File No. 333-222786

Dear Mr. Zapata:

This letter is in response to the comments received by telephone on July 31, 2023. All responses are how they appear within the prospectus. Corresponding changes will be applied to the other prospectuses of the registration statement, as applicable.

b. We have revised to use the term to Segment Maturity Value, which is a defined term.

a. If the Dual Performance Trigger Rate were to change it would only impact new investments and would not impact existing investments. We currently provide that it is determined at the beginning of each Indexed Term and would not, therefore, change mid-segment.

b. We have updated the chart accordingly.

1. Cover page and first page of prospectus: Please ensure that the legal name is used for both.

We intend to file the post-effective amendment on August 14, 2023, along with a request under Rule 461 for an accelerated effective date of August 14, 2023. Please advise if you believe this timetable is unreasonable.

Thank you for your attention to this filing, and your review and comments. Please call me at 860-466-2832 with any questions or additional comments.

THE LINCOLN NATIONAL LIFE INSURANCE COMPANY

Lincoln Life Variable Annuity Account N

Lincoln Level Advantage® B Share variable and index-linked annuity

Lincoln Level Advantage® B Class variable and index-linked annuity

Lincoln Level Advantage® Access variable and index-linked annuity

Lincoln Level Advantage® Advisory variable and index-linked annuity

Lincoln Level Advantage® Advisory Class variable and index-linked annuity

Lincoln Level Advantage® Design Advisory variable and index-linked annuity

Lincoln Level Advantage® Design B Share variable and index-linked annuity

Lincoln Level Advantage® Select B Share variable and index-linked annuity

Supplement dated June 16, 2023 to the prospectus dated May 1, 2023

This supplement describes changes to the prospectus for your Lincoln Level Advantage® variable and index-linked annuity contract. It is for informational purposes and requires no action on your part. All other provisions in your prospectus not discussed in this supplement remain unchanged.

Overview

Several new Indexed Accounts will be available for new Contracts beginning on or about August 21, 2023. You can find complete details about all of the features of your Contract in your prospectus. The following revisions are in the order in which they appear in your prospectus.

Description of Changes

The following terms have been added to the Special Terms section:

Dual Performance Trigger Rate – The rate used, in part, to determine the Performance Rate for an Indexed Segment at the end of the Indexed Term if the Index performance is positive, negative or zero. A different Dual Performance Trigger Rate may be declared for each Indexed Segment and for each Death Benefit type.

Dual15 Plus – A Crediting Method that uses a Performance Cap and Dual Rate to determine the Performance Rate for and Indexed Segment at the end of the Indexed Term.

Dual Rate - The rate used, in part, to determine the Performance Rate for an Indexed Segment of a Dual15 Plus Indexed Account at the end of the Indexed Term if the Index performance is positive, negative or zero. For Dual15 Plus Indexed Segments, the Dual Rate is 15%.

The following term has been revised:

Crediting Method – The method used in determining the Performance Rate for an Indexed Segment. There are several Crediting Methods including Performance Cap, Participation Rate, Performance Trigger Rate, Dual Performance Trigger Rate, Dual15 Plus, and Spread Rate.

Risk Factors – In addition to those Risk Factors outlined in Risks of Investing in the Indexed Accounts section, the following potential risks are associated with Dual Performance Trigger Rate and Dual15 Plus Indexed Accounts and is added to the Risks of Investing in the Indexed Accounts section.

| • | Gains in your Indexed Segment are limited by any applicable Dual Performance Trigger Rate. If the performance of the Index is zero, positive, or negative, the Dual Performance Trigger Rate is used in determining the Segment Maturity Value. The Dual Performance Trigger Rate may be lower than the actual performance of the Index, which means that your return could be lower than if you had invested directly in a fund based on the applicable Index. The Dual Performance Trigger Rate applies for the full term of the Indexed Segment. The Dual Performance Trigger Rate will be lower for contracts with the Guarantee of Principal Death Benefit. Dual Performance Trigger Rates for new Segments will be declared at least 5 business days in advance of the beginning of a Segment. |

| ● | Gains in your Dual15 Plus Indexed Segment are limited by any applicable Performance Cap, which means that your return could be lower than if you had invested directly in a fund based on the applicable Index. If the performance of the Index is zero, positive, or negative, a Dual Rate is used to determine the Segment Maturity Value. The Performance Cap exists for the full term of the Indexed Segment. The Performance Cap will be lower for Contracts with the Guarantee of Principal Death Benefit. Performance Caps for new Segments will be declared at least 5 business days in advance of the beginning of a Segment. Subsequent Performance Caps may differ from the Performance Cap used for new Contracts or for other Contracts issued at different times. |

Investments of the Indexed Accounts -The following discussion describes changes and additions to the sub-sections of the Investments of the Indexed Accounts section.

The following Indexed Accounts are added to the list of available Indexed Accounts, available to new Contracts beginning on or about August 21, 2023:

The following Indexed Accounts will be available for contracts purchased on or after August 21, 2023, subject to state availability. (See your prospectus for the complete description of all footnotes.)

1-Year Dual Performance Trigger Rate Indexed Account with Protection Level

| • | S&P 500 ®, Dual Performance Trigger (1), 10% Protection |

| • | Russell 2000®, Dual Performance Trigger(2), 10% Protection |

| • | Capital Strength Net Fee IndexSM, Dual Performance Trigger(3), 10% Protection |

| • | First Trust American Leadership IndexSM, Dual Performance Trigger(4), 10% Protection |

6-Year Dual15 Plus Indexed Account

| • | Capital Strength Net Fee IndexSM |

| • | First Trust American Leadership IndexSM |

The first paragraph of the Crediting and Protection Methods sub-section is changed; it is replaced with the following paragraph:

Different Crediting and Protection Methods are available for your Indexed Account and are listed in the chart below. Interest is credited for any performance earned or deducted for any loss only on the End Date of a Segment. If the End Date is not a Valuation Date, then the amount will be credited or deducted on the next business day.

The heading for the first chart under Crediting and Protection Methods has been changed to:

These are the Crediting Methods available when the index performance is positive (or zero for the Performance Trigger Rate; or zero or negative for the Dual Performance Trigger Rate and Dual15 Plus):

The following additional language is added to the chart in the Crediting and Protection Methods sub-section “These are the Crediting Methods available when the index performance is positive (or zero for the Performance Trigger Rate; or zero or negative for the Dual Performance Trigger Rate and Dual15 Plus):”

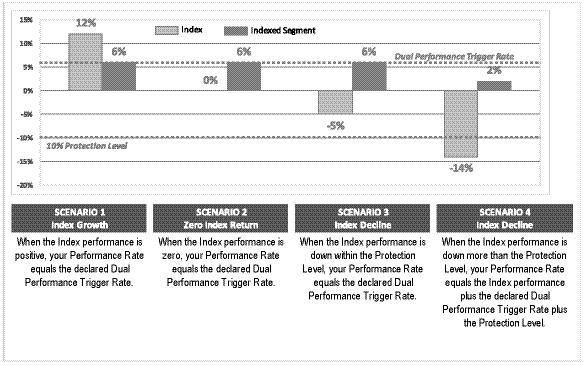

Dual Performance Trigger Rate | You receive 1) the Dual Performance Trigger Rate if the Index performance is zero, positive, or negative within the Protection Level; or 2) the Index performance percentage plus the Protection Level plus the Dual Performance Trigger Rate if the Index performance is negative and beyond the Protection Level. |

| Dual15 Plus | You receive the 1) the Dual Rate if the Index performance is zero or positive and equal to or less than the Dual Rate; or 2) the Index performance up to the Performance Cap if the Index performance is higher than the Dual Rate; or 3) the Performance Cap if the Index performance is higher than the Performance Cap; or 4) the Index performance plus the Dual Rate if the Index performance is negative. |

The following sections are added as a new sub-sections immediately prior to the Protection Levels sub-section:

Dual Performance Trigger Rates – The

Dual Performance Trigger Rate is a rate of return for an Index Segment that we declare at the beginning of the Indexed Term. It is used, in part, to determine the Segment Maturity Value if the Index return for the Indexed Term is zero, positive, or negative. If Lincoln changes the Dual Performance Trigger Rate for an Indexed Segment, that change will only apply to new investments, and will not impact any current investments in that Indexed Account.

The Dual Performance Trigger Rate may vary depending on the Death Benefit option, the Index, the Term, and the Protection Level.

The initial Dual Performance Trigger Rate applies to the initial Indexed Term. Indexed Segments with a Guarantee of Principal Death Benefit will have lower Dual Performance Trigger Rates than Indexed Segments with the Account Value Death Benefit. The Company will declare, at its discretion, a Dual Performance Trigger Rate for each subsequent Indexed Term, if any. Subsequent Dual Performance Trigger Rates may differ from the Dual Performance Trigger Rate used for new Contracts or for other Contracts issued at different times.

The Performance Rate is the percentage change in the Index Value from the Start Date to the End Date, adjusted by the Protection Level and the Dual Performance Trigger Rate. The Performance Rate can be positive, negative, or zero. The percentage change in the Index Value is calculated by subtracting the Index Value on the Start Date from the Index Value on the End Date, with the difference then divided by the Index Value on the Start Date. The daily Index Value is posted on the Index’s website. If an Index Value is not published for a particular day, we will use the Index Value at the close of the next Valuation Date the Index is published.

If the percentage change of the Index Value is greater than or equal to zero on the End Date, the Performance Rate is equal to the Dual Performance Trigger Rate. If the percentage change in the Index Value is less than zero but within the Protection Level, the Performance Rate is equal to the Dual Performance Trigger Rate. If the percentage change in the Index Value is negative and beyond Protection Level, the Performance Rate is the percentage change in the Index Value, plus the Dual Performance Trigger Rate, plus the Protection Level. The Performance Rate could be negative.

The amount credited to or deducted from the Indexed Segment is equal to the Performance Rate multiplied by the Indexed Crediting Base on the End Date. This will be used to determine the Segment Maturity Value as set forth below. The Indexed Crediting Base is the amount that you allocated to the Indexed Segment, less any transfers or withdrawals during the Indexed Term deducted proportionately by the amount that the transfers or withdrawals reduced the Interim Value. Withdrawals include any applicable surrender charge, premium tax or rider charge deductions. The Performance Rate is used to determine the value credited after all adjustments. If the Performance Rate is positive, the value of your Indexed Segment will increase. If the Performance Rate is negative (after calculation including the Protection Level), the value of your Indexed Segment will be reduced. If the Performance Rate is zero, the value of your Indexed Segment will not change.

The Segment Maturity Value on the End Date is equal to the sum of A and (A multiplied by B) where:

A= the Indexed Crediting Base on the End Date and

B= the Performance Rate.

The Indexed Crediting Base is used only to calculate the performance of Indexed Accounts on the End Date and to calculate the Interim Value. This amount is not available for surrender, withdrawal, transfer, annuitization or as a Death Benefit.

The following examples show the Performance Rates assuming an initial Dual Performance Trigger Rate of 6% and a Protection Level of 10%.

Depending on market conditions, subsequent Dual Performance Trigger Rates may be higher or lower than the initial Dual Performance Trigger Rate. Subsequent Dual Performance Trigger Rates may differ from the Dual Performance Trigger Rate used for new contracts or for other contracts issued at different times. The Company will determine new Dual Performance Trigger Rates on a basis that does not discriminate unfairly within any class of contracts. There is no guarantee that the Indexed Account will be available in the future.

Dual15 Plus: The Dual15 Plus Indexed Accounts offer a Dual Rate and Performance Cap for an Indexed Segment that we declare at the beginning of the Indexed Term that are both used in determining the Segment Maturity Value if the Index return for the Indexed Term is zero, positive or negative. The Performance Cap is the maximum Performance Rate that can be credited to the Indexed Segment for an Indexed Term for which it is declared. The Performance Cap may vary depending on the Death Benefit option, the Index, and the Term length. The Performance Cap Rate will not change during the Indexed Term. The Dual Rate is 15% and will not vary depending on the Death Benefit option, the Index, or the Term length and will not change during the Indexed Term.

The amount credited to or deducted from the Indexed Segment, is equal to the Performance Rate times the Indexed Crediting Base on the End Date. This will be used to determine the Segment Maturity Value as set forth below. The Indexed Crediting Base is the amount that you allocated to the Indexed Segment, less any transfers or withdrawals during the Indexed Term deducted proportionately by the amount that the transfer or withdrawal reduced the Interim Value. Withdrawals include any applicable surrender charge, premium tax, or rider charge deductions. The Performance Rate is used to determine the value credited after all adjustments.

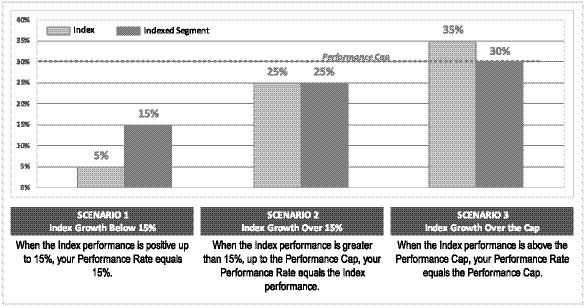

The Performance Rate equals (1) the Dual Rate if the percentage change of the Indexed Value from the Start Date to the End Date for an Indexed Term is zero, or is positive and equal to or less than the Dual Rate; or (2) the percentage change up to the Performance Cap if the percentage change is higher than the Dual Rate; or (3) the Performance Cap if the percentage change is higher than the Performance Cap; or (4) the percentage the index has decreased plus the Dual Rate, if the Index Value at the end of the Indexed Term is less than the Index Value at the beginning of the Indexed Term. If the Performance Rate is negative, the value of your Indexed Segment is reduced.

The percentage change of the Index Value from the Start Date to the End Date for an Indexed Term equals the percentage increase, if any, in the Index Value at the end of the Indexed Term over the Index Value as of the beginning of the Indexed Term. The percentage change is calculated by subtracting the Index Value as of the beginning of the Indexed Term from the Index Value at the end of the Indexed Term. The difference is then divided by the Index Value as of the beginning of the Indexed Term.

The Segment Maturity Value on the End Date is equal to the sum of A and (A multiplied by B) where:

A= the Indexed Crediting Base on the End Date and

B= the Performance Rate.

The Indexed Crediting Base is used only to calculate the performance of Indexed Accounts on the End Date and to calculate the Interim Value. This amount is not available for surrender, withdrawal, transfer, annuitization or as a Death Benefit.

The following examples showing the Performance Rates assuming a Dual Rate of 15% and an initial Performance Cap of 30%.

The initial Performance Cap applies to the initial Indexed Term. Indexed Segments with a Guarantee of Principal Death Benefit may have lower Performance Caps than Indexed Segments with the Account Value Death Benefit. The Company will declare, at its discretion, a Performance Cap for each subsequent Indexed Term. If no Performance Cap is declared for an Indexed Term, there is no maximum Performance Rate for that Indexed Term.

Depending on market conditions, subsequent Performance Caps may be higher or lower than the initial Performance Cap. Subsequent Performance Caps may differ from the Performance Cap used for new Contracts or for other Contracts issued at different times. The Company will determine new Performance Caps on a basis that does not discriminate unfairly within any class of policies.

While this account is being offered, the initial and subsequent Dual Rate will always be 15%.

The following bullets are added to the Crediting Methods Considerations sub-section:

| • | If you choose an Indexed Segment with a Dual Performance Trigger Rate, and there is positive performance, the Performance Rate on the Indexed Segment End Date could be lower, possibly significantly lower, than the actual Index return. |

| • | If you choose an Indexed Segment with a Dual Rate and Performance Cap, and there is positive performance, the Performance Rate we apply on the Indexed Segment End Date could be less than the actual Index performance. If the actual Index performance is greater than the Performance Cap, your Performance Rate will be lower, possibly significantly lower, than the actual Index return. |

The following bullets are added to the Protection Method Considerations sub-section:

| • | For accounts with a Performance Cap, Participation Rate, Performance Trigger Rate, or Spread Rate, if there is negative index performance, we absorb the first portion of the negative performance up to the stated percentage and you bear the risk of loss after your chosen Protection Level, including the loss of any previously credited amount. |

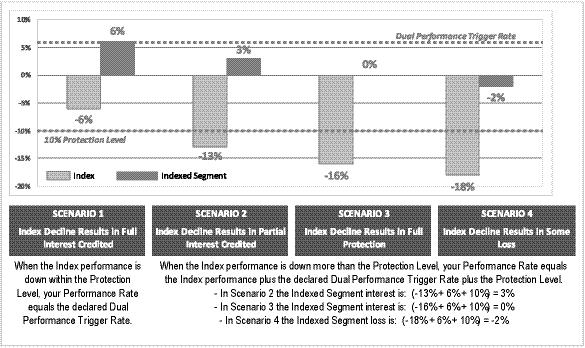

| • | For accounts with a Dual Performance Trigger Rate, if there is negative index performance, we absorb the first portion of the negative performance up to the stated percentage of the Protection Level. If there is negative index performance beyond the Protection Level, we continue to absorb the portion of the negative performance up to the stated percentage of the Dual Performance Trigger Rate. For example, if the Dual Performance Trigger Rate is 5%, we would absorb the first 5% of loss beyond the Protection Level. You bear the risk of loss thereafter, including the loss of any previously credited amount. |

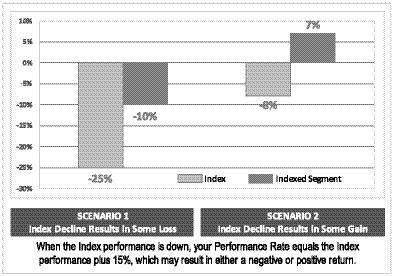

| • | For accounts with a Dual Rate, if the Index performance is negative, your Performance Rate equals the Index performance plus the Dual Rate, which may result in either a negative or positive return. |

The following disclosure is added to the end of the Protection Levels sub-section:

For the Dual Performance Trigger Indexed Accounts, the Protection Level is used to determine the Performance Rate on the End Date of the Segment when there is negative Index performance. If the percentage change in the Index Value is negative but within the Protection Level, the Performance Rate is equal to the Dual Performance Trigger Rate. However, if the percentage change in the Index Value has decreased by a greater percentage than the Protection Level then the amount of your investment in the Indexed Segment may be reduced. The Performance Rate would equal the percentage change in the Index Value, plus the Dual Performance Trigger Rate, plus the Protection Level. The amount of loss or gain is dependent on the percentage change in the Index Value, the Dual Performance Trigger Rate and the Protection Level on the Indexed Segment.

The following examples show the Performance Rate(s) based on the percentage change in the Index Value using a 6% Dual Performance Trigger Rate.

While Dual15 Plus accounts do not include a Protection Level, the Dual Rate itself may provide some protection. If Index performance is down, your Performance Rate equals the index performance plus the Dual Rate which may result in either a negative or positive return.

The following examples show the Performance Rate(s) based on the percentage change in the Index Value and using a Dual Rate of 15%.

ADDITIONAL INFORMATION – Information Incorporated by Reference. The second paragraph of this section of the prospectus is re-stated as follows:

Lincoln Life files reports and other information with the SEC, as required under the Securities Exchange Act of 1934 (“the Exchange Act”). Lincoln Life’s annual report on Form 10-K and its amended annual report on Form 10-K/A for the year ended December 31, 2022, as well as Lincoln Life’s quarterly reports filed on Form 10-Q for the periods ending March 31, 2023 and June 30, 2023, are incorporated by reference into this prospectus. Lincoln Life’s annual reports contain information about Lincoln Life, including its consolidated audited financial statements for Lincoln Life’s latest fiscal year. Lincoln Life files its Exchange Act documents and reports (including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K) electronically with the SEC under File No. 000-55871. In addition, all documents subsequently filed by Lincoln Life pursuant to sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering are also incorporated by reference into this prospectus. We are not incorporating by reference, in any case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules.

Independent Registered Public Accounting Firm. This section is re-stated as follows:

The consolidated financial statements and financial statement schedules of The Lincoln National Life Insurance Company (LNL) included in LNL’s Current Report on Form 8-K (Form 8-K) dated May 23, 2023, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

APPENDIX B – The following examples are added to Appendix B of your prospectus.

Interim Value for Indexed Segment(s) with Dual Performance Trigger Rates and Protection Level

The Interim Value of an Indexed Account is equal to the sum of (1) and (2), where:

(1) is the fair value of the Crediting Base of a Segment on the Valuation Date the Interim Value is calculated. It is determined for a Segment as C multiplied by (1+D)–E where:

C = the Crediting Base of the Segment on the Valuation Date of the calculation;

D = the Reference Rate;

E = the total days remaining in the Term divided by 365.

(2) is the fair value of hypothetical replicating portfolio of options and/or other instruments on any Valuation Date that the Interim Value is calculated for a Segment.

Interim Value for Dual15 Plus Indexed Segment(s)

The Interim Value of an Indexed Account is equal to the lesser of (A) or (B) where:

(A) is the sum of (1) and (2), where:

(1) is the fair value of the Crediting Base of a Segment on the Valuation Date the Interim Value is calculated. It is determined for a Segment as C multiplied by (1+D)–E where:

C = the Crediting Base of the Segment on the Valuation Date of the calculation;

D = the Reference Rate;

E = the total days remaining in the Term divided by 365.

(2) is the fair value of hypothetical replicating portfolio of options or other instruments on any Valuation Date that the Interim Value is calculated for a Segment.

(B) is F multiplied by (1+I+((G-I) multiplied by H)), where:

F = the Crediting Base of the Segment on the Valuation Date of the calculation;

G = the Performance Cap for the Segment;

H = the total days elapsed in the Term divided by total days in the Term;

I = the Dual Rate for the Segment.

The Fair Value of Replicating Portfolio of Options section of Appendix B is restated as follows:

2. Fair Value of Replicating Portfolio of Options. We utilize a fair market value methodology to value the replicating portfolio of options that support this product.

For each Segment, we solely designate and value options, each of which is tied to the performance of the index associated with the Segment in which you are invested. We use derivatives to provide an estimate of the gain or loss on the Indexed Crediting Base that could have occurred at the end of the Indexed Term. This estimate also reflects the impact of the Crediting Method and Protection Level at the end of the Indexed Term as well as the estimated cost of exiting the replicating options prior to the End Date of a Segment (and the time to Index Anniversaries for Annual Lock Segments). The valuation of the options is based on standard methods for valuing derivatives and based on inputs from third party vendors. The methodology used to value these options is determined solely by us and may vary, higher or lower, from other estimated valuations or the actual selling price of identical derivatives. Any variance between our estimated fair value price and other estimated or actual prices may be different from Segment type to Segment type and may also change from day to day.

The options valued for each Indexed Account type are as follows:

A. At-the money call option: This represents the market value of the potential to receive an amount equal to the percentage growth in the Index during the Indexed Term.

B. Out-of-the-money call option: This represents the market value of the potential for gain in excess of the Performance Cap rate or Spread Rate, or Dual Rate, as applicable.

C. Out-of-the-money put option: This represents the market value of the potential to receive an amount equal to the excess loss beyond the Protection Level.

D. Digital option: This represents the market value of the option to provide the Performance Trigger Rate under zero or positive index returns.

E. At-the money put option: This represents the market value of the potential to receive an amount equal to the percentage loss of the index during the Indexed Term.

F. Dual structure: This represents the market value of receiving a maturity amount equal to the Dual Performance Trigger Rate or Dual Rate at the end of the Indexed Term, independent of the underlying index returns.

NOTE: Put option C will always reduce the Interim Value even if the index has increased during the Indexed Term.

For each Segment with no Annual Lock with Performance Cap rates and Protection Levels, the replicating portfolio of options is equal to: A minus B minus C.

For each Segment with a Dual Performance Trigger Rate and Protection Level, the replicating portfolio of derivatives is equal to: F minus C.

For each Segment with Performance Triggers and Protection Levels, the replicating portfolio of options is equal to: D minus C.

For each Segment with a Spread Rate, the replicating portfolio of options is equal to: B minus C.

For each Segment with Annual Lock, we designate and value a replicating (derivative) structure which is tied to the compounded performance for each year of the Annual Lock Segment. The market standard model is adjusted by us to account for additional market risks relevant to the Annual Lock Segment.

For each Dual15 Plus Segment, the replicating portfolio of options is equal to: F plus B (at the Dual Rate) minus B (at the Performance Cap Rate) minus E.

The following examples are added to the Examples section of Appendix B.

The following examples demonstrate how the Interim Value is calculated in different scenarios for Indexed Segments with Dual Performance Trigger Rates and Protection Level.

| | | 1 Year | | | 1 Year | |

| Indexed Term length …………………………………………………………. | | 12 months | | | 12 months | |

| Months since Indexed Term Start Date ……………………………………. | | | 9 | | | | 3 | |

| Indexed Crediting Base ……………………………………………………… | | $ | 1,000 | | | $ | 1,000 | |

| Protection Level ………………………………………………………………. | | | 10 | % | | | 10 | % |

| Dual Performance Trigger Rate…………………………………………….. | | | 6 | % | | | 6 | % |

| Months to End Date ………………………………………………………….. | | | 3 | | | | 9 | |

| Change in Index Value is -15% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | (40 | ) | | $ | (40 | ) |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 983 | | | $ | 956 | |

| Account Interim Value ………………………..…………………………….. | | $ | 983 | | | $ | 956 | |

| Change in Index Value is -5% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 8 | | | $ | 3 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,031 | | | $ | 999 | |

| Account Interim Value ……………………….…………………………….. | | $ | 1,031 | | | $ | 999 | |

| Change in Index Value is 10% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 27 | | | $ | 31 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,050 | | | $ | 1,027 | |

| Account Interim Value ……………………………………………………….. | | $ | 1,050 | | | $ | 1,027 | |

| Change in Index Value is 20% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 30 | | | $ | 39 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,053 | | | $ | 1,035 | |

| Account Interim Value ……………………….…………………………….. | | $ | 1,053 | | | $ | 1,035 | |

The following examples demonstrate how the Interim Value is calculated in different scenarios for Dual15 Plus Indexed Segments.

| | | 6 Years | | | 6 Years | |

| Indexed Term length …………………………………………………………. | | 72 months | | | 72 months | |

| Months since Indexed Term Start Date ……………………………………. | | | 54 | | | | 18 | |

| Indexed Crediting Base ……………………………………………………… | | $ | 1,000 | | | $ | 1,000 | |

| Dual Rate ……..………………………………………………………………. | | | 15 | % | | | 15 | % |

| Performance Cap …………………………………………………………….. | | | 70 | % | | | 70 | % |

| Months to End Date ………………………………………………………….. | | | 18 | | | | 54 | |

| Change in Index Value is -15% | | 6 Years | | | 6 Years | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 976 | | | $ | 953 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | (6 | ) | | $ | (47 | ) |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 970 | | | $ | 906 | |

| Account Interim Value ………………………..…………………………….. | | $ | 970 | | | $ | 906 | |

| Change in Index Value is -5% | | 6 Years | | | 6 Years | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 976 | | | $ | 953 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 61 | | | $ | 25 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,037 | | | $ | 978 | |

| Account Interim Value ……………………….…………………………….. | | $ | 1,037 | | | $ | 978 | |

| Change in Index Value is 10% | | 6 Years | | | 6 Years | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 976 | | | $ | 953 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 176 | | | $ | 128 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,151 | | | $ | 1,081 | |

| Account Interim Value ……………………………………………………….. | | $ | 1,151 | | | $ | 1,081 | |

| Change in Index Value is 20% | | 6 Years | | | 6 Years | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 976 | | | $ | 953 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 258 | | | $ | 190 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,233 | | | $ | 1,144 | |

| Account Interim Value ……………………….…………………………….. | | $ | 1,233 | | | $ | 1,144 | |

THE LINCOLN NATIONAL LIFE INSURANCE COMPANY

Lincoln Life Variable Annuity Account N

Lincoln Level Advantage® B-Class Variable and Indexed-linked Annuity

Supplement dated ______, 2023 to the Prospectus dated May 1, 2023

This supplement to your Lincoln Level Advantage® B-Class variable and index-linked annuity prospectus discusses the death benefit options that are available to new purchasers of this contract. It is for informational purposes and requires no action on your part. All other provisions in your prospectus not discussed in this supplement remain unchanged.

OVERVIEW

The following changes will be effective beginning August 21, 2023:

| • | the Account Value Death Benefit is available for election by new purchasers of this contract; and |

| • | the Contractowner, joint owner, and Annuitant must be under age 86 at the time the Contract is issued. The oldest of the Contractowner, joint owner, and Annuitant must be under age 76 to elect the Guarantee of Principal Death Benefit. |

DESCRIPTION OF CHANGES

The following discussion describes changes that are incorporated into the specified sections of your prospectus.

Important Information About Your Contract – The following line item is added to the Minimum and Maximum Annual Fee Table, and footnote 1 is replaced as follows:

| Annual Fee | Minimum | Maximum |

| Base Contract – Account Value Death Benefit | 1.10%1 | 1.10%1 |

1As a percentage of average Account Value in the underlying funds. This charge is applicable only to contracts purchased on and after August 21, 2023, and is not applied against Contract Value invested in the Indexed Accounts.

Fee Tables – Annual Contract Expenses. The following line item is added to the Annual Contract Expenses Table under Base Contract Expenses, and footnote 1 is replaced as follows:

Account Value Death Benefit …………………………………………………………………… | 1.10%1 |

1The base contract expense is 1.10% after the Annuity Commencement Date. This charge is not applied against Contract Value invested in the Indexed Accounts.

The Account Value Death Benefit charge applies only if the Contractowner has elected the Account Value Death Benefit on a contract purchased on and after August 21, 2023. The Guarantee of Principal Death Benefit will automatically terminate at any time all Contractowners or Annuitants are changed. If this happens, the Account Value Death Benefit will be in effect, and the corresponding base contract expense will apply.

Charges and Other Deductions –

The following section replaces the Deductions from the VAA (Base Contract Expense) in the Charges and Other Deductions section of your prospectus.

Deductions from the VAA (Base Contract Expense)

A charge is applied to the average daily net asset value of the Subaccounts, which is equal to an annual rate of:

Guarantee of Principal Death Benefit ……………………………………………… 1.30%*

Account Value Death Benefit ………………………………………………………. 1.10%*

*0.10% of the Base Contract Expense is attributable to an administrative charge, and the remaining amount is attributable to a mortality and expense charge.

The Contracts – Who Can Invest. The second sentence of the first paragraph of the Who Can Invest section is replaced with the following two sentences, and applies to new purchasers of this contract beginning August 21, 2023:

At the time of issue, the Contractowner, joint owner, and Annuitant must be under age 86. The oldest of the Contractowner, joint owner, and Annuitant must be under age 76 to elect the Guarantee of Principal Death Benefit.

Benefits Available Under the Contract. The following entry is added to the Benefits Available Under the Contract table under Standard Benefits.

| Name of Benefit | Purpose | Maximum Fee | Brief Description of Restrictions/ Limitations |

| Account Value Death Benefit | Provides a Death Benefit equal to the Contract Value. | 1.10% (as a percentage of Contract Value invested in the Subaccounts) | •Poor investment performance could significantly reduce the benefit. •Withdrawals could significantly reduce the benefit. |

Death Benefits. The Account Value Death Benefit paragraph is deleted and replaced in its entirety with the two paragraphs below. Additionally, the first sentence of the Guarantee of Principal Death Benefit section does not apply to contracts purchased on and after August 21, 2023.

Account Value Death Benefit (for contracts purchased on and after August 21, 2023). The Account Value Death Benefit provides a Death Benefit equal to the Contract Value on the Valuation Date the Death Benefit is approved by us for payment. No additional Death Benefit is provided. For example, assume an initial deposit into the Contract of $10,000. The Contract Value increases and equals $12,000 on the Valuation Date the Death Benefit is approved. The amount of Death Benefit paid equals $12,000. Once you have elected the Account Value Death Benefit, the Death Benefit cannot be changed.

Account Value Death Benefit (for contracts purchased prior to August 21, 2023). The Account Value Death Benefit provides a Death Benefit equal to the Contract Value on the Valuation Date the death claim is approved by us for payment. The Account Value Death Benefit was not available for election at the time your contract was issued and will become effective only in the event all Contractowners and Annuitants are changed. Once you have the Account Value Death Benefit, the Death Benefit cannot be changed.

Please retain this supplement with your prospectus for future reference.

THE LINCOLN NATIONAL LIFE INSURANCE COMPANY

Lincoln Life Variable Annuity Account N

Lincoln Level Advantage® Advisory Class Variable and Indexed-linked Annuity

Supplement dated _______, 2023 to the Prospectus dated May 1, 2023

This supplement to your Lincoln Level Advantage® Advisory Class variable and index-linked annuity prospectus discusses the death benefit options that are available to new purchasers of this contract. It is for informational purposes and requires no action on your part. All other provisions in your prospectus not discussed in this supplement remain unchanged.

OVERVIEW

The following changes will be effective beginning August 21, 2023:

| • | the Account Value Death Benefit is available for election by new purchasers of this contract; and |

| • | the Contractowner, joint owner, and Annuitant must be under age 86 at the time the contract is issued. The oldest of the Contractowner, joint owner, and Annuitant must be under age 76 to elect the Guarantee of Principal Death Benefit. |

DESCRIPTION OF CHANGES

The following discussion describes changes that are incorporated into the specified sections of your prospectus.

Important Information About Your Contract – The following line item is added to the Minimum and Maximum Annual Fee Table, and footnote 1 is replaced as follows:

| Annual Fee | Minimum | Maximum |

| Base Contract – Account Value Death Benefit | 0.10%1 | 0.10%1 |

1As a percentage of average Account Value in the underlying funds. This charge is applicable only to contracts purchased on and after August 21, 2023, and is not applied against Contract Value invested in the Indexed Accounts.

Fee Tables –

Annual Contract Expenses.

The following line item is added to the Annual Contract Expenses Table under Base Contract Expenses, and footnote 1 is replaced as follows:

Account Value Death Benefit …………………………………………………………………… | 0.10%1 |

1The base contract expense is 0.10% after the Annuity Commencement Date. This charge is not applied against Contract Value invested in the Indexed Accounts. The Account Value Death Benefit charge applies only if the Contractowner has elected the Account Value Death Benefit on a contract purchased on and after August 21, 2023. The Guarantee of Principal Death Benefit will automatically terminate at any time all Contractowners or Annuitants are changed. If this happens, the Account Value Death Benefit will be in effect, and the corresponding base contract expense will apply.

Charges and Other Deductions –

The following section replaces the Deductions from the VAA (Base Contract Expense) section in the Charges and Other Deductions of your prospectus.

Deductions from the VAA (Base Contract Expense)

A charge is applied to the average daily net asset value of the Subaccounts, which is equal to an annual rate of:

Guarantee of Principal Death Benefit ……………………………………………… 0.30%*

Account Value Death Benefit ………………………………………………………. 0.10%*

*0.10% of the Base Contract Expense is attributable to an administrative charge, and the remaining amount is attributable to a mortality and expense charge.

The Contracts – Who Can Invest. The second sentence of the first paragraph of the Who Can Invest section is replaced with the following two sentences, and applies to new purchasers of this contract beginning August 21, 2023:

At the time of issue, the Contractowner, joint owner, and Annuitant must be under age 86. The oldest of the Contractowner, joint owner, and Annuitant must be under age 76 to elect the Guarantee of Principal Death Benefit.

Benefits Available Under the Contract. The following entry is added to the Benefits Available Under the Contract table under Standard Benefits.

| Name of Benefit | Purpose | Maximum Fee | Brief Description of Restrictions/ Limitations |

| Account Value Death Benefit | Provides a Death Benefit equal to the Contract Value. | 0.10% (as a percentage of Contract Value invested in the Subaccounts) | •Poor investment performance could significantly reduce the benefit. •Withdrawals could significantly reduce the benefit. |

Death Benefits. The Account Value Death Benefit paragraph is deleted and replaced in its entirety with the two paragraphs below. Additionally, the first sentence of the Guarantee of Principal Death Benefit section does not apply to contracts purchased on and after August 21, 2023.

Account Value Death Benefit (for contracts purchased on and after August 21, 2023). The Account Value Death Benefit provides a Death Benefit equal to the Contract Value on the Valuation Date the Death Benefit is approved by us for payment. No additional Death Benefit is provided. For example, assume an initial deposit into the Contract of $10,000. The Contract Value increases and equals $12,000 on the Valuation Date the Death Benefit is approved. The amount of Death Benefit paid equals $12,000. Once you have the Account Value Death Benefit, the Death Benefit cannot be changed.

Account Value Death Benefit (for contracts purchased prior to August 21, 2023). The Account Value Death Benefit provides a Death Benefit equal to the Contract Value on the Valuation Date the death claim is approved by us for payment. The Account Value Death Benefit was not available for election at the time your contract was issued and will become effective only in the event all Contractowners and Annuitants are changed. Once you have the Account Value Death Benefit, the Death Benefit cannot be changed.

Please retain this supplement with your prospectus for future reference.