SCHEDULE 14A

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Salomon Brothers Inflation Management Fund Inc.

(Name of Registrant as Specified in Its Charter)

Karpus Management, Inc. d/b/a/ Karpus Investment Management

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set ( forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

KARPUS MANAGEMENT, INC. D/B/A/ KARPUS INVESTMENT MANAGEMENT

183 SULLY’S TRAIL

PITTSFORD, NEW YORK 14534

Proxy Statement of Karpus Investment Management, a Beneficial

Shareholder of the Salomon Brothers Inflation Management Fund Inc.,

in Opposition to the Solicitation by the Board of Directors -

Annual Meeting of Shareholders to be held on February 27, 2006

January 19, 2006

Fellow Stockholders:

This Proxy Statement and the enclosed GREEN proxy card are being furnished to you, the stockholders of Salomon Brothers Inflation Management Fund Inc. (“IMF” or the “Fund”), a Maryland corporation, in connection with the solicitation of proxies by Karpus Management, Inc. d/b/a Karpus Investment Management (“Karpus”) for use at the at the Annual Meeting of stockholders of the Fund, including any adjournments or postponements thereof and any consequent meeting that may be called (the “Meeting”). The Fund has announced that an annual meeting of the stockholders will be held at Citigroup Center, 153 East 53rd Street, 14th Floor Conference Center, New York, New York, on Monday, February 27, 2006 at 3:30 p.m. E.S.T. The Fund has announced that the record date for determining stockholders entitled to notice of and to vote at the Meeting is December 29, 2005 (the “Record Date”).

Karpus is soliciting proxies to take the following action at the Meeting:

TO ELECT THE KARPUS NOMINEES TO THE BOARD OF DIRECTORS.

The date of this Proxy Statement is __________________, 2006. This Proxy Statement is first being furnished to Fund stockholders on or about ___________________, 2006.

As of December 29, 2005, Karpus was the beneficial owner of 333,566 shares of the common stock of the Fund which represents 3.46% of the Fund’s issued and outstanding common stock.

Additional information concerning Karpus, the party making this solicitation, is set forth under the heading “Information Concerning the Participant in the Solicitation.”

The enclosed GREEN proxy card may be executed by holders of record as of the Record Date. You are urged to sign and date the enclosed GREEN proxy card and return it in the enclosed envelope whether or not you plan to attend the Meeting.

YOUR LAST DATED PROXY IS THE ONLY ONE THAT COUNTS, SO RETURN THE GREEN PROXY CARD EVEN IF YOU HAVE ALREADY DELIVERED A PRIOR PROXY. WE URGE YOU NOT TO RETURN ANY PROXY CARD SENT TO YOU BY THE FUND.

THIS SOLICITATION IS BEING MADE BY KARPUS MANAGEMENT, INC. d/b/a KARPUS INVESTMENT MANAGEMENT AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE FUND.

If you have any questions concerning this Proxy Statement or need help in voting your shares, please contact:

Karpus Investment Management

Cody B. Bartlett Jr., CFA, Investment Strategist

183 Sully’s Trail

Pittsford, New York 14534

(585) 586-4680 (ext. 235)

e-mail: cody@karpus.com

Copies of the Fund’s most recent annual report and semi-annual report succeeding such annual report, if any, is available without charge to stockholders upon request to the Fund by writing to: Salomon Brothers Inflation Management Fund Inc., c/o Salomon Brothers Asset Management, Inc., 125 Broad Street, New York, New York 10004; or by calling the following number toll free: 1-888-777-0102.

PROXY STATEMENT

Introduction

This proxy solicitation comes before you for a very important reason and requires your immediate consideration. Our current Board members do not represent our best interests and now is our opportunity to assure that two Board members do not get reelected.

Our fund, Salomon Brothers Inflation Management Fund Inc. (“IMF” or the “Fund”), has recently asked you to approve a new management agreement which is now operating on an interim basis. As of December 1, 2005, our Fund temporarily became a subsidiary of Legg Mason, Inc. (“Legg Mason”). However, the shareholder approval necessary to approve the proposed management agreement was not obtained.

According to our Fund’s proxy statement the duties of the Board include:

| | · | ensuring that the Fund is managed in the best interest of its stockholders. |

| | · | reviewing the Fund’s financial statements, performance and market price as well as the quality of the services being provided to the Fund. |

| | · | reviewing the Fund’s fees and expenses to determine if they are reasonable and competitive in light of the services being received while also ensuring that the Fund continues to have access to high quality services in the future. |

| | · | making suggestions to the Fund’s management and monitor to ensure that responsive action is taken. |

We do not believe that our Fund’s Board has fulfilled the duties outlined above. Evidence of our Board’s ineffectiveness and unified vision toward management’s concerns can be seen as follows:

| | 1. | The Board has not closed the discount to net asset value at which the Fund trades; and |

| | 2. | The Board has not assured us that top quartile investment management will be hired. |

If you have been a shareholder of the Fund for six months or more, you have received prior communication from us. You know that we believe the central issue for the Fund is closing the trading gap from net asset value. We have carried this message to the Board by every means available to us as shareholders. To date, the Board has been unwilling to listen or address this core problem. Consequently, we have proposed two nominees to the Board who we believe are highly qualified and who we believe have views about the trading gap that are consistent with our own.

Because the Board has a tiered structure, we can only replace two Board members this year. But, we will stick with this endeavor and propose replacement Board members at the next annual meeting if this issue still has not been addressed.

We believe that the Board lost its proxy contest with shareholders concerning assigning our Fund’s management agreement to Legg Mason. However, the Board nonetheless decided to adjourn the meeting at which it lost (November 29, 2005) so that it could “provide shareholders an opportunity to consider further issues being presented at the special meetings.” If a necessary and sufficient number of shareholders told our Fund that they did not want the management agreement assigned to Legg Mason, why did our Board go against our wishes?

Is this a Board that you would like to continue to oversee our Fund?

What can we do as Shareholders?

Since the Board has failed to address the core issue which they are entrusted to fulfill and has continued to attempt to assign our investment management contract without adequate shareholder approval, we believe that new Board members are needed to represent our interests as shareholders. The purpose of an “independent” Board is not to rubber stamp the dicta of management.

Accordingly, we ask you to TO ELECT THE KARPUS NOMINEES TO THE BOARD OF DIRECTORS and advocate voting for Board members who are truly independent and who will have shareholders best interests in mind.

Proposal 1: Election of Directors

In accordance with the Fund’s Charter, the Fund’s Board of Directors is divided into three classes: Class I, Class II and Class III. At the Meeting, stockholders will be asked to elect three Class I Directors to hold office until the year 2009 or thereafter when their respective successors are duly elected and qualified.

At the Meeting, Karpus intends to nominate the individuals below for election as directors. Each nominee has consented to being named in this proxy statement and to serve as a director if elected. None of the nominees we are proposing below have any arrangement or understanding with any person with respect to employment by or understanding with any person with respect to employment by or transactions with the Fund or any affiliate of the Fund. Karpus knows of no material conflicts of interest that would prevent any of its nominees from acting in the best interests of the Fund. Please refer to the Fund’s proxy soliciting material for additional information concerning the election of directors.

Name, Address and Age | Professional Experience | Other Directorships |

Brad Orvieto 10824 NW 2nd Street Plantation, Florida 33324 Age: __ | · Founded Horizon Financial Group, a Financial Planning and Investment Advisory firm, 1985. Horizon Financial Group merged with Strategic Asset Management Group, 1997. Mr. Orvieto’s firm’s practice consists of investment management consulting for high net worth individuals, municipal and corporate pension funds and non-profit organizations. · · Dean Witter, Account Executive, 1980 - 1985 | · Board of Directors, Equus II Inc. (EQS) · Broward County Housing Finance Authority - Member and past Chairman · Steering Committee for the Incorporation of the City of Weston · McDonald Family Foundation - Trustee · City of Plantation Comprehensive Planning Board · Anti-defamation League Civil Rights Committee · Broward County Tourist Related Program Grant Panel · Broward County Cultural Arts Grant Panel · Broward County Art in Public Places Steering Committee · Board of Directors - Temple Kol Ami |

Gerald Hellerman 10965 Eight Bells Lane Columbia, Maryland 21044 Age: 67 | · Principal of Hellerman Associates, a financial and corporate consulting firm since 1993 | · Director of The Mexico Equity and Income Fund · Director and President of Innovative Clinical Solutions, Ltd. · Director of MVC Capital; and director of Brantley Capital Corporation · Manager-Investment Advisor for a U.S. Department of Justice Settlement Trust · Trustee or Director of Third Avenue Value Trust · Trustee of Third Avenue Variable Series Trust · Director of Clemente Strategic Value Fund |

Mr. Orvieto is a registered broker who refers clients to Karpus Investment Management, from time to time, and receives compensation in such capacity commensurate with other referring brokers.

Required Vote

Directors are elected by a plurality of the votes cast by the holders of shares of the Fund’s common stock present in person or represented by proxy at a meeting at which a quorum is present. For purposes of the election of Directors, abstentions and broker non-votes will not be considered votes cast, and do not affect the plurality vote required for directors.

Other Matters

Except as set forth in the Proxy Statement, we are not aware of any matters affecting the Funds to be brought before the Meeting. Should other matters properly be brought before the Meeting that Karpus is unaware of a reasonable time before this solicitation, the attached GREEN proxy card, when duly executed, will give the proxies named therein discretionary authority to vote on all such matters and on all matters incident to the conduct of the Meeting, including the authority not to vote green proxies in order to defeat establishment of a quorum. Such discretionary authority will include the ability to vote shares on any proposal to adjourn the Meeting. Execution and delivery of a proxy by a record holder of shares of Common Stock or Preferred Stock (if applicable) will be presumed to be a proxy with respect to all shares held by such record holder unless the proxy specifies otherwise.

Voting Procedures

Voting and Revocation of Proxies

For the proxy solicited hereby to be voted or used as otherwise provided herein, the enclosed GREEN proxy card must be signed, dated and returned in the enclosed envelope in time to be voted at the Meeting. Shares may also be voted via the internet or telephone. If voting by telephone, please dial 1-800-454-8683. If you choose to vote via the internet, go to www.proxyvote.com and follow the on-screen instructions.

If you wish to vote in accordance with our recommendations, you must submit the enclosed GREEN proxy card and must NOT subsequently submit the Fund’s proxy card. IF YOU HAVE ALREADY RETURNED THE FUND’S PROXY CARD, YOU HAVE THE RIGHT TO REVOKE IT AND ALL MATTERS COVERED THEREBY AND MAY DO SO BY SUBSEQUENTLY SIGNING, DATING AND MAILING THE ENCLOSED GREEN PROXY CARD. ONLY YOUR LATEST DATED PROXY WILL COUNT AT THE MEETING. Execution of a GREEN proxy card will not affect your right to attend the Meeting and to vote in person.

Any proxy may be revoked as to all matters covered thereby at any time prior to the time a vote is taken by: (i) submitting to the Fund or to us a later dated written revocation or duly executed proxy; or (ii) attending and voting at the Meeting in person (mere attendance at the Meeting will not in and of itself constitute a revocation).

Although a revocation of a proxy solicited by the Fund will be effective only if delivered to the Funds, we request that either the original or a copy of all revocations be mailed to Karpus Investment Management, c/o Regan & Associates, Inc., 505 Eighth Avenue, Floor 12A, Suite 800, New York, New York 10018, so that we will be aware of all revocations and can more accurately determine if and when the requisite proxies have been received.

We may use legally permissible tactics to pressure the Board to address our issues in lieu of voting the green proxies.

UNLESS THE BOARD AGREES TO SUPPORT OPEN-ENDING, A SELF-TENDER OFFER, OR SOME OTHER SUBSTANTIVE ACTION TO ADDRESS THE DISCOUNT, WE WILL NOT ATTEND THE MEETING, WE WILL NOT VOTE YOUR SHARES, AND YOUR SHARES WILL NOT BE COUNTED TOWARD A QUORUM. IF YOU UNCONDITIONALLY WANT YOUR SHARES TO BE REPRESENTED AT THE MEETING, YOU SHOULD NOT GIVE US YOUR PROXY. IF A QUORUM IS NOT ACHIEVED, THEN IN 2007 WE MAY SEEK TO: (1) ELECT A MAJORITY OF THE BOARD; OR (2) PREVENT A QUORUM AGAIN AND THEN OBTAIN A COURT ORDER TO LIQUIDATE THE FUND AS PROVIDED FOR BY MARYLAND LAW. IF THE FUND IS LIQUIDATED, WE BELIEVE THAT ALL SHAREHOLDERS WILL RECEIVE NET ASSET VALUE FOR THEIR SHARES, LESS LIQUIDATION EXPENSES.

Shares represented by a GREEN proxy card where no specification has been made will be voted:

TO ELECT THE KARPUS NOMINEES TO THE BOARD OF DIRECTORS.

If any of your shares were held on the Record Date in the name of brokerage firms that are members of the New York Stock Exchange (the “NYSE”), only that institution can vote your shares and only upon receipt of your specific instructions. If your shares are held in the name of a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or the Fund’s distributor, the service agent may be the record holder of your shares. At the Meeting, a service agent will vote shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization by a shareholder that does not specify how the shareholder’s shares should be voted on a proposal may be deemed an instruction to vote such shares in favor of the applicable proposal.

If a service agent is not a member of the NYSE, it may be permissible for the service agent to vote without instruction from its customer. The Fund’s definitive proxy materials indicate that service agents may vote such shares (for which they do not receive instructions) in the same proportion as the votes received from their customers. Please vote using the enclosed GREEN proxy card or promptly contact the person responsible for your account at such institution and instruct that person to execute and return the GREEN proxy card on your behalf. You should also promptly sign, date, and mail the voting instructions form (or GREEN proxy card) that your broker or banker sends you. Please do this for each account you maintain to ensure that all of your shares are voted. If any of your shares were held in the name of a brokerage firm, bank, bank nominee, or other institution on the Record Date, to revoke your proxy you will need to give appropriate instructions to such institution. IF YOU DO NOT GIVE INSTRUCTIONS TO YOUR BROKER OR OTHER NOMINEE, YOUR SHARES MAY NOT BE VOTED OR THEY MAY BE VOTED WITHOUT YOUR DIRECTION.

Only holders of record as of the close of business on the Record Date will be entitled to vote at the Meeting. If you were a stockholder of record on the Record Date, you will retain your voting rights for the Meeting even if you sell shares after the Record Date. Accordingly, it is important that you vote the shares you owned on the Record Date or grant a proxy to vote such shares, even if you sell some or all of your shares after the Record Date.

Based on publicly available information, the shares of Common Stock and Preferred Stock are the only shares of capital stock of the Funds entitled to notice of, and to vote at, the Meeting. According to the Fund’s Semi-Annual Report for the period ending October 31, 2005, for IMF there were 9,632,505 shares of Common Stock issued and outstanding. Every shareholder is entitled to one vote for each share of Common Stock or Preferred Stock held.

Solicitation of Proxies

In connection with our solicitation of proxies for use at the Meeting, proxies may be solicited by mail, courier service, advertisement, telephone, telecopier, or other electronic means, and in person. Solicitations may be made in the manner set forth in the Proxy Statement, by certain of the officers or employees of Karpus, none of whom will receive additional compensation for such solicitations. We may request banks, brokerage firms, and other custodians, nominees, and fiduciaries to forward all of the solicitation material to the beneficial owners of the shares of the Common and Preferred Stock (if applicable) that they hold of record.

We have retained Regan & Associates, Inc. for solicitation and advisory services in connection with the solicitation of proxies. Karpus will pay a fee to be mutually agreed upon between Karpus and Regan & Associates, Inc. based on the services provided.

All expenses associated with any solicitation of proxies by Karpus in connection with the Meeting will be borne directly by Karpus and clients of Karpus. Karpus intends to seek reimbursement from Citigroup, the Advisor and the Board of Directors should the proposals be approved. We estimate that the costs incidental to our solicitation of proxies, including expenditures for advertising, printing, postage, legal and related expenses, will be approximately $__________________. Karpus estimates that its costs incurred to date are approximately $__________________. Karpus intends to deliver a proxy statement and form of proxy to holders of at least the percentage of the Fund’s voting shares required under applicable law to elect its proposed directors.

INFORMATION CONCERNING THE PARTICIPANT IN THE SOLICITATION

Karpus Investment Management was founded in 1986 by George Karpus and Jo Ann Van Degriff. Karpus is an independent registered Investment Adviser with slightly over $1.1 Billion under management and is employee owned. Our founding goal is to achieve investment results in the top quartile of professionally managed monies over a three-to-five year period based on each client’s risk/return objective. We provide customized, conservative investment management for high net worth individuals, pension plans, foundations, endowments, trusts, estates, and Taft Hartley accounts. Karpus is located in Pittsford, New York (a suburb of Rochester, New York). We pride ourselves on independent research. One of our fundamental beliefs is that “street research” is tainted with conflicting motives. We are not affiliated with any brokerage firm.

Karpus has gained national recognition through rankings in as a “Worlds Best Money Manager” according to Nelson Information.

Officers of Karpus Management, Inc., d/b/a Karpus Investment Management

Summary Biographies - Karpus Investment Management

Karpus Professional | | Overall/Firm | | Higher Education | | Other Experience |

| | | | | | | | | |

George W. Karpus CEO & Chief Investment Officer | | | | BS | | St. Lawrence University - Physics | | Qualified Consulting, Inc., Bache & Co., Marine Midland, Shearson Hayden-Stone |

| | | | | | | | | |

Jo Ann Van Degriff Executive Vice President | | 36/19 | | BS | | Elmira College - Economics | | Marine Midland Bank - Trust Dept. Investment Services |

| | | | | | | | | |

Dana R. Consler Senior Vice President | | 29/11 | | MBA BS | | Boston University Rollins College - Economics | | Marine Midland Bank - Trust Dept. Investment Services |

| | | | | | | | | |

Kathleen F. Crane Chief Financial Officer | | 19/19 | | BS | | St. Bonaventure University - Management Science | | |

| | | | | | | | | |

Sharon L. Thornton Senior Fixed Income Analyst/Portfolio Mgr. | | 31/15 | | BS | | University of Rochester - Economics | | Marine Midland, Cowen & Co., Sage Rutty |

| | | | | | | | | |

Thomas M. Duffy, Client Support/Office Support Manager | | 14/13 | | BA | | SUNY Geneseo - Communications | | Fleet Bank - Client Services - Mutual Fund Areas |

| | | | | | | | | |

Cody B. Bartlett, Jr., CFA Investment Strategist & Senior Fixed Income Analyst | | 7/7 | | CFA MS BA | | Chartered Financial Analyst Rochester Inst. of Technology - Finance SUNY Fredonia - Psychology | | |

Shares of Salomon Brothers Inflation Management Fund Inc. beneficially owned by Officers/ Employees/ and Directly Related Accounts of Such.

Garnsey Partners, L.P. is a limited partnership managed by Karpus Investment Management that holds 30,000 shares of the Fund. George W. Karpus owns 10.6% of Garnsey Partners, L.P.

Shares Owned by Karpus Employees | |

| | | | |

| **Donald Consler | | | 2570 | |

**Relative of Karpus Employee

Other than as set forth in this Proxy Statement, there are no contracts, arrangements, or understandings entered into by any of the participants in the solicitation or, to the participants’ knowledge, any of their respective associates within the past year with any person with respect to any of the Fund’s securities, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division or losses or profits, of the giving or withholding of proxies.

Except as set forth in the Proxy Statement, none of the participants in the solicitation or, to the participants’ knowledge, any of their respective associates has entered into any agreement or understanding with any person with respect to: (i) any future employment by the Funds or its affiliates; or (ii) any future transactions to which the Funds or any of its affiliates will or may be a party.

Certain Information About the Fund

The Fund is a Maryland Corporation with its principal executive office located at: 125 Broad Street, New York, New York 10004.

The Funds are subject to the informational requirements of the Exchange Act and the Investment Company Act of 1940, as amended, and in accordance therewith files reports, proxy statements, and other information with the SEC. Reports, registration statements, proxy statements, and other information filed by the Fund with the SEC can be inspected and copied at the public reference facilities maintained by the SEC at the Public Reference Room, 450 Fifth Street, N.W. Room 1024, Washington, D.C. 20549. Documents filed electronically by the Funds are also available at the SEC’s Web site: http://www.sec.gov.

Stockholder Proposals for the Fund’s Next Annual Meeting

All proposals by stockholders of the Fund which are intended to be presented at the Fund’s next Annual Meeting of Stockholders to be held in 2007 must be received by the Fund for inclusion in the Fund’s proxy statement and proxy relating to that meeting no later than September 15, 2006. Any stockholder who desires to bring a proposal at the Fund’s 2007 Annual Meeting of Stockholders without including such proposal in the Fund’s proxy statement must deliver written notice thereof to the Secretary of the Fund (addressed to Salomon Brothers Inflation Management Fund Inc., 300 First Stamford Place, Stamford, Connecticut 06902) during the period from December 4, 2006 to January 2, 2007. However, if the Fund’s 2007 Annual Meeting of Stockholders is held earlier than January 29, 2007 or later than April 27, 2007, such written notice must be delivered to the Secretary of the Fund during the period from 90 days before the date of the 2007 Annual Meeting of Stockholders to the later of 60 days prior to the date of the 2007 Annual Meeting of Stockholders or 10 days following the public announcement of the date of the 2007 Annual Meeting of Stockholders.

The persons named as proxies for the Fund’s next annual meeting of the shareholders will have discretionary authority to vote on any matter presented by a shareholder for action at that meeting unless that Fund receives (or received) notice of the matter between __________________ and __________________, in which case these persons will not have discretionary voting authority except as provided in the SEC’s rules governing shareholders proposals.

Additional Information

The information concerning the Funds contained in this Proxy Statement has been taken from, or is based upon, publicly available information. Although we do not have any information that would indicate that any information contained in this Proxy Statement concerning the Funds is inaccurate or incomplete, we do not take any responsibility for the accuracy or completeness of such information. We have omitted from this Proxy Statement certain disclosure required by applicable law that is already included in the Fund’s Proxy Statement. This disclosure includes, among other things, information about the Fund’s nominees for director and the nomination process, a description of the responsibilities of the Board, the report of the Board’s Audit Committee, information concerning the transaction between Citigroup and Legg Mason and the interim investment contract, information about beneficial ownership, information about fees paid to auditors, requirements for shareholder approval of agenda items at the Meeting and security ownership of management and persons who beneficially own more than 5% of the shares.

The address of Salomon Brothers Asset Management Inc. is: 125 Broad Street, New York, New York 10004.

Questions, or requests for additional copies of the Proxy Statement, should be directed to:

Karpus Investment Management

Cody B. Bartlett Jr., CFA, Investment Strategist

183 Sully’s Trail

Pittsford, New York 14534

(585) 586-4680 (ext. 235)

e-mail: cody@karpus.com

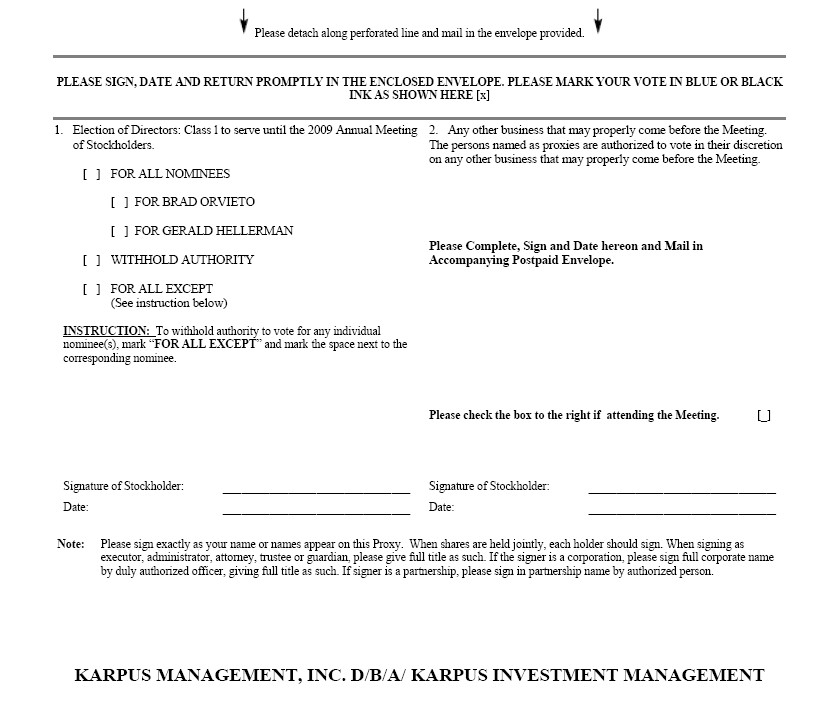

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

| | 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card. |

| |

| | 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

| | | |

| | 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| | | |

| | Registration | Valid Signature |

| | | |

Corporate Accounts | |

| (1) | ABC Corp | ABC Corp. (by John Doe, Treasurer) |

| (2) | ABC Corp | John Doe, Treasurer |

| (3) | ABC Corp., c/o John Doe, Treasurer | John Doe |

| (4) | ABC Corp. Profit Sharing Plan | John Doe, Trustee |

| | |

Trust Accounts | |

| (1) | ABC Trust | Jane B. Doe, Trustee |

| (2) | Jane B. Doe, Trustee, u/t/d 12/28/78 | Jane B. Doe |

| | |

Custodial or Estate Accounts | |

| (1) | John B. Smith, Cust., f/b/o John B. Smith, Jr. UGMA | John B. Smith |

| (2) | John B. Smith | John B. Smith, Jr., Executor |

ANNUAL MEETING OF STOCKHOLDERS OF

SALOMON BROTHERS

INFLATION MANAGEMENT FUND INC.

February 27, 2006

Please sign, date and mail your proxy card in the

envelope provided as soon as possible.

KARPUS MANAGEMENT, INC. D/B/A/ KARPUS INVESTMENT MANAGEMENT

183 SULLY’S TRAIL

PITTSFORD, NEW YORK 14534

Proxy Statement of Karpus Investment Management, a Beneficial

Shareholder of the Salomon Brothers Inflation Management Fund Inc.,

in Opposition to the Solicitation by the Board of Directors -

Annual Meeting of Shareholders to be held on February 27, 2006

THIS PROXY IS SOLICITED ON BEHALF OF KARPUS INVESTMENT MANAGEMENT, INC., D/B/A KARPUS INVESTMENT MANAGEMENT. THE BOARD OF DIRECTORS OF THE FUND IS NOT SOLICITING THIS PROXY.

The undersigned, revoking prior proxies, hereby appoints Sharon L. Thornton, and Cody B. Bartlett, Jr. and each of them, Proxies with several powers of substitution, to vote all of the shares of stock of Salomon Brothers Inflation Management Fund Inc. owned by the undersigned and entitled to vote at the Annual Meeting of Shareholders of the Fund to be held at Citigroup Center, 153 East 53rd Street, 14th Floor Conference Center, New York, New York, on Monday, February 27, 2006 at 3:30 p.m. E.S.T., or at any postponement or adjournment thereof, upon the following matters as described in the Notice of Meeting and accompanying Joint Proxy Statement, which have been received by the undersigned.

UNLESS THE BOARD AGREES TO SUPPORT OPEN-ENDING, A SELF-TENDER OFFER, OR SOME OTHER SUBSTANTIVE ACTION TO ADDRESS THE DISCOUNT, WE WILL NOT ATTEND THE MEETING, WE WILL NOT VOTE YOUR SHARES, AND YOUR SHARES WILL NOT BE COUNTED TOWARD A QUORUM. IF YOU UNCONDITIONALLY WANT YOUR SHARES TO BE REPRESENTED AT THE MEETING, YOU SHOULD NOT GIVE US YOUR PROXY. IF A QUORUM IS NOT ACHIEVED, THEN IN 2007 WE MAY SEEK TO: (1) ELECT A MAJORITY OF THE BOARD; OR (2) PREVENT A QUORUM AGAIN AND THEN OBTAIN A COURT ORDER TO LIQUIDATE THE FUND AS PROVIDED FOR BY MARYLAND LAW. IF THE FUND IS LIQUIDATED, ALL SHAREHOLDERS WILL RECEIVE NET ASSET VALUE FOR THEIR SHARES.

If no direction is given on these proposals, this proxy card will be voted “FOR” all Karpus submitted Director nominees, and will be voted in accordance with the proxy’s best judgment as to any other matters.