UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08495

NATIONWIDE MUTUAL FUNDS

(Exact name of registrant as specified in charter)

One Nationwide Plaza: Mail Code: 05-02-210R Columbus, OH 43215

(Address of principal executive offices) (Zip code)

Eric E. Miller, Esq.

One Nationwide Plaza

Mail Code: 05-02-210R

Columbus, OH 43215

(Name and address of agent for service)

Registrant’s telephone number, including area code: (614) 435-1795

Date of fiscal year end: April 30, 2018

Date of reporting period: May 1, 2017 through April 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than ten (10) days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR § 270.30e-1). The Commission may use the information provided on Form N-CSR in the Commission’s regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, D. C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR § 270.30e-1).

2

Annual Report

April 30, 2018

Nationwide Mutual Funds

Equity Funds

Nationwide Long/Short Equity Fund

| Nationwide Funds® |

Commentary in this report is provided by the portfolio manager(s) of each Fund as of the date of this report and is subject to change at any time based on market or other conditions.

Third-party information has been obtained from sources that Nationwide Fund Advisors (NFA), the investment adviser to the Funds, deems reliable. Portfolio composition is accurate as of the date of this report and is subject to change at any time and without notice. NFA, one of its affiliated advisers or its employees may hold a position in the securities in this report.

This report and the holdings provided are for informational purposes only and are not intended to be relied on as investment advice. Investors should work with their financial professional to discuss their specific situation.

Statement Regarding Availability of Quarterly Portfolio Holdings

The Trust files complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. Additionally, the Trust files a schedule of portfolio holdings monthly for the Nationwide Government Money Market Fund on Form N-MFP. Forms N-Q and Forms N-MFP are available on the SEC’s website at http://www.sec.gov. Forms N-Q and Forms N-MFP may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The Trust also makes this information available to investors upon request without charge.

Statement Regarding Availability of Proxy Voting Record

Information regarding how the Funds voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 800-848-0920, and on the SEC’s website at http://www.sec.gov.

| Table of Contents |

This page intentionally left blank

| Message to Investors |

Dear Investor,

The financial markets experienced a choppy start to 2018 as long-term interest rates jumped and the S&P 500® Index (S&P 500) fell into its first correction in two years. Firming inflation data and rising rate hike expectations led to higher Treasury yields, which in turn helped to push stock prices lower.

From a broader perspective, the long-running economic expansion still appears unlikely to be in peril anytime soon. The labor market continues to tighten, slowly but surely putting upward pressure on wage growth and consumer confidence. Ebb and flow likely will continue in both the economy and financial markets, but the underlying path for now should continue to be to the upside.

Economic Review

During the annual period ended April 30, 2018, equity markets rallied, as a synchronized global growth environment and accelerating earnings growth drove equity returns. Fixed-income returns, however, were mixed on higher interest rates and tighter credit spreads. U.S. equities were strong, with the S&P 500 returning 13.27% for the reporting period. International markets outperformed U.S. markets on a strong economic rebound, improving earnings and fading fears of political instability. The MSCI EAFE® Index (MSCI EAFE) returned 14.51% for the reporting period, while the MSCI Emerging Markets® Index returned 21.71%.

In the United States, equity markets were notably strong during most of the reporting period, with the S&P 500 returning 20.21% through January 2018 on encouraging economic data and strong corporate profits, but saw a sharp correction in February on fears of inflation, rising interest rates and the prospect for a trade war that moderated the full-period performance. Gross domestic product (GDP) continued to be strong, with growth rates of 3.1%, 3.2%, 2.9% and 2.3%, respectively, in the four consecutive calendar quarters ended March 31, 2018. Corporate profits accelerated materially, with growth of nearly 12% in 2017 compared with less than 1% in 2016. Expectations are for continued strong growth,

with 7% sales growth and 21% earnings growth forecast for 2018.

Long-term rates moved higher during the reporting period.

The Federal Reserve continued its steady path for a higher federal funds rate, moving to raise rates by 0.25% in June 2017, December 2017 and March 2018. Inflation is moving toward the Fed’s 2% target, economic growth remains strong, and fears of global deflation have moderated, allowing the Federal Open Market Committee (FOMC) to target two additional rate hikes in 2018. Long-term rates moved higher during the reporting period, with the 10-year U.S. Treasury yield rising from 2.29% to 2.93%, reaching the highest level in more than four years.

During the first eight months of the reporting period, the S&P 500 enjoyed an unprecedented period of strength and calm, with a record streak of positive returns from November 2016 through January 2018. That reversed quickly in February, with a precipitous drop from an all-time high to a 10% correction in just nine trading days, primarily driven by fears of inflation and rising interest rates. The remainder of the reporting period saw a gradual return to calm and a relatively tight trading pattern as investors waited on the sidelines for signs of a resumed move higher.

S&P 500 returns ranged from 5.7% in January 2018 (the best month since March 2016) to -3.7% in February 2018 (the worst month since January 2016). The best-performing sectors were technology, financials and consumer discretionary, while consumer staples, telecommunications and real estate lagged. Growth stocks outperformed value stocks for the reporting period, while large-capitalization stocks modestly beat small-cap stocks.

U.S. economic activity remains relatively supportive for equity market returns.

International stocks were higher for the reporting period, continuing an extended period of strength. Since mid-2016, the MSCI EAFE has outperformed the S&P 500 in four of seven

1

| Message to Investors (cont.) |

calendar quarters, as optimism has grown surrounding the synchronized global growth environment. During the reporting period, the MSCI Emerging Markets Index substantially outperformed the S&P 500, while the MSCI EAFE’s outperformance in relation to the S&P 500 was more modest. Economic data began to moderate throughout the period, particularly in Europe, as the strong euro in 2017 was a headwind for growth. Fears of growing trade tensions and rising commodity prices also acted as a headwind, causing relative weakness late in the reporting period.

The performance of fixed-income markets was mixed during the reporting period, as rising interest rates across the yield curve were largely offset by tightening credit spreads. The 10-year Treasury yield rose by 0.64% during the period, while the 2-year yield gained 1.21%; spreads narrowed between the two rates to 0.45%, the lowest spread since 2007. Credit spreads were little changed during the reporting period.

| Index | Annual Total Returns (as of April 30, 2018) | |||

| Bloomberg Barclays U.S. 1-3 Year Government/Credit Bond | -0.05% | |||

| Bloomberg Barclays U.S. 10-20 Year Treasury Bond | -2.42% | |||

| Bloomberg Barclays Emerging Markets USD Aggregate Bond | 0.87% | |||

| Bloomberg Barclays Municipal Bond | 1.56% | |||

| Bloomberg Barclays U.S. Aggregate Bond | -0.32% | |||

| Bloomberg Barclays U.S. Corporate High Yield | 3.27% | |||

| MSCI EAFE® | 14.51% | |||

| MSCI Emerging Markets® | 21.71% | |||

| MSCI World ex USA | 13.22% | |||

| Russell 1000® Growth | 16.60% | |||

| Russell 1000® Value | 7.50% | |||

| Russell 2000® | 11.54% | |||

| S&P 500® | 13.27% | |||

Source: Morningstar

Nationwide continues to focus on a consistent, long-term approach to investing and encourages investors to do the same. The best way to reach your financial goals is to adhere to a disciplined

investment strategy, stay informed and have regular conversations with your financial advisor.

At Nationwide, we are confident in our ability to help investors navigate the markets, both U.S. and global, and are committed to helping them make informed investment decisions.

As always, we appreciate your continued trust and thank you for investing in Nationwide Funds.

Sincerely,

Michael S. Spangler

President & CEO

Nationwide Funds

2

| Fund Commentary | Nationwide Long/Short Equity Fund |

For the annual period ended April 30, 2018, the Nationwide Long/Short Equity Fund (Institutional Service Class) returned 7.81% versus 13.27% for its benchmark, the S&P 500® Index (S&P 500). For broader comparison, the median return for the Fund’s closest Lipper peer category of Alternative Long/Short Equity Funds (consisting of 121 funds as of April 30, 2018) was 5.73% for the same period. Performance for the Fund’s other share classes versus the benchmark is stated in the Average Annual Total Return chart in this report’s Fund Performance section.

For the first nine months of the reporting period, the market experienced historically low volatility. Beginning in February 2018, however, the environment suddenly changed. The market experienced a dramatic increase in volatility — really, just a reversion to more normal levels of volatility — and the market began struggling.

The Fund adjusted to these changed conditions by becoming more aggressive on the short side, particularly in February. Gross short exposure got as high as 45% in February. The market peaked in February and then went into a consolidation phase. It is notable that during the broad pullback that occurred in February and March, the Fund declined significantly less than its benchmark index, the S&P 500. The current market environment demonstrates the benefits of a Long/Short allocation, namely, lowering portfolio volatility during market declines and offering the opportunity to potentially make positive returns during periods when long-only strategies suffer.

What’s been happening? — A look at current conditions affecting the market

The first few months of 2018 reminded us that markets can — and will — go down. After a booming start to 2018, multiple macroeconomic surprises erased January’s strong gains in U.S. stocks.

The unusually low market volatility has ended — and if there’s a single reason for the market’s recent turbulence slump, it’s the uptick in “uncertainty.”

Federal Reserve uncertainty. The Fed hiked rates in late March 2018 and made waves with a more-

aggressive plan for 2019 than was predicted. If inflation picks up, that has historically resulted in the Fed’s hiking rates more quickly. Fed-watchers fear that new Fed chair Jerome Powell is more focused on normalizing short-term rates than he is on supporting the U.S. economy.

Trade war uncertainty. The Trump administration announced proposed tariffs on steel and aluminum imports. Then, the administration tacked on up to $60 billion in tariffs on Chinese imports. China countered with proposed tariffs on U.S. goods totaling $50 billion. The trade fight is still unfolding.

Technology uncertainty. America’s favorite five growth stocks (“FAANG” — Facebook, Apple, Amazon, Netflix, and Google’s Alphabet) account for over an 11% weighting in the S&P 500. While this group has provided long-term market leadership, including a stellar start to the year, a few bad business practice allegations (involving, for example, Amazon and Facebook) sparked uneasiness for technology’s sweethearts by the end of the first quarter of 2018.

Although market volatility has recently spiked, the fundamental foundation behind this multi-year market rally remains steadfast. Strong economic data and growing corporate earnings that helped propel stocks higher in 2017 are still in place. In summary, while an increase in macroeconomic uncertainty caused an uptick in market volatility, the longer-term, fundamental drivers of stock performance are still present. That context is important to keep in mind as we move forward.

Exposure/sectors — contributors/detractors

For the reporting period, the Fund was on average 100% long and 18% short. Our long portfolio appreciated essentially in line with the S&P 500 while our short portfolio negatively affected overall performance by approximately 397 basis points. The net result was Fund performance that lagged the S&P 500 for the 12 months ended April 30, 2018.

From a stock sector perspective, during the reporting period Information Technology and Healthcare were the largest positive sector contributors to long performance while Consumer

3

| Fund Commentary (cont.) | Nationwide Long/Short Equity Fund |

Staples was the largest detractor. Despite its being the largest positive contributor to performance on the long side, Healthcare was the largest detractor from performance on the short side.

Individual stocks — best/worst

The top three contributors to portfolio performance during the reporting period were Boeing, Royal Dutch Shell and Align Technology. On the other side of the ledger, the top three detractors from performance for the period were General Electric (GE), Applied Optoelectronics and Philip Morris. Both GE and Applied Optoelectronics have been sold because they no longer meet our investment criteria.

Boeing’s stock has had an impressive appreciation during the reporting period as investors recognized the financial strength of the company. As a result, we found its valuation relatively unattractive and it was sold in January 2018. Royal Dutch Shell’s stock price benefited from rising oil prices, resulting in a surge in the company’s free cash flow. The short portfolio winners included Electronics for Imaging, Esterline Technologies Corp. and Plantronics. All three companies reported disappointing earnings and/or outlooks relative to consensus analyst expectations.

GE was sold because of its declining cash flow, which resulted in the company’s cutting its dividend. In the case of Applied Optoelectronics, lower sales from top customer Amazon and increased competition from Intel detrimentally affected Applied Optoelectronics’ business. We concluded that these challenges would impede future growth of the company and, as a result, the position was eliminated from the portfolio.

Fund performance also was hurt by short holding athenahealth, Inc. (no longer short). This stock’s price rallied strongly after Elliot Associates disclosed an ownership stake and announced plans to engage with the company in order to maximize shareholder value. We exited the Fund’s position, given Elliot’s record as an activist investor.

Market outlook

Looking ahead, we expect heightened volatility to persist into mid-year and possibly for all of 2018.

As mentioned, uncertainties such as Fed policy, trade war worries and technology company uncertainty remain. That means we will be keeping a watchful eye on financial markets, economic news and political moves.

Successful investing is a marathon, not a sprint. Corrections, volatility, and short-term events are unlikely to derail a thoughtful and diversified approach designed to meet long-term investment goals. Therefore, it’s critical for investors to remain patient and stay focused on the big picture. Market volatility will sometimes scare investors enough to make them pull out of their investments because the anxiety caused by wild swings in the market can sometimes become difficult to tolerate. Long/short strategies don’t make volatility go away, but they do help reduce its impact. As part of a total portfolio, allocating some funds to a long/short strategy may smooth performance volatility and help investors stay in the market and make them less likely to pull out at the wrong time.

Subadviser:

Logan Capital Management, Inc.

Portfolio Managers:

Al Besse; Richard E. Buchwald, CFA; Guy Judkowski; Marvin I. Kline, CFA; Stephen S. Lee; David F. Schroll; and Dana H. Stewardson

The Fund is subject to the risks of investing in equity securities. The Fund uses a long/short strategy: a long position (i.e., the Fund owns a stock outright), will cause the Fund to lose money if the price of the stock declines, and selling equity securities short will cause the Fund to lose money if the price of the stock increases. Short sales involve a form of leverage (investment exposure that exceeds the initial amount invested), which can exaggerate the Fund’s losses. The Fund may invest in more-aggressive investments such as exchange-traded funds (ETFs) (shareholders will bear additional costs). The Fund also is subject to the risks of investing in foreign securities (which are volatile, harder to price and less liquid than U.S. securities). The Fund uses both a growth style and a value style of investing, and may underperform other funds that use different investing styles. Please refer to the most recent prospectus for a more detailed explanation of the Fund’s principal risks.

The S&P 500® Index is an unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

4

| Fund Overview | Nationwide Long/Short Equity Fund |

Asset Allocation†

| Long Common Stocks | 101.6% | |||

| Short-Term Investments and Liabilities in excess of other assets | (1.6)% | |||

| 100.0% |

Top Long Industries††

| IT Services | 11.9% | |||

| Oil, Gas & Consumable Fuels | 8.2% | |||

| Pharmaceuticals | 6.1% | |||

| Internet Software & Services | 4.9% | |||

| Insurance | 4.6% | |||

| Beverages | 4.6% | |||

| Health Care Equipment & Supplies | 4.0% | |||

| Biotechnology | 4.0% | |||

| Semiconductors & Semiconductor Equipment | 3.9% | |||

| Chemicals | 3.8% | |||

| Other Industries | 44.0% | |||

| 100.0% |

Top Long Holdings††

| Royal Dutch Shell plc, Class B, ADR | 4.2% | |||

| Chevron Corp. | 4.0% | |||

| AT&T, Inc. | 3.8% | |||

| General Motors Co. | 3.5% | |||

| Philip Morris International, Inc. | 3.3% | |||

| Mastercard, Inc., Class A | 3.0% | |||

| Facebook, Inc., Class A | 3.0% | |||

| Coca-Cola Co. (The) | 3.0% | |||

| Apple, Inc. | 2.9% | |||

| Align Technology, Inc. | 2.7% | |||

| Other holdings | 66.6% | |||

| 100.0% |

| † | Percentages indicated are based upon net assets as of April 30, 2018. |

| †† | Percentages indicated are based upon total long positions as of April 30, 2018. |

5

| Fund Performance | Nationwide Long/Short Equity Fund |

Average Annual Total Return

(For periods ended April 30, 2018)

| 1 Yr. | 5 Yr. | Inception | ||||||||||||

| Class A | w/o SC1 | N/A | N/A | (1.00)% 2* | ||||||||||

| w SC3 | N/A | N/A | (6.70)% 2* | |||||||||||

| Class R64,5,6 | 8.02% | N/A | 7.20% 7 | |||||||||||

| Institutional Service Class4,5,8 | 7.81% | 7.32% | 6.76% 9 | |||||||||||

| S&P 500® Index | 13.27% | 12.96% | 13.73% | |||||||||||

| CPI | 2.46% | 1.50% | 1.43% | |||||||||||

All figures showing the effect of a sales charge (SC) reflect the maximum charge possible, because it has the most significant effect on performance data.

| N/A | — Not Applicable. |

| * | Not annualized. |

| 1 | These returns do not reflect the effects of SCs. |

| 2 | Since inception date of December 8, 2017. |

| 3 | A 5.75% front-end sales charge was deducted. |

| 4 | Not subject to any SCs. |

| 5 | Total returns prior to the Fund’s inception on December 8, 2017 are based on the performance of the Fund’s predecessor fund. |

| 6 | Effective December 9, 2017, Institutional Shares were renamed Class R6 Shares. |

| 7 | Since inception date of August 28, 2015. |

| 8 | Effective December 9, 2017, Investor Shares were renamed Institutional Service Class Shares. |

| 9 | Since inception date of September 28, 2012. |

Expense Ratios

Gross Expense Ratio^ | Net Expense Ratio^ | |||||||

| Class A | 3.85% | 3.38% | ||||||

| Class R61 | 3.35% | 2.88% | ||||||

| Institutional Service Class2 | 3.45% | 2.98% | ||||||

| ^ | Current effective prospectus dated September 1, 2017 (as revised December 11, 2017). The difference between gross and net operating expenses reflects contractual waivers in place through December 31, 2019. Please see the Fund’s most recent prospectus for details. Please refer to the Financial Highlights for each respective share class’ actual results. |

| 1 | Effective December 9, 2017, Institutional Shares were renamed Class R6 Shares. |

| 2 | Effective December 9, 2017, Investor Shares were renamed Institutional Service Class Shares. |

6

| Fund Performance (cont.) | Nationwide Long/Short Equity Fund |

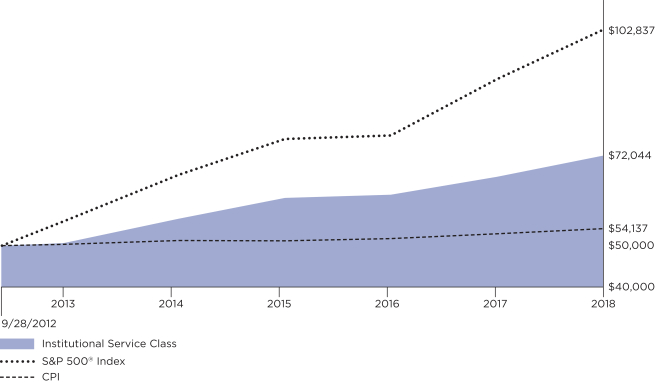

Performance of a $50,000 Investment

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions.

Comparative performance of $50,000 invested in Institutional Service Class shares of the Nationwide Long-Short Equity Fund from inception through 4/30/18 versus the S&P 500® Index and the Consumer Price Index (CPI) for the same period. Unlike the Fund, the returns for these unmanaged indexes do not reflect any fees, expenses, or sales charges. Investors cannot invest directly in market indexes. Performance prior to the Fund’s inception (12/8/17) is based on performance of the Investor Class shares of the Fund’s predecessor fund from 9/28/12 through 12/7/17.

The S&P 500® Index is an unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; gives a broad look at the U.S. equities market and those companies’ stock price performance.

7

| Shareholder Expense Example | Nationwide Long/Short Equity Fund |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) paid on purchase payments and redemption fees; and (2) ongoing costs, including investment advisory fees, administration fees, distribution fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Per Securities and Exchange Commission (“SEC”) requirements, the examples assume that you had a $1,000 investment in the Class at the beginning of the reporting period (November 1, 2017) and continued to hold your shares at the end of the reporting period (April 30, 2018).

Actual Expenses

For each Class of the Fund in the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid from November 1, 2017 through April 30, 2018. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of each Class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Expenses for Comparison Purposes

The second line of each Class in the table below provides information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period from November 1, 2017 through April 30, 2018. You may use this information to compare the ongoing costs of investing in the Class of the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs were included, your costs would have been higher. Therefore, the second line for each Class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The examples also assume all dividends and distributions are reinvested.

Schedule of Shareholder Expenses

Expense Analysis of a $1,000 Investment

| Nationwide Long/Short Equity Fund | Beginning Account Value ($) 11/01/17 | Ending Account Value ($) 4/30/18 | Expenses Paid During Period ($) 11/01/17 - 4/30/18 | Expense Ratio During Period (%) 11/01/17 - 4/30/18 | |||||||||||||||||||||

| Class A Shares | Actual | (a) | 1,000.00 | 990.00 | 13.02 | 3.39 | |||||||||||||||||||

| Hypothetical | (b)(c) | 1,000.00 | 1,008.00 | 16.86 | 3.39 | ||||||||||||||||||||

| Class R6 Shares(d) | Actual | (e) | 1,000.00 | 1,017.40 | 13.81 | 2.76 | |||||||||||||||||||

| Hypothetical | (b)(c) | 1,000.00 | 1,011.10 | 13.77 | 2.76 | ||||||||||||||||||||

| Institutional Service Class Shares(f) | Actual | (e) | 1,000.00 | 1,017.50 | 13.85 | 2.77 | |||||||||||||||||||

| Hypothetical | (b)(c) | 1,000.00 | 1,011.06 | 13.81 | 2.77 | ||||||||||||||||||||

| (a) | Actual expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value from December 11, 2017 through April 30, 2018 to reflect the period from commencement of operations. |

| (b) | Represents the hypothetical 5% return before expenses. |

| (c) | Hypothetical expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value from November 1, 2017 through April 30, 2018 multiplied to reflect one-half year period. The expense ratio presented represents a six month, annualized ratio in accordance with Securities and Exchange Commission guidelines. |

| (d) | Effective December 9, 2017, Institutional Shares were renamed Class R6 Shares. |

| (e) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value from November 1, 2017 through April 30, 2018 multiplied to reflect one-half year period. The expense ratio presented represents a six-month, annualized ratio in accordance with Securities and Exchange Commission guidelines. |

| (f) | Effective December 9, 2017, Investor Shares were renamed Institutional Service Class Shares. |

8

Statement of Investments

April 30, 2018

Nationwide Long/Short Equity Fund

| Long Positions 101.6% | ||||||||||||

| Shares | Value | |||||||||||

| ||||||||||||

| COMMON STOCKS 101.6% | ||||||||||||

| Automobiles 3.6% | ||||||||||||

General Motors Co. | 24,605 | $ | 903,988 | |||||||||

|

| |||||||||||

| Beverages 4.7% | ||||||||||||

Coca-Cola Co. (The) | 17,708 | 765,162 | ||||||||||

Constellation Brands, Inc., Class A | 1,783 | 415,671 | ||||||||||

|

| |||||||||||

| 1,180,833 | ||||||||||||

|

| |||||||||||

| Biotechnology 4.1% | ||||||||||||

AbbVie, Inc. | 5,331 | 514,708 | ||||||||||

Amgen, Inc. | 2,950 | 514,716 | ||||||||||

|

| |||||||||||

| 1,029,424 | ||||||||||||

|

| |||||||||||

| Building Products 1.4% | ||||||||||||

Lennox International, Inc. | 1,810 | 350,000 | ||||||||||

|

| |||||||||||

| Capital Markets 3.2% | ||||||||||||

S&P Global, Inc. | 2,014 | 379,841 | ||||||||||

SEI Investments Co. | 6,871 | 434,453 | ||||||||||

|

| |||||||||||

| 814,294 | ||||||||||||

|

| |||||||||||

| Chemicals 3.9% | ||||||||||||

Ecolab, Inc. | 3,200 | 463,264 | ||||||||||

Sherwin-Williams Co. (The) | 1,413 | 519,504 | ||||||||||

|

| |||||||||||

| 982,768 | ||||||||||||

|

| |||||||||||

| Communications Equipment 2.3% | ||||||||||||

Cisco Systems, Inc. | 13,400 | 593,486 | ||||||||||

|

| |||||||||||

| Construction & Engineering 1.5% | ||||||||||||

Dycom Industries, Inc.* | 3,547 | 368,391 | ||||||||||

|

| |||||||||||

| Diversified Telecommunication Services 3.8% | ||||||||||||

AT&T, Inc. | 29,790 | 974,134 | ||||||||||

|

| |||||||||||

| Electrical Equipment 0.6% | ||||||||||||

Acuity Brands, Inc. | 1,199 | 143,604 | ||||||||||

|

| |||||||||||

| Electronic Equipment, Instruments & Components 1.5% | ||||||||||||

Littelfuse, Inc. | 1,977 | 369,541 | ||||||||||

|

| |||||||||||

| Health Care Equipment & Supplies 4.1% | ||||||||||||

Align Technology, Inc.* | 2,760 | 689,586 | ||||||||||

Masimo Corp.* | 3,848 | 345,281 | ||||||||||

|

| |||||||||||

| 1,034,867 | ||||||||||||

|

| |||||||||||

| Health Care Providers & Services 1.6% | ||||||||||||

UnitedHealth Group, Inc. | 1,707 | 403,535 | ||||||||||

|

| |||||||||||

| Hotels, Restaurants & Leisure 1.3% | ||||||||||||

Starbucks Corp. | 5,888 | 338,972 | ||||||||||

|

| |||||||||||

| Household Products 2.5% | ||||||||||||

Procter & Gamble Co. (The) | 8,900 | 643,826 | ||||||||||

|

| |||||||||||

| Insurance 4.7% | ||||||||||||

Marsh & McLennan Cos., Inc. | 4,750 | 387,125 | ||||||||||

MetLife, Inc. | 10,450 | 498,151 | ||||||||||

Primerica, Inc. | 3,218 | 311,342 | ||||||||||

|

| |||||||||||

| 1,196,618 | ||||||||||||

|

| |||||||||||

| Internet Software & Services 5.0% | ||||||||||||

Alphabet, Inc., Class A* | 244 | 248,533 | ||||||||||

Alphabet, Inc., Class C* | 245 | 249,246 | ||||||||||

Facebook, Inc., Class A* | 4,463 | 767,636 | ||||||||||

|

| |||||||||||

| 1,265,415 | ||||||||||||

|

| |||||||||||

| IT Services 12.1% | ||||||||||||

Broadridge Financial Solutions, Inc. | 4,363 | 467,757 | ||||||||||

| Long Positions (continued) | ||||||||||||

| Shares | Value | |||||||||||

| ||||||||||||

| COMMON STOCKS (continued) | ||||||||||||

| IT Services (continued) | ||||||||||||

Cognizant Technology Solutions Corp., Class A | 5,047 | $ | 412,946 | |||||||||

Fiserv, Inc.* | 7,622 | 540,095 | ||||||||||

Global Payments, Inc. | 3,388 | 383,013 | ||||||||||

International Business Machines Corp. | 3,272 | 474,309 | ||||||||||

Mastercard, Inc., Class A | 4,348 | 775,118 | ||||||||||

|

| |||||||||||

| 3,053,238 | ||||||||||||

|

| |||||||||||

| Machinery 2.5% | ||||||||||||

Cummins, Inc. | 2,109 | 337,145 | ||||||||||

Wabtec Corp. | 3,381 | 300,266 | ||||||||||

|

| |||||||||||

| 637,411 | ||||||||||||

|

| |||||||||||

| Oil, Gas & Consumable Fuels 8.3% | ||||||||||||

Chevron Corp. | 8,201 | 1,026,027 | ||||||||||

Royal Dutch Shell plc, Class B, ADR-NL | 14,947 | 1,082,462 | ||||||||||

|

| |||||||||||

| 2,108,489 | ||||||||||||

|

| |||||||||||

| Pharmaceuticals 6.2% | ||||||||||||

Merck & Co., Inc. | 8,600 | 506,282 | ||||||||||

Pfizer, Inc. | 14,961 | 547,722 | ||||||||||

Zoetis, Inc. | 6,154 | 513,736 | ||||||||||

|

| |||||||||||

| 1,567,740 | ||||||||||||

|

| |||||||||||

| Professional Services 1.8% | ||||||||||||

Verisk Analytics, Inc.* | 4,227 | 449,964 | ||||||||||

|

| |||||||||||

| Real Estate Management & Development 2.2% | ||||||||||||

CBRE Group, Inc., Class A* | 12,275 | 556,180 | ||||||||||

|

| |||||||||||

| Road & Rail 2.0% | ||||||||||||

CSX Corp. | 8,580 | 509,566 | ||||||||||

|

| |||||||||||

| Semiconductors & Semiconductor Equipment 4.0% | ||||||||||||

Broadcom, Inc. | 2,359 | 541,202 | ||||||||||

ON Semiconductor Corp.* | 21,251 | 469,222 | ||||||||||

|

| |||||||||||

| 1,010,424 | ||||||||||||

|

| |||||||||||

| Software 2.7% | ||||||||||||

Electronic Arts, Inc.* | 2,880 | 339,783 | ||||||||||

Paycom Software, Inc.* | 3,100 | 354,051 | ||||||||||

|

| |||||||||||

| 693,834 | ||||||||||||

|

| |||||||||||

| Specialty Retail 3.8% | ||||||||||||

Five Below, Inc.* | 5,389 | 380,517 | ||||||||||

Home Depot, Inc. (The) | 3,216 | 594,317 | ||||||||||

|

| |||||||||||

| 974,834 | ||||||||||||

|

| |||||||||||

| Technology Hardware, Storage & Peripherals 2.9% | ||||||||||||

Apple, Inc. | 4,458 | 736,729 | ||||||||||

|

| |||||||||||

| Tobacco 3.3% | ||||||||||||

Philip Morris International, Inc. | 10,271 | 842,222 | ||||||||||

|

| |||||||||||

Total Investments |

| 25,734,327 | ||||||||||

Liabilities in excess of other |

| (408,649 | ) | |||||||||

|

| |||||||||||

NET ASSETS — 100.0% |

| $ | 25,325,678 | |||||||||

|

| |||||||||||

9

Statement of Investments (Continued)

April 30, 2018

Nationwide Long/Short Equity Fund (Continued)

| Short Positions 34.0% | ||||||||||||

| Shares | Value | |||||||||||

| ||||||||||||

| COMMON STOCKS 22.9% | ||||||||||||

| Beverages 1.1% | ||||||||||||

Monster Beverage Corp.* | 5,200 | $ | 286,000 | |||||||||

|

| |||||||||||

| Commercial Services & Supplies 1.0% | ||||||||||||

Steelcase, Inc., Class A | 19,000 | 251,750 | ||||||||||

|

| |||||||||||

| Diversified Consumer Services 1.3% | ||||||||||||

K12, Inc.* | 21,000 | 321,300 | ||||||||||

|

| |||||||||||

| Health Care Equipment & Supplies 3.6% | ||||||||||||

Cardiovascular Systems, Inc.* | 13,400 | 306,190 | ||||||||||

Lantheus Holdings, Inc.* | 19,000 | 338,200 | ||||||||||

Varex Imaging Corp.* | 7,500 | 269,925 | ||||||||||

|

| |||||||||||

| 914,315 | ||||||||||||

|

| |||||||||||

| Health Care Technology 2.4% | ||||||||||||

Omnicell, Inc.* | 7,054 | 304,027 | ||||||||||

Vocera Communications, Inc.* | 12,000 | 300,840 | ||||||||||

|

| |||||||||||

| 604,867 | ||||||||||||

|

| |||||||||||

| Hotels, Restaurants & Leisure 2.4% | ||||||||||||

Jack in the Box, Inc. | 3,513 | 315,116 | ||||||||||

Restaurant Brands International, Inc. | 5,200 | 282,984 | ||||||||||

|

| |||||||||||

| 598,100 | ||||||||||||

|

| |||||||||||

| Internet & Direct Marketing Retail 1.2% | ||||||||||||

TripAdvisor, Inc.* | 8,100 | 303,102 | ||||||||||

|

| |||||||||||

| IT Services 0.8% | ||||||||||||

Acxiom Corp.* | 8,000 | 207,840 | ||||||||||

|

| |||||||||||

| Leisure Products 1.0% | ||||||||||||

Nautilus, Inc.* | 18,000 | 261,900 | ||||||||||

|

| |||||||||||

| Personal Products 1.1% | ||||||||||||

elf Beauty, Inc.* | 15,000 | 272,550 | ||||||||||

|

| |||||||||||

| Professional Services 1.1% | ||||||||||||

Huron Consulting Group, Inc.* | 7,500 | 280,875 | ||||||||||

|

| |||||||||||

| Semiconductors & Semiconductor Equipment 1.2% | ||||||||||||

Power Integrations, Inc. | 4,400 | 298,320 | ||||||||||

|

| |||||||||||

| Software 1.3% | ||||||||||||

CommVault Systems, Inc.* | 2,602 | 182,010 | ||||||||||

Take-Two Interactive Software, Inc.* | 1,400 | 139,594 | ||||||||||

|

| |||||||||||

| 321,604 | ||||||||||||

|

| |||||||||||

| Specialty Retail 2.3% | ||||||||||||

Children’s Place, Inc. (The) | 2,400 | 306,120 | ||||||||||

Conn’s, Inc.* | 11,200 | 285,600 | ||||||||||

|

| |||||||||||

| 591,720 | ||||||||||||

|

| |||||||||||

| Textiles, Apparel & Luxury Goods 1.1% | ||||||||||||

VF Corp. | 3,500 | 283,045 | ||||||||||

|

| |||||||||||

Total Common Stocks |

| 5,797,288 | ||||||||||

|

| |||||||||||

| Exchange Traded Funds 11.1% | ||||||||||||

| Shares | Value | |||||||||||

| ||||||||||||

| Equity Funds 11.1% | ||||||||||||

SPDR S&P 500 ETF Trust | 10,100 | $ | 2,671,551 | |||||||||

SPDR S&P MidCap 400 ETF Trust | 400 | 136,204 | ||||||||||

|

| |||||||||||

Total Exchange Traded Funds |

| 2,807,755 | ||||||||||

|

| |||||||||||

TOTAL SECURITIES SOLD SHORT |

| $ | 8,605,043 | |||||||||

|

| |||||||||||

| * | Denotes a non-income producing security. |

| ADR | American Depositary Receipt |

| ETF | Exchange Traded Fund |

| NL | Netherlands |

The accompanying notes are an integral part of these financial statements.

10

Statement of Assets and Liabilities

April 30, 2018

| Nationwide Long/Short Equity Fund | ||||

Assets: |

| |||

Investment securities, at value (cost $22,599,658) | $ | 25,734,327 | ||

Cash | 1,347,426 | |||

Deposits with broker for short positions | 6,897,647 | |||

Interest and dividends receivable | 18,888 | |||

Receivable for investments sold | 303,545 | |||

Reimbursement from investment adviser (Note 3) | 8,807 | |||

Prepaid expenses | 37,358 | |||

|

| |||

Total Assets | 34,347,998 | |||

|

| |||

Liabilities: |

| |||

Short positions in securities, at value (proceeds $8,614,937) | 8,605,043 | |||

Payable for investments purchased | 324,740 | |||

Payable for capital shares redeemed | 4,200 | |||

Accrued expenses and other payables: | ||||

Investment advisory fees | 28,485 | |||

Fund administration fees | 12,304 | |||

Distribution fees | 4 | |||

Administrative servicing fees | 2,461 | |||

Accounting and transfer agent fees | 6,380 | |||

Trustee fees | 64 | |||

Custodian fees | 156 | |||

Compliance program costs (Note 3) | 35 | |||

Professional fees | 26,870 | |||

Printing fees | 8,266 | |||

Other | 3,312 | |||

|

| |||

Total Liabilities | 9,022,320 | |||

|

| |||

Net Assets | $ | 25,325,678 | ||

|

| |||

Represented by: |

| |||

Capital | $ | 22,672,853 | ||

Accumulated net investment loss | (51,988 | ) | ||

Accumulated net realized losses from investment securities and short positions in securities | (439,750 | ) | ||

Net unrealized appreciation/(depreciation) in investment securities | 3,134,669 | |||

Net unrealized appreciation/(depreciation) in the value of short positions in securities | 9,894 | |||

|

| |||

Net Assets | $ | 25,325,678 | ||

|

| |||

11

Statement of Assets and Liabilities (Continued)

April 30, 2018

| Nationwide Long/Short Equity Fund | ||||

Net Assets: |

| |||

Class A Shares | $ | 18,268 | ||

Class R6 Shares | 14,888,939 | |||

Institutional Service Class Shares | 10,418,471 | |||

|

| |||

Total | $ | 25,325,678 | ||

|

| |||

Shares Outstanding (unlimited number of shares authorized): | ||||

Class A Shares | 1,312 | |||

Class R6 Shares | 1,063,296 | |||

Institutional Service Class Shares | 747,186 | |||

|

| |||

Total | 1,811,794 | |||

|

| |||

Net asset value and redemption price per share (Net assets by class divided by shares outstanding by class, respectively): | ||||

Class A Shares (a) | $ | 13.92 | ||

Class R6 Shares | $ | 14.00 | ||

Institutional Service Class Shares | $ | 13.94 | ||

Maximum offering price per share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent): | ||||

Class A Shares | $ | 14.77 | ||

|

| |||

Maximum Sales Charge: | ||||

Class A Shares | 5.75 | % | ||

|

| |||

| (a) | For Class A Shares that were purchased without a sales charge because such purchase exceeded $1,000,000, a contingent deferred sales charge of 1.00% may apply to any redemption of such shares within 18 months of their purchase. |

The accompanying notes are an integral part of these financial statements.

12

Statement of Operations

For the Year Ended April 30, 2018

| Nationwide Long/Short Equity Fund | ||||

INVESTMENT INCOME: |

| |||

Dividend income | $ | 330,545 | ||

Interest income | 11,271 | |||

|

| |||

Total Income | 341,816 | |||

|

| |||

EXPENSES: |

| |||

Investment advisory fees | 228,680 | |||

Fund administration fees | 75,519 | |||

Distribution fees Class A | 10 | |||

Distribution fees Institutional Service Class (a) | 12,812 | |||

Administrative servicing fees Class A | 10 | |||

Administrative servicing fees Institutional Service Class (a) | 4,369 | |||

Registration and filing fees | 17,566 | |||

Professional fees | 43,428 | |||

Printing fees | 14,124 | |||

Trustee fees | 6,795 | |||

Custodian fees | 4,404 | |||

Accounting and transfer agent fees | 28,499 | |||

Compliance program costs (Note 3) | 7,694 | |||

Other | 11,634 | |||

|

| |||

Total expenses before dividend and interest expense on short positions | 455,544 | |||

|

| |||

Dividend expense on short positions | 46,195 | |||

Broker interest expense on short positions | 110,632 | |||

|

| |||

Total expenses before expenses reimbursed | 612,371 | |||

|

| |||

Expenses reimbursed by adviser (Note 3) | (146,963 | ) | ||

|

| |||

Net Expenses | 465,408 | |||

|

| |||

NET INVESTMENT LOSS | (123,592 | ) | ||

|

| |||

REALIZED/UNREALIZED GAINS (LOSSES) FROM INVESTMENTS: | ||||

Net realized gains (losses) from: | ||||

Transactions in investment securities (Note 10) | 798,952 | |||

Closed short positions in securities (Note 2) | (436,142 | ) | ||

|

| |||

Net realized gains | 362,810 | |||

|

| |||

Net change in unrealized appreciation/depreciation in the value of: | ||||

Investment securities | 445,236 | |||

Short positions in securities (Note 2) | 10,581 | |||

|

| |||

Net change in unrealized appreciation/depreciation | 455,817 | |||

|

| |||

Net realized/unrealized gains | 818,627 | |||

|

| |||

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 695,035 | ||

|

| |||

| (a) | Effective December 9, 2017, Investor Class Shares were renamed Institutional Service Class Shares. |

The accompanying notes are an integral part of these financial statements.

13

Statements of Changes in Net Assets

| Nationwide Long/Short Equity Fund | ||||||||||||

| Year Ended April 30, 2018 | Year Ended April 30, 2017 | |||||||||||

Operations: |

| |||||||||||

Net investment loss | $ | (123,592 | ) | $ | (89,118 | ) | ||||||

Net realized gains (losses) | 362,810 | (456,036 | ) | |||||||||

Net change in unrealized appreciation/depreciation | 455,817 | 1,244,429 | ||||||||||

|

|

|

| |||||||||

Change in net assets resulting from operations | 695,035 | 699,275 | ||||||||||

|

|

|

| |||||||||

Distributions to Shareholders From: | ||||||||||||

Net realized gains: | ||||||||||||

Class A | – | (a) | – | |||||||||

Class R6 (b) | – | (127 | ) | |||||||||

Institutional Service Class (c) | – | (93,634 | ) | |||||||||

|

|

|

| |||||||||

Change in net assets from shareholder distributions | – | (93,761 | ) | |||||||||

|

|

|

| |||||||||

Change in net assets from capital transactions | 14,259,490 | (2,865,674 | ) | |||||||||

|

|

|

| |||||||||

Change in net assets | 14,954,525 | (2,260,160 | ) | |||||||||

|

|

|

| |||||||||

Net Assets: | ||||||||||||

Beginning of year | 10,371,153 | 12,631,313 | ||||||||||

|

|

|

| |||||||||

End of year | $ | 25,325,678 | $ | 10,371,153 | ||||||||

|

|

|

| |||||||||

Accumulated net investment loss at end of year | $ | (51,988 | ) | $ | (15,091 | ) | ||||||

|

|

|

| |||||||||

CAPITAL TRANSACTIONS: | ||||||||||||

Class A Shares | ||||||||||||

Proceeds from shares issued | $ | 18,899 | (a) | $ | – | |||||||

Dividends reinvested | – | (a) | – | |||||||||

Cost of shares redeemed | – | (a) | – | |||||||||

|

|

|

| |||||||||

Total Class A Shares | 18,899 | (a) | – | |||||||||

|

|

|

| |||||||||

Class R6 Shares (b) | ||||||||||||

Proceeds from shares issued | 14,990,000 | – | ||||||||||

Dividends reinvested | – | 127 | ||||||||||

Cost of shares redeemed | (15 | ) | (108,434 | ) | ||||||||

|

|

|

| |||||||||

Total Class R6 Shares | 14,989,985 | (108,307 | ) | |||||||||

|

|

|

| |||||||||

Institutional Service Class Shares (c) | ||||||||||||

Proceeds from shares issued | 455,032 | 769,362 | (d) | |||||||||

Dividends reinvested | – | 90,074 | ||||||||||

Cost of shares redeemed | (1,204,426 | ) | (3,616,803 | ) | ||||||||

|

|

|

| |||||||||

Total Institutional Service Class Shares | (749,394 | ) | (2,757,367 | ) | ||||||||

|

|

|

| |||||||||

Change in net assets from capital transactions | $ | 14,259,490 | $ | (2,865,674 | ) | |||||||

|

|

|

| |||||||||

14

Statements of Changes in Net Assets (Continued)

| Nationwide Long/Short Equity Fund | ||||||||||||

| Year Ended April 30, 2018 | Year Ended April 30, 2017 | |||||||||||

SHARE TRANSACTIONS: | ||||||||||||

Class A Shares | ||||||||||||

Issued | 1,312 | (a) | – | |||||||||

Reinvested | – | (a) | – | |||||||||

Redeemed | – | (a) | – | |||||||||

|

|

|

| |||||||||

Total Class A Shares | 1,312 | (a) | – | |||||||||

|

|

|

| |||||||||

Class R6 Shares (b) | ||||||||||||

Issued | 1,062,156 | – | ||||||||||

Reinvested | – | 10 | ||||||||||

Redeemed | (1 | ) | (8,626 | ) | ||||||||

|

|

|

| |||||||||

Total Class R6 Shares | 1,062,155 | (8,616 | ) | |||||||||

|

|

|

| |||||||||

Institutional Service Class Shares (c) | ||||||||||||

Issued | 32,700 | 61,719 | ||||||||||

Reinvested | – | 7,359 | ||||||||||

Redeemed | (86,522 | ) | (293,840 | ) | ||||||||

|

|

|

| |||||||||

Total Institutional Service Class Shares | (53,822 | ) | (224,762 | ) | ||||||||

|

|

|

| |||||||||

Total change in shares | 1,009,645 | (233,378 | ) | |||||||||

|

|

|

| |||||||||

Amounts designated as “–” are zero or have been rounded to zero.

| (a) | For the period from December 11, 2017 (commencement of operations) through April 30, 2018. |

| (b) | Effective December 9, 2017, Institutional Class Shares were renamed Class R6 Shares. |

| (c) | Effective December 9, 2017, Investor Class Shares were renamed Institutional Service Class Shares. |

| (d) | Includes $10 redemption fees retained. |

The accompanying notes are an integral part of these financial statements.

15

Statement of Cash Flows

For the Year Ended April 30, 2018

| Nationwide Long/Short Equity Fund | ||||

INCREASE IN CASH | ||||

Cash flows used in operating activities: | ||||

Net increase in net assets from operations | $ | 695,035 | ||

Adjustments to reconcile net increase/decrease in net assets from operations to net cash used in operating activities: | ||||

Purchase of investment securities | (19,623,415 | ) | ||

Proceeds from disposition of investment securities | 6,310,272 | |||

Covers of investment securities sold short | (30,340,275 | ) | ||

Proceeds from investment securities sold short | 36,630,361 | |||

Proceeds/Purchases of short-term investments, net | 527,040 | |||

Change in unrealized appreciation/depreciation in the value of investment securities | (445,236 | ) | ||

Change in unrealized appreciation/depreciation in the value of short positions in securities | (10,581 | ) | ||

Net realized gain from transactions in investment securities | (798,952 | ) | ||

Net realized loss from closed short positions in securities | 436,142 | |||

Increase in deposits at broker for securities sold short | (5,827,579 | ) | ||

Increase in reimbursement from investment adviser | (2,934 | ) | ||

Increase in receivable for investments sold | (303,545 | ) | ||

Increase in interest and dividends receivable | (3,806 | ) | ||

Decrease in interest expense payable on securities sold short | (6,655 | ) | ||

Increase in prepaid expenses | (24,294 | ) | ||

Decrease in payable for investments purchased | (17,827 | ) | ||

Decrease in dividends and distributions payable | (1,095 | ) | ||

Increase in investment advisory fees payable | 28,485 | |||

Decrease in fund administration fees payable | (12,956 | ) | ||

Decrease in distribution fees payable | (10,264 | ) | ||

Increase in administrative servicing fees payable | 2,461 | |||

Decrease in accounting and transfer agent fees payable | (3,227 | ) | ||

Increase in trustee fees payable | 64 | |||

Decrease in custodian fees payable | (982 | ) | ||

Decrease in compliance program costs payable | (3,043 | ) | ||

Increase in professional fees payable | 26,870 | |||

Increase in printing fees payable | 8,266 | |||

Decrease in other payables | (28,794 | ) | ||

|

| |||

Net cash used in operating activities | (12,800,464 | ) | ||

|

| |||

Cash flows provided by financing activities: | ||||

Proceeds from shares issued | 15,463,931 | |||

Cost of shares redeemed | (1,316,041 | ) | ||

|

| |||

Net cash provided by financing activities | 14,147,890 | |||

|

| |||

Net increase in cash | 1,347,426 | |||

|

| |||

Cash: | ||||

Beginning of period | – | |||

|

| |||

End of period | $ | 1,347,426 | ||

|

| |||

Amounts designated as "–" are zero or have been rounded to zero.

The accompanying notes are an integral part of these financial statements.

16

Financial Highlights

Selected data for each share of capital outstanding throughout the periods indicated

Nationwide Long/Short Equity Fund

| Operations | Distributions | Ratios/Supplemental data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss) (a) | Net Realized and Unrealized Gains (Losses) from Investments | Total from Operations | Net Investment Income | Net Realized Gains | Total Distributions | Redemption Fees | Net Asset Value, End of Period | Total Return (b)(c) | Net Assets at End of Period | Ratio of Expenses to Average Net Assets (d) | Ratio of Net Investment Income (Loss) to Average Net Assets (d) | Ratio of Expenses (Prior to Reimbursements) to Average Net Assets (d)(e) | Ratio of Expenses to Average Net Assets (Excluding Dividend and Broker Interest Expense on Short Positions) (d) | Portfolio Turnover (c)(f) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Class A Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Period Ended April 30, 2018 (g) | $ | 14.06 | (0.08 | ) | (0.06 | ) | (0.14 | ) | – | – | – | – | $ | 13.92 | (1.00% | ) | $ | 18,268 | 3.39% | (1.49% | ) | 3.75% | 2.24% | 37.50% | ||||||||||||||||||||||||||||||||||||||||

| Class R6 Shares (h) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2018 | $ | 12.96 | (0.12 | ) | 1.16 | 1.04 | – | – | – | – | $ | 14.00 | 8.02% | $ | 14,888,939 | 2.76% | (0.87% | ) | 3.09% | 1.74% | 37.50% | |||||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2017 | $ | 12.22 | 0.32 | 0.53 | 0.85 | – | (0.11 | ) | (0.11 | ) | – | $ | 12.96 | 7.03% | $ | 14,787 | 3.04% | (0.71% | ) | 3.04% | 1.74% | (i) | 35% | |||||||||||||||||||||||||||||||||||||||||

Period Ended April 30, 2016 (j) | $ | 11.92 | (0.05 | ) | 0.55 | 0.50 | – | (0.20 | ) | (0.20 | ) | – | $ | 12.22 | 4.16% | $ | 119,272 | 2.82% | (0.59% | ) | 2.82% | 1.71% | (i) | 83% | ||||||||||||||||||||||||||||||||||||||||

| Institutional Service Class Shares (k) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2018 | $ | 12.93 | (0.09 | ) | 1.10 | 1.01 | – | – | – | – | $ | 13.94 | 7.81% | $ | 10,418,471 | 2.79% | (0.67% | ) | 3.97% | 1.90% | 37.50% | |||||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2017 | $ | 12.20 | (0.12 | ) | 0.96 | 0.84 | – | (0.11 | ) | (0.11 | ) | – | $ | 12.93 | 6.96% | $ | 10,356,366 | 3.10% | (0.80% | ) | 4.78% | 1.99% | (i) | 35% | ||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2016 | $ | 12.24 | (0.09 | ) | 0.25 | 0.16 | – | (0.20 | ) | (0.20 | ) | – | $ | 12.20 | 1.27% | $ | 12,512,041 | 3.13% | (0.86% | ) | 4.33% | 2.14% | (i) | 83% | ||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2015 | $ | 11.24 | (0.10 | ) | 1.11 | 1.01 | – | (0.01 | ) | (0.01 | ) | – | $ | 12.24 | 9.01% | $ | 10,401,111 | 3.33% | (1.23% | ) | 4.53% | 2.50% | (i) | 68% | ||||||||||||||||||||||||||||||||||||||||

Year Ended April 30, 2014 | $ | 10.05 | (0.12 | ) | 1.31 | 1.19 | – | – | – | – | $ | 11.24 | 11.84% | $ | 6,260,403 | 3.48% | (1.43% | ) | 6.13% | 2.50% | (i) | 135% | ||||||||||||||||||||||||||||||||||||||||||

Amounts designated as "–" are zero or have been rounded to zero.

| (a) | Per share calculations were performed using average shares method. |

| (b) | Excludes sales charge. |

| (c) | Not annualized for periods less than one year. |

| (d) | Annualized for periods less than one year. |

| (e) | During the period, certain fees may have been waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratios would have been as indicated. |

| (f) | Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

| (g) | For the period from December 11, 2017 (commencement of operations) through April 30, 2018. Total return is calculated based on inception date of December 8, 2017 through April 30, 2018. |

| (h) | Effective December 9, 2017, Institutional Shares were renamed Class R6 Shares. |

| (i) | In the prior year audited financial statements, the ratio was noted as 1.30% and 1.11% for the year ended April 30, 2017 and period ended April 30, 2016, respectively for Class R6 and 1.11%, 0.99%, 0.83%, and 0.98% for the years ended April 30, 2017, 2016, 2015 and 2014, respectively for Institutional Service Class, which included the ratio of interest expense and dividends on short positions to average net assets. |

| (j) | For the period from August 28, 2015 (commencement of operations) through April 30, 2016. Total return is calculated based on inception date of August 28, 2015 through April 30, 2016. |

| (k) | Effective December 9, 2017, Investor Shares were renamed Institutional Service Class Shares. |

The accompanying notes are an integral part of these financial statements.

17

April 30, 2018

1. Organization

Nationwide Mutual Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, organized as a statutory trust under the laws of the State of Delaware. The Trust has authorized an unlimited number of shares of beneficial interest (“shares”), without par value. As of April 30, 2018, the Trust operates fifty-one (51) separate series, or mutual funds, each with its own objective(s) and investment strategies. This report contains the financial statements and financial highlights for the Nationwide Long/Short Equity Fund (the “Fund”), a series of the Trust. Nationwide Fund Advisers (“NFA”) serves as investment adviser to the Fund. NFA is a wholly owned subsidiary of Nationwide Financial Services, Inc. (“NFS”), a holding company which is a direct wholly owned subsidiary of Nationwide Corporation. Nationwide Corporation, in turn, is owned by Nationwide Mutual Insurance Company and Nationwide Mutual Fire Insurance Company.

The Fund currently offers Class��A, Class R6 and Institutional Service Class shares. Each share class of the Fund represents interests in the same portfolio of investments of the Fund and the classes are identical except for any differences in the sales charge structure, distribution or service fees, administrative services fees, class specific expenses, certain voting rights, conversion features, exchange privileges, and class names or designations.

The Fund commenced operations on December 9, 2017 as a result of a reorganization in which the Fund acquired all of the assets, subject to stated liabilities, of the Logan Capital Long/Short Fund, a former series of Advisors Series Trust (“Predecessor Fund”). The Fund has adopted the historical performance of the Predecessor Fund. The Fund and its Predecessor Fund have substantially similar investment goals and strategies.

Class A shares commenced operations on December 11, 2017.

The Fund is a diversified fund, as defined in the 1940 Act.

2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the accounting and the preparation of its financial statements. The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 (“ASC 946”). The policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including, but not limited to, ASC 946. The preparation of financial statements requires fund management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. The Fund utilizes various methods to measure the value of their investments on a recurring basis. Amounts received upon the sale of such investments could differ from those estimated values and those differences could be material.

| (a) | Security Valuation |

U.S. GAAP defines fair value as the price that a Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. Pursuant to procedures approved by the Board of Trustees of the Trust (the “Board of Trustees”), NFA assigns a fair value, as defined by U.S. GAAP, to Fund investments in accordance with a hierarchy that prioritizes the various types of inputs used to measure fair value. The hierarchy gives the highest priority to readily available unadjusted quoted prices in active markets for identical assets (Level 1 measurements) and the lowest priority to

18

Notes to Financial Statements (Continued)

April 30, 2018

unobservable inputs (Level 3 measurements) when market prices are not readily available or reliable.

The three levels of the hierarchy are summarized below.

| ● | Level 1 — Quoted prices in active markets for identical assets |

| ● | Level 2 — Other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Changes in valuation techniques may result in transfers into or out of an investment’s assigned level within the hierarchy.

An investment’s categorization within the hierarchy is based on the lowest level of any input that is significant to the fair valuation in its entirety. The inputs or methodology used to value investments are not intended to indicate the risk associated with investing in those investments.

Securities for which market-based quotations are readily available are valued at the current market value as of “Valuation Time.” Valuation Time is as of the close of regular trading on the New York Stock Exchange (usually 4:00 p.m. Eastern time). Equity securities are generally valued at the last quoted sale price or official closing price, or, if there is no such price, the last quoted bid price provided by an independent pricing service approved by the Board of Trustees. Prices are taken from the primary market or exchange on which each security trades. Shares of exchange-traded funds are generally valued at the last quoted sale price or official closing price, or, if there is no such price, the last quoted bid price provided by an independent pricing service. Equity securities and shares of exchange-traded funds valued in this manner are generally categorized as Level 1 investments within the hierarchy.

The Board of Trustees has delegated authority to NFA, and the Trust’s administrator, Nationwide Fund Management LLC (“NFM”), to assign a fair value under certain circumstances, as described below, pursuant to valuation procedures approved by the Board of Trustees. NFA and NFM have established a Fair Valuation Committee (“FVC”) to assign these fair valuations. The fair value of a security may differ from its quoted or published price. Fair valuation of portfolio securities may occur on a daily basis.

Securities may be fair valued in certain circumstances, such as where (i) market-based quotations are not readily available; (ii) an independent pricing service does not provide a value or the value provided by an independent pricing service is determined to be unreliable in the judgment of NFA/NFM or its designee; (iii) a significant event has occurred that affects the value of the Fund’s securities after trading has stopped (e.g., earnings announcements or news relating to natural disasters affecting an issuer’s operations); (iv) the securities are illiquid; (v) the securities have defaulted or been delisted from an exchange and are no longer trading; or (vi) any other circumstance in which the FVC believes that market-based quotations do not accurately reflect the value of a security.

The FVC will assign a fair value according to fair value methodologies. Information utilized by the FVC to obtain a fair value may include, among others, the following: (i) a multiple of earnings; (ii) the discount from market value of a similar, freely traded security; (iii) the yield-to-maturity for debt issues; or (iv) a combination of these and other methods. Fair valuations may also take into account significant events that occur before Valuation Time but after the close of the principal market on which a security trades that materially affect the value of such security. To arrive at the appropriate methodology, the FVC may consider a

19

Notes to Financial Statements (Continued)

April 30, 2018

non-exclusive list of factors, which are specific to the security, as well as whether the security is traded on the domestic or foreign markets. The FVC monitors the results of fair valuation determinations and regularly reports the results to the Board of Trustees. The Fund attempts to establish a price that it might reasonably expect to receive upon the current sale of that security. That said, there can be no assurance that the fair value assigned to a security is the price at which a security could have been sold during the period in which the particular fair value was used to value the security. To the extent the inputs used are observable, these securities are classified as Level 2 investments; otherwise, they are classified as Level 3 investments within the hierarchy.

At April 30, 2018, 100% of the market value of the Fund was determined based on Level 1 Inputs. Transfers between levels are recognized as of the beginning of the reporting period.

During the year ended April 30, 2018, there were no transfers into or out of Level 1, Level 2 or Level 3.

The FVC continues to evaluate any information that could cause an adjustment to the fair value for these investments, such as market news, the progress of judicial and regulatory proceedings, and subadviser recommendations.

Above security valuation policy is consistent with Predecessor Fund.

| (b) | Leverage and Short Sales: |

The Fund may use leverage in connection with its investment activities and may effect short sales of securities. Leverage can increase the investment returns of the Fund if the securities purchased increase in value in an amount exceeding the cost of the borrowing. However, if the securities decrease in value, the Fund will suffer a greater loss than would have resulted without the use of leverage. The use of short sales creates investment leverage in the Fund’s portfolio. A short sale is the sale by the Fund of a security which it does not own in anticipation of purchasing the same security in the future at a lower price to close the short position. A short sale will be successful if the price of the shorted security decreases. However, if the underlying security goes up in price during the period in which the short position is outstanding, the Fund will realize a loss. The risk on a short sale is unlimited because the Fund must buy the shorted security at the higher price to complete the transaction. Therefore, short sales may be subject to greater risks than investments in long positions. With a long position, the maximum sustainable loss is limited to the amount paid for the security plus the transaction costs, whereas there is no maximum attainable price of the shorted security. The Fund would also incur increased transaction costs associated with selling securities short. In addition, if the Fund sells securities short, it must maintain a segregated account with its custodian containing cash or high-grade securities equal to (i) the greater of the current market value of the securities sold short or the market value of such securities at the time they were sold short, less (ii) any collateral deposited with the Fund’s broker (not including the proceeds from the short sales). The Fund may be required to add to the segregated account as the market price of a shorted security increases. As a result of maintaining and adding to its segregated account, the Fund may maintain higher levels of cash or liquid assets (for example, U.S. Treasury bills, repurchase agreements, high quality commercial paper and long equity positions) for collateral needs thus reducing its overall managed assets available for trading purposes.

| (c) | Redemption Fees: |

Effective December 9, 2017, the Fund does not impose redemption fees.

Prior to December 9, 2017, the Predecessor Fund charged a 1% redemption fee to shareholders who redeemed shares held for 60 days or less. Such fees were retained by the Fund and

20

Notes to Financial Statements (Continued)

April 30, 2018

accounted for as an addition to paid-in capital. For the period from May 1, 2017 through December 8, 2017, the Predecessor Fund received $0 in redemption fees.

| (d) | Security Transactions and Investment Income |

Security transactions are accounted for on the date the security is purchased or sold. Security gains and losses are calculated on the identified cost basis. Interest income is recognized on the accrual basis and includes, where applicable, the amortization of premiums or accretion of discounts, and is recorded as such on the Fund’s Statement of Operations. Dividend income and expense are recorded on the ex-dividend date and are recorded as such on the Fund’s Statement of Operations.

| (e) | Distributions to Shareholders |

Effective December 9, 2017, distributions from net investment income, if any, are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and distributed at least annually. All distributions are recorded on the ex-dividend date.

Dividends and distributions to shareholders are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are considered either permanent or temporary. Permanent differences are reclassified within the capital accounts based on their nature for federal income tax purposes; temporary differences do not require reclassification. The permanent differences as of April 30, 2018 are primarily attributable to dividend expense for securities sold short and net operating loss. These reclassifications have no effect upon the NAV of the Fund. Any distribution in excess of current and accumulated earnings and profits for federal income tax purposes is reported as a return of capital distribution.

Reclassifications for the year ended April 30, 2018 were as follows:

| Capital | Accumulated Net Investment Loss | Accumulated Net Realized Losses from Investment Transactions and Short Positions in Securities | |||||||||||

| $ | (68,178 | ) | $ | 86,695 | $ | (18,517 | ) | ||||||

Amounts designated as “—” are zero or has been rounded to zero.

Prior to December 9, 2017, the Predecessor Fund declared and paid distributions from net investment income annually. Any net realized capital gains, if any, were declared and distributed at least annually.

| (f) | Federal Income Taxes |

The Fund elected to be treated as, and intends to qualify each year as, a “regulated investment company” by complying with the requirements of Subchapter M of the U.S. Internal Revenue Code of 1986, as amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all, or substantially all, federal income taxes. Therefore, no federal income tax provision is required.

The Fund recognizes a tax benefit from an uncertain position only if it is more likely than not that the position is sustainable, based solely on its technical merits and consideration of the relevant taxing authorities’ widely understood administrative practices and precedents. Each year, the Fund undertakes an affirmative evaluation of tax positions taken or expected to be taken in the course of preparing tax returns to determine whether it is more likely than not (i.e., greater than 50 percent) that each tax position will be sustained upon examination by a taxing authority. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

21

Notes to Financial Statements (Continued)

April 30, 2018

The Fund files U.S. federal income tax returns and, if applicable, returns in various foreign jurisdictions in which they invest. Generally, a Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| (g) | Cash and Cash Equivalents |

For the purposes of the Statement of Cash Flows, the Fund defines Cash and Cash Equivalents as cash, money market funds and other investments held in lieu of cash.

| (h) | Allocation of Expenses, Income, and Gains and Losses |

Expenses directly attributable to the Fund are charged to the Fund. Expenses not directly attributable to the Fund are allocated proportionally among various or all series of the Trust. Income, fund level expenses, and realized and unrealized gains or losses are allocated to each class of shares of the Fund based on the value of the outstanding shares of that class relative to the total value of the outstanding shares of the Fund. Expenses specific to a class (such as Rule 12b-1 and administrative services fees) are charged to that specific class.

3. Transactions with Affiliates

Effective December 9, 2017, under the terms of the Trust’s Investment Advisory Agreement, NFA manages the investment of the assets and supervises the daily business affairs of the Fund in accordance with policies and procedures established by the Board of Trustees. NFA has selected Logan Capital Management, Inc. (the “Subadviser”) as subadviser for the Fund, and provides investment management evaluation services in monitoring, on an ongoing basis, the performance of the Subadviser.

Effective December 9, 2017, under the terms of the Investment Advisory Agreement, the Fund pays NFA an investment advisory fee based on the Fund’s average daily net assets. During the year ended April 30, 2018, the Fund paid investment advisory fees to NFA according to the schedule below.

| Fee Schedule | Advisory Fee (annual rate) | |

All assets | 1.35% |

Prior to December 9, 2017, the Predecessor Fund was managed by and paid investment advisory fees to Logan Capital Management, Inc. (“Logan Capital”) at an annual rate of 1.40% of the Predecessor Fund’s average daily net assets. Logan Capital had selected Waterloo International Advisors, LLC (“Waterloo”) as subadviser to manage the short portion of the Predecessor Fund. Logan Capital paid Waterloo from its own assets and these fees were not an additional expense of the Predecessor Fund.

For the year ended April 30, 2018, the Fund’s effective advisory fee rates before and after expense reimbursements, stemming from the expense limitation agreement described below, were 1.37% and 0.49%, respectively.

From these fees, pursuant to the subadvisory agreement, NFA pays fees to the unaffiliated subadvisers.

Effective December 9, 2017, the Trust and NFA have entered into a written Expense Limitation Agreement that limits the Fund’s operating expenses (excluding any interest, taxes, brokerage commissions and other costs incurred in connection with the purchase and sale of portfolio securities, acquired fund fees and expenses, short sale dividend expenses, Rule 12b-1 fees, fees paid pursuant to an Administrative Services Plan, other expenditures which are capitalized in accordance

22

Notes to Financial Statements (Continued)

April 30, 2018

with U.S. GAAP, expenses incurred by the Fund in connection with any merger or reorganization, and other non-routine expenses not incurred in the ordinary course of the Fund’s business) from exceeding 1.74% for all share classes until December 31, 2019.

Prior to December 9, 2017, Logan Capital had contractually agreed to waive its fees and/or absorb expenses of the Predecessor Fund to ensure that the net annual operating expenses (excluding Acquired Fund Fees and Expenses, taxes, interest and dividends on securities sold short and extraordinary expenses) did not exceed the following amounts of the average daily net assets for each class of shares:

| Class | Expense Limitation | |

Investor Class | 1.99% | |

Institutional Class | 1.74% |