities pursuant to agreements with clients; |

| | • | | Future plans relating to our business strategy; and, |

| | • | | Trends, or proposals, or activities of clients or industries which we serve. |

Such statements involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited, to the following:

| | • | | Competition from other third-party providers and those of our clients and prospects who may decide to do the work that we do in-house; |

| | • | | Industry consolidation which reduces the number of clients that we are able to serve; |

| | • | | Potential consumer saturation reducing the need for our services; |

| | • | | Certain needs for our growth; |

| | • | | Our dependence on the continuation of the trend toward outsourcing; |

| | • | | Dependence on the industries we serve; |

| | • | | Our ability and our clients’ ability to comply with state, federal and industry regulations; |

| | • | | Reliance on a limited number of major clients; |

| | • | | The effects of possible contract cancellations; |

| | • | | Reliance on technology; |

| | • | | Reliance on key personnel and recent changes in management; |

| | • | | Reliance on our labor force; |

| | • | | The possible impact of terrorist activity or attacks, war and other international conflicts, and a downturn in the US economy; |

| | • | | The effects of an interruption of our business; |

| | • | | The volatility of our stock price; |

| | • | | Risks associated with our stock trading on the OTC Bulletin Board; and |

| | • | | Our inability to successfully operate our communication center in the Philippines. |

10

Our principal executive offices are located in Arlington, Virginia. We have operations in Maryland, Virginia and Maine, domestically, and internationally, in Manila, Philippines. All of our facilities are leased and have lease terms of two to ten years. The new center in Manila, Philippines adds approximately 17,600 square feet to our facility space. We believe that our current facilities are adequate for our needs for the foreseeable future. Set forth below is a list of the facilities that we currently utilize.

| | | | |

Location | | Principal Use | | Approx. Square Feet |

Business Services Segment: | | | | |

| Arlington (Roslyn), VA | | Corporate Headquarters | | 3,000 |

| Boca Raton, FL | | Administrative Offices | | 2,000 |

| Arlington (Roslyn), VA | | Customer Sales and Service Programs | | 33,300 |

| Hyattsville, MD | | Customer Sales and Service Programs | | 24,500 |

| Augusta, ME | | Customer Sales and Service Programs | | 15,000 |

| Manila, Philippines | | Customer Sales and Service Programs | | 18,000 |

| Manila, Philippines | | Customer Sales and Service Programs | | 17,600 |

None

| Item 4. | Submission of Matters to a Vote of Security Holders |

None.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

(a) Market Information

Our common stock trades on the Over the Counter Bulletin Board under the symbol “AWWC.” The over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions. The following table sets forth the high and low intra-day sale prices for our common stock as reported by the markets in which our stock traded for the periods indicated:

| | | | | | | | | | | | |

| | | Market Prices |

| | | 2006 | | 2005 |

Fiscal Quarters | | High | | Low | | High | | Low |

First Quarter | | $ | 0.54 | | $ | 0.47 | | $ | 0.87 | | $ | 0.76 |

Second Quarter | | | 0.60 | | | 0.32 | | | 0.98 | | | 0.75 |

Third Quarter | | | 0.46 | | | 0.32 | | | 0.94 | | | 0.47 |

Fourth Quarter | | | 1.01 | | | 0.38 | | | 0.66 | | | 0.51 |

(b) Holders

The number of record holders of common stock as of March 28, 2007 was 227 and the number of beneficial owners of common stock as of March 28, 2007 was approximately 582.

(c) Dividends

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends on our common stock in the foreseeable future.

(d) Stock Performance Graph

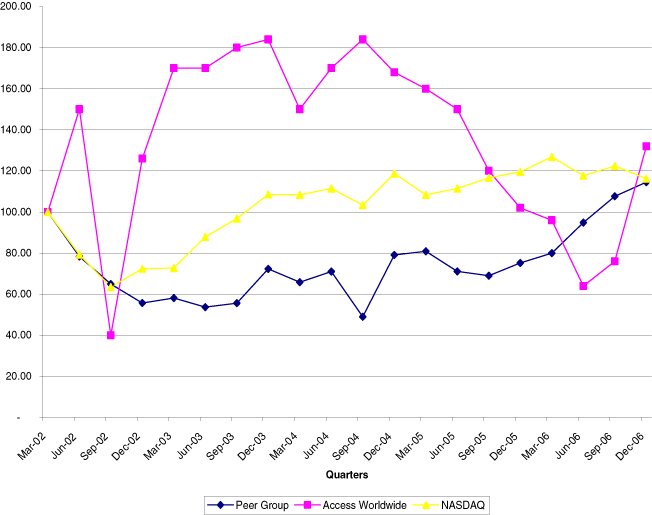

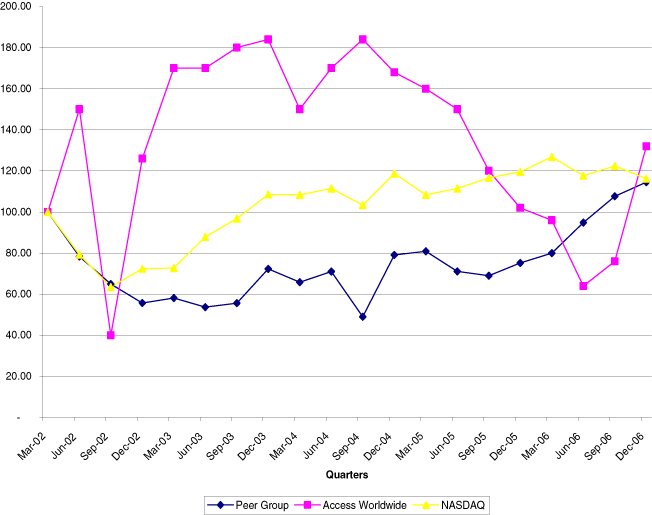

Out common stock began trading on the Nasdaq National Market System on February 13, 1998 when its initial public offering commenced. Since July 17, 2001, the Company’s Common Stock has traded on the Over the Counter Bulletin Board. The following performance graph shows the total return to stockholders of an investment in the Company’s Common Stock as compared to an investment in (i) the Nasdaq Composite Index and (ii) a peer group made up of PeopleSupport, Inc., Parexel International Corporation, TeleTech Holdings, and Convergys, Inc. (the “Peer Group”) for the period commencing January 1, 2002 and ending December 31, 2006. The data assumes that $100 was invested on January 1, 2002 in each of the Company’s Common Stock, the Nasdaq Composite Index and companies in the Peer Group Index (on a weighted market value basis) and that all dividends were reinvested. The Company has never paid any dividends.

11

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG

THE NASDAQ COMPOSITE INDEX,

THE PEER GROUP INDEX, AND

ACCESS WORLDWIDE COMMUNICATIONS, INC.

| | | | | | | | | | | | | | | |

| | | 12/31/2002 | | 12/31/2003 | | 12/31/2004 | | 12/31/2005 | | 12/31/2006 |

AWWC | | $ | 63 | | $ | 92 | | $ | 84 | | $ | 102 | | $ | 132 |

NASDAQ | | $ | 72 | | $ | 109 | | $ | 119 | | $ | 120 | | $ | 116 |

Peer Group | | $ | 56 | | $ | 72 | | $ | 79 | | $ | 75 | | $ | 115 |

12

ITEM 6. SELECTED FINANCIAL DATA (UNAUDITED)

The following tables present summarized historical consolidated financial data as of and for the years ended, December 31, 2006, 2005, 2004, 2003 and 2002. Our summarized consolidated financial data as of, and for the years ended December 31, 2006, 2005 and 2004 has been derived from our audited consolidated financial statements included in this Annual Report on Form 10-K. The 2006 audited financial statements, and reclassification of discontinued operations in the 2005 and 2004 consolidated financial statements were audited by DaszkalBolton LLP and the 2005 and 2004 audited financial statements were audited by BDO Seidman, LLP. You should read this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes for the years ended December 31, 2006, 2005 and 2004 which are included elsewhere in the Annual Report on Form 10K. Historical results are not necessarily indicative of the results to be expected in the future.

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

| | | (In Thousands Except for Per Share Data) | |

Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 27,712 | | | $ | 14,809 | | | $ | 22,359 | | | $ | 28,250 | | | $ | 21,564 | |

Cost of services | | | 21,315 | | | | 13,145 | | | | 17,443 | | | | 20,447 | | | | 14,921 | |

Selling, general and administrative expenses | | | 6,558 | | | | 4,498 | | | | 5,394 | | | | 6,324 | | | | 4,976 | |

Depreciation expense | | | 1,038 | | | | 893 | | | | 658 | | | | 1,062 | | | | 1,133 | |

| | | | | | | | | | | | | | | | | | | | |

Total cost and expenses | | | 28,911 | | | | 18,536 | | | | 23,495 | | | | 27,833 | | | | 21,030 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income from operations | | | (1,199 | ) | | | (3,727 | ) | | | (1,136 | ) | | | 417 | | | | 534 | |

Interest income | | | 117 | | | | 32 | | | | 10 | | | | 5 | | | | 14 | |

Interest income – related parties | | | — | | | | — | | | | — | | | | — | | | | — | |

Interest expense – related parties | | | (131 | ) | | | (92 | ) | | | (87 | ) | | | (112 | ) | | | (285 | ) |

Interest expense – unrelated parties | | | (3,038 | ) | | | (1,667 | ) | | | (1,238 | ) | | | (1,255 | ) | | | (523 | ) |

Other expense | | | | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (4,251 | ) | | | (5,454 | ) | | | (2,451 | ) | | | 945 | | | | (260 | ) |

Income tax (benefit) expense | | | — | | | | — | | | | — | | | | 546 | | | | (139 | ) |

(Loss) income from continuing operations | | | (4,251 | ) | | | (5,454 | ) | | | (2,451 | ) | | | (399 | ) | | | (121 | ) |

Discontinued operations(2)(1): | | | | | | | | | | | | | | | | | | | | |

Loss from discontinued operations, net of income tax(1) | | | (592 | ) | | | 773 | | | | 1,040 | | | | (11,242 | ) | | | (857 | ) |

Gain on disposal of segment, net of income tax expense of $1,506 for 2002. | | | 7,729 | | | | — | | | | — | | | | — | | | | 8,869 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from discontinued operations | | | 7,137 | | | | 773 | | | | 1,040 | | | | (11,242 | ) | | | 8,012 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 2,886 | | | | (4,681 | ) | | | (1,411 | ) | | | (11,641 | ) | | | 7,891 | |

Deemed dividend – warrants issued to certain stockholders | | | — | | | | (740 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) applicable to common stockholders | | $ | 2,886 | | | $ | (5,421 | ) | | $ | (1,411 | ) | | $ | (11,641 | ) | | $ | 7,891 | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share of common stock: | | | | | | | | | | | | | | | | | | | | |

Continuing operations | | $ | (0.25 | ) | | $ | (0.42 | ) | | $ | (0.24 | ) | | $ | (0.04 | ) | | $ | (0.01 | ) |

Discontinued operations | | $ | 0.41 | | | $ | 0.06 | | | $ | (0.10 | ) | | $ | (1.15 | ) | | $ | 0.82 | |

Net income (loss) | | $ | 0.17 | | | $ | (0.41 | ) | | $ | (0.14 | ) | | $ | (1.20 | ) | | $ | 0.81 | |

Weighted average common shares outstanding | | | 17,340,065 | | | | 13,084,761 | | | | 10,008,271 | | | | 9,740,418 | | | | 9,740,001 | |

Diluted earnings (loss) per share of common stock: | | | | | | | | | | | | | | | | | | | | |

Continuing operations | | $ | (0.25 | ) | | $ | (0.42 | ) | | $ | (0.24 | ) | | $ | (0.04 | ) | | $ | (0.01 | ) |

Discontinued operations | | $ | 0.41 | | | $ | 0.06 | | | $ | (0.10 | ) | | $ | (1.15 | ) | | $ | 0.82 | |

Net income (loss)(3) | | $ | 0.17 | | | $ | (0.41 | ) | | $ | (0.14 | ) | | $ | (1.20 | ) | | $ | 0.81 | |

Weighted average common shares outstanding | | | 17,340,065 | | | | 13,084,761 | | | | 10,008,271 | | | | 9,740,418 | | | | 9,740,001 | |

13

| | | | | | | | | | | | | | | | | | | |

| | | As of December 31, |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 |

| | | (In Thousands Except for Per Share Data) |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

Current assets | | $ | 10,756 | | | $ | 10,381 | | | $ | 11,660 | | | $ | 14,451 | | | $ | 15,394 |

Total assets | | | 14,860 | | | | 16,263 | | | | 16,010 | | | | 19,479 | (1) | | | 29,431 |

Current liabilities | | | 6,624 | | | | 14,477 | | | | 13,526 | | | | 17,368 | | | | 18,462 |

Long-term debt, less current maturities | | | 4,885 | | | | 2,050 | | | | 1,563 | | | | 1,085 | | | | 52 |

Mandatorily redeemable preferred stock | | | 4,000 | | | | 4,000 | | | | 4,000 | | | | 4,000 | | | | 4,000 |

Common stockholders’ (deficit) equity | | | (1,180 | ) | | | (5,060 | ) | | | (3,865 | ) | | | (3,750 | ) | | | 6,603 |

| (1) | In 2003, we recorded an impairment charge of approximately $9.0 million in accordance with FASB 142, “Goodwill and Other Intangible Assets” and FASB 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”. |

| (2) | In accordance with FASB 144, we have reclassified as discontinued operations, the operations of our Cultural Access Group and Phoenix divisions which were sold in the first quarter of 2002, our TMS Professional Markets Group which we sold in July 2006, and our AM Medica Group which discontinued business as of December 31, 2006. |

| (3) | Since the effects of outstanding stock options, common stock equivalents, and warrants are anti-dilutive, these effects have not been included in the calculation of diluted EPS. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Many of the statements included in this Annual Report on Form 10-K contains forward-looking statements and information relating to our company. We generally identify forward-looking statements by the use of terminology such as “may,” “will,” “could,” “should,” “potential,” “continue,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” or similar phrases or the negatives of such terms. We base these statements on our beliefs as well as assumptions we made using information currently available to us. Such statements are subject to risks, uncertainties and assumptions, including those identified in “Risk Factors,” as well as other matters not currently considered material by us. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Important factors that may affect these projections or expectations include, but are not limited to those discussed in “Risk Factors.”

Given such risks and uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements. Forward-looking statements do not guarantee future performance and should not be considered as statements of fact.

These forward-looking statements speak only as of the date of this report and, unless required by law, we undertake no obligation to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should, however, review the factors and risks we describe in other reports and documents we will file with the Commission after the date of this Annual Report.

14

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion of our financial condition and results of operations should be read in conjunction with Selected Financial Data and our Consolidated Financial Statements and the Notes thereto included elsewhere in this Form 10-K.

OVERVIEW

Access Worldwide Communications, Inc. (“Access Worldwide,” “Access,” “we,” “our,” “us” or the “Company” refers to Access Worldwide and/or, as the context requires, one or more of our subsidiaries) was incorporated in the State of Delaware on August 11, 1983 and has been a provider of outsourced sales and marketing services since its inception. Over the past couple of years Access has sold various non-core businesses to focus on the rapidly growing business process outsourcing (“BPO”) market. Access is a provider of customer management services in the Telecommunications, Financial Services, Retail/Catalog and Media industries. Access currently has over 1,000 employees worldwide with communication centers in the U.S. and the Philippines.

QUARTERLY RESULTSOFOPERATIONSANDPERFORMANCETRENDS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarters Ended | |

| | | Dec. 31, 2006 | | | Sept. 30, 2006 | | | June 30, 2006 | | | March 31, 2006 | | | Dec. 31, 2005 | | | Sept. 30, 2005 | | | June 30, 2005 | | | March 31,

2005 | |

| | | (In Thousands Except for Per Share Data) | |

Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 8,467 | | | $ | 7,406 | | | $ | 6,336 | | | $ | 5,503 | | | $ | 4,689 | | | $ | 3,267 | | | $ | 3,286 | | | $ | 3,567 | |

(Loss) from continuing operations | | | (328 | ) | | | (1,815 | ) | | | (1,105 | ) | | | (1,003 | ) | | | (1,168 | ) | | | (1,820 | ) | | | (1,430 | ) | | | (1,036 | ) |

(Loss) income from discontinued operations | | | (458 | ) | | | 8,193 | | | | (468 | ) | | | (130 | ) | | | (236 | ) | | | (197 | ) | | | 740 | | | | 466 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (786 | ) | | $ | 6,378 | | | $ | (1,573 | ) | | $ | (1,133 | ) | | $ | (1,404 | ) | | $ | (2,017 | ) | | $ | (690 | ) | | $ | (570 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic (loss) earnings per share of common stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Continuing Operations Discontinued Operations Net (loss) income | | $

$

$ | (0.02

(0.03

(0.04 | )

)

) | | $

$

$ | (0.11

0.47

0.37 | )

| | $

$

$ | (0.06

(0.03

(0.09 | )

)

) | | $

$

$ | (0.06

(0.00

(0.07 | )

)

) | | $

$

$ | (0.07

(0.01

(0.08 | )

)

) | | $

$

$ | (0.13

(0.01

(0.20 | )

)

) | | $

$

$ | (0.13

0.07

(0.06 | )

) | | $

$

$ | (0.09

0.04

(0.05 | )

) |

Weighted average common shares outstanding | | | 17,340,065 | | | | 17,340,065 | | | | 17,350,507 | | | | 16,889,039 | | | | 16,609,552 | | | | 13,599,552 | | | | 11,286,219 | | | | 11,177,052 | |

Diluted (loss) earnings per share of common stock:(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Continuing Operations. Discontinued Operations Net (loss) income | | $

$

$ | (0.02

(0.03

(0.04 | )

)

) | | $

$

$ | (0.11

(0.47

0.37 | )

)

| | $

$

$ | (0.06

(0.03

(0.09 | )

)

) | | $

$

$ | (0.06

(0.00

(0.07 | )

)

) | | $

$

$ | (0.07

(0.01

(0.08 | )

)

) | | $

$

$ | (0.13

(0.01

(0.20 | )

)

) | | $

$

$ | (0.13

0.07

(0.06 | )

) | | $

$

$ | (0.09

0.04

(0.05 | )

) |

Weighted average common shares outstanding | | | 17,340,065 | | | | 17,340,065 | | | | 17,350,507 | | | | 16,889,039 | | | | 16,609,552 | | | | 13,599,552 | | | | 11,286,219 | | | | 11,177,052 | |

| (1) | Since the effects of outstanding stock options, common stock equivalents, and warrants are anti-dilutive for all quarters in 2006 and 2005, these effects have not been included in the calculation of diluted earning per share. |

15

CRITICAL ACCOUNTING POLICIESAND ESTIMATES

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, sales and expenses as well as the disclosure of contingent assets and liabilities. We regularly review our estimates and assumptions. Our estimates and assumptions, which are based upon historical experience and on various other factors which we believed to be reasonable under the circumstances, form the basis of our judgments about the carrying values of our assets and liabilities that are not readily apparent from other sources. Our reported amounts and disclosures may have been different had management used different estimates and assumptions or if different conditions had occurred in the periods presented. Our accounting policies can be found inNote 2to our Consolidated Financial Statements. Below is a discussion of the policies that we believe may involve a high degree of judgment and complexity.

REVENUES

Our customer management revenues are recognized based on rates per production hour, talk time, fixed monthly fee and phone calls placed and/or received which end in sales. We recognized revenues when we have no significant obligations remaining, fees are fixed and determinable and collection of the related accounts receivable is reasonably assured.

As of December 31, 2006, we no longer provide medical education and meeting program services for which revenues were recognized on a percentage of completion methodology using project milestones, which at times results in unbilled receivables and favorable and unfavorable cost variances.

ACCOUNTSRECEIVABLE

We extend credit to our customers in the normal course of business. Our accounts receivable are concentrated in a relatively few number of customers most of which are Fortune 500 companies. However a significant change in the liquidity or financial position of these customers could have a material adverse impact on the collectability of our accounts receivable and our future operating results. We continuously monitor accounts receivable balances and payments from our customers and maintain an allowance for doubtful accounts based upon historical experience and any specific customer collection issues. For the years ended December 31, 2006 and 2005, we maintain allowance for doubtful accounts of $99,130 and $61,994, respectively. While our bad debt expenses have been historically within our expectations and the allowances we established, we cannot guarantee that we will continue to have the same experience in the future. Management’s assessment and judgment are vital in assessing the ultimate realization of accounts receivable, which include the credit-worthiness, financial stability and effects of market conditions on each customer.

VALUATIONOFLONG-LIVEDASSETS

We review our long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount may not be fully recoverable. If we determine that the carrying amount of long-lived assets may not be fully recoverable, we measure impairment by comparing the asset’s estimated fair value to its carrying value. We determine fair value based on quoted market prices in active markets, if available, or independent appraisals; sales price negotiations; or projected future cash flows discounted at a rate we believe to be commensurate with our business risk. When we estimate fair value utilizing discounted forecasted cash flows, it includes significant judgment regarding assumptions of revenue, operating and marketing costs; selling and administrative expenses; interest rates; property, plant and equipment additions and retirements; and industry competition and general economic and business conditions, among other factors.

INCOMETAXES

We recognize deferred tax assets and liabilities based on differences between financial statement carrying amounts and its tax basis. We assessing the need for a valuation allowance we consider tax loss carrybacks, reversal of deferred tax liabilities, tax planning and estimates of future taxable income. When we determine that we are unable to realize deferred tax assets in excess of our recorded amount, an adjustment to the deferred tax asset is made which increases income. Likewise, if we determine that we would not be able to realize all or part of our net deferred tax assets in the future, an adjustment to the deferred tax assets is made which would decrease income.

ACCOUNTINGFOR STOCK-BASED COMPENSATION

FASB Statement No. 123,Accounting for Stock-Based Compensation(“SFAS No. 123”), defines a fair value method of accounting for issuance of stock options and other equity instruments. Under the fair value method, compensation cost is measured at the grant date based on the fair value of the award and is recognized over the service period, which is usually the vesting period. Pursuant to SFAS No. 123, we were not required to adopt the fair value method of accounting for employee stock-based transactions through December 31, 2005. We were permitted to account for such transactions under APB Opinion No. 25,Accounting for Stock Issued to Employees(“APB No. 25”), which defines an intrinsic value method of accounting for the issuance of stock options and other

16

equity instruments, but are required to disclose in a note to our consolidated financial statements pro forma net income and per share amounts as if we had applied the methods prescribed by SFAS No. 123. For purposes of the pro forma disclosure, we calculate the fair value of our stock options using the Black-Scholes option-pricing model. To use this model, we must judgmentally determine the estimated life of the stock option, the projected volatility of our common stock over the estimated life of the stock option, the projected dividend yield of our common stock over the estimated life of the stock option, and the risk-free interest rate. For further information regarding our pro forma disclosure estimates, seeNote 2to our Consolidated Financial Statements.

In December 2004, the FASB issued Statement No. 123 (revised 2004),Share-Based Payment (“SFAS No. 123R”). This statement is a revision of FASB Statement No. 123.Accounting for Stock-Based Compensation (“SFAS No. 123”), and supersedes APB Opinion No. 25, and its related implementation guidance. Under SFAS No. 123R, entities are required to recognize the cost of an equity award based on its fair value at the date of grant. The cost, which is calculated in a similar manner to the pro forma calculation shown inNote 2 to our Notes to Consolidated Financial Statements, is recognized over the attribution period, which is the expected period of benefit. SFAS No. 123R is effective for fiscal periods beginning on or after June 15, 2005. In April 2005, the Securities and Exchange Commission (“SEC”) amended its Regulation S-X to amend the date of compliance with SFAS No. 123R to the first reporting period of the fiscal year beginning on or after June 15, 2005.

SFAS No. 123R permits public companies to adopt its requirements using one of two methods- “modified prospective” or “modified retrospective”. The “modified prospective” method requires that compensation cost is recognized beginning with the effective date (a) based on the requirements of SFAS No. 123R for all share-based payments granted, modified or settled after the effective date and (b) based on the requirements of SFAS No. 123 for all award; granted to employees prior to the effective date of SFAS No. 123R that remain unvested on the effective date. The “modified retrospective” method which includes the requirements of the modified prospective method described above, but also permits entities to restate, based on the amounts previously recognized under SFAS 123 for purposes of pro forma disclosures, either (a) all prior periods presented or (b) prior interim periods of the year of adoption. We plan to adopted SFAS No. 123R using the modified prospective method.

RECENT ACCOUNTING PRONOUNCEMENTS

In September 2006, the Commission issued SAB 108,Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements. SAB 108 requires analysis of misstatements using both an income statement (rollover approach) and a balance sheet (iron curtain) approach in assessing materiality and provides for a one-time cumulative effect transition adjustment. SAB 108 is effective for our fiscal year 2006 annual financial statements. The adoption of the statement did not have a material impact on our consolidated results of operations, financial position or cash flows.