It is not possible to determine the amount of Option Rights that may be granted in the future under the Plan because the grant of Option Rights is discretionary.

Under the Plan, the Board may authorize the granting to Eligible Participants of Tandem Appreciation Rights in respect of Option Rights and Free-Standing Appreciation Rights. A Tandem Appreciation Right is a right, exercisable by surrender of the related Option Right, to receive from DTG an amount determined by the Board which will be expressed as a percentage of the spread (not to exceed 100%) at the time of exercise. Tandem Appreciation Rights may be granted at any time prior to the exercise or termination of the related Option Rights. A Free-Standing Appreciation Right will be a right of the Eligible Participant to receive from DTG an amount determined by the Board, which will be expressed as a percentage of the spread (not to exceed 100%) at the time of exercise. Any grant may specify that the amount payable on exercise of an Appreciation Right may be paid by DTG in cash, in Common Stock, or in any combination thereof, and may either grant to the Eligible Participant or retain in the Board the right to elect among those alternatives. Any grant of Appreciation Rights may specify management objectives that must be achieved as a condition to the exercise of such rights, in which case such Appreciation Rights will specify that, before the Appreciation Rights will become exercisable, the Board must certify that the management objectives have been satisfied.

It is not possible to determine the amount of Appreciation Rights that may be granted in the future under the Plan because the grant of Appreciation Rights is discretionary.

Under the Plan, the Board may authorize the grant or sale of Restricted Stock to Eligible Participants. A grant or sale of Restricted Stock involves the immediate transfer by DTG to an Eligible Participant of ownership of a specific number of Shares in consideration of the performance of services. The Eligible Participant is entitled immediately to voting, dividend and other ownership rights in such Shares. Restricted Stock is subject to a “substantial risk of forfeiture” within the meaning of Section 83 of the Code for a period of not less than three (3) years (which may include pro-rata or graded vesting over such period) to be determined by the Board at the date of grant and may provide for the earlier lapse of such substantial risk of forfeiture in the event of a Change in Control of DTG. Any grant of Restricted Stock may specify management objectives which, if achieved, will result in termination or early termination of the restrictions applicable to such Restricted Stock. Such grant or sale will specify that, before the Restricted Stock will be earned and paid, the Board must certify that the management objectives have been satisfied.

It is not possible to determine the amount of Restricted Stock that may be granted in the future under the Plan because the grant of Restricted Stock is discretionary.

Under the Plan, the Board may authorize the granting or sale of Restricted Stock Units to Eligible Participants. A grant or sale of Restricted Stock Units constitutes an agreement by DTG to deliver Common Stock to the Eligible Participant in the future in consideration of the performance of services, but subject to the fulfillment of such conditions during a restriction period as the Board may specify. During the restriction period, the Eligible Participant has no right to transfer any rights under his or her award and no right to vote such Restricted Stock Units, but the Board may, at the date of grant, authorize the payment of dividend equivalents on such Restricted Stock Units on either a current or deferred or contingent basis, either in cash or in additional Common Stock. A grant or sale of Restricted Stock Units made to an Eligible Participant who is (a) an officer or other key employee will be subject to a restriction period of not less than three (3) years (which may include pro-rata or graded vesting over such period), or (b) a non-employee director or not an officer or other key employee will be subject to a restriction period of at least six (6) months, as determined by the Board at the date of grant, except that the Board may provide for a shorter restriction period in the event of a Change in Control of DTG.

In February 2003, 25,929 Restricted Stock Units were granted under the Original Plan to non-employee directors which generally vested on December 31, 2003. In March 2004, 24,500 Restricted Stock Units were

granted under the Original Plan to non-employee directors which vested on December 31, 2004. In May 2005, 24,500 Restricted Stock Units were granted under the Plan to non-employee directors which vested on December 31, 2005. In February 2006, 27,511 Restricted Stock Units were granted under the Plan to non-employee directors which vested on December 31, 2006. In February 2007, 21,610 Restricted Stock Units were granted under the Plan to non-employee directors which vested on December 31, 2007 (except for 1,100 of such Restricted Stock Units which vested on May 17, 2007). In March 2008, 22,301 Restricted Stock Units were granted under the Plan to non-employee directors which will vest on December 31, 2008 (except for 1,301 of such Restricted Stock Units which will vest on May 15, 2008). Based on elections made by the non-employee directors, of such 22,301 Restricted Stock Units, only 7,000 will settle in Shares of Common Stock and the remainder will settle in cash.

It is not possible to determine the amount of Restricted Stock Units that may be granted in the future under the Plan because the grant of Restricted Stock Units is discretionary.

Performance Shares and Performance Units

Under the Plan, the Board may authorize the granting of Performance Shares and Performance Units that will become payable to an Eligible Participant upon achievement of specified management objectives to meet within a specified period (the “Performance Period”). Further, on or before the date of grant, in connection with the establishment of management objectives, the Board may exclude the impact on performance of charges for restructurings, discontinued operations, extraordinary items, and other unusual or non-recurring items and the cumulative effects of changes in tax law or accounting principles, as such are defined by generally accepted accounting principles or the SEC. The Performance Period will be a period of time not less than six (6) months, except in the case of a Change in Control of DTG, if the Board shall so determine. A minimum level of acceptable achievement will also be established by the Board. If by the end of the Performance Period, the Eligible Participant has achieved the specified management objectives, the Eligible Participant will be deemed to have fully earned the Performance Shares or Performance Units. If the Eligible Participant has not achieved the management objectives, but has attained or exceeded the predetermined minimum level of acceptable achievement, the Eligible Participant will be deemed to have partly earned the Performance Shares or Performance Units in accordance with a predetermined formula.

The Plan requires that the Board establish “management objectives” for purposes of Performance Shares and Performance Units. When so determined by the Board, Option Rights, Appreciation Rights, Restricted Stock, other awards under the Plan or dividend credits may also specify management objectives. Management objectives may be described in terms of either Company-wide objectives or objectives that are related to the performance of the individual Eligible Participant or subsidiary, division, department, region or function within the Company. Management objectives applicable to any award to an Eligible Participant who is, or is determined by the Board likely to become, a “covered employee” within the meaning of Section 162(m) of the Code, will be limited to specified levels of or growth in one or more of the following criteria: (a) earnings before interest and taxes, (b) earnings before interest, taxes, depreciation and amortization, (c) net income, (d) revenues, (e) earnings per share, (f) pre-tax profit, (g) pre-tax profit margin, (h) cash flow, (i) return on equity, (j) return on investment, (k) return on assets, (l) stock price, (m) total shareholder return, (n) economic value added, (o) performance against business plan, (p) customer service, (q) market share, (r) profit per vehicle, (s) employee satisfaction, (t) quality, and (u) vehicle utilization. If the Board determines that a change in the business, operations, corporate structure or capital structure of DTG, or the manner in which it conducts its business, or other events or circumstances render the management objectives unsuitable, notwithstanding any loss of deduction under Section 162(m) of the Code to DTG, the Board may in its discretion modify such management objectives or the related minimum acceptable level of achievement, in whole or in part, as the Board deems appropriate and equitable. Any grant of Performance Shares or Performance Units will specify that, before the Performance Shares or Performance Units will be earned and paid, the Board must certify that the management objectives have been satisfied.

On January 31, 2001, 167,572 Performance Shares earned for 1998, 1999 and 2000 were awarded as Common Stock under the Original Plan to certain Eligible Participants that were then employed by the Company. On February 14, 2003, 120,000 Performance Shares earned for 2002 were awarded as Common Stock under the Original Plan to certain Eligible Participants that were then employed by the Company. These Performance Shares vested in one-third installments on February 14, 2003, January 31, 2004 and January 31, 2005, respectively. In June 2006, 272,610 Performance Shares earned for the 2003-2005 performance period were awarded as Common Stock

under the Original Plan to certain Eligible Participants that were then employed by the Company. In January 2007, 196,597 Performance Shares earned for the 2004-2006 performance period were awarded as Common Stock under the Original Plan to certain Eligible Participants that were then employed by the Company. In addition, in January 2007, 23,933 and 9,823 Performance Shares earned for the 2005-2007 performance period and 2006-2008 performance period, respectively, were awarded as Common Stock under the Plan to certain Eligible Participants pursuant to separation or retirement arrangements. In March 2008, 122,864 Performance Shares earned for the 2005-2007 performance period were awarded as Common Stock under the Plan to certain Eligible Participants that were then employed by the Company. In addition, in March 2008, 10,888 and 3,892 Performance Shares earned for the 2006-2008 performance period and the 2007-2009 performance period, respectively, were awarded as Common Stock under the Plan to certain Eligible Participants pursuant to separation or retirement arrangements.

In February 2006, 213,508 target Performance Shares were granted under the Plan to certain Eligible Participants. Such grants may be earned over a three year measurement period of January 1, 2006 to December 31, 2008 (the “2006-2008 Performance Period”). The number of Performance Shares ultimately earned by an Eligible Participant would be expected to range from zero to 200% of the Eligible Participant’s target award, depending on the level of the Company’s corporate performance over the 2006-2008 Performance Period against certain management objectives. The weighted management objectives to be used to determine the number of Performance Shares ultimately earned for the 2006-2008 Performance Period are (a) DTG’s total stockholder return performance against companies listed in the Russell 2000 during the 2006-2008 Performance Period, (b) increasing the Dollar “brand” and Thrifty “brand” market share (whether corporate or franchised) in the top 100 U.S. airports, and (c) achieving a target level of customer service as measured by an internal customer dissatisfaction index metric.

In February 2007, 148,360 target Performance Shares were granted under the Plan to certain Eligible Participants. Such grants may be earned over a three year measurement period of January 1, 2007 to December 31, 2009 (the “2007-2009 Performance Period”). The number of Performance Shares ultimately earned by an Eligible Participant would be expected to range from zero to 200% of the Eligible Participants target award, depending on the level of the Company’s corporate performance over the 2007-2009 Performance Period against certain management objectives. For additional information relating to these grants, see “Executive Compensation-Compensation Discussion and Analysis-Discussion of Elements of Compensation.”

In January and March 2008, 142,865 and 3,588 target Performance Units, respectively, were granted under the Plan to certain Eligible Participants. Such grants may be earned over a three year measurement period of January 1, 2008 to December 31, 2010 (the “2008-2010 Performance Period”). The number of Performance Units ultimately earned by an Eligible Participant would be expected to range from zero to 200% of the Eligible Participant’s target award, depending on the level of the Company’s corporate performance over the 2008-2010 Performance Period against certain management objectives. The management objectives to be used to determine the number of Performance Units ultimately earned for the 2008-2010 Performance Period are (a) DTG’s total stockholder return performance against companies listed in the Russell 2000 during the 2008-2010 Performance Period, and (b) maintaining customer retention as measured by an internal customer retention index. If the total stockholder return calculation results in a payout, then the award percentage for the total stockholder return award will be adjusted up or down by the award percentage for the customer retention award.

It is not possible to determine the amount of Performance Shares or Performance Units that may be granted in the future under the Plan because the grant of Performance Shares and Performance Units is discretionary.

Awards to Non-Employee Directors

Under the Plan, the Board may, in its discretion, authorize the granting or sale to non-employee directors of Option Rights, Appreciation Rights, Restricted Stock, Restricted Stock Units or other awards under the Plan. Non-employee directors are not eligible to receive Performance Shares or Performance Units under the Plan. Each grant or sale of Option Rights, Appreciation Rights, Restricted Stock, Restricted Stock Units or other awards to non-employee directors will generally be upon terms and conditions as described herein.

Other Awards

Under the Plan, the Board may, subject to limitations under applicable law, grant to any Eligible Participant

such other awards that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to, Common Stock or factors that may influence the value of such Common Stock (including, without limitation, convertible or exchangeable debt securities, other rights convertible or exchangeable into Common Stock, purchase rights for Common Stock, awards with value and payment contingent upon performance of the Company or any other factors determined by the Board, and awards valued by reference to the book value of Common Stock or the value of securities of, or the performance of specified subsidiaries of DTG or affiliates or other business units of DTG). The Board will determine the terms and conditions of these awards. Common Stock delivered pursuant to these types of awards will be purchased for such consideration, by such methods and in such forms as the Board determines. Cash awards, as an element of or supplement to any other award granted under the Plan, may also be granted. The Board may also grant Common Stock as a bonus, or may grant other awards in lieu of obligations of the Company to pay cash or deliver other property under the Plan or under other plans or compensatory arrangements, subject to such terms as are determined by the Board.

Restrictions on Awards Under Plan

Transferability

Except as otherwise determined by the Board, no Option Right, Appreciation Right or other derivative security granted under the Plan is transferable by an Eligible Participant except upon death, by will or the laws of descent and distribution. Except as otherwise determined by the Board, Option Rights and Appreciation Rights are exercisable during the Eligible Participant’s lifetime only by him or her or by his or her guardian or legal representative. The Board may specify at the date of grant that part or all of the Common Stock that is (a) to be issued or transferred by DTG upon exercise of Option Rights or Appreciation Rights, upon termination of the restriction period applicable to Restricted Stock Units or upon payment under any grant of Performance Shares or Performance Units, or (b) no longer subject to the substantial risk of forfeiture and restrictions on transfer referred to in the Plan with respect to Restricted Stock, will be subject to further restrictions on transfer.

Adjustments

The number of Shares covered by outstanding awards under the Plan and, if applicable, the price per Share applicable thereto, are subject to adjustment in the event of stock dividends, stock splits, combinations of Shares, recapitalizations, mergers, consolidations, spin-offs, reorganizations, liquidations, issuances of rights or warrants, and similar events. In the event of any such transaction or event, the Board, in its discretion, may provide in substitution for any or all outstanding awards under the Plan such alternative consideration as it, in good faith, may determine to be equitable in the circumstances and may require the surrender of all awards so replaced. The Board may also make or provide for such adjustments in the number of Shares available under the Plan and the other limitations contained in the Plan as the Board may determine appropriate to reflect any transaction or event described above.

Resale

Eligible Participants who are reporting persons reselling Shares of Common Stock acquired under the Plan may only resell (unless they are a party to a Rule 10b5-1 trading plan) during DTG-imposed window periods and only in compliance with the limitations of SEC Rule 144 (other than the holding period requirements which are not applicable because the Shares have been registered).

Incentive Option Rights

Pursuant to the Plan, the aggregate number of Shares of Common Stock actually issued or transferred by DTG upon the exercise of incentive Option Rights shall not exceed 1,500,000 Shares.

Option Rights

Pursuant to the Plan, in no event may an Eligible Participant during any calendar year be granted Option Rights in excess of 285,000 Shares of Common Stock.

Appreciation Rights

Pursuant to the Plan, in no event may any Eligible Participant be granted Appreciation Rights for more than 285,000 Shares of Common Stock in any calendar year.

Performance Shares

Pursuant to the Plan, in no event may any Eligible Participant in any calendar year be granted Performance Shares that specify management objectives in excess of 160,000 Shares of Common Stock.

Performance Units

Pursuant to the Plan, in no event may any Eligible Participant in any calendar year be granted Performance Units that specify management objectives having an aggregate maximum value as of their respective dates of grant in excess of $7,100,000.

Restricted Stock

Pursuant to the Plan, in no event may any Eligible Participant in any calendar year be granted Restricted Stock that specifies management objectives in excess of 80,000 Shares of Common Stock.

Restricted Stock Units

Pursuant to the Plan, in no event may any Eligible Participant in any calendar year be granted Restricted Stock Units that specify management objectives in excess of 80,000 Shares of Common Stock.

Withholding Taxes

To the extent that DTG is required to withhold federal, state, local or foreign taxes in connection with any payment made or benefit realized by an Eligible Participant or other person under the Plan, and the amounts available to DTG for such withholding are insufficient, it will be a condition to the receipt of such payment or the realization of such benefit that the Eligible Participant or such other person make arrangements satisfactory to DTG for payment of the balance of such taxes required to be withheld, which arrangements (in the discretion of the Board) may include relinquishment of a portion of such benefit.

Compliance with Section 409A

The Plan is affected by Section 409A of the Code (“Section 409A”). Section 409A was enacted as part of the American Jobs Creation Act of 2004 and was effective on January 1, 2005. Section 409A provides rules governing deferred compensation. Awards granted in the future under the Plan will comply with the requirements of the final Section 409A regulations and related Internal Revenue Service (“IRS”) guidance. See also “Executive Compensation-Compensation Discussion and Analysis-Impact of Accounting and Tax Treatment on Compensation-Compliance with Section 409A” below.

Federal Income Tax Consequences

General

DTG believes that based on federal income tax laws in effect on January 1, 2008, the following are the federal income tax consequences generally arising with respect to awards granted under the Plan. The following summary provides only a general description of the application of federal income tax laws to the types of awards under the Plan, but does not address the effects of foreign, state and local tax laws.

Non-Qualified Option Rights

In general, (i) no income will be recognized by an Eligible Participant at the time a non-qualified Option

Right is granted, (ii) at the time of exercise of a non-qualified Option Right, ordinary income will be recognized by the Eligible Participant in an amount equal to the difference between the option price paid for the Shares and the fair market value of the Shares, if unrestricted, on the date of exercise, and (iii) at the time of sale of Shares acquired pursuant to the exercise of a non-qualified Option Right, appreciation (or depreciation) in value of the Shares after the date of exercise will be treated as either short-term or long-term capital gain (or loss) depending on how long the Shares have been held.

Incentive Option Rights

No income generally will be recognized by an Eligible Participant upon the grant or exercise of an incentive Option Right. The exercise of an incentive Option Right, however, may result in alternative minimum tax liability. If Common Stock is issued to the Eligible Participant pursuant to the exercise of an incentive Option Right, and if no disqualifying disposition of such Shares is made by such Eligible Participant within two (2) years after the date of grant or within one (1) year after the transfer of such Shares to the Eligible Participant, then upon sale of such Shares, any amount realized in excess of the option price will be taxed to the Eligible Participant as a long-term capital gain and any loss sustained will be a long-term capital loss. If Common Stock acquired upon the exercise of an incentive Option Right is disposed of prior to the expiration of either holding period described above, the Eligible Participant generally will recognize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such Shares at the time of exercise (or, if less, the amount realized on the disposition of such Shares if a sale or exchange) over the option price paid for such Shares. Any further gain (or loss) realized by the Eligible Participant generally will be taxed as short-term or long-term capital gain (or loss) depending on the holding period.

Appreciation Rights

No income will be recognized by an Eligible Participant in connection with the grant of a Tandem Appreciation Right or a Free-Standing Appreciation Right. When the Appreciation Right is exercised, the Eligible Participant normally will be required to include as taxable ordinary income in the year of exercise an amount equal to the amount of cash received and the fair market value of any unrestricted Common Stock received on the exercise.

Restricted Stock

The recipient of Restricted Stock generally will be subject to tax at ordinary income rates on the fair market value of the Restricted Stock (reduced by any amount paid by the Eligible Participant for such Restricted Stock) at such time as the Shares are no longer subject to forfeiture or restrictions on transfer for purposes of Section 83 of the Code. However, a recipient who so elects under Section 83(b) of the Code within thirty (30) days of the date of transfer of the Shares will have taxable ordinary income on the date of transfer of the Shares equal to the excess of the fair market value of such Shares (determined without regard to such restrictions) over the purchase price, if any, of such Restricted Stock. If a Section 83(b) election has not been made, any dividends received with respect to Restricted Stock that is subject to the restrictions generally will be treated as compensation that is taxable as ordinary income to the Eligible Participant.

Restricted Stock Units

No income generally will be recognized upon the award of Restricted Stock Units. The recipient of a Restricted Stock Unit award generally will be subject to tax at ordinary income rates on the cash or the fair market value of unrestricted Common Stock on the date that such cash or Shares are transferred to the Eligible Participant under the award (reduced by any amount paid by the Eligible Participant for such Restricted Stock Units), and the capital gain/loss holding period for such Shares will also commence on such date.

Performance Shares and Performance Units

No income generally will be recognized upon the grant of Performance Shares or Performance Units. Upon payment in respect of the earn-out of Performance Shares or Performance Units, the recipient generally will be required to include as taxable ordinary income in the year of receipt an amount equal to the amount of cash

received and the fair market value of any unrestricted Common Stock received.

Tax Consequences to the Company

To the extent that an Eligible Participant recognizes ordinary income in the circumstances described above, the Company will be entitled to a corresponding deduction provided that, among other things, the income meets the test of reasonableness, is an ordinary and necessary business expense, is not an “excess parachute payment” within the meaning of Section 280G of the Code and is not disallowed by the $1 million limitation on certain executive compensation under Section 162(m) of the Code.

Registration of Shares

On May 28, 1999, DTG filed a Registration Statement on Form S-8 to register 2,412,594 Shares of Common Stock authorized for issuance under the Original Plan. On November 28, 2000, DTG filed a Registration Statement on Form S-8 to register 2,400,000 Shares of Common Stock authorized for issuance under the Original Plan. On September 30, 2005, DTG filed a Registration Statement on Form S-8 to register 795,000 Shares of Common Stock authorized for issuance under the Plan. Upon stockholder approval of the Amendment, DTG will thereafter register the additional Shares issuable under the Plan with the SEC on Form S-8.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

Certain Beneficial Owners

The following table sets forth certain information as of March 17, 2008 with respect to each person known by DTG to beneficially own more than 5% of the outstanding Shares:

Name and Address of Beneficial Owner

| Amount and Nature of Beneficial Ownership |

Percent of Class (1)

|

Franklin Resources, Inc. (2) Charles B. Johnson Rupert H. Johnson, Jr. One Franklin Parkway San Mateo, California 94403 Franklin Advisory Services, LLC One Parker Plaza, 9th Floor Fort Lee, New Jersey 07024 | 2,232,867 | 10.34% |

T. Rowe Price Associates, Inc. (3) 100 East Pratt Street Baltimore, Maryland 21202 | 2,231,640 | 10.33% |

Dimensional Fund Advisors LP (4) 1299 Ocean Avenue Santa Monica, California 90401 | 2,042,411 | 9.46% |

MSD Capital, L.P. (5) MSD SBI, L.P. 645 Fifth Avenue, 21st Floor New York, New York 10022 | 1,805,800 | 8.36% |

Hound Partners, LLC (6) Hound Performance, LLC Jonathan Auerbach 101 Park Avenue, 48th Floor New York, New York 10178 | 1,082,303 | 5.01% |

______________________

(1) | Based on 21,597,084 Shares outstanding as of March 17, 2008. |

(2) | Charles B. Johnson and Rupert H. Johnson, Jr. (the “Principal Shareholders”) each own in excess of ten percent (10%) of the outstanding common stock of Franklin Resources, Inc. (“FRI”). Franklin Advisory Services, LLC (“FAS”), an advisory subsidiary of FRI, has the sole power to vote or to direct the vote of 2,219,967 of the Shares and the sole power to dispose or to direct the disposition of all of the Shares. The Principal Shareholders, FRI and FAS, each disclaim beneficial ownership of the Shares. |

(3) | The Shares are owned by various individual and institutional investors which T. Rowe Price Associates, Inc. (“Price Associates”) serves as investment advisor with power to direct investments and/or sole power to vote the Shares. For purposes of the reporting requirements of the Securities Exchange Act of 1934, as |

amended, Price Associates is deemed to be a beneficial owner of such Shares; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such Shares.

(4) | Dimensional Fund Advisors LP disclaims beneficial ownership of the Shares. |

(5) | MSD SBI, L.P. (“SBI”) is the record and direct beneficial owner of the Shares and MSD Capital, L.P. is the general partner of SBI. |

(6) | The Shares may be deemed to be beneficially owned by (a) Hound Performance, LLC, (b) Hound Partners, LLC, and (c) Jonathan Auerbach, the managing member of Hound Performance, LLC and Hound Partners, LLC. Each reporting person disclaims beneficial ownership in the Shares. |

Directors, Director Nominees and Executive Officers

The following table sets forth certain information as of March 17, 2008, with respect to the number of Shares owned by (a) each director nominee of DTG, (b) Molly Shi Boren, a current director of DTG who will not stand for re-election at the Annual Meeting of Stockholders, (c) each named executive officer of DTG, and (d) all directors and named executive officers of DTG as a group.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (2) |

Molly Shi Boren | 26,565 (3) | Less than 1% |

Thomas P. Capo | 38,495 (4) | Less than 1% |

Maryann N. Keller | 33,996 (5) | Less than 1% |

The Hon. Edward C. Lumley | 62,268 (6) | Less than 1% |

Richard W. Neu | 12,738 (7) | Less than 1% |

Gary L. Paxton | 258,023 (8) | 1.2% |

John C. Pope | 61,810 (9) | Less than 1% |

Edward L. Wax | 65,748 (10) | Less than 1% |

R. Scott Anderson | 69,041 (11) | Less than 1% |

Yves Boyer | 48,244 (12) | Less than 1% |

John J. Foley | 116,741 (13) | Less than 1% |

Steven B. Hildebrand | 60,427 (14) | Less than 1% |

All directors and executive officers as a group |

854,096

|

3.95%

|

_______________________

(1) | The SEC deems a person to have beneficial ownership of all shares which such person has the right to acquire within sixty (60) days. Accordingly, Shares subject to options exercisable within sixty (60) days are included in this column. |

(2) | Based on 21,597,084 Shares outstanding as of March 17, 2008. |

(3) | Consists of (a) 23,250 Shares subject to a deferral agreement between DTG and Ms. Boren, and (b) 3,315 Shares owned by Ms. Boren. |

(4) | Consists of (i) 34,995 Shares subject to a deferral agreement between DTG and Mr. Capo, and (ii) 3,500 Restricted Stock Units that shall vest on December 31, 2008. |

(5) | Consists entirely of 33,996 Shares subject to a deferral agreement between DTG and Ms. Keller. |

(6) | Consists of (a) 42,268 Shares owned by Mr. Lumley, and (b) 20,000 Shares subject to options. |

(7) | Consists of (i) 9,238 Shares subject to a deferral agreement between DTG and Mr. Neu, and (ii) 3,500 Restricted Stock Units that shall vest on December 31, 2008. |

(8) | Consists of (a) 33,215 Shares owned by Mr. Paxton’s trust, (b) 140 Shares owned by Mr. Paxton’s spouse and father-in-law, (c) 101,258 Shares held in the Deferred Compensation Plan (hereinafter defined), (d) 210 Shares held in DTG’s 401(k) Plan, and (e) 123,200 Shares subject to options. |

(9) | Consists of (a) 6,000 Shares owned by Mr. Pope, (b) 40,810 Shares subject to a deferral agreement between DTG and Mr. Pope, and (c) 15,000 Shares subject to options. |

(10) | Consists of (a) 6,200 Shares owned by Mr. Wax, (b) 39,548 Shares subject to a deferral agreement between DTG and Mr. Wax, and (c) 20,000 Shares subject to options. |

(11) | Consists of (a) 28,736 Shares owned by the trust of Mr. Anderson’s spouse, (b) 205 Shares held in DTG’s 401(k) Plan, and (c) 40,100 Shares subject to options. |

(12) | Consists of (a) 8,173 Shares owned by Mr. Boyer, (b) 25,755 Shares held in the Deferred Compensation Plan, (c) 116 Shares held in DTG’s 401(k) Plan, and (d) 14,200 Shares subject to options. |

(13) | Consists of (a) 27,184 Shares owned by the trust of Mr. Foley’s wife, (b) 855 Shares held in the Deferred Compensation Plan, (c) 6,000 Shares owned by Mr. Foley, (d) 202 Shares held in DTG’s 401(k) Plan, and (e) 82,500 Shares subject to options. |

(14) | Consists of (a) 13,830 Shares owned by Mr. Hildebrand, (b) 197 Shares held in DTG’s 401(k) Plan, and (c) 46,400 Shares subject to options. |

INDEPENDENCE, MEETINGS, COMMITTEES AND

COMPENSATION OF THE BOARD OF DIRECTORS

Independence

The Board has determined that all of the director nominees, other than Chief Executive Officer Gary L. Paxton, who is an employee of DTG, are “independent” as defined by DTG policy, the Sarbanes-Oxley Act of 2002 and New York Stock Exchange rules and regulations. Specifically, the Board’s determinations of director independence were made in accordance with the categorical standards for director independence reflected in DTG’s Corporate Governance Policy adopted by the Board and located on DTG’s website (www.dtag.com) under the heading “Corporate Governance.”

Subsequent to such determination, on April 1, 2008, Richard W. Neu was elected the interim Chief Financial Officer of DTG. Mr. Neu will not be considered independent while serving as interim Chief Financial Officer.

As a part of its review of the independence of directors, the Board considered the relationship of DTG with BMO Nesbitt Burns, where The Honorable Edward C. Lumley serves as Vice Chairman. Since 1999, BMO Nesbitt Burns has structured the financing for DTG’s Canadian vehicles. BMO Nesbitt Burns was selected after a review of multiple financing proposals from other lenders. Mr. Lumley has no involvement with this financing and none of his compensation at BMO Nesbitt Burns relates to this program. In addition, Mr. Lumley is not in a management position at BMO Nesbitt Burns. The directors also considered the amounts of various fees and interest payable by DTG to BMO Nesbitt Burns. The Board then applied its categorical standards for independence and determined that DTG’s relationship with BMO Nesbitt Burns was in the ordinary course of business, and that because Mr. Lumley had no involvement in the financing, he would be treated as an independent director of DTG.

DTG has established policies and procedures for the review, approval, ratification or disapproval of related party transactions. Related parties include directors, director nominees, executive officers, beneficial owners of more than 5% of the Shares and their respective immediate family members. Transactions subject to review include any business or commercial transaction, arrangement or relationship. The Governance Committee of the Board receives information concerning and then approves or disapproves all related party transactions. The detailed policies and procedures are in writing and form a part of DTG’s corporate compliance policies.

Meetings and Committees

The Board has established certain standing committees, which are comprised solely of independent directors, to consider designated matters. These committees of the Board are: the Governance Committee, the Audit Committee and the Human Resources and Compensation Committee. The Board annually selects from its members the members and chairman of each committee. The following table sets forth the number of Board and committee meetings (including teleconference meetings) held in 2007, the members of each committee and the chairman of each committee:

Director | Board | Governance | Audit | Human Resources

and Compensation |

Molly Shi Boren | X | X | | X |

Thomas P. Capo (1) | X | X | X | X |

Maryann N. Keller (2) | X | | X | |

The Hon. Edward C. Lumley (3) | X | | | X |

Richard W. Neu (4) | X | | X | |

Gary L. Paxton | X | | | |

John C. Pope (5) | X | X | | X |

John P. Tierney (6) | X | | X | |

Edward L. Wax | X | X | X | |

Meetings Held in 2007 | 14 | 5 | 11 | 7 |

____________________

(1) | Mr. Capo is Chairman of the Board and is an ex-officio member of all Board committees. |

(2) | Ms. Keller became the chairman of the Audit Committee effective April 1, 2008. |

(3) | Mr. Lumley is the chairman of the Human Resources and Compensation Committee. |

(4) | Mr. Neu was the previous chairman of the Audit Committee from May 17, 2007 through March 31, 2008. Effective April 1, 2008, he was elected the interim Chief Financial Officer of DTG. |

(5) | Mr. Pope is the chairman of the Governance Committee. |

(6) | Mr. Tierney was the previous chairman of the Audit Committee from January 6, 1998 through May 17, 2007, his date of retirement from the Board. |

During the 2007 year, each director attended 75% or more of the total of all meetings held by the Board and the committees on which he or she served, and the average attendance level for all Board and committee meetings was approximately 96%.

Effective March 31, 2008, the Board established a Finance Committee comprised of four directors, Thomas P. Capo (chairman), Maryann N. Keller, Richard W. Neu and John C. Pope.

As required by New York Stock Exchange rules and regulations, the Board has adopted DTG’s “Corporate Governance Policy” and charters for each of the Board committees. The Corporate Governance Policy and each charter are located on DTG’s website (www.dtag.com) under the heading “Corporate Governance.” DTG shall provide a copy of the Corporate Governance Policy and each charter to any stockholder upon request.

Also, as required by New York Stock Exchange rules and regulations, at each regularly scheduled meeting of the Board, the non-management directors of DTG meet in executive session without members of management present. These sessions are presided over by the independent Chairman of the Board, Thomas P. Capo.

Interested parties may communicate with the Chairman of the Board and with the independent directors in the manner described below under “Communications with Stockholders.”

Attendance at Annual Meetings of Stockholders

It is DTG policy that all directors should attend the Annual Meeting of Stockholders. All of the DTG directors attended the Annual Meeting of Stockholders held on May 17, 2007.

Governance Committee

The Governance Committee of the Board is as of the date of this Proxy Statement comprised of four independent directors, Molly Shi Boren, Thomas P. Capo (an ex-officio member), John C. Pope (chairman) and Edward L. Wax. Each of the members is currently “independent” as defined by DTG policy, the Sarbanes-Oxley Act of 2002 and New York Stock Exchange rules and regulations.

The Governance Committee evaluates the organization, function and performance of the Board and its committees, the qualifications for director nominees and matters involving corporate governance. A more detailed description of the Governance Committee’s duties and responsibilities may be found in its charter adopted by the Board and located on DTG’s website (www.dtag.com) under the heading “Corporate Governance.”

Consideration and Evaluation of Director Nominees

The Governance Committee will consider director nominees recommended by stockholders. Director nominations by stockholders may be submitted at the times and in the manner described below under “Stockholder Proposals and Director Nominations for Next Annual Meeting.”

The Governance Committee believes that the following qualities or skills are necessary for DTG directors to possess and reviews the same when recommending to the Board nominees for election as directors:

| 1. | the nominee should be independent as defined by DTG policy, the Sarbanes-Oxley Act of 2002 and New York Stock Exchange rules and regulations; |

| 2. | the nominee should have the ability to apply independent judgment to a business situation; |

| 3. | the nominee should have the ability to represent broadly the interests of all of DTG’s stockholders and constituencies; |

| 4. | the nominee must be free of any conflicts of interest which would interfere with the nominee’s loyalty to DTG and its stockholders; |

| 5. | the nominee should have practical or academic experience in business, economics, government or the sciences - and ideally fifteen (15) or more years of experience including management responsibilities; and |

| 6. | the nominee should have the time to be an active member of the DTG Board, as well as a member of one or more Board committees. |

Following the above criteria, the Governance Committee may identify and recommend to the Board qualified nominees for election as directors through various sources, including (a) members of the DTG Board, (b) stockholders, and (c) search firms (which may be paid a fee), as needed. There will be no difference in the manner in which the Governance Committee evaluates director nominees if the nominees are recommended by stockholders.

Audit Committee

The Audit Committee of the Board is as of the date of this Proxy Statement comprised of three independent directors, Thomas P. Capo (an ex-officio member), Maryann N. Keller (chairman) and Edward L. Wax. Each of the members is currently “independent” as defined by DTG policy, the Sarbanes-Oxley Act of 2002 and New York Stock Exchange rules and regulations.

The Audit Committee appoints the Independent Auditors, reviews and approves their fees for audit and non-audit services, and reviews the scope and results of audits performed by the Independent Auditors and by DTG’s internal auditors. It also reviews corporate compliance matters and reviews the Company’s system of internal accounting controls, its significant accounting policies and its financial statements and related disclosures. A more detailed description of the Audit Committee’s duties and responsibilities may be found in its charter adopted by the Board and located on DTG’s website (www.dtag.com) under the heading “Corporate Governance.”

Audit Committee Financial Expert

The Board has determined that each of Thomas P. Capo and Maryann N. Keller is an “audit committee financial expert,” as defined by the SEC.

Human Resources and Compensation Committee

Independence and Charter

The Human Resources and Compensation Committee of the Board is currently comprised of four independent directors, Molly Shi Boren, Thomas P. Capo (an ex-officio member), Edward C. Lumley (chairman) and John C. Pope. Each of the members is currently “independent” as defined by DTG policy, the Sarbanes-Oxley Act of 2002 and New York Stock Exchange rules and regulations.

The Human Resources and Compensation Committee makes recommendations to the Board regarding DTG’s executive compensation program, as well as generally reviewing the human resources area for the Company, including its management development and succession. As a part of its executive compensation function, it approves salaries, retirement benefits, incentive compensation awards and equity incentive grants for officers and senior executives, as well as corporate goals under performance based compensation plans. A more detailed description of the Human Resources and Compensation Committee’s duties and responsibilities may be found in its charter adopted by the Board and located on DTG’s website (www.dtag.com) under the heading “Corporate Governance.”

Processes and Procedures for Consideration and Determination of Executive and Director Compensation

The Human Resources and Compensation Committee annually reviews the performance of all officers. Executive officers also contribute to this review process. The Human Resources and Compensation Committee

makes all decisions regarding cash and equity awards for all officers of the Company after consultation with the other independent directors. The Human Resources and Compensation Committee also reviews the performance and pay of the Chief Executive Officer and discusses its review with the Board. As part of all compensation reviews, the Human Resources and Compensation Committee uses data obtained by Towers Perrin, its independent compensation consultant.

The Human Resources and Compensation Committee also reviews the compensation for the Board and its committees. In recommending such compensation to the Board, the Human Resources and Compensation Committee utilizes comparable data furnished by Towers Perrin.

The agenda for meetings of the Human Resources and Compensation Committee is determined by its Chairman with the assistance of DTG’s Chairman of the Board, Chief Executive Officer and Executive Vice President-Administration. Such meetings are regularly attended by the Chairman of the Board, the Chief Executive Officer and the Executive Vice President-Administration. At each meeting, the Human Resources and Compensation Committee also meets in executive session. The Chairman of the Human Resources and Compensation Committee reports the committee’s recommendations on executive compensation to the Board. Independent advisors and DTG’s human resources department support the Human Resources and Compensation Committee in its duties and such department may be delegated authority to fulfill certain administrative duties regarding the compensation programs. The Human Resources and Compensation Committee has authority under its charter to retain, approve fees for and terminate consulting firms as it deems necessary to assist in the fulfillment of its responsibilities.

Report of Audit Committee

Meetings With Management, Internal Auditors and Independent Auditors

The Audit Committee reviewed and discussed the audited financial statements and effectiveness of internal controls with management, internal auditors and the Independent Auditors of DTG, Deloitte & Touche LLP. Based on these discussions and its other work, the Audit Committee recommended that the Board include the audited consolidated financial statements in DTG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2007.

The Audit Committee also has met and held discussions with management, internal auditors and the Independent Auditors regarding various topics in addition to matters related to financial statements.

The discussions with Deloitte & Touche LLP also included the matters required by Statement on Auditing Standards (“SAS”) No. 114, The Auditor’s Communication with Those Charged with Governance.

In addition, Deloitte & Touche LLP also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with the Audit Committee such firm’s independence.

Responsibility

The Audit Committee is not responsible for either the preparation of the financial statements or the auditing of the financial statements. Management has the responsibility for preparing the financial statements and implementing, maintaining and evaluating the effectiveness of internal controls and the Independent Auditors have the responsibility for auditing financial statements and evaluating the effectiveness of the internal controls. The Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the Independent Auditors included in their report on DTG’s financial statements.

THE AUDIT COMMITTEE

Richard W. Neu, Chairman

Thomas P. Capo, ex-officio

Maryann N. Keller

Edward L. Wax

March 24, 2008

Compensation

| Board Meeting Fees, Committee Meeting Fees and Retainers |

In 2007, the independent directors were paid an annual board retainer of $35,000, payable in quarterly amounts of $8,750 exclusively in Common Stock. They were also paid an attendance fee of $1,000 for each meeting of the Board of Directors and $1,000 for each meeting of a Board committee (excluding members of the Audit Committee), in each case payable in cash or Common Stock, as desired by the director. Members of the Audit Committee were paid an annual attendance fee of $18,000, payable in quarterly installments of $4,500 in cash or Common Stock, as desired by the director.

In addition to the meeting fees described above, the Governance Committee chairman was paid an annual retainer of $5,000, payable in quarterly installments of $1,250 exclusively in Common Stock. The Human Resources and Compensation Committee chairman was paid an annual retainer of $7,500, payable in quarterly installments of $1,875 exclusively in Common Stock. The Audit Committee chairman was paid an annual retainer of $10,000, payable in quarterly installments of $2,500 exclusively in Common Stock.

All retainer fees described above will be paid in Common Stock until the director meets DTG’s stock ownership guidelines described elsewhere herein. Upon meeting the guidelines, retainer fees may be paid in cash or Common Stock, as desired by the director. Also, directors may elect in advance to defer their fees.

Mr. Capo is the Chairman of the Board of Directors. Service of an independent Chairman and separation of such role from the office of Chief Executive Officer is considered a corporate governance best practice. Mr. Capo’s compensation for services rendered as Chairman was $200,000 for the fiscal year ended December 31, 2007.

Restricted Stock Grants

In February 2007, each independent director was granted 2,930 Restricted Stock Units, except for Mr. Tierney who was granted 1,100 Restricted Stock Units because of his anticipated retirement from the Board without serving a full year. The Restricted Stock Units vested on December 31, 2007 (except for Mr. Tierney’s which vested on May 17, 2007).

Other

In 2007, DTG made available to each independent director the personal use of up to two vehicles while serving as a director of DTG, including routine maintenance, tags and insurance coverage. Effective January 1, 2008, this benefit was reduced to one vehicle. Rental cars are also furnished for short-term use for product and service evaluation. In the event of a change in control of DTG, ownership of the vehicle will be transferred to the director and the use of rental cars for product and service evaluation will continue. Upon retirement from the Board with five years or longer of service, a director shall be permitted to retain the vehicle until its scheduled turnback date and the use of rental cars for product and service evaluation will continue.

No Employee Director Compensation or Benefits

DTG does not pay compensation or provide benefits for service to any director solely in such capacity who is also an officer or employee of the Company.

| Director Compensation Table |

The following table provides certain summary information concerning compensation of the directors for the fiscal year ended December 31, 2007:

2007 DIRECTOR COMPENSATION

Name (a) | Fees Earned or Paid in Cash ($) (b) | Stock Awards ($) (c)(1) | Option Awards ($) (d)(2) | Non-Equity Incentive Plan Compensation ($) (e) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (f) | All Other Compensation ($) (g)(3) | Total ($) (h) |

Molly Shi Boren |

$ 61,000

|

$ 137,417

|

-0-

|

-0-

|

-0-

|

$ 28,266

|

$ 226,683

|

Thomas P. Capo |

$ 279,000

|

$ 137,417

|

-0-

|

-0-

|

-0-

|

$ 18,620

|

$ 435,037

|

Maryann N. Keller |

$ 66,000

|

$ 137,417

|

-0-

|

-0-

|

-0-

|

$ 26,321

|

$ 229,738

|

The Hon. Edward C. Lumley | $ 63,500 | $ 137,417 | -0- | -0- | -0- | $ 35,366 | $ 236,283 |

Richard W. Neu |

$ 73,194

|

$ 137,417

|

-0-

|

-0-

|

-0-

|

$ 18,779

|

$ 229,390

|

John C. Pope | $ 66,000 | $ 137,417 | -0- | -0- | -0- | $ 27,120 | $ 230,537 |

John P. Tierney |

$ 32,975

|

$ 51,590

|

-0-

|

-0-

|

-0-

|

$ 13,926

|

$ 98,491

|

Edward L. Wax |

$ 72,000

|

$ 137,417

|

-0-

|

-0-

|

-0-

|

$ 23,000

|

$ 232,417

|

________________________

(1) | The amount shown in column (c) for each director reflects the value attributable to the Restricted Stock Unit awards in accordance with SFAS No. 123(R) (hereinafter defined), which awards vested on December 31, 2007 (except for 1,100 of such awards which vested on May 17, 2007). The amounts were calculated by multiplying the number of Restricted Stock Unit awards by the closing price per Share of $46.90 on the February 1, 2007 grant date. |

(2) | Since May 2002, no director has been awarded Option Rights. The amount of outstanding Option Rights that are fully vested but not yet exercised are as follows: (a) Mr. Lumley (20,000), (b) Mr. Pope (15,000), and (c) Mr. Wax (20,000). |

(3) | The amount shown in column (g) for each director reflects the value attributable to the personal use by each director of up to two Company vehicles, including routine maintenance, tags and insurance coverage. The value of a vehicle to the directors is determined by using its annual lease value. For a vehicle provided only part of the year, the annual lease value is prorated for the number of days of use. |

Stock Ownership Guidelines

The current stock ownership guidelines for independent directors of DTG are 20,000 Shares. Directors are generally given five years from commencing service on the Board to meet the stock ownership guidelines. All of the directors meet or exceed the applicable stock ownership guidelines.

Communications with Stockholders

Stockholders may send communications to the DTG Board that should be addressed to: Secretary, Dollar Thrifty Automotive Group, Inc., 5330 East 31st Street, Tulsa, Oklahoma 74135. All such communications received by the Secretary will be forwarded to the Chairman of the Board and to the Chief Executive Officer. The Secretary and the Chairman of the Board will review the communications and determine whether or not it is appropriate to forward the communications to the Board or any director.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Objectives of Compensation Program

The Human Resources and Compensation Committee is guided by the following key objectives in determining the compensation of the Company’s executives (Staff Vice President levels and higher employees):

Compensation should reflect the competitive marketplace so that the Company can attract, retain and motivate high caliber executives. In constructing the various elements of total compensation, the Company generally targets base pay to be at or slightly below the market median, and incentive compensation to be at or slightly above the market median. These component objectives support the Company’s overall objective to establish a competitive executive compensation program where total compensation is within +/-15% of the market median on a program-wide basis.

| Accountability for Business Performance |

Compensation should be tied largely to overall Company financial and operating performance, so that executives are held accountable through their compensation for achievement of Company financial and operating results.

| Accountability for Individual Performance |

Compensation should also be tied to the individual’s performance to encourage and reflect individual contributions to the Company’s performance.

| Alignment with Stockholder Interests |

Compensation should reflect DTG’s Common Stock performance through equity-based incentives, such as Performance Shares, Performance Units and Option Rights, to align the interest of executives with those of DTG stockholders.

Compensation Program Design

DTG’s executive compensation program is designed to clearly and fairly relate pay to performance, with the objective of creating long-term stockholder value. DTG’s executive compensation program is also designed to match pay practices with corporate goals. Each year, DTG establishes cash incentive compensation plans and equity incentive compensation plans. At the end of each year, the Human Resources and Compensation Committee conducts a full review of the elements of compensation and compares those elements to DTG’s key objectives.

Participants in Compensation Decisions

The following table identifies the various individuals and groups who participate in decision making for DTG’s executive compensation program and their duties in 2007 in connection with such participation.

Participant | Duties |

Human Resources and Compensation Committee | • Reviewed performance of the Chief Executive Officer, the other named executive officers and other select members of the executive group • Approved compensation of the Chief Executive Officer and discussed review with the Board • Made all decisions regarding cash and equity awards for executives after consultation with other independent directors • Consulted with and used data obtained by Towers Perrin, its independent compensation consultant, as a part of all compensation reviews |

Chief Executive Officer | • With input from other senior executives, contributed to the review process of select members of the executive group |

Towers Perrin | • Worked directly for the Human Resources and Compensation Committee • Assisted in design of the compensation program • Conducted original compensation research and prepared reports • Reviewed all presentation materials developed by DTG management • Consulted with, asked questions of and provided comments to DTG management and the Human Resources and Compensation Committee regarding all compensation plans, presentations, proposed actions, documents and related materials |

It should be noted that Tillinghast, a business unit of Towers Perrin, performs separate work for DTG in relation to the valuation of insurance reserves. This relationship and the work performed by Tillinghast is unrelated to the work performed by Towers Perrin at the request of the Human Resources and Compensation Committee. All Towers Perrin or Tillinghast work for DTG must be approved in advance by the Human Resources and Compensation Committee beginning in 2008.

Comparison Data or Benchmarking

The Company believes that it competes for executive talent against many different companies and such competition is not limited to the Company’s direct business competitors. The Company also believes that executive pay levels should reflect the size and scope of its operations. As such, the Company attempts to provide executive compensation levels that, at target, are competitive with the pay levels for comparable positions at companies with comparable revenues to the Company.

The Human Resources and Compensation Committee obtains data from Towers Perrin relating to competitive salaries, annual incentives, long-term incentives, retirement benefits and other compensation (including perquisites). In 2007, the primary source of compensation comparisons was a database of general industry pay

information matched to similar DTG jobs and adjusted for revenue size. This broad database matches the labor market that DTG competes in and allows for robust comparisons for the majority of executive positions at DTG. Discussions of comparisons to market information and graphic displays in this report are developed using information derived from this database. In addition to this database, Towers Perrin has included in its report information for the Chief Executive Officer and certain other named executive officer positions as compared to: (a) information on the two rental car companies that was publicly available, and (b) information on ten companies in the same Global Industry Classification Standard Code as DTG. This information was developed at the request of the Human Resources and Compensation Committee due to the frequent use and comparisons of the information noted in (a) and (b) above by stockholder investment services. These sources of information provide the Human Resources and Compensation Committee with additional points of reference. Towers Perrin compiled all of the comparison data and prepared a report for the Human Resources and Compensation Committee. Management and the Human Resources and Compensation Committee reviewed the report with Towers Perrin. The Human Resources and Compensation Committee then discussed and considered the report when making compensation decisions in 2007, along with other relevant facts and circumstances, including among others internal equity, individual performance, individual job responsibilities and tenure.

| General Information Regarding Elements of Compensation |

DTG’s executive compensation objectives are achieved through five elements: base salary, cash incentive compensation, long-term incentive compensation, retirement benefits and other compensation (including perquisites). During 2007, DTG used these elements of compensation to create an overall executive compensation program that combines traditional base salary with short-term incentives in the form of cash incentive compensation together with long-term incentives in the form of Performance Shares. Prior to 2002, DTG’s long-term incentive compensation was primarily in the form of Option Rights. Since 2002, DTG has only used Performance Shares for long-term incentive compensation. DTG believes the use of Performance Shares and Option Rights aligns the long-term interests of executives with the long-term interests of stockholders.

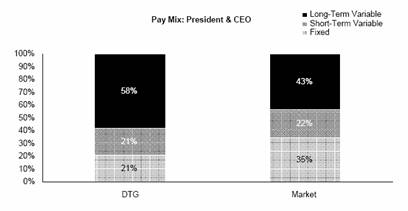

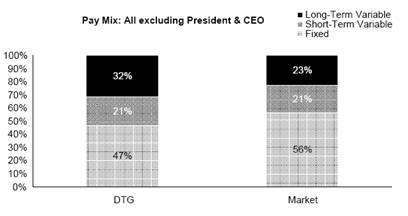

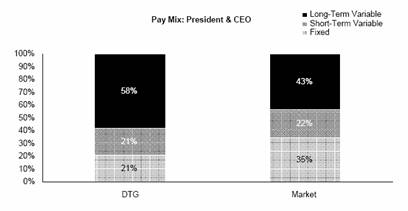

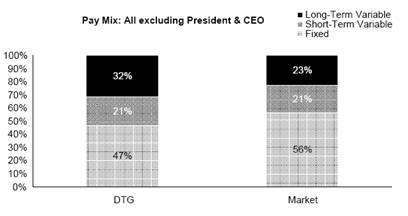

The graphs below, which are based on data from the report prepared by Towers Perrin, show an overall comparison for the Chief Executive Officer and all executives excluding the Chief Executive Officer, each compared to a database of general industry pay information matched to similar DTG jobs and adjusted for revenue size. Target total direct compensation is a combination of base salary, cash incentive compensation and long-term incentive compensation as shown in the graphs below. The total direct compensation is within the +/-15% objective set by the Human Resources and Compensation Committee for the compensation of the Chief Executive Officer and all executives excluding the Chief Executive Officer.

DTG’s compensation goal is to have competitive pay that is slightly below market in terms of base salary and slightly above market in terms of incentive compensation (cash and long-term) or at risk pay. The graphs below, which are based on data from the report prepared by Towers Perrin, show the comparison of DTG’s compensation elements of base salary (fixed), cash incentive compensation (short-term variable) and long-term incentive compensation (long-term variable) compared to market information (which includes time-vested restricted stock as an element of fixed compensation) for each of the Chief Executive Officer and all executives excluding the Chief Executive Officer.

The graphs above demonstrate that DTG has achieved its goal of having more compensation at risk and tied to individual or Company performance than the market as a whole. The Chief Executive Officer should and does have the highest percentage of compensation at risk and tied to performance targets.

The following table summarizes each of the compensation elements, the recipients of each element and the key objectives achieved through each element. A more detailed description of each element of compensation is provided under “Discussion of Elements of Compensation” below.

Element | Description | Recipients | Objectives Achieved |

Base Salary | • Annual cash compensation for services rendered during the fiscal year | • Executives • Other employees | • Competitive pay • Retention |

Cash Incentive Compensation | • Performance based compensation awards for achievement of corporate financial objectives and individual performance considerations during the past year | • Executives • Middle management • Field • Other employees’ profit sharing | • Value-sharing with executives and other employees in the Company’s pretax profits • Competitive pay • Accountability for business performance • Accountability for individual performance • Alignment with stockholders’ interests |

Long-Term Incentive Compensation | • Equity based incentives such as Option Rights, Restricted Stock Units and Performance Shares and other equity awards provided pursuant to the Plan | • Executives | • Accountability for business performance • Alignment with stockholders’ interests |

Supplemental Retirement Benefits (Deferred Compensation Plan, Retirement Plan and KEYSOP) | • Deferred Compensation Plan provides for elective deferrals of compensation and Company may make contributions in addition to the elective deferrals • Retirement Plan provides retirement income and Company may make contributions • Single non-qualified trust established under Deferred Compensation Plan and Retirement Plan to provide source of payment for benefits • KEYSOP provided elective deferrals of compensation • Trust established under KEYSOP to hold deferrals of compensation | • Executives | • Competitive pay • Retention |

Other | • Financial counseling services • Supplemental executive life insurance • Supplemental medical and long-term disability premiums • Car usage | • Chief Executive Officer and other named executive officers participate in all plans • Remainder of executive group participate in all or some of the plans | • Competitive Pay |

Discussion of Elements of Compensation

Base Salary

The base salaries for all executives were established by the Human Resources and Compensation Committee by matching positions at the Company to comparable positions from data obtained by Towers Perrin. Base salaries may vary from comparable positions depending on factors such as responsibility, current performance and tenure.

During 2006, a position by position review was performed by Towers Perrin and provided to the Human Resources and Compensation Committee. Based upon a review of the incumbent’s responsibilities, performance and pay relative to market, some executives did receive an increase in their 2007 base salary. The base salary for Gary L. Paxton, the Chief Executive Officer, was increased to $700,000 in 2007 from $654,387 in 2006 and was approved by the Human Resources and Compensation Committee in February 2007. This review did not result in base salary increases for the other named executive officers.

| Cash Incentive Compensation |

In 2007, DTG established a discretionary compensation pool equal to 12.75% of pretax profit with a minimum profit margin requirement of 4.00% and no maximum on the size of the pool. A portion of that pool equal to 3.50% of pretax profit was established for executives, which includes the named executive officers. The remainder of the pool was established for frontline managers and for all other eligible employees through their participation in profit sharing. This 12.75% level has been used since 2002 and DTG believes it remains a competitive level. In addition, this level was also determined to approximate the value of the cash incentive target compensation levels DTG was seeking.

While profitable Company performance is sufficient for establishment of the cash incentive compensation pool, the actual compensation awards for executives are at the discretion of and subject to adjustment by the Human Resources and Compensation Committee. The incentive compensation pool is allocated to executive participants based on individual target award levels, subject to adjustment based on individual performance. These target award levels differ by participant and by the responsibilities of the positions held by each such participant. In addition, each annual incentive compensation plan includes a mechanism for recovery of awards where a participant engages in certain detrimental activities, including competing with DTG, solicitation of employees for other employment, disclosure of confidential information, activity that results in termination for cause, any conduct determined to be harmful to the Company or conduct that causes the need for restatement of any financial statements or financial results of DTG.

The Company had a 2007 pretax profit margin of 2.94% which did not meet the minimum pretax profit margin of 4.00% to establish the pool. Therefore, the Chief Executive Officer, the other named executive officers and other executive officers did not receive cash incentive compensation.

| Long-Term Incentive Compensation |

DTG’s long-term incentive compensation is provided through the Plan. The Plan is intended to primarily provide equity-based incentives to executives of the Company that serve to align their interests with those of stockholders. DTG adopted the Plan to encourage participants to focus on long-term Company performance and to provide an opportunity for executive officers and certain designated key employees to increase their stake in the Company through grants of Performance Shares. The performance metrics under the Performance Share grant agreements match certain of the Company’s key corporate goals in the areas of stockholder return, market share growth and customer service. In addition, the Performance Share grant agreements contain the same mechanism as in the annual incentive compensation plan regarding recovery of all awards where a participant engages in certain detrimental activities. The purpose of the Plan is also to attract and retain independent directors and to provide compensation in the form of stock to align their interests with stockholders. The various types of awards under the Plan and the description of the Plan are discussed earlier in this Proxy Statement. See “Additional Information for Share Addition Proposal” above.

In 2007, the value of DTG’s long-term target incentive compensation at the time of grant was, on an overall basis, 4% above the market median. This is consistent with DTG’s goal to have long-term incentive compensation or at risk pay at or slightly above the market median.

In April 2004, 280,058 target Performance Shares were granted under the Original Plan to executives of the Company. Such grants may be earned over the three year measurement period of January 1, 2004 to December 31, 2006 (the “2004-2006 Performance Period”) based on certain management objectives. The weighted management objectives used to determine the number of Performance Shares ultimately earned for the 2004-2006 Performance Period were (i) a certain percentage increase of the cumulative Dollar “brand” and Thrifty “brand” market share (whether corporate or franchised) in the top 100 U.S. airports, and (ii) DTG’s total stockholder return performance relative to companies listed in the Russell 2000 during the 2004-2006 Performance Period. In January 2007, the Human Resources and Compensation Committee approved the issuance of 196,597 Performance Shares for the 2004-2006 Performance Period. As shown in the table below, such issuance represented a payout of 74.6% of target Performance Shares granted to executives employed for the full 2004-2006 Performance Period. DTG’s total stockholder return for the 2004-2006 Performance Period was 77.6% compared to the median peer group of 39%.

Performance Metric | Target Payout | Actual Payout |

Market Share Increase - 4% annual growth | 50% | 0% |

Total Stockholder Return - 50th percentile to Russell 2000 Companies | 50% | 74.6% |

In February 2007, 148,360 target Performance Shares were granted under the Plan to executives of the Company that may be earned over the 2007-2009 Performance Period. By comparison, in May 2005, 248,432 target Performance Shares were granted under the Plan and in February 2006, 213,508 target Performance Shares were granted under the Plan. The 2007 target Performance Share grants were reduced from grants in 2006 due to fewer participants (35 v 41) and a then higher underlying price of the Common Stock. In addition, the Human Resources and Compensation Committee considered the 2007 Performance Share grant levels for each executive and where some positions were showing total direct compensation significantly above or below their market benchmark, and where the scope of the individual responsibilities was determined to be significant, adjustments were then made to the 2007 Performance Share grant levels. The number of Performance Shares ultimately earned

by an executive would be expected to range from zero to 200% of the executive’s target award, depending on the level of the Company’s corporate performance over the 2007-2009 Performance Period against certain management objectives. The number of target Performance Shares granted to the Chief Executive Officer and the other named executive officers for 2007 and 2006 is as follows:

Name | 2007 | 2006 |

Gary L. Paxton | 47,500 | 56,460 |

Steven B. Hildebrand | 12,900 | 16,929 |

R. Scott Anderson | 10,200 | 13,365 |

John J. Foley | 10,200 | 13,365 |

Yves Boyer | 5,400 | 7,128 |

The weighted management objectives used to determine the number of Performance Shares ultimately earned for the 2007-2009 Performance Period are (a) DTG’s total stockholder return performance against companies listed in the Russell 2000 during the 2007-2009 Performance Period, (b) increasing non-airport revenue, (c) maintaining market share at the top 100 U.S. airports, (d) achieving a target level of customer service as measured by an internal customer dissatisfaction index metric, and (e) increasing customer retention as measured by an internal customer retention index metric. The following table describes the weighted management objectives and the rationale for using these objectives for the 2007-2009 Performance Period:

Performance Metric | Target Payout | Rationale |

Total Stockholder Return - stock price growth equal to 50th percentile of Russell 2000 Companies | 50% | Requires DTG stockholder value to be equal to or better than market performance |

Non-Airport Revenue - 50% growth over three years | 10% | Stretch goal to increase new business segments |

Market Share - maintain share over three years | 20% | Directly reflects the competitive environment |

Customer Service - maintain customer service over three years | 10% | Maintain a standard of less than five complaints per 1,000 customers |

Customer Retention - increase customers “very likely” to rent by 15% | 10% | One standard deviation improvement over prior year |

| Supplemental Retirement Benefits |

In December 1994, Pentastar Transportation Group, Inc., predecessor to DTG, adopted a deferred compensation plan (the “Deferred Compensation Plan”) to provide a means by which executives of the Company may elect to defer receipt of specified percentages or amounts of their compensation, and to encourage such employees to remain employed by the Company. The Company may (but is not required to) make contributions to the Deferred Compensation Plan in addition to elective deferrals of compensation by executives. The Deferred Compensation Plan currently covers 30 employees of the Company.

DTG adopted a retirement plan in December 1998 (the “Retirement Plan”) to provide a means by which the Company can provide retirement income to executives to encourage them to remain employed by the Company. The Company may (but is not required to) make contributions to the Retirement Plan. The Retirement Plan currently covers 25 employees of the Company, but was discontinued for any new executives beginning in December 2004. Any such new executives will instead receive a higher level of Company contributions to the Deferred Compensation Plan.

DTG has established a single non-qualified trust to provide a source of payment for benefits under the Deferred Compensation Plan and the Retirement Plan.

Effective June 1, 2002, DTG adopted an executive option plan (the “KEYSOP”). The KEYSOP is a nonqualified deferred compensation plan and provides a means by which executives of DTG may elect to defer receipt of specified percentages or amounts of their compensation in exchange for mutual fund options. DTG has never made contributions to the KEYSOP. DTG established a trust to hold the shares that are subject to purchase through the exercise of the mutual fund options. The KEYSOP has been amended to eliminate deferrals of compensation into the KEYSOP after December 31, 2004. The remaining mutual fund options can be exercised at any time by the executive but no later than 15 years from the grant date.