March 25, 2011

Via EDGAR

U.S. Securities and Exchange Commission

RE: Nationwide Mutual Funds (the “Trust” or “Registrant”)

File Nos. 333-40455 and 811-08495

Dear Ms. DiAngelo:

Please find below the Registrant’s responses to the comments conveyed by you on February 15, 2011, with regard to the Form N-PX, Form N-MFP, and Form N-CSR of the Trust. We have provided below the Registrant’s response to each comment.

In connection with our responses to your comments, we acknowledge, on behalf of the Registrant, that:

| § | The Registrant is responsible for the adequacy and accuracy of the disclosure in the filing; |

| § | Staff comments or changes to disclosure in response to staff comments in the filing reviewed by the staff do not foreclose the SEC from taking any action with respect to the filing; and |

| § | The Registrant may not assert staff comments as a defense in any proceeding initiated by the SEC or any person under the federal securities laws of the United States. |

| | 1. | Comment – Form N-PX should be signed by the Trust’s PEO going forward. |

Response – Beginning with the June 30, 2011 Form N-PX filing, the Trust’s PEO will sign the form.

| | 2. | Comment – Amended Filings-going forward should include a cover sheet outlining the reasons for the amendments. |

Response – All future amended filings by the Trust will include a cover sheet outlining the reason(s) for the amendments.

| | 3. | Comment – Why was the Form N-PX amended? |

Response – The June 30, 2010 Form N-PX was amended because the filing date was omitted in the original filing on August 30, 2010.

| | 4. | Comment – Why was the Form N-MFP amended? |

Response – The November 30, 2010 Form N-MFP was amended due to additional guidance in reference to Item 17, the gross yield presentation, on Form N-MFP after the initial filing was completed. The generic comment letter from the SEC indicated the gross yield should be reported in decimal format without the percentage symbol. The gross yield was revised for the Nationwide Money Market Fund from 33.36% to 0.33.

| | 5. | Comment – MDFP, relating to the $10k chart: |

How are classes selected for the MDFP Disclosure?

Response – For the MDFP disclosure, we use the oldest share class of a fund. If all share classes have the same inception date, we use the largest (by assets) share class of a fund.

How are classes selected for the Graph of the Performance of a $10,000 Investment?

Response – For graph presentation, we use the oldest share class of a fund. If all share classes have the same inception date, we use the largest (by assets) share class of a fund.

Why are different classes discussed between the Graph and MDFP in some instances?

Response – We recognize that we previously showed different share classes. We consistently will present the same share class throughout a fund's annual and semi-annual reports going forward.

| | 6. | Comment – Fund Performance: Average Annual Total Return Chart - Some funds include the benchmark for all periods shown. The request was made to add benchmarks for all funds for the same period (1-, 3-, 5-, 10-years). |

Response – We will include the benchmark in the (1-, 3-, 5-, 10-year) Average Annual Total Return Chart going forward.

| | 7. | Comment – Nationwide Bond Index Fund: Portfolio Turnover (“PTO”) 338% in one year (2009) and 177% in another year (2010). The Prospectus states the Fund adopts a passive investment style; so why is the PTO so high? |

Response – In 2009, the To Be Announced (“TBA”) securities were treated as Mortgage Dollar Rolls and the gains/losses were rolled forward; thus, these amounts were included in the PTO calculation. In 2010, the TBA securities were treated as purchase/sale transactions, thus lowering the portfolio turnover calculation.

| | 8. | Comment – October 31, 2010 Annual Report for the Index Funds: Notes To the Financials state the Funds reimbursed NFA, but still were waiving fees. How was recoupment possible? |

Response – The Funds were receiving reimbursement from NFA for the first half of the fiscal year to maintain the operating expense ratio at the level stated in the expense limitation agreement. During the second half of the year, the Funds began operating under the expense cap, which permitted NFA to recover previously-waived advisory fees. The financial statements reflected the gross reimbursement and recoupment amounts for the entire fiscal year.

| | 9. | Comment – Index Funds Affiliated Funds ownership: If Affiliates own 95% or more of a Fund then why are 12b-1 fees accrued and who receives the payments? |

Response – A Nationwide Fund-of-Funds that invests in an underlying Nationwide Fund invests only in an Institutional Class of Shares of that underlying Nationwide Fund, which Institutional Share Class is not subject to a Rule 12b-1 fee. The only Rule 12b-1 fees that a Nationwide Fund-of-Fund shareholder will bear are those Rule 12b-1 fees that are imposed directly at the Nationwide Fund-of-Funds level.

| | 10. | Comment – Shareholder Expense Example: Include the actual number of days used in the calculation instead of the general language “over the period.” |

Response – The Shareholder Expense Example will include the actual number of days used in the calculation, instead of the general language “over the period,” beginning with the April 30, 2011 filing of Form N-CSR for the Trust's semi-annual shareholder report.

| | 11. | Comment – Fund of Funds Disclosure: If there is a 25% or more investment in an underlying fund, then the shareholder should receive copies of the underlying fund annual report. This report normally is provided to the shareholders either through mail, disclosure in the Notes by including a website addresses in the Notes, or a link provided on a website, etc. How are the underlying funds annual reports that break 25% communicated to our shareholders? |

Response – Going forward, we will include language in our fund-of-funds annual and semi-annual reports that instructs shareholders to visit our website nationwide.com/mutualfunds for more information on shareholder reports of underlying Nationwide-branded funds.

| | 12. | Comment – Comments on the Notes to the Financial Statements. |

Note 1, Organization Notes, should identify whether the fund is diversified or not diversified.

Response – Beginning with the April 30, 2011 filing of Form N-CSR for the Trust's semi-annual shareholder report, Note 1, the “Organization Note,” will identify whether the fund is diversified or not diversified.

Note 3, Expense Limitation Agreement, should include language that the acquired funds fees and expenses are excluded in related party transactions.

Response – Beginning with the April 30, 2011 filing of Form N-CSR for the Trust's semi-annual shareholder report, Note 3, the “Expense Limitation Agreement Note,” will include language that states the acquired fund’s fees and expenses are excluded in related party transactions.

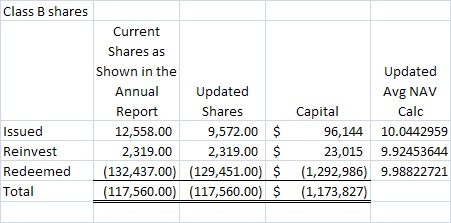

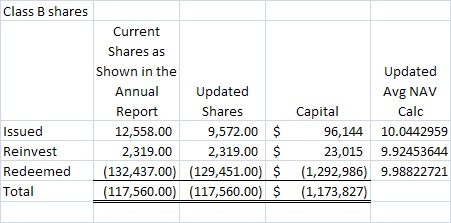

| | 13. | Comment – Nationwide Investor Destinations Conservative Fund Class B, Shareholder Activity: The SEC computes an Average NAV and compares this Average NAV to the shareholder activity. For the Fund’s Class B shares, capital shares for purchases were lower than the Average NAV Calculation. Why? |

Response – There was a cancellation of a shareholder purchase transaction as of October 29, 2010. The cancelled transaction was recorded as a redemption, rather than as a cancellation of the purchases in preparation of the financial statements. This oversight was corrected for the dollar amounts associated with the transaction and was properly adjusted for in the financial statements. The share balances were not adjusted, however, and this caused the subscriptions and redemptions shares to be overstated for financial statement purposes only. Thus, the average NAV per share calculation is skewed by the 2,989 share differences in subscriptions and redemptions. Actual shares outstanding as of October 31, 2010, are correctly reflected on the October 31, 2010 financial statements. The shareholder activity regarding this transaction was processed and recorded correctly, and resulted in no NAV errors.

| | 14. | Comment – Trustee Matrix: Trustees Term of Office: Include whether the term is indefinite, until a successor is named, or specify the number of years. |

Response – Beginning with the April 30, 2011 filing of Form N-CSR for the Trust's semi-annual shareholder report, the Trustees Term of Office will be included in the Trustee matrix section.

* * *

Registrant believes it has fully responded to each comment. If, however, you have any further questions or require further clarification of any response, please contact me by telephone at the number listed below.

Respectfully submitted,

/s/ Joseph Finelli

Joseph Finelli

Chief Financial Officer and Treasurer

Nationwide Funds

1000 Continental Drive, Suite 400

King of Prussia, PA 19406

610-230-2849

CC: Eric E. Miller, General Counsel and Secretary

Dorothy Sanders, Chief Compliance Officer