As used in this Proxy Statement, “Company” means collectively, DTG and its subsidiaries.

Each stockholder is entitled to one vote for each Share held of record at the close of business on the record date. Directors are elected by a plurality vote, which means that if there are more nominees than positions to be filled, the nominees for whom the most affirmative votes are cast will be elected. Each other matter voted on at the meeting will be approved if a majority of the votes cast are in favor of such matter. Abstentions and broker non-votes are not votes cast and are not counted in determining whether a nominee is elected or a matter approved. Inspectors of election appointed by the Board will tabulate the votes cast.

The proxy card represents the Shares held of record by each stockholder. Each stockholder can authorize the individuals named in the proxy card to vote Shares by signing, dating and mailing the proxy card. Each stockholder’s Shares will then be voted at the meeting as the stockholder specifies or, if the stockholder does not specify a choice, as recommended by the Board. Each stockholder may revoke the proxy by voting in person at the meeting, or by submitting a written revocation or a later dated proxy that is received by DTG before the meeting. If you hold your Shares through a brokerage firm or other nominee, you may elect to vote your Shares by a toll-free phone number or over the Internet by following the instructions on the proxy materials forwarded to you.

Execution and return of the enclosed proxy is being solicited by and on behalf of the Board of Directors of DTG for the purposes set forth in the Notice of Annual Meeting. Solicitation other than by mail may be made personally, by telephone or otherwise, by employee officers and employees of DTG who will not be additionally compensated for such services. Brokerage firms, banks, fiduciaries, voting trustees or other nominees will be requested to forward the soliciting material to each beneficial owner of Shares held of record by them. Georgeson Shareholder Communications Inc. has been retained to assist in the solicitation of proxies at a cost of approximately $6,500. The total cost of soliciting proxies will be borne by DTG.

PROPOSAL - ELECTION OF DIRECTORS

DTG has nominated for re-election to the Board eight candidates who currently serve on DTG’s Board. Incumbent director, Edward J. Hogan, will retire from the Board upon the Annual Meeting of Stockholders and will not stand for re-election.

If elected, each candidate will serve for a one-year term ending at the Annual Meeting of Stockholders to be held in 2004 or when their successors are duly elected and qualified. For more information concerning these director nominees, see “Biographical Information Regarding Director Nominees and Named Executive Officers - Director Nominees”. Unless otherwise designated, the enclosed proxy card will be voted FOR the election of the foregoing nominees as directors. The Board does not believe that any of these nominees will be unable to stand for election, but should any nominee unexpectedly become unavailable for election, the stockholder’s proxy will be voted for a new nominee designated by the Board unless the Board reduces the number of directors to be elected.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES DESCRIBED HEREIN AS DIRECTORS OF DTG.

BIOGRAPHICAL INFORMATION REGARDING

DIRECTOR NOMINEES AND NAMED EXECUTIVE OFFICERS

Director Nominees

Below is information concerning each of the nominees for election to the Board, including their name, age, principal occupation or employment during at least the past five years and the period during which such person has served as a director of DTG.

Molly Shi Boren, age 59,has served as a director since May 2000. A lawyer and former judge, she has been active in Oklahoma and national civic affairs. Ms. Boren has previously served as a director of Pepsi-Cola Bottling Company of Chicago, Liberty Bancorporation, Pet Food Company and Central and South West Corporation.

Thomas P. Capo, age 52,has served as a director since November 1997. Mr. Capo was a Senior Vice President and the Treasurer of DaimlerChrysler Corporation, from November 1998 to August 2000. From November 1991 to October 1998 he was Treasurer of Chrysler Corporation. Prior to holding these positions, Mr. Capo served as Vice President and Controller of Chrysler Financial Corporation. Mr. Capo is also a director of Sonic Automotive, Inc.

Joseph E. Cappy, age 68, has served as a director since November 1997. Mr. Cappy served as a Vice President of Chrysler Corporation from August 1987 to December 1997. Mr. Cappy is also a director of BOK Financial Corporation.

Maryann N. Keller, age 59,has served as a director since May 2000. Ms. Keller was President of the Automotive Services unit of priceline.com from July 1999 to November 2000. She joined priceline.com from Furman Selz (now part of ING Barings), where she served as a managing director of the firm since 1986. Ms. Keller also served as Chairman of the Society of Automotive Analysts from 1994 to 1999. Ms. Keller is also a director of Sonic Automotive, Inc.

The Honorable Edward C. Lumley, age 63,has served as a director since December 1997. Mr. Lumley has been Vice Chairman of the investment banking firm BMO Nesbitt Burns since August 1994. Mr. Lumley previously served as a Member of the Canadian Parliament and as Minister of International Trade, Industry, Trade and Commerce, Communications, and Science and Technology. Mr. Lumley is also a director of Air Canada, Canadian National, Magna International, Magna Entertainment, Intier Automotive and Bell Canada Enterprises.

5

John C. Pope, age 54,has served as a director since December 1997. Mr. Pope has been Chairman of PFI Group, an investment firm, since July 1994. Mr. Pope was the Chairman of the Board of MotivePower Industries, Inc. from January 1996 to November 1999 and a director from May 1995 to November 1999. Mr. Pope served as a director and in various executive positions with UAL Corporation and United Airlines, Inc. between January 1988 and July 1994. Mr. Pope is also a director of Air Canada, CNF, Inc., Federal Mogul Corporation, Kraft Foods Inc., Per-Se Technologies, Inc., Wallace Computer Services, Inc. and Waste Management, Inc.

John P. Tierney, age 71,has served as a director since December 1997. Mr. Tierney was the Chairman and Chief Executive Officer of Chrysler Financial Corporation, the financial services subsidiary of Chrysler Corporation, from August 1987 until his retirement in December 1994. Mr. Tierney is also a director of Charter One Financial, Inc.

Edward L. Wax, age 66,has served as a director since December 1997. Mr. Wax has been Chairman Emeritus of Saatchi & Saatchi Advertising Worldwide, an advertising firm with substantial experience in the travel industry, since January 1998. Mr. Wax is also a director of Golf Trust of America, Inc.

Named Executive Officers

The following sets forth information concerning the executive officers of DTG identified under “Executive Compensation - Summary Compensation Table”, including their name, age, principal occupation and employment during at least the past five years and the period during which such person has served as an executive officer of DTG.

Peter G. Guptill, age 60,is currently an Executive Vice President of DTG and was the Executive Vice President of Dollar Rent A Car Systems, Inc. - Florida Region (now known as DTG Operations, Inc.) from January 1996 through December 2002. Mr. Guptill is also a director of the Travel Industry Association of America and the Florida Tourism Commission.

Steven B. Hildebrand, age 48,is currently an Executive Vice President and the Chief Financial Officer of DTG and was the Vice President of DTG from November 1997 through May 2000. Prior to his election as a DTG officer, Mr. Hildebrand was Executive Vice President and Chief Financial Officer of Thrifty Rent-A-Car System, Inc. since August 1995.

Donald M. Himelfarb, age 57,is currently the Chief Operating Officer and President of DTG - Marketing, Franchising and Administration, and was an Executive Vice President of DTG from November 1997 through December 2002. Mr. Himelfarb also served as a director of DTG from November 1997 to May 2000. Mr. Himelfarb was President of Thrifty Rent-A-Car System, Inc. from June 1992 through December 2002 and Thrifty, Inc. from December 1998 through December 2002.

Gary L. Paxton, age 56,is currently the Chief Operating Officer and President of DTG - Corporate Operations, and was an Executive Vice President of DTG from November 1997 through December 2002. Mr. Paxton also served as a director of DTG from November 1997 to May 2000. Mr. Paxton was President of Dollar Rent A Car Systems, Inc. (now known as DTG Operations, Inc.) from December 1990 through December 2002.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

Certain Beneficial Owners

The following table sets forth certain information as of March 27, 2003 with respect to each person known by DTG to beneficially own more than 5% of the outstanding Shares:

| | | | | | | |

| Name and Address | | Amount and Nature | | | | |

| of Beneficial Owner | | of Beneficial Ownership | | Percent of Class (1) | | |

| | | | | | | |

| Tweedy, Browne Company LLC | | 2,165,265 | | 8.8% | | |

| 350 Park Avenue | | | | | | |

| New York, New York 10022 | | | | | | |

| | | | | | | |

| Franklin Resources, Inc. (2) | | 1,776,500 | | 7.2% | | |

| Charles B. Johnson | | | | | | |

| Rupert H. Johnson, Jr. | | | | | | |

| One Franklin Parkway | | | | | | |

| San Mateo, California 94403 | | | | | | |

| Franklin Advisory Services, LLC | | | | | | |

| One Parker Plaza, 16th Floor | | | | | | |

| Fort Lee, New Jersey 07024 | | | | | | |

| | | | | | | |

| Dimensional Fund Advisors Inc. (3) | | 1,775,600 | | 7.2% | | |

| 1299 Ocean Avenue, 11th Floor | | | | | | |

| Santa Monica, California 90401 | | | | | | |

| | | | | | | |

| AXA Financial, Inc. (4) | | 1,736,105 | | 7.0% | | |

| 1290 Avenue of the Americas | | | | | |

| New York, New York 10104 | | | | | | |

| AXA Conseil Vie Assurance Mutuelle | | | | | | |

| AXA Assurances I.A.R.D. Mutuelle | | | | | | |

| 370, rue Saint Honore | | | | | | |

| 75001 Paris, France | | | | | | |

| AXA Courtage Assurance Mutuelle | | | | | | |

| 26, rue Louis le Grand | | | | | | |

| 75002 Paris, France | | | | | | |

| AXA | | | | | | |

| 25, avenue Matignon | | | | | | |

| 75008 Paris, France | | | | | | |

| | | | | | | |

7

| | | | | | | |

| The Carmel Trust (5) | | 1,723,300 | | 7.0% | | |

c/o Skadden, Arps, Slate, Meagher

& Flom | | | | | |

| 333 West Wacker Drive | | | | | | |

| Chicago, Illinois 60606 | | | | | | |

| DTI Investments, LLC | | | | | | |

| 4000 Island Blvd. | | | | | | |

| Williams Island, Florida 33160 | | | | | | |

| Carmel Holding Co. | | | | | | |

| c/o Carmel Investment Fund | | | | | | |

| TK House | | | | | | |

| Bayside Executive Park | | | | | | |

| West Bay Street & Blake Road | | | | | | |

| Nassau Bahamas | | | | | | |

| | | | | | | |

| | | |

| (1) | Based on 24,680,346 Shares outstanding as of March 27, 2003. |

| | | |

| (2) | Charles B. Johnson and Rupert H. Johnson, Jr. (the"Principal Shareholders") each own in excess of ten percent (10%) of the outstanding common stock of Franklin Resources, Inc. ("FRI"). Franklin Advisory Services, LLC ("FAS"), an advisory subsidiary of FRI, has the sole power to vote or to direct the vote of the Shares and the sole power to dispose or to direct the disposition of the Shares. The Principal Shareholders, FRI and FAS each disclaim beneficial ownership of the Shares. |

| | | |

| (3) | Dimensional Fund Advisors Inc. disclaims beneficial ownership of the Shares. |

| | | |

| (4) | AXA Conseil Vie Assurance Mutuelle, AXA Assurances I.A.R.D. Mutuelle, AXA Assurances Vie Mutuelle and AXA Courtage Assurance Mutuelle are collectively "The Mutuelles AXA". The Mutuelles AXA, as a group, controls AXA ("AXA"). AXA owns AXA Rosenberg Investment Management LLC ("AXA Rosenberg") and AXA Financial, Inc. ("AXA Financial"). AXA Financial owns Alliance Capital Management L.P. ("Alliance"). AXA Rosenberg and Alliance own 624,100 and 1,112,005 Shares, respectively. |

| | | |

| (5) | The Carmel Trust owns all of the outstanding membership interests of DTI Investments, LLC ("DTI") and all of the outstanding capital stock of Carmel Holding Co. ("CHC"). DTI and CHC own 391,600 and 1,331,700 Shares, respectively. |

8

Directors, Director Nominees and Executive Officers

The following table sets forth certain information as of March 27, 2003, with respect to the number of Shares owned by (i) each director nominee of DTG, (ii) Edward J. Hogan, a current director of DTG who will not stand for re-election at the Annual Meeting of Stockholders, (iii) each named executive officer of DTG, and (iv) all directors and named executive officers of DTG as a group.

| | | | | | | | | | |

| | | | Amount and Nature | | | | |

| Name of Beneficial Owner | | | of Beneficial Ownership (1) | | Percent of Class (2) | |

| | | | | | | | | | |

| Molly Shi Boren | | | 20,022 | (3) | | | Less than 1% | |

| | | | | | | | | | |

| Thomas P. Capo | | | 18,646 | (4) | | | Less than 1% | |

| | | | | | | | | | |

| Joseph E. Cappy | | | 489,573 | (5) | | | 2.0% | |

| | | | | | | | | | |

| Edward J. Hogan | | | 31,459 | (6) | | | Less than 1% | |

| | | | | | | | | | |

| Maryann N. Keller | | | 20,326 | (7) | | | Less than 1% | |

| | | | | | | | | | |

| The Hon. Edward C. Lumley | | | 37,530 | (8) | | | Less than 1% | |

| | | | | | | | | | |

| John C. Pope | | | 41,533 | (9) | | | Less than 1% | |

| | | | | | | | | | |

| John P. Tierney | | | 40,121 | (10) | | | Less than 1% | |

| | | | | | | | | | |

| Edward L. Wax | | | 36,971 | (11) | | | Less than 1% | |

| | | | | | | | | | |

| Peter G. Guptill | | | 105,577 | (12) | | | Less than 1% | |

| | | | | | | | | | |

| Steven B. Hildebrand | | | 150,771 | (13) | | | Less than 1% | |

| | | | | | | | | | |

| Donald M. Himelfarb | | | 179,245 | (14) | | | Less than 1% | |

| | | | | | | | | | |

| Gary L. Paxton | | | 205,128 | (15) | | | Less than 1% | |

| | | | | | | | | | |

All directors and executive

officers as a group | | | 1,376,902

| | | | 5.6%

| |

| | | |

| (1) | The SEC deems a person to have beneficial ownership of all shares which such person has the right to acquire within sixty (60) days. Accordingly, Shares subject to options exercisable within sixty (60) days are included in this column. |

| | | |

| (2) | Based on 24,680,346 Shares outstanding as of March 27, 2003. |

| | | |

| (3) | Consists of (i) 10,022 Shares subject to a deferral agreement between DTG and Ms. Boren, of which 3,500 are restricted Shares that shall vest on December 31, 2003, and (ii) 10,000 Shares subject to options. |

| | | |

| (4) | Consists of (i) 10,002 Shares subject to a deferral agreement between DTG and Mr. Capo, of which 3,500 are restricted Shares that shall vest on December 31, 2003, and (ii) 8,644 Shares subject to options. |

9

| | | |

| (5) | Consists of (i) 87,300 Shares owned of record by Mr. Cappy's trust, (ii) 57,573 Shares held in the Deferred Compensation Plan (hereinafter defined), (iii) 18,200 Shares that shall vest in two equal annual installments on January 31, 2004 and January 31, 2005, (iv) 295,200 Shares subject to options, and (v) 31,300 Shares owned of record by the trust of Mr. Cappy's spouse. |

| | | |

| (6) | Consists of (i) 12,030 Shares owned of record by the trust of Mr. Hogan and his spouse, (ii) 1,429 restricted Shares that shall vest upon Mr. Hogan's retirement from the Board on May 29, 2003, and (iii) 18,000 Shares subject to options. |

| | | |

| (7) | Consists of (i) 10,326 Shares subject to a deferral agreement between DTG and Ms. Keller, of which 3,500 are restricted Shares that shall vest on December 31, 2003, and (ii) 10,000 Shares subject to options. |

| | | |

| (8) | Consists of (i) 16,030 Shares owned of record by Mr. Lumley, (ii) 3,500 restricted Shares that shall vest on December 31, 2003, and (iii) 18,000 Shares subject to options. |

| | | |

| (9) | Consists of (i) 6,000 Shares owned of record by Mr. Pope, (ii) 17,533 Shares subject to a deferral agreement between DTG and Mr. Pope, of which 3,500 are restricted Shares that shall vest on December 31, 2003, and (iii) 18,000 Shares subject to options. |

| | | |

| (10) | Consists of (i) 6,000 Shares owned of record by Mr. Tierney, (ii) 16,121 Shares subject to a deferral agreement between DTG and Mr. Tierney, of which 3,500 are restricted Shares that shall vest on December 31, 2003, and (iii) 18,000 Shares subject to options. |

| | | |

| (11) | Consists of (i) 3,200 Shares owned of record by Mr. Wax, (ii) 15,771 Shares subject to a deferral agreement between DTG and Mr. Wax, of which 3,500 are restricted Shares that shall vest on December 31, 2003, and (iii) 18,000 Shares subject to options. |

| | | |

| (12) | Consists of (i) 1,000 Shares owned of record by Mr. Guptill, (ii) 8,952 Shares held in the Deferred Compensation Plan, (iii) 3,666 Shares that shall vest in two equal annual installments on January 31, 2004 and January 31, 2005, (iv) 225 Shares held in DTG's 401(k) Plan, and (v) 91,734 Shares subject to options. |

| | | |

| (13) | Consists of (i) 3,000 Shares owned of record by Mr. Hildebrand, (ii) 18,105 Shares held in the Deferred Compensation Plan, (iii) 6,866 Shares that shall vest in two equal annual installments on January 31, 2004 and January 31, 2005, and (iv) 122,800 Shares subject to options. |

| | | |

| (14) | Consists of (i) 24,012 Shares held in the Deferred Compensation Plan, (ii) 7,933 Shares that shall vest in two equal annual installments on January 31, 2004 and January 31, 2005, (iii) 143,800 Shares subject to options, and (iv) 3,500 Shares owned of record by the trust of Mr. Himelfarb's spouse. |

| | | |

| (15) | Consists of (i) 9,000 Shares owned of record by Mr. Paxton's trust, (ii) 26,662 Shares held in the Deferred Compensation Plan, (iii) 9,466 Shares that shall vest in two equal annual installments on January 31, 2004 and January 31, 2005, and (iv) 160,000 Shares subject to options. |

10

Equity Compensation Plan Information

The following table sets forth certain information for the fiscal year ended December 31, 2002 with respect to compensation plans under which Common Stock of DTG is authorized for issuance:

| | | | | | | | | | | | | | |

| | | | | | | | | | Number of securities |

| | | | | | | | | | remaining available for |

| | | | | | | | | | future issuance under |

| | | | Number of Securities to | | | Weighted-average | | | equity compensation |

| | | | be issued upon exercise | | | exercise price of | | | plans (excluding |

| | | | of outstanding options, | | | outstanding options, | | | securities reflected in |

| Plan Category | | | warrants and rights (a) | | | warrants and rights (b) | | | column (a)) (c) |

| | | | | | | | | | |

| Equity compensation plans | | | 3,025,427 | | | $17.20 | | | 1,177,381 |

| approved by security holders | | | | | | | | | |

| | | | | | | | | | |

| Equity compensation plans | | | None | | | None | | | None |

| not approved by security | | | | | | | | | |

| holders | | | | | | | | | |

| | | | | | | | | | |

| Total | | | 3,025,427 | | | $17.20 | | | 1,177,381 |

11

MEETINGS, COMMITTEES AND COMPENSATION OF THE BOARD OF DIRECTORS

Meetings and Committees

The Board has established certain standing committees, which are comprised solely of non-employee directors, to consider designated matters. These committees of the Board are: the Governance Committee, the Audit Committee, the Human Resources and Compensation Committee and the Finance Committee (formerly known as the Strategic Planning Committee). The Board annually selects from its members the members and chairman of each committee. The table below sets forth the number of Board and committee meetings (including teleconference meetings) held in 2002, the members of each committee and the chairman of each committee:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Human Resources | | |

Board Member | | Board | | Governance | | Audit | | and Compensation | | Finance |

| | | | | | | | | | | | | | | | | | | | | |

| Molly Shi Boren | | | X | | | | X | | | | | | | | X | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Thomas P. Capo | | | X | | | | | | | | X | | | | | | | | X | |

| | | | | | | | | | | | | | | | | | | | | |

| Joseph E. Cappy | | | X | (1) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Edward J. Hogan | | | X | | | | X | (1) | | | X | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Maryann N. Keller | | | X | | | | | | | | X | | | | | | | | X | |

| | | | | | | | | | | | | | | | | | | | | |

The Hon. Edward C.

Lumley | | | X | | | | | | | | | | | | X | (1) | | | X | |

| | | | | | | | | | | | | | | | | | | | | |

| John C. Pope | | | X | | | | | | | | | | | | X | | | | X | (1) |

| | | | | | | | | | | | | | | | | | | | | |

| John P. Tierney | | | X | | | | X | | | | X | (1) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Edward L. Wax | | | X | | | | X | | | | | | | | X | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Meetings Held in 2002 | | | 8 | | | | 4 | | | | 9 | | | | 7 | | | | 2 | |

| | | |

| (1) | Designates the chairman. |

During the 2002 year, each director attended 75% or more of the total of all meetings held by the Board and the committees on which he or she served, and the average attendance level for all Board and committee meetings was approximately 96%.

Governance Committee

The Governance Committee evaluates the organization, function and performance of the Board and its committees, the qualifications for director nominees and matters involving corporate governance. Director nominations by stockholders may be submitted at the times and in the same manner as stockholder proposals. See “Stockholder Proposals for Next Annual Meeting”.

12

Audit Committee

The Audit Committee appoints the independent auditors, reviews and approves their fees for audit and non-audit services, and reviews the scope and results of audits performed by them and by the Company’s internal auditors. It also reviews corporate compliance matters and evaluates and reviews the Company’s system of internal accounting controls, its significant accounting policies and its financial statements and related disclosures. See “Report of Audit Committee”.

Human Resources and Compensation Committee

The Human Resources and Compensation Committee makes recommendations to the Board regarding DTG’s executive compensation program, as well as generally reviewing the human resources area for the Company, including its management development and succession. As a part of its compensation function, it approves salaries, executive retirement benefits, incentive compensation awards and equity incentive grants for officers and senior executives, as well as corporate goals under performance based compensation plans. See “Executive Compensation - Report of Human Resources and Compensation Committee on Executive Compensation”.

Finance Committee

The Finance Committee is charged with the responsibility of reviewing DTG’s financial position and capital structure. An additional responsibility is to initially review for the Board the financial implications of extraordinary, complex or other material business transactions and to act as an advisory committee to management on such transactions.

Report of Audit Committee

Independence and Charter

The Audit Committee of the Board is currently comprised of four independent directors and operates under a written charter adopted by the Board. Each of the members is currently independent as defined by DTG policy, the Sarbanes-Oxley Act of 2002 and New York Stock Exchange rules regarding director independence on audit committees.

Meetings With Management, Internal Auditors and Independent Auditors

The Audit Committee reviewed and discussed the audited financial statements and effectiveness of internal controls with management, internal auditors and the independent auditors of DTG, Deloitte & Touche LLP. Based on these discussions and its other work, the Audit Committee recommended that the Board include the audited consolidated financial statements in DTG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

The Audit Committee also has met and held discussions with management, internal auditors and the independent auditors regarding various topics in addition to matters related to financial statements.

The discussions with Deloitte & Touche LLP also included the matters required by Statement on Auditing Standards (“SAS”) No. 61 (Codification of Statements on Auditing Standards, Communication with Audit Committees), as amended by SAS No. 89 (Audit Adjustments) and SAS No. 90 (Audit Committee Communications).

In addition, Deloitte & Touche LLP also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with the Audit Committee such firm’s independence.

13

Responsibility

The Audit Committee is not responsible for either the preparation of the financial statements or the auditing of the financial statements. Management has the responsibility for preparing the financial statements and implementing, maintaining and evaluating the effectiveness of internal controls and the independent auditors have the responsibility for auditing financial statements and evaluating the effectiveness of the internal controls. The Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the independent auditors included in their report on DTG’s financial statements.

| | | | |

| | | | |

| | | | John P. Tierney, Chairman |

| | | | Thomas P. Capo |

| | | | Edward J. Hogan |

| | | | Maryann N. Keller |

March 27, 2003

Compensation

Fees

In 2002, as a part of Company-wide cost savings initiatives, the non-employee directors agreed to a twelve percent (12%) reduction in fees. Such directors were paid an annual board retainer of $22,000, payable in quarterly amounts of $5,500 in Common Stock. They were also paid an attendance fee of $880 for each meeting of the Board of Directors and $880 for each meeting of a committee thereof (excluding members of the Finance Committee, and for the fourth quarter, members of the Audit Committee), in each case payable in cash or Common Stock, as desired by the director. Members of the Finance Committee were paid an annual attendance fee of $4,400, payable in quarterly amounts of $1,100 in cash or Common Stock, as desired by the director. For the fourth quarter of 2002, members of the Audit Committee were paid a fee of $4,500 for the quarter, payable in cash or Common Stock, as desired by the director. In addition to the meeting fees described above, committee chairmen were also paid an annual retainer of $4,400, payable in quarterly amounts of $1,100 in Common Stock. For the fourth quarter of 2002, the Audit Committee chairman was paid a fee of $2,500 for the quarter, payable in Common Stock. Such directors could elect in advance to defer their fees. As per agreement since DTG reached certain earnings targets, in December 2002, the twelve percent (12%) reduction in fees taken during the 2002 year was restored two to one for each director.

Stock Options

In May 2002, non-employee directors were granted NQSOs (hereinafter defined) to purchase 5,000 Shares at the exercise price of $23.20 per Share. Such NQSOs become exercisable on May 31, 2003 and expire on May 22, 2012. Under certain circumstances, including a change in control of DTG, the NQSOs would be exercisable immediately.

Other

In 2002, DTG made available to each non-employee director the personal use of two vehicles while serving as a director, together with insurance coverage. Rental cars are also furnished for short-term use for product and service evaluation purposes. In the event of a change in control of DTG, ownership of the vehicles will be transferred to the director and the use of rental cars for product and service evaluation will continue.

14

No Compensation or Benefits

DTG does not pay compensation or provide benefits for service to any director solely in such capacity who is also an officer or employee of the Company.

Stock Ownership Guidelines

In 2002, all current non-employee directors of DTG were required to own Shares or options valued at not less than five times the annual retainer of $25,000, for a total of $125,000. The requirements were to be phased in over five years of service on the Board of Directors. Effective January 2003, all current non-employee directors of DTG are required to own Shares valued at not less than five times their approximate average annual compensation of $100,000, calculated under an assumed appreciation formula to result in 18,051 Shares.

EXECUTIVE COMPENSATION

Report of Human Resources and Compensation Committee on Executive Compensation

This report explains DTG’s executive compensation program for 2002. The Human Resources and Compensation Committee, which is comprised solely of non-employee directors, determines the compensation of senior executives of the Company.

Compensation Philosophy

DTG’s executive compensation program is a critical part of the effective management of its key executives. The program provides incentives and rewards senior management for building long-term stockholder value. It is designed to: (i) establish a comparative framework of companies for pay/performance analysis, (ii) maintain a strong relationship between performance and awards, (iii) communicate a link between pay and performance, (iv) encourage stock ownership and focus on the use of equity-based incentives, and (v) balance all compensation components to create a total pay program based on specific performance goals.

Stock Ownership Guidelines

DTG maintains stock ownership guidelines to more closely align the interests of executives with those of stockholders ranging from one half of annual base salary to three times annual base salary for executives currently employed by the Company.

Components of Executive Compensation Program

DTG’s executive compensation program has four components: base salary, incentive compensation cash bonuses, long-term Share incentive compensation and supplemental retirement benefits. The following is a summary of the considerations underlying each component.

Base Salary

The Human Resources and Compensation Committee establishes base salaries for executive officers in relation to base salaries paid by a group of companies which was compared to the Company because they were similarly sized service companies in terms of corporate revenues, or had operations in the local geographic job market, or were vehicle rental industry peers. Base salaries may vary depending on factors such as responsibility, current performance and tenure.

15

Incentive Compensation Cash Bonuses

DTG’s annual incentive compensation plan is a cash bonus plan designed to provide performance based compensation awards to executives for achievement of corporate objectives during the past year. In 2002, pretax profit objectives were established for the Company. These objectives range from a minimum threshold to earn a partial award to a maximum award. Annual awards to executives for the 2002 year were based upon the Company’s consolidated performance.

Long-Term Incentive Compensation

DTG has adopted a long-term incentive plan (the “LTIP”). The LTIP is intended to provide equity-based incentives to officers and key employees of the Company that serve to align their interests with those of stockholders. The LTIP permits the granting of any or all of the following type of awards: (i) stock options, including incentive stock options and non-qualified stock options (“NQSOs”), (ii) stock appreciation rights, (iii) restricted stock awards, (iv) performance awards, including performance shares (“Performance Shares”), and (v) other forms of stock-based incentive awards.

In January 2002, 60,000 target Performance Shares were approved for granting to officers and certain key employees of the Company. Such awards established a target number of Shares that could be earned based upon the 2002 performance year, vesting in three equal annual installments. The number of Performance Shares ultimately earned by a grantee would be expected to range from zero to 200% of the grantee’s target award, depending on the level of corporate performance for the 2002 year against established profit targets. The maximum 200% target award was realized and the first installment of Performance Shares vested was delivered to grantees on February 14, 2003. Grantees not employed by the Company on that date forfeited their Performance Shares.

Compensation consultants were retained to analyze incentive practices of publicly traded car rental companies, other travel and leisure companies and other corporations. Their recommendations were considered in setting the design and size of the Performance Share grants.

Supplemental Retirement Benefits

In December 1994, Pentastar Transportation Services, Inc., predecessor to DTG, adopted a deferred compensation plan (the “Deferred Compensation Plan”) to provide a means by which certain executives of the Company may elect to defer receipt of specified percentages or amounts of their compensation, to also permit certain other deferrals of compensation, and to encourage such employees to remain employed by the Company. The Company may make contributions to the Deferred Compensation Plan in addition to elective deferrals of compensation by executives.

DTG adopted a retirement plan in December 1998 (the “Retirement Plan”) to provide a means by which the Company can provide retirement income to key executives to encourage them to remain employed by the Company. The Companymakes contributions to the Retirement Plan. DTG has established a combined non-qualified trust to provide a source of payment for benefits under the Deferred Compensation Plan and the Retirement Plan.

Effective June 1, 2002, DTG adopted an executive option plan (the “KEYSOP”). The KEYSOP is a nonqualified shares option plan covered by the Employee Retirement Income Security Act of 1974, as amended, and provides a means by which certain executives of the Company may elect to defer receipt of specified percentages or amounts of their compensation in exchange for mutual fund options in the KEYSOP. DTG has established a trust to hold the Shares that are subject to purchase through the exercise of options. The Company may make contributions to the KEYSOP in addition to elective deferrals of compensation by executives.

Compensation for the Chief Executive Officer

In 2002, despite the effects of the slowing U.S. economy and continuing declines in airline traffic, the Company had a substantial improvement in net income from $13.8 million in 2001 to $46.8 million in 2002. During the 2002 year, Mr. Cappy also led the realignment of the Company’s operations that helped provide a platform for execution of the Company’s growth strategy.

16

In establishing each of the components of Mr. Cappy’s compensation, the Human Resources and Compensation Committee relied on information developed from compensation surveys with the assistance of a compensation consulting firm, and comparative industry data.

Compensation Committee Interlocks and Insider Participation

The Hon. Edward C. Lumley, Human Resources and Compensation Committee Chairman and a director of DTG, is the Vice Chairman of BMO Nesbitt Burns. In February 1999, BMO Nesbitt Burns assisted in a fleet securitization for Thrifty Rent-A-Car System, Inc.’s Canadian vehicles. Although only a one-time structuring fee was paid to BMO Nesbitt Burns at closing, additional program fees will be paid to BMO Nesbitt Burns to cover placement, liquidity and administration fees during the five year term of the arrangement.

| | | | THE HUMAN RESOURCES AND

COMPENSATION COMMITTEE |

| | | | |

| | | | The Hon. Edward C. Lumley, Chairman |

| | | | Molly Shi Boren |

| | | | John C. Pope |

| | | | Edward L. Wax |

March 27, 2003

17

Summary Compensation Table

The following table provides certain summary information concerning compensation of DTG’s Chief Executive Officer and each of the named executive officers of DTG for the three fiscal years ended December 31, 2002, 2001 and 2000:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Annual Compensation | | Long-Term Compensation | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Awards | | Payouts | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Restricted | | Securities | | | | All Other |

Name and Principal | | | | | | Stock Awards | | Underlying | | LTIP | | Compensation |

Position | | | Year | | | Salary ($) | | Bonus ($) | | ($) (1) | | Options (#) | | Payouts ($)(2) | | ($) (3) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Joseph E. Cappy, | | | | 2002 | | | | 580,000 | | | | 841,000 | | | | 416,598 | | | | -0- | | | | -0- | | | | 96,141 | |

| Chairman of the Board | | | | 2001 | | | | 580,000 | | | | -0- | | | | -0- | | | | 75,000 | | | | 993,468 | | | | 140,588 | |

| and Chief Executive | | | | 2000 | | | | 550,000 | | | | 757,350 | | | | -0- | | | | 75,000 | | | | -0- | | | | 152,419 | |

| Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gary L. Paxton, | | | | 2002 | | | | 353,541 | | | | 390,662 | | | | 216,692 | | | | -0- | | | | -0- | | | | 249,791 | |

| President and Chief | | | | 2001 | | | | 353,541 | | | | -0- | | | | -0- | | | | 39,300 | | | | 454,013 | | | | 101,816 | |

| Operating Officer | | | | 2000 | | | | 315,662 | | | | 326,000 | | | | -0- | | | | 39,300 | | | | -0- | | | | 423,527 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Donald M. Himelfarb, | | | | 2002 | | | | 314,604 | | | | 347,637 | | | | 181,594 | | | | -0- | | | | -0- | | | | 215,905 | |

| President and Chief | | | | 2001 | | | | 314,604 | | | | -0- | | | | -0- | | | | 32,700 | | | | 399,995 | | | | 94,983 | |

| Operating Officer | | | | 2000 | | | | 280,896 | | | | 290,095 | | | | -0- | | | | 32,700 | | | | -0- | | | | 300,730 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steven B. Hildebrand, | | | | 2002 | | | | 265,356 | | | | 293,219 | | | | 157,178 | | | | -0- | | | | -0- | | | | 131,474 | |

| Executive Vice | | | | 2001 | | | | 265,356 | | | | -0- | | | | -0- | | | | 28,200 | | | | 300,689 | | | | 89,249 | |

| President and Chief | | | | 2000 | | | | 252,720 | | | | 260,997 | | | | -0- | | | | 28,200 | | | | -0- | | | | 210,249 | |

| Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Peter G. Guptill, | | | | 2002 | | | | 240,500 | | | | 216,450 | | | | 83,930 | | | | -0- | | | | -0- | | | | 155,819 | |

| Executive Vice | | | | 2001 | | | | 240,500 | | | | -0- | | | | -0- | | | | 25,400 | | | | 147,376 | | | | 74,824 | |

| President | | | | 2000 | | | | 227,500 | | | | 191,919 | | | | -0- | | | | 26,000 | | | | -0- | | | | 246,922 | |

| | | |

| (1) | The value of the Performance Shares shown in the table is based on the closing stock price of $15.26 on January 23, 2002, the date the target Performance Shares were granted. An aggregate total of 69,200 Performance Shares were actually awarded to DTG's Chief Executive Officer and the named executive officers of DTG on February 14, 2003, and the total value of such Performance Shares as of December 31, 2002 for such five officers was $1,463,580 based on the closing stock price of $21.15. One-third of these Performance Shares vested on February 14, 2003, and the remaining Performance Shares will vest in two equal annual installments on January 31, 2004 and January 31, 2005. In the event DTG decides to pay dividends, they will be paid on Performance Shares that have vested. |

| | | |

| (2) | Represents Performance Shares earned with respect to the years 1998, 1999 and 2000, and fully vested in 2001. |

| | | |

| (3) | Represents amounts for 2002 which consist of: (i) the Company's contributions to its qualified and non-qualified defined contribution plans, including supplemental retirement plans, totaling $612,184, (ii) life and disability insurance premiums totaling $17,850, (iii) imputed income related to the use of company vehicles totaling $134,120, (iv) payment of club dues totaling $47,648, and (v) financial advisory fees of $37,328. |

18

Certain Continuing Arrangements

In September 1998, DTG entered into an Employment Continuation Agreement with Mr. Cappy. The agreement provides for benefits to be paid to Mr. Cappy upon termination of his employment following a change in control of DTG subject to certain requirements contained in the agreement. The agreement was filed as Exhibit 10.3 to DTG’s Quarterly Report on Form 10-Q for the period ended September 30, 1998. Amendments to the agreement were filed as Exhibits 10.23 and 10.25 to DTG’s Quarterly Report on Form 10-Q for the period ended June 30, 2001, and as Exhibit 10.27 to DTG’s Annual Report on Form 10-K for the 2001 fiscal year.

In September 1998, DTG also established the Employment Continuation Plan for Key Employees. The plan provides for benefits to be paid to certain employees upon termination of their employment following a change in control of DTG subject to certain requirements contained in the plan. The plan currently covers 43 employees of the Company. The plan was filed as Exhibit 10.4 to DTG’s Quarterly Report on Form 10-Q for the period ended September 30, 1998. Amendments to the plan were filed as Exhibit 10.21 to DTG’s Quarterly Report on Form 10-Q for the period ended March 31, 2001, Exhibits 10.24 and 10.26 to DTG’s Quarterly Report on Form 10-Q for the period ended June 30, 2001, and Exhibit 10.28 to DTG’s Annual Report on Form 10-K for the 2001 fiscal year.

Following a change in control of DTG, certain senior executive officers of DTG (currently four individuals) will receive the same leased vehicle and rental car benefits as the non-employee directors. See “Meetings, Committees and Compensation of the Board of Directors - Compensation - Other”.

INDEPENDENT AUDITORS

Selection of Independent Auditors

The Audit Committee has selected the firm of Deloitte & Touche LLP, independent public accountants, as the independent auditors of DTG for the fiscal year ended December 31, 2003. In making the determination to reappoint Deloitte & Touche LLP as DTG’s independent auditors, the Audit Committee considered whether the providing of services (and the aggregate billed for those services) by Deloitte & Touche LLP, other than audit services, is compatible with maintaining the independence of the outside auditors. Deloitte & Touche LLP has served DTG as independent auditors since DTG’s inception in November 1997.

A representative of Deloitte & Touche LLP will be present at the Annual Meeting of Stockholders and will be available to respond to appropriate questions. Although the audit firm has indicated that no statement will be made, an opportunity for a statement will be provided.

19

Audit and Non-Audit Fees

The following table provides the various fees and out-of-pocket costs billed by Deloitte & Touche LLP in the aggregate for fiscal years ended December 31, 2002 and 2001:

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | 2002 | | | 2001 (1) | |

| | | | | | | | |

Audit Fees | | | | | | | | |

| | | | | | | | |

| Fees related to audits of the consolidated and subsidiaries' annual | | | | | | | | |

| financial statements, reviews of the consolidated quarterly financial | | | | | | | | |

| statements, statutory airport concession fee audits, comfort | | | | | | | | |

| procedures and audit of the employee benefit plan | | $ | 1,076,313 | | | $ | 1,067,863 | |

| | | | | | | | |

Audit-Related Fees | | | | | | | | |

| | | | | | | | |

| Fees primarily related to agreed-upon debt compliance procedures, | | | | | | | | |

| accounting consultations and information security reviews | | $ | 172,001 | | | $ | 430,228 | |

| | | | | | | | |

Tax Fees | | | | | | | | |

| | | | | | | | |

| Fees related to tax preparation and tax consulting, including | | | | | | | | |

| consultation regarding employee benefit plans | | $ | 127,320 | | | $ | 78,437 | |

| | | | | | | | |

All Other Fees | | | | | | | | |

| | | | | | | | |

| Fees primarily related to actuarial services in 2002 | | $ | 98,804 | | | $ | 21,914 | |

| | | |

| (1) | Certain reclassifications have been made to the 2001 fees and out-of-pocket costs to conform to the classifications used in 2002. |

The Audit Committee of the Board has the sole authority to retain and terminate DTG’s independent auditors and to pre-approve any significant non-audit services performed by such independent auditors. The Audit Committee reviewed and pre-approved all fees paid to Deloitte & Touche LLP for audit and non-audit services in 2002, and in 2001, reviewed and approved any amounts incurred outside the annual fee proposal in excess of $25,000 per engagement. The Audit Committee approved 100% and 94% in 2002 and 2001, respectively, of the services included in “Audit-Related Fees”, 100% in each of 2002 and 2001 of the services included in “Tax Fees”, and 100% in each of 2002 and 2001 of the services included in “All Other Fees” set forth above.

20

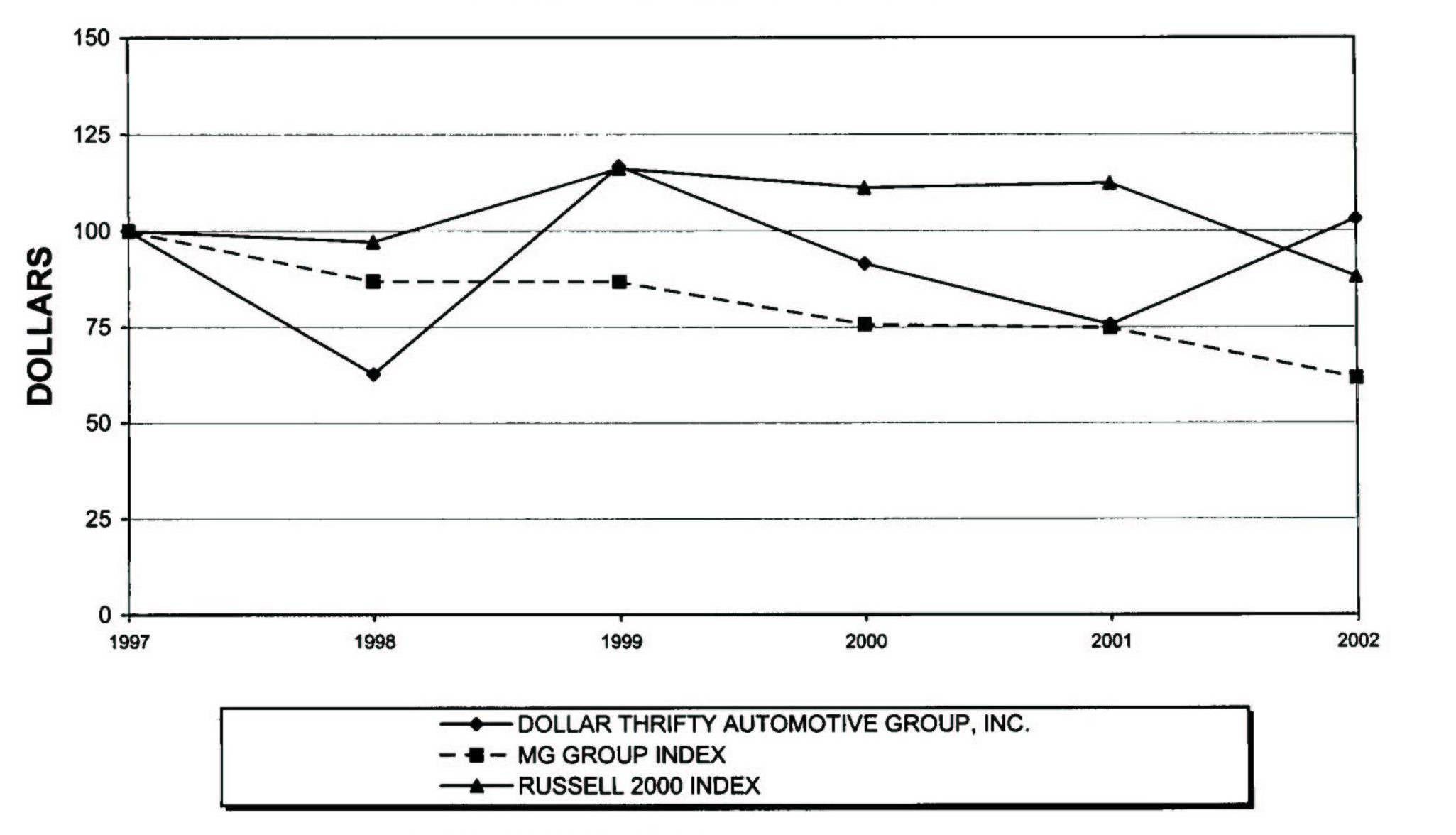

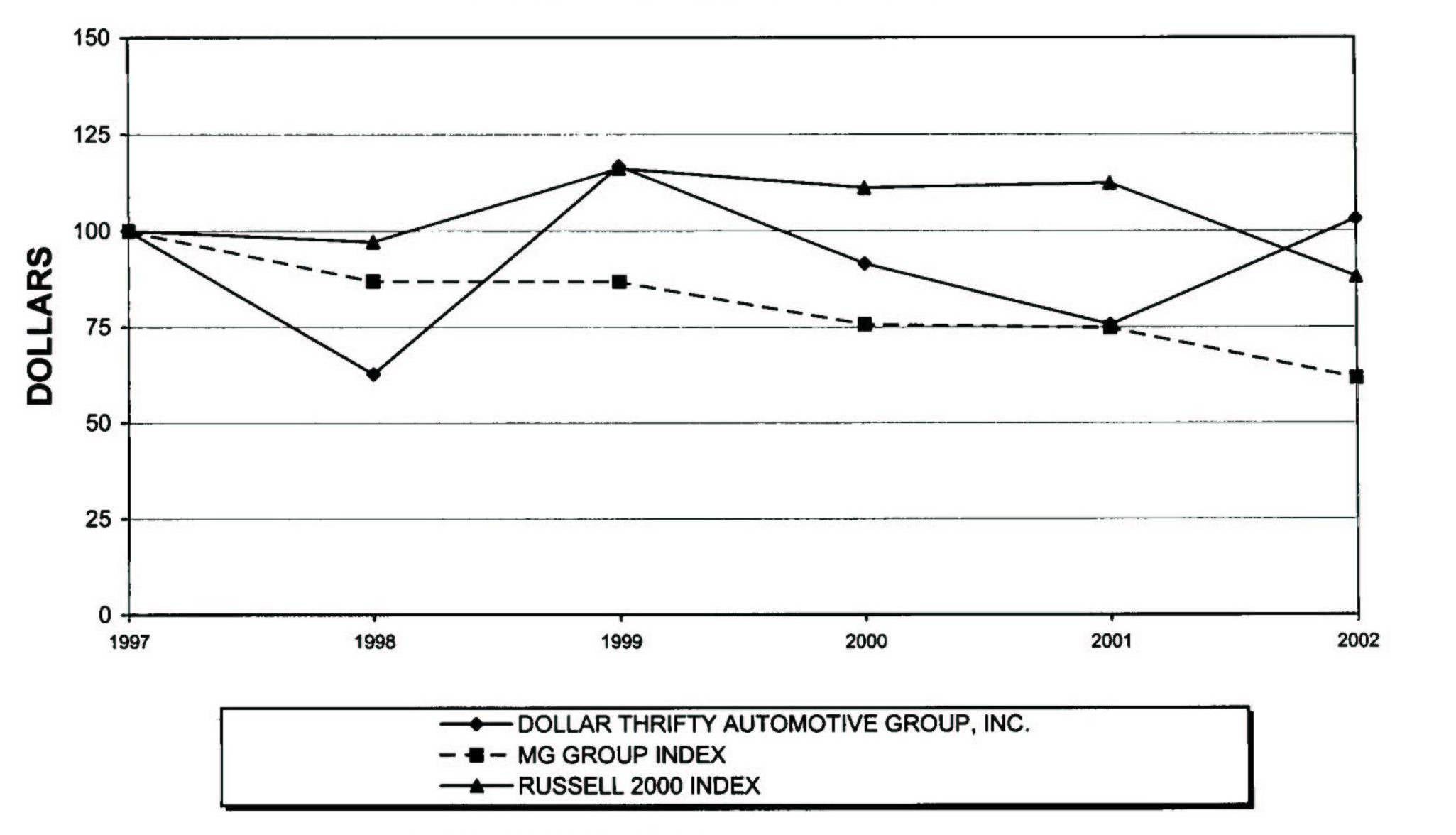

STOCKHOLDER RETURN PERFORMANCE PRESENTATION

The following graph compares the cumulative total stockholder return on DTG Common Stock with the Russell 2000 Stock Market Index and the Media General Rental and Leasing Services Group Index. The Media General Rental and Leasing Services Group Index is a published index of 26 stocks including DTG, which covers companies that rent or lease various durable goods to the commercial and consumer market including cars and trucks, medical and industrial equipment, appliances, tools and other miscellaneous goods.

The results are based on an assumed $100 invested on December 31, 1997, and reinvestment of dividends through December 31, 2002.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

Dollar Thrifty Automotive Group, Inc., Russell 2000 Stock Market Index, and Media General Rental and

Leasing Services Group Index

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company/Index/Market | | | | | | 12/31/97 | | 12/31/98 | | 12/29/99 | | 12/31/00 | | 12/31/01 | | 12/31/02 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollar Thrifty Automotive | | | | | | | | 100.00 | | | | 62.80 | | | | 116.77 | | | | 91.46 | | | | 75.61 | | | | 103.17 | |

| Group, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000 Stock Market | | | | | | | | 100.00 | | | | 97.20 | | | | 116.24 | | | | 111.22 | | | | 112.36 | | | | 88.11 | |

| Index | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Media General Rental and | | | | | | | | 100.00 | | | | 86.81 | | | | 86.76 | | | | 75.66 | | | | 74.71 | | | | 61.69 | |

| Leasing Services Group Index | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Hon. Edward C. Lumley, Human Resources and Compensation Committee Chairman and a director of DTG, is the Vice Chairman of BMO Nesbitt Burns. In February 1999, BMO Nesbitt Burns assisted in a fleet securitization for Thrifty Rent-A-Car System, Inc.’s Canadian vehicles. Although only a one-time structuring fee was paid to BMO Nesbitt Burns at closing, additional program fees will be paid to BMO Nesbitt Burns to cover placement, liquidity and administration fees during the five-year term of the arrangement.

21

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and persons who own more than 10% of the Common Stock to file with the SEC initial reports of ownership and statements of changes in ownership of Common Stock, as well as annual statements of ownership. Based solely upon a review of forms furnished to DTG, during the fiscal year ended December 31, 2002, DTG believes that all SEC filing requirements applicable to the Company’s directors, executive officers and persons owning more than 10% of the Common Stock were met.

REPORT ON FORM 10-K

A copy of DTG’s Report on Form 10-K for the period ended December 31, 2002, filed with the SEC (including related financial statements and schedules) is available to stockholders without charge, upon written request to the Executive Director of Investor Relations, Dollar Thrifty Automotive Group, Inc., 5330 East 31st Street, Tulsa, Oklahoma 74135.

STOCKHOLDER PROPOSALS FOR NEXT ANNUAL MEETING

The deadline for submitting proposals for the possible inclusion in next year’s proxy statement is not less than 90 nor more than 120 days before the Annual Meeting of Stockholders to be held in 2004, and a proposal received outside of this time frame will be untimely and not considered for the Annual Meeting of Stockholders to be held in 2004; provided, however, that in the event that less than 100 days notice or prior public disclosure of the date of the Annual Meeting of Stockholders is given or made to stockholders, then such proposals will be considered if received not later than the tenth day following the day on which the meeting date is disclosed. Proposals, including any accompanying supporting statement, may not exceed 500 words and should be addressed to: Secretary, Dollar Thrifty Automotive Group, Inc., 5330 East 31st Street, Tulsa, Oklahoma 74135.

OTHER MATTERS

As of the date of this Proxy Statement, the Board does not intend to present any matter for action at the Annual Meeting of Stockholders other than those set forth in the Notice of Annual Meeting. If any other matters properly come before the meeting, the holders of the proxies will act in accordance with their best judgment.

| | | | By Order of the Board of Directors |

| | | | /S/ STEPHEN W. RAY |

| | | | |

| | | | Stephen W. Ray |

| | | | Secretary |

Tulsa, Oklahoma

April 16, 2003

22

APPENDIX A

(FRONT SIDE OF PROXY)

PROXY -- DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

Annual Meeting of Stockholders

May 29, 2003

The undersigned stockholder of Dollar Thrifty Automotive Group, Inc., a Delaware corporation, hereby appoints Pamela S. Peck or Michael H. McMahon, or either of them voting singly in the absence of the other, attorneys and proxies with full power of substitution and revocation, to vote all shares of Common Stock of Dollar Thrifty Automotive Group, Inc. which the undersigned is entitled to vote at the Annual Meeting of Stockholders of said corporation to be held at the Williams Presentation Center Theatre, 2 East First Street, Tulsa, Oklahoma 74172, on May 29, 2003, at 11:00 a.m., C.D.T., or any adjournment thereof, in accordance with the following instructions.

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. This proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. If no direction is made, the proxy will be voted “FOR” all nominees in the Proposal.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION OF THE NOMINEES.

YOUR VOTE IS IMPORTANT. PLEASE VOTE BY MARKING, SIGNING AND DATING THIS PROXY ON THE REVERSE SIDE AND RETURNING IT PROMPTLY IN THE ACCOMPANYING ENVELOPE.

(Continued and to be signed on reverse side)

(REVERSE SIDE OF PROXY)

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.

ANNUAL MEETING PROXY CARD

Election of Directors

| | | | | | | | | | | | | | |

| | The Board of Directors recommends a vote FOR the listed nominees. |

| | | | | | | | | | | |

| | | | | | | For | | Withhold | | | | | |

| | | | | | | | | | | |

| | 01 - Molly Shi Boren | | | | | | | |

| | | | | | | | | | | |

| | 02 - Thomas P. Capo | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | 03 - Joseph E. Cappy | | | | | | | |

| | | | | | | | | | | |

| | 04 - Maryann N. Keller | | | | | | | |

| | | | | | | | | | | |

| | 05 - The Hon. Edward C.

Lumley | | | | | | | |

| | | | | | | | | | | |

| | 06 - John C. Pope | | | | | | | |

| | | | | | | | | | | |

| | 07 - John P. Tierney | | | | | | | |

| | | | | | | | | | | |

| | 08 - Edward L. Wax | | | | | | | |

| | | | | | | | | | | |

AUTHORIZED SIGNATURES -- SIGN HERE -- THIS SECTION MUST BE COMPLETED FOR YOUR INSTRUCTIONS TO BE EXECUTED.

The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders and of the Proxy Statement.

Please sign exactly as your name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a business entity, please sign in full business entity name by an authorized representative.

| | | | | |

| Signature 1 | | Signature 2 | | Date (mm/dd/yyyy) |

| | | | | |

| | | | | |