UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | |

| þ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED AUGUST 31, 2007 OR |

| | | |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD

FROM TO |

Commission File Number: 1-15829

FEDEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | |

Delaware

(State or other jurisdiction of incorporation or organization) | | 62-1721435

(I.R.S. Employer Identification No.) |

| | | |

942 South Shady Grove Road

Memphis, Tennessee

(Address of principal executive offices) | |

38120

(ZIP Code) |

(901) 818-7500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesþ Noo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filerþ Accelerated filero Non-accelerated filero

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yeso Noþ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | |

Common Stock

Common Stock, par value $0.10 per share | | Outstanding Shares at September 17, 2007

309,265,298 |

FEDEX CORPORATION

INDEX

PART I. FINANCIAL INFORMATION

-2-

FEDEX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS)

ASSETS

| | | | | | | | | |

| | | August 31, | | | | |

| | | 2007 | | | May 31, | |

| | | (Unaudited) | | | 2007 | |

| | | | | | | | | |

| CURRENT ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 1,112 | | | $ | 1,569 | |

| Receivables, less allowances of $142 and $136 | | | 3,959 | | | | 3,942 | |

| Spare parts, supplies and fuel, less allowances of $158 and $156 | | | 342 | | | | 338 | |

| Deferred income taxes | | | 533 | | | | 536 | |

| Prepaid expenses and other | | | 282 | | | | 244 | |

| | | | | | | |

| | | | | | | | | |

| Total current assets | | | 6,228 | | | | 6,629 | |

| | | | | | | | | |

| PROPERTY AND EQUIPMENT, AT COST | | | 27,700 | | | | 27,090 | |

| Less accumulated depreciation and amortization | | | 14,757 | | | | 14,454 | |

| | | | | | | |

| | | | | | | | | |

| Net property and equipment | | | 12,943 | | | | 12,636 | |

| | | | | | | | | |

| OTHER LONG-TERM ASSETS | | | | | | | | |

| Goodwill | | | 3,502 | | | | 3,497 | |

| Intangible and other assets | | | 1,233 | | | | 1,238 | |

| | | | | | | |

| | | | | | | | | |

| Total other long-term assets | | | 4,735 | | | | 4,735 | |

| | | | | | | |

| | | | | | | | | |

| | | $ | 23,906 | | | $ | 24,000 | |

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

-3-

FEDEX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS, EXCEPT SHARE DATA)

LIABILITIES AND STOCKHOLDERS’ INVESTMENT

| | | | | | | | | |

| | | August 31, | | | | |

| | | 2007 | | | May 31, | |

| | | (Unaudited) | | | 2007 | |

| | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Current portion of long-term debt | | $ | 134 | | | $ | 639 | |

| Accrued salaries and employee benefits | | | 959 | | | | 1,354 | |

| Accounts payable | | | 2,018 | | | | 2,016 | |

| Accrued expenses | | | 1,584 | | | | 1,419 | |

| | | | | | | |

| | | | | | | | | |

| Total current liabilities | | | 4,695 | | | | 5,428 | |

| | | | | | | | | |

| LONG-TERM DEBT, LESS CURRENT PORTION | | | 2,007 | | | | 2,007 | |

| | | | | | | | | |

| OTHER LONG-TERM LIABILITIES | | | | | | | | |

| Deferred income taxes | | | 918 | | | | 897 | |

| Pension, postretirement healthcare and other benefit obligations | | | 1,119 | | | | 1,164 | |

| Self-insurance accruals | | | 788 | | | | 759 | |

| Deferred lease obligations | | | 656 | | | | 655 | |

| Deferred gains, principally related to aircraft transactions | | | 336 | | | | 343 | |

| Other liabilities | | | 166 | | | | 91 | |

| | | | | | | |

| | | | | | | | | |

| Total other long-term liabilities | | | 3,983 | | | | 3,909 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| COMMON STOCKHOLDERS’ INVESTMENT | | | | | | | | |

| Common stock, $0.10 par value; 800 million shares authorized; 309 million shares issued as of August 31, 2007 and 308 million shares issued as of May 31, 2007 | | | 31 | | | | 31 | |

| Additional paid-in capital | | | 1,761 | | | | 1,689 | |

| Retained earnings | | | 12,433 | | | | 11,970 | |

| Accumulated other comprehensive loss | | | (1,000 | ) | | | (1,030 | ) |

| Treasury stock, at cost | | | (4 | ) | | | (4 | ) |

| | | | | | | |

| | | | | | | | | |

| Total common stockholders’ investment | | | 13,221 | | | | 12,656 | |

| | | | | | | |

| | | | | | | | | |

| | | $ | 23,906 | | | $ | 24,000 | |

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

-4-

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | |

| | | Three Months Ended | |

| | | August 31, | |

| | | 2007 | | | 2006 | |

| | | | | | | | | |

| REVENUES | | $ | 9,199 | | | $ | 8,545 | |

| | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | |

| Salaries and employee benefits | | | 3,483 | | | | 3,285 | |

| Purchased transportation | | | 1,025 | | | | 896 | |

| Rentals and landing fees | | | 593 | | | | 570 | |

| Depreciation and amortization | | | 473 | | | | 399 | |

| Fuel | | | 964 | | | | 941 | |

| Maintenance and repairs | | | 544 | | | | 515 | |

| Other | | | 1,303 | | | | 1,155 | |

| | | | | | | |

| | | | 8,385 | | | | 7,761 | |

| | | | | | | |

| | | | | | | | | |

| OPERATING INCOME | | | 814 | | | | 784 | |

| | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | |

| Interest, net | | | (25 | ) | | | (9 | ) |

| Other, net | | | (2 | ) | | | (5 | ) |

| | | | | | | |

| | | | (27 | ) | | | (14 | ) |

| | | | | | | |

| | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | 787 | | | | 770 | |

| | | | | | | | | |

| PROVISION FOR INCOME TAXES | | | 293 | | | | 295 | |

| | | | | | | |

| | | | | | | | | |

| NET INCOME | | $ | 494 | | | $ | 475 | |

| | | | | | | |

| | | | | | | | | |

| EARNINGS PER COMMON SHARE: | | | | | | | | |

| Basic | | $ | 1.60 | | | $ | 1.55 | |

| | | | | | | |

| | | | | | | | | |

| Diluted | | $ | 1.58 | | | $ | 1.53 | |

| | | | | | | |

| | | | | | | | | |

| DIVIDENDS DECLARED PER COMMON SHARE | | $ | 0.10 | | | $ | 0.09 | |

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

-5-

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(IN MILLIONS)

| | | | | | | | | |

| | | Three Months Ended | |

| | | August 31, | |

| | | 2007 | | | 2006 | |

| | | | | | | | | |

| Operating Activities: | | | | | | | | |

| Net income | | $ | 494 | | | $ | 475 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | | | | | |

| Depreciation and amortization | | | 473 | | | | 399 | |

| Provision for uncollectible accounts | | | 33 | | | | 29 | |

| Stock-based compensation | | | 29 | | | | 31 | |

| Deferred income taxes and other noncash items | | | 32 | | | | (12 | ) |

| Changes in operating assets and liabilities: | | | | | | | | |

| Receivables | | | (35 | ) | | | (138 | ) |

| Other current assets | | | (32 | ) | | | (13 | ) |

| Accounts payable and other operating liabilities | | | (166 | ) | | | (85 | ) |

| Other, net | | | (25 | ) | | | (21 | ) |

| | | | | | | |

| | | | | | | | | |

| Cash provided by operating activities | | | 803 | | | | 665 | |

| | | | | | | | | |

| Investing Activities: | | | | | | | | |

| Capital expenditures | | | (766 | ) | | | (699 | ) |

| Proceeds from asset dispositions and other | | | (5 | ) | | | 5 | |

| | | | | | | |

| | | | | | | | | |

| Cash used in investing activities | | | (771 | ) | | | (694 | ) |

| | | | | | | | | |

| Financing Activities: | | | | | | | | |

| Principal payments on debt | | | (507 | ) | | | (221 | ) |

| Proceeds from debt issuance | | | — | | | | 999 | |

| Proceeds from stock issuances | | | 40 | | | | 30 | |

| Excess tax benefit on the exercise of stock options | | | 9 | | | | 6 | |

| Dividends paid | | | (31 | ) | | | (28 | ) |

| Other, net | | | — | | | | (4 | ) |

| | | | | | | |

| | | | | | | | | |

| Cash (used in) provided by financing activities | | | (489 | ) | | | 782 | |

| | | | | | | |

| | | | | | | | | |

| Net (decrease) increase in cash and cash equivalents | | | (457 | ) | | | 753 | |

| Cash and cash equivalents at beginning of period | | | 1,569 | | | | 1,937 | |

| | | | | | | |

| | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 1,112 | | | $ | 2,690 | |

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

-6-

FEDEX CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(1)General

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES.These interim financial statements of FedEx Corporation (“FedEx”) have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information, the instructions to Quarterly Report on Form 10-Q and Rule 10-01 of Regulation S-X, and should be read in conjunction with our Annual Report on Form 10-K for the year ended May 31, 2007 (“Annual Report”). Accordingly, significant accounting policies and other disclosures normally provided have been omitted since such items are disclosed therein.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (including normal recurring adjustments) necessary to present fairly our financial position as of August 31, 2007 and the results of our operations and cash flows for the three-month periods ended August 31, 2007 and 2006. Operating results for the three-month period ended August 31, 2007 are not necessarily indicative of the results that may be expected for the year ending May 31, 2008.

Except as otherwise specified, references to years indicate our fiscal year ending May 31, 2008 or ended May 31 of the year referenced and comparisons are to the corresponding period of the prior year.

Certain prior period amounts have been reclassified to conform to the current period’s presentation.

NEW ACCOUNTING PRONOUNCEMENTS.New accounting rules and disclosure requirements can significantly impact the comparability of our financial statements. We believe the following new accounting pronouncement is relevant to the readers of our financial statements.

On June 1, 2007, we adopted Financial Accounting Standards Board (“FASB”) Interpretation No. (“FIN”) 48, “Accounting for Uncertainty in Income Taxes.” This interpretation establishes new standards for the financial statement recognition, measurement and disclosure of uncertain tax positions taken or expected to be taken in income tax returns.

The cumulative effect of adopting FIN 48 was immaterial. Upon adoption, our liability for income taxes under FIN 48 was $72 million, and the balance of accrued interest and penalties was $26 million. The liability recorded includes $57 million associated with positions that if favorably resolved would provide a benefit to our effective tax rate. We classify interest related to income tax liabilities as interest expense, and if applicable, penalties are recognized as a component of income tax expense. These income tax liabilities and accrued interest and penalties are presented as noncurrent liabilities because payment of cash is not anticipated within one year of the balance sheet date. These noncurrent income tax liabilities are recorded in the caption “Other liabilities” in our condensed consolidated balance sheets.

We file income tax returns in the U.S. and various foreign jurisdictions. We are no longer subject to U.S. federal income tax examination for years through 2003 except for specific U.S. federal income tax positions that are in various stages of appeal. No resolution date can be reasonably estimated at this time for these appeals.

It is difficult to predict the ultimate outcome or the timing of resolution for tax positions under FIN 48. Changes may result from the conclusion of ongoing audits or appeals in state, local, federal and foreign tax jurisdictions, or from the resolution of various competent authority proceedings between the U.S. and foreign tax authorities. Our liability for tax positions under FIN 48 includes no matters that are individually material to us. It is reasonably possible that the amount of the benefit with respect to certain of our unrecognized tax positions will increase or decrease within the next 12 months, but an estimate of the range of the reasonably possible outcomes cannot be made. However, we do not expect that the resolution of any of our tax positions under FIN 48 will be material.

-7-

DIVIDENDS DECLARED PER COMMON SHARE.On August 17, 2007, our Board of Directors declared a dividend of $0.10 per share of common stock. The dividend will be paid on October 1, 2007 to stockholders of record as of the close of business on September 10, 2007. Each quarterly dividend payment is subject to review and approval by our Board of Directors, and we evaluate our dividend payment amount on an annual basis at the end of each fiscal year.

(2)Stock-Based Compensation

We have two types of equity-based compensation: stock options and restricted stock. The key terms of the stock option and restricted stock awards granted under our incentive stock plans are set forth in our Annual Report.

We use the Black-Scholes option pricing model to calculate the fair value of stock options. The value of restricted stock awards is based on the price of the stock on the grant date. We recognize stock-based compensation expense on a straight-line basis over the requisite service period of the award in the “Salaries and employee benefits” caption of our condensed consolidated income statement.

Our total stock-based compensation expense was $29 million for the three months ended August 31, 2007 and $31 million for the three months ended August 31, 2006.

During the first quarter of 2008 we made stock option grants of 2.4 million shares, primarily in connection with our principal annual stock option grant. We granted options to purchase 1.6 million shares during the first quarter of 2007.

See our Annual Report for a discussion of our methodology for developing each of the assumptions used in the valuation model. The fair value of our stock option grants, as determined by the Black-Scholes valuation model, was $31.21 during the first quarter of 2008 and $32.08 during the first quarter of 2007, using the following assumptions:

| | | | | | | | | |

| | | Three Months Ended | |

| | | August 31, | |

| | | 2007 | | | 2006 | |

| |

| Expected lives | | 5 years | | 5 years |

| Expected volatility | | | 19 | % | | | 22 | % |

| Risk-free interest rate | | | 5.03 | % | | | 4.99 | % |

| Dividend yield | | | 0.322 | % | | | 0.299 | % |

-8-

(3)Comprehensive Income

The following table provides a reconciliation of net income reported in our financial statements to comprehensive income (in millions):

| | | | | | | | | |

| | | Three Months Ended | |

| | | August 31, | |

| | | 2007 | | | 2006 | |

| Net income | | $ | 494 | | | $ | 475 | |

| Other comprehensive income: | | | | | | | | |

| Foreign currency translation adjustment, net of deferred taxes of $1 in 2007 | | | 16 | | | | — | |

| Amortization of unrealized pension actuarial gains/losses, net of deferred taxes of $8 in 2007 | | | 14 | | | | — | |

| | | | | | | |

| Comprehensive income | | $ | 524 | | | $ | 475 | |

| | | | | | | |

(4)Financing Arrangements

We have a shelf registration statement filed with the Securities and Exchange Commission (“SEC”) that allows us to sell, in one or more future offerings, any combination of our unsecured debt securities and common stock. In August 2006, we issued $1 billion of senior unsecured debt under our shelf registration statement, comprised of floating-rate notes totaling $500 million and fixed-rate notes totaling $500 million. The $500 million in floating-rate notes were repaid in August 2007. The fixed-rate notes bear interest at an annual rate of 5.5%, payable semi-annually, and are due in August 2009. The net proceeds were used for working capital and general corporate purposes, including the funding of several acquisitions during 2007.

From time to time, we finance certain operating and investing activities, including acquisitions, through borrowings under our $1.0 billion revolving credit facility or the issuance of commercial paper. The revolving credit agreement contains certain covenants and restrictions, none of which are expected to significantly affect our operations or ability to pay dividends. Our commercial paper program is backed by unused commitments under the revolving credit facility and borrowings under the program reduce the amount available under the credit facility. At August 31, 2007, no commercial paper borrowings were outstanding and the entire amount under the credit facility was available.

-9-

(5)Computation of Earnings Per Share

The calculation of basic and diluted earnings per common share for the three-month periods ended August 31 was as follows (in millions, except per share amounts):

| | | | | | | | | |

| | | 2007 | | | 2006 | |

| | | | | | | | | |

| Net income | | $ | 494 | | | $ | 475 | |

| | | | | | | |

| Weighted-average shares of common stock outstanding | | | 308 | | | | 306 | |

| Common equivalent shares: | | | | | | | | |

| Assumed exercise of outstanding dilutive options | | | 16 | | | | 17 | |

| Less shares repurchased from proceeds of assumed exercise of options | | | (12 | ) | | | (13 | ) |

| | | | | | | |

| Weighted-average common and common equivalent shares outstanding | | | 312 | | | | 310 | |

| | | | | | | |

| Basic earnings per common share | | $ | 1.60 | | | $ | 1.55 | |

| | | | | | | |

| Diluted earnings per common share | | $ | 1.58 | | | $ | 1.53 | |

| | | | | | | |

We have excluded from the calculation of diluted earnings per share approximately 2.7 million antidilutive options for the three months ended August 31, 2007, and approximately 1.7 million antidilutive options for the three months ended August 31, 2006, as the exercise price of these options was greater than the average market price of common stock for the period.

(6)Retirement Plans

We sponsor programs that provide retirement benefits to most of our employees. These programs include defined benefit pension plans, defined contribution plans and retiree healthcare plans. Key terms of our retirement plans are provided in our Annual Report. Our retirement plans costs for the three-month periods ended August 31 were as follows (in millions):

| | | | | | | | | |

| | | 2007 | | | 2006 | |

| | | | | | | | | |

| U.S. domestic and international pension plans | | $ | 85 | | | $ | 114 | |

| U.S. domestic and international defined contribution plans | | | 38 | | | | 40 | |

| Retiree healthcare plans | | | 16 | | | | 14 | |

| | | | | | | |

| | | $ | 139 | | | $ | 168 | |

| | | | | | | |

-10-

Net periodic benefit cost of the pension and postretirement healthcare plans for the three-month periods ended August 31 was composed of the following (in millions):

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Postretirement | |

| | | Pension Plans | | | Healthcare Plans | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| Service cost | | $ | 129 | | | $ | 132 | | | $ | 9 | | | $ | 8 | |

| Interest cost | | | 180 | | | | 177 | | | | 8 | | | | 7 | |

| Expected return on plan assets | | | (246 | ) | | | (232 | ) | | | — | | | | — | |

| Amortization of prior service cost and other | | | 22 | | | | 37 | | | | (1 | ) | | | (1 | ) |

| | | | | | | | | | | | | |

| | | $ | 85 | | | $ | 114 | | | $ | 16 | | | $ | 14 | |

| | | | | | | | | | | | | |

We made tax-deductible voluntary contributions to our qualified U.S. domestic pension plans of $110 million during the first quarter of 2008 and $100 million during the first quarter of 2007. We expect to make tax-deductible voluntary contributions to our qualified U.S. domestic pension plans for the remainder of 2008 at levels consistent with 2007.

(7) Business Segment Information

We provide a broad portfolio of transportation, e-commerce and business services through companies competing collectively, operating independently and managed collaboratively under the respected FedEx brand. Our major service lines include Federal Express Corporation (“FedEx Express”), the world’s largest express transportation company; FedEx Ground Package System, Inc. (“FedEx Ground”), a leading provider of small-package ground delivery services; and FedEx Freight Corporation, a leading U.S. provider of LTL freight services. FedEx Services provides customer-facing sales, marketing and information technology support, as well as retail access for customers through FedEx Kinko’s, primarily for the benefit of FedEx Express and FedEx Ground. These businesses form the core of our reportable segments.

Our reportable segments include the following businesses:

| | | |

FedEx Express Segment | | FedEx Express (express transportation) |

| | | FedEx Trade Networks (global trade services) |

FedEx Ground Segment | | FedEx Ground (small-package ground delivery) |

| | | FedEx SmartPost (small-parcel consolidator) |

FedEx Freight Segment | | FedEx Freight LTL Group: |

| | | FedEx Freight (regional LTL freight transportation) |

| | | FedEx National (long-haul LTL freight transportation) |

| | | FedEx Custom Critical (time-critical transportation) |

| | | Caribbean Transportation Services (airfreight forwarding) |

FedEx Services Segment | | FedEx Services (sales, marketing and information technology functions) |

| | | FedEx Kinko's (document and business services and package acceptance) |

| | | FedEx Customer Information Services ("FCIS") (customer service, billing and collections) |

| | | FedEx Global Supply Chain Services (logistics services) |

-11-

The FedEx Services segment includes FedEx Services, which is responsible for our sales, marketing and information technology functions, FCIS, which is responsible for customer service, billings and collections for FedEx Express and FedEx Ground, and FedEx Global Supply Chain Services, which provides a range of logistics services to our customers.

During the first quarter of 2008, we revised our reportable segments as a result of an internal reorganization of FedEx Kinko’s. As a result, FedEx Kinko’s is now a part of the FedEx Services segment. FedEx Services and FedEx Kinko’s have missions that are uniquely aligned. FedEx Kinko’s provides retail access to our customers for our package transportation businesses and an array of document and business services. FedEx Services provides access to customers, through digital channels such as fedex.com. Under FedEx Services, FedEx Kinko’s will benefit from the full range of resources and expertise of FedEx Services to continue to enhance the customer experience, provide greater, more convenient access to the portfolio of services at FedEx and increase revenues through our retail network. As part of this reorganization, we will be pursuing synergies in sales, marketing, information technology and administrative areas. Also we are re-evaluating priorities for FedEx Kinko’s, including the rate of expansion for new locations. With this reorganization, the FedEx Services segment is now a reportable segment. Prior year amounts have been revised to conform to the current year segment presentation.

FedEx Kinko’s will continue to be treated as a reporting unit for purposes of goodwill and tradename impairment testing. A material change in our strategy for FedEx Kinko’s could trigger the need to perform an impairment test on these assets in advance of our regularly scheduled annual tests in the fourth quarter.

The costs of providing the sales, marketing and information technology functions of FedEx Services and the customer service functions of FCIS, together with the net operating costs of FedEx Global Supply Chain Services and FedEx Kinko’s, are allocated primarily to the FedEx Express and FedEx Ground segments based on metrics such as relative revenues or estimated services provided. We believe these allocations approximate the net cost of providing these functions.

The operating expenses line item “Intercompany charges” on the accompanying unaudited financial summaries of our transportation segments includes the allocations from the FedEx Services segment to the respective transportation segments. The “Intercompany charges” caption also includes allocations for administrative services provided between operating companies and certain other costs such as corporate management fees related to services received for general corporate oversight, including executive officers and certain legal and finance functions. Management evaluates segment financial performance based on operating income.

Certain FedEx operating companies provide transportation and related services for other FedEx companies outside their reportable segment. Billings for such services are based on negotiated rates, which we believe approximate fair value, and are reflected as revenues of the billing segment. These rates are adjusted from time to time based on market conditions. Such intersegment revenues and expenses are eliminated in the consolidated results and are not separately identified in the following segment information, as the amounts are not material.

-12-

The following table provides a reconciliation of reportable segment revenues, depreciation and amortization, and operating income to our condensed consolidated statements of income totals for the three months ended August 31 (in millions). The table also provides a reconciliation of segment assets to our condensed consolidated balance sheets totals as of August 31, 2007 and May 31, 2007 (in millions).

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | FedEx | | | FedEx | | | FedEx | | | FedEx | | | | | | | |

| | | Express | | | Ground | | | Freight | | | Services | | | Other and | | | Consolidated | |

| | | Segment | | | Segment | | | Segment(1) | | | Segment(2) | | | Eliminations | | | Total | |

| Revenues | | | | | | | | | | | | | | | | | | | | | | | | |

| 2007 | | $ | 5,889 | | | $ | 1,618 | | | $ | 1,233 | | | $ | 525 | | | $ | (66 | ) | | $ | 9,199 | |

| 2006 | | | 5,640 | | | | 1,417 | | | | 1,013 | | | | 527 | | | | (52 | ) | | | 8,545 | |

| Depreciation and amortization | | | | | | | | | | | | | | | | | | | | | | | | |

| 2007 | | $ | 230 | | | $ | 73 | | | $ | 57 | | | $ | 112 | | | $ | 1 | | | $ | 473 | |

| 2006 | | | 205 | | | | 61 | | | | 31 | | | | 102 | | | | — | | | | 399 | |

| Operating income | | | | | | | | | | | | | | | | | | | | | | | | |

| 2007 | | $ | 519 | | | $ | 190 | | | $ | 105 | | | $ | — | | | $ | — | | | $ | 814 | |

| 2006 | | | 475 | | | | 159 | | | | 150 | | | | — | | | | — | | | | 784 | |

| Segment assets | | | | | | | | | | | | | | | | | | | | | | | | |

| August 31, 2007 | | $ | 16,276 | | | $ | 4,114 | | | $ | 3,192 | | | $ | 5,294 | | | $ | (4,970 | ) | | $ | 23,906 | |

| May 31, 2007 | | | 15,650 | | | | 3,937 | | | | 3,150 | | | | 5,384 | | | | (4,121 | ) | | | 24,000 | |

| (1) | | Includes the operations of FedEx National LTL, which was acquired in the second quarter of 2007. |

| |

| (2) | | The FedEx Services segment was formed during the first quarter of 2008 and includes the operations of FedEx Kinko’s and FedEx Global Supply Chain Services. Net operating costs have been allocated to our transportation segments as described above. |

The following table provides a reconciliation of reportable segment capital expenditures to consolidated totals for the three months ended August 31 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | FedEx | | | FedEx | | | FedEx | | | FedEx | | | | | | | | |

| | | Express | | | Ground | | | Freight | | | Services | | | | | | | Consolidated | |

| | | Segment | | | Segment | | | Segment | | | Segment | | | Other | | | Total | |

| 2007 | | $ | 448 | | | $ | 132 | | | $ | 74 | | | $ | 112 | | | $ | — | | | $ | 766 | |

| 2006 | | | 394 | | | | 134 | | | | 86 | | | | 85 | | | | — | | | | 699 | |

-13-

The following table presents revenue by service type and geographic information for the three months ended August 31 (in millions):

REVENUE BY SERVICE TYPE

| | | | | | | | | |

| | | 2007 | | | 2006 | |

| FedEx Express segment: | | | | | | | | |

| Package: | | | | | | | | |

| U.S. overnight box | | $ | 1,615 | | | $ | 1,654 | |

| U.S. overnight envelope | | | 512 | | | | 511 | |

| U.S. deferred | | | 711 | | | | 705 | |

| | | | | | | |

| Total U.S. domestic package revenue | | | 2,838 | | | | 2,870 | |

| International Priority (IP) | | | 1,820 | | | | 1,665 | |

International domestic(1) | | | 156 | | | | 52 | |

| | | | | | | |

| Total package revenue | | | 4,814 | | | | 4,587 | |

| | | | | | | | | |

| Freight: | | | | | | | | |

| U.S. | | | 593 | | | | 607 | |

| International priority freight | | | 292 | | | | 248 | |

| International airfreight | | | 94 | | | | 104 | |

| | | | | | | |

| Total freight revenue | | | 979 | | | | 959 | |

Other(2) | | | 96 | | | | 94 | |

| | | | | | | |

| Total FedEx Express segment | | | 5,889 | | | | 5,640 | |

| | | | | | | | | |

| FedEx Ground segment | | | 1,618 | | | | 1,417 | |

FedEx Freight segment(3) | | | 1,233 | | | | 1,013 | |

| FedEx Services segment | | | 525 | | | | 527 | |

| Other and Eliminations | | | (66 | ) | | | (52 | ) |

| | | | | | | |

| | | $ | 9,199 | | | $ | 8,545 | |

| | | | | | | |

| | | | | | | | | |

GEOGRAPHICAL INFORMATION(4) | | | | | | | | |

| Revenues: | | | | | | | | |

| U.S. | | $ | 6,693 | | | $ | 6,346 | |

| International | | | 2,506 | | | | 2,199 | |

| | | | | | | |

| | | $ | 9,199 | | | $ | 8,545 | |

| | | | | | | |

| | | | | | | | | |

The following table presents noncurrent assets as of August 31, 2007 and May 31, 2007 (in millions):

| | | | | | | | | |

| | | August 31,

2007 | | | May 31,

2007 | |

| Noncurrent assets: | | | | | | | | |

| U.S. | | $ | 14,572 | | | $ | 14,191 | |

| International | | | 3,106 | | | | 3,180 | |

| | | | | | | |

| | | $ | 17,678 | | | $ | 17,371 | |

| | | | | | | |

| (1) | | International domestic revenues includes our international domestic express operations in the United Kingdom, Canada, India and China. |

| |

| (2) | | Other revenues includes FedEx Trade Networks. |

| |

| (3) | | Includes the results of FedEx National LTL, which was acquired in the second quarter of 2007. |

| |

| (4) | | International revenue includes shipments that either originate in or are destined to locations outside the United States. Noncurrent assets include property and equipment, goodwill and other long-term assets. Flight equipment is allocated between geographic areas based on usage. |

-14-

(8)Commitments

As of August 31, 2007, our purchase commitments for the remainder of 2008 and annually thereafter under various contracts were as follows (in millions):

| | | | | | | | | | | | | | | | | |

| | | | | | | Aircraft- | | | | | | | |

| | | Aircraft | | | Related(1) | | | Other(2) | | | Total | |

| | | | | | | | | | | | | | | | | |

| 2008 (remainder) | | $ | 325 | | | $ | 122 | | | $ | 572 | | | $ | 1,019 | |

| 2009 | | | 810 | | | | 143 | | | | 201 | | | | 1,154 | |

| 2010 | | | 907 | | | | 135 | | | | 104 | | | | 1,146 | |

| 2011 | | | 665 | | | | 11 | | | | 62 | | | | 738 | |

| 2012 | | | 30 | | | | — | | | | 57 | | | | 87 | |

| Thereafter | | | — | | | | — | | | | 164 | | | | 164 | |

| | |

| (1) | | Primarily aircraft modifications. |

| |

| (2) | | Primarily vehicles, facilities, and advertising and promotions contracts. |

The amounts reflected in the table above for purchase commitments represent non-cancelable agreements to purchase goods or services. Commitments to purchase aircraft in passenger configuration do not include the attendant costs to modify these aircraft for cargo transport unless we have entered into non-cancelable commitments to modify such aircraft. Open purchase orders that are cancelable are not considered unconditional purchase obligations for financial reporting purposes and are not included in the table above.

Deposits and progress payments of $95 million have been made toward aircraft purchases, options to purchase additional aircraft and other planned aircraft-related transactions. In addition, we have committed to modify our DC10 aircraft for two-man cockpit configurations. Future payments related to these activities are included in the table above. Aircraft and aircraft-related contracts are subject to price escalations. The following table is a summary of the number and type of aircraft we are committed to purchase as of August 31, 2007, with the year of expected delivery:

| | | | | | | | | | | | | | | | | |

| | | A300 | | | B757 | | | B777F | | | Total | |

| | | | | | | | | | | | | | | | | |

| 2008 (remainder) | | | 6 | | | | 7 | | | | — | | | | 13 | |

| 2009 | | | 3 | | | | 14 | | | | — | | | | 17 | |

| 2010 | | | — | | | | 4 | | | | 6 | | | | 10 | |

| 2011 | | | — | | | | 5 | | | | 9 | | | | 14 | |

| 2012 | | | — | | | | 3 | | | | — | | | | 3 | |

| | | | | | | | | | | | | |

| Total | | | 9 | | | | 33 | | | | 15 | | | | 57 | |

| | | | | | | | | | | | | |

-15-

A summary of future minimum lease payments under capital leases at August 31, 2007 is as follows (in millions):

| | | | | |

| 2008 (remainder) | | $ | 97 | |

| 2009 | | | 13 | |

| 2010 | | | 97 | |

| 2011 | | | 8 | |

| 2012 | | | 8 | |

| Thereafter | | | 137 | |

| | | | |

| | | | 360 | |

| Less amount representing interest | | | 53 | |

| | | | |

| Present value of net minimum lease payments | | $ | 307 | |

| | | | |

A summary of future minimum lease payments under non-cancelable operating leases with an initial or remaining term in excess of one year at August 31, 2007 is as follows (in millions):

| | | | | | | | | | | | | |

| | | Aircraft and

Related | | | Facilities and | | | | |

| | | Equipment | | | Other | | | Total | |

| |

| 2008 (remainder) | | $ | 471 | | | $ | 856 | | | $ | 1,327 | |

| 2009 | | | 555 | | | | 991 | | | | 1,546 | |

| 2010 | | | 544 | | | | 813 | | | | 1,357 | |

| 2011 | | | 526 | | | | 664 | | | | 1,190 | |

| 2012 | | | 504 | | | | 554 | | | | 1,058 | |

| Thereafter | | | 3,430 | | | | 3,472 | | | | 6,902 | |

| | | | | | | | | | |

| | | $ | 6,030 | | | $ | 7,350 | | | $ | 13,380 | |

| | | | | | | | | | |

While certain of our lease agreements contain covenants governing the use of the leased assets or require us to maintain certain levels of insurance, none of our lease agreements include material financial covenants or limitations.

FedEx Express makes payments under certain leveraged operating leases that are sufficient to pay principal and interest on certain pass-through certificates. The pass-through certificates are not direct obligations of, or guaranteed by, FedEx or FedEx Express.

(9)Contingencies

Wage-and-Hour.We are a defendant in a number of lawsuits filed in federal or California state courts containing various class-action allegations of wage-and-hour violations. The plaintiffs in these lawsuits allege, among other things, that they were forced to work “off the clock,” were not paid overtime or were not provided work breaks or other benefits. The plaintiffs generally seek unspecified monetary damages, injunctive relief, or both. In August 2007, we won summary judgment regarding one such lawsuit against FedEx Kinko’s. In September 2007, we tentatively agreed to settle two such lawsuits against FedEx Ground for an immaterial amount. We have denied any liability and intend to vigorously defend ourselves in the other wage-and-hour lawsuits. Given the nature and status of the claims in these other lawsuits, we cannot yet determine the amount or a reasonable range of potential loss, if any.

Independent Contractor. Estrada v. FedEx Groundis a class action involving single work area contractors in California. In August 2007, the California appellate court affirmed the trial court’s ruling inEstradathat a limited number of California single work area contractors (most of whom have not contracted with FedEx Ground since 2001) should be reimbursed as employees for some of their operating expenses. The appellate court remanded the case to the trial court for reconsideration of the amount of such reimbursable expenses. We will petition the California supreme court for a review of the appellate court decision. We do not expect to incur a material loss in theEstradamatter.

-16-

FedEx Ground is involved in numerous other purported class-action lawsuits and administrative proceedings that claim that the company’s owner-operators should be treated as employees, rather than independent contractors. Most of the purported class actions have been consolidated for administration of the pre-trial proceedings by a single federal court, the U.S. District Court for the Northern District of Indiana. With the exception of recently filed cases that have been or will be transferred to the multi-district litigation, discovery and class certification briefing are now complete, and we are awaiting a hearing date from the court. Adverse determinations in these matters could, among other things, entitle certain of our contractors to the reimbursement of certain expenses and to the benefit of wage-and-hour laws and result in employment and withholding tax liability for FedEx Ground. We strongly believe that FedEx Ground’s owner-operators are properly classified as independent contractors and that we will prevail in these proceedings. Given the nature and status of the claims, we cannot yet determine the amount or a reasonable range of potential loss, if any, in these matters.

Antitrust — FedEx Freight Fuel Surcharge.In late July 2007, a purported antitrust class action lawsuit was filed in California federal court, naming FedEx Corporation (particularly FedEx Freight Corporation and its LTL freight subsidiaries) and several other major LTL freight carriers as defendants. The lawsuit alleges that the defendants conspired to fix fuel surcharge rates in violation of federal antitrust laws and seeks injunctive relief, treble damages and attorneys’ fees. Since the filing of the original case, similar cases have been filed against us and other LTL freight carriers, each with the same allegation of conspiracy to fix fuel surcharge rates. We believe that this allegation has no merit and intend to vigorously defend ourselves. Given the nature and status of the claims, we cannot yet determine the amount or a reasonable range of potential loss, if any, in these matters.

Other.FedEx and its subsidiaries are subject to other legal proceedings that arise in the ordinary course of their business. In the opinion of management, the aggregate liability, if any, with respect to these other actions will not materially adversely affect our financial position, results of operations or cash flows.

(10)Supplemental Cash Flow Information

| | | | | | | | | |

| | | Three Months Ended | |

| | | August 31, | |

| | | 2007 | | | 2006 | |

| | | (In millions) | |

| Cash payments for: | | | | | | | | |

| Interest (net of capitalized interest) | | $ | 51 | | | $ | 35 | |

| Income taxes | | | 91 | | | | 125 | |

(11)Condensed Consolidating Financial Statements

We are required to present condensed consolidating financial information in order for the subsidiary guarantors (other than FedEx Express) of our public debt to continue to be exempt from reporting under the Securities Exchange Act of 1934.

The guarantor subsidiaries, which are wholly owned by FedEx, guarantee approximately $1.2 billion of our debt. The guarantees are full and unconditional and joint and several. Our guarantor subsidiaries were not determined using geographic, service line or other similar criteria, and as a result, the “Guarantor” and “Non-Guarantor” columns each include portions of our domestic and international operations. Accordingly, this basis of presentation is not intended to present our financial condition, results of operations or cash flows for any purpose other than to comply with the specific requirements for subsidiary guarantor reporting.

-17-

Condensed consolidating financial statements for our guarantor subsidiaries and non-guarantor subsidiaries are presented in the following tables (in millions):

CONDENSED CONSOLIDATING BALANCE SHEETS

August 31, 2007

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Guarantor | | | Non-guarantor | | | | | | | |

| | | Parent | | | Subsidiaries | | | Subsidiaries | | | Eliminations | | | Consolidated | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 762 | | | $ | 141 | | | $ | 209 | | | $ | — | | | $ | 1,112 | |

| Receivables, less allowances | | | 2 | | | | 3,083 | | | | 922 | | | | (48 | ) | | | 3,959 | |

| Spare parts, fuel, supplies, prepaid expenses and other, less allowances | | | 6 | | | | 538 | | | | 80 | | | | — | | | | 624 | |

| Deferred income taxes | | | — | | | | 502 | | | | 31 | | | | — | | | | 533 | |

| | | | | | | | | | | | | | | | |

| Total current assets | | | 770 | | | | 4,264 | | | | 1,242 | | | | (48 | ) | | | 6,228 | |

| | | | | | | | | | | | | | | | | | | | | |

| PROPERTY AND EQUIPMENT, AT COST | | | 22 | | | | 25,225 | | | | 2,453 | | | | — | | | | 27,700 | |

| Less accumulated depreciation and amortization | | | 14 | | | | 13,666 | | | | 1,077 | | | | — | | | | 14,757 | |

| | | | | | | | | | | | | | | | |

| Net property and equipment | | | 8 | | | | 11,559 | | | | 1,376 | | | | — | | | | 12,943 | |

| | | | | | | | | | | | | | | | | | | | | |

| INTERCOMPANY RECEIVABLE | | | — | | | | 864 | | | | 689 | | | | (1,553 | ) | | | — | |

| GOODWILL | | | — | | | | 2,667 | | | | 835 | | | | — | | | | 3,502 | |

| INVESTMENT IN SUBSIDIARIES | | | 15,099 | | | | 3,339 | | | | — | | | | (18,438 | ) | | | — | |

| OTHER ASSETS | | | 668 | | | | 456 | | | | 746 | | | | (637 | ) | | | 1,233 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 16,545 | | | $ | 23,149 | | | $ | 4,888 | | | $ | (20,676 | ) | | $ | 23,906 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ INVESTMENT | | | | | | | | | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| Current portion of long-term debt | | $ | 46 | | | $ | 85 | | | $ | 3 | | | $ | — | | | $ | 134 | |

| Accrued salaries and employee benefits | | | 35 | | | | 772 | | | | 152 | | | | — | | | | 959 | |

| Accounts payable | | | 36 | | | | 1,563 | | | | 462 | | | | (43 | ) | | | 2,018 | |

| Accrued expenses | | | 20 | | | | 1,383 | | | | 186 | | | | (5 | ) | | | 1,584 | |

| | | | | | | | | | | | | | | | |

| Total current liabilities | | | 137 | | | | 3,803 | | | | 803 | | | | (48 | ) | | | 4,695 | |

| | | | | | | | | | | | | | | | | | | | | |

| LONG-TERM DEBT, LESS CURRENT PORTION | | | 1,248 | | | | 757 | | | | 2 | | | | — | | | | 2,007 | |

| INTERCOMPANY PAYABLE | | | 1,553 | | | | — | | | | — | | | | (1,553 | ) | | | — | |

| OTHER LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| Deferred income taxes | | | — | | | | 1,271 | | | | 284 | | | | (637 | ) | | | 918 | |

| Other liabilities | | | 390 | | | | 2,557 | | | | 118 | | | | — | | | | 3,065 | |

| | | | | | | | | | | | | | | | |

| Total other long-term liabilities | | | 390 | | | | 3,828 | | | | 402 | | | | (637 | ) | | | 3,983 | |

| | | | | | | | | | | | | | | | | | | | | |

| STOCKHOLDERS’ INVESTMENT | | | 13,217 | | | | 14,761 | | | | 3,681 | | | | (18,438 | ) | | | 13,221 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 16,545 | | | $ | 23,149 | | | $ | 4,888 | | | $ | (20,676 | ) | | $ | 23,906 | |

| | | | | | | | | | | | | | | | |

-18-

CONDENSED CONSOLIDATING BALANCE SHEETS

May 31, 2007

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Guarantor | | | Non-Guarantor | | | | | | | |

| | | Parent | | | Subsidiaries | | | Subsidiaries | | | Eliminations | | | Consolidated | |

| ASSETS | | | | | | | | | | | | | | | | | | | | |

| CURRENT ASSETS | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 1,212 | | | $ | 124 | | | $ | 233 | | | $ | — | | | $ | 1,569 | |

| Receivables, less allowances | | | — | | | | 3,083 | | | | 894 | | | | (35 | ) | | | 3,942 | |

| Spare parts, fuel, supplies, prepaid expenses and other, less allowances | | | 7 | | | | 500 | | | | 75 | | | | — | | | | 582 | |

| Deferred income taxes | | | — | | | | 505 | | | | 31 | | | | — | | | | 536 | |

| | | | | | | | | | | | | | | | |

| Total current assets | | | 1,219 | | | | 4,212 | | | | 1,233 | | | | (35 | ) | | | 6,629 | |

| | | | | | | | | | | | | | | | | | | | | |

| PROPERTY AND EQUIPMENT, AT COST | | | 22 | | | | 24,681 | | | | 2,387 | | | | — | | | | 27,090 | |

| Less accumulated depreciation and amortization | | | 14 | | | | 13,422 | | | | 1,018 | | | | — | | | | 14,454 | |

| | | | | | | | | | | | | | | | |

| Net property and equipment | | | 8 | | | | 11,259 | | | | 1,369 | | | | — | | | | 12,636 | |

| | | | | | | | | | | | | | | | | | | | | |

| INTERCOMPANY RECEIVABLE | | | — | | | | 870 | | | | 593 | | | | (1,463 | ) | | | — | |

| GOODWILL | | | — | | | | 2,667 | | | | 830 | | | | — | | | | 3,497 | |

| INVESTMENT IN SUBSIDIARIES | | | 14,588 | | | | 3,340 | | | | — | | | | (17,928 | ) | | | — | |

| OTHER ASSETS | | | 670 | | | | 457 | | | | 755 | | | | (644 | ) | | | 1,238 | |

| | | | | | | | | | | | | | | | |

| | | $ | 16,485 | | | $ | 22,805 | | | $ | 4,780 | | | $ | (20,070 | ) | | $ | 24,000 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ INVESTMENT | | | | | | | | | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| Current portion of long-term debt | | $ | 551 | | | $ | 85 | | | $ | 3 | | | $ | — | | | $ | 639 | |

| Accrued salaries and employee benefits | | | 60 | | | | 1,079 | | | | 215 | | | | — | | | | 1,354 | |

| Accounts payable | | | 37 | | | | 1,563 | | | | 448 | | | | (32 | ) | | | 2,016 | |

| Accrued expenses | | | 36 | | | | 1,197 | | | | 189 | | | | (3 | ) | | | 1,419 | |

| | | | | | | | | | | | | | | | |

| Total current liabilities | | | 684 | | | | 3,924 | | | | 855 | | | | (35 | ) | | | 5,428 | |

| | | | | | | | | | | | | | | | | | | | | |

| LONG-TERM DEBT, LESS CURRENT PORTION | | | 1,248 | | | | 757 | | | | 2 | | | | — | | | | 2,007 | |

| INTERCOMPANY PAYABLE | | | 1,463 | | | | — | | | | — | | | | (1,463 | ) | | | — | |

| OTHER LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| Deferred income taxes | | | — | | | | 1,262 | | | | 279 | | | | (644 | ) | | | 897 | |

| Other liabilities | | | 451 | | | | 2,445 | | | | 116 | | | | — | | | | 3,012 | |

| | | | | | | | | | | | | | | | |

| Total other long-term liabilities | | | 451 | | | | 3,707 | | | | 395 | | | | (644 | ) | | | 3,909 | |

| | | | | | | | | | | | | | | | | | | | | |

| STOCKHOLDERS’ INVESTMENT | | | 12,639 | | | | 14,417 | | | | 3,528 | | | | (17,928 | ) | | | 12,656 | |

| | | | | | | | | | | | | | | | |

| | | $ | 16,485 | | | $ | 22,805 | | | $ | 4,780 | | | $ | (20,070 | ) | | $ | 24,000 | |

| | | | | | | | | | | | | | | | |

-19-

CONDENSED CONSOLIDATING STATEMENTS OF INCOME

Three Months Ended August 31, 2007

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Guarantor | | | Non-guarantor | | | | | | | |

| | | Parent | | | Subsidiaries | | | Subsidiaries | | | Eliminations | | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | |

| REVENUES | | $ | — | | | $ | 7,646 | | | $ | 1,649 | | | $ | (96 | ) | | $ | 9,199 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | 33 | | | | 2,856 | | | | 594 | | | | — | | | | 3,483 | |

| Purchased transportation | | | — | | | | 746 | | | | 298 | | | | (19 | ) | | | 1,025 | |

| Rentals and landing fees | | | 1 | | | | 519 | | | | 74 | | | | (1 | ) | | | 593 | |

| Depreciation and amortization | | | — | | | | 399 | | | | 74 | | | | — | | | | 473 | |

| Fuel | | | — | | | | 896 | | | | 68 | | | | — | | | | 964 | |

| Maintenance and repairs | | | — | | | | 506 | | | | 38 | | | | — | | | | 544 | |

| Intercompany charges, net | | | (53 | ) | | | (18 | ) | | | 71 | | | | — | | | | — | |

| Other | | | 19 | | | | 1,100 | | | | 260 | | | | (76 | ) | | | 1,303 | |

| | | | | | | | | | | | | | | | |

| | | | — | | | | 7,004 | | | | 1,477 | | | | (96 | ) | | | 8,385 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATING INCOME | | | — | | | | 642 | | | | 172 | | | | — | | | | 814 | |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | | | | | |

| Equity in earnings of subsidiaries | | | 494 | | | | 74 | | | | — | | | | (568 | ) | | | — | |

| Interest, net | | | (9 | ) | | | (13 | ) | | | (3 | ) | | | — | | | | (25 | ) |

| Intercompany charges, net | | | 12 | | | | (13 | ) | | | 1 | | | | — | | | | — | |

| Other, net | | | (3 | ) | | | 1 | | | | — | | | | — | | | | (2 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | 494 | | | | 691 | | | | 170 | | | | (568 | ) | | | 787 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | — | | | | 245 | | | | 48 | | | | — | | | | 293 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCOME | | $ | 494 | | | $ | 446 | | | $ | 122 | | | $ | (568 | ) | | $ | 494 | |

| | | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATING STATEMENTS OF INCOME

Three Months Ended August 31, 2006

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Guarantor | | | Non-guarantor | | | | | | | |

| | | Parent | | | Subsidiaries | | | Subsidiaries | | | Eliminations | | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | |

| REVENUES | | $ | — | | | $ | 7,468 | | | $ | 1,162 | | | $ | (85 | ) | | $ | 8,545 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | 27 | | | | 2,870 | | | | 388 | | | | — | | | | 3,285 | |

| Purchased transportation | | | — | | | | 729 | | | | 174 | | | | (7 | ) | | | 896 | |

| Rentals and landing fees | | | — | | | | 514 | | | | 56 | | | | — | | | | 570 | |

| Depreciation and amortization | | | — | | | | 362 | | | | 37 | | | | — | | | | 399 | |

| Fuel | | | — | | | | 904 | | | | 37 | | | | — | | | | 941 | |

| Maintenance and repairs | | | — | | | | 497 | | | | 18 | | | | — | | | | 515 | |

| Intercompany charges, net | | | (50 | ) | | | (31 | ) | | | 81 | | | | — | | | | — | |

| Other | | | 23 | | | | 1,037 | | | | 173 | | | | (78 | ) | | | 1,155 | |

| | | | | | | | | | | | | | | | |

| | | | — | | | | 6,882 | | | | 964 | | | | (85 | ) | | | 7,761 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATING INCOME | | | — | | | | 586 | | | | 198 | | | | — | | | | 784 | |

| | | | | | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | | | | | |

| Equity in earnings of subsidiaries | | | 475 | | | | 114 | | | | — | | | | (589 | ) | | | — | |

| Interest, net | | | 1 | | | | (10 | ) | | | — | | | | — | | | | (9 | ) |

| Intercompany charges, net | | | 1 | | | | (9 | ) | | | 8 | | | | — | | | | — | |

| Other, net | | | (2 | ) | | | (1 | ) | | | (2 | ) | | | — | | | | (5 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | 475 | | | | 680 | | | | 204 | | | | (589 | ) | | | 770 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | — | | | | 237 | | | | 58 | | | | — | | | | 295 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCOME | | $ | 475 | | | $ | 443 | | | $ | 146 | | | $ | (589 | ) | | $ | 475 | |

| | | | | | | | | | | | | | | | |

-20-

CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS

Three Months Ended August 31, 2007

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Guarantor | | | Non-guarantor | | | | | | | |

| | | Parent | | | Subsidiaries | | | Subsidiaries | | | Eliminations | | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH PROVIDED BY OPERATING ACTIVITIES | | $ | 123 | | | $ | 637 | | | $ | 43 | | | $ | — | | | $ | 803 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTING ACTIVITIES | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | | — | | | | (699 | ) | | | (67 | ) | | | — | | | | (766 | ) |

| Proceeds from asset dispositions and other | | | — | | | | (7 | ) | | | 2 | | | | — | | | | (5 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH USED IN INVESTING ACTIVITIES | | | — | | | | (706 | ) | | | (65 | ) | | | — | | | | (771 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| FINANCING ACTIVITIES | | | | | | | | | | | | | | | | | | | | |

| Net transfers (to) from Parent | | | (86 | ) | | | 87 | | | | (1 | ) | | | — | | | | — | |

| Principal payments on debt | | | (505 | ) | | | (1 | ) | | | (1 | ) | | | — | | | | (507 | ) |

| Proceeds from stock issuances | | | 40 | | | | — | | | | — | | | | — | | | | 40 | |

| Excess tax benefit on the exercise of stock options | | | 9 | | | | — | | | | — | | | | — | | | | 9 | |

| Dividends paid | | | (31 | ) | | | — | | | | — | | | | — | | | | (31 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES | | | (573 | ) | | | 86 | | | | (2 | ) | | | — | | | | (489 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS | | | | | | | | | | | | | | | | | | | | |

| Net (decrease) increase in cash and cash equivalents | | | (450 | ) | | | 17 | | | | (24 | ) | | | — | | | | (457 | ) |

| Cash and cash equivalents at beginning of period | | | 1,212 | | | | 124 | | | | 233 | | | | — | | | | 1,569 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 762 | | | $ | 141 | | | $ | 209 | | | $ | — | | | $ | 1,112 | |

| | | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS

Three Months Ended August 31, 2006

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Guarantor | | | Non-guarantor | | | | | | | |

| | | Parent | | | Subsidiaries | | | Subsidiaries | | | Eliminations | | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH PROVIDED BY OPERATING ACTIVITIES | | $ | 123 | | | $ | 474 | | | $ | 68 | | | $ | — | | | $ | 665 | |

| | | | | | | | | | | | | | | | | | | | | |

| INVESTING ACTIVITIES | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | | — | | | | (655 | ) | | | (44 | ) | | | — | | | | (699 | ) |

| Proceeds from asset dispositions and other | | | — | | | | 1 | | | | 4 | | | | — | | | | 5 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH USED IN INVESTING ACTIVITIES | | | — | | | | (654 | ) | | | (40 | ) | | | — | | | | (694 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| FINANCING ACTIVITIES | | | | | | | | | | | | | | | | | | | | |

| Net transfers (to) from Parent | | | (245 | ) | | | 237 | | | | 8 | | | | — | | | | — | |

| Proceeds from debt issuance | | | 999 | | | | — | | | | — | | | | — | | | | 999 | |

| Principal payments on debt | | | (200 | ) | | | (21 | ) | | | — | | | | — | | | | (221 | ) |

| Proceeds from stock issuances | | | 30 | | | | — | | | | — | | | | — | | | | 30 | |

| Excess tax benefit on the exercise of stock options | | | 6 | | | | — | | | | — | | | | — | | | | 6 | |

| Dividends paid | | | (28 | ) | | | — | | | | — | | | | — | | | | (28 | ) |

| Other, net | | | (4 | ) | | | — | | | | — | | | | — | | | | (4 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH PROVIDED BY FINANCING ACTIVITIES | | | 558 | | | | 216 | | | | 8 | | | | — | | | | 782 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS | | | | | | | | | | | | | | | | | | | | |

| Net increase in cash and cash equivalents | | | 681 | | | | 36 | | | | 36 | | | | — | | | | 753 | |

| Cash and cash equivalents at beginning of period | | | 1,679 | | | | 114 | | | | 144 | | | | — | | | | 1,937 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 2,360 | | | $ | 150 | | | $ | 180 | | | $ | — | | | $ | 2,690 | |

| | | | | | | | | | | | | | | | |

-21-

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

FedEx Corporation

We have reviewed the condensed consolidated balance sheet of FedEx Corporation as of August 31, 2007, and the related condensed consolidated statements of income and cash flows for the three-month periods ended August 31, 2007 and 2006. These financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of FedEx Corporation as of May 31, 2007, and the related consolidated statements of income, changes in stockholders’ investment and comprehensive income, and cash flows for the year then ended not presented herein, and in our report dated July 9, 2007, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of May 31, 2007, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ Ernst & Young LLP

Memphis, Tennessee

September 19, 2007

-22-

Item 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition

GENERAL

The following Management’s Discussion and Analysis of Results of Operations and Financial Condition describes the principal factors affecting the results of operations, liquidity, capital resources, contractual cash obligations and critical accounting estimates of FedEx. This discussion should be read in conjunction with the accompanying quarterly unaudited condensed consolidated financial statements and our Annual Report on Form 10-K for the year ended May 31, 2007 (“Annual Report”). Our Annual Report includes additional information about our significant accounting policies, practices and the transactions that underlie our financial results, as well as our detailed discussion of the most significant risks and uncertainties associated with our financial and operating results.

We provide a broad portfolio of transportation, e-commerce and business services through companies competing collectively, operating independently and managed collaboratively under the respected FedEx brand. Our major service lines include Federal Express Corporation (“FedEx Express”), the world’s largest express transportation company; FedEx Ground Package System, Inc. (“FedEx Ground”), a leading provider of small-package ground delivery services; and FedEx Freight Corporation, a leading U.S. provider of less-than-truckload (“LTL”) freight services. The FedEx Services segment provides customer-facing sales, marketing and information technology support, as well as retail access for customers through FedEx Kinko’s Office and Print Services, Inc. (“FedEx Kinko’s”), primarily for the benefit of FedEx Express and FedEx Ground. These companies form the core of our reportable segments. See “Reportable Segments” for further discussion.

The key indicators necessary to understand our operating results include:

| • | | the overall customer demand for our various services; |

| • | | the volumes of transportation services provided through our networks, primarily measured by our average daily volume and shipment weight; |

| • | | the mix of services purchased by our customers; |

| • | | the prices we obtain for our services, primarily measured by yield (average price per shipment or pound or average price per hundredweight for FedEx Freight LTL Group shipments); |

| • | | our ability to manage our cost structure for capital expenditures and operating expenses and to match our cost structure to shifting volume levels; and |

| • | | the timing and amount of fluctuations in fuel prices and our ability to recover incremental fuel costs through our fuel surcharges. |

Except as otherwise specified, references to years indicate our fiscal year ending May 31, 2008 or ended May 31 of the year referenced and comparisons are to the corresponding period of the prior year. References to our transportation segments include, collectively, our FedEx Express, FedEx Ground and FedEx Freight segments.

-23-

RESULTS OF OPERATIONS

CONSOLIDATED RESULTS

The following table compares revenues, operating income, operating margin, net income and diluted earnings per share (dollars in millions, except per share amounts) for the three months ended August 31:

| | | | | | | | | | | | | |

| | | | | | | | | | | Percent | |

| | | 2007 | | | 2006 | | | Change | |

| Revenues | | $ | 9,199 | | | $ | 8,545 | | | | 8 | |

| | | | | | | | | | | | | |

| Operating income | | | 814 | | | | 784 | | | | 4 | |

| | | | | | | | | | | | | |

| Operating margin | | | 8.8 | % | | | 9.2 | % | | (40 | ) bp |

| | | | | | | | | | | | | |

| Net income | | $ | 494 | | | $ | 475 | | | | 4 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

| Diluted earnings per share | | $ | 1.58 | | | $ | 1.53 | | | | 3 | |

| | | | | | | | | | |

The following table shows changes in revenues and operating income by reportable segment for the three months ended August 31, 2007 compared to 2006 (in millions):

| | | | | | | | | | | | | | | | | |

| | | Revenues | | | Operating Income | |

| | | Dollar | | | Percent | | | Dollar | | | Percent | |

| | | Change | | | Change | | | Change | | | Change | |

| | | | | | | | | | | | | | | | | |

| FedEx Express segment | | $ | 249 | | | | 4 | | | $ | 44 | | | | 9 | |

| FedEx Ground segment | | | 201 | | | | 14 | | | | 31 | | | | 19 | |

FedEx Freight segment (1) | | | 220 | | | | 22 | | | | (45 | ) | | | (30 | ) |

| FedEx Services segment | | | (2 | ) | | NM | | | | — | | | | — | |

| Other and Eliminations | | | (14 | ) | | NM | | | | — | | | NM | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $ | 654 | | | | 8 | | | $ | 30 | | | | 4 | |

| | | | | | | | | | | | | | | |

| | |

| (1) | | FedEx Freight segment results for 2008 include the results of FedEx National LTL, which was acquired in the second quarter of 2007. |

-24-

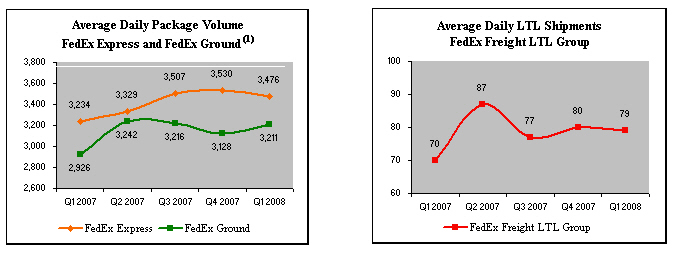

The following graphs for FedEx Express, FedEx Ground and the FedEx Freight LTL Group show selected volume statistics (in thousands) for the five most recent quarters:

The following graphs for FedEx Express, FedEx Ground and the FedEx Freight LTL Group show selected yield statistics for the five most recent quarters:

| | |

| (1) | | Package statistics do not include the operations of FedEx SmartPost. |

-25-

Overall results for the first quarter of 2008 were restrained by the continued softening economic environment in the U.S., which is limiting the demand for our U.S. domestic package and LTL freight services, and reduced profitability at the FedEx Freight segment due to operating losses at FedEx National LTL. Strong growth at FedEx Ground, partially offset by higher legal costs, and growth in international shipments at FedEx Express favorably impacted our quarterly results. Lower variable incentive compensation and reduced retirement plans costs partially mitigated the impact of the softening U.S. economy on overall results.

Revenue growth for the first quarter of 2008 was primarily attributable to strong volume growth at FedEx Ground and continued growth in FedEx Express International Priority (“IP”) volumes. FedEx Freight segment revenue growth was due to the inclusion of FedEx National LTL, which was acquired in the second quarter of 2007. Growth at FedEx Ground and in our IP volumes offset slight declines in U.S. domestic package volumes and the impact of weaker volumes in our LTL freight businesses as a result of the soft U.S. economy.

Operating income increased marginally in the first quarter of 2008, as revenue growth was largely offset by planned spending on initiatives associated with improving customer service and productivity. Lower operating income at the FedEx Freight segment due to operating losses at FedEx National LTL from integration activities and soft volumes, and our reduction of the fuel surcharge on LTL freight shipments negatively impacted operating income in the first quarter of 2008. Improved operating margins at FedEx Ground and FedEx Express were more than offset by reduced profitability at FedEx Freight, causing consolidated margins to decline for the quarter.

While fuel expense increased approximately 2% during the first quarter of 2008, fuel surcharges were not sufficient to mitigate the effect of higher fuel costs on our operating results based on a static analysis of the year-over-year changes in fuel prices compared to changes in fuel surcharges. Though fluctuations in fuel surcharge rates can be significant from period to period, fuel surcharges represent one of the many individual components of our pricing structure that impact our overall revenue and yield. Additional components include the mix of services purchased, the base price and other extra service charges we obtain for these services and the level of pricing discounts offered. In order to provide information about the impact of fuel surcharges on the trend in revenue and yield growth, we have included the comparative fuel surcharge rates in effect for the first quarter of 2008 and 2007 in the following discussions of each of our transportation segments. During the first quarter of 2008, we announced a reduction of our LTL fuel surcharges by 25% effective July 23, 2007 to assist customers, who are facing both a challenging economy and high fuel prices.

Net interest expense increased during the first quarter of 2008 primarily due to increased legal costs, higher debt balances and decreased interest income from lower cash balances.

Our effective tax rate was 37.2% for the first quarter of 2008 and 38.3% for the first quarter of 2007. The 2008 tax rate was lower than the 2007 rate primarily due to a favorable tax audit adjustment and to increased international earnings permanently reinvested in our global network outside the United States. We expect the effective tax rate to be between 37.5% and 38.0% for the remainder of 2008. The actual rate will depend on a number of factors, including the amount and source of operating income.

Outlook

We expect our revenue growth rates to moderate from 2007 across all segments for the remainder of 2008, as the continued softness of the U.S. economy is expected to restrain demand for U.S. domestic package and LTL freight services. Earnings growth for the remainder of 2008 is expected to be driven by revenue growth, primarily from IP services at FedEx Express and increased volumes at FedEx Ground, as well as cost containment initiatives. We expect that the LTL fuel surcharge reduction will have a negative impact on revenue and earnings for the remainder of 2008; however, this change is expected to strengthen us competitively and drive incremental volumes over the long-term. We continue to expect our earnings in 2008 to be below our long-term goal of 10% to 15% annual earnings growth due to the softening U.S. economy and planned investments in our businesses; however, we remain optimistic about the long-term prospects for all of our business segments.

-26-

We expect to continue to make significant investments to expand our global networks and broaden our service offerings, in part through the integration and expansion of FedEx National LTL and our international investments. Our planned investments for 2008 are focused on support for long-term volume growth, such as additional or expanded facilities and new aircraft, improvements in service levels, and improvements to productivity, including updates and enhancements to our technology capabilities.

All of our businesses operate in a competitive pricing environment, exacerbated by continuing volatile fuel prices. Historically, our fuel surcharges have generally been sufficient to offset incremental fuel costs; however, volatility in fuel costs may impact earnings because adjustments to our fuel surcharges lag changes in actual fuel prices paid. Therefore, the trailing impact of adjustments to our fuel surcharges can significantly affect our earnings in the short-term.

See “Forward-Looking Statements” for a discussion of potential risks and uncertainties that could materially affect our future performance.

NEW ACCOUNTING PRONOUNCEMENTS

New accounting rules and disclosure requirements can significantly impact the comparability of our financial statements. We believe the following new accounting pronouncement is relevant to the readers of our financial statements.

On June 1, 2007, we adopted Financial Accounting Standards Board (“FASB”) Interpretation No. (“FIN”) 48, “Accounting for Uncertainty in Income Taxes.” This interpretation establishes new standards for the financial statement recognition, measurement and disclosure of uncertain tax positions taken or expected to be taken in income tax returns. The cumulative effect of adopting FIN 48 was immaterial. For additional information on the impact of adoption of FIN 48, refer to Note 1 to the accompanying unaudited condensed consolidated financial statements.

-27-

REPORTABLE SEGMENTS

FedEx Express, FedEx Ground and FedEx Freight represent our major service lines and, along with FedEx Services, form the core of our reportable segments. Our reportable segments include the following businesses:

| | | |

FedEx Express Segment | | FedEx Express (express transportation) |

| | | FedEx Trade Networks (global trade services) |

| | | |

FedEx Ground Segment | | FedEx Ground (small-package ground delivery) |

| | | FedEx SmartPost (small-parcel consolidator) |

| | | |

FedEx Freight Segment | | FedEx Freight LTL Group: |

| | | FedEx Freight (regional LTL freight transportation) |

| | | FedEx National LTL (long-haul LTL freight transportation) |

| | | FedEx Custom Critical (time-critical transportation) |

| | | Caribbean Transportation Services (airfreight forwarding) |

| | | |

FedEx Services Segment | | FedEx Services (sales, marketing and information technology functions) |

| | | FedEx Kinko’s (document and business services and package acceptance) |

| | | FedEx Customer Information Services (“FCIS”) (customer service, billing and collections) |

| | | FedEx Global Supply Chain Services (logistics services) |

FEDEX SERVICES SEGMENT

The FedEx Services segment includes FedEx Services, which is responsible for our sales, marketing and information technology functions, FCIS, which is responsible for customer service, billings and collections for FedEx Express and FedEx Ground, and FedEx Global Supply Chain Services, which provides a range of logistics services to our customers.

During the first quarter of 2008, we revised our reportable segments as a result of an internal reorganization of FedEx Kinko’s. As a result, FedEx Kinko’s is now part of the FedEx Services segment. FedEx Services and FedEx Kinko’s have missions that are uniquely aligned. FedEx Kinko’s provides retail access to our customers for our package transportation businesses and an array of document and business services. FedEx Services provides access to customers, through digital channels such as fedex.com. Under FedEx Services, FedEx Kinko’s will benefit from the full range of resources and expertise of FedEx Services to continue to enhance the customer experience, provide greater, more convenient access to the portfolio of services at FedEx, and increase revenues through our retail network. As part of this reorganization, we will be pursuing synergies in sales, marketing, information technology and administrative areas. Also, we are re-evaluating priorities for FedEx Kinko’s, including the rate of expansion for new locations. With this reorganization, the FedEx Services segment is now a reportable segment. Prior year amounts have been revised to conform to the current year segment presentation.

FedEx Kinko’s will continue to be treated as a reporting unit for purposes of goodwill and tradename impairment testing. A material change in our strategy for FedEx Kinko’s could trigger the need to perform an impairment test on these assets in advance of our regularly scheduled annual tests in the fourth quarter.