UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-604

Washington Mutual Investors Fund, Inc.

(Exact Name of Registrant as specified in charter)

1101 Vermont Avenue, NW

Washington, DC 20005

(Address of principal executive offices)

Registrant's telephone number, including area code: (202) 842-5665

Date of fiscal year end: April 30, 2007

Date of reporting period: April 30, 2007

Burton L. Raimi

Secretary

Washington Mutual Investors Fund, Inc.

1101 Vermont Avenue, NW

Washington, DC 20005

(name and address of agent for service)

ITEM 1 - Reports to Stockholders

Annual report dated April 30, 2007

| The right choice for the long term® |

Washington Mutual Investors Fund

Annual report for the year ended April 30, 2007

Washington Mutual Investors FundSM seeks to provide income and growth of principal through investments in quality common stocks.

This Fund is one of the 30 American Funds. The organization ranks among the nation’s three largest mutual fund families. For 75 years, Capital Research and Management Company,SM the American Funds adviser, has invested with a long-term focus based on thorough research and attention to risk.

Contents | |

| Letter to shareholders | 1 |

| Investment adviser’s report | 2 |

| The value of a long-term perspective | 3 |

Feature article American Funds At Your Service | 6 |

| Investment portfolio | 12 |

| Financial statements | 18 |

| Board of directors, advisory board and other officers | 32 |

Figures shown are past results for Class A shares (unless otherwise indicated) and are not predictive of results in future periods. Fund results shown (unless otherwise indicated) are at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Current and future results may be lower or higher than those shown. For current information and month-end results, visit americanfunds.com. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended March 31, 2007 (the most recent calendar quarter end):

| | | 1 year | 5 years | 10 years |

Class A shares | | | | |

Reflecting 5.75% maximum sales charge | | +7.52% | +5.73% | +9.00% |

The total annual Fund operating expense ratio for Class A shares as of the most recent fiscal year-end was 0.60%. This figure does not reflect any fee waivers currently in effect; therefore, the actual expense ratio, which reflects the fee waivers described below, is lower.

The Fund’s investment adviser and business manager each waived 5% of its management fees from September 1, 2004 through March 31, 2005, and increased the waivers to 10% on April 1, 2005. Fund results shown reflect actual expenses, with the waivers applied. Fund results would have been lower without the waivers. Please see the Financial Highlights table on pages 25 and 26 for details.

Results for other share classes can be found on page 29.

Large-capitalization stocks performed quite well during Washington Mutual Investors Fund’s fiscal year ended April 30, 2007. In late April, the Dow Jones Industrial Average reached a new milestone, exceeding 13,000 for the first time. This was followed in early May with the unmanaged Standard & Poor’s 500 Composite Index reaching a value over 1,500 for the first time since March 2000. These market results surprised some, as the U.S. economy continued to slow, dragged down partly by the slump in the housing industry. Some economists even began mentioning the possibility of a recession. The Federal Reserve has held the federal funds rate steady at 5.25% since June 2006, adhering firmly to its anti-inflationary policy.

Continuing record-level corporate earnings have been an important and positive factor in market results during the period. Consumer spending in the U.S. has remained strong. Some U.S. companies have also been helped by higher exports and expanding business abroad, as many economies around the world have been strengthening while the value of the U.S. dollar — relative to other major currencies — has been falling. With high cash flows, many U.S. companies have also been buying back their shares, boosting per share net income and contributing to market liquidity.

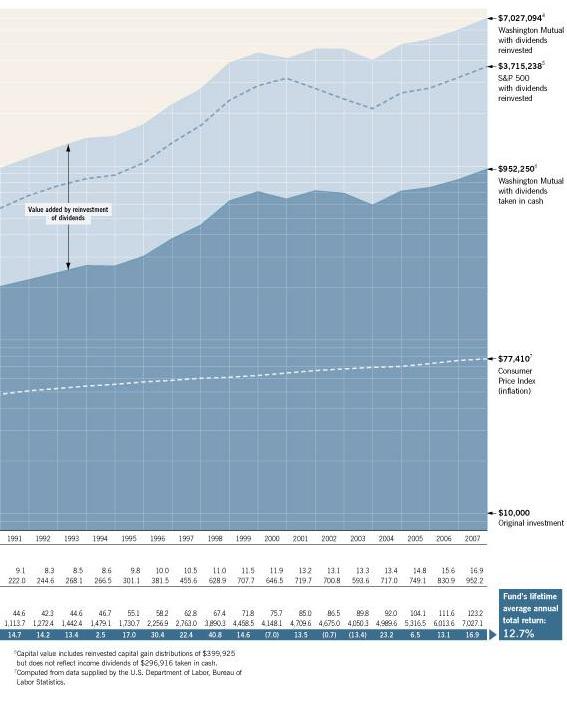

For the 12 months ended April 30, 2007, your Fund posted a total return of 16.9%, compared with a total return of 15.2% for the S&P 500. The Fund usually has provided better investment results than the S&P 500 over 10-year periods, and as the chart below illustrates, this pattern continues to hold true. This year marks your Fund’s 55th anniversary and, over its lifetime, its average annual return has exceeded that of the S&P 500 by 1.4%.

Average annual total returns for periods ended April 30, 2007 |

| | | 1 year | 5 years | 10 years | Lifetime (Since 7/31/52) |

| Washington Mutual Investors Fund | | +16.9% | +8.5% | +9.8% | +12.8% |

| Standard & Poor’s 500 Composite Index* | | +15.2% | +8.5% | +8.0% | +11.4% |

*The S&P 500 is unmanaged and does not reflect sales charges, commissions or expenses. |

During the past fiscal year, the Fund raised its quarterly dividend from 16 cents to 17 cents per share for Class A shares, and paid total dividends of 66 cents per Class A share. In addition, the Fund paid a long-term capital gain distribution of 83.5 cents per share in December. Ninety-six (or 80%) of the approximately 120 companies held at the end of the Fund’s fiscal year increased their dividend payments during the fiscal year ended April 30, 2007, enabling the Fund to raise its own dividend for the third straight year.

Since our last report to you at October 31, 2006, three new companies appeared in the Fund’s portfolio: Fifth Third Bancorp, Newmont Mining and Wm. Wrigley Jr. Fifteen companies have been eliminated: Applied Materials; Automatic Data Processing; Baxter International; Becton, Dickinson; BellSouth; EDS; Embarq; First Data; FirstEnergy; Fluor; Sara Lee; Sallie Mae; Temple-Inland; Walt Disney; and Xilinx.

As always, we are pleased to hear your comments and questions.

Cordially, |  | |

| | James H. Lemon, Jr. Vice Chairman of the Board | Jeffrey L. Steele President of the Fund |

May 31, 2007

For current information about the Fund, visit americanfunds.com.

Investment adviser’s report

The U.S. economy slowed during the 2007 fiscal year because of a weakening housing market and high energy prices. However, consumer spending, state and local government expenditures and business investing proved to be positive influences. Corporate earnings continued to grow albeit at a lower rate than in recent years. In addition, low interest rates and widespread liquidity have resulted in an upsurge of acquisitions and mergers and a wave of buyouts by private equity funds using cheap debt to take companies private. At the same time, corporations continued to initiate and increase dividends and to buy back their shares.

Against this backdrop, the value of an investment in Washington Mutual Investors Fund, with distributions reinvested, rose 16.9% during the one-year period ended April 30, 2007. The Fund exceeded the unmanaged Standard & Poor’s 500 Composite Index, which gained 15.2% over the same period. The Fund’s average annual total return also has outpaced the S&P 500 over the 10-year period ended April 30, 2007, and over its 55-year lifetime.

The economic picture and outlook

Although the gross domestic product grew at an annual rate of only 0.6% in the first quarter of the 2007 calendar year, the Federal Reserve has kept the federal funds rate unchanged at 5.25% since June 29, 2006. In May 2007, the Fed said that the economy seemed likely to expand at a moderate pace over coming quarters and that its main concern "remains the risk that inflation will fail to moderate as expected."

The cooling in the housing markets has been an important source of the slowdown in the U.S. economy. Sales of both new and existing homes have dropped sharply from their peak in the summer of 2005, the inventory of unsold homes has risen substantially and single family housing starts have fallen by roughly one-third since the beginning of 2006. Building permits, a key indicator of the future housing market, declined almost 9% in April to a seasonally adjusted annual rate of 1.4 million, the lowest since June 1997.

Most troubling have been difficulties in the subprime mortgage market (mortgage loans made to borrowers who do not qualify for prime financing terms). Banks and other lenders are tightening their standards for subprime borrowers and curbs on this lending is expected to be a source of some restraint on home purchases and residential investments in coming quarters. However, the Federal Reserve said the effect on the broader housing market of troubles in the subprime housing sector should be limited and that it doesn’t expect "significant spillovers" from the subprime market to the rest of the economy or the financial system.

The Fund’s investments

The Fund’s five largest investment sectors at fiscal year-end as a percentage of net assets were Financials (19.8%), Industrials (13.4%), Health care (12.9%), Energy (11.4%) and Informational technology (8.0%). Energy and Utilities stocks (including Telecommunication services) helped the Fund the most during the past year. Energy stocks were fueled by the worldwide demand for energy and the high level of oil and gas prices. Utilities stocks were aided by AT&T’s acquisition of BellSouth. Five of the Fund’s 10 largest holdings provided very strong total returns ranging from 24.1% to 51.9%. They included AT&T (+51.9%), Merck (+49.4%), Chevron (+27.5%), ExxonMobil (+25.8%) and IBM (+24.1%). Not all stocks rose, however. Halliburton (–18.7%), Best Buy (–17.7%) and United Parcel Service (–13.1%) detracted from results.

Corporations have continued their practice of initiating and increasing dividends and of buying back their shares. For the 12-month period ended March 31, 2007, Standard & Poor’s reported that the number of dividend declarations increased 7.4% and the number of extra dividends increased 13.5%. Under the current tax regime, there is every reason to believe that companies will continue sharing profits with their share-holders through dividends and share buybacks. As noted in the shareholder letter, the Fund’s own dividend increased 6.25% during the 2007 fiscal year.

We believe that large-capitalization, dividend-paying stocks remain one of the most attractive opportunities in the market-place. On balance, these companies are better financed, have higher returns and throw off more cash than most small- or medium-sized firms. Share buybacks and exposure to international markets have helped increase their earnings. However, we caution shareholders from being overly enthusiastic about future returns based on the recent fiscal year’s results. As always, we will continue to focus on investing in quality companies that meet strict standards of financial soundness including a consistent record of paying dividends. This approach has served the Fund well in all kinds of markets and we believe it will continue to do so in the future.

— Capital Research and Management Company

For current information about the Fund, visit americanfunds.com.

The value of a long-term perspective

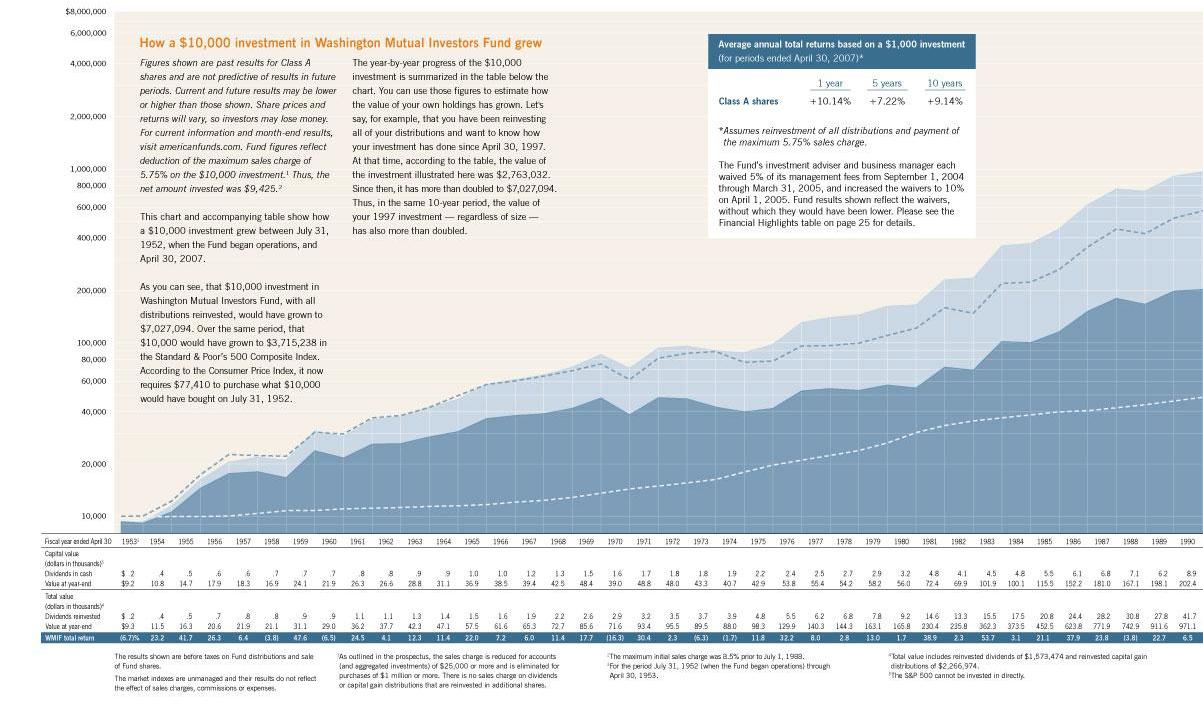

Below are plot points for the mountain chart image featured above.

WASHINGTON MUTUAL INVESTORS FUND | | | | | |

| MOUNTAIN CHART AND INDEX PLOT POINTS | | | | | |

| | | | | | | | |

| Results of a $10,000 investment in WMIF, the S&P500, and the CPI. | | | | |

| July 31, 1952 through April 30, 2007 | | | | | | |

| | | | | | | | |

| Year | CAPITAL VALUE3 | TOTAL VALUE2 | | | |

| ended | Dividends in | | Dividends | | TOTAL | | |

| April 30 | Cash | WMIF1,3 | Reinvested | WMIF1,2 | RETURN | S&P500 | CPI5 |

| | | | | | | | |

| 07/31/52 | | $9,425 | | $9,425 | | $10,000 | $10,000 |

19536 | $170 | 9,161 | $170 | 9,330 | -6.7% | 10,094 | 9,963 |

| 1954 | 434 | 10,773 | 449 | 11,494 | 23.2 | 12,282 | 10,037 |

| 1955 | 500 | 14,665 | 542 | 16,288 | 41.7 | 17,295 | 10,000 |

| 1956 | 580 | 17,851 | 654 | 20,565 | 26.3 | 22,938 | 10,075 |

| 1957 | 647 | 18,304 | 756 | 21,877 | 6.4 | 22,520 | 10,449 |

| 1958 | 680 | 16,928 | 825 | 21,055 | -3.8 | 22,269 | 10,824 |

| 1959 | 701 | 24,125 | 885 | 31,071 | 47.6 | 30,569 | 10,861 |

| 1960 | 728 | 21,871 | 948 | 29,041 | -6.5 | 29,850 | 11,049 |

| 1961 | 815 | 26,300 | 1,097 | 36,167 | 24.5 | 37,071 | 11,161 |

| 1962 | 824 | 26,592 | 1,146 | 37,654 | 4.1 | 38,158 | 11,311 |

| 1963 | 891 | 28,838 | 1,279 | 42,278 | 12.3 | 42,296 | 11,423 |

| 1964 | 923 | 31,149 | 1,369 | 47,109 | 11.4 | 49,698 | 11,573 |

| 1965 | 956 | 36,940 | 1,462 | 57,490 | 22.0 | 57,450 | 11,760 |

| 1966 | 1,048 | 38,487 | 1,648 | 61,603 | 7.2 | 60,563 | 12,097 |

| 1967 | 1,176 | 39,424 | 1,906 | 65,270 | 6.0 | 64,731 | 12,397 |

| 1968 | 1,331 | 42,481 | 2,231 | 72,692 | 11.4 | 69,365 | 12,884 |

| 1969 | 1,516 | 48,408 | 2,627 | 85,576 | 17.7 | 75,988 | 13,596 |

| 1970 | 1,605 | 39,049 | 2,874 | 71,603 | -16.3 | 61,834 | 14,419 |

| 1971 | 1,711 | 48,769 | 3,193 | 93,387 | 30.4 | 81,718 | 15,019 |

| 1972 | 1,779 | 47,991 | 3,455 | 95,521 | 2.3 | 87,267 | 15,543 |

| 1973 | 1,818 | 43,290 | 3,671 | 89,522 | -6.3 | 89,214 | 16,330 |

| 1974 | 1,858 | 40,682 | 3,907 | 87,956 | -1.7 | 77,959 | 17,978 |

| 1975 | 2,185 | 42,855 | 4,828 | 98,315 | 11.8 | 79,061 | 19,813 |

| 1976 | 2,350 | 53,771 | 5,498 | 129,949 | 32.2 | 95,785 | 21,011 |

| 1977 | 2,510 | 55,449 | 6,171 | 140,348 | 8.0 | 96,702 | 22,472 |

| 1978 | 2,658 | 54,228 | 6,849 | 144,340 | 2.8 | 100,121 | 23,933 |

| 1979 | 2,870 | 58,180 | 7,785 | 163,075 | 13.0 | 110,959 | 26,442 |

| 1980 | 3,203 | 56,032 | 9,167 | 165,848 | 1.7 | 122,446 | 30,337 |

| 1981 | 4,784 | 72,410 | 14,603 | 230,424 | 38.9 | 160,796 | 33,371 |

| 1982 | 4,097 | 69,851 | 13,327 | 235,768 | 2.3 | 148,977 | 35,543 |

| 1983 | 4,497 | 101,855 | 15,517 | 362,293 | 53.7 | 221,825 | 36,929 |

| 1984 | 4,840 | 100,116 | 17,527 | 373,509 | 3.1 | 225,698 | 38,614 |

| 1985 | 5,465 | 115,473 | 20,783 | 452,498 | 21.1 | 265,541 | 40,037 |

| 1986 | 6,110 | 152,209 | 24,380 | 623,768 | 37.9 | 361,778 | 40,674 |

| 1987 | 6,781 | 180,960 | 28,228 | 771,949 | 23.8 | 457,672 | 42,210 |

| 1988 | 7,116 | 167,083 | 30,815 | 742,856 | -3.8 | 427,911 | 43,858 |

| 1989 | 6,183 | 198,139 | 27,838 | 911,609 | 22.7 | 525,847 | 46,105 |

| 1990 | 8,920 | 202,429 | 41,689 | 971,051 | 6.5 | 581,168 | 48,277 |

| 1991 | 9,136 | 222,016 | 44,574 | 1,113,747 | 14.7 | 683,361 | 50,637 |

| 1992 | 8,319 | 244,607 | 42,315 | 1,272,372 | 14.2 | 779,015 | 52,247 |

| 1993 | 8,468 | 268,131 | 44,625 | 1,442,389 | 13.4 | 850,855 | 53,933 |

| 1994 | 8,583 | 266,513 | 46,719 | 1,479,112 | 2.5 | 896,027 | 55,206 |

| 1995 | 9,790 | 301,054 | 55,060 | 1,730,694 | 17.0 | 1,052,264 | 56,891 |

| 1996 | 10,008 | 381,514 | 58,187 | 2,256,894 | 30.4 | 1,369,880 | 58,539 |

| 1997 | 10,506 | 455,551 | 62,763 | 2,763,032 | 22.4 | 1,714,024 | 60,000 |

| 1998 | 11,033 | 628,864 | 67,443 | 3,890,253 | 40.8 | 2,417,442 | 60,861 |

| 1999 | 11,527 | 707,654 | 71,812 | 4,458,483 | 14.6 | 2,945,129 | 62,247 |

| 2000 | 11,935 | 646,507 | 75,684 | 4,148,130 | -7.0 | 3,243,332 | 64,157 |

| 2001 | 13,153 | 719,687 | 85,030 | 4,709,580 | 13.5 | 2,822,817 | 66,255 |

| 2002 | 13,116 | 700,823 | 86,458 | 4,674,962 | -0.7 | 2,466,687 | 67,341 |

| 2003 | 13,345 | 593,597 | 89,753 | 4,050,310 | -13.4 | 2,138,513 | 68,839 |

| 2004 | 13,383 | 717,050 | 92,016 | 4,989,599 | 23.2 | 2,627,509 | 70,412 |

| 2005 | 14,846 | 749,077 | 104,079 | 5,316,457 | 6.5 | 2,793,876 | 72,884 |

| 2006 | 15,614 | 830,885 | 111,648 | 6,013,586 | 13.1 | 3,224,286 | 75,468 |

| 2007 | 16,895 | 952,250 | 123,209 | 7,027,094 | 16.9 | 3,715,238 | 77,410 |

1These figures, unlike those shown elsewhere in this report, reflect payment of the maximum sales charge of |

| 5.75% on the $10,000 investment. Thus, the net amount invested was $9,425. As outlined in the prospectus, |

| the sales charge is reduced for larger investments of $25,000 or more. There is no sales charge on dividends |

| or capital gain distributions that are reinvested in additional shares. The maximum sales charge was 8.5% prior |

| to July 1, 1988. Results shown do not take into account income or capital gain taxes. |

| |

2Total value includes reinvested dividends of $1,573,474 and reinvested capital gain distributions of $2,266,974. |

| |

3Capital value includes reinvested capital gain distributions of $399,925 but does not reflect income dividends of |

| $296,916 taken in cash. |

| |

4Computed from data supplied by the U.S. Department of Labor, Bureau of Labor Statistics. |

| |

5Since the Fund's inception on July 31, 1952 |

| |

American Funds At Your Service | |

| |

American Funds Service Company shareholder services representative Vickie Wright. | Helping you when you need it Not long after Hurricane Katrina devastated the Gulf Coast, American Funds Service CompanySM shareholder services representative Vickie Wright received a call from a New Orleans resident whose home and workplace were among the casualties. The caller’s spouse needed access to money in his 401(k) account, but could not locate a plan trustee required to authorize a withdrawal. The caller gave Vickie, who is based in Norfolk, Virginia, the trustee’s name, phone number and e-mail address. Vickie used that information to find the trustee on a website set up by the employer and before long she was able to get the shareholder a check through his employer’s temporary headquarters. |

While the portfolio counselors and invest-ment analysts for Washington Mutual Investors Fund strive to maintain superior long-term investment results, many other people like Vickie Wright work just as hard to make your overall experience as a shareholder a good one.

First, there’s your broker or financial adviser. He or she can provide investment advice, put all your holdings (in the Fund and elsewhere) in perspective and help you achieve the overall balance that’s right for your circumstances and goals. When you have questions about how changes in the markets or your own life should be reflected in your portfolio, your broker or financial adviser is definitely the person to call. Of course, they can also help with anything from checking your account balance to changing your address.

Then there’s American Funds Service Company (AFS) — a team of some 3,000 people who work behind the scenes to help brokers, financial advisers and shareholders in all 30 of the American Funds, including Washington Mutual Investors Fund.

When you add to your investment, take money out of your account, exchange money from or to another of the American Funds, set up a retirement plan, change your address or your name, or receive a statement, a report or a tax form, AFS makes it happen.

From the time AFS was founded in 1969, it has grown and evolved to keep pace with or stay ahead of changes in rules and regulations affecting financial institutions as well as in the ways that people invest. Individual Retirement Accounts (IRAs), for example, became available to most people in 1982, and today IRAs represent roughly 40% of all investments in Washington Mutual Investors Fund.

Of course, advances in technology have also played a major role. In the 1970s, a toll-free number for incoming calls (800/421-0180) took the place of time-consuming collect calls. In the 1980s, an automated telephone information service called American FundsLine¨ (800/325-3590) was added to provide share prices, balance verifications and last transaction confirmations around the clock. And in the 1990s, the website americanfunds.com debuted. |

| | | |

| "We don’t focus on beating the clock. Our focus is on providing friendly and exceptional customer service." Maria Lockard |

The American Funds website The website makes it possible to do almost anything you want with your account, at any hour. If, for instance, it’s getting close to tax time and you’re struggling to prepare your tax return but can’t find your Form 1099 from American Funds, no problem: You can download a summary of the form. If it’s a Saturday afternoon and you need to know what your fund balance was in 1992, you can find out easily online. If you’ve just moved, notifying American Funds of your address change using the site means your account will be updated instantly and you’ll even save the cost of a stamp.

New services are often added, incorporating suggestions from shareholders. When some site users reported they were unable to call up their accounts because they had forgotten their passwords, adding a security question allowed shareholders to reset the entry code immediately. Sometime in the future, in response to comments from shareholders who want to minimize the pieces of paper in their lives, AFS hopes to offer e-mail notifications when annual reports, prospectuses and other documents are available online.

The news content of the site — which includes detailed fund descriptions, articles on a variety of investment topics, a detailed glossary of terms, and savings and cost calculators enabling shareholders to figure out how much they’ll need to pay for retirement or college tuition — is also updated regularly.

The American Funds website records an average of 2.5 million "hits" (or contacts) each month, most from shareholders checking their account balances or the share prices of their funds — a convenient alternative in an era when many newspapers are cutting costs by eliminating detailed financial listings.Shareholders use the site for about one in every five transactions. It’s most popular with investors adding to their American Funds accounts. Those who have signed up for FundsLink — linking their fund accounts to their bank accounts — can buy shares instantly by transferring money online. Investing through FundsLink puts your money to work faster than investing by mailing a check.

There are some instances where personal contact may be preferable to using the website. For example, changes resulting from life-changing events such as marriage or estate-related matters may be best handled by the telephone or in writing.In any case, if you don’t have computer access or if you’d simply prefer to deal with a person, your broker, your financial adviser or AFS would be happy to hear from you. | americanfunds.com page |

Shareholder account representatives: 800/421-0180 Call anytime between 8 a.m. and 8 p.m. Eastern Time and you’ll reach an American Funds shareholder account representative who has received more than six months of intensive training to help you with almost anything related to your investment. "Our people really appreciate the thorough training," says Maria Lockard, a shareholder services senior manager. "Too often companies just hand the phone representatives a manual and say ‘Here’s your desk.’"

There are more than 1,700 American Funds shareholder account representatives. Typically they handle a total of 25,000 calls a day, but some days the volume can be twice that high. Incoming calls go to the next available representative at any one of the eight service centers across the country. Although the person you talk withmay be in, say, San Antonio or Phoenix, all representatives have access to the same information and can assist you, regardless of where they are located.

Importantly, representatives are encouraged to spend as long on each call as is necessary to answer all questions completely and correctly. "We’re a service center, not a call center," Maria observes. "We don’t focus on beating the clock. Our focus is on providing friendly and exceptional customer service." | | Maria Lockard, center, discusses shareholder services with Fund directors Barbara Franklin and Jim Miller. |

| "It’s very important that the quality of American Funds shareholder services is in keeping with the quality of American Funds investment results. That’s a high standard." Daniel Callahan |

On each representative’s desk are two computer monitors tied to a pair of data systems: One is SONI (Source of Needed Information), which includes a search engine covering a multitude of investment topics. The other is SHARE (System to Help Associates Respond Effectively). By entering an account number in SHARE, an American Funds shareholder services representative can call up complete details for that account and any related accounts, instantly.

Quite a few calls are to request transactions — so to make life simple and confirm the details, a list of questions comes up on the SHARE monitor for the representative to ask the caller after the buy, sell or exchange order is entered. The account numbers, amounts of money involved, dates and times and even the representative’s name and phone extension are included.

Requests for documents or forms are usually among the easiest to handle. Typically a representative can dispatch a copy of the file by e-mail or fax with a single click while still on the phone with the caller.

While every call is important to the person making it, sometimes a shareholder account representative can really save the day. As recalled by shareholder services senior manager Joyce Kirby, "A shareholder who had been investing in Washington Mutual Investors Fund since 1985 realized he needed an additional $10,000 to complete his home loan closing. Recognizing the urgency we gathered additional information and were able to redeem the amount needed from his account. The funds were wired and he got the house." | Shareholder services senior manager Joyce Kirby. |

Despite the convenience of the website and the human touch of American Funds’ telephone representatives, many service requests still arrive in the mail — including 25% of all transaction orders. Representatives from each service center begin picking up mail at the post office during the wee hours — as early as 1 a.m. — so that it’s processed as quickly as possible. After the envelopes are opened, the documents inside are run through high-speed scanners that can read 125 pages a minute. Once scanned, they can be processed at any of the service centers.

In the event bad weather is expected that could knock out power at one location before the documents can be scanned, incoming mail is quickly routed to another service center. When Hurricane Isabel threatened the East Coast in 2003, mail sent to the Norfolk office was put on a plane to Indianapolis and processed there.

The operations of American Funds Service Company are overseen by a committee of members from the boards of directors of each of the American Funds. Among other things, the committee members review reports, tour facilities and are shareholders themselves. Daniel Callahan — vice chairman and treasurer of one of the largest independent charitable foundations in Washington, DC — is a committee member and director of Washington Mutual Investors Fund. He says, "It’s very important that the quality of American Funds shareholder services is in keeping with the quality of American Funds investment results. That’s a high standard. American Funds Service Company not only continues to meet the challenge, but is constantly working to make it easier for shareholders to do what they want, when they want, with their accounts." ■ | | Fund Chairman Cyrus Ansary and fellow director Daniel Callahan. |

Daisy Shamlee operates a high-speed mail scanner. | | |

Investment portfolio April 30, 2007

Industry sector holdings | Percent of net assets | | Ten largest holdings | Percent of net assets |

| Financials | 19.82% | | AT&T | 3.77% |

| Industrials | 13.42 | | General Electric | 3.62 |

| Health care | 12.86 | | Chevron | 3.44 |

| Energy | 11.45 | | ExxonMobil | 2.84 |

| Information technology | 7.98 | | Citigroup | 2.63 |

| Consumer discretionary | 7.94 | | IBM | 2.19 |

| Consumer staples | 7.24 | | JPMorgan Chase | 2.17 |

| Telecommunication services | 5.97 | | United Parcel Service | 1.98 |

| Utilities | 5.28 | | Fannie Mae | 1.91 |

| Materials | 3.60 | | Merck | 1.85 |

| Miscellaneous | .76 | | | |

| Short-term securities & other assets less liabilities | 3.68 | | | |

| Common stocks — 96.32% | Shares | Market value (000) | | Percent of net assets |

Energy — 11.45% | | | | |

| Apache Corp. | 4,000,000 | $ 290,000 | | .33% |

| Baker Hughes Inc. | 4,670,000 | 375,422 | | .43 |

| Chevron Corp. | 39,029,800 | 3,036,128 | | 3.44 |

| ConocoPhillips | 12,800,000 | 887,680 | | 1.01 |

| EOG Resources, Inc. | 7,005,000 | 514,447 | | .58 |

| Exxon Mobil Corp. | 31,515,000 | 2,501,661 | | 2.84 |

| Halliburton Co. | 5,830,000 | 185,219 | | .21 |

| Marathon Oil Corp. | 12,562,612 | 1,275,733 | | 1.45 |

| Schlumberger Ltd. | 13,918,702 | 1,027,618 | | 1.16 |

| | 10,093,908 | | 11.45 |

| | | | | |

Materials — 3.60% | | | | |

| Air Products and Chemicals, Inc. | 4,000,000 | 306,000 | | .35 |

| Alcoa Inc. | 19,415,200 | 689,046 | | .78 |

| E.I. du Pont de Nemours and Co. | 14,900,000 | 732,633 | | .83 |

| MeadWestvaco Corp. | 1,200,000 | 40,032 | | .04 |

| Newmont Mining Corp. | 4,600,000 | 191,820 | | .22 |

| PPG Industries, Inc. | 6,374,700 | 469,050 | | .53 |

| Weyerhaeuser Co. | 9,450,000 | 748,629 | | .85 |

| | 3,177,210 | | 3.60 |

| | | | | |

Industrials — 13.42% | | | | |

| 3M Co. | 3,500,000 | 289,695 | | .33 |

| Avery Dennison Corp. | 270,300 | 16,813 | | .02 |

| Boeing Co. | 9,000,000 | 837,000 | | .95 |

| Caterpillar Inc. | 7,850,000 | 570,067 | | .65 |

| Deere & Co. | 4,600,000 | 503,240 | | .57 |

| Eaton Corp. | 1,200,000 | 107,052 | | .12 |

| Emerson Electric Co. | 3,400,000 | 159,766 | | .18 |

| General Dynamics Corp. | 2,950,000 | 231,575 | | .26 |

| General Electric Co. | 86,680,000 | 3,195,025 | | 3.62 |

| Illinois Tool Works Inc. | 7,100,000 | 364,301 | | .41 |

| Ingersoll-Rand Co. Ltd., Class A | 3,400,000 | 151,810 | | .17 |

| Lockheed Martin Corp. | 3,650,000 | 350,911 | | .40 |

| Northrop Grumman Corp. | 13,500,000 | 994,140 | | 1.13 |

| Pitney Bowes Inc. | 4,000,000 | 192,000 | | .22 |

| R.R. Donnelley & Sons Co. | 4,150,000 | 166,830 | | .19 |

| Raytheon Co. | 3,000,000 | 160,620 | | .18 |

| Southwest Airlines Co. | 10,500,000 | 150,675 | | .17 |

| Tyco International Ltd. | 17,695,000 | 577,388 | | .65 |

| Union Pacific Corp. | 1,400,000 | 159,950 | | .18 |

| United Parcel Service, Inc., Class B | 24,772,900 | 1,744,755 | | 1.98 |

| United Technologies Corp. | 13,605,000 | 913,303 | | 1.04 |

| | 11,836,916 | | 13.42 |

| | | | | |

Consumer discretionary — 7.94% | | | | |

| Best Buy Co., Inc. | 12,395,000 | 578,227 | | .65 |

| Carnival Corp., units | 15,012,900 | 733,981 | | .83 |

| Gannett Co., Inc. | 3,250,000 | 185,445 | | .21 |

| Harley-Davidson, Inc. | 3,800,000 | 240,616 | | .27 |

| Home Depot, Inc. | 8,300,000 | 314,321 | | .36 |

| Johnson Controls, Inc. | 6,279,400 | 642,571 | | .73 |

| Limited Brands, Inc. | 17,562,100 | 484,187 | | .55 |

| Lowe’s Companies, Inc. | 52,800,000 | 1,613,568 | | 1.83 |

| McDonald’s Corp. | 7,000,000 | 337,960 | | .38 |

| ServiceMaster Co. | 11,900,000 | 183,141 | | .21 |

| Target Corp. | 20,285,000 | 1,204,320 | | 1.37 |

| TJX Companies, Inc. | 5,300,000 | 147,817 | | .17 |

| VF Corp. | 3,800,000 | 333,678 | | .38 |

| | 6,999,832 | | 7.94 |

| | | | | |

Consumer staples — 7.24% | | | | |

| Avon Products, Inc. | 14,190,000 | 564,762 | | .64 |

| Coca-Cola Co. | 24,385,600 | 1,272,684 | | 1.44 |

| ConAgra Foods, Inc. | 4,400,000 | 108,152 | | .12 |

| General Mills, Inc. | 2,000,000 | 119,800 | | .14 |

| H.J. Heinz Co. | 2,270,000 | 106,940 | | .12 |

| Kellogg Co. | 5,000,000 | 264,550 | | .30% |

| Kimberly-Clark Corp. | 8,300,000 | 590,711 | | .67 |

| PepsiCo, Inc. | 18,002,500 | 1,189,785 | | 1.35 |

| Procter & Gamble Co. | 4,843,100 | 311,460 | | .35 |

| SYSCO Corp. | 4,500,000 | 147,330 | | .17 |

| Unilever NV (New York registered) | 4,000,000 | 122,000 | | .14 |

| Walgreen Co. | 7,300,000 | 320,470 | | .36 |

| Wal-Mart Stores, Inc. | 20,022,300 | 959,469 | | 1.09 |

| Wm. Wrigley Jr. Co. | 5,154,100 | 303,473 | | .35 |

| | | 6,381,586 | | 7.24 |

| | | | | |

Health care — 12.86% | | | | |

| Abbott Laboratories | 23,820,000 | 1,348,688 | | 1.5 |

| Aetna Inc. | 4,965,000 | 232,759 | | .26 |

Amgen Inc.1 | 8,026,000 | 514,788 | | .58 |

| Bristol-Myers Squibb Co. | 53,295,000 | 1,538,094 | | 1.75 |

| Cardinal Health, Inc. | 7,750,000 | 542,113 | | .62 |

| CIGNA Corp. | 1,090,000 | 169,593 | | .19 |

| Eli Lilly and Co. | 24,745,000 | 1,463,172 | | 1.66 |

| Johnson & Johnson | 11,550,000 | 741,741 | | .84 |

| McKesson Corp. | 2,500,000 | 147,075 | | .17 |

| Medtronic, Inc. | 13,050,000 | 690,737 | | .78 |

| Merck & Co., Inc. | 31,760,000 | 1,633,734 | | 1.85 |

| Pfizer Inc | 37,880,500 | 1,002,318 | | 1.14 |

| Wyeth | 23,644,600 | 1,312,275 | | 1.49 |

| | | 11,337,087 | | 12.86 |

| | | | | |

Financials — 19.82% | | | | |

| AFLAC Inc. | 3,505,000 | 179,947 | | .20 |

| Allstate Corp. | 6,150,000 | 383,268 | | .43 |

| American International Group, Inc. | 12,326,600 | 861,753 | | .98 |

| Aon Corp. | 3,150,000 | 122,062 | | .14 |

| Bank of America Corp. | 30,230,000 | 1,538,707 | | 1.74 |

| Bank of New York Co., Inc. | 19,770,000 | 800,290 | | .91 |

| Citigroup Inc. | 43,171,000 | 2,314,829 | | 2.63 |

| Fannie Mae | 28,607,700 | 1,685,566 | | 1.91 |

| Fifth Third Bancorp | 4,850,000 | 196,861 | | .22 |

| Freddie Mac | 11,540,000 | 747,561 | | .85 |

| HSBC Holdings PLC (ADR) | 5,172,000 | 477,686 | | .54 |

| JPMorgan Chase & Co. | 36,720,000 | 1,913,112 | | 2.17 |

| Lincoln National Corp. | 6,050,000 | 430,458 | | .49 |

| Marsh & McLennan Companies, Inc. | 22,522,900 | 715,327 | | .81 |

| State Street Corp. | 1,500,000 | 103,305 | | .12 |

| SunTrust Banks, Inc. | 800,000 | 67,536 | | .08 |

| Travelers Companies, Inc. | 3,000,000 | 162,300 | | .18 |

| U.S. Bancorp | 21,400,000 | 735,090 | | .83% |

| Wachovia Corp. | 16,550,000 | 919,187 | | 1.04 |

| Washington Mutual, Inc. | 32,950,000 | 1,383,241 | | 1.57 |

| Wells Fargo & Co. | 41,460,000 | 1,487,999 | | 1.69 |

| XL Capital Ltd., Class A | 3,232,300 | 252,055 | | .29 |

| | | 17,478,140 | | 19.82 |

| | | | | |

Information technology — 7.98% | | | | |

Dell Inc.1 | 3,300,000 | 83,193 | | .09 |

| Hewlett-Packard Co. | 23,285,000 | 981,230 | | 1.11 |

| Intel Corp. | 40,250,000 | 865,375 | | .98 |

| International Business Machines Corp. | 18,875,000 | 1,929,214 | | 2.19 |

| Linear Technology Corp. | 8,165,000 | 305,534 | | .35 |

| Maxim Integrated Products, Inc. | 4,000,000 | 126,880 | | .14 |

| Microsoft Corp. | 51,140,000 | 1,531,132 | | 1.74 |

Oracle Corp.1 | 37,191,943 | 699,208 | | .79 |

| Texas Instruments Inc. | 15,035,300 | 516,763 | | .59 |

| | | 7,038,529 | | 7.98 |

| | | | | |

Telecommunication services — 5.97% | | | | |

| AT&T Inc. | 85,946,587 | 3,327,852 | | 3.77 |

| Sprint Nextel Corp., Series I | 52,189,360 | 1,045,353 | | 1.18 |

| Verizon Communications Inc. | 23,470,000 | 896,084 | | 1.02 |

| | 5,269,289 | | 5.97 |

| | | | | |

Utilities — 5.28% | | | | |

| Ameren Corp. | 3,368,800 | 177,098 | | .20 |

| American Electric Power Co., Inc. | 7,100,000 | 356,562 | | .40 |

| Constellation Energy Group, Inc. | 2,250,000 | 200,520 | | .23 |

| Dominion Resources, Inc. | 7,375,600 | 672,655 | | .76 |

| Duke Energy Corp. | 2,500,000 | 51,300 | | .06 |

| Entergy Corp. | 3,717,700 | 420,621 | | .48 |

| Exelon Corp. | 16,870,000 | 1,272,167 | | 1.44 |

| FPL Group, Inc. | 4,000,000 | 257,480 | | .29 |

| NiSource Inc. | 2,500,000 | 61,475 | | .07 |

| PPL Corp. | 4,800,000 | 209,328 | | .24 |

| Progress Energy, Inc. | 1,150,000 | 58,132 | | .07 |

| Public Service Enterprise Group Inc. | 6,450,000 | 557,602 | | .63 |

| Southern Co. | 7,000,000 | 264,530 | | .30 |

| Xcel Energy Inc. | 4,000,000 | 96,360 | | .11 |

| | | 4,655,830 | | 5.28 |

| | | | | |

Miscellaneous — 0.76% | | | | |

| Other common stocks in initial period of acquisition | | 668,778 | | .76 |

| | | | | |

Total common stocks (cost: $57,951,337,000) | | 84,937,105 | | 96.32 |

| Short-term securities — 4.00% | Principal amount (000) | Market value (000) | | Percent of net assets |

| | | | |

3M Co. 5.18%–5.20% due 5/29/2007 | $ 77,700 | $ 77,377 | | .09% |

Abbott Laboratories 5.22%–5.24% due 5/1–6/1/20072 | 156,000 | 155,565 | | .18 |

American Express Credit Corp. 5.21% due 5/25/2007 | 25,000 | 24,913 | | .03 |

Atlantic Industries 5.18% due 5/30/20072 | 45,000 | 44,809 | | .17 |

Coca-Cola Co. 5.18%–5.21% due 5/11–6/27/20072 | 102,800 | 102,423 | |

Bank of America Corp. 5.235% due 5/9–5/29/2007 | 65,300 | 65,122 | | .21 |

Ranger Funding Co. LLC 5.25%–5.26% due 5/24–6/11/20072 | 124,800 | 124,211 | |

Becton, Dickinson and Co. 5.20% due 6/7/2007 | 12,400 | 12,332 | | .01 |

Caterpillar Financial Services Corp. 5.21% due 5/7/2007 | 20,000 | 19,980 | | .02 |

CIT Group, Inc. 5.22%–5.25% due 5/11–7/6/20072 | 100,100 | 99,282 | | .11 |

Citigroup Funding Inc. 5.24% due 7/11/2007 | 76,400 | 75,611 | | .09 |

Clipper Receivables Co., LLC 5.24%–5.25% due 5/17–6/14/20072 | 181,000 | 180,021 | | .20 |

Colgate-Palmolive Co. 5.21% due 5/15/20072 | 25,000 | 24,946 | | .03 |

Concentrate Manufacturing Co. of Ireland 5.29% due 5/1/20072 | 28,000 | 27,996 | | .03 |

E.I. duPont de Nemours and Co. 5.19% due 5/23/20072 | 25,000 | 24,917 | | .03 |

Emerson Electric Co. 5.23% due 5/2/20072 | 25,000 | 24,993 | | .03 |

Fannie Mae 5.14% due 5/16/2007 | 50,000 | 49,885 | | .06 |

FCAR Owner Trust I 5.25%–5.26% due 5/4–6/18/2007 | 75,000 | 74,627 | | .08 |

Federal Farm Credit Banks 5.10% due 7/9/2007 | 33,000 | 32,677 | | .04 |

Federal Home Loan Bank 5.115%–5.15% due 5/25–7/18/2007 | 351,300 | 349,142 | | .40 |

Freddie Mac 5.10%–5.145% due 5/16–7/9/2007 | 112,600 | 112,015 | | .13 |

Harley-Davidson Funding Corp. 5.19%–5.21% due 5/1–6/18/20072 | 50,500 | 50,234 | | .06 |

Harvard University 5.18%–5.185% due 5/15–6/5/2007 | 50,000 | 49,800 | | .06 |

Hershey Co. 5.19%–5.21% due 5/10–5/11/20072 | 68,500 | 68,395 | | .08 |

Hewlett-Packard Co. 5.24% due 5/17/20072 | 50,000 | 49,876 | | .06 |

Honeywell International Inc. 5.16% due 9/14/20072 | 68,469 | 67,115 | | .08 |

IBM Corp. 5.20%–5.23% due 5/24–6/14/20072 | 125,000 | 124,407 | | .14 |

Illinois Tool Works Inc. 5.21% due 5/18/2007 | 20,000 | 19,948 | | .02 |

International Lease Finance Corp. 5.20%–5.22% due 5/14–6/11/2007 | 182,400 | 181,639 | | .21 |

Johnson & Johnson 5.18%–5.19% due 6/5–6/22/20072 | 70,900 | 70,403 | | .08 |

JPMorgan Chase & Co. 5.30% due 5/1/2007 | 23,450 | 23,447 | | .08 |

Jupiter Securitization Co., LLC 5.24% due 6/18/20072 | 50,400 | 50,040 | |

Kimberly-Clark Worldwide Inc. 5.19%–5.20% due 5/21–5/29/20072 | 75,500 | 75,201 | | .08 |

Merck & Co. Inc. 5.19%–5.20% due 6/8–6/26/2007 | 47,950 | 47,628 | | .05 |

NetJets Inc. 5.19%–5.20% due 5/1–5/18/20072 | 73,000 | 72,907 | | .08 |

Paccar Financial Corp. 5.20%–5.22% due 5/31–7/9/2007 | 33,500 | 33,303 | | .04 |

Private Export Funding Corp. 5.19%–5.23% due 5/10–7/17/20072 | 136,000 | 135,172 | | .15 |

Procter & Gamble International Funding S.C.A. 5.21%–5.23% due 5/11–7/10/20072 | 164,690 | 164,027 | | .19 |

Tennessee Valley Authority 5.145% due 5/3/2007 | 38,745 | 38,728 | | .04 |

Three Pillars Funding, LLC 5.27% due 5/15/20072 | 11,000 | 10,976 | | .01 |

Union Bank of California, N.A. 5.26% due 6/15–6/25/2007 | 100,000 | 100,000 | | .11 |

United Technologies Corp. 5.21%–5.22% due 5/1–5/22/20072 | 62,600 | 62,479 | | .07 |

Variable Funding Capital Corp. 5.23%–5.24% due 5/2–6/19/20072 | 221,100 | 220,404 | | .25 |

Wal-Mart Stores Inc. 5.19%–5.21% due 6/12/20072 | 108,590 | 107,922 | | .12 |

| | | | | |

Total short-term securities (cost: $3,526,753,000) | | 3,526,895 | | 4.00 |

| | | | | |

Total investment securities (cost: $61,478,090,000) | | 88,464,000 | | 100.32 |

| Other assets less liabilities | | (283,128) | | (.32) |

| | | | | |

Net assets | | $88,180,872 | | 100.00% |

| | | | | |

"Miscellaneous" securities include holdings in their initial period of acquisition that have not previously been publicly disclosed.

Investments in affiliates |

A company is considered to be an affiliate of the Fund under the Investment Company Act of 1940 if the Fund’s holdings in that company represent 5% or more of the outstanding voting shares of that company. Further details on this holding and related transactions during the year ended April 30, 2007, appear below. |

Company | Beginning shares | Purchases | Sales | Ending shares | Dividend income (000) | Market value of affiliate at 4/30/07 (000) |

Limited Brands3 | 19,930,000 | — | 2,367,900 | 17,562,100 | $11,589 | — |

1Security did not produce income during the last 12 months.

2Restricted security that can be resold only to institutional investors. In practice, this security is typically as liquid as unrestricted securities in the portfolio. The total value of all such restricted securities was $2,138,721,000, which represented 2.43% of the net assets of the Fund.

3Unaffiliated issuer at 4/30/2007.

ADR = American Depositary Receipts

See Notes to financial statements

Financial statements

Statement of assets and liabilities at April 30, 2007 | (dollars and shares in thousands, except per-share amounts) |

Assets: | | |

| Investment securities at market (cost: $61,478,090) | | | $88,464,000 |

| Cash | | | 412 |

| Receivables for: | | | |

| Sales of investments | | $226,288 | | |

| Sales of Fund’s shares | | 77,945 | | |

| Dividends and interest | | 145,183 | | 449,416 |

| | | | | 88,913,828 |

Liabilities: | | | | |

| Payables for: | | | | |

| Purchases of investments | | 548,078 | | |

| Repurchases of Fund’s shares | | 111,807 | | |

| Management services | | 16,647 | | |

| Services provided by affiliates | | 54,563 | | |

| Deferred director and advisory board compensation | | 1,638 | | |

| Other | | 223 | | 732,956 |

Net assets at April 30, 2007 | | | | $88,180,872 |

| | | | | |

Net assets consist of: | | | | |

| Capital paid in on shares of capital stock | | | | $58,732,477 |

| Undistributed net investment income | | | | 536,429 |

| Undistributed net realized gain | | | | 1,926,056 |

| Net unrealized appreciation | | | | 26,985,910 |

Net assets at April 30, 2007 | | | | $88,180,872 |

Total authorized capital stock — 4,000,000 shares, $.001 par value (2,414,612 total shares outstanding) |

| | Net Assets | | Shares outstanding | | Net asset value per share* |

Class A | $70,810,966 | | 1,937,137 | | $36.55 |

Class B | 3,296,205 | | 90,738 | | 36.33 |

Class C | 3,481,096 | | 96,013 | | 36.26 |

Class F | 3,178,582 | | 87,138 | | 36.48 |

Class 529-A | 1,093,532 | | 29,947 | | 36.51 |

Class 529-B | 218,281 | | 6,002 | | 36.36 |

Class 529-C | 373,966 | | 10,289 | | 36.35 |

Class 529-E | 60,867 | | 1,673 | | 36.39 |

Class 529-F | 47,140 | | 1,292 | | 36.47 |

Class R-1 | 69,014 | | 1,899 | | 36.33 |

Class R-2 | 985,191 | | 27,181 | | 36.25 |

Class R-3 | 2,198,781 | | 60,447 | | 36.38 |

Class R-4 | 1,212,801 | | 33,267 | | 36.46 |

Class R-5 | 1,154,450 | | 31,589 | | 36.55 |

*Maximum offering price and redemption price per share were equal to the net asset value per share for all share classes, except for Class A and 529-A, for which the maximum offering prices per share were $38.78 and $38.74, respectively.

See Notes to financial statements

Statement of operations for the year ended April 30, 2007 | (dollars in thousands) |

Investment income: | | |

| Income: | | |

| Dividends (net of non-U.S. taxes of $1,270; also includes $11,589 from affiliate) | | $1,959,963 | |

| Interest | | 140,061 | | $2,100,024 |

| | | | | |

Fees and expenses*: | | | | |

| Investment advisory services | | 157,426 | | |

| Business management services | | 56,603 | | |

| Distribution services | | 256,478 | | |

| Transfer agent services | | 55,016 | | |

| Administrative services | | 20,939 | | |

| Reports to shareholders | | 1,911 | | |

| Registration statement and prospectus | | 1,306 | | |

| Postage, stationery and supplies | | 6,471 | | |

| Director and advisory board compensation | | 1,369 | | |

| Auditing and legal | | 288 | | |

| Custodian | | 406 | | |

| State and local taxes | | 1 | | |

| Other | | 236 | | |

| Total fees and expenses before reimbursements/waivers | | 558,450 | | |

| Less reimbursements/waivers of fees and expenses: | | | | |

| Investment advisory services | | 15,743 | | |

| Business management services | | 5,661 | | |

| Administrative services | | 298 | | |

| Total fees and expenses after reimbursements/waivers | | | | 536,748 |

| Net investment income | | | | 1,563,276 |

| | | | | |

Net realized gain and unrealized appreciation on investments: | | | | |

| Net realized gain on investments (including $19,957 net gain from affiliate) | | | | 2,894,512 |

| Net unrealized appreciation on investments | | | | 8,389,975 |

| Net realized gain and unrealized appreciation on investments | | | | 11,284,487 |

Net increase in net assets resulting from operations | | | | $12,847,763 |

*Additional information related to class-specific fees and expenses is included in the Notes to financial statements.

Statements of changes in net assets | (dollars in thousands) |

| | | Year ended April 30 |

| | | 2007 | | 2006 | | |

Operations: | | |

| Net investment income | | | $1,563,276 | | | $1,578,232 |

| Net realized gain on investments | | | 2,894,512 | | | 1,992,122 |

| Net unrealized appreciation on investments | | | 8,389,975 | | | 5,840,968 |

| Net increase in net assets resulting from operations | | | 12,847,763 | | | 9,411,322 |

| | | |

Dividends and distributions paid to shareholders: | | |

| Dividends from net investment income | | | (1,512,000) | | | (1,464,289) |

| Distributions from net realized gain on investments | | | (1,982,588) | | | (1,051,850) |

| Total dividends and distributions paid to shareholders | | | (3,494,588) | | | (2,516,139) |

| | | |

Capital share transactions | | | (205,260) | | | (2,318,017) |

| | | |

Total increase in net assets | | | 9,147,915 | | | 4,577,166 |

| | | |

Net assets: | | |

| Beginning of year | | | 79,032,957 | | | 74,455,791 |

| End of year (including undistributed net investment income: $536,429 and $484,601, respectively) | | | $88,180,872 | | | $79,032,957 |

See Notes to financial statements

Notes to financial statements

1. Organization and significant accounting policies |

Organization — Washington Mutual Investors Fund (the "Fund") is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The Fund’s investment objective is to produce current income and to provide an opportunity for growth of principal consistent with sound common stock investing.

The Fund offers 14 share classes consisting of four retail share classes, five CollegeAmerica¨ savings plan share classes and five retirement plan share classes. The CollegeAmerica savings plan share classes (529-A, 529-B, 529-C, 529-E and 529-F) can be utilized to save for college education. The five retirement plan share classes (R-1, R-2, R-3, R-4 and R-5) are sold without any sales charges and do not carry any conversion rights. The Fund’s share classes are described below:

Share class | Initial sales charge | Contingent deferred sales charge upon redemption | Conversion feature |

Class A and 529-A | Up to 5.75% | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | None |

Class B and 529-B | None | Declines from 5% to 0% for redemptions within six years of purchase | Class B and 529-B convert to Class A and 529-A, respectively, after eight years |

Class C | None | 1% for redemptions within one year of purchase | Class C converts to Class F after 10 years |

Class 529-C | None | 1% for redemptions within one year of purchase | None |

Class 529-E | None | None | None |

Class F and 529-F | None | None | None |

Class R-1, R-2, R-3, R-4 and R-5 | None | None | None |

Holders of all share classes have equal pro rata rights to assets, dividends and liquidation proceeds. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses ("class-specific fees and expenses"), primarily due to different arrangements for distribution, administrative and shareholder services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each class.

Significant accounting policies — The financial statements have been prepared to comply with accounting principles generally accepted in the United States of America. These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of the significant accounting policies followed by the Fund:

Security valuation — Equity securities are valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market in which the security trades. Fixed-income securities, including short-term securities purchased with more than 60 days left to maturity, are valued at prices obtained from an independent pricing service when such prices are available. However, where the investment adviser deems it appropriate, such securities will be valued at the mean quoted bid and asked prices (or bid prices, if asked prices are not available) or at prices for securities of comparable maturity, quality and type. Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are valued in the manner described above for either equity or fixed-income securities, depending on which method is deemed most appropriate by the investment adviser. Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates market value. The value of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to par when they reach 60 days or less remaining to maturity. The ability of the issuers of the debt securities held by the Fund to meet their obligations may be affected by economic developments in a specific industry, state or region.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the investment adviser are fair valued as determined in good faith under procedures adopted by authority of the Fund’s board of directors. Various factors may be reviewed in order to make a good faith determination of a security’s fair value. These factors include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions.

Security transactions and related investment income — Security transactions are recorded by the Fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations—Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, administrative and shareholder services, are charged directly to the respective share class.

Dividends and distributions to shareholders— Dividends and distributions paid to shareholders are recorded on the ex-dividend date.

2. Federal income taxation and distributions |

The Fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The Fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to differing treatment for items such as short-term capital gains and losses; capital losses related to sales of certain securities within 30 days of purchase; and cost of investments sold. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the Fund for financial reporting purposes. The Fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

During the year ended April 30, 2007, the Fund reclassified $650,000 from undistributed net realized gain to undistributed net investment income, and reclassified $98,000 from undistributed net investment income and $111,849,000 from undistributed net realized gain to capital paid in on shares of capital stock to align financial reporting with tax reporting.

As of April 30, 2007, the tax basis components of distributable earnings, unrealized appreciation (depreciation) and cost of investments were as follows:

| | (dollars in thousands) |

| Undistributed ordinary income | $ 538,067 |

| Undistributed long-term capital gain | 1,955,027 |

| Gross unrealized appreciation on investment securities | 27,078,833 |

| Gross unrealized depreciation on investment securities | (121,895) |

| Net unrealized appreciation on investment securities | 26,956,938 |

| Cost of investment securities | 61,507,062 |

The tax character of distributions paid to shareholders was as follows (dollars in thousands):

| | Year ended April 30, 2007 | | Year ended April 30, 2006 |

Share class | Ordinary income | | Long-term capital gains | | Total distributions paid | | Ordinary income | | Long-term capital gains | | Total distributions paid |

Class A | $1,275,081 | | $1,597,354 | | $2,872,435 | | $1,246,004 | | $ 856,631 | | $2,102,635 |

Class B | 37,056 | | 75,227 | | 112,283 | | 36,979 | | 41,104 | | 78,083 |

Class C | 36,403 | | 78,461 | | 114,864 | | 36,207 | | 42,338 | | 78,545 |

Class F | 54,831 | | 70,012 | | 124,843 | | 50,606 | | 35,323 | | 85,929 |

Class 529-A | 17,405 | | 22,998 | | 40,403 | | 13,993 | | 10,202 | | 24,195 |

Class 529-B | 2,090 | | 4,793 | | 6,883 | | 1,805 | | 2,293 | | 4,098 |

Class 529-C | 3,511 | | 8,006 | | 11,517 | | 2,901 | | 3,641 | | 6,542 |

Class 529-E | 823 | | 1,280 | | 2,103 | | 662 | | 578 | | 1,240 |

Class 529-F | 794 | | 955 | | 1,749 | | 531 | | 353 | | 884 |

Class R-1 | 637 | | 1,438 | | 2,075 | | 468 | | 566 | | 1,034 |

Class R-2 | 9,964 | | 21,847 | | 31,811 | | 8,618 | | 10,244 | | 18,862 |

Class R-3 | 32,045 | | 49,786 | | 81,831 | | 30,347 | | 24,319 | | 54,666 |

Class R-4 | 19,453 | | 25,099 | | 44,552 | | 17,967 | | 12,688 | | 30,655 |

Class R-5 | 21,907 | | 25,332 | | 47,239 | | 17,201 | | 11,570 | | 28,771 |

| Total | $1,512,000 | | $1,982,588 | | $3,494,588 | | $1,464,289 | | $1,051,850 | | $2,516,139 |

3. Fees and transactions with related parties |

Business management services — The Fund has a Business Management Agreement with Washington Management Corporation (WMC). Under this agreement, WMC provides services necessary to carry on the Fund’s general administrative and corporate affairs. These services encompass matters relating to general corporate governance, regulatory compliance and monitoring of the Fund’s contractual service providers, including custodian operations, shareholder services and Fund share distribution functions. Under the agreement, all expenses chargeable to the Class A shares of the Fund, including compensation to the business manager, shall not exceed 1% of the Class A average net assets of the Fund on an annual basis. The agreement provides for monthly fees, accrued daily, based on a declining series of annual rates beginning with 0.175% on the first $3 billion of daily net assets and decreasing to 0.030% on such assets in excess of $77 billion. WMC is currently waiving 10% of business management services fees. During the year ended April 30, 2007, WMC reduced business management services fees by $5,661,000. As a result, the fee shown on the accompanying financial statements of $56,603,000, which was equivalent to an annualized rate of 0.069%, was reduced to $50,942,000, or 0.062% of average daily net assets. During the year ended April 30, 2007, WMC paid the Fund’s investment adviser $2,287,000 for performing various fund accounting services for the Fund and for The American Funds Tax-Exempt Series I, another registered investment company for which WMC serves as business manager. Johnston, Lemon & Co. Incorporated (JLC), a wholly owned subsidiary of The Johnston-Lemon Group, Incorporated (JLG) (parent company of WMC), earned $583,000 on its retail sales of shares and distribution plan of the Fund. JLC received no brokerage commissions resulting from the purchases and sales of securities for the investment account of the Fund.

Investment advisory services — Capital Research and Management Company (CRMC), the Fund’s investment adviser, is the parent company of American Funds Service CompanySM (AFS), the Fund’s transfer agent, and American Funds Distributors,SM Inc. (AFD), the principal under-writer of the Fund’s shares. The Investment Advisory Agreement with CRMC provides for monthly fees accrued daily. These fees are based on a declining series of annual rates beginning with 0.225% on the first $3 billion of daily net assets and decreasing to 0.177% on such assets in excess of $89 billion. CRMC is currently waiving 10% of investment advisory services fees. During the year ended April 30, 2007, total investment advisory services fees waived by CRMC were $15,743,000. As a result, the fee shown on the accompanying financial statements of $157,426,000, which was equivalent to an annualized rate of 0.193%, was reduced to $141,683,000, or 0.173% of average daily net assets.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are described below:

Distribution services — The Fund has adopted plans of distribution for all share classes, except Class R-5. Under the plans, the board of directors approves certain categories of expenses that are used to finance activities primarily intended to sell Fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.25% to 1.00% as noted below. In some cases, the board of directors has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

For Class A and 529-A, the board of directors has also approved the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. These classes reimburse AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit of 0.25% is not exceeded. As of April 30, 2007, there were no unreimbursed expenses subject to reimbursement for Class A or 529-A.

Share class | Currently approved limits | Plan limits |

Class A | 0.25% | 0.25% |

Class 529-A | 0.25 | 0.50 |

Class B and 529-B | 1.00 | 1.00 |

Class C, 529-C and R-1 | 1.00 | 1.00 |

Class R-2 | 0.75 | 1.00 |

Class 529-E and R-3 | 0.50 | 0.75 |

Class F, 529-F and R-4 | 0.25 | 0.50 |

Transfer agent services— The Fund has a transfer agent agreement with AFS for Class A and B. Under this agreement, these share classes compensate AFS for transfer agent services including shareholder recordkeeping, communications and transaction processing. AFS is also compensated for certain transfer agent services provided to all other share classes from the administrative services fees paid to CRMC described below.

Administrative services — The Fund has an administrative services agreement with CRMC to provide transfer agent and other related shareholder services for all share classes other than Class A and B. Each relevant share class pays CRMC annual fees up to 0.15% (0.10% for Class R-5) based on its respective average daily net assets. Each relevant share class also pays AFS additional amounts for certain transfer agent services. CRMC and AFS may use these fees to compensate third parties for performing these services. CRMC has agreed to pay AFS on the Fund’s behalf for a portion of the transfer agent services fees for some of the retirement plan share classes. For the year ended April 30, 2007, the total administrative services fees paid by CRMC were $191 and $298,000 for Class R-1 and R-2, respectively. Administrative services fees are presented gross of any payments made by CRMC. Each 529 share class is subject to an additional annual administrative services fee of 0.10% of its respective average daily net assets; this fee is payable to the Commonwealth of Virginia for the maintenance of the CollegeAmerica plan. Although these amounts are included with administrative services fees on the accompanying financial statements, the Commonwealth of Virginia is not considered a related party.

Expenses under the agreements described above for the year ended April 30, 2007, were as follows (dollars in thousands):

| | | | | | Administrative services |

Share class | Distribution services | | Transfer agent services | | CRMC administrative services | | Transfer agent services | | Commonwealth of Virginia administrative services |

Class A | $158,964 | | $52,469 | | Not applicable | | Not applicable | | Not applicable |

Class B | 31,025 | | 2,547 | | Not applicable | | Not applicable | | Not applicable |

Class C | 32,133 | | | | $4,209 | | $546 | | Not applicable |

Class F | 7,137 | | | | 2,493 | | 295 | | Not applicable |

Class 529-A | 1,925 | | | | 745 | | 116 | | $935 |

Class 529-B | 1,947 | | | | 155 | | 51 | | 195 |

Class 529-C | 3,244 | | Included in | | 258 | | 75 | | 324 |

Class 529-E | 260 | | administrative | | 41 | | 6 | | 52 |

Class 529-F | — | | services | | 31 | | 5 | | 38 |

Class R-1 | 563 | | | | 67 | | 24 | | Not applicable |

Class R-2 | 6,617 | | | | 1,291 | | 2,654 | | Not applicable |

Class R-3 | 10,049 | | | | 2,829 | | 946 | | Not applicable |

Class R-4 | 2,614 | | | | 1,525 | | 32 | | Not applicable |

Class R-5 | Not applicable | | | | 985 | | 16 | | Not applicable |

| Total | $256,478 | | $55,016 | | $14,629 | | $4,766 | | $1,544 |

Deferred director and advisory board compensation — Since the adoption of the deferred compensation plan in 1994, independent directors and advisory board members may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the Fund, are treated as if invested in shares of the Fund or other American Funds. These amounts represent general, unsecured liabilities of the Fund and vary according to the total returns of the selected funds. Director and advisory board compensation of $1,369,000, shown on the accompanying financial statements, includes $1,144,000 in current fees (either paid in cash or deferred) and a net increase of $225,000 in the value of the deferred amounts.

Affiliated officers and directors — All officers and all interested directors of the Fund are affiliated with WMC. Officers and interested directors do not receive compensation directly from the Fund.

4. Investment transactions |

The Fund made purchases and sales of investment securities, excluding short-term securities, of $14,678,721,000 and $17,730,684,000, respectively, during the year ended April 30, 2007.

5. Capital share transactions |

Capital share transactions in the Fund were as follows (dollars and shares in thousands):

| | Sales* | | Reinvestments of dividends and distributions | | Repurchases* | | Net (decrease) increase |

Share class | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares |

Year ended April 30, 2007 |

Class A | $5,485,824 | | 161,128 | | $2,714,524 | | 79,294 | | $ (9,140,888) | | (269,164) | | $(940,540) | | (28,742) |

Class B | 167,204 | | 4,940 | | 107,610 | | 3,151 | | (384,471) | | (11,403) | | (109,657) | | (3,312) |

Class C | 416,267 | | 12,327 | | 109,088 | | 3,198 | | (523,219) | | (15,564) | | 2,136 | | (39) |

Class F | 730,783 | | 21,540 | | 110,798 | | 3,241 | | (638,997) | | (18,824) | | 202,584 | | 5,957 |

Class 529-A | 179,183 | | 5,246 | | 40,396 | | 1,180 | | (68,337) | | (2,010) | | 151,242 | | 4,416 |

Class 529-B | 19,859 | | 586 | | 6,881 | | 201 | | (11,217) | | (332) | | 15,523 | | 455 |

Class 529-C | 62,414 | | 1,838 | | 11,515 | | 336 | | (32,201) | | (954) | | 41,728 | | 1,220 |

Class 529-E | 10,815 | | 318 | | 2,103 | | 62 | | (4,589) | | (136) | | 8,329 | | 244 |

Class 529-F | 12,042 | | 354 | | 1,749 | | 51 | | (2,838) | | (83) | | 10,953 | | 322 |

Class R-1 | 26,397 | | 777 | | 2,059 | | 60 | | (13,412) | | (394) | | 15,044 | | 443 |

Class R-2 | 265,526 | | 7,854 | | 31,803 | | 932 | | (225,982) | | (6,658) | | 71,347 | | 2,128 |

Class R-3 | 636,863 | | 18,771 | | 81,789 | | 2,395 | | (627,948) | | (18,481) | | 90,704 | | 2,685 |

Class R-4 | 414,755 | | 12,155 | | 44,401 | | 1,300 | | (382,117) | | (11,283) | | 77,039 | | 2,172 |

Class R-5 | 519,446 | | 15,001 | | 46,541 | | 1,359 | | (407,679) | | (11,828) | | 158,308 | | 4,532 |

Total net increase (decrease) | $8,947,378 | | 262,835 | | $3,311,257 | | 96,760 | | $(12,463,895) | | (367,114) | | $(205,260) | | (7,519) |

Year ended April 30, 2006 |

Class A | $5,298,942 | | 169,863 | | $1,984,249 | | 63,236 | | $ (9,900,129) | | (316,730) | | $(2,616,938) | | (83,631) |

Class B | 197,144 | | 6,359 | | 74,794 | | 2,398 | | (387,807) | | (12,467) | | (115,869) | | (3,710) |

Class C | 411,237 | | 13,293 | | 74,370 | | 2,389 | | (637,968) | | (20,562) | | (152,361) | | (4,880) |

Class F | 645,258 | | 20,720 | | 77,224 | | 2,466 | | (812,986) | | (26,060) | | (90,504) | | (2,874) |

Class 529-A | 169,808 | | 5,447 | | 24,194 | | 771 | | (59,439) | | (1,898) | | 134,563 | | 4,320 |

Class 529-B | 23,901 | | 770 | | 4,098 | | 131 | | (10,474) | | (336) | | 17,525 | | 565 |

Class 529-C | 64,090 | | 2,065 | | 6,542 | | 210 | | (25,102) | | (805) | | 45,530 | | 1,470 |

Class 529-E | 9,853 | | 317 | | 1,240 | | 40 | | (3,572) | | (114) | | 7,521 | | 243 |

Class 529-F | 9,675 | | 309 | | 884 | | 28 | | (2,272) | | (73) | | 8,287 | | 264 |

Class R-1 | 22,484 | | 725 | | 1,026 | | 33 | | (14,131) | | (455) | | 9,379 | | 303 |

Class R-2 | 297,143 | | 9,596 | | 18,857 | | 606 | | (191,087) | | (6,147) | | 124,913 | | 4,055 |

Class R-3 | 621,188 | | 20,035 | | 54,620 | | 1,748 | | (659,035) | | (21,381) | | 16,773 | | 402 |

Class R-4 | 364,970 | | 11,744 | | 30,654 | | 979 | | (295,958) | | (9,478) | | 99,666 | | 3,245 |

Class R-5 | 373,131 | | 12,027 | | 28,237 | | 900 | | (207,870) | | (6,613) | | 193,498 | | 6,314 |

Total net increase (decrease) | $8,508,824 | | 273,270 | | $2,380,989 | | 75,935 | | $(13,207,830) | | (423,119) | | $(2,318,017) | | (73,914) |

*Includes exchanges between share classes of the Fund. |

Financial highlights1

| | Income (loss) from investment operations2 | Dividends and distributions | | | | | | |

| | Net asset value, beginning of period | Net investment income | Net gains (losses) on securities (both realized and unrealized) | Total from investment operations | Dividends (from net investment income) | Distributions (from capital gains) | Total dividends and distributions | Net asset value, end of period | Total return3,4 | Net assets, end of period (in millions) | Ratio of expenses to average net assets before reim- bursements/ waivers | Ratio of expenses to average net assets after reim- bursements/ waivers4 | Ratio of net income to average net assets4 |

Class A: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | $32.66 | $ .68 | $ 4.71 | $ 5.39 | $(.66) | $(.84) | $(1.50) | $36.55 | 16.85% | $70,811 | .60% | .57% | 2.00% |

| Year ended 4/30/2006 | 29.85 | .66 | 3.20 | 3.86 | (.62) | (.43) | (1.05) | 32.66 | 13.11 | 64,202 | .60 | .57 | 2.13 |

| Year ended 4/30/2005 | 28.79 | .67 | 1.22 | 1.89 | (.60) | (.23) | (.83) | 29.85 | 6.55 | 61,185 | .61 | .60 | 2.24 |

| Year ended 4/30/2004 | 23.99 | .59 | 4.94 | 5.53 | (.54) | (.19) | (.73) | 28.79 | 23.19 | 57,027 | .64 | .64 | 2.14 |

| Year ended 4/30/2003 | 28.37 | .55 | (4.35) | (3.80) | (.54) | (.04) | (.58) | 23.99 | (13.36) | 43,701 | .67 | .67 | 2.28 |

Class B: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.47 | .42 | 4.69 | 5.11 | (.41) | (.84) | (1.25) | 36.33 | 15.98 | 3,296 | 1.36 | 1.33 | 1.24 |

| Year ended 4/30/2006 | 29.69 | .42 | 3.17 | 3.59 | (.38) | (.43) | (.81) | 32.47 | 12.24 | 3,053 | 1.37 | 1.34 | 1.37 |

| Year ended 4/30/2005 | 28.64 | .43 | 1.22 | 1.65 | (.37) | (.23) | (.60) | 29.69 | 5.75 | 2,902 | 1.38 | 1.37 | 1.47 |

| Year ended 4/30/2004 | 23.88 | .37 | 4.92 | 5.29 | (.34) | (.19) | (.53) | 28.64 | 22.25 | 2,549 | 1.40 | 1.40 | 1.36 |

| Year ended 4/30/2003 | 28.25 | .36 | (4.32) | (3.96) | (.37) | (.04) | (.41) | 23.88 | (14.01) | 1,538 | 1.45 | 1.45 | 1.52 |

Class C: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.41 | .39 | 4.68 | 5.07 | (.38) | (.84) | (1.22) | 36.26 | 15.91 | 3,481 | 1.42 | 1.40 | 1.17 |

| Year ended 4/30/2006 | 29.64 | .40 | 3.16 | 3.56 | (.36) | (.43) | (.79) | 32.41 | 12.15 | 3,113 | 1.43 | 1.41 | 1.30 |

| Year ended 4/30/2005 | 28.59 | .41 | 1.22 | 1.63 | (.35) | (.23) | (.58) | 29.64 | 5.69 | 2,991 | 1.46 | 1.45 | 1.39 |

| Year ended 4/30/2004 | 23.84 | .35 | 4.92 | 5.27 | (.33) | (.19) | (.52) | 28.59 | 22.19 | 2,460 | 1.48 | 1.48 | 1.27 |

| Year ended 4/30/2003 | 28.22 | .35 | (4.33) | (3.98) | (.36) | (.04) | (.40) | 23.84 | (14.10) | 1,214 | 1.51 | 1.51 | 1.46 |

Class F: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.60 | .67 | 4.70 | 5.37 | (.65) | (.84) | (1.49) | 36.48 | 16.83 | 3,179 | .62 | .59 | 1.97 |

| Year ended 4/30/2006 | 29.80 | .65 | 3.19 | 3.84 | (.61) | (.43) | (1.04) | 32.60 | 13.06 | 2,646 | .63 | .61 | 2.10 |

| Year ended 4/30/2005 | 28.74 | .64 | 1.22 | 1.86 | (.57) | (.23) | (.80) | 29.80 | 6.47 | 2,505 | .69 | .68 | 2.15 |

| Year ended 4/30/2004 | 23.95 | .56 | 4.94 | 5.50 | (.52) | (.19) | (.71) | 28.74 | 23.13 | 1,917 | .71 | .71 | 2.04 |

| Year ended 4/30/2003 | 28.33 | .53 | (4.34) | (3.81) | (.53) | (.04) | (.57) | 23.95 | (13.42) | 899 | .74 | .74 | 2.24 |

Class 529-A: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.63 | .65 | 4.71 | 5.36 | (.64) | (.84) | (1.48) | 36.51 | 16.75 | 1,094 | .67 | .65 | 1.91 |

| Year ended 4/30/2006 | 29.83 | .64 | 3.19 | 3.83 | (.60) | (.43) | (1.03) | 32.63 | 13.01 | 833 | .68 | .65 | 2.05 |

| Year ended 4/30/2005 | 28.76 | .63 | 1.23 | 1.86 | (.56) | (.23) | (.79) | 29.83 | 6.47 | 633 | .71 | .70 | 2.12 |

| Year ended 4/30/2004 | 23.97 | .56 | 4.95 | 5.51 | (.53) | (.19) | (.72) | 28.76 | 23.07 | 426 | .71 | .71 | 2.03 |

| Year ended 4/30/2003 | 28.36 | .54 | (4.35) | (3.81) | (.54) | (.04) | (.58) | 23.97 | (13.38) | 199 | .70 | .70 | 2.29 |

Class 529-B: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.50 | .38 | 4.68 | 5.06 | (.36) | (.84) | (1.20) | 36.36 | 15.82 | 218 | 1.48 | 1.46 | 1.11 |

| Year ended 4/30/2006 | 29.72 | .38 | 3.17 | 3.55 | (.34) | (.43) | (.77) | 32.50 | 12.07 | 180 | 1.51 | 1.48 | 1.22 |

| Year ended 4/30/2005 | 28.68 | .38 | 1.21 | 1.59 | (.32) | (.23) | (.55) | 29.72 | 5.52 | 148 | 1.58 | 1.57 | 1.26 |

| Year ended 4/30/2004 | 23.91 | .32 | 4.96 | 5.28 | (.32) | (.19) | (.51) | 28.68 | 22.08 | 110 | 1.59 | 1.59 | 1.15 |

| Year ended 4/30/2003 | 28.34 | .32 | (4.35) | (4.03) | (.36) | (.04) | (.40) | 23.91 | (14.18) | 53 | 1.62 | 1.62 | 1.36 |

Class 529-C: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.49 | .38 | 4.69 | 5.07 | (.37) | (.84) | (1.21) | 36.35 | 15.84 | 374 | 1.48 | 1.45 | 1.11 |

| Year ended 4/30/2006 | 29.71 | .38 | 3.18 | 3.56 | (.35) | (.43) | (.78) | 32.49 | 12.10 | 295 | 1.50 | 1.47 | 1.23 |

| Year ended 4/30/2005 | 28.67 | .37 | 1.22 | 1.59 | (.32) | (.23) | (.55) | 29.71 | 5.54 | 226 | 1.57 | 1.56 | 1.27 |

| Year ended 4/30/2004 | 23.91 | .32 | 4.93 | 5.25 | (.30) | (.19) | (.49) | 28.67 | 22.06 | 156 | 1.58 | 1.58 | 1.15 |

| Year ended 4/30/2003 | 28.33 | .32 | (4.34) | (4.02) | (.36) | (.04) | (.40) | 23.91 | (14.18) | 69 | 1.61 | 1.61 | 1.38 |

Class 529-E: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.52 | .55 | 4.70 | 5.25 | (.54) | (.84) | (1.38) | 36.39 | 16.44 | 61 | .97 | .94 | 1.62 |

| Year ended 4/30/2006 | 29.74 | .54 | 3.17 | 3.71 | (.50) | (.43) | (.93) | 32.52 | 12.64 | 46 | .98 | .96 | 1.74 |

| Year ended 4/30/2005 | 28.69 | .53 | 1.22 | 1.75 | (.47) | (.23) | (.70) | 29.74 | 6.09 | 35 | 1.05 | 1.04 | 1.79 |

| Year ended 4/30/2004 | 23.92 | .46 | 4.94 | 5.40 | (.44) | (.19) | (.63) | 28.69 | 22.68 | 23 | 1.06 | 1.06 | 1.68 |

| Year ended 4/30/2003 | 28.34 | .45 | (4.35) | (3.90) | (.48) | (.04) | (.52) | 23.92 | (13.73) | 9 | 1.08 | 1.08 | 1.92 |

Class 529-F: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.59 | .72 | 4.70 | 5.42 | (.70) | (.84) | (1.54) | 36.47 | 17.01 | 47 | .47 | .44 | 2.11 |

| Year ended 4/30/2006 | 29.79 | .70 | 3.18 | 3.88 | (.65) | (.43) | (1.08) | 32.59 | 13.20 | 32 | .49 | .46 | 2.24 |

| Year ended 4/30/2005 | 28.74 | .60 | 1.22 | 1.82 | (.54) | (.23) | (.77) | 29.79 | 6.35 | 21 | .80 | .79 | 2.03 |

| Year ended 4/30/2004 | 23.96 | .53 | 4.95 | 5.48 | (.51) | (.19) | (.70) | 28.74 | 23.00 | 11 | .81 | .81 | 1.90 |

Period from 9/16/2002 to 4/30/2003 | 23.98 | .32 | .10 | .42 | (.40) | (.04) | (.44) | 23.96 | 1.85 | 3 | .825 | .825 | 2.255 |

Class R-1: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.48 | .39 | 4.68 | 5.07 | (.38) | (.84) | (1.22) | 36.33 | 15.86 | 69 | 1.43 | 1.41 | 1.15 |

| Year ended 4/30/2006 | 29.71 | .39 | 3.17 | 3.56 | (.36) | (.43) | (.79) | 32.48 | 12.10 | 47 | 1.47 | 1.44 | 1.26 |

| Year ended 4/30/2005 | 28.68 | .40 | 1.21 | 1.61 | (.35) | (.23) | (.58) | 29.71 | 5.62 | 34 | 1.50 | 1.47 | 1.35 |

| Year ended 4/30/2004 | 23.92 | .35 | 4.93 | 5.28 | (.33) | (.19) | (.52) | 28.68 | 22.16 | 16 | 1.52 | 1.49 | 1.25 |

Period from 5/29/2002 to 4/30/2003 | 28.52 | .32 | (4.46) | (4.14) | (.42) | (.04) | (.46) | 23.92 | (14.50) | 8 | 1.715 | 1.515 | 1.505 |

Class R-2: | | | | | | | | | | | | | |

| Year ended 4/30/2007 | 32.40 | .39 | 4.68 | 5.07 | (.38) | (.84) | (1.22) | 36.25 | 15.91 | 985 | 1.47 | 1.41 | 1.15 |