UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | Filed by the Registrant x |

| | Filed by a Party other than the Registrant ¨ |

| | Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Dear Stockholder:

You are invited to attend the Annual Meeting of Stockholders of Dollar Thrifty Automotive Group, Inc. which will be held at 9:00 a.m., C.D.T., Thursday, June 9, 2011, at the Doubletree Hotel Warren Place, 6110 South Yale Avenue, Tulsa, Oklahoma.

The formal Notice of Annual Meeting of Stockholders and Proxy Statement accompanying this letter provide detailed information concerning matters to be considered and acted upon at the meeting.

Whether or not you plan to attend the meeting, please execute and return the enclosed proxy at your earliest convenience. Your shares will then be represented at the meeting, and the Company will avoid the expense of further solicitation to assure a quorum and a representative vote. If you attend the meeting and wish to vote your shares in person, you may revoke your proxy and vote at that time.

Sincerely,

/S/ Richard W. Neu

Richard W. Neu

Chairman of the Board

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 26, 2011

TO THE STOCKHOLDERS OF DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.:

The Annual Meeting of Stockholders of Dollar Thrifty Automotive Group, Inc. (the “Company”) will be held at 9:00 a.m., C.D.T., Thursday, June 9, 2011, at the Doubletree Hotel Warren Place, 6110 South Yale Avenue, Tulsa, Oklahoma for the following purposes:

| | 1. | To elect six directors to serve until the next annual meeting of stockholders and until their successors shall have been elected and shall qualify or as otherwise provided by the By-laws of the Company; |

| | 2. | To ratify the appointment by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2011; |

| | 3. | To cast an advisory vote on the compensation of named executive officers; |

| | 4. | To cast an advisory vote on the frequency of future advisory votes on executive compensation; and |

| | 5. | To conduct any other business properly brought before the meeting. |

Only stockholders of record at the close of business on April 11, 2011 are entitled to notice of, and to vote at, the meeting and any postponements or adjournments thereof (unless the Board of Directors fixes a new record date for any such postponed or adjourned meeting). A list of such stockholders will be available for examination by any stockholder for any purpose germane to the meeting, during ordinary business hours, for at least 10 days before the meeting in the Office of the General Counsel, Dollar Thrifty Automotive Group, Inc., 5330 East 31st Street, Tulsa, Oklahoma 74135. The list will also be available for inspection at the meeting site during the meeting.

Your vote is important. Whether or not you plan to attend the meeting, please vote now by proxy in order to ensure the presence of a quorum. You may vote by marking, signing and dating your proxy card on the reverse side and returning it promptly in the accompanying postage-paid envelope. A proxy may be revoked at any time prior to its exercise at the meeting, and your return of the enclosed proxy will not affect your right to vote your shares if you attend the meeting in person.

| | By Order of the Board of Directors |

| | |

| | /S/ VICKI VANIMAN |

| | |

| | Vicki J. Vaniman |

| | Secretary |

| |

| Your vote is important. Please vote by marking, signing and dating your proxy |

| card on the reverse side and returning it promptly in the accompanying postage-paid envelope. |

| |

TABLE OF CONTENTS |

| INFORMATION ABOUT THE MEETING | 1 |

| | | |

| | Quorum | 1 |

| | Vote Required | 1 |

| | Proxy Voting | 2 |

| | Proxy Solicitation | 2 |

| | | |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders | |

| to Be Held on June 9, 2011 | 2 |

| | |

| PROPOSAL NO. 1 - ELECTION OF DIRECTORS | 2 |

| | |

PROPOSAL NO. 2 - APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 3 |

| | |

PROPOSAL NO. 3 - ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS | 5 |

| | |

PROPOSAL NO. 4 - ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION | 6 |

| | |

BIOGRAPHICAL INFORMATION REGARDING DIRECTOR NOMINEES AND EXECUTIVE OFFICERS | 7 |

| | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS | 10 |

| | |

| | Certain Beneficial Owners | 10 |

| | Directors, Director Nominees and Executive Officers | 11 |

| | | |

INDEPENDENCE, MEETINGS, COMMITTEES AND COMPENSATION OF THE BOARD OF DIRECTORS | 13 |

| | | |

| | Independence | 13 |

| | Meetings and Committees | 13 |

| | Attendance at Annual Meetings of Stockholders | 14 |

| | Governance Committee | 14 |

| | Audit Committee | 15 |

| | Human Resources and Compensation Committee | 15 |

| | Report of Audit Committee | 16 |

| | Compensation | 18 |

| | | Board Meeting Fees, Committee Meeting Fees and Retainers | 18 |

| | | Restricted Stock Grants | 18 |

| | | Other | 18 |

| | | No Employee Director Compensation or Benefits | 18 |

| | | Director Compensation Table | 19 |

| | Stock Ownership Guidelines | 19 |

| | Leadership Structure of the Board | 19 |

| | Board’s Role in Risk Oversight | 20 |

| | Communications with Stockholders | 20 |

| | |

| EXECUTIVE COMPENSATION | 21 |

| | | |

| | Compensation Discussion and Analysis | 21 |

| | | 2010 Overview | 21 |

| | | Objectives of Compensation Program | 22 |

| | | Participants in Compensation Decisions | 23 |

| | | Comparative Data and Benchmarking | 24 |

| | | Internal Pay Equity | 24 |

| | | General Information Regarding Elements of Compensation | 24 |

| | | Discussion of Elements of Compensation | 24 |

| | | Change in Control Arrangements | 27 |

| | | 2011 Compensation Decisions | 28 |

| | | Impact of Accounting and Tax Treatment on Compensation | 29 |

| | | Common Stock Ownership Guidelines | 29 |

| Compensation Committee Report | | 29 |

| Summary Compensation Table | | 30 |

| Grants of Plan-Based Awards | | 32 |

| Outstanding Equity Awards at Fiscal Year-End | | 33 |

| Option Exercises and Stock Vested | | 34 |

| Nonqualified Deferred Compensation | | 35 |

| Potential Payments Upon Termination or Change in Control | | 35 |

| | Introduction | 35 |

| | Payments Made Upon Involuntary Termination With Cause or Voluntary Termination | |

| | | (Other Than Retirement) | 36 |

| | Payments Made Upon Involuntary Termination Without Cause or Due to a Reduction in Force | 36 |

| | Payments Made Upon Retirement, Death or Disability | 37 |

| | Payments Made Upon a Change in Control | 38 |

| Equity Compensation Plan Information | | 42 |

| | | | |

| TRANSACTIONS WITH RELATED PERSONS, PROMOTERS | | |

| | AND CERTAIN CONTROL PERSONS | | 43 |

| | | | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 43 |

| | | | |

| CODE OF ETHICS | | 43 |

| | | | |

| ANNUAL REPORT ON FORM 10-K | | 43 |

| | | | |

| STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS | | |

| | FOR NEXT ANNUAL MEETING | | 43 |

| | | | |

| OTHER MATTERS | | 44 |

| | | | |

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.

5330 East 31st Street

Tulsa, Oklahoma 74135

PROXY STATEMENT

INFORMATION ABOUT THE MEETING

This Proxy Statement is solicited by the Board of Directors (the “Board”) of Dollar Thrifty Automotive Group, Inc., a Delaware corporation (“DTG”), on behalf of DTG, and is furnished in connection with the Annual Meeting of Stockholders to be held at 9:00 a.m., C.D.T., Thursday, June 9, 2011, at the Doubletree Hotel Warren Place, 6110 South Yale Avenue, Tulsa, Oklahoma. DTG began mailing this Proxy Statement and the accompanying proxy card on or about April 26, 2011.

As used in this Proxy Statement, the “Company” means collectively DTG and its subsidiaries.

Quorum

The record date for the meeting is April 11, 2011. DTG has outstanding one class of voting securities: its common stock, $0.01 par value (“Common Stock” or “Shares”), of which 28,929,182 Shares were outstanding as of the close of business on the record date. A majority of those Shares (a quorum) must be present, in person or by proxy, to conduct business at the meeting. Abstentions and broker non-votes are counted as present in determining whether there is a quorum. In addition, any stockholder who properly executes and returns the proxy card withholding authority to vote for a director nominee will be counted as present in determining whether there is a quorum.

Vote Required

Each stockholder is entitled to one vote for each Share held of record at the close of business on the record date. Directors of DTG are elected by a plurality of the votes cast at the meeting. Because each director nominee is running unopposed, any nominee can be elected upon any affirmative vote so long as a quorum exists, regardless of whether such nominee receives more than 50% of the stockholder vote. Under recent amendments to the rules of the New York Stock Exchange, Inc. (“NYSE”), Proposal No. 1 – Election of Directors is no longer a “routine” item as to which brokerage firms may vote in their discretion on behalf of clients who have not furnished voting instructions with respect to an uncontested director election. Because DTG has a plurality voting standard for the election of directors, however, broker non-votes will have no impact on the outcome of the vote on Proposal No. 1.

Under NYSE rules, Proposal No. 2 - Appointment of Independent Registered Public Accounting Firm is considered a “routine” item under NYSE rules. This means that brokerage firms may vote in their discretion on behalf of clients who have not furnished voting instructions. In accordance with DTG’s Fourth Amended and Restated By-laws (the “By-laws”), Proposal No. 2 will be approved on the favorable vote of a majority of the Shares present in person or represented by proxy and entitled to vote on such matter. Abstentions will have the effect of votes against Proposal No. 2.

Under NYSE rules, Proposal No. 3 - Advisory Vote on Compensation of the Named Executive Officers and Proposal No. 4 – Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation are non-binding, advisory votes only. In accordance with the By-Laws, Proposal No. 3 will be approved on the favorable vote of a majority of the shares present in person or represented by proxy and entitled to vote on such matters. In the case of Proposal No. 4, the frequency of future stockholder advisory votes on executive compensation that receives a plurality of the votes cast will be deemed to be the frequency selected by stockholders. Proposal No. 3 and Proposal No. 4 are not “routine” items under NYSE rules, and therefore brokerage firms may not vote on behalf of clients who have not furnished voting instructions. Broker non-votes will have no effect on the outcome of the vote on either of these Proposals. Abstentions will count as votes against Proposal No. 3 and will have no effect on the outcome of the vote on Proposal No. 4.

Inspectors of election appointed by the Board will determine whether a quorum is present and will tabulate the votes for the meeting.

Proxy Voting

The proxy card represents the Shares held of record by each stockholder at the close of business on the record date. Each stockholder can authorize the individuals named in the proxy card to vote Shares by signing, dating and promptly returning the proxy card. Each stockholder’s Shares will then be voted at the meeting as the stockholder specifies or, if the stockholder does not specify a choice, as recommended by the Board. Each stockholder may revoke the proxy by voting in person at the meeting, or by submitting a written revocation or a later-dated proxy addressed to the Secretary of DTG that is received by DTG before the meeting. If you hold your Shares through a brokerage firm, bank, fiduciary, voting trust or other nominee, you may elect to vote your Shares by a toll-free phone number or over the Internet by following the instructions on the proxy materials forwarded to you.

Proxy Solicitation

Execution and return of the enclosed proxy is being solicited by the Board, on behalf of DTG, for the purposes set forth in the Notice of Annual Meeting of Stockholders. Solicitation other than by mail may be made personally, by telephone or otherwise and by employees of DTG who will not be additionally compensated for such services. Brokerage firms, banks, fiduciaries, voting trustees or other nominees will be requested to forward the soliciting material to each beneficial owner of Shares held of record by any such nominee. DTG has retained Georgeson Inc. to assist with the solicitation of proxies for a fee not to exceed $7,500, plus reimbursement for out-of-pocket expenses. The entire cost of soliciting proxies will be borne by DTG.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 9, 2011:

Stockholders may view this Proxy Statement, our form of proxy and our 2010 Annual Report to Stockholders over the Internet by accessing the website www.proxydocs.com/dtg.

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

In accordance with the By-Laws, the Board has set its size at six members. Under the By-Laws, the number of directors may be changed at any time by resolution of the Board. The terms of each of the six current directors expire upon the election and qualification of the directors to be elected at the Annual Meeting of Stockholders, or as otherwise provided by the By-laws. DTG has nominated for re-election to the Board the six individuals who currently serve as directors on the Board, each of whom has consented to serve as a director if elected.

If elected, each director nominee will serve for a one-year term ending at the Annual Meeting of Stockholders to be held in 2012, or when such nominee’s successor is duly elected and qualified or as otherwise provided by the By-laws. For more information concerning these nominees, see “Biographical Information Regarding Director Nominees and Executive Officers.” Unless otherwise designated, the enclosed proxy card will be voted FOR the election of such nominees as directors. The Board does not believe that any of these nominees will be unable to stand for election, but should any nominee unexpectedly become unavailable for election or decline to serve, the stockholder’s proxy will be voted for a substitute nominee designated by the Board unless the Board reduces the number of directors to be elected.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES DESCRIBED HEREIN AS DIRECTORS OF DTG.

PROPOSAL NO. 2 - APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has appointed, subject to stockholder ratification, Ernst & Young LLP (“E&Y”), an independent registered public accounting firm, as the independent auditors of DTG (“Independent Auditors”) for the fiscal year ending December 31, 2011. In making this appointment, the Audit Committee considered whether the provision of services (and the aggregate fees billed for those services) by E&Y, other than audit services, is compatible with maintaining the independence of the outside auditors.

As previously reported, consistent with its charter responsibility to consider rotation of the independent auditors for the Company, the Audit Committee of the Company’s Board of Directors conducted a “request for proposal” process in which it evaluated the credentials of various candidates to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011. Following completion of that process, the Audit Committee determined to retain E&Y in such capacity for the quarterly reviews and annual audit of the 2011 financial statements. The Company notified Deloitte & Touche LLP (“Deloitte”) of the Audit Committee’s determination on January 31, 2011. Deloitte remained in place as the Company’s independent registered public accounting firm as of and for the fiscal year ended December 31, 2010, and was dismissed by the Audit Committee effective upon the completion of such audit on February 28, 2011.

During the Company’s fiscal years ended December 31, 2009 and 2010, and for the period January 1, 2011 through February 28, 2011, there were no disagreements with Deloitte on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Deloitte, would have caused Deloitte to make reference thereto in their reports with respect to the Company’s consolidated financial statements for any of such periods. During such periods, there were also no “reportable events” as defined in Item 304(a)(1)(v) of Regulation S-K. The reports of Deloitte with respect to the Company’s audited consolidated financial statements as of and for the fiscal years ended December 31, 2009 and 2010 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

The following table provides the various fees and out-of-pocket costs billed by Deloitte in the aggregate for the fiscal years ended December 31, 2009 and 2010:

| | 2010 | 2009 |

Audit Fees In 2009 and 2010, audit fees related to audits of the consolidated and subsidiaries’ annual financial statements, reviews of the consolidated quarterly financial statements and the audit of internal control over financial reporting. | $965,093 | $1,091,854 |

Audit-Related Fees In 2009 and 2010, audit-related fees primarily related to agreed-upon debt compliance procedures, advisory services (including merger-related due diligence in 2010), comfort procedures and accounting consultations. | $844,757 | $ 193,915 |

Tax Fees | $ -0- | $ -0- |

All Other Fees | $ -0- | $ -0- |

The Audit Committee has the sole authority to retain and terminate the Independent Auditors and to pre-approve any non-audit services performed by such Independent Auditors as set forth in the Audit Committee charter. The authority to grant pre-approvals may be delegated to one or more designated members of the Audit Committee whose decisions will be presented to the full Audit Committee for ratification. Pre-approvals are granted on a case-by-case basis. The Audit Committee pre-approved all engagements of Deloitte to provide audit and non-audit services in 2009 and 2010, including estimates and/or hourly rates proposed under the engagements.

On January 31, 2011, the Audit Committee engaged E&Y as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011, subject to stockholder ratification at the Annual Meeting of Stockholders. During the Company’s fiscal years ended December 31, 2009 and 2010, and for the period January 1, 2011 to February 28, 2011, the Company did not consult with E&Y regarding accounting or disclosure requirements related to any of the matters specified in Items 304(a)(2)(i) and 304(a)(2)(ii) of Regulation S-K.

Representatives of E&Y and Deloitte will be present at the Annual Meeting of Stockholders and both will have an opportunity to make a statement and respond to questions.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2011.

PROPOSAL NO. 3 – ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in July 2010 (the “Dodd-Frank Act”) and related rules of the Securities and Exchange Commission (“SEC”), the stockholders of DTG are entitled to vote at the Annual Meeting of Stockholders to approve the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K.

The vote on the compensation of DTG’s named executive officers is advisory only, and it is not binding on DTG or its Board of Directors. Although the vote is non-binding, the Human Resources and Compensation Committee and the Board of Directors value the opinions of the stockholders and will consider the outcome of the vote when considering the Company’s compensation policies and arrangements.

As described more fully in the Compensation Discussion and Analysis section of this Proxy Statement, DTG’s executive compensation program is designed to attract, motivate and retain individuals with the skills required to achieve annual and long-term performance goals necessary to create stockholder value, while at the same time avoiding the encouragement of excessive risk-taking. The program seeks to align executive compensation with stockholder value on an annual and long-term basis through a combination of base pay, annual incentives and long-term incentives. The 2010 annual incentive award is based on Company performance and is limited to 150% of the target opportunity. In addition, long-term incentive awards are comprised of Option Rights which are designed to link executive compensation with increased stockholder value over time, and Performance Units which are based on total stockholder return relative to the Russell 2000 and DTG’s Customer Retention Index.

DTG also has several governance programs in place to align executive compensation with stockholder interests and mitigate risks in its plans. These programs include: stock ownership guidelines for the executives, limited perquisites, and compensation “clawback” policies that permit the Company to recoup incentive compensation in certain circumstances.

The vote on this Proposal is not intended to address any specific element of compensation; rather the vote relates to the compensation of our named executive officers as described in this Proxy Statement.

DTG believes that the information provided in the Compensation Discussion and Analysis section of this Proxy Statement demonstrates that DTG’s executive compensation plan was designed appropriately and is working to ensure management’s interests are aligned with the stockholders’ interests to support long-term value creation. Accordingly, the Board of Directors recommends that stockholders approve the executive compensation of the named executive officers by approving the following advisory resolution:

“RESOLVED, that the stockholders approve the compensation awarded to the Company’s named executive officers for 2010, as disclosed under SEC rules, including the Compensation Discussion and Analysis, the compensation tables and related material included in this Proxy Statement.”

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

PROPOSAL NO. 4 – ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Act and related SEC rules, the stockholders of DTG are entitled to vote at the Annual Meeting of Stockholders regarding whether the stockholder vote to approve the compensation of the named executive officers as required by Section 14A(a)(2) of the Exchange Act should occur every one, two or three years. Stockholders may also abstain from voting on this matter. The vote on the frequency of the stockholder vote to approve executive compensation is advisory, and it is not binding on DTG or its Board of Directors.

The Board of Directors recommends an annual advisory stockholder vote on executive compensation is the best approach for DTG, although stockholders are not voting on this recommendation. The Board believes that an annual vote is desirable for several reasons, including the following:

| · | An annual advisory vote on the compensation of our named executive officers will allow DTG to obtain information on stockholders’ views of the compensation on a more frequent and consistent basis. |

| · | An annual advisory vote on the compensation of our named executive officers provides the highest level of accountability and communication by enabling the advisory stockholder vote to approve the compensation to correspond with the most recent executive compensation information presented in our proxy statement for the annual meeting of stockholders. |

Although the vote is non-binding, the Human Resources and Compensation Committee and the Board of Directors value the opinions of the stockholders and will consider the outcome of the vote when determining the frequency of the stockholder vote on executive compensation.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR AN ANNUAL (“1 YEAR”) ADVISORY VOTE ON EXECUTIVE COMPENSATION.

BIOGRAPHICAL INFORMATION REGARDING

DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

The Company is a provider of value-priced rental vehicles serving customers in over 80 countries, with over 600 Company-owned and franchised locations in the United States and Canada. As of December 31, 2010, the Company employed approximately 6,000 full-time and part-time employees. All of our directors hold, or have held, senior executive positions in large, complex (and, in many cases, global) organizations, as well as directorships at other U.S. public companies. In these positions, they have demonstrated their leadership, intellectual and analytical skills and gained deep experience in all of the core management disciplines, including strategic planning, brand management, finance, compensation and leadership development, compliance and risk management. All of them also have significant experience in corporate governance and risk oversight through their positions as directors of other public companies, and many have served as members of audit, compensation and nominating/corporate governance committees at these companies, as well as at DTG. These skills and experience are pertinent to the Company’s current and evolving business strategies, and permit the Board to offer senior management a diverse range of perspectives about the complex issues facing the Company.

The following table highlights specific qualifications, skills and experiences considered by the Governance Committee in recommending DTG’s slate of director nominees. Additional biographical details about the director nominees follow this table.

Director Nominee | | | Qualifications, Skills and Experience |

| Thomas P. Capo | ● ● ● ● ● | | Executive management experience in automotive industry business Core management skills Experience in finance, financial reporting, compliance and controls and franchised operations Public company directorship and committee experience, including in the automotive industry and at board chairman level Independent of management |

| Maryann N. Keller | ● ● ● ● ● | | Executive management experience, including in automotive industry business Core management skills Experience in finance, financial reporting, compliance and controls and investment analysis Public company directorship and committee experience, including in the automotive industry Independent of management |

| Hon. Edward C. Lumley | ● ● ● ● ● | | Executive management experience in financial services, government, and in the manufacturing industry Core management skills Experience in investment analysis, finance, compliance and controls Public company directorship and committee experience, including at board chairman and lead director levels Independent of management |

| Richard W. Neu | ● ● ● ● ● | | Executive management experience in financial services business, including at the chief financial officer level Core management skills Experience in finance, financial reporting, compliance and controls Public company directorship and committee experience, including at board chairman level Independent of management |

Director Nominee | | | Qualifications, Skills and Experience |

| ● ● ● ● ● | | Executive management experience, including in transportation industry business and at the president, chief operating officer and chief financial officer levels Core management skills Experience in finance, financial reporting, compliance and controls and international business Public company directorship and committee experience, including in the transportation industry and at board chairman level Independent of management |

| ● ● ● ● | | Operating and management experience in automotive industry businesses, including at the chief financial officer level and at the executive vice president of operations level Core management skills Company Chief Executive Officer’s unique perspective and insights into the Company and its businesses, relationships, competitive and financial positioning, senior leadership and strategic opportunities and challenges Public company directorship and committee experience, including at board chairman level |

Below is information furnished to us by the director nominees, including their name, age, principal occupation or employment during at least the past five years and the period during which such person has served as a director of DTG.

Thomas P. Capo, 60, has served as a director of DTG since November 1997 and as Chairman of the Board from October 2003 to November 2010. Mr. Capo was a Senior Vice President and the Treasurer of DaimlerChrysler Corporation from November 1998 to August 2000. From November 1991 to October 1998 he was Treasurer of Chrysler Corporation. Prior to holding these positions, Mr. Capo served as Vice President and Controller of Chrysler Financial Corporation. Mr. Capo is also currently a director and member of the audit committee of Cooper Tire & Rubber Company, and has served in that capacity since 2007. Since November 9, 2009, he has also served as a director and member of the audit committee of Lear Corporation. Mr. Capo previously served as a director of Sonic Automotive, Inc. from 2001 to 2006, of JLG Industries, Inc. from 2005 to 2006, and of Micro-Heat, Inc., a private company, from 2006 to 2007.

Maryann N. Keller, 67, has served as a director of DTG since May 2000. Ms. Keller was President of the Automotive Services unit of priceline.com from July 1999 to November 2000. Prior to joining priceline.com, she was a senior managing director and investment analyst at Furman Selz LLC from 1985 to 1998 and was a financial analyst with ING Barings (which acquired Furman Selz LLC in 1998) from January 1999 to June 1999. Since December 2000, Ms. Keller has been the President of Maryann Keller & Associates, a consulting firm. Ms. Keller was also a director of Lithia Motors, Inc. from 2006 to 2009. Since May 2010, Ms. Keller has been a director of DriveTime Automotive Group, Inc., and currently serves on its audit, compensation and governance committees.

Hon. Edward C. Lumley, 71, has served as a director of DTG since December 1997. Mr. Lumley has been Vice Chairman of the investment banking firm BMO Nesbitt Burns Inc. since January 1991. Prior to this, Mr. Lumley was Chairman of the Noranda Manufacturing Group and was an elected member of the Canadian Parliament, serving as a Minister of the Crown in several portfolios such as industry and international trade. He has served as a director of CN Rail since 1996 and as a director of BCE Inc. since 2003. Mr. Lumley has previously served as a director of Magna International Inc. from 1989 to 2007, of Magna Entertainment Corp. from 2000 to 2006, and of Intier Automotive Inc. from 2001 to 2005. In 2006, Mr. Lumley was appointed Chancellor of the University of Windsor.

Richard W. Neu, 55, has served as a director of DTG since February 2006 and was appointed as its Chairman of the Board on November 29, 2010. Mr. Neu served as the interim Chief Financial Officer of DTG from April 2008 until the appointment of Mr. Thompson to that position in May 2008. Mr. Neu was the Chief Financial Officer and Treasurer of Charter One Financial, Inc. from December 1985 to August 2004, was a director of Charter One Financial, Inc. from 1992 to August 2004, and previously worked for KPMG LLP as a Senior Audit Manager. Mr. Neu has been a director of MCG Capital Corporation since November 2007, and has been Chairman of the Board since April 2009. In January 2010, Mr. Neu was elected a director of Huntington Bancshares Incorporated.

John C. Pope, 62, has served as a director of DTG since December 1997. Mr. Pope has been Chairman of PFI Group, an investment firm, since July 1994. Mr. Pope has also been Chairman of the Board of Waste Management, Inc. since November 2004 and a director since 1997. In addition, Mr. Pope has served as a director of Con-Way, Inc. since 2003, of Kraft Foods Inc. since 2001, and of RR Donnelley & Sons, Inc. (or a predecessor company) since 1997. Mr. Pope was the Chairman of the Board of MotivePower Industries, Inc. from January 1996 to November 1999 and a director from May 1995 to November 1999. Mr. Pope also previously served as a director of Federal-Mogul Corporation from 1987 to 2007. Further, Mr. Pope served as a director of Per-Se Technologies, Inc. from 1996 to 2005. Mr. Pope served as a director and in various executive positions with UAL Corporation and United Airlines, Inc. between January 1988 and July 1994, including as Chief Financial Officer, President and Chief Operating Officer. Mr. Pope also has served as Chief Financial Officer (from 1985 to 1988) and Treasurer (from 1979 to 1985) of AMR Corporation/American Airlines.

Scott L. Thompson, 52, has served as a director of DTG since October 2008 and is the Chief Executive Officer and President of DTG. Prior to serving as Chief Executive Officer and President, Mr. Thompson was a Senior Executive Vice President and the Chief Financial Officer of DTG from May 2008 to October 2008. Prior to joining DTG, Mr. Thompson was a consultant to private equity firms from 2005 until May 2008, and was a founder of Group 1 Automotive, Inc., a NYSE and Fortune 500 company, serving as its Senior Executive Vice President, Chief Financial Officer and Treasurer from February 1996 until his retirement in January 2005. Mr. Thompson is non-executive Chairman of the Board of Houston Wire and Cable and has served in that capacity since 2007, and has served as a director of Conn’s, Inc. since June 2004. Mr. Thompson is a Certified Public Accountant and a member of, and designated as a certified director by, the National Association of Corporate Directors.

BIOGRAPHICAL INFORMATION REGARDING EXECUTIVE OFFICERS

The following sets forth information concerning the executive officers of DTG other than Mr. Thompson (whose information appears above) as of the date of this Proxy Statement, including their name, age, principal occupation and employment during at least the past five years and the period during which such person has served as an executive officer of DTG.

R. Scott Anderson, 52, is Senior Executive Vice President, Operations and Global Sales and Marketing of DTG. Prior to his election as a DTG officer in January 2003, Mr. Anderson served in several management positions with Thrifty Rent-A-Car System, Inc. since October 1995.

H. Clifford Buster III, 41, joined DTG in October 2008 and is Senior Executive Vice President, Chief Financial Officer and Treasurer. Mr. Buster is a Certified Public Accountant and previously served as Vice President of Finance and Treasurer of Helix Energy Solutions Group, Inc. from March 2006 to October 2008 and in various finance positions, including Vice President and Treasurer, with Group 1 Automotive, Inc. from 1998 to 2006.

Rick L. Morris, 52, is Executive Vice President and Chief Information Officer of DTG, and has served in such capacity since October 2007. Prior to joining DTG, Mr. Morris had been the Chief Information Officer of a division of Capital One Financial Corporation since 2002.

Vicki J. Vaniman, 54, is Executive Vice President, General Counsel and Secretary of DTG. Prior to her election as a DTG officer in January 2003, Ms. Vaniman had been Vice President and General Counsel for Dollar Rent-A-Car Systems, Inc. since February 1996.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

Certain Beneficial Owners

The following table sets forth certain information as of April 11, 2011, with respect to each person known by DTG to beneficially own more than 5% of the outstanding Shares:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (1) |

York Capital Management Global Advisors, LLC 767 Fifth Avenue, 17th Floor New York, New York 10153 | 4,173,642 (2) | 14.43% |

PAR Investment Partners, L.P. PAR Group, L.P. PAR Capital Management, Inc. One International Place, Suite 2401 Boston, Massachusetts 02110 | 2,191,800 (3) | 7.58% |

BlackRock, Inc. 40 East 52nd Street New York, New York 10022 | 2,048,239 (4) | 7.08% |

Westchester Capital Management, LLC Westchester Capital Management, Inc. 100 Summit Drive Valhalla, New York 10595 | 2,028,131 (5) | 7.01% |

| (1) | Based on 28,929,182 Shares outstanding as of April 11, 2011. |

| (2) | As reported in a Schedule 13G dated April 11, 2011, York Capital Management Global Advisors, LLC has sole voting and dispositive power in respect of all of the reported Shares and shared voting and dispositive power in respect of none of the reported Shares. |

| (3) | As reported in a Schedule 13G dated July 14, 2010, PAR Investment Partners, L.P., PAR Group, L.P. and PAR Capital Management, Inc. have sole voting and dispositive power in respect of all of the reported Shares and shared voting and dispositive power in respect of none of the reported Shares. |

| (4) | As reported in Schedule 13G dated February 4, 2011, BlackRock, Inc., a parent holding company, has sole voting and dispositive power in respect of all the reported Shares and shared voting and dispositive power in respect of none of the reported Shares. |

| (5) | As reported in a Schedule 13G dated February 14, 2011 filed jointly by Westchester Capital Management, LLC (“Westchester LLC”), Westchester Capital Management, Inc. (“Westchester Inc.”), The Merger Fund, The Merger Fund VL, the Dunham Monthly Distribution Fund (“DMDF”) and Green & Smith Investment Management L.L.C. (“Green & Smith” and, together with the other named entities, the “Reporting Companies”) and Messrs. Roy Behren, Michael T. Shannon and Frederick W. Green (the “Principals”). According to the Schedule 13G, Westchester LLC and Westchester Inc. may each be deemed to beneficially own 2,028,131 Shares, consisting of (i) 1,990,731 Shares held by The Merger Fund, (ii) 7,400 |

| | Shares held by The Merger Fund VL and (iii) 30,000 Shares held by the DMDF. Westchester LLC is the investment advisor of The Merger Fund and The Merger Fund VL, and the sub-advisor of the DMDF. Westchester Inc also held those positions with respect to such Reporting Companies until December 31, 2010. Green & Smith may be deemed to beneficially own 50,111 Shares held by GS Master Trust, for which it serves as investment advisor. Each of the Principals may also be deemed to beneficially own all of the foregoing Shares by virtue of their shared voting and dispositive power with respect thereto with the applicable Reporting Companies. Each of Messrs. Behren and Shannon are Co-President of Westchester LLC and Co-Manager and members of Green & Smith. Until December 31, 2010, Mr. Green was President of Westchester Inc. and a Manager of Green & Smith. |

Directors, Director Nominees and Executive Officers

The following table sets forth certain information as of April 11, 2011 with respect to the number of Shares owned by (a) each director nominee of DTG, (b) each named executive officer of DTG and (c) all current directors and named executive officers of DTG as a group.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (2) |

| Thomas P. Capo | 70,510 | (3) | Less than 1% |

| Maryann N. Keller | 66,011 | (4) | Less than 1% |

| Hon. Edward C. Lumley | 60,828 | (5) | Less than 1% |

| Richard W. Neu | 38,351 | (6) | Less than 1% |

| John C. Pope | 83,013 | (7) | Less than 1% |

| Scott L. Thompson | 434,433 | (8) | 1.5% |

| H. Clifford Buster III | 136,010 | (9) | Less than 1% |

| R. Scott Anderson | 225,260 | (10) | Less than 1% |

| Vicki J. Vaniman | 127,166 | (11) | Less than 1% |

| Rick L. Morris | 88,012 | (12) | Less than 1% |

All directors and named executive officers as a group | 1,329,594 | | 4.6% |

| (1) | The SEC deems a person to have beneficial ownership of all shares that such person has the right to acquire within 60 days. Accordingly, Shares subject to vested options as well as options exercisable within 60 days are included in this column. Restricted Stock Units that are to be settled in stock or may be settled in cash or stock at the option of the holder are only included in this column if they vest within 60 days. Restricted Stock Units that have been granted but not included in this column are identified below. |

| (2) | Based on 28,929,182 Shares outstanding as of April 11, 2011. |

| (3) | Consists of (i) 66,950 Shares subject to a deferral agreement between DTG and Mr. Capo and (ii) 3,560 shares owned by Mr. Capo. Not included are 1,866 Restricted Stock Units that vest on December 31, 2011. |

| (4) | Consists of 66,011 Shares subject to a deferral agreement between DTG and Ms. Keller. Not included are 1,866 Restricted Stock Units that vest on December 31, 2011. |

| (5) | Consists of (i) 50,828 Shares owned by Mr. Lumley and (ii) 10,000 Shares subject to options. Not included are 1,866 Restricted Stock Units that vest on December 31, 2011. |

| (6) | Consists of 38,351 Shares subject to a deferral agreement between DTG and Mr. Neu. Not included are 1,866 Restricted Stock Units that vest on December 31, 2011. |

| (7) | Consists of (i) 32,203 Shares owned by Mr. Pope, (ii) 40,810 Shares subject to a deferral agreement between DTG and Mr. Pope and (iii) 10,000 Shares subject to options. Not included are 1,866 Restricted Stock Units that vest on December 31, 2011. |

| (8) | Consists of (i) 114,804 Shares owned by Mr. Thompson, (ii) 13,387 Restricted Stock Units and (iii) 306,242 Shares subject to options. Not included are (a) 3,387 Restricted Stock Units that vest on May 22, 2012, (b) 16,670 Restricted Stock Units that vest on October 13, 2011, (c) 30,000 Restricted Stock Units that vest on May 13, 2012, (d) 12,925 Shares subject to options that vest on May 22, 2012, (e) 65,833 Shares subject to options that vest on October 31, 2011 and (f) 150,000 Shares subject to options that vest on May 13, 2012. |

| (9) | Consists of (i) 9,343 Shares owned by Mr. Buster and (ii) 126,667 Shares subject to options. Not included are (a) 33,333 Shares subject to options that vest on October 31, 2011 and (b) 90,000 Shares subject to options that vest on May 13, 2012. |

| (10) | Consists of (i) 26,325 Shares owned by Mr. Anderson, (ii) 43,337 Shares owned by the trust of Mr. Anderson’s spouse, (iii) 211 Shares held in DTG’s 401(k) plan and (iv) 155,387 Shares subject to options. Not included are (a) 41,667 Shares subject to options that vest on October 31, 2011 and (b) 90,000 Shares subject to options that vest on May 13, 2012. |

| (11) | Consists of (i) 15,082 Shares owed by Ms. Vaniman, (ii) 4,522 Shares owned by Ms. Vaniman’s trust, (iii) 21,734 Shares subject to a deferral agreement between DTG and Ms. Vaniman, (iv) 881 Shares held in DTG’s 401(k) plan and (v) 84,947 Shares subject to options. Not included are (a) 15,000 Shares subject to options that vest on October 31, 2011 and (b) 60,000 Shares subject to options that vest on May 13, 2012. |

| (12) | Consists of (i) 10,297 Shares owned by Mr. Morris and (ii) 77,715 Shares subject to options. Not included are (a) 15,000 Shares subject to options that vest on October 31, 2011 and (b) 60,000 Shares subject to options that vest on May 13, 2012. |

INDEPENDENCE, MEETINGS, COMMITTEES AND

COMPENSATION OF THE BOARD OF DIRECTORS

Independence

The Board has determined that all of the director nominees, other than Chief Executive Officer and President Scott L. Thompson, who is an employee of DTG, are “independent” as defined by DTG policy and NYSE rules and regulations. Specifically, the Board’s determinations of director independence were made in accordance with the categorical standards for director independence reflected in DTG’s Corporate Governance Policy adopted by the Board and located on DTG’s website at www.dtag.com under the heading “Corporate Governance.”

As a part of its review of the independence of directors, the Board considered the relationship of DTG with BMO Nesbitt Burns Inc. (“BMO”), of which Mr. Lumley serves as Vice Chairman. Since 1999, BMO has structured the financing for the Company’s Canadian vehicles. BMO was selected after a review of multiple financing proposals from other lenders. Mr. Lumley has no involvement with this financing and none of his compensation at BMO relates to this program. In addition, Mr. Lumley is not in a management position at BMO. The Board also considered the amounts of various fees and interest payable by DTG to BMO. The Board then applied its categorical standards for independence and determined that DTG’s relationship with BMO was in the ordinary course of business, and that because Mr. Lumley had no involvement in the financing, he would be treated as an independent director of DTG.

Meetings and Committees

The Board has established certain standing committees, which are comprised solely of independent directors, to consider designated matters. These committees of the Board are the Governance Committee, the Audit Committee and the Human Resources and Compensation Committee. The Board annually selects from its members the members and chair of each committee. The following table sets forth the number of Board and committee meetings (including teleconference meetings) held in 2010 and the members of each committee and the chair of each committee as of the date of this Proxy Statement:

| Director | Board | Governance | Audit | Human Resources and Compensation |

| Thomas P. Capo (1) | X | | X | |

| Maryann N. Keller (1) | X | | Chair | X |

| Hon. Edward C. Lumley | X | X | X | Chair |

| Richard W. Neu (1) | Chair | X | X | |

| John C. Pope | X | Chair | | X |

| Scott L. Thompson | X | | | |

| Meetings Held in 2010 | 28 | 4 | 13 | 8 |

| (1) | Mr. Capo was, until November 29, 2010, Chairman of the Board and an ex-officio member of all Board committees. Subsequent to that date, Mr. Capo remained a member of the Audit Committee. Effective November 29, 2010, Mr. Neu was elected as Chairman of the Board and Ms. Keller became Chair of the Audit Committee, replacing Mr. Neu in that capacity. |

In 2010, each director attended 99% or more of the total of all meetings held by the Board and the committees on which he or she served.

The Board has adopted a Corporate Governance Policy and charters for each of the Board committees. The Corporate Governance Policy and each committee charter are located on DTG’s website at www.dtag.com under the heading “Corporate Governance.” DTG will provide, without charge, a copy of the Corporate Governance Policy and any committee charter to any stockholder upon written request.

At each regularly scheduled meeting of the Board, the non-management directors of DTG meet in executive session without members of management present. These sessions are presided over by the independent Chairman of the Board.

Interested parties may communicate with the Chairman of the Board and with the independent directors in the manner described below under “Communications with Stockholders.”

Attendance at Annual Meetings of Stockholders

It is DTG’s policy that all directors should attend the Annual Meeting of Stockholders unless there are extenuating circumstances. All of the DTG directors attended the Annual Meeting of Stockholders held on June 10, 2010.

Governance Committee

Independence and Charter

The Governance Committee is as of the date of this Proxy Statement comprised of three independent directors, Messrs. Lumley, Neu and Pope (Chair). Each of the members is “independent” as defined by DTG policy and NYSE rules and regulations.

The Governance Committee evaluates the organization, function and performance of the Board and its committees, the qualifications for director nominees and matters involving corporate governance. A more detailed description of the Governance Committee’s duties and responsibilities may be found in its charter adopted by the Board and located on DTG’s website at www.dtag.com under the heading “Corporate Governance.”

Consideration and Evaluation of Director Nominees

The Company has a policy with respect to the consideration of director candidates. Under the policy, the Governance Committee establishes criteria for director nominees, screens candidates and recommends director nominees who are approved by the full Board. The Governance Committee will consider director nominees suggested by its members, other directors, stockholders or other sources. The Governance Committee may also retain a search firm (which may be paid a fee) to identify director candidates. Director nominations by stockholders may be submitted at the times and in the manner described below under “Stockholder Proposals and Director Nominations for Next Annual Meeting.”

All candidates, including those recommended by stockholders, are evaluated on the same basis in light of their credentials and the needs of the Board and the Company. The Governance Committee seeks directors with established records of accomplishment in areas relevant to the Company’s strategy and operations and who share characteristics identified in DTG’s Corporate Governance Policy as valuable to a well-functioning Board: ability to apply independent judgment to a business situation; ability to represent broadly the interests of all of DTG’s stockholders and constituencies; the absence of any conflicts of interest that would interfere with the potential nominee’s loyalty to DTG and its stockholders; practical or academic experience in business, economics, government or the sciences (ideally, 15 or more years of experience including management responsibilities); and time to be an active member of the Board and one or more Board committees. Under the Company’s policy, the Board takes into account principles of diversity. While the policy does not prescribe diversity standards, as a matter of practice, the Board considers diversity in the context of the Board as a whole, including with respect to diversity of experience, geographic background, gender, race, age and current affiliations that may offer the Company exposure to contemporary business issues. Candidates are also evaluated in light of Board policies, such as those relating to director independence and service on other boards, as well as considerations relating to the size and structure of the Board.

Audit Committee

Independence and Charter

The Audit Committee is, as of the date of this Proxy Statement, comprised of four independent directors, Mr. Capo, Ms. Keller (Chair), Mr. Lumley and Mr. Neu. Each of the members is “independent” as defined by DTG policy and NYSE rules and regulations, and each of them is also “financially literate” as required by NYSE rules and regulations.

The Audit Committee appoints the Independent Auditors, reviews and approves their fees for audit and non-audit services, and reviews the scope and results of audits performed by the Independent Auditors and by DTG’s internal auditors. It also reviews corporate compliance matters and reviews the Company’s system of internal accounting controls, its significant accounting policies and its financial statements and related disclosures. A more detailed description of the Audit Committee’s duties and responsibilities may be found in its charter adopted by the Board and located on DTG’s website at www.dtag.com under the heading “Corporate Governance.”

Audit Committee Financial Experts

The Board has determined that each of Mr. Capo, Ms. Keller and Mr. Neu is an “audit committee financial expert” as defined by SEC rules.

Human Resources and Compensation Committee

Independence and Charter

The Human Resources and Compensation Committee is, as of the date of this Proxy Statement, comprised of three independent directors, Ms. Keller, Mr. Lumley (Chair) and Mr. Pope. Each of the members is “independent” as defined by DTG policy and NYSE rules and regulations.

The Human Resources and Compensation Committee makes recommendations to the Board regarding DTG’s executive compensation program, and generally reviews the human resources area for the Company, including its management development and succession. As a part of its executive compensation function, it approves salaries, retirement benefits, incentive compensation awards and equity incentive grants for officers, as well as corporate goals under performance-based compensation plans. A more detailed description of the Human Resources and Compensation Committee’s duties and responsibilities may be found in its charter adopted by the Board and located on DTG’s website at www.dtag.com under the heading “Corporate Governance.”

Processes and Procedures for Consideration and Determination of Executive and Director Compensation

The Human Resources and Compensation Committee annually reviews the performance of all officers. Executive officers also contribute to this review process by discussing executive performance with the Human Resources and Compensation Committee as requested. The Human Resources and Compensation Committee makes all decisions regarding cash and equity awards for all officers of the Company after consultation with the other independent directors. The Human Resources and Compensation Committee also reviews the performance and pay of the Chief Executive Officer and discusses its review with the Board. As part of its compensation reviews, the Human Resources and Compensation Committee may use data obtained by Towers Watson, its independent compensation consultant. The independent compensation consultant is engaged directly by the Human Resources and Compensation Committee and, in general, compiles information for, and makes presentations to, the Human Resources and Compensation Committee, and reviews compensation plans proposed by DTG. It should be noted that the Risk and Financial Services Group of Towers Watson, performs separate work for DTG in relation to the valuation of insurance reserves, for an annual fee which does not exceed $120,000. This relationship and the work performed by the Risk and Financial Services Group are unrelated to the work performed by Towers Watson at the request of the Human Resources and Compensation Committee and, therefore, the Human Resources and Compensation Committee has determined that Towers Watson is independent with regard to its compensation consulting. Further, all of Towers Watson’s work for DTG must be pre-approved by the Human Resources and Compensation Committee.

The Human Resources and Compensation Committee also reviews the compensation for the Board and its committees. In recommending such compensation to the Board, the Human Resources and Compensation Committee utilizes data furnished by Towers Watson.

The agenda for meetings of the Human Resources and Compensation Committee is determined by its Chair with the assistance of the Chairman of the Board, Chief Executive Officer and Senior Vice President-Human Resources. Such meetings are regularly attended by the Chief Executive Officer and the Senior Vice President-Human Resources. At each meeting, the Human Resources and Compensation Committee also meets in executive session. The Chair of the Human Resources and Compensation Committee reports the Human Resources and Compensation Committee’s recommendations on executive compensation to the Board. Independent advisors and DTG’s human resources department support the Human Resources and Compensation Committee in its duties and such department may be delegated authority to fulfill certain administrative duties regarding the Company’s compensation programs. The Human Resources and Compensation Committee has authority under its charter to retain, approve fees for and terminate consulting firms as it deems necessary to assist in the fulfillment of its responsibilities.

Compensation Committee Interlocks and Insider Participation

Directors Thomas P. Capo (ex-officio), Maryann N. Keller, Edward C. Lumley and John C. Pope served as members of the Human Resources and Compensation Committee during 2010. None of the foregoing directors has ever been an officer or employee of DTG or has had any relationship requiring disclosure by DTG as a related party transaction.

Report of Audit Committee

Meetings With Management, Internal Auditors and Independent Auditors

The Audit Committee reviewed and discussed the audited financial statements and effectiveness of internal controls with management, internal auditors and the Company’s independent registered public accounting firm for 2010, Deloitte & Touche LLP. Based on these discussions and its other work, the Audit Committee recommended that the Board include the audited consolidated financial statements in DTG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010.

The Audit Committee also has met and held discussions with management, internal auditors and the Independent Auditors regarding various topics in addition to matters related to financial statements.

The discussions with Deloitte also included the matters required by the Statement on Auditing Standards No. 114, The Auditor’s Communication with Those Charged with Governance.

In addition, Deloitte has provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the firm’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed the firm’s independence with the firm.

Responsibility

The Audit Committee is not responsible for either the preparation of the financial statements or the auditing of the financial statements. Management has the responsibility for preparing the financial statements and implementing, maintaining and evaluating the effectiveness of internal controls and the Independent Auditors have the responsibility for auditing financial statements and evaluating the effectiveness of the internal controls. The Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the Independent Auditors included in their report on DTG’s financial statements.

THE AUDIT COMMITTEE

Maryann N. Keller, Chair

Thomas P. Capo

Edward C. Lumley

Richard W. Neu

March 31, 2011

Compensation

Board Compensation has historically consisted of a combination of cash, equity grants and vehicle privileges. In 2010, director compensation was modified to reflect current market practice, including the elimination of meeting fees and the vehicles provided to the directors for their personal use.

Board Meeting Fees, Committee Meeting Fees and Retainers

Beginning in 2010, the annual compensation program for independent directors provides that for each fiscal year of service, each independent director will receive an annual retainer of $60,000 in the form of cash, paid in quarterly installments of $15,000 each, and $90,000 in the form of equity compensation, discussed below. The Company did not pay separate meetings fees but continued to pay additional fees to the committee chairs as follows: The Governance Committee chair was paid an annual retainer of $5,000, in quarterly cash installments of $1,250. The Human Resources and Compensation Committee chair was paid an annual retainer of $7,500, in quarterly cash installments of $1,875. The Audit Committee chair was paid an annual retainer of $10,000, in quarterly cash installments of $2,500. Mr. Capo was the non-executive Chairman of the Board from January 1, 2010 to November 29, 2010. Mr. Capo’s compensation for services rendered as Chairman was $137,500 for the fiscal year ended December 31, 2010.

Effective December 1, 2010, the compensation for independent directors in 2011 will remain as it was in 2010 with the exception of the retainer for the Chairman of the Board, which is $100,000 annually, paid quarterly in arrears.

Directors were permitted to elect in advance to defer all or any portion of their compensation that was to be paid in Common Stock.

On January 27, 2010, each independent director was granted 3,560 Restricted Stock Units under the Plan having an aggregate grant date fair value of $90,000. The number of Restricted Stock Units granted was calculated on the basis of the closing price per Share on the day of the grant ($25.28). The Restricted Stock Units vested on December 31, 2010. Beginning in 2011, each independent director will receive a retainer in the form of Restricted Stock Units with a grant date fair value of $90,000 in addition to the cash retainer discussed above. Accordingly, on January 26, 2011, each independent director was granted 1,866 Restricted Stock Units having an aggregate grant date fair value of $90,000 and which will vest on December 31, 2011.

Effective January 2010, Restricted Stock Units will be settled exclusively in Common Stock.

Other

Effective January 1, 2010, the benefit of providing one vehicle for personal use to each independent director while serving as a director was eliminated. DTG will continue its policy of furnishing rental cars for short-term use for product and service evaluation to each director. Following a change in control of DTG or retirement from the Board with five or more years of service, each director is permitted the use of rental cars for product and service evaluation for the life of the director.

| | | No Employee Director Compensation or Benefits |

DTG does not pay compensation or provide benefits for service to any director solely in such capacity who is also an officer or employee of the Company, except that Mr. Thompson, as a director, is entitled to the use of rental cars for product and service evaluation for life if he retires from the Board with five or more years of service or following a change in control of DTG.

Director Compensation Table

The following table provides certain summary information concerning compensation of the independent directors for the fiscal year ended December 31, 2010:

2010 DIRECTOR COMPENSATION

Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | | Total ($) | |

| (a) | | | (b) | | | | (c)(1) | | | | (d)(2) | | | | (e) | | | | (f) | | | | (g) | | | | (h) | |

| Thomas P. Capo | | | 197,500 | | | | 90,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 287,500 | |

| Maryann N. Keller | | | 60,833 | | | | 90,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 150,833 | |

| Hon. Edward C. Lumley | | | 67,500 | | | | 90,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 157,500 | |

| Richard W. Neu | | | 77,500 | | | | 90,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 167,500 | |

| John C. Pope | | | 65,000 | | | | 90,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 155,000 | |

| | (1) | The amount shown in column (c) for each director reflects the grant date fair value attributable to the Restricted Stock Unit awards (3,560 Restricted Stock Units for each independent director in accordance with Accounting Standards Codification Topic 718, “Compensation – Stock Compensation” (“ASC 718”)). The grant date fair value was determined as of the grant date of January 27, 2010, based on a closing Share price of $25.28. |

| | (2) | Since May 2002, no independent director has been awarded Option Rights. As of December 31, 2010, the amount of outstanding Option Rights that are fully vested but not yet exercised by the current directors were as follows: (a) Mr. Lumley, 10,000, and (b) Mr. Pope, 10,000. |

Stock Ownership Guidelines

The Company’s current stock ownership guidelines require each independent director of DTG to hold at least 20,000 Shares. Directors are generally given five years from commencing service on the Board to meet the stock ownership guidelines. All of the current independent directors meet or exceed these guidelines.

Leadership Structure of the Board

Mr. Capo, a non-employee independent director, served as DTG’s Chairman of the Board from 2003 to November 29, 2010, when Mr. Neu, also a non-employee independent director, assumed that role. Mr. Thompson serves as our Chief Executive Officer and President. Separating the positions of Chairman of the Board and Chief Executive Officer allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to, and independent oversight of, management. The Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman. While DTG’s By-Laws and Corporate Governance Policy do not require that our Chairman and Chief Executive Officer positions be separate, the Board believes that having separate positions and having an independent director serve as Chairman of the Board is the appropriate leadership structure for the Company at this time.

Board’s Role in Risk Oversight

The Board as a whole has responsibility for risk oversight, with reviews of certain risks and exposures being delegated as described below to Board committees that report on their deliberations to the full Board. The oversight responsibility of the Board and its committees is supported by management reporting processes that are designed to surface key risk exposures and assist the Board in evaluating them in light of the Company’s overall risk profile and in assessing the scope and effectiveness of risk management and mitigation initiatives. The Audit Committee plays a principal role in evaluating the process by which the Board and its committees exercise their oversight responsibilities with respect to risk. The Board believes that its leadership structure, which includes a non-executive Chairman of the Board, facilitates an independent assessment of the Company’s risk profile and major risk exposures.

The Board’s oversight focuses on four principal areas of risk: strategic; financial; operational; and compliance and regulatory. The Board annually conducts an in-depth review of the business, which addresses strategic and other key risks that could materially affect execution of the Company’s plans. This review is supplemented throughout the year with regular management presentations that highlight material risks and exposures and related initiatives. In addition, the Board and its committees conduct, as needed or appropriate, executive sessions with management personnel responsible for certain areas of risk. For example, the head of internal audit and the Chief Financial Officer each meet separately with the Audit Committee periodically, without any other management personnel present.

Oversight of risks directly relating to the responsibilities of the Board’s committees is undertaken at the committee level. The allocation of risk oversight among the Board’s committees is as follows:

| | |

| Audit Committee | Risks and exposures associated with financial matters, financial reporting, accounting, tax, internal control over financial reporting and ethics matters. |

| | |

| Governance Committee | Risks and exposures relating to corporate compliance, legal and regulatory matters. |

| | |

Human Resources and Compensation Committee | Risks and exposures associated with the Company’s compensation programs and arrangements, leadership development and management succession planning. |

Communications with Stockholders

Stockholders may send communications to the Board, or to any individual director or the non-management or independent directors as a group. Such communications should be addressed to the Secretary at Dollar Thrifty Automotive Group, Inc., 5330 East 31st Street, Tulsa, Oklahoma 74135. All such communications received by the Secretary will be forwarded to the Chairman of the Board and to the Chief Executive Officer. The Secretary and the Chairman of the Board will review the communications and determine whether or not it is appropriate to forward the communications to the Board or any director or group of directors.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

2010 Overview

Despite lingering economic uncertainty in 2010, management shifted its focus on stabilization during 2009 to a strategy of maximizing profitability and cash flow. The objectives of this shift were to further strengthen the balance sheet, enhance liquidity and position the Company for future success and growth in a recovering economic environment.

While management was focused on the execution of this stand-alone business plan, it faced the additional challenge of delivering on this plan while attempting to minimize the distractions to its personnel and operations resulting from the execution in April of a merger agreement with Hertz Global Holdings, Inc. Throughout the first nine months of 2010 until the failure of the stockholder vote to approve the merger in September, management was required to devote significant time and resources to merger-related activities, while keeping the business running as a profitable stand-alone entity. This required a significant emphasis on retaining and engaging key employees in light of the uncertainty caused by the potential merger.

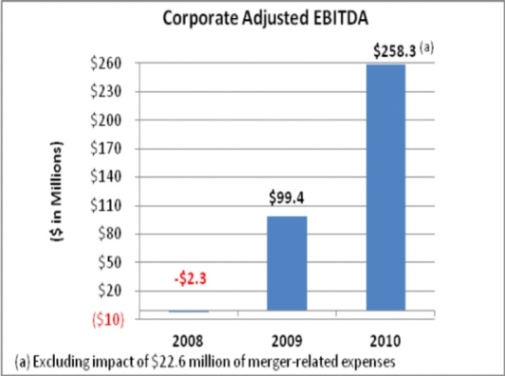

As discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, management successfully executed on its stand-alone business plan for 2010, maximizing profitability and further strengthening the balance sheet through continued focus on cost control and operating efficiencies. The Company generated corporate earnings before interest, taxes, depreciation and amortization (“Corporate Adjusted EBITDA”) of $235.7 million in 2010. Excluding $22.6 million of expenses related to a proposed merger, the Company delivered the highest level of Corporate Adjusted EBITDA in its history, totaling $258.3 million in 2010, a $158.9 million improvement from the $99.4 million reported in 2009. There was also significant growth in Corporate Adjusted EBITDA over the last three years as shown by the chart below:

The Company was able to successfully mitigate personnel distractions and disruptions to its operations related to the proposed merger by keeping employees informed of developments, implementing retention tools and ensuring that everyone’s focus remained on product delivery and customer service during the period of uncertainty. The Company favorably resolved fleet financing issues in 2010, completing over $1 billion of new financing to support the Company’s rental business, and ended 2010 with profitable operations, abundant liquidity and a share price that had improved from $25.61 on December 31, 2009 to $47.26 on December 31, 2010, an increase of approximately 85%. In a study by Bespoke Investment Group LLC of Harrison, New York, DTG was named as having the second best performing shares in the Russell 3000 Index over the past two years.

The Human Resources and Compensation Committee’s actions during 2010 with respect to executive pay reflected these circumstances and results. Given the ongoing uncertainty in the economy and the fact that the Company had only recently completed the first phase of its turnaround plan in 2009, the Human Resources and Compensation Committee chose not to increase base pay for its named executive officers for 2010. In addition, the Human Resources and Compensation Committee did not issue equity as a component of management’s compensation plans for 2010, taking into account the retention value and alignment of interests with stockholders provided by equity grants made in 2009.

The Company’s annual cash incentive plan for 2010 was designed to provide additional incentive compensation in the event the Company was able to exceed certain financial targets, with such performance incentives capped at a pre-determined level. Because the Company significantly exceeded the financial targets under the annual incentive plan for 2010, management (including the named executive officers) was paid incentive awards at the maximum amounts determined under the plan.

The Human Resources and Compensation Committee believes that the compensation actions in 2010, taken in conjunction with the 2009 actions with respect to equity incentives to reward and retain management, were appropriate in light of existing business conditions.

Objectives of Compensation Program

The Human Resources and Compensation Committee is guided by the following key objectives in determining the compensation of the Company’s named executive officers:

Competitive Pay

Compensation should reflect the competitive marketplace so that the Company can attract, retain and motivate high-caliber executives.

Accountability for Business Performance

Compensation should be tied largely to overall Company financial and operating performance, so that executives are held accountable through their compensation for achievement of Company financial and operating results.

Accountability for Individual Performance

Compensation should also be tied to the individual’s performance to encourage and reflect individual contributions to the Company’s performance.

Alignment with Stockholder Interests

Compensation should reflect DTG’s Common Stock performance through equity-based incentives, such as Performance Shares, Performance Units, Restricted Stock, Restricted Stock Units and Option Rights, to align the interests of executives with those of DTG’s stockholders.

Design and Risk Mitigation

DTG’s executive compensation program is designed to clearly and fairly relate pay to performance, with the objective of creating long-term stockholder value. DTG’s executive compensation program is also designed to match pay practices with corporate goals. Each year, the Human Resources and Compensation Committee establishes annual cash incentive award levels and considers the grant of long-term equity incentive compensation awards under the Second Amended and Restated Long-Term Incentive Plan and Director Equity Plans (as amended, the “Plan”). At the end of each year, the Human Resources and Compensation Committee conducts a full review of the elements of compensation and compares those elements to DTG’s key objectives.

A primary objective of DTG’s executive compensation program is to encourage and reward performance by the executives, including the named executive officers, that meets or exceeds DTG’s financial and operational performance goals, without encouraging the taking of excessive risks that could be detrimental to the interests of DTG’s stockholders.

Further, the Company strives to develop overall compensation packages that include a variety of short- and long-term awards, as well as a balanced mix of cash and equity incentives. Performance targets for our performance-based awards, whether cash or equity, are established to encourage the executives, including the named executive officers, to maximize DTG’s performance over the long-term, as opposed to focusing on short-term profits.

The Human Resources and Compensation Committee believes that its compensation decisions are aligned with these objectives and that risks arising from the compensation programs, if any, would not be reasonably likely to have a material adverse affect on the Company.